Day of reckoning for shadow inventory and distressed properties – 40 percent of properties in foreclosure have not made a payment in two years or more.

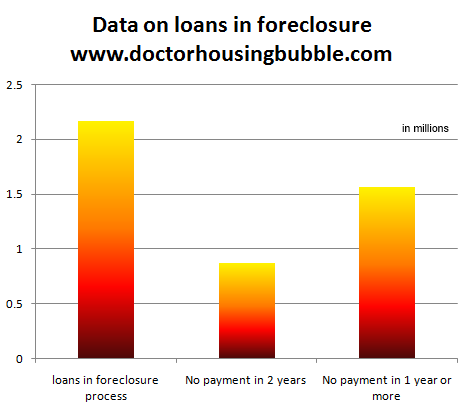

What we are witnessing on a large scale is an economy that has it completely backwards when it comes to banking and housing. Homes and the financial grease that keep the system running should be an extrapolation of an underlying healthy employment market. Today we have a misfit system of denial, outright corruption, and graft that is largely making our banking system unrecognizable. It is astounding to see how many people simply assume that the distressed pipeline has somehow miraculously disappeared. It emphatically has not. Data released this week shows that 2.17 million loans are actively in foreclosure. Of these loans, 40 percent have not made a payment in over two years! 72 percent have not made a payment in over one year! In essence, just like with our financial fixes, this has been the equivalent of covering up our eyes like a child fearing the boogieman and pretending there was no issue in the system. Psychologically you have many that bought in bubble markets the last few years trying to convince each other that they somehow made a wise decision simply because they did not purchase at the peak. The data on the clogged toilet of housing distressed properties shows us that we still have some serious plumbing problems ahead.

The pipeline of distressed properties sits at 6.37 million

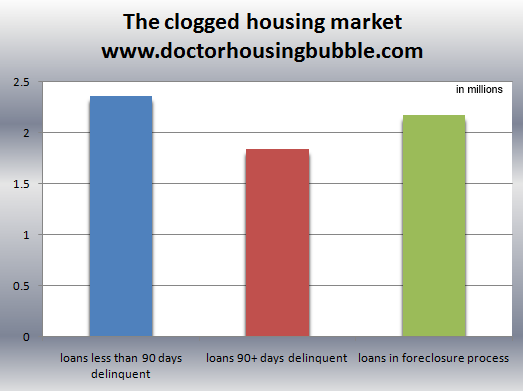

Given the dismal re-default rates and cure opportunities most loans that get behind will end up as lower priced sales either through a short sale or a full-fledged foreclosure. It might help to get a full snapshot of the current situation:

In all some 6.37 million homes can be considered distressed. This is a large pipeline. Given the astounding reality that over 40 percent of the loans in foreclosure have made no payment in two years, you can understand why the other two columns are brimming to the top. When we splinter out the foreclosure column the data looks daunting:

Not much has improved on this front largely because the economy is still mired in an economic mess and Europe is dealing with what else, a giant debt crisis. We are inextricability linked to global banking markets and our entire financial edifice rests on debt. Not just a little bit of debt but heaping amounts of debt. The game can only go on for as long as you can convince enough suckers to jump into the system to believe that the next decade will follow similar patterns to those that they know in the 1970s, 1980s, 1990s, or 2000s. You can rest assured that the upcoming decade will not resemble any of those.

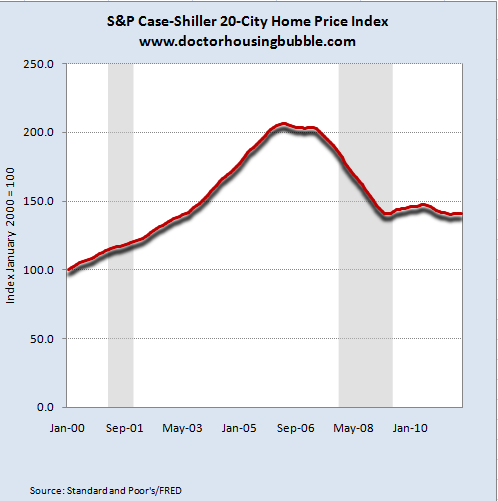

The name of the game is confidence. The housing bubble was largely a giant psychological ploy based on easy access to debt and a large cult like mentality that home values would only go up irrespective of underlying economic fundamentals. Bubbles work this way and play on consumer behavior and the flaws of our primordial brains. Deep down we still have a few things to work out and we are seeing these things play out on a global stage. Around the world you are seeing housing bubbles from Australia to China to the United States. Prices have done very little in the last four years after collapsing:

Those that make the case for diving in right now usually have simplistic visions of the new financial system. The dynamics of the current system move much faster and some are using outdated models and assuming the demographics of yesterday will apply to the future. These people even miss simple benefits of renting; like the flexibility offered especially for younger professional couples who need to move around and with careers shifting so quickly, many may end up in New York, Chicago, Los Angeles, or any other large city. Renting provides quick mobility. Buy now and you can expect to stay put for a very long time. I’ve talked with a few younger and bright professional couples and some are actually very happy to talk about renting. Even four years ago this was rare to hear. Today the one’s arguing for buying in this market may largely be justifying their purchase and assuming some kind of Mad Men era of prosperity.

A quick glance on Realtor.com shows that roughly 4.3 million properties are up for sale nationwide:

The clogged housing pipeline is up over 6.37 million! I find this comparison interesting because much of the distressed pipeline is behind the scenes. Take California as an example:

Non-distressed for sale:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 169,000

Notice of default:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 85,000

Scheduled for auction:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 55,000

Bank owned homes:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 64,000

The bank owned category is large at 64,000 but more troubling is you have 55,000 properties scheduled for auction that are likely to be inventory shortly (even after delaying the inevitable for years). What will this do to prices? Push them lower:

CA median price

September 2010:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $265,000

September 2011:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $249,000

Keep in mind the above price decline has occurred from a peak median price drop from $484,000 in 2007. Maybe the 22+ percent underemployment rate has something to do with it or the fact that with lower wages, more money is being floated to housing and taking away from the productive side of the economy. Ironically some of the best boom times for the nation occurred when home prices were moderately priced and people didn’t need maximum leverage to squeeze into the party dress house to think they looked good.

It is interesting to hear some people have a “I got mine so screw you attitude†when it comes to housing especially when many of these people have children. Are they happy just kicking the can down to future generations to deal with? So far that has been the strategy in dealing with the banking and housing collapses.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

80 Responses to “Day of reckoning for shadow inventory and distressed properties – 40 percent of properties in foreclosure have not made a payment in two years or more.”

I was wondering if you know how many homes total have been foreclosed upon since the beginning of the housing bust? An article I read implied the number was around 5 million and that 4 million were subject for reviews. I was just curious if you knew the actual number.

JLP

The stats are all over the place. That’s why I love this blog and a few others. Rick Sharga, the former V.P. of RealtyTrac (now with another firm) was interviewed in Housing Wire just the other day. I thought he had some interesting things to say.

http://www.housingwire.com/2011/10/31/sharga-several-more-years-with-nearly-1m-foreclosures-per-year

According to RealtyTrac 8.9 million homes have been lost to foreclosure since the bust began. Astonishing!

You can expect the current house of cards to be proped up until after the elections in 2012. Everyone in office has an incentive to keep this going for one more year.

After the elections next year, we will see all the necessary corrections come to fruition.

You would have to be insane to buy a house this year.

I think your right on the money. I wonder how large the correction will be after the elections when O and Company have been shown the door by the voters and electoral college?

J said, “I wonder how large the correction will be after the elections when O and Company have been shown the door by the voters and electoral college?”

Have you noticed that the media has already gone to absurd lengths to keep almost all mention of Ron Paul out of the main stream news sources? And as soon as Cain got a little traction all this negative stuff comes out?

I wouldn’t be a bit surprised if they call off the election for some contrived reason. At the very least, the so-called election will be between Obama and an Obama clone, probably Romney, the inventor of Obama-care himself, in Mass.

The bottom line is that the banksters are in firm control, and it is certainly going to stay that way. Since they seem to adore Obama, you might be right about the delay in the avalanche of bad news for a year, but it won’t matter who wins. You really gotta be in love with your job, neighborhood, schools, etc. to buy a home now. I’d wait a few years if I was in the market for one.

You really think one of these so-called Republicans can win? HAHAHA!

I think the correction will be larger if O is re-elected. He will be a lame duck and no longer so interested in kicking the can down the road. Of course he could be for his party, but certainly not for his sake. Whereas a new candidate facing the possibility of 8 whole years ahead of them, lets keep the can kicking. Eventually you can’t kick the can down the road anymore anyway. Not eventually. And so maybe it’s better if we just got it all over with.

Sadly, I have to agree with Tom too. What a nightmare of tomfoolery.

If I can only keep my house-demanding wife under control for a couple more years….

Sold my house in 2008 and I love renting, all the while watching the stratospheric listing prices drift ever lower despite all the government programs funded with borrowed taxpayer money and RE spin.

Last weekend we ran into a RE agent out walking her dogs. When my wife told her wistfully that we were still renting, the agent enthusiastically told us now was the best time in years to buy a house. I didn’t want to be rude in front of my wife, but I felt like slapping her back into reality. The best I could do was point out that the house we are renting has lost 300,000 to 400,000 in valuation during the time we have rented it. That shut her up….

Suzanne researched this!!!!!

I bought a house this year, but what is sad is the main reason I did it is because when I can’t pay the mortgage anymore either, I know I still have a place to live for a while. One of the LEAST of the reasons was looking at it as an investment as you hear so many parrot about home ownership. They don’t realize even if it was paid off, our government of fear can take it away at a moments notice. I miss the apartment life now though. I had a LOT more free time.

You are right on the money, or political contributions that will come in for both sides of these wolves dressed in sheep clothing. It will not be until after the election.

Every election there’s a main theme, one was family values, in an other, the gulf war, the second the war on terrorism, this past one change, supposedly we Americans having alittle part or say in team Obama. Of course this next one will be with jobs and with maybe alittle side order of flat tax. I’m for neither party, the only one I would vote for is the good Dr. because he speaks the truth, and hasn’t sold out to any lies, no he has uncovered them for us and exposed them for what they really are. Again he was the early voice talking about shadow inventory, even before we started to hear the word on the news and internet.

It’s hard to say what’s going to happen, look what we hear about Greece today, the stock market. The only thing we can forsee, is taxes going up, prices for food up, services being cut, and the housing market prices continue to be inflated by the hand of our government. Also the politicans being pawns, paid for by corporate money.

We are the damned best country, I love America, glad to be born here. Proud to be free,

God has blessed us.

Just hope the politicans would quit thinking of themselves, and do what’s best for us the citizens…..

I assume that most housing interest rate risk and loan default risk is now under the federal government (aka the tax payer). My question is if the goal of the Fed is to inflate our way out of the current crisis, does there not come a time when interest rates rise to accommodate the devaluation of the future payment of the borrowed money? Wouldn’t the cost of money (i.e. new rising interest rate) erase any gains from the lower valued principal if the bond market, not the government, determines the interest rate in the end? Would this not make the national debt more expensive as we turn over the debt? If this is the case, then wouldn’t we simply create inflation which would cause more uncertainty and in turn slow economic growth? Is it even possible to have runaway inflation with low interest rates over an extended period of time? The other question I have is how do you cause inflation if the labor market has a great amount of slack? I am under the impression that we would need wage inflation to support the price inflation. Wouldn’t the only way for this to work would be for all workers to receive an annual COLA? I thought that the COLAs included in most labor contracts during the 70’s was one of the reasons that you could have “stagflationâ€. I don’t see much COLA going on in our current economy…

You know, the way you’ve written this, it’s really hard to answer your questions. I’ll just deal with a couple. Yes, at some point interest rates will rise, but the Fed, along with the major Banks, have about $300 Trillion in derivatives that they are using to manipulate interest rates, and keep them low. So interest rates aren’t going to rise soon, barring a Black Swan coming along.

Yes, the Fed’s goal is to spark inflation. That they have failed to do so in housing, in spite of massive intervention in the housing market, should be a clue that they have no idea of what they are doing, and are pretty powerless, in this regard.

Yes, the debt will eventually get out of hand. The basic problem is that they are trying to solve a debt problem by using more debt. This is impossible. But, I kid you not, they not only think they can, but are really pursuing this approach with that goal. They think it’s the only solution and it will work. Some in this crowd have stated such, even recently.

That’s just one example of the Fed and mainstream Economists not having a clue as to what is going on, or how to fix it. There are numerous others.

The bottom line is that one can’t expect a return to a healthy economy any time soon. What you are seeing in Greece and Europe is guaranteed to come here. Most people buying a house in this environment will come to regret that decision, just like most have over the past 5+ years.

You ain’t seen nothing, yet.

Thanks for attempting to answer my question. Writing is not my forte as wydeeyed pointed out on another post. I think what I am really asking is the following:

Assumption 1: that interest rate includes the cost of money + “anticipated†inflation + interest rate risk + default risk

Assumption 2: the government has taken on interest rate risk and default risk by purchasing 2 trillion or so worth of MBS (Fed & Treasury)

Assumption 3: The higher inflation the higher the “anticipated†inflation component of the interest rate.

Question 1: How can the Fed control the nominal (i.e. less than %4) mortgage rate if inflation is higher than 4% over any period of time? Is it even possible to have this occur over an extended period of time? I have had the conversation with you on a prior post on the $300 Trillion in derivatives and I am still not clear who is on the other side of that bet. That is a very large number.

Question 2: How do you get inflation if there is high unemployment? I agree that commodity prices and import prices will increase as the dollar falls relative to other currencies but I do not see how we get runaway inflation with downward pressure on wage inflation.

In the end I am arguing that we can not inflate our way out of this mess because the increasing interest rate will eliminate our gains in lowering the value of the principal. I am not even convinced that the Fed has the control over the long term of decoupling interest rate and inflation rate (i.e. high inflation and low interest rates).

What am I missing?

@What?

I’m not sure which interest rate you’re referring to. Treasuries? Mortgages? The former tends to serve as influencing the latter, but the two are not directly linked. Loosely coupled is a better way of looking at it.

Both are ultimately determined by the market, and people’s judgement of things. The Fed can set interest rates all it wants, but under normal circumstances, it’s the buyers who decide if the price is right. When it isn’t, you have a failed Bond auction. The Fed almost had one back in June, 2009, IIRC. So right now the Fed, in collusion with the big Banks as their Primary Dealers, has been the primary market. Somewhat similar to what we see in mortgages.

In short, toss your assumptions out the window. So much is rigged, that it’s not funny. What we have is Crony Capitalism of the worst sort. I hope that answers question #1 as well.

For question #2, it depends on what one means by “inflation”. Thinking of inflation as simply a rise in prices is not useful if you want to see what’s going on. The most useful definition (from a variety of Economists of widely different camps) needs to include both Credit as well as money. Credit is 95% of the money supply. And that has been decreasing since 2008. Thus we are in a depression, and won’t get out of it until all the bad debt out there is cleared.

Instead of “price inflation”, it’s better IMO to think of dollar destruction. The Fed is trying every way to offset the collapse in Credit. One way is by “printing” more dollars. Keep in mind that dollars are simply IOU’s. I.e. another form of debt/credit. This is one form of credit that they can control, since there are so many bad debts out there.

But it’s a small part of the equation, even if it does impact people most directly.

You are correct that we can’t inflate our way out of this, with Credit being the vast majority of the money supply. And after a certain point, people question taking dollars. Most notably with oil. The Arabs are not stupid. They currently insist upon partial payments in Gold. You can see some of that in Federal reports (either each year or quarter, I’ve forgotten which). But the gold payments to the big oil countries is classified. It’s only reported for the smaller Countries.

Destroy the dollar, and then we have to pay in gold, or cut back on oil. So yes, the Fed is contrained here, even with Reserve Currency status.

Only after all of the bad debts are out of the system, THEN you can (and probably will) see serious inflation, and probably hyperinflation. Or rather, the end of the dollar. All fiat currencies collapse. Every single one has. The longest has lived 90 years. I think the average is around 40 years. We went fiat back in 1971, with Nixon going off of the gold standard.

So that is the path to inflation. But you’ll have to survive the depression first. I hope that helps you understand what’s going on.

“I got mine so screw you attitudeâ€

Ah, truer words could not have come such a socially-conscious boomer….

1. I got mine…education, all paid, I’m not paying for yours.

2. I got mine…college degree, all but paid, I’m not paying for yours.

3. I got mine…retirement paid, and I’m not paying for any of yours.

4. I got mine…housing cheap, and I’m only selling at an inflated value.

5. I got mine…let’s kick the can down the road, I only have another 25 – 40 years here!

With all due respect, you are ranting the usual media meme and ignoring convenient facts.

Many of us older than you–

1. Had parents who paid for our private schooling (while paying for others’ who didn’t use it nearly as well) by scrimping and taking second, even third, shit jobs. We repaid them by taking care of them till their deaths and making sure they wanted for nothing–out of our paychecks, and without fancy schmancy financialized instruments to externalize the costs onto others.

2. I paid for my own college education. AND my Ph.D. program. (Technically the latter was paid for by a billionaire family who thought I was a good bet for their investment. Where did they get their money? They used stock market speculation and other financial methods to skim it from the productive class.) I repaid that by advising every young person I ever talked to, or whoever advised me, not to go into debt for higher education, and by spending endless hours, for free, giving that advice where asked. The number who listened was painfully small.

3. There will be no retirement for people my age. We saved, our savings have been systematically and repeatedly looted, and the future looks like the GOP rallying up the young for a generational war where elders are sent to the Soylent Green factory so the youth can continue thumbing buttons for pixelpellets of brain stimulation. I and my partner haven’t had a vacation in ten years. We work. Period.

4. If I were to sell my house today–which we bought after having saved up a 50% down payment and refused crazy financing schemes–it would be worth about what I paid for it. By contrast, the salaries of the young people looking to move into neighborhoods like this one are so fat, and so are their expectations, that they still don’t want a modest American house on acreage. They want an Executive Home and at least 10 acres. The expectation bubble is alive and well among upscale young professionals–many of them in the Social Oversight (i.e., “services”) and Cashectomy (“health” “care”) industries.

5. I’m not kicking any can down any road. I continue to make the same frugal choices, and base major decisions on that, that I have all my life, through multiple recessions, through the rape of the Rust Belt in the 1960s (a decade media-consecrated to tie dye, bongs, and mud-humping–when it wasn’t like that for most of us at all), through the oil embargoes, through the S&L crash, the tech bubble and crash, the housing bubble and crash.

I refuse to whip out the pity violin for people who screwed themselves with debt. The writing was not only on the wall, it was on outstanding blogs like Doc’s and others’ back to the early Aughts. I found DHB in 2006, feeling I was going to go bananas watching the madness all around us. And I’d been reading Nouriel Roubini, Steve Keen, M. King Hubbert, and Jim Hansen for decades.

Just because, for many younger people, their expectations of irrational exuberance have given way to tantrums of doom does not mean anything. When 800,000 people in California alone get to live for free in their houses, after I and other working people have bailed them out, my sympathy is in short supply, and my willingness to be cast as whipping boy for a bunch of financial Peter Pans is even less.

Beautifully said! Thank you!

This was nicely written and I agree, you did it right and lived a solid life. You shouldn’t be lumped in or scape goated.

I will say though that the majority of baby boomers did not behave as you did. There is one thing that you can look at for insight into the state of the majority of baby boomer balance sheets. All of them know retirement is getting closer. Wouldn’t they be looking to pick up a retirement property or condo on the cheap buying a bit ahead of the curve while prices are depressed and financing for qualified buyers with money down is cheap? They certainly were doing so in 2000-2007. I’m a bit young for that but I would buy early with today’s financing if I was relocating for 20+ years of retirement. The fact that Florida, AZ and other retirement heavy communities have anemic housing demand and the vacation house market is dead says it all…most boomers are already in too deep and leveraged to the hilt.

There are exceptions to this and people who did things right but on the whole a lot of them are finding themselves with their hand caught in the cookie jar and getting a whole lot thinner. There is a reason people feared taking on debt after the depression, it took many years to forget and for financial leverage to become and every day thing again. Cycles repeat and we are working hard to mitigate the pain this time around but make no mistake, the cycle did turn and I don’t think there’s any way to go back.

This has nothing to do with age or ones entire generation. I’m 28 years old, my husband and I have both worked our way through school without having to take out student loans. We have lived well below our means for years trying to save up a large down payment for a house and our eventual retirement. We never had any trust funds or help, we have just worked hard and saved our money instead of buying fancy cars and going on vacation. Yes there are some of my generation that are spoiled brats whining about how they can not afford their BMW and their ridiculous student loans. On the other hand there are also people from my parents baby boomer generation that are whining because their house is worth less than what they owe on it after blowing their HELOC on lavish vacations. There are morons in every generation, sadly those of us who are responsible will ulitmately pay the highest price.

In short, Compass, you took responsiblity for yourself. Kudo’s to you for being one of the few upstanding Americans that has the nerve to tell it like it is. I’m where you are – excepting I don’t have the Ph.d, and as an early Gen-X’er, I’m flabbergasted at what the BB have done to the nation as a whole. I see it in my own family – the greed. My hope for the Millenials is that they come to terms with the changing financial landscape and lower their expectations for “things” and focus instead on each other. Only then will the pursuit of housing (which is a “thing” in my book) be modulated to pursuit of a home instead of an investment. Thank you for writing such a well written post.

The America you grew up and prospered in no longer exists. I don’t expect you to grasp that as I’ve read enough of your comments to know you won’t. The fact is Baby Boomers – Specifically Republican Baby Boomers have made a mess of our country while oppressing GenX. We are now armed with a critical mass of support of population % as the Millenials are coming of age and joining the ranks of the oppressed.

Maintain your self righteous, condescending attitude at your own peril. We will fix our country without regard for whether you like the change or not.

There is no cake.

That was a knock-out, Rose…what a piece of writing. Love it.

Ignore the geezers who will whine they didn’t have anything to do with letting our society rot while benefiting from it’s best years. You are right on the money. Gen X and Millenials works longer hours, with better educations for a lower standard of living and no job security but somehow the aged can’t figure out what’s wrong.

This warfare between groups of Americans is just what the Republican “I got mine screw you” party wants.

In Germany it was the Jews who were the cause of hardships on the working Germans, now today, it is the elderly.

There is plenty of money to finance the retirement of the boomers. We just don’t have enough to spend more on our military than the rest of the world COMBINED and fulfill the social contrac..

As far as any particular generation that is to blame for the dismantling of the middle class, that is horse pucky and Paul Ryan is proof of that.

I don’t yet have everything that you mentioned. I do have my college degree, though. And what I do know is that we work hard for the things we want in life. We shouldn’t sit back and expect it to come out of the pockets of other people who are working hard for what they want in their lives.

If everyone got everything they wanted/needed for free on the backs of others the nobody would get anything at all, because nobody would want to work like that only to have it taken away and redistributed to others that the government deems more deserving than those who earned it.

Kicking the can down the road, though, is immoral in my opinion. It’s as if our society has taken on immense debt in order to throw a really wild party for years while expecting our kids, grandchildren and others in the future to pay for it all. We should pay for how we live and they should pay for how they live, but what we are doing is setting them up to have no choice buy to be paying for how we lived so irresponsibly all these years.

Great post. Long-term public debt is exactly that. Putting bills off to the next generation because the current generation wants something for nothing.

tbgpalisades –

Wow – that attitude is exactly why this country is going down the toilet. No one should be forced to pay for anyone else’s education, house, retirement, etc. The sense of entitlement to someone else’s money/property is unbelievable.

And BTW – I’m a Gen-Xer.

No payments in 2 years!

How long will it be before we start seeing significant non-payment stats for 3,4 or even 5 years?

So I buy a $500k house at 3.5% down ($17.5k), add $10k closing costs. Total monthly is what, $5k?

Make one payment then stop. Lose the house after 25 months. For a $27.5k investment, I live in a place for two years or $120K of missed payments or about 25 months of $2.5k rent or $60k housing savings.

Looks one could reduce their cash flow by about $2k a month for two years or more by gaming the system like this with a $28k investment. Break even after one year or so.

Am I wrong?

You can try to game the system, but the banks will game you. They don’t foreclose because it’s in their interest. If you are underwater by hundreds of thousands of dollars, they can’t afford to write you down just yet, but when you are just about even, they will foreclose in a hurry. Not to mention all the other issues you will deal with such as credit rating and tax liabilities. Why don’t you try and let us know how it works out.

Yes, please, please go ahead and do it – can’t wait to hear back from you in 3-6 months whining about how banks picked you to foreclose on in record time 🙂

The less you’re underwater (in absolute dollar amounts) the less likely you will get to squat…

Trying to rent later, with a trashed credit score in a competitive environment, is a really bad idea. You’ll probably be looking a paying more, where there are fewer questions asked if you have the cash.

So, be certain to save up that cash and not blow that, too. You’re going to need it.

Whoops.I forgot what everyone else is forgetting. Unless you do this right now, today, the IRS will come after for the difference between what the loan was for, and what the Bank ended up selling the house for. Obama deferred taxes on such “profits”, but that expires this year, IIRC.

So that $60K you “made” could easily be eaten up by taxes, with you still owing more.

Come to think of it, this point notably shifts the outcome in the Doctors’ article, and deserves mention.

Not that I was thinking of actually trying this gambit!

Good objections but I do question the assertion that the nearer breakeven a delinquent loan is the faster they will foreclose. Seems reasonable from an accounting point of very but banks don’t SEEM that efficent or effective but I could be wrong.

The tax issue is interesting.

I think people need to ditch this notion anything is being done legitimately. How do we know any of these figures are even close to accurate?

These crooks can say and do anything they want. They can simply make-up reports like they make-up more cash as needed. It is extremely dangerous to assume anything is being done honestly. Dangerous to rely on firms which have been proved manure spreaders. Why trust anything S&P says? or case-shiller? nobody trusts the Government, why trust these quasi public firms?

The entire thing is one massive Shell Game. The only real number which counts is local wages and historic percentages of that income for housing.

I wonder if this is part of the set-up for the hedge funds that are going to picking up these properties for pennies on the dollar???

I live in a small, expensive town on the central California coast. In 2003-2005 they made a small new housing community in my town. The homes sold from about $700K, up to over $1.1 million! The interesting thing about this is that these were “normal” homes – not mansions, and certainly not in an upscale, wealthy community.

Reality is now setting in like the Bubonic plague. I told my wife 2 years ago that 90% of the people in the community will end up losing their homes. She didn’t believe me, but now that is coming true. Many of the homes are empty, many others have “for sale” signs, and I wonder how many families which are still there have not made payments for months or maybe years.

Many of these homes which sold for close to $1 Million are now selling for about HALF their selling price! How many other investments can a person/family lose a half a million bucks on ??!! It is devastating.

The families that have held out and are still paying on their homes are unfortunate in one big way – think of all the money going into a home they vastly overpaid for and which could be going into other good uses – buying cars, savings, paying for their children’s college/school, starting businesses, taking vacations, etc. Many, unfortunately, are slaves to their gigantic mortgages.

I am convinced that the housing market is in GRAVE condition, and will not improve for many, many years. Housing prices still have only ONE direction to go in – and it’s NOT UP.

The family living in the house does not loose a half a million dollars. The owners of the debt loose the half million dollars. You do not own your home if you have a mortgage. The debt holder owns the home and any loses over the 0 – 3.5% down payment. My guess is that the mortgages on the houses you describe are included in numerous mortgage backed securities. The really sad thing is that the Fed and US treasury own a great deal of these. So, in the end, you and I as tax payers will loose that half a million dollars many times over…

The family living in the house does not lose a half a million dollars. The owners of the debt lose the half million dollars. You do not own your home if you have a mortgage. The debt holder owns the home and any losses over the 0 – 3.5% down payment.

There I fixed it for you. I sure hope you aren’t one of the complainers about teachers. Just because spell check does not recognize bad grammar does not make your word right. Loose is a term related to things like bolts and someone blowing cash on an overprices house as in: He is loose with money. Things are lost as in “lose a half…” and loses is not a word the word is losses ( a hint on how to spell lose).

By the way it is not true that the lender owns your house – you own the house, trust me on this the lender is not going to pay the taxes. The lender owns your debt, your house is collateral for the debt just like your knees are the collateral for Tony the jaw breakers fronting you that 4 grand. Pay up or get a busted knee. Pay the loan or lose the house. Simple isn’t it. Now don’t lose sight of making those payments cause your knee cap will get kinda loose. Got it yet? Pass it on to the rest of the notdeepthinkers on the internet.

Thanks for the grammar check wydeeyed. I have a simple question for you. Who has the physical deed? That is like saying I own my car when the bank has the title… I will let your personal attacks go as you are just another laptop gangster (someone who is really tough on-line but in person not so tough)…

Wydeeyed and Questor, The question of who actually owns the house is interesting. But, I have to side with wydeeyed. The bank owns the debt. The “homeowner” actually owns the house. He or she is responsible for taxes, maintenance, and liability. Kind of a sweet deal for the bank. They keep the deed, we keep all the payments and responsibility.

I would say the opposite. The bank owns the house and we own the debt. I would ask the following question. I rent a car from avis. I am responsible (if you read the fine print) for the car and all that happens to it while it is under my control. And guess what! I am responsible to pay taxes if you read your statement! Does this mean I own the car? I think we believe some strange things that the banks have taught us over the past hundred or so years. I will always go back to the fact that the bank has the title/deed to the asset. Just because we are responsible to make payments (rent to own) does not mean that we “own†the asset. We control the asset as we do when we rent a car from avis. But if you miss a payment the bank takes the asset (i.e. takes back the rental car).

I think I know this city, or at least a location which is similar. The place I’m thinking of is really disgusting. They took a nice piece of land, shoved as many houses on top of it as they could get away with, put a wall around it (though not quite gated) and sold it all to a bunch of suckers around 2005-2006. People with more credit than brains. And certainly no taste.

This whole yuppie ghetto is now seriously underwater, and the owners there are stuck.

And there are many, many other similar yuppie ghettos around, if you look. Basically any new development after 2004 is in a similar boat. Nice neighbourhoods. nice cars, nice schools, and all of it is a freaking mirage. Every owner there is too broke to be able to sell and move.

I once suggested that the Doc do a theme on underwater yuppie ghettos. Might be a nice filler when there’s a slow news day. Which, alas, is not now.

The course of action is obvious. This is the time to buy a home. A person locks in rates unheard of just 5 years ago and gets to live in a home at rock bottom price in excellent locations. When inflation hits and it will, my payment will be made with cheaper dollars. Plus this investment is one I live in. And my payment is cheaper than rent. Plus I get interest deduction to boot.

Lastly, rent is a suckers game. My parents did it and all the had after 30 years was a box of cancelled checks. My rent is fixed for decades. Trust me, the people who rent now will pay twice the amount in ten years.

Bob

Bob, I heard the NAR is having their annual convention in Anaheim this year. Be sure to book your tickets now or you’ll surely miss out. 🙂

Rock bottom prices in excellent locations…you better check your facts man. Any decent area is still inflated.

If inflation hits and interest rates skyrocket, what will that do to home prices? Probably not a good thing unless you have massive wage inflation to go along with it.

You keep telling your scary stories and I’ll keep renting!

Like 🙂

We have rented in the south bay since 2008 and have twice renegotiated a lower rent. It turns out that a renter that takes care of a place and pays on time has quite a bit of leverage. I guess more than just home loan renters are not the only ones who want to live in a place for free. Landlords are having a tough go of it right now.

How does one respond to this… You are RENTING the money to maybe own the house that you think you own. You need to include asset depreciation in any investment decision. Why does this seem so alien to RE agents? Maybe it is because you make money on other people’s bad decisions?

Banksters have so utterly destroyed housing that inflation will not effect it. Also we are entering a hyperinflationary depression. This means food and products will be very expensive with high unemployment and no wage increases.

Heh. I take it you show up once and a while just to troll. If you had been reading the comments, you would’ve seen the one on the last thread where a guy was paying $200 more a month over rent, just so that he could lose $2,000 a month in his home price.

And he’s not the first one, just the latest.

Buying a house now is like buying Real Estate on the Titanic. You’ll be underwater shortly.

If inflation hits it is likely to be commodity inflation caused by the ever-sinking US dollar and increasing worldwide (non-US) demand. Rising prices for food, gas, electricity (not to mention health care and education that have been going up forever) mean less money remaining for housing in an environment of stagnating/declining median incomes — this is a negative for house prices and rents.

Mobility is same as a renter, if your overhead is less than equivelent rent, assuming you dont mind becoming a landlord.

There was no reply button for Jason Emery and Rhiannon. Here goes. Jason, if the elections are “put on hold” it will be because of major civil unrest in Chicago next May 2012 when the G-20/UN meet in concert. The last time the two met in concert was 1977 in London. Major unrest occurred. If this happens, it will make the OWS look weak in comparison. This is the perfect storm for O and Company to declare Martial Law suspending the elections. Then the question becomes how long will Martial Law be in place before its removed and the elections can proceed. This guy by far is the worst we have ever had in our nations history. Rhiannon, Mickey Mouse could be Obama. How can a guy be re-elected with such a horrible record? Think 1976-80 with Carter. We were in a touch patch then and the voters booted him. This time around we are in dire straits to the Nth degree. Remember that a very large voting block in the nation are the senior citizens. My bet is they do not want another 4 years of this goof. The electoral college will follow suit and O can be returned to Chicago.

J, you need a tinfoil hat. Did you forget to take your meds?

Hi J–Your reply to me was fine, except that there are other instances where he could invoke the so-called Patriot Act. If you read the Act’s fine print, it says that the government has the right to lock you up, with no right to an attorney, bail, or other niceties, for any reason, or no reason at all. Probably a clause on the suspension of elections too, but not sure about that one.

Regarding your reply to R., I think you have your demographic blocs backwards. The elderly will be scared out of their wits by the coming scare campaign coming from Obama. Barrack will say, to a large degree truthfully, that any attempt to balance the budget will cause a gutting of social security and medicare. Of course his plan to kick the can down the road with more borrowing will have the same ultimate effect, but it shifts the burden to a slightly younger crowd. Also, the elderly have, to a large extent, paid off their mortgages. So they are less vulnerable to the foreclosure monster. Their heirs might be in for a surprise, at house selling time, though.

Besides, the elderly mainly vote Republican anyway, so Obama has not much to lose there. His electoral problem is that the youth are the ones that have figured out that Obama is a public servant of the bankers, and that their determination is to keep Americans deeply indebted, even if it destroys the republic. But how can Republicans exploit this? The Tea Party crowd, excepting Ron Paul, is either afraid of the banking elite, or in bed with them.

Here’s my prediction: Obama or a clone [Romney] will get elected in 2012, and the economy will go lower, either quickly or slowly, for four more years, until November of 2016. Then, Ron Paul (or similar) will finally be elected. Housing prices will have bottomed, unemployment will be much higher, ditto inflation, and the Libertarians and other new parties will get most of the vote.

Cancel the presidential election? Wow. Hard to imagine. The Battle in Seattle was enormous if you saw it in the media. I lived a few miles away. It was a nothing burger. The occupiers seem like a big force if you watch on TV, but are really a small group of people. There is no force behind them… yet.

How would a cancelled election play out? The order to stop the election would go straight to the Supreme Court. There is simply no constitutional provision to cancel a presidential election. In order for the cancellation to go forward, the Supreme Court would have to be actively thwarted. Hard to imagine that happening without tanks rolling in the streets. That would require the collusion of at least the reserves if not the entire military.

It does not seem to this observer that such a scenario is remotely possible.

When a loaf of bread is 10 bucks, trust me, wages will have risen sharply. Houses are not immune to inflation just like any other tangible asset with a limited supply and a floor of demand is not immune from inflation. Of course, houses are over priced and over supplied right now, and that is a “headwind” to the ravages of inflation.

But there will be ravaging.

And when houses are double or triple the nominal price now within 20 years (but really just the same value in inflation adjusted terms, or possibly even less), the one who made the decision to purchase an affordable mortage rather than rent will be sitting on vastly undermarket mortage payments.

You can take that one to the bank over time. Next three years? Who knows.

Homeowners will probably become out ahead, but not because of inflation as such as because of federal government policy. Just inflation alone would raise interest rates which won’t be 100% positive for housing. But really it’s not a free market but a rigged game, so I’m sure the government will come out with some bailout to avert this.

Inflation would be positive for home prices if you locked in low rates soon (albeit at what should be 20% lower prices). I think the sweet spot will be in 2013, when homeowners are feeling max pain, foreclosures are flooding the market, and interest rates are still at insane lows per the fed’s dedicated policy. Much beyond that and I agree with you, the rising interest rates will cause trouble.

I agree with Jay. If you are going to buy, waiting until 2013 will likely be a decent entry point. Prices are continuing to drift down (~5% or so per year), the pipeline of distressed properties will be bursting at the seems and rates will still be insanely low (Fed to hold rates low through 2013).

this is, of course, assuming you can keep your job.

A loaf of bread, Pan Bimbo, is 24 pesos in Mexico. That is about $1.75. The minimum wage in Mexico, what about one third of the country makes if they are lucky enough to have a job, is around 55 pesos a day, around $4.00. That would be the equivalent of around $15.00 for a loaf of bread in the US. Fifty precent higher than your hyper-inflation. What do think will come of this? By the way, most real estate in Mexico is falling in price.

While the price of things that people need (like food) is going to go up, what all of the silly housing inflationistas forget is that housing is primarily credit driven. Especially when there’s an oversupply of houses.

Take away the credit, and prices go down. The concept is pretty simple.

WIth the supply of credit going down, and still a long ways to go, there is no upward pressure on housing prices in the near future. This is THE key point that all of the inflationists are so incredibly clueless about. And seem destined to remain so, never mind that reality has been hitting them over the head every single day for the past three years. Illusions are funny that way.

Let me know when housing actually starts going up. But that’s not going to be any time soon. Food,, though, is a different matter.

Under what economic principal? I am not sure this works given our latest example of when gas is 4 bucks a gallon. I am not aware of any dramatic wage increase since gas was 2 buck a gallon…

My understanding is that in the countries in Latin America that had hyperinflation that the people with 30 year mortages did really well.

Essentially, they bought a house for 8x their income, got a 30 year fixed rate mortgage, then there was hyperinflation so their income went up 8x

suddenly their mortage went from being 8x income to being 1x income.

putting it another way, as long as your mortgage is fixed rate you should borrow as much as you can and hope for massive hyper inflation

The fallacy in that statement about hoping for massive hyper inflation is simple. If you are going to gamble like that, you will have to have a job to pay for that mortgage in extreme financial stress – and how many people can guarantee the income? No mortage is a bargain if there is no job to pay for it inflated dollars or otherwise. You are much better off mortgage-free and clear of the whole currency thing when the hyper inflation takes off. If I were shopping for a home, the only way I’d be buying now is to pay cash in full, and have the deed in my hand at closing.

Glad to see that somebody gets it… When Hyper inflation hits good luck paying for the basic neccesities such as gas and food…

I’ve got a couple of friends — one grew up in the USSR when they collapsed and one lived in Argentina during their crisis… Learned a lot from them… much more then you’ll learn from so called experts who have never actually experienced anything like what is facing the U.S. (I grew up in Germany until 1983…. I’ve got loads of $5 Million+ Weimar Marks that are worthless… Most of the old timers that lived through that period are long gone now.)

I recently paid cash for a dirt cheap property. Smallest place I’ve lived in for the past 15 years but it’s in a good area and it’s upgraded/comfortable. Cheap to maintain with no mortgage and no rent to worry about when the crap hits the fan. Made it a point to know as many neighbors as possible right away.

I also have my passport ready with some South American destinations in mind such as Argentina with some gold and silver on hand to take along in case it gets really nasty…. (Argentina is really cheap to live in nowadays…)

All of this class warfare rhetoric accomplishes nothing but gives the hoodlums some great excuses to do what they do best when the checks in the mail end. The Rodney King riots and Downtown New Orleans after HK are going to look like frat parties compared to what’s going to go down with our current “leadership”.

Everybody should take the time to learn from people who survived countries that went through a collapse…. they’ll all tell you that there were warnings if you paid attention but when the crap really hit the fan, it happened really, really fast. They’ll be the first to tell you though that their way of life when it happened made it easier for them to adapt. Here in the U.S. we have riots and people getting killed for Black Friday deals…. just imagine what these same people will do when they go hungry.

Love this blog for telling the truth about the true conditions taking place…. but some of the followers need to do some research and learn from other people that have actually experienced financial armagedon first hand…. and the really important things to concentrate on in order to survive it.

Best Wishes Everybody…

dafs Wrote:

“November 3, 2011 at 4:30 pm

My understanding is that in the countries in Latin America that had hyperinflation that the people with 30 year mortages did really well.

Essentially, they bought a house for 8x their income, got a 30 year fixed rate mortgage, then there was hyperinflation so their income went up 8x

suddenly their mortage went from being 8x income to being 1x income.

putting it another way, as long as your mortgage is fixed rate you should borrow as much as you can and hope for massive hyper inflation”

I just had to laugh when I read this. Finally a clear definition of the 08 election promise. Hope is pretty obvious but I sincerely thank you for pointing out Obama’s change plan. If I had only known I would have bought a half dozen houses or so as soon as he won the election.

The high inflation in the U.S. in the late 70’s and early 80’s actually caused house prices to fall. Home buyers did their purchase evaluations based on the monthly payment they’d have to make. When mortgages were 15%, home prices mostly fell so that the monthly payment at 15% was roughly the same as they would have paid if the mortgage were much lower. I had to settle for a 15% mortgage when I bought a home in 1982. The home had fallen in value to offset the higher interest rates, i.e., the sellers lost money when they sold to us. By the time we sold it several years later, rates had fallen to under 10%, which allowed up to get about 50% more for the house than we paid for it because the monthly payment stayed roughly constant, i.e., higher rate X lower price = lower rate X higher price.

The best time to buy a house is when rates are very high, topping out, and will fall. That will cause prices to go up and you can sell at a profit. The worst time to buy is a time like right now, with interest rates very low. The only way they can go eventually is up and that will cause home values to fall to adjust for the higher payments on higher interest rates.

Bernanke and the Fed don’t seem to understand much about the housing market and, consequently, their low interest rates are not stimulating housing but they are stimulating commodity prices worldwide, literally to the point of starvation in some very poor parts of the world due to exploding grain prices. And exploding grain prices have also caused another bubble to form, in farmland prices. The sale price of good farm ground (think Iowa) is directly linked to grain prices and grain prices have exploded in the past 5 years, due to the ethanol boondoggle and the Fed’s zero interest rate policy, and as a result farmland prices have shot way up as farmers expand while the good times roll. The same sort of farmland bubble existed in the late 70’s and early 80’s and when it exploded, tens of thousands of farmers found themselves deeply in debt on land that had devalued by 50% or more. That will happen this time too, just wait and see.

This is exactly my point! I believe we learned in econ 101 that interest rate includes the cost of money + “anticipated” inflation + interest rate risk + default risk. I am not aware of any way that the fed could inflate our way out of this. I believe the fed is simply trying to stop deflation.

Idiocracy: “You think Einstein walked around thinkin’ everyone was a bunch of dumb $hits?”

I think perhaps he did…

Yes that is the plan. Trouble is, only prices are going up. Since incomes are flat, you only get to pay more for taxes, insurance, upkeep, utilities, gas to drive to work and trash-can-photo-ops. That makes as much sense as giving hedge-fund billionaires tax breaks and thinking they will create jobs…

Hi dafs–I think you might be comparing apples to oranges. If some podunk little country devalues their currency, and wages and prices adjust accordingly, the only loser is the debt holder.

But the USA is the printer of the world’s reserve currency. You have already seen the ‘Arab Spring’ protests that resulted from some of Bernanke’s hyperinflation attempts leaking out into the rest of the world. And wages haven’t risen here a dime.

There is too much globalization now to get away with hyperinflating the dollar. That won’t stop the Bernank from trying, though.

Manhattan Dogs and Englishmen:

They have really emphasized the metaphor of kicking the Cannes down the road in Europe. The market swings wildly in both directions as the economic dogs want to have their mouths open when the European bailout spigot tinkles on Greece again…and again, and again. There is no solution to this debt problem short of default. And get in line–there’s like 180 other countries up to their Cannes at least in debt. Greece is about to take down the world it would seem, but I believe that California alone has more un-payable debt than that entire country. Looking for a bottom? Job was patient, but he would have just become a renter in SoCal these days. This is essentially a bottomless pit.

Anyway back to housing, and the good doctor’s writing on shadow inventory reminds me of the phenomenon of ‘housing shortages’ during speculative real estate bubbles.

I’m Australian, and my country is currently going through a doozyof a bubble. Reports abound in the media of chronic and and housing shortages (this in a nation the size of the continental United Sates with some 20 odd million people living in it lol). I’m wondering if the same brain washing techniques were used by the corporate media in areas like SoCal, Nevada and Florida, to free up more land for spec development (a lot of which would be vital for agriculture) to quench the appetite of the FIRE leaches?

The Dr’s logic and research appears impeccable. A housing bust caused by a major credit contraction will take a decade or more just to bottom out, never mind achieving the income to price ratios seen at the peak of the mania, which might occur again in a century or so. Anyone recommending buying or relying on hyperinflation to pay of your debts is either certifiably insane, a fool or a shill.

Lots of laughing…. Yep… I remember reading media reports back in 2005 for areas such as Las Vegas quoting cheerleaders screaming that there was a land / housing shortage and you’ve gotta buy now!! 1/2 acre sandboxes were selling for $500K…

Sounds like you’ve got the same thing going on in Australia today…

If I hear one more person talk about Obama fixing things in the next 4 year term I am going to explode. Why would anyone think that he cares about the little people when he has done everything in his power to protect, help, and empower the Banks that got him elected! Biggest Wall Street money maker in US president history, lowest fraud prosecution of any president in history after a crash the size of the Great Depression. PLEAASSEE educate yourself. He is not on your side!

Everyone but Ron Paul is the same by the way. Both Dems and Repubs are deeply in bed with Wall Street.

Leave a Reply to Questor