Foreclosure Avoidance: A Society that is Psychologically Bent On Avoiding the Brutal Facts.

Jim Collins in his book Good to Great examines the successful traits of prosperous companies. His focus wasn’t on high flying companies that made a torrent of money and suddenly crashed. He looked at the attributes of sustainable and successful companies. He offers various characteristics of these companies such as choosing the right people from the beginning, focusing on your core strengths, and also having the ability to confront the brutal facts. The last point seems rather harsh and down right pessimistic. Yet the essence of facing the brutal facts is optimistic because you cannot move on to greater and better things until you first address the underlying issues. In psychology 101 we learn that a prerequisite to having a healthy mental state is being able to confront our demons not with fear but with courage. Once we face up to what is at the root of the problem we can start to progress and live a healthier life.

So what does this have to do with the mortgage crises? It actually has a lot to do with it. We currently live in a society that is repressed on economic issues. The impending credit crises instead of being attacked at the root is being prescribed a valium to numb the current pain. Even the term “rate freeze†gives us the perception that all is well for the moment and we’ll deal with the problem at a later date. Yet this perception circumvents the true culprit and that is we are in a historical credit bubble that needs a severe correction. As a society we have not come to terms that without credit, we have a very hard time functioning. That is why even the mere hint of a rate cut makes the financial markets slap happy because it postpones the inevitable for one more day. But is this really a healthy long term approach?

A Culture of Avoidance

This isn’t only seen in the economics of our consumerist society but also the psychology of other parts of our nation. Think of the avoidance of old age. Plastic surgery and cosmetics play into this desire of the forever young and give the perception that the fountain of youth has been discovered. But again, how appropriate to have plastic cover up the real you. Is this not what is occurring by funneling credit into a market that clearly needs a massive 90210 makeover? There is no drug or surgery that is going to make this market look beautiful. Think of it as a

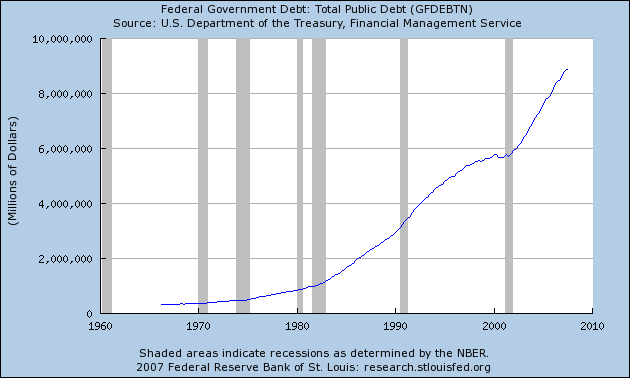

Take a look at the public debt:

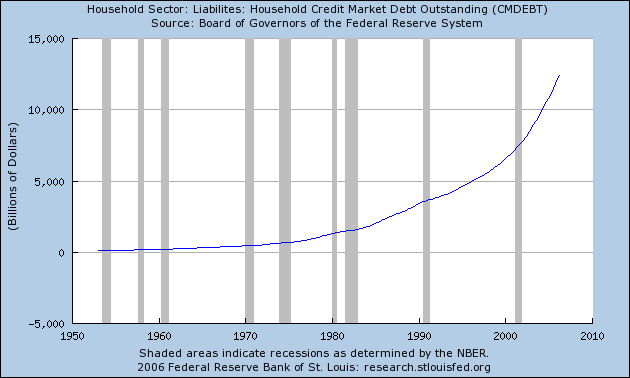

Mortgage debt is at a whopping $13.3 trillion. Couple this with stagnant wages and you realize that people are subsidizing their current lifestyle via credit.

Delaying the Inevitable

As I’ve been reporting at least here in

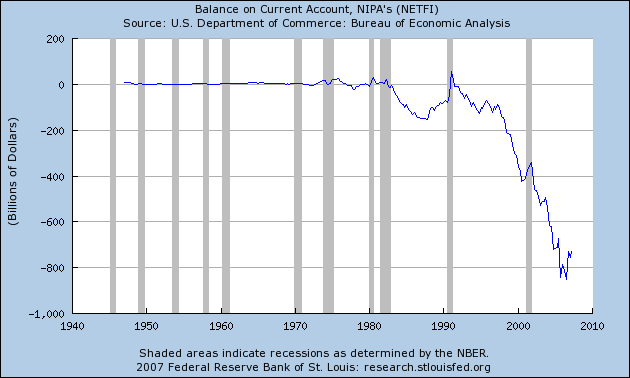

This imbalance is clearly seen when we look at our trade deficit:

Just to offer you a direct example, in the month of October we had 323,131 20-foot containers coming into the

Broken Window Theory of Mortgages

Some of you are already familiar with the broken window theory. Here’s a good explanation of the theory:

“Consider a building with a few broken windows. If the windows are not repaired, the tendency is for vandals to break a few more windows. Eventually, they may even break into the building, and if it’s unoccupied, perhaps become squatters or light fires inside.

Or consider a sidewalk. Some litter accumulates. Soon, more litter accumulates. Eventually, people even start leaving bags of trash from take-out restaurants there or breaking into cars.”

How does this apply to the mortgage and credit crises we are facing? It won’t explain the economic reason in numbers but will help to paint the picture of the psychology of what got us to where we are. The problem should have been addressed when a few “broken windows†were appearing in the mortgage industry. The first stated income loans. The early stages of fraud. Rampant speculation. An industry with no barriers to entry. Wall Street greed. These things didn’t appear with the current market but were exacerbated by the credit addiction mentality. Think of superstars who crash and burn with their addictions. When you have money, it magnifies your good attributes (donating to worldly causes) or highlights your demons (drugs and partying every night). Think of the broken window theory and why it occurs. You see someone driving a leased BMW, taking on a $500,000 mortgage, and having 10 different department store credit cards. This is the rule rather than the exception in your neighborhood. So instead of litter, you can interchange easy credit. It is easier to dive into debt when those around you follow suit. This is an observable phenomenon in sociology and goes back to the 1920s with “keeping up with the Joneses.†We can even go further back with the tulip bubble and South Sea Bubble so this is something that spans over time and is inherent in human nature. Now that the reality needs to be faced, instead of tightening up our belts as a society we are simply lowering the credit bar and trying to run on credit fumes.

I’m not sure what will happen in an election year but the real solutions exists in getting our financial house in order, for example with cram downs and stopping the credit addiction cold turkey. Isn’t it ironic that the perpetrators of the housing bubble are the same one’s coming up with solutions? This is like asking a drug dealer what is the best way for a person to recover from an addiction. Politics isn’t about what makes the most economic sense over the long run but politics is the art of the possible.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

18 Responses to “Foreclosure Avoidance: A Society that is Psychologically Bent On Avoiding the Brutal Facts.”

With WaMu now in dire straights, perhaps some of the heroin (easy credit) will be taken away from the addicts.

Excellent article. Concise, insightful and spot on. I especially like the reference to the Tulip Bubble; I frequently use it myself as a cautionary tale. I’ve been in the mortgage business since 1984 and I’m horrified at what I am and have seen in my industry in the past 5 years. I live in Phoenix and we’re on life support with no idea whatsoever as to when the worst will finally come. The prognosis is certainly not good here in The Valley of The Sun.

When my neighbors starting using their equity lines in the early 00’s for depreciable items, I knew that the foreclosure rate would go through the roof in a few years. Compound that with the lending fiasco and, yeah, there aren’t any windows left.

I agree with you about a society addicted to instant gratification, but surely you aren’t suggesting that this nation would be better off by eliminating all consumer debt. I actually favor a cash only society, but our economy would never recover from that kind of shock. We need to remember that most people have no idea how to handle money and would fail financially no matter what system they were to operate in.

“Overcoming Real Estate Losses”

http://WhineCountryRealEstate.blogspot.com/

Enlightening. Thanks to the author!!

I recently discovered your blog, and enjoy reading it. I do note that it is somewhat ironic that, in this excellent piece on the dangers of credit, the in-line adds associated with the words “credit cards” are invitations to take out more credit :).

–Kibitzer

This is absolutely true. The most disturbing part of this is that our political leaders and leading presidential candidates (save Ron Paul) all go on reassuring us nothing fundamental needs to change! In my opinion, we can either do some belt-tightening now or we can wait for an Argentina-style collapse a few years down the line. Your thoughts, doctor?

When I see the CEO of Freddie Mac talking publicly about the coming impacts he expects from the spectacle of people standing on the lawn with their furniture after an eviction, it gives me a tiny bit of hope that the meaning of all this is starting to get a toehold.

But just a very tiny bit…as we await the announcement this hour of another shipment of credit crack being unloaded from the USS Bernanke.

Bob

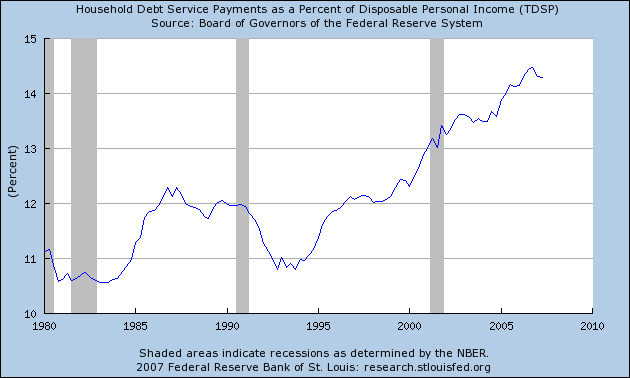

The last graph is interesting, but isn’t really useful in analysis of the housing market. This is because Baby Boomers, who by and large don’t have a lot of debt, are a larger percentage of the population. But, they are not the people that traditionally are housing consumers. BB’s are nearing retirement, so are either going to stay put, or downsize. The useful information would be debt levels of the 25-35 age bracket, because they are the people that are going to be buying into the next phase of housing. There debt levels, thanks to student loans caused by loose credit driving up the prices of degrees, are out the roof. For them to afford a house, we can’t just use the typical 2.8x yearly income, that will need to be much lower because of the student loans.

This article reminds me of the 1964 film “The Visit” with Anthony Quinn and Ingrid Bergman. Anyone familiar with that movie? I wish I could find that on dvd. It would be a great lesson in the pitfalls of easy credit for the kids.

A few candidates are saying that things are wrong and need to be changed. It is up to us to promote them ourselves. The media will ignore, malign, and outright “swift boat” anybody who doesn’t say what the big corporations want to hear. So get out there, get active, and make a difference. Don’t just sit around complaining.

BJSchaefer said

“There debt levels, thanks to student loans caused by loose credit driving up the prices of degrees, are out the roof.”

A big part of the increase in costs for education have been the BB’s and others not wanting to spend the money to fund the educational system. They ignore the fact or don’t care that the previous generation had given them so much opportunity. Costs when I went through school in the 90’s went up double digits each year because of cuts to education spending, not loose lending. We are killing this country by not investing in the future and only spending on short-term pleasure.

Gael @ 12:24pm

You can probably find the movie at http://www.movielead.com/, they specialize in old/rare movies.

The challenging thing is many of the leading candidates from both major political parties do receive large contributions from Wall Street and major players in the housing industry. Given that next year is a major election year, one that will set the tone for possibly a decade, both parties are treading water very carefully. They realize Americans don’t want to lose their homes but many are opposed to a bailout. Can you imagine a candidate coming out and saying, “My fellow Americans! As I witness the masses shopping in the malls this holiday seasons swiping credit cards like hamsters pushing a button for food, I realize that many of you simply do not have the cash to purchase what you are buying. We have become a debtor nation and it is time to curtail our spending for the sake of future generations. I know it is tempting to spend since credit makes it so easy. After all, how can you resist a $100 payment for a nice, sleek, flat panel television to watch shows that will sell you even more nice, sleek, flat panel televisions? It is a call to action that we restrain our spending and that is why I will be pushing for a stronger dollar and reigning in our credit machine pushers such as the Federal Reserve. Will you vote for me?â€

Of course the majority of Americans care not of their finances until the eviction notice is on their front door or the bills start billing up. How do we change an entire culture that is so dependent on credit? We are one hour away from another HGH credit injection.

Dr. HB; Yes, it is really incredulous! On news radio here in DC this afternoon, they were actually reporting that the Fed might have to come back immediately and cut the rate by another quarter point “because of the negative market reaction to only a one quarter point cut.” I was thinking exactly what you were in that these people (the wall street gang) now think they can dictate what the Fed should or shouldn’t do based solely on their “happiness” gage!

You guys will love this:

Dec. 11 (Bloomberg) — Wells Fargo & Co. Chairman Richard Kovacevich said he expects the Federal Reserve to cut its discount rate today by as much as three-quarters of a point and guide the economy through 2008 without a recession.

The central bank will lower its benchmark lending rate by a quarter of a percentage point and reduce the discount rate by half to three-quarters of a point to reassure markets that credit will be available, Kovacevich said during an interview in New York today. If the Fed takes both of those actions today, it may not need to cut rates again, he said.

As we all know, the Fed cut both the fed funds rate and the discount rate by 25-basis-points. My question to you all is do you think places like CNBC and the WSJ think they can will the Fed to drop rates simply because they want to? In fact, Bernanke is walking a very tight rope and all projections aside, the market was expecting a .5 basis cut. Since it didn’t get this, it got hammered and once again demonstrates how dependent we are on credit. For crying out loud he cut rates! Which means there will be more liquidity but the credit drug fiends are looking for more and the dosage must be upped.

The Fed understand that they need to save some ammunition for the biggest battle which is 2008. That is when you know what will hit the fan. There will be plenty of time for more rate cuts.

It really makes me sick seeing how Wall Street behaves. They are completely out of touch with reality. They need the rate cuts to stimulate the stock market to keep their paper profits coming in. I really couldn’t care if the traders don’t get their bonuses this Q. Meanwhile the cuts do little for the economy and less for individuals. We’re headed for recession, and likely a nasty one. If the Fed keeps cutting rates we can add inflation to the mix, which will hurt everyone. I’ll take a recession over stagflation any day.

Well there’s the parasite economy in practice presented in graphs. The dumbing down of American culture through public schools and television (two sides of the same coin), easy credit expansion driven by contracts with language impervious even to the most trained legal experts, the shipping of jobs and raw materials overseas and the importation of poor quality, dangerous finished goods with little, if any, accountability for manufacturers. And now – Super Government Intervention Man to the rescue!

“..like asking a drug dealer what is the best way for a person to recover from an addiction.”

Hi! I work at CurrentForeclosures.com a foreclosures site. I agree with your analysis. For many years our culture has been “loan or credit-card-cultureâ€, that is spend first before having the money to pay for the purchases. Analysts have reported that before the foreclosure crisis, people with marginal income were offered sweet-rate deals so they can easily avail of housing loans. Amortizations were computed against their capacity to pay and there was no room for unexpected increase in the amount to pay. When the bubble burst, as expected most of the borrowers were unable to pay. Therefore lenders are equally responsible for all these mess, not only the borrowers. It takes a lesson like this foreclosure crisis to teach people to shift the mentality from spending to saving. As credit services are becoming easier to avail, many people are abusing these facilities.

Housing related stocks are up and with the prospect of further rate cuts, all seems well until you start facing the brutal reality of what is occurring.

Leave a Reply to Carol