Federal Reserve Fighting Inflation in the 1970s and Restraining the Housing Market. Today the Federal Reserve is Juicing the Housing Market Trying to Cause Inflation. Researching the 1970s and 1980s Mortgage Markets and how 30 Year Fixed Mortgage Rates went from 7.25 Percent to 17.5 Percent in one Decade.

People have a hard time predicting the future especially when it comes to economic behavior. Many people saw the housing boom and bust but few had the wherewithal to take action at optimal points. Once the herd catches wind, it is usually too late. How many people rushed in at the tail end of the technology bubble only to see their investments vaporize into thin air? How many people overpaid for homes during this boom only to be left with mortgages that don’t reflect the value of the item they are supposed to reflect? The U.S. Treasury and Federal Reserve know full well that bubbles and their subsequent busts are only part of human nature. We learned painful lessons during the Great Depression and reigned in the banking sector. It took a full generation to forget all those important rules of the road. Yet we don’t even need to go back so far. We can look at the 1970s and 1980s to see how quickly things can spiral out of control with mortgage rates and all things connected to the interest rate.

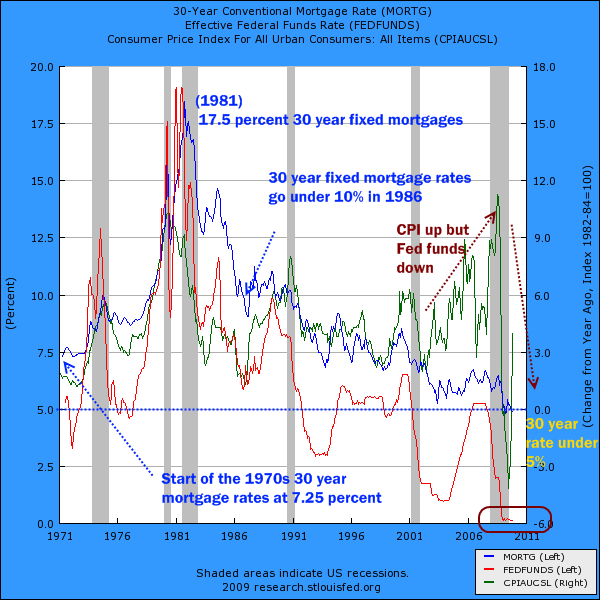

I did some sleuthing and pulled up some fascinating articles in older newspapers showing how the typical mortgage rate went from 7.25 percent in the early 1970s to a record 17.5 percent in 1981. In less than a decade rates went up 100+ percent. It is hard for people to imagine this but let us walk through what happened with the benefit of hindsight. Let us chart out the average 30 year fixed mortgage, Fed funds rate, and CPI rate of change:

During the start of the 1970s the 30 year fixed mortgage rate started at 7.25 percent. By the late 1970s the rate was already over 10 percent and by 1981 it reached a peak at approximately 17.5 percent. The 30 year fixed rate didn’t go under 10 percent again for another five years until 1986. The Federal Reserve with the help of Paul Volcker brought inflation under control by raising the Fed funds rate over 17.5 percent. Unlike the current U.S. Treasury and Federal Reserve, we had someone at the head of the ship concerned with the viability of the dollar and put mortgages on the back burner. This current Fed and Treasury is concerned more with appeasing the crony bankers on Wall Street.

But let us walk through the above chronologically with snippets from papers:

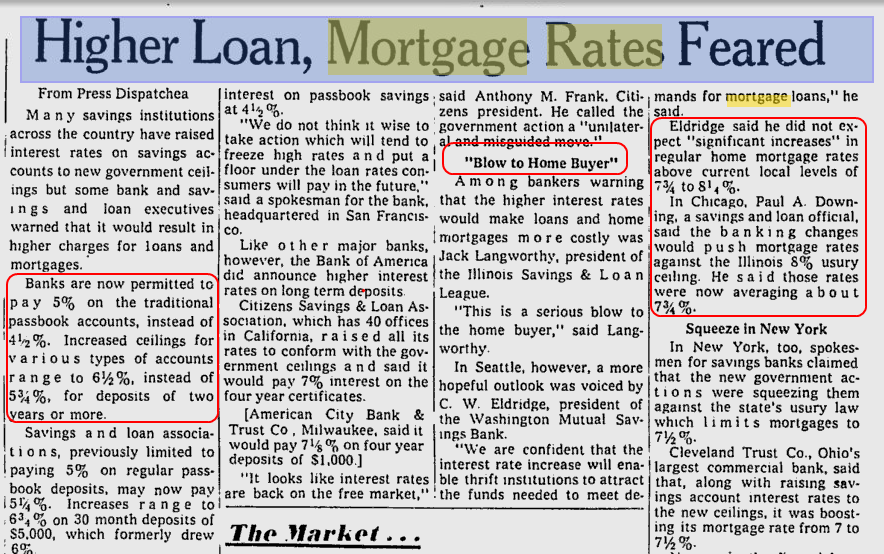

The Milwaukee Journal – Jul 6, 1973

Competing with other forms of deposit vehicles, banks and savings and loans were allowed to raise interest rates to attract money. As you might remember Americans were actually saving some money at this time so banks did have to compete for major deposits instead of getting massive bailouts from the government. So banks started increasing their deposit rates. At the time mortgage rates were around 7.75 percent on 30 year fixed loans. Some didn’t think rates could go up much higher during this time but then again as we are now finding out forecasting is not a strong skill of the financial sector.

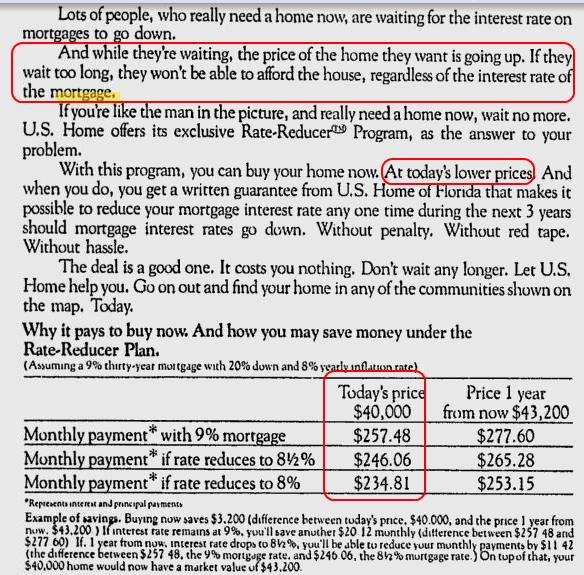

Sarasota Herald-Tribune – Feb 16, 1975

You have to remember that in the early 1970s the U.S. went off the gold standard. What followed was rampant inflation. The U.S. basically decided to give itself a 30 year deficit spending party that is now finally coming to an end. The above is a fascinating advertisement from 1975. Rates are now moving on up. By 1975 the 30 year fixed mortgage is now up to 9 percent but home prices are going up. This was the decade of stagflation but incomes were also going up so there was a form of balance at least. The ad is interesting because it talks about buying today assuming home prices will go up no matter what. So what if rates go lower? This ad was for a product that locked in your rate should rates go down. Today, we have nowhere to go but up. You can’t go any lower than the zero bound.

Our current predicament is a troubling one. The CPI for the entire decade looking at owner’s equivalent of rent completely missed the entire housing bubble. The biggest item in a household balance sheet and the entire CPI missed it. So when we look at our first chart, inflation might seem subdued during the 2000s but it was running rampant in housing prices. The U.S. Treasury and Federal Reserve knew this so housing prices going up was of no worry; in fact this was their desired goal.

But as the 1970s went further into inflation madness, things started getting out of hand.

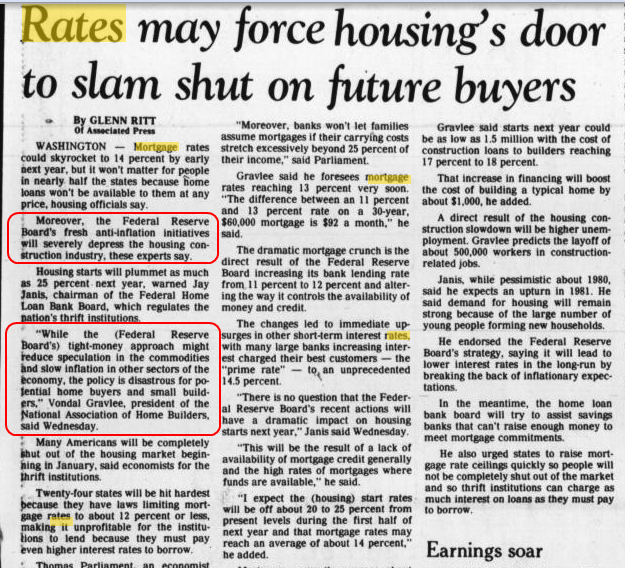

Eugene Register-Guard – Oct 11, 1979

Now the above piece is fascinating. When was the last time you saw the National Association of Home Builders attack the Federal Reserve? The Fed at this time had its eyes set on controlling inflation and commodity speculation. This was the goal. In our current crisis it seems that getting people to buy homes no matter what is the ultimate goal. People forget that during these times many sellers were allowing borrowers to assume their mortgages at their old lower rates. This was common practice. Today many loans have a clause that force new buyers to get a new loan to pay off an old one. Welcome to the new world of finance.

By 1979 mortgage rates were reaching 14 percent. Home building was already taking a hit. Inflation was running rampant. The Fed was jacking up the Fed funds rate fast and aggressively. Yet today, the fear of inflation is largely absent. Or is it? For the entire decade the CPI missed the biggest housing inflation ever recorded. So where are we really? If our best measure is not looking at the entire picture then something is amiss. That is why I have argued that the BLS with the CPI and employment numbers doesn’t really reflect reality.

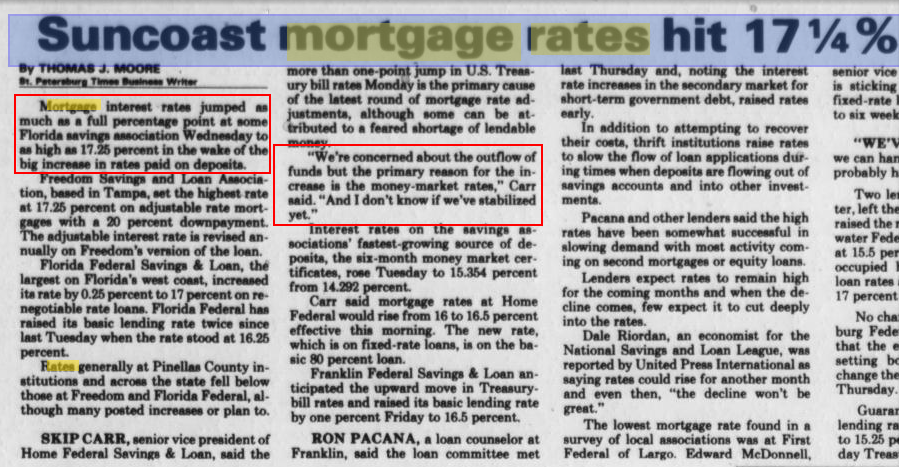

By 1981 mortgage rates hit their peak.

St. Petersburg Times – May 7, 1981

Mortgage rates hit a massive peak topping in at 17.5 percent. Can you imagine a 17.5 percent interest rate today? Can you imagine getting 17 percent in your savings account? It is hard to even imagine such a time but that was 1981. Today you are lucky to get 0.5 percent on your savings account even though the U.S. dollar is getting slammed into oblivion by the Federal Reserve.

By 1981 the Fed was winning the battle against inflation but housing was taking it on the chin. Apparently saving our economy was more important than saving Wall Street and the housing industry. Today, the Fed is more concerned about the banks and the housing industry than the actual real economy. Remember those previous articles from the 1970s? Did anyone see these rates coming? Absolutely not. And this is an important case study in behavioral economics. Today does not equal tomorrow. So those thinking interest rates can stay this low forever are out to lunch. Higher rates will crush prices further.

But by 1982 with the Fed controlling inflation mortgage rates also came lower.

N.Y. Times, October 24, 1982

“(NY Times) Prices will not rise soon, Mr. Downs said, because ”there is a tremendous supply of houses on the market – for the next six months or a year, I think prices will remain relatively flat.” Mr. Downs and others believe that lower interest rates will lead to less seller financing.

One commonly held theory among housing and real-estate specialists is that interest rates must get back down to 12 percent before most families will be able to afford to buy a home.

But even though rates on mortgages guaranteed by the government may be at 12.5 percent, different lenders have different forces to respond to and it could take time before many of them drop their rates that low. Many savings and loan associations cannot afford to offer such low rates because they are paying high rates to depositors; some types of savings accounts are paying 16.55 percent interest and will be for the next 18 months.â€

12 percent to make homes affordable? Hah! 12 percent today would rock the entire market to its foundation. Yet the Fed did manage to control inflation and mortgage rates went lower and lower until they went under 10 percent in 1986. But this was a decade of high mortgage rates. To think what we are going through right now is normal is wrong. The average 30 year mortgage rate over 40 years is 9 percent. Do you think we can handle a 9 percent rate?

Some will argue that rates are low because they reflect low inflation risk and the Fed can print freely. Yet the risk is appearing in the declining U.S. dollar. The mainstream media seems to ignore this but something else similar happened in the 1970s. Gold soared:

Source:Â BBC

In the 1970s gold went from $35 an ounce in 1970 to nearly $850 in 1980. This was a reflection of the U.S. coming off the gold standard but also rampant inflation. So if we had little to no inflation this decade, why is gold now up over $1,100? Because the U.S. dollar is tanking, that is why. And why wouldn’t it be? The U.S. Treasury and Federal Reserve, unlike Paul Volcker, only care about Wall Street and the banks since they are governed by crony politics. They are more worried about people buying homes with no jobs than getting people to have jobs with good wages so they can buy homes. It really is backwards. That is why anytime the U.S. dollar makes a strong move up gold gets slammed but also the stock market.

I’m no gold bug but I do follow the markets. In the 1970s gold shot up because of the U.S. going off the dollar standard and rampant inflation. Today, gold is rising more because the U.S. dollar is being crushed by the enormous amounts of debt. The fact that we are bailing out banks with trillions is simply inexcusable with no actual reform on the table.

So what can we gather from the above? Over the next few years things are going to happen that many of us cannot predict. The unemployment rate is still up at 10 percent and if we add in the underemployment rate, we are up to 17 percent. The government is blowing through money that would be normal if we were entering a world war. With banks offering 0 percent on savings accounts Americans are nearly forced to gamble in the stock market if they want any sort of return. Social Security has already stated they will offer no cost of living adjustments for the next two years. All the while the U.S. dollar is doing this:

A few things are certain:

-Mortgage rates can only go up. We are at the lower bound. It is a matter of when they go up.

-We will never ever pay off our debt. Anyone who believes otherwise does not understand arithmetic. We are spending more than what we are bringing in? Paying it off? Hah! To the contrary, we are spending even more. I doubt Keynes envisioned fiscal stimulus in the form of trillions to a select group of crony bankers.

-U.S. households are being crushed by enormous amounts of debt. The Fed hopes to generate massive inflation so we can pay off current debts with cheaper dollars. In their mind, big deal to have a $500,000 mortgage if the median income is $200,000. Clearly they are not following the employment market.

As we look at the 1970s and 1980s we can learn many things. First, massive inflation is no party and this is what the Fed is trying to induce. Second, many financial “experts†have no clue where things will be heading. Yet spending more than you earn never ends well. The signs are all there. We just need to be open to history and listen to what it is telling us.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

31 Responses to “Federal Reserve Fighting Inflation in the 1970s and Restraining the Housing Market. Today the Federal Reserve is Juicing the Housing Market Trying to Cause Inflation. Researching the 1970s and 1980s Mortgage Markets and how 30 Year Fixed Mortgage Rates went from 7.25 Percent to 17.5 Percent in one Decade.”

the only doc to see:

http://video.google.fr/videoplay?docid=-2550156453790090544&ei=ixcuS9W6Ds6z-AaE2OjcAw&q=money+as+debt&hl=fr&emb=1

In 1980, we bought a house and were “lucky” to get a 13% mortgage.

Every “expert” on Wall Street, real estate experts,etc. said “you will NEVER see mortgage rates in single digits again”.

Around the late 80’s, I was doing some retirement planning, and calculated my returns at 7 to 8 percent, on very safe bank CD’s, figuring that was realistic, for my retirement in 2007.

Predicting the future is indeed risky, and today we are in totally uncharted waters. Ten years ago, if someone had said GM and Chrysler will go bankrupt,

Lehman Bros. will go belly up, and interest rates on bank CD’s will be 1%, you would have called them absolutely crazy. All financial markets are now on a roller coaster, and the next decade will be unlike anything we have seen.

Take a look at the “Survival Blog”, on the right side of this screen. Some people are preparing for the future with bullets, and figuring out how to make a secure bunker home.

The future right now does not look very pretty.

Great post.

This is something that a lot of people don’t understand about debt: if China makes you a Playstation 3 and ships it over here, they expect a Playstation 3 plus some interest sometime in the future.

If you think of debt in terms of physical objects and services instead of dollars/Euros/whatever, it makes sense. You can’t just run up a bunch of debt and expect to inflate your way out of it because while the debt is denominated in dollars, interest rates are not denominated in anything and the market will always adjust to the kind of imbalances that the Fed is trying to create.

I think a double-dip style recession is likely as soon as the shenanigans that are currently being perpetrated to keep the economy moving catch up to us, probably in unexpected ways as this post describes.

Good post! One question: How much would you expect the median US or CA house price to decline if the 30-yr mortgage rate were to rise from its current 5% to a more normal 8-9%?

“You have to remember that in the early 1970s the U.S. went off the gold standard. What followed was rampant inflation. “

>>

Doc must disagree with you on this one! Inflation was ALREADY a huge problem well before the gold standard change!

>>

I remember the early 70s quite well. Inflation had been a serious problem in the last half of the 1960s! It truly accelerated after certain events in 1973 – the oil crisis when OPEC jacked the price. That went on all through the winter of 73-74 (and was directly due to the US’s unrelenting funneling of money to Israel) and certain other -and very key – events that had nothing to do with the gold standard..

>>

(1) Inflation had been occurring through out the 60s. From 1960 –1970, there had been an inflationary rate of 31.1% or an average of 3.1% a year. Between 1965-1970, 23.15% of that inflation occurred – or an average of 4.63% a year. 75% of all inflation had occurred in just 5 years! This was largely due to the rising incomes of middle and lower class households who then had more disposable income to spend which drove up the prices of goods and services. Further, at that time, workers had sufficient power to demand – and receive – wage increases to keep their household incomes at or above the rate of inflation.

>>

(2) In 1970, the Economic Stabilization Act, was passed giving Nixon power to set wages and prices. We are talking wage and price controls, folks. Wage controls limited increases to 5.5% per year, and price increases were limited to 2.5% a year.

>>

(3) In 1971, Nixon ended any pretentsions of the ‘gold standard’. Gold was undervalued and the US currency was overvalued at the time.

>>

As your chart shows, interest rates were not substantially increasing at that time.

>>

(4) In March 1973 began the oil crisis. The price of gas went up several multipiers from its existing price. (I remember the gas crisis – lines at the pump, rationing as to how many gallons you could purchase at one time, mumsy and daddy shutoff my waterskiing behind the 38 ft cruiser that got ½ mile per gallon……..)

>

(5) In 1974, the legislation permitting wage and price controls expired and was not renewed.

>>

What then happened was due to factors (a) pent-up inflation that had been contained for 4 years and (b) the inflationary impact of higher gas prices which affected all aspects of the economy. (Remember workers still were able to demand and get wage increases to keep up with inflation.) And so began the ever accelerating inflation of the mid-late 1970s. And interest rates began climbing to try and get ahead of inflation…….

>>

It wasn’t until the wage and price controls ended – 3 years after the removal from any connection with the gold standard – that interest rates began their climb. Keep in mind that in the 1960s and the 1970s the US MADE things – it made most of the world’s goods and we were not importing junk from China. That meant that for the consumer in the US, the international rate of exchange was not of significant importance as they were not buying from other countries (except for oil). The US was a largely closed and a circular economy.

>>

Yes interest rates skyrocketed in 1979 – after Volcker was appointed Chairman of the Fed. Reserve that year and promply jacked the Fed rate way way way up. I remember that we were thrilled to get a 10% mortgage in 1984. Who these days could afford even the median priced house (around $176,000) at a 10% interest rate, eh? With 20% down, that would take a household income well over $80,000 – the upper 20% in the US. And that would hardly be a market in balance when only 20% of the population could buy 50% of the houses……

The most tragic aspect of financial bubbles and government efforts to sustain them at any costs, is that they produce distortions in the economy that suck capital out of it and divert it away from where it is needed the most, which is in savings and in investment in the industries of the future.

We badly need to rebuild our railroads and most of all to build new power plants and improvements to the grid utilizing much more advanced technology. Our cities need badly to replace 90-year-old water and sewer infrastructure while fuel is still relatively cheap.

But we’re not doing these things because our policy makers are steering all available capital plus everything we hope to earn for the next 20 years into a rearguard effort to re-inflate the credit-driven boom that would never have happened to begin with in a healthy, honest economy driven by production and investment in necessary goods and services.

This sucks! Thanks a lot Baby Boomers!

Comment by El Patron

December 20th, 2009 at 1:27 pm

This sucks! Thanks a lot Baby Boomers!

__

>>

What ever are you whining about? First define “Boomer”. That means those who were born between 1946 – 1961/64. That means those who were only 43 – 61 in 2007 when the collapse occurred – and most were in their lates 40 or early 50s.

>>

Those between 50 and 63 (the older 1/2 of the ”Boomers’) were the ones paying 10%+ interest for their first home in the early 80s.

>>

Those between 50 and 63 were the ones to first experince RIFs (reduction in force no matter how good of a job you were doing) – and to experience it when they were in their mid 30s to early 40s which is not a good time to have the world change when you are trying to plan your future.

>>

Those between 50 and 63 were the ones to first have their retirement plans upended when pensions began disappearing – and to have such things disappear after they were 1/3 -1/2 through their working careers.

>>

Those between 50-63 were the ones to have the misfortune to produce such spoiled brats as you.

>>

The ones in control of major corporations and government policy in the 70s, 80s and 90s were NOT those who were then, at most,14 – 30 years old (1975s), 24 -40 years old (1985) or 34 – 50 years old (1995.) In fact even in 2005, most so-called Boomers were UNDER 55 years old. It is the rare 45-55 year old who is the head of a major company or senior in governmental bodies.

>>

Try blaming the WWII generation for the 60s and 70s – born before 1927. Blame the Korean War and Elvis Presley generation of the mid-late 50s for the 80s and 90s – those born between 1927 and 1940. Blame those who came of age in the early 60s (and thus born before 1940) for the 90s.

>>

Apparently this poster does not realize that the so-called ‘Boomers’ do not include all those between from ages 35 to 99+++.

>>

In our area, the ones defaulting on their mortgages and drowning in credit card debt are NOT typically over 45. The ones whose unbridled greed and over-blown sense of entitlement caused them to buy more than they could afford, chase after get-rich-quick-schemes and run up debt are between 25 – 40. It was their ridiculous belief that at the outset of their lives they were ENTITLED to live as well or better than their parents that caused them to do that. An generation of spoiled brats. They are the children of (1) those who came of age in the mid-1950s and early 60s, and (2) the very oldest of the ‘Boomers’ (at most those age 57 – 63 and not of the rest of that age group who are 46 -56. )

>>

Blame your own age group for the greed.

El Patron,

That is where you put the blame? Boomers?

How about those we elect and then sell out to the deepest pockets?

Anyone who blames just Boomers or just Republicans or just Democrats are Sheeple and deserve what they get.

Dr. Housing Bubble, you rock. I’ve been reading this site since….I don’t know…a long time ago. Your perspective is the needle in the haystack of this whole mess. I love the comments on here as well.

I’m just wondering though, if the Fed is truly attempting to inflate our way out of debt, wouldn’t it be prudent to buy now, even in still inflated areas and just ride the wave of inflation? Granted though, that inflation will kill the unemployed in this country and holds the real possibility of sparking civil unrest to some degree, especially when the truth of who really got bailed out sets into the psyche of even our most illiterate and ignorant citizenry.

There are some really smart commentators here. Maybe I’m just missing the mark. It seems that we are in a deflationary spiral, which would signal that it’s a great time to hoard cash and wait on the sidelines. However, if we are staring at the prospect of real and unavoidable inflation, buying now could become massively cheaper in an inflationary environment?

I’m friggen lost haha.

So, given all the above, what would be a good entry point to the housing market? buy now, intrest rate are low & RE price high, or wait till intrest rate are higher -> RE prices must go lower, or be cheaper due to inflation? and then anyway intrest payment are deductible on your taxes…no?

Didnt Freud say to blame your parents?

-We will never ever pay off our debt.

That’s why the move to decouple from the dollar peg and the petrodollar by the Gulf states. We think the rest of the world is ignorant, but they know the game–we get their oil and they get our paper. Just like the Donald in the 90’s they know if the dollar collapses the world will be in a frightful state. Mathematically, the only method to shrink the debt is to shrink the dollar. They are trying to unwind our galaxy-sized debt without triggerring WW-III. It’s probably the only course there is left to take from here.

Good points, AnnS.

“First, massive inflation is no party and this is what the Fed is trying to induce.”

Yes, massive inflation is bad overall, however, it can solve some problems (while creating new ones.) If people’s wages double they will be able to afford their previously unaffordable fixed mortgages. Of course they will not be able to buy food and other necessities because the prices of those items will also skyrocket.

Unfortunately, my children may have a tougher time than what I did. I am not in the boomer category, but the US was ascendent at that time. I just read in the 1950’s 47/50 corporations were based in the US. The levels of debt that as a society we have accumulated, and how we are dealing with long term problems does not portend a good situation. Baby boomers did have a part to play in these problems. I hope we can stop seeking such short term solutions, and if necessary have the courage to rectify our problems.

I remember that time – I was just out of college, and honestly didn’t know how bad things were. I guess I was basically poor, but, jeez, I had a good time. It was the seventies, after all, and I was in my twenties. Reminds me of a story I heard from and old experienced trader recently when he was describing the day in ’87 when the market tanked. He’s reaching for the phone to tell the wife to go draw all the money out of the bank, but all the kids on the floor weren’t bothered. They had no skin in the game, and just took it in stride.

Anyway, interesting time frame you’re bringing up. The 70’s were when the boomers were all out of childhood and out starting their lives and buying a lot of stuff, like, of course, the first home. Of course inflation was rampant with that many people consuming like the little gluttons they always have been. Fast forward to today, and now all of them are going into the end game with mucho debt, no savings, and reduced earning power with no job or half a job. Can inflation take hold with that many people out there who will become Social Security poverty cases over the next twenty years? (That’s the only income a large majority will have) hmmmmmm….. I wonder……..As always, look to Japan with it’s aging population as an indicator. But they saved a lot. We didn’t.

Oh, and I’ll never forget sitting on the back deck watching a steak on the grill as my father chuckled about the two 15% five year cd’s he bought that day at two different. Imagine that, folks, federally insured 15% 5 year cds. Now that’s easy investing.

@AnnS – this is very telling – “It was their ridiculous belief that at the outset of their lives they were ENTITLED to live as well or better than their parents that caused them to do that.”

The expectation that we would live as well as our parents – and the other side – the responsibility to make sure to leave the world as well or better for our children are not ridiculous. I’m sure you grew up expecting to live poorer than your parents and that the greatest generation made sure that you would – yeah right.

Personally, I know that relying on exponential growth on a finite planet will make things more difficult for my children and grandchildren. That is why I consider it my responsibility to do as much for them as possible to help them face the future. I’m not greedily taking as much for myself as possible so I can complain about them being spoiled when they expect the same out of live that I’ve gotten but get much less because I’ve sucked the world dry for short term gain.

The more posts I read by Kid Charlemagne, the more I find myself in agreement with him/her. They *HAVE* to inflate the dollar in order for us to pay off …ahem, “our” debt. which was thrust upon us by the corrupt politicians.

“It is the Right of the People to Alter of Abolish Government” – Declaration of Independence

I think it’s high time to flush out Washington, and elect new officials. Hell, it may be time to overhaul our structure, not on a constitutional level, but to ABIDE by the constitution like our forefathers wanted. F the Central Banksters.

I remember reading a real estate article about ten years ago on rising interest rates. Each one percent rise in mortgage rate cause the house value to decrease 4%. Make sense when you figure most people buy a house on how much they can afford to make monthly payments.

Using PV tables, a house at $350,000 @ 5% interest for 30 years fixed = $1,878.88 per month mortgage (mortgage only). To achieve the same payment at 6%, the principal value needs to decrease to $313,381, a drop of 10.46%. An increase of 5% to 8% is a drop in principal of 26.84%. You can’t just assume “x drop in interest = y drop in value”. Also, my assumptions and calculations have not addressed taxes (income and property), which is different for everyone depending on your marginal income tax rates for Federal and State. In theory, the increase in the interest rate will correspond with a subsequent drop in the value of the home to reflect the decline in affordability, absent any other factors.

So you can see how ridiculous this bubble has been. Consider a real example – California house purchased 2006, $565,000 (3br, 2ba, 1,696 sq ft), fixed rate mortgage 80/20, combined interest rate of ~7.35% (6.875% first, 8.95% second). House sold at auction 12/15/2009 for $350,000. If we were to use a 5% interest rate in 2006, to achieve the same payment, the person could have “afforded” a home for $725,000. This is over a 50% decrease in the principal value of the home if we keep the interest rate contstant. From here, if we go from 5% interest to 7.35% interest, the value may decrease by ~22% to $272,000, if all else remains constant and ignoring taxes (for simplicity and the sake of argument, I understand that taxes are an important factor).

More interesting facts. Investor has listed this house for $499,900. REALLY?!?! Yes, really. It’s a pipe-dream, but you can see what is going on here. Manipulation at its finest. Also, a direct neighbor with the same floorplan bought their house (which has a pool and a little more usable lot) in 1996 for $210,000. So, adjusted for inflation, we’re right back to the late 90’s if we use the auction price. That is not to say that $350,000 is a good deal. Better to pay higher interest, which is deductible, and lower principal. For 1), Property taxes, 2) you may be able to refinance later at a lower rate, while having a lower payoff.

Yes, this is my story. And yes, I did walk away intentionally (after trying to negotiate with the bank for over a year). You can argue the moral ramifications all you want, but the bank is equally responsible. They made a bet, and the risks were embedded in the interest rate that I paid to them. They also understood that if I were to default on the loan, they would be receiving the property as collateral. They understood this. I did not refinance and did not live lavishly. I’ll be paying for it in the future by being forced to become the “Bank of Me”.

It all comes down to one thing. The Federal Reserve (off-shore banksters) with the help of Wall Street are deliberately destroying the dollar to replace it with a world currency. With the destruction of the dollar, so goes the American middle class. This is why the current financial world seems to make no sense. The toughest aspect all of us have to face is comprehending how destructive these elites are to our lives and futures.

@AnnS: “It was their ridiculous belief that at the outset of their lives they were ENTITLED to live as well or better than their parents that caused them to do that. An generation of spoiled brats.”

Couldn’t agree more, but greed and additction are how we ALL as a people have been manipulated. Those who would keep us in bondage do it easily with usury. In the depression they started with a dollar down and a dollar a week to keep us indentured. Now it the giant mortgage, school loans (not just for college–private middle and high schools cost more than college should), seven-year car loans, equity lines for homes and vacations, multi-thousand annual family cellphone and cable TV plans. We’re too numb from our high-stress jobs, commutes, and constant media suggestions. Yes, fellow hamsters–jump on the wheel in the cage–just don’t try to get off.

Ann S.

It certainly is the boomers who went to college in the late sixties, and early seventies running the show of unprecedented greed, corruption, back room deals, and political payoffs in Washington DC these days.

Another driver of inflation in the sixties was LBJ’s “Guns and Butter” spending on Vietnam and the Great Society Programs.

—

A market response to the high interest rates in 1980 was owner financed deals, with the sellers being paid interest instead of the banks higher rates.

We sold some property in 1981, and owner financed the deals at 10% with substantial down payments.

That money then earned 17% in Treasuries and Bank Certificates of Deposits!

No free lunch, of course, until inflation was reined in.

—

Foreclosed homes top 1 million; half default a 2nd time

Stubborn unemployment makes it tough for homeowners to cover debts. Many whose loans were modified still can’t keep up with the lower payments.

For the first quarter ever, the number of homes in foreclosure with mortgages serviced by U.S. national banks and savings and loans topped the 1-million mark, according to figures released Monday by the Office of Thrift Supervision and the Office of the Comptroller of the Currency.

The percentage of prime borrowers whose loans were 60 or more days past due doubled from the July-to-September period a year earlier. And more than half of all homeowners whose payments had been lowered through modification plans defaulted again.

Monday’s report comes on the heels of a private report last week that said there were 1.7 million homes headed for the market because of foreclosures or delinquency.

That backlog of “shadow inventory” increased 55% in the year that ended Sept. 30, said the report by First American CoreLogic, a Santa Ana research firm.

—

Small-business bankruptcies rise 81% in California

Over the last year, the Los Angeles, Riverside/San Bernardino and Sacramento metropolitan areas have led the nation in small-business bankruptcy filings, said Tim Klein, a spokesman for Equifax.

About 19,000 small businesses filed for bankruptcy in California during the 12 months ended Sept. 2009, up from 10,500 the previous year.

If you over lay the median price of homes with the unemployment graph, you can see that any unemployment over 7% starts to flatten out and begin to force prices down. Other factors such as interest rates and govt incentives have an effect, but the correlation between unemployment and home price is very strong.

Dr.

Can you find reliable resale home values and U6 numbers for the late seventies thru the early 80’s? Including this info in the 30 year mortgage graph would be helpful.

This source does not satisfy me, but I thought others may find it interesting.

http://www.realestatedecline.com/homepricehistory.htm#median home price charts city by city

There’s are reason why engineers build airplanes and power plants and economists don’t. Engineers have to use real math, while economists use the “oh, that’s bad, no that’s good” voodoo math that does not resolve to a solution. If our lives depended on the accuracy of economists and realtors we’d have been dead a long time ago. But they’re the ones in control now. So go ahead and justify a half-million mortgage for a box that will get burned up in a wildfire or swept away in a mud slide (btw, sometimes CA weather sucks) if that’s what you want, you can find some unsustainable method to usurp the majority of income of your adult life to buy into the declining remnants of the largest asset bubble in modern history (no way the 20’s bubbles were this big, however you measure them). We got some great colleges on the east coast too, turning out some of the smartest retail clerks and pizza delivery guys you will find anywhere…Folks, this ain’t over yet. Sure you want that Charlton Heston neck ring on for the next 30 years? Planet of the Alt Apes is the scariest thing since Goldman Sachs advised us they were doing God’s work…God must be punishing us then.

Kid Charlemagne your post and your rationale rocks! If everyone would just see it that way, prices would revert back to reality quickly. Great post as always Dr. HB!

Well as the Chinese say “may you live in interesting times”. The Fed is trying to inflate our way out of this mess. I believe we are in a deflationary environment and either of two things will occur; we will have a deflationary depression or we will end up like Japan a long, long, long deflationary stagnated economic conditions for a long time. Japan has experienced two decades of deflation where the economy show signs of life only to sputter again.

@IB: If you think that housing prices will go down, and mortgage rates will go up, the ideal thing to do would be save up a big pile of cash and then buy a house outright in the future. If you’re paying cash, the mortgage rate won’t matter, and you can take advantage of prices depressed by the high rates. Unfortunately this isn’t an option for most people because they just can’t pile up that much cash in a reasonable amount of time.

Thanks @It’s gonna,

I think Ben’s chopper is about out of gas. Elliot Wave folks present a great case for the Fed not driving interest rates, but actually following them. Alpha’s Charles Smith makes a great case as well that rates will start to rise soon no matter what the target is because the $ is losing reserve status around the world and China doesn’t need to buy as much as exports drop. I think that if CA home prices drop significantly it won’t help most buyers that much because whatever their source of income it will likely diminish. Even state workers will be slashed as state budgets fail and they cannot print currency. If home prices fall to where they should be, the collapse may be unstoppable.

Look at oil prices. They have so much crude they are running out of places to store it, but the MSM parrots deceptive statistic manipulation like we drew down supplies last week. It’s BS, but it works–crude demand continues to drop but prices go up. Why should housing be different, particularly with the PTB doing every thing imaginable to reflate the housing bubble. If it were supply and demand it would already have happened. It should, but it’s just not that simple.

Leave a Reply to Nimesh Patel