A crisis in American housing: higher rents, expensive homes, and lower incomes are a problem impacting all Americans.

Americans are realizing something is wrong with the system. You can see it this year with the rise of outsiders in both political parties. People realize the system is rigged. Instead of some folks that kowtow and simply move forward like subservient lemmings, millions are mobilizing and taking action. Many are voting with their wallets. The number of renter households has increased by 10 million over the last decade while net homeowners has been stagnant. The bailouts were supposed to help American families but what happened is that many were kicked out of their homes (for missing payments) and then giving them to banks that also missed much larger payments (too big to fail). People got a quick education on how things work. This is why the homeownership rate fell dramatically yet somehow, homes sold to investors and now rents are at all-time highs while incomes are stuck in neutral. This is a major problem and people are taking notice.

A crisis in American housing

Zillow has some really good research on the topic. You would think that rising home prices and rising rents would be a sign of more families buying. Yet it is more of a sign of continued manipulation in the market. It is also a sign of outside money, either from big investors, Wall Street, or foreign money pushing up values and crowding out regular families from buying. The Fed has set the stage. By creating a low interest rate environment, big pools of money are hungry for yield in nearly any sector.

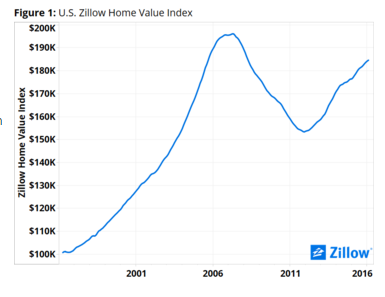

First take a look at home prices:

Source:Â Zillow

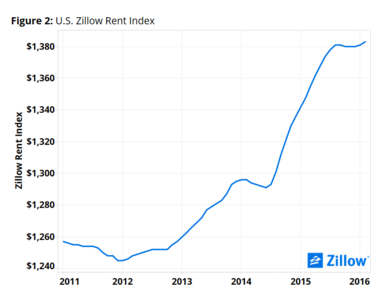

The trend is clear and at least in the short-term, prices seem to nearing a plateau. It is certainly being reflected in rents:

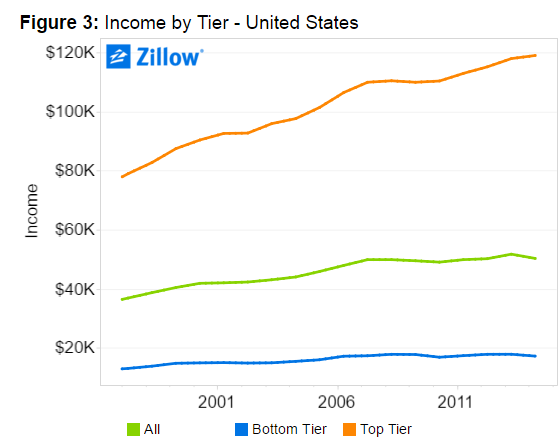

But for most people, incomes are not rising at this pace:

Incomes absolutely matter for the economy. It is naïve to say otherwise. In fact, this is a big reason why so many people are voting for outside candidates. Many people simply feel the American dream slipping away.

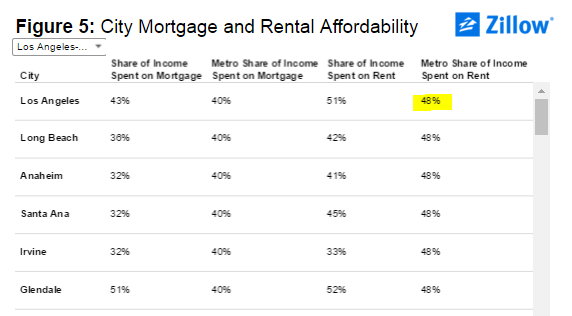

Even in high priced areas like California, most people are living on the financial edge even if their incomes are higher. Just take a look at what renters and homeowners spend as a percentage of their income on housing per month:

Home buyers of crap shacks are spending 43% of their income on the mortgage while renters spend a jaw dropping 51% of their income on rents. This is why L.A. is the most unaffordable rental market in the country.

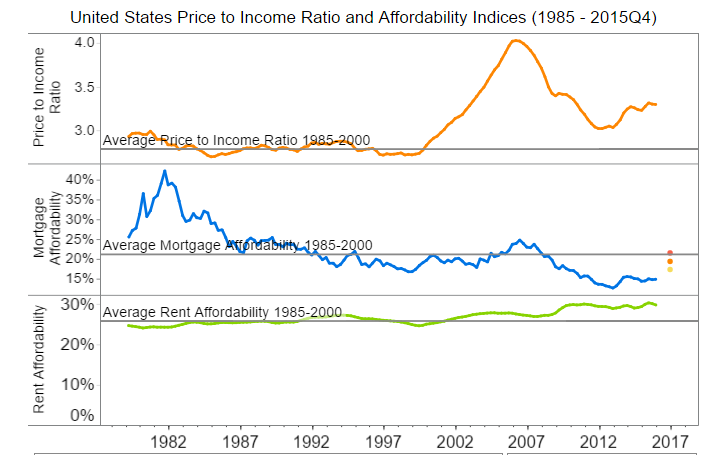

And Zillow also looked at the price to income ratio:

Notice how things got all out of whack starting in the 2000s? This is when housing turned into a speculative asset class right along with hot tech stocks. At this point, we’ve hit a wall and that is why the homeownership rate has hit a generational low. It is also looking like rents are hitting an interim high. There is only so much you can squeeze out of the market when incomes are stuck. And since we have millions of new properties converted to rentals, what happens when the economy hits that first hiccup since early 2009? If your income dries up, no rental money is going to come in. And we now have 10 million more rental households than we did a decade ago.

The manipulation in the market is a problem because builders are reluctant to build even though price signals and demand would suggest otherwise. They look at demographics and income figures and realize people simply can’t afford homes at these prices. There is still a housing crisis in America. All it means is that more income is being sucked into a largely unproductive sector of our economy.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

186 Responses to “A crisis in American housing: higher rents, expensive homes, and lower incomes are a problem impacting all Americans.”

10% owning and 90% their serfs, welcome to the new normal.

All the housing and all other economic bubbles can be solve in few days. NORMALIZE INTEREST RATE.

How would that work?

Yes it would pop the current bubble but not over a couple of days. You would also still have the economic fallout to deal with.

There are no easy, quick, or problem free means of dealing with a bubble once its been blown. The best you can do is to try and deflate it over several years.

Higher interest rates won’t do much for affordability either. It will take changes in local, state, and federal policy when dealing with housing debt and builders to really stop any further bubbles while also making homes affordable. Germany seems to have pulled it off, I don’t see why we couldn’t here in the US.

And by “solved” you mean kicking off the next Great Depression…

Do you plan on keeping your job?

OK now your basic Fed rate is 8%. Now Joe Blow can’t afford that $250 house any more than he can afford the $500k one now, but some guy from overseas who pays with a suitcase full of cash is even more advantaged than now.

Yeah, that’s work out well.

The issue in Southern California is available land at a reasonable price…. Home building and inventory is being kept low compared to prior bubbles… Homes are not expensive to build… I’ve been selling all the building materials that go into a home for 30 years… Labor is still reasonable as well… It’s available land and low interest rates… There is plenty of land but it’s either not for sale (Government owned) or invester owned. Investors sit on land and push the price… It’s all supply and demand… Demand is strong… Supply needs to get in line… Low morgage rates are allowing demand to push price…. There is a solution in Southern California (large government land sales) with the understanding it must be built and affordable for the middle class.. This with bumping interest rates up would cause a normalization in the market… Good luck right??

re: GS

That is nonsense. Here is a map of govt. and privately owned land in CA.

https://archive.epa.gov/region9/fedfac/web/jpg/map.jpg

The govt. does indeed hold a lot of land BUT its mostly in areas that are undesirable and out in the middle of proverbial nowhere or too difficult to develop anyways. They could put it up for sale tomorrow and little to none of it would sell to developers for immediate or even long term building. How so? NO JOBS IN THOSE AREAS! THOSE AREAS ARE ALMOST UNIVERSALLY POOR AS ALL HECK!! There is also little to no infrastructure and local govt. is wispy thin at best and can usually offer no development help since there is hardly any tax base there.

Most of the land near where most people live in CA is in private hands. If you want to force them to sell instead of holding for decades at a time you have to change the laws that are applicable to trusts and taxation of large private land plots. Good luck with that though. Too many in that state have bought into the nonsense that is Prop 13.

Of course there is no real need to keep growing the city and suburb sized out. At this point in time its actively a bad idea due to the cost of the infrastructure needed (which also requires higher taxes) and the effect oil supply shocks will have on gas. So what to do? Build up. Improve population density where ever you can by rezoning for affordable low cost apt. and condos. You don’t need to do NYC or Tokyo levels of population density either.

Unfortunately we can’t count on the market to correct itself here.

Too many monied interests are effecting the market to benefit themselves at the expense of others. Unfortunately they’re doing a very good job of it too.

They were also very smart about how they did it and have got so much lobbying power on their side on a state and national level that is very hard to see how things change in the short term no matter who is elected to Congress, state legislature, or Presidential office.

Long term maybe the demographic shift of younger generations to more Lefty policies may be able to shake things up as older establishment Republicans and Democrats get voted out of office. Or just get too old and die or go senile. We’re years away from that happening though. At best too.

I know lots of people here might not like the idea of younger Americans being more Lefty than they are but to them I’d say: take any sort of change for the better at this point, no matter who or where its from. The alternative is to maintain the status quo.

Need I remind you that those in the 10% started out at Woodstock and turned out completely opposite of that. Pepsi made a sarcastic commercial about it once.

The Yuppies formed because the system offered them a decent life. Today’s “kids” (20-30yr olds) know they’re screwed now and will be even more so as they get older.

Screwing an entire generation or 2 tends to have major political consequences.

tts – I know it’s the current fashion to say that the millennials are “screwed”, but I’m going to have to disagree with that. The kids that rack up $100k in loan debt for liberal arts degrees, or fail to get degrees are screwed and it’s of their own making.

I’m very aware of how difficult it is to find work, but I’m also aware of how many high paying jobs are out there and available. Go get a STEM degree, do degree-related internships in the summer, get good grades and you’re set.

Or – get into construction with an eye to being a general contractor. Or be an independent auto mechanic.

I don’t think there was ever a time in history when it was a good idea to get a Master’s degree then work at a coffee shop.

Life today is simply easier than it was even 40 years ago. Easier meaning we have more reliable/safer vehicles and machines, far more conveniences, and better/more healthcare available.

Re: Jeff

“I know it’s the current fashion to say that the millennials are “screwed—

Fashion?! Did you not see any of the charts in the article above or what? Facts aren’t fashion or up for debate. There is real good evidence to show that today’s 20-30yr olds have it worse than previous generations 20-30yr olds in the post-WWII years. And their economic situation appears to be getting worse not better.

“but I’m going to have to disagree with that,,,,kids that rack up $100k in loan debt for liberal arts degrees, or fail to get degrees are screwed and it’s of their own making”

Kids aren’t racking up $100K in debt to get Liberal Arts degrees. That is Republican talking point (which these days is just a round about way of saying its a lie in most cases) with no basis in reality.

http://www.economicmodeling.com/wp-content/uploads/TopDegreeAreas_US-e1341941091819.png

And given the cost of degrees, as well as the necessary time investment required, and the uncertainty of the job market, its unreasonable to blame people for being screwed for not getting a degree. A degree shouldn’t be required at all, it didn’t used to be for previous generations, to get a job that allows people to be middle class in the US. Its just one of the many more subtle ways younger generations are screwed and you’re acting like a awful person if you fail to acknowledge that.

Especially when you consider everyone is supposed to have to retrain into a new career 2-3 times at least during their working years now. No more “lifetime” careers like previous generations had. What the hell are young people supposed to do exactly? Go to college and work their way out of all that debt another 2-3 times over? They’re virtually guaranteed to be stuck in debt with a mediocre to crappy quality of life, certainly worse off than their parents at a minimum, for the rest of their lives!!

“but I’m also aware of how many high paying jobs are out there and available. Go get a STEM degree, do degree-related internships in the summer, get good grades and you’re set.”

Nope. High paying jobs haven’t even recovered to the same level they were at before the Global Financial Crisis/Housing Bubble bombs went off on the economy.

http://thinkprogress.org/economy/2014/04/28/3431351/recovery-jobs-low-wage/

And STEM fields have a huge surplus of workers available which is driving wages down in those fields in general.

http://www.popecenter.org/commentaries/article.html?id=2701

On top of that relative few can do STEM work, especially the very high paying stuff that requires genius or near genius levels of intelligence. So saying ‘just get a STEM degree’ is impossible as a widespread general purpose solution. Its not like previous generations had to be genius or near geniuses to be middle class, so why should the current younger generation be required to be so? Especially when they have no control over their intelligence, you’re born with it or your not!!

“Or – get into construction with an eye to being a general contractor. Or be an independent auto mechanic.”

Hahahah man you don’t know anything about the current job market. Both those jobs pay crap and offer little to nothing in the way of opportunity to increase their income. Construction/general contracting hasn’t been a blue collar job since at least the late 90’s.

Auto mechanic’s get paid and treated like crap too. Many effectively make minimum wage. How so? Well you know that labor fee that most shops have posted somewhere? That isn’t really the labor fee. That is the ::shop:: labor fee. The actual mechanic’s pay rate is typically around $15-25/hr. Which would be OK if that is what they actually got paid. But they don’t. Not for warranty work or most of the other service they perform which is what most of the work is. They get paid on a ‘job’ basis and shops go by the insurance/OEM manual for how long it should take to do a job. So if a job is on the book as 3hr you only get paid for 3hr even if you work 8hr doing it!!

Now you might say some nonsense like, ‘oh well that is the mechanic’s fault for being lazy’ but that is ignorant BS. You see the manual job hours are based off how long it takes for carefully trained and drilled mechanic’s to do the job on what is a new car. Virtually no shop mechanic will have the level of training to do it as quick as the book team does and even if they it doesn’t matter. Why not? Because used cars have rust! Rust which practically welds the bolts into the frame or component and often results in their breaking when you try to remove them. Do you have any idea how hard it is to repair a broken bolt in a newer car where everything is crammed in? Its damn hard. And time consuming no matter how good you are. So a 3hr job can easily take 8hr in real life and that is all they get paid for.

“I don’t think there was ever a time in history when it was a good idea to get a Master’s degree then work at a coffee shop.”

What in the world makes you think they want to do that? Do you have any idea how hard it is to get a Master’s degree? No one does that for giggles. Especially not for the debt it puts you in. They’re doing it because they have no choice because the job market is trash, not because they want to. You have to be near totally out of touch to say something like what you just did. But then most of what you’re posting is effectively years old Republican talking points so I highly doubt you’re interested in doing much thinking for yourself.

“Life today is simply easier than it was even 40 years ago. Easier meaning we have more reliable/safer vehicles and machines, far more conveniences, and better/more healthcare available.”

If you can’t afford it none of it matters.

The whole hippy thing was about avoiding military service, plain and simple. Once we got out of Viet Nam, the hippies became the yuppies and the “economic draft” made sure no rich kids would have to go get shot at.

TTS

Right on buddy! You nailed it. Jeff wants to believe it’s just lazy, whining, poor decision makers ( those who get liberal arts degrees) who are the problem and in general things are the same, even “better” for the younger generation.

I never went to college, I am 53. By the time I was 23 I owned a single family house and a duplex, in a decent neighborhood, in a major city! Yes, even back then that was uncommon but it was possible for someone who was prudent.

Today, such a scenario, I would have to say, is virtually impossible for someone straight out of highschool.

Martin – Hail to thee, fat person, you kept us out of war! Wait, wrong dialog, Dad’s Allen Sherman records had no effect on me, no, not at all.

I’m the same age and if I’d kept the hell off of a college campus, and been careful, I’d be in the same (rather nice) boat.

My parents were East European immigrants. For my father, as for many immigrants, higher education was a no brainer. He pressured me and my sister to get as many degrees, from the most prestigious universities, as possible. I got two. My sister got three.

I never wanted to go to college. In retrospect, I’d of been happier doing something — helicopter pilot, plumber, electrician, NYC train or subway engineer, any of those. But everyone assumed I’d go into white collar work, and I went with the flow.

My father saw blue collar as shameful. He said he respected workers, but it was obvious he saw them as a class beneath people “who worked with their minds.”

My father isn’t even Asian or Jewish. Most Asians and Jews worship higher education. They’ll do anything to get their kids into the Ivy League.

There’s a preschool Learning Center at the Brentwood Country Mart, amid yoga studios, clothes boutiques, and a Starbucks. I often go to that Starbucks. I see all these Asians tots, sitting at tinny-tiny desks, doing math assignments. I know it’s math, because the sales brochures pasted in the window state the curricula, and there’s much emphasis on math.

TTS- I’m very familiar with the auto industry especially within fixed ops side.

You can make 100-150K as a master tech within most dealership shops, if you know driveability and diagnostics your in great shape. Express lane not so much..

Warranty and recall work pays about the same, their are issues keeping techs so pay is competitive, Tesla is hot after high level Audi, BMW, Mercedes techs and get shares

re: cd

I’m going to have to call BS on your $150k “master tech”. You can easily google up the numbers on avg. wages for that position (closer to $40-50K nationwide avg.) and they’re nowhere near that.

Now you might’ve heard of someone somewhere getting a job in the industry getting that salary but that might as well be the same thing as hearing about someone winning the lotto.

I know people in the industry too and they virtually all say the same thing about what its like right now.

TTS,

Call bullshit all you want, I have been in more dealerships in one year more than you or all your auto friends have been in for their entire lives…

You don’t know jack as far as I can see by your meandering muttering…

go back to your crayons and chalkboard…

re: cd

You could’ve been to every dealership that ever existed and you would still be wrong.

http://www.salarylist.com/jobs/Master-Mechanic-Salary.htm

Looking at national numbers is actually worse than I thought. I had said $40-50K but apparently that is just for CA. Nationally the average pay is $34K a year for a Master Mechanic. The average national high is $51K a year. The average national low is $25K a year.

Note those are all averages so its still possible to get a $150K a year Master Mechanic job but my lotto comparison was right on point. They’re so rare as to not even be considered reasonable to get for nearly everybody including the highly skilled.

If you want a 2nd source than here you go: http://www.payscale.com/research/US/Certification=ASE_Master_Technician/Hourly_Rate

What’s left tho’?

Eisenhower? Who set up the national highway system to transports troops and looks like a screaming socialist now?

Hell Eisenhower and Nixon would be considered far-left now.

Eisenhower would be labelled a fucking commie. “During the eight years of the Eisenhower presidency, from 1953 to 1961, the top marginal rate was 91 percent.”

Source: http://www.politifact.com/truth-o-meter/statements/2015/nov/15/bernie-s/income-tax-rates-were-90-percent-under-eisenhower-/

The hippy Nixon created the EPA.

So would Reagan! Its absolutely surreal what politics in the US has devolved into.

The Democrats have real issues but good lord the Republicans are such a mess that the only reasonable reaction, for the uninformed or dis-informed, is vehement disbelief when you tell them how bad they are in terms of policy and political action.

I feel kind’ve ashamed for the schadenfreude that I’ve felt watching Republicans vote in Bevin for ideological reasons only to have him start dismantling Kynect (Kentucky’s state run Obamacare program) soon after he got office. But then I remember: if he had kept it some sort of secret then that would be different but he was quite public about what he wanted to do and the fools voted for him anyways! And now they’ll quite literally suffer for their decision since many will lose access to healthcare.

Unbelievable how people keep voting against their own best interests. I wonder how long it can last even among the older generations who are Republican base. Young people certainly aren’t buying into the BS the GOP is pushing.

Reagan was fairly middle of the road when he was younger but by the time he was running for president he was a bought and paid for right wing f*ck.

re: Alex

Well yeah of course but compared to today’s Republicans he’d be considered too Left and booted out of the party as a RINO. Which is hilarious/horrifying given his current deified status with the party.

With respect to a purchase, not much has changed. I researched some 1987 prices in Manhattan Beach. In 1987, a home in East Manhattan Beach were priced at $375,000 for an a decent 1950s home. Mortgage rates were around 8.5%. Rent on a home like that ran around $1200. A mid level engineer was making around $75000. Interest on that mortgage was about 8.5%*$375,000 = $31,875 per year. That was 42.5% of the engineers salary.

Today, that same house would cost $1,750,000. Today, a mid level engineer makes around $175,000 Mortgage rates are 4%. Interest on a new mortgage today is

4%*$1,750,000 = $70,000 per year. That is 40% of the engineers salary. That home would rend for $4200 today.

So, in 1987 and today, the starter East Manhattan Beach home is just as unaffordable to the mid level engineer as today when looking at interest on the mortgage. However, the down payment is much more difficult to come up with. In 1987, the 10% down payment was about 1/2 a year of a salary, and interest rates were higher so that savings grew. Today, the down payment is more than one year of the the engineers salary, and you get no interest on your savings. That is the big problem with today. The down payment is stopping people from getting in.

Typo. Today, the mid level engineer makes about $150,000, not $175,000. Boeing is paying $150,000 for an experienced engineer.

Just a quibble jt: While some experienced engineers do indeed make $150K and more at Boeing this isn’t the average. Boeing has six technical grades for engineers (T1-T6) and $150K salaries are only common at the T5 level and up. This requires 20+ years experience (or ~15 after a MS or PhD). The situation is comparable at the other big aerospace companies in the area.

My point is that these are pretty senior people, typically in their mid-40s and older, and thus past the age where one typically wants to buy one’s first home. The typical established engineer in their mid-30s with 10-15 years is a T3-T4 and makes closer to the $110-130K range.

FWIW your figure for 1987 is closer to my recollection. I started in the industry around then (at the equivalent of a T4 level) at around $50K and recall that the more senior T5 types were making $65-70ish.

jt, if only 150,000 as salary, then it will 53% of the monthly salary as mortgage payment. with 20% down.

Here is the punchy question on the face, where can this beoing engineer come up with $350,000 as 20% downpayment?

Check your slide rule, more like $15k.

That is on the high end though. Avg. engineer wages are nowhere near $150K/yr. Its around $60-70k/yr depending on whose numbers you’re looking at. Simply Hired says its $66k/yr.

Jt, I know some of these Boeing engineers you are talking about. One thing is for sure, they generally aren’t dumb at picking mates. Most of these guys have high paid spouses as well (other engineers, doctors, pharmacists, etc). The South Bay is filled with these people. Not flashy, driving 15 year old Camrys and Accords, but making 250K+. One more reason the market is hard to break into around here.

post the ad, i’d like to see that, I’m in engineering and i don’t know a single person making that kind of money……hell, i know people who own businesses that don’t pay themselves that much money.

Good point.

On the other hand, a teacher with ten years of experience with the Long Beach Unified School District makes $75 k. A 2/1 starter home in Lakewood (a typical, nearby “middle class” neighborhood for argument’s sake) lists at $450k now.

So unless that teacher has saved $90k for a 20% down (unlikely) he/she is going with a 3.5% 31%/43% DTI FHA loan. According to Zillow said teacher can afford only 2,200/mo in mortgage payments WITHOUT any other debt. Factor in student loans or car payments and that’s around $2,000 mo for mortgage. Again, using Zillow’s calculator’s that teacher can afford only a $350k house (give or take 20 grand) with 3.5% down.

Unless my calculations are off, the market would have to fall 25% for a single teacher to afford a tiny house in Lakewood. And from experience, in 2000, I was a single teacher with 8 years experience and I qualified for and bought a tiny Lakewood house with 5% down.

So unless the entire dynamic of Southern California has changed (and it could have with Wall Street and Chinese money muscling out the locals) then prices would have to fall around 25% for starter homes to go back to being starter homes.

I think.

Hey are you Jimmy with the CDM rentals? We miss your perspective on the OCHousingNews blog.

Creepy stalking, but is Irvine Renter still renting and pumping his real estate business?

Corona del Meh? I say, Feh.

He uses the blog to promote his real estate brokerage, but if you are referring to the Las Vegas rental investments, I think he still manages them but isn’t courting new investors (and hasn’t for many years). Occasionally, he will advertise some special opportunity on his blog. He was looking for investors for a non-real estate, spa-like business in Carlsbad awhile ago. Apparently, his decision to make a living off his writing turned a lot of people off back in the day. It doesn’t bother me. I’m just glad there are still some forums around to talk real estate without the mainstream bias.

A spa business? Good lord, that guy needs to upgrade his skills, he is smarter than that. He should have money on a new degree.

But, with Prop 13 your 1987 property taxes would be 1% of 1987 purchase price with 2% cap max increases per year.

Whereas purchasing said same house in 2016 at 1.75 Million would lock you into higher property taxes for the same level of service as your neighbor that bought in 1987!

Many people do not consider property taxes when buying a home. Most homes in nicer OC neighborhoods will cost you over a 1000 a month just in taxes/mello roos and HOAs

You’re right about that down payment. I’ve owned a small business for 5 years, and I now make $175K. To even buy a home for a “measly” $600K, you’re talking $120K down, and, since I do own a business, I’m going to want another $100K on top of that in case of emergency. It takes a while to come up with that kind of thing up front, unless it’s a gift…which is how most of the people that I know do it: cash from friends/family.

Hello Doc; more on these high rents, from recent article in all the LA news rags.

sorry to say but population growth and employment growth (per article) are driving demand…

http://laist.com/2016/04/12/rent_is_too_damn_high.php

high apartment rents in Southern California are expected to climb further in coming years, as construction fails to keep up with population and job growth, according to a forecast released Tuesday.

The average rent in Los Angeles County is expected to hit $1,416 a month in 2018, an 8.3% jump from last year, while in Orange County, average rents are likely to rise 9.4% to an average of $1,736, the USC Casden Multifamily Forecast said.

Rent or own: Where can you afford to live?

The projections come even as developers are building. Permits for more than 38,000 multifamily units were pulled last year across Los Angeles, Orange, San Bernardino, Riverside and San Diego counties — the most since before the recession, according to the forecast, completed by Beacon Economics and USC’s Lusk Center for Real Estate.

But much of the new supply is on the pricey end, and economists say much more construction is needed because California has consistently built too few units relative to population growth.

Last year, a report released by the California Housing Partnership Corp. said Los Angeles County needed more than 500,000 additional below-market rental homes if low-income residents were not to live beyond their means or in overcrowded apartments.

“Population and employment growth are driving up demand faster than new inventory can hit the market,” said Raphael Bostic, interim director of the USC Lusk Center for Real Estate, which collaborated on this week’s forecast with Beacon Economics, a Los Angeles consulting firm.

Stunning photos, celebrity homes: Get the free weekly Hot Property newsletter

In San Diego County, average monthly rents should increase to $1,577 in 2018, up 10.9% from last year, and in Riverside and San Bernardino counties they’ll grow 7.3% to $1,239 a month.

But annual rent growth should slow as new apartments open.

L.A. County rents rose nearly 5% to $1,307 last year from 2014, a pace that will slow to 3.1% this year, 2.4% in 2017 and 2.5% in 2018, according to the forecast. A similar slowdown is expected in other Southern California markets.

“For renters, new construction has simply kept a bad situation from getting drastically worse,” Bostic said.

I think this may be the year Jim Taylor is finally right – “Home prices in San Francisco just fell for the first time in 4 years” http://www.businessinsider.com/san-francisco-house-prices-fall-redfin-2016-4 — unless the Chinese money abandons Vancouver and floods the west coast. But Canada has a strange deal where a house can be transferred multiple times while in escrow. Too many middle men making money to let too much of that money come down the coast.

1.8% is meaningless. And vary well within a margin of error. I don’t know about San Fran, but speaking from real world experience I see no slow down whatsoever. Yesterday I put an offer on a property in Riverside county. Only on the market a couple days. They already had multiple offers with most over asking for cash. I have also recently seen crummy gross properties with entrenched tenants paying less then market value going for over asking price within days of getting listed. I don’t see any slow down, especially during these peak months for RE.

Hunan, it isn’t surprising with the rapid decline in rates this year. It was reported yesterday that interest rates are at their lowest point since Bernanke’s Taper Talk in May 2013, which means rates are bouncing along the low for this cycle. This is like steroids for the housing market, highly artificial but effective at creating strength in the short term.

Wishful thinking. Jim Taylor will be wrong at least for another year or 2. Need to wait until after election, when no more political influence to block rate hike and maintain market stability, then things should finally go with Jim’s way. Also it takes another year for all the shieat finally hitting the fan.

Thanks! Housing TO Tank Hard SOON!

Jim’s drunk again. Has been for a couple years now.

“It’s just a gully, that’s all.” – The Big Short

@hunan. I beg to differ. A price drop in SF is not meaningless. In fact it’s the opposite. Startup after start up is shutting down. VC wants profits not eyeballs. These startups were paying outrageous amounts for “talent”. This talent has to live somewhere but now it’s being laid off. BofA says RE is 14% over valued. Silicon God Peter Thiel stated publically RE and everything else is in a bubble. You can be a perma-bull all you want. I don’t care. But don’t you’re in a bubble. You’re not looking at sign after sign. Yes, a house priced right will get offers from knuckle heads or people chasing yield — God Bless them. I suspect your chasing yield which is hard to find in a low interest money printing environment. Good luck to you. I wish everyone well. But do note I make my money off of SV and I watch it closely. LA will follow soon enough. Don’t underestimate how artificial and grossly engineered the world is right now.

If you are actually in the market for a home in SF you know there is no slow down.

The only “issue” is the over built high rised condos….

so if you want to buy one of those for $900K instead of $1.1M you may be in luck

otherwise you are still screwed

@tolucatom

Hunan worships the Fed god and puts in his faith in zero interest rates. He believes that wealth can indefinitely be created out of pure speculation.

Prince of Heck is mad because he missed out the last time the housing train came around. Maybe you’ll next time? I’m rooting for you.

@holo, thanks for bringing up another big problem — condo glut. Overbuilding. Looking for yield. Twitter is trying to sublease 100K ft. Other startups signed leases on commercial real estate they can’t support. That’s gonna hit the market soon. You can believe what you want to but don’t create the impression that all is rosy. It’s not. SF is boom and bust. Always has been. I walked the streets of SOMA after the dotcome bust. Empty building after empty building. But this time it’s different. Why? Never in human history has so much money been printing. Never has the world carried this much debt. Never has there been this type of beta testing financial engineering. All of that SF real estate price hike was possible because VC was throwing 10’s of billions at 21 year olds who claimed they’d disrupt the world with another new twist on a ride sharing app. And they paid they’re employees ungodly amounts of money and they paid ungodly amounts for housing because this time it’s different. This time it’s worse.

@Prince Of Heck, the FED is owned by the major banks. The FED is a joke. Yellen recently said, she doesn’t see any bubbles — everything is great — as we head towards NIRP.

@Hunan

Funny, Hunan. I remember real estate agents practically begging for any kind of business during the downturn. The air supply getting too thin at the top for you now?

funny this is… it was a gully

Sorry Prince of Heck, but I am not a RE agent. If I had to have a label I guess it would be investor. In the past 5 years I have bought four properties and sold three and I have made money on each and every on of them, including property I bought less then six months ago. I am no smarter then anyone else here, but I do know how to spot opportunity. And I will say opportunity still exists in today’s market, it’s just harder to come by. My feeling is this, if the market goes up it’s great for those of us who own property. If the market goes down it is just a opportunity to add rental property on the cheap and ride it back up.

Hunan, the word you’re looking for is “flipper”. As far as I’m concerned, there is nothing wrong with that term or those actions in the market.

In Glendale, many people have income off the books, hence the high percentage of 51%. When you report low income, you get all the government benefits and they do not question you when you drive a S550 under lease. American is truly the land of opportunity for us “refugees”.

In Glandale many people are Irani, and they know all about the fiddle, making money off the books. It’s only common sense.

One time in Glendale I was purchasing flowers at a Florist. A Glendale resident in front of me proceeded to complete her transaction by searching through her Fendi purse for a method of payment. After removing a WIC voucher, 2 US Treasury checks, 8 different Visa/MCs, 1 EBT she finally managed to locate her BLACK AMEX to pay for the dozen roses.

I’d not commit an OPSEC error like that but I’m considering going off the grid again; I can probably double-triple my income by investing in a squeegee and some windex.

The U.S. housing market has become enveloped in the fraud and corruption of the global financial system, and that of the political system as well. There are those in the establishment who profit from the fraud and corruption, so they will defend it to their dying breath, but more Americans are realizing this is nothing but institutionalized looting sanctioned by the govt. It seems like every day brings another head-spinning example, whether it’s Goldman Sucks’ latest hand job from the DOJ or our own state attorney general getting charged by the SEC for securities fraud (a year late I might add). I’m warning every buyer I work with to see the situation for what it is… a bug looking for a windshield!

Our local real estate board chairman had me laughing hysterically with this spin on our March sales numbers: “Positive home sales in the $150,000 to $250,000 price range and increasing housing inventory suggest that we are in a more sustainable market.†Prices are rolling over here in Houston Texas, but the establishment continues to try to spin it six ways to Sunday, as though everything that happened during the last 8 years was all perfectly normal, sustainable growth.

http://aaronlayman.com/2016/04/katy-texas-west-houston-real-estate-market-march-2016/

it boggles the mind at the level of manipulation that exists in the RE market and then you get the bulls here who act like they are some sort if financial genius for getting in on the fraud.

well it makes no sense to me BUT when reality comes back to the market, and it will eventually, i think we’re going to be shocked at how much of this demand is from people with multiple properties all heading for the exits at the same time.

there was a story in Canada about some realtor dude that had interest in 18 properties……..8-fucking-teen….my x finally sold her house (at a loss of $30K i might add) and she sold it to…….you guessed it, an investor. fully 1/3 of the homes in her old hood are investor owned….this will not end well, it is mathematically impossible.

and finally, if those crowing the loudest get bailed out again that is going to really piss me off this time

What blows my mind is how soon all this madness came back – less than a decade after the last bubble. Shows how desperate people are to try and get ahead – most by not doing real work.

“Yet it is more of a sign of continued manipulation in the market. It is also a sign of outside money, either from big investors, Wall Street, or foreign money pushing up values and crowding out regular families from buying.”

What it is is a sign of overpopulation. For 300 years (1650 to 1970) rent and home prices were affordable for the middle class. That started to change as the population 25 – 34 shot up during the 1970s. Today there are no vacant lots left in major East and West Coast metropolitan areas. In city after city, decent houses are being bought and torn down for the land under them.

LOL no. You could the entire population of the earth into Texas with New York City levels of population density. If that is too tight for you then with Houston levels of pop. density then the entire global pop. could still fit into the CONUS with room to spare.

The problem is lack of wages + lack of regulatory oversight + Congress is too amenable to lobbying.

Nope. One noticeable feature in overvalued markets such as Vancouver and London are houses with no lights on. Investors laundering their money in western properties.

“Notice how things got all out of whack starting in the 2000s?”

This is a valid point and something I am going to bring up at the UCLA Anderson Housing Conference at the end of the month

If you look at the price gains at the start of the century for both new and existing homes, clear deviation from any type of historical norms.

Another know fact that people don’t know. The story line has always been that low inventory has held housing demand back. That more homes on the market would create more sales. The housing inflation thesis both rent and primary doesn’t get enough attention.

My evidence and charts here show that we have more inventory now from 2012-2016 than any period from 1999-2005, we are just missing the sales numbers.

– More Inventory

– Lower Rates

Demand is a lot less and if it wasn’t for the extra % of cash buyers, existing home sales would have had an under 5 million print every month this economic cycle.

https://loganmohtashami.com/2016/04/08/low-housing-inventory-lie-still-lives-on/

Exactly! the “low inventory” story doesn’t hold water. Sales are not suffering from a lack of inventory. Sales are suffering from the manipulation that has enveloped the market, the systemic corruption of the system from top to bottom. Of course the Fed doesn’t see any bubbles in asset prices, because they are they rooted in the corruption of the system.

Interesting article. Basically it’s a chicken and the egg. Prices are high because inventory is low but according to the article this is a direct result of un-affordability for move-up buyers. High prices is preventing those looking to upgrade from selling. Thus creating a lack of inventory. If prices came down, would there be a influx of inventory from those looking to upgrade? Maybe, but then again they would have less equity and buying power. Many are just now breaking even if they bought during the last market peak. This boils down to the fact that inventory is low. According to the article it’s just under 2006 levels. I think inventory really varies depending on where look and the price range of course. In LA there is plenty of inventory <300K, but in South LA.

No. You either didn’t read the article or are mis-representing it. The title clearly stated, “Low Housing Inventory Lie Still Lives On”. Even the conclusion refutes your claims:

“In real terms, therefore, home affordability is the problem not low inventory. We have more inventory now than during the housing bubble years but not the demand. Demographics, lack of exotic loans, high home prices and lack of liquid assets are the main reasons were are not selling homes.”

Move up buyers are fewer not only because the upgrade market is expensive but also because first time buyers are economically shut out. The bubble has always and will be in prices, or qualifiable affordability.

I’m sorry that I don’t agree with you Prince of Heck (by your name I assume the glass is ALWAYS half full), but you need to take it easy. People are allowed different opinions and disseminate information differently. You seem to have a chip on your shoulder.

@Hunan

I should ask you the same thing, how glasses of government and Fed kool aid are you consuming every day to keep the happy talk going? You are entitled to your own opinions. But it gets ridiculous when you thoroughly distort someone’s thesis.

Hunan

BTW, you’ve been on this blog for how long and still expect happy news? It is called Dr HOUSING BUBBLE for a reason.

Heck – the only houses Hunan’s dealing in is those little Monopoly game ones that hurt like hell when you step on them.

Check out the crazy price history on this teardown crap shack in a great area in Ventura County:

http://www.zillow.com/homedetails/116-W-Carlisle-Rd-Thousand-Oaks-CA-91361/16490603_zpid/

Carlisle Road is something of a special case. There’s been a moratorium on construction there for at least the last 10 years – and for the foreseeable future until major road improvements are made pursuant to Ventura County Fire Department requirements. I haven’t looked at this particularly property, but if it can be “remodeled” and thus skirt the new construction ban it might actually be an OK deal for estate acreage.

Then again, the Fire Department has essentially written off that whole road so buying there and just waiting to get burnt out might not be the best idea after all.

Apolitical – this is a sore point with me – even self professed survivalists don’t know dick shit about fire control. It’s not hard to learn about, keeping combustibles under control, etc.

Alex & a.s.: You guys are so right about people and fire areas. THe great Laguna Beach fire of 1993 is a case in point. I remember going down the street to a big wide open athletic field to watch it from about 20 miles away. The flames were huge. There was an engineer who had his custom built house stuccoed under the eaves, a fireproof tile roof, xeric plantings (not next to the house), lots of crushed rock and gravel in his landscaping, and NO brush. His whole neighborhood burned to the ground…except his place. Chance? I don’t think so.

Here’s an article about a guy who designed houses that could survive almost any natural disaster:

https://en.wikipedia.org/wiki/Ceramic_houses

I’ve long had an idea for a substance you essentially shoot all over your house – something like pumace? That would protect it from fire but apparently it doesn’t work that way because it’s the sheer heat that cooks out the flammable gases, then well you’ve got fire.

So yeah, 100′ clear areas, flame-resistant plants (and who doesn’t like nopales?) and so on.

Californian high incomes is such a myth. Average incomes in California is slightly above the the rest of the country, while housing is more than double. This has turned most of the state into the working poor. I still don’t understand why most of the state stays. Sure you have nice weather, but struggling financially to get by vs being comfortable and having a winter don’t feel like fair comparisons.

http://www.luckyoz.com/the-rise-of-the-luxury-city/

This is home to many of us. Born and raised here, not going anywhere. I get by fine, no desire to be wealthy in the monetary sense.

I was born here in cali but the truth is, I see the ocean once every 2-3 years, my angular Anglo features just get me by (thanks Dad!) but since I’m gonna die in poverty in the streets let me die in Tel Aviv.

The problem is you effectively NEED, not want :NEED:, to be wealthy to afford to live in many parts of CA while also affording to retire and pay for healthcare at a OK standard of living.

@tts, that is not true. I have friends doing it now. No way would they considered wealthy. We get by best we can. Some friends love their work and never want to retire.

Rhiaanon:

Avg. home price in CA right now is a tad over $450K. To be able to afford that house, with no other debt, you need to be making around $150K.

Very few make that much in CA.

Then you have to account for healthcare costs and retirement savings too and suddenly it turns out you really need quite a bit more than $150K to make it in CA.

Now there are lots of people in CA who are squeaking by. But that isn’t the same thing and you know it. They’re 1 missed paycheck or car wreck away from losing everything. I lived in CA for a long time so I know how it is. I still have family there who manage to live on $14hr by sharing a apartment with 2-3 other people. It varies. But they never have money to do anything. They have to shop at Goodwill. And they never go out. They just drink at home.

Its depressing as all hell and they all know tons of others who are just like them. Quite a few have college degrees and still can’t find work after looking for over 2yr. Its unreal.

“Avg. home price in CA right now is a tad over $450K. To be able to afford that house, with no other debt, you need to be making around $150K.”

Negative. That may have been true when interest rates were 8%. People making in the range of 150K (which you claim is not many) have their sights set on much more expensive homes in more desirable areas.

re: Blankfein

You’re right that people who make $150K are getting into more expensive homes in CA, usually closer to $1 million. Which is why even the HENRY’s (High Earner Not Rich Yet) are usually just as mired in debt as those who make $40k.

I, and Rhiannon, were talking about affordability though. That is an entirely different subject from what you’re bringing up! Gotta keep it on topic or these disscussions get mighty messy and confusing fast.

I’m with you. I see all the working class around me struggling to get by and spending endless hours in traffic commuting. If I were them I would get the hell out. Life can be much better in other places.

I make $10k a year and live with no running water and am probably dieing from chromiaum-6.

I am doing better than at least half of san jose

We are Brazil.

We should start a GoFundMe for Alex to get him to Isreal.

let’s get him a van and gym membership so he can squeak by in Santa Cruz selling art

Nah folks I’m alright, if I qualify for citizenship da evul joos will fund my move.

I know you are… I just live vicariously through your off the grid life style

while I hit the salt mines for my $1M+ McMansion

Holo – I keep thinking of holoholo holidays so pardon me but yeah, I work for a 60-something HENRY and I don’t envy the treadmill he’s on a bit.

Housing is just the tip of the iceberg, so-to-speak! Personal savings and retirement are in crisis, wages have stagnated for decades, healthcare costs are skyrocketing, and governments at all levels are still robbing ‘Peter to pay Paul’ or simply hoping their growing list of unfunded liabilities go away! The economy is barely mustering a positive, and in reality, there are few prospects for this improving significantly. Housing is symptomatic and while inventories are in extreme short supply keeping prices high, it still remains to be seen how long the game can be played with just foreign investors, Wall Street money, and a few millennials getting down payments from their folks!

Shhh. Don’t let reality get in the way of the roaring 2010’s. Maxing out credit lines isn’t as as positive of a real estate headline as “bidder wars due to low inventory”.

It is a weird coincidence that the Fed and the President and VP had a closed door meeting days ago and the market suddenly went up.

Yellen doesn’t have that kind of power…or does she? bum bum buummm

http://www.zerohedge.com/news/2016-04-01/inside-janet-yellens-diary-stunning-discovery-two-phone-calls-saved-world

With a “secret” phone call could she do something like that? No. Too much money is required to do it, billions if not tens of billions easily. With a FOMC, which requires some degree of public disclosure, then sure yeah Central Bankers like Yellen can do all sorts of things.

Realistically I really doubt anyone over in EU-land would bother to wait for or need a call from the FED before bailing out a bank. Its not like they’ve been shy about their bailouts over there when they need to be.

I read Zerohedge too but I treat them like the Nat. Enquirer of financial news most of the time. They’ve just been wrong too many times to take them more seriously than that.

ZeroHedge is a ces pool of nonsense….. don’t even go there, it’s a waste of time that will help you to make horrible decisions based on irrational fear.

Calculatedrisk blog will let you know when the next recession is coming

Yes they are most of the time. I think they’re still worth a quick glance since they’ll talk about stuff no one else does, which can be interesting, and their POV is great as a indicator for what the current conspiritorial/InfoWars meme’s are.

Treat them as a trusted source like CalculatedRisk though? Oh heck no. Totally in agreement with you there.

Housing To Tank Hard Soon!

(I got you, Big Jim. No worries.)

YOu are being herded to living areas under agenda 21/nwo. reaperishere.weebly top left video

Father’s generation was very populous, my generation is childless and that’s saying something considering there are 5 of us.

I’d say agenda 21 is coming along nicely.

Yeah just like Jade Helm and REX 84 have totally allowed Democrats to completely take over the country and install Obama and Bill Clinton before him as our new Glorious High Leaders?

Nah. Didn’t think so.

For some actual content instead of just snark: younger generations aren’t having as many kids because they don’t have the money to start a family, have greater job insecurity (labor is treated in general as disposable cogs these days), and housing prices are still insane.

Also read less InfoWars and crappy far Right conspiracy blogs. You’ll be happier and less mis-informed.

tts- you don’t understand sarcasm do you?

I cannot tell anymore half the time.

I have family who really do believe in the Agenda 21 Left Conspiracy, that Obama is a indeed a secret Muslim Kenyan, and go on and on about Benghazi, etc.

It is a result of massive labor dumping.

Mortgage rates lowest in 3 years !!

Buy, Buy, Buy at the top !!

http://www.reuters.com/article/us-usa-mortgages-freddie-mac-idUSKCN0XB2E0

Buy high, sell low!

And here in San Diego all the “new” houses being built are all 2 story monstrosities at over 2,400 sqft and master bathrooms with showers big enough to shower a polygamist and his 5 wives, all at the same time!

Insane!!!!

They’re not building the houses we want to buy! Especially at a price we can afford, without having to spend 50% of our income on housing alone!

Eddie, couldn’t agree with you more. New construction small detached starter homes are likely a thing of the past. Home builders are business to make money. Most new houses are built on postage stamp lots. Building a 2 story house 2500 sq ft house with all the bells and whistles will command quite a premium compared to a one story 1300 sq ft. bare bones starter. One more reason the supply side is severely constrained in socal…especially for first time buyers.

I always enjoy how San Diego is considered a lower salary zone than LA and OC by corporations yet the cost of living is just as much and sometimes more. SD is an awesome place…but also a strange place at the same time.

It’s been accelerating out east and in the midwest now over the past couple of months. Prices are increasing so fast that people are taking their homes off the market days after listing to relist them at a higher price.

It must be people on SS/SSDI because there are no jobs in flyover country

“no jobs in flyover country”? My goodness what an incorrect opinion.

https://www.reddit.com/r/lostgeneration/comments/4egmm9/the_workers_caring_for_our_grandparents_are_paid/

This is how 99% of us live now.

Great link. Forwarded it to every Millennial I’ve ever known.

Millenials already know all that.

Its the older generations who need to read that article the most. They’re the ones who generally view anyone under the age of 30 to be entitled, narcissistic, and lazy.

Which is complete BS:

http://www.theatlantic.com/national/archive/2014/03/here-is-when-each-generation-begins-and-ends-according-to-facts/359589/

Millenial is just a made up marketing term by 2 guys, Strauss and Howe, to sell marketing strategies to companies which caught on. And by all accounts they’ve been successful at it so good for them I guess.

If you’re willing to go back you can find articles from the 50’s, 60’s, 70’s, 80’s, and 90’s crapping on the previous generations as being too lazy, entitled, or out of it too. It is somehow accepted wisdom in the media, and even often by society’s thinkers, that every new young generation ever is somehow crappier than the last.

“The counts of the indictment are luxury, bad manners, contempt for authority, disrespect to elders and a love for chatter in place of exercise. Children begin to be the tyrants, not the slaves, of their household. They no longer rise from their seats when an elder enters the room; they contradict their parents, chatter before company, gobble up the dainties at the table, and commit various offenses against Hellenic tastes, such as crossing their legs. They tyrannize over the schoolmasters.â€

Some things never change.

tts- it started with generation X.

“It was not cool to be a kid in the 70s” – Ted Rall, in his book “Revenge Of The Latchkey Children”.

Economically speaking yes. In the late 70’s is when wages stopped going up with productivity and inflation.

Older generations have always crapped on younger ones though. The quote I gave was from a historian compiling the gripes of ancient Greek philosophers thousands of years ago.

I was 8 in 1970, and 18 a decade later. So I was a kid throughout the 1970s.

I was never a “latchkey kid.” My mother was a standard 1950s, stay-at-home housewife. Maybe because she was an immigrant.

Two factors I don’t see people talking about. I agree that prices are way too high, but in terms of affordability, every year, people on the sidelines grow. Keep in mind that that pool of buyers grow every year. You now have tons of people that have been saving for the past 8 years, since the last crash. Coming up with $120K down over 8 years is saving $1250/month. That’s pretty feasible.

Second, regarding subject population growth (or none thereof), one side effect is parents with savings are basically diversifying their retirement wealth into real estate and many buying their kids homes (since they only have one or two kids, and to try to time the real estate inflation in a low yields environment).

High rents are keeping people from saving up as you suggest. $1250/mo is the marginal case scenario.

Omigosh, the rationalization for currently ludicrous prices continues to be amusing. I heard the same hypotheses several years ago. They always tend to forget how lopsided against the lower 99.9999% the current “recovery” has been.

As someone pointed out in this thread, you can pay more than 1K/mo for property tax, mello roos and hoa fees. Bottom line is the system is destined for implosion.

I have never posted here but enjoy the forum a lot. I bought my first property in 2005 (nobody helped me) and fast forward to present day have $1.5M-2M in RE equity. I have made a lot of money over the past decade buying cheap crappy places (and never over leveraging) that are cash flow positive and renting them out until there is enough from froth that someone overpays me for them and then I hold cash. Rinse and repeat. Without sounding like some kind of awful real estate investment seminar it has made me rich at a young age. I attribute my success largely to emulating the platform of longterm seasoned real estate investors (not flipper bozos) and also being a contrarian. I am a seller when everyone else is buying for the most part. I just sold some property because someone paid me way more than it was worth. I am holding cash and believe Mr. Taylor is right that housing will tank soon. When it does I’m gonna keep doing what I have been which is snapping up distressed and or trashed properties. This time is not different, prices are way out of line, again. Good luck to everyone out there and thanks for this forum, you guys rock.

miyagi,

Nothing magical about it. I’ve been doing that for decades. It always work. All you need are nerves a steel to not act on emotions (most people lack that and act on emotions), a good long term plan and lots of patience.

Nothing magical about it. It helped me to be a multimillionaire, too. You don’t have to be super smart; just frugal, disciplined and patient.

Hopefully zillow used actual sales and rental prices because their “zestimates” are crap!

The digital age and social media creating an inefficient marketplace. Sounds like buying a home now-a-days is like keeping up with the Jones. Not a decision based on finances but based on appearances and the crowd. If it makes FINANCIAL sense I will buy but its just not a priority and never will be. Owning a business and having a family is all I really want. Doesn’t matter if we own where we live or rent it.

Apparently people really pack these open houses, follow the lemmings into a packed house and make it rain like you’re at the gentleman’s club. Sounds more like a hobby than a financial decision.

Same here. I’m in my 50s and have never seen the appeal of owning a home; owning rental property is quite enough work. I love my small apt. in a good area.

One problem that realtors have are the lookiloos. I mean hardcore lookiloos — people with absolutely no intent to buy. They go to open houses as a hobby. They do so for years on end, never making an offer, but showing up nonetheless.

I read about these lookiloos years ago. Most serious buyers hate house-hunting, hate open houses. They just want to buy so the house-hunting nightmare will end. But lookiloos attend open houses every weekend for fun. Curious to peek into other people’s homes.

Question for the bubble people here.

Over the past week, I heard two RE investor groups pitch for funds.

The 1st was publicly traded looking to pay 6% monthly on preferred stock, along with warrants and other sweeteners.

The 2nd was a smaller firm looking to pay 12% annually to investors, since they were paying 18% to the bank for their funds.

Both companies will tie up the investment for years, both firms are investing/building rental and commercial properties.

I get ads from RE agents pitching Cap Rates in the 6 to 9% range to purchase Walmarts, Dollar Stores etc., stable RE tenants to throw off revenue stream to the investor.

So finally to my question, how can the RE firms asking for cash at 6 to 12% +++ cost of capital make money when Cap rates are so low?

What am I missing?

Are these firms based in Nigeria or China? They sound desperate for investors and will promise whatever is needed to part you from your money.

Scam ’em back – sell ’em an ANUS laptop.

https://www.thescambaiter.com/forum/index.php?/topic/17878-anus-laptops-the-martins-cole-saga-complete/

NSFW because you’ll laugh your asses off and the boss will know you’re goofing off.

Running for the hills: young people can’t afford to buy or rent, so they are building their own houses

We meet members of Generation Rent who have given up on the housing market and private rental sector and are living illegally off-grid.

With real earnings falling, house prices rising and more young adults living with their parents, it seems like the only way anybody under 30 will ever be able to own their own home is to sneak off into the woods and build it for themselves. I speak to a couple of members of Generation Rent who have done exactly that.

Young people are screwed. We’re just never going to own houses. Here are some numbers…

http://www.newstatesman.com/politics/uk/2016/04/running-hills-young-people-can-t-afford-buy-or-rent-so-they-are-building-their

Back in the ’70s, my Brother and I did that on some rural property in Western Oregon we got from our Parents. We still own the houses because we can’t get enough money from them to make it worth our while to sell. We have some new neighbors who are off the grid types. (Last I heard, she was pregnant). I’m trying to use the rent money to upgrade enough to sell to retirees who want to return to nature. So far, there aren’t a lot of boomers doing that. My folks’ “born in the Country” generation was more into that.

Lots of people “go back to the land” and find themselves spending more, using more gasoline/diesel, and just plain consuming more.

When I left the rural place for San Jose I expected my food expenses to go up because no more garden and I’d have to pay for eggs again, but they stayed the same.

Several people have written about this, and the famous “ferfal”, a real survivalist, has written about how people in the country fared far worse than people in the city. He personally moved to a small city in Ireland.

Alex, it’s true that the Country can have unexpected costs. Also, unless you were born in the Country, you might not have the skill set to take advantage of the possible cost savings. My Mom was an expert at canning, pickling, etc. Cooking, sewing, knitting..you name it. Where they lived, the electricity is very cheap due to the REA coop getting Federal hydropower. That can be a significant saving. What can be expensive is running your own water system. Wells aren’t free, and in some areas you need to treat the water to make it useful. If you’re far enough out in the Country, the dirt or gravel roads beat the hell out of cars.

Also, there is a lot of solitude in Country life, and if you weren’t born into it, you might get awfully lonely. But I was OK there because I always had projects to keep busy with, and hobbies that I could do by myself (reading and music).

Here’s an example of a SFR in LA for under 500K and a flip gone bad.

https://www.redfin.com/CA/Los-Angeles/2426-S-Harcourt-Ave-90016/home/6897071

Has been sitting on the market for about five months. Probably something to do with the 10 freeway underpass about a 100 ft away or maybe that this was a genuine crackhouse. Check out the before pics:

https://www.redfin.com/CA/Los-Angeles/2426-S-Harcourt-Ave-90016/home/6897071/crmls-MB15117259

So far the flipper has lowered the price 50K from original listing price of 525K. I have to admit that the interior looks OK to me. But that pink exterior color, concrete backyard, and location leave a lot to be desired. What’s it going to take to entice someone to buy this junk?

Shame- that could be an awfully cute house, and you can tell it was once a rather nice one, by the kitchen appointments, which were very advanced for their time. I love these old Los Angeles Spanish Colonial Bungalows. That place has everything it needs to be made into a little gem- note the nice architecture and vintage interior details. But the price is horrifying- I’d want to pay $50K for this little wreck in a slummy, dangerous neighborhood, not over $500K.

maybe remove the bars on the windows…. and grafitti inside the house….. before you take pictures…. then you have a half million dollar house in third world LA

Clearly California needs more trailer parks. Land and zoning are a problem but there are plenty of derelict strip malls and big box store sites that could be converted into ‘affordable housing’ sites.

Trailer parks can be pleasant enough communities given the proper management. The better ones here in Florida were much sought after by investors as the revenue is almost recession proof as all the tenants are retirees living on SS and pensions.

Tiny homes on wheels. Drive to the park or ocean by day, then back to the big box store parking lot at night and live in a community of tiny homes and shipping containers in vacant parking lots. If Steinbeck were writing today, he might entertain this train of thought.

I don’t quite understand the lack of understanding, Sewer nation has been “morphed” into a Talmudic state, an oligarchy if you will. The tragi-comedy in it all is the fact that the vast majority haven’t a clue as to the responsible party… well, other than the “Judas Class” in D.C.

California’s rich keep getting richer — despite paying an ever greater share of taxes: http://www.sacbee.com/news/politics-government/capitol-alert/article71944477.html

I hope you are right Doctor that people are waking up. However, the skeptic in me tells me that most people are lemmings and will not even go into the voting booth to vote for their best interests.

Case in point, November 5, 2011 was supposed to be Bank Transfer Day. This was supposed to be a protest movement against big banks. I said a big f you to Chase bank and transferred my money from Chase to a smaller family owned community bank. I told my coworkers, friends, relatives and neighbors. Sadly only ONE OTHER PERSON joined me. Nationwide only 440,000 people joined in this action. https://en.wikipedia.org/wiki/Bank_Transfer_Day

It looks like to me that the American people will gripe and complain of the greedy bankster mafia but they won’t even take one hour of their time to transfer their money away from the bankster mafia. In my heart I hope the American people fucking wake up and tell the crony capitalists that their time is up. But my brain tells me the vast majority are too lazy and too beaten down to act upon it.

The reason is that people have it too good in this country… even the group that complains most these days… the Millennials have amazing lives in this country.

Sure people love complaining… and there are reasons to complain… but life is so much better today and so much better in the US nobody will really take out the pitch forks.

I want to add something else. Why on earth is it that in our culture that if something is made more expensive then more Americans will want it. If something offers a great value then we don’t want it? I live in Chicago and we have plenty of housing choices. There are lots of cheap neighborhoods and a lot of affordable neighborhoods.

It is interesting to see how some neighborhoods become “hip” and “hot” and all of a sudden the lemmings all want to get in and then boom the home prices and rent prices zoom up. In the end the American working class are just as much at fault for their predicament as the big banks, the crony capitalists, etc. Without the American working class’ keeping up with the Jones’ attitude, the house of cards can not be built.

Nimesh, you are so correct. I have seen the same thing in every city I’ve lived in or visited. Note how Chicago’s affluent “hippoisie” have driven the prices to nosebleed levels in intrinsically ugly neighborhoods like Wicker Park and Bucktown, which were still reeking, decrepit, dangerous slums with no decent architecture; ancient, decrepit housing stock that was built for factory workers in the late 19th century; and plagued with crime, violence, and gangs………while perfectly lovely, but dull, neighborhoods with gorgeous, luxury housing stock available for gift prices, like Peterson Woods, Hollywood Park, North Park, and West Ridge are held in contempt. It seems like our well-heeled hipsters are appalled at the thought of living beside cab drivers, CTA workers, secretaries, and other “working class” people….. but don’t mind living side by side Project Section 8 housing stuffed with gangs and 15-year-old baby mommas with 4 kids by 4 different baby-daddies, dead people in the el stations, or on streets littered with trash and shootings every night.

Nimesh, the tendency to value things more highly when they are overpriced and “fashionable” isn’t just an American thing- it is a universal human trait, and those who market luxury goods have always known that the best way to move these goods and create the perception of value is to overprice the goods on offer.

However, people in the U.S. once took a more sensible, pragmatic approach to expensive necessities like housing. What astonishes and disgusts me the most is how the hipster crowd will make a slum fashionable, and bid up prices on decrepit, ugly houses in neighborhoods that are reeking slums with nightly shootings, dead people in the el stations, and total gang ownership of public spaces, while snubbing perfectly beautiful housing with reasonable prices in extremely nice neighborhoods. Chicago is not the only city where this happens- it was the same in St Louis 35 years ago. Tell me why the hippoisie of Chicago would bid prices up to nosebleed levels in neighborhoods like Wicker Park and Bucktown, which were reeking, fetid, decrepit, dangerous slums as late as 1990 and are still pretty “marginal” today; while spurning clean, safe neighborhoods like Peterson Woods, West Ridge, and Hollywood Park with their gorgeous, bargain-priced housing stock, convenience, and proximity to all the amenities of the lakefront, but without the congestion and lack of parking there. I guess the neighborhood has to become extremely old and slummy and “funky” to be of any interest to the hipsters. Thanks to Section 8, that just might happen- we are getting an influx of extremely undesirable people in W Ridge. Somehow, the same affluent hipsters who despise clean, hard-working, polite working-class people, labelling them “bigoted” and “ignorant”, and are appalled at the thought of living beside cab drivers, restaurant workers, and the like; are perfectly willing to move into areas dominated by gangs, crime, 16-year-old baby mammas with 4 kids by 4 different daddies, and Section 8 housing- and label you a bigot and an idiot if you object to either the rapidly escalating prices or taxes, or the increasing prevalence of trash all over the street, shootings, street crime, and general incivility.

Flyover, exactly. You nailed it. Patient, frugal etc. but otherwise nothing proprietary. I am sure you have seen what I have, which is those that have made a lot of $ in RE are not necessarily highly intelligent, but have the qualities that you mentioned above. I am not the brightest guy in the world but I am disciplined as hell, frugal, and patient. Bam! It has worked! Take care my friend.

Boca Condo King, I think you mean Walgreens not Walmarts. I used to sell commercial RE before I became a full time investor. Walgreens (and Dollar Stores) are generally peddled as being a lower yield alternative to owning multifamily (apartments.) Walgreens are NNN leases which means an investor owns the underlying real estate but the tenant, in this case Walgreens, is your tenant on a longterm lease which is adjusted for inflation. Tenant pays prop. taxes, maintenance, insurance, etc. It works well as long as Walgreens corporate doesn’t go belly-up. If they do you are stuck with a large box space to lease out. I saw these get popular when I last sold them in 2007ish. People were cashing out of apartments and trading into them. I personally am not at all comfortable with commercial assets, they fluctuate too much with the economy. I like bread and butter C class rentals, that is where you make money. I don’t know if that helps at all or answers your question, if not sorry! I tried! haha

You have to wonder how the current job market will effect the housing market. I have about 10 years in the job market and I have moved 15 times for companies and better job offers. One of my friends has moved about 30 times on 5 different continents, all paid for by companies. The game seems to be, continuous education and then go with the highest bidder. I don’t quite get the reasoning that outsiders know some magical formula but that seems to be the Kool-aid corporate management is drinking these days.

If you are saddled with a house you are condemning yourself to lower wages and dead end jobs. Absolutely zero desire to be a homeowner – ever.

That sounds perfect if your young, dont need a retirement or benefits or dont plan on having kids.

Repeal the Costa-Hawkins Rental Housing Act and Prop. 13!

Look, we as a nation must come to terms that America as a once country of everything is possible has ended. The American revolution is now replaced by hi tech firms/ computers and millions of lost jobs.

The gov’t has no idea of what to do with displaced people because that would mean a major shift in capitalism as we know it. The players that make up our financial system have it good for now why change the game plan, even though the country is dying slow capitalism death.

Colleges are just factories for sports TV revenues and the sheep students pay 100 to 150k to get in debt, they never can repay during there earning years 25 to 45 crucial for retirement most don’t and won’t retire in good shape.

American dream is a illusion folks, crumbling old Eastern cities that would take trillions to rebuild, pensions gone away and yet the folks are told everything is fine a tweak here a tweak there and the system is fixed? Just this morning another sporting goods going out of business, who has money for sports equip most barely make the rent or mortgage.

What is the answer, a major shift away from the rich and famous life style, bull by the horns and take no prisoners approach. Colleges have to be for folks who really need that degree and athletics must take a back seat with major TV contacts wiped out, no more new uniforms every week on the teams, grass roots or no public money or endowments allowed. The pro sports teams can’t just raid the schools to make billions on kids who are on step away from injury and bankruptcy.

Firms must reinvest in the local economies or face huge fines, cities that raid pension funds, we will find you and throw you in jail for what you have done.

High Schools will be the new JR colleges preparing for the new ever changing tech sector and so called trade schools must be brought back, our roads and buildings will need a huge make over train the kids to build something, tradesman are in real need in America, xlnt pay and benefits will bring the youth on board.

A BMW or MBZ in every garage with a huge lease payment fine if you will be lucky enough to have the job in the future to pay for it. We need good solid cars and Suv’s with no frills just low payments and reliable to get to the new job that waits.

Housing can be affordable, 2000 sq ft 2.5 bath homes in a nation that builds stealth bombers for billions of dollars that most will never see combat, yes they can be built on a huge scale.

Sounds like a mix of whatever “ism” you want to call it, I say change is not in a word or fear that change is bad for America.