Down Payment Assistance Backdoor to No Money Down? Seller-funded Down Payment Scams. The Government looking to resurrect No Money Down Loans.

We are in the “throw the spaghetti at the wall and see what sticks” phase of this economic contraction. In fact, we have some bills that seek to prop up housing prices while others seem to advocate a “hands off” approach. So what is it? Do we think affordable housing is good or do we want to artificially prop up the housing market? Do we want strict regulations or do we want to go back to the days where a cat named Messiah can get a $4,200 credit card and a $14,000 a year income can purchase a $720,000 home? Aaron Krowne over at the Implode-O-Meter sent me a message regarding a bill in Congress regarding Seller Funded Down Payment Assistance (SFDPA), which is simply another cockamamie idea of getting people not ready to purchase a home over leveraged once again. It is as if they have blinders to one of the causes of this economic catastrophe.

There are many things that are infuriating about this bill. The intellectual dishonesty is bothersome but then somehow, these Congress folks are seeking to help minority home buyers when in fact, this does little to help the buyer but more to line the pockets of so-called non-profit groups who collect sizable fees for arranging these purchases. In addition, you have to wonder how desperate a seller must be if they are “donating” the down payment for the seller. Before you shed a tear for the charity of the seller, they normally inflate the home price by the amount of the seller-funded down payment.

SFDPA programs are a loophole for no-money down home purchases, which is largely a culprit in the economic fiasco that has brought the world economy down to its tender knees. In addition, I’m not talking about only sub-prime mortgages here or people struggling financially. Many prime borrowers went with no money down via Pay Option ARMs which are just as devastating in the market place. Many Alt-A and Option ARM borrowers had “good” credit supposedly. But you can have a FICO score of 800 and there is no way you are going to make the mortgage on a $700,000 home with a $100,000 yearly income. There was even a brief mania period in the bubble when you could actually get cash out of a home that you bought! These 103, 105, or 110 percent loans gave you the opportunity to leave escrow with a check to your name.

Others are also supporting the campaign against SFDPA programs:

Blown Mortgage

HousingDoom

Patrick.net

Barry Ritholtz

Danny Schecter/Mediachannel.org

The Mess That Greenspan Made (Tim Iacono)

Mish

A big issue with SFDPA is that typically default rates are 2 to 3 times higher than regular FHA loans. You may be asking yourself, why would the government be pushing legislation such as a program with historically proven default rates that are higher than other standards? Well, I hate to tell you that this legislation has sponsors on both sides of the political isle. This is similar to the push earlier this decade with the absurd and idiotic notion that every person should be a homeowner. I suggest you read the in depth piece over at Ml-Implode:

“H.R. 6694, before Congress currently, would revive a recently-banned practice known as FHA “seller-funded downpayment assistance” (SFDPA) lending. In SFDPA, a third party arranges for the seller to make a “donation” to the buyer (through the third party) equal to the FHA mandatory 3.5% downpayment, which is then used for the purpose of the downpayment, in direct violation of HUD policy. This means that the buyer does not make a true downpayment born of personal sacrifice, undermining its purpose. In the end, this is the same sort of “100% financed” lending that was a major contributor to the collapse.”

Since SFDPA lending was considered a “scheme” by the IRS and in direct violation of HUD, this legislation being pushed, the more recent amendment is HR 600 that adds a few updates to the full bill of HR 6694 has minor tweaks that actually defeat the spirit of the bill in the first place. They are pushing FICO as the metric of establishing the creditworthiness of borrowers. This is wrong on so many fronts. First, having a higher FICO score is going to do nothing to determine the viability of a borrower. All this tells you is that you have managed your credit wisely according to Fair Isaac standards. Okay. Does that now mean you can afford a $500,000 home on a $60,000 income? In addition, wouldn’t you think that a lower priced home would be a better indicator of whether someone could afford a home?

“(Mortgage Whistleblower) Despite the credit score protections proposed by H.R. 600, the bill specifically exempts borrowers with credit scores above 680 from paying higher risk-based premiums. The proposed legislation also limits credit scores to 620 for loans with SFDPA unless HUD is able determine a premium structure for these loans that would offset the risk to FHA. This is interesting because SFDPA providers cite that they assist minority and low-income borrowers. Yet, according to statistics taken from the “Brill Report” posted on the Ameridream website, 48% of borrowers using SFDPA included in the data set would have been displaced by H.R. 600 for having credit scores below 620. While it is not clear whether limiting credit scores would impact low income or minority borrowers, the opening statements of Maxine Waters at the Financial Services Oversight Hearing on “Credit-Based Insurance Scores” October 2007 is cause for alarm”

Data is now showing that the number one indicator of defaulting is negative equity. There are many reasons for defaulting on a loan but negative equity is a leading cause. Like smoking for lung cancer. The notion that simply using a FICO score is sufficient to assess the ability of someone to buy a home is insane. This is like using the credit agencies AAA rating as some sign that a company was worthy. Need we look at Bear Stearns or Lehman Brothers or AIG to see how magnificently that worked out?

So why is this bill being pushed hard? Could it be that lobbyist are contributing some $300,000 for this purpose? There is much money to be made in pimping SFDPA bills. Now let us logically think for a second. Don’t you think that the number one way to afford a home is ummmm…let me think…THE PRICE OF THE HOME! How is inflating the price of the home going to help someone with a lower income become a homeowner? It isn’t. And since when was it a smart idea to make everyone a homeowner?

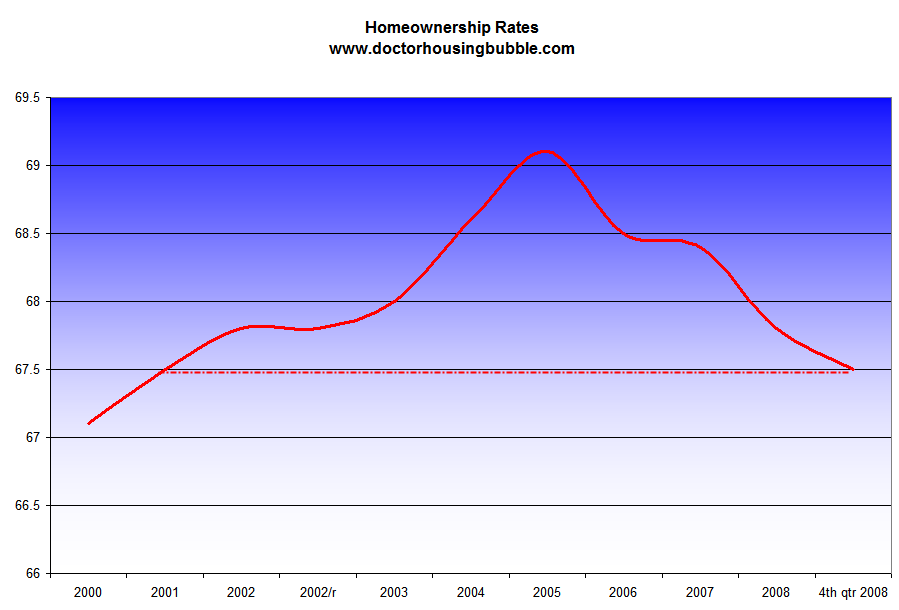

That is another perplexing question lingering out there. Since when was it a right for someone to be a homeowner? You work at being a homeowner. You save for your down payment. Why? Because it shows that you have the discipline and dedication to forgo spending money on a new car lease or eating out every night and maybe spending 2 or 3 years to have a nice chunk of change to buy a home. Why? Because if you spent 3 years saving meticulously for a down payment, you’d be less apt to moonwalk away from your mortgage like tens of thousands are doing right now. And by the way, that push for higher homeownership earlier in the decade has now faded in the wind:

Getting people into overpriced homes with toxic mortgages is never sustainable. That is why for nearly 40-years, the de facto way to keep a relatively stable housing market was:

-sizable down payment (10 to 20 percent)

-30-years fixed mortgages

-verifying tax returns and income

-assessing borrowers ability to pay

I can’t believe that we are still not learning any lessons from what is currently going on. Instead of actually learning our tough lesson that mathematically, someone with very little income is not going to be able to buy a home no matter how much down payment assistance you give them. This also applies to someone making $100,000 trying to buy a $500,000 home. Yet it would appear that Washington and Wall Street look at things one dimensionally. The big banks are using the U.S. Treasury and Federal Reserve to absolutely fleece the U.S. taxpayer since they run around with impunity while trillions are put at risk for their irresponsible behavior. Then we have some in D.C. trying to push SFDPA which is nothing more than government sponsored ninja loans. So we are looking at FICO now as the gold standard for purchasing a home? You have got to be kidding me. What have we learned with the credit rating agency debacle?

The problem as you can see and what this fallout has taught us is that it is not good to get into a debt cycle where the only way you can keep going forward is by using a model that relies on larger and larger amounts of pyramided debt. The messed up notion of this all was that it was built on the false premise that housing prices always go up. They don’t. Especially when you inflate the bubble because of:

-A corrupt Wall Street system

-Complicit and bought out politicians

-A media pimping itself to advertisers, many who were in cahoots with Wall Street and politicians

-A society based on consumption

-A system based on debt financed by the world

All this is tied into the extreme fallout we are now dealing with. Do you know why it is so hard to determine how to fix this problem? The reason it is so hard to put your finger on one solution is because so many pieces of the puzzle are in the game. Just think of all the bailouts we have done so far:

(a) Bear Stearns

(b) Lehman Brothers

(c)Â AIG

(d)Â Citigroup and Bank of America (and other TARP participants)

(e)Â Fannie Mae and Freddie Mac

(f)Â FDIC bailout

(g)Â Federal Reserve lending money through the alphabet soup facilities

These are only a few of the issues at hand here. The SFDPA programs are an absolute waste of money and do not have any empirical evidence showing higher SUSTAINABLE homeownership rates. So what if you can get someone into a home for 1 or 2 years. How does that benefit the homeowner if they are struggling after 2 years and lose their home due to foreclosure? At the end, not only have they lost their home but have ruined credit (so how is the FICO score going to look after this?). Of course, those pushing SFDPA don’t care much like the street pushing mortgage brokers that had the only incentive to get their commission off the top. If you default in 1 or 2 years, who really cares since they got their nice cut. Same applies here. The market has washed out much of the mortgage brokers. Yet here we are trying to create a government-sponsored no-money down program? How absurd is that!

In addition, what is so wrong with renting a home until you are financially ready to buy a home? This is something we need to be talking about because this is part of the solution. In fact, in many areas of this country homes are now going for $75,000 to $100,000 where if you and your family were making $50,000 a year, this would be completely within your realm of purchasing. All you would need to save up is $7,500 to $10,000 and you could then be a homeowner. Yet this instant gratification culture is so obsessed with debt that it can’t imagine a world without financial prudence.

Also, no one is going to be buying big ticket items with job losses coming from every corner of the country. So if you really want to help people, how about developing a sustainable economy built on production and making things instead of spending every penny on buying stuff? We have truly become a bailout nation.

Let me tell you a little story that I remember vividly during the housing bubble. A few realtors that I knew had this philosophy of how the housing system would work. If you were a middle-income family, your path to your dream home was simple. First, you would buy a small home in a questionable neighborhood and live there for 2 years. After 2 years, given that this was California and we were seeing 20+% appreciation each year, you would then buy a home in a “step-up” neighborhood with your equity and live there for another 2 years, after that you ideally would land in your “ideal” neighborhood and that was your path to the American dream achieved in only 4 years. I’m not sure how many people they convinced to do this but they are many.

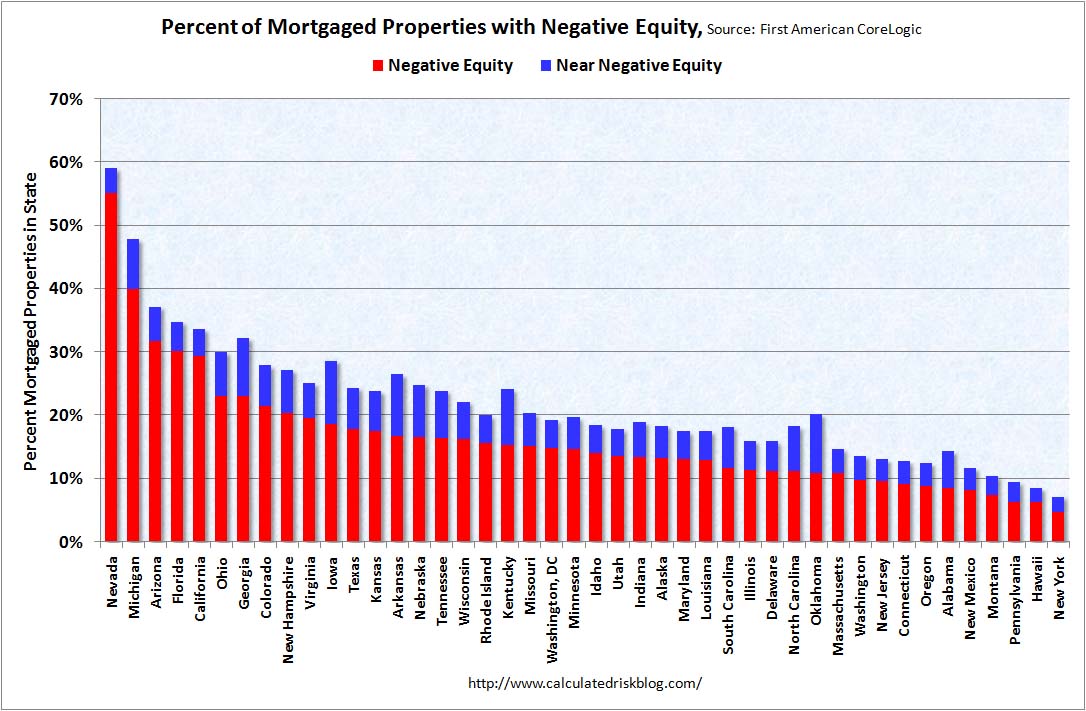

The only problem of course is once that appreciation stops, it is a massive game over. You are then stuck. If you don’t like the area, you can’t sell since you will need to come to the table with money. California with many other states are massively underwater now:

*Source:Â Calculated Risk

Your only option if don’t want to live there and are underwater is to walkaway and many are doing this. And that is the right move contrary to some financial hypocrites on the financial cable shows who want bailout money for banks while asking homeowners to tough it out like champs. I think I saw these folks on the previous Batman as Two-Face. The same is going on with these SFDPA programs. They say that they want to help homeowners but what they are doing is actually hurting homeowners. What is truly needed is the following:

(1)Â Reasonable home prices (3 times gross family income max)

(2)Â Stable employment markets (not many right now until the dust settles)

(3)Â Down payments (shows discipline to save money and having some skin in the game)

(4) 30-year fixed. End of story. I’d be happy to let a private bank go forth and make insane loans with their own money like Option ARMs or interest only loans but guess who ends up paying for it when things blow up? These crony capitalist want the government out when the game is hot but when things go flaming down, they are quick to stick out their hats for money at the taxpayer’s expense.

(5) Forget FICO. Look at tax returns and employment statements. Go back to a regional based lending system. Do you think someone making a loan from New York to someone in Phoenix really understand the local economy of Arizona? Of course not. That is why we are in this mess. Everyone passed the buck. The buck now stops at a local level.

(6) Encourage renting! You don’t go to graduate school straight from high school. You actually have to go to a 4-year college or university before making that leap. Why? It is assumed you will learn basic skills needed for the more rigorous world of graduate education. Same with buying a home. If you demonstrate the ability to save for a down payment, have stable employment, and go with a boring conventional mortgage congratulation, you’ve earned your homeownership diploma.

Is this too much to ask for?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

18 Responses to “Down Payment Assistance Backdoor to No Money Down? Seller-funded Down Payment Scams. The Government looking to resurrect No Money Down Loans.”

Someone mentioned on the last thread that you detail many problems, but seldom offer no solutions.

Well, you just did that, and they show logic and wisdom. Well done.

Someone should send these six rules to Geithner and Obama,.. stat!

We’ll call it the DR.HB. Housing Standards Act of 2009.

Doc,

Everything you say is absolutely true.

Common sense.

Our government has NO common sense whatsoever.

Soooooooooooo….kill them all.

Just kill ’em.

Kill all the Wall St. titans…kill most of the Congress(and and all that took

FIRE money, most of the bastards)kill the banksters…line ’em all up and blow their effing brains out.

These people richly DESERVE to die.

Their actions were/are treason…

30% of California underwater and we haven’t even seen the worst of it. Outlying areas have corrected, where now, the Westside gets its due. Alt-A and Prime defaults will dwarf the subprime problem. Moonwalking away from a mortgage with no money down, will become the latest fashion trend. This spring and summer ought to be eye-opening for the Westside.

West Hollywood and Venice are the first in the pool last month.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Dr. Housing Bubble for president!!!

The following representatives wrote and support this bill:

http://www.opencongress.org/bill/111-h600/show

Rep. Al Green [D, TX-9]

Rep. Sanford Bishop [D, GA-2]

Rep. Jim Costa [D, CA-20]

Rep. Barton Gordon [D, TN-6]

Rep. Henry Johnson [D, GA-4]

Rep. Eddie Johnson [D, TX-30]

Rep. Gary Miller [R, CA-42]

Rep. Albio Sires [D, NJ-13]

Rep. Debbie Wasserman Schultz [D, FL-20]

Rep. Maxine Waters [D, CA-35]

Rep. Robert Wexler [D, FL-19]

Rep. Charles Wilson [D, OH-6]

Everyone of these corrupt politicians who do not care or simply do not understand the problem need to be booted!

The funny thing is- DAP programs started back in 1992 and did not have any problems for years. Also, FHA is a full doc program-so a guy making $60,000 a year won’t qualify for the $500,000 purchase price like in the argument above. As far as down payments, FHA allows a gift from a family member or a long term friend- so do you think that should go away too since the actual borrower has no skin in the game? In the present marketplace, I have a customer who just two years ago put 20% of hard earned money into the transaction, and they are now upside down and walking on the home- this is a social issue with loan performance, not a down payment issue. It somehow has become OK to walk on a home that is underwater-no matter how much “skin” is in the game. I know Aaron, and he is dead wrong on this front. We have many qualified buyers who make the income and have good credit, but with the cost of living as it is, cannot save enough for a down payment. We won’t have a stabilization of values until inventory levels balance out-and we need those 1st time buyers to be able to buy. DAP’s are just one of many tools to help stabilize the economy.DAP’s were successful in a poor real estate economy back in the early 1990’s, and I believe will be today if monitored/administered properly.

SPDPA is only a minor factor of the housing bubble. When the mortgage bubble was at its peak and on a decline FHA mortgages only comprised of 2% of the market. Subprime loans are the culprit and not HUD backed mortgages. You are barking up the wrong tree here.

Feel the same way but messy and ugly. I say, boycott them. Don’t borrow even a penny. Ever. Pay EVERYTHING cash. Go live in a trailer at your parents place (yeh, I am). Save at the most dull small local bank you can find as much money as you can. Buy a house when you really want to live there, not ever as a investment, and pay CASH for it.

I’ve sooo had it with this government/banking/realestate mafia, trying to inflate, inflate, inflate and getting you and me into eternal debt servitude.

Mich

I can’t stand the bailouts to the banks. I’m 27 and would love to own a home, I have an ok job but I’m not sure if the job will be here in 2010. I’ve saved for a home my whole life, yes really, no BS. My family and I came to the US when I was a baby, and I was always told that owning a home was critical, BUT that you had to save first and not buy beyond your means. The criteria you proposed to qualify for a home loan make perfect sense to me.

Housing bubble in Germany near at the end of WWII

http://www.youtube.com/watch?v=bNmcf4Y3lGM&e

What if the seller is a bank, who coincidentally took TARP money, and they participate in a SFDPA program. Does that mean the tax payers have provided seller assisted down payment financing? 🙂

Also, I thought I saw an article in the Washinton Post 3/7 about FHA first payment defaults increasing. SFDPA will not help this issue. The real problem is mortgage brokers. 90% of their industry is corrupt (along with Wall St) and the rest of the world is paying for it.

“We have many qualified buyers who make the income and have good credit, but with the cost of living as it is, cannot save enough for a down payment.”

Wait a second. Won’t the monthly cost of a home EXCEED what these people are presumably paying now to rent a home/apartment? But these people live so close to the edge they can’t save anything for a down payment now? Or is it just that they can’t save 20% of say 500k , which is 100 grand. Ok, fair enough, it’s nearly impossible for most people earning average incomes to save that (especially after taxes). No argument there. But most people earning average incomes are in no position to buy a 500k house either! They couldn’t make the monthly nut on a traditional mortgage on 500k. And what about all the costs of home ownership like repairs. Can people without a down payment really afford those?

At the end of the day there is no way around it, houses cost too much at present.

Doc,

The rental thing makes so much sense. People are always moving to forward their careers and so forth. There is the foolish thought process that if you rent you are throwing your money away and if you buy it is an investment and you can live for free. It just ain’t so.

I used to sail a lot but never owned a boat. For a couple of hundred bucks, we could take a large boat out for the day, have fun, bring the boat back, get our deposit and drive home–none of the hassles of ownership, just the fun.

Some people buy time shares thinking that is an investment. I rented a house in Jamaica a couple of times shared with some great friends, had a ball, flew home. I didn’t have to pay for the maintenance, taxes, staff, all that. You just have fun and go home.

Buying a home is a giant commitment in a world with no guarantees. There’s no free lunch, but if you pony up a couple bucks, you can pay for a nice lunch. If you rent a house and save the difference, you can live the same way without the extra costs of ownership and buy something when you are ready. There is nothing worse than having to sell a house after you have moved to another state and are working hard to establish yourself in a new town at a new job. When you have to sell on a timetable, you often lose. Where’s the economy in that?

I know most of us hate to think, but it’s a good idea.

@ Koko

Interesting that the one Republican was from California–imagine that.

There must be a god because we as a species are too stupid to survive by our own wits…

I agree that this is not the same thing as the subprime and Alt A fiasco. FHA does require the customers to fully document their incomes and typically stay with a 29/41 housing/debt ratios. The old program was abused by the lenders and the builders but there were a lot of people that benefitted from that program. My first loan was a VA loan with no money down. I am now on my 3rd home and have $32,000 left on a $270,000 home. It comes down to personal responsibility and with the amount of inventory that is stacking up, it may actually help. A realtor charges a 6% commission. Does that the home is worth 6% less if you buy from a realtor instead of a FSBO?

DrHB,

How much do you think the bubble will be deflated 2 years from now?

Keep up the great work!

Tom

It seems that the system my grand parents used is still viable. They bought a small house. Then moved up. then moved up again. In their life time they had 4 houses. With many homeowners now underwater with their mortgage, the time spent in a house will be longer. Maybe 10 years. So if you bought a house at age 25, you can still move every 10 years and be okay.

Very important…get a downpayment.

A lot you are saying is true and a lot you are saying are not true. I am purchasing a home by downpayment assistance because of a disability I incurred and had to leave my career. The qualifications have changed drastically from the housing bubble burst. You do have a limit on the price of a home that you can buy based on your income, you are put through drastic screening and it’s not just walking up and taking classes. I thought once they were going to ask me to take a lie detection test. It’s going on 3 month now. I’ve qualified for the assistance and due to all the investigations they are doing, I am suppose to close on the 9th of January 2015, but it doesn’t seem like we will make it. I also had to present my birth certificate and definite you will not qualify for a loan thru FHA that your income doesn’t qualify you for.

Leave a Reply to Bob M