Real Homes of Genius – Culver City 900 square foot home with three mortgages up to $572,000. A few places down, a 800 square foot home is selling for $500,000. L.A. cities still in housing bubbles.

How many homes in California have 2, 3, even 4 mortgages secured by the property? This was very common during the housing craze. Even today, as that toxic mortgage chapter is closed many of the loans silently sit away rotting in the balance sheet of banks. We discussed in a previous article that as a rough estimate some 30,000 people a month were strategically defaulting on mortgages. While bringing this up, the stock market went off the cliff and dropped nearly 1,000 points in a matter of a few minutes. Still think the banks aren’t turning our stock market into a Casablanca like financial casino? Yet the fact of the matter remains that in many parts of California home prices are absurdly high and are disconnected from fundamentals. Dare we even say that home prices are still in a bubble in some cities?

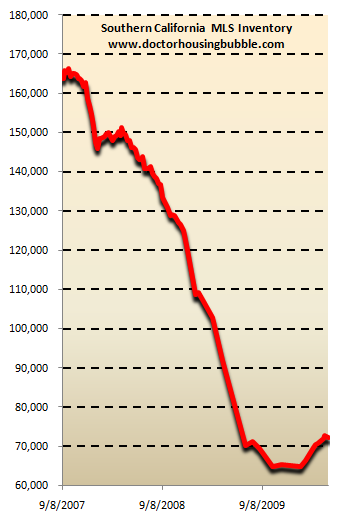

For the first time in many months, overall inventory in Southern California dropped:

Source:Â MLS

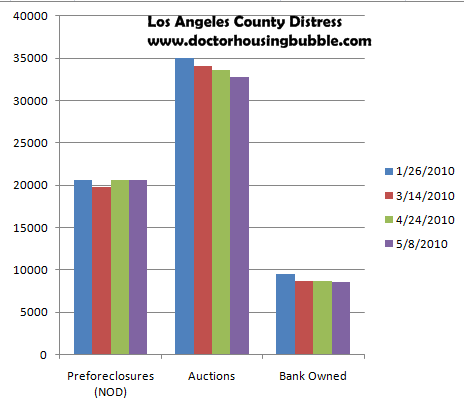

I’ve been tracking the MLS for many years and this has been the first weekly drop since October of 2009 in the recent uptrend. Much of this I attribute to demand being pulled forward by the expiring federal tax credit and the new California home credit. Overall distress properties in Los Angeles County seem to be stabilizing:

This is still incredibly elevated but the fact that notice of defaults have stalled is actually a good sign. Or a sign that people are strategically defaulting. Or it could be that banks are simply not moving. It is hard to say because so many points conflict and the crony banks are fighting against any transparency. Overall we know that the 30+ days late count is at record levels yet actual NODs filed by banks are stalling. These are reported from different data sets so this may be the reason for conflict but it is easy to assume that this discrepancy comes from banks not moving with the foreclosure process in normal timelines. The toxic mortgages in California are part of this as well.

Going back to the topic at hand of mortgage equity withdrawals, I wanted to look at a home in Culver City that exemplifies the hits banks will take on many homes in supposedly prime areas of California. Today we salute you Culver City with our Real Home of Genius Award.

Three Time Mortgage Equity Withdrawal Action

This home isn’t listed for sale but it is scheduled for auction. From the Zillow description we get the following:

“Gorgeous poinsettia hedge out front. BIG yard, dog-tight fencing. Huge tree shades the back. Charming retro gas kitchen. Hardwood floors throughout. New tile in kitchen and den/converted garage.â€

This is a lot of description for a 920 square foot home with 2 bedrooms and 1 bath built back in the 1950s.  But leave it to Southern Californians to put a nice spin on it! Although we don’t have a picture of the home from whoever gave us the description outside of the Poinsettia, we can thank technology for this front view:

Nothing extravagant but a good place for a single person to start off with. I think most that live in Southern California would rather have a smaller place in a good area instead of a mansion in a troubled area. Plus, big places in good areas are usually out of reach for most. But this home is the perfect example of using the bubble and converting the home into a home equity machine:

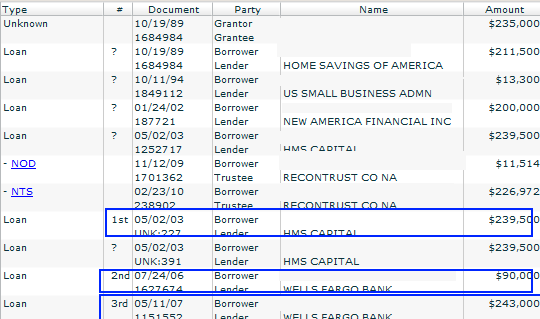

Let us walk through the above. The home was purchased for $235,000 back in 1989. It looks like the person even back in 1989 was required to come in with 10 percent down. It looks like $23,500 was put down on a home costing $235,000. This is really where we should be today. Instead, you can now buy a $670,000+ home with the same down payment. This has tripled the buying power of home owners today even though the economy is in much worse shape than it was back in 1989.

After the 1989 purchase, a loan was secured on the property from the SBA for $13,300 in 1994. Nothing too big here. Things were calm for a few years after that. Then things in 2003 started picking up. A first mortgage of $239,500 was secured on the place. By 2006, getting $90,000 off a second was a piece of cake in Culver City. Now the home has $329,500 in mortgages. The bubble keeps getting bigger and a third mortgage is put on the place in 2007 for $243,000 (an amount larger than the first mortgage back when the place was purchased!). In total, this 920 square foot home in the end went up to having $572,500 in mortgages from a modest $211,500. This is the history of the housing bubble.

But now, the home is in foreclosure. Back in November a notice of default was filed. A few months later, the auction date was set. The auction is scheduled for May 19 but hard to say what is going on beyond that. The Zillow Zestimate has this place valued at $538,500. If that were the case, this place wouldn’t be going to auction. Use caution when going by appraisals in high flying Southern California cities loaded with Alt-A loans.

On this same street, only a few houses down, we have a 3 bedrooms and 1 bath home for sale. This home has more rooms but is listed at 873 square feet. It was built in 1924:

The home has been listed on the MLS for 86 days and they have already had to drop their price:

Price Reduced: 03/09/10 — $520,000 to $499,999

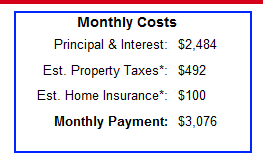

Let us run the numbers for the above home with a 10 percent down payment. That is a fair number given the home only a few places away was bought for 10 percent down as well (even though you can go with a lower down payment):

$3,076 is coming out of your wallet each month to live in an 800+ square foot home. Given the tanking Southern California economy, you can get gorgeous rentals for this price. Some argue the tax benefit but this is beside the point because you will pay out of your wallet $3,000+ per month to service the mortgage and other home owning payments. Using the simple 3 times your income rule a family would need to make at least:

$450,000 (mortgage) / 3 = $150,000 per year gross income

Now something tells me that a family making $150,000 a year is going to be reluctant to shell out $500,000 for an 800 square foot home in Culver City.

Today we salute you Culver City with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

28 Responses to “Real Homes of Genius – Culver City 900 square foot home with three mortgages up to $572,000. A few places down, a 800 square foot home is selling for $500,000. L.A. cities still in housing bubbles.”

Northern Calif looks the same noticing greater inventory builds above 450K. I live in Sonoma the tract was built in 89 is pretty upscale but suddenly 14 homes are forsale and nothing is moving over 400K. Lots of shock among the homeowners, I am renting a great house for $1500 a month that was sold in 2005 for 550K. I am currently looking at rural property in several Northern counties and find very similar price points with stranded sellers, lots of over priced bubble property.

Ever wonder why those futuristic movies always seem to show a world in ruin? What a wasted opportunity. The premise that our country was based on was a blueprint from a continually improving life for all men. What the hell happened?

I don’t really think anyone believes all is well or sees a plan how the future can be less than apocolyptic, but back in the 60s the Kingston Trio was sure we were on the eve of destruction. Depression, WW I, II, same thing, but we’re still here. Pour me another Manhattan and let the band play on…

Culver City is a very nice place to live in. But, quite frankly, this house looks like it belongs in a nice trailer park. If you buy this house you have to ask yourself, “Do I live in the House?” or, “Do I live in Culver City?” If you spend most of the time inside the house, then you need the best house you can afford. If you spend most of your time in the community, then you need the best location.

A mere halving of the down payment requirement should not double the buyer’s buy power.

Say that I, with an income of appx.. $50K a year, decide to buy a $150K apartment. 10% is $15,000. 5% is 7500. Obviously, a five percent down stroke will leave me with a mortgage that is $7500 larger, and certainly larger in relationship to my income. I can easily qualify for a cheaper place with 5% or no down, if the payment is in keeping with my income, but if I want anything more expensive, I will have to come up with more cash up front to keep the size of the mortgage in line with my income. No way would my 10% down on a $150K dwelling be allowed to become a 5% down on a $300K dwelling, because the remaining balance would be too large a loan for my income. However, I could easily go even 3% on something cheaper, for the loan amount would still be much less and result in a lower DTI.

We financed houses in this country with little or no down payment with no bad consequences for a long time, because buyers had to have decent credit and the DTI ration had to be reasonable. But when we allowed mortgages that were totally out of proportion to income, then things got out of hand. For example, if you make $50K a year, it does not matter if you put $300K that you inherited, or 40%, down on a $750K house, you STILL cannot afford that house and will end up losing it even in a decent market. The payments will be over your head, more so if you opted for a cheap payment on a pay option loan and ended up getting back ended with a balloon payment and much higher payment after that.

DTI is everything, and the only thing else that matters is the credit rating.

The banks are clearly playing the waiting game…can they hold back filing all the NOD’s until the economy recovers enough to start creating jobs again and thus create buyers? With more and more mortgagees not paying, the lenders must be seeing a strong decline in cash flows.

I think this will be the next problem they must contend with as the jobs are not coming anytime soon. It looks to be an issue of attrition since they dont have to mark-to-market anymore. It really is the Japanese experience.

That house looks like a crack house, for half a million dollars to boot. I remember back 10 years ago (not that long ago), 500K was considered a lot of money and bought you a really nice house. What the hell happened? Incomes have not increased to justify those prices and we are in the midst of the worst recession in decades. Something will give sooner or later…and I think it might be sooner.

Anybody who buys this house for 500K needs their head examined. In a normal market, this house shouldn’t be more than 300K tops. Buyer beware….

@Nick,

The beauty of an RHG such as this is that it ages like a fine wine. And if you can’t find your BMW keys it only takes a minute to peruse the whole house and find them. Your kid’s easy-bake oven would be a suitable replacement for the appliances. Get one of those futons and the place is almost done furnishing.

I’m sure I’d rather live in a Culver city tent than nice 3000ft/sq in the midwest or southeast…or not.

This way the bubble damage can keep causing harm for decades to come. Couple of MBA’s with a million in mortgage, student loans, car leases. How do we even start to fix this stuff, when half the kids growing up have never seen anything but the huge culture of debt. They don’t even know that anything is wrong.

I wouldn’t call these houses but rather shacks on tiny lots in Culver City. The closet space in the bedrooms is as long as someone’s arm. Even if these shacks were going for $250K, I wouldn’t buy them. There are plenty of vacanies around for $2-$3K a month, so why risk your money in an economy that is on critical condition with rising gas prices.

@Sabin Figaro

That was pretty funny. And just think about how much money you can save on electricity, heating, air-conditioning, vacuum bags, furniture, etc. Yes, small is beautiful. But, what will you do with that 65 inch TV that you bought with your HELOC? It will not fit in that shack.

It is all about interest rates.

The housing bubble is the oldest in Ca. so is the most entrenched. Low rates allow banks to hold with little to no cost. Low rates allow current buyers to finance more.

As long as rates remain low, the bubble will not be washed out.

I grew up believing the lie that I was taught in Economics 101, “The Fed controls short term rates, the market places controls long rates.”

The last two years have proven beyond a shadow of a doubt the market doesn’t “demand” a dang thing, the market is fed what the FED whats to feed it. With the advent of the FED purchasing Mortgage Backed Securities and under the table purchases of 10 and 30 year bonds (effectively monetizing debt) I now know I was duped in ECO 101, the FED indeed does control 30 year rates.

The question is, how long can they get away with this game before inflation becomes so great that even the phony CPI can not hide what is going on?

If anyone can answer the above question then we will have the answer to the question…….”When will the Ca. housing bubble collapse?’

I grew up on LA’s Westside and I can tell you right now there is NO house of average size worth 500K in my view. There is NO WAY regardless of interest rates that I would saddle myself in debt with a HALF A MILLION DOLLAR loan on what is to me nothing more than a shack (and there are plenty of overpriced shacks not only in Culver City but also Santa Monica AND yes Beverly Hills.) I know people in LA are a bit brain dead but COME ON.

In Arkansas where I currently reside, which obviously is no comparison to SoCal for sure, either of these houses would go for no more than $50K, and only then if you could find a sucker wanting something this old and tiny. Most houses like these around here are rentals.

Ahhh, so much to comment on – and Nick, Sabin, Kid Charlemagne fantastic comments all around.

One question though, Dr. HB:

“$3,076 is coming out of your wallet each month to live in an 800+ square foot home. Given the tanking Southern California economy, you can get gorgeous rentals for this price.”

Can anyone point me in the direction of gorgeous rentals in desirable parts of LA for $3K? I’m talking 3 bed/2 bath minimum, single family detached homes with a front and back yard. I’ve been looking and can’t find anything for that price or less that is remotely decent, since the wife wants to buy and I have put my foot down and told her if we have to stay in (west) LA we’ll be renting until home prices in desirable areas become rational and reasonable again (at most 4x median income for their respective areas/zips etc. instead of the 6x to 20x+!!!)

I think if you study any market , seldom does it move in a staright line. Maybe the first drop was over and it has consolidated for a while and now is getting ready for the next leg down.

These prices would look good if we were staring at massive job and wage growth. Even if the job market recovers-wage is not going to recover. Why pay someone 150k here, when you can get someone for 30k to do the same job in India or China? Some jobs have to be done here, but quite a few can be done anywhere. If 150k is needed to qualify for this shack, I shudder to think what salary is needed for houses that were rotinely quoted for 800 or 900k before. I think houses have to come down a lot to match wages and this new economy.

Does the picture show the front yard or the back yard. At any rate, there should have been a video of the blind appraiser stumbling around that Mc Mansion. And they dropped the price 20 K? That should be the selling price.

caboy…..

Bingo! The beneficiaries of those cheap labor countries are buying the high-priced houses here for cash in those pocket areas. Once again, those buyers don’t care about the local economy here. It appears they are not waiting for anything, but the dollar to crash. It’s just crazy, but will someone out there tell me they purchased a nice, clean house in a clean neighborhood in Cerritos for under 500K lately….

We just looked at a nice home for rent in Culver city. Three bedrooms, nice yard, garage with a little studio or work room attached for 2000 a month. That’s less money and more room than what one would pay for the homes discussed in this article.

Still don’t get Culver City. I work here and its a dive. :p

One more reason not to buy a home in LA:

L.A. City Could Shift Sidewalk Repair Costs To Property Owners

http://blogs.laweekly.com/ladaily/city-news/sidewalk-repair-costs-la/

The childhood saying goes, “Step on a crack, break your mother’s back.” In the city of Los Angeles, maybe it should be, “If your sidewalk has a crack, it might break the bank.” You see, the City Council is pondering a move that would leave it up to home- and business-owners to repair sidewalks and driveways.

(more at link)

Phew, that was close. Trillion to fix the Euro problem and now it’s back to the races. What’s amazing is that there is so much insanity that common sense don’t make no sense no more…

Doc,

You got the facts and figures, but the underlying mechanics are so misaligned from rational economics I don’t think they will be reconciled any time soon unless there is a major collapse.

When we were kids we played a board game called ‘go for broke’. If only I’d known what I know today, I could have ruled that game. Can you imagine Boardwalk with one hotel-“that will be 120 times all of the money that came with the monopoly set.”

Great comments everyone. Where is the wage growth in LA going to come from? Please someone name an industry or occupation that can support an entire city of million dollar homes and condos. What? There aren’t any?

Wage decline is real and it will affect everyone from professionals to day laborers. What happens when 150K new people enter the labor force each month and there aren’t enough jobs to sop them all up? You get wage deflation. Mix that with outsourcing, businesses moving to cheaper locales, rampant greed from asset owners, increasing junk fees, increasing utilities and you’ve got an entire generation or two that won’t have much buying power for cars, houses, pretty much anything. House prices will drop, dramatically in most areas. Forget about the so-called “people with money”, rich Asians, Hollywood lottery winners – there just aren’t enough of them around to save the housing market. There are too many ritzy areas and too few independently wealthy folks to hold up every high end area.

@Dr HB

Good post. Keep it up.

@Laura Louzader

Those are very good points, assuming the banks are being careful and conservative. I remember back in 2005 I was shopping for a HELOC for ~15k, the bank offered me a lower rate if I went with a larger amount ( 50k+). (Hint the major bank’s name rhymes with Erica.) I remember thinking to my self that didn’t make any sense for a split second. At the end I went with the higher limit and the lower rate and only took out the 15k. I didn’t come across this blog early enough and I paid for my mistake. It appears WE (the tax payers) are paying and will continue to pay for everyone else’s mitakes until they (the politicians, banks, builders, brokers and their lobbyist) stop trying to artificially prop up the market. But I have to hand it to them, they appear to be doing a good job slowly syphoning properties into some socal cities.

Due to huge losses, Fannie Mae and Freddie Mac are asking for more money from the Federal Govt…I bet no one could see that one coming.

http://dealbreaker.com/2010/05/fannie-mae-seeks-another-government-bailout/

http://www.themoneytimes.com/featured/20100506/freddie-mac-ask-another-10-billion-bailout-funds-id-10111514.html

That 10/1989 purchase was also during the last big a$$ bubble.

Sometimes I wonder if people forget how big the late 80’s bubble was. Homes, Cars etc. screamed up in 1989.

Remember the original Mazda Miatas reselling for 60-70k?

That’s a $150k house. Probably not even worth that much. It certainly won’t outlast a 30 year mortgage.

Foolio, look on Westsiderentals.com.

There are 3bd/2ba houses with front and back yard for rent in the 2500-3000/mo range in Culver City, Westchester, Mar Vista, and West LA. Nice places too with remodled kitchens and bathrooms.

If you are willing to live in Sherman Oaks or Encino and drive an extra 20 minutes each day, the same(sometimes with a pool can be had for $2100-2700/mo, and very close to the 405(within 6 blocks).

I’m glad you posted this, as I had been thinking there must be someone from outside Southern California that can point out the sheer astronomically ridiculous nature of our local housing market.

$50K?

In SoCal that’ll get you a cardboard appliance box in an alley.

And I’m talking a dishwasher.

Wage decline may be real in the private sector, but not in the government sector.

There are many, many federal, state, and city employees making $200,000. to $400,000. per year (One State employee in California makes over $1,000,000.)

If you make $300,000.per year, and do not have to save for retirement

(your retirement will be over $100k per year), you can easliy afford to drop

$1,000,000. for a house. In many cities in Calif., over half of all employees make at least $100,000.

$1 trillion to rescure Greece? Have we lost our senses of how much money is being printed in order to patch the unprecedented debt loads facing many global economies? The hypothesis is that by monetizing the loan obligations that we’ll all grow out of these debts and deficits. Combine that with 0% rates everywhere, which is adding fuel to the fire of the game of chasing assets (equities, commodities, etc.) because govt T-bills pays nothing.

Unprecedented global liquidity is one additional factor that will continue to support RHG’s in “desirable” neighborhoods like Culver City.

Just to let everyone know some going rates, I’m up in San Jose, and I just landed a lovely 1400sq/ft condo townhouse 2 bedroom, 2.5 bath, covered parking large walk-in storage, with pool and jacuzzi, clubhouse, washer dryer inside, fireplace, and a huge outdoor porch. Price? $1500 month. In Sunnyvale on a golf course, very nice neighborhood, all residential homes nearby. They bought in 82, long since paid for, now they just need good people to take care of the place. Another pre-bubble find. So why in the hell would I buy anything around here? 750k chicken-shacks in Campbell make me laugh my ass off.

Leave a Reply