Leading indicators in prime Southern California cities show real estate weakness ahead in 2011. Condo market collapses in prime markets. Culver City condo flood and those still asking for nearly half a million for an 800 square foot home.

When the California housing market started falling apart in 2006 and 2007 the first areas to see major pricing and sales hits were in condos and townhomes. Many might remember the long lines and waiting lists for future condo developments. Condos do not carry the premium that single family homes do and also cater to those just starting out. I remember having a conversation with a colleague at the time that was in the process of buying a condo during the mania. He casually told me as if it were some sort of unwritten rule that I should know that, “first you buy a condo, let the equity build up, then you buy a starter home, then let the equity build up, and then you have your ideal home.â€Â Simple enough process right? Amazingly this kind of economic superstition permeated the California real estate market for the large part of the decade. Not once during the bubble did I hear someone say that prices were disconnected from incomes or that the California housing market resembled Florida in the 1920s. We had articles and a handful of economists chiming the bell but the public on the ground had bought the idea that my colleague was talking about hook, line, and sinker. Today we are seeing a methodical correction in the condo market just like we did in 2006 and 2007 but this time it is happening in prime areas like Culver City. Let us examine the data closely.

Source:Â Redfin

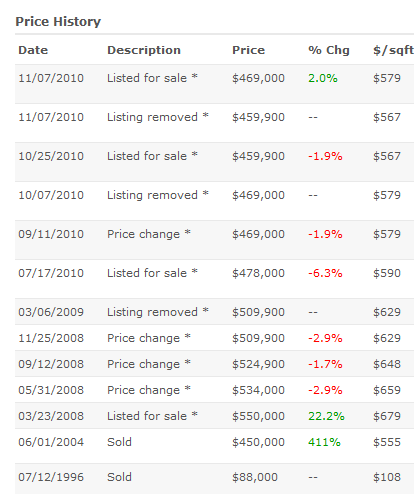

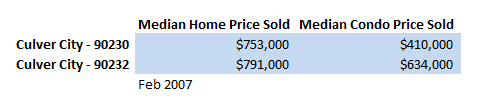

The above chart only goes back two years. But we can see that over the last two years the sold square foot price has steadily decreased dropping by 18 percent. This doesn’t really do the price correction justice so we’ll get data from the peak in 2007 just to put this in context. Let us take a sample of how insane prices got in Culver City back in 2007:

This should put the collapse in condo prices even more in perspective. Prices for Culver City condos have now steadily fallen for over three years. The condo market in many other areas corrected first before home prices followed. After all, if prices are low enough demand will be pulled to condos in the short-term. It is also the case that condos are purchased by those with fewer resources (typically) so any weaknesses in the economy are seen here first. With the California economy still mired in problems people are looking for affordable options. It is interesting that when we look at current home sales trends you can see that the condo market is correcting first:

Source:Â Redfin

You clearly see the early 2010 gimmick where people thought the bottom was fully in and many rushed out to take advantage of the tax credits. With that exhausted prices fell from nearly $540 per square foot to the current $490. Yet this amount is still in a bubble. If we look at the February 2007 data we find that the price per square foot sold was $507. In other words, this market is still fully in a bubble.

We should examine what we have on the market in Culver City:

MLS non-distressed listings

Single family homes:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 51

Condos:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 63

Townhomes:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 8

But if we include distressed inventory as well the numbers blast upwards:

Single family homes:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 103

Condos:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 136

Townhomes:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 8

When we include distressed inventory the amount of properties nearly doubles for a prime location. We also find that condos dominate the market in Culver City. The Southern California housing market has still not figured out a way to deal with the immense amount of shadow inventory. That is why sales have completely collapsed in the last few months. If people are going to hold out on prices then the pool of buyers is limited because they now have to verify income. If we look at total home sales they are tracking lower but right now this is seasonal:

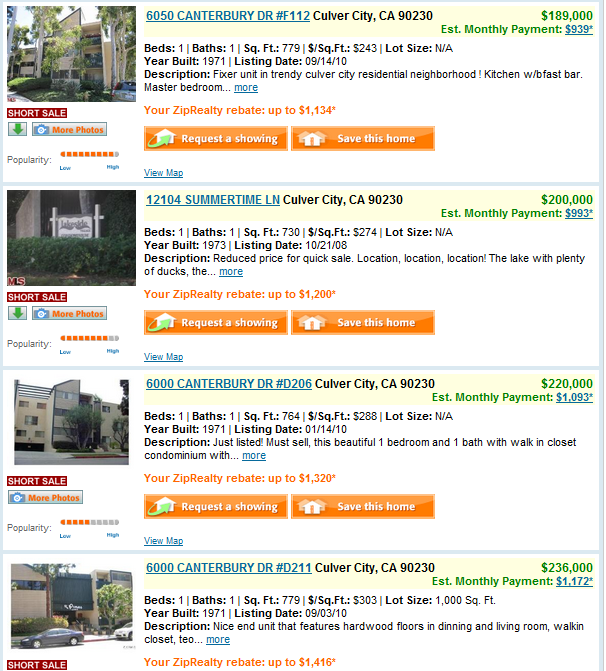

Will we see a major jump upwards during the spring in the summer? That is the real question especially if no other gimmicks are put out into the market. But if you are looking for a cheap condo Culver City is starting to have a flood of short sales:

The condo on Summertime Lane sold for $335,000 in May of 2007. At $200,000 it is now down by 40 percent in Culver City. The psychology is fascinating for the delusional out there. You can see the progression as follows:

First it was: “Home prices are only falling in areas like the Inland Empire. Not in prime areas or counties.â€

Then it was: “Well only lower income cities in Los Angeles are falling. It won’t happen in the prime cities.â€

Finally we have: “Well home prices are only falling on condos and crappy home in prime markets. The good homes in the prime areas with the prime designers with the exquisite kitchens aren’t falling.â€

Can you spot the pattern? We even see this in some of the current listings for homes that are clearly yearning for the days of 2007:

12023 ALBERTA DR, Culver City, CA 90230

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1

Square feet:Â Â Â Â Â Â 800

This is a perfect example of a home thinking we are in 2007. Let us look at the listing history:

This place sold of $450,000 back in 2004. In 2008 they were trying to get $550,000 for this place! Today the home is now listed at $459,900. If you run the numbers, at this sale price the buyer at $450,000 won’t even make a profit. But they would be lucky if it sold at this price. Let us take a look at the listing description for more information:

“Beautiful turnkey home! Move right in to this charming cottage with decorator touches throughout. Home features an open floor plan and is flooded in natural light. Original hardwood floors, smooth ceilings, crown molding all add to the charm and warmth. Nursery/bedroom was professionally decorated by “queer eye”” tv show several years back- a real show-stopper! Cedar lined walk-in closet. There is an added permitted area at the rear of the home currently used as a sound-proof music studio, but would make a perfect home office/storage area or playroom. Home also features dual paned windows, convenient location to all westside cities/amenities. Beautifully landscaped yard with rose garden, brick walkway/patio. This is a prefect alternative for condo buyers who prefer privacy and their own space. It’s hard to find a home in this price range that is this turnkey..And a standard sale – no waiting for the bank!!! Not to be missed!!â€

The place does have a good design obviously. I find it interesting that the description says this is a good alternative to a condo. Let us look inside:

Yet the price is much too high. It is rather clear that the condo market has tanked and is correcting even further in Culver City. Some condos are seeing 40 percent price cuts. Condos are usually the first places to fold in housing corrections and we saw this in 2006 and 2007. Does this tell us what is in store for 2011 and 2012? Keep in mind home prices in Culver City are down by 20 percent from their peak so the correction is hitting. Yet prices based on incomes and the current economy still signify a bubble.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

45 Responses to “Leading indicators in prime Southern California cities show real estate weakness ahead in 2011. Condo market collapses in prime markets. Culver City condo flood and those still asking for nearly half a million for an 800 square foot home.”

Bubbleliscious!

Amen to that> This house was overpriced per national home values for comps in ’96. But if you accepted that value as valid ( I had a good job at mid 30’s income meaning I could spend $90,000. with 0 down – not that I would buy that with it) and calculated 3% per year for inflation and wages it would fall far short of $469,000 dollars. I ran a simple 3% for 14 years and added 10% to the result for compounding and came up with a current value of $137,456. That leaves it’s current asking overpriced at $331,544.00. Obviously it would be a safe income ration buy for the median income of LA in the mid 50s but I think anyone making the median deserves better than a small pre WWII tract with a space heater and zero garage. It’s a working class home in a working class town not a home for upper middle class buyers. There are towns across America where homes like that would not fetch $60,000.00. And I am not talking the ghettos or urban wastelands.

During the bubble years, was there a huge amount of condos built in southern California? In Chicago, from 1994 all the way to 2007 (in trendy/yuppy neighborhoods) and from 2001 to 2006 in decent neighborhoods the cost of a house was way out of reach for most people and hence there was a huge condo boom. A lot of apartment buildings were converted to “condos” just by making a little bit of improvements and wallah; it’s a condo. Did this same trend occur in southern California?

I saw firsthand the condo conversion madness in South OC. Unfortunately, most of these apartment to condo deals were done right at the peak of the bubble. Can’t blame the owners for wanting to cash in on their lottery ticket. I knew a couple who bought a condo conversion in Laguna Niguel, that place has taken at least a 50% haircut. Likewise, the big Aliso Viejo conversion stalled out and went to auction. Those fools all still overpayed to live in a friggen 2 bedroom apartment.

Like the Dr. said in the article, condos were a stepping stone in the housing chain. This all works fine and dandy as long as there is constant appreciation. Few if any condo buyers want to stay there forever, this is only a temporary arrangement. I think the next generation of buyers have finally wised up to this…why not just rent a 2 bedroom apartment rather than roll the dice buying a condo. The chances of losing equity in the nearterm is great and there is zero percent change of apprecitaion. When you take today’s shakey job market into account, having mobility is definitely worth something also. These are all factors that will sink the condo market for the forseeable future.

Ordinarily we think of price being set by the interaction of supply, in housing that’s inventory, and demand, or income. However, houses are not oranges. Almost no one buys a house with cash. Settlement requires a mortgage and mortgages are based on what banks are willing to lend on a property. With prices falling, guess what banks are thinking. Oh, and did I say that the GSE’s are deep in the red? Who is going to put up the funding against collateral that is losing value?

Tom. I believe the tax payer has put up the funding against collateral that is losing value.

The cottage on Alberta you feature is a charming little place that has obviously been well-maintained and improved, but it’s difficult to see how the price could catapult from $88k in 1996 to anything like $400K or above. $500K is absolutely surreal.

Given the trend in prices, and pricing in improvements on this place since that low-priced sale in 1996, I would think that $250K would be the absolute top end for this place.

What think all you L.A. denizens? And how easy would it be to get a loan of any sort on this place with less than 50% down, at any price above $250K?

You are right, prices are still way to high. In the short term, naive buyers think ‘relative to where prices were before.’ But that is a poor metric. Think instead of cash flow. It is nowhere near cash flow positive. If I generously assume the property does not lose value over the next ten years (and I think it takes a serious haircut), and put in HOA of 300/mo (some places are 400 or 500/mo), and 1% mello-roos, then for a typical fha 3% down on 470k, the nytimes calculator ( http://www.nytimes.com/interactive/business/buy-rent-calculator.html?ref=patrick.net ) says you never get in the black compared to renting. If I further put in what my actual investment returns are on the money I don’t pay towards an oversized mortgage, taxes, or maintenance/depreciation, then by year 6 I am almost $200k ahead by renting instead of buying. Year six is the closest gap, where I only lose 30k/yr. After that it falls off more rapidly (my investment gains are compounding).

Way way way too early to buy.

That calculator is poor as it neglects the fact that at the end of 30 years, you no longer have a mortgage payment, and now have savings/equity equivalent to the future value of the property. This is a huge oversight.

“Nursery/bedroom was professionally decorated by “queer eye— tv show several years back-”

Well, that cinches it. I gotta have it. But they gotta throw in a DVD of that particular show so when my friends come over, we can watch it, and my nursery/bedroom will be a star, and they will be impressed, and that’s all that matters. Where do I sign?

ding ding ding, you are the winner!! Humans are emotional and seldom rational, let alone mathamatically incompetent, hence we have irrational herd mentality frenzies!!

Clearly, the value is in the time tested design elements, from the faux wood/aluminum awnings and carved window headers to the craftsman quality brick rose garden area.

The eye delights at design elements sprinkled throughout.

Think of the pride of ownership you’ll feel living in and maintaining this gem:

How many contemporary homeowners have the opportunity to re-putty windows, or fight for space with family members in front of the classic gas wall heater on those chilly Culver City mornings?

Here’s your chance to step back in time and pick up this gem at 2004 prices!

in

No, the place could have buyers. I’d guess most rentals in Los Angeles aren’t any nicer or aren’t even as nice as that place. And having a stand alone home does have advantages over a rental apartment. The problem is: it’s not priced for that market! It just costs too much!

We are never going to reach a point where everyone in Los Angeles is buying a classic craftman home, that day will never come, there aren’t enough of them to go around. But when the median income earner can’t even afford the place shown, something is very wrong.

I am just astounded that Culver City is considered a premium area. In 1980 I played softball in the Santa Monica city leagues, for a team sponsored by a Culver City bar. We were ashamed to admit that we were based in Culver City. At the time it was considered a lower middle class suburb which was aging badly, maybe ok for the bus driver, but certainly not socially acceptable for professionals. Now this is an elite area??? WTF!!!

NewZ-

I know- an older friend of mine grew up there and moved away, and she’s astounded that I was talking about buying there once the prices correct. Cluver city pulled it’s socks up, fixed their schools, refurbished their parks and now has a first-rate shopping/restaurant downtown. Since it’s small and autonomous, they could exert enough control to make a small middle-class bastion in the LA mire of crummy monster school district etc. That’s why people want to buy there now.

BUT the Fox Hills area is still a dubious “transition area” where families from nearby Ingallwood and Compton try to step up to (and, unfortunately, bring along their problems). So you’ll notice the cheapest prices and most desperate sounding condo sales are in the Fox Hills area.

You don’t even know how to spell “Inglewood” but think that families from there and “Compton” cause problems in “Fox Hills”? Do you realize how ignorant you sound?

Do you realize Compton doesn’t even border Culver City?

So in reality, Compton and Inglewood is your racist code word for too many ??????

Pathetic.

Ditto on that. Once the fancy restaurant mini-district goes belly up (only a matter of time), Culver City will revert to being that funny little area waaayy too close to South Central. Accept it.

The areas directly East of Culver City have homes and neighborhoods that blow anything that West LA has to offer out of the water. But you go on thinking that it is “South Central” and we will keep our mostly African-American affulant area with well manicured homes, tree lined streets, and views of the entire city to ourselves.

Im guessing you like to believe that any area that has people of color is considered some sort of ghetto but truth be told you can keep the cramped, traffic filled, dirty westside all to yourself.

Grat story Kiwi!! A LA Locals Opinion:

CC is Geographically located better than palmdirt, the I.E., or compton, but still lame.

And, of course, someone would comment that any negativity about Culver City’s proximity to South Central is code for you-know-what.

Yet, the whole point of DrHousingBubble is that prices have lost their connection to income. What is the average income in the huge swath of LA beginning to the East and South of Culver City? Very low. Low for decades, ever since big manufacturing left. So, when you have a little municipality adjacent to a huge swath of low income earners, what are the prospects? Not good, I think, no matter how much money is in the Baldwin Hills area on the other side.

No surprise here. The cheapest homes are first to go down in price. The sub-prime areas led the way, and now it is the condos in the better areas. The most expensive homes will be last to go down probably to year 2000 prices.

Just amazing that the house listed for 469k, sold for 88k in 1996, when the economy and incomes were way better than today.

1996 was the first year SoCal real estate started to rise since tanking in 1991. It didnt slow down until 2002. And then picked up again in late 2003. So this price rise doesnt surprise me. That’s two bubbles worth of increases. But condo’s are step children homes in most markets. They take the beatings first.

How much will the Alberta cottage rent for?

It seems a little out of place. The majority of the lots in the street are bigger and have a driveway with a 1+ car garage.

I heard the “prices are holding in this area” line yesterday from a realtor in Rossmoor. I was also told that ‘sales have been strong and inventory is decreasing.” Maybe Zillow is running behind because they sure don’t show these “brisk” sales that I heard about. The homes are nice but many of them are too close to the freeway and the actual city looks like one long strip mall.

You mean Rossmoor down below Long Beach in OC?

Yeah, that’s another hold out area that hasn’t fully adjusted. As far as I can see, no prices have really come down- it’s mostly been “foreclose and hide” or “a slow, grudging drop of 50k when the price should be halved”.

I know someone in real estate down there who is also insisting that things are moving…..as yet another mortgage broker/real estate buddy has announced his search for a non RE job on Facebook. Trouble is, I think they’re all still “drinking the cool aid” of real estate denial. Retail stores all over OC are shutting down, and when I drive around LB, I still see more “For Sale” signs than I ever saw before, even in choice areas. There might have been a few tax-break fueled sales, but it’s all still moribund.

We’ve been looking in Rossmoor for awhile now. I don’t think I would say sales have been strong, though several houses went “pending†last week but only after being on the market for awhile. Inventory is pretty bad, unless you don’t mind living next to the freeway. Very frustrating. Which house did you make it in the other day?

Double Dip has arrived. Gov’t tricks are useless. I would stay far away from any big condo buildings. Foreclosures will take their tolls on the HOAs. Glorified apartments with all the extra headaches.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

I rent a house in Culver City and constantly look at open houses, but, because of DHB-type concerns, am happy to rent until I see a feel-it-in-my-bones good deal (which may be never). I do want to point out a few things about Culver City that I don’t find mentioned often in DHB posts on the area.

First, the good public schools are a giant draw in this area and explain much of the price premium. You will find many Japanese and Spanish-speaking families (such as my own) come to the area because there is a special bilingual school that is highly desireable.

The condo area Dr. Housing Bubble is highlighting here is a unique part of Culver City. For one thing, it is largely African American. Safety is a big concern in these “Green Valley Circle” condos, in a way that it is not in the rest of Culver City. The district school for this area is El Rincon, the only school in the Culver City system that is not considered desireable. There are also many foreclosures, in complexes that have relatively high Common Charges. These factors combine to help explain the huge difference in price between condos here and in other parts of Culver City.

The 90232 zip code of Culver City is filled with elderly people–often original owners. Tons of equity, of course. Quiet and safe. It also lacks the freeway noise that characterizes the Sunset Park part of Culver City. Blocks that do not have rentable units in the back add another premium–these would be the Vet’s Park and Carlson Park areas.

I don’t think you can fairly compare Culver City today with the area over 10 years ago. Sony’s move into the neighborhood came with a dramatic renovation of the commercial area, which is walkable, chic and lovely. It completely changed the feeling of the area.

All of that said, the architecture of the homes is a joke relative to the insane prices! I pay 3K to rent a house that could easily sell for $850,000, though the owners of my house want WAAAAY move than that. No way would I go for it and I may never buy. But I did want to point out a few details that help explain a few things about the area.

Be patient. I looked at prices since I was teenager in highschool. When I finally bought, I had 10+ years of knowledge in my brain, for my specific area. That is how you make a comfortable decision. My purchase was lowest price I had ever seen for my zipcode over at least that long.

“first you buy a condo, let the equity build up, then you buy a starter home, then let the equity build up, and then you have your ideal home.†– this is not recent “wisdom”, this has been the norm since at least the 1970’s. For those who want to prosper from the knowledge that we’ve been through a tremendous crash, you do have to realize that millions and millions of people have been indoctrinated into this line of thinking. The vast majority of people put the blame on “irresponsible borrowers” – NOT exploitative banks.

So, be aware housing prices will start going up again, and probably sooner than you think. Stocks lead housing, and then housing leads the broader economy. Bubbles will be reinflated aggressively as long as there is a Federal Reserve.

I work with a couple kids (early 20s) that just had to rush out earlier this year and buy a condo. There were two reasons, the 8K tax credit was one and the other was the fairytale told by their parents that CA real estate is a for sure thing. These boomer parents made out like bandits buying 30 years ago. Unfortunatley, their offspring won’t have nearly the luck they did. This is no different than buying CSCO stock. If you bought in the early 90s you saw your investment go to the moon. Likewise if you bought in 2000, you are still way, way, way upsidedown.

Even during the peak of the bubble in 2005, many experts said prices can’t go down simply because real estate hasn’t had a negative return nationally since the Great Despression. Well, we all saw what happened with that prediction.

Bear,

Condos might stay as the first step, and the market may rebound….but no crash before this has left a shadow inventory and devastated state budget like this. And unless North Korea is about to hit us with another war (Dear God and his Saints forfend) I don’t see where the new industry is coming from to provide our population with the jobs they need to buy homes. Public quarter has been slower to cut back than the public, so we may yet see more jobs lost before the so-called “economic recovery” actually reaches us non-banker plebs here on main street.

“but no crash before this has left a shadow inventory and devastated state budget like this.” – yes, actually a very similar crash happened during the Great Depression. The solutions were (a) banks became long-term landlords, (b) inventory was witheld from the market for 10+ years, (c) banks paid to knock down houses to decrease inventory and boost prices. They are doing the same things this time. Banks are actively bulldozing vacant homes right now in the US. It’s just not making breaking news – Assange’s sex life is much more interesting to us vapid Americans.

DHB wrote: “Not once during the bubble did I hear someone say that prices were disconnected from incomes or that the California housing market resembled Florida in the 1920s.”

Doc, you must not have been listening to yourself.

Though many of us were. 😀

That Alberta Drive “cottage” is HIGH-larious! You couldn’t get closer to the noise and pollution of the freeway if you wanted to! (w/out violating public easements)… Indeed, it does look like a sub-divided TINY “leftover” lot.

Angelenos, please enlighten me, but is that an LA County drainage culvert running behind that tiny cottage, the kind that gets REAL exciting during LA’s rare downpours? It’s funny, because on a MAP it looks like a HIGHLY DESIRABLE ocean-going CANAL (a la Fort Lauderdale, where I’m at), but the aerials show it to be more like a flood control structure… =:O

Anyway, in SANE parts of the USA, bordering the freeway is called Duh Ghetto, or (with better PLANNING) The Industrial Strip; like New Zealander, I’m surprised it’s called a “prime” area… to me, it’s “not that far” from prime areas, but $450K?… yeeee-ah… going NOwhere at anything close to that sticker price.

@katy,

First I enjoy this blog very much and the comments are always right on point.

But I am surprised at your comment Katy, as if a neighborhood is African American makes it bad. And you claim to either be a person of color or related. I would suggest you read more about black neighborhoods and pick up a history book or two. From your comment it tells me you are very ignorant on culture and race in America. Like most Americans you probably think every African American is either a gangster or Barak Obama when the real truth is we are a very diverse group like everyone else. I would suggest you take a tour of the so called ghetto and you may be surprised what you find.

I grew up in a all black neighborhood and it was very very nice. My parents have been married for over fifty years, and all my siblings are professional people and so are my friends.

I didn’t infer that it being a black neighborhood made it bad; you made that assumption. Neighborhoods that are ethnically specific may limit the buyer pool, that’s all. The rest of Culver City is very mixed, with white, black, Hispanic and Asian people living together. FYI, I lived in a black neighborhood for most of my adult life, too, though sadly, I wouldn’t describe it as “very very nice.”

@Katy,

First let me apologize to the Dr because his blog is not about this topic per ser,

But Katy I said I had grown up in a black neighborhood not that I still live in one. I also didn’t state my age or what part of the country I grow up in, which had much to do with it being a very very nice place to live.

But there are really nice black neighborhoods in America today and also in Southern Ca.

Katy I think my suggestion that you pick up a book or actually drive through some neighborhoods are still valid. And your reading comprehension could be better also.

I live in south orange county at the beach, not because of the color of my neighbors but because I sail and scuba dive ok.

However I am not saying the inner city does not have a ton of problems.

Sorry to readers, I will not talk about this subject again,

Im glad you posted this. I was reading some of these comments and had the same reaction.

I like them staying ignorant though. Keeps them out of my neighborhood.

A shiny floor, fresh paint and cheap crown moulding for $469,000. Are you out of your fricking mind??!! What mental institution did you (the owner) get released from? It must be the marijuana, or marijuana laced with PCP. What fricking planet are you living on??

My goodness, the housing bubble is alive and well !!

First, let me say that I’m white and female and I owned one of those Fox Hills condos in the 90s, and it was COMPLETELY safe. During the riots I had to laugh at white people who were scared of “those people coming into our neighborhood.” My next door neighbor was African-American, yes — he was a retired high school principal. Was I worried about him looting? Of course not. It was a nice area full of middle-class people, just happened to be racially mixed, which some of us actually prefer.

Second, let me say how much I enjoy reading this blog, especially the pieces on Culver City, where I was born and raised. I moved out of state 10 years ago, and I still have trouble believing that my hometown has somehow become trendy. I’m now living in a small college town, still renting, but eventually I’ll buy a nice little place for under $200k. I’m glad I got out when I did, and I’m never moving back.

I notice that several commenters are from outside the area, and they’re a bit confused by the notion that an 800 s.f. house with a freeway or drainage ditch in its backyard would be considered “prime” real estate. I wanted to explain that a bit more.

A lot of people in L.A. – especially new transplants – buy into the myth that the only safe place to live is on the “west side.” It’s true that some of L.A.’s toniest neighborhoods (Beverly Hills, Brentwood) fall into this area. But there are a lot of crappy and semi-crappy neighborhoods in there too, many of them with fairly high crime and a large homeless population. In many cases, you’ll see a tiny house in one of these neighborhoods sell for an overinflated price… simply because people believe it’s in a “desirable” west side location. Meanwhile, there are many suburban neighborhoods where prices are falling dramatically. But because prices are dramatically lower and these neighborhoods are considered less “cool,” people have the impression that these are bad areas.

The L.A. Times web site has a nifty feature that tracks crime statistics in different neighborhoods, and if you play around with it, you’ll see some interesting data. Many of the more expensive neighborhoods have much higher crime than some of the neighborhoods that are considered marginal. And in spite of the fact that many Angelenos believe that certain parts of the San Fernando Valley (Van Nuys, Reseda, North Hollywood) have turned “ghetto”, the truth is that these neighborhoods have lower crime than all but the priciest neighborhoods on the west side, and you can get a lot more house – on a prettier street – for less money.

But then, if the bubble has taught us anything, it’s that real estate values have nothing to do with reality. As long as people believe that a $500K, 800 s.f. house next to the 10 freeway is a good deal (and a $300K, 1700 s.f. house on a tree-lined street in Reseda is “the ghetto,”) the west side will continue to command premium prices… deserved or not.

And, of course, someone would comment that any negativity about Culver City’s proximity to South Central is code for you-know-what.Yet, the whole point of DrHousingBubble is that prices have lost their connection to income. What is the average income in the huge swath of LA beginning to the East and South of Culver City? Very low. Low for decades, ever since big manufacturing left. So, when you have a little municipality adjacent to a huge swath of low income earners, what are the prospects? Not good, I think, no matter how much money is in the Baldwin Hills area on the other side.

I notice that several commenters are from outside the area, and they’re a bit confused by the notion that an 800 s.f. house with a freeway or drainage ditch in its backyard would be considered “prime” real estate. I wanted to explain that a bit more.A lot of people in L.A. – especially new transplants – buy into the myth that the only safe place to live is on the “west side.” It’s true that some of L.A.’s toniest neighborhoods (Beverly Hills, Brentwood) fall into this area. But there are a lot of crappy and semi-crappy neighborhoods in there too, many of them with fairly high crime and a large homeless population. In many cases, you’ll see a tiny house in one of these neighborhoods sell for an overinflated price… simply because people believe it’s in a “desirable” west side location. Meanwhile, there are many suburban neighborhoods where prices are falling dramatically. But because prices are dramatically lower and these neighborhoods are considered less “cool,” people have the impression that these are bad areas.The L.A. Times web site has a nifty feature that tracks crime statistics in different neighborhoods, and if you play around with it, you’ll see some interesting data. Many of the more expensive neighborhoods have much higher crime than some of the neighborhoods that are considered marginal. And in spite of the fact that many Angelenos believe that certain parts of the San Fernando Valley (Van Nuys, Reseda, North Hollywood) have turned “ghetto”, the truth is that these neighborhoods have lower crime than all but the priciest neighborhoods on the west side, and you can get a lot more house – on a prettier street – for less money.But then, if the bubble has taught us anything, it’s that real estate values have nothing to do with reality. As long as people believe that a $500K, 800 s.f. house next to the 10 freeway is a good deal (and a $300K, 1700 s.f. house on a tree-lined street in Reseda is “the ghetto,”) the west side will continue to command premium prices… deserved or not.

Leave a Reply to Doug N