Southern California Housing Report: New Housing Motto: Foreclosure Data is so Bad, it has to be Good! Median Price Down 31% to $348,000.

The spin is out in full force folks. The Southern California housing numbers are now out and once again they show a dismal and pathetic market. Yet even in the face of falling prices ala the Wal-Mart commercials, you can rest assured that some are going to spin the data for all it is worth. You also need to remember that the recent data on Southern California is for the month of July, a historically strong month simply because of seasonal factors. In addition, the month of August should look similar to this month but expect the report for September due out in October to show the actual pay option ARM smack down.

But even with seasonality the spinsters are going to use the current minor bump in home sales as a major positive:

“(DQNews) La Jolla, CA—The number of Southern California homes sold last month edged up to its highest level in more than a year as bargain hunters swept up foreclosure properties in affordable neighborhoods, a real estate information service reported.

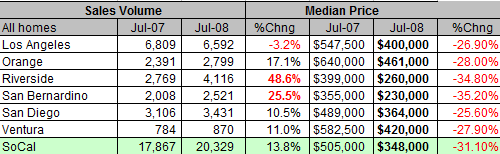

A total of 20,329 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 16.7 percent from 17,424 the previous month and up 13.8 percent from 17,867 for July a year ago, according to San Diego-based MDA DataQuick.

Last month’s sales count was the highest since 21,856 homes were sold in March 2007, though it still fell 23 percent short of the average July sales total since 1988, when MDA DataQuick’s statistics begin. From last September through June, sales for each month were at an all-time low for that particular calendar month, with the exception of April which was the next lowest. Last month’s sales total was the first since September 2005 to rise above the year-ago level.”

Bargain hunters? Foreclosures in affordable neighborhoods? Isn’t that an oxymoron? If the neighborhood was affordable in the first place you wouldn’t be seeing large number of foreclosures but that is an entirely different subject. Even though this report is trying to spin the 21,856 sales as a significant jump it is nowhere close to the sales that occurred during the bubble frenzy. Take a look at this data:

July 2004: 32,988

July 2005: 31,069

July 2006: 25,628

July 2007: 17,867

July 2008: 20,329

It helps to put things in perspective doesn’t it? Of course they aren’t going to say that sales for Southern California are off by 38% from their peak July month only a few years ago. And when they say that the jump was bolstered by “affordable neighborhoods” what they mean is that the majority of the sales were fueled by the Inland Empire were homes are being sold for whatever the market will take. Let us look at the details of the report:

I first direct your attention to the stunning jump in sales for Riverside and San Bernardino Counties. These two counties make up the Inland Empire. But what the report doesn’t highlight is the actual median price of both these counties. They are now down 34 and 35 percent on a year over year basis and carry a median price of $260,000 and $230,000. Do you realize that Riverside County for example hit a high median price of $432,000 in December of 2006? So if we take that peak price to the current median price we get:

$430,000 – $260,000 = $170,000 (A 39% Discount)

Los Angeles County hit a peak of $550,000 and is now at $400,000. Nice $150,000 discount. Orange County? Orange County had a median price of $645,000 in June of 2007. That is a drop of $184,000 in one year. Would you wait a year for $184,000? I think most would.

Across the board prices are getting hammered. The reason sales jumped last month was in large part to the big jump in the Inland Empire. And of course homes are now selling for 50 to 60 percent off peak sales prices. To think this won’t happen in Los Angeles County and Orange County is simply unrealistic. It will happen. Just wait until the pay option ARM loans in these areas hit their anniversary dates.

You’ll love some of the reasons given for the fall off in prices:

“What we’re looking at is a fire sale of properties in newer affordable neighborhoods that were bought or refinanced near the price peak with lousy mortgages. What we’re still not seeing is this level of distress spreading to more expensive or established neighborhoods,” said John Walsh, MDA DataQuick president.

The median price paid for a Southland home was $348,000 last month, down 2.0 percent from $355,000 in June and down 31.1 percent from $505,000 for July 2007. That peak of $505,000 was reached in March, April, May and July of last year.

The median has fallen because of depreciation, especially in inland markets, and because of the steep drop off in home financing in the so-called jumbo category, which until recently was defined as loans above $417,000.

Before the credit crunch hit in August 2007, nearly 40 percent of Southland sales were financed with jumbo loans. Jumbos last month accounted for 15.8 percent of Southland sales.”

First, what qualifies as a more established neighborhood? Are we talking about Malibu or Newport Coast? Sure, those areas are positive but only a fraction of the entire 20,000,000+ people that live in Southern California live there. That reminds me of something said during the Crash of 1929. Mr. Rockefeller during the crash of the Great Depression announced that he was buying stocks while everyone was selling. To paraphrase a market observer, “of course he is buying. He’s the only one left with money.” Well of course these areas are doing fine! They always do well irrespective of the economy. Yet I draw your attention to the chart above again. Every single county is down from 26.9% to 35.2%. That is a major correction in one year and we are yet to see the truly “lousy” mortgages hit the actual market.

Another interesting part of the report is the implication that jumbo loans are somehow hurting the market. Did you look at the overall Southern California median price? It’s at $348,000! You don’t need a stinking jumbo loan anymore. What you need is good credit and a solid income to buy a home and not some banana republic mortgage from the bubble days. Given that our unemployment rate is at 7.3% who really wants to buy a home when their income is at risk? You think those 200,000 state workers are hungry to buy a home given that Arnold is trying to cut them down to the minimum wage? What about all the jobs in housing that are now no longer bringing in good paychecks? If you connect the dots prices are going down because the entire state was turned into a housing casino and mortgages were used as chips.

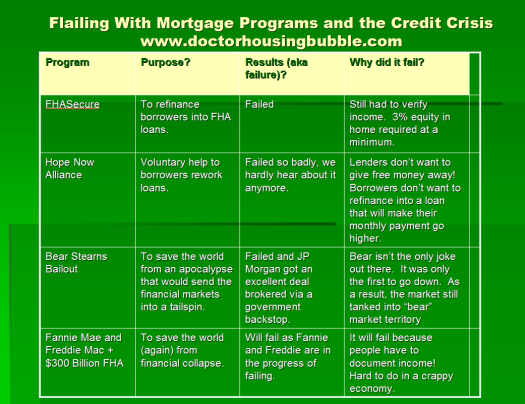

I recall clearly a few months ago hearing on the radio here in Southern California, these permabull brokers talking about how great the Hope Now program would be for buyers. When this failed, it was going to be the fantastic Fannie Mae and Freddie Mac bailout. Well of course all these idiotic programs failed because they missed one simple yet obvious fact. The economy is in distress! This is like offering lobster to a person with no taste buds. Or offering someone that lives in Palm Springs an Eskimo jacket. They don’t need gimmicks. What we need is for the state to get its budget in order and not offer tax breaks for subprime lenders. We need an infrastructure that is sustainable and not one built around finance, insurance, and real estate. Did people really think that we were going to trade homes to one another ad infinitum? Sure makes that $729,500 loan limit seem like an absolute boneheaded move.

I was going through some of the historical “help” that was going to save the market and have compiled a list here for your mental historical note keeping:

Of course these programs are all failing because they fail to address the structural problems of the system. That is, this was a bubble of epic proportions and the only way to sustain it is to bring back the toxic credit that fueled the market. I was digging through some images I have saved and found this screenshot of Hank Paulson on CNN from December of 2007:

Subprime help is indeed on the way. On the way out the door that is.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

23 Responses to “Southern California Housing Report: New Housing Motto: Foreclosure Data is so Bad, it has to be Good! Median Price Down 31% to $348,000.”

There was an interesting story on my local housing market in Richmond, Virginia

yesterday in the Times-Dispatch. Wachovia Securities is moving all of its operations to St. Louis. You may remember the feds raiding their offices there as part of the Auction Rate Securities scam. Anyway some 630 local employees are being relocated and to expedite the move Wachovia is now buying the employees houses. One example was a home that had been on the market for $725,000 and failed to sell. Wachovia paid their employee $675,000 for it and it is now on the market for $595,000. These company buyout homes were concentrated in the more affluent part of the metro area and there are howls

of protest from neighbors who accuse Wachovia of undermining an already weak

housing market. Ironic too, in that Wachovia is a major mortgage lender here and their dumping of all these homes at big markdowns isn’t going to help those who have Wachovia mortgages and don’t work for the bank. Hey, nobody ever said Wachovia was the sharpest blade in the financial industry unless you were trying to catch its stock. I gather Wachovia could be the ‘big bank’ Kenneth Rogoff meant when he said a large US bank is likely to fail in the coming months.

You’re absolutely right about why the government programs so far have failed and will continue to fail. Prolonging a bubble’s deflation is doomed to failure, although our central planners in Washington will do whatever they can to give their propaganda artists a few more reasons to spin bad housing numbers.

It’s not the conservative borrowers who took out reasonable loans who are pushing the foreclosure numbers to record levels — they’ll still be facing foreclosure for the same old reasons as in the past.

But inject the market with essentially free money, no verified income, and inflated appraisals, and a correction has to occur sooner or later. And these are the people that won’t qualify for any of the government’s programs, because they never had income to verify in the first place, and probably didn’t put down even 3% of the purchase price. If they did put it down, then it’s probably gone now through price declines.

I am on my way to Las Vegas in October, wile I’m there I’ll be getting the scoop on what is really going on there with the real estate market. Just wanting to stop the spin mysters & get hard facts.

Could you find out what “sales” mean in SoCal market for us?

These figures are very confusing because some people take a “foreclosure” into account as a normal sale. To me, a foreclosure is not a sale.

The news said SoCal sales jumped 16% and price went down in July. That’s against the principle of demand and supply, isn’t it?

DrHB- awesome as always. But I believe you’re wrong on one point “Are we talking about …Newport Coast? …Well of course these areas are doing fine! They always do well irrespective of the economy.”

Its my opinion that the McMansions in Newport Coast are going to tank HARD. Laguna and CdM – those places have “old money” and I believe they’ll decline, but not free fall. Newport Coast, IMO, has a LOT of “all hat and no cattle” folks who have been keeping up with the Joneses.

On top of that, with energy costs being what they are, why would you want to buy a 3k-4k sqft house? I’m thinking that many people are going to see 2000-2500sqft homes and realize thats plenty big for even a family of 5.

The contrast to my argument is the fact that we live in SoCal and there will ALWAYS be people who try to live like movie stars and are worried about their appearances…

Dr HB, you are right on target as always. Why can’t people see that it was, and has always been another California Ponzi Scheme. With 20,000,000 potential suckers and the Fox in the Henhouse (GWB…2000-2008) it’s Banks Gone Wild!!

I do have to concur with dafox though on the Newport Coasts of the marketplace They will be the first rats to leave the ship once they get a whiff of no escape. I remember how hard Montecito in Santa Barbara got hit during the early 90s. I think it will be the same if not worse this time, as problems are 10 times as bad.

Transfer of wealth, rape and pillage, etc… etc… The only difference is GWB doesn’t wear a long grey wig.

Some things never change.

http://www.westsideremeltdown.blogspot.com

Coastal homes purchased from 2004 to 2006 are prime units to travel down the NOD/REO path. Many of these homes were purchased by FIRE economy employees whose $200kpy income has evaporated.

The REALTARD (c) community pushes these sales numbers like crazy, not understanding that if foreclosures were taken out of the mix, sales would be at all time lows. Prices will continue to fall. Sales will continue to be made, but come October when Fed rules requiring income verification, FHA loans requiring 3.5% down with a 3% PMI charge, and December when Conforming loan maximums FALLING to $625k from $729k, expect more EPIC failure. Tough news, but reality is what it is.

The 200k homes pull down the price on the 300k homes. The 300k pull down the price of the 400k homes. All the way up to Kobes house in Newport Coast and CDM.

I live (rent for 3400) in Laguna Beach and I dont see it. Sure there are a lot of homes on the market but as a realtor just told me – she is busier this season than last…whatever that means. All i know is that to buy my house I rent my mortgage would be 6000k – rent is half that and prices have not really declines – not to 2004 levels. I have no idea what will happen to the prime coastal towns…but i see the stay at homes getting part time jobs more and more these days..

Poor Hank. Looks like a circusman about to catch a cannonball with his teeth.

Positive spin is the bane of rational thought, as is the deliberate cultivation of fear and paranoia. When there is nothing but genuine bad news, the responsible thing to do is hitch up one’s jeans and dig in to assessing and fixing the problem. Not to deny it, trying to extend the scams that made the bad news happen in the first place. And not trying to scare people into surrender, compliance or recklessness.

But that is the evil of mass consciousness engineering. It is the highest form of cleverness grafted onto the worst forms of stupidity, greed, and sociopathy.

Far as I can tell we are in a period of what amounts to economic terrorism. But that was always the agenda of Reaganomics and globalization, wasn’t it? A minority of people grabbing massive power through corporate, economic and political violence? Terrorizing others into going along with them in the fantasy that it’s better to be on the side of the trickle-down warlords than agin’ ’em? A lot of the talk I hear today is akin to how shocked, SHOCKED!, people were when Enron hit the skids…doing exactly what that corporation was created to do: concentrate wealth, socialize costs, and leave the largest possible number of schmucks holding the sack of rotting organ meats.

We’re seeing the end game of 50 years of systematic devaluation of work (labor, not hot-air peddling), saving, bricks-n-mortar, public mindedness and responsible investing in favor of slacking, scamming, gambling, debt, privatization and speculating. Bling uber alles.

And who are the crash dummies mad at and want to get even with? The institutions and individuals who engineered this mess? Themselves? Nope. The big anger I’m witnessing is against those of us who never felt the need to play along (nor get rich), and who lived prudently and modestly in these decades of gourmet this, designer that, and luxury the other. I overheard something in a cafe the other day that wasn’t entirely surprising, but I urped java when I heard it–three housing industry fellows opining that savings, rather than income, should be taxed. “Why should THEY be comfortable when we’re all struggling?” I was too caffeinated to engage them civilly, and in retrospect should at least have pointed out that inflation is exactly that: a tax on our savings. Without representation.

This is literally a war on the principles and culture of frugality. Frugality may be “cool,” but only so long as it’s the fashion du moment, and not the north star of our nation’s helm.

http://www.theonion.com/content/news/recession_plagued_nation_demands

rose

Over at Minyanville they remind us that investing is a function of time, risk, and discipline, that house prices are sticky going down, that tin foil hats (i.e. Roubini et al) may turn out not to be so crazy after all, and that the market can stay irrational longer than you can stay solvent. So it’s no surprise that house price declines are taking longer than many predicts / want / hope, especially in coastal enclaves like LB.

So patience – let’s see how the POA wave plays out. Maybe it’s Bande Aceh all over again, or maybe it turns out the savings rate and job security and payrate of all those debtors is way higher than average and they can pay down the loans / make the monthly nut when the reset occurs.

I also live in Laguna Beach, and many people I know either got 30 year fixed rates when the getting was good (having bought before 2005 before the last big run-up), or have high wage professions. Since prices are set on the margins, and the bulk of owners did NOT buy in 05-07, it’s doubtful you’ll see too many fire sales not getting snatched up before the discount hits 20%. I don’t see prices in LB falling much below 2003 levels. It’s the areas that had huge numbers of foolish buyers and fraud that will be / have been hit hardest and will see 2000 or earlier price points.

Huge price declines will occur everywhere. Those of you saying your town is immune and will not be affected as much sound just as ridiculous as the people who are saying that now is the time to buy. Call Ed up and ask him if he was immune.

Great radio interview:

Go to http://www.Europac .net

Click on Resources – there click on VIDEO archives

(although this is a radio interview)

Scroll down the page and pass the video interviews and

Under the AUDIO Interviews,

Click on Real Estate Radio USA

Wow!!!

Compass Rose, yours is one of the most astute (as well as witty and entertaining) reader comments here.

You are dead on in fingering the anger of the burned and duped greedy, delusional, and flatly dishonest participants at the people who sat it out. It is really something to sit here in my modest rental, having sat it out through this rampage, wondering will I ever, EVER, in the world be able to own a home, and listen to the crap and blaming out of people who lived lifestyles many levels above mine even though they couldn’t afford it, and are now angry at the cautious and prudent among us for not being in foreclosure and bankruptcy with them. One disgruntled bubble buyer in my neighborhood referred to new buyers, who bought in at prices 30% below her, as “vultures”. This attitude is really disgusting when you consider how snotty and superior these people were at the high swell of the bubble, for it reeks of a violated sense of entitlement.

I never made anyone borrow 4X or more their income. I didn’t make them buy exurban crapboxes 65 miles from work, or tap their HELOCs to buy three cars, or pay the ask price for some garbage rehab that can’t even get itself rented now. I never left my fellow condo owners stuck with my $10,000 assessment arrears.

Positive Spin!

Take a look at this headline: “American Home to pay fraction of bankruptcy claims”

>

A “fraction” is $0.06 per $1.00 invested. This is the spin the press is putting on this thing. Kinda akin to saying the hole in the Titanic covered less than 0.6% of the hull.

>

http://news.yahoo.com/s/nm/20080819/bs_nm/americanhomemortgage_bankruptcy_dc_1

What does paying 6 cents on the dollar for the mortgage tell us about the value of the property?

@CompaJD

Given that 2003 prices in LB were about 30 to 40% lower than peak 2007 prices, I’d say that’s a fairly substantial drop. I should have been more specific and pointed out that the “20% drop” is from present prices, already some 10% to 20% below peak.

Remember that it’s easier to point to tract housing in the IE or north SD county and see 70% drops. But in coastal areas there are simply fewer houses, and many are multi-million dollar properties, and those simply were never financed in the way that were subject to bubble loans. The largest institutional loans that CFC funded were $6 million, and insofar as I know they required 30% equity and pretty damn close to full doc – at least, verified assets. So the big number houses on the coast just don’t fit into the neat boxes of POA failure or IO failure. There were fewer properties sold, and they did not use the financing options that slew the rest of the country.

Was it Nick in the Great Gatsby that noted, the rich are different from you and I? Whether you like it or not, the wealthy ALWAYS have a different set of rules. Not the wanna-be wealthy, the 30,000-aires, the ‘equity-rich’. I mean, the truly wealthy, with money in the bank. And it’s these who populate the Emerald Bay’s, the Lido Islands, the Malibus.

And if you think I’m ridiculous – note that Mr. Ed got bailed out by the Donald. Think the rich don’t have different rules? WTF do you think the Paulson / Bernanke bailout is all about? It’s about saving the plutocrats a$$es at the expense of everyone else. I just made the point that certain areas will not decline quite as much as other areas. Location, location, location. If you don’t understand that “average” is not the same as “uniform” then even the good Doctor can’t help you.

No area will be immune to this perfect storm. Simple mathematics illustrates that the highest end areas had the most appreciation in terms of dollar increases. Hence there was probably more speculation. More affluent buyers generally have more access to credit as they tend to have more collateral. Especially in this last credit game. I think they will be the first ones to send in their “Jingle Mail” once their toxic loans recast. Easy for them, just a business decision, and not necessarily a place to live. Besides 7 years or so down the line, they can do it again, and again, and again.

When I hear people say their area won’t be hit, those are exactly the places I will be watching.

http://www.westsideremeltdown.blogspot.com

Huh. I know people with homes in Hermosa Beach, Long Beach and Redondo with ARMs. I don’t think everyone in the coastal region is Old Money immune from housing woes. It’s taking a while for prices to come down in my area (west hollywood) as well. But there are a lot of homes in pre-foreclosure and foreclosure. When I look on homes.com I see twice as many homes in foreclosure than those listed simply for sale in long beach and my area. That can’t be good, can it?

I do agree that the rich have separate rules, but that’s a whole another can of worms. It really makes no difference to me what happens to the mighty mansions of Malibu. They are a tiny part of the market, and it’s the rest that matters to me.

Btw, is it true that foreclosures count in the sales data? I have heard this mentioned before, but I have no idea if it’s correct or not. If it is doesn’t that throw the numbers completely off?

Doc is great!

The main damage when it is all over will be done to the gheto and will go towords the beaches, but nobody will be safe. When prices on one particurar city colapse it afects neighbouring cities ( neighboring in a socio-economic way) and this ripple efect goes from Lancaster to Beverly Hills. There is convolution efect on prices. Let say 20% drop in Lancaster will cause efect of 1% drop in Beverly Hills, but 20% drop in Santa Monica will cause 15% drop in Beverly Hills. An this is happening becouse the “killing of demand” and change in prices in Santa Monica on prices in BH is by far bigger because they share almost the same buyers pool, not so with Lancaster. This waves will go like this back and fort few times till we have new equilibrium of prices. And at the bottom of the foodchain where it started we will see drops of 60-70% and in the choosen coastal areas ( not all of them) only 30% when the dust is setled. That is my working theory.

I’m fairly confident we’re all working on the same assumption that significant price drops are in the works all over, and differ in severity only by zip code (or even smaller geographical units.) I wonder if the difference isn’t so much between bulls and bears, but between bears and get-the-bomb-shelter-ready camps.

I fully expect most areas to revert to the long-term mean of appreciation essentially matching inflation (with an overshoot to the downside before it re-calibrates). This will entail prices dropping to 3.5 to 5x income in prime coastal areas, less than that in less desirable areas, and pockets which defy ‘common sense’ because the wealthy set their own rules. All data sets are fluid, not static, prices are set at the (now rapidly increasing) margins, but the bulk of present day owners will not default. That failure may hit 20% is astonishing, unprecedented, and sickening to the defaulters and to the banks. But it will NOT mean that Malibu or Laguna Beach are going to drop to 1999 prices (even adjusted for inflation) unless, of course, Roubini turns out to be too bullish in his predictions.

And if that’s the case – be careful what you wish for, because I don’t know of too many bomb shelters in the OC.

I was wrong. It wasn’t a cannonball in the teeth. It was a bazooka in the pocket.

http://www.bloomberg.com/apps/news?pid=20601110&sid=aPXHiGcv1OvU

rose

CALIFORNIA HOME SALES UP UN JULY

California Real Estate market gave signs of relief. Home sales went up 12.3 percent in July compare to the same month last year. According the Quick Data, a company that monitors Real Estate Activity nationwide.

Of the homes sold 44.8 percent were foreclosure resales.

The median home price last month was 318,000 down 3% from 328,000 for the month before and down 33.5 percent from July a year ago. Most of the drop in home prices is due to the depreciation properties are facing because of the mortgage meltdown.

Not even the most knowledgeable Real Estate indicators know exactly where the market is going. Foreclosure activity is at record levels, banks are asking for tougher requirements, non-owner occupied homes are almost impossible to re-finance.

Leave a Reply