Real Homes of Genius – Culver City foreclosures focus on lower priced homes. Banks moving on lower priced homes in mid-tier markets. 175 homes distressed in Culver City yet only 3 show up on the MLS.

The foreclosure solution, if we can even call it that, is based on banks foreclosing on lower priced homes and allowing higher priced delinquent borrowers to sit in their homes payment free. The tragic aspect of this all is that agencies like the FHA, Fannie Mae, and Freddie Mac were specifically designed to help lower to moderate income home buyers yet the opposite is occurring. In mid-tier markets like Culver City, what you see is a handful of foreclosures on the MLS while higher priced foreclosures sit hidden in the shadow inventory. There is no denying this and the reason for this is apparent. Banks are merely buying time until they can lobby the government to setup a virtual trash bin to move off their books the giant underwater homes. Today we’ll take another deeper look at Culver City which serves as a good example of a mid-tier city.

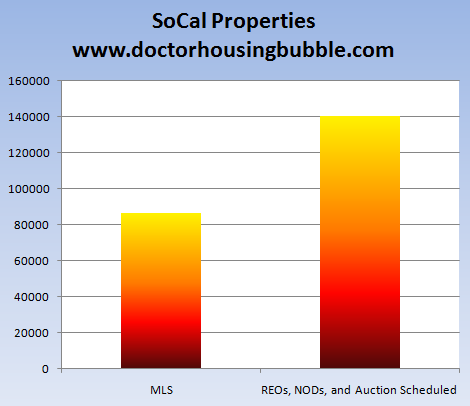

First, let us take a look at Southern California MLS inventory versus distressed properties:

Source:Â MLS, foreclosure filings

While inventory is growing on the MLS docket, the properties that enter view for public consumption are usually handpicked lower quality homes for that specific market. It is interesting to note that a market like Florida, where home prices have absolutely collapsed, there is now a McDonalds like court system to clear foreclosures as fast as possible:

“(New York Times) Florida law requires that banks argue their cases before a judge if they want to recover property from borrowers in default, and 471,000 such cases were pending in Florida at the end of July, according to the Florida State Courts administration.

Setting up discrete foreclosure courts statewide was seen as a way to help deal with the issue; consumer law experts say they aren’t aware of any other state that has set up a temporary court to work down such a backlog.

But it is paradoxical, say lawyers representing homeowners in the cases, that Florida’s attorney general acknowledges problems in the cases while retired judges, intent on reducing caseloads, seem unconcerned about those same problems — like flaws in the banks’ documentation of ownership.â€

The article is worth a full read. What we find out is that the system is one giant mess and those making out like bandits are banks and lawyers. Yet the essence of the measure is clear and that is to clean out foreclosures as quickly as possible even if documentation isn’t clear (think of the mortgage broker loan mills except this involves judges and foreclosures). Here in California, it looks like we are clearing out the low hanging fruit as quickly as possible but banks are holding off on those higher priced homes even if people have flat out stopped paying on their mortgage. The above chart looking at Southern California is representative of the state. The MLS shows 86,000 homes while the distressed inventory is up to 146,000. Yet let us look at the data for Culver City in detail:

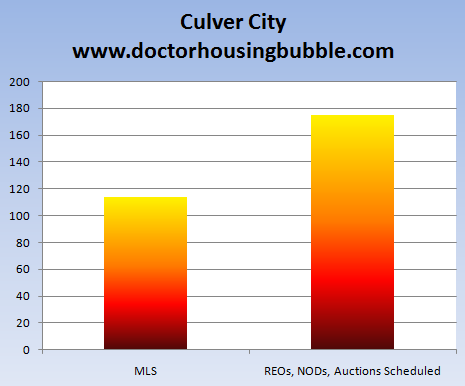

Culver City lists 114 homes on the MLS but 175 homes are listed as distressed properties. These are not easily seen by the public without access to foreclosure filing data. You might say there is overlap between the two. You want to see how many foreclosures show up on the MLS for Culver City?

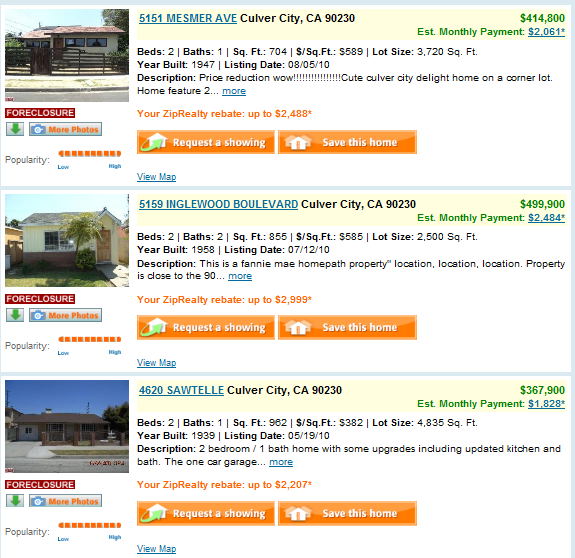

Only three homes show up! And the price range for these foreclosures are from the mid $300,000s to the mid $400,000s. This for an area with two zip codes with the following median prices:

90230:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $569,000

90232:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $749,000

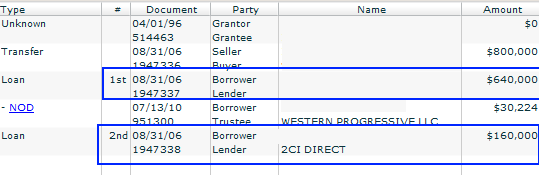

But take a look at this home that is nowhere to be found except in the shadow inventory:

Bedrooms:Â Â Â Â Â Â Â Â Â 2

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1

Square ft:Â Â Â Â Â Â Â Â Â Â Â 1,157

Year built:Â Â Â Â Â Â Â Â Â Â Â 1941

Zip code:Â Â Â Â Â Â Â Â Â Â Â Â Â 90232

Sales history:

4/1/1996:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $245,000

8/31/2006:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $800,000

The home is now wildly behind on payments because the home was purchased with 100 percent financing back in 2006:

The notice of default was filed and shows back payments of $30,000. For the sake of argument let us assume a 7% blended mortgage payment at 30 years fixed. The monthly payment hovers around $4,500 and $5,000. So we’re talking about 6 months of back payments for the first NOD to be filed. Yet this property shows up nowhere except deep in foreclosure filing records. Interesting that on the MLS no property from the higher priced 90232 zip code shows up for Culver City. Yet this zip code has 31 distressed properties. This is deliberate and completely on purpose.

It is interesting that while the obvious is being seen here, over the Labor Day holiday the government is planning to take on more toxic loans:

“(WSJ) The Obama administration on Tuesday will launch its most ambitious effort at reducing mortgage balances for homeowners who owe more than their homes are worth.

Officials say between 500,000 and 1.5 million so-called underwater loans could be modified through the program, the first initiative to target homeowners who are current on their mortgage payments but are at risk of default because they have no equity in their homes. Some experts are warning, however, that the same knots that tied up prior initiatives could do so again.

Under the new “short refinance” program, banks and other creditors that write down mortgages to less than the value of the property can essentially hand off the reduced loan to the government. The process involves refinancing borrowers into loans backed by the Federal Housing Administration.â€

It is interesting that in the article we are given an example from of course, California:

“The White House hopes to reach borrowers like Irene Gerloff, 62 years old, who was turned down for a loan modification because she can afford her payments. While she owes $292,000 on her two-bedroom condominium in La Habra, Calif., the property is probably worth less than $200,000.

She is worried about what happens in five years, when her “interest-only” loan begins requiring much larger payments. “If things don’t improve between now and 2015, I’m going to have to let this house go,” said Ms. Gerloff, a secretary.â€

La Habra is a bubble market out in Orange County. Did you notice that we’ll be helping someone with an “interest only†loan? In other words, a dumping ground for toxic mortgage waste. They should have used a higher priced home to drive the point further. Banks are playing hardball with the government and after three years nothing has changed because what banks want is to have a way to unload their previous sins onto the taxpayers. The reason this person can’t refinance is because she can actually afford her payment. When the note resets in 2015 it will be game over. But banks are betting on two things:

-1. Either the taxpayers are apathetic enough to allow our government to take on these junk loans and allow banks to continue the looting of the American public

-2. The bubble will re-inflate by that time and Irene will be able to sell her home to another ponzi player

By the way, carrying a mortgage payment is insane at 62 years of age. But that is another story all together. The banks are idiots for making this loan in the first place and this person should have never bought with that mortgage. Yet this story has played out tens of thousands of times over. What isn’t being covered is those mega defaulters in places like Culver City that are sitting in homes without making payments. Why are banks moving on lower priced homes while letting the higher priced homes sit without action? I think you can put two and two together and figure that out for yourself.

Today we salute you Culver City with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

59 Responses to “Real Homes of Genius – Culver City foreclosures focus on lower priced homes. Banks moving on lower priced homes in mid-tier markets. 175 homes distressed in Culver City yet only 3 show up on the MLS.”

I voted for Obama, but am extremely disappointed in his handling of the economy.

One give away program after another does NOTHING to stimulate the economy.

For those who saved, and only bought what you could afford, you are subsidizind another give away program.

Obama is like Jimmy Carter- personally likeable, but incompetent as a leader.

And like Carter, he will be a one term president.

Ray, I could not agree with you more about Obama as a leader. I too voted for him, and am deeply surprised that he has turned out to be completely incompetent. He seems to think the country is funded with Monopoly money. I hope that he’ll be a one-termer, but I am also surprised at how incapable many of my friends are at seeing his failures of leadership. I think many liberals are in denial.

Eric, the true liberals will always be in denial no matter who their leader is. Independents largely decided the last election. I would hope that most of them are seeing what a failure Obama has been and will think twice before voting for him again. Sure he inherited a mess, but then again he is ignoring the voice of the people on most critical issues…that will ultimately cost him in the end.

Because Republicans did such a good job when they were running things. Why do you and all the other monday morning QBs think that this disaster which was decades in the making can be fixed in two years. That would be like a 300lb man expecting to lose 100lb overnight… it’s impossible. If the Republicans gain control in November do you really think they’re going to come up with any better solutions… really? Weren’t they the ones in control when this country ran off the rail and into the ditch? If your ideas are so great, why don’t you run, no… I didn’t think so, everyone’s a critic, because that’s the easiest thing to do, criticize some one else’s ideas. The fact is it doesn’t matter who’s in power, any solutions they can come up with are going to be inherently flawed because humans lack the ability to forsee the unintended consequences of the decisions they make today not matter how well intended.

Every presidential election is a choice between the lesser of two evils. Yeah, I would fix the problem differently than Obama, but what’s the other choice? The Paulson method of the last administration was to write a three page memo, ahem I mean bill, saying give me $750 Billion and I’ll get back to you. Which by the way was the same administration that turned a surplus into a deficet, financed two wars on a credit card from China, and kept the war expense out of the budget (cooking the books).

While I can appreciate your disappointment, having a gaping hole in the foot is better than having a gaping hole in the head. Your survival chance is better, too.

Take a stroll down the streets of Eureka,CA. In the morning, the streets are filled with tough looking, homeless charecters. They all look like ex cons. All look like they would rob you in a heartbeat.These are not displaced families, caught in the housing bubble.

This may be a preview of where we are heading.

The banks are sitting on the more expensive homes because it is harder to move them. As we know the income from the jobs are not there for people to buy the more expensive homes. It is easier to move the cheaper homes.

Doesn’t sound hopeful.

Either we remain renters for the next 10 to 15 years or bite the bullet and pay twice as much for a house than its worth.

I have always been fiscally conservative and socially liberal and voted that way until I was forced to vote 100% Democrat due to the change the Republican party underwent in the last 20 years.

I am wondering, if the Houses became Republican controlled it would create such gridlock that it would help our cause?

I have no doubt if Republicans controlled the Houses and the Presidency we would be facing many of the same issues regarding housing (because republicans nor democrats control the government, lobbyists do) but if we could just make it so that the two branches were always gridlocked it might be the best thing for the public.

I have already come to that conclusion so I, a social liberal will be voting Republican this fall.

Your idea is a VERY GOOD IDEA.

The best times in history have had a backdrop of news about how ineffective and squabbling congress is being. The less congress “gets done”, the better for all people who intend to pay their own way in life.

So many people seem to have short memories. The Neoconservatives going back to Reagan have had decades to create this economic hell-hole, and yet after less than two years you’ve all given up on Obama. Considering that Republicans have attempted to thwart, quite successfully, nearly every good proposal by the Dems to get us out of this mess, your solution to go back to Republican rule now mirrors an abused spouse’s repeated reconciliations with the abuser.

You’ve experienced gridlock for the past two years. There have been more filibusters requiring a 60 senate majority in the past two years than in any time in history. More gridlock is hardly the answer. Overwhelming force is often the best military tactic. Similarly, overwhelming those who cause inaction is often better than conceeding to more inaction.

I’m taking a broader view than DHB. The government CAN’T have the banking system fail and massive, widespread, and expensive write-downs of their mortgage portfolios right now would do that. It is far too important to the country and the overall economy. Of course the financial industry thought they bought Democrat love with their donations last election but Democrats are not the honest type of politicians that stay bought.

While a straight-ticket, rock-ribbed Republican, even with control of both houses of Congress, they won’t bring any magic bullet to this problem. They may well spread the pain better though.

“Interesting that on the MLS no property from the higher priced 90232 zip code shows up for Culver City. Yet this zip code has 31 distressed properties. This is deliberate and completely on purpose.”

Forgive my ignorance but how did you find the actual number of distressed properties?

I love reading this blog. Absolutely jaw dropping.

I looked at those homes priced at nearly 600 bucks (and higher) a sqf and I asked myself about everyone involved in the sale… WTF were you thinking?

Nothing demonstrates the greed and insanity of our society better than this blog. Keep up the good work!

What are a few sites I can go to to find this “hidden inventory”? Is it some of those paid sites? What is a good one, Doctor!

Lots of 2nd’s+Heloc+3rd’s on upper valued homes greater then 500K all sitting on big bank balance sheets? I noticed several stories this week from the MSM hyping homeownership as some kind of forced savings and another article pushing new tax deduction based on generating faster equity accumulation all signs that the greater pain in housing deflation is ahead. The initial recession sparked by the banking industry impacted the credit markets but this 2nd phase of higher unemployment looks to be the beginning of the larger down phase which has many structural components none of which seems to be responsive to low interest rates or generating luxury consumer demand which is the heart and sole of the American consumer market.

Our local RE market reflects your observations regarding foreclosures but is over loaded with short sales for these upper priced homes. Not sure how many are selling but my guess is that most of these will become next years REO,s.

Thanks for your time and effort Dr!

The prices in the sub-prime, poorer areas went up the most, and those are the area that are coming down the soonest and the most.

Of course, the bankers already received their bonuses, so they already won. They just want more tax-payer bailout, so that they can get more bonuses.

Wow ! I know 2006 was at the peak-but I can’t beleive someone bought that 2 bedroom 1 bathroom shack for $800,000 !

It’s amazing we are seeing houses in Culver City priced in the $300,000s. We haven’t see prices like those since the 90s. It just goes to show you how overpriced Culver City is, when median prices are still in the $700,000s in areas like 90232. This area is going to take a big hit before it is all over. Eventually, some neighboroods in Culver City will see houses selling in the $200,000s.

Some of the most recent sales in Culver City are quite amazing.

http://www.westsideremeltdown.blogspot.com

Almost all the higher dollar mortgages were portfolio loans, so they are still owned by the lenders who originated them. It’s a double whammy for these lenders. They stand to take a much higher dollar loss on each of these loans and absolutely no one will buy these loans from them. If the govt does not intervene to buy these loans, these lenders are in deep trouble. If I had a loan over $600K , I’d stop paying it. Chances are there’d be no eviction for a long time.

Doc,

This article from Reuters news service says that Fannie Mae intends to start getting tougher with mortgage servicers, i.e., making them go forward on foreclosures:

http://www.reuters.com/article/idUSTRE6804A020100901

Having the data access, I thought I’d research Miss Gerloff and share it with everyone, which by the way I’m extremely familiar with Miss Gerloff area, being I live less than an hour away from her and was raised practically next door to her. Miss Gerloff not only owes $292k on her home from a re-fi in 2005 but ALSO took out what appears to be a 2nd trust deed for approx $50k. She purchases the home for $250k on 12/2/2003 using a toxic loan. So us the tax payer is suppose to foot the bill for Miss Gerloff? No way, get outtta here you crazy politicians! Gets even better, this property was flipped to Miss Gerloff from 3/19/2003 where that buyer paid $195k for a condo that should be no more than $100k in today’s market. That’s a 22% gain in home appreciation in less than 8 months. With all these toxic loans out there, we can clearly see how home prices got out of control. And are still definitely out of control especially in bubbalicious areas such as Orange County even with the current price declines. More to go.

I am sure there are people in high places that realize that the game is fixed, and becoming more so, yet do not do a thing about it. This ‘winking’ at runaway greed will have it’s final result. The real estate crash is just one wave of many. However, IRS and local government liens are ahead of all other liens – except for the tax lien investor. The lien is on the property, not the deed holder. Banks have political power, the consumer (owner/deed holder) does not, so the banks shift the burden back to the deed holder. The burden will always lie with the consumer who is last in the pecking order, so it is the consumer who will ultimately pay. If the lien is satisfied by someone other than the deed-holder, i.e. the tax lien investor, and ultimately discharged at the tax deed sale (if it makes it to one), then there is no problem for the former deed-holder. All they care about is getting their money.

Just look at the one house you profiled 2 bed 1 bath shitbox. Sold for 245K in 1996 and then (drum roll please) 800K in 2006. WTFFFFFFF. Yup, no bubble existed here, can’t see any evidence of a bubble. Based on the party we had and the impending hangover, real estate is dead money for the next decade. Anybody buying today in still frothy markets better think this out real carefully. California real estate has always been “easy to sell in a few years if you have to.” That took some of the risk out of the game, I think that equation has forever changed now due to the bubble.

DR – Thanks very much for your continued great analysis. This bubble example truly demonstrates the extent of the problem we have ahead of us. Not just for housing but for the economy as a whole. The extend of the develeraging that remains is being GROSSLY underestimated by the WH and many economists, let alone stock analysts. We are probably 2-3 innings into the deleveraging with MANY years left to go. This is a good decade long process that will see high unemployment and very little GDP growth.

I am not a conspiracy theorist but, rather, a full-time investor (in real estate and many other assets). And I have to say that I’m betting on asset deflation for years to come. I laugh out loud when I hear about economists writing that things will “pick up” next year. They clearly don’t understand that the money supply is shrinking because banks aren’t lending. Consumers AND business lack access to credit and consumer spending, which accounts for 70% of the US economy, is now DONE. Consumers can no longer access more and more credit card debt and, more importantly, have no more equity left to access in their ATM – Oh, I mean house. The next decade is done and written in stone. 70% of our GDP can no longer afford to come to the table. And businesses aren’t going to make up for it if consumers can’t spend.

What we’re going to see in the short-term is the government try to spend to make up for this gap but congress won’t allow it and, frankly, they have no bullets left.

I urge everyone to read up on Japan’s lost decade. We’re already going through the same thing. DR wrote a fantastic article about it somewhat recently. And the most important chart in his analysis showed the bogus (ie. gov’t manipulated) Japan CPI looking fairly ok for the entire lost decade (0-1% increases), while the stock market lost over 50% and real estate lost over 50% of its values (one of these actually lost 80% but I can’t remember which). So don’t be faked out by the CPI if you’re an investor. You can lose big time while the “CPI” looks ok.

I forced my wife to rent as I saw the bubble coming when I get married in 2005 and we have watched all of this unfold as renters. Go figure that we’re now renting a new construction condo in West LA that couldn’t be sold by the builder. As the banks keep extending and pretending, we keep pushing back our target purchase date.

Don’t be fooled by manipulated gov’t statistics and the crap that comes out of politicians’ mouths. They’re not telling the public the truth. All DR readers know that the major banks would be bankrupt without gov’t intervention + tax rule changes. You have to fend for yourself, especially as an investor, homeowners, and/or renter, as CLEARLY no one else is going to take care of you.

Sorry for my rant. I am fortunate enough to have side-stepped the housing + economic downturn mess and, while I am glad that I am doing ok, it has amazed me to watch the greed and deception coming from politicians and banks. I’m fortunate enough to understand how all of this works and to position myself to benefit from all of this as a full-time investor but I’m boiling over about how the average American has been treated through all of this. It’s ludicrous that, because I understand all of this, I can benefit from this while most suffer. And don’t get me started on the division in the country – there’s clearly no middle class left thanks to greed and deception…

You can argue that life isn’t fair but this MASS FRAUD and deception is over the line. And notice that no one was held accountable. Then again, I can’t say I’m surprised. There is so much corruption and greed in this country that everyone is in everyone’s pockets in DC.

So much for the American Dream. Marketing at its finest, just like the (stock) brokerage firms.

Good luck to everyone.

You’re not ranting- you’ve nailed it. Banks and politicians have let their greed run wild and the middle class is being screwed. Obama is smart enough to see this, yet does nothing- you can try to explain his actions, tell us to be patient, etc. but let’s get real here. If you had told me two years ago that someone could be more useless than Bush at fixing the USA economy, I would have died laughing.

JR I agree we have been fooled for a long time. Even in terms of upward mobility, such “socialist” countries such as France, Denmark, Norway, Germany, Canada are ahead of us. We are only ahead of Britain !! I just find it odd that in a socialist country like France, with its universal healthcare etc. their vacations etc-their populace has a better chance of moving up the ladder than we do. Even in this economy, Germany and France are holding up much better-despite the strong Euro(it has weakened now-but still way off parity).

I think what happened when WalMart came to town witht heir made in China junk and drove away all the mom and pop shops is happening to the regular workers everywhere. The same situation was there in the Great Depression-only then they called them the robber barons and so many rules were put in place to prevent a redux. Just an irony that when Glass-Seagal was repealed, banks went back to their old tricks.

Caboy,

Every morning, I drive to work and listen to the radio, and every morning there is an ad for Bill O’Reilly’s talking points where he says “the land of opportunity- is America still that?â€

What’s bothersome is not Bill O’Reilly’s question, but the fact that it took him 30 years to notice. I mean, seriously, if he’s only noticing now that we’re not quite the shiny, happy place we used to be, where everyone has 2.3 kids, a dog, and a picket fence, where anyone who puts out the effort can be rich, we have a problem. Granted, the guy’s an entertainer and not a politician, but entertainers have to provide interesting content in order to be popular. And if “the land of opportunity- is America still that?†is a fresh, interesting topic to a listenership of tens of millions of people, well, that says something. It says that a significant portion of us, all of us, have been living with our heads in the sand for quite some time.

We haven’t been the “land of opportunity†for well over 30 years, now. The numbers don’t lie. And the numbers tell a story that is completely contrary to what a lot of folks would have us think. America didn’t stop being the land of opportunity with Obama. The only difference is that we can no longer cover it up.

Fixed costs as a share of family income in the US:

Single Income family, early 1970’s:

Fixed costs: $22,890

Discretionary income:$19,560

Dual income family, early 2000s:

Fixed costs: $55, 660

Discretionary income: $18,110

What’s going on here is not rocket science. First, when things started getting more expensive, our wives started going to work. Then, when that wasn’t enough, we started borrowing. Then, when a “normal” loan wouldn’t cover it, the banks got creative, so we could still say we were “middle class.” Now there’s nothing left to be borrowed. There is nothing left to hide the fact that the average American wage is not that great.

Bill can say whatever he wants, but the simple truth is that American wages need to rise. When they do, we can begin buying things again, and then they can tax us again, which are both good things. But as the way things stand right now, mobility is going in only one direction- down. Even the “European Socialist†countries beat us on it.

Trulia (http://www.trulia.com/real_estate/Culver_City-California/) shows 183 homes for sale and 198 foreclosures(pre foreclosures, auction, or bank owned). The Blanco district has 9 homes for sale and 6 foreclosures.

Thanks, John! Works for my area in the midwest too. Appreciate your info.

I hear a lot of people are blaming Obama for some of the programs that have been implemented but it’s like being a Monday morning quarterback. I don’t think anyone can really turn this economy around in 2 years (come on – it took a lot of incompentent leaders to cause this mess and not only in the US). I too don’t agree with the HAMP program but you can’t espect everything to be perfect. He’s done quite a bit – especially in stopping the recession from becoming a Depression (but no one gives him credit for that!!). Yeah the healthcare bill is questionable – but it hasn’t even taken effect yet until 2014 (at least not the bulk of it) and a lot of people are already calling it bad policy before it can even play out (we are talking about the largest social bill since the 1960s). That’s the same thing they said about Social Sercurity and Medicaid when they were first introduced. Now, if you even touch those programs, it political suicide. All I’m saying is before you give up on our president, be a little patient and give him a chance. The other presidents before him did nothing but cause this mess. Obama is working hard for the last 2 years and battling every possible diasters you can think of – 2 wars, flu pandemic, the economy, and a damn oil spill. Sometimes I wish there was a parallel universe to see how well President McCain would have done.

Joe, you need to put that big pitcher of Obama kool-aid down. Sure he is inherited a big mess, but he has done nothing to fix it. He is just as complicit as the two idiots before him. He does not understand that economy will not be fixed until the private sector starts hiring and starts growing. How about some incentives for private businesses to grow? 800 B porkulus bill that did what? Bailing out his union buddies at GM/Chrysler. Ramming an unpopular healthcare bill down our throats that the MAJORITY of the people did not want. Sueing the state of Arizona for trying to enforce illegal immigration, what was his solution…putting up a few signs in the desert and assigning a handful of troops to the border. Allowing the construction of a mosque near 9/11 ground zero. The list goes on and on and on. Most people just don’t relate with this guy and the other “leaders” such as Pelosi and Reid, these people are more communist than anything else. It is very clear that he has a radical agenda and will do what ever it takes to accomplish his goals. November 2 will be very telling if the MAJORITY of the American public has had it with Obama and the democratic party.

Joe;

Obama needs to OWN IT, because his credibility is shot. His cabinet has done what they did in the GD the last time. Thrown money at a problem that needed austerity installed to stop the bleeding. The housing market is just one example. If they’d left it alone, and not tried to prop it up, we’d be 1/2 the way through it already and maybe seeing signs of market stabilizing. I’ve never heard of an economic policy that advocates “spend your way out of debt”. What we have is a young, ignorant, arrogant president that is way way way over his head. My biggest disappointment in the Congress, despite the foul-ups of the POTUS, because they plunged head long into a spending spree we didn’t need because it doesn’t FIX anything (especially Healthcare!). So you tell me that I need to give him more time is like saying I should open my wallet and let him have all the cash and be damed with the consequences.

Thankfully, we have the power to vote and can restore some checks and balances and maybe, just maybe, with gridlock restored, the normal American can find a foothold in this slippery slope we have going on right now. Something has to give and its not going to be the taxpayer. We are tapped out.

Don’t worry Joe, you are right. While there is legitimate criticism on the approach Obama has taken with housing, many of the other domestic policies have been beneficial to the middle class. With housing, it would have been far better to take a bottom up approach by enacting “cramdown” legislation that would give BK courts the ability to reduce principle in a public manner, but Republicans and some Democrats blocked it.

But, things like forcing health insurance companies to allow Americans to keep their children on their policies until age 26 if they want, eliminating lifetime caps on what insurance companies pay for care, and eliminating the “pre-existing” condition way of denying Americans healthcare are all good for the middle class. That’s not Kool-aid; that’s real help for real people.

The good doctor here uses very specific facts to support his propositions and does an excellent job. It’s too bad other people simply want to make vauge references to “owning it” and forcing healthcare down people’s throats. Ask any parent:

“Do you think you should have the option of keeping your child on your health insurance until they are 26?” I haven’t met a parent yet who said “no.” Granted most of the parents I know have younger children. I suppose there might be some parents out there who don’t care about their children’s health and would say “no,” but I haven’t met them yet.

Ryan, as usual when in doubt just claim it’s all for the children. We’ve heard that whopper before many times. The fact is little if anybody knows what exactly is in the healthcare bill. And from past history, if you want to screw something up and make it completely inefficient…put government in charge of it. I’m all for healthcare reform, just not the way this thing was brought about and it took some arcane law to pass this bill when the majority of the public did not want it. See a problem here?

If anything, healthcare reform should have been enacted one step at a time. But Pelosi wouldn’t have that, it was all or nothing. This was just another power grab to have government in control of one facet of your life. Nobody knows what the final cost of this program will be, if it’s anything like the other entitlement programs…we are finished.

In my world, which is being a responsible adult when you come of age, a young adult should not have to wait until they are 26 to get their own health insurance. They can buy a car, fight in wars and kill people with a gov’t issued military weapon.

The HC system is so messed up that they (Congress) added that to stave off the coming flood of insurance premiums that people can’t pay. Can’t you all see this new HC act is a ponzi scheme at its best? If there were serious about really doing anything they would’ve tackled tort reform, stopped the usurious outlays in malpractice claims, and insurance the doctors must pay, and made general care available for an affordable fee. Put the care back into the doctors hands. But no, that means that the big insurance/Pharm companies are going to make less profit. So its really about the money, afterall!

At some point, SOMEONE is going to have to pay for all this and with everyone who WORKS paying through the nose NOW, I wonder WHO it will be, since we’ll all be in the poor house from paying all the extra taxes starting next year in 2011.

This is not about emotional responses, but facts. We are broken as a nation because we value everything by the $, and that has to change. We are broken as a nation because we believe that “somone else” is going to pay the bill or that the “gov’t is going to take care of us”. Well, guess again.

The gov’t is US. And we’ve screwed up and need to get our priorities in order first, but good luck because that means fighting the big money machine who incidentally pays into the campaign coffers to keep it all going their way.

@Wheresthe beef: Sorry, the fact is anyone who can read and has access to the internet can read the Healthcare Reform bill. People who choose to remain ignorant do so by choice. You generalize saying the government can’t do anything right. Well, what you say is simply untrue. I’m sure you drive around on a government funded paved road, you probably used the government funded court system at least once in your life, you rely on a government funded police, fire and military, etc. Here is the FACT: Because of Healthcare reform, if you have a child under the age of 26, you will be able keep them on your health insurance policy as of 1/1/11 if you want. Period.

Question: Are you a parent who would like the option of keep your son or daughter on your health insurance up to the age of 26?

@Ohiogal: What part of the word “choice” do you not understand? You have the option of keeping your children on your insurance policy until they are 26. You talk about the age of majority and responsibility as if your responsibility for your children ends when you boot them out of the house at 18. Believe it or not, there are a lot more parents in this country who want their children to have better lives. These parents are willing to sacrifice to put thier children through college rather than toss them out on the street once they turn 18. A responsible 18 year old can just as well go to college, trade school, or even get their own starter job, which by the way usually doesn’t have insurance. Even back when I was in college and working at a Chevron station, guess what…they did not provide health care with my minimum wage job.

Your anger is misdirected. You say you want medicine to be less about big insurance money and more about care, then you rail against healthcare refrom, which STARTS to put boundries on health insurance companies, i.e. eliminating lifetime caps and denial of coverage for preconditions.

Same Question:Are you a parent who would like the option of keep your son or daughter on your health insurance up to the age of 26?

Yes. Thank you! Anyone (like you) who has spent more time paying attention than the time since Obama started, would realize that the support by Republicans for economic greed and deregulation is the driving force of our current Great Recession.

So true Mike. People with agendas tend to ignore facts and play on emotions like anger, disappointment, and hatred. They also tend to try to compare reality against some sort of envisioned state of perfection. Realistically speaking, it was deregulation that caused our current economic woes. If greed is left unregulated, it destroys a nation’s economy and the patriotism of the people. Take Meg Whitman, candidate for governor in CA. While the head of Ebay, she fired 100s of American workers and shipped those jobs overseas to India. She did it for money. Is it unpatriotic to eliminate American jobs and re-create them in a foreign nation with foreigners having those positions? In my mind, the answer it “yes” and haven’t met too many Americans who disagree.

Meg Witman did what the CEO does in a company. Maximize shareholder interests. Its the American way and unfortunately respected. Look what Mark Hurd did with NCR, and then HP. CUT salaries across the board, CUT jobs, and alienated the work force. It wasn’t like that 30 years ago. When ethics was shoved under the rug and the massive consolidations took place (takeovers) in the ’81 recession, this country forgot its roots. It was quick to cut jobs because that was instant profit.

Ohiogal: This is rich. First, you complain that everything is controled by money and pine for people to focus values. Then, when it comes down to the basic value of patriotism, you give Meg Whitman a pass because of the money she supposedly made for herself and her shareholders. Let me put it simply: If you take American jobs away and give them to foreigners so you can line your pockets or the pocket of your company, you value money, NOT patriotism. And, if you defend sending American jobs to foreigners, you are no better.

Take a long hard look at your values and the values of the people you are supporting. I’ll give you an example. S Truett Cathy, founder of Chik-A-Filet. There is a man believes so strongly in his Christian faith that all his restruants in 38 states are closed on Sundays and it does not matter how much money he is loosing because of it.

Question: Is it patriotic to not making as much money as you can in order to keep Americans employed?

My simple answer is: Yes. There are values more important than making money.

Mike;

If you look at the long view, as in the last 40 years, its been BOTH parties that contributed to this mess. By far though, the Dem’s have created more entitlement programs than any other party in power in history. Those programs have to now be paid for. The greed you so eloquently identified is greed by the American consumer to have something for “free” and live off the taxpayer. We’ve created a society based on entitlements – what you can get for free – without regard to the consequences. The idea was a good one – help the poor, unwed mothers, unemployed, yada yada yada. What we have now is a whole class of society that works the system and on top of that, a totally misguided and corrupt Congress who does not know the meaning of “budget”. You forget that Bill Clinton was in office for 8 years prior to Bush. Those years primed us for the .dotcom bust which gave us recession in 2000-2001. The policies have been bad for some time so lets put the blame where it lies in ALL of us.

yeah, like I said, wouldn’t it be nice to have a parallel universe to see whether we would be “1/2 through it” or be standing in the bread line. From what I hear from most economists is that it would have been worst AND they think that $800 billion in stimulus was not enough. If you never heard of an economic policy of spending your way out of debt – then you must not have heard about “Trickle Down Economics” made poplular by our beloved President Ronald Reagan. Back then our national debt more than double but nobody was crying because his “stimulus” was big enough to create jobs. I’m not saying that Obama is perfect. He could have directed those stimulus money to better programs but right now everybody is guessing on what to do – so stop being a Monday Morning Quarterback.

Joe, eventually someone has to pay the bill. Digging deeper into debt is like buying one of those overpriced McMansions with no intention of paying off the debt. We have to stop doing that as the longer we go, the higher the bill is to pay off….

Whe has the bill ever been paid? Never!

What makes it all feasable is the hidden tax of inflation. Anyone who thinks deflation is an issue is drinking moldy koolaid.

The Sun newspaper in San Bernardino has 18 pages of property tax defaults listed (in very small print) in the classified section today. They were put there by the county Treasurer/Tax Collector so I think that the list is for the entire county. I’m not sure how many there are but it’s easily in the thousands. Some owe a few hundred dollars but others owe $10k-$15k or more. I assume that if someone is a few thousand dollars or more behind on their property taxes that they probably aren’t paying their mortgages either. Is my logic flawed?

Actually wheresthe beef most people don’t relate with the tea party folks. They scare me. I have spent quite a bit of time in third world countries and what they are asking for is to make our country into a third world country-some would say we are already there.

I think Obama and team put in the stimulus and all that stuff hoping that this would be a regular recession cycle. The stimulus would put the economy on life support till it regained its strength and was able to walk on its own. However I think where they miscalculated was that they expected this recession to be the same as the other normal ones. It ain’t. We got to deal with the jobs crisis-this is where I get extremely miffed at the republicans. They keep saying tax cuts and more deregulations-a thing they have been saying since the 80s. But honestly look at the economy and tell me giving a corporation a tax cut is going to convince them to build a factory here as opposed to China? What most folks forget is that the tax rate is on net profits-not gross. So lets say Meg Whitman is the CEO and buys a corporate jet or two and flies around the world a couple of times a month-on business-that gets deducted from gross. That is a business expense-in fact I think she was the second most frequent flyer-as in user of the corporate jets in corporations or some such. Most businesses I worked in may pay like 10%tax, once their army of accountants get through with it-that is on the high end. That 40 million dollar severance package that fiorina got is a legitimate business expense. Just hiring a contractor vs employee and how you classify a project can get you a tax deduction or even make the difference between an asset and a liability. Having seen balance sheets for along time and worked with them-i don’t trust any of them-yes they are legally done, but you wouldn’t believe the games they play and it is all legal.

That comes to the crux of the problem. Republicans have the same mantra from the 80s. Democrats tried somehting, it held up the economy for a while and now the dam is crumbling. That just leaves most folks who are looking for a solution frustrated. Nobody has an idea. China artificially lowers its currency and therefore gives its manufacturers a 30-40% edge (assuming as the yuan has never floated) on top of the naturally cheap labour. But what is the solution? Do we go proetectionist and instead of a free trade one size fits all-just have a trade agreement with each country that benefits us. But will that lead to the same thing that happened in the Great Depression and cause even more damage to everyone? I really don’t know the answers .

I have no problem voting for the republicans and have plenty of times in the past(ok I admit I voted both times for Arnold -Gasp-well it was him or the porn star !!). But on a serious note, it is just the same old broken record from them ,that got us in the mess. Now the democrats tried the keynesian stuff and to a small extent it put a floor underneath and not a plunge in the abysss. But now the fundamental problem remains-in this global economy American workers and our cherished lifestyle is simply too expensive. But Chinese workers live in a dorm and work 7 days a week and go see their family once or twice a year. Is that what we want? I don’t think so. I just don’t know the answers and so was hoping to hear some solutions from the politicians-perhaps I was hoping too much.

Caboy, I never mentioned the tea party once. Most people are frustrated with BOTH parties because their policies have shown to be failures for the last few decades. Most Americans want to productive citizens and live out a decent existense. Thanks to the stupidity of BOTH parties, this is becoming harder by the day. Unfortunately I don’t think there will be a decent third party anytime soon, the system here does not allow for it.

I think many Americans are finally realizing that the good old days are now in the past. Us serfs have been sold out by the ruling noble class here. I cringe for the future generations…America is definitely not what it used to be and looks like it never will be again.

The big banks are hoarding money…….they won’t and don’t take the losses on foreclosures until its mandated. Mark to market accounting was suspended. All the while, they use their ridiculously high “reserves” to make a guaranteed spread on their money…pay the depositors next to nothing-expressed on the right side of the decimal point…..and then “buy” or invest in govt. securities which yield 300% more than they are paying….talk about minting money…the big banks can virtually “finance” themselves out of their problems the longer they wait…..there are no coincidences here……its manipulation at its best…..As to Obama, clearly he’s out of touch with main st., mainstream america….I’m sick and tired of our politicians claiming they’re somehow so much smarter than us……Most of these politicians couldn’t hold a private industry job for more than five minutes. Less taxes, less regulation, less large spending programs/intervention, is the only way for equilibrium to reappear in our economy.

I saw President Obama on View the other day, and he was saying that he’s always trying to do what “he” thinks is good for the country. But considering how he represents the people, shouldn’t he be doing what the public wants? Shouldn’t be what he wants. Maybe that is the mistake that many presidents make.

Yes but do the people really know what they want? If the polls are to be believed these are the same people that are getting ready to vote the Republicans back in control… what have they (Republicans) found their magic wand?

[i]In mid-tier markets… what you see is a handful of foreclosures on the MLS while higher priced foreclosures sit hidden in the shadow inventory. There is no denying this and the reason for this is apparent. Banks are merely buying time until they can lobby the government to setup a virtual trash bin to move off their books the giant underwater homes. [/i]

DING! DING! DING! Once again, the good DR-HB is right on target in tracking the moves and motives of the FIRE supercriminals, in their ongoing Crimes Against Humanity. Keep it up, doc!

This is not the place to debate healthcare reform, but should you wish to defend the health care system as is stood 12 months ago, I’d be very amused to hear it.

Let’s give the republicans a chance. Maybe since they got us into this mess, they know the way out. Here is the scary thought: what if neither party can do anything to prevent the “lost decade”?

Mike,

Forgive me if I’m wrong, but have we not had four decades of consecutive “lost decades?” We just covered it up in various ways.

Please, someone correct me if I’m wrong here. I’m just looking for a time when we had “real” economic growth here in the US that benefited everyone, especially the middle class, and I’m not seeing it.

We’ve given the Republicans a chance, and they gave us this debacle, then we gave the Dems a chance, and they just continued it.

Let’s give a third party a chance? We could just TRY the Libertarian Party, or an independent, just once.

Banks have been moving on lower priced homes while letting the higher priced homes sit without action because there is much greater loss stored in higher priced homes, that the banks do not want to take as a loss to their income statement.

Furthermore the banks operate as a cartel and do not want to suffer the wrath of their peers by foreclosing in the higher priced neighborhoods.

You relate that this means that mega defaulters in places like Culver City, CA, are sitting in homes without making payments, while subprime defaulters in places like Englewood-Chicago, IL, have been foreclosed on long ago. Now the latter neighborhood is a blighted and vacant wasteland. Welcome to the “banking industry matrix and desert of the real”.

Yet September 1, 2010, was a watershed date in investment, economic and housing history, as the banking and real estate industry’s “extend and pretend†policy, which came from the FASB 157 entitlement to mark real estate “at the manager’s best estimateâ€, rather than “mark to marketâ€, was impaired, as the United States 30-10 Yield Curve, $TYX:TNX, broke down to the point where bonds of all types, BND, fell parabolically lower in value.

As banks, KBE, fall lower in value through short selling and through increasing credit default swaps; and as their 1.2 Trillion in Excess Reserves at the Federal Reserve looses value with a flattening 30-10 yield curve, $TYX:$TNX, the FASB 157 entitlement will exponentially loose value and become like an expired option.

As a result of flattening sovereign debt yield curve, and ongoing yen carry trade disinvestment, real estate investments, FIO, PSR, REZ, values will plummet and banks will transition of necessity, from being mortgage and lending institutions, to property leasing institutions.

IrvineRenter writes of a truth we need to be reminded of: â€The foreclosure inventory described above as 2 million homes is the visible inventory, loan owners that have received a foreclosure notice. The shadow inventory is several million more. The bottom line is that delinquencies are far exceeding foreclosures. At some point, foreclosures must exceed delinquencies, and the foreclosures must be pushed through the system. We have many, many more foreclosures to come.â€

The push for foreclosures started September 1, 2010 with a flattening yield curve and a fall lower in Banks, KBE, on September 7, 2010, as EuroIntelligence relates that the Wall Street Journal reported that the European Financial Institutions, EUFN, stress tests were essentially a fraud. This revelation sent bond spreads to new records, the latest ten year spreads: Ireland 372 bp, Greece 9 44 bp, Portugal 355 bp, all up substantially yesterday, in the case of Portugal and Ireland to new record levels.

Squatting, that is the entitlement to living payment free in a property, that came by the way of FASB 157, will soon be coming to an end as banks pressed for cash flow will actively and continually foreclose and lease properties.

Be sure to check out a recent article that came out on the AP Wire Aug. 18th, 2010. Just Google ‘MERS not a real party of interest-62 million homeowners May be shielded from forclosure”. This was a bank formed/ owned company that broke mortgage laws utilized for last 100 + years. Another way the banks have defrauded the middle class to transfer the wealth.it’s been fraud all around and they fund whoever they can corrupt to do tbier bidding. Republican, Democrat whatever too many corrputed politicians on both sides the realy culpability lies with the international bankers.

Leave a Reply to theyenguy