4 emerging trends in the housing market – Pending sales falling in spite of record low mortgage rates. How does the $750,000+ new home market look like? Would a 90 percent drop get your attention?

The market seemed to be stunned that pending home sales fell in spite of mortgage rates being so low that they are essentially tracking inflation. Yet the narrow focus on financial liquidity still continues to miss the slow degradation of the American household balance sheet. I always found this fascinating even during the boom how rarely household incomes were mentioned in the context of purchasing a home. People at networking events or cocktail parties were quick to talk about their “$700,000†or “$1 million†home purchase yet felt that it was taboo to discuss actual income growth. In many ways buying a home with a giant mortgage became a socially acceptable way to flaunt your notion of wealth instead of pulling out your electronic pay stub. So this fall in pending home sales is merely a reflection of the shadow inventory leaking out into the market but also of weak household income growth. The Case Shiller Index made a new post bubble low in synchronization with the new mortgage rate low. What is going on with the housing market?

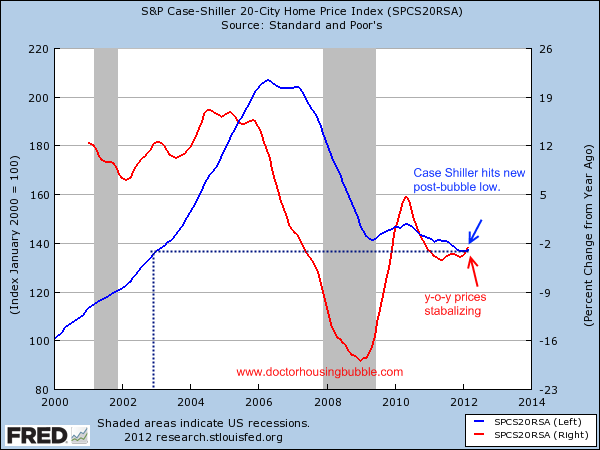

Case Shiller Index

The Case Shiller Index showed a new post bubble low but overall with year-over-year changes we do appear to be reaching a nationwide bottom. Even the creators of the index discussed that it trails the market by a few months and recent buying does suggest that overall we may be reaching a bottom. You can see this in the index:

The year-over-year drops are starting to stabilize and will likely turn up. Yet this is likely temporary unless wages go up. But as many are noting, a bottom does not mean home prices will rise or even outpace inflation. The push of mortgage rates lower is occurring because the credit markets need more and more dramatic efforts to keep the massive debt game going. So a lower mortgage rate almost becomes like a pay boost for many homeowners and those massively in debt. Yet with rates straddling the lower bound this fuel is being quickly wasted while the Federal Reserve balance sheet still is at peak levels with nearly $3 trillion in “assets†that we have little idea about.

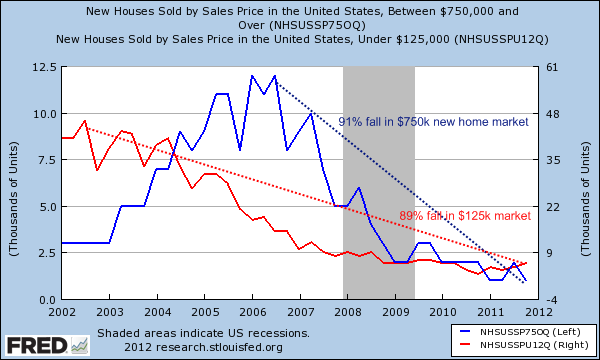

New home sales

The leaking out of shadow inventory also has other unintended consequences. Since we have years of inventory to work through, there is little need for construction or the creation of new homes. In fact, the low range and the high range of new home sales continues to be crushed:

More new homes priced above $750,000 were sold in 2002 than in 2012 and that also applies to homes under the $125,000 range. Both of these markets are down by roughly 90 percent from their peaks and are both near their nadir. You notice that tiny little uptick in the red line? That means whatever new homes sales are occurring are coming from the sub-$125,000 market. Builders that are low-cost are seeing a mini-boost but definitely not in the more expensive segment of new home sales.

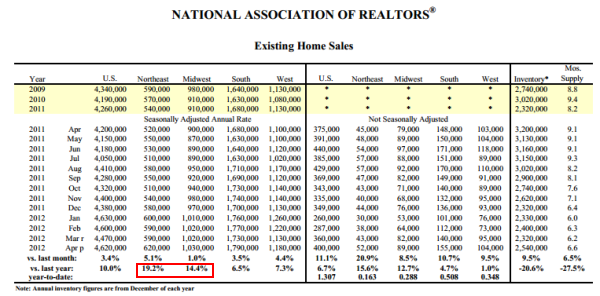

Regional sales differences

I find it interesting that the big existing sales jump has occurred in the Northeast and Midwest. The South and West which had the biggest bubbles are seeing more moderate home sales increases. Sure we hear about ravaging hoards of investors swooning in on Las Vegas and Arizona but overall, it doesn’t seem like a massive jump. What do these investors have in mind? The rental market is currently flooded and the flipping action will slow down since the underlying economy is still hurting.

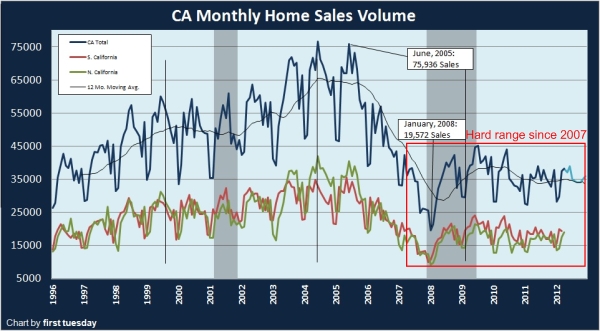

The tight range of sales

The recent tick up in sales which is now losing steam came largely from the ridiculously low mortgage rate that is absolutely artificial. Even in California all the rhetoric about buying a home when put into a bigger picture context shows a very tight sales range:

Where is the massive jump in home sales courtesy to 3% mortgage rates? Could it be that our financially broke state is likely going to be cutting and raising taxes soon? After all, if things were so fantastic you would expect tax revenues to be up but sadly they are not. Remember all the tax revenues we were going to get from the Facebook IPO? Try seeing how well that stock is doing plus you have one of their top winners renouncing their citizenship conveniently to help with taxes. Like Europe is quickly realizing, extending loans into the future is like playing a big game of kick the can. I find it amusing how easily some analysts just quickly accept the fact that the shadow inventory is somehow a normal occurrence instead of a giant pseudo nationalization of the housing market. They talk about the “market†and mortgage rates as if they are being set by the market instead of glorious manipulation to benefit financial institutions. In California, the underemployment is still above 20 percent and tens of thousands are losing unemployment insurance on a monthly basis and falling off the employment statistics but hey, at least we have low mortgage rates!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

82 Responses to “4 emerging trends in the housing market – Pending sales falling in spite of record low mortgage rates. How does the $750,000+ new home market look like? Would a 90 percent drop get your attention?”

Another wind sprint from the good Doctor.

DHB noted, “So a lower mortgage rate almost becomes like a pay boost for many homeowners and those massively in debt.” Actually, that’s how these rates are sold to consumers. In fact what happens is that the RealTorz end up talking house buyers into more expensive houses. And by “more expensive” I mean maybe $5-20K more expensive, so the activity still occurs in the media range of pricing…but the buyer is on the hook for that amount financed (plus interest on it), and the Realtorz and banksters get their cuts….

All a huge Gothic cathedral of cards. Without sustainable income, the winds of arithmetic will eventually collapse it all. The clever numbers games at work in the economy, which started in the 1970s and hardened under Reagan and were engraved in tungsten by Greenspan, were very clever indeed. Those who climbed on that wagon back in the day, and got all the Things they wanted, had a good run. But it was always a joyride headed for a cliff. It just amazes me that this is still the mentality in so many parts of the economy.

BTW, a 90 percent drop in a $3/4 mil would not get my attention (I mean, as a buyer). Who the hell is going to pay for its cleaning, upkeep, insurance, taxes, etc? Pas moi.

“RealTorz end up talking house buyers into more expensive houses. And by “more expensive†I mean maybe $5-20K more expensive,”

In practice I’ve never seen a Realtor try to push someone into a more expensive house than they were pre-qualifed for by the bank, unless there were no other potential houses in that price range. That could result in the financing falling through. Even the dumbest know that. It’s the bank that was approving them for much more than they can afford.

I trust you write from SoCal? My experience is more typical, I believe, of where I live in the PNW. And I base it both on personal experience seeking financing (and turning down the pressure to Debt Up) AND what I hear from borrowers I advise.

If where you are, only reckless lending is the problem, then consider yourself lucky. But it is a fact of a mass economy that skimming a little from the many is just as profitable–or more so–than wringing a wad out of a few (who then go tits up)..

Thanks.

1. “a bottom does not mean home prices will rise or even outpace inflation.”

They don’t have to outpace inflation. Normal people only look at nominal numbers.

2. “The rental market is currently flooded “. Not in Denver. Rents are rising at 5-10%/year. Lots of talk in the City-Data Denver forum about rising rents.

“The Denver-area housing market was hot in May.

The number of previously owned homes and closings rose by almost 24 percent from May 2011”

http://insiderealestatenews.com/2012/06/home-market-sizzles-in-may/#more-18074

You might need to “get out more”.

In another news …

“Another interesting result from the NAR’s foreclosure data is who gets the blame for the US housing collapse:

Americans blame the economy and job losses (22.2%), lenders (24.8%) and the government (22.1%) equally responsible for the foreclosure problems facing the nation today. Defaulting homeowners (10.3%) and Wall Street (9.4%) were least blamed by survey respondents. Homeowners with annual incomes of $40,000 or more (30%) and those age 25 to 64 (29%) blame lenders more than other groups, while older Americans 65+ (32.8%) and those earning over $50,000 (26%) blame government most. Younger consumers (18-24) are more likely to blame the economy (28.7%) and defaulting homeowners (26.9%) for today’s foreclosure problems.

Wall Street gets the least blame! You can’t make this stuff up. ”

http://247wallst.com/2012/05/30/pending-home-sales-fall-in-april-foreclosed-properties-attract-buyers/

That’s because what Wall Street givith, Wall Street can also takeith away.

Just for fun & enjoyment I like watching House Hunters on HG-TV. It’s amazing how many times the agents either find a property that is deliberately out of the clients price range or not what the client asked for. The other thing I notice is if it is a couple buying, one of the two is either unrelistic on what they can aford or has some psychological problem. It doesn’t happen all the time, but it does happen more often than not do to casting.

Joke from young friend, newly naturalized US citizen from former Soviet republic:

In capitalist US, bank rob you.

What housing collapse? Everything around me is still standing. These are all paper gains & losses. What is all the fuss about? Blame is denial & scapegoating. This is human nature, the result of Sheeple & herd mentallity of a population poor at math and common sense. No-problem, the fed fires up the priniting press to save the (bad) debt-holders, the consequence of which is doubling gas prices among other items…we are all getting fleeced, like sheep!!!

New homes under $125K? Where and what are these new homes???

I’ve sene decent sized condos in Gresham Oregon at that price.

A builder has been building a subdivision near me for three years here in one of the few pockets of solvency in Michigan, Ann Arbor. They have been super cautious, building about 25 homes a year, so as not to exceed demand. I estimate they have space for 200 total homes.

I think they are asking around $197,000 for 1,950 sq-ft. A few months ago they abruptly stopped building, except to finish the ones already started.

My guess is that there just aren’t that many new households being formed. Young adults in their 20’s living with their parents, and similar arrangements. No point in building any more, for now.

Just got back from the Alabama and MS Gulf area, saw real estates signs selling new single family homes at $145K with 5 to 8 acres. If you are over 65 years of age, you would be exempted from paying property tax up to 125K in market value.

I can think of nothing better over 65 than dry humping my John Deere rider, spewing glorious grass cuts like sick NASCAR exhaust, beer koozie in hand, surveying my 6 acres of Manifest Destiny, smacking at ‘squito’s and insanely laughing at the So Cal home fetish cult who wait and wait and wait for the day when they can out-bid an all-cash flipper for a 3/1 in Palms at a mere $425k.

but dude, it’s Alabama.

I’d freakin’ jump at the chance to be the first Ivy League redneck Zen punk in Alabama.

Except they have this thing called the Gulf, and it routinely unleashes some of the crappiest weather on earth.

Also fire ants. I hate fire ants. On the other hand, fire ants swarming up your legs could be a great test of one’s dharmic equipoise.

There’s chiggers to go with the fire ants. And palmetto bugs. And insufferable humidity. and torrential rain.

I have a question of someone familiar with this subject, which I am not. The junky option-ARM /exotic mortgage financing is still winding out with recasts through 2012 (at least for those mortgagors who haven’t already thrown in the towel). With these low interest rates, will they recast to a much lowered rate than at origination….?? I assume many of these surviving toxic mortgages didn’t qualify for earlier refinancing due to collateral deterioration.

I can give you my experience. I had an interest-only ARM and was a bit underwater. Well, it recast and the interest rate dropped a full 2%. Since it became fully-amortizing, the payment actually went up a bit. But because of the lower interest rate, the increase in payment was relatively small, like $200 or so. Now more than half my payments go straight into principal, which is great.

As for the good doctor’s post, I don’t know. I live in SoCal, and the housing market here feels very strong. It’s mainly because banks (and, I suppose, hopeful owners) are keeping homes off the market. This greatly lowers supply. While demand is also pretty low, the supply is so much lower that there are bidding wars on anything decent and reasonably priced. The housing market definitely feels stronger now than say 6 months ago. Will this strength last when winter comes, who knows.

HenryE

Yep, So Ca feels like a micro bubble. Our broker embellishes a lot (reality has spoken otherwise), but we are viewing a short sale this morning that he claims has 6 offers on it already (within 14 hrs of listing). The home was priced at $320K, which we knew was a come on, and then jumped to $400K in the afternoon. Our broker (he owns the firm) told us we should offer $425K+, and we’re not the only cash and close buyer. He always says there is a lot of cash right now. The house is nice, and I think our top is in that range, but no bidding war for us.

I called an escrow officer yesterday.She told me that people are pulling out IRA and 401K money to buy homes. I personally think that is insane, and of course, the escrow officer is part of the REIC, so I factor in the embellishment factor.

At first, we wanted a pool/spa combo, but now I am thinking of a swim spa, Pools are money sinks and seldom cost effective for adult households. This SS (another long post from hell on that subject)is a combo. It is our favorite floor plan but we will not over pay more than we need to.

This inventory, the interest rates, the REIC, and our nefarious PTB, have made our lives a living housing hell. We need a home. Our multiple rents are killing us.

Everybody has a great day.

enjoy it while it last the tbill and libor are usalley 4-6% + your margin. they will go up.

@MadAsHeck: If you’re going to use financing put as little down as possible, offer $500k and make sure the contract is contingent on financing. That will blow out all the competition and the bank is most likely going to approve you for what the property appraises for. What do the comps say?

Dear Mad, I’ve kept abreast of your home-buying drama and often wondered why you keep trying to go all-cash in the $400k area. Why not go a little bigger (say, $600-700k) and jump on something really nice and outside of the FHA/Flipper crowd with the low, low, low interest rates? Yes, I recall your earlier posts about having a very big property and not wanting to go back to McMansion-land. But, seriously, don’t complain about being out-bid, out-punched, out-FHA’d in the 400k realm….that’s where the market manipulation/frenzy is right how.

many option option arms had a 1% teaser for 5y. there will be a huge payment shock, lower IR but fully amortised, 25y term, and incrased loan balance. the goodthing ismany of ths ar now defunu

The libor forcast shows little acceleration currently. Does anybody have a good handle on what defines the libor? It looks to my uninformed view that none of the UK/European banks think it’s a good idea, presently, to loan money to each other at 4-6%, even if government bonds spike here and there (which, again to my uninformed view looks like such is not coupled well with inter-bank lending).

Libor is the interbank lending rate ( a grossly manipulated metric ). The Banks in the Eurozone are reluctant to lend to each other due to FEAR anyway, for the most part.

I wonder if the mortgage rates are still linked to the 10 year Treasury….now at 1.55 % ??? That’s a key question. The flight to safety is driving US yields down dramatically. That and a strong dollar smashing commodities seems like a good set of excuses for the Fed to PRINT !

Income may actually matter? What a novel concept.

Funny how all the charts show that band of recession ending three years ago, but people in real life refer to the recession as right now. You can call a skunk a polecat but it still smells the same when it’s flat on the road. You can call inflation flat but pay five bucks for a small box of cereal…You can call debt an asset but it’s still a polecat. There is no end in sight and the bankers have bankrupted virtually the whole world.

Agreed. If inflation has been between 0 and 3% for the past several years, why is it that I’m paying close to $9 for a burger and fries for lunch now when 5-6 years ago, it was maybe $6.50? That’s the real measure. Inflation according to my lunch budget is more like 5.5 to 6%. (also worth noting my pay increases in the same time have been barely over 3% on average. And as a young professional, I’m expected to pony up 6 or more years of wages to buy a house? Keep dreaming.)

Not inflation because no wage inflation…but let’s argue the burger-flippers min wage has gone up?…YES, thus increasing the input cost of your meal, since burger-flipper has to eat too, so what you are witnessing is a decrease in std of living!! Its A big circle jerk.

http://www.shadowstats.com/

Using the same metric for inflation that our Government used in 1990, inflation is a full 4% higher than whatever the Government currently states. Using the same metric that the Government used in 1978, inflation is a full 5% higher than whatever the current metric shows.

The future looks bleak for most, for savers, even bleaker.

the stock market crashed in ’29, the depression officially started in ’32 – I’d say we’re pretty much on schedule.

Now the story is clear as to what the banks have been doing with the slow-step interest rate cuts and making their profits from serial refinancings even when there was no reason for them to so slowly to cut rates…but they did so. This is an incredibly important but short article

http://online.wsj.com/article/SB10001424052702303395604577434641685243230.html

Note the banks, by cutting rates slowly, slowly, keep running up refinance business at $3000 profit each, and this author concludes…surprise…there is very little to no real competition in the mortgage business. (And the nice bankers get some federal giveaway supplements for certain refinancing as well, nice work, isn’t it?) Study the chart in the article as well, and the forecast.

Now, the key question, if there simply is nothing left to cut in the interest rate so that yet one more round of profitable refinance is occuring, and no refinance further squeezing to be done, what trick do the bankers have next (already planned, of course) to run up these huge profits (which help them absorb and hide their past losses hidden in their accounting). It seems to me that if there is any one question someone about to buy a home needs to know, is the answer to that question, what will the banks and its captive/looted government do next? Rest assured, the banks will move on to the next coordinated stunt to capture the money left with the working class…any guesses?

i would guess refinancing foreclosed homeowners at lower rate,no break on the principle.the banks will get their fees and then foreclose on the homeowner, again.

Dear Doctor,

According to well respected economist, John Williams, he calculates true inflation rate based on calculators used by government pre-Clinton, is running about 6% annually. check out shadowstats.com.

Also, I would never trust anything from the national association of realtors. Last year they have admitted to over reporting home sales by the millions since 2007. They admit only they made mistakes but I suspect it was sinister.

Well my friends, Europe is imploding in front of our eyes. With Europe failing and going into a deep recession, goes our export market. The US cannot decouple from this. China is winding its economy down, and social unrest will build. The US cannot decouple from the cheap labor without pain. Welcome world (official) recession number 2. Let’s see how well housing does when we start shedding jobs again. Then in December we face a US crisis with tax cuts expiring and mandatory cuts. How well can the bankers and wall street kick those cans down the road? Geniuses….that they are.

What do we export/sell to Europe? Cheap labor? $4/hr is fine with me, just give me back the .60cent hamburger. NO joke, this is possible: A strong dollar, eliminate minwage, let real estate fall, and BAAM, us poor folk can work hard, and afford what we need. OR we stay status quo, generous EBT, 50% of population on the dole, which is essentially creating an artificial price floor on everything. I’d love to employ 2 people at $4/hr vs one at min wage…duh.. this is so simple, we need lawmakers to be law-busters, hatchet HALF of all rules, all budgets, whack them, we dont need them, they are all just part of the overhead. What are we so afraid of?? The market is pushing us there anyhow, but just in a long drawn-out painful way. Yank-off the band-aid.

In real terms the minimum wage is about half of what it was in the 60’s. Minimum wage is not too high and is not the problem..

Most minimum wage workers get food stamps, section 8 housing or medicaid. Why should I as a taxpayer be subsidizing Walmart, McDonald’s and 7-11? Their work force for the most part is subsidized by the u.s. tax payer.

Back in the 60s minimum wage workers had employer paid health care and dental and full time workers were above the poverty line, not anymore.

The problem with the world economy is excessive capacity and not enough demand. Any proposal that takes money out of the hands of the spending public is counter productive. Two workers splitting the wage of one worker is not the recipe for a thriving economy.

I might add, I get your point, the Government is all about creating artificial price floors and I agree it has proven a huge mistake. I just draw the line on wages, wages are not the problem.

I concurr, and realize it is just a pipe dream to end govt meddling and let free people make free choices in a free market.

Martin- you shouldn’t have to subsidize someone else’s workers, so stop voting for politicians who give handouts.

Minimum wage is a disgusting policy. You’re telling someone they’re not allowed to work if their labor is not worth at least $x.xx per hour. Which a lot of labor isn’t, so people go unemployed. Let people make their own choices.

making war takes money.

Joe Average,

I could never understand the people who are eager to become economically more like Mexico instead of more like Germany. To each his own.

Gubberment is addicted to the taxes that they get from the inflated prices….Their revenue has been falling anyway and the cost of goods has gone up to it too. Streetlights, tires, gas, wire, asphalt etc all cost more…they will do half as much with half as much money….and some things they will not do at all.

Europe is in fact a mess. Pushing the reset button in many places, including the US (long term unfunded liabilities) may be the only option.

Unfortunately, instead of breeding tough humans like during WW2 era, the last 30+ years have breed nothing but white collar, entitlement, hopium smoking populations that will riot when their stomachs are hungry.

When’s the last vegetable garden you saw in SoCal?

I’m running east. Far east. FAST.

PapaToBe

Congrats on the baby. When’s the little critter do to arrive?

I would love to grow a garden.

I like to know what’s in my food,

and I think it would give me a better

appreciation for my produce.

One caveat is the water bill- the yin

the plus is the quality – the yang

You need to get more in touch with your community.

My Rx: check out the urban food initiatives at Occidental.

I noticed homes moving, the ones in perfect condition and priced right. This is the time homes sales go up anyway . The inventory has been low for the last month. However more listings coming on but over priced. While looking on zillow last night in San Juan Capistrano I noticed quite a few condos in pre forecloure/foreclosure pop up on the inventory. You had mentioned something about that recently with the condo market. It sure would be a great time to be rich, well I guess anytime would be a great time to be rich!

http://news.firedoglake.com/2012/05/31/hard-times-in-california-for-bank-accountability/

Looking to buy in Thousand Oaks, Westlake Village, Oak Park area, price range 450,000 to 500,000 do you think now is the time to buy?

Does the reply posted here influence your decision to buy a home? If so, you should never make investment decisions. You need to determine yourself when the time is right and take the risk. No one here knows what the future holds and everything is speculation. A lot of money was made from 2003 to 2006 on homes, and then a lot of money was lost. But if you are asking when to get in or out, you mine as well ask us if you should bet on red or black at the roulette wheel.

All of the information you need to make a good purchase is out there. If you haven’t figured it out yet, your haven’t done your homework.

So that answers the question. For you, no, don’t buy.

Some of the best advice I’ve seen anywhere.

Having just completed an engineering degree, I’ve had about 20 coworkers, young and old, ask me “Should I get a degree in _____.” I give the same answer–No matter what field you choose you will spend a ton of money and thousands of hours earning that degree. Including all the money you spend and the opportunity costs you’ll be in about $200,000 by the time you’re done. So if you don’t know what you’re going to study, why you want it, and how you will pay the bill, you should not make the commitment. You shouldn’t even start down the road until those questions are answered.

Nobody can tell this potential buyer the right time, area, house, and price for him except him! You’re advice was dead on.

Hell-YES!! Better move quick, or forever be priced out of the market!! If you don’t belive me, just ask your local realtor!!

No, absolutely not – even if you’re really eager to buy you should at least wait till the fall, especially in your price range there’s a very fierce competition right now.

Renter

We live in T O. All we have previewed is a lot of liptick on a pig homes. Overpriced dressed up homes that an inspector told us to run, don’t walk. I would wait until fall. It’s a seasonal micro-bubble. This is our 3rd year looking and if the SS we offered on doesn’t “take”, we’re waiting until fall again. Prices have always softened. We’re a cash and close, and a workable house for us comes up periodically. Our needs are very defined.

I would say wait. Kidlettes go back to school, prices soften. Experienced buyers here. This our 3 and final home. Also, do your own due diligence and hire your own inspector. (I’m R E licensed.)

http://www.businessinsider.com/another-housing-collapse-is-coming-soon-2012-5

apocalyptic but….

I have good news and bad news.

The good news is that NAR states that the recovery is on baby!

http://www.dsnews.com/articles/nar-data-points-to-recovery-2012-05-22

The bad news is that according to the Mayans the world is coming to an end on December 21st 2012.

http://en.wikipedia.org/wiki/2012_phenomenon

Cancel Christmas…

Quick vote, which article do you think is more believable…

Yeah, and Dick Clark died, so we can’t have New Year’s 2013.

Well played, Mayans!

A better poll would be: How many people think the idea of the world ending is crazy, but put 100% trust in NAR?

March 2012 made offer on 3/2 1900sq, 2 car in 92123. Ask price was 429K, I eventually increased my offer to 439K. There were a total of 12 offers, the winning bid was all cash 450K AS IS.

April. 2012 offer on 3/2.5/2car 2002 sq. in 92104. Ask price was 665K, eventually went up to 685K but lost out. There were 4 bids and the winning bid was 705K.

May 2012. Offer on 3/3/2car 2700 sq in 92117. Ask price 699K, offered 689, went up to 695K. They just came back with a counteroffer of 720K and wanted me to buy the house AS IS. I told them to jump in the lake.

We have reached a frenzy in coastal California. With 3.5% down and 3.8% 30 year fixed, price is not an object as long as it is not too much higher than the FHA limits. And, I hate to say it, with Europe in crisis, I would say sub 3.5% 30 year fixed is baked into the cake.

I would be interested in knowing what the future holds for FHA loan limits, how they are calculated and what is the likely hood they will be increasing or decreasing. There may be a frenzy sub 725 to 750K ish but prices are falling above 750K.

This current inflating bubble is the product of Government. How far will it inflate before it pops? Given what I have been through, I have given up because, even with 550K to put down, I have been priced out and I will be damned if I pay 550K for a fixer in the HOOD.

With all due respect, Martin. $550k is a respectable amount of cash. Congrats. But why the whining? It’s a story of lack of inventory (i.e. supply) and FHA juicing. This is a deflating bubble in So Cal, and the policy-makers’ self-serving interests and the global economic dynamics are such that a slow, farty deflating of the 2006 bubble is going to continue in desirable CA until incomes in properties/neighborhoods eventually line up with the “California premium,” Prop 13 lottery winners/hold-outs, no-more-land dynamics, eventual recovery in economic activity (i.e. higher interest rates). Papa has brought it up many times before….it boils down to opportunity costs. How long are you willing to wait for the “perfect” deal??????????

I will keep whining as long as I want. Having cash means you worry about its real purchasing power. Is it going to be stolen while you wait? In all likely hood, YES! The Government has given me plenty to whine about and I intend to.

Martin

Your posts are very interesting, and I for one learn from them. We had a bidding war on a nice short sale, but the house needed $50K minimum (seems to be common). They seem to be using the prior days high, as the next days low bid. Screw that noise. The owner has just one loan,but has owned the house long enough to have it paid off, or almost paid off. They owe some big bucks, and I think it will still go to auction. It is already on the docket and the timing is tight.

I believe we are in the typical seasonal micro bubble, but with a very tight inventory. We’re cash, and we could pay more, but for what we want, we would be the most expensive home in an average neighborhood. We’re not that stupid.

Dfresh- your posts have an arrogant and nasty tone.Practice the golden rule, please. Thank you.

Regarding our offer on the short sale post. I believe from the way it was handled, the over in debted (suck a boat load of money out) homeowner filed a BK to postpone the courtstep auction for now. WE WERE ALL USED. She took the highest offer for her day in BK court. Meanwhile she already had her BK going. Just my opinion, but feasible, no?

Why not buy 2 $200K rentals instead with your cash, and Make that money work for you? I guess you ‘monied’ folks must be smarter than I.

Martin, I haven been through the same thing. I put a number of offers in the last two years, and I finally got one from a flipper who bought at auction and fixed up. Short sale and forecloure and auctions are heavily manipulated by the realtors, bankers, their friends and investors. If you are one of them, you can get a good deal. Otherwise, it’s hard to get a deal. Banks don’t want to lend unless you have a decent credit history and the debt and income ratio of less than 45%. If you can get a mortgage to buy, it makes sense to do it today. The rate is low, but most people won’t qualify.

Mad, I for one find your post referencing the golden rule comically ironic.

Is the bottom in yet? I ask that rhetorically, as Barry Ritholtz has posted this tineline of bottom calls since 2006:

The Housing Bottom Is Here!

All those forecasters meat-heads need to get their crystal balls recalibrated.

You live under a roof, not statistics. A lot of factors involved in a decision, kids, school, neighbors, work and price. Nobody really know where the bottom is. Now looking back, if you bought at early 2009, you probably got the best price. But you wouldnt know that until after. The price is down quite a bit. Housing is personal, just like anything else. listening to those who are getting paid to turn out BS daily is bad idea IMHO.

The roller coaster junkies are a holding their collective breath in hopes of the fabled bottem and start of a new rise (cycle). Problem is all the oxygen got sucked out of the economy so don’t hold your breath, and we’ll probably be a double dippin soon. But the weather’s turned hot, not like the market that the realtorz so want. so let’s all go skinny dippin and enjoy the next double dip. just in time for the banksters to suck some more welfare $$$$$$$$$$$$$$$$$$$$ from the state.

Wonder if today will be a Black Friday, or if Uncle Ben will show up with his wheelbarrow and paper it all over, murmuring comforting words like “ease”, “surge” and “hopes”? Appears to me more QE is a done deal.

Like Martin mentioned above, we will see even lower mortgage rates soon. The 10 yr note is below 1.5%. This will be even more frustrating for people trying to buy when money gets consistently cheaper by the day. Forget about this market today…check back in 6 months.

Same route as Japan..even with 0% interest rates…could not stop their housing market downturn…23 years later..

The psyche of the Japanese is much much different. In simple terms, the Japanese care more about what the total cost of something is, while 80% of Americans only care about what the payment is and only think of the total cost as something abstract that really has no meaning.

And, more importantly, the population of Japan is declining while ours is increasing.

That would be ok if was 18 years old, I can’t wait 20 years….

Matt

That has crossed my mind as well. Japan is a good case study. With salaries down and jobs scarce it has to be playing on consumer psychology. I also think people are now immune to low rates. Wishful thinking maybe, but I suspect fall is going to look better for us buyers. What do you guys/gals think?

People also think its ok (immune) to buy a middle class house in the San Fernando Valley for half a million dollars when 15 years ago you could get a beachfront propery for that cash. Hey when the big one hits its surfs up in Van Nuys guys!

Git outa southern cal git out the USof A you all gitting radiated from geepan

No one wantz ta live in a radiated house with radiated kids eatti’n radiated food, sashimi any1? Gotta look at the bigger picture here folks.

Your post is incomprehensible.

maken cents two me

Comment unrelated to this article…Just rediscovered “drhousingbubble”! I followed his blog for in the middle of the last decade, divested myself of “my” home and have never looked back. Thanks doc!

Classical Econ 101: there is no such thing as an asset bubble…

Keynesian Econ 101: there may be asset bubbles but it is a psychological thing…

Common Sense 101: asset bubbles are caused by easy credit/expanding money supply with a dash of psychology…

If they are both wrong, how do we expect these folks to solve any economic problems?

Leave a Reply to One-Hung Lo-Show