Forecasting the Societal Impact of the Housing and Credit Crisis: Recession Trends and Psychological Changes Regarding Housing.

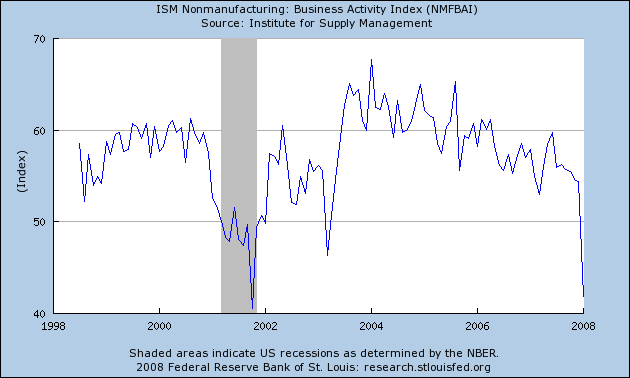

Last week we were presented with a very weak service sector report. The Institute for Supply Management issues a monthly report on non-manufacturing employment and market sentiment. The market was expecting a reading from 52 to 53 on the scale and we ended up getting a reading in at 44.6; anything below a 50 is considered a contraction. Now why did this report send the Dow Jones Industrial Average tumbling 366 points on Super Tuesday? Well the report itself for one cemented the idea that we are in the early stages of a recession and also our employment base is heavily dependent on the service sector so a contraction is not good for the overall health of our economy. Take a look at the ISM chart and you can see on a visual scale what occurred:

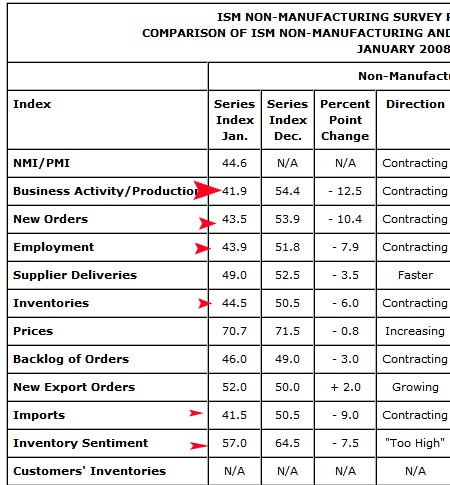

Let us take a look at the actual report further and you can see that from December to January, there was radical drop in many areas:

On virtually every standard measure, the chart fell off a cliff since business activity fell, new orders are falling, employment is decreasing, and the general sentiment is that inventory is too high. We can assume looking back, that the upcoming recession started in the forth quarter of 2007. The index is important because it looks at 4 key areas:

1. Business Activity

2. New Orders

3. Employment

4. Supplier Deliveries

We can also see that market sentiment is now hitting a tipping point by what respondents to the survey are saying:

*”Recession fears taking hold as cost containment strategies have been dusted off from 2002.” (Finance & Insurance)

*”Business [is] slow as normal after holiday rush.” (Management of Companies & Support Services)

*”Oil increases affecting delivery costs and the costs of goods.” (Retail Trade)

*”Business is tough coming into Q1 after a very tough, unprofitable Q4. Competitive pricing is driving rates to unreasonable levels as competition is over fleeted.” (Real Estate, Rental & Leasing)

*”… business activity is currently lower than normal at this time.” (Wholesale Trade)

With that said, we can also see that unemployment has been steadily increasing since January of 2007:

As the chart highlights, the previous recession lasting officially from March of 2001 to November of 2001 didn’t see peak unemployment until two years later in the summer and fall of 2003. It can be said that the impact of a relatively short recession such as the one in 2001 had lasting impacts for 4 years. Clearly the confluence of issues facing us this time are much bigger and deeper and reflect more of a parallel to the recession lasting from 1980 to 1982. That is why we shouldn’t expect a general bottom until 2010 or 2011. This isn’t some wild guess but based on previous economic downturns.

Social Impact – Deal or No Deal

As we enter into this recession, it is already apparent that social attitudes regarding debt and housing are changing overnight. In a culture where marriage is as easy as going to a drive-thru and divorce isn’t much harder, breaking a seemingly important commitment is easier to do even when times get tough. This is not a moral judgment. I’m simply struck by how quickly the honeymoon with real estate is ending. Looking back at market psychology during the boom times it was almost sacrosanct to talk about housing in a cautious tone. If you mentioned anything negative about housing you were at once labeled as a neg-head only focusing on doom and gloom. It really was a cultural phenomenon as much as it was an economic one.

We need only look at the television shows that sprouted up during this decade. With titles as follows:

Flip This House

Property Ladder

What’s My House Worth?

Million Dollar Listing

House Hunters

Anyone that has watched these shows realizes that the underlying psychological draw was the ability to make big money fast. Think of Deal or No Deal. In fact, the appeal of these shows wasn’t the nuts and bolts of the financial backing (since it was almost always a given that money and credit was available) but the appeal was based on slapping on a few trinkets, calling a few contractors, ringing up your agent, and flipping the house. It was as simple as the recipe for chocolate chip cookies. The dough was never ending. This was all fine and good so long as more and more people kept buying into the hype and belief that the ponzi scheme would go on forever. After all, no one really bothered to ask, “but what if prices decline?” That simple question would shatter the allure of the show’s inherent premise that property always goes up with a few minor upgrades.

It’ll be interesting to see how these shows do now that credit isn’t so easy to find and prices are on a steady path down. In fact, these shows walk a very thin line since as we have highlighted with the increasing contraction in employment, how will audiences feel worried about the economy watching real estate cowboys/girls flipping houses and making tens of thousands of dollars when they are concerned about their own jobs? When everyone is doing well, you are fine with leaving a little room for conspicuous consumption but when times get tight, folks generally don’t like people making easy money and shoving it in their face.

Why People are Willing to Walk Away

As we examined two weeks ago, people are much more willing to walk away from a poor investment decision. This is a radical shift in the supposed love relationship that has existed with housing over the decade. In fact, this decision shows us how commoditized housing has become. You can theoretically buy and sell a home with never coming in touch with a physical person. How?

1. First, call up a broker and get an online quote.

2. Next, ask them to electronically send you any statements you need to fill out. Remember during the bubble times your income was taken many times at face value.

3. After you have a pre-approval, simply go online through any of the MLS public services that now offer online offer submissions.

4. Put your offer in, ask the selling agent to put you in touch with the title company.

5. Ask said title company to either fax or electronically send you all documents for you to sign.

6. Send your cashier check, close escrow, and get your keys.

All this accomplished and now you own a home without coming into contact with a living breathing human being. I’m not saying this is the way to go but many people bought homes like this especially in the 2nd home market where would be investors bought out of state site unseen. The psychological impact on all this is that a poor decision in housing suddenly becomes a purely economical one. Therefore, the assumption models many lenders and Wall Street were using optimistically assumed people would have the same commitment as previous historical buyers; this was not that time in history. And with the advent of zero down mortgages current owners really have nothing to lose except their credit and frankly many of these people already have poor credit! Bottom line, they have nothing to lose, except a back breaking mortgage and a depreciating asset.

The lenders are also not in a position to argue morality. What are they going to say? “Dear Homeowner. We’ve noticed that you are not making any payments. Please pay up and show your commitment to your home. We loaned you $500,000 knowing that you would fight as hard as you can to maintain your home. You may have read that we aren’t able to make our own credit payments but that is not the point here, we are asking you to help us help you – your friendly servicer/bank/lender.” The fragility of the entire system collapsed once the first few cracks in housing appeared. The Case-Shiller Index which tracks many metro areas, only shows a 7.8% decline nationally on a year over year basis and we are already seeing the entire system come to a grinding halt. Recent estimates discuss housing dropping 20 to 30 percent so you can imagine how drawn out this thing can go. Let us run a few scenarios to show how much wealth will be lost simply in the residential housing downturn:

Total Residential Housing Value: $20.66 Trillion

A 10 percent decline – $2.066 trillion lost

A 20 percent decline – $4.132 trillion lost

A 25 percent decline – $5.165 trillion lost

A 30 percent decline – $6.198 trillion lost

Just as a historical frame of reference, the technology bust which occurred in the earlier part of this decade wiped out $5 trillion from technology companies. How much more money will be lost from high paying finance jobs that will no longer be here? What about the contraction in construction? On NPR there was a recent story about a couple that both worked in real estate up in central California. The man was talking about how they had lost their home to foreclosure in the early 80s. It had scared them psychologically and they vowed never to let that happen again. They mustered enough courage after doing extremely well this decade and decide to buy a $430,000 home in their immediate area. The central part of California is seeing some of the worst of this downturn with some homes selling for 50 percent less. Now they are struggling to make their payment on a resetting mortgage with a decrease in their pay since their industry is directly tied to real estate. The man goes on to say that they will most likely lose their home.

As he ends his story he says something that has really become an issue with thousands and encompasses the recession sentiment further. “I’m not worried about my rate resetting since my income just reset.” With incomes resetting, we are now hearing less about “freezing rates” or trying to somehow blame the entire problem on resetting loans. What we are now facing is the bursting of a credit and housing bubble and there is no way to keep the game going except to return to things such as no-doc loans and a hungry secondary mortgage market. Do you really see that happening?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

15 Responses to “Forecasting the Societal Impact of the Housing and Credit Crisis: Recession Trends and Psychological Changes Regarding Housing.”

Hi,

I live in Southern California. I have no idea what will happen in the next five years because of this mess, so I’m kinda scared.

Right now I rent an apartment, and I have a small emergency fund stored in a treasury money market fund. I have no debt. I’m saving what I can, but is there anything else can I do to prepare for the next five years?

Thank you for running this excellent site,

Jen

Dr,

I think folks care about their credit and I enjoy your posts; but coughing up a hundred grand or two at closing isn’t something most of us can do. Anyone that bought a house here in the last four years has to keep their walking shoes handy. It’s a necessity if any life events threaten your status quo.

THE DOCTOR writes “If you mentioned anything negative about housing you were at once labeled as a neg-head only focusing on doom and gloom”

Ah yes…..all that garbage about “postive thinking”. If the facts are negative then the only sensible thing to do is acknowledge the facts are neagtive and deal with the reality. If one doesn’t deal in and with reality, that behavior is usually labelled “delusional” and will get the person a nice long stay in a locked hospital ward and lots of very strong drugs.

THE DOCTOR also comments that “After all, no one really bothered to ask, “but what if prices decline?â€

I read an interview with one of the Wall Street wizards who designed those risk models for the weird and funky loans. (Wish I could remember where so I could give you the link.) Anyway, he was ask what behavior of the market and prices the model was based on. He said it assumed that prices would keep rising. He was ask what happened to the risk model predictions if house prices went flat. He said the model failed. He was ask what hppened to the accuracy of the risk model if prices fell. He said the model failed. When I finished reading it I turned ot my husband and stared ranting about where in the world they found such morons let alone paid them huge sums of money to be so stupid. (FIY, I have degrees in economics with aspecialty in pricing and demand for goods and services and law. The econ training allows me to see the issues in assessing demand and consumer behavior. The law degree and doing litigation makes me very concious that you hope for the best and prepare for the absolute worst possible outcome and remotely possible events.) In utter exasperation, I ask my husband how in the world if I could see that the model was a complete disaster from the get-go , why couldn’t the designers; and I should have applied for their jobs since at least I had a grip on reality. He looked at me and said that (1) they didn’t want to consider that their positive-only assumptions might not be the reality or they wouldn’t have made billions peddling snaake-oil and that (2) if I had been working for those firms, I would have informed them in no uncertain terms that their assumptions were nuts and impossibly risky, and the vaunted models were garbage – and promptly gotten fired for “not being a team player.”

BTW DOCTOR- sure wish you ran some Real Homes of Genius from other places. I have a doozy for you where the foreclosure auction notice was just published. Bought in 3/06. First listed for sale around 12/06-1/07. Had price cuts so it now 30% of the original list – and still can’t sell it. Original list – $3,900,000. Current list – $2,700,000. Amount owed to lender and running 8.875% interest – $1,900,000. Guess the attempted ‘flip’ of a summer home that is 4-5 hours from any city with more than 15-20,000 people didn’t work out too well.

Unlike the dot.com bust we are now seeing both the equities markets AND the real estate industry losing value. Add to this the fall in interest rates that will erode even the value of cash and there are few places for investors to go that will earn them a decent return.

Because of this poor investment climate many are investing overseas. This has often been a problem for third world nations wherein capital is moved out of the country to a point where governments try and enforce capital controls limiting the amount of money that can be taken out of the country.

DHB:

The guy who lost his house 27 years ago is going to lose the next one in a matter of time. He is also a new member of the Housing Bubble Hall of Shame for cashing out over $100K of “equity”. See the attached link.

http://realestaterecord.blogspot.com/2008/02/kevin-mims.html

It still amazes me that lenders were so eager to throw the money at people without any due diligence. During my career in public accounting, I have never before seen such lax lending standards by banks and other lending institutions. In the past, I have seen banks require companies to jump through hoops and offer their first born just to get approval for an operating line of credit of $100,000. If they fell below the standards set by the bank, the line was pulled. Go figure.

There will be some examples made out of this debacle, but for the most part, a great number will get off scott free. In the end the taxpayers will be the group to get the shaft. I have no more to say today, I am starting to get really pissed.

Take care.

Back in OC in 2012 . . . maybe

No one can tell what is going to happen in the future but I bet this year is finally the last year anyone will hold on to the real estate dream and it becomes a nightmare. I still see people trying to sell houses for $600+ per square foot in middle income neighborhoods. Their dream will because a nightmare now that credit is harder to get. Rupert Murdoch and Warren Buffet was very nieve when they say that credit is available. But to who? Them? What about the average person? Are they going to by all the overpriced homes? Or are they going to give them a zero interest loan which for some still cannot afford to pay the principle? I think the end of this sping/summer selling season will be the panick.

It’s just all the insanity of basically having a bait-and-switch product all-in-one.

Look at my LOW monthly payment! We can afford much MORE house! Don’t worry, we can sell or refinance before our rates go up! EVERYONE says real estate only goes UP!

OOPS!

What a psychotic river of denial! Real Estate is cyclical, like EVERYTHING ELSE. I mean, I’m a late boomer. I remember the real estate cycle in the early 1980’s. Most baby boomers are older than me. WHAT THE F*CK IS WRONG WITH THE BOOMERS?

One last thought. As all those boomers retire and go through their kids gone/downsizing phase, what happens to all those McMansions?

@doug r

” I mean, I’m a late boomer. I remember the real estate cycle in the early 1980’s. Most baby boomers are older than me. WHAT THE F*CK IS WRONG WITH THE BOOMERS?

One last thought. As all those boomers retire and go through their kids gone/downsizing phase, what happens to all those McMansions?”

While some of our generation got involved in the real estate gambling casino, what I am seeing far far more are the late 20ish – barely over 40ish group sliding into foreclosure with these toxic loans. I do volunteer counseling and am on the board of the housing agency for my county (we have real problems with workforce housing because of 2nd homeowners who show up for 4 weeks in the summer and drive up prices.) It is always the same old stories: (1) but it was our dream house and we didn’t want to wait or (2) we deserved it because our parents live in houses like that and we shouldn’t have to make do with less or (3) our kids are entitled to live in a house at least as nice as our parents……..

They could be cut into duplexes or apartments just like all the oversized Victorians around our local campus. All those kid’s bedrooms each have their own bath, you’d just have to work out separate entrances.

I must admit that it has been a personal struggle to sit back in my 2300 square foot home with family of 5 (with no basement), while innumerable firends and family members making less than half of my salary have bought spacious new homes (yes, McMansions – so crud construction but lots of space), with 2-3 times the space we have, although 4 times the cost…the desire to “move-on-up” is incredibly strong – but common sense continued to tell me that it just didn’t make sense that regular Joes could have these dream homes. We continue to delay gratification until some sense of logic is restored

We are in a recession in the United States. The housing downturn is negatively impacting property sales in second home communities in Florida. This is also slowing sales in NC mountain resorts that depend on Florida buyers.

Still the downturn in prices and building of inventories is starting to attract second home buyers from Florida looking for cool temperatures in our mountains. Also the dramatic decline in the dollar combined with weakness in American real estate markets are beginning to attract bargain hunting European investors.

Ron Holland, Broker/Realtor with Wolf’s Crossing Realty. See http://www.ronaldholland.com Ron markets resale mountain and ski resort properties in NC in Wolf Laurel and The Preserve at Wolf Laurel.

Great Article Dr.

I enjoy reading your blog. I say this spring is when all hell is going to break

loose. I’ve been hearing that there are ARM resettings scheduled out into like 2008. 09, 10, 11, & 12. Heaven help people employed in any sector of real estate.

My guess is that we are no were near bottom and things are only going to improve for those who have 1) lived with their means, 2) been saving money for a 20% plus downpayment, 3) have waited out this ridiculous roller coaster ride for affordability to return to the market. 4) the folks who are good at bargain hunting for a house that once was priced at say 550K that will be worth 250K in a one to two years down the road.

It will not suprise me if in California (I’m in the Sacramento Area) as a whole, values may depreciate at least 50%. Could go higher than 50%,it’s anyone’s guess. Get ready and hold on, it’s gonna be an interesting ride.

Well in fairness to “Flip This House” the other night I saw an episode where a 20-something “real estate consultant” and his wife managed to lose $120K on a remodel.

The fact is that morality will not be considered as part of the issue since it is just

one more thing this country is too politically correct to challenge and is after all, something yet to be successfully legislated.

Let’s just stick to “for every action there is a reaction”. For those of you who

truly believe everyone in the real estate industry, particulary Mr. Bank, will finally get what they deserve, then be happy. Should Mr. Bank decide the best way

to deal with the new phenomenon of “walkers” and “jingle keys” is to prohibit any mortgage lending to such for the next five years or possibly even longer, you

no doubt will not be surprised.

Dr. HB,

I beg you to please, please, please write a book about the housing bubble of this decade.

Our young people need to learn from your brilliant analysis for their future.

Leave a Reply to Louise