Emerging Economic Trends: Housing Swaps, Frugality, and Selling Homes in Lower Priced Areas.

The selling pressure on Fannie Mae and Freddie Mac has been heavy this week after a Barron’s article published on the weekend made the case that both government sponsored entities would require a full fledged bailout. This was made clear even prior to the Housing and Economic Recovery Act of 2008 being signed into law. The challenge now becomes if they do go out and sell more stock that current shares will be diluted to a point where the shares become worthless. Both Fannie Mae and Freddie Mac are testing multi-decade lows.

Sometimes people forget what these two companies stand for. Part of their mission is of creating liquidity on the secondary mortgage market. Yet with a struggling housing market these large institutions have to contend with a faltering portfolio that is seeing more and more losses. Now it is very likely that current shareholders would be wiped out in the event of a bailout. The question becomes why would foreign investors purchase bonds or preferred shares in the company if the likelihood of failure is around the corner. Certainly they will be made whole but not at premium rates. The well is drying up quickly.

There are a few emerging trends in the housing market. It is rather clear that housing still remains in a precarious situation. We are nearing the end of the summer selling season and the boost that was expected unfortunately did not materialize. Record inventory is still on the market and questionable mortgages such as pay option ARMs still loom on the balance sheets of many lenders. One of the trends that is emerging is people engaging in housing swaps. That is, people exchanging homes normally without a broker or agent. In many cases, it is a barter trade. Another trend is towards frugality. Now some would argue that this isn’t a trend more than the economic situation forcing the hand of many to face the grim reality. Yet there should be little doubt that prudence is making a comeback. Also, we will examine the hidden housing numbers embedded in the Southern California housing market. Are we really approaching some sort of market bottom?

Housing Swaps

I happened to stumble upon housing swaps on Craigslist. For those two of you who haven’t heard of Craigslist, this is one of the most visited sites on the internet with some 20,000,000 visits per month in the United States alone. You can consider this a dynamic classified section where you can find pets, look for employment, trade cars, get rid of unwanted furniture, and now swap your home with someone else. Now I’ve used housing swaps when traveling for a temporary living arrangement. For example, you need a place to stay and you find someone in your desired location who is looking to travel as well, and you come to an agreed upon trade. Now this I used during college and was amazed at how many people are out there and the ability of technology to shrink the world.

That isn’t the new trend. But what I am noticing is postings from people looking to permanently swap their place with others. That is something that is new. There were the unique postings in the past but now everyday you can find a person looking to trade their home with your home. Here is an example:

The person above is looking to exchange their Chicago home with a home out here in Burbank either temporarily or permanently. Now why would someone do a housing swap as opposed to selling their home? There are actually many good reasons. First, you may be an area with depressed sales and can’t sell your home. For many corporate careers, if you are in a junior position you may need to go where the company sends you. This may translate into you relocating but if you own your home and cannot sell, then you are stuck. What if you absolutely love your career? Then most would do anything they can to find a way to move to their new location.

Another reason people would do a housing swap instead of selling is they may be in a negative equity position. Say you bought a home for $350,000 and the home is now “worth” $250,000. A large number of people do not (or don’t want to) come to the table with $100,000 simply to sell their home. There is a large portion of the population that can manage the housing payment but is simply stuck in this position of limbo. They would like to sell their home but cannot. There only other option is to ruthlessly default and some are going down this path as well.

Finally, this may workout for people who are on the margins. If you have say a 4 or 5 percent equity position in your home, it may cost you $10,000 or $30,000 simply to sell your place. Why not contact someone and save yourself that amount? You can hire a real estate attorney for a few hours, get the paperwork drawn up and finish the deal. This may work for cases like the person that needs to relocate and doesn’t really care if they get a profit on their home. They are simply looking to sell the home.

It’ll be interesting to see if more and more of these cases pop up on Craigslist.

Frugality

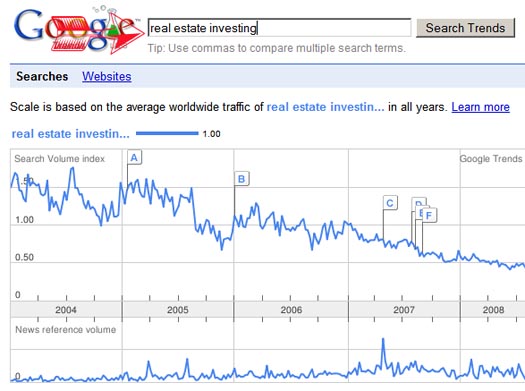

There is a definitive emerging trend in frugality. There is a fountain of wealth with Google. You can use Google Maps and have access to technology that only a few years ago was accessible by the highest level government officials. You also have the luxury of searching for information from a variety of sources. One of the features I enjoy from Google is their Google Trends search feature. In this, you can see the amount of search queries for any phrase or word. Since Google dominates the search world, this is an excellent view of what people are searching for at any given time. Take a look at this search phrase:

As you can see from the above chart, not many people are searching for “real estate investing” anymore which shouldn’t come as a surprise. Ironically, in times where people should be more financially educated they tend to steer away from this.  They ramp up their investments at the worst time, near a peak, and face rapid problems. Is it any wonder that California has now seen a drop of 38 percent in one-year for a median priced home?

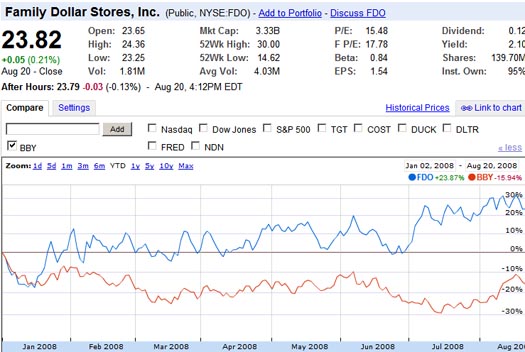

This trend can also be seen perfectly by comparing two stocks for the year. That of Family Dollar Stores and Best Buy:

For the year Family Dollar Stores are up 24 percent while Best Buy is down 15 percent. So what does this mean? What it means is that people are focusing on things they “need” and avoiding things they “want.” It is interesting to note that consumer and producer inflation is running at decade highs. Now why is this? Clearly housing prices collapsing and credit tightening is wealth destruction so you would think that we would be seeing possibly deflation. The problem however is items that people need such as food, fuel, and healthcare are not growing exponentially. These remain fixed while the U.S. Dollar declines and purchases less and less of these items. In addition, many Wal-Mart goods are produced in China which is facing its own inflation. The workforce is slowly getting more educated and is demanding slightly higher wages which find their way into the price of the goods that people consume.

With budgets getting tight “want” stores like Best Buy are facing the brunt of the economic contraction. We saw this with Mervyn’s filing for Chapter 11 bankruptcy in July. Another clear example is looking at a low cost food source such as McDonald’s and comparing it to P.F. Chang’s China Bistro:

Over the past year McDonald’s is up 29 percent while P.F. Chang’s is down 27 percent. Frugality is becoming a way of life because money is tight and this is being reflected in the spending behavior of Americans.

Census Selling

Much to the chagrin of many the housing market won’t see a bottom at least in California until 2011. There is some positive aspects to this including more affordable housing for many. It will also lighten the debt load for households in the future. It may also give people the incentive to purchase homes in areas they plan on staying in and investing their time in creating a better community.

Foreclosures are still at historical highs. Given the recent housing report for Southern California and the modest jump in sales, I think it is important to look at the actual sales and how they played out in various regions. Let us first get a population count for the 6 major counties:

Population Count For County:

Los Angeles:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 9,948,081

Orange:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3,002,048

Riverside:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2,026,803

San Bernardino:Â Â Â Â Â Â Â Â Â 1,999,332

Ventura:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 799,720

San Diego:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2,941,454

Total Southern California:Â Â 20,717,438

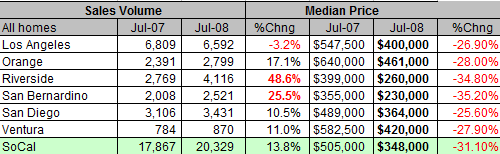

So that gives us the entire population count for Southern California. The total population of California is 36,457,549 so Southern California makes up 56 percent of this amount. Now let us look at last months sales data:

Now I made the case in a previous article that the minor bump in sales was in large part by the fire sale of homes in the Inland Empire. Let us now break down the numbers to get an actual proportion:

Riverside + San Bernardino Total July Sales =Â 6,637 / (20,329 total SoCal Sold)

So these two counties made up 32.6 percent of all sales for Southern California. Now we should look at what percent these counties make up for the Southern California population:

Riverside + San Bernardino Population = 4,026,135 / (SoCal total 20,717,438)

Total population percentage for these two counties is 19.4 percent. So essentially these two counties are selling at twice the percent of their population representation. I was listening on the radio to someone explain the median price drop and cautioning that sales are getting skewed because “expensive” homes aren’t selling and only foreclosures and lower priced homes are selling. This in fact is true. The only thing I would caution these folks about is that distress sales are now the bulk of the market even though miraculously in some of the data, foreclosures don’t pop up in multiple listing services.

These new trends are simply a way people are coping with the economic conditions. It is very unlikely we will be seeing a second half recovery especially for housing.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

14 Responses to “Emerging Economic Trends: Housing Swaps, Frugality, and Selling Homes in Lower Priced Areas.”

Does this person in Chicago realize that they will get less than half the size home in this swap?

Chicago and the surround areas are littered with McMansions of all kinds that are virtually sale-proof in this market.

DRHB,

Alway’s love reading your posts, Ineed to correct you on something you overlooked.

Comparing retailers& restaurants that way doesn’t make sence. Wall Streeters like to assume what you said in your article here maybe true. That would send MCD shares up & PFC shares down. The inportent word here is ASSUME, if figures at MCD miss expectations for example the stock will be hammered. Another thing is people eat at MCD reguardless if the econemy is good or bad. However, if current trends continue, people wont have the money to eat out anywhere because they will be unemployed.

Then what, fewer customers & higher prices resulting in lower stock prices.

The BBY example is interesting because a large portion of there profits came from plazma & LCD TV sales & all of the ansellary avenues such as installation,purchases of DVD players, x-boxes & the like.

I’m 100% certain that BBY had NO clue just how bad things were getting, dispite the fact that they baught a CA company that builds custom cabenatry for entertainment rooms. They also baught a Seattle retailer of high end electronics.

They didn’t care where the money came from, as long as people were buying. Now we know where all the dollars originated, taken out of the home like an ATM. Now, these houses are worth far less than last year & people are under water with morggages they cant pay off.

Look at all of the retail fileings for chapter 11 this year, it’s eye opening.

AT THE HEIGHT OF THE DEPRESSION SOME MULTIMILLION DOLLAR MANSION FARM/MINES WERE SELLING FOR PENNIES ON THE DOLLAR, BUT BEFORE YOU REJOICE REMEMBER THAT MOST FINANCIAL LOSES WERE FROM SECURE ACCOUNTS………………

Dr. HB, something was brought to my attention worth discussing. Many people in the IE are buying foreclosures as a second home (At 1/2 the price), while keeping payments current on their 1st home (Bought from 2003 – 2007). When the second one closes they let the other one go back to the bank. Perhaps they were 100% financed on the first one, and are no longer underwater.

This could be adding to why there are so many foreclosure sales in the IE. This will eventually lead to even more foreclosures.

A possible trend???? What do you think?

http://www.westsideremeltdown.blogspot.com

Enjoy your posts very much; mainstream financial press doesn’t seem to have a clue about California. I see a problem with swapping—they still owe the bank more than the house is worth.

I don’t think the decline in home prices is over yet. It has not even started in Manhattan.

Ekonomix

http://turkeconomy.blogspot.com/

The Prudent Bear included this link today to a story in the reprehensible CFO.com with their own headline as follows:

Outrage over exec pay? So what?

http://www.cfo.com/article.cfm/11958664/c_11964773

Speculative bubbles abuse economic democratization while also ultimately undermining it. It’s diabolical.

rose

What’s really frightening is that the real “emerging trend” in SoCal real estate right now is blatantly lying or misrepresenting properties in order to convince people that the crisis doesn’t exist.

Case in point: My wife and looked at a foreclosed home last month (July ’08) that had been on the market for over 340 days. It started out listed at $479,000, then the bank kept dropping the price until it finally hit $284,000. Went into Escrow a couple of times, but none of the sales went through (most of the prospective buyers were trying to utilize nothing-down FHA loans, but the home was in such bad shape that it wouldn’t pass an FHA inspector’s requirements – i.e., that the home be in habitable condition). The bank then took the home off the MLS for a week. We just saw that same home listed on the MLS again – now for $275,000 – with a statement saying that it was JUST LISTED on 8/11/08. Original listed price: $284,000. NEW TO THE MARKET.

And this fraud is just being force-fed to prospective buyers by unscrupulous real estate agents, who are convincing their clients that they should rush in and buy this “incredible investment property” while there’s still time. “Offer more than asking price, so you can have a strong offer and compete with all the other buyers out there who will be jumping at the chance to buy this home, since it just got listed.”

Did I mention that the seller is only taking cash offers now? Seems like NO FHA or mortgage inspector will pass off on the home. Sounds like a great deal to me. I feel like running out right now and “making a strong offer” so I don’t get left behind by all the smart investors…

Or, we all have to realize that it’s buyer beware and you can’t trust ANY real estate professional to give you the truth. They’re all desperately trying to save their own skins. EVERY real estate agent & mortgage broker that my wife and I have talked to told us that prices weren’t going to drop considerably after July ’07. And they sure knew what they were talking about, didn’t they?

The financial meltdown of the GSEs should have Americans up in arms. We were told repeatedly that these were ‘well capitalized’ institutions, that they owned only AAA rated securities and mortgages. Then we learn they owned junk including each other’s junk to include liar loans. Now we are told that their are bonds have to be backed by the US taxpayer even though the prospectus for their sale clearly stated these were not obligations of the US government. It is perfectly ok for the Fed to steal the income of widowers and pensioners through interest cuts but to ask Russia or the Cayman Islands to take a cut on their GSE

investments would be unthinkable. Instead the American people are about to be swindled one final time to make whole those who ended up holding the crap from the housing bubble. Why is it a small investor can be wiped out ( and they will be if they own GSE common stock) but a sophisticated bank, insurance company or foreign government investing billions cannot be stuck with the consequences of their search for ‘higher yield’. They could have bought US Govt treasuries but they didn’t. They bought Fannie and Freddie bonds because they paid more. Any casual reader of the Wall St. Journal can tell you higher yield means higher risk.

It is absolutely amazing how uninformed people still are about

the whole trend change in financing, etc.

Went to a shoe store today for a new pair of sneakers and overheard

two cashiers talking about buying a house.

These poor 20 something kids are still under the impression that

once the boyfriend has a couple more months on the job that they

should be able to qualify for a zero down loan to buy a house.

I am wondering where in my area they are going to qualify for a house…

Scott:

I’m up in arms…they are just bony girl arms and not very frightening.

Keep up the good work Doctor.

>

Good question… why are foreign entities buying our debt? Who is supporting the dollar? The dollar rallied this week….

@OilWellDoctor

The US is still the dominant economic and military force on the planet, by multiples in size over the next several countries. We make more stuff, we buy and consume more stuff, and we have the most weapons. And we have the world’s largest advertising campaign, sometimes called “The American Way”.

If people overseas don’t buy our debt, we don’t buy their stuff with our borrowed money, and we don’t protect their ruling elites with our military.

And the dollar is up because… oh hell, I don’t know. Oil is down? McCain took the lead in the polls? Lehman is about to go belly up? The inflation and unemployment numbers are rigged? There was a full moon? Michael Phelps won a gazillion gold medals? The European Union is having economic difficulties, including their version of the credit crunch and housing price cliff-diving? Russia invaded Georgia and the cold war looks like it’s returning?

Of course a strengthening dollar threatens exports and encourages imports, which in turn feeds the current accounts deficit. Ah, the joy of leverage.

We need to have a new Huell Howser special on California’s housing bust.

He can can it California’s Fools Gold. And he can burst into people’s homes as they are packing their stuff and leaving their foreclosed homes behind, stick his microphone in their faces and say, “this is amazing, what’s it like to lose your home to a toxic mortgage?” And when he gets punched out, we will know that his bafoonish schtick has finally gone too far.

Leave a Reply