Foreclosure and Short Sale Report: 33.79% of All Southern California Inventory for Sale is Distressed Homes.

The amount of distressed homes for sale in Southern California is simply mind boggling. The more stunning revelation is the bulk of pay option ARM recasts don’t even begin until 2009 with a small percentage starting this quarter and a larger number in the forth quarter. Even with that said 33.79% of all homes for sale in the Southern California market are in some form of distress. Since distressed property sales usually result in a lower price, you can rest assured that future price measures are going to continue to trend lower.

Given that the majority of homes that are selling in California are distressed properties it goes without saying that offering aggressive discounts will result in some price movement. The vast majority of buyers in the current market with a good financial balance sheet realize that they are the one’s who set the terms regarding a deal. There is no immediacy to buy a home today for fear of prices going higher next month. They most likely will be lower. The urgency to make an offer contingency free on the one home in the neighborhood for fear of being overbid is now a long memory of manic delusions of the housing bubble.

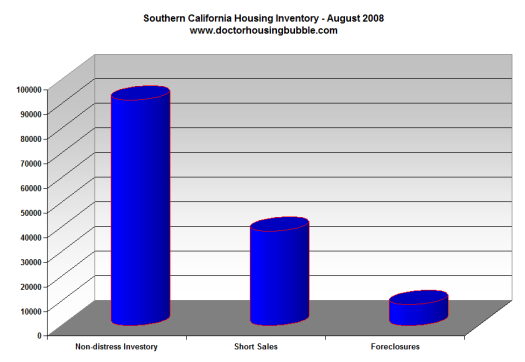

Let us get a quick snapshot of the Southern California market:

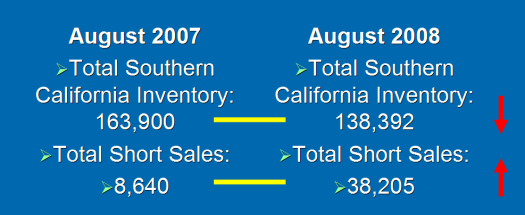

What you’ll notice is that currently, there are over 38,000 short sales in the Southern California market. In addition, 8,500+ homes are foreclosed properties which puts the distressed inventory at over 46,500. You may be thinking that the chart shows a healthy amount of non-distress homes with an inventory of over 91,600. Yet you would be completely mistaken because even in late August of 2007, not even one year ago the total amount of short sales in Southern California was 8,640 and total market inventory was over 163,900.

I want to give you a heads up that there will be some spinning going on in the next couple of months because of these nuisances. Overall inventory has decreased since last year. There is no arguing that point. Yet most of this decrease has occurred with non-distress properties being removed from the market while distressed properties are now a larger portion of the overall market inventory. More importantly, sales that are currently happening are happening in large part in the distress segment thus pushing market prices lower at least when it is reflected in monthly reports. For a quick visual, this is the breakdown of short sales in a one year time horizon:

If you need a thorough breakdown of why we are years away from a housing bottom, please read 10 reasons why we are nowhere near a bottom in California. So you can see how the data will be massaged even though the overall housing picture is deteriorating before our very eyes. Take the inventory number from August that we just brought up. According to DataQuick there were 17,755 homes sold for the month. So a quick look at inventory and sales we get:

August 2007 SoCal Inventory: 163,900

August 2007 SoCal Sales: 17,755

Total months of inventory: 9.23 months

August 2008 SoCal Inventory: 138,392

June 2008 SoCal Sales: 17,424

Total months of inventory: 7.94 months

Things are getting fantastic! Keep in mind the August sales data won’t be out until mid-September but June, July, and August sales are normally the strongest months and vary slightly. The point is that people are already using this fuzzy Sesame Street math to show that inventory is going down. This is flat out irrelevant in a market where first, we are in economic hard times and people are hunkering down but more importantly most sales are happening on the distressed margin. In fact for June 41.1% of sales for Southern California were foreclosure resales.

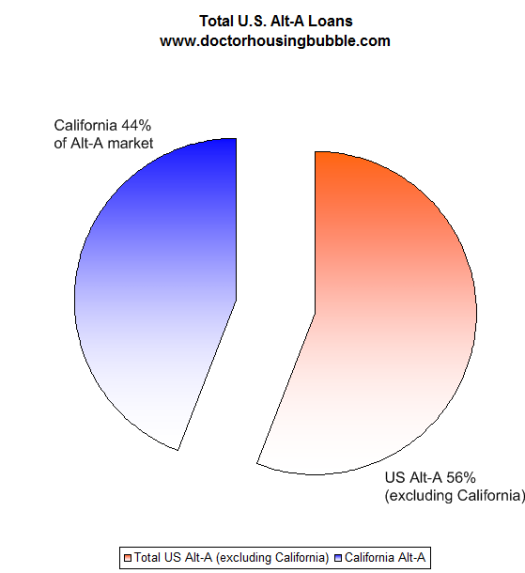

The problem is going to fully expose itself like a blossoming orchid when lenders suddenly send out that first recast anniversary payment only to receive a cold shoulder once day 31 arrives. The fact that California has a whopping $300 billion in pay option ARMs that will recast over the next few years is simply going to put a cap in any bottom talk for a long time. Keep in mind in the entire United States there are $653,502,658,632 in Alt-A loans out there. The vast majority of these pay option ARMs fall in this category. So California by itself has nearly half of the entire nominal amount of these toxic sludge mortgages that make subprime loans look conservative.

Let us not forget that there are still subprime loans out there. California still has over 465,000 subprime loans “active” as of June of 2008. So we are not out of the woods on that one. If the housing market correction has caused housing prices to drop by 38% in California in one year simply with the majority of the subprime problems, can you imagine when the marriage of subprime and pay option ARMs confront us at the same time later this year and throughout 2009? Take a look at this graph if you are more a visual learner:

I have a feeling that since the data for July and August is forthcoming and given the fact that lenders are holding off as much as they can on certain REOs, the overall inventory to sales number will be the recipient of major spin. You can arrive at your own conclusions. The fact that we still don’t have a budget in California and the unemployment rate is 6.9% and will go higher, who will be buying these homes? Do you realize there are homes in Detroit selling for $500 but there is a reason for the price! The economy is in shambles. People forget that we were in an incestuous business model were many jobs related to housing only had viability if prices kept going up. Well of course that is unsustainable. I remember articles talking about a median county price of $1 million for Orange County. Absurd! California became a circus sideshow and thanks to Wall Street’s appetite for toxic mortgages became the biggest casino known to humankind.

33.79% of current inventory in Southern California is distressed yet some want to call this a bottom. If you really think this is the bottom you are welcome to go out there and purchase a home with your own money.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

23 Responses to “Foreclosure and Short Sale Report: 33.79% of All Southern California Inventory for Sale is Distressed Homes.”

I’d like to hear some comments/predictions on this aspect of the coming Alt-A meltdown: what WILL happen to these larger/high-end homes going into foreclosure? Even at vastly reduced prices, who will be in the market for McMansions anymore? I’ve been following my old neighborhood in Northern Virginia, where 3,000 sq.ft. houses were selling for 500,000 to 600,000 in 2006 and 5,000 sq.ft. lakefront houses were selling for 1 million. These houses have two story family rooms, open-to-below foyers, basements with wet bars and pool tables and dedicated weight rooms. The cost of running these places–heat, electric, HOA fees, etc.–is just outrageous. ($500 a month to heat 2600 sq.ft. in the winter and $300 a month to cool in the summer.) When we sold in spring 2007, there were 26 of us on the market; 2 of us sold. (The 2 that were listed 50,000 to 75,000 below what everyone else had listed at.)

There are now 14 houses in the neighborhood for sale (with approx. 6 in some stage of foreclosure), all within a 295,000 to 400,000 price range, and NOTHING is selling. Because, as is rightly pointed out so often on this blog, the purchase price really is only the initial expense of carrying a home.) We knew when we bought another home (the home we plan to retire in), it would be a much smaller space, easier to maintain and more energy efficient. And this seems to be the trend with most of the aging population. Even younger families I’ve talked to want smaller homes in the neighborhoods with good schools. So will these monster houses just sit empty? Will people buy them for the land and tear them down to build smaller places? (Is this even possible in a community with an HOA?)

There is an outside chance that the Pay Option ARM crash won’t be as big as anticipated. Granted, the difference between “epic” and “armageddon” is a matter of semantics…but I digress. LIBOR based POArm loans have a very low fully indexed rate relative to what was expected so many of these loans have pretty good rates to begin with. Theoretically speaking when Downey, First Fed and WAMU are taken over by the Feds (my belief) they may begin to cram down these loans faster than the banks normally would of. The two wild cards for me is what BofA will do with CW’s POA’s, and what solution Wachovia will have for the World Savings POA portfolio.

Anyone picking a bottom in housing today is like the wicked witch standing right under that Kansas farm house as it falls from the sky and saying “I can see the bottom, and it’s getting closer….”

Whats the least amount you can borrow for a mortgage.

The distress property percentage seems low. In Lower to Middle class cities like Long Beach, Norwalk, and Downey, anything below 450,000$ is a distress sale. The banks will be the first to realize that the price has to drop over 50% in order to sell most of the homes on their books. I believe there are just too many greedy people out there who are still trying to find a knife catcher. But I believe hunger will overtake greed and desperation will set in soon.

Well, here it is, finally: the $1 house:

http://www.detnews.com/apps/pbcs.dll/article?AID=/20080813/METRO/808130360/&imw=Y

No, no, no! New homes are going to march the market downward. Sub-contractors are getting stiffed, already sold houses are getting attached with mechanics liens, builders are going belly up. Believe me, they don’t have the luxury of sitting on their assets like the banks do. A person must be crazy to buy a new house right now, in light of all that is going on. These builders have monthly expenses regardless, and they are going to start dumping for dollars.

Re: Riverside

Excellent point – big house = big monthly bills (GAS, ELECT, etc.)

Most likely will tend to become home for “multi-generational” households.

Not exactly a big element for “regression” but it will have an impact.

Dr.

Thank you very much for this post and the 10 reasons post.

My wife and I are renting.

We are also “visual learners” so thanks for dumbing it down for us.

My wife wanted us to get out of renting and buy a house asap, but the alt-A explosion-to-be has sort of caused an about face. Now is precisely NOT the time to get off the fence, listen to local realtors and buy a $600,000 single family home in OC.

Thank You again and please keep the posts coming.

Every year over 1% of us will die. Boom or bust homes become available just through our own mortality. Few heirs will want or be able to keep their parents homes and if they do, then their old house must be disposed of. Anyone in this position since housing prices began their decline is facing this issue. The longer the downturn lasts the more pent up inventory there is. Divided estates, location, lack of income, disenchantment with owning rental property etc.will force more and more of this ‘natural’ turnover onto the market. My guess is that quite a lot of it is being witheld for the obvious reason no one wants to take a 20% or more haircut on a piece of property they own free and clear. Much easier in the first year or two to simply pay the property taxes and insurance and consider one’s options. That will grow old though as time passes and expenses mount. This is, IMO, going to put a lot of prime property through the same wringer that lesser homes have been going through.

There was a show called What You Get For the Money, I believe it was on HGTV. The premise was what can you buy for a given dollar amount. There were 3 properties shown in each episode in different cities. I can see it now, what you get for $1.

Obviously the figures used were based on inflated home values. Does anyone remember that tv program?

How about the next new trend in foreclosures: reverse cash out jingle mail!

The “prime” borrowers who drank the Kool-aid and are now underwater on their dream McMansions and will eventually realize how trapped they are in a rapidly depreciating asset, especially once the rate resets or they lose their job. Since banks are now dragging their feet in even admitting loans are delinquent (e.g., latest Wells Fargo accounting trick), let alone foreclosing on properties, these borrowers will try to pay/bribe the bank to foreclose on their properties in a timely manner. In CA, many have non-recourse loans and can walk away without penalty. This is a scary loophole if you are a banker.

I am concerned that the banks will drag their feet until McBama (are McCain and Obama really different when they both play for the same CFR team?) takes office and, in the name of saving the U.S. economy and helping the “little people,” will force all borrowers to make payments on their house if it can be shown they have a job/money, overriding any state law and preventing the only loophole left from being used by consumers to avoid personal balance sheet destruction. The return of debtors prisons will make many happy and the bankers are bailed out yet again – it’s a win-win.

Homeowners, walk away now while/if you still can! I don’t advocate trash outs, but I understand them…

Doc is, as usual, exactly correct.

I see another 4Q/08 and 1Q/09 housing minefield: energy.

After this winter’s explosion in electricity and heating oil/gas prices–whether or not it’s a mild season, and especially if it’s not–I predict that housing sales will be cooled even further by people’s realization that, never mind the mortgage, many houses for sale are going to bust their budget in the chops with energy costs.

People are going to start thinking and asking about that, as we did when we bought our place in 2001. As Riverside notes, we put energy at the top of our list: to hell with cathedral ceilings and granite countertops, we wanted location (walking commute to work and transit), passive solar design, correct site location and deciduous/evergreen plantings and possibilities, small size, low ceilings, zone heating (by room), all-electric everything, wood backup. We were planning for the long haul, expecting to be here at least 10 years; now it looks like it’ll be more like 20 to 30. 🙂

Most of the overbuilt housing stock AS WELL AS the older, inefficient houses amount to little more than energy consumption vectors. The 2005-07 houses in particular were built for the quick sale and lender/builder profits, Doc–another topic that could use your keen view and mind–not for long term sustainability. Any more than they were mortgaged within sustainable models.

rose

PS–our current energy saving tweak: turning a chest freezer into a refrigerator that runs on a fraction of a conventional unit’s energy consumption.

@SEAN

“What You Get For the Money” on HGTV! Your post just made me spit wine all over my computer screen! Those episodes are still running–as are “Secrets That Sell” and “Get it Sold.” Two shows with the same premise: selling your house is all about STAGING it, not the price you’re asking for it. (Hysterical, if you can pretend you are watching actors and not real people/families involved.) All these HGTV programs are going to make their way into a cultural studies class in the next few years for students studying the Greater-than-Great-Depression.

Adam where are you coming up your last paragraph about forcing borrowers to make payments, or debtors prisons? You were sounding sane and then I started to wonder if have you taken your meds?

JohnW,

If a crisis has been predicted, then it wouldn’t turn to a real crisis. Now everyone is talking about the Pay Option ARM crash, many institutions and government will do something to prevent it.

I agree with you.

@ JohnW

“Anyone picking a bottom in housing today is like the wicked witch standing right under that Kansas farm house as it falls from the sky and saying “I can see the bottom, and it’s getting closer….—

One of the best lines I have read yet on the housing bottom. Kudo’s, had me laughing, and I am going to admit that I will be stealing it (but crediting you).

Personally I’ve been using the ‘wizard – pull back the curtain’ meme for a couple of years now. Something about that movie… maybe it’s the tagline – “there’s no place like home…” (tap ruby slippers)

Wouldn’t about 80% of the Pay-option-Arms reset even earlier when you consider how many people opted to pay the absolute minimum payment

which didn’t even cover the interest and resulted in a negative ammortization?

Unless your house is appreciating and you have equity wouldn’t your

rising mortgage debt start triggering a reset once you house isn’t worth

what you owe on the mortgage?

And how come we hear so little about the Pay Option Arms in the media?

Every hype is about subprime and now even about prime loans. But I don’t hear the banks making one comment about the Option Arms…

Are they just hiding them on the books for now? Probably listing them with full payment option futures… to make the books look good until a reset hits

and they start to default?

What is going to happen when the investors have had their fills on the foreclosures? There is only so much they will need – especially when their goal is to “upgrade” and then sell the house for more.

I still watch the HGTV channel for fun and giggles. I wonder whether we are watching 2006 and 2007 re-runs… they have dropped the “flipping shows” for let’s vamp up that house for $2000 and get it sold… and the imfamous “staging”

shows. It’s amazing to think that they honestly try to make us believe that a buyer wouldn’t be able to see the potential unless you have the right shade curtains on your bay window.

I can’t wait until granite counter tops, vaulted ceilings and the stupid dark brown wood floors are no longer in fashion. This will trigger the next “remodeling” wave

when everybody drops the ceiling, puts in carpet and remodels the kitchen again.

And frankly… the next “designer” that thinks dark red or blue is the right choice to paint your walls… needs to be committed to a padded cell decorated in the above colors.

I was watching some HGTV House Porn while making parrot toys a few weeks ago. It was one of the “let’s tag along while Couple X shops for a house” ones. It was about as idiotic as they all are. I’m convinced the only function of these shows is to underscore for my parrot her superior intelligence to humans’.

I mention this show because it really threw me. It was from 2006 or 2007. And it appeared that the show was re-edited to leave out any mention of the prices of the houses they looked at, and what they finally decided to pay for it. So the whole thing didn’t make a whole lot of sense–especially with the apparent insertion of clips of a RealTor endlessly and slowly walking between houses and car while a voice-over repeated things s/he’d already said 20 times.

There ARE a lot more of those “pimp my sale” type shows now. If you watch closely, few to none of them end with an actual sale. They end with people gushing at the open house about the staging and decorator botox…but never an actual offer.

I’m seeing these shows also depicting sellers who face having to lower their asking price. It’s like a short ride on the Schadenfreude Express–the sellers squirming, clearly upset, but, you know, we have to look reasonable and polite for the camera, while opining through clenched teeth that we EXPECTED such-and-so price and therefore DESERVE it.

I’m waiting for a new program to emerge on HGTV: “SoCal Shorters.” The new, exciting show about people who turn a short sale into a LIFETIME OPPORTUNITY. Episode one: interior design for gutted shells with no plumbing, wiring, or wallboard. I can hear the NAR now, “And the airy exposed wall-studs allow easy pest inspections and lots of nooks for your DVD collection!”

rose

Dr., you are correct that the MLS is less than honest – I don’t think that surprises anyone. One thing I have noticed recently is a large number of previously for sale houses in Newport Beach (and there are so few listings now- – nothing selling really and no one is listing for fear of losing their ATMs – -er, assets) have fallen off the MLS completely – -there is no history of them ever being listed (or at a minimum the recent listing is completely gone). Yet the sign is still up in front of the house, and has been for months and months. So they get no advertising via the MLS yet it’s the same RE agent’s sign sitting there. This is a VERY common practice hre now for some reason. What’s the logic on that? Saving a few bucks in MLS listing fees, or is it perhaps that they wat the history to not show 284 DOM?

The absolutely top of stupidity show on HGTV:

What is my house worth?

You get so see the poor homeowner cringe when the Realtor points out that the granite top is the wrong shade or that the bathroom is still too 80’ish.

And of course… once you want to actually sell your house the chic new

purple wall paint isn’t what a buyer would look for.

and yet they usually appraise the house higher than what the homeowner

was shooting for… I wonder are they working for the tax assessors benefit

or do they really believe that this house could sell at such a ridiculous price?

I still think that one of the funniest show to watch on HGTV is the

one where they “appraise” the value of a house after the poor homeowner

has spent thousands of dollars of equity line credit on remodeling and

upgrading the house.

I think it’s called “What’s my house worth??”

You see a smug Real Estate “Expert” walk around in their house picking apart their “upgrades” making comments like “this is the wrong shade of granite to use as a countertop and what were you thinking when you painted this wall purple? Of course at the end of the drama she will haughtily announce what she, the absolute expert, claims as the correct price for the house.

If you listen careful you will notice that the terminology goes like this:

If I were to list this property on the market today…. it would be

(insert price 10 to 20% higher than what homeowner expected”

Hmm… let me list the home even higher than what they want… they will give me the listing and if I happen to find an idiot to buy this property (no problem… after all it has been aired on HGTV..) guess what I get …. % commission on the SALES price that I just quoted.

The Homeowner is in seventh heathen and will of course jump at the carrot

like any hungry bunny. Who needs a reality check?

Too bad that they are not honest enough to actually post updates on whether

or not that house sold for the inflated listing. In the meantime they (the homeowners) will of course follow any advise for addtional improvements that would allow an even higher sales recommendation and promise to tackle that bathroom rebuilt and to install hardwood floors in the bedrooms…

Oh yeah… after all the guy hosting the next show is the world famous

carpenter/designer and he needs a couple of projects….

I wonder when they will hand the property from one show to the other

remodeling and restaging it over and over again in hopes of finding a rich

buyer that hopefully comes with a suitcase full of money.

Read a book called The Millionaire Next Door. It’s been a few years since I read it, but it was written by a college Prof. who wanted to see what the average millionaire was like. Not the movie-star, athlete, singer or what have you millionaire, but the average guy who got up every day and went to work building a business and portfolio that eventually made him wealthy.

He was surprised to find that the “average” millionaire was someone you would never even suspect of being worth that much money, if you looked at his lifestyle. As you would expect, most of these people are business owners, and as such they understand one very important ingredient in a person’s financial life; overhead.

These millionaires live in houses and neighborhoods well below where you would expect a millionaire to live. These are smaller houses with smaller overhead; smaller heating bills, smaller property tax bills, smaller upkeep costs. The average millionaire understands wealth and net worth can be be fleeting, and doesn’t saddle himself with something that carries a continual king’s ransom to upkeep.

The people who generally buy the McMansions are “posers.” They want to project the appearance of wealth while they’re leveraged to the hilt. Real millionaires don’t buy McMansions.

I live in a remote area in northern Iowa. Not much going on here except farming and some light industry (although Winnebago Industries is about 15 miles away, but they’re laying people off left and right.)

However, if you’re able to live anywhere you wish to do your job, which I am able to, it’s EXTREMELY affordable. We bought a 3 bedroom ranch built in 1959, on 4 lots (1/4 of a town block), 3 years ago for $35,000. We’ve put about $12,000 in upgrades in it. The property tax bill came Thursday, $362/year. Heating and cooling average bill for last 12 months is about $72.50/mo. Quiet little town of about 475 (in a county of less than 13,000) people where you can walk or bike anywhere in 5 minutes. We don’t have pizza delivery, we don’t have 24 hour conveniences like the city (we’ve lived in Denver, Milwaukee, Des Moines and Minneapolis in the last 27 years). We do have clean air, quiet streets and an affordable lifestyle that suits us fine. We have just decided we would rather have money left over for enjoying life a little rather than spending all our energies paying for a house. Believe me, a $600,000 McMansion does no more to keep us warm or dry than our house does.

I guess I am seeing first hand the growing divide between the haves and have nots. Homes in my town are selling..laguna beach…even though i see many for sale and for lease signs, I also see SOLD eventially placed on the signage. No one is willing to part with a home of any drastic reduction…and this place saw a bubble too! So perhaps the remaining with money will remain in towns such as LB, Newport and other nicer coastal towns.

Leave a Reply to JohnW