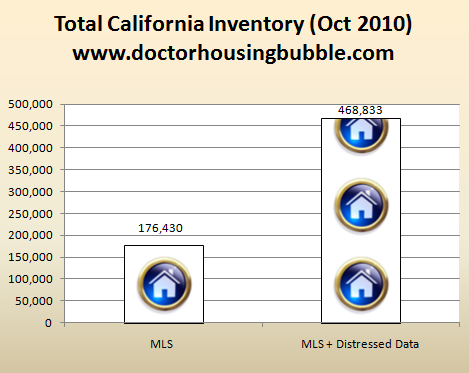

California has nearly 9 years of housing supply – MLS lists 176,000 properties while total shadow inventory is over 468,000. A detailed real estate count of all 58 California counties.

I’ve never made the giant attempt of gathering MLS data for every one of the 58 counties in California. Let us not even discuss gathering foreclosure data for each of the counties on an individualized basis. Yet this is necessary if we want an accurate count of shadow inventory. Over the weekend I went ahead and gathered MLS data and foreclosure data for each county to put together the full inventory for the entire state. What did I find? The data is startling because it shows that California, should it keep the current pace of things in the real estate market, won’t empty out the entire inventory for nearly 9 years! Let us first take a snapshot of total MLS data and also MLS + foreclosure data.

The MLS data is what is readily available for the public to view and the foreclosure data is housing that is already in the foreclosure pipeline but isn’t easily viewable by the pubic (i.e., NODs, REOs, etc):

Source:Â MLS, foreclosure filings

Now the above data is gathered from the following 58 counties:

This is stunning data. The MLS lists slightly over 176,000 homes yet if we throw in homes in the foreclosure pipeline the total inventory jumps up to a stunning 468,000! The shadow inventory in the state is off the charts and locks us in to years of distressed inventory. Now we can see how some in the housing industry can play with these numbers. Just take a look at the current inventory if we simply go by the MLS figures and the latest month of sales:

176,430 (MLS inventory) / 34,239 (CA home sales August 2010) = 5.15 months of inventory

A healthy market usually has 6 months of inventory. Yet this is assuming no shadow inventory which is actually a new real estate phenomenon. So let us run those numbers with the new inventory figures:

468,833 (MLS inventory + distressed inventory) / 34,239 (CA home sales August 2010) = 13.69 months

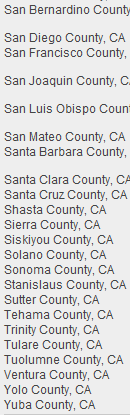

All of a sudden the inventory count jumps up to over 13 months. But you might ask, some of these homes will cure right? Some, but not many:

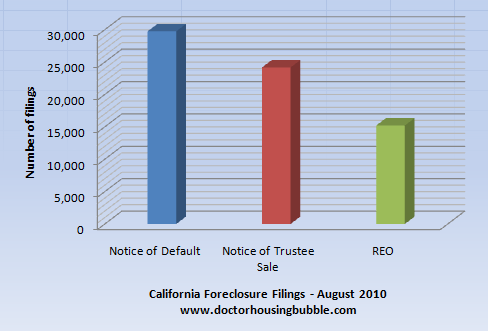

Keep in mind that all homes listed as distressed will be at least 3 months behind to have a notice of default (NOD) filed. A big portion is scheduled for auction and other homes are bank owned. In other words, most of the homes in the pipeline will end up as foreclosures and that is why we are now seeing banks more willing to move on higher priced inventory in the state. The dam is simply holding too much inventory and there has to be some method of putting this out in the market, even if it means lower prices as much as banks want to avoid this. So where do we get the 9 years of inventory data from? You have to remember that people are still defaulting as we speak. The figure above isn’t static. More people are entering the chamber as inventory is cleared out. Let us look at the latest figures:

Source:Â RealtyTrac

The auctions and REOs are already in the shadow inventory pipeline. Yet the NOD figure is the loading up of future inventory. Last month 29,753 new NODs were filed. As we all know, banks are lagging in this category so this figure could be higher if they actually adhered to simply filing a NOD after 3 missed payments. Given the above cure rates, it is safe to say many of these will end up as REOs or will sell at some stage of the process. In other words, this is future inventory in the pipeline. So current sales need to be measured against what is coming online through the foreclosure pipeline:

Keep in mind the above doesn’t account for potential organic inventory that will come online through the normal channels of selling a non-underwater home; moving up, downsizing, locking in a profit, divorce, new job, and any other reason why people would sell when they have equity. The market has been turned on its head. Distressed inventory always used to be a tiny sliver of the market. Today, it is the market. So to discount the shadow inventory is simply ignoring reality. Given the latest data with NODs still hitting the market plus actual sales, the actual inventory count is only being drawn down by 4,486 homes per month. So then we can run the numbers yet again:

468,833 (MLS inventory + distressed inventory) / 4,486 (CA home sales August 2010) = 104.5 months (8.7 years)

Do people really want things to be drawn down slowly? If that is the case, you can rest assured that real estate will be a bad bet for the next decade and will drag the fragile state economy with it.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

41 Responses to “California has nearly 9 years of housing supply – MLS lists 176,000 properties while total shadow inventory is over 468,000. A detailed real estate count of all 58 California counties.”

How many of those distressed properties have multiple NODs filed? One for the 1st and one for a HEOC or more?

On the flipside, how many homes are listed (or unlisted) that don’t show up as distressed as there either hasn’t been any NOD filed (even though there should be) or perhaps the owner, while still making payments, is hanging on by a thread burning through savings until “things turn around”? Or perhaps a price reduction on the so called “non-distressed” listings will bump it into the “distressed” category?

I’m starting to think that RE in general is one of the biggest financial scams ever and that there is FAR more desparation than we are led to believe. There was never a better way to enslave people.

I can see it now.

.gov to desparate homeowner…”Want help? Just enlist in the armed forces for 4 years and you can qualify for the homeowners mortgage discount!”

In WWII, a combat fatality was known as ‘buying the farm’. The concept you mention is not a new one.

This is one of the biggest eye-openers I’ve read in a while. So is it better to go out with a whimper or a bang?

Let’s say we decide to go out with a bang and release of all these things, what would realistically happen? I assume it would just be a free-for-all for a while, then the market would slowly repair itself.?

How would that scenario compare to our current route, aka going out with a whimper. Is there any way to calculate this?

If everything were released all at once, it would be a rapid race/movement (rapid relative to real estate…you have to remember that RE moves far slower and is far more illiquid than equities and various other assets) to the true market bottom, with tremendous volatility (again, volatile as far as real estate is concerned), then perhaps a nice bounce up, or just a severely jagged/”bumpy”, relatively flat or very slowly increasing period.

There would be many cash investors catching falling knives, many well connected/financial insiders getting sweetheart deals/bundles of prime properties for next to nothing relative to the peak, etc.

Sobering numbers, Dr. HB. Thank you so much for doing the hard work of digging up these numbers and shredding the NAR statistical games and gimmicks!!! We still have a long way (down) to go.

Don’t forget the back log of people living rent free that have not made a mortgage payment. I can’t remember the number of mortgages that are at least one year without a payment and have still not received any notice but I think it was in hundred of thousands. Take 33% for California share.

I am laughing hysterically.

I have been trying to tell people just how bad this is and then guys like you actually go out and get the facts. This is a snipped headline from Zero Hedge- one of the few places I trust.

Is A 90 Day “Mortgage Meltdown” Foreclosure Moratorium Imminent As The RoboSigning Scandal Goes Mainstream?

It gets better. Not only will the Robosigning scandal cause every state to shut down pending sales in REO’s but title insurers are now refusing to do business in many states and with banks who blindly signed foreclosure docs. It gets even better. This is also going to hinder those people that have already bought (albeit good faith laws) REO’s and it is going to slow normal sales dramatically as lenders and insurers are going to demand that the law is complied with. It is literally going to cause sales to backload and plunge. Ultimately, I really do believe Congress is going to have to step in again and I am not kidding…I think another bail out will loom.

All of this begs the question. How are banks owning this garbage- pretending to be solvent? The TBTF banks have 70% of these toxic loans, Fannie and Freddie are absolutely bleeding (6 trillion) and yet everyone would have us believe that bank balance sheets are fine. Millions of people are not paying mortgages. And you can damn sure bet they aint paying property taxes. The creative accounting methods that these banks, aided by our government, must be using- amounts to fraud. It has to.

I posted a great one minute vid on this national insanity and cover up at my url. Now waiting for the next implosion. Thanks for the great work Doc.

Ironically, this was posted at almost exactly the same time my local paper published an article called “CA home sales: Worst is over, but prices will lag,” where they interviewed a bunch of “experts,” aka realtors, who have absolutely no vested interest whatsoever in keeping the charade going!

Note that in Ca the adverse possession laws apply after 5 years of paying taxes and with color of title. So that means any action against the foreclosing bank, can only get the house back for 5 years, because after that the current owner (or member of a chain of owners since the foreclosure), has aquired the ownership by adverse possession. So if people want to reclaim then need to start filing now. Of course this is a great way to solve the surplus of Lawyers in the US.

So true, please read: http://www.patrick.net/forum/?p=28945

(How to get a Free House in CA, with Adverse Possession) Good if your bank wants to drag out the foreclosure.

I see a lot of litigation ahead. This is good for attorneys and CPA’s.

The bigger picture may be to just take an approximation of how many homes are now underwater on their loans? ~30%? A majority of these will end-up in the sales cycle as unemployment persists and homes dont go up in value. And yes, there will be the homes with equity that will be put on the market for the more usual reasons. But it does look like these organic/non-distressed homes will be in the minority for quite some time.

At some point the RE market will come to life per the MSM and then the folks who have been hoping to sell will flood the market with inventory. The RE market is a total mess and as the Doctor notes may take a few years to correct!

The good Doctor unmasks mainstream real estate news like Jon Stewart pummels a foot-tapping Senator.

Dr. HB:

Although there is no mention in this article of the virtually-complete halting of new replacement inventory, shouldn’t the demographic of new household formation have an ameliorating effect on these figures? Where I live in northeast suburban Phoenix, I feel that I can derive some comfort in the fact that there can be no new construction in a market where homes are selling below a builders’ replacement cost. But then, young people have no alternative but to just move back in with mom and dad because they can’t qualify for a loan. I would welcome anyone’s input.

Dr. HB:

Recent experience: a bank-owned townhome just a few doors down sold for $165k or less last week.

Both For Sale signs were removed by the real estate agent.

However, on Zillow, all the info shows is that the listing was removed by the agent.

Zillow does not show that this unit sold at all.

So there is deception practiced by realtors and banks to hide the true state of price action.

~Misstrial

Zillow sometimes shows the sale a number of weeks later. Check the MLS at Realitor.com.

Arizona Jim,

Although the Doctor’s fundamentals cannot be argued with, no one really knows what will happen with the market. That’s simply because we do not live in a free market the the government is free to change the rules of the game as much as they’d like. If I had to take a side, I’d go with the government being able to keep this game going (at the cost of a lost decade similar to Japan) rather than having fundamentals take over and drive the market the way we all want.

I agree with Arizona Jim that population growth and a continued influx of people in certain regions will certainly take up some of the slack once people get jobs and banks figure out how to lend money. If you spend time talking to people in land/housing development, it isn’t just wishful thinking that there may soon be a housing shortage in some high-growth areas.

@ Juliius: To answer your question, see DHB posting of September 18th, 2010 –

“Removing a generation of college educated graduates from purchasing homes – Higher education bubble will force many students to hold off on buying a home to service college loan debt. Renters take brunt of household correction. Demographic trends will put pressure on home and stock prices.”

Mostly I’m standing on a chair clapping.

It’s going to be very interesting to see what happens to the professional RealTorz whose ranks were ballooned by cream-skimmers and scammers. And how that profession (and its profit-making formulas) will change. A nine-years’ backlog also means nine years of no income for RealTorz who envisioned an economy of them skimming 6% off of serial sales on the same properties.

The big puzzle piece in my mind isn’t backlog, it’s the organic sales. I.e., when the cancer spreads, it affects the healthy tissue as well. (Which is part of what DHB has been saying all along about the sub-prime/ARM toxic malignancy spreading to prime/fixed mortgages.)

I’m guessing that at this point, with all these bailouts, the eventual cures will be as bad as the disease. For example, yes, the bromide of “population growth taking up slack” is always an option, but the larger question remains of how to have that population growth amount to anything but Third Worldification/race to the bottom, especially in a state like CA with a collapsing infrastructure already so deeply dependent on stealing essential resources (esp. energy and water) from elsewhere.

To provide an answer from elsewhere. In Texas in the 1980s the whole states real estate market crashed and burned. In the small town where I live 1/2 the real estate offices disappeared. I suspect this will happen in Ca, along with the mortgage brokers underwriters and closing agents. Perhaps finally this might lead to a rationalization of the market and a reduction in the 10% private real estate transfer tax that now applies.

Petrin, I can’t imagine a quick break (getting everything to market, if that were feasible) wouldn’t be better in the long run. It’s the mode of growth that makes for a stable market. Get the pain over with, get back to growth, even if it’s slow growth. That’s my take. People are waiting because they think it will fall further. People don’t know what their assets are really worth for personal planning . . . Endless uncertainty in the current situation. Bad, but predictable sure SEEMS like it has to be better than this. But it isn’t going to happen. Even if every party wanted it to . . . it just can’t.

Yeah, I can see your point. One of the first things they teach you in a law school contracts class is that the contract came out of the need for predictability.

While a certain amount of unpredictability (ie, the stock market) is expected and even encouraged, economies cannot function without a base level of predictability. People will not act. Commerce will cease. In short, it’s one of the cornerstones of any economy.

So from this perspective, what’s better, one short, but massive period of instability that settles relatively quickly into a predictable (but diminished) pattern where people can go on with their lives, or nine years where you really have no idea what’s going to happen? Which is going to be less damaging, not only to the economy as a whole, but to the psyches of those participating?

One thing I don’t think people realize (and probably can’t be quantified) is the effect prolonged instability would have on the market, particularly to those new to it. I am in my early 30s and my economic world view was forged in the fires of a series of booms and busts. From my perspective, we haven’t really produced anything since the 70s. The government just comes in and decides X market is ripe for the bubbling, puffs it up to make it appear that we’re actually doing something, then the lie can no longer hold and the bubble bursts. Rinse, repeat. The problem now is that we no longer have anything left to puff up (except maybe school loans and gold), so our economy is finally shown for what it is, which isn’t a whole lot.

So the trick lies in learning to ride the bubbles properly if you can predict them, but if you can’t or don’t want to take risks, you find one of those few niches that is stable and just make do. As a result, I work in manufacturing. At least then I can live my life with some predictability, but do so assuming that growth is a lie. All my financial planning is thus done based on what I have now, not what I may have in the future, which translates to very cautious behavior on my part. For instance, when calculating my 401k deduction, I assume a very low rate of return and that I will never receive that wage-doubling promotion. Many people of my age are this way- either major risk takers or the exact opposite.

Kids these days, though- Those graduating college now were 13 when the 9/11 happened, grew up in a different bubble, but one with worse consequences. They’re probably similarly pessimistic, but unlike me, their pessimism is accompanied by bottle of snake oil with a $30,000 hangover that even bankruptcy can’t cure.

Add nine more years of instability to the mix. How do you think these kids are going to end up? What kinds of investors are we creating?

That was a rant, but you get my point.

88% of people in riverside country have underwater mortgages. A lot of these people aren’t delinquent yet, but over time they have balloon payments. An underwater mortgage with balloon payment might as well be thrown into this pot of distressed inventory. Riverside county will see 2006 prices again in 2030 or beyond.

LOL @ the term “balloon payment” when associated with a mortgage.

What is this – 1929? They used to do those 10 year motgages with balloons way back then.

Ooopps..my bad.

What really ticks me off is how the government is manipulating the housing market – even Obama admitted this in his latest State of the Union Addresss. He said “That’s why we’re working to lift the value of a family’s single largest investment — their home.” Excuse me?….Lift the value of homes, when the market is self correcting after the largest financial bubble/frenzy in all of history. THE FREE MARKET IS TRYING TO BRING HOME PRICES DOWN TO WHERE THEY SHOULD BE, but no, the government knows better.

So, who wins when housing prices are kept artificially high? Banks, banks, banks, and governments, from increased tax revenues. Who loses? Young working people trying to buy a home, but find prices artificially high.

The GOVERNMENT HAS NO BUSINESS MANIPULATING THE FREE MARKET, or PRICES. That’s not the job of government. That is counter-productive to a free market and a free society.

Yes, all that and more. Has anyone stopped to consider the position of home insurance companies? My insurance company is insisting on a value for my place that is way out of whack in this market. But, that higher rate means higher premiums. Hello!

Ahh…a man or (lady) after my own heart. Exactly.

There’s a couple things I’d say to that…

1. The Fed is practically a private entity. Congress plays somewhat of a big brother role to the Fed, but really, the Fed has its own agenda. They are by the banks, for the banks and quite frankly ‘of the banks.’

2. If the Fed actually did a good job to promote a healthy, growing economy while hedging against recessions, I wouldn’t mind such intervention, and I don’t think anyone else would if they are thriving within that ‘manipulated’ market.

In the grander scheme of things, a handful of rich entities had us at checkmate for the better part of this decade. Whatever scraps we could get off their bounty was an illusion, and it’s now time for a rematch. If the American people can focus not on winning back their losses, but on winning back their power to pave a new path, then we will win. As long as it is a battle of money between the have’s and have-not’s, most of us will forever be locked in place, as they play this game much better than any of us.

Well put

I know everyone wants to point to banks’ balance sheets, but really the tbtf banks have securized the bulk of their loans. So those who bought them through Goldman etc are the big financial losers here (former homeowners not withstanding). That’s why banks are paying back tarp. Money off fees, money for originating new loans, money betting against securities holders, taking their cuts from foreclosure and shortsale deals. They’re getting everybody coming and going. Expenses like legal fees? What they can’t get from the buyers they put to the securities holders. What a racket. No wonder they want to drag it out forever. And when interest rates rise and real estate is really in the toilet, the banks will be loaning their own money at high interest rates to buyers who actually qualify at home new low prices. Cha cha Ching.

Profit on the upside. Profit on the downside.

That’s the difference between the Big Players at the casino, and the rest of us.

Amen

Your numbers are seriously skewed. First thing I see is that you are counting ALL NODs as if they will become defaults. In fact, one of your charts shows how there is only half as many REOs as NODs. Second you are assuming the MLS has no REO’s or short sales listed. In fact, a majority of the listings are bank owned or short sales. Finally, the listing supply when searched incorrectly (under market conditions) will give you 3 months stretch of listings instead of currently active. Basically triple the supply, this is the problem with the appraisal addendum called 1004MC. FNMA finally recognized the problem and asked appraisers to correct this in their latest update which takes effect Nov.1,2010. You obviously havent taken the time to talk to a Realtor or a buyer trying to find a home. We are in a seller’s market!!! Get out from behind the computer monitor and ask your local agent what is going on. Best case scenario we have a 30 – 90 day supply and prices will be skyrocketing in the coming years.

IDIOT!!

AC,

I don’t see where the market is going to come from for the “skyrocketing” prices you predict in the coming years. Without some miraculous spike in household income, prices will need to come down a lot more to make them affordable.

And let’s be honest, even if real estate prices were basically affordable, do you know anyone who would want to spend the next thirty years of their life paying off a $350,000 mortgage to live in Norwalk, Paramount, or South Gate? Or is this frenzied crowd of manic home buyers you see coming going to be trampling over each other to buy some sixty year old house in Culver City next to the 405 freeway for half a million dollars? With an underemployment/unemployment rate of close to 23% and wages in real dollars flat lining or worse, where will these buyers who will send prices soaring once again come from?

AC- when the pipe gets THAT hot, put it down!

Why did you reduce the denominator by your NOD count, rather than add to the numerator of distressed inventory?

AC is partly right. I’ve been watching the shadow inventory numbers and news articles for a couple years and the vast foreclosures have repeatedly failed to arrive. I don’t know the real # but it seems at least half NODs cure or are sold via normal market. Investor activity and cash purchases are getting fairly high again, so normal folk don’t seem to have a real shot a buying most foreclosures. On top of that prices are more determined by school district that the actual value of the property so in any community with a top 10-20th percentile district, people are willing to pay far more rather that deal with the applications process and annual tuition bills.

I’m not entirely on board with your calculation for 9 years of inventory. You deducted NOD’s, the “future inventory” directly from monthly Ca home sales. Why deduct NOD’s directly from the sales side of the equation? I should think NODs go on the other side of the equation, added to distressed inventory. If I punch in the numbers that way, NODs + distressed inventory/CA monthly sales, I get the equation:

528279/34239 = 15.45 months.

This is still a dramatic enough number in and of itself. This housing bubble does feel worse to me than 1987, and It is hard to calculate exactly how long it will take for a 15.5 month inventory to be whittled back to a 5-6 month; the variables of marketplace dynamics are too difficult to quantify. But we can all surmise it’s going to be a long haul.

Leave a Reply