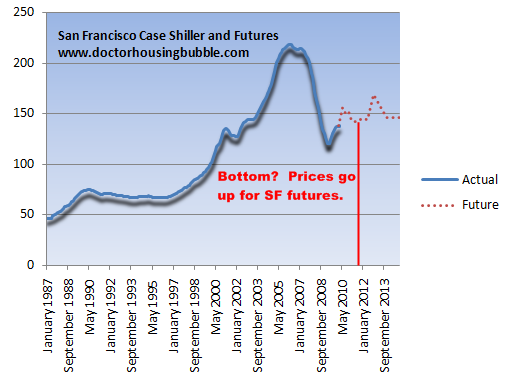

Futures market predicting housing bottom for Los Angeles and San Diego in May of 2012. LA to drop 12.8 percent and San Diego to drop 26.8 percent. San Francisco future predict increase in prices?

The futures market is betting on a housing bottom for Los Angeles and San Diego out to May of 2012. This prediction seems to coincide with many of the toxic mortgage reset/recast charts that we have now etched to memory. These futures contracts reflect real money at play. People that invest and understand these more “sophisticated†investment products are betting on still significant price declines for the Los Angeles and San Diego Case Shiller measures. Interestingly enough, for San Francisco the futures market is predicting increase in prices although this is by the far the most over priced market in the state. Two out of three winning bets in Vegas makes you rich.

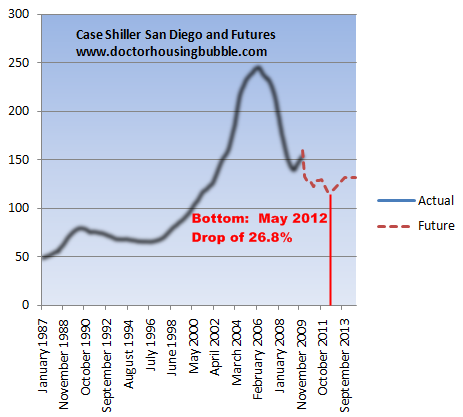

First, let us examine the Los Angeles chart:

I went ahead and compiled a chart that includes the latest CS data and plotted out the current futures contracts that extend out to 2014. Not much is trading beyond 2012 however. For the LA area, the markets are predicting an additional 12.8 percent price drop for the entire region. Keep in mind that for the Case Shiller data on Los Angeles we are also including Orange County.

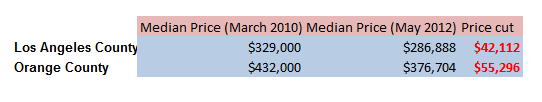

For example, according to Case Shiller this is what is reflected:

MSA:

Los Angeles-Long Beach-Santa Ana, CA Metropolitan Statistical Area

Counties represented:Â Los Angeles CA, Orange CA

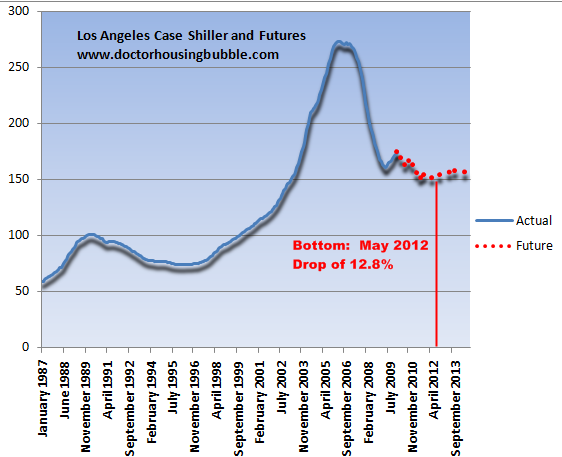

The San Diego MSA simply looks at San Diego County. So how much does this drop represent in prices? Let us compile that:

Are you interested in losing $42,000 or $55,000 in two years because you decide to purchase today? Keep in mind these are actual money bets predicting additional price declines from where we stand today. I would venture to say that in some areas like Culver City and Pasadena price declines will be much steeper. The futures markets do not see any price increase for the next few years. So the rush to purchase a home today doesn’t seem to be grounded on any facts or market trends.

It seems that San Diego will face the biggest price drop:

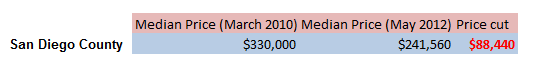

The markets are betting on a same trough date as Los Angeles but the actual price decline is much more significant. The market is predicting a 26.8% decline from the current point. What does this translate to in dollars?

Are you open to losing $88,000 in equity for buying today because of a state tax credit that doesn’t really even do much for your tax situation? Are you willing to lose $88,000 just for a low mortgage rate? Keep in mind that if you decide to sell in the future with higher interest rates, what makes you think other families will be able to afford the home with a now higher rate? Unless the state of California starts shooting out high paying jobs in mass, the market will be slow going for years to come.

The state budget and all problems associated with that will keep a lid on the housing market for years to come. It is interesting however that the futures are predicting price increases for San Francisco although this is probably the most overpriced real estate in the nation:

It doesn’t look like we’ll be heading back to the peak but prices seem to be going up at least if you believe the current bets. I tend to believe that the MSA trend with Los Angeles and San Diego will also play out up north. Local area incomes still do not justify current prices. Low interest rate or not, prices will start trending lower.

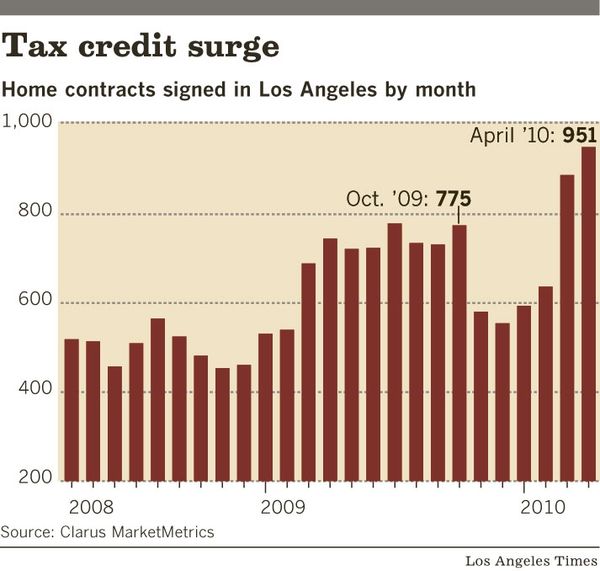

If we look at data closely it is clear that the recent tax credit that expired did pull demand forward at least in Los Angeles:

Source:Â L.A. Times

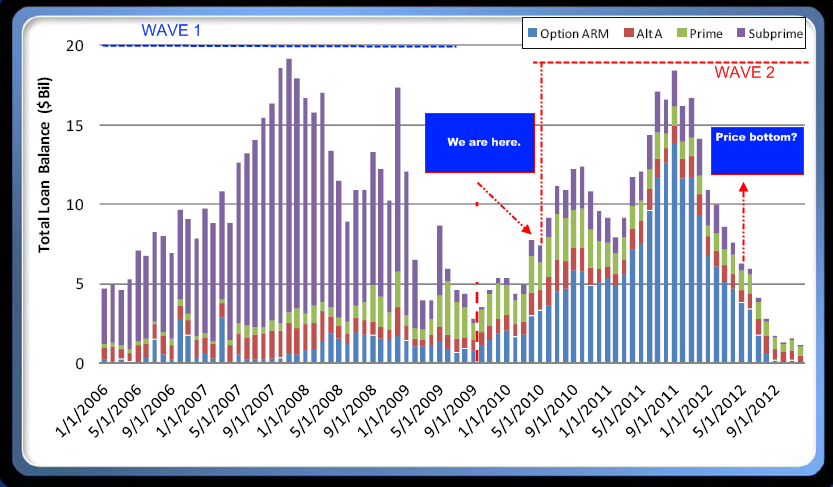

But what now? Now that the federal tax credit is over and the state tax credit will finish up in a few months, what will be the next step? The futures markets tend to believe we are heading down this road:

Seems that we are tracking the above even after trillions of dollars in bailouts to the Wall Street bankers. Now what really did we accomplish with all that money flowing to the banks?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

24 Responses to “Futures market predicting housing bottom for Los Angeles and San Diego in May of 2012. LA to drop 12.8 percent and San Diego to drop 26.8 percent. San Francisco future predict increase in prices?”

The chart shows a bell shaped curve — I think a black swan event, economic collapse and subsequent leasing will take prices back to the 1992 level — things have a way of reverting to normal.

Irvine Renter in article Government Sponsored Loan Modifications Are The New Liar Loans relates that (the banks) “are choosing squatting over foreclosure because when they foreclose, declining neighborhood values encourage too much strategic default. Of course, the squatting causes its own issues including moral hazard, but the banks are so desperate they are choosing moral hazard to stay alive — a zombie existence.â€

The zombie existence comes by the FASB 157 entitlement, where banks value assets at manager’s estimate rather than at market.

Banks such as SunTrust Banks, Inc, STI, were capitalized with TARP funds; and as Irvine Renter relates should have been nationalized.

So the question comes up, why were the banks not nationalized? The reason being, is that there was forward thinking on the part of Ben Bernanke and other central bankers, finance ministers and heads of state to effect a political and economic coup de etat by trading out Government Treasuries for toxic debt of all types under a global program of quantatative easing.

And these leaders congratulated themselves at a May 5, 2009 Bilderberger Meeting as recorded by Elaine Meinel Supkis in article Bilderberger Secret Name List Leaked In Germany.

Astute investors would have gone long March through May 2009 in the financial sector with the ETF, RWW, which is the Ben Bernanke Portfolio, that is the financial institutions chosen to be the very foundation of the new and prevailing state corporate rule.

While some don’t see interest rates rising very fast, I see a black swan event, perhaps a failed Treaury auction, or war between Israel and Syria, where there will be a sudden evaporation of liquidity, and no money at the US Treasury for weeks.

Then there will be an interest rate vacume, and real estate prices will collapse, and the zombie banks will be faced with a predicament because most of their assets, the US Treasuries received via TARP are on reserve at the FED receiving 0.2% interest, and these will plummet in value; and the market value of the banks will plummet, resulting in the banks forcing the squatters out and commencing a leasing program. The new era of leasing will begin and the prior era of mortgage lending will cease.

I am surprised the way they are releasing these properties. It is a perfect statergy but who is coordinating the property release in the market between different banks. I am seeing few properties come in the market and get sold before the next batch come in. I can only talk about Cerritos and can tell you that there is a panic amongst the buyers. I also noticed that American people are not paying attentiion and did not react to 1 Tri. dollar bailout over the weekend (We are too busy in watching Lakers game). How can someone make such a important decsion over the weekend without any discussion ? Bailout for everyone but not for hard working people like me. My 4 yr old always ask me when I will buy her a dog ? She is not very happy listening to same answer “WHEN WE BY THE HOUSEâ€. I am not shure when that will happen ?

I think you should just find somewhere to rent that will take a dog :). It is not worth giving up living waiting for the insanity of CA housing to become sane. And as per the Doctor, it’s also probably a bad idea financially to buy now. So look for a rental that allows pets?

@ theyenguy

Yep, Yep…The Bilderberger Commission, Project INOC, New World Order- Its happening!

The sheeple (CONSUMER) cannot see this because everyone is too concerned about their soon to be worthless properties… Wake up SHEEPLE!

I was a business major, with an econ. minor. I ran a successfull business in CA. for 10 years, before selling out in my late 50’s.

There has never been a time, in my lifetime, with so much economic uncertainty. Do not buy a house, or make any ecomomic decision that locks you into payments for years.Send your kid to a community college, not an expensive private collage. Do not “jump” at something that looks like a great deal. In 1970, if you had told me that GM, Montgomery Ward, K-Mart, Chrysler,etc.,etc. would all go bankrupt, I would have thought you insane.

In the next two years, life savings are going to be lost by thinking this is all behind us. Does not matter if you are a Dem., GOP, liberal,or conservative.

No one, and I mean NO ONE knows how this will play out.

Is there away to superimpose the Case Shiller San Diego MSA on top of the futures market for the same period (say two years ahead of time) to see how well the futures market has predicted actual price moves? I’d be particularly interested to see how far ahead of time it predicted the price bump from last year.

I love my dog. That being said my kids are 14 and almost 12. They wanted a dog for years and we finally asked our landlord if we could get one. He had just adopted one himself and said why not. We adopted him last may and started looking for a rental with a patio. Our new landlords met the dog before we signed the lease. The townhomes in our place have been selling for 400k with a 1.25% property tax rate and a HOA of 300.00 a month. We rent our newly remodeled, dogs welcome Fountain Valley townhome for 1600.00. I’m just sitting on a large down payment and enjoying my life. Sometimes you can’t wait for that perfect situation.

I love my dog. I would rather be homeless with my dog than live in a 20000 sq foot mansion without her. So, what do I do? I rent a cabin near Santa Barbara for $1100 a month. The house across the street from me, if you can call it that (it’s a half mile away) languished on the market for the last 2.5 years, dropping from 2.4 million to a 1.3 million sales price. Buy at your own risk. I’ll keep renting.

Agree with everyone else. This is not the time to buy. You can rent much cheaper, and in the event you loose your job (not a pleasant though, but a real possibility),you can MOVE to another job. If you buy now, and loose a job, you are STUCK.

My guess is that overpriced areas like Culver City, Pasadena, Santa Monica, Brentwood, Sherman Oaks, etc. will drop more than 30%. Sub-prime areas will probably not drop at all, or might even increase in price. So, an overall drop of 12.8% might be fairly accurate. We will know in two years.

Puzzed in Pasadena I agree.

I think the problem is that the dems are trying their tried and tested solutions and the repubs are trying the tried and tested solutions. The problem is that both do not work. We have a new problem and unfortunately they are trying their old playbook.

I myself am keeping everything liquid. I mean before it was companies that were collapsing and now it is countries. if ever we come that situation, God help us and unlike the Greeks, our citizens are all armed..

The Euro bailout is the same bailout we did. The Greeks don’t get any money–just the crony bankers get bailed out. This is a money-driven world. People will not always do the right thing if money or sex (another form of money, let’s face it) is involved. The Manhatters understand this. It is all about control and money, and when they have us locked into usury loans, they have both. And actually a thrid thing. The Man-hatters don’t need the money but take sport in getting something cheep. Heard an old comedian: “I got it for wholesale”, “I got it for cost”, “I got it for less than cost”, “how’s he do that?” “He sells a lotta watches”

The Man-hatters have just about got us locked up, so keep rowing that slave ship SoCal. …. Heard SUV’s are flying off the lots and hybrids are languishing. Americans don’t have a clue as they are doing the same things again and expecting a different outcome.

This time is different. When housing crashes again, which it really is now despite all the backstops and bailouts, they’ve already fired the whole quiver. What’s the next trick. Next year all the two-year debt will have to be rolled over while the paper the gov and fed are holding is still mostly kitty-box liner. We’ll see.

China is backing off big time and their market is down over 20%, so far. This is not a good sign for the planet. Unless the federal govt wants to see unemployment sky rocket from state and local lay-offs, they’re going to have to bailout a bunch of states. The US$ will get hammered and people will feel more financially threatened than ever. Good time to buy a house? I think not.

In my hometown of Chicago finally in good neighborhoods we are seeing foreclosures. They are down by 50% to 60% from their peak prices. However, I am happy renting. No thank you, I will just wait it out.

I think property prices have much longer way to go down. What I will never understand is this obsession we have in our country with “owning” a house. Whenever I get together with family or good friends, I hear the same thing “when are you going to buy a house?”, “it’s a great time to buy, if you don’t buy now you will be left in the dust”, “you gotta buy now”, etc…. Oh well, to each their own!

“Tried and tested solutions” on both “sides” are either kick the can down the road non-solutions or scams.

Democorp politicians = Republicorp politicians = user interface for a crime syndicate of, by, and for the elite.

All Congressional incumbents need to be voted out of office in 2010.

I think the futures data for San Diego and San Francisco were accidently swapped. I just looked at the futures data for both of these markets and they both predict a decline. San Diego is predicted to bottom in May, 2011 at an index value of 141.8. San Francisco is predicted to bottom in May, 2012 at an index value of 117.

Oops! A whole 10% delinquent mortgages and 4.6% in foreclosure for the first 3 months of 2010. Delinquency is up from 9.5% for last 3 months of 2009. Oops!

Yep these stats are EYE POPPING!

http://news.yahoo.com/s/ap/20100519/ap_on_bi_ge/us_home_foreclosures

the 1Q numbers are in for the general public to consume, and they are not looking good at all!

NickHandle is right. Most of the drops in the lower priced areas of LA county have already occurred. The 30% drop is going to come from the “insulated” areas in central LA and high-demand suburbs like Pasadena. Even though LA is mostly built up, there was an increase in housing stock over the past 10 years via condos and SFH going up on lots that were marginal before the boom. More homes + fewer people= higher prices? Not for long, look for prices to come down to meet market demand. Downsizing boomers will also have an effect. Tons of houses in W. LA, Santa Monica are going to be sold in the coming decade putting downward pressure on housing.

Hope there is a bottom, but I think it’s a generation away. What makes you think doing the same thing as Japan we will have a better outcome? We have far more financial infrastructure problems than japan and they have been drifting down for 20 years. I’ll be dead and gone before SoCal recovers. Remember they own a trillion of our bonds and who knows home much real estate in US. We have a thousand times the debt of Greece and they are taking the whole world down. Why hasn’t anyone noticed 800 Ton Blue Whale in the room? Our biggest trading partners going into forced austerity?

If things are getting better, why are interest rates still at 0? Recession? Depression?

Dus this have thow have a mug of ale for me and me mate? He has been pitched in battle for a fort night. And has a kings thirst for the frosty brew thuse thow have for thuse.

Welcome to Medieval Times and the Dark Ages…Next, All-States Bailout–People? No, banks again.

1998 is when they really started taking off. That was the year the CRA was expanded.

Considering the federal government is originating almost all of the new loans, the bubble should remain until the government itself defaults like Greece.

Re: 5/18; yes, DHB, and yes to commenters.

~

I’ve been sharing Shiller and futures data with anyone who will listen in my circles, particularly the young people who just found good jobs and want to get started with their lives by buying a house, etc. This DHB posting will come in very very handy, thanks Doc.

~

We observed the other night driving to our part of the woods how interesting it was not to see huge beds of FOR SALE signs sprouting everywhere. For a few years it was like Burma Shave on crack around here.

~

I still see the bottom no earlier than 2013, and wouldn’t be surprised to see Dark Ages proved correct: that the bottom won’t come for a generation. The globalizers set out to destroy the US in the 1960s and 1970s. Their agenda is playing out. Question is: how will we keep the US from being destroyed, and how will we decouple our own expectations from the insane notion that the globalizers’ culture represents a better Good Life than the old view of life, liberty, and the pursuit of happiness for all, in freedom.

~

Maybe some of you have seen this chart, correlating money and happiness.

http://www.infographicworld.com/work-money.html

~

rose

Yes people are still listing (and even selling) for crazy prices in prime LA. My neighborhood is really not that fabulous and there are many homes (not very big) listed above $1mil. Plenty of realtors still blowing smoke. We all know it’s nuts, but folks I know who should know better don’t seem to get it. I think it’s just pent-up demand: people who have been looking for the last 4 years or so and now’s the time!! And I keep saying do you really want to lose $200k on that within 3-4 years? And they keep saying ‘prices are down!’ And ‘your predictions aren’t coming true and homes are selling.’ Whatever, I’ll continue to save and happily rent. 3 years is a long ways away. Who knows maybe it will be good bye Cali soon after that anyway… or maybe I’ll take one of those houses from them for a cool 30% discount (like the commenters above say- that’s what I’m thinking, too).

Hope there is a bottom, but I think it’s a generation away. What makes you think doing the same thing as Japan we will have a better outcome? We have far more financial infrastructure problems than japan and they have been drifting down for 20 years. I’ll be dead and gone before SoCal recovers. Remember they own a trillion of our bonds and who knows home much real estate in US. We have a thousand times the debt of Greece and they are taking the whole world down. Why hasn’t anyone noticed 800 Ton Blue Whale in the room? Our biggest trading partners going into forced austerity?

If things are getting better, why are interest rates still at 0? Recession? Depression?

Dus this have thow have a mug of ale for me and me mate? He has been pitched in battle for a fort night. And has a kings thirst for the frosty brew thuse thow have for thuse.

Welcome to Medieval Times and the Dark Ages…Next, All-States Bailout–People? No, banks again.

Leave a Reply