Sales volume of California homes reflecting 2008 and 2009 numbers: Sales fall 13 percent from previous month and median price dips.

It didn’t take long for the minor dip in the stock market to reflect in real estate trends. Month-over-month sales volume fell by 13 percent. August sales volume in California was very low resembling the volume of sales seen in 2008 and 2009. What followed was a dip in 2010. The pattern is typical in California real estate since we have converted the market into a speculative roller coaster causing renter households to shoot up while people see their income sucked into the housing vortex. House lusting buyers are seeing a slowdown in real estate and are balking at current prices. They want to see continued double-digit gains even though household income is stagnant. The slowdown is also being driven by big investors pulling away from the market. What you have left is a smaller group of buyers buying at inflated values using maximum leverage and flippers still thinking they can squeeze out double-digit gains. The tide is now shifting.

August sales volume slows down dramatically

August tends to be a good sales month for California. Home buyers and sellers can make big changes as the kids are still out of school. Once the fall and winter hit, home buying and selling tends to enter a seasonally slow pattern. Yet the drop from July was rather strong. Home sales volume dropped by 13 percent.

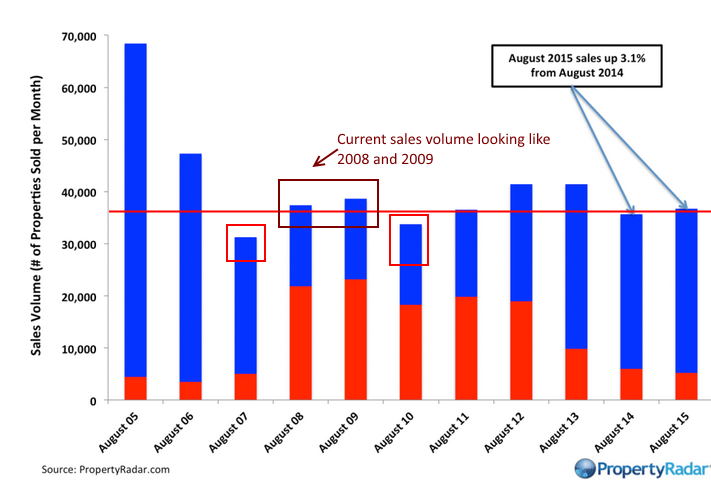

Take a look at August sales volume:

The worst year for sales volume in California came in 2007. When did home prices hit a peak in California? 2007. Sales volume is a leading indicator. And the reason for this slow down is coming from a few sources:

-Big money pulling away from California

-Current prices are out of reach for many families

-Inventory growing as buyer lust ebbs

-Stock market slowdown impacting trend

-Double-digit gains become single-digit gains which become…?

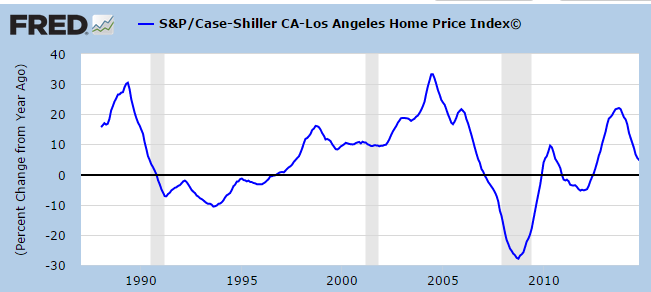

You can see this slow turning of the tide by looking at the Case Shiller data:

You see the crash followed, followed by a minor uptrend, followed by the 2009 and 2010 slowdown. You then see the recent boom and you can draw your conclusion as to where the trend is heading. People argue that housing is driven by emotion and this perspective was being espoused by those justifying higher prices despite weak income growth. I agree with this but emotions are feeble things. As year-over-year gains look weak and it is very likely we will see a negative year-over-year price change soon, the perception will change quickly. Once this hits you enter another multi-year trend. The housing market is now a speculative segment of the economy just like oil futures or bonds. Naïve people choose to drink the Kool-Aid of survivorship bias and forget the 7,000,000+ people that lost their homes to foreclosure (with 1,000,000 here in California). You can absolutely make money in housing but to make it appear as a safe bet is foolish and goes against recent history.

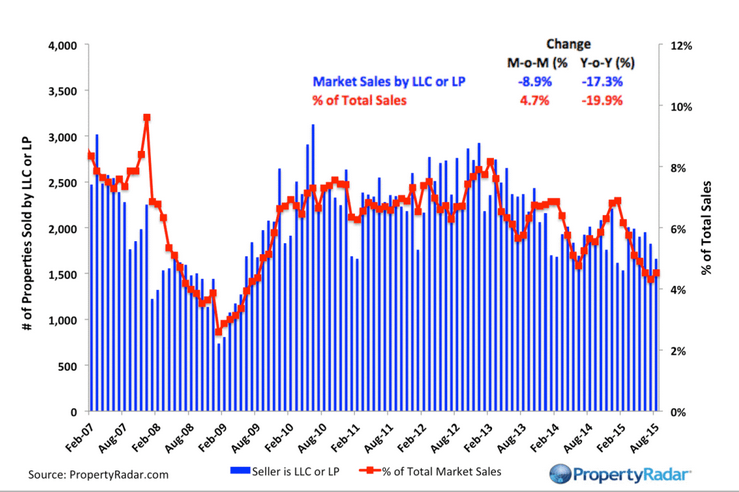

Big money is seeing limited deals in California and is pulling money out:

Sales to big investors are down 17 percent year-over-year. They made their money and are now enjoying the fruits of rental Armageddon. This is the result of the bailouts: a big drop in the homeownership rate while low rates transferred properties to those least needing it with low rates. Now rents are being increased even though incomes are stagnant. And you wonder why this political season is so extreme and the mainstream press is largely being overshadowed by outsider candidates. Populism is all the rage it would seem and California is seeing a growing number of renter households. Los Angeles is a renting majority county.

There seems to be little reason to rush out and buy at this point as sales volume falls, prices drop, and inventory is increasing right before the fall and winter season. The tide turns very slowly in real estate but when it does, the momentum tends to last.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

89 Responses to “Sales volume of California homes reflecting 2008 and 2009 numbers: Sales fall 13 percent from previous month and median price dips.”

Sticker shock still in Culver City – I look at some of these little shacks once built for the middle class that now cost 1M and up and wonder who is buying them. Rents are skyrocketing as well. After 20 pkus years here I am beginning to wonder if it is worth it – esp on a muggy night like this that reminds me of Florida. Ugh.

Humidity has been killer here in Phoenix as well. For a good month, it has been in te 50% range in the morning. Two days ago it was 75%. It’s like living in Houston, or for God’s sake, Florida …

I don’t understand humidity in Arizona. Where does the moisture come from? Los Angeles is next to the Pacific. But Arizona is all desert, lying next to other states’ desert. And the entire southwest is in drought.

How did Arizona get humid?

Gulf of California Low in summer is common and part of weather pattern, drawing up moist are from the sub tropics….

Thus Arizona is having a normal monsoon season as that low was cutoff from the subtropics over the last 8 years….

Air circulates counterclockwise around a low pressure area. Big low pressure system in the Pacific off Baja thus produces moist flow from the South into SoCal and Arizona. Also the Gulf of California is closer to SW Arizona than to SoCal – plenty of opportunity for that flow from the South to pick up extra moisture.

Keep in mind that Culver City has a few factors that are causing sticker shock (as well as everything West of Culver City).

a) Culver City is next on the list of areas where the somewhat well-to-do are moving who cannot afford closer to the ocean. In other words if you cannot afford Santa Monica, Venice or WLA, then Culver City is the next choice.

b) There are over 300 film/tv/production/software companies now in Culver City. This link below lists about 240 companies (not including software companies, startups, etc)

http://www.culvercity.org/Services/BusinessDirectory.aspx?type=ENTERTAINMENT%20INDUSTRY%20-%20MISC.

c) Inasmuchas people on this blog commenting on what a dump LA is, the fact is it is an area of massive inflow of money into film/tv/software/technology companies (replacing the old manufacturing core). e.g. Culver City adjacent to the booming Silicon Beach region. LA ranks 5th in most amount of Venture Capital investment.

Those who pray for a crash in home prices should consider that no one knows where the bottom will be and investors may come out of the woodwork again and outbid everyone with all cash offers.

“Those who pray for a crash in home prices should consider that no one knows where the bottom will be and investors may come out of the woodwork again and outbid everyone with all cash offers.â€

You’re right that no one knows where the bottom is. But it’s beginning to be clear where the top is (likely right about where we are currently). A 20% decline would work for me.

Regarding investors outbidding everyone with cash offers in the event of a crash, I just don’t entirely buy this based on past experience. There will, of course, be investors with cash offers. However (and I’ve said this numerous times), I realistically could have purchased multiple different houses during the last downturn (2011-2012), but backed out at the last minute for various reasons. If you offer more than the cash investors and have a serious offer (at least 20% down and a pre-approval letter), you will probably have a decent chance of buying the place you want. Sure, you will pay a bit more because you don’t have all cash. But you’d still likely be getting a great deal relative to today’s prices.

And don’t forget Culver City’s excellent school district and expo line coming to Santa Monica.

a) It’s different this time because people are lowering their standards.

b) It’s different this time because industries are evolving.

c) It’s different this time because money.

Those who pray for no crash in home prices should consider that no one knows where the bottom will be and investors might not come out of the woodwork again and outbid everyone with all cash offers.

QEA, I get a good chuckle when we hear the daily “LA is a dump” arguments. I’ll definitely agree that most of LA is a dump. However, LA is so big that there are vast nice areas also. If you can afford it, the desirable areas of LA are hard to beat. Most of those people stay in their little bubbles, they aren’t making daily trips to the third world toilet ghetto areas everybody here mentions. This is definitely one of the reasons there is such a divide between the haves and have nots in this city.

You are missing one very significant factor: schools. Culver has some of the best public schools on the Westside, and they keep improving – particularly with the infusion of cash from a referendum passed last summer. True that it’s not a destination for the rich, but for the “somewhat well to do” young professionals, especially with children, it is in many ways more desirable than nearly anywhere else in West L.A. generally. You also get other Culver services, like the police, which are top-notch. We’ve been in Culver for about a year and a half, and it’s amazing how the market keeps booming. Several houses in our neighborhood undergoing major remodels, and the “McMansionization” is a huge topic in the community right now. Many of the “crap shacks” are still being purchased for land value and successfully flipped for hundreds of thousands more.

A 20% loss in prices would represent a huge loss for many for many RE-based financial portfolios. I bet that quite a few investors wouldn’t simply ride out losses of such magnitude. Think that the exit will be orderly and deliberate? Judging on the volatility of the stock market, I think not.

The “all cash offers” claims are simply amusing. Since when did non-mortgage loans become “all cash”? Shouldn’t have to pay my Visa balance because, when I used my credit card, I was paying “all cash”.

“they aren’t making daily trips to the third world toilet ghetto areas everybody here mentions”

This all assumes that none of the garbage will blow across the field into the promised land.

Guaranteed that the L.A. area will undergo perpetual boom and bust cycles! It is that ‘California Dream’, the weather and miles of beaches that will keep L.A and So. Cal. alive. In reality, though, only a very small percentage of people can get up Saturday mornings and walk just a few blocks to the beach! The bigger problem is that the financial health of many households isn’t what it used to be, so the numbers of individuals that can pay to play, i.e, that could take advantage of even a 20% real estate decline, has dwindled significantly, and there are even fewer who can outbid everyone else with all cash!

@Prince Of Heck, you are correct. “All cash offer” does not mean all cash.

Case-in-point: Margin Loans

A person uses a margin loan to borrow against their investment portfolio. An investor can borrow up to 80% of the value of their investment portfolio to fund a real estate purchase. The transaction shows up as a “all cash” real estate purchase when reality it is a margin loan using an investor’s portfolio as collateral.

The Chinese use their commodity holdings (copper, steel, gold, oil, etc.) to obtain margin loans to buy property in the U.S.

U.S. citizens use margin loans against their stock market portfolios to buy property on the Westside.

Margin loans are subject to margin calls if the value of underlying portfolio (collateral) drops more than 10%. This is why I suspect the Federal Reserve did not raise interest rates last week. Raising interest rates causes a bigger collapse in the stock markets. Margin calls start coming in on real estate margin loans. This creates a domino effect where the stock market and (mid and upper tier) real estate prices begin to collapse due to the Fed’s interest rate hike.

JNS: only a very small percentage of people can get up Saturday mornings and walk just a few blocks to the beach!

I’m one of those few people. I can see the beach from my balcony. Santa Monica’s beach is over-rated. I haven’t actually walked on the sand since 1993.

Living near the beach doesn’t make up for living in a 690 sq ft condo, with paper thin walls, and a shared community washer/dryer. Thus I’ve been looking at houses in Pasadena and Woodland Hills. And even Seattle.

I moved to Santa Monica in 1987. Since then it’s gone way downhill. Many think so, though many disagree. It’s become so over-crowded. It’s impossible to drive with all the traffic, and cyclists (the city is WAY too “bike friendly), and new construction, and street closures.

During rush hour, I’ve seen traffic backed up, bumper to bumper, even on side streets like Arizona Ave. Even at 11 a.m., it took me nearly an hour to drive from Santa Monica to Westwood. Too many people heading to the 405.

Back in 1987, Santa Monica was still a seedy little, quiet beach community. Not as seedy as decades past, but still nicely seedy to some extent. Old restaurants and diners and hardware stores. Biff’s and Zucky’s and King George’s. All gone now.

After they built that damn Promenade in 1990, the development, with its flood of hipsters and yuppies, has never stopped.

the bottom line is as so many have said – 5% of LA is prime with good school districts and 95% of LA is turd world ghetto where you wouldn’t want your daughter to live in

@ben, you are being to harsh.

75% of SoCal is ghetto / barrio / garbage dump / third world hell-hole.

15% is prime (Rancho Palos Verdes, Malibu, Bel Air, Pacific Palisades, Holmby Hills, Hidden Hills, Calabasas, Beverly Hills, San Marino)

10% is mid-tier (Pasadena, Torrance, Westchester, El Segundo, Culver City)

You also forget Windsor Square, Hancock Park, Mulholland Dr, and the Hollywood to Loz Feliz Hills.

This news isn’t surprising at all! And, I’ll bet if the trend continues, there will be some panicked new homeowners. I will bet the vast majority of those who bought into these high prices, because of the premiums they paid, perceived that these homes are always going to go up in value! The next recession, when it hits, should be interesting as the pink slips slash household incomes! You’ve been talking about ‘crap shacks’ for several years now. First they were $750k, then $1 million, but that was an obvious warning sign of an over-priced market!

Why do all the doomsayers think that if a recession occurs, that they’ll be immune to it? If they can’t afford a house now, most likely they’ll be in a bad of a rut or worse than others during a recession.

sigma stated: “Why do all the doomsayers think that if a recession occurs, that they’ll be immune to it? If they can’t afford a house now, most likely they’ll be in a bad of a rut or worse than others during a recession.â€

I wouldn’t consider myself a doomsayer, but in my opinion, it just seems foolish to buy right now. I wouldn’t be surprised at all to see a 20%+ correction. As to when that might happen, who knows?

I certainly don’t think I will be immune from a recession. However, if my wife and I can hang onto our jobs, or at least obtain replacement jobs earning 60% or so of what we earn now, we will be just fine and will be able to purchase a house we want. I don’t know about others here, but we are perfectly able to afford the type of house we want now. It’s just that we feel the market is overheated at the moment and are perfectly content waiting it out to see what happens. Maybe our patience will be rewarded and we will able to buy an even nicer place than what we anticipated. Or not; no one really knows for sure. But a correction seems much more likely than a significant increase in prices at this point.

Your premise is flawed. Resets do not have to be a doom scenario because it’s expected that a functioning system will seek balance. Expecting a correction of imbalances is the most optimistic case.

Doom and gloom is placing a bet on increased greed and disparity fueling an ever larger imbalance that never resets.

If an individual participant within the system is not positioned to make a move at the bottom, then they certainly weren’t positioned to make a move at the top and ride out the bottom as well. Prudent individuals are positioning ahead of time in order to be able to make the move later.

Good response to more bubble-rationalizing derision, Hotel CA. Like “all cash offers” by investors, “affordability” for today’s organic buyers requires assuming risky debt that would most likely go sour should the economy try to re-balance itself (i.e. during recession).

“All cash offers” and “affordability” in today’s terms are both fueled by cheap debt that tend to lead to over-speculation and mis-pricing of assets. Aversion to such debt is to be commanded.

when housing is juiced via the fed and other entities then naturally it will lose it’s fluidity near the end of the juicing….

tops and bottoms are always retested…..hopium loses it’s strength very fast when things turn…

It will correct, their is no reason it will not…how much it will correct is a guessing game that most people here should not try…

2016 will see depreciation of assets on all fronts

The funny thing about this blog is posters believe water is endless….

without significant snowpack this year…enjoy your casitas with aqua malo y paquito…

pray for rain, not housing gains….greed distracts too many sheeple

if a recession hits, those who overstretched themselves and are living paycheck to paycheck will be in bad shape leaving those who saved an opportunity to capitalize on the losses of others…

based on my business we are already in recession and it’s going to be a bad one, worse than 2007 IMHO based on my workload has fallen off a cliff…..like i say worse than 2007.

also, does any one really think “investors” are going to ride this out? They are all going to head for the exits at the same time. And when price start falling the flow can/will turn into a pre-rich investor stampede.

the other thing is, and as the DR has pointed out, there are tons of boomers that own homes bought in the 70’s so even if prices drop by 1/2 they will still make money when selling and most likely will try and get out during the next down turn. I personally know WAY TO many mid lifers that are caregivers for their parents and once that family member passes the plan is to unload the house ASAFP…..this is far more prevalent than anyone knows, then factor in all the reverse mortgage morons and we could see a overwhelming flood of inventory, now add in the coming rains (i think it’s going to pour this winter) and the one other thing i NEVER hear anyone mention, earthquakes…..it’s been far too quite for far too long and we could start having them and that could last for several years.

this could be a perfect storm for California real-estate…..got popcorn?

This is what happens when you keep interest rates near zero forever. The Reality Market pushes housing at the high end. Reducing the housing mortgage deduction on taxes which was pushed by Romney in 2012 would have helped but Obama didn’t want to do that and kept of course the very low interest rates which causes this.

Thanks, Obama…

It’s ridiculous to think any president directly impacts interest rates.

Although the Federal Reserve system was set up so that no president could appoint more than two of the seven Federal Reserve Governors in a four year term, four of the seven in an eight-year term, this is not how the system has worked in recent years.

Due to the large number of resignations before Federal Reserve Governors have served their full fourteen-year term, both Obama and Bush have appointed all of the members of the Federal Reserve Board. This is important because so long as the seven Board members are united on policy matters, they can dominate the vote on the twelve-member monetary policy committee.

Thus, the president has a large influence on the shape of monetary policy.

Demand Demand Demand

You can’t have a real strong housing recovery or market place without mortgage buyers and when we look at this cycle, the adjusted population demand curve from mortgage buyers for exiting homes is the lowest ever

Here is some data line charts

Why Mortgage Purchase Applications Are Near An All Time Low When Adjusted To Population

http://loganmohtashami.com/2015/09/24/why-mortgage-purchase-applications-are-near-an-all-time-low-when-adjusted-to-population/

Once you look at the data 2015 is the 2nd worst adjusted to population mortgage purchase application data line ever and this is with 4% rates in year 7 of the economic cycle

Just look at new home sales yesterday at 552K

Adjusting to population it’s -45% below 1963 levels and the only time in American economic history it was this low was back in the early 1980’s when rates were above 14%

Math, Facts and Data Matter, the rest is storytelling

Agreed! Facts and data matter, but unfortunately the sell-side shills in our industry will continue to try to “seasonally adjust” and “statistically estimate” the story into a positive headline. I just negotiated a 17 percent discount for a buyer on a spec home because our local market has already started rolling over. What’s amazing is that there are still some buyers foolish enough to build from scratch in this environment. I guess they are wealthy enough that they don’t care about losing money on the deal, because that’s the scenario they have to look forward to.

Adjusted for population growth, the rebound in existing sales and new home sales has been an abysmal failure while Wall Street has continued lining their pockets. I have a feeling things are going to get rough for home builders as they run out of buyers willing to absorb their artificially inflated inventory of land and homes.

http://aaronlayman.com/2015/09/lennar-homes-q3-earnings-new-home-orders-in-houston-fall-12-percent-with-high-price-of-new-homes/

Hey Logan,

Should we looking at demand based on population size or just pure absolute demand. I think demand relative to population is telling in how crappy our economy is. Theoretically as increases, the demand should increase. However at the end of the day, regardless of how big or small the population is, it becomes an absolute demand versus supply issue correct?

Prices have dipped, so that means it’s time to buy. Buy the dip.

Haha, they haven’t dipped yet…they’re just going up less and less. Eventually that turns to zero…and THEN it goes negative.

No! Housing To Tank Hard SOON!!!

Welcome back Jim!

You and the “housing to go up foevah” guy used to crack me when I first started coming here.

No surprise , market always slow down in the fall and winter

This isn’t a “seasonal” trend. Here’s a zoomed in view of the last 3+ years. From Jan 2012 to Jan 2014, it was nothing but an INCREASE in the percent increase YOY.

Simply saying it’s typical seasonal slowdown is nonsense.

http://i.imgur.com/UkMlIsv.jpg

Still selling like crazy, at inflated prices, in the Eastern suburbs of Sacramento. I have no idea who is dumb enough to buy in Sac at these prices.

No small number are displaced souls from Silicon Valley.

They can cash in older holdings (real estate) and cash in stock options.

Compared to where they came from, Folsom pricing looks like they are just giving it away.

The old saying is correct. “There’s always a greater fool”. In my neck of the woods, seems the local greater fools have dried up, but plenty of greater fools pouring in from Silicon Valley. Lots of East Indians here buying up at any price. Renting is a no-no for them.

We’ve got to be running out of fools soon, surely.

Always make sure the juice is worth the squeeze.

Pasadena just hit its highest inventory in two years and inventory has been climbing rapidly last two weeks.

It’s a little too early to call things. “Sophisticated” buyers are trying to buy around the date they think the Federal Reserve is going to raise interest rates. This caused September volatility in sales numbers and this will likely continue through December. Lot’s of “pull-forward” demand has been occurring this year due to fear of interest rate hikes.

This doesn’t really make sense to me. If interest rates rise, house prices will likely fall. You pay one way or the other. What difference does it make? Especially for people like me who intend on paying off their house in much less than the 30-year mortgage term anyway.

It’s much better to buy when rates are high and prices are low. When the cycle swings and rates dip while prices jump, your equity is safe and you may even refinance into a better mortgage. On the flip side – buying when rates are low and prices are high, when things swing to high rates and and low prices, your equity disappears and there’s no way you can refi with negative equity.

Higher Interest Rates = Lower Home Price

Lower Home Prices lead to lower propery taxes

Higher Interest Rates = Higher tax deduction

Monthly payment may be the same. However, you have a lower property tax basis, higher interest deduction, lower down payment, and (if you bought before a dip) no loss in the cash down payment.

Mexicans are use to being renters, so L.A. is a renter county. So what. Economics is what it is. L.A. is still great for us. I can understand that those that leave L.A. are unhappy, but life is change, as my professor tells me. It is all about change. change is hard for many people. The investors bought the homes at bargain prices and now they rent them. This is capitalism. Do you want to live like Chavez’s Venezuela or Fidel’s Cuba?

Change being too hard for people is exactly why they don’t move away, despite the financially calamity of living in Los Angeles.

Unless you’re trying to “make it” in Hollywood, or you make $200K+ per year, or you prefer a multi-generational living situation, I can’t imagine why anyone would stay in LA.

Unless you are making big money or housing already paid off, it does not make sense anyone to live in socal.

there are much better places.

Prices have been busted many times before, it’s gonna happen again , no one knows for sure when

Sounds exactly like the Bay Area! “Unless you’re trying to “make it†in Tech, or you make $200K+ per year, or you prefer a multi-generational living situation, I can’t imagine why anyone would stay in SF… 🙂

Yes, when Hitler in Germany was elected in the early thirties, I have been told that most of the Jews loved their homes, their furniture, and etc. too much and made excuses for what was going on until it got too late for most of them. It takes courage to pick up and move. People will put up with a lot due to fear of the unknown. Look at the old baby boomers who are afraid to make a move. I guess that it is human nature which is not always rational.

Ira, it’s human nature to become complacent with living situations. LA, SD and OC are still the best weather in the country. Just watched a doc. on Pompeii. Crazy how after all this time people have not changed much

It’s not capitalism when the govt chooses the investors (BlackRock), and makes backdoor deals to sell the real estate for pennies on the dollar. Capitalism is when the market crashes and everyone is able to get “deals”.

Christo, you hit the nail on the head!

Juanita needs to take economics 101 over again! Capitalism was tossed out the window in 2009. Anyone counting on capitalism as the guiding principle for our economy ( like myself) has been in the woodshed going on 6 years now.

Capitalism sailed away years ago.

Right, Christo

This is not Free Market Capitalism. If we had anything resembling a free market, interest would be at 8% and prices would have, ah, corrected.

This is state-sponsored Mercantilism, rigged by government and the Fed to keep the party going for well-positioned speculators. Our savings accounts and buying power are being destroyed to by them to kep the party going.

Don’t worry homeowners, the Syrians will be arriving by the thousands to support housing prices soon. 🙂

This is a very dangerous market fueled by investors big and small. An unsustainable market where perception can change quickly, if one of the big players decides the game is over. Once they cash out, other dominoes begin to fall and you will see a rush towards the exits like never before. It is all about PERCEPTION. Nothing else, as values don’t make sense. It’s a question of who decides to the pull the plug first and when.

http://www.westsideremeltdown.blogspot.com

Chinese have slowed their buying and increased their selling. Problems at home.

Are you suggesting that volatility in the Chinese economy can affect all sorts of assets, including real estate, and not just the stock market? How shocking!

With the feds using taxpayer money to insure 90+% of the loans thru Freddie and Fanny, it would be apocalyptic for the US economy if we had a crash like in 2007. Therefore it can’t happen. The feds won’t let it. All I see currently in LA, is low inventory and people falling all over-themselves to buy anything halfway decent at speculative/exaggerated prices. So what’s changed?

Assuming the Feds can keep it going; they can’t, they’re configuring the plan to enrich the FIRE (finance, insurance & real estate parasites) on the way down. Crumbs will be available if you’re in the right place.

Yes, the did slow down in late summer when the stock market started to stumble. So, I would think the next report will also be weak.

However, in the last week or two, I have noticed another wave of new pendings. It looks like the home sales frenzy is starting again. It is possible people are losing money in both stocks and bonds, so they have decided to turn to real estate. The report rekeased in November will be strong.

The sooner the RE market has a blow off top, the better. Suck in the last few stragglers before the fall.

I’m seeing the opposite. More stuff coming on market, very few things going pending.

So there’s some anecdotal evidence to counter yours…so it all means nothing. 🙂

Hunan,

If the government was that powerful the last down turn would not have happened. Yes they reversed it by suspending all reasonable accounting rules and pumping seeming endless fiat. They have made it much worse and the failure of their policies is going to be epic. The fact that you believe it will not happen is evidence that it will. Perhaps you should have taken the red pill instead of blue.

Does anyone know the legal consequences of having a non-permitted guest house on your backyard?

I’ve looked at several houses in recent weeks whose garages had been converted into guest houses. (I don’t like that. No place for the car.) When I asked, some realtors told me the conversion was permitted. But some admitted the guest house was without a permit.

What are the legal consequences of that? What if the City of Los Angeles, or Pasadena, find out? Or does it fall under County jurisdiction? Will they compel you to make it a garage again? Will they fine you?

And why are there so many guest houses conversions? Airbnb rentals? A sign of wage stagnation? Or perhaps people want McMansions but can’t afford them, so they extend their living area into the garage?

Legal consequences? If your neighbors know that and they don’t like it, they can complain. There’s a guy that lives next door to me in a 2 story garage/barn way in their backyard. It does not have a permit and he’s not supposed to be there and I know that from calling 311 and asking them. When I was told that the place was not permitted I told them that he was living there and within weeks he was paid a visit from one of their inspectors and told to leave. Of course he didn’t. He just waited a few months till he thought I’d forgotten, now he sneaks in there each night, trying to be covert. Ha. I see his window lights go on each night. But I guess I’ll let him off the hook, as long as he stays quiet and does not disturb me.

BTW, 311 is Building and Safety, and if I were to continue to complain, and the inspector were to come out again and found that the person living in the non permitted dwelling was still living there, the homeowner would be slapped with a fine. So yes, it would start with a fine, how much, I don’t know.

Don’t waste your time complaining to L.A. because they support such rentals so more people can live in the city and put traffic on the streets and receive welfare and so on. It is all political and it is part of the affordable housing program of the L.A. politicians. Yes, L.A. is a failed city. It is just a matter of time. If these tenants don’t burn the garage down, then the city doesn’t care. Do you real want to live in a neighborhood where the garages are converted rentals? Leave town, leave the state, have some dignity.

Anyone know what is happening in Ventura County? Namely, Thousand Oaks, Westlake, Agoura, Oak Park (Conejo Valley)? This area seems to be underreported here, but has a large contingent of folks sick of LA prices not wanting to live in the valley and searching for good schools. Online, it appears most prices are at peak levels. Any current market observations would be appreciated as I am in limbo deciding whether to buy, rent, or commute there from LA as a result of office moving

“Does anyone know the legal consequences of having a non-permitted guest house on your backyard??â€

Sorry, I don’t know the technical legal consequences.

However, based on my experience from dealing with code enforcement in a few cities in OC, pretty much nothing will be done. From my experience, city and county employees are generally lazy people who know it is very difficult to get fired. Therefore, they do the minimal amount of work required, if that. If it’s a simple issue that doesn’t take much work (such as one I had with a nearby nuisance rooster), they will probably take care of the problem. But if it’s anything that takes work (such as yours which would entail looking up permits, legally forcing someone to modify a structure, and/or legally evicting someone), I highly doubt anything would be done. It’s way too much work for a typical local government employee to bother with. They’ll tell you they will investigate, and maybe they will to a small degree. But as far as doing anything more than calling/visiting the owner to asking them to make the necessary changes, I wouldn’t count on it. Which might work out well for you, depending on what side of the fence you’re on.

Jeff’s reply seems to support my general guess of what might happen if an unpermitted structure is brought to the attention of local authorities.

Is the red shading of the chart telling us anything?

As I recall it, the red shading of the first chart = the August sales volume chart is for ‘distressed property sales’ / blue being non-distressed sales. A simple reading from that chart suggesting distressed property sales falling right back.

@ Son of Landlord:

I lived in SM in the early eighties while in grad school. I lived just round the corner from Zucky’s and was very sad to see that it was long gone when I was out there for a grad school reunion 3 years ago – SM had taken on the tone of hipster ville – something I never thought it would reduce itself to.

I was happy to see that the old buildings at Berkeley St. where SCI-Arc was are still there – granted it is a yoga studio now but still there. Rainbow Records was just up the way from the school at the time. So much on Olympic all different now and downtown SM – forget it.

If I am selling my house and if someone is paying bit above my asking price with strong loan/pre-approval Vs cash offer, I’d accept the higher offer price.

JAE…Good solid location , your best buy in homes would be Newbury Park just north of Thousand Oaks. TO would be second in line for house prices, the rest can be very pricey.

Is Simi Valley ( Ventura county) out of the way for you? They have a gambit of prices, the location could be a problem if you need direct acesss for your job.

Folks you don’t want the legal headaches of converted garage or anything else not properly permitted. There is some good reasons for living in a HOA neighborhood, that kind of nonsense would never be allowed.

And there are MANY bad reasons for living in a HOA neighborhood.

I’d like the freedom to decide what to put on my lawns. Political signs, Christmas or Halloween decorations, religious statues — any or all of them might be banned or limited by HOAs.

I read one set of HOA rules for a community in Topanga that said holiday decorations may not be set up prior to two weeks before the holiday, and must be removed the day after.

WTF? It’s MY lawn!

If someone else wants the freedom to park their cars on their lawns, go ahead. It’s a small price to pay for the freedom to do with my lawn as I see fit.

I’ve lived under condo’s HOA rules. I know these rules are 1. ARBITRARY, and 2. ARBITRARILY ENFORCED.

Some rules are ignored, some get warning letters, are incur fines. It all depends on who or which faction sits on the board at any given time. HOA boards are mini-dictatorships.

FAR better to have people build non-permited guest houses, or park cars on lawns, than have some HOA say “We don’t tolerate that!” We have enough layers of government

If HOA isn’t your bag don’t buy a house that clearly states this is a covenant development with a set of guidelines before you purchase. nobody is forcing anybody to buy into a HOA. As far as a dictator board, I don’t defend or profess anybody live in a HOA, but I can say I have dealt with city planning commissions and permit depts. they are just as bad if not worse?

I don’t disagree with the fact that it often times seems like you’re living in communist country when dealing with an HOA, BUT, if I think the upside is you don’t have to deal with riff raff on your own.

Bingo Dean, we didn’t build our dream home ( a significant invetment) to have a Ford Bronco parked on the front lawn or structures not to code. If that is your bag fine but don’t buy or build a house in a HOA, I won’t pass judgement on your lifestyle please don’t pass judgement on us?

Blert had said that extensive building of super-expensive homes is a sign of an impending real estate collapse.

Here’s a Bloomberg article about the super-expensive mansions being built in L.A., including one for $115,000,000: http://www.bloomberg.com/news/articles/2015-09-28/jpmorgan-financing-los-angeles-mansions-starting-at-115-million

There’s actually a specific term for it with fancy new corporate HQs often signalling approaching market tops, but I’ve forgotten the term.

—————————

Historically, however, when a company becomes preoccupied with the grandeur of its premises, it often signals a high point in its fortunes.

http://www.huffingtonpost.com/2013/05/27/tech-headquarters_n_3341597.html

Historically, however, when a company becomes preoccupied with the grandeur of its premises, it often signals a high point in its fortunes.

That observation goes at least as far back as Parkinson’s Law, a book that was published in 1957. You can buy plenty of cheap, used copies on Amazon.

Can’t wait for the bust…. Been waiting a little too long. Hurry up ans pop before Tax Season.

Leave a Reply to Jim Taylor