Hope Now Alliance: Press 1 for Subprime, Press 2 for Spanish. Looking at a Hypothetical Case.

There has been a torrent of information shrouding the new Hope Now Alliance proposal that was offered up this past week. We’ve heard outraged battle cries of “no government bailout†and we’ve also heard the argument that this plan does not go far enough to help those facing foreclosure. Aside from the philosophical debate, how many people does this plan really help in its current format? Now that we have a few more details of the plan, it is apparent as it stands that this proposal will only offer support to a small portion of the 1.2 million subprime borrowers facing trouble next year. Let us give you a quick recap of what we know so far:

This will only apply to owner occupied properties with at least a 36 month ARM reset period or less.

The loan must be current.

LTV must be greater than 97 percent

The borrower must have a FICO score less than 660

The borrower’s FICO score cannot be higher than 10% since the loans origination date.

Each servicer must determine the owner cannot afford higher payments.

Should you fall within this if-then statement of complexity, you will qualify for the 5-year rate freeze. So instead of a 2/28 mortgage we now have a 7/23 mortgage. In this post we will analyze our hypothetical case study of Johnny Subprime who meets all the above contingencies and has a scheduled rate reset on 1/1/2008. Just to show my due diligence in this, I decided to call up the Hope Now Alliance program. I called at a late hour as everyone was hitting their slumber since I know they are extremely busy. After a brief summary of what they are about, I am led to the omnipresent “press 1 for English, press 2 for Spanish.†From what it appears, they are being an advocate and are running a quick triage report to see if you even qualify. Early estimates from various sources state that this plan will currently help anywhere from 125,000 to 240,000 people. This plan doesn’t even begin to address the potentially more dangerous mortgage bubble of Option ARM mortgages that are set to hit in 2010 through 2011. According to Fitch Ratings, 80 percent of Option ARM borrowers only make the minimum payment. What this means is these folks are going negative amortization in a time where across the country every large metro area is seeing real estate depreciation. This is a guaranteed recipe for being underwater at a time when analyst are predicting the bottom of the housing market will be hit. It is literally the second tidal wave of this housing credit explosion.

Let us deal with one thing at a time. Let us run some assumptions just to show how this Hope Now Alliance will play out for Johnny Subprime:

Mortgage Type: 2/28 Mortgage

Origination Data: 1/1/2006

Home Purchase Price: $250,000

Mortgage Amount: $250,000

Mortgage Rate: 7 percent with expected rate at reset of 10

Current Principal and Interest: $1,663

Expected Principal and Interest at Reset: $2,173 *2/28

Taxes and Insurance: $260

Yearly Income: $50,000

Monthly Net Take Home Pay: $3,080

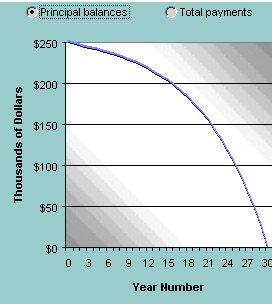

Car Payment: $300

Car Insurance:$100

Auto Fuel: $120

Food: $400

We’ll leave out other factors like cell phones, healthcare, utilities, and credit cards which many borrowers have. With the current payment Johnny Subprime has disposable monthly income of $237. After talking with a counselor on the phone, Johnny hasn’t missed a payment and falls within the guidelines and demonstrates that a rate reset will suddenly put his $237 monthly surplus into a monthly deficit of $273. Since most subprime borrowers already start out at a higher rate, it is very common to see a starting rate of 7 percent especially if the note originated in 2005 or 2006 when rates were very low and the secondary market was buying them up like hotcakes. So instead of his rate resetting in 1/1/2008 it will now reset in 1/1/2013. Without the rate freeze the rate payoff curve looks as follows:

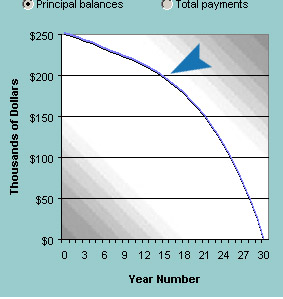

For simplicity, we will only assume that there is a rate cap of 10 percent and doesn’t go higher which is a very high probability given the current economic circumstances and the structure of many subprime loans. Interest rates cannot remain at multi decade lows forever. So the freeze is on and Johnny lives to fight another day. Does this freeze really help long-term? Johnny goes on living his life, paying his bills, and doing the things of daily life. Let us assume that Johnny has received a 4 percent pay raise each year and now we are in 1/1/2013. How does our scenario variables change?

Current Principal and Interest: $1,663

Expected Principal and Interest at Reset: $2,112 *7/23

Taxes and Insurance: $260

Yearly Income: $60,800

Monthly Net Take Home Pay: $3,597

First you’ll notice that the difference between the 2/28 reset payment and the 7/23 reset payment is only off by $61. So how is Johnny Subprime now doing in 2013? With the new rate reset he is now with a monthly surplus of $305. On the surface, it looks like the rate freeze has saved Mr. Subprime from losing his home. But there are many assumptions that we are assuming here.

Three Assumptions of the Hope Now

The second assumption is that housing prices will stabilize over this timeframe. Who is to say prices will stay the same? In fact, we have another major mortgage debacle awaiting us in 2010 and 2011 just when this one is getting cleansed from the system. We are already seeing that yes, real estate does go down and in fact can go down on a national scale. Estimates abound that home prices can fall anywhere from 10 to 30 percent depending on the area. Many analyst predict the bottom somewhere in 2010 but of course the dormant giant of Option ARMs hasn’t even been tackled. So assuming Johnny Subprime’s property falls by 10 percent nominally, he will still owe $227,868 on the new 7/23 mortgage and the property will be worth $225,000. He will have zero appreciation and will lock himself into a place for 7 years. As you can see, sometimes renting is better than buying. After all, having a roof over your head and building up no equity is the simplistic definition of renting.

The final assumption here is that Johnny will in fact want to stay in his home. We’ve heard countless times from the industry how no one ever stays in one place anymore. Well in this case, Johnny will not have much of a choice in the first few years since he doesn’t have the equity to sell especially in a declining market. What if he gets a new job somewhere else and needs to move? Is he going to be compelled enough to stay in the place? What if he realizes that the only true winner here is the lender and he in fact may be coming out with no equity in the end? Will he want to continue making payments to keep the lenders afloat?

You can see that it is much too early to determine how this thing will go. Will people in foreclosure that don’t qualify for this plan call for equality? Why should they be punished because they didn’t fall within the given timeline of the current proposal? What about prime borrowers that are underwater? Why shouldn’t they be able to freeze their rates as well? Again these are philosophical questions more than economic but I assure you they will come up in the coming years. Even though this isn’t a bailout per se, it does open the door slightly for more government meddling. We already know that Paulson said this isn’t a “Federal bailout†but the wording giving tax-exempt status to states should be watched. Another major thing that would be a bailout is what Angelo Mozilo, CEO of Countrywide mortgage is pushing. He is calling for caps to be raised to $625,000 so the FHA, Freddie Mac, and Fannie Mae can purchase larger mortgages. Mozilo had actually called for raises of as much as $850,000. Since Countrywide and WaMu have nearly 45 to 50 percent of their mortgages in

What are your thoughts? Is this a bailout or is this something more benign?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

24 Responses to “Hope Now Alliance: Press 1 for Subprime, Press 2 for Spanish. Looking at a Hypothetical Case.”

It really is not a ‘bailout.’ It is a political pretense of ‘doing something.’

Read a great description of it – maybe here, maybe somewhere else. Anyway, it was described as “rather than a finger in the dike, this is throwing a sandbag in the Mississippi to stop the flood.” It is a whistling past the graveyard by politicans and lenders who are seriously into reality avoidance about what is going to happen when the option and hybrid ARMs blow sky high. It is ignoring the fact that the supply and prices of houses simply do not match up with consumers’ ability to pay because of the depression in income for 90% of the US over the last 20-25 years. The ability to get credit is NOT the same as income. They are hiding their heads in the sand and saying “If we don’t think about anything bad happening, it won’t happen. If we think ‘positively’, it will be okay.” Reality is such a bitch.

It allows the lenders some political cover to say ‘but we tried -there just wasn’t much that could be done.’ It allows the politicans of all flavors to say ‘we tried…..’ And then they can all go off and wring their hands like Lady MacBeth.

Max Fradd Wolff did a column on whether this is really any help to the subprime borrower given the falling prices. http://www.huffingtonpost.com/max-fraad-wolff/1888995hope-hope-for-_b_75525.html

“Hope Now Alliance” should be called “False Hope Now Alliance.”

The default rate on credit cards, car loans and student loans is rising. The ’30 day late car payment’ rate for well-qualified prime borrowers just jumped 3% up to 4.6% in the last month or so.

Your calculations are interesting. You used the most optomistic view though – rising income and no inflation. Wages for 80% of the wage-earning workforce have been flat for the past 4 -5 years. Median income, after adjustment for inflation, was flat for 5 years and finally rose a whole $480 (1%) in 2006. In 2007 alone, fuel has goneup over 30%, food has gone up 8-12% depending on the area, and healthcare ……too depressing to talk about.

Your Joe Subprime would need a LOT more than 4% a year just to tread water as the bulk of his income goes to the goods and services which are rising at a whole lot faster rates of inflation than that every year. Highly doubtful that Joe would have wage inceases large enough to cover the inflation in the necessities of food, fuel, healthcare etc and still have an additional 4% of income for the mortgage reset.

Given that at after a loan modification, at least 40% of borrowers ultimately default, and that Joe’s income will probably not rise enough to cover the inflation of core goods (food etc) and the future mortgage reset, all this does is buy Joe some time to make other arrangements.

The option-ARM and hybrid-ARM bombs used by prime borrowers will start to go off in 2009/2010. 6.8% of mortgages are the subprime ARMs with a default rate of 43%.. The prime borrower ARMs are 14.5% of all mortgages and option ARMS are 12.3% or 85% of all prime ARMS. The prime ARMS are currently defaulting at a rate of 18.7%. That doesn’t sound so bad until you realize that prime fixed loans (63.1% of mortgages) are only defaulting at the rate of 17.6%. Even subprime fixed (14.5% of loans) have a lower default rate (12%) than the prime ARM default rate.

The prime ARMS bomb is going to go off about 3 years into any freeze for the subprime borrower in 2010. The defaults and foreclosures from the prime ARMs will be hitting in 2010 and 2011. The excessive inventory of REOs from the prime ARMs will be going on market in 2011 and 2012 and depressing prices sharply.

Joe Subprime has to refinance in 2012 or 2013 in order to avoid a sharp rate reset – and needs to either (a) show equity in the property or (b) come up with a down payment of 3-20% of the then depressed value of the property plus any difference between the real value and amount owed. Joe’s home drops 20% in value because of current flood of REOs and the prime ARM mountain of REOs. How much he has to come up with for a down payment depends on how far his value drops. If the predictions of a 30% drop are correct, it won’t appraise for more than $175,000 but after 5 years of frozen rates, he still owes $200,000. To even refi into an FHA loan, he has to come up with 3% of $175,000 plus the difference of $25,000 or a total of $30,250.

Bottom line is Joe couldn’t afford more than $1166 in mortgage AND taxes AND insurance (at a 6.25% interest rate over 20 years.) He couldn’t afford more than about a $133,000 mortgage. Nothing has changed that. Nothing will change that except a current and immediate increase in Joe’s income up to around $83,000 and having income get to at least $89,000 by the 5th year. Not likely to happen.

“Each servicer must determine the owner cannot afford higher payments.”

This last condition is pointless, because the servicer has no authority to renegociate a mortgage contract. The holder of the CDO that has the said mortgage is the only one in position to change the term. Let say hedge fund managers or Chinese government or pension fund managers do want to change the mortgage contract, how will they do it? If they choose to do it one mortgage at a time, then we’ll need two lawyers for every case. Do we really need more lawyers? This whole thing is a mess when financial geniuses in Wall Street started spreading risky loans around. Now the stench is so ubiqutious even AAA rated bonds smells.

The government may want to adopt a new mantra i.e. do no harm, which means to keep out of the way.

planobcl

Maybe you should be allowed to refi into a 30 year fixed.

Maybe inflation will catch up.

Maybe people who assumed things would keep flying along should face the consequences. Somehow that don’t seem to happen to boomers…but why do they have to drag the rest of us down with them?

Good article and comment.

It is a “pray for rain” solution. Maybe they’re hoping that by pushing the debt ahead they will have a better ability to deal with it then.

Suggestion: I’ve followed this for a while, but I lose track of all of the different types of loans. You should post a refresher for us naming and describing the various type of loans we’re talking about.

I’ve also seen the chart of reset dates. I wouldn’t mind seeing the numbers in a table.

Ann Scott has accidentally hit on the only thing that will get us out of this mess, a return to demand side economics that raises Johnny Subprime’s wages enough that he can afford that $250,000 house, a dump next to a tire company on either coast and hardly a mansion in most of flyover country. The only thing that is going to salvage this economy is the return to the New Deal philosophy of scraping obscene wealth off the top and “priming the pump” at the bottom to restart the consumer economy as a whole and end the housing credit implosion specifically.

I live in an area that didn’t see a price bubble, but we did see a tremendous amount of overbuilding of housing stock to satisfy a market created by out of state real estate speculators. We now have a glut of housing on the market, much of it never lived in and under 5 years old, and all of it driving down the prices of existing housing for sale all over the area. So not only didn’t we see those paper profits, we’re getting insult added to injury by seeing our net worth represented by our home equity evaporating every time another speculator with a shaky loan dumps a bunch of properties in an attempt to salvage anything from a bad investment.

At the same time, lenders are gunshy and lending to a pool of buyers that is getting smaller by the day, buyers with savings, few debts, and good credit with the few debts they’ve had, plus a return to a 20% down payment. None of those speculator houses are moving any time soon, and the reduced pool of buyers is an additional downward pressure on house prices.

The only thing that will save this economy is a return to demand side economics, making sure that people who work a full day are paid a living wage for whatever work they do, and that includes a wage that will allow them to buy safe housing.

Clinging to the supply side fantasy will see the credit bubble implosion rocket through every facet of this economy leaving none unscathed, not even the plutocrats who think they’ve stolen enough to ride it out, floating far above the people they encouraged to substitute easy credit for inadequate wages for decades.

Great Analysis AnnScott!

In truth, we are only delaying the inevitable, properties becoming REO’s, reverting back to the lenders, them taking their hit (Iike they should) financially. They are the ones that took the risk, adjusted the guidelines. To me the only borrowers that deserve help are the ones blatantly ripped off by some mortgage broker, or borrowers that didn’t lie on their applications. If you bail people out, this is rewarding cheaters, because there is no consequences for their actions.

Once the properties revert back to the lenders, they will have to be sold at a reasonable price, and yes it will drop the value on other properties for the time being. This will make property values coincide with the Joe Blow income.

Who ever thought of “stated income” ? An invitation to fraud.

I thought I read somewhere that one of the conditions was that the home is currently worth more than the mortgage amount. Johnny Subprime won’t get a dime if he’s upside down.

I could be wrong, but I swear that was in there, and that may be the reason so few people will qualify.

Thank you for the comment AnnScott. They know a housing collapse is coming, so they want to spread a little bit of it into the future so it doesn’t come crashing down all at once–but it will come crashing down. Interesting that the plan was laid out just before we start voting for presidential candidates. Not much to add to the AnnScott’s post and the always thorough Dr.

AnnScott

Very good commentary. You hit one point that should be in big, bold letters…

“The ability to get credit is NOT the same as income.”

Easy and exotic credit is the fire that fueled this bubble and lenders, who wish to remain in business, tightening and a return to sane underwriting is what will bring it back to earth. Current income levels simply aren’t high enough to pay these sky-high prices. Like AnnScott says, reality is such a bitch. Another reality that I guarantee is gonna be a bitch is the amount of fraud that has been going on with these mortgages the past 7 or so years. Everything is so wonderful when these loans close in a bull market the fraud angle is overlooked. When the market reverses, the lenders want their money back. Credit obtained by fraud is a big deal, not that hard to prove in competent hands and the slammer is gonna be getting a lot more occupants in the next few years.

Odd……around here it is the mid 20s – 40 year olds who are slamming into foreclosure on their ‘just gotta have house.’

Their parents who are in their 50s and 60s are horrified at the high risk loans and crazy house prices.

Get over being angry with your mommy.

Comment by Warpster: Ann Scott has accidentally hit on the only thing that will get us out of this mess,

Sorry to disillusion you but I was trained as a micro-economist and historian with a specialty in the social thought and economic hirstory of early 20th century.

This instance of government meddling will open the door to more “bailout” programs at the federal, state,and local levels. Already, authorities in my city are discussing ways to enable buried borrowers to stay in their unaffordable homes.

This “revenue neutral” program is only the foot in the door.

Look for more direct bailout programs involving grants and low-interest city loans to threatened homedebtors. Senator Clinton has proposed a $5 billion fund be established to help these borrowers stay in their homes. Look for programs just like it at the local level.

One thing I’ really glad to see are all the voices saying the Hope Now scheme “isn’t fair”. Because when it comes down to it Americans expect two conditions: that they have the freedom to take risks and the playing field should remain level. That is the good news.

The idea that large Wall Street firms created CDOs and tranches by bundling these loans and then reselling them to make a profit is really ludicrous. These greedy folks have added NO value and have resold these items at a large profit. The old wall street saw stating that only two things drive the markets and those are “greed and fear”, holds true once again. There was plenty of greed to go around. The comment above about the “baby boomers” rings true. The greed started with the home buyer and went clear up to the purchasers of the CDOs, and there are many people in between taking their “cut” off the top. Greed Greed, but now the party is over and its time for people to reflect. Its time for FEAR to replace Greed, and it has with a vengeance. To the rescue, Henry Paulson Treasury Secretary, to save the day or ease the pain as it were. Its a placebo folks. Next year is an election year and you can bet one side of the other is going to try to make hay from this issue. And so it goes. Lastly, what ever happened to people who lived within their means?

Where are all the supporters of this plan? You would think that by looking at raw poll numbers, there would be at least a few chiming in to support it. Yet from reading these comments, it appears that most are against this ill planned freeze. The lenders, if they were truly serious about helping people out, would propose legislation allowing restructuring of debt to reflect current home prices. You won’t see this coming from the industry. In fact, I’m sure most of you can see the path unwinding. Some bold lender is going to propose making a 30-year loan into a 40-year loan as long as they get a payment coming in. Why stop there when we can follow Japan’s lead and do multi-generational loans? Something to leave the kiddies as a parting gift.

Good comments all around. You know the issue of debt not being income is an important one. Yet as a society, debt is money and we can only support our consumption via spending and credit expansion. I would argue that most people need to go into debt to achieve the so called American dream. Take a look at college. The average cost of a 4-year college education is approximately $100,000. Venture a guess to how many people pay college in cash? Also, a recent phenomenon that exploded and kept this economy humming was mortgage equity withdrawals. The wealth effect in conjunction with this social epidemic of dressing up your home, created billions in revenue for many companies. Why do you think consumption is slowing down? You can pinpoint it directly to the credit crunch. It forces us as a society to realize that without credit, we simply cannot spend anymore.

The marketing behind this was simple and touches on consumer behavior. The perception was “You are sitting on a gold mine! That equity in your home is like a virtual ATM. Let us help you attach your own tailored Diebold ATM and let the spending begin!†A few decades ago paying off your mortgage was something to aspire to and you had mortgage burning parties to celebrate the occasion. Now the common financial wisdom is paying off your mortgage is a bad idea. I’ve talked with people young and old mind you, that somehow psychologically they felt that the equity in their home was the same as cash. In a way it is. You can spend it like cash, it feels like cash, and it walks like cash but in the end you need to pay it back unlike cash. That is one major component of the credit squeeze; look at some of the structured debt markets. You had BB rated bonds mixed in with AAA rated bonds and the ratings would shoot up. It was credit on top of credit and the game is finally collapsing on its own weight. Take a look at this chart showing household debt:

Household debt as % of disposable income

As we are seeing, a large portion of society will spend whatever is put in front of them. If they had access to 1 million in credit, they would use it. Why do you think Mr. Mozilo over at Countrywide is pushing for caps to be raised to $625,000? If anything, he knows what feeds the beast.

Interesting and pertinent comments, particularly AnnScotts reference to parents in their 50’s and 60’s who never considered ownership of a home as an investment but rather shelter in which to remain until mortage fulfilled.

I read an article recently that stated in the 45 years of keeping records this year will be the lowest ratio of home ownership on record.

So much for substituting debt for “Filthy Luca”

Dear Doctor:

An issue of some concern. The rates will be “frozen”.

Does that mean that the borrowers principal balance will:

A) NOT be increased by the difference between the “introductory rate now frozen”, and the “rate hike as normal”, or

B), be INCREASED by that difference, (throwing them into negative amortization)?

Do we know the answer for sure? It would seem, in order to “sell” it to investors, the option B would be more attractive to them.

What EVERYONE seems to be neglecting is the fact that almost all these loans were written as 80/20 combos and the current plan makes no mention of these second mortgages. That being said, take a look at a similar example with a second mortgage and you’ll see that most of these homeowners will subsequently not qualify.

Example:

Original Purchase price – $250,000

1st Mortgage – $200,000

2nd Mortgage – $50,000

Assuming no appreciation, this borrower’s 1st mortgage is still at 80%. Take this a step further and assume a 10% decline in property value and the home is now worth $225,000 and the first mortgage is only at 88%. Of course, these assumptions do not take into account any principal payments made on the mortgage before the attempted modification, however, any decreases in principal only puts the borrower that much further out of reach of the 97% threshold.

The question begging to be answered is do they really mean CLTV (Combined Loan to Value) when they state LTV as this will make all the difference in the world??

There is a lot of misinformation about the “freeze” program, both in the original article above and in the comments.

“LTV must be greater than 97 percent” – Not true. A person could have any LTV, or any current CLTV, and qualify for a loan modification under this program. The confusion comes in because people who are eligible to refinance into an FHA or FHASecure (or other commercial) mortgage are not eligible for the “freeze” – they should refinance into a fixed rate mortgage instead. One of the criteria for the FHA programs is LTV of 97% or less, but there are other requirements that must also be met, so someone could have 80% LTV but still not qualify for an FHA mortgage.

“the servicer has no authority to renegotiate a mortgage contract” – Servicers have always had the authority to renegotiate mortgage contracts. If they didn’t, mods and work-outs could have never been done. This plan was written by the American Securitization Forum, which represents mortgage investors. It says “The ASF believes that this framework is consistent with the authority granted to a servicer to modify subprime mortgage loans in typical PSAs.”

“the current plan makes no mention of these second mortgages” – Wrong. The treatment of second liens is dealt with extensively in the plan.

Other terms of the plan that many people have gotten wrong include that there is something about “foregone interest” to be forgiven or added on to the principle. There isn’t, the interest rate charged is the interest rate paid.

For interest-only loans, that are scheduled to both reset the rate and begin requiring principle payments, only the rate is frozen. The principle payments still need to be made: “For loans that require payment of interest only prior to the initial reset, followed by amortizing payments, the rate would be kept at the current rate during the modification term, but the borrower would be required to make an amortizing payment beginning after the reset date.”

I’ve read the plan very carefully and I’m fairly smart sometimes, so who exactly qualifys for this plan? It doesn’t look like it will help may of the people who truely need help.

Great article. I think you’ve hit the nail on the head here, and the wealth of information you provided on the topic is really helpful.

Don’t deposit at Countrywide banks and financial centers. Learn more about the national mortgage crisis and Countrywide’s role in it. Visit http://www.dontdepositatcountrywide.info

WARNING – This bust goes beyond subprime. The prime borrowers will leave when they realize their house is worth 60% of what they paid for it.

Did the President, Treasury Secretary Paulson and HUD Secretary Jackson know the rate freeze allows servicers to modify loans without written authorization?

If mortgage servicers don’t have to make contact with borrowers to freeze loans, how do the servicers know the properties are owner occupied, and not investment properties?

If borrowers won’t have to document current income for the rate freeze, how can servicers avoid modifying initially fraudulent loans?

Does the industry group that wrote the rate freeze represent investors in Mortgage Backed Securities, or companies that profit from the issuance of the securities?

Did the top mortgage service providers, ratings agencies and bond issuers, who are all members of the industry group which wrote the rate freeze, influence the decision to charge bond holders for counseling and modification expenses?

How much have the servicers agreed to charge for modification and counseling?

If the rate freeze temporarily props up housing markets and mortgage bonds that some lenders, borrowers credit rating agencies and appraisers fraudulently helped inflate, will would-be buyers face artificially overpriced housing markets?

How much did Treasury Secretary Paulson and Goldman Sachs profit from involvement in the mortgage securitization process from 2004 to 2006?

Should those who created and profited from the subprime problems be trusted to author and facilitate the remedy?

In creating the framework for the rate freeze, did those who created and profited from the subprime problems prioritize their financial interests and avoidance of criminal liability?

Does the rate freeze encourage borrowers to keep paying for assets that continue to fall in value?

Will the freeze prevent owners of mortgage-backed securities from suing U.S. banks to force them to buy back worthless mortgage securities at face value?

Who would benefit if fewer foreclosures occur as homeowners continue to pay on mortgage larger than current values?

If investors believe contracts can be altered, could the rate freeze reduce confidence in mortgage bonds, leading to higher rates for those trying to refinance or buy?

Could higher foreclosure rates encourage further political interference with contracts?

Will some borrowers miss payments on other debt that they otherwise wouldn’t have been late on to bring down credit scores to qualify for the freeze?

How many credit card payments would it take for a 700 FICO score to fall under 660, to qualify for the loan freeze?

Should Americans help borrowers, lenders and investment banks who didn’t understand the consequences of their actions?

If fraud is found in the origination process, can mortgage bond investors require banks to buy back loans at face value?

By putting off foreclosures for several years, could the freeze delay bond investors from suing?

Leave a Reply