Is the housing boom running out of gas? Pending home sales face largest monthly drop since home buying-tax credit expired in 2010. Median price nationwide drops.

There are now signs that the unrelenting housing price boom is slowing down. Pending home sales faced their largest monthly drop since the home-buyer tax credit expired back in 2010. If you notice a pattern, any time the government even remotely hints at pulling back the housing market suddenly reverses. The Fed’s hint of a taper ending sent mortgage rates soaring. Of course the taper never materialized and the Fed even became more aggressive in QE. The government shutdown did impact housing from data we are seeing. Existing homes sales pulled out a weak performance and the drop in pending sales, a leading indicator are showing signs of a slowing housing market. In this boom and bust market with no middle ground, are we now to expect a “normal†healthy market after this recent boom?

Existing home sales and pending sales feel pinch

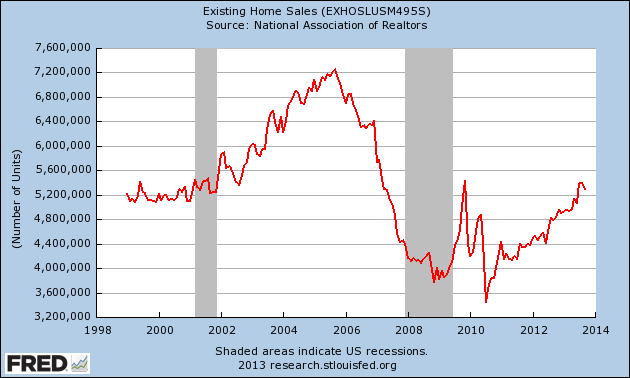

In spite of all the government intervention and investors diving into the housing market, existing home sales hit a wall in the last couple of months:

Everything looks better than the lows reached between 2008 and 2010 but compare the annualized rate today versus where we were in the last decade. Also keep in mind that since 2009 roughly one-third of purchases have gone to investors (whereas in the past it was roughly 10 percent). More importantly looking forward, pending home sales hit a wall:

“(Bloomberg) The index of pending home sales slumped 5.6 percent, exceeding all estimates in a Bloomberg survey of economists and the biggest drop in more than three years, after a 1.6 percent decrease in August, the National Association of Realtors reported today in Washington. The index fell to the lowest level this year.â€

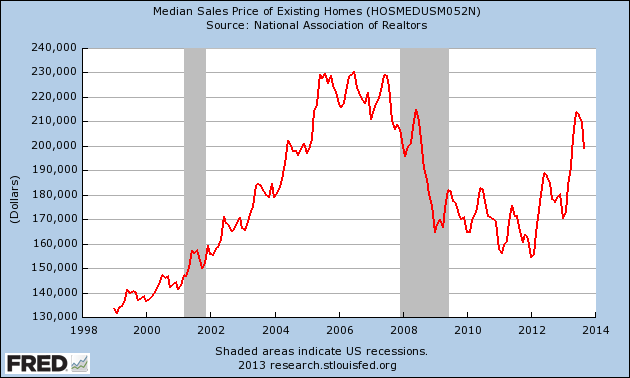

It should be expected that with higher rates, home prices are now softening without any rise in household income:

The housing market has been propped up by easy money from the Fed, investors, and artificially low inventory that has caused a bottleneck with supply. Some people try to use past comparison but this is the first time in history where mark-to-market has been frozen, the Fed has intervened to this level, and never have we seen this volume of investors. The recent government shutdown merely accelerated what was beginning to emerge with housing. The gas was running out of the boom.

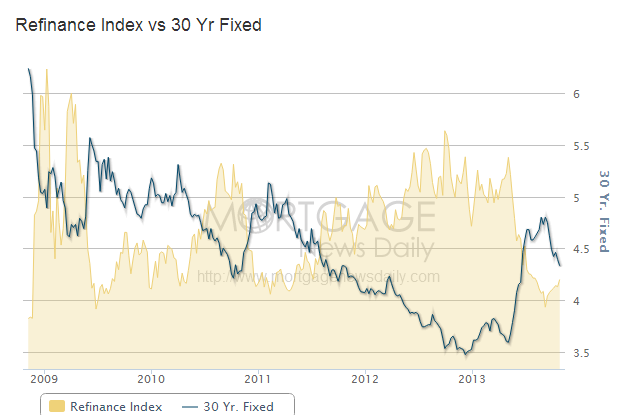

Refinance Index

Since 2009, mortgage rates have been dropping every single year. People become conditioned to easy money. So this year, as rates had their first move up, the market has reacted strongly:

Refinancing activity has plunged and thousands have been laid off because of this drop in activity. But more importantly, whatever juice that was unlocked by lowering rates has already been pushed into the economy. Banks loved the easy money that came from refinancing loans lower. People that save $100, $300, or $500 a month just by refinancing free up extra spending in the economy. For the past four years we have been giving homeowners a boost each month. That boost is dramatically slowing down in 2013 and many metrics on housing are reflecting this change in pace.

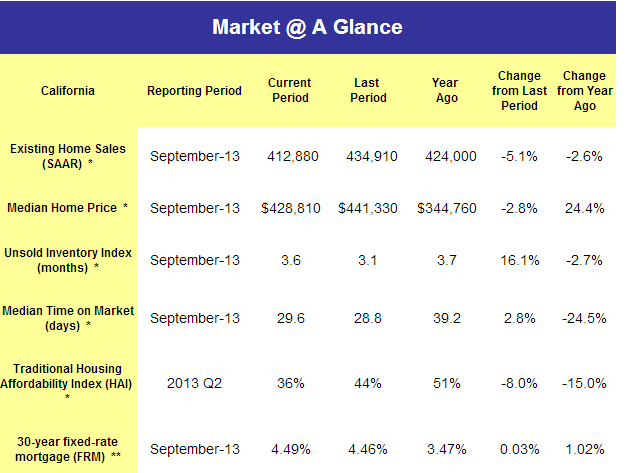

California market at a glance

Even the insane California market is showing some signs of slowing:

Existing home sales are down 5 percent M-o-M and down 2.6 percent Y-o-Y. The median price dipped 2.8 percent from last month (but what do you expect after rising 24 percent Y-o-Y?). Unsold inventory is up 16 percent from last month. The data for October should be released shortly and this is where we should see the big impact of the government shutdown.

The bottom line is that a housing market dependent on multiple crutches of easy money can only keep going up if the river of easy money continues. Unfortunately we have bigger financial battles ahead as the shutdown highlighted. It was interesting to see those that think housing is in a “free market†suddenly come out with microphones screaming “please come back government! We need our easy money again!â€Â This is the kind of financial system that we have created. One that is addicted to low rates but in the mean time, the country has largely forgotten of younger generations. It is abundantly clear that younger households are in a much weaker position to buy so going forward, affordability will be important. Yet some think that investor buying will make up this gap so there is nothing to worry about. Investors are still hungry for higher yields yet these recent figures show how dependent housing was on easy money. What will be the next easy money scheme to prop housing?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

53 Responses to “Is the housing boom running out of gas? Pending home sales face largest monthly drop since home buying-tax credit expired in 2010. Median price nationwide drops.”

Spot on analysis. Throw in 1995 levels of mortgage purchase applications and declining real median household income, and the bubble may pop…. again.

Subprime 2.0

Someone needs to do a paper on the evolution of post industrial economies. Once the standard of living is raised to a certain level and can no longer be supported by manufacturing jobs, service industries are left to grow the economy. But because they don’t create tangible goods with real value, money chases itself and feeds on itself in an endless self-destructive loop. We don’t know the eventual outcome, but the Great Recession was a taste of what can happen. People have lost the intuitive sense of value and have forgotten how to question things. To pass your Realtor exams you just need to know one answer: it is what it is.

Great (and true) post. You might get a kick out of a book that talks about how artificial pricing is nowadays. Particularly applicable to the service industry. http://www.amazon.com/Priceless-Myth-Fair-Value-Advantage/dp/0809078813/ref=sr_1_7?ie=UTF8&qid=1383745376&sr=8-7&keywords=priceless

It’s strange to read this post after reading in the last post about how the Chinese are buying up all our prime real estate.

If you remove the abnormal number of “investor” purchases, we would still be at the lows in existing home sales. The investor purchases are the result of the Fed’s QE and nowhere else for the money to go as the economy is not growing, same thing with stock market and agricultural land.

“The company said the number of all-cash deals hit 57 percent in the first quarter of this year (2013) compared with only 19 percent in the first quarter of 2005. Over the same period, the dollar volume of all-cash deals has risen to 56 percent from 33 percent.” http://www.sfgate.com/business/networth/article/All-cash-home-purchases-top-50-reports-says-4744757.php

If the poor exclusive California buyer did not have enough to worry about already:

http://www.theguardian.com/society/2013/nov/03/welcome-to-malibu-rehab-city

Sounds even more ominous than the Chinese.

Pending home sales dropping is basic Economics 101 at work.

When interest rates went from 3.25% to 4.5%, home sales prices needed to be slashed by about 14% in order for the monthly mortgage payment to remain the same. i.e. incomes are not going up therefore the other side of the equation requires sales prices to drop. If the selling price is not slashed then sales drop since monthly income is the driving force behind the loan the buyer qualifies for.

About to Tank baby!

Define “tank”

50% reduction from current levels

I’d love to hear your thesis on this, just for perspective.

I think it’s inevitable, as well, but just as with the stock market, irrational markets can remain irrational longer than you can remain solvent (or patient, in the case of real estate).

The macroeconomic picture says that, eventually, the piper will have to be paid, but the gov’t keeps coming up with new ways to keep the bubble going. How much life is left in this? Six months? Five years? Twenty years? That’s why I’d love to hear your thoughts…

So is this housing market gonna bust or what? Tired of all the foreplay and blue balls. Let’s fucking get a climax already dang. I’m willing to put my money down for a good time, it’s burning a hole in my pocket. Burn baby burn.

To be realistic though, I don’t see why the Fed will stop printing money. Their goal is inflation (isn’t it?) to wipe out the foreign debt, and to pump up asset bubbles of all their recent investor cronies who purchased the homes. They’re reluctant to let house prices drop again, for fear of the Chinese buying it all up. But they do want to fleece current home buyers, with another up and down cycle. Dilemmas.

It’s all about timing, trying to make sense of the whims of the lunatics in charge, and predict their next move. QE could go on forever. This could be the hyperinflation we’ve all been waiting for.

Actually, there really doesn’t need to be another down cycle, it could just go up up and away, and they could fleece the American plebeians via rental fees. Don’t let homes reach affordable levels, let the prices sky rocket due to QE, wipe out their savings so they are desperate to work as slaves, and keep them minimally fed and housed in their rentals. Autonomous slaves. Hmm maybe I should immediately trade in this green paper, for a piece of paper that says I own a house. I guess “they” could still raise property taxes whenever they want though. So still just “renting”.

The only salvation is to remain employable, have skills to trade for the currency that will have value in the future. I’d bet that the next currency will be purple paper. Or more probably EBT debit cards, with Obamabucks. If you fall behind, and can’t find a job, don’t count on a bailout though, those are only for bankers. Maybe you will be sent to an Obamacare facility for reeducation and rehabilitation, or maybe your organs will just be salvaged instead. Welcome to the New America!

A little too much shock value for me, but the macro analysis is right on. Indeed, when will it crash, and why? All this micro analysis is worthless in a world where a dial can be turned to either monetize or reduce interest rates. The question that is worth answering is…what benefits the people who own our government the most. Once you answer that, you know which way the market will go.

The answer you look for is in HARP 3.0. The banksters will sell this as a benefit that we have a moral obligation to make available to the poor homeowners whose loans aren’t owned by Fannie and Freddie – we have a moral duty to help these people.

The fact is that the motivation for the banksters is to get those loans off their books where they can’t hurt them before home prices go back down to 1998 levels where they should be. The FED’s arms are trembling. They can’t hold the roof up forever; subterranean interest rates, hedge funds funded circuitously by the FED sweeping inventory off the market; they need the coup-de-gras now – HARP 3.0.

Once you see the transfer of these loans from the banksters books to the FED via Fannie and Freddie – watch out below. This is the end-game.

Here’s some of the setup that’s out there:

“The White House has made frequent reference to HARP 3 lately, calling the refinance program “A Better Bargain For The U.S. Homeowner”. Plus, in Congress, there’s an active bill in committee known the “The Responsible Homeowners Act of 2013”. This bill could be the HARP 3 blueprint once it’s passed as law.

“By any name, HARP 3 would expand the program’s scope. Similar to how HARP 2.0 added unlimited LTV clauses to render more U.S. households refinance-eligible, HARP 3’s changes are expected to do the same.

“Among the discussed changes for HARP 3 :

Allow “Re-HARP”, the refinance of an existing HARP mortgage

Allow non-Fannie Mae and Freddie Mac loans to get refinanced

Allow larger loan sizes in high-cost areas

Allow loans from after May 31, 2009″

And here’s the kicker:

“It’s not known whether HARP 3 will pass today, this week, this month, or even this year. However, it should be noted that the Federal Home Finance Agency does not require congressional approval in order to expand HARP.

If the agency wants to make changes to HARP, it can.”

Did you catch that? No congressional approval required. The writing is on the wall.

Read for yourself:

https://www.google.com/search?hl=en&gl=us&tbm=nws&authuser=0&q=HARP+3.0&oq=HARP+3.0

Paine,

Great post. So, how do you see that impacting the So. Cal. housing market? It’s such a distorted market already…you already have semi-unemployed actors spending 6x annual income on housing without breaking a sweat.

“QE could go on forever. This could be the hyperinflation we’ve all been waiting for.”

Can’t have Hyper Inflation when the velocity of money is at a stand still. $$$ are going nowhere but the stock market and other assets with currently retarded valuations.

All of that green toilet paper is finding its way from stocks and home prices via reverse mortgages, etc. into the general market place in the real world. It’s gotta go somewhere. It won’t stay in stocks forever, stocks are just a means to an end, a representation of value in limbo, not yet realized. It’s just another fiat currency. People can sell stocks at any time. The QE money will hit the fan eventually. Sure credit crunch can offset some inflation, but credit can’t crunch forever. Green paper can be printed forever though. Not to mention all of the foreign reserves washing up on our shores.

HARP 3.0 seems like a good sign that the shakers want to dump the toxic debt onto the taxpayer, surprise surprise, and run off with the money. Once that happens they have no skin in the housing market, so won’t care to keep propping it up. This bodes well for us having an opportunity to swoop in and buy cheap homes. Seems like for this to happen though, they’re going to want to let prices run up a bit more from where they bought (unless “they” want to fuck over Blackstone), they need bag holders, everyday Joe blows to buy up these homes with liar loans from them, before they can do another up down cycle, and dump all the toxic debt onto tax payers again. Gov will probably come in and take ownership of all the underwater homes (HUD), and just turn them into public housing projects to house all the plebeians. This will be done over and over until there is no private home ownership left. Renter nation. Will probably be compelled by law to buy some kind of renter’s insurance as well lol, something akin to an HOA fee, but without the supposed ownership.

I am personally looking to buy in the Thousand Oaks Area. I don’t want to but the wife is tired of the living in a rental and wasting 160K the last 7 years. However, with prices over $314/sq ft, it is ridiculous out there. I personally believe the bubble won’t pop until a black swan event. QE can take the prices higher and higher, so pretty much in a dilemma. Been waiting for prices to come down for 3 years, should have but early last year but thought prices were high then, now they are 100K more. Args, tough decision.

Several months ago, the socal beach cities slowed down. Then, all of a sudden, over the last few weeks, beach close properties in Newport, Manahattan, Hermosa, Redondo, CdM, and Laguna are going pending at an amazing clip. This is unusual for this time of the year. I am not sure of why the sudden surge occurred, but it is possible buyers are front running the spring season.

What changed is that a few months ago the taper was almost guaranteed. Rates shot up and were close to 5%. Big Ben just couldn’t take the punch bowl away. Rates are now near 4% and some of the inventory that was languishing on the market pre-taper is now all but gone. As I have said many times, betting against the Fed or trying to outlast the Fed is a fool’s game!

@jjttkk, here’s some fabulous beachfront property. It’s only $100,000,000.00 (estimated monthly mortgage, $370,500.00)

Maybe some rich Chinese investor will pick this up and we will see many disgruntled posters here complaining about how they were outbid by an all-cash investor.

http://www.homefinder.com/CA/Playa-Del-Rey/6819-Pacific-Ave-102289618d

I bet the sellers will settle for $88,888,888. (That’s eight eights–super lucky!)

Does the property include a life time supply of earplugs

you forgt the 88 cents. But then, you tend to conveniently fit artificial numbers to your point, don’t ya?

Told you guys

Remember this joke promoted by financial pundits on CNBC

When rates rise people will rush to buy homes “Larry Kudlow” countless times.

I had interview on Bloomberg financial on this myth that I had to dispel but the reality is that you will have a better change of spotting Big Foot than seeing sideline buyers rush to the market to buy homes when rates rise

http://loganmohtashami.com/2013/07/18/housings-sideline-buyer-the-new-bigfoot/

I’m waiting for rates to rise before buying.

Agree- this “recovery” has been based solely on QE and ended when the fed started their taper talk earlier in the spring

Here is a chronology of how the phony real estate recovery fizzled out

http://smaulgld.com/the-false-housing-recovery-of-2013-and-how-it-unraveled/

“housing boom running out of Gas?” Apparently not. Everything is peachy though:

the stock market is up and up and up up…

housing is up and up,

No inventory … ehh

Holidays are coming make sure you consume as much as possible… you country needs you to… after all people a house rich again… yippie yeah!!!

As long as there’s a cold 12’er of Bud Light in the fridge every night, who cares about anything? Just live your life and feel good.

Here is what Mortgage Bankers Association says:

“Many of the recent job losses stem from the rise in interest rates and resulting decline in mortgage refinancing activity. Rates for 30-year fixed mortgages have risen to 4.13% from 3.35% in May. The Mortgage Bankers Association estimates mortgage refinancing volume will drop to $989 billion this year and $388 billion in 2014, from $1.2 trillion in 2012.” And, when rates regress to the mean of 7% what the hell will happen? Of course, that might take 400 years.

This is what is great about the Fed, a stable, smooth economy where tens of thousands of finance/mortgage specialists are thrown out on the street every 4 or 5 years. Not bad, drop from 1.2 trillion to 338 billion. The magic of manipulated interest rates.

the feds stated that there be no more bail out for banks with tax money. unsecured credit holders will take the hit which means bank deposits. like in cypress, bank holiday will be coming.

Cash in your hand will be king. Precious metals will be a plus. Cash in larger bank may not be there…

Yeah right, they’ll just pull another Taper fake out.

The only way for bankers to keep making the profits they do, is by eating up all the delicious profits, taking all the benefits, and shitting all the liabilities onto the tax payers. This is the name of the game. They keep the profits, we keep the toxic debts. Oh wait, you thought they were there to serve you? Lol

On Fast Money or Kudlow yesterday, there was a guy who more or less made the point that the Fed under Yellen is setting up to possible extend tapering to 2017. Sorry, I wasn’t paying close enough attention to all of the details to recite them, but it would be interesting to see the taper punted that far away.

Rates are rising, better run out and buy a house before rates go any higher.

Rates are falling, better get locked in now, great time to buy.

Values are rising, buy now or be priced out forever.

Values are down, great time to buy the dip.

For God’s sake people get out there and start buying, the time is now.

You’re ready for a REALTOR(r) license!

Maybe he is. For those of us who are level headed and know what we can afford, are you telling us this is really a bad time to buy.

Or, by reading your post, do you just have a personal issue with how CA, and SoCal specifically, RE and other social and political dynamics have progressed thoughout the years.

Don’t know how long you’ve been posting here or elsewhere about RE, have you ever believed that there is/was a good time, at the time, to buy? If so, please link it.

Otherwise, from the standpoint of a person who’s seeking good, unbiased, objective, opinions, yours is hard to take seriously.

Policy-makers in D.C. have essentially given up on the notion of making the sort of tough decisions necessary to strengthen America’s middle class (reduction in military spending and spend in global influence, increase in tariffs/VAT’s, increase in expensive public investments in infrastructure, punishing corporate job exporters and tax evaders, etc.), and have doubled-down on using the worst possible economic multiplier conceived — propping up home values — to build consumer “wealth.” The majority of Americans are home “owners” and 100% of the real power brokers are owners (George Carlin’s “ownernship class”), so this ill-conceived tactic will not be abated nor successfully attacked by either the populace or the power base.

A paradigm shift in what the American Dream means will be necessary in order to escape the golden sarcophagus trap that has been set for us.

“Single home buyers have been suppressed for the past three years by restrictive mortgage lending standards, which favor dual-income households who are more likely to have higher credit scores,” noted Lawrence Yun, chief economist for the Realtors.

Love how the NAR spins…

So making sure you have income to pay the note and the credit worthiness to be trusted to do so is restrictive? I can’t see how these guys in the FIRE economy sleep at night… Any person of ethics would have a break down from all the required double think. Tellys you a lot about the sociopathic leanings og guys like Yun, Bernanke, Yellen, etc.

Cognitive dissonance. I sense that they are setting the stage for the next wave of subprime.

Here in Naples Florida new housing construction is in high gear. Baby Boomers started to retire in 2010 with a new found source of funding: Social Security. They don’t need to sell their house to younger generations to buy a second house. They are financing new homes with Social Security. It’s back to the races here. New home construction is everywhere and failed developments from the past bubble are being completed. Normally I am a contrarian but my eyes see building everywhere.

lol…I’m in Naples, too, from Southern California. But it’s such a different market here. You see how these developments go from the $200s to $1+M–there’s something for everyone. A lot of folks switch their full-time residency to here to avoid state taxes. The quality of life is exceptional. You only need your “old” home for July and August when the thunderstorms come. Why would you want to spend your sunset years in Torrance when you can go walk around Waterside Shops?

Increasing home prices is just bad for America. That just means less money for the average hard working American to spend their money on things or services that can stimulate the economy. These new generations are being screwed over by make homes so unaffordable. The government has artificially blow up the housing market again by keeping housing inventory low and interest rates low… and then claim that the housing market is recovering. This is a fake recovery base on the Fed’s QE, which they will never taper because as soon as they do, the whole market will crash. I am just sick to the stomach. It’s all going to end bad.

>> Increasing home prices is just bad for America. <<

I agree. What surprised me was that "progressives" disagree.

For decades, I've heard "progressives" complain about the high cost of housing. But then when housing began to tank in 2007, "progressive" pundits complained about THAT.

I suppose it was partially because Bush was in the White House, and "progressives" bashed anything that occurred under Bush, especially with an election coming up.

But also because many Americans are schizophrenic about political policies. They want to buy cheap houses, but want their own house prices to rise. Just as they want less taxes, but more govt services.

“You want the prices of things to go down, but not the prices that you sell. You want the prices of the things you buy to go down and the things you sell to go up. Well that’s a neat trick if you can do it.” – Milton Friedman, The Phil Donahue Show 1979

Real estate and equities are headed higher for the next couple of years. There’s no other game in town and the banks are sounding sketchy. Might as well sink your dough into something valuable or at least paying a return. Govt debt is now in scary land and pays nothing anyway. So it’s off to the races. Only problem is that this too will run out of gas….and when it does…..BOOM BOOM, OUT GO THE LIGHTS.

Good article here with quite a bit on the housing market

According to a recent post by Zero Hedge, “The ‘Oh Crap†Moment For Housing is in the Canâ€, Mark Hanson stated the following:

http://www.silverdoctors.com/coming-of-qe5-much-higher-precious-metals-prices/

Thoughts on the new mortgage rules about to kick in Jan 2014? Ability to repay, mortgage payment can’t exceed 43% of your monthly gross pay..I’ve been reading this blog for over 4 years now and I don’t recall The Doc touching this subject

Yeah my guess is that it won’t amount to much in the long run. Rules tend to get modified, loopholes will be exploited, and semantical games get played.

“Ability to repay, mortgage payment can’t exceed 43% of your monthly gross pay.”

My gawd. That means you’re allowed to commit 50% of your NET pay, which is what counts, toward your mortgage…..before utilities, house taxes, and all the extra expenses that come with home ownership.

If this is “conservative” and “sensible”, we’re well on our way to another financial meltdown, which of course we already were.

A sensible standard would be no more that 33% of your pre-tax income, or 25% of your net, especially considering that most people these days carry not one but at least 2 car loans, as well as college loans, and are confronting higher food and utility costs.

Leave a Reply to Lord Blankfein