Frankenstein real estate market – $3.5 trillion in commercial real estate debt and $10.3 trillion in residential real estate debt. Will we reach a 50 percent underwater market where 25 million Americans sit in homes worth less than their mortgage?

The real estate market has morphed into a beast that is largely sinking the overall economy into the ground. If we combine the commercial real estate market ($3.5 trillion in debt) with residential outstanding mortgages ($10.3 trillion) we arrive at a figure that nears the annual GDP of our country. What makes the figure even more troubling is the amount of leverage found in the real estate market. Many of these loans will default yet banks are maintaining the notion that at some point par value will be reached; for many the par value scenario is the worst case they have mapped out, and this is highly optimistic. We have created a real estate Frankenstein that now has a mind of its own and will do everything it can to stay afloat going forward, even at the expense of the real economy. In fact, the real estate monster thinks it is the economy.

There is a flip side to housing values falling which seems to be ignored since most of the mainstream rhetoric is guided by the FIRE (finance, insurance, and real estate) experts. The most obvious benefit is those looking to buy their first home don’t need to put themselves into so much debt that they risk their entire financial future for a home. The next subtle change is the amount of money diverted from housing related spending to other sectors of the economy. This last change will take time to sink into the overall economy but there is definitely a benefit of moving away from an economy highly dependent on Wall Street finance and real estate.

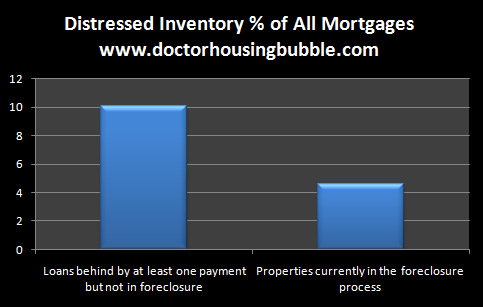

If we look at the current nationwide situation, the amount of distressed loans is stunning:

I think that the above disaster in distressed mortgages is causing very little reaction because we have somehow adapted to the current shocking situation. Over 10 percent of all U.S. mortgages are at least one payment behind and another 4 percent are already in the process of foreclosure. This figure is incredible given the entire mortgage market is made up of over 51 million active mortgages. In 2007 if you were to tell someone that prices in California would fall by 50 percent (even 10 percent) many would have ignored you. Now, it is standard practice for the market.

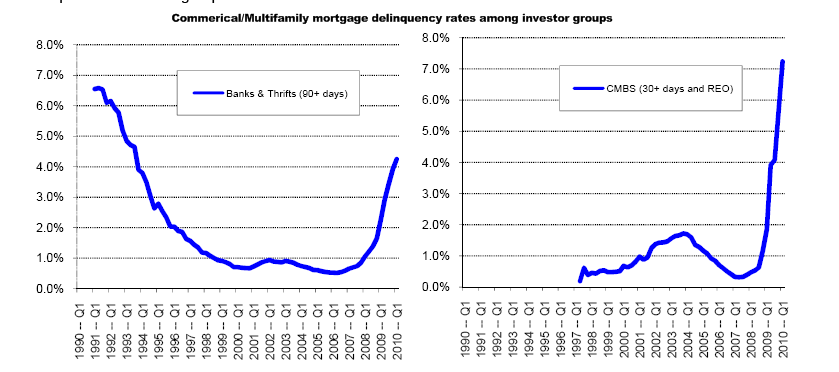

As a country we are much too reliant on real estate. Commercial real estate is the next tragic saga in the RE bubble bursting with prices already falling by 42 percent. At one point, CRE values in the U.S. were up to $6.5 trillion (now this was a rough generous estimate at the time). Today, CRE values are down closer to $3 to $3.5 trillion; this is roughly the same amount of CRE loans outstanding. This has pushed defaults through the roof:

The exponential rise is cause for serious concern. There is little energy or political will to bailout the enormous CRE market. This probably won’t stop the Federal Reserve and U.S. Treasury to game the system yet again and put taxpayers on the hook. They created this massive monster and now want the public to fight it off with pitchforks. The above chart is disturbing and the amount of bank failures we are seeing is directly related to the above trend. Many smaller banks are deep in the trenches with CRE debt and much of this is now going bad. How many strip malls do we really need? Maybe having 20 Taco Bells in a one mile radius probably isn’t such a good idea. Many of the commercial projects were built in the anticipation of sky high residential prices to justify their absurd underwriting expectations. The above results have no excuse and are largely a reflection of massive delusional speculation in all things real estate.

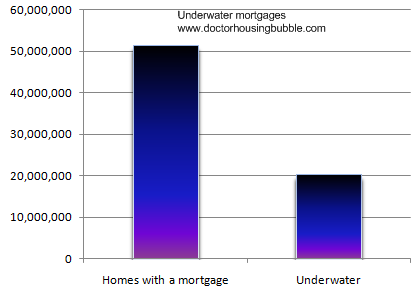

Now that expectations are coming more into line and the fantasy world of Alt-A, subprime, and option ARM loans are behind us, most people have to qualify to get a loan with actual real income which many are now finding less of. Banks lending virtually all government money, are now beholden to stricter (aka basic due diligence) in order to give out loans. Yet if we look at the negative equity situation, the real estate monster grows scarier:

Over 20 million mortgage holders are underwater. It is amazing that a few years ago, Deutsche Bank estimated that at the ultimate trough of the housing market, nearly half of all mortgages would be underwater. This “doomsday†scenario seemed extremely farfetched. Today, another 10 percent nationwide price decline would put us there. Even without prices declining further, having 20 million Americans underwater is not a good sign going forward. You figure over 7 million people are one payment behind or in foreclosure. But what about the other 13 million? This enormous group is basically a large cohort of renters but in a worse financial situation. They are stuck.

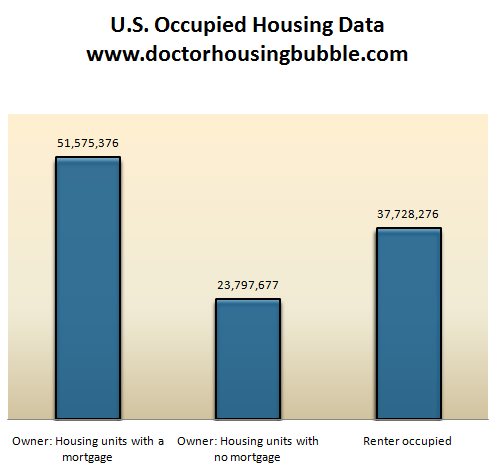

In this market, renters are treated as second class citizens although they make up a large part of the market:

1 out of 3 people in the U.S rent their place of residence. In states like California the number is closer to 1 out of 2 (some counties have more renters than owners). Yet there has been little discussion about this market. There have been programs to defer or even help in paying for mortgages of those who lost their jobs but what about those who rent and lost their jobs? Who are we helping here really? If anything, this is a transfer of wealth to banks since many of these people will lose their home anyway. I’d be curious to see a breakdown of the “official†15 million unemployed and their housing status. Trying to keep housing prices at levels that were clearly unsustainable is bad policy going forward and is partly a large reason why the economy is still muddling through.

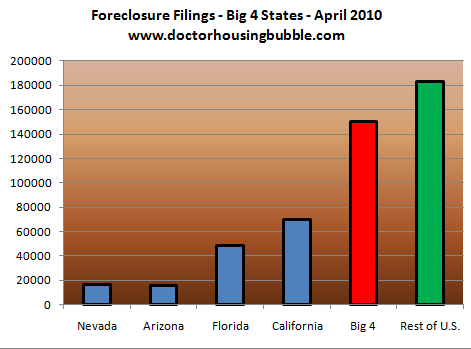

Most of the parts of this real estate Frankenstein show up in a few common states:

Nearly half of all the latest foreclosure filings came from four states. The concentration of toxic mortgages in these states and also, the massive jump in prices is still hurting the market years after the bubble burst. With the employment market weak and anemic, there is little reason to believe (or even hope for) higher housing prices. This actually hurts those who will buy in the future and commits a large portion of their income to housing moving forward. This also means they have little money to spend in other areas of this consumer based economy. So this idea that we need to keep feeding housing is really a preoccupation and obsession that comes from the FIRE economy. These bad habits are hard to change and so far, little has been done to change this. Normally it takes drastic circumstances to change people’s behavior. You would think that the deepest recession since the Great Depression would do that but it hasn’t. People realize what needs to be done merely by intuition yet we have no Pecora to move the political wheels forward. The deep capture of our government to Wall Street is stunning. And because of this, we have a massive real estate Frankenstein walking around our country bumping into taxpayer dollars at every turn of the corner.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

24 Responses to “Frankenstein real estate market – $3.5 trillion in commercial real estate debt and $10.3 trillion in residential real estate debt. Will we reach a 50 percent underwater market where 25 million Americans sit in homes worth less than their mortgage?”

I live in the San Francisco area, very near to a newish business park. The park currently has at least 5 vacant office/light mfg. buildings for sale(2 were never occupied, other 3 moved out).

A sign just went up that they are breaking ground on FIVE new office buildings.!!

Can someone explain the logic of that, to me??

Albert. Yes. I can explain the logic. They start building now, and by the time the buildings are finished in three years, the prices will be up again.

What these people haven’t realized is that Yogi Berra was right when he said, “The future ain’t what it used to be.”

San Francisco had all the new commercial/residential development in the pipeline years ago. Buildings are being handed back to lenders, but this long-term building plan goes forward whether it makes any sense or not.

@Albert

I’ve seen the same thing in Tampa. Empty buildings, new one’s being built. Developers will build on every square inch of land if they are allowed. Demand is no reason to build. Like despair.com: “If you can’t be part of the solution, there’s good money to made in prolonging the problem.” That was for Consultants, but developers and all things FIRE fit perfectly.

As a speculative investment vehicle, tax shelter and source of tax free funds besides it more blue collar daily use for collateral loans, all make housing a critical part of the financial landscape. The other issue is that its a key element of the post world war two economy with the automobile/truck providing transportation for the continued expansion of the urban landscape. The asset deflation in housing probably indicates changes ahead for our economy as growth based upon cheap available energy seems to be coming to a close.

I’ve noticed a trend lately….local govts are trying to raise property taxes to increase their revenue. Parcel taxes, specifically. But it’s starting to look like home owners could become tax donkeys and that wont help their market at all.

What happened to the government’s great push for housing affordability. Shouldn’t this new era of affordability be celebrated? Oh that’s right, the economy was running on debt, and houses were not homes but credit facilities you could live in.

The nationwide overvaluation was a product of the FED and non-existent underwriting standards. The ability to market the mortgages to investors relied on turning the mortgage investment into a Quisinart so opaque that investors bought Standard and Poors ratings and did no due diligence themselves. Fraudulent triple A ratings allowed this toxic 100% LTV, NINJA crapstorm into 401ks and public retirement portfolios like illegal immigrants – they had no right to be there.

When this Hindenberg of pyramid schemes reached its inevitable point of ignition, the ensuing firestorm should have reaped all who participated and promoted it; destroying their toxic careers and landing many of them in the big house. Instead, we’re told they are too big to fail and that if we don’t allow them to be paid ridiculous bonuses commensurate with their immense genius they will most certainly be lost to suitors lined up to french kiss them. The only useful purpose these lowlifes could provide is serving as fodder in a BP junkshot.

What should have happened is for the immense market overvaluation to have been allowed to pour back down the throats of those who financed it; allowing financial Darwinism to do its job, clearing these asshats from the landscape and relegating them to forever have their fingers smell like vegetable oil and secret sauce. Instead, to make any headway in this centralized economy you have to be a disgusting sycophant yelping at the door of the Politburo overlords for soup bones.

Throw them all out of office. It’s time for America 2.0

One-word answer to the question posed in this article’s title: YES.

@CAE

Home owners are becoming “burros” because California Republicans love letting Corporations (which are poor, repressed People, according to the SCOTUS) not pay their fair share of property taxes:

“the share of property tax paid on residential property has increased since two-thirds of voters approved California’s landmark Proposition 13 tax law in 1978, while the share paid on commercial property has decreased…many corporations are using loopholes when they buy and sell properties to avoid having them reassessed and their property taxes go up.”

http://www.bubbleinfo.com/2010/05/11/commercial-prop-13/

As Gomer Pyle used to say “SUPRISE, SUPRISE, SUPRISE!!!!”

The City of Alameda, CA passed a parcel tax 6 years ago, to “save the schools” After several teacher raises, another parcel tax was added –

“It’s for the kids.”

This year, they wanted to add a thrid parcel tax,bigger than the first 2 combined, to pay for teacher pensions and raises.

Property owners have had enough.

It did not pass.

Parcel taxes are the proverbial camel’s nose inside the tent.Once you let it in, there is no stopping it.

Before you realize it, the entire camel is inside.

“An unlimited power to tax involves, necessarily, a power to destroy; because there is a limit beyond which no institution and no property can bear taxation.” -John Marshall

I’ve heard that some banks carry foreclosure insurance, which explains some of their “irrational” behavior.

Carried by AIG, Lehman, etc.

Can anyone flesh out this story?

@Mort

I followed the Measure E campaign closely. Glad it failed. It needed 66% to pass and got 65%, I think.

I found it amazing that it got that close considering the tax was regressive, unfair and an increase while the Alameda School system was giving out raises to administrators. For the kids, indeed!!! Also, the school disrtict scores for the last 10 years are very mediocre at best.

How can the so-called “affordability” effort from the government mean “doing anything to keep the home prices high”? Lies and more lies. They just want to keep their buddies – big fish – already wealthy people making more money.

More slam dunkies from DHB.

~

There is a larger picture to all of this: the effort by the massively powerful FIRE industry and its lawyers and paid political henchcreatures to reassert a feudal system where all citizens are serfs. Michael Hudson and others have been pointing this out for well over a decade. But somehow the message doesn’t get traction because the spotlight continues to be on irrelevant details like mortgage rates going down down down, and how to give up cable TV to pay your insurance premiums, taxes, and bank loan interest.

~

The way I see it: either you’re renting from the landlord, or you’re renting from your local municipality (in the form of escalating taxation voted on by people who want others to pay for their stuff).

~

But property is increasingly meaningful only when it is owned, controlled, and speculated upon by the large trusts and cartels. I.e., back to the ages when churches and kings controlled everything.

~

And now the biggest housing landlord is the US itself?

~

cambridge has it exactly correct. Prop 13 has been abused by corporate interests from the get-go. Doc has it exactly correct. The commercial RE meltdown is going to be hideous. Sadly, I doubt that any of this will lead to a saner, more positive or productive economy. People even have gotten into the fashionable habit of sneering at The American Dream, as though it never had any merit.

~

rose

A poster threw this up on the redfin Los Angeles message boards…no information to back this up, so take it with a grain of salt. But seeing what we’ve seen and what we know of this system now, I don’t doubt it.

Apparently the banks KNOW they will be made whole by the magic of the federal government/FED (sooner rather than later):

I”nteresting conversation I overheard recently. Having been asked by a friend to accompany her to a meet and greet between distressed homeowners and representatives from major banks, I was privy a fascinating statement. BofA representative stands up and blithly assures the room that mortgage debt relief is a sooner, rather than later foregone conclusion. “How so,” he’s asked. “Simple, ” he replies, “we’re (the bank) holding off on any serious response until the federal govt. is forced to step in and take the problem off our hands. Once it does, everyone will find themselves whole again.”

Silence. From the homeowners, from the bank representatives, silence. I then ask the BofA guy if he’s serious. “Dead,” he replies.

Serial bailouts?”

Amen painesquest!

Many people hate taxes.

Why?

Show me one country that has higher taxes than the U.S. where the quality of life, by any measurable standard, is lower than the U.S.? Betcha ya can’t name a single one.

And conversely, show me one country where taxes are LOWER than the U.S. that has a higher standard of living than the U.S. Betcha ya can’t name a single one.

Countries with higher taxes have higher standards of living (like almost any European country or Canada).

Countries that have lower taxes have lower standards of living (like Somalia).

High taxes is a {“strawman” argument and has no crediblity whatsoever.

More brainwashing by those who want to turn the U.S. into Somalia…

Foolio, I would take that with a big grain of salt regarding banks being made whole in the near future. One thing is for certain, there are many responsible citizens who will not tolerage another giant bailout to these fraudulent institutions. If there are trillions of more dollars that our grandkids will be on the hook for, there will be bricks thrown through windows and cars burned in the streets…and I might be one of the people partaking in the activities. So far the sheeple have been more than happy to go along with this circus, but I think too many people have now woken up and won’t take anymore abuse.

cambridge02140

You noticed that too?

I never thought I would see the day that the public took to the streets to protect the “Poor owners of commercial realestate” and don’t forget the recent outrage from the common folk when the “poor defenceless Insurance companies” were being attacked.

With a good portion of the public thinking that way we are doomed as a country.

@Paine

Great post…thanks for encapsulating the rage that is strangely missing…

Anyone want oto comment on this? I am currently looking to buy in San Diego and have been watching things closely. Is this true?

From: Jane L.

San Diego Realtor – an expert in San Diego Real Estate – Lic # 01439083

“Is the San Diego housing market really going up as the news reports?

Our dearly beloved Union Tribune has consistently tagged San Diego as a downturned market, we were the first to hit the bottom and they have targeted that to buyers and sellers alike. In reality, the bottom hit early 2007, it is now 2010, we have seen a huge amount of short sales and foreclosures, mainly in the South Bay between the 94 and 54 last year, this year it is sporadic. We have a shortage of homes for sale, the Federal Tax break has gone, California has a $10,000 tax “credit” to first time buyers and buyers of newly built homes, the first bracket of first time buyers will be used up within a month or so, and they are anticipating the buyers of newly built homes to be used up in about 6 months or so.

So where are we exactly? Prices HAVE gone up, not much, and not like back in the day, they will continue to increase slowly, we are now in a regular market with a good sprinkling of short sales and foreclosures but everything is priced similarly – looking for a bargain here – that was last year, now everything is priced to sell correctly, no bargains anymore.

There is a funnel of foreclosures coming but it’s a funnel, there’s only so much banks can deal with so expecting a flood is probably not going to happen, it will be a stream not a tidal wave!

What does anyone else have to contribute, I’m just one opinion !!! “

@Rob

I am a realtor in Danville and have been for the past 12 years. I sold my house back in August 2007 because I know a lot of smart people who told me this was coming and convinced me to do something about it.

As for the post regarding San Diego real estate, some of it is true, but skewed. The low end of almost every market/city is good, but not for attached housing. The middle markets in almost every city is slow and the upper end is still getting hammered. In the boom days back in 04 – 06, there was a trickle up effect where people were buying bigger and bigger houses. Now we have no reverse effect as there are too many other factors crushing the market. With the change Fannie Mae guidlines allowing investors to own up to 10 investment properties, it spurred the housing market a lot.But that will end. Interest rates are nearing a double bottom and one year from now I believe they will be higher. Tax credits will be gone and inventory will be higher. Banks can’t hide their inventory forever, but they will release it slowly. Free money gives them time. The goverment should have marked to market and let the chips fall where they may.

My opinion, 5-8% decrease in pricing overall for the next year and then we bump along the bottom for years with minimal increases in valuation. We won’t see anything significant until 2013. Be patient and wait for the right deal. Don’t let an agent talk you into jumping into anything that isn’t a deal.

You fail to mention the fact that ALL of this loans are made using Fiat Currency, fairy dust, monopoly money or the honest term COUNTERFEIT money. The money loaned for all those mortgages was created by the bank at the time of the loan. It never existed prior to that instance.

HERE are some quotes on the subject:

“Some of the most frank evidence on banking practices was given by Graham F. Towers, Governor of the Central Bank of Canada (from 1934 to 1955), before the Canadian Government’s Committee on Banking and Commerce, in 1939.

Q. But there is no question about it that banks create the medium of exchange?

Mr. Towers: That is right. That is what they are for… That is the Banking business, just in the same way that a steel plant makes steel. (p. 287) The manufacturing process consists of making a pen-and-ink or typewriter entry on a card in a book. That is all. (pp. 76 and 238) Each and every time a bank makes a loan (or purchases securities), new bank credit is created — new deposits — brand new money. (pp. 113 and 238) Broadly speaking, all new money comes out of a Bank in the form of loans. As loans are debts, then under the present system all money is debt. (p. 459) ”

This is backed up by:

Testimony by Mr. Morgan, the bank’s president,First National Bank of Montgomery vs. Daly (1969)

Plaintiff admitted that it, in combination with the Federal Reserve Bank of Minneapolis, . . . did create the entire $14,000.00 in money and credit upon its own books by bookkeeping entry. That this was the consideration used to support the Note dated May 8, 1964 and the Mortgage of the same date. The money and credit first came into existence when they created it. Mr. Morgan admitted that no United States Law or Statute existed which gave him the right to do this. A lawful consideration must exist and be tendered to support the Note.

THE BANKERS ARE STEALING US BLIND. This is backed up by two more quotes:

“In 1976 A typical American CEO earned 36 times as much as the average worker. By 2008 the average CEO pay increased to 369 times that of the average worker.”

AND where does your tax dollar actually go?? To the BANKERS according to the Grace Commission report to President Regan:

“With two-thirds of everyone’s personal income taxes wasted or not collected, 100 percent of what is collected is absorbed solely by interest on the Federal debt and by Federal Government contributions to transfer payments. In other words, all individual income tax revenues are gone before one nickel is spent on the services which taxpayers expect from their Government.”

NOTE: Since 1913 the US government has been “borrowing” newly created COUNTERFEIT money from the bankers and the American suckers… excuse me taxpayers have been serfs to the bankers ever since. Transfer payments by the way are the cost of transferring money between banks. The US tax payer got stuck with that tab too, not the banks.

Leave a Reply to CAE