Conforming loan limits should expire lower – how is a $729,000 government backed mortgage viewed as affordable housing when most families only make $50,000 a year?

Southern California enjoys adding flare to any event and Carmageddon certainly did not live up to the hype. Certainly the massive amount of coverage given to the event kept many people home and off the 405 between the 101 and the 10 freeways. Unlike the housing apocalypse that has wiped out $6.5 trillion in home equity across the country I’m sure it is manageable for people to sit back and allow for some work to be done on a much used freeway. Housing continues to be a drag on the economy because household incomes are simply facing tough times ahead. No amount of focusing on interest rates or conforming loan limits is going to increase the amount of income entering a household unless the economy improves on the jobs front. With conforming limits set to move lower soon some are arguing that the limits should be kept high for a longer duration. The five year old housing bubble is an issue of inflated housing prices so it is hard to understand why we would want to keep tools that make homes more unaffordable to Americans with more cramped incomes.

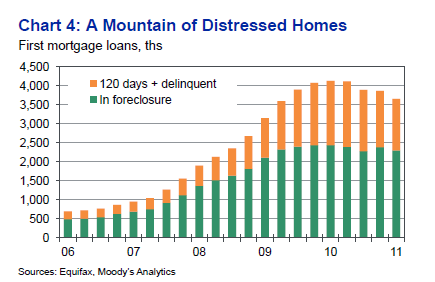

The market of distressed homes

Source:Â Economy.com

We still have over 2 million homes in some stage of foreclosure. The housing market has plenty of lower priced homes for supply and this is what is keeping sales moving. Families are gravitating to lower priced homes because their incomes are unable to support inflated homes that still carry the essence of the housing bubble days. The actions of the Federal Reserve buying up $1.25 trillion in mortgage backed securities simply extended the correction but also provided banks time to fix their own balance sheets. The bailouts were never about helping homeowners and the above chart should be a testament to that most obvious fact.

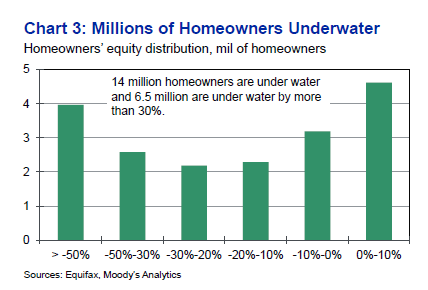

Underwater nation

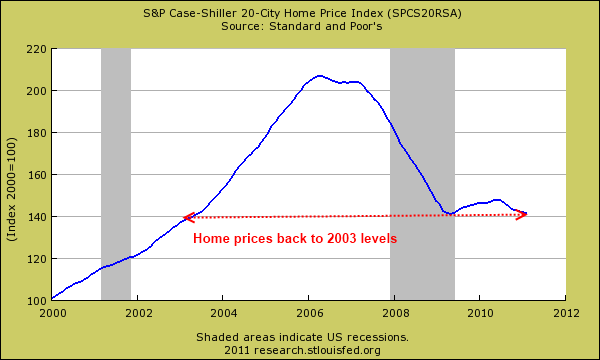

14 million homes are in a negative equity position. Being underwater is one of the biggest predictors in forecasting future foreclosure. 6.5 million mortgages are underwater by 30 percent or more. Now keep in mind over 2 million homes are currently in foreclosure. How long would it take for a home to go up 30 percent in value in these times? Now during the bubble this would have occurred over 1 or 2 years especially here in the sunny state of California. With stagnant incomes and massive inventory home values are now back to levels last seen in 2003:

Not only are we not seeing any year-over-year price increases but home prices are actually falling. Now after five years you would think many people would get it that the demand is being driven by lower priced homes. The other outside factors like low mortgage rates or tax credits are simply short-term boosts that give a false sense of recovery. Even after trillions of dollars pumped into the system here we are in the middle of summer in 2011 and home prices are inching back closer to 2003. Why? Because household incomes never kept up with home values. It is all about the paycheck amount.

The jumbo market

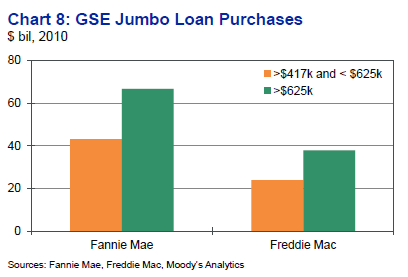

Mark Zandi from Moody’s has this to say about the coming conforming limit change:

“Without an extension, Fannie and Freddie’s loan limit will fall from $729,750 in the highest- cost areas of the country to $625,000.11 FHA loan limits in these areas are likely to fall even more, since they are defined as the lesser of 115% of an area’s median-priced home or $625,000. The high-cost areas that would be significantly affected are primarily in the Northeast and California but include some parts of Florida and the Chicago metro area. The higher loan limits affected approximately $140 billion in loans originated in 2010, or less than a tenth of the $1.5 trillion in mortgages made that year (see Chart 8).â€

It is hard to find any reason to keep these limits so high. The nationwide median home price is approximately $160,000 so these current figures already seem rather generous to say the least. Fannie Mae and Freddie Mac are the backbone of the current mortgage market because no other buyer would soak up this amount of loans in a fragile economy. Add into the mix FHA insured loans and you have a housing market that is virtually all predicated on the government buying up mortgages and then selling them to itself through the Federal Reserve. It is clearly an unsustainable system.

We should welcome the drop in conforming loan limits because this is an old throwback to the days of the housing bubble. I remember contacts sending over rate sheets almost on a semi-annual basis where caps kept going up arbitrarily with the rising bubble. The banks and lenders were all the more responsive to moving things up even if we now know that it was an entire bubble. So wouldn’t it make sense to simply press the reset button and go back to pre-bubble limits? Of course the fight is not going down as easily as you would imagine. Lenders now completely rely on the government since the global market is now a bit weary of mortgage debt even if it is stamped and labeled triple-A.

Ultimately if the government wants to take an active role in fixing the economy it should not take advice from the main players who caused this downturn. The focus should be on creating a system that allows for the thriving of better paying jobs (this assumption is based on the government having to take a major role). The meddling and aiding of banks on Wall Street has merely served as the biggest redistribution of wealth we have ever seen but to the banking sector. Look at the above data and see how much bang for our buck we got with housing from the historic bailouts. Ironically in a time when households need more affordable housing these same actions are keeping home prices inflated. Again, why in the world do we need these $729,750 conforming loan limit caps? How about we peg the cap to the nationwide median home price and other areas that are more expensive should use a hybrid model where the remaining difference will be made up by local banks? This way, banks get to share in the fun of holding giant mortgages and will exercise more due diligence.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

41 Responses to “Conforming loan limits should expire lower – how is a $729,000 government backed mortgage viewed as affordable housing when most families only make $50,000 a year?”

Re-paving roads, such as the 405, is one of the very few things the gov’t. does that benefits the general population. Having paid thousands is taxes every year, how does the average middle class family benefit? Three wars, two of which are run by the U.S.? Food stamps? Section 8 housing? Subsidy not to grow crops?

The fact is that the Federal government is highly skewed to benefit the lower classes, to keep them molified, and peaceful. If even a small portion of entitlement programs were eliminated, there would be riots in every major city in the U.S.

I couldn’t agree with you more.

Of course you can’t be referring to s.s. and medicare as everyone will get it.

And since you can’t be referring to the above, your statement is pure Teabagger propaganda.

The biggest beneficiary of the federal budget is the military industrial complex. Programs for the “poor” are way down on the list.

On the other hand, Republicans do want to means test s.s. and medicare so that if you have too much savings, you don’t qualify.

Why would they want to do that? So that down the road they can claim that s.s. and medicare are welfare programs, only for the poor. Once they get means testing for s.s. and medicare, it is only a matter of time before they get s.s. and medicare abolished as just another welfare program for the poor.

Class warfare is the end game.

Medicare is the biggest Federal outlay, not defense.

I couldn’t agree with YOU more

Actually, the goverment is heavily benefiting both the rich and the poor. It is mostly the middle class that is impacted the most since they don’t make enough to benefit from the special interest concessions for the wealthy but they make too much to qualify for government help and subsidies for the poor.

I’m not sure even the federal highway building program benefited the general population. But maintaining it to minimal standards and doing necessary replace and repair on essential elements of it, like the project this weekend in CA, is only the government’s job and the least our policy makers can do.

The construction of the massive, and massively expensive, network of highways, from the 50s onward, was the principal cause of the destruction of our cities and our almost total car dependence, and generated a pattern of development that now has 80% of our population living and working in places where people cannot perform the basic functions of daily life- going to work and school, obtaining food and clothing and other necessities, or running errands and participating in recreational and cultural activities- without driving at least 10 miles a day and usually more, and in general using copious quantities of liquid fuels, to the point where any significant reduction (like, say,10%) of the fuel available would mean complete disaster for many parts of the country, and real hardship everywhere else.

Worse, we’ve induced our population to become dependent on things, whether it’s our welfare system with all its subsidies, or our fuel-dependent auto infrastructure, that have made life much costlier for everyone and can no longer be sustained. Section 8, for example, benefits very few people but artificially elevates rents at levels that price the lower middle class and working poor (most of our population) who are still far too “rich” to qualify for the subsidy out of decent rental housing.

All government development programs and subsidies for housing and other key industries has done is skew the market and drive growth in direction that has made life much more complex and expensive that it needs to be, while wages have stagnated or fallen in the past 30 years. Now we’re at the inflection point where rising costs, depleting resources, and lower incomes are making the whole hairball of subsidies and artificial props completely unsustainable, including our hugely overscaled infrastructure.

I LOVE cars.

I agreed with you until you said that the government was highly skewed to the poor. It is not. it is highly skewed to benefit the rich and poweful. The bankers got trillions of dollars and the poor, and middle class got nothing. The justice department has not arrested one single bankster who sunk the economy. Compare the percentage of poor people in prison to banksters in prison to see who is getting the benefits.

“since they are defined as the lesser of 115% of an area’s median-priced home or $625,000.”

This is an absurd definition considering the stated function of the helping poor: Those can’t ever buy even median-priced homes and definitely not anything above it.

So this really is another trick to keep housing price high, nothing else. No matter what the government lies about it.

If it really was for the poor it would have limits like 70% of the median (from deals done, not from asking price) and absolute limit of 250 thousands.

Another “right on” spot observation by Dr. HB. The RE industry is still up to its old tricks. I noticed that the Realtors in our area, the IE, are not driving around in their expensive cars. Instead they are driving older, less expensive cars. My guess is now that property is supposedly “bottoming out”, RE commissions are lower. One of my neighbors, who was a RE salesman is now working more security guard contracts. He owns his own security business and during the housing mania, pretty much had moth balled his security business, focusing on selling RE.

Here in the IE, the local new homes are still being built, but at a slower rate. Every weekend, the newspapers are running ads of new homes just released for sale to the public. These new homes are way over priced, and are keeping the IE resale price of existing homes inflated.

If you are in the IE, you may find “G4T” interesting. He reports on the effects of the downturn on California in general and the IE specifically.

G4T is a former mortgage broker:

http://www.youtube.com/user/george4title

~Misstrial

I don’t think the banks know how to do due diligence anymore, because they’ve long since culled their ranks of loan officers who know how to do anything but sell loans.

Agree. They got rid of anyone over the age of 40 back in the eighties and nineties.

The ones left had never experienced an economic calamity.

~Misstrial

The Case Schiller Index is interesting but too broad for me. I would like to see an index showing California, North and South (two different markets) and a tie in to the shadow inventory held by banks. In fact maybe the banks could share their data with us. My gut feel is that resale prices are lower than shown in Case Schiller, for California and we are probably closer to 2001-2002 prices and poised to head lower. I really enjoy Dr Bubble’s Blog, it helps keep me grounded in reality.

Pricing is justified by carrying capacity which is in turn limited by wages.

If this fact were recognized, we would be in an entirely different economic landscape right now. Only by throwing caution to the wind and ignoring the tenets of proper risk management did prices grow so completely out of control.

The corollary is that the pricing correction should necessarily reflect wages. The problem is, middle class wages have been stagnant for 20-30 years. Realistically, they have been outpaced by inflation. So where my parents’ generation was looking at house purchases of $25,000-75,000 on $20,000-40,000 of wages, my generation is currently looking at $350,000-500,000 on $50,000-100,000.

At the height of the bubble, here in OC, the median wages were around $62,000 per year while the median house price reached $640,000. The salary necessary to purchase the median house according to the aggressive side of traditional guidelines (20% down, no more than 1/3 gross income for payments) was achieved by approximately 1.5% of the population.

Even now, with the “fire sale” prices on housing, historical indices such as Case Shiller show us that prices are still 5-7x annual household wages. Historically speaking, this is pretty close to the ceiling against which prices would peak. So while the numbers might be working out to accommodate sales, there is nowhere to go but down.

I think your gut is right, R.F., because the Case Shiller index doesn’t include sales out of foreclosure. When such a large part of the market is just such sales and when their prices are obviously lower than other sales, the C-S index can’t help but be overshooting actual market conditions.

“The bailouts were never about helping homeowners and the above chart should be a testament to that most obvious fact.”

bah-DUM-TSSSss! (*rimshot*) OUCH!

“… and you have a housing market that is virtually all predicated on the government buying up mortgages and then selling them to itself through the Federal Reserve. It is clearly an unsustainable system.”

Oh, Doc, why so pessimistic? Have ye no Faith in the Federal Reserve? 😉

Here we go:

http://www.marketwatch.com/story/bipartisan-bill-backs-high-conforming-loan-limit-2011-07-15?link=MW_latest_news

NO surprises there… two faux parties to fool the sheeple into a faux “choice”, both controlled by the bankSters.

SO… do you think the MBA lobbies these tools directly, or, to avoid being too obvious, uses proxies???

Terrible news if the proposed bill to extend the loan limits passes. The government’s push for affordable mortgages instead of affordable housing is only going to hurt the average borrower. I’m beginning to think the market will never be allowed to correct and homes will forever be kept out of reach for first time buyers, unless they want to enslave themselves to overwhelming amounts of debt for the rest of their lives.

Thanks Dr. Once again more evidence of the corruption of the system. You know back in the day it was a lucrative business for a bank to sit down with someone, review their finances, qualify them for a loan, and hold the note for 30 years. They made a bundle. But who wants that anymore when we got gimmicks, smoke and mirrors to tripple the money made off the loan. The bigger the better, we’ll worry about ability to pay it off tomorrow. ABC remember! Always be closing!

Well…they can only shove so much dirt under the rug until the rug becomes the dirt. Investors will grow impatient. The economy will not recover in any real palpable sense, and the chickens will come home to roost.

On a local note, watching pieces of junk going up for sale in Burbank for half a million dollars. They don’t even bother to paint, or clean the carpets. Half a million…are you kidding me??? They must be smoking crack and hopium.

Last week’s Business Week features an article that’s bearish on house prices for years to come, which as we Dr. HB readers know, is a realistic stance. However, they quote some idiot who claims that the principal problem (I don’t think he uses that word, but isn’t that a clever pun on my part? :)) isn’t incomes, but too-tight credit. Will these people never stop?

“Will these people never stop?”

Never, not so long as they’re getting a skim off the churning… WHY would they?

It’s up to YOU to have a brake failure when they are alone in the crosswalk… 😉

You know, I… think I… might have been drawn down a negative path by the Dr. HouBub bandwagon… I mean… remembering the jumbo figures are the LOAN amount, thus in this post-Bubble era, the house price is 10-20% higher, well… I just don’t think I could sleep at night if my lobbying and calls to Congress-critters resulted in some poor American homebuyer having to forego a modest $1.1M home, and to instead settle for a cramped $800k home… it would weigh heavily on my conscience… 🙄

My peace of mind would be especially disturbed if said jumbo homebuyer were forced into said “downsizing” by something purely political, such as their documented income, or current debt load. 😡

There, there, you mustn’t feel bad. That $1.1M home was on target to fall to $500k based on market fundamentals, so the $729k assist will get those buyers the very same home and a lagniappe to the seller as well. Winz all ’round.

Is it possible that the reason for the relative “stickiness” of high prices in pockets of Southern California is a massive demographic shift whereby areas near where incomes and wealth are high will remain inflated, while everything else gradually becomes more and more “third worldish”? Could this plausibly account for continued high prices in Santa Monica, Malibu, and to a lesser extent the OC, other West LA areas, and even Culver City and Pasadena, etc? After all, housing is not particularly strong all over southern California – just look at the poorer areas like Sacramento and Riverside.

I understand that this theory would not explain the elevated “PE Ratios” of these exclusive enclaves, but hasnt that been a phenomenon of exclusive areas for decades?

Hard to say what are the most important factors for the ‘stickiness’ of high priced real estate in glamorous zip codes. One of them has to be the low interest rate environment. As Schiller and Lacy Hunt have mentioned, the economy is way too fragile to support higher interest rates, so they will remain low for quite some time.

But as Dr. H. has pointed out, this is actually bad news for housing prices going forward, at least in most areas. If the economy isn’t strong enough to push interest rates higher, then it isn’t strong enough to create any decent jobs either.

As this horrible economy trolls along, even the top areas will eventually succumb to gravity. Remember, we ARE just like Japan, so there will be a decade or two of falling housing prices. Give it another year or two, and let’s see where we stand.

If the Fed is bound and determined to keep propping up the stock market, that could help keep high end housing elevated, for awhile, but it will also lead to devastating inflation throughout the economy, which will destroy home builders of small and mid-sized homes.

Agreed, this prolonged period of artificially low interest rates encourages speculation, and in areas where there is either money, or ability to get loans it’s encouraging people to leverage that money into housing. The poorer areas don’t have the access to credit anymore. I don’t think that means that the wealthier areas are necessarily immune, but their access to credit hasn’t been shut off like it has in lower income areas. This credit includes higher conforming loan limits. I think the eventual drop in these areas is inevitable no matter how sticky prices seem, but as long as the low interest rate, low down payment environment continues it will just prolong the fall.

Jay, go to Redfin and run a search on homes in Burbank, Culver City, West LA, Alhambra, etc.

Use a modest home example…1500sq ft, 3bd, 2ba…the quintessential “starter” home.

When you do find homes that were sold prior to 2000, what you will see is that the price to income ratios are high, but by a factor of 4.5-6x

Currently, it’s more like 10x in those areas.

This is part of the reason why we are in the mess today. Loans were given, knowing that repayment will almost be impossible. This just created more mess.

Goggle./Yahoo Search: DailyJobCuts

Its insane, the ripple effect

Jay, the world is an unstable place, and the nice parts of Southern California will be very desirable as “bolt holes” for foreigners from China, India, the Middle East, etc. for the foreseeable future. Some of these foreigners are buying houses in nice areas and having their wives and children live in them while they continue to run businesses in other parts of the world.

Most of the rest of Southern California is indeed becoming a third-world dumping ground. It is VERY sad. The end result will be like a South American city — wealthy enclaves surrounded by impoverished ghettos/barrios.

The only way that things go in a different direction is if inter-ethnic violence breaks out to such a degree that people don’t feel safe even in their little enclave. At that point, you have a South Africa type situation, with people trying to sell for whatever they can get and make a run for it.

The future of California does NOT look too attractive for the non-rich.

Laura, I live in Burbank. I’ve not noticed a big influx of foreigners. Remember as it has been pointed out before, when we thought the almighty Japanese nationals were going to buy the USA. China is overheated and posturing to fall. If their GDP goes below 10% growth there will be hell to pay and probable social unrest.

What I have seen is that the group that I would call “solidly middle-class whites” no longer consider California a good place to raise children. These people move out of California in droves as they reach their early 30s. They are replaced by immigrants who can afford housing by sharing a residence with numerous relatives. So the poor move in, the rich move in, the high-earning can afford to compete for scarce resources (nice housing and good schools) and the average white family moves to Texas at some point.

Southern California is VERY foreign compared to when I moved there in the early 80s. It will be a far different place 20 or 30 years from now than it is today. I sincerely believe that a tipping point has been reached and that everything is downhill from now on.

+1. I agree with you about the bigger cities having larger ghettos. We’ll see this trend growing over the next decade, at least.

That explains all the lonley foreign women that need servicing in my neighborhood…

Holy housing bubble, have you guys seen the story out today (7/20/11) on the latest existing home sales? Existing home sales are down a little, which is horrible news for home prices. But what is absolutely deathly is the fact that 1st time buyers are now only 31% of the purchasers of existing homes that change hands, down from being about 50% of the existing home buying population a few years ago.

This is critical, because every time a first time buyer buys an existing home, there is a very high probability that the seller buys another, more expensive home, or ‘moving up in the world’, some might say. And it could even set off a daisy chain, as the seller of the larger home buys an even MORE expensive home, etc. Obviously, as equity gets eaten away, this will happen less and less.

Also, if you can’t sell your house, you can’t take a better job offer in another state.

They need to just get out of the way and let house prices collapse, and get it over with. Then, people will start building equity, almost immediately, once the bottom is in.

One reason given for the dearth of 1st time buyers was the lack of affordable homes. Part of this is the high prices, as the bubble deflation is not complete. But another factor is that they built way too many big and medium sized homes during the bubble, and not very many shoe box starter homes.

Jason, I wonder to what extent the whole starter-home concept has died. People no longer need to buy a condo to lock in a low monthly payment in most areas, and there is no longer any rush to buy any house at all as prices are stagnant at best, and dropping 1% per month in a lot of places. I wouldn’t be surprised if young couples increasingly decide to live in an apartment until the oldest child is 5 to 10 years old and then move to the best house that they can afford and stay there indefinitely.

Kids transition from one school to another with reasonable ease up until the third or fourth grade, and their howling for a private bedroom usually doesn’t get unmanageable until 5th or 6th grade.

Agree with you 100% – you just described my situation perfectly. We are happy to stay in our two bedroom rent-controlled apartment in Santa Monica (no rent increase for the 6 years we have been here) with our two sons, 6 and 4 years who share a room without a problem. Backyards are over-rated for young kids anyway and we have a blast hitting all the local parks. In the meantime, we save every dime and wait patiently for our turn. Couldn’t afford a “starter house” without financial suicide 6 years ago, and in a couple of years our significant savings plus further price decreases will allow us to skip the starter house all together.

I’m 34. I just finished a short-sale of my “Starter home” condo in Marina del Rey. I have been married just over a year now. We will try for a kid this year. Granted, b/c of the short-sale I will be locked out of loans for a few years, but here is what I have learned having been through the wringer of the housing market from 2005-2011.

1. I don’t care what prices do for the next 5 years, I will rent, and save.

2. When I do get a mortgage, it will be as small as possible. I will borrow as little as possible. Borrowing $500K means paying back the bank DOUBLE that amount. I’d rather rent and save.

3. You can rent a house if you think your kids all need their own bedrooms.

4. At least some of the sticky prices on the westside will be bolstered as rents rise making the rent vs own equation closer to equal. All the money in LA concentrates itself into a few enclaves, so don’t hold your breath waiting for a collapse of prices. Its a slow decline…

Leave a Reply