Foreclosed: Predicting Foreclosures in California. How Many Homes will Be Foreclosed in 2008?

Making predictions is a tricky business. Just ask any political pundit or economist how easy it is to forecast the future. Yet we have enough current data from multiple sources to give us a solid idea that foreclosures, the ultimate finality to housing distress will continue to be a problem for the upcoming years. California is not immune to this and in fact, will have a much larger problem because of the magnitude of price increases over the past decade.There are multiple factors that will continue to put pressure on the California housing market:

1. Continued job losses from heavy reliance on the real estate industry.

2. Size of California loans much larger than national average.

3. Income growth is stagnant; in fact with more job losses this will put strains on the public.

4. Horrible state budget. This still is something not being dealt with adequately.

5. Perception. Psychology does have an impact but a much smaller one than the above key points.

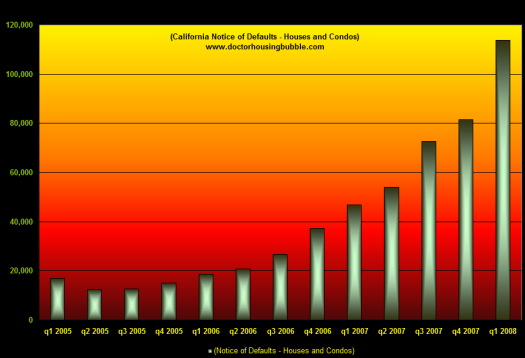

With that said, let us try to forecast how many foreclosures we’ll have in California by the end of 2008. First, let us take a look at the current notice of defaults:

As you can see from the chart above, the increase in lenders sending notices to homeowners has drastically increased over the last few quarters. We are up 143.1% since the first-quarter of 2007. The significance of notice of defaults is that they are a preliminary indicator of how many more foreclosures we will be seeing in the upcoming months. The trend for actual foreclosures is also startling. Take a look at the chart below:

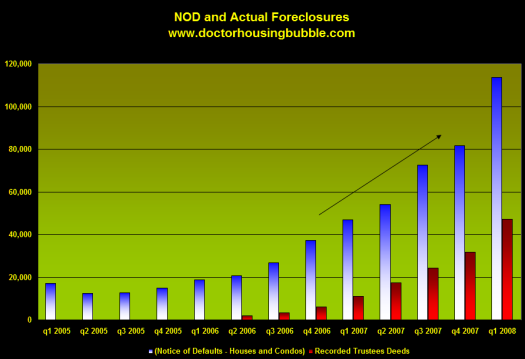

I started keeping track of trustee sales in q2 of 2006. But as you can see, the issue that we are now confronting is that even though NODs were relatively stable for 2006, trustee sales slowly started to increase during this time. Why is that? For one, a property that was having problems in 2006 was still able to back out by selling into a market that was still going strong in California. This was an exit strategy. Now that the price correction is accelerating this option is no longer on the table and that is why we are seeing both NODs and foreclosures simply growing at a large rate. What is more disturbing, is how many of these NODs are now going into foreclosure:

“Of the homeowners in default, an estimated 32 percent emerge from the foreclosure process by bringing their payments current, refinancing, or selling the home and paying off what they owe. A year ago it was about 52 percent. The increased portion of homes lost to foreclosure reflects the slow real estate market, as well as the number of homes bought during the height of the market with multiple-loan financing, which makes ‘work-outs’ difficult.”

What this means of course is that 68 percent will not emerge from this process and will lose their home in foreclosure. Since we know notice of defaults are a good indicator of the future trend with foreclosures, let us apply this number to the current NODs:

(110,392 individual homes with NODs for Q1 of 2008) x 68% will not go current = 75,066

With this said, in the first quarter of 2008 we had 46,760 homes go into foreclosure. Given that many of these NODs are on the verge of foreclosing, we can estimate that the numbers are going to increase substantially in the second quarter of 2008:

“On primary mortgages, California homeowners were a median five months behind on their payments when the lender started the default process. The borrowers owed a median $11,474 on a median $346,750 mortgage.”

Frankly the above is rather shocking because of the size of the mortgages and how far behind people are getting. If a borrower is having a hard time making a $2,000 payment do you think they are going to be able to get $11,474 out of thin air given the lack of savings many Americans have? I wouldn’t be surprised to see that 68% jump to a much higher number in the second quarter.

Without a doubt, California is going to have record foreclosures by the end of 2008 just given the state of the economy and how over leveraged the state is. Not a pretty forecast.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

11 Responses to “Foreclosed: Predicting Foreclosures in California. How Many Homes will Be Foreclosed in 2008?”

550,000 of which 320,000 will be reported, 80,000 “pocket foreclosures” where the bank won’t actually file the final paperwork but the people don’t know it, 100,000 families living in the foreclosed house for nominal rent and 50,000 gone in the night with no forwarding address.

I’m scaring myself.

Yeah, I would say that foreclosures and walk-aways are the next big thing to come, and when they start they will tend to reinforce the “okayness” of doing so, which will make it even more acceptable and so on and so on and so on…..

Bottom line: until housing corrects to where median income folks who save a little money can afford to buy a house we are nowhere near the bottom of this.

Shouldn’t there be a Black monday, tuesday, wednesday, thursday or friday soon?

I agree California’s housing market seems to be nearing a ‘real estate’ blackhole where the ‘gravity’ of falling prices and the huge number of option ARMS set to recast will suck ever more property through the ‘event horizon’. As more property falls into the vortex of negative equity, tighter credit standards, foreclosure sales, unsold inventory, a weakening macro economy the ‘black hole’ could grow and grow until nothing is left outside its financial gravity. What can stop this cumulative process or where the real estate market will emerge out of the black hole are the questions for which I have no answers. Certainly price falls are not ‘limitless’. I read an interesting question over at Seeking Alpha from a teacher in Denver. He reckoned that the heavy debt today’s college graduates are carrying in the form of student loans will hamper any housing recovery for sometime. He has a point. Unless and until the ‘entry level’ rung of the housing ladder is restored, largely eviscerated by the collapse of subprime lending, fixing the rest of the housing rungs maybe impossible. It is, perhaps, here that government efforts should be focused but through what mechanism I know not.

WPIX TV in New York reported last night that the econemy may have hit bottom with better earnings from Ford & a few other companies, Oh really! How does that help the home owner that is under water with there morggage? And pay higher prices at the pump & Safeway to boot.

You were doing so well until you said “the entry level rung of the housing ladder was largely eviscerated by the collapse of subprime lending…” It was subprime lending and the abuse of same that drove prices to uneconomical levels that wiped out that rung. Now you say government should be involved.

What do you think is ultimately going to happen to our dollar if the government continues to spend even more money than it already has to “fix” so many other problems, most of which are of it’s own making. Think supernova. Then you can forget about the “entry level” rung; there won’t be anything left.

Dr. HB,

Very interesting and spot on.

I think the one thing that people can’t grasp, or dont’ want to grasp is the magnitude of what is going on. The numbers are so large that they almost start losing meaning, because we have no reference point to compare this too.

The scale of what is going on is off the chart, there is no infrastructure to deal with this size of economic disaster. Katrina and the Tsunami sort of come to mind, compare it to a economic nuclear bomb going off in Florida and California. One can argue that this economic disaster is going to have the same end result as if a Nuclear weapon went off in LA county, etc. I would also argue that this may be even more difficult to deal with because this is happening over 18 plus month period vs. a nanosecond. Sure, what I am saying can be dismissed as so much hyperbole… but when you begin to think of what is happening now, and try to plot possible event futures you begin to see that the future is very scary. We are in a “System of a Down”, or a negative spiral…. the energy needed to pull us out of this is so massive that it is beyond comprehension, and most likely beyond possibility. One almost can come to the logical conclusion, “well I better get mine, before the whole @@@@house goes up in flames”… thank you Jim Morrison…

I’m a realtor and I feel that we are getting close to the bottom. You are starting to see lenders dumping properties now and multiple buyers for them. I think we are going to see prices level off and start to climb again next year. greg moser

realtor greg you must be on crack! No your job depnds on people buying..so go figure..the market will not hit a bottom for years and by then the fiat money you dumb americans and illegals (cant leave them out our 3rd world work force) allow your gov to print unchecked will crash…then you wont have to worry about making your house payment because the dollar will be worthless..you will enjoy the barter system..but they wont take plastic (that means you are screwed)..so offer up your wife for a blow job for a can of food…Now go back to watching your tv shows and play your video games stupid americans with your head in the sand..get up and go to work for your soon to be worthless currency..suckas!

Something no one ever looks at; every dollar made in the market someone has to lose a dollar. As long as there were Americans with money the market had new money and it looked as if money was being made but some day there is going to be a day of reckoning, like when all the baby boomers start take from their 401k’s, unless there are new fish to be fried these baby boomers are going to be in the soup lines.

Stocks have nothing to do with the companies profits or loses it has only to do with how many people selling and buying. When the baby boomers start selling shit will hit the fan because no one else has any money any more. Except the HNWI but there shit will be gone as the real big boys play their molly game on them.

Hey Dr. HB,

So, if Obama and Biden win it, and do work to change the Ch 13 bankruptcy laws, how will this affect the mortgage mess?

see these related articles:

http://www.bankruptcylawnetwork.com/2008/08/24/obama-biden-bankruptcy-what-is-really-going-on-here/

http://www.bankruptcylawnetwork.com/2008/08/20/bankruptcy-changes-foreclosue-crisis/

Leave a Reply to Matt