Real Homes of Genius – Agoura Hills and a $280,000 discount on a once million dollar home. The expensive foreclosures are now hitting the Southern California market.

The big foreclosures are now hitting the market in a steady stream. It was only a matter of time before the shadow inventory started leaking out into the market for all the public to see. The banking industry made a bet with your tax dollars that home prices would rebound shortly after the bubble burst. But by definition a bubble is based on unsustainable prices that have very little connection to economic fundamentals. Just take a look at the NASDAQ and see how close we are to the peaks that were reached a decade ago. In many Southern California areas home prices won’t be seeing their peak levels for at least a decade. Earlier in the week we covered a home in Mar Vista that had a $200,000 price discount. The purpose of this is to show that banks are now pushing onto the MLS prime location properties at steep discounts. How does this differ from last year? Last year banks would put a home on the MLS and try to recoup bubble level prices. Today we’ll look at a home in Agoura Hills that has a steeper discount in an arguably more desirable area.

Agoura Hills is another L.A. County city that is considered prime but nothing close to being an elite area. There is a difference. These are the markets that will face the brunt of the correction in the next year. Today we salute you Agoura Hills with our Real Homes of Genius Award.

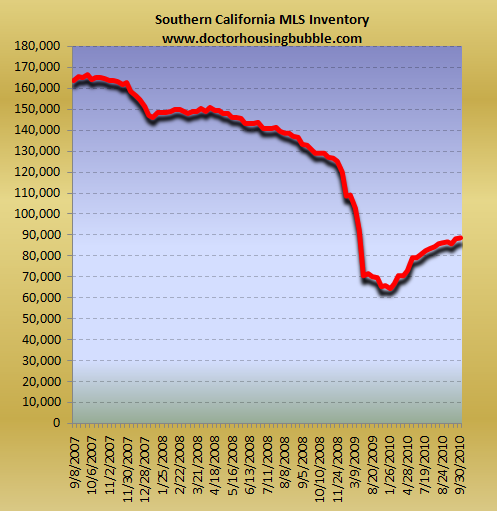

Southern California MLS inventory growing

The trend is unmistakable for Southern California. Inventory is growing and much of this is being pushed by growing foreclosure listings and also short sales. It is also remaining elevated because sales have fallen steeply in the last few months. Now going into the seasonally slow fall and winter, we can expect this trend to continue. After all, a foreclosure doesn’t care if it is raining or sunny outside. I’ve received a few e-mails about foreclosures being halted with GMAC and now JP Morgan Chase:

“(NY Times) In a sign that the entire foreclosure process is coming under pressure, a second major mortgage lender said that it was suspending court cases against defaulting homeowners so it could review its legal procedures.

The lender, JPMorgan Chase, said on Wednesday that it was halting 56,000 foreclosures because some of its employees might have improperly prepared the necessary documents. All of the suspensions are in the 23 states where foreclosures must be approved by a court, including New York, New Jersey, Connecticut, Florida and Illinois.

The bank, which lends through its Chase Mortgage unit, has begun to “systematically re-examine†its filings to verify that they meet legal standards, a spokesman, Tom Kelly, said.â€

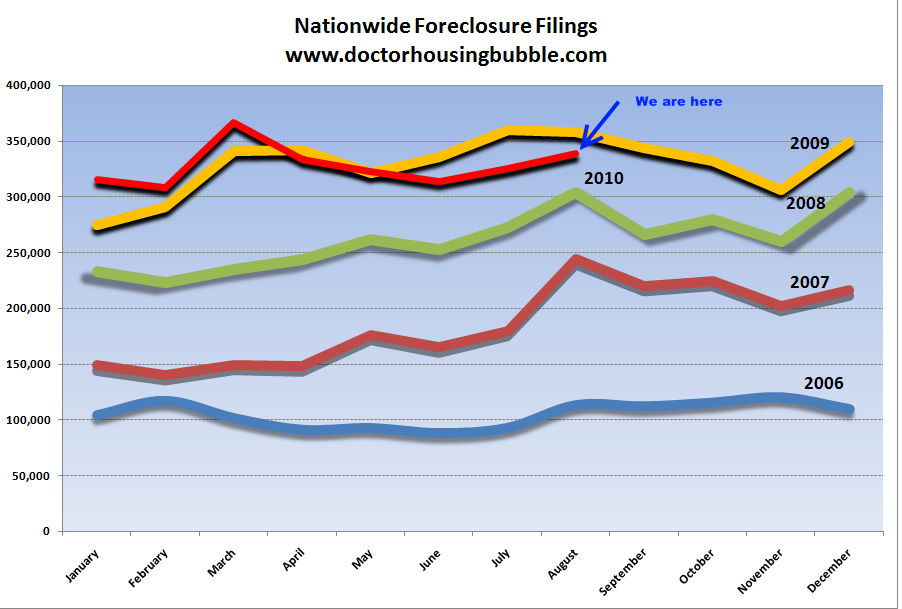

My take on this is that yes, banks do shoddy work. What do you expect? This is the same industry that brought you the option ARM for crying out loud. Now we expect them to actually do an ethical job handling foreclosures? Just like they rushed and forged documents during the boom time trying to get every borrower with a pulse into a home, in many areas they are trying to kick people out the door without even checking their facts. In one case, a person with no mortgage in Florida was foreclosed on by Bank of America! My take on this is that there is tons of shoddy work out in the system. Yet the sad majority of foreclosure filings are actually happening for one reason and that is the sad state of the economy and toxic mortgages made in “legal†ways. Take a look at foreclosure filings:

Even if JP Morgan is announcing a halt on 56,000 foreclosure filings this is a drop in the bucket. We are on pace to have 3.5 to 4 million foreclosure filings in 2010. Now what does this have to do with the foreclosure I’m going to show in Agoura Hills? It has to do with it in every way because many of these mid-tier areas have paperwork that is filled out correctly. No subprime-Bill-Gates-is-my-cosigner-and-I-make-$200k-at-Costco fraudulent documents. In many cases these are people that took on Alt-A and option ARM products trying to live a Real Housewives of Wherever lifestyle. If you’re household makes $100,000 or more you are in the top 20 percent of all U.S. households. But I can tell you this; $100,000 doesn’t even come close to financing a $1 million property (even a $500,000 mortgage is too much). So in expensive California areas I’m sure the paperwork is likely to check out (sanity is another issue). These people just can’t pay.

From $1 million to $739,900

29019 INDIAN RIDGE CT, Agoura Hills, CA 91301

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2/1

Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1980

Square feet:Â Â Â Â Â Â 2,620

List date:Â Â Â Â Â Â Â Â Â Â Â Â Â 9/13/2010

List Price:Â Â Â Â Â Â Â Â Â Â Â $739,900

The above home is a foreclosure and only has two weeks being listed on the MLS. The current list price is $739,900. This is a good area and the home is a nice looking place:

Those don’t look like 1980 floors. Where did the money come from for those upgrades? We can only take a guess.

Even foreclosures have pools.

I can’t tell you how many times last year I heard from people in these mid-tier markets talking about “how their area was different.â€Â As we all now know, they are clearly not. Mathematics doesn’t suspend itself for certain zip codes.

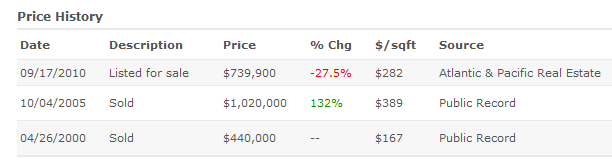

If we look at the sales history, we see the progression of the housing bubble here:

This is just nuts. In five years this home doubled in price even though incomes went stagnant. This is the definition of a bubble. The current price even with a $280,000 price discount is still inflated. These markets are flooded with shadow inventory:

Agoura Hills

MLS listed foreclosures:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 7

Total shadow inventory (NODs, scheduled auctions, bank owned homes):Â Â Â Â Â Â Â Â Â Â 178

Now run the numbers for this place with a 10 percent down payment:

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $73,990

PITI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $4,447Â Â (30 year fixed)

A household would need to make $200,000 to $240,000 to safely afford this place with a 10 percent down payment. In 2007 the average adjusted gross income for this area was $112,000. In other words, even a near $300,000 discount still renders this home inflated.

Today we salute you Agoura Hills with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

36 Responses to “Real Homes of Genius – Agoura Hills and a $280,000 discount on a once million dollar home. The expensive foreclosures are now hitting the Southern California market.”

“So in expensive California areas I’m sure the paperwork is likely to check out (sanity is another issue).” So true, especially the part in parenthesis). BTW Doctor, as you know, the JP Morgan Chase suspension is irrelevant to us in California as Cali is a non-recourse state but allows foreclosure without going through the court. More than likely it won’t have any effect here and JPMC will continue to foreclose throughout the state.

I think if you refinanced or pull a second mortgage your purchase loan the banks can get a delinquency judgment against the homeowner.

So, JP Morgan and GMAC still need to have their act together.

Doesn’t anyone think there will be class action lawsuits filed to this robo-signing? I mean if you can’t afford the mortgage then you can’t live there.

I’m amazed the banks are handling legal documents in such a unprofessional way. I thought at least there paperwork and processing systems would be OK.

We are going to hear much more of this story…

Non-recourse applies to a borrowers assets beyond the house. The whole problem with the conduct of JPM and GMAC ( and most likely all the other “note” holders) is that they never maintained a legally binding chain of custody on the title in order to take possession of the house. They just took MERS digital records as a starting point to re-enter the realm of legitimate legality and never allowed for the possiblity that leaving the path of legally recorded title transfers would obviate their right to take the house away.

The whole point of MERS and securitization is that it only worked if you got rid of the paper trail. When Fannie and Freddie went along with this idea, it was game over for clear titles. For the majority of mortgages, MERS went only to the county recorders at the start of the loan to record in paper that they would keep track of things on their own and weren’t going to bother the county recorder with an update until a loan was closed out. Well sorry that is not how it works.

Now title insurance companies have started denying coverage on any house tainted by JPM and GMAC. This will snowball. The only way the banks can stop this from hitting the fan is to stop all foreclosures and continue exclusively on short sales.

Short Sales would allow banks to wash their hands of the issue of an unjust “taking” of what is not legally theirs, because they did not maintain a legally binding custody of titles. If they can get you to agree to a short sale, you gave them the house of your own volition. No harm no foul.

I would expect an explosion of short sales. And I would gather that smart underwater bag holders are going to drive a hard bargain with the banks.

“Oh, excuse me Mr. Loan Officer, you will take $100/Sf for my house from Mr. Lucky Kashinhand or have your lawyers produce a chain of custody on all the title transfers you forgot to make down at the County Recorders office.”

“Whats that you say, MERS lost the papers……fine I’ll just have my lawyer deposition the MERA corporate officer that was never paid by MERS and ask him why he lost something he was not legally empowered to hold in his possession in the first place.”

“What’s that….. Oh no, well Mr Kashinhand just withdrew his offer of $100 a square. But Mr. Hits Knowornever is offering $80. I would hurry up if I were you.”

This also puts flippers who purchased by Short Sale in the cat bird seat. As these are the only homes on the market without a cloud of title or just don’t smell as bad.

I also doubt the politicians are going to allow the peons a chance in court to make things right by rule of law.

Regarding the Foreclosure freeze by GMAC & JP Morgan, Is this just another attempt to stall the housing correction? The banks were (are) really this Stupid? Doc, what do you think – are we gonna be “Played” at every chance we get to by reasonably price homes?

I think people always have this idea in their minds that banks and other institutions are so professional in how they handle things. They’re no different than a small business trying to get things done and clean up messes, except on the exterior everything looks nicer. I’m speaking from experience working at one of the largest banks in the US.

@Oil Can

You’re right, more and more of this will surely come to light. We’ve learned nothing about fixing our processes from when people were applying for loans, and we’re demonstrating that in how we’re closing people out of loans.

Wow, where did you all come from? What great Postings, Tell Me More – please! Fresno State never taught me stuff like this… What a great site. The Best & the Brightess post on this site, I’ve combed through many other sites before finding the Doc. Not much out there with this kind of research and just plain hard work. Well done!

The banks have to move their REO’s for regulatory reasons. The foreign money(e.g. China and India, and etc.) will come in and buy them at the deeply discounted(like Riverside discounts) prices. This, of course, will drive down your MLS prices too. People who sale in the next 12 months will only be people who HAVE to say. Time for the turtle to pull his head in, and wait it out. In the meantime, learn to be happy where you live. Thank God I live in Toon Town.

In many Southern California areas home prices won’t be seeing their peak levels for at least a decade

they will never reach their peack!!

In nominal terms I think housing prices will reach peak levels within ten years. With QE1 now history and QE2 in our future the FED has made it clear they will do whatever it takes to get the economy going and make housing prices fair value in NOMINAL TERMS.

In other words I am confident the FED will succeed at its endeavor to create inflation, after all, they can print money and are printing money and that is inflation. Maybe not visible today but certainly will be visible tomorrow.

That said, in REAL TERMS, housing in S.C. will NEVER be as high as it was at the peak. It would take another bubble to reach the peak in real dollars and bubbles never repeat except perhaps after a few generations.

I think that you might be thinking about it in a completely different sense. First of all there is a massive amount of money that is being destroyed over the last few years. Money is created when a bank makes loans. The Federal Reserve is such a bank and it originates the first loan. Via “velocity of money” it gets deposited in another bank and another loan is made and so on.

Over the last few years so many people have been defaulting on loans or repaying loans early that not only the velocity of money has slowed but also the total amount of debt held by Americans is decreasing. This results in a shrinking of the amount of money in circulation and eventual deflation.

The government has been trying to counteract this trend by bringing more and more money into existence and finding novel ways of distributing it into the markets while mainting some ability to remove it if people start to borrow again and/or the velocity of money starts to pick back up. Where do you think that trillions of dollars in stimulus have gone? Only to fill up the hole that was left by the great recession and housing bubble burst.

What is most interesting to me is that this likely was a paradigm shift in the way the American consumer thinks. Changes in the way that people view debt, banks, corporations, and government. I’m not sure that we will return to the same views that we had previously on the economy and government. This is a major shift in what it means to be American.

Enjoy the fireworks.

That house for $739,000????? Hahahaha….hahahahahahahhahahahahahah. LMAO.

What a comlete joke. !!!! Who is the owner trying to sell, Bozo the Clown? … or the Bank of Bozo? hahahah

The housing bubble made EVERY SINGLE AMERICAN A MILLIONAIRE (what a joke) and made every house worth a gazillion dollars.

Decent looking house – no joke – but $739,000???? Sorry Bozo!!! No Way!!!

No offense Dr. HB but I think I have just witnessed evidence of your own MSM brainwashing. I’m guilty too.

Here’s the deal.

Stop thinking *DISCOUNT*.

The house sold for a bubble price in 2000 as the bubble started in 1997.

I don’t see a $1,020,000 house listed at a $280,000 discount. I see a $280,000 (max) house listed at $460,000 crazy bubble *PREMIUM*.

I’d be willing to bet that had we never had an internet bubble that homes would have continued their downward trajectory as outsourcing was already on a roll by then.

The latest homedebtor/agent/bagholder spin is little more than a disingenuous statements regarding real vs nominal values. This group of debtors already know their ****ed so their new form of denial is that they will only have to take a hit in *real* value but of course, *nominally* they’ll be just fine.

I’m not seeing any wage inflation on the horizon, and when home prices quadrupled in a decade 1996-2006, thinking that getting a house for only *triple* it’s 1996 value is even close to being sane is just, well…insane.

The high $ jobs of the past (tech, mortgage broker, realtor) are gone and in due time, the high $ healthcare jobs will be gone too as it faces more competition from medical tourism abroad.

Great Comment, Dead on except for the $ high dollar healthcare jobs observation. Those jobs will still be sustained by criminally high insurance premiums. Enough of us are not going abroad for surgical procedures yet to impact those salaries. If that does happen, Insurance rates will just go up.

I agree. The Fed can print all the money it wants. If that money never makes it into the hands of the people buying things, then prices won’t go up. Wages have been stagnant for decades. Prices have gone up due to easy/crazy/loooong term financing, but it is finally time to pay the note. I don’t see banks lending money out left and right. They took the bailout money and bought treasuries with it. I don’t how prices can go back to 2007 when wages are stagnant and lending (even though it is subsidized) isn’t crazy. I would guess home prices will roll back to 1997 or maybe even 1987. You can try to fiddle with markets, but in the long run they are going to do what they are going to do.

E’s comment is easily one of the best I’ve ever read on here. Brilliant! To hell with the pittance of a “discount” offered on some homes – they’re still charging a “delusional seller pricing (TM)” aka DSP premium!

I had the same idea, that this was just another ploy by the banks that serves their purposes somehow. This stops them from having to put homes on the market now.

I am not sure how this will play out, being a lowly lay person et all, (who would love to buy a home but… hey, I live in the Bay Area, fagetabouddit…) but i see the banks co-opting this eventually to their benefit. Just not sure how.

I wonder how long it will take for all this to play out. Maybe the banks just wanted to buy time with all this. And the govt, too. After all, it’s pre-election.

Is there something fishy here? if i took out a loan and made a profit on a house, and it was a shoddy loan, could the banks repossess that too?

Something unexpected will emerge. People blame the banks and I can see that. But no one complained when home prices rose. Maybe banks will reposess everyone’s house where there’s a profit and a shoddy loan doc!!!

It’s sad to say, but I don’t think we’ll ever see home prices go back to where they belong. I’m not arguing with anyone about where prices should be, but banks and the government make the rules in this game and there’s no way they are losing. Nothing short of a depression where the people take over again and change the rules will be enough to stop their casino games.

Really think about it. Wouldn’t you rather print money and loan at low rates to keep Americans holding the bag than take losses on your own balance sheets? This will be a long and drawn out affair and I don’t think the average person will win. Eventually enough people will cave in and buy to resettle the market. I am 100% hoping I’m wrong.

Wow, this is exactly what I’ve been thinking, too!

There are quite a lot of smart people here that are probably correct in what the market would do if left alone. However, aren’t we in this mess because the market was manipulated by those in power? I would expect both big banks and the government to try everything it can to disperse the losses on everybody through inflation and other indirect means rather than let the ball drop all the way and hit rock bottom. Why would these entities all of a sudden stop messing with things? As we can see, they are still doing everything they can to still prop up house prices.

I do feel bad for people that bought at the peak, but the very simple fact remains that honest working people cannot afford homes. The prices need to come down. Banks want people to take bigger loans so they can get more interest. Government property taxes, etc. Ugh.

At this price point, this home is still grandly overpriced. Even if someone is making over $100,000 per year, they are still hopelessly “middle class” unless they are in the top 3% tax bracket and I doubt they would live in Agora Hills if they were. We should blame every banker, every real estate agent (especially local ones), every house “Flipping” show and every speculator for artificially escalating housing prices in the past 13 years. Great, you make $250k per year? Think you can afford this place? Wait until they downsize you and hire someone half your age for half your salary, Oh, wait. That person can’t afford this house either. They are still paying off their student loan. This is the beginning of the “Third Worlding of America”. One would be naive to think otherwise.

I agree.

Agreed.

Every Third World person I’ve seen wears cotton t shirt, cotton pants, and cotton sneakers. WE are already dressed for the third world !

Has anyone given any thought to the upcoming election? Do you think the lenders may be holding off to see the results and how that will effect them in this whole mess? They thought they would get another round of TARP Golden Parachute bail outs or better yet the Toxic Asset Bail Out that never took place. Short sales and Foreclosures will both play a significant role in housing for many years but I really do not see one taking over the other they are not the same animal at all.

This website is fantastic! Dr. HB knows his stuff and many of the commenters are incredibly knowledgeable. We live in a semi-rural part of a mid-Atlantic state, about a 75 minute drive (non rush hour) to the White House and we did not have the big bubble in housing prices. Our local prices went up somewhat and have now backed off to levels of maybe 5 or 6 years ago, but the up and down percentages were no more than 20 – 25% or so. We also still have a lot of relatively small local banks that examine borrowers’ financials closely and still hold some loans in their own portfolios instead of selling them. There is also a lot more owner financing here, especially on farms and orchards, such as ours. Of course, the median household income here is lower (in the $50-60K range) than most of California’s suburbs/cities, but this is more than offset by the much lower cost of living and, at least where we live, by MUCH lower state and local income taxes and real estate taxes. On the other hand, our weather is colder in winter than So. Cal. and we get around 20 – 30 inches of snow between Dec. and April, which is really the only time we think it might be nice to live in Dr. HB’s vicinity. Cheers to you Dr. HB and keep up the good work!

Nice comment, Eddie.

Good for me to read, that there are still parts of America, where America is as it used to be.

How much of a weather premium to you have to pay for 113° in September (LA, 2010) wildfires, smog-capital of the world, El Nino winters every 3-5 years anymore? Of course, it’s a dry 113…

Really. I mean ok right along the coast, there’s your weather premium, but that leaves out much of the L.A. area. Does anyone really think climate change is going to make this any better? We’ve already broke the thermometer.

I bought houses at contra costa county trustee auction sales till 2000 when the bubble was just beginning. I always did a very careful title search before bidding. The trustee document says that the seller guarantees nothing, not even if the address is correct. If there is any problem with the title it is the buyer’s problem at a trustees sale oonly a pending bankruptcy can cancel the sale.. And if there is any problem with title you can’t get title insurance and you will not be able to get a loan or sell the property.

The ramifications of this title mess are endless. I would think that title companies could be on the hook to honor title insurance policies. i would think the banks could be sued by both purchasors and displaced former owners. Chain of title is basic to our property laws. Without clear and enforced title laws, buying property would be a very risky gamble. Where will all this end?

E – you are RIGHT ON! To say this house is discounted is ludicrous. IT’S NOT DISCOUNTED, IT’S WAY OVERPRICED. That is one of my primary observatons on the housing bubble/insanity – it distorted most peoples’ perception of housing prices and the value of money.

The Doctor himself stated “Agoura Hills is another L.A. County city that is considered prime but nothing close to being an elite area. There is a difference.” But it’s priced at an “elite” price. I agree with you E – this house is probably worth $280,000 max. This house is “discounted” $280,000 from its completely insane, nonsensical level, which leaves it, at $739,900, still about $450,000 OVERPRICED. HOW INSANE.

The Dr. also says: “Today we’ll look at a home in Agoura Hills that has a steeper discount in an arguably more desirable area.” However, he does admit later that the house is “still overpriced.” Anyway, I say “Discount???? Discount, my assss.”

I could not agree more with mama erhardt

Propery laws are a few of the things that differentiate us from a Venezuela or other such banana republic.

Allowing MERS and the banks to ride rough shod over the basic concept of properly administering title documetns really does threaten the very foundation of this tenet of our society.

I for one am surprised like hell lthat the county tax assesors have not got on board on the side of the mortgagors, and taken the banks, securitization funds, and MERS to task for not paying the fees and filing the proper documents every time these changed hands.

It would be like me selling my car that has a bank lien on it, and the other guy selling the car to another guy, who sells off pieces of it to another guy, and no one ever bothers to change title, re-register it, put different plates on it – and expects the cops to understand when they impound it for unpaid parking tickets. who gets the fine.

We wouldn’t get away with this in a minute.

Why should the banks and MERS (who by the way is the banks)

Doc has, or should do a blog on MERS one time.

That’s a real eye opener of a story as well.

Thinking of “buying” a house? Do any of you realize that you never truly OWN the house even if you pay off the mortgage? Heck, let’s even discuss how you “own” an automobile. Do you really think you actually own a car, even though you paid money for it?

Home ownership is the biggest scam ever perpetrated on the mass sheeple population. Only a true idiot would spend so much of their hard earned wealth to purchase something that they think they “own”.

Stop paying your property taxes and then see who really owns your home. Don’t register your automobile and see who really owns it the first time you get pulled over.

Any of you ever heard of Mark Zuckerberg???… He’s the guy who created Facebook and is worth 4.4 BILLION DOLLARS at 26 years old. Guess what… he RENTS a house!

See the video link below by Florida Rep Alan Grayson regarding mortgage foreclosure fraud. The most incredible example he lists is of a man who had his house foreclosed on but he didn’t even have a mortgage with the bank that attempted the foreclosure. In fact, he didn’t even have a mortgage… PERIOD because he paid cash in full for his home!

http://video.godlikeproductions.com/video/Fraud_Factories_Rep_Alan_Grayson_Explains_the_Foreclosure_Fraud_Crisis

Let me expand on what Fred said.

There is no way anyone today could afford to buy a house. If it costs more than 3 times your annual salary then you are living in a dream world. Get real folks, if you think your job will last for 30 years while you attempt to pay off a massive mortgage on some massive home that has far too much square footage than you will ever need, then YOU need a reality check, and possibly psychiatric help. What is it with people that think they need to spend HUGE money on items they will never truly own? Oh, and you never really own your house even if you pay off the mortgage.

Did I mention that the Fed and other Central Banks print money out of thin air whenever they need to do so? What would happen if you or I tried printing our own bank notes? Yes, you know we would be thrown in jail for counterfeiting or forgery. But the bankers and government do this sort of stuff every single day. Kinda gives you a warm and fuzzy feeling all over, doesn’t it?

Stop being an idiot and a sucker. Learn how to reduce the effects from your past dumb choices like buying a mortgage from a bank that simply printed the money out of thin air… from nothing, and is now charging you interest on their scam to create something (interest payments) from nothing, and making you believe you actually OWN the house!

I’m going to come up with another original, legal scam whereby I can fool so many people into believing that they actually own something that they really don’t, meanwhile they pay me interest on the fake money I lend them. Whoops, the banks already do that. Guess I’ll have to come up with something else.

Benefits of Homeowners Challenged.

http://www.latimes.com/business/realestate/la-fi-home-ownership-20101003,0,878533.story

Ed, I couldn’t agree more! Thanks for your post!

Leave a Reply