The crash diet of California home buying – You cannot purchase a $226,000 starter home on a $33,000 income and state this is affordable. The twisted definition of affordability.

You will notice that most ads to purchase a car or a home always discuss financing with big bold letters but never dive into an adequate income analysis before you should even consider buying a European luxury car or a home in an expensive metro area. Income is the most important feature yet never discussed like a taboo topic. This might reveal a glaring reality about household incomes but also net worth. This isn’t something that is new. There are many households especially in California that funnel large portions of their household income into purchasing a home. Any person that has had the fun experience of driving on our freeways must come to the conclusion that every person living in California is able to afford a $30,000+ car even though most are financed. The artifacts of wealth simply do not highlight a decade of stagnant incomes and oh, by the way, a 20+ percent underemployment rate and state deficits for as far as the eye can see. This is a major reason why FHA insured loans are facing massive defaults. People think just because they qualify they can somehow afford an expensive home.

What is affordable after all?

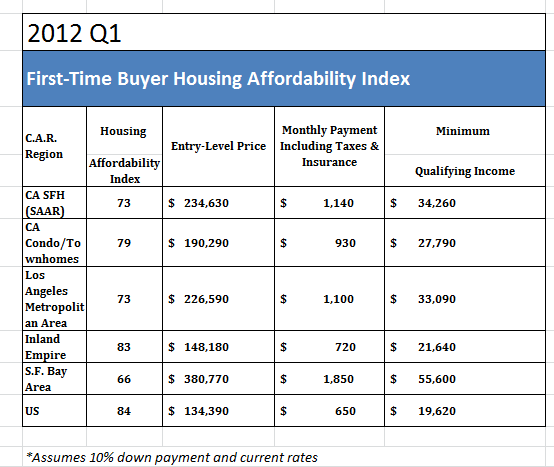

The California Association of Realtors has a first-time home buyer affordability chart on their website. The figures are interesting:

I find this chart amusing. First, what constitutes an entry level house in Los Angeles? At a price point of $226,590 I’m really curious to see some samples of this. Yet more importantly, take a look at the qualifying income. Do you really think a household making $33,000 can afford a $226,000 home? This is nearly 7 times the annual income of this household. Compare this to the US where half of households are making $50,000 or more and the median price home is roughly $180,000 (closer to ratio of 3.6). That looks more affordable.

This data isn’t surprising. Or look at the Bay Area. Can a household pulling in $55,000 a year really afford a $380,000 home? According to the above figures, yes they can. Let us not include the other big spending items in California such as cars, fuel, insurance, food, healthcare, and everything else in life.

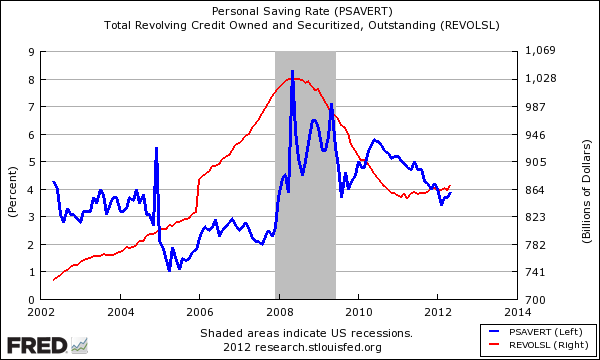

The concept of affordability is so out of whack. Part of this is that first, the US is a high consumption society. We have a tough time saving money as demonstrated by multiple sources of data:

At some point in the early 2000s we actually had a negative savings rate. Why save when you can go into debt? This is exactly what Americans did. California is even more extreme in that it is a hyper-consumption state. Billion dollar deficits for years to come yet somehow, going into massive debt just because interest rates are low seems to make sense for some. Those cities going bankrupt are not exactly a beacon of financial stability. The income stream has dried out just like the millions currently in foreclosure.

Spending to squeeze into a home

FHA insured loans continue to be the entry point for new buyers. 1 out of 3 homes purchased in California come from this low down payment option. Contrary to the above chart, the vast majority are diving in with a typical 4 percent down payment (slightly above the minimum 3.5 percent). Another 1 out of 3 buyers are buying homes with all cash or for investment purposes. So you have those barely able to squeeze in and those buying for investment purposes as the bulk of your market.

We discussed this before, but FHA is a big player in California and default rates are surging:

Source:Â CNN Money

Why is this not surprising? Of those that own homes, over 50 percent spend more than 30 percent of their gross income on housing costs. In fact, more than 40 percent spend more than 35 percent! The Census caps out at 35 percent but you have people spending 40, 50, and even 60 percent of their gross income just to get into a home in California. Is it any wonder why California has such a massive amount of underwater mortgages?

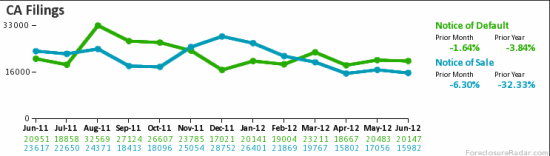

Just because you qualify by these odd measures of affordability does not mean you can actually afford a home. Foreclosure filings are still robust:

Half of homes sold in California last month were part of the distressed pipeline (foreclosure re-sales or short sales). Those homes are attached to families that are taking a loss one way or another. Yet the focus is always on jamming people in and the lack of income analysis in the media is astounding but not at all surprising. Like casinos that state they are for responsible gambling but offer major comps to players that lose the most. So for the time being the low interest rate and constrained inventory is pushing prices higher. Yet higher prices without stronger household incomes and a better economy is simply setting up a short-term push up. For California, this is very similar to the First-Time Home Buyer tax credit a couple of years ago.

It is startling how ill prepared many are for retirement and this mindset is one of those reasons. For many especially in California, some baby boomers look to have as their retirement plan Social Security while staying in a Prop 13 protected property. Yet with the spendthrift habits of decades will people be able to adjust? They really have no choice. What an odd state we live in where someone can live in a $700,000 (not purchased at that price) paid off house and collect $1,500 a month in Social Security as their only source of income. Then you wonder why our state has so many fiscal issues.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

91 Responses to “The crash diet of California home buying – You cannot purchase a $226,000 starter home on a $33,000 income and state this is affordable. The twisted definition of affordability.”

Zero Hedge says that shadow inventory is starting to creep back up ( http://www.zerohedge.com/news/so-much-housing-has-bottomed-shadow-housing-inventory-resumes-upward-climb ). Oh, and that Compton may not sell enough crack to prop up its finances …

Although Zero Hedge has many excellent articles on trading and financial shenanigans, the articles on the site seem to be drifting more and more towards an armaggedon scenario. Many of the ZH posters are beside themselves waiting for the Mad Max world to arrive, where guns and gold will rule.

“seem to be drifting”?

I’ve been reading that blog since the crash, and, they’ve always been way over the top. Always worth a visit, though, because they peer behind curtains and into places that most won’t, and back themselves up with good data. Just bring your salt shaker and a sense of humor.

“State deficits,” eh? You might want to read this:

http://realitybloger.wordpress.com/2012/05/25/california-government-hides-billions-from-taxpayers/

The guy that wrote the blog is a complete idiot.

He states “What if I could show you over $577 billion in investment fund balances that aren’t being reported by the California State Government on its budget report?”

However, he does not tell you that those funds are total assets by CalPERS and CalSTRS, pension funds for all California government employees and school employees. Those funds CAN NOT be touched by Jerry Brown.

Private pension funds in USA are worth about $15 trillion.

http://www.towerswatson.com/assets/pdf/3761/Global-Pensions-Asset-Study-2011.pdf

No, he’s not the idiot. He’s pointing out that 2/3 of the money in those pension funds came from taxes paid by people who are not state employees, and are never going to see one cent of that money. Brown is threatening to cut services if those people don’t vote for his slimy tax increases. If all of that money hadn’t been illegally shifted into state pension funds, there would be plenty of money to pay for the services he’s threatening to cut. Where does it say anything in the state constitution that non-state employees are required to fund state employee pension funds?

In 1930 California voters approved an amendment to the State Constitution to allow pensions to be paid to state workers. See Wikipedia.

The real problem is not with these pension funds. The problem lies with the distribution of wealth in USA. The top 20% have 87% of the entire wealth of the nation. 40 years ago, that 87% of wealth was in the middle class. The largest transfer of wealth in the history of the World occured under our noses by union destruction, fiat currency dilution, abolishment of profit sharing, and theft by Wall Street. We have become a Banana republic. The blame for society ills lies with our policy makers, Democrat and Republican, for being servants to Banksters and Oligarch corporations, and outsourcing of jobs.

Over 120 billion is not listed as pension fund investments.

Good try, idiot.

Dear Clint,

With your comment that $120 billion are not pension funds it appears you admit that the other funds are PENSION funds and you were wrong to state that there is this slush fund available for Brown to use. Those PENSION funds WERE taxpayer funds but are now PRIVATE funds to pay former government employee pensions.

The other $120 billion are ENTERPRISE funds that cannot be used to balance the GENERAL fund budget. It appears you are implying that Brown should use these SPECIAL ENTERPRISE FUNDS to balance the budget and that is considered corruption in the real world.

Your blog is a sham and completely misleads ordinary citizens thinking that Brown and government are evil and there is all this money lying around for Brown to use.

Read this and might understand that you have no idea about the financial situation of California.

http://www.usatoday.com/money/perfi/retirement/story/2012-07-16/California-state-pension-fund/56256380/1

Gosh dang! I hate unions and entitled public employees. Private employees or the self employed and have to deal with risks and the posibility of losing money every day. Especially in this economic environemnt. My stock investments sometimes lose money some years –and the money I have in the bank only makes 1% interest –and that’s on the high end for a bank! I know someone who retired as a state employee at –I think age 55– she gets a certain percentage of her previous salary every month -rain or shine. And she goes into a frothy anger when she hears about benefits being cut. I used to work for a government funded non-profit, which I considered a soul-sucking job and “glorified welfare.” I just don’t understand the sense of entitlement that unions and government employees have –that they are entitled to health care and a guaranteed retirement check because they stuck with a sucky job. And the funny thing is that they’ve managed to find unanimous support from the private sector. Few people mention anymore that one of the first things Schwartzenegger tried to do when he got into office was to take on the unions. He failed because the unions had money and flooded the tv with ads about how Schwartzenegger wants to hurt teachers and firemen. That was almost 10 years ago.

Sounds like you are suffering pension envy of a public employee. The average pension of a public employee is $2,300 a month. Hardly anything to cry wolf.

http://www.calpers.ca.gov/eip-docs/about/facts/retiremem.pdf

Gosh darnit, without unions, we would be working 12 hour days, minimum wage, with no health benefits, no vacation, no sick time. I am flabbergasted that some citizens are so anti-union.

Matt, that’s one of Calpers’ favorite misleading numbers. It’s hilarious how many people cling on to this propoganda. Now pay attention here is the important part: the average includes many people who didn’t make a career out of working in the public sector. If you took only those who made a career in the public sector that number gets MUCH higher.

Unions had their day in this country when workers didn’t have a voice. Present day unions are nothing more than a money collection system for a certain political party. That’s a fact!

The article states:

“CalPERS 20-year investment return is 7.7 percent.”

“It’s important to remember that CalPERS is a long-term investor and one year of performance should not be interpreted as a signal about our ability to achieve our investment goals over the long-term,†said Henry Jones, Chair of CalPERS Investment Committee.”

See “The Great Pension Fund Hoax” on youtube.

More Calpers massaging of numbers I see. If you take investment returns for the last 20 years you included the HUGE bull market of the mid/late 90s and the tech/internet boom. I doubt we will see anything like this in the near future…maybe our lifetimes.

What should really be looked at are the Calpers returns since pensions were put on steroids (starting with SB400 in 1999). I’m not even going to bother looking at the returns because they aren’t anywhere near 7.75%, they’ll be lucky to get half of that!

Dear Blank,

Your comment comes across as though there are many CalPERS pensioners making much more pension a month than the average across the board. Let me enlighten you on the facts and not the propaganda you read.

The average CalPERS pension is about $25,000 per year. Half of CalPERS retirees receive $18,000 per year or less in benefits. Unlike the private sector, 40% of CalPERS retirees do not receive Social Security, making their CalPERS pension their sole source of pension income, other than savings.

Seventy-four percent of CalPERS retirees receive $36,000 per year or less. School pensioners in the CalPERS program receive on average $1,192.00 a month.

Finally, about 2 percent of the nearly half million CalPERS retirees receive annual pensions of $100,000 or more. Many are retired non-unionized or specialized skilled employees or other high wage earners who worked 30 years or more. Many served in high-level management positions

It is those 2% that is causing sleepless nights for some people. Their comments come across as though there is this massive heist by government pensioners occuring by taxpayers. I guess those 2% are guilty.

Dear Clint,

You are attacking the wrong group of people. You should redirect your attack energy to banksters that have stolen ten’s of trillions of dollars of wealth by currency dilution, their bad bets and taxpayer bailouts, and billions in bonuses. You should vote in candidates that are not servants to bankers and oligarch corporations. The issues with government pensions is petty compared to the true evil scum that have destroyed the middle class these past 40 years with fiat money.

Matt, your talking points are all great however you didn’t respond to the “returns won’t be anywhere near 7.75% since pensions were put on steroids back in 1999.” Guess what, many of these people who got their pension juiced are just now starting to retire and will drain the calpers warchest.

You guys can assume whatever return you want on your investments as long as the taxpayer isn’t required to pitch in if shit hits the fan. Fair?

I think you brought up an interesting point how most baby boomers do not have adequate savings for retirement. I think that many of these ill prepared will most likely reverse mortgage their property if they own outright. Not sure there will be a lot of property transfers to offspring if this is the case…

I have paid-off rental property that brings in $11K a month. You can bet I’m holding on to it! Luckily, no kids to pass it down to. If I get desperate, I can sell.

Rhiannon I am sure everybody by now knows about your inherited rental in S. Pasadena, your starting to sound like a very lonely person.

Yes Rhiannon we know. I guess if I had it, I would flaunt it too.

You can tell her emptyness by her ego on this board. She needs self gratification, a clear sign of self esteem issues.

And I’m sure her man probably isn’t too much of a prize…

Rhiannon, why are you wasting time on this board? That’s quite a nice windwall you inherited…and let me guess you inherited the Prop 13 tax basis to go along with it.

From reading this blog, you know exactly how the housing market in socal works. So take advantage of it, start mailing out those yearly $100/month rent increases to your poor tenants. Are they going to threaten to leave and buy a house? Bwahahahaha!

Not lonely at all, actually. Got a man and a dog 🙂

I wouldn’t flaunt it too much. It’s not exactly a lofty accomplishment living off the froth of inherited rental income. Unearned legacy rental income is no better a thing than the speculative gambits of the bankers you like to rag on.

Glorified welfare. She didn’t earn a thing.

Don’t pay no mind to them at all.

Regards,

Your Long Lost Son.

You are set, not many people can do what you have done, for it takes disipline. Do you know the story about the ant and the grasshopper? Don’t let these grasshoppers get you down, they are just jealous.

Rhiannon, I don’t begrudge you your inheritance, for I hate the jealousy some have for the gifts others receive. However your choice of words that “Luckily” you have no kids strikes me as odd. Have you ever considered that God’s blessings of Providence were intended to be passed on and multiplied in their effects?

I was hoping to strike up some discussion on how the BB’s not saving enough for retirement will have an impact on the future of housing. I really don’t see the value of personal attacks. How about attack my hypothesis instead? I know there are many bright folks on this blog that disagree with me and I would love to hear their position…

Who exactly “attacked” you?

I read a few books on retirement, just to get an idea what I should plan for the future, or what I need to start doing.

Most books said people think they are prepared, but when it comes to it, they are far from ready, especially to live the way they do now, or same life style, plus inflation.

I think healthcare, besides mortage are the two biggest factors.

I heard of a guy from work who retired, and about six months later asked to come back and the company said no, when I asked another coworker how the guy was doing.

There were some changes and I think he just didn’t want to put up with it. I think he didn’t realize the expense. I have another friend who retired and told me he pays $400.00 for Blue Cross Blue Sheild for family, and that’s just him and his wife. Both guys are under civil service, better gov’t pension plan than I’m under. Do have alittle in 401k, but not much.

So I don’t think as many people will retire early, also read alot of people will work part time just for insurance.

Plus with everything going on economically, who really knows what lies ahead even six months from now. All those other countries, what if they really start tanking even next year, where would that put our economy? As they say we are all tied together.

So I think there’s too much uncertainty. Unless your house is paid off and You got cash, I don’t see Baby Boomers having much to add to the housing market, unless they really want to downsize or move for personal reasons, death, divorce, etc.

Anybody else want to weigh in?

Missplaced Pats fan,

I was talking about the personal attacks on Rhiannon…

What?

At some point Rhiannon has to bring something to the table other than her endless braggadocioues on her property in S. Pas. I think peopled just tired of it, myself included, and called her on it. She should know better living in SoCal with the endless “look at me” culture. Heck, this might actually help her realize what she is doing. btw, S Pas is not all that great, crowed, smoggy, noisy, etc. I bought my first house in La Crescenta, the whole area is just one big noisy freeway. Did I tell you I made a killing on that crappy little 1000sf house in La Crescenta………….

Riddle me this. Why are intelligent contributors to this site so easily distracted by bragging, jealousy, attacks, etc. I think I made a valid point that seems to be missed by all but 1 of the 15 responses. I know that many of the 14 have made very insightful posts and are capable of intelligent thinking…

Interested in feedback. Landlord purchased our rental in 2003 for 319K (East Bay Area), levered it up to loan balance of 370K – may have been Neg Am mortgage. Came to us this week offering rent REDUCTION (we’ve been there 3 years, no missed payments, treat the property well) becuase he was able to refinance. Claims mortgage now owned by private equity firm, they approached him and lowered his principal to $186K (lower than current house value, prob $230K) at 2% interest rate over remaining 26 yeaars on original loan. Said the private equity firm called it a ‘short sale to myself’, and he agreed to give up 25% of any future gain at time of sale. Claims it was never re-titled and according to the county still taxed at $370K. WTF?? We agreed to a new lease to lock in lower rent payment, since he offered – he wanted to to keep us as tenants and share his ‘good luck’. Anyone know of anything like this? Sounds very fishy to me, but I don’t know what to believe in this day and age. Happy to keep renting – we feel lucky since rents have been rising fast, but wary of this purported ‘deal’ he got himself into.

Please do keep us updated if you find out any more specific details. This is a new one to me as well but it would be nice to know if these types of deals are really happening.

I can actually believe some of this. I’ll bet he gave up way more than 25%, though. Probably more like 50%. Really, the hedge fund is just buying a 50% stake in the property. However, if the tax figures aren’t changing it makes me wonder if they’re trying to do it without recording a new deed. If that’s the case, it’s an incredible risk for the partner buying in, especially if any of the parties are married. In CA, a spouse has an automatic interest in the property unless he or she specifically signs it away.

Ah, so, 25%, huh? So, that’s the game. I’ve been wondering what these PE guys see in buying up crappy old homes, and, I guess that’s it – price appreciation. Certainly can’t be the rental income, which would probably be negative after hiring a property manager. Let’s see how that works out. A very messy business, indeed.

There used to be the reasonable expectation that, if it was a financial strain to buy a house, that one would would be earning more money in the next few years. Raises were pretty much an automatic 2-4% per year and promotion was a possibility too. Home prices were rising on the whole so it made sense to struggle to buy a house as soon as you could. America was growing and your income would grow right along with it and that interest deduction would be worth something even to a person of moderate income.

My how times change if not the NAR affordability chart. Pay raises are not so automatic anymore. If you work for state and local government you only hope you don’t take a pay cut or lose your job entirely. Price appreciation? Not likely, the risk is all to the downside nowadays. Even the interest deduction isn’t so valuable in a ZIRPed world.

Yeah, the situation has reversed. Instead of incomes likely to go up, it is daily living expenses that are almost certain to go up. Go to stockcharts.com and put in symbols $corn, $soyb, or $wheat. All the major grain crops have broken out to new all time highs.

Think food prices are high? Wait a few months and you can add $50 to your weekly food bill. Not much left over for housing.

All those increases are probably due to the severe drought killing off a significant portion of America’s grain/soy crops this summer. The price of food will really double by 2030, due to global warming (extreme conditions becoming the norm, thus making it harder to sustainably grow things for a given, large area), population rise, using crops for fuel, etc.. And when I say double, that’s adjusted for inflation.

Great point, angell. For some people it is reasonable to expect their income to raise. Mine basically tripled in the first 5-6 years of my career but for the past several years has essentially not moved–I’m not even at a 1% raise/year right now. So, compared to inflation, it’s gone down. Meanwhile, my cost of living on many items (food, fuel) has increased. I never stretched myself financially and that’s been very helpful, but many millions have seen their wages mostly flat or even dropping (obviously many continue to gain, though).

if you consider the source of this chart, the numbers are understandable..

the source of the chart is “Source: CALIFORNIA ASSOCIATION OF REALTORS®”

http://www.car.org/marketdata/data/ftbhai/

and ofcourse, a realtor thinks that everyone can afford the big house and will qualify for loans and live the american dream .. they just want your commission..

Most of the economic problems we have today can be traced back to the essential sleaziness and dishonesty of salestrash. Anything is ok as long as there is a commission in it for them. Currently too few working people are carrying too many parasitical salesboys and marketeers on their back.

Salestrash values have taken over company after company as the b-school boys say the only purpose of a business is to make money. They do not care about quality, value, service, productivity or the community as long as they personally can suck out a profit. The finance syndicates churn paper wealth without producing a single thing except commissions for the investment salesboys. And that brought our economy to a point where it would have collapsed without a bailout. The economy will not recover till a whole bunch of the bankster types wind up in prison and about 80 percent of the salestrash is carried to the curb and put to useful work.

Yes, Harry, you’re right. I heard about this new salestrash guy the other day. I think his name is P.T. Barnum. A real peach. Said something about a sucker being born every minute. His ilk are responsible for today’s economic problems! On the other hand, there was once this mom jeans and black turtle-neck wearing entrepreneur named Steve Jobs who went before big audiences and actually sold them things they could use. Those were the days.

It might boggle your mind, but we may actually end up with Boomers that have multiple paid-off homes.

The WWII generation is still making a (hopefully graceful) exit and in CA you really have no reason to give up that tax status when you can rent it out for extra cash every month. I have seen this happen several times over the last five years.

226k home on 33k/year sounds insane. BUT how much is that 33k/year person spending on rent? If it’s already more than PITI than what’s one supposed to do?

i’ll tell what we’re paying in rent, $500 for a room with kitchen privilages and a shared bathroom…AKA a total fuggin nightmare. with no hope of every having any other living situation….and a family forgitaboutit.

That’s 4650 a month. After taxes, probably more like $3350. And even with the employer contribution, health insurance runs another $250. Down to $3100 to live on. So now 1850 for the mortgage and let’s guess $150 for utilities. So down to $1100. Gotta pay the car’s note, too. There’s another $300. Don’t forget gas and insurance… $200 more. And that roof/water/leaky sink/etc. won’t fix itself. Let’s just lowball that to around $150 month. Only $450 left, and we haven’t even really started to live yet. Groceries… easily $250. Want to take a girl out every other week? Well that’s it. Student loan? bust. Traffic ticket? bust. root canal? car wreck? medical emergency? bust. bust. and a bust. The plain fact of the matter is, an 1850 mortgage wrack the debt-to-income ratio right up to 40%. It’s not a tenable position unless there’s absolutely no other trace of debt, and even then… I’d be surprised if anyone would actually write that loan. The doc is right: That whole chart is laughable at best.

oops. I self edited to oblivion. I meant to start with something to the effect of ‘Let’s take a closer look at the “affordability” of the San Francisco scenario above.’

Anyway the point is that no matter how it’s sliced, the mortgage payments indicated in the chart amount to almost exactly 40% of the wages claimed to be able to afford it. That leaves no room for any other debts or any kind of unexpected expenses. The numbers make no sense whatsoever.

As long as there’s someone else to hand-off the hot potato, things will be fine.

In a sane market 33000 income equates to a 99000 mortgage.

And by the way, over 70% of those luxury cars you see running around SoCal are leased, for the most expensive Mercedes, that figure is 90%. Simply rentals, nothing more.

In the good old daze it was 2 X to 2.5 X. californio has a tendency to californicate the home buyer with ,uh, stiff prices, if you know what I mean.

I make $35500 per year. My rent and parking is $825. I live very frugally, have no loans, no credit card debts, no debts of any kind. I can save $650/month. I am not married, no pets, don’t smoke, hardly drink, have 401K and medical/dental insurance through work. I could afford to pay the $1100 per month in the affordability chart, but really how many people are there like me out there?? The affordability chart and the fact that most people have virtually nothing saved for retirement go together. Sure you can spend 5X your income on a mortgage, but then you can’t save a dime for retirement.

Comment about So Cal and cars is perfect in so many ways. The whole region is about faking it ’til you make it. Houses, cars, stuff, all the same attitude.

I’m a lawyer, have had a cr***y couple of years with most of my small-business clients going broke, and guess what…I drive a little $10K car because THAT’S WHAT I CAN AFFORD. What a concept!

This site would be a great wake up call, if anyone were listening.

I came to socal for a job that lasted 3 years. I couldn’t stand all the status fakes. Who do they think they’re kidding? Since nearly everyone is doing it, it’s not like they’re fooling anyone. In social situations, all they talked about was their house, car and diet. After the job ended I got out… fast.

Don’t be like that. It makes you look boring and silly. Save for retirement instead of making some car dealer and bankers rich. You’ll get off the hamster wheel and be free. That would be a truly unique status symbol.

Didn’t give it enough time. Spent 20 years in West LA, met many great people from all different circumstances and made friends for life. Once you get past the veneer, So CA residents are much the same as other places.

DC — I like your style, but I don’t think that mentality is unique to SoCal. I know people who are status obsessed all over the States.

I guess we can’t all be like the dad in Surfwise, but I think more people should sit down and watch it.

I was looking at the income, purchase price, and payments chart. The payments purportedly include taxes and insurance. Just running off my quick and dirty excel payment calculator and estimating tax and insurance at ~4000 a year on the $234630 dollar home on the top, you’d have to come in with $75,000 down and a 4.5% mortgage to get the payment they have listed up there. My question is how a person making 34K a year in California is going to save 75 grand while having enough revolving accounts to have a 700+ credit rating. I guess we could call this person the “ideal borrower”. S/He only exists in the imagination of the person building the model. One more question—how much of that $34K a year will go to maintenance? Even with a 6 year old home I still have to toss about 2K a year into repairs, repainting, etc. The analysis has little relation to reality.

I don’t get it – our annual takehome is $63000, which is $5250 per month. I pay $1000 for rent and barely get by. After paying for utilities, car insurance, a $250/mo car payment, $700 in gas, well over $500 in food for the family, about $700 to credit cards and $500 to a loan, what’s left? Well you know there are kids clothes, going out to eat a couple times, things like that. Car repairs, oil changes, a haircut, all add up.

But the point is, on almost $100k pre-tax income, I can’t afford a $300k house. I’d be house-poor, everything going to the house. What kind of life is that? Just another reason SoCal sucks, the “weather tax” is so high. I’ve lived other places and housing is cheap. You get the nice place to live, and the entertainment too. Here it’s one or the other unless you are rich, or are a “legacy resident” with passed down wealth/property.

why do you have credit card debt? Pay it off asap. If you can’t afford it, don’t put it on your card. Remember WANT vs NEED.

Why do you have a car payment? Buy a used car you can afford to buy in cash. Don’t put money into a depreciating asset.

You mean like a house? Wait… did I just say that out loud? Whoops, sorry…

Or if you lease a car, then at least get a Prius. $700 in gas per month is scary!

About the car – it is a lease, for the wife. I don’t have a lot of cash sitting around, and you can’t finance a car over 7 years old. So as late model cars cost too much, we leased an economical car for the wifey. That’s the $250/mo. She refused a bucket, I guess with the kids I don’t blame her. My car is older but reliable, and gets me on my 70 mile each way commute, hence the high gas bill per month. But even with gas, it’s still cheaper to live in the I.E.

The train is a cheaper option but takes 2.5 hrs each way, that’s crazy. Almost as much time in the trains as the work day! No thanks.

You know…it really was not *that* long ago that 65K was damn good take home pay. It still is depending on what part of the country you’re in. I really do suspect that we will eventually see the day where it is once again considered a solid take home.

Just for perspective…our family lives off one income of 60K/yr. Family of 4, two boys under 5 (so food bill isn’t super high, yet). We can only afford, max, $1400 for rent. We share a house with my mom though, who pays half the rent (which is 2500), even though she only takes up a bedroom and some storage space. The more people I talk to the more I hear about unique circumstances like ours. But we love So Cal living enough to deal, anyone who doesn’t LOVE it here, should leave cause its ridiculous.

Thank you for the perspective, I was thinking about asking for people to post that.

So you get by on $60k, and pay $1400 rent? I suppose with just my income, and no credit card debt (which I am paying off as we speak!!!) I could swing $1400 a month, but barely. And I really wouldn’t have much left. So do you guys get to go out a lot? Like dinner, movies, anything like that? I mean I feel I suffer enough here, as relating to your comment about love it or leave, I guess I agree. I personally am leaning toward leaving, I just know out east I get more for my money on all fronts.

But again, I am interested, because on “$100k” (pretax) we are not living high on the hog either. And the home prices are sky high along with the taxation and all that.

I am in Austin right now. I am paying 1400K a month for an 840 sq ft single family home.

My mother-in-law makes less than 30K a year, and I work part time. We rent a place that costs 1400 a month, because she refuses to move. We have 4 people in our apartment, and she also supports her other children a lot. We do not have insurance, and she has no savings. The more I look around, the more I see extremely poor people thinking this is normal. SoCal is a weird, weird place…

Oh, I forgot to add she has loads of credit card debt, bought a new SUV, and is thinking about going to a for-profit college for training in something she will not make more than $10/ hour in (total cost would be $6000).

That entry-level price for the Bay Area is a joke. First of all, the Bay Area has too many different markets to be lumped into a single number.

I’ve rented a small house in Oakland for over 15 years and am looking to buy here.

My impression is that in San Francisco, it would be hard to find a tiny entry-level studio condo for $380k, unless you lived in a rough neighborhood. If they’re talking about SFRs, then in San Francisco and the Peninsula, no way. You might find a small house in SF in the high 400s to 500s if you’re lucky, but they’d probably need a lot of work. And the Peninsula? Over at burbed.com, they showed a crappy old ranch house fixer in Palo Alto that recently sold for something like $900k.

I’ve been watching the Oakland market closely the past year. My agent sends me weekly listings of open houses and, for what it’s worth, there have been very few properties under 400k, and many of those are condos. It IS possible to get an SFR at 380k or less, but they’re in areas that are very iffy, if not downright dangerous.

Despite out-of-control crime (on my neighborhood email list, two people reported being robbed at gunpoint within four days, one of them in broad daylight), it’s almost impossible to find a decent SFR in a half-decent neighborhood (i.e., above hwy 580) for under 500k.

Meanwhile, the number of SFRs for sale in Oakland continues to decline, and dropped below 400 this week (to 390). That’s because the distressed inventory isn’t making it to the market. A recent search at realtytrac showed 913 REOs (only 40 of which are on the market), 497 houses schedule for auction, and 630 preforeclosures.

That’s a total of about 2,000 distressed properties that are not on the market – five times the number of active listings. And presumably there are a good number in the shadow inventory – houses in default but which haven’t received an NOD because the banks are dragging their feet.

The banks’ market manipulation, and the apparent large supply of people who can afford 500-800k for a house in Oakland, are pricing me out of the market. But this latest post makes me wonder how many of those buyers can really afford the houses they’re getting.

I didn’t take a whole lot of time, but I jusr redfin’d San Fransisco proper, and it looks like there are some dumps in the far south area in the $300k’s. Anywhere close to Market St all the way down to Ghirardelli pier area is $600k for a condo. Forget about a SFR under 1 million.

The market in the Bay area is wildly distorted by the tech companies and their employees. Drive around San Jose and there is no evidence of economic malaise or lowered expectations. Add to that the too-clever, dribble-em-out strategy of the banksters, and it’s easy to see why home prices there are in the Twilight Zone.

For a reality check, look at what is happening in places like metro Atlanta. If any unforseen event pops the magic bubble of Sillycon Valley, the decline in RE prices will be biblical.

Existing home sales drop 5.4% in June:

http://www.marketwatch.com/story/sales-of-existing-homes-drop-54-in-june-2012-07-19

What a surprise.

I’d like to see the bank that is making loans like that these days! Even FHA doesn’t go that far.

Nobody makes loans like those. This is only a teaser chart to get you to call a realtor, visit some homes, and then find out that you could afford an entry level home if you live on ramen noodles, bike to both jobs, lease a room, and “watch as your payment gets more affordable as your income grows year over year.” After all, this is an investment in your future, and they’re not making any more land. You don’t want to get priced out. After all, Suzanne researched this.

It will be interesting to see what comes ahead for us in California. I wonder how many people on this blog will vote for a sales tax increase come November, that Brown is calling for. On the news, I’m hearing alot of these cities are having problems because of excessive pensions, and I also read a few years ago what some, sheriff’s could retire with, and how they would pad extra overtime and such, so it could be calculated in. I don’t blame them and would’ve done the same thing.Those were the good ol’ days for some. I don’t know if it can be changed, because of budgets. I heard it was law.

I will not vote for a sales tax, I believe we are taxed enough. I have to budget, and think government has to as well. Right away they want to cut services to people, police, firefighters, teachers. How about doing away with their perdeim pay, they can’t pass budgets on time anyway. If they don’t like it, let someone in who’s willing to do without.

At least Brown did get rid of cell phones and some cars. Cut more!!! How many of us have to use our vechiles to get to work. Give them gas money, and if need be, mileage when deemed necesary.

Also there maybe crop damage, meaning higher prices down the road. So on top of inflation and higher prices for food and possible tax increase, how will that help people to save more to buy a house? Will it effect housing prices, since little inventory is being pushed out and controlled anyway. Will it just be investors and people who just got to have “A PLACE OF THEIR OWN.” It’s their money, so more power to them and good luck.

I heard today that either Cal State or UC system is proposing raising tuition by 20% next year if the tax increases don’t pass. That’s right you read that correctly…20 effing percent. Those dirtbags in Sacramento and their underlings running the university system are nothing short of CRIMINAL. I would personally like to see most of this scum charged with treason, extortion and economic terrorism.

I’ll be voting HELL NO on any tax increases come November. Those scumbags have plenty of spending to cut…get to work you idiots! It must be great to play with other people’s money because these bozos couldn’t run a GD taco stand!

This is how much the State has in these public funds to pay pensions:

TOTAL IN PENSION/EMPLOYEE BENEFIT FUNDS = $409,623,766,000.

Yep, although the general fund runs at a deficit there are three other funds that do not and you are not told about them because essentially the general fund is an operating fund while the other funds are assets and investments.

How soon we forget. People see what they want to see. Looking at their contrived local inventory, they have the feeling they have to buy now in multiple offer situations, or fear being left behind. The world is deleveraging, no matter what anyone says, and . Don’t be fooled by govt/fed smoke and mirrors. Smart people are now getting 35 – 50% off on short sales across the Westside. Weekly real estate meltdowns are popping up every week in most of the Westside neighborhoods.

http://www.westsideremeltdown.blogspot.com

We just moved from central California to Portland, OR. I was wondering if anyone had any insight into the housing market here. Some people see prices as cheap here, but when I compare prices to the prices in California in the last 10-12 years, prices seem high. And property taxes seem very high, as well. I don’t think average incomes here are particularly high, like they might be in San Francisco.

karen – just spend an hour or two reading all the blog entries, and comments, and you will be able to answer your question.

Housing prices are lower, but property taxes are much higher (per house price $). Paychecks are significantly smaller than LA/SF, and there’s almost always a LOT of competition for professional jobs…muchly due to the steady influx of California refugees.

Don’t forget the stop at Starbucks on the way to work, tolls, Mello-Roos, HOA fees and daycare.

Anyone considering buying in the Bay Area better considering location, looks like the govt is seriously gunning to begin taxing people for every mile they drive…

http://www.sacbee.com/2012/07/17/4638040/san-francisco-bay-area-will-consider.html

A little off subject but all this talk about how much it costs just to get ends to meet, got me thinking.

Regarding the Citizens United Ruling and the Supreme Court, where the Supreme Court ruled corporations are people.

Every aspect of a corporations existence is tax deductible, from the electric bill to the structure it is housed in whether rented or owned, to input costs, which would be food to a human.

So, if Corporations are people and they can deduct the entire cost of their existence, why can’t naturally born people do the same?

Someday there will be a test case where the IRS takes someone to the Supreme Court on weather one class of people (corporations) can deduct the cost of their existence from their taxes, while another class of people (the vaginal class) can’t.

I especially like to see how Scalia and Thomas reconcile the two. Great entertainment I am sure.

I should clarify……someday someone will try to deduct everything it takes to exist, just as a corporation does and the IRS will sue them, which should lead to a court case.

Most of the FHA defaults are from 2007 and 1st half of 2008 vintages when houses prices were falling off a cliff. FHA loan vintages from 2009 to present are actually performing extremely well.

Leave a Reply