FHA insured loans now cross a giant tipping point exceeding $1 trillion in book value at risk. The low down payment option with rising defaults that will require taxpayer bailouts of billions of dollars.

Cash strapped home buyers have quietly shifted to financing their home purchases with FHA insured loans since the crisis accelerated in 2007 after pocket lint was discounted as sufficient collateral to secure a mortgage. The reason for the alteration in loan volume is both disturbing and simply reflects the reality that American households are still broke and addicted to debt. The FHA total book value of loans has soared to over $1 trillion. These are loans made with 3.5 percent down payments and carry laxer lending standards. So it should be no surprise that defaults for FHA insured loans are hitting record levels. The mission of the FHA was to make homes more affordable to lower income households which ironically are now a larger part of the U.S. population. However the FHA has been used as a conduit to increase loans in housing markets where bubbles are still persistent. The median U.S. home prices is $163,000 so to make a FHA loan for say $500,000 makes absolutely no sense and has no resemblance of a low income market. Sort of like the real estate industry claiming option ARMs were for doctors and actors that simply did not want to document large amounts of income, which consequently never materialized and ended up in the hands of aspiring Joneses purchasing million dollar homes on $50,000 to $100,000 annual incomes. Keep in mind simply by loan and market size the FHA secured loan portfolio has increased largely from infiltrating bubble markets like California under the guise of helping lower priced areas. Let us look at the absurd increase of FHA insured loans since the crisis started.

From zero to crazy in a couple of years

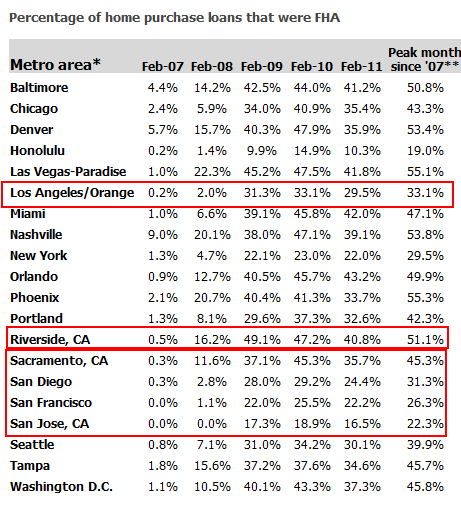

Source:Â DataQuick

There should be little doubt that FHA insured loans have stepped in to fill the vacuum of low down payment to nothing down NINJA loans. Just because you now have to document some income to qualify for a loan does not make financial sense to give someone a loan with 96.5 percent loan-to-value leverage. The FHA’s mission was never intended to be a large part of the market but it is now the only game in town for many buyers. Take a look at the above chart. In the manic markets of San Francisco and San Jose FHA insured loans made up roughly 0 percent of home purchases in 2007. Today they are up to 22 and 16 percent respectively. These are $500,000+ markets (a very long way from the U.S. median price of $163,000). Or look at a market like Phoenix. Over 33 percent of purchases are made with FHA insured loans and close to 50 percent come from investors. So the entire market is being held up with low down payment households and speculators! When I see the rising defaults of FHA insured loans you realize that one of the main causes of default is having little skin in the game.

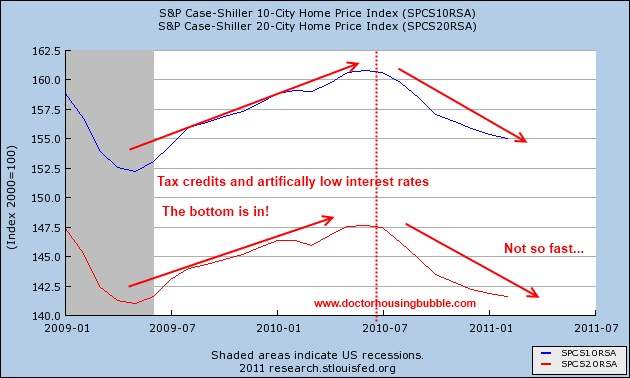

So the above chart is incredibly telling of the nature of the market. Keep in mind that anyone that purchases a home with the typical 3.5 percent down payment is underwater from day one. Why? Well you have to sell your home and that still costs 5 to 6 percent if you use a real estate agent. And home prices haven’t exactly been going up in the last year:

The market is so sensitive to little changes that people even respond to any changes that may alter their monthly nut. Since the FHA insured loan portfolio is experiencing stress the cost of these loans is increasing through PMI. Even a slight change did this to the market:

“(NY Times) In the first quarter, 17.7 percent of new loans were F.H.A., according to Inside Mortgage Finance, an industry data provider, while P.M.I. had a 5.4 percent market share. Applications for F.H.A. loans jumped 20 percent in the month preceding the price increase, then tumbled when it went into effect, according to the Mortgage Bankers Association.

In addition to lower minimum down-payment requirements, F.H.A. has laxer rules for credit scores and debt-to-income ratios. Right now, it also has lower interest rates, said Thatcher Zuse, the president of Sound Mortgage, a lender and broker in Guilford, Conn. “Almost as a rule, as the rates stand right now, the less equity you’re putting down, the better the F.H.A. deal becomes.â€

The toxic loan market in terms of Alt-A and option ARM loans is largely nonexistent but there is no doubt that we have a questionable loan products through FHA insured loans. The default rates are soaring because giving loans to people with very little down payment makes absolutely no sense especially when household incomes are so fragile. I’m surprised how many people come to defend the FHA as it inches closer and closer to a bailout. Why not agree on the fact that if FHA’s mission is for lower income households why not cap it at the median U.S. home price? Look at this insanity reported from the CBO regarding the FHA’s missions:

“(CBO) To target the program toward low- and moderate-income borrowers, the law limits

the size of a mortgage that may be insured. The limits vary by geographic region and

depend on such factors as the ceilings that apply to mortgages that are legally eligible

for purchase by Fannie Mae and Freddie Mac, appreciation in home prices, and the

cost of living in an area. Currently, the limit for a one-unit property in most areas is

$271,050, although in some high-cost areas FHA can insure loans up to $729,750.

(By comparison, the median sales price of existing single-family homes in the United

States in 2010 was $173,000, according to the National Association of Realtors.)â€

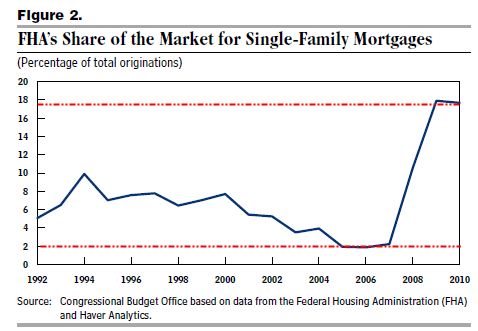

How in the world is $729,750 a price geared to low to moderate income buyers? This is the kind of mentality that led us into the bubble in the first place. The higher limit will come down but it is absurd to think that this product is somehow for the “working†people of the country. It is merely another shadow bailout to protect the banking interests to keep loan volume churning. And make no mistake FHA insured loans were never a big part of the market:

FHA’s share of the market never surpassed 10 percent and went as low as 2 percent. The average from 1992 to 2007 was closer to 6 percent. Today it is 18 percent! This is unsustainable but shows the fact that many people have no ability to even come up with a 10 percent down payment (forget about the more historical average of 20 percent). 20 percent wouldn’t be such a big deal if home prices weren’t inflated by the Federal Reserve, artificially low mortgage rates, and low down payment government products now used as a catchall product. A down payment with enough teeth is absolutely crucial. First, it shows people have the adequate ability to save but it will also lower home prices to reflect actual household incomes. That is the supreme irony here. A program designed to help housing become more “affordable†is actually keeping it inflated because more and more people can buy a home with a pathetic down payment. Not only is that the case, as we have shown above in the 20 metro chart many high priced markets are relying on FHA insured loans and these are not low to moderate income areas.

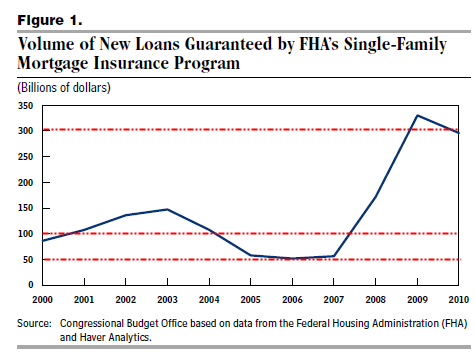

The FHA continues to guarantee an absurd amount of loans:

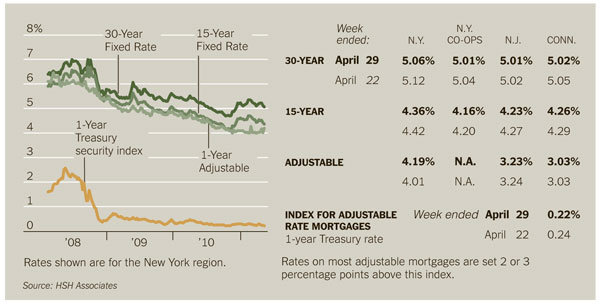

What the above tells me is that we still haven’t learned our lessons about the housing bubble. We went from 2007 where the FHA was insuring about $50 billion of total loan originations to $350 billion in 2009. Can you tell what loan product is taking up the slack from Alt-A and option ARMs going away? The fact that home sales are slow and prices are dropping reflect the fact that wages are weak and jobs are lower paying as an overall trend. It certainly isn’t mortgage rates:

Source:Â NY Times

Let me provide you a chart to soothe your mind:

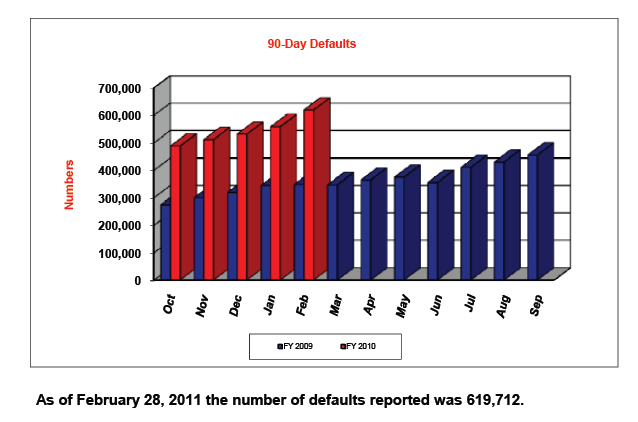

Source:Â HUD

Glad we learned our lesson about the housing bubble. Defaults are soaring so what do we do? We continue doing what we’ve been doing.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

69 Responses to “FHA insured loans now cross a giant tipping point exceeding $1 trillion in book value at risk. The low down payment option with rising defaults that will require taxpayer bailouts of billions of dollars.”

Superb article! Thank you for publishing this important look at the FHA.

One thing that I’d add is the fact that if you buy today with just 3.5% down, you’ll be underwater in 4 months, if Housing keeps dropping in price by 1% a month. A year from now, you’ll be underwater by 8.5%. My guess is at least 10%.

When you pass out easy money, people don’t care about the future. And they’ll be back asking for more bailouts. Not much different from the Banksters in that regard. Truly addicted to credit.

do not forget the current 1% UFMIP and the past 2.25% UFMIP. upside down on day one considering 6% RE commsion and anywhere from 0-6% seller credits…….

“Glad we learned our lesson about the housing bubble. Defaults are soaring so what do we do? We continue doing what we’ve been doing.”

We are a Nation of ignorant, uneducated hedonists. We are not going to change a damn thing because we believe that we are the best people in the World. Well, the Japanese thought the same thing. Now they are finished. We are going to keep going until we are forced to change and deal with reality.

I blame it on the public education system that produces good, obedient consumers.

It is now five years of declining prices for housing. Will the United State follow Japan housing decline for twenty years??

United States government is making all the same mistaks as the Japanese. Nobody will take the hard hit for two years. Like the 1920 recession.

never understood why the gov’t helps rich people buy homes, and not rich people get in over their heads – there’s really many fewer cases where this “aid” makes sense for both parties and the economy

Fantastic article DHB. Now I understand what they discuss at these Governors Conferences as well as the Mayors Conferences. ” Equity “. These low income home loan programs help nobody except the property tax collectors.

If you can not scrape together at least a 10% down payment, you should keep renting . Puting yourself deeply into debt, in a declining market, could jeoporadize your entire future.

From what I’ve been reading on various online newspaper and housing sites, the ones who want this FHA loan limit of $729k+ to continue are upscale-area homeowners, real estate agents and sellers on the coasts who want to make a mint on the resale of their over-priced properties.

http://www.estatesofcarmel.com/carmel-ca-homes-news-fannie-freddie-fha-loan-limits-extended

OK, so poor and low-income people buy in Carmel?

Another from FHA’s own site:

“FHA Loans in Carmel Valley, California

FHA loans can benefit those who would like to purchase a home in Carmel Valley but haven’t been able to save enough money for the purchase: like recent college graduates, newlyweds, or people who are still trying to complete their education. It also allows individuals whose credit has been marred by bankruptcy or foreclosure to qualify for an FHA loan.”

http://www.fha.com/fha_loan_appraiser.cfm?city=CARMEL%20VALLEY&state=CALIFORNIA

~Misstrial

“It also allows individuals whose credit has been marred by bankruptcy or foreclosure to qualify for an FHA loan. ”

this particular sentence elicits the same response from me regardless of the location: W T F.

if you have a recent bankruptcy or foreclosure, you have no business even thinking about “owning” a house!!!

What is recent? I believe that is to general of a comment. Myself and some very good friends have been squeezed in this market from a job or business perspective. Not from over extension on a home purchase. The hardship we face, is weighted to outside influences. We struggle and look to live up to the obligation; however, the best “business” decision is to take the hit and let the contract play out. I’m willing, not just forced, to move on; however, the largest financial institutions have been saved. Not having to realize the hit on the balance sheet. Pretent and extend !!!!!!

>> “It also allows individuals whose credit has been marred by bankruptcy or foreclosure to qualify for an FHA loan. â€

this particular sentence elicits the same response from me regardless of the location: W T F.<<<

Not everyone's situation is the same. So please don't assume the WTF here. In my case had a really messy divorce, ex got the house, then it was foreclosed on. My name was still on the loan and my credit went into the toilet. But I still make a lot of money and can easily make payments on a medium house in my area. However, no one will lend me money.

Our lack of mathematical understanding is contributing to the problem. We’re so used to things getting better in the future, but that is anything but the trend anymore. Another point Doc has made a number of times is that people think their houses are their savings accounts. That doesn’t make much sense. Many used equity as an ATM, adding debt to their lack of saving understanding.

Has the rule changed about only one FHA loan? Are they doling out multiples now?

Well, darkages, if you want you can choose one of two FHA document formats that are intended to simplify current “complex” paperwork.

http://www.consumerfinance.gov

Apparently, in their quest for government loan money, borrowers find the current documents to be incomprehensible and they just can’t get it together to take the time to comprehend it all

After making my choice, in the comment box provided, I gave additional feedback on the choices presented, stating that:

“OK I looked at the forms and made my choice.

Nevertheless, I think the forms need to be dumbed-down even further – I’m talking here about a third-grade level coloring book presentation: multiple colors, simple graphics, connect-the-dots, do-the-math interactive type-of-thing.

Sorry, but for many borrowers, the decision is an emotional one, not mental. You’ve got to make the mental process for them tolerable.”

I repeated this same text on the Los Angeles Times article page.

~Misstrial

Thanks for the consistent article links Mistrial. You really do your homework, and it’s appreciated. This other outside linked information does lend a good hand to the depth of the conversation.

I am speechless… I am without speech… ;’) …mostly ’cause The Doc covered it all, to wit:

“The mission of the FHA was to make homes more affordable to lower income households which *ironically* are now a larger part of the U.S. population. ”

D’OH! CRUEL irony, indeed!

…

“How in the world is $729,750 a price geared to low to moderate income buyers? This is the kind of mentality that led us into the bubble in the first place. The higher limit will come down but it is absurd to think that this product is somehow for the “working†people of the country. [b]It is merely another shadow bailout to protect the banking interests to keep loan volume churning.[/b]”

🙄

The government and our fellow citizens are ADDICTED to debt. The idea of saving your money, watching it grow, saving for a big ticket purchase item, etc…. are completely foreign.

God only knows when we will get back on track financially. If you can’t save 20% for a down payment for a house then maybe “owning” a house isn’t for you. But despite it all, according to Gallup, Americans still believe owning your own house is the American Dream!

It is hard to overestimate the power of decades of NAR propaganda, delivered straight to the sheeples’ minds by the most powerful brainwashing instrument ever devised: Duh Boob Tube. So-called “product placement” (i.e. showing name-brand consumer items in TV shows and movies) is nothing compared to the “home ownership = bliss” mantra, and its corollary “renter = loser”, all pounded home by Duh Beautiful People and Duh Talking Heads. It’s all deadly effective.

The readers of this blog, while savvy to the scams, are statistically insignificant to the macro trends, played like a fiddle by our PTBs in DC and Manhattan.

Unscathed by the damage wrought on Phony Mae and Fraudie Mac, the FHA was the natural “go-to” alphabet agency when more slinkies were needed to set in motion down-down-down the extend-and-pretend stairway.

A graph of US housing, due to Duh Fed:

http://www.youtube.com/watch?v=7JhVbybEXdY

I was driving on Ventura Blvd in Tarzana the other day and noticed an ad for a local RE agent. Her catchphrase was “I don’t sell houses, I help people buy their dreams”. Unbelievable denial still reigns. These agents are out of their money grubbing minds, playing on emotions rather than the reality of the market. I just moved from one rental home to another, and people always ask, “why didn’t you buy”, and I tell them I’m not putting my hard earned 20% down on a declining asset, just to support an unsustainable, fake bubble that still exists in the more desirable areas of SFV. I will continue to rent until prices reflect what people earn, like what the good DR. says.

The guy who lives across the street from my sister bought his house in 06, “at the very peak”, for 1.7M. He promptly gutted the house and landscaped his acre backyard, rebuilt virtually everything, putting in another 3/4 M when all was said and done…. So now it’s five years later, he’s into in for at least 2.5M, in a plain, middle class neighborhood. Nothing special about it. Zillow has his house estimated now at “872K.” Wow!! That’s gotta leave a mark.

I’m surrounded by the same story here in So-Fla… even though most probably sold/flipped something into Duh Bubble, to make the buy, they’re still hosed with huge losses of REAL money. Broward and Miami-Dade Counties’ prop appraisers have fairly good websites that make it easy to track a flipper’s “career” by name, and often link to the mortgage too… you can see the “heroin” taking hold… while the credit noose tightened… by late 2005 you see them putting 50% or more down–can you say STUCK in place?

But many skated all the way, screwing the banks but good, i.e. mortgage for 80%, thus it APPEARS it was 20% down, but further links show entire 20% rolled into a 2nd lien (typically with same lender!) for effective 0% down, maybe even got a little cash at closing… make a few years’ (rent) payments, then stop, squat for 36 months, money AHEAD. Second mortgage totally “vacated” by foreclosure court, no recourse for bank on that dicey deal.

“But many skated all the way, screwing the banks but good, i.e. mortgage for 80%, thus it APPEARS it was 20% down, but further links show entire 20% rolled into a 2nd lien (typically with same lender!) for effective 0% down, maybe even got a little cash at closing”

Enzo, last year my husband and I met with a realtor and considered buying in a not so special town in N. California. Talking to the realtor, that was my impression of how things were working. She said we were in the minority to have money for a down payment. Most homes required that she went through hoops to piece together financing for the buyers. We decided not to buy in that area. I was put off by the crappy homes in a crappy town that were still asking for a premium price. And I was put off by the realtor who shuttled us around to homes asking over $400,000 –and when we said, “But, we could get a better house for that price in a better city” she just said, “Well, that’s what they’re worth here.”

These 2 lines says it all …what happened and whats happening now..

———–

The mission of the FHA was to make homes more affordable to lower income households which ironically are now a larger part of the U.S. population. However the FHA has been used as a conduit to increase loans in housing markets where bubbles are still persistent.

————-

Is the problem that people are too complacent, self-centered, plain dumb, uneducated, greedy, and don’t give a shit about anything that they don’t see what’s going on here? It’s only been a few years and they are loading up the real estate heroin needle again?!? AT OUR EXPENSE, AGAIN!

Dr. H.B., our guiding light through this mess, please schedule a seminar, where we can attend in person and start getting some signatures going to get some change happening. It’s one thing to bitch on the internets, but we have to do something about this, and everything else that is sinking this ship.

I thank you for another excellent article!

California appears to have another program which can be combined with FHA loans.

The California home buyers down payment assistance program (CHDAP) lowers the down payment to 1% or £1000 (which ever is greater).

Even though it’s limited to first time buyers this strikes me as incredibly risky.

The American Dream By The Provocateur Network

http://www.youtube.com/watch?v=ZPWH5TlbloU

We have been in a gradual state of decline for many jears,

How about real esate taxes. In Texas, most large cities hit around 2.5% and some up to 3% a year. Figure that into your growing “equity” with 3.5% down payment. And, these taxes are going up.

A great and often forgotten point. Houses must appreciate by your tax rate every year just to break even. And this doesn’t include all the other costs, or the 5-6% you lose when you sell.

Good point. However, with Texas as an example, you need consider the fact that they do not levy an individual income tax. This cannot be overlooked, for as we know, here in CA the top marginal rate is as high as ~10% (doesn’t take much income to get there). For example, a Family of 4 with taxable income of ~$100,000 will pay a little over $4,000 of income tax (progressive tax rates).

Factors vary from state to state. I just didn’t want anyone to be mislead when it comes to taxation in this particular example. The states WILL get their money in one way or another (NV largely from casinos, etc.)…

California has a 1% property tax rate. That’s probably why we had a more severe bubble that almost every other state. We have a relatively high progressive income tax, too. That’s why we’re having budget shortfalls – income dropped a lot.

The problem is that poor people aren’t politically organized enough to resist this giveaway to the upper middle class. Moderate income buyers are facing foreclosure processes that are a lot swifter than the middle to upper income buyers. The banks see investors buying, so they foreclose on the working class buyers who used to be one of the constituencies aided by the FHA.

I know this goes against the tea party and even Republicrat and MSM media story – but if you consider it, it’s so patently true. The 700k FHA loan benefits the wealthy. The 400k FHA loan benefits the middle class. The 3.5% down benefits the real estate business.

Meanwhile the areas that should be bought up by the working class — that is the working class neighborhoods — where the rents are roughly equal to the monthly mortgage, are being raided by rich investors. This is absolute absurdity.

If the poor had any pull, the money would be used to support the poor renters who can save the 10% down on a $80k to $150k house. But last time I checked, the poor didn’t have much of a lobby presence, especially with regard to homebuying. The far-right scum killed off ACORN (who were not a conduit for liar loans, incidentally). The real estate industry has lobbyists. The banks have lobbyists. The rich have their connections. The middle class are solid voters. Even the unions, who used to support the working class, are really focused on the middle class today.

As a future buyer (when it makes financial sense) I get so tired of these programs that are going to help me afford a home by extending credit and making it easier to get me into a loan…and massive amounts of debt. This whole scam sounds like something created to help a bank, not lower income or moderate income borrowers. We need to get rid of this idea that we are “helping’ anybody just by getting them to sign for a mortgage, we haven’t helped them, we’ve just signed their lives away to debt for the next 30 years.

Preferably the government should stop guaranteeing all loans, but at the very least they shouldn’t be backing loans all the way up to 729k. The sooner they stop trying to prop up the market, the sooner 20% down actually becomes realistic for the average borrower. We’ve created a never ending cycle where prices become so inflated that nobody can afford a real down payment, so the solution is always easier credit and loans. Have we learned nothing from the bubble?

“This whole scam sounds like something created to help a bank,”

That’s what it sounds like to me, too. Something to help prop up the values of the homes they need to sell. Looks like it’s not working very well, though.

The other big factor at play here is the increase in PMI (private mortgage ins) which is required in an FHA loan. PMI is now adds a whopping 1.5% to your loan at close of escrow and an absolutely insane 1.15% of your loan balance PER YEAR. So if you buy a tiny condo in Santa Monica or Brentwood for $525,000 then your monthly PMI is going to tack on an extra $480.00 per month to your payment. BTW this $480/month doesn’t include taxes, HOA dues, homeowners ins, earthquake ins or your actual mortgage payment. It’s insane. FHA is only good if your buying an $80,000 property in Missouri.

I know someone who used FHA to buy a $700K house…crazy.

Bloody HELL! WHO is underwriting this PMI and UFMIP paper? Obviously the actuaries have made sure the risk is covered by these knife-in-the-back premiums, but what connected companies are writing this shyt?… AIG???

Need to know, to complete the Big Pic/Scam… thanks in advance.

Why is “rent” such a bad word. Personally, I’m a reasonably successful professional. I do reasonably well yet rent and drive a Toyota. Most people in my bracket would be in a huge home with a 745 in the driveway. Who the F do you think you must impress.People would prefer to be an underwater “home owe

When I first read quickly through your post, I read “….747 in the driveway.”

~Misstrial 🙂

PasaFrank,

I wouldn’t say that “rent” is a bad word, but there are major disadvantages to renting. For example, you can’t do anything to the house. You can’t soundproof it, you can’t insulate it, you can’t expand it, you can’t change the floor coverings, etc. So if it’s an energy hog, or noisy, you’re stuck unless you want to find a better rental, and if you’re looking for a reasonably priced rental that’s well-insulated or soundproofed, good luck.

Disadvantages to renting? I live in a house that would cost at least another 2k per month if you throw in taxes/maintenance etc… I pay a flat fee for everything and it includes association dues/taxes/ access to tennis/ basketball/ 25 yard lap pool. Boy renting sucks!! 🙂 Out of the 30 McMansions on my street over 20% are in some form of foreclosure some with seven figure loans. I sure wish I was in there boat!! No, renting is a a really good idea. I get much more banf for my buck and I can move tomorrow if I want or need to.

You can talk to the landlord and ask for better insulation and new carpet or floor repair.

Yeah, I know it’s weird, but it can be done.

Also, some landlords are okay with tenants making changes or repairs to the property if they’re approved — and some even offer to pay. The cost of project management is so high that they’re happy if the tenant will do that and make sure it’s done okay.

But, that’s not every landlord, just some of them.

I bought a house in 94. It is rented out. Have lived in rentals for the last 8 years. I’m in the same position as PasaFrank. Good salary, professional. It still makes zero sense to buy a depreciating asset. Even if you personally shell out for the new carpet, (did that) you are still way ahead financially. Heck, the carpet and furniture I bought for my daughter was about 2 weeks of the difference between the rent and what the note would be. Factor in an average monthly loss in value on the property, and I am miles ahead.

“Stop buying things you don’t need, spending money you haven’t yet earned, to impress people you don’t like”. Deepok Chopra

You must not be familiar with Bravo TV’s “Real Housewives” franchise!

As I meant: people would prefer to be underwater “home owners” than positive savings balance renters. Real balance sheet metrics mean nothing… you are judged by what you owe. A recipe for failure.

That’s what’s so funny. A lot of the people with these houses and cars don’t “own” anything. You don’t own until the asset is paid off and with ultra high prices compared to incomes, you’ll be paying a damn long time for what people these days consider a decent upper-middle class home (where most people bought years ago making $150K and now requires a $350K income to actually support it).

The prices are bogus based on bogus real estate equity inflation. That perceived wealth is gone for the most part (victim of leverage going the wrong way). The move-up buyer is dead too without an equity ponzi in place, now that we are income based, no one is there to drive prices up and interest rates aren’t going down to help anymore. Honestly I feel jumbo loan land and upper-middle end is just a waiting game, eventually it falls to income levels which will in-turn pressure higher end housing. The very top is always real wealth so anyone expecting to live on the beach in prime Malibu or Carmel without a truly large income or chest of wealth is in denial (it could be pressured over time and may decline but its desirable enough that the truly wealthy will always dominate those markets).

Ben will just print more money, it’ll all work out. Take a walk and enjoy the beautiful day.

I’m afraid you’re right. QE2 is going to end soon, but now that we have used this tool to solve the present troubles, we will be tempted to resort to this solution the next time we hit a bump in the road.

You can’t get the toothpaste back into the tube.

I have got to agree.

Housing is in big trouble and as long as it is Ben will print. At some point housing will finally turn and the inflation that Ben Shalome Bernanke has and will sow, will come as a thief in the night.

Actually that thief is already here and in your house, it is just most people are still asleep and don’t know that someone is in their house and is about to screw them, financially speaking.

That thief is Ben Shalome Bernanke.

There are ways to protect yourself.

Here is a strange event…. I just built a new home with a builder, used their mortgage company and it was sold to Wells Fargo in a week. A few weeks later I got a letter that it is now “Transfered ownership of your mortgage loan to Fannie Mae”…

Wells Fargo is now the servicer of my mortgage.

They claim to do this to free up money for Wells Fargo. Fair enough. But with 20% down and a super deal on a new construction home, $80 sq/ft. I was surprised?

I guess they needed a good loan to stick in the crap.

this is normal

I refinanced one of my mortgages 6 months ago or so in LA, 700k

within 8 weeks it went like this

firstIB

bank of america

chase

and then chase sold it off to fannie and now only services it.

Sure… they’re already using your note to inflate the ratings on Yet Another MBS turd blossom, which Ben will buy up under the charter of Maiden Lane XV… 🙄 😡

” This whole scam sounds like something created to help a bank, not lower income or moderate income borrowers. ”

No wonder, it is. Not just a bank but those banks who own FED, from the inside.

” We’ve created a never ending cycle where prices become so inflated that nobody can afford a real down payment, so the solution is always easier credit and loans. Have we learned nothing from the bubble?”

You may have but remember that banks still have huge load of unsold houses; Someone has to buy those, at inflated prices. The state and FED exist only for protecting banks from losses, not for the citizens. The citizens are the ones who pay the multimillion salaries of banksters, those real thieves. Assisted with Congress and FED, of course: No change at all and Obama lied.

I wonder about Obama. It does not feel to me like he is lying. It strikes me that he is surrounded by the “bright lights” of banking. If that is his information stream then we should expect the banker’s party line from the White House. I think he honestly believes that this is the best course in a bad situation.

For years it was obvious that science would be largely responsible for Industry getting mechanized, by using robots and less people. The unemployment situation is unfortunate, but is a direct result of the evolution of modern technology. That was the beginning of a number of problems. The next unfortunate situation came when property values went south. The cause of the housing problem is the fact that millions could purchase a house without the necessary income. This phenomenon did not come by accident. It was encouraged by Banks, Government agencies etc. I leave it up to the reader to draw the conclusions.

Thanks for this article. If there is one thing that is crystal clear about the most recent burst in California it is that having easy access to credit with little skin in the game is the recipe for disaster. This is precisely the point of the FHA loans. Maybe it isn’t necessary for people that can’t put down more than 3.5% to live in houses. In my opinion, it is necessary to show income and be able to put down a size able down payment to purchase a property. I don’t know where this moral obligation came to facilitate this type of lending…

Oh wait…it isn’t a moral obligation that created this lending environment. The reason these loans are becoming so popular is that the lending giants would stop if small down payments weren’t accepted. Therefore, the popularity of these ticking time bomb loans is simply based on short term profit, with little long term vision.

WB, the problem with your analysis is not factoring in the reality that most manufacturing jobs moved overseas. In other words, the robots purchased to replace 10 out of 13 jobs in a department were moved overseas where they can pay those final 3 employees much less. The final analysis, the death of US manufacturing and many working to middle class jobs for, primarily males.

This is only partially true. We still make things, but not the same kind of things. We still make food, which was never a well-paying job, but it’s stable. We still make machines, but these are increasingly very expensive machines, and made in small quantities. What we’re losing are the big assembly line jobs where one factory will employ hundreds, and where the margins were good enough that workers could earn a solid middle class wage there. It would be most correct to say that the jobs that helped create the American middle class — the kind that didn’t require a college degree — are gone. They’re being done in the 3rd world, and by people who don’t have college degrees.

Great article about something I wasn’t aware of. Truth be known I’ve been wondering why home prices around here in the Bay Area are still for the most part grossly overpriced. I know for fact I’m making well over the median income. We combined make close to 200k. Yet average homes are still 500k here. No way. Sure- we could afford it but that’s simply too much dough. I’m guessing the hordes of desperate home buyers around here are using some sort of hocus-pocus loan to get in.

The really sad part ( sad as in pathetic) is that homes in the 500k range are now not really selling these days. If it really and truly only takes a 3.5% down payment these days with one of these loans then that means buyers only have to save up around $17,000 for the down payment on a 500k home. If homes aren’t selling at that price today and this article underlies current loans being used then that would indicate that buyers today can’t even come up with that tiny amount. That’s ridiculous if that be the case.

Heck yeah to everything you posted, and you can monitor the craziness up in the Peninsula here:

http://www.burbed.com

~Misstrial

Excellent link. I love that site, burbed.com. Used to live close to Palo Alto. Sure brings back memories. The moderator on the site wonderfully entertaining. Prefer Dr. HB, natch, but if you like the lighter side check it out.

Great article! Bob, you guys make WAY above the median income. According to http://www.city-data.com/city/San-Jose-California.html, the median household income for San Jose (which is higher than SF and Oakland) for 2009 was $76,500. Try living in the Bay on that income and saving a big down payment (and closing costs, etc) for a $500k overpriced house.

so when does everyone here think is the correct time to buy?

at some point this thing has to bottom……

i think the lower limits from FHA / fannie / Freddie as well as the fed slowing or halting the purchases of treasuries could be the combo for the final leg down.

2013 the bottom?

Home prices are “sticky” meaning that if they fell last month, they are likely to fall again this month. And if they rose last month, they are likely to rise again this month. Keep track of the Case-Shiller report for your area, and don’t bother trying to get in at the bottom. Wait until prices have begun to rise again (and not due to a tax gimmick) before you buy. That’s going to take a lot of patience.

Mortgage rates will have to rise eventually. If mortgage rates rise to a historical norm of about 8%, that will cut house prices by another 25%. We are therefore stuck in a swampland, where an improving economy will lead to higher mortgage rates which will lead to lower house prices which will lead to a worsening economy. Because we’ve chosen not to deal with house prices in one fatal blow, the recovery will be sluggish for a long time, and house prices will fall further in real terms.

/earning 160k in Washington DC and priced out of buying

You’re right, Obama lied. I hate all of the lying scum that we call representation. They represent the oligarchy.

Does the FHA actually foreclose on anyone? I thought maybe the Obama admin would just want to give everyone a free house. I wonder how long it actually takes to get kicked out of the house if you just stop paying?

I have owned two homes and I purchased the first one with a 3% down FHA loan. The second home was a 100% loan. I bought the homes to be a home….I wanted a garden, dog, etc…things that are not always possible when renting. I sold in 2002 and 2006 – not to make a buck but because of life changes. Now I’m back to renting and it’s awful. If I could qualify (I’m a real estate appraiser), I would buy a house in a New York minute. I’m throwing away $900 per month on a 1 bedroom apartmart. Yea, I could find a slightly cheaper gig further from work. The point is I could buy a house cheaper than rent (yes…I’ve done the math on my trusty HP12C) I’m thowing the money away either way but at least I would own it (sort of.) BTW….Not all folks who bought homes with low down no down are losers!!!

Especially if you sold in 2006. Doubt you lost much then.

lol, some “lucky” guy purchased your overpriced house in 2006, I wonder how’s he doing now.

Leave a Reply to M2M