FHA bailout inches closer – FHA defaults surge 26 percent while upping mortgage insurance premiums to make loans more expensive. Foreclosure starts outnumber foreclosure sales 3 to 1.

A market dominated by investors, low down payment buyers, and government loans in need of a bailout.  This might sound like a recap of the housing crisis of the 2000s but this is actually the face of the current market. FHA insured loans are inching closer to the predictable bailout we have been talking about since 2009. What a stunner that allowing people to dive in with only a 3.5 percent down payment and squeezing them in during a weak economy was a smart move. This is the scenario at hand and FHA insured loans for the last few years have been a big part of the home buying equation making up roughly one third of all mortgage originations. The average down payment is 4 percent. Defaults are surging. At the core mission FHA backed loans are about affordability yet in many markets the cap is $729,750! How is it even remotely an option when the median household income in the US floats around $50,000 and the median US home costs around $180,000? The FHA structure is simply a symptom of a bigger problem. Hide the underlying structural issues of our housing market, ignore the obvious, and continue inflating the price of homes even though the market clearly demands lower prices to go with weaker incomes.

The unsurprising deterioration of FHA loans

While delinquencies in other loan products have fallen, FHA delinquencies are surging:

Source:Â CNN Money

This is a big issue because FHA loans are now a giant part of the housing market. FHA delinquencies are up a whopping 26 percent from last year. And the housing market is supposedly recovering? So how is the FHA dealing with this? They are simply making it more expensive to get loans with mortgage insurance premiums. For example, the upfront mortgage insurance premium (UMIP) is now up to a large 1.75 percent. On a $500,000 loan this is $8,750. Next, you have the annual MI that is tacked on and this will add 1.20 percent annual MIP to your loan payment. In other words to shore up the short fall with the fund the FHA is simply making these “affordable loans†more expensive by making the monthly nut and upfront cost more expensive. Don’t you think it would be easier to up the minimum down payment requirement and actually make the monthly payment lower? Yet that would reveal that most households don’t have the ability/income/desire/diligence to save up even a modest 10 percent down payment. The number one predicting factor is negative equity for foreclosures and by default, anyone that buys with a FHA insured loan with the standard down payment is already underwater given the minimum 5 to 6 percent upfront cost in selling a home.

The naïve belief that only low priced markets US FHA

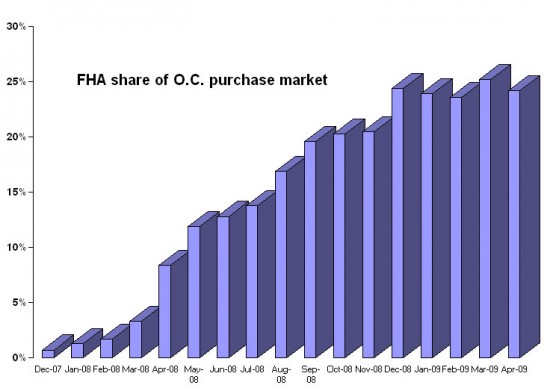

Contrary to the silly notion that only low priced markets are using FHA insured loans, very expensive counties like Orange County are using FHA loans as staple of their originations:

Source: OC Housing News    Â

Since 2008 FHA loans have made up 1 out of every 4 loans in Orange County (versus a handful before this time).   I know this is hard to believe for many but people are simply leveraging up to the maximum and are facing additional problems. It is amusing when you read “well at least they are looking at income†as if this was the only predictor in paying your bills. Obviously not since these FHA loans that are defaulting had incomes verified with careful diligence. The premise is screwed up. A low down payment is a big risk factor with NINJA loans and with carefully verified loans. At the very least, put the cap of any FHA insured loan to the nationwide median home price. Why should people in Oklahoma or Kansas need to fork over money when these mega FHA loans default in California and New York? In Orange County with condos selling briskly, you have people buying homes without doing a careful analysis of HOAs, Mello-Roos, taxes, and insurance premiums. They are blind and only look at the principal and interest which looks very tasty with the Fed forcing mortgage rates to record lows. But once people are in, especially the FHA insured variety, many are becoming delinquent in large numbers.

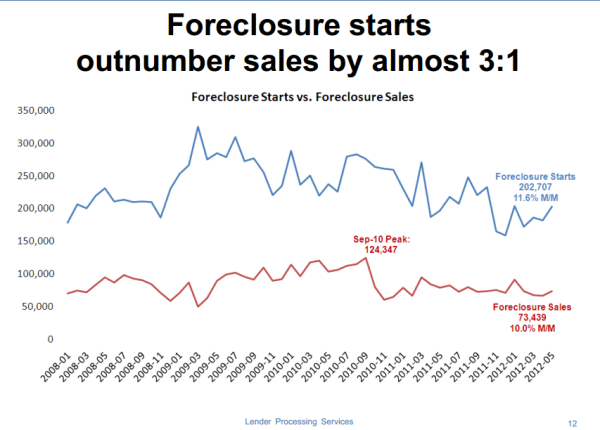

Foreclosure starts are outnumbering sales 3:1 in the current market:

And you wonder why the distressed pipeline is still massive? Where is the inventory? Ignore all these current issues and just focus on what is being fed to you via the MLS listings. Pay no attention to LIBOR scandals or lack of change in the financial system. There is nothing behind the curtain except another government bailout and fresh foreclosures.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

73 Responses to “FHA bailout inches closer – FHA defaults surge 26 percent while upping mortgage insurance premiums to make loans more expensive. Foreclosure starts outnumber foreclosure sales 3 to 1.”

It’s perverse….FHA is trying to make up for it’s shortfall in capital reserves by increasing fees (i.e. UMIP and MI) that are directly tied to purchase price….higher the leverage by the buyer the more FHA makes in the short-term and the more likely said buyer will default in the future.

The Dr. stated that FHA is closer to a bailout, I believe what he’s saying because our government can do what it pleases. Who cares about the little people, as they have shown. The citizens need to just go to work and pay their taxes and they will take care of the rest, as they deem fit.

It’s sad what’s happening to our country, and most of all, to the citizens, and all of us on this blog.

As the Dr. mentioned before, no one is accountable on the governments end.

How much the election will change things, maybe we will be able to tell at the same time next year.

I will not be holding my breath..Will the manipulation continue, low rates, banks and shadow inventory.

Only God knows.

I’m just glad we got a voice in Dr. H.B. Who lets us know the truth, and don’t have to eat the lies that our being feed to the rest of the public.

$180,000? No place in my neck of the woods or Mike M’s for that matter will you find anything in that price range.

That is the Dr.’s point. If you limit the access to the funds, housing will have to revert to market prices. If people can only rent because they cant save the money, produce the down payment, or qualify for another mortgage they will remain renting. The rental-ownership parity will skew in the favor if rentals, but the market will begin to become more abundant with properties dropping to market prices.

Personally, moving from Suburban Philly to Redondo Beach, I am dumbfounded at how SOOO many people can afford these properties. Its not like it is Manhattan (being a huge finance region), but rather stretching from San Diego to Santa Barbara and further North. How can this many people be doing this well in this economy. Financially, it just doesn’t add up to me.

The illusion of widespread prosperity in So-Cal is for the same reason seen in DC/N. Virginia: GOV’T MONEY… it’s just a bit more disguised in So-Cal, i.e. “laundered” through the aerospace industry. Also, lots of US Navy and retired USN in So-Cal, and even more state.gov and county.gov employess than corrupt old Philly/PA.

Also, The Great Recession has had very little impact on Duh Televison/Movie/Infotainment industry, aka Hollyweird… after all, unemployed peeps gotta watch sum-thin’ ;^)

Westcoast Transplant, welcome to Redondo Beach. To answer your question: how can sooo many people afford coastal california properties. The answer is they can’t, most owners couldn’t afford to buy their house back today if they had to. A large portion of people living in these areas are long time owners. They won the CA housing lottery and aren’t moving anytime soon (prices have skyrocketed and interest rates went to the floor). In addition, we have Prop 13 here which limits the increase in property taxes. This also keeps people staying put.

So you have very limited supply in these desirable areas and people will pay an arm and leg to live there. Remember, houses that sold in the 200K range in the 90s are selling for 600K plus today. Even back in year 2000, 500K got you into very exclusive parts of LA (Palos Verdes, Beverly Hills, the Beach cities). Fast forward 12 years and 500K gets you a starter home in an average mid tier area. I have witnessed the CA real estate market the last 25 years…there should be case studies in graduate school written about this.

Yo, Enzo, why bag on the entertainment industry? What, those aren’t real jobs making real, respectable money? And you haven’t seen a Hollywood movie and thoroughly enjoyed yourself? Don’t lie and say that your beloved Florida or any other state in the union for that matter wouldn’t kill for the thousands of high-paying entertainment jobs that Southern California produces. Sorry, it’s not widgets or circuit boards…oh, wait, those types of things are being made overseas. Give me a break.

THEY ALL SEEMED TO FALL TO 25,000 CASH……..

Another excellent post. The Doc hits the nail on the head by identifying the problem, namely a $700,000+ loan cap. We should be reducing that cap, not going the other way. Same with FDIC. It was not that long ago that accounts were only guaranteed for $20,000. After that, let the depositor beware.

Last night a friend in her 50s told me that she is giving up on “saving” the house she and her husband share. They have spent all their savings trying to keep it up through this economic downturn. They are praying her husband’s mother doesn’t die during the foreclosure process, as they would lose his small inheritance as well. Most upsetting.

Dr., you saved us from a similar fate. When my husband lost his job three years ago everyone told us to borrow from our retirement account and hang on. We bailed instead. Now, not quite two years after agreeing to a DIL we qualify for a new loan. But the market is so manipulated (we see foreclosures that sit and rot; cheap houses are snapped up by investors, and rentals are scarce, awful and expensive) that we don’t want to buy anything! So we will buy the cheapest thing we can just to get our kids registered for school. That is the housing reality for millions: Bad options and worse options.

If the government had forced cramdowns over the objections of the banks in 07-08 we would probably have had some healing of the market by now. As it is, the banks have passed the bad paper off to the government and, in the process, destroyed the credit and faith of millions more homebuyers who weren’t paying attention or believed that it was all temporary. Nothing short of criminal.

Cramdowns would have been a terrible idea, rewarding innumeracy and speculative bets and adding yet another layer to the already criminogenic environment created by the blank check bailouts to the banks.

Steve Keen’s idea of an across the board QE for consumers would have been and remains a far superior concept. This consists of a sizeable cash bailout for the people, with the conditions being that if you have any debt, you must use all of the money from your bailout toward paying it off. A saver, however, or someone with low to no debt would be rewarded in that they could keep the bailout money as a windfall. Everyone wins.

Sure, but the odds of this happening within our lifetime are precisely zero. Politically it is a non-starter. “So and so wants to give free money to everyone! It’s unAmerican! Let’s lynch him.” Can you imagine the pandamonium?

On the other hand, cramdowns are and always have been a part of bankruptcy law. The law was rigged during the run-up to the crisis by the very banks that caused the crisis (but who could’ve seen it coming, right Mr. Diamond? Mr. Dimon?) and it was well within Congress’ powers to change it back. Barney Frank did a deal with Paulson but Obama wouldn’t sign onto it. Go figure. This would’ve given the banks the kick they needed to begin voluntary writedowns which might have stopped the slow bleed which has hobbled the economy for 5 years. Now we’re very vulnerable to a double dip or worse because we never really recovered the first time.

So yeah, I guess I’m sticking by my first thought. This could’ve been prevented. Now it can’t really be fixed.

I understand the cramdown concept because after all the borrowers Were duped along with the investors in the banksters equity stripping ponzi scheme, however your idea is superb! Too bad the crooks that we hired to rep us in DC don’t care about us at all, at all, at all.

Windy City — debt jubilees go much farther back than bankruptcy laws. A modern iteration of a jubilee wouldn’t be free money for everyone, it would be (ahem) quantitative easing of the end consumer, and of course, there would condition tied to the bailout.

A balance sheet depression is a very different animal. It appears at first to be a plain vanilla cyclical recession, but it is not. The sad irony is that government insists on these interventions, which are simply political can-kicking schemes that will eventually put even MORE pressures on real estate pricing for a longer period of time. And of course, once the fiscal dam breaks, there will be hell to pay.

Affordability cannot be government-induced…..you either have the cash and/or the income or you don’t…..just as Dr. Bubble has preached over and over.

Looks to me like the GSE bad banks are just passing around the default hot potato. What a mess !

I keep wondering why, then, there are bidding wars on every affordable house in the San Fernando Valley (I’ve given up on trying to find something on the “cooler” side of the hill)…I feel like there’s collusion between the banks and the realtors to keep inventory low and thus keep prices up. So frustrating.

Realtors can’t manipulate inventory. If they have a listing, the only way they can make money is to sell it. 🙂

In my neighborhood, it’s the same as a lot of places this summer – as soon as a listing hits the market, everyone is grabbing at it like it’s the last fresh-baked cookie. Why? Pent-up demand, articles written by clueless journalists who don’t specialize in real estate who are touting the bottom is here, or writing about the lack of inventory, which Dr. HB and others has already explained is an artificially-induced dearth.

So people get scared that they are going to miss “the bottom” and they have been waiting with their hot low-interest-rates to jump in before they are left behind.

It’s sad. Sad because, depending on the market, in many markets these people jumping in this summer are going to be in negative equity before the end of the year is out, most likely.

Purehapa,

You forgot to mention or acknowledge Dee’s other reason for the current housing frenzy market now, which is the fake low inventory. There is definitely a massive shadow inventory in the millions that is purposefully kept off the market by the Banksters. The good Doctor has been writing stories about that for years with examples showing how many houses listed on the MLS and how many in shadow inventory not listed.

The Banksters diabolical plan will only work for a short while until probably the election because as soon as house prices keep rising, regular inventory will flood the market by many underwater homeowners. The higher the prices, the more inventory will come on the market. It will be a check and balance.

This is a fake market setup by the government, Banks, and NRA. Government keeping interest rates very low, Banks withholding inventory, and NRA’s daily media propaganda.

There is another reason for the rush. Forgiven debt from a foreclosure or short sale on your principal residence is excluded from income only through 2012. There is no guarantee that the law will be extended. So if you want to do a short sale, this is the year to do it.

Dee

Boy do I hear ya. We were 1 of 9 bids on a home, and the final round was the blind auction joke called “Highest & Best”. Well, we went a lot over list (we’re a cash & close) and didn’t get the house. On top of that, we put in a clause that said we would close escrow when we verified the tenant was gone. I’m thinking the listing office sold to a buyer of theirs, using our H&B as the floor, and we were gamed. A friend in the biz tells me her brokerage (the same one that had this listing) is pretty seedy.

Housing is still way overpriced for basic housing. We’re in the same boat, as you, and many here are. Extend & Pretend is getting old, but you know, so far the PTB are winning.

Trust your feeling. It’s more the banks in control than Realtors but yes the NAR lobbied to supposedly protect homeowners from fraudulent foreclosures so bills have been passed to slow this down for the banks thus allowing the banks to keep the foreclosure homes on their books at the bubble value and allowing the banks to appear solvent since they can show assets on their books. If reality were shown the houses would cost the equivalent of a sandwich and the banks would shutter their doors. It’s a damned if we do and damned if we don’t since the banks already stripped 100’s of trillions out of the housing market years ago now. They should be prosecuted and jailed but since they own our government and us that won’t happen.

Lynn

Yeah, Mark To Market is a Banster’s orgasm, for sure. This extend and pretend is insane. CAR was against this Ca Homeowners Bill Of Rights. What’s your take on the effect of the bill before Jan 1, 2013, when it goes into effect?

I bid $300k for a house in the SFV (20% down, 770 credit) and it sold for $240,000. After 18 months in the department of RE, no one could prove my offer was actually shown to the bank. The investor started doing repairs 2 days after it was in escrow. The house was ‘listed’ for 3 days and all offers were due on the third. I think these realtors are getting cash outside of escrow for not showing all offers. Beyond filing a complaint with the CA Dept of RE and contacting the LA Times, what can I do??? I was following the house for a year as it was near my mother and I raelly wanted it. I have been at my job 28 years so getting the loan be easy and I send in the pre-qual the ‘announcement’ required. Ideas???

I am not an authority on this, so take what I say with a grain of salt. But here are some ideas.

Research the laws involved. If you feel you have a case, go to the attorney general. Go to consumer protection groups. Tell your legislators (probably futile, but at least register the complaint). Hire a private detective to document the situation? Blog. Start a class action suit? Find as many people in similar situations as you can and band together. Every time I read all the complaints on this blog, I wonder why all these like-minded people can’t do something to change things. There certainly are enough of us.

Tom

July 12, 2012 at 1:51 pm

I bid $300k for a house in the SFV (20% down, 770 credit) and it sold for $240,000. After 18 months in the department of RE, no one could prove my offer was actually shown to the bank. The investor started doing repairs 2 days after it was in escrow. The house was ‘listed’ for 3 days and all offers were due on the third. I think these realtors are getting cash outside of escrow for not showing all offers. Beyond filing a complaint with the CA Dept of RE and contacting the LA Times, what can I do??? I was following the house for a year as it was near my mother and I raelly wanted it. I have been at my job 28 years so getting the loan be easy and I send in the pre-qual the ‘announcement’ required. Ideas??? The loss was taken by some faceless old folks’ pension fund. Nothing to worry about.

You are correct. There is an artificial constriction of supply.

I don’t think alot of people are savy buyers using FHA. On

top of the high PMI there is the fact that you’re stuck with it till you satisfy 5 years and 22% equity…. Both! Can’t pay it down fast and get out of PMI. I also think people do t realize how expensive it is and it is NOT tax deductable. It’s like flushing cash. It’s like a tax to subsidize defaults. BS!

This market is a mess! Sold my home to downsize in February, not realizing how bad this “controlled market” had become. Had equity in my home, plenty of cash down with excellent credit. I’ve been in a tiny apartment with everything in storage with apparently no houses to buy for who knows how long. It appears all “the investors” have bought them up to rent them out! I guess I should not have been so rigorous about paying a mortgage on time, building up equity, and having good credit. It appears just the opposite works. It would have been better to not pay on the mortgage, go buy a new car like everyone else and let the government bail me out…..LOL Realtors barely want to talk to you if you are a traditional buyer in Las Vegas. All the Realtors in this area seem to glorify the fact they are selling all the housing to investors to rent and raising the prices in the process holding on to offers and bids for the highest. I think some of “these investors” are even qualifying for loans with additional financing from somewhere. Will this ever end or better yet why is all this even legal to create such a false market? A lot of these homes have been sitting empty for a long time with not even renters.

Hot Las Vegas

Your post blew my mind, and not many things do anymore. Considering how bad

Las Vegas got durring the bubble, and the aftermath, it should be allowed to find equilibrium, and your post says it all. These US housing market is being run by the Mafia.

We’re in your boat as renters and storage in So Ca. I don’t know youur age bracket, but this is burning up precious years for us. FHA buyers are over bidding, and defaulting in 2 months, living free. It’s insane. As you stated, our credit is perfect, we pay our bills, no debt, our incomes have been slashed, and we just want a home. Next time (in our next life) we’re going too be deadbeats. It pays better.

Morality and Integrity are just so old school.

Your comment is so sad but so true, when the system fails and the leaders lie cheat and steal from it’s citizens it truly destroys the integrity of the people they are stealing from. Please prepare now for the escalating economic and social unrest. Good Day.

It does make you wonder….doesn’t it?

What really is concerning is a lot of our housing is already sold the minute it hits the MLS. Which tells me there must be some deals going on somewhere before anyone else sees the housing. I just checked on a listing that was sent to me and the Realtors replied, “already sold, it was a short sale.” Something is strange as all this housing is sold and you never see the sale price or barely the listing! The listing just disappears. The Realtors here don’t even respond to paperwork or offers. My home I sold in February was sold to a “cash buyer” $375 K. I have a sick feeling now that it was an “investment buyer” and I got sucked into the game too with my own home. Yes, this is the first time in my life I haven’t had a home. I have always owned. It doesn’t look like this housing economy is going to let me get into one anytime soon either. Yes, I just want to retire in my own home and get out of this mess! Sorry about your situation too….interesting…. it is all over the country it appears.

Hot Las Vegas

I just read your reply. We’re older (39+LOL) as well, and my husband has Glaucoma. We’ve been stuck in the So Ca housing hell for years, having sold our oversized McMansion a long time ago.We would have had it paid off by now. Who wants to age in a two-story 4,000 stucco canyon (with a view and good size lot) home. We want something different. I named it our “toe-tag” home! LOL

Real-turds are pos, and the insiders are getting what they want. They play dirty. I agree with your opinion by observation. Our Broker tells us to pay big bucks, but some of these homes are fixers with an attitude. I notice the same MLS stuffhere as well. Not only that, but sellers are so dilludional if they have a regular sale of a plain jane home, it’s a $10K PREMIUM on the offer..

I’m livid. I can relate totally. I feel bonded. Keep posting as your journey plays out.

Mad As Heck, I love your term “fixers with attitude.” Seeing quite a few of those in my neck of the woods.

Hot In Las Vegas…………….

I have always owned a home too since I was 20! I am now 49 and am without a house.

Something is crazy wrong with what is going on, I don’t have a clue how this will play out but I can’t imagine stupid people will be in the “cat birds seat” for very long.

It amazes me that as soon as lending standards went back to where they used to be, documented income, most homes start going to all cash buyers! Something very fishy is going on.

Teresa,

Thank you. I have a vivid imagination (and horrible editing skills).

I always thought I was a “victim” of grade inflation. (There’s that word again, “victim”.) “Homemoaners” love that word.

100’s of $1,000’s in the bank sitting making .25%. Now, that’s victimhood. I look at our bank statement and shake me head.Why are the responsible being punished!

Thanks for the kudos, Teresa. I am a little magenta today. I needed that.

Something is indeed very wrong. Investors can get access to thousands of properties buying them for pennies on the dollar. The buy directly from the banks and they never appear on the MLS. No time for that. It is an invisible market. We have become a country of wheeler dealers into criminal activity. I suspect the same people who are the investors of today are also the mortgage brokers and lenders and banksters who duped people during the bubble. And Hedge Funds. Not only is the housing supply carefully controlled but the banks set the price and no negotiating – written in concrete. Why do we need real estate agents to take 6% on top of that? They buy wholesale – we buy retail. It’s wrong. The banks run the business like they run everything else. Criminal organizations run our government and the country. How do they get away with it? They have the power to change any and all laws and they did. Now we are screwed. But we have the power to let our voices be heard. We have the power to not play their game by their rules. The 99% may actually have more power than the banks but we’ll never know because no one seems to care. Things are just not bad enough for Americans to care while other countries have huge protests American sit home and watch the MSM network news and actually believe it.

Bobi6

Thank you for that well state, elequente, “truthiness” contribution. You nailed it.

Does anyone know if the banks or the mortgage holders of shadow inventory homes are obliged to pay property taxes?

I managed a portfolio of units in California, Nevada and Arizona in 2010. Can’t go into too much detail, but yes the banks are paying for taxes, maintenance and insurance on the units. Although we did appeal their tax valuations, they still cringe every December and April.

Carner — no offense, but the two assets are vastly disproportional in every sense. Besides, try selling a diamond someday either to a pawn shop or a jeweller and let me know what you get. Cut diamonds have terrible resale value. I actually had a guy swear up and down to me that the sentimental value of a diamond made it worth it and the resale or actual intrinsic value (as in, I need to sell this to eat – what is it worth to someone who isn’t my wife) was meaningless. Diamonds are one of the most astonishing examples of how indelible really good marketing can be on the public psyche.

So are Luis Vuitton purses.

Ack! Wrong thread…trying to post this on the last thread. (sorry)

dr bubble, are this FHA loans sold into the international financial market like fannie and fredie? to pension funds etc. Packed/sliced and diced like the banks did ? so who is going to pay for this when things go wrong.

Do you really need to ask?

You are.

You cannot compete with fiat printing and loans. The counterfeiters are taxing you via inflation. Inflation is when you suffer from less buying power because people who print money can afford to buy and hoard the things you need. Or loan to foolish people who bid up prices.

Sure you can compete. Buy silver and gold. Since 2000 they are up 600%!

This is a great web site and very informative. My only question is if you are factoring in the trustee sales to 3rd parties in your numbers. I know that a lot of investors are buying at the courthouse steps sometimes at a discount from outstanding loan balance, so maybe that is one reason we aren’t seeing shadow inventory – it is going to investors on trustee sales and not showing up on MLs or other available statistics.

In the IE (SB & R Co.’s) hot money LLC’s will bid on cherry courthouse auctions where the first lien is ridiculously low compared to the 2nd and all the HELOCs piled on since the first mortgage. First lien holder could care less if it goes for $1000 over his first lien note, if his bank is not on the hook for the 2nd or the HELOCs.

So now the hot money LLC has a dirt cheap house. That is not enough for some of them, the really ambitious ones, put into the amendments of the sale that the buyer has to use a “preferred lender” or they get dinged a liquidated damage if escrow is delayed by agents of the buyer.” By some coincidence the Seller, the Escrow Co, and everyone else down the line getting fees, by coincidence, reside in the same office building. Imagine that?

Are the vulture LLC’s to blame that they can get away with this shakedown, nope. They have Wall Street to thank for that. They are playing the rigged game handed to them. If you play the game also and don’t know who the chump is, you are better off buying a mirror instead of a house.

Dr. H as always hits it spot on. Buying a home is also a very emotional act for most people, and as such they do not see the “true” costs involved, they are seeking instant gratification. “living the American Dream” The past 2 years has been a lie. This year especially, because it’s an elelction year, you cannot believe the mainstream media! Yesterday news hit that San Bernadino will file BK, no surprise there. What is news, however is that a investor group is trying to talk SB into using the Eminent Domain law to lessen the impact, of course they will make 5-6% on the deal. This alone should send out a red flag about how bad housing really is. After the electon the sh**t will hit the fan and the u.s. will go into a double-dip recession, home prices will fall again. Remember good things come to those who wait…..

Let the bodies hit the floor

Let the bodies hit the floor

What if the FDIC enforced the mark to market accounting rules that apply to banks and two million homes hit the market next month. Would the economy decline or would it be the best one year in the economic hisotry of the United States of America? D for P

Off-topic re: FHA…

The primary reason for stable or rising prices is falling inventory.

In 16 of the 19 markets measured, the number of houses for sale declined since May 2011; in 15 of the 19 the decline was by 20% or more:

May 2012 Changes in Number of Single-Family Homes for Sale (per Redfin):

Listings Yearly Change Monthly Change

Phoenix -32.7% 2.1%

Inland Empire -52.9% -20.9%

LA -45.9% -14.8%

Sacramento -34.7% -7.7%

San Diego -49.6% -13.7%

San Francisco -53.9% -12.7%

San Jose -57.1% -5.6%

Ventura County -60.1% -16.1%

Denver -41.7% -2.9%

DC -26.3% -3.4%

Chicago 2.4% 8.9%

Boston 15.6% 16.5%

Baltimore -21.2% -0.1%

Las Vegas -24.9% -4.9%

Long Island -8.3% 0.8%

Portland -25.4% -0.9%

Philly 46.8% 1.2%

Austin -24.8% -0.5%

Seattle -39.4% -4.7%

National -23.5% -1.7%

Real Homes of Genius Culver City, where flipping is alive and well!

Look at this idiot trying to DOUBLE their money since 2009:

http://www.redfin.com/CA/Culver-City/3858-Girard-Ave-90232/home/6722741

Honey stop the car, I see granite counter tops! Too bad $899k is above the FHA limit. If they lowered the price to $729k I’d put in a bid today 🙂 Or maybe we can borrow the difference from our 401k? I’m so glad homes are the most affordable in 20 years right now…

It was a scary summer of 2011… And we regretted our purchase at first. Now a year later, I must admit a lot of the worry and stress is gone. We are fixing/upgrading things slowly but surely… Our before and after pictures are pretty fun to look at. The feeling of accomplishment of overcoming a tough year and turning a outdated rundown home into something to be proud of is nice.

Last summer i was sick worrying that we should have waited another year or more to buy. But looking at the market now… A full year later… We got a pretty good deal. We refinanced at a lower rate .. a full point under our lock last year… Monthly payments are lower than our previous rent.

Enjoying the pool and believe it or not.. enjoying doing landscaping and yard work… Very relaxing and a more affordable and rewarding workout than going to the gym.

I’m preparing for a scary double dip in the fall and winter of 2013…. BUT, prices are actually flat or up Year over Year in my neighborhood.

Good luck to those waiting and those buying soon… There are deals to be had, but probably less than last summer. Maybe that will change, maybe it won’t…

I hear you. We spent 3 years in a dumpy rental with landlords who asked “can you live with it?” when something was broken in the home. 70,000 in rent paid waiting for a return to fundamentals in the market. Guess what people…it ain’t gonna happen. I could have bought 3 years ago, taken a 70,000 hit, and be better off anyway. I’m tired of giving my hard earned money to a landlord who runs their property into the ground while I pay their way. They’re so cheap they could squeeze the eagle off a quarter. I’ll take the 5-10% loss and get my tax break in the meantime and say goodbye to Ma and Pa Kettle.

> At the core mission FHA backed loans are about affordability yet in many markets

> the cap is $729,750! How is it even remotely an option when the median household

>income in the US floats around $50,000 and the median US home costs around

> $180,000?

Oh, come now. It is hard to find a house in the SF Bay Area for less than $730k. This is a government program for the entire US, not just the affordable 90% of it. They could have done a double standard with higher subsidies for specific areas, but that might have violated the equal treatment clause of the 14th amendment. Besides, Republicans in the fly-over states would have screamed that they were unfairly subsidizing overpriced housing in bubble zones without being able to benefit themselves. Your solution just isn’t tenable.

There obviously needs to be means testing to qualify for such a large loan. Hopefully, there was.

-> “they could have done a double standard with higher subsidies for specific areas”

FHA limits are absolutely variable not just by state, but by county as well; Modoc county here in CA, for example, has an FHA limit of just $271K. http://www.fha.com/lending_limits.cfm

-> “Republicans in the fly-over states would have screamed that they were unfairly subsidizing overpriced housing in bubble zones without being able to benefit themselves.”

They absolutely should be if they weren’t too busy alienating voters over other (far less important) issues.

-> “It is hard to find a house in the SF Bay Area for less than $730k.”

This is the crux of the problem. Even an affluent county like Marin only has an average HH income of ~$100K which should translate into an “affordable” house price of no more than $350-$400K. High FHA limits, along with suppressed interested rates and shadow inventory, are all tactics for kicking the can on an unsustainable situation at the expense of our tax dollars.

you tell me, why a person/family purchasing a 3/4 of million dollar home and say 150k + income can not put down 10-20%? if they cant, should they buy that home? i say NO, NOPE, NADA, NEIT. i have said this in the past and will say it again, high cost markets will be the death nail for FHA. huge losses will come from that sector. why did NAR fight so badlly to keep the loan limit in the sky. right now, very few portfolio banks will not lend in those market values and i bet none at 90%+ ltv. They are smart, finally! when the FHA bubble pops and if they have lent at these values they will be BK’d by the FED’s reserve requirment.

you tell me, why a person/family purchasing a 3/4 of million dollar home and say 150k + income can not put down 10-20%?

—————————————————————————————–

We together are making 200k per year and cannot put down 20%. Why? Because while we we’re waiting for the housing to be normalized we invest somewhere else, gold, CD oversea with 10% return, properties oversea etc. We don’t want to withdraw from those investment to put 20% down payment because who knows what’s gonna happen in the next few years? At least money we put oversea and physical gold are much safer than any investment in this country. We are in our late 30’s and are only 50k away from Obama’s definition of being “rich”. God knows we are still driving a 7-yr and 11- yr old cars and don’t even have cable nor a 50″ flat TV.

Er…Ian…think about what you just said. Do you think that maybe these houses are so expensive because there is a facility in place that allows them to be so expensive? Also, is it really fair to put the other 90% of the country at risk with government backed loans so that a couple of would-be mr big stuff’s out in Cali can lever up and buy an overpriced edifice to their ego? I think not.

My husband and I decided to buy since our son is moving back at the end of August and our apartment lease is up at the end of September. We are looking in the Huntington Beach/Fountain Valley area. (That’s where we had our last house, but stupidly sold when we had to relocate – now we are back and wish we had that house.) We went to scope out a couple places and a realtor happened to be showing a townhouse that we wanted to check out. She let us in without an appointment. She was very casual and open about the house, pointing out all it’s flaws, which were many because some of it was unfinished construction. Drywall missing in spots. She said the sale fell through, buyers walked away. Then, in an “are you kidding me” kind of look and tone…she said, “now the bank wants 385K.” She actually seemed a bit tired of the whole game going on now. The game the banks are playing, that is. I’m getting the impression that some of the realtors would like to see more reasonable prices so they could sell more. Must be frustrating for them to show so many dumps. This will be our 5th home due to relocations, but our 3rd here in SoCal. We’ve used the same realtor since the early 80s and even he said things are crazy now. Hard to figure out. From what I can see, it’s tough to find anything decent under 500K. Although we qualify for a 600K, we don’t want to pay more than 420 or 430K with 20% down. We just started looking, but not looking good…so wish us 50+ers luck.

I would not want to be taking on that kind of debt at your age – does it have to be?

Shellz, we already pay close to 1,900 just for 1 bedroom apartment and storage. Our son is moving back too. We plan on getting a 30 year fixed, no prepayment penalty, and pay it down like a 15. It’s the best we can do in our present situation, but it is achievable with planning. Thank you.

I mean no disrespect, but…I wonder why anyone (especially those near retirement or even middle aged) would volunteer to relocate to SoCal, an area with a very high cost of living/poor job market, eager to take on big debt at this stage in life? I know quite a few 40+ CA natives thrilled to move back “home” after relocating elsewhere…yet once back in CA for a few months, reality sets in; they stress about keeping a job/paying bills; I know several who have adult children living at home who can’t find jobs, or the “lucky” kids who make $10/hr. I’m sorry, I don’t understand why people move here, then quickly become embittered by high housing costs; its like moving to Manhattan then complain about high rents? Due diligence, anyone? I hope your situation is different, best of luck to your family.

We Don’t Make Those Drinks No More, we are one of those people that got laid off at the end of 2009 when the big axe of economic collapse was waving across the jobs of America. My husband’s company did rehire and relocate us back to the SoCal office. He was allowed to keep seniority, etc. We will spend the rest of our lives here. Right now, between storage and apartment rental, we are close to 1,900 a month. So for a few more hundred, we can have a home. Get a 30 year fixed, no prepayment penalty, and pay it down like a 15. It’s the best we can do in our present situation, but it is achievable with planning. It sucks, but we have friends who lost their jobs back then and are still unemployed. If the banks would just be more reasonable with their distressed inventory pricing, many of us who have been sitting on the fence would have purchased a while ago. We sold our home in Fountain Valley back in 2000, bought in Roswell, Ga. because company relocated husband to corporate office there. In the Atlanta area, we had a bigger home (3 story), bigger utility bills, more land, constant maintenance due to the elements, bug killer. weed killer, incredible storms. I’m glad to be back. That place was a money pit and we were slaves to it. A single lawn mow was 75.00. Trees constantly had to be trimmed. Pine straw racked. . It was a nightmare. I‘ll take a little place out here because to us, location is very important. The quality of our life is much better, even though we have less. So in the end, although we didn’t have a choice and had to move back, I’m much happier here. We are reasonably frugal people who have managed to ride the wave of this economic storm, but it is still scary. We just have to do the best we can. Thank you for your input and good wishes.

Bought_ in_ 2011, can I ask you what you paid for your home, square footage and location just so I can compare to now? We are looking in the Huntington Beach/Fountain Valley. If you don’t feel comfortable, that’s okay. Thanks and I’m so glad you are happy in your home. I hope to be soon too. Been in this apartment almost 3 years…patiently waiting.

Patiently Waiting

Doesn’t it suck to be former homeowners, selling a great home, over 50 yo, and now be in housing hell? At this stage in our lives, who would have “thunk” they could extend and pretend so brilliantly, until the final chapter. I think that will be when our currency is at the end of its death spiral.

“and now being”…I told you guys I suck at editing. S L O W Down gal!

Mad As Heck, it sure does suck to be in our 50s and starting all over again. We’ve had to relocate a few times, but we should have been savvy enough to keep at least one of our homes here. Dumb mistake. On the other hand, since we have lived in Florida, Chicago, NY, Atlanta and SoCal, I can tell you, personally, SoCal is the best place for us, so we’ll deal with the housing situation. Thanks for letting us know we are not alone. We would probably wait a little longer to buy, but our son is moving back after graduating (Information Technology) with a fatty student loan debt so we need more space.

FHA buys the mortgages after the fractional reserve bank prints up on average 38 debt dollars for every dollar borrowed that compete equally with a DOLLAR OF SAvings DRIVING PRICES AT THE BID..? HOW IS IT THAT HOUSIN?G HAS NOT BEEN 38 TIMES TO HIGH PRICED..? SOUNDS AS OUTRAGEOUS AS THE PRINTUP OF 38 DEBT DOLLARS THAT COMPETE EQUALLY WITH A DOLLAR OF SAVINGS…

IF ALL YOU CAN AFFORD IS THE DOWN PAYMENT, THATS ALL THE HOUSE IS WORTH…

Been having a thought. The markets seem to have fallen in the low and middle tiers. The upper tier has not dropped substantially. Does this reflect the buying power of the various classes. I read lots of news about the wealthy getting wealthier and everyone else falling back. Could this contribute to the lack of correction in the upper tier markets?

In this country, if you are strong you get taken advantage of and if you are weak you are taken care of scott free. Sound like communism?

Leave a Reply to WestCoast Transplant