California Housing Report: Still Going Down in Flames. Median Price for the State $301,000. 37,988 Homes Sold in August. 101,724 Distressed Foreclosure Filings. You do the Math.

“There are three kinds of lies: lies, damned lies, and statistics.”

-Mark Twain

There is no question that the current $700 billion USA Housing Motherland Bailout is the biggest story going around. The magnitude of the bailout has quelled other big stories that would have been the day’s topic du jour. For example, Ambac and MBIA were once again put under the microscope given the events going on in the markets. Over the weekend, Goldman Sachs and Morgan Stanley, the last two independent investment banks have changed their stripes. The big investment bank model has come to a fitting close. On the radio I heard someone say, “all those Harvard undergrads are going to have to change their majors.” Indeed.

At the heart of this mess is the housing market. That wonderful housing bubble that sucked a vast majority of our country into a spending orgy once only found in Vegas casinos. Who would have thought that there truly was a one ARM bandit? The entire financial edifice came inches away from “melting down” or so the talking heads would like you to believe. Maybe it came close to melting down for Wall Street but there are many people that are currently unemployed or living on the edge that the system has already melted down. The initial bailout bill pushed by Hank Paulson was for free reign, a check with no blue ink dripping from it for bailing out Wall Street. Not a good way to ask for nearly $1 trillion.

King Paulson this weekend ran into a hitch. As it turns out, there may need to be a bit of oversight for that $700 billion bailout. I’ve only heard a few folks in the late stages of delusion on the intertubes or teletubes have the gall to say, “in fact, we may actually turn a profit here!” Comments like that go in the file cabinet next to Alan Greenspan saying in Feburary of 2004,

“American consumers might benefit if lenders provided greater mortgage product alternatives to the traditional fixed-rate mortgage.”

“American consumers might benefit if lenders provided greater mortgage product alternatives to the traditional fixed-rate mortgage.”

Thanks Alan! They took your advice and things turned out superb. Any more words of wisdom you’d like to impart with us? Before we examine the California housing market, let us look at some of the new requested provisions for the bailout:

(a) Executive compensation restrictions

(b) Regulation with accountability

(c) Mortgage cram-downs in bankruptcy court

(d) Equity sharing

Frankly, these should have been in the bill from the beginning. The initial 3 page skeleton from comrade Paulson looked like one of those napkin deals you do with a drunken buddy. In fact, it was amazing in simplicity and lacked any depth but provided incredible power. Someone must of thought they found, “my precious.” It is as if you wrote a bill saying, “as of this moment, I give [insert name of l33t U.S. Treasury dude] total power to take all my money, spend it how they like, and never be held accountable for their actions.” Here is the 44 page bill that has a little bit more substance that came out today. When you elect someone because you feel comfortable to have a drink with them, don’t get mad when you get them unequivocally supporting back of the napkin solutions to the biggest financial crisis the world has ever witnessed.

The nuts and bolts are still being worked out. I was thinking about the initial plan and maybe thought it was a basic strategy of negotiation. How so? Well first, there is no way in the world that people would be willing support a $700 billion bailout if most of the benefit was going to go to banks and Wall Street with such little substance. Look at how long the Housing and Economic Recovery Act of 2008 took to get passed. So instead, they throw out a plan that had zero chance of passing just to get the political capital to actually move the bill. Now, we hear about basic regulations, oversight, and standards and the public almost wants to jump up and cheer and sign the bill. It’s as if you were selling your home and I told you, “yes, I really like your property so let me offer you a good starting point. How about $1?” At first you’d probably flip out but what if in my next move I offer you slightly less than what you initially wanted? “Okay, I’ll give you $200,000.” Of course anything sounds better than the first offensive offer. In fact, it may even seem generous. That is where we are at in the negotiation process.

California Housing – Motherland Bailout DistractsÂ

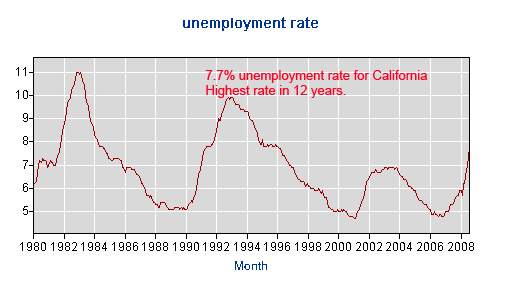

If it wasn’t for the almighty bailout chatter, we’d be talking about the absolutely pathetic numbers coming out of California. Last week the unemployment numbers for the state came out and they were abysmal:

The California unemployment rate is increasing at a rapid pace hitting its highest peak in 12 years. Currently, the state unemployment rate is at 7.7% which stands in stark contrast to August of 2007 data which only puts the number at 5.5%. How can the rate skyrocket so quickly? Easy. A large part of the state was highly dependent on the housing market so the one year crash has essentially exposed the economy of the state.

The state also has had one of the most contentious budget battles of all time. We broke the record in terms of how long we went without a budget. The current budget which has yet to be finalized looks like a flat out joke and capitulation just to move something through but we’ll be back here again next year. Think about it. Unemployment is surging and housing prices are dropping like a rock and a high amount of revenues come from both of these streams. So do you think we are going to bring in more money next year? I think we are at the point where housing prices are accelerating even faster simply because of the overall economic condition.

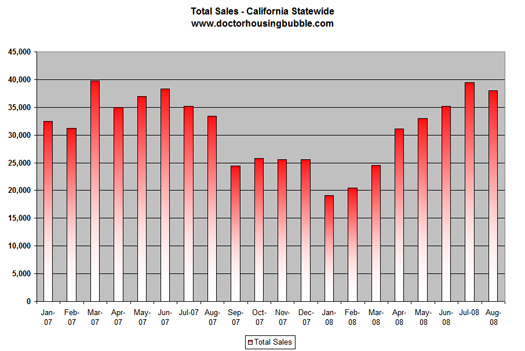

First, let us look at statewide sales first:

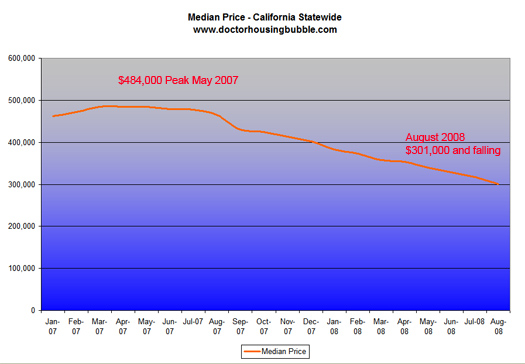

You need to remember that July and August are the strongest months of the year and these numbers are weak. The California housing market like most markets relies on a strong spring and summer season to carry them over a typically slower fall and winter. We just got a horrific start and now given the USA Motherland bailout more focus is on reassuring the country as opposed to one single state. 46% of all sales in the state last month were foreclosure re-sales. You want to see how quickly prices fall when a bubble pops? Take a look at this chart:

So as late as of May of 2007, the median price was $484,000 according to DataQuick. The current median price? $301,000. I also wrote an article on how divergent different price measures were during the bubble but now that things are crashing, prices on the low end are starting to converge. In fact, the peak price from the California Association of Realtors had the median price at $597,640! So if we are to use the bottom price from DataQuick of $301,000 for August of 2008 and the peak price from April of 2007 from the C.A.R. the median price for a California home is now down 49.6%. The state has now seen a near 50% correction in one year. Stunning. What is even more unreal is that $301,000 is actually too high for certain areas in the state.

The more troubling sign is the onslaught of bad properties hitting the market. Let us take a look at some market data for August of 2008:

California

Total homes sold:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 37,988

Notice of Defaults:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 44,278

Notice of Trustee Sale:Â Â Â Â Â Â Â Â Â 24,241

REO:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 33,205

What is troubling is the amount of Notice of Defaults that do end up in foreclosure:

“(DQNews) Of the homeowners in default, an estimated 22 percent emerge from the foreclosure process by bringing their payments current, refinancing, or selling the home and paying off what they owe. A year ago it was about 52 percent. The increased portion of homes lost to foreclosure reflects the slow real estate market, as well as the number of homes bought during the height of the market with multiple-loan financing, which makes ‘work- outs’ difficult.”

Basically 80% of the 44,278 will lose their home. That is 35,422. The rate was for July so I imagine we are now probably looking at 85 to 90 percent of NODs going to foreclosure. Take a look at the sale number for the best month of the year. We didn’t even include the actual REOs and Notice of Trustee Sales in this number! Overall, the distress action in California for August was at 101,724 and made up 33 percent of all foreclosure filings for the entire country!

In fact if you add the 4 states of California, Florida, Arizona, and Nevada you get 56% of all foreclosure filings! I remember getting e-mails from people out of the state claiming that a decline in California will have little impact on the country. It was contained. Bwahaha! Where have we heard that before? California is a freaking monstrous state in size and economic pull. We also had the biggest financial bubble. Much of the circus lending from Wall Street found its home here. There are still $500 billion in toxic Pay Option ARM mortgages that have yet to recast with $300 billion here in the state. If you are not from California, would you like to see some of your tax money bailout a Real Home of Genius?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

24 Responses to “California Housing Report: Still Going Down in Flames. Median Price for the State $301,000. 37,988 Homes Sold in August. 101,724 Distressed Foreclosure Filings. You do the Math.”

The funny thing is… all the bubble blogs predicted this stuff was going to happen. All the naysayers were telling them they were crazy, CA RE never goes down, our economy is strong, blah blah blah….

Even funnier- this economic meltdown is 100 times worse than all the bubble callers were even predicting.

The U.S.A. is f’d.

What I don’t understand is that, in a declining market which is showing little signs of bottoming out, in August there were still 38,000 homes sold. This is higher than in August 2007, and I am surprised. Who is buying houses? I am hoping to buy or build a house as soon as possible, but that may not be for years. House prices are still not in line with incomes, and until that happens, I don’t see the logic in paying still-inflated prices and letting speculators off easy.

Thanks to Sacramento, a lot of homeowner will get an extra thirty day delay on the foreclosure process. Law went into action on September1. doesn’t matter. The winter months will be brutal with foreclosures equal to houses sold. How is an organic sale to happen with that inventory. (Organic sale is from Mr. Mortgage. It is a house that is not in foreclosure, notice of default or has already been foreclose offered for sale.)

Here’s my suggestion: go to Target or Amazon an order 1 pitchfork and 1 tiki torch, then overnight it to Capitol Hill. I’m sure a few thousand of these landing on the Capitol steps would give pause to think by a couple of Senators. What do you think?

Director of Fannie/ Freddie today:

The housing agency’s director, James Lockhart, suggested Tuesday that mortgage finance companies Fannie Mae and Freddie Mac could loosen lending standards to help more homebuyers qualify for a loan and stabilize the market.

OK… that’s one way to slow the slide down – have the government start offering NINJA loans again. It worked SO WELL the first time around.

Wow… Get ready for the stealth tax bill, in the form of higher inflation. Also, sharpen up your cooking skills – Paulson will need a chef for that new 150 foot yacht he’ll be buying when he completes a “pass to himself” after leaving office in four months.

Renting 4 Now

Easy answer: Besides dummies, it might be foreigners that have the $$. If the dollar is weak, it is ‘cheap’ to them. Who bought Trumps palm beach mansion? A russian. Who owns the chrysler building now? An Ahrab. YOU are competing on a global playfield now. That house on the strand in manhattan beach is being looked-at by pro aff-letes, hollywood actors, and crude-oil peddlers from foreign lands, NOT working-stiffs like us!!

Your remarks remind me of a joke….

An extremely rich banker went up to a beautiful girl one day.

“Would you sleep with me for 1 Million dollars”, he asked.

She sputtered, and finally said, “Yes, I guess I would!”

He then said, “would you sleep with me for 1 dollar?”

She stiffened, and said “What do you think I am buddy?”

He replied, “We’ve already determined what you are, we’re just haggling on price now!”

No good because the pitchfork and tiki torch were manufactured in China.

Well, despite the meltdown in LA County, the metro area sellers are still clinging to their bubble. Listings in 90048, 36, 46, 64, 35 etc. are at bubble levels. in-f-ing-sane. Who on earth is buying? Also, on the ch-4 news last night, a report about the bailout. The main points were:

“the gov’t is going to be buying foreclosed houses” WTF?!?!

How much less of a clue could this “news’ organization have? Yet this is what mainstream America is being fed. But here’s the best part. The story ended with the reporter saying that the bailout will “probably cause housing prices to rise, which will be bad for buyers.” Huh?

They have no idea what they’re talking about, but this is what average people hear, and believe. We are doomed. 🙂

Who’s Buying Now? 4 Different People are buying now.

1. The Rich: The Rich have cash to buy foreclosures and know in the long run these properties will gain in value. These are the people that send guys dressed in t-shirts, jeans, and strapped with bluetooth pdas to the court house with wads of $100k cashiers checks to buy foreclosed properties at well-below market value. Even if these properties would go down an additional 15% to hit bottom, the Rich will rent them out and keep them in their portfolio until they mature in value and make them money.

2. The Indifferent: The Indifferent have 5 – 20% down-payment either saved up or they have inherited the money someway and want a house. They want to move on with their lives and establish a home for their family. They are not interested in waiting an addition 2 – 5 years for a housing bottom and are willing to buy now, seeing prices have declined over the last 2 years.

3. The Delusional: The Delusional is an investor and cannot believe prices have come down this far! They believe the mantra that real estate always goes up and think this housing decline will be short lived. Once the subprime houses all foreclose and are eaten up by the market, prices will shoot back up. So they are willing use profits from flipping houses back in the boom days to finance properties now.

4. The Uninformed: The Uniformed is uneducated about the housing market and credit crisis. They have probably scrapped together the minimum 3% down for an FHA loan and are willing to get into any home they can afford/qualify for because they hate wasting money on rent. They are also part Indifferent and part Delusional because they have been brainwashed by the real estate industry and our own government.

To Renting 4 Now’s question, “Who’s buying now?”–I’d reply that “buying” only means “still able to go into hock.” Joe’s got a pretty good field guide to them, and our federal-level NINJA-trainers are doing their job.

~

I’d add a category, probably a subset to #4, the Uninformed. When DHB said, “You do the math,” the very air around me shuddered with horror. DO MATH? Doc, isn’t against the Geneva Convention?

~

Thus I would add the category of “The Arithmetically Impaired.”

~

And really, what we’re talking about here isn’t math at all but simple arithmetic. I learned about compounding interest and how mortgages work before age 10, at the knee of my father, who had an eighth-grade level of schooling. In his day (he was born in 1919), you got all that by the fourth grade!

~

When I was studying graduate-level statistics and quantitative research methods at an Ivy League university, I was astonished to see how many of my professors did not, for instance, comprehend the Rule of 72 in daily life. And further astonished by how many of my student colleagues went on to write quantitative-method master’s theses without knowing anything about numbers. They just put the numbers in the computer and had the computer crunch away till something interesting came up, then wrote an article with sixteen other people.

~

For the past 60 years, we have been redefining the GDP as “whatever is going up.” As the global corporations did away with US productive capacity, that they might maximize profits and socialize costs, there was nothing left to count but houses. Houses called homes, built at minimum cost and quality not as sustainable shelter but as giant places to barn all the consumer crap from China, bought with debt. A very clever expansionist scam, but destined to fail.

~

rose

~

PS–I thought the bubble would burst in ’04; we prepared for that. We had no idea that Greenspan would go to such idiotic lengths to prop it up and get worse. Seeing his photo here literally made my guts churn.

Joe, if this bailout does something to prop up the prices you can add another category of people in your list: Out of patience. Count me in. I am 39 years old, have family and 2 children, good salary, working wife with good salary too. It is not the affordability that was stopping us form buying a house but the common sense. Prices were out of whack unless you measure by some third world standard. This is exactly why I almost lost my sanity waiting for the bubble to bust, because I can buy, but it was wrong. If the bailout works the only way the prices get back with reality is slowly leaking years and years. In Japan’s case it took 15 years to get bottom. I have only one life I cannot wait that long, I cannot wait even 2 more years because everybody is making fun of me since I am waiting form 2003. What is going to happen is we (USA) are turning into debt zombies without any end in sight and hope. People been smart in my situation will be sacrificed for the good of the morons. It is so unfair. Why change the rules of the game in the beginning of the second half?

The one thing I am wondering about right now…

Will this 700 billion dollar bail out cover the defaults and losses caused by the next wave of $500 billion in pay option ARMS ready to hit the “reset” mark

in 2009, 2010, etc…?

Or is this money only covering the situation as of now?

I mean… how much more money will it take to bail out Wall Street

in 2010 or 2011?

The other day I read a comment from, I believe, the NAR saying that the median price statistics were being distorted by foreclosures. Consequently, home prices were not down as much as claimed. This was touted as a good thing!

These idiots still don’t understand. They are either grossly stupid, crazy, or criminal. I plump for all three.

AFFORDABILITY! Sheeple earning $48k a year can afford a $135k home. Anything more is a big risk in this economic climate. There is no magic formula. If I buy a one million dollar home on a $75k income, I can’t afford it no matter what the price goes up to. Even if the house is valued at two million, I can’t afford the mortgage and must sell it or foreclose.

This country, possibly this entire world, is hopelessly doomed by the inherent stupidity and greed of average people. It did not matter before mass travel and communication, when populations were low and basically local. Now that the average moron in Duluth can interact with the village idiot in Pakistan, the world can not recover from the collective stupidity. It is fitting that the “greatest” country in the world has perhaps the dumbest leader.

I’m glad you mentioned about the unemployment numbers in CA. I mentioned it this in my blog last week also. http://hbrealestateandmore.blogspot.com/ Across the nation..let’s see: Michigan is first, (no surprise there), Rhode Island was second, and CA is tied with Mississippi for the third highest in the nation. Don’t worry we’ll move from that bronze position soon. Then we can compare ourselves to Detroit..wonderful

Dear Comrades,

~

Like many of you, I’ve been giving a lot of thought to the fine mess we are in. As I’ve said in the past, I believe that the Baby Boom generation might be known by the history books as the generation that wrecked America. Looking beyond the obvious, I think the root cause is that we have evolved a society totally void of prudence. To wit, here is the definition of prudence from Mirriam-Webster. Tell me if I am wrong:

~

1 : the ability to govern and discipline oneself by the use of reason 2 : sagacity or shrewdness in the management of affairs 3 : skill and good judgment in the use of resources 4 : caution or circumspection as to danger or risk

~

Let’s remember that the European settlers of this country were extremely prudent and our constitution arose from these core values. So what happened to the Baby Boomers that changed the course of history? First is the sense of entitlement that came with being raised in unprecedented abundance (more is better). Second is the sense of rebellion from their parents generation (that may have been the most prudent in the 20th Century). This set in motion a pattern of belief systems in the 1960’s that ingrained imprudence during the formative years of the generation. “Free love” translated into a life with no consequences for being imprudent (I can f*** whoever I want and no one gets hurt). Sounds like Wall Street? Are Bill Clinton and George W. any different in this sense?

~

But here’s the truly scary part: we have exported our value system (or at least tried like hell to) around the world creating the greatest bubble scenario ever devised by mankind. And who are the bagholders? All future generations.

~

Are we now ready to get past the blame game of this election season and accept that there are extreme consequences to all of this? Comrades, it’s gonna hurt because failure is suppose to hurt. For the sake of future generations, let’s make the necessary sacrifices now. The decisions that we make about the rescue plan and the election are so consequential that I urge everyone to get involved and ACT PRUDENTLY!

Mish’s post this morning states the government will become the biggest owner of foreclosed properties in America. What are they going to do with them? Think about it! You want welfare recipients living next to you in your neighbor’s foreclosed house?

>

Pity the poor sucker that worked hard, scrimped and saved, to buy his piece of the American dream. When is the last time you saw a social program doled out by Uncle Sam that worked? And now they are taking control of our most prized possessions!

>

This is thanks to the liberal policies of our elected officials. Many still don’t get it! This is not a Republican or Democratic issue. It is the selling off of Americas middle class by both.

blutown – nail hit on head.

I am copying/pasting your words to my entire email contact list

Now I’m beginning to understand why you gringos are building “the great of Mexico” NOT to keep us from entering but so that we can not leave…

“Wait amigo – aren’t you going to help pay for our great capitalist society”

Heck no! Hay nos vemos!

F#ck writing/calling your senators/congressmen; this is too important:

US Treasury Department (Branch Office)

11099 S La Cienega Blvd

Los Angeles, CA 90045

(310) 215-2414‎

I like this site a lot but it doesn’t mean it is always accurate. For example we bought the media’s coverage on AIG. That coverage is very misleading. AIG’s

exposure to Financial Investments represent less than 8% of their total business. Of that 8% AIG is on the hook for only the top graded investment in terms of risk (doesn’t mean too much with housing but still much better than being on the hook for the bottom grade products).

Furthermore the reason why it looked like AIG had to be bailed out was

because of regulatory requirements which imposed upon them to come up

with $25 billion in cash instantly. But all of AIG insurance companies are

somewhat insulated from the parent company and although they are still doing

very well and made $25 billion + last year, that money cannot be accessed by the parent company.

So did AIG loose a lot of money in that 8% exposure, yes. Was it stupid like

everyone else, yes. However let’s not confuse a cash flow problem (even if huge) triggered by regulatory requirements with an ailing company. So far as

I know AIG has $80 billion + of capital as a whole to meet their obligation.

I am not familiar with all the details and someone can easily correct me but

this sound a lot different than the media coverage, doesn’t.

I learned this evening that both Treasury Secretary Henry Paulson and

Federal Reserve Chairman Ben Bernake departed Capitol Hill today

allegedly quite perturbed at the “obstinate” attitude of Congress over

their $700 Billion financial bail-out request!

Both men answered scores of questions in front of the Senate Banking

Committee and both reportedly felt as though Congress refused to

acknowledge the urgency of the situation.

I am told the real fireworks took place after the public hearings behind

closed doors in the Senate. According to one senate staffer who claims to

have witnessed the exchange, Senator Chris Dodd allegedly ripped-into

Henry Paulson asking who the hell he thought he was dealing with by

demanding Congress just fork-over hundreds of billions of dollars in

under a week?

Paulson allegedly replied, “do whatever you want but as for the Treasury,

we will not be intervening any further in the markets. When the markets

crash, the banks crash and the economy goes under – and they will – the

voters will blame you and dump all of you this November!”

Senator Dodd allegedly got so furious at this reply that his face turned

beet red and he started roaring curses at Paulson with phrases along the

lines of “you fucking Wall Street douchebags. . . .” The senate staffer

said Dodd and Paulson almost came to blows!!

I’ve read the post blaming this mess on the baby-boomers several times.

I don’t agree. Gen Y’ers are just as complicit.

It’s too simple minded to blame this on the boomers.

Scared Indio, it’s time to leave. The free money is gone. No more liar’s loans with false paperwork and a Matricula.

No more builder friends looking to throw us out of work and hire you.

Just think. You can do what you always wanted to do: go back to your motherland with a handful of pesos.

We’ll give you a call when we want you back.

Leave a Reply to JBR