The failed mission of the FHA – supporting high home prices when your mission is affordability. Low interest rates are a reflection of a global financial crisis and not a healthy economy.

The fog of low interest rates is really clouding the judgment of many prospective buyers. The reason we have low interest rates isn’t because the economy is booming or things are going strong for the state. The reason interest rates are low is because of the second round financial crisis in Europe but also the Federal Reserve pushing rates to their lower bound range. In other words low interest rates are a reflection of how bad the overall global economy is. California is in bad shape yet pocket market delusion is back in full force. Even when you talk to people they transform into real estate zombies when it comes to buying a home. “I’ve been waiting too long and need to buy! These historically low rates are encouraging me to squeeze into a home.â€Â Of course, if you plan on staying put this might make sense but people need to realize that rates this low are a major anomaly yet are buying as if this is the status quo. You make money on the price of the asset and not so much on the financing.

A snapshot of Los Angeles County

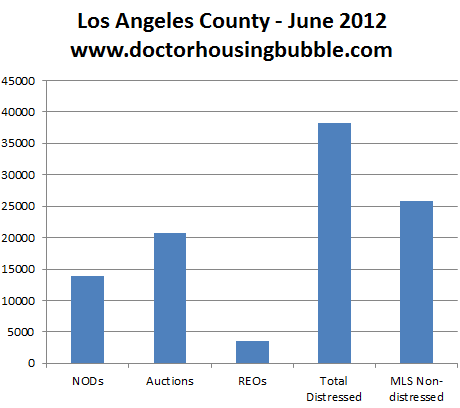

I think looking at the entire housing picture is better than simply looking at one item. The reality is that momentum has pushed prices a bit higher in the last few months. Again this has occurred because of low interest rates brought on by a continuing global financial crisis. The current inventory of Los Angeles County looks like the below:

You still have more problem property versus actual organic home sales. We really have an interesting market unlike any other in history. A large part of sales are from the distressed pipeline. Many are well aware of current market conditions and have simply decided to sit this one out. I’ve talked with many baby boomers that have told me they are simply waiting “until prices recover†before they list their home. I think they’ll be waiting for a very long time before that occurs. We are living in a Black Swan world.

The above chart still highlights a very uneven market. The total distressed pipeline is much bigger than the non-distressed MLS listed inventory. So what you are seeing isn’t really a true reflection of the market. Many have elected to ignore this and are simply buying because of low rates. I have to shake my head when some talk about buying a home and walking away if prices would fall further. So say you buy a place for $500,000 with a 10 percent down payment. Would you really walk that easily away from $50,000? That is why 9 out of 10 underwater buyers continue to pay their mortgage on time even though they are underwater.  Just look at how many people try to unload expensive European cars on Craigslist. You make money on the price of the asset you purchase not on going with a 2.9% interest rate on a car selling for $80,000.

FHA subsidizing inflated housing markets

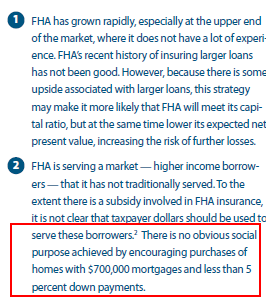

FHA insured loans are another disaster waiting to happen. A recent report from the George Washington School of Business found that FHA loans are far removed from their initial mission and have been subsidizing inflated markets:

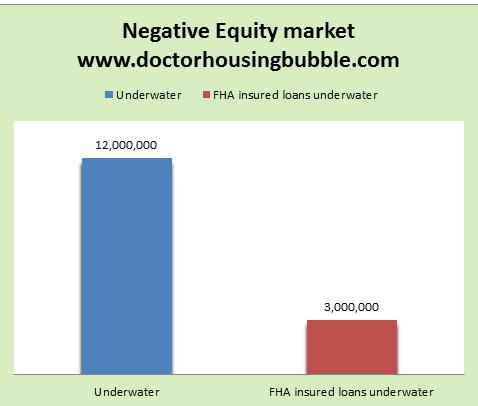

How can anyone look at using a FHA insured loan above say $400,000 and say it is to encourage affordable housing? The median US home price is roughly $170,000 so they should peg it to that. Instead we have these products encouraging maximum leverage and default rates are soaring. This is a big issue for California. In fact, many of the recent underwater loans have come about because of the FHA:

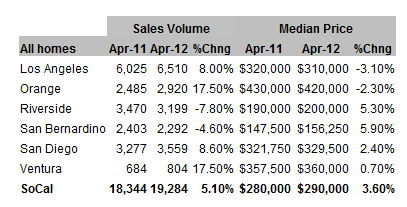

If you look at virtually all markets in SoCal beside the Inland Empire, they are much higher than nationwide median prices yet here we are using the FHA insured loans to keep the bubble market afloat:

Those calling for a bottom fail to mention where the good jobs will be coming from to make the market rebound. They also fail to talk about how all the rampant state budget issues will be solved without taxes or cutting. What about the future prospects of younger adults? We are now living in an “I got mine so screw the future†system. As much as we chide Europe for their high youth unemployment rate, we need only look at ourselves here. Do artificially high home prices really help young families looking to start out? Ironically those that champion higher home prices thanks to the government basically owning the mortgage markets are at the same time looking to “cut†government spending even though there is no larger subsidy than what banks are receiving via the Fed and GSEs for housing. In other words, very little consistency is provided here but a big heap of justification. I will wait until we see solid employment growth before being some bobble head for higher home prices.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

105 Responses to “The failed mission of the FHA – supporting high home prices when your mission is affordability. Low interest rates are a reflection of a global financial crisis and not a healthy economy.”

Too much truth for one article!

FHA recently priced itself out of the market with additional mortgage insurance premiums. 5% conventional loans are cheaper.

I just saw someone on another housing bubble blog buy in San Diego. Some people there are saying prices won’t go any further in SoCal, just remain flat for a long time. A few even commented how employment is rising here!? It’s still odd to me that all of these OLDER people (the ones who still have a job) have so much optimism. What about MY generation? I’m 21, and I’m so lucky that I have been following the economy for quite some time. I’m planning on avoiding that education bubble and also getting out of Cali. Most of these optimistic people forget they are lucky to have a job and riddled with this horrible start in life like many of their offspring. I sense there is going to be a population decline with my generation, because the employment/college/housing outlook is too horrible to start a family. I really feel for the students these days who will have nothing to look forward to. I sense the unemployment is going to get a lot worse, and without any money, no one will be able to afford even cheap houses, let alone this MESS. I hope people will help others if it comes to the point where unemployment gets way higher…

Stop reading all the BS on the internet, and study something useful. Get a skill that actually matters to your own life and hopefully others. Regardless educational bubble or not, people still will have to have some kind of training to do something. You won’t allow some butcher in the neighborhood to do surgery on your testicles or breasts, and you won’t be able to come up with ipad if you know nothing about engineering. The best thing you can do is to invest in yourself.

Who said I WASN’T investing in myself? I’m moving to a cheaper state, saving up money, and *hopefully* getting a job where my mother works (they have tuition reimbursement). Do you know how many people are in college right now? Do you know how many are riddled with loans and will NOT get a job? What’s the point of a college degree if you get NO JOB? I fail to see how informing myself about the economy is “BS on the internet?” Many people have training,degrees, and experience along with their nice layoff. I won’t dare even think about engineering for a long time (mostly all contracting work, high unemployment). And, for your information, I wanted to become a dermatologist, but instead, I’m being realistic. So, you should probably lecture someone else. I am appreciative of this site, even though I won’t be buying a home anytime soon. It’s nice to know these things.

Agreed

CeeCee, I understand your point, I want to tell you one thing though. I found getting an AS degree at a Community College is the best bang for the buck. It’s the cheapest degree, and the majors are the ones that are used the most not just in SoCal but everywhere. Accounting, auto mechanic, diesel technician, computers, all that kind of stuff.

I make $60k to $80k with my 2 yr AS degree. I know people with Masters that are making less than $50k because they didn’t pick the good fields.

You will be ok! 🙂

Cee Cee, Pete is one of the folks that you mentioned in your earlier post. He has his, so screw everyone else. You are on your own! He got the GI bill, you get student debt. He has a six figure state pension, you get to work 2 minimum wage jobs. He gets medicare, you get to die in a broom closet of the emergency room since you don’t have medical coverage. My advise, move to Asia, or S America, or somewhere they still make stuff.

James, that’s just simply not true. I started mopping the floor and washing the dishes, and I am not even qualified to serve the food to people. My point is simply that if you want to learn, you have to learn from the best available to you. You can go to MIT open course or Robert Shiller’s financial market. It’s free. Reading the posts here is not only depressing, the world will end, but also much of the stuff is not really true. It’s tough out there, no doubt about it. You know what, life will go on. You will have to make the best of it.

By the way, James, I am only over the hill, not close to the pension and Medicare you mentioned. I am starting a small business, and I have to pay everything myself. Sometimes the truth hurts.

“The best thing you can do is to invest in yourself.”

Yes. But you need capital for investment and loan is negative investment until it pays back. Who can guarantee it will, ever?

University is good but overvalued and in many cases not worth it anymore: It is never going to pay itself and I’d calculate about 10 years pay back time. With current salaries and job market very few will manage to do that.

You’ll feel much better when you finally do get that job! As for auto mechanics, this strikes me as a risky choice. I can’t predict when electric vehicles will take off, but when/if they do, it will be tough to be mechanic.

CeeCee, you’re not alone; LA Times ran an article yesterday about the surge of college bound HS grads bailing out of CA for a more promising university experience.

http://www.latimes.com/news/local/la-me-out-of-state-20120604,0,4111457.story

As other states have successfully courted businesses to relocate, now states are courting California’s young, their best and brightest, to relocate for a better college experience. I wonder how many won’t return after graduation because of better job opportunities, more affordable living/better quality of life, or if the weather, beach and Disneyland will be irresistible urges that draw them back?

Funny, I’m a transplant and I enjoy the weather but I never go to the beach or Disney! The beach is a lifestyle choice, I guess I’m just not into it. As far as the Disney, you’re talking a $500 day for a family to go there.

Even to go into Pasadena or any local hotspot to hang out, it’s $100 just to drive, park, and eat something. The SoCal “lifestyle” is a money drainer! When you live out east you find other things to do to fill the time, like wrenching in the garage or landscaping a large yard. I’m also fond of dive bars, they are wayyyy better out east.

Don’t listen to these guys, CeeCee. Do all the research you can. On the internet! Don’t go into a field you are not interested in; you may find a job, but your spirit will be crushed. Good luck to you.

CeeCee, kudo’s for you for seeing how it is in Cali. I’m in Ohio, I have an AS degree and that has indeed paid for a lot but it does close a few doors for those wanting a bachelors. The only thing that is keeping me alive is the fact I have 35 years experience doing the work I do. My skills are not easily created/found.

I suggest that you find something you like to do, because you are going to do it a long time most likely, and get the associated education with it. For instance, if you do HVAC, get the technical school under your belt etc. Then work, and then go back and do the bachelors on your own time/dime on something else.

DIVERSIFY. Not many people know it but I paid my way through college doing hair as a cosmetologist. I’m still licensed, so I can go back into that if need be – run my own shop or rent booth space. Its all about having multiple skillsets, a mix of paper education and real world skills to make it work. Good luck and good for you for thinking ahead and not going the debt route!

Avoid student loans yes, but get an education if you can. None of which is easy in California with all the state and community college cutbacks, so it probably really is better for a student to live elsewhere, but regardless.

Pete, I am in a situation where it makes sense for me to leave. I cannot afford community college right now, but I am trying to save. I can’t even get a job at Walmart here. I have turned in a LOT of applications, but the point is, they don’t want to hire me because I don’t have a lot of job experience. I have tried volunteering, but places don’t want me either. I have my CNA certification. Over here, there are no jobs for CNAs, LVNs, or RNs. Well, unless you already have experience or you know someone. And over here, the nursing homes like to pay you only $8/9 an hour. If I go back to my home town, I will make at least $10. The nursing home where my mother works pays you $12. Most jobs over there have benefits. Over there, people don’t want to do the dirty jobs. Over here, people are competing for min wage jobs with no benefits. At least, the younger people. My parents refuse to help with community college, and I get no financial aid because I am only 21 and combined they make over $130K a year in an area where the cost of living is so low. Their house is only 40k, so it’s not like they can’t afford it. If I move back, I can easily find an apartment for $350/ month, and a lot of times utilities are included. Right now, I live with my boyfriend and his mother, and I am paying his mother $500 a month to help with this expensive rent. My boyfriend’s family do not own houses out here. Both of our families expect us to be own our own and pay high rent out here when we can’ t even get stable jobs. My mother expected me to be out when I was 18. So, if I had family that understood how hard it was out there, I wouldn’t be complaining so much. But, a lot of families are like this. I have no car, and while I could take the bus here, the current job I have requires me to be at places all over LA for 12 hour shifts (if I am lucky to get hours), so I don’t think I would be able to do college and a job. The community college I plan on going to in PA will allow me to graduate in 2-3 years (LVN or nursing), instead of over here competing with a bunch of other students to try and get your classes because there are too many people in the schools. Also, there are a lot of people being hired with only a two year degree. Over in California, you need a 4 year to compete. Whatever you want to call what universities are going through right now, I cannot afford it either way. By the way, this is definitely not the only site that I read. I understand there may be some false information on some, but the reality is for many people my age, these “depressing” comments are really what we are are/going to have to deal with. I am a hard worker, but it’s just too much out here unless your family helps you.

Ohiogal, I definitely am going to look into getting a few more certifications, just in case I lose a job where I am going.

Thanks everyone else for the advice/encouragement. It’s going to be a lot easier for me over in Pennsylvania.

Kudos to you on really considering where you can be successful. So many people are willing to sit on the sidelines and watch life pass them by, as they struggle to make ends meet and build a life. There is no rule that says someone cannot move somewhere else, advance your career, and then return when it makes sense. SoCal is becoming increasingly difficult to make a living. OC requires roughly $53,080 a year to rent a 1 bedroom, and that is out of range for most new graduates from 4 year programs. Entry level housing is $435,040, which would need an income of $66,790. Not including down payment and paying student loans. Oh, and you need a car too.

Source: Orange County Workforce Indicators 2011-2012

CeeCee –

I have a niece who did the Berkeley Low Demand Degree thingie. Bright girl, but also clueless in some ways. She was jobless and asked me for an opinion on her next move. I told her to do Breast Ultrasounds. The schooling is faster than most technical curriculums, and it is a flexible hrs, decent pay, and you aren’t part of the diagnosis communicators. I also mentioned other future mommie/wife medical tech jobs as well. Set your life up while you are young. It flies by! Best of luck.

It seems that you are figuring out the situation you are in and I hope you make the best decision. Growing up is never easy. There are a few things that are almost universally true. First, most of, if not all, the parents want their children to succeed in their lives. But parents are all human too, and they have emotions, in addition to resources. It usually doesn’t take much to make them happy. This is almost universally true. I know people will argue about it, and they always do. You will be surprised to find out that they have learned a lot about life in the past 6 years. Second, most of the things in the society happen in a mechanical way. In another word, if you make a decision to do one thing, it will lead to a consequence of that particular thing. There will be exceptions, but exception is not the rule, and the rule is the result of human behavior. Good luck.

SUPERSIZE ME GOVERNMENT!

Home ownership is a privilege. You have to earn that privilege by working hard and save enough money for a 20% down payment. FHA financing is a dump joke. For example, you can buy a $300K house in Southern California with 3.5% down with FHA financing which is only $10,500. As soon as escrow closes, don’t bother to send in your first payment. Stop making payment on day-1 and live free of rent on property for at least 1-2 years as it takes that long to foreclose on your home. Do short sale, loan modification. File bankruptcy to delay foreclosure. After trustee sale, delay eviction another 3-6 months with many more tactics. You will get your $10,500 down payment back with lots of profit.

FHA never learns the past mistake. Never sell home to unqualified buyers. Owning a home is not for everyone, only the few who work hard and earn that privilege.

OK, fair enough. Then let the home prices drop enough so we can save the “20%”.

Out east they are cheap, $50k to $150k for middle class homes. $250k for a nicer one. This is easier to save up for, and why over 60% are home owners in those parts. In CA, homeownership is closer to 33%. Very wrong. It’s not a “privledge” to own a home in SoCal, trust me this banana republic aint all you think it is. Ever seen the ghettos or 1/2 the Inland Empire???

Dropping home prices usually indicate something wrong with the economy, which will make it harder to save that 20%, or feel secure enough to commit to a 30 year vassalship under a lender. You can get lucky and work for / own a booming company in a bust economy, but the odds of that are quite slim.

The secret is to subscribe to the fast bear theory. You don’t have to be faster than the bear, just faster than the next guy. Prices up, down, it doesn’t matter. You will do well if you are doing much better than they guy next door. You are all competing against the other buyers out there, and it is the Nth highest bidder on N homes that sets the price.

When the govt says “affordable” they mean the loan payments, not the price. But that’s how a credit driven society evaluates most costs…can you make the monthly payments?

Trouble is, last time I checked, one now needs to be employed in order to get a home loan.

For all the “young” people whining about not being able to get a job – join the military. Stop being chickens and do something useful, and guess what, you get training and education too. Stop living with mommy and daddy and ruining their lives – they don’t want you living with them. Otherwise, you’re doomed to a life a government dependence, and doesn’t that look attractive?

I hardly think declining to sign up to get shipped to the Middle East and slaughtered by Islamists really makes someone a “chicken,” and I don’t think most of their parents would want them to move out if it meant signing up for combat duty in our infinite string of military deployments (and perhaps the joy of being “stop lossed” when they’re supposed to be coming home). These kids just want a job that doesn’t involve a high likelihood of getting killed for some idiot politician, this is not an unreasonable wish!

Some of them (the Wall St. protesters come to mind) admittedly want a lot more, their loans waived, etc., not unlike many homeowners have obtained at the expense of the rest of us, and that’s nonsense, but I think you’ve taken it a bit too far here. In fact, sounds like *YOU* might be well served releasing that hostility and aggression over there…

Bravo! Excellent response.

I can’t think of a more ‘govt dependent’ job than being in the military.

I would say that you should get a degree in something useful like sciences, engineering, etc. Underwater basket weaving degrees, social sciences etc might be touchy feel good degrees but who would hire you based on value to their company?

Most current figures (May, 2012) is the jobless rate for veterans who have left the military since 2001 is 12.7 percent, which compares to a national unemployment rate of 8.2 percent. Don’t mention the PTSD (30.9% for men and 26.9% for women serving in Vietnam [VA data]), loss of limbs or life from being in multiple tours in our two recent outrageously stupid and unproductive wars. Apart from that, I think it’s grand for someone to be dependent on the government by joining the military.

Interesting that you bring that up, MikeGreat. I’ve been saying for years that our government has been so freaked out by Vietnam (yes, there are still many in power that remember that great loss), that they have been quite successful in creating a young, unemployed or unemployable underclass who will do exactly what you are advocating, and keep our all volunteer army filled with bodies, and never have to deal with the protests that would surely engulf our towns if the draft was re-instated. First, there was the offshoring of the same jobs those kids would have out of high school as a real choice to war games, and, now, there is the great debt servitude of the middle to upper middle class kids as they rack up a trillion in college loans. I’ll bet that many see the military as the only way out of that trap.

Does not sound like you ever served. I did 21 years, and the military gave me no marketable skills whatsoever. (Not much call for morse code radio operator or parachute rigging in the civilian world.) What the military does teach you, is how to be where you should be, when you should be there, with the stuff you should have. That might help you keep a job — and after years in the corporate world I have my doubts — but it won’t get you one.

Im sorry I have to comment on this although off topic at this point. As a mother I would never want my sons joining the military because they are out of other options and just to get out of the house. Everyone loves to pick on the current young generation regarding their poor choices of majors in college…too many Liberal Arts degrees. But where is the accountability with thier parents? I know you can only direct a kid so much but maybe if the parents had offered some sort of useful insight into their child’s educational path then things would be different. Schools have been nothing more than glorified daycare/warehousing for kids for the last 30 years. Perhaps we should refocus the education system on science and technology before it claims another generation to psychology and literature majors who work at Subway.

That will be hard to do with the current push of the science deniers. Since today proves that money can buy an election and the Right Wing has so much more of it, I think science is going to be scarce in the post citizens united US of A.

But…I can buy a $600,000 house for less than 20,000 down on an FHA. I only have 15,000 in the bank, so I’m gonna borrow the down from my 401K! I’ve managed to put a whole $50,000 in that so I think I can borrow half. I’ve got a Chase Visa with only a two thousand dollar balance, but they give me checks, and my limit is $17,000 so I could use $15,000 of that for my down payment if need be! Gee wiz, I’ve got all the bases covered and by golly I’m ready to live the American dream. Oh did I forget to mention I got in on Facebook at $36.00 a share. I bought 10 shares. That’s only 2 bucks under the IPO price, and I am gonna be rich when they turn into the next Google or Apple!!! My $50,000 a year job is solid, and my wife makes $10,000 on the side babysitting other kids while she takes care of our three kids. I know it might be tight at first, but we don’t mind eating at McDonalds, the kids love the happy meals there. Some day we’ll be able to go to Red Lobster again, maybe for my wife’s birthday. Hope you guys join us soon!

Ahh, the rationalizing the trade offs of a debt you cannot afford.

Bravo!

LOL Brilliant! I guess some people didn’t catch the sarcasm…. It was too believable. 🙂

Wait a second, this is really alarming. According to GW School of Business report cited by DHB, the FHA is strategically using (and/or influenced Congress to maintain) higher FHA loan limits as a way to attract higher income/higher FICO loan customers in order to be more profitable in the short-term (while increasing the risk of future losses) because it’s not currently meeting its capital requirements due to its book of bad and getting worse loans?

Looks like some of those ex-employees from Wamu and Country Wide et al have found some new jobs in our government agencies.

The true motivation of the FHA in moving up the value chain is undoubtedly to prop up the mid-tier “move-up” market which is being crushed by the utter lack of equity among the 20-40something demographic. The only people with equity are the elderly, and they aren’t budging, as DHB points out, because they think the gravy train is acoming their way again soon and they don’t want to miss out.

The problem with the FHA strategy isn’t really to do with “fairness to the taxpayer” (though that may be a consideration to voters). It is that this tier of homebuyers are not the strong backbone of the upper middle class they once were, but rather are incredibly vulnerable to downsizing, marital stress, medical problems, etc., on the income side; and on the expenditure side they are REALLY taking it on the chin (soaring college costs, skyrocketing property tax, income tax, etc.). These people are being squeezed from all sides. Now, if you only ask them for 10-20k down payment, they may be willing to gamble in the RE market, but any downturn in the value of their house or income (or rise in taxes) and they will bail, figuring they will never make up the losses and it is better to take the two year hit on their credit.

If you give someone a $100k mortgage with 3.5% down they won’t fly off the handle if their home declines 10%. But give someone a $700k loan on the same terms, with the same decline, and they are looking at a deep hole they’re not sure they can ever climb out of. These people have a better sense of their financial prospects and WILL ruthlessly default (not without reason). That’s why the FHA strategy is bad for everyone.

Mathematics always defaults to the lowest common denominator. Something most liberals and Obummer lovers never seem to grasp.

You are ignoring the flaw in your argument. No one can get an FHA loan at 3.5% on a $700,000.00 loan. I doubt you can get that with a FICO of 900 and 2 million in the bank – unless your in bed with the banker.

In reply to Papa please stop with the Obama bashing. Your unrealistic name calling looks bad on your sensible comments. Obamma has many flaws but our current economic crisis was gifted to us by the prior administration (including both parties voting in bad policy) and our 50 years of industrial military complex. Additionally Obama is hamstrung economically by Republican obfuscation.

@Windy City

That was an excellent post.

The “move up” level is dead because those with “move up” incomes already moved up and are also sitting in houses that they couldn’t afford off their incomes via their own equity event(s) in the past decade or so. There is a break in the chain here as pricing is a continuum and there are far more houses valued in the upper 40% of the continuum than there are equivalent incomes/savings pools in that 40%.

They can plug all they want but a gap has to be closed eventually and I think a good amount of the homes in that move up area (that can’t be easily financed via subsidized mortgages) are being held off market as they represent 1) a very significant single event write down and 2) serious mark-to-market in more prime areas that erode the confidence of those people who have decent incomes and spend money.

wydeeyed, the MIC should be doubled, not cut as it is now. This keeps us strong, #1, and supports over 6 million jobs, many of them in SoCal.

There is a big NAR lobby to get and keep those loan limits high………………….

Some people are fogetting one thing though – these things never get smaller. They get BIGGER. More socializing, more control, more “printing”, whatever it takes.

Please don’t shoot the messenger.

I don’t like it anymore than anyone else, but I don’t see anything changing, as far as going back toward free market capitalism. Both parties are corrupt. Independent parties have little to no chance. The only thing you can do is look out for yourself.

Eventually, I will have to buy a house…I’m sick of 5, and now almost 6, people in a 2BR! And I’m even a white professional, apparently that’s unusual for out here, as far as I’m told anyway. But to me it’s fiscal conservatism. The house will probably come sooner, rather than later, and there is no way I can keep living like a sardine until I’m 1)debt free 2) 20% down and 3) 6 mo emergency fund.

Yes I understand I can move east (as in different time zone east) and live better. That’s not off the table.

I’ll be paying off my credit card, probably buying with minimum down payment, and living a better quality life before I hit my grave. After that nothing else matters anyway.

PapatoBe,

I hear ya! How much does this all really matter when all of us have a clock ticking toward death. Also I think it is a misconception that the market will return to a “normal” way of operating. It seems we are waiting for some utopian fair market which seems unlikely. Husband and I inherited a house in CO, we are selling now. Will be left with 100K, I want to buy in the South Bay but there is a bubble occurring again here. Our kids are 4 and 1, if it doesn’t deflate by winter or show signs at least we will just buy in Lomita. I’m homeschooling anyways but would have preferred closer to the coast but I too do not want to stay in my current living situation forever waiting for something that will never happen because the forces that be are manipulating the market too much.

Keep staying informed, be patient, don’t let your emotions interfere with your money. Funny how Lomita is considered a comprimise, it is actually the best value in southbay.

the 90717 lomita?

Candace, Lomita is a lot better than it used to be. A friend just downsized and retired there and we visit often. People are jogging after work, walking their dogs and pushing baby strollers down Lomita Blvd. It’s clearly “gentrified” and it’s close to everything. People with school-age children try to get into Torrance, but young couples and retirees have no problem moving here now.

In your case, I’d pick what meant the most to me and do it. Prioritize! Sometimes making headway in a crazy world and swimming against the tide really doesn’t make sense. Look at me – I bought a farm. Everyone said I’d fail – too much work, house was run down, barns falling down, etc. I’ve rebuilt everything through sweat equity and I have a business going now on that same property and am out of debt. All in 5 years. It can be done…if you are young enough! You have a family and I’d be asking what type of environment I’d want them in when the SHTF and there are no gov’t services like police/fire, etc. That CAN happen. Most likely WILL happen and the question is, where do you go from there?

Hang in there PapatoBe. We are all living through the largest bubbles ever created in the history of mankind. RE is one of the big bubbles, college is the other big bubble. Just remember that banks are being allowed to hold their inventory and ingnore losses via paper due to the Frank Dodd Bill (Mark to Fantasy). Mark to market will come back….and probably one or two years from now if Obama if voted out. When that happens, it will be like a ballon popping. SoCal will still be higher priced than back east, but it will come down to earth. This mess is all fueled by greed and the players are the Federal Govt, Banks, and Wall Street. Another FYI is to keep your eye on what is happening in Europe. They have a huge problem over there and when that goes sideways, it will have an affect on the USA.

Are you saying that the Republicans will revert to a normal behavior based on this article: Ezra Klein says Republicans have got a ‘gun to the economy’s head’ http://www.newser.com/story/147458/the-gop-is-forcing-us-to-elect-romney.html ?

Or are you blaming Obamma for the state we are in? I am honestly curious as to the reason behind your claim.

Really enjoy reading responses to your Blog, DHB! Can we get a like or unlike similiar to facebook under each comment??!!

please no facebook.thank you.

I sold my home out of sheer panic 4 years ago, we have been renting since. I’m paying more in rent for a dump but it’s convient to the kids school,shopping and pre house sale life style. We have always lived conservatively. I was just about to purchase the rest of my life home when the most recent numbers on unemployment came out. I always wonder the actual number since I doubt they include all the undocumented workers in California (Nannies, House keepers, gardners) who own homes, drive cars and shop like all of us. With the inventory being as low as the rates, this combination had me looking not for a home but for anything in my price range. I found myself saying I could live like that instead of feeling like this is a great home and looking forward to spending the rest of my life there. If it were not for your articles, Im certain that I would act like a puppet too. Thanks DB for helping me cut the strings with facts.

Here in San Diego I would say prices are a full 15% higher than they were in November.

I wonder if the underwriters for a mortgage are making any adjustments on appraisals? Surely they must know 3.5% mortgage money is due to an international financial crisis and will last at most a couple years, if that and the climb back to bubble prices is due to extraordinary cheap money?

It would seem to me lenders are just asking for a major calamity down the road without making any sort of adjustment for this anomaly in 30 year rates. But then again, stupid is as stupid does.

As you all know, I have been actively looking and am shocked at how many buyers I am competing with and how many have cash. It seems like I always loose out to cash offers.

There may have always been a certain percentage of housing sales that were all cash and now that there is such low inventory, it may just seem like there is more all cash but as a total number, historically, who knows. If all cash is truely at a higer rate, I really think that too is a function of the current international finacial crisis.

For example, with a 10year treasury now paying less than 1.5%, the risk in the stock market, there is no better use for anyones money than paying off your principal residence in full. Then, how many people have a Grand Parent now in the poor house because their savings are no longer generating ANY income? Would that GrandParent, be willing to lend a trustworty family member the full amount for the house and instead of making the 3.5% interest payments to a bank, you make that payment to GrandPappy, and now Gramps and Grandma can eat without worry about exhausinting their principal?

Yes, a lot of guess work but I think all the cash flying around the realestate makret is all about savers earning little to nothing on their savings.

Interesting point Martin. You mention losing out to the cash buyers and i found that when working to get a home for a buyer with an FHA loan we always had to bid higher to compete with the cash buyers. I have won many bids against the cash investors this way, but it would also give a new higher comp for the neighborhood and inch the prices up, coupled with the banks hiding most of the inventory on their books it’s all a fantasy market.

Lynn

I think you’re scum along with all the other UHS milking this market for their own gain. We’re a cash and close, and NEED a home. Our FICO’s are 825ish, no debt, and we sold regular sale. You are in fact part of the problem.

Do you have remorse when your sheeple clients default and go under?

Do you think it is OK to load up the taxpayer with bailouts, while you make a commission?

Do you not understand their are relationships to incomes, debt load reality, and husing prices?

I think your type is total trash.

We have been out bid from your pos clients (read that as the next defaulters) and always walk from the howmuchamonth club.

I find your remarks insulting to a responsible household who has a medical issue.

housing prices

I’m livid. We deal with FHA no skin in the game, worthless,should not be buyers every offer, and they are total ignorant of economics, accounting, finance, or reality. They follow their housewife or life drop out agent. Meanwhile, us responsible people are being screwed. I am totally sick of it.

Lynn, for the most part, I am shopping in the 600 to 700K range being that I am using my money for the purchase (up to 550Kish anyway), I have gone up in every instance but you know, there is a line of crazy I won’t cross.

If I had the income to support a fully financed FHA loan, I could easily over pay and if things go the wrong way, well, it ain’t my money I would be losing. In short, I would be happy to be loose with someone else’s money but not mine. Especially when I don’t know how these prices could hold with current lending standards and over 5% mortgages. It is possible that if the government manufactured recovery in housing reaches escape velocity, lenders might get loose again but that remains to be seen.

As a prudent person, I fear prudence will ruin me and the fools will be laughing all the way to their newly minted ATM California cash cows.

Hey Jay – many people don’t mind their children living at home. Combining incomes, support structure, social contacts, and daily family camaraderie makes great sense The philosophy of kicking our kids out of the nest at 18 is one of the tragedies of our time and culture. Many of the problems we face today would go away if families stayed close and became their own support system, but…that’s not the American way. Better that everyone owns their own home, lawnmower, car, etc., than combine our assets and live a wealthier, less wasteful lifestyle.

Whelp, I would say in my humble opinion that FHA is like the enabler and we got a 12 step problem with our collective addiction to so called the affordability thang. No interest loans, negative amortization, dream loans, no interest loans, etc. All of these devices help to push up real estate prices in California to obscene, all oresctrated by the happy chior of brokers with multiple bids, loan brokers with such a deal, greedy sellers, and escrosians and title insurance dudes with their greedy hands out for little of nothing in return. Meanwhile the hapless buyer hope they got something. 2 to 4 X annual income was the old standard for affordability but with all that help, you get a bubble, sort of an economic pimple that begs to be squeezed. meanwhile the pols are conjuring up bail out plans for the hapless, stoopid over thier heads buyers….with my money. Bull Shorts! gemme a break.

One-Hung Lo-Show

Love your clarity, and thank you for your more eloquently stated post. I am just so livid at the situation. We just want a home and need to pay cash due to a Glaucoma issue, and all this micro bubble FHA buyer promoting just burns my arse.I wish the howmuchamonth club would wake up. That’s what bubble buyers paid attention to, and look what happened! How dumb are sheeples?

An excellent article I found yesterday. He makes the case with the low amount of inventory vs. shadow but also goes into detail on the disappearing organic seller, and the soon to be resetting 2nd mortgages that are never accounted for when underwater homeowners are discussed (only including first mortgages). Find the article here.

http://www.businessinsider.com/another-housing-collapse-is-coming-soon-2012-5

KEITH JUROW: Prepare For The Coming Housing Collapse

Interested in any feedback form DHB or fellow readers.

If we’re talking public policy here, then one event of note was the $16 – $29 trillion issued by the Fed (the U.S. Central Bank) to bail out the financial sector in the wake of Lehman’s collapse in late 2007. This pushed money at Wall Street (the banks), in hopes they’d be solvent, then lend to Main Street. The figures come from the first audit of the Fed, sponsored by the congressional odd couple, Ron Paul and Bernie Sanders.

So several questions arise: If just issuing money is inflationary, this was 5 years ago… Where’s the inflation? (Hint: paying off bets doesn’t demand goods or services, hence no inflation.)

Also: Why do the guys who crashed the economy with their frauds get bailouts without limit, instantly, without any congressional action, but the far smaller needs for funding the social safety net programs and revenue sharing for the states get the shaft?

FYI, for $9 trillion, they could have paid everyone’s mortgage off. For $5 trillion, we could have renewable energy infrastructure.

One other note: Just considering the relative chump change of the Federal “stimulus” ($800 billion, 35% tax cuts), if you net that out after State and Local cutbacks, there has been roughly zero, count ’em zero, of that vaunted Keynesian government stimulus.

Anyway, we’ll muddle along in lost decade(s) mode until this gets straightened out…

Lost production creates sloth, thus paying off everyone’s house is a losing proposition. What will they do with their time?

But that’s in a normal market and lifestyle. To answer your question in greater detail, the Founding Fathers nkew what happens when banks cam take over. History repeats itself, and once again, where is the money???

It’s mostly on paper anyway, and it’s chasing fuel (oil) and the inflated DOW. It’s being shipped out of the country buying outsourced products. TPTB in Washington and NYC don’t want change or progress, and why should they? They want their riches from the status quo as it’s being handed to them.

Best reader post award. Remember ol Dubya ranting how they had to get that deal closed by Monday or the whole country would collapse. At least the US Congress was chicken little enough to envision post WW I wheelbarrows of cash to buy a nickle bag of cashews to push that payoff to the banks. So here we are right where you say when we could be well over half way back by now. “Too big to fail. Protecting your freedoms. The greatest country on……” blah blah blah con artist sales propaganda.

So several questions arise: If just issuing money is inflationary, this was 5 years ago… Where’s the inflation? (Hint: paying off bets doesn’t demand goods or services, hence no inflation.)

Have you been to the gas station or grocery store lately? Inflation is rampant. Some stores are doing hidden inflation by redesigning container sizes so you think you are getting the same amount but it is actually less and at a higher price. Gas prices are $4.50 a gallon. Everything at Costco is much more expensive than 5 years ago.

Bah! Gas needs to be MORE expensive! We waste gas like there is no tomorrow. Much of the US has domestically produced natural gas piped into our houses at something like half the cost of gasoline — fill up at home! — and yet we drive oversized vehicles that funnel our money overseas to dictators and potentates. It is time for the big wrecking ball to come to our transportation energy infrastructure.

There is no inflation, just peak oil

and making war does not come cheap.

Defense spending relative to GDP is the lowest it has been since WW2.

War creates jobs, don’t shoot the messenger.

POPS,

After doing a little checking, it is a bit untrue. Bush started a little thing that still holds up to this day, and that is the cost of fighting any current wars is “off budget”. So, if you add the cost of the wars, defense spending is just below average but that average includes the Soviet era.

The Soviet Union died in the early 90’s so shouldn’t have our defense spending have decreased from that?

“war creates jobs” A war to see how fast we can rebuild our infrastructure would create just as many jobs, if not more.

I’d love to share this with FB, Im working for a large RE firm. I believe I’d be fired, though the file would say it’s for something else. I have recently been told from seasoned agents “everywhere you go grocery store, movies, friends, neighbors tell them how great everything is” they go on to explain, “they will believe you and word spreads and thats how we get out of this mess!” Most say the shadow inventory is all a lie, thats all been snatched up by big investors.

Wait a minute here, maybe if we click our heels together and repeat.. there’s no place like home. This whole stinking mess will be over like a bad dream.

Not so sure about that lie. Almost 99% of all new listings that come in to my inbox are foreclosures in the markets I am looking in. I looked at a few (overpriced but equal to rental rates) properties this weekend. Agent who said he works with Wells and B of A on real estate owned listings told his tale of a multi-million dollar properties neighborhood in Orange county not being foreclosed on by the banks because they can’t sell them. He said the whole community was not paying mortgages. Sounds far fetched but I’m confident that is only in degree. The only question is how long can they keep bailing the water to keep it at a constant rate? Once they lose that control increasing water will sink the boat. Restore mark to market and games over.

It is truly amazing how people are falling for the limited inventory on the MLS bait. By deliberately witholding shadow inventory and the lack of those able to sell, there is the illusion that prices are starting to increase in certain neighborhoods on the Westside of LA. Packed open houses, multiple offers, bloggers buying and trying to justify their puechases, and of course Alejandro Lazo of the LA Times doing whatever he can for a housing story. Most buyers are sheep and don’t take the time to do their own research. And guess whose fault it really is? Theirs. Government, banking, and real estate professionals feast on them for a living. That’s the definition of a parasite.

Well, that is their choice unfortunately, as they fear they are “missing out” on their chance to become housing elites and retire easily. Times have changed, in case you haven’t seen what is happening in this country and our “global economy” Best to “batten down the hatches” and ride this one out if you can. You will be one of the few survivors in the future, that will be able to choose what you want in housing.

http://Www.westsideremeltdown.blogspot.com

Yup, it’s a Sucker’s Rally and unfortunately, people still really, really, really want to buy a home and will look at any positive sign to justify jumping in. Like it’s a race. Yes it’s a race for sure – a rat race.

Guys and gals, I went to a Junior college for 5 years – 3 to study Respiratory Therapy and got an AS in the allied health field. The cost was very low not counting the books and when I was done I had several job offers, and accepted a position at UCLA Medical center. The pay was great but I was dying to get back to school for a BS. I went to Cal State Northridge to look into the accounting program. They told me I would be crazy to take all the lower division classes there when the JC offered the same classes for free. So 2 years later I transfer to Northridge, spend 3 more years and get 2 BS degrees. My cost of education was paid for by my job as a therapist, working 3 days per week, and I did not receive any employer help.

Take advantage of the JC system, and transfer all the courses to the university – up to 77 units when I was in school. I’m currently a controller for a Chapter 13 bankruptcy office, own an incredible home in the hills of the San Fernando Valley and love my job. I also completed college with zero student debt – all thanks to the junior college system.

Hey Sal! Graduate of Valley College and CSUN HERE! Transfered to CSUN with junior status. The California Jr. College and CS, UC systems was what MADE CA. the best and most progressive state.

CAll out to MAD AS HECK adn RENTER: We are still looking and waiting here in Newbury Park. We changed realtors since our old relator didn’t need or want to go through the paperrwork on Short Sales. We have been looking for a home going on three years now.

Your going down the right path – educate yourself and you will be not only more marketable to employers but an overall better human being. Keep looking to purchase – I don’t think we will ever see interest rates this low again, barring a depression.

Check out Woodland Hills, incredible homes, beautiful views, old and mature trees and vegetation everywhere – almost heavenly – can’t wait to get home every day.

Renting for 2,000 per month would support a 300,000 mortgage. If you could buy, don’t hesitate and don’t listen to the naysayers.

Good luck and study hard.

“Tim Ready” ,

Valley girl – this guy put me in my home -incredibly aggressive when negotiating for you. I paid $642K for a home originally listed at $745K. Been there since 2004 and I still am in awe when I go home – can’t believe I live in this house.

He will badger the owner,realtor and everyone else to get the sale done. Great guy.

If you contact him, tell him Sal from the Escobedo house with the view told you he is a bull dog when dealing with the sellers.

Good luck and God bless you

Valley Girl

We’re still renting in a tenement on Erbes Rd. 3/48 units are Americans. English is the second language around these parts. And that “aint” funny 🙁

Love the dead mice on my car for asking the anchors to pick up the trash on the ground in the courtyard.

Anyway, we tried the short sale route. Just backed out this morning. What a crook of you know what. 12 offers, bidding war, and in the end the house will probably not go through as a SS, or an auction as scheduled, due to a delay from filing a BK. Short Sales have a 50% failure rate, but we were willing to hang in there. The problem was a pos listing agent, a seller who was playing all of us buyers with her pos listing agent (WLV super star), and the deal was dirtier than the REIC (r e industrial complex). Someone was used to stop the auction and probably offered way over what the house was worth. Our offer was a solid and fair cash deal. That cuts a lot of the lender roadblocks out. We were told not to counter. The agent counter all of us, yet had a buyer already. The deal was all for the seller, and us buyers got the shaft. It was being handled wrong. The listing agent lied to us verbally, knowing damn well if it isn’t in writing it means nothing. (Ca R E Law)

Doesn’t this east ventura county area suck in this market?

“The agent countered all of us…” oops, fixed it.

Valley Girl

I am licensed. I don’t do SFHs, but I have taken a Short Sales Class (information gathering). It has served me well to know when I am being lied to. My salaried career was at a much higher level than SFHs, but I understand the process, and have been to many association and brokerage meetings. I am a different flavor (so to speak).

Mad as Heck: You did the right thing by backing out. If somthing feels wrong it probaby is wrong. My husband and I refuse to be a part of a bidding war. That’s the same senaro from the 2001-2008 years. We were looking at a home in Agoura, built in the 1970’s. The layout was poor and needed major updating. Than the agent said it :”Many interested parties in this home”. We knew it was time to jump in the car and head home! “Many interested parties” will not motivate us into throwing our money away!

To all the posters thanks all for the encouragement, and interesting real life stories. Let’s see what happens in the Fall. The talking heads at CNBC are predicting recession and inflation. Could they both happend at the same time? Throw an earthquake into the mix and we could all be living at Lake Sherwood!

HA!

“…people need to realize that rates this low are a major anomaly….”

Yes, this is certainly an anomaly. I’m starting to wonder, however, if we have somehow passed a line in the sand, sort of like a black hole’s event horizon, from where return is impossible.

Simple arithmetic tells us that if interest rates rise, the whole house of cards will buckle rather quickly. If you discard the conspiracy theories, it is certainly in the interests of the Federal Reserve Bank and other authorities to keep this leaking ship afloat as long as possible, so I would expect interest rates to keep falling, until such time as they are all at zero.

The yield on 10-year US Treasury Bond is at 1.5%, with the economy supposedly growing a little. What will it yield as we enter the next recession in the coming year? Certainly below 1%, I would think.

1oy t-bill @ 1.5% but, Fed say 2% inflation. 0.5% loss assuming best case inflation numbers, which i believe is alot higher than stated by “there is no housing bubble” Federal Reserve. it will get worse…

I am in agreement, for the most part. With a deficit approaching 20 trillion by 2015 how could rates ever go up?

Well, to play Devils advocate, if the treasury takes advantage of people willing to lend money for 30 years at less than 4%, then if rates do rise, it is only on the new debt the rates rise. Should the FED get the 7% inflation that it secretly hopes for, it would mean putting the prime rate at 7 or 8%. The new debt is financed at 8%, the old debt locked in at 4%. Effectively 20 trillion dollars in federal debt would be eroded at a rate of 4% a year, in 10 years it is effectively cut in half, in REAL TERMS, due to inflation.

Most of the nations realestate stock is fairly priced and could withstand easily an increase in 30 year rates to 6 or 8%. It is the bubble markets that would get hammered under such a scenario, not the nation in general. If the fake energy crisis California suffered from due to the inaction of the Bush Administration is any guide, the Federal Government is perfectly willing to sit by while Democratic leaning states go through a little suffering. In this case I would be cheering the collapse.

To me it looks like low rates will never end but there is a scenario where rates can rise a few years from now.

So true. If interest rates went up on the treasury bills, the USA would immediately go bankrupt because the interest payment would explode higher on the already exponentially increasing national debt.

> So true. If interest rates went up on the treasury bills, the USA would immediately

> go bankrupt because the interest payment would explode higher on the already

> exponentially increasing national debt.

Can’t happen, at least not without congress voting for it. The USA is a fully sovereign nation and can print as much currency as it needs. Borrowing money is wholly unnecessary. Our government is not like a family or a company and has no legal need to balance its books, except as it makes up rules for its own behavior. We borrow money because the electorate wants it that way.

No. No event horizon. Nothing has changed except opinions / fear. It’s not like all the advancements of the last 100 years went away overnight, or we ran out of energy, or some other physical cap on the system. What we have is an exaggerated business cycle. Before 2008, people saw no evil. Now, they see no good. Before all sorts of nonsense passed as a good investment — companies without a business plan, unintelligible securities, CDS. Now nobody wants to invest, even in the good stuff, but they will buy gold, doorstop that it is.

Don’t believe the hype. Be a contrarian investor.

I’m fully invested in stocks, except for some cash which is patiently waiting for Greece to exit the euro in a disorderly fashion. Don’t know about you.

Why do you think DHS recently bought 450 million rounds of hollow point ammo if the Govt doesn’t think the Shite is going to hit the fan soon & people are going to take to the streets. Maybe they think little green men are going to invade from outer space but I think they are more afraid of the armed unwashed masses.

It’s for the squirrels. Global warming has increased their reproductive rate drammatically.

People buy a house for a home, a nest, to raise children and have the retired parents live to baby sit the children. A lot of you people just look at a house as an investment, like a stock. I read on CNBC that the wealthy are going out of stocks and intangibles and putting their money into hard assets, such as real estate.

Hey, Mad as Hell hang in there, take a look at average Joes link to Keith Jurow article. It gave me peace of mind.

Auntie M –

Thank you for the encouragement. The real estate jungle is mighty fierce out there, and I need to munster up more courage and sharpen my teeth. I’ve done enough dumb things in my life, but falling into a r e trap, just isn’t going to happen.

Thanks again.

Good paying jobs could come from a boom in green energy if CA ever figured out that we have an amazing amount of sunlight and space for wind farms. One doesn’t need to believe in climate change to realize we should stop polluting the planet with fossil fuels.

OK, I know we’ll never do that because humans suck.

What I don’t understand is why conservatives aren’t all over solar. They are all about self sufficiency and independence. I know people who say their power meters run backwards because of their solar panels. Why favor subsidies for an energy source that keeps our nation dependent and hate on subsidies that lead to self sufficiency? Whatever…

Here’s an interesting link though:

Where are underwater homes?

(An interactive map from Zillow that covers the nation)

http://www.zillow.com/visuals/negative-equity/

Zillow tends to overestimate home worth though doesn’t it? Interesting that the higher cost neighborhoods claim to not be underwater. Is it just because they haven’t been forced to realize their true worth?

The only way Republicans will ever embrace renewable energy is if Democrats came out against Renewable Energy. It all started when Jimmy Carter put Solar Panels on the White House and God Reagan ripped them down.

That map just looks like a population density map, heh.

I have now lost all faith in the human race. Everyone is jubilant when we are fed manufactured good news. Everyone panics when we are fed manufactured bad news. One week we are panicking about the EU and the world is coming to an end the next week we forget about the EU and China/India will save us. I ask myself what has changed and I don’t see any fundamental changes. The EU is collapsing. The US continues to kick the can and smoke hopium. China/India are slowing down. This ain’t news folks. News comes from the word “new†and there is nothing new about this.

Krugman for President!

By race, Asian families have the highest average household income among other races in United States. I think the reason is because most Asian families support their kids at least until they are college graduated. I believe in a long run Asian families help their kids to get on their feet sooner than those who don’t have parents financial supports. I don’t understand why would a parent kick a kid out the family when s/he reaches 18? How can you expect a 18 years old kid to make ends meet while paying his/her tuition fees without any skill? When I was 18, I had no idea what to do or where I should go in life. I even thought about committing suicide at 28 because that would be old enough to experience the whole world. Majority human beings are just not mature enough at their 18. So if you are able, help your kids a little.

Leave a Reply to MadAsHell