The booming collapse of housing – why housing will be a bad investment for the current decade. 5 charts exploring the demographic and financial perfect storm with U.S. real estate.

The American housing market is entering into a perfectly orchestrated storm of demographics, debt, and cultural shifts. Strongholds do fall and deeply held economic beliefs can crumble in a few short months. If you were to tell someone in 2007 that a lost decade in housing values was just around the corner you would have had a heck of a time trying to convince them. Yet here we are, inching closer to a lost decade in home values. There is a financial tempest ahead of us. Home prices have locked in a lost decade but what about two lost decades? Don’t rule this out until you hear the potential reasons why another lost decade is very likely for American housing values.

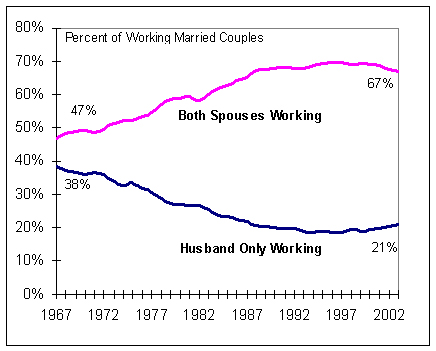

Reason #1 – Dual income peak

Source:Â Tax Foundation

Part of the reason home values went up from the 1950s through 2000 was largely based on the two income household. Single wage households became a smaller minority while two paychecks made their way into the household bottom-line. Of course this provided more income to be spent on housing. Yet this trend hit a peak in the 1990s. Actual household wages have fallen for over a decade so no longer can the dual income argument be made to support higher prices. What is also problematic is that the rise in dual income households hid the reality that actual per capita wages were falling behind for the last decade.

Part of this trend is also based on the demographics of our country. Raising a family is not cheap so two paychecks in many cases is simply an economic necessity. However many baby boomers are now entering retirement age with many of their kids reaching adulthood.

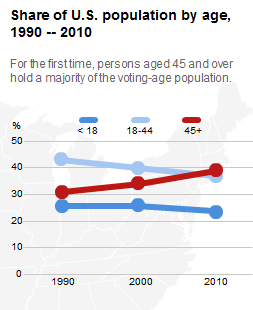

Reason #2 – Older America

Source:Â Brookings Institution

The U.S. population is undoubtedly getting older. Many baby boomers will look to downsize but demographic shifts will provide fewer potential buyers for those over priced homes. The population is growing but the younger generation is not seeing the large wage gains that baby boomers experienced. So what you have is the largest cohort of Americans gearing up to sell homes simply because of natural progression but a smaller and poorer young cohort unable to pay the inflated prices many have come to expect.

The chart above provides a rather clear look at where things are heading. If current trends are any indication older Americans will vote to protect their funds while pushing on debt to their children and grandchildren. Unfortunately we are not seeing any shared sacrifice here. Yet in a karmic twist baby boomers planning on selling homes and stocks into the market will have lesser demand simply because they have a smaller group following in step. This trend is not going to change so this will add fuel to another lost decade. I’ve seen a few people counter this argument by saying we are not Japan and that our population is growing. This in fact is true but much of the growth is occurring with people picking up lower paying jobs. In other words, no big payday for the McMansion.

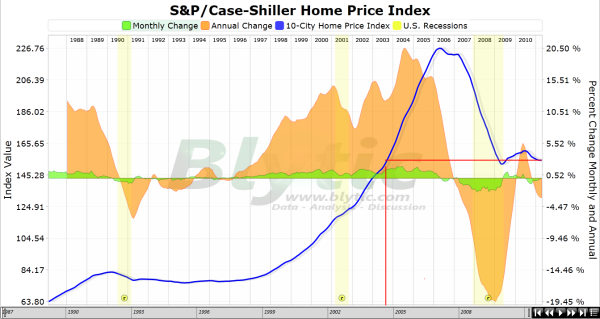

Reason #3 – Case-Shiller double-dip

The Case-Shiller Index is already reflecting a double-dip in home values. Prices are back to 2003 levels and this is only the case because banks continue to maintain an excessive amount of homes in the shadow inventory. The fact that we are double-dipping with historically low interest rates and street vendor like gimmicks tells us many American households are completely maxed out. 40 to 50 years ago virtually any household with a desire to purchase a home could do so without going into gargantuan debt. Today, even a professional couple would likely go into massive debt for a tiny box in an overpriced neighborhood. Yet as the above chart is reflecting, that bounce is largely running its course.

Home prices in many regions of the country are still inflated. More pressure will come as the shadow inventory is leaked out but also the natural flow of selling from older American households looking to retire and downsize. Banks can hide some of their dubious loans but you can’t stop the clock on aging. Some boomers with their pensions and 401ks will need to sell into a market with much lower demand. Did people ever bother to look at the numbers?

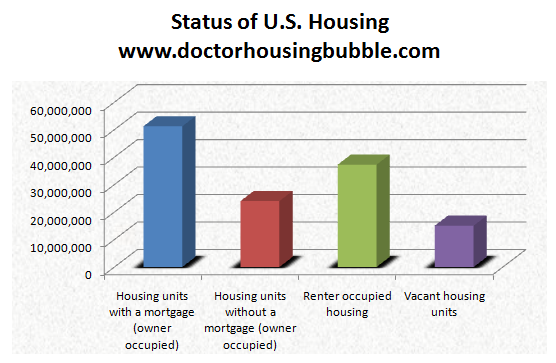

Reason #4 – Housing dynamics

Source:Â US Census

It is useful to lay out the entire housing data for the United States to get a better picture of where things stand. 24 million Americans own their home free and clear (this doesn’t clear them from paying annual taxes, maintenance, and insurance by the way). 51 million Americans own a home but with a mortgage. 37 million rent and another 15 million housing units sit vacant. The percentage of vacant homes is alarming. This is simply more inventory out in the market that needs to be absorbed. There is little demand for new housing when so much housing is already destined to come online.

When you look at this data carefully seeing another lost decade in home values becomes more apparent. The only wildcard in all of this is if we start to see real household incomes going up. Are we even seeing this? To the contrary, the employment situation is tenuous and the numbers hide the grim reality that many people have taken up new jobs at much lower wages. How is this evidence for rising home values going forward?

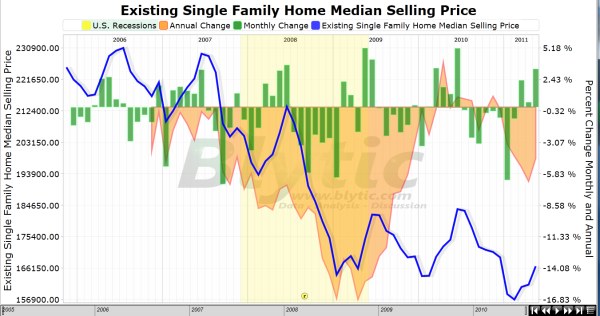

Reason #5 – Median home price

The median home price has fallen dramatically because of toxic mortgages exiting the market but also because household incomes have remained stagnant for over a decade. It should make logical sense that home prices with a home loan cannot move up without household incomes moving up as well. The gimmicks of low rate teaser mortgages are not enough to mask the financial doldrums we are living through. A large part of this is unavoidable simply because of the demographic nature of our country.

Depending on what measure we look at U.S. home prices are down 30 to 34 percent from their peak reached in 2006. Adjusting for inflation this figure looks more daunting. Lower priced housing seems to be the new status quo. It is hard to say how hard home prices will fall moving forward and some areas have pockets that are still reflecting bubble like dynamics. There is little doubt the next decade will be a tumultuous one for housing. Those arguing for rising home prices ignore the booming demographic tsunami now aligning itself with the epic shadow inventory on the banking balance sheets.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

70 Responses to “The booming collapse of housing – why housing will be a bad investment for the current decade. 5 charts exploring the demographic and financial perfect storm with U.S. real estate.”

Dear Dr. HB. As always a most excellent post. I was railing at the banksters and politicians the other day when my wife asked a pretty simple question, “OK, what would can the politicians do?” That brought me up short. Every path that I examine leads to a bad outcome. My rose colored solution of having Obama and Bernanke come clean with the American people leads to panic and collapse. Extend and pretend may avoid the panic, but adds to the debt with no appreciable increase wages or productivity. Cutting govenment spending leads to strikes and a slower economy.

The best that I can come up with is to reinstate Glass Steagall. Give the banks two years tops to divorce the investment and commercial arms. Add the requirement that the investment banks fully disclose that they are not in any way backed by the federal government. Print the minimum amount of money to keep the commercial banks afloat, and let the investment houses reorganize as they will.

Unfortunately, this does not fix the housing bubble, low wage jobs, american trade imbalance. For those, I am stumped.

Excellent point regarding bringing back Glass Steagall. I firmly beleive in my humble opinion that the repeal of GS is what fueled the outrageous run up in home prices. I would also say that if GS were in place now, housing prices would be in the 3.5 to 4 times income. As long as the banks are tied in with the investment groups, this housing malaise will go on for many years.

That is a good fix, for the financial side of the house if it deals with leverage too. The political side is where the root of our problems lie. Go completely public financed elections to get to the heart of it:

“If you allow $1 in campaign contributions, then you also allow $10 million. There is no way to finesse bribery, so it has to be cut and dried: no member of Congress can accept any gift or contribution of any nature, monetary or otherwise, and all campaigns will be publicly financed.”

http://www.oftwominds.com/blogjune11/buy-congress-back6-11.html

I could not agree more. The problem is the First Amendment. Pretty hard for the courts or Congress to limit anyone’s ability to buy air time or newspaper inches.

I am in agreement that reinstating Glass-Steagall would be a step in the right direction.

DHB has done an excellent job chronicling the inflated housing prices and the flaws in government policy that have exacerbated this problem for the middle-class.

If Washington eliminated federally insured FHA loans with 3.5% down, would housing prices instantly plummet further than they already have? Absolutely.

Will this policy keep housing prices from plummeting in the next 10 years? No. The only difference is it will be a slow bleed and the middle class will be holding the debt, rather than the banks.

The same thing is true about the Bank Bail Outs of 2008 (and the inevitable future bailouts that will continue to proposed in the next few years)

With the enormous amount of debt in the US economy the question isn’t if we will hit bottom, it is when.

Current elected representatives (Democrat and Republican) on the whole do not represent the interests of the middle-class, instead they represent the interests of Goldman Sachs and their ilk.

DHB is spot on with his analysis. The problem is the mainstream media has consistently missed this story since I’ve been alive (Born in 1979).

This problem is not going to correct itself until we have an informed citizenry. We won’t have an informed citizenry until we have a media that actually puts the interests of the middle class over that of corporate interests. Currently most Americans get their news from television, the problem is that this is probably one of the worst places to become informed. Television news must place entertainment value and profit above substance to appease advertisers. There is no real incentive to hold politicians and corporations accountable, in fact quite the opposite.

Now, the Internet is increasingly becoming dominated by the same corporate interests that control television. Real solutions won’t be possible until we re-think media and journalism in the 21st century and protect our open and decentralized Internet.

You should check out this documentary project that seeks to illuminate these issues:

http://www.kickstarter.com/projects/akorn/killswitch-a-documentary-film

Take tax rates back up to what 1995 levels for individuals in the upper tiers. Cut out loopholes. Bring mfg. back to US with low rates for corporations + stop funding NATO and reduce our military costs + stop building big exotic defense toys that crash + revise NAFTA + enforce import quotas + protectionist measures + reduce green cards for white collar workers coming from India/China/Phillippines/etc. + deport illegal alians + rid of harmful illegal drugs + stop medical insurance crime. I think that would bring in 900Bil, cut some social services and reduce all govt. pensions. If our debt is 14Tril it would be back down to 0 in 12 years or so.

I am retired, and want to sell my house and downsize. Unfortuately, the Fed has screwed us retirees.

I have savings, which I expected to yield 5 or 6% (long term CD’s).

They are now yielding 2 or 3%. With my income cut in half, I can no longer afford to move and buy.

In the early 80’s, my mortgage rate was 13%. If mortgages had been 4%, housings could not have been built fast enough. Today, at 4%, barely anyone is buying.

That should tell you the REAL state of the economy.

I’m not near retirement age yet. But I have a decent amount of savings. And I feel robbed with the .2 % interest I’m getting on the CDs I have for my kids. It’s also frustrating because I think for what we have we should be on the path to retiring early. But not with these interest rates.

What is this retirement age you speak of? The new norm is work until they close the lid…Manhattan has successfully destroyed America, or programmed us to do it to ourselves. There may still be time for many of us to figure out we are in the fight of our lives, but for most part, we are too for gone. Until we finally understand the source of our demise, we cannot defend ourselves.

Manhattan controls all of the financial aspects of all of our lives for the purpose of mass enslavement. Don’t you see it?

Karen, think for yourself. Be creative. Get your money out of the bank and make it work for you!! Buy and sell something. Start a business. Come up with ideas. Turn the tv off. Think a little bit.

People retire?

I agree about the two-income households; but in addition to that, the introduction of credit cards in the 1950s further fueled the fire of living beyond one’s means. I’m always amazed that the majority of the population doesn’t understand the concept of compounded interest. And having taught consumer credit classes to many types of people, I’m further amazed that no one cares.

Maybe all those old folks looking to downsize (#2) will sell their homes to themselves via a reverse mortgage?

Do they still do that? I have no clue but it seems crazy with the excess inventory they are sitting on.

Many banks have eliminated reverse mortgages, due to the decliing property prices.

Banks are not going to pay out $500,000. to a retiree, only to find that when they die, the value has dropped to $300,000.

I read wells fargo has already stopped writing reverse mortgages, I suspect many will follow, as they make absolutely no sense for the banks

Reverse mortgages make sense if the owner of the house owned it free and clear and the bank is listed as beneficiary, not a family trust, or there is a lot of equity in the property.

Using actuarial tables banks compute the reverse mortgage payment stream on expected life but may attempt to give the reverse mortgage to a less healty person that will not live as long as the actuarial tables/annunity. I wonder if Wells Fargo bought mailing lists of people rejected for life insurance.

In such a case the bank may takeover a house with a lot of equity if the owner passes earlier than the actuarial tables predicted. Often banks “refinance” them collecting $10k in fees, or “back-end” fees for each refiance of the annunity stream. The homeowner thinks they are getting a deal increasing their monthly income $50/mo at a cost of $10k – or they are unaware of the real cost. The banks ripped-off some seniors.

What all this tells me is that housing in many areas, such as south Orange (ppel) County have a long way to fall.

For example, homes in Lake Forest/Mission Viejo are still overpriced. No one wants your 4 bed 3 bath 2 car with a poll for $750K, let alone $450K, esp. with the way things are going and even w/Prop 13, taxes will creep on you.

People cannot afford and will not buy your 2400 sq. ft. 35- year old tract shack for $600K. Even w/20% down (if you can find anyone with that and willing to part with it), no one wants to pay almost 3 grand a month PITI plus upkeep and maintenance for the next 360 months of life.

Heck, much, not all, of the younger generation have figured this out and therefore, the gig is up.

With the exception of coastal areas and a few others, housing should be no more than 2.5-3X income od one earner in the family. YOU CANNOT COUNT ON 2 INCOMES FOR 30 YEARS!!!!!!!!!

3x income worked for decades, and is what we need to go back to, simple.

Meant to say (peel) and pool.

This post is excellent, it is apparent as I drive through south Redondo and see the countless elderly people living alone in 4 bedroom houses before arriving at te densely populated apartment areas with the 30somethings with kids holed up in the 2beds, that something is really wrong. The exception to all of this is the boomers who never downsize leaving the house to the kids. Hopefully the mortgage is reasonable or non existant for those folks. I would also like to point out that at least in my case my husband and I have reverted back to the single income household, it’s best for our kids and the Jones’ are indebted losers.

The lack of wage growth keeps coming up, seemingly in every Dr. Housing post, and for good reason I might add. I pointed out in an earlier post that in the Max Keiser video where Dr. Housing is mentioned, the following guest was Steve Keen. Keen thinks the solution is higher wages, but doesn’t mention even the faintest hint how to raise them.

In the very well written piece entitled ‘Bankrupt Greece Blackmails Europe’, Nadeem_Walayat, mentions, almost in passing, that the 3rd phase of this global financial crisis will have wage inflation. But again, as with Keen, Walayat doesn’t offer any clues how wages will be goosed higher. He’s writing from a UK perspective.

I just don’t see how wages go higher, without collapsing bod prices, which would quickly lead to hyperinflation and dollar failure. It would seem that Bernanke would have to print so many more dollars, in so little time, as to force the Chinese to abandon the Yuan/dollar peg. Otherwise, any wage increases here would just force more job exportation, which would be even worse than incomes not going up.

They go higher by collapsing profits. In the last 10 years or so, profits have nearly doubled. Wages have been flat. This is bad for investors, but good for the rich/poor gap.

Ian-I agree with your observation that an increase in wages would likely lead to a drop in profits, and help to close the rich/poor gap. What I don’t see is what is the MECHANISM for forcing wages higher. The government certainly won’t mandate higher wages, except for a modest increase in the minimum wage, which is irrelevant for housing prices.

With very high unemployment, there is no upward pressure on wages. The government could raise the wages of government workers, theoretically, but state, local and federal government units are cutting jobs and benefits, not raising wages, at the present time.

+1. Exactly, and as I’ve explained before to Mr. Emery. The problem is that Corporations are required to maximize shareholder value. Hence wages are reduced whenever possible to increase profits.

Unfortunately, only a tiny portion of the profits ever “trickle down” to the rest of society, with most of them being pooled at the top.

The estimates on vacant housing seem to vary from 4 to 20 million. Does anyone know what the various assumptions are? Does the lower figure exclude vacation rentals and the higher figure include them unless rented for more than, say, 14 days per year? There must be some other variables I haven’t figured out.

WHat I think will happen to alot of these places, like the one Candace mentioned is that they will become petrified, like wood.

Gentrification is probably not the fight word, so I decided to use petrified, unless someone has a different economic term. I don’t know of one.

You see, all these oldsters bought in the 80s when those 2400 ft. monsters were 150-200K. In 30 years, they know want a 250-300% increase.

Rubbish! So what will happen?

Petrified housing, and not just in terms of scared buyers, but in terms of people not selling and being stuck, although maybe w/o a mortgage, until they die and the kids or the state get the house!

Everybody’s definition of “investment†likely differs as does the way that it is measured. Many gauge “investments†by alternatives or other available options. But most important, should a house truly be an “investment†in the classic sense where one is looking for an increase in the value of an asset?

Thus, at this point in time of the bubble if you have a family and are not looking to flip a house, are prudent, know how to save and have a decent income, I say to you find the right pocket and buy (my guess those that read this blog are educated and fall into this camp). Additionally, if you are lucky enough to stay in a home for 30 years the IRR will crush that of renting.

And for those of you holed up in apartments, home ownership offers immense value in the peace and quiet of not hearing elderly ladies blaring “I Love Lucy†until 2am, or hearing flatulence pass through paper-thin walls, or those that can’t control their unruly kids, or 20-somethings boozing it up throughout the night every weekend. Throw in the element of raising kids in a good neighborhood with quality schools, and the argument to buy strengthens.

I had been scouring the real estate landscape around West LA/Calabasas/Woodland Hills areas for the better part of the last three years, waiting, watching, and learning about the dynamics of REO and short sales. In fact, in the last year I began submitting offers on both distressed and non-distressed properties that I deemed reasonable but to no avail. Quality properties in quality areas would receive numerous bids, many all cash. In one case, a REO I bid on received 22 bids! My point is that when I initially undertook my search for a home, I thought I was significantly more diligent with my savings and held a better income than most. Guess what? I soon realized I was far from alone. Many gripe on this blog about wage growth. But guess what? Who needs wage growth when you have stagnant household incomes of $150k+ that far exceeds reasonable living expenses? I know MANY in LA with these types of incomes, and more, who are prudent and waiting for the right time to bite.

Thus, if you are contemplating buying I would tell you to be concerned about macro trends and policies, to which I find this blog is very useful, but know your local pockets like the back of your hand. And do not rely on realtors. There are few that are good, but most are absolutely worthless. Case in point, I found a REO on the books of a major bank that was not on the MLS that not one single realtor in the area of the house had a clue about (I guess the dead landscaping was too obvious). Consequently, my attorney wrote an offer that I thought was reasonable (well below post bubble comps) and the bank accepted. I just closed with 20% down at 4.625% fixed (non conforming).

What’s worse than your apartment scenario is buying a home and then having someone with a bunch of noisy kids or parties move in next door! At least with an apt you can pick up and move.

If you really understood the macro trends at all, you’d realize that you’re a complete fool to be taking on a mortgage right now with so little down. I hope you have quite a lot of reserves.

Do tell me: how does one fix the problem of excessive bad debt?

Once you understand that problem, and the outcome, you might want to question whether a 4-5% loan is such a good deal. Especially when housing is going down 5-10+% per year.

Here’s another question that the housing bulls never, ever answer. What has been done to keep the crash of 2008 from repeating again?

Glossing over those uncomfortable questions can only be done for a while. The answer will eventually become painfully obvious.

Meh. Look, here’s a video which explains things pretty well:

http://www.youtube.com/watch?v=NblhUrcdrSc

Amazing. It’s been around for about 1 day and it has over 17,000 views. A lot of people are understanding what’s going on.

The one issue that I have with it is that it only covers the U.S. debt. It doesn’t cover the far bigger picture of credit in the derivatives market (which is what brought down Lehman back in the Fall of the 2008 and started this whole mess).

So keep in mind that we have two critical things that will eventually catch up to us. And keep that thought in mind when you go and sign on the dotted line for a new house.

“If you really understood the macro trends at all, you’d realize that you’re a complete fool to be taking on a mortgage right now with so little downâ€. I would argue putting anything more than 20% down with an interest rate of 4.625% would be foolish.

“Do tell me; how does one fix the problem of excessive bad debt� It sound to me like Gerry is a shrewd saver who did his homework and is now going to benefit from other people who took on bad debt, not vice versa.

“Once you understand that problem, and the outcome, you might want to question whether a 4-5% loan is such a good dealâ€. Is this a trick comment? I’m sure Gerry questions that interest rate every day, right after he pinches himself to make sure he isn’t dreaming. Interest rates are at historically low levels. For those smart enough to have saved during the boom, and intelligent enough to find the right deal (as Gerry seems to be), now is as good a time to pounce as ever.

“Especially when housing is going down 5-10% per yearâ€. So in 5 years real estate in Woodland hills should be at 1980’s levels. Dream on. I can only speak to Los Angeles and surrounding areas because that is where I live. Just like Gerry said, desirable areas have multiple buyers at market rates. Houses that are fairly priced (generally speaking 30% off 2006 highs) will continue to be in demand in highly sought after areas. Gerry touched on a key point…, “raising kids in a good neighborhood with quality schoolsâ€. There are areas of the San Fernando Valley that just 20 years ago were considered nice but today, I wouldn’t even consider raising kids. As Southern California’s population continues grow, the desirable neighborhoods get not just fewer, but smaller. As pressure from the burgeoning underclass (the only segment of the population that is growing in Los Angeles) seeps into (just for example) West Hills, it makes that neighborhood less and less desirable. The result is a constant migration of middle and upper middle class further south and west. It is this natural migration to the outer edges of the county that will ensure high demand, in those specific areas, for the foreseeable future.

“What has been done to keep the crash of 2008 from repeating againâ€? While I’m probably not qualified to answer this, I’ll try anyway. It all started with a master plan by (in order of importance), Goldman Sachs, The Fed, The US Treasury, The Republicrats, Bush and Obama. The goal was for a slow descend of the housing bubble burst in order to retain as much wealth as possible for the smartest guys in the room, and avoid an economic catastrophe. The feds bailed out AIG, protecting Goldman Sachs and rewarding Warren Buffet. Next, Congress bailed out the banks, mandating they move their toxic assets off their books and into fictional companies to protect their buddies on Wall Street. The treasury printed a bunch of money the Feds purchased. Banks began to foreclose on people who were victims of their own stupidity (not predatory lending). And a bunch of other unethical and criminal things. Now, that is a lot of stuff that “has been done to keep the crash of 2008 from repeating againâ€. And while it is by no means over, I think Gerry is probably one of the better positioned people in this scheme.

One final note on your “…keep that thought in mind when you go and sign on the dotted line†quip and doomsday video. Homeownership is one of the last tax shelters for the middle class. In my opinion, the tax laws for homeownership in California are downright unfair. But that is the world we live in, a world where homeowners are and will always be protected. In fact, look for this to get even worse in the future. So, when the world’s economy collapses, and nobody can pay rent/mortgage, who do you think is going to have it worse, the person who owns, or the person who rents? See I file a 3 day notice to quit on my tenants immediately. And the banks, well they have an army of home owners who write the laws that are going to be a very, very formidable group to contend with. When it comes time to pay the piper, and I’m in the group that thinks it’s coming, it is going to be a hell of a lot better to own than rent. After all, there is no better hedge against inflation than a 4.625% mortgage.

@TheNumbersNeverLie:

I’m afraid you didn’t understand the questions. They were in the context of the big, macro, picture. To put it more simply, if the economy crashes hard again, like 2008 (but only harder, since there are less resources and options available next time), then this will have a severe impact on housing, again. You can look forward to another significant downward trend with housing, and upwards trend on unemployment. And that’s being optimistic.

I would suggest getting acquainted with what’s going on in terms of the big picture, especially if you never saw the crash of 2008 coming. People just have no excuse for the next time it happens.

Gerry: I rent an apartment with an huge patio where I have a wonderful container garden, a gorgeous view of the Marina, amenities, etc.. My neighbors in my building are my friends, 3 of them came to my wedding! In fact, it is the only place where I have ever been able to run next door to borrow a cup of sugar, literally. The sense of community is amazing. Did I mention my apartment is in one of the most desirable school districts on the west side? They allow me to paint the walls and even install a wood floor. They let me have a large dog. I call the mgt. when something goes wrong rather than having to pay out of pocket. AND I get this for half of what it would cost to buy in the same area.

The Dow has gone up by 7.2% just in the first half of this year. Home prices have gone down.

What possible advantage would you argue I gain by buying?

I think for the sake of argument, you bring up a few good points. Ultimately, home is about who, and not what. However, I’m sure it wouldn’t hurt if the what was a home owned and operated by you, and a place to weave and form into your own (and not just painting the walls). Therefore, there are certainly advantages to home ownership. Whether they outweigh the advantages of renting comes down to personal values and preferences.

I think most people on these blogs are on here because they want to eventually own a home. That reality should already speak for itself.

Questor, if/when we reach the ultimate collapse of our currency and financial system, there are far bigger things to worry about than personal debt. Doesn’t matter if you’ve signed on the dotted line as everyone will have lost everything. If anything, we’ve learned when the debt load gets too heavy a burden for the big boys, the little ones can just freeload and walk away, and I wouldn’t be surprised if this scenario occurs again in an endgame situation.

Also, in regards to your question: What has been done to keep the crash of 2008 from repeating again?

What I would ask is what have people learned as a result of peak credit, and how will they react when credit expands again? Banks and financial institutions provide the means, but the actions are still done by consumers. This is not to put blame solely on the general public, but it’s a two way street. We could argue just as easily that responsible behavior could have prevented this crash as well. (Not just financial regulation)

Ed: While I agree that there will be a lot of things to be concerned with when credit implodes, history strongly suggests that you are very much mistaken about debt forgiveness. Even during recent history. Note well that the IRS is still going after people who have defaulted on second mortgages, if they’ve used the money for anything other than their house. And next year, they’re going after defaulted first mortgages. To say nothing of the debt collectors who go after people as well.

The name of the game is very simple: debt enslavement. To suggest that the financial industry is simply going to easily let people out of all this money that they owe is contrary to a lot of present behaviour. Greece comes to mind. And the 2005 banking act (which made it harder to enter bankruptcy) is another. Over longer historical periods, you see the same general theme, only worse.

To suggest that people are going to get a get-out-of-debt free card is extremely optimistic, and contrary to many present examples.

The bottom line is that debt will become a very heavy millstone for many, from which there is no escape. Witness student loans.

And I noticed that you avoided answering my question. I take it then that you are in agreement that nothing has been done to prevent the crash of 2008, and that it’s only a matter of time before it happens again. One wonders why you would wish to make your own situation worse, then.

Chris, ed and Questor,

Owning a house is a funny proposition. There are so many factors mixed up in the decision. We live in England, but own our house in the Seattle area. It rents out at market rate, but is a poor investment. The ROI is weak. We keep it because it is an anchor in uncertain times. If the world economy breaks, at least we can move home.

For many the psychologic benefit of owning a house outweighs the financial considerations. We rent here in England with a benign landlord. We paint walls, own cats even put down carpet and are financially way ahead of the market because of the money we have saved. OTOH if you have a bad landlord, or really value your own independence, then renting is not your answer. Just understand that you are paying a financial price for that independence.

PS One of the great things I love about this blog is the lack of flaming. It is remarkable to have discussions about sensitive and financial issues in a calm manner. It is nearly unique on the net.

What possible advantage would you argue I gain by buying?

____

Not having to get the leash out and walk your dog. Instead you could have a fenced yard and open the door for him.

For the sake of your dog, I truly hope that by ‘large’ dog you mean under 40 – 45 lbs lbs and not more than 18 -20″ at the shoulder. . Life in an apartment/condo is NOT good for the big breeds (the over 60 lb and more than 22 inches at the shoulder.) They need room to romp and play in order to keep themselves fit. And a weekly trip to a dog park or a run with you in the evening is not the same thing. Pay the vet bill for Cruciate Ligament surgery and physical therapy and you will change your tune. It is becoming a very very common (and expensive) injury in large dogs who do not get enough regular strenuous exercise. Something as simple as jumping off the couch can do it when the dog is an apartment couch potato.

And yes, I know what I am talking about. I have been trianing and competing performance dogs (obedience, tracking etc) for over 45 years. I now rely upon a Service Dog (long story – dangerous sports -injury) who is 29″ at the shoulder and tips in at 115lbs of solid muscle ( he works so hard he needs as many calories as an Idatrod sled dog and keeping his weight up is a struggle.) No way could he do his job and live in an apartment – he would break down in a heartbeat from not being in good enough shape.

So if you have a large dog, do the dog a favor and at elast rent a house with a fenced yard. You will save on the vet bills.

Questor, I am in complete agreement with you on what the gov/financial institutions have done to prevent over-leveraging. Never meant to avoid it, or dance around it. However, I disagree with putting the entire burden on banks and government. This was the insinuation At least that was the insinuation I’ve picked up from your posts (including the last response).

They’ve certainly provided the means and sold the ‘dream’ quite well, but it doesn’t remove all of the responsibility on the people that tried to have too much cake. Just like you can’t put sole blame on McDonald’s and the entire fast food industry for obesity. People eat. People spend. Nothing has been done in our laws to regulate peak credit (debt), but to stake claim on that as the source of our current woes is turning a blind eye on a cultural issue surrounding both sides (banks as well as consumers).

In regards to your comment on people staying debt slaves regardless of a financial breakdown, I can’t imagine why the IRS (or any debt collector for that matter) would even go after delinquent owners in the case of total currency meltdown, a financial ‘Armageddon’ of sort (what your youtube link anticipates). If you believe (like I do), that the dollar will live on, and we’ll struggle but we’ll never really be out, then perhaps you could be right. It really depends on how our laws will change to handle this huge wave of delinquencies. There is no such thing as debt forgiveness, but there certainly is some notion of amnesty after a few slaps on the wrist.

The last time we went to an open house the realtor made a comment about how she and other people she knew had been holding on waiting for a bounce but are finally breaking in and selling –so they can downsize. I have to admit when the bubble started, I wanted a big house. But now that we’re on the sidelines, the big houses don’t look all that appealing. I feel like I’ve become more practical since the bubble burst. I see large homes and I just think: Extra cost of mortgage, extra cost of heating and air conditioning, extra cost of maintenance, more space to clean.

If I were a retiree, especially, I wouldn’t want all the extra expenses that come from owning a larger home.

Another blog pointed out that the rising percentage of blacks and hispanics in the prime house-buying age groups is a problem because the government wants to get rid of Zero-down mortgages, and minority home purchases have always been very dependent on Zero or very-low-down mortgages. That will affect the lower end of the market, while the lowering of the cap on mortgages underwritten by FannieMae, etc. is going to hit the upper end, starting on September 30, 2011. It looks to me as though there will be another downward jolt in the fall, as everyone who wants to get a big loan needs to get it done by September 30.

So very true. By analogy, it’s as if, over the decades, the NAR and the MBA (Mort BankSters’ Ass’n) see the whole market as a multi-storey big box furniture mart, offering everything from the lowest-end schlock to the most outlandish upscale chic… and their lobbyists have been buzzing around like bees, puffing up the pillows and upholstery in each part of the store, using different sales scams in each dept., as needed, to protect their commission/points stream… never have so many skimmed so much for adding so little…

… have you ever seen the salaries lists from FNMA and FHLMC? I’m not talking about the crony appointed plutocrats at the very top, but the leagues of paper pushers! UNreal! Doing God’s work, uh-huh… 🙄

Sure you can get a deal in a lousy area, but I believe the mid tier market is rigged by banks. They sure as hell are gonna hold back inventory to inflate prices. I’m getting to the point of capitulation. I believe I will never be able to afford a decent home in Burbank regardless of my over 100,000 K income, not to mention my wife’s income. There are still plenty of people ready to out bid me at 450 to 500K on a simple middle class home. Let em! I’ll buy a retirement home out of LA for a song someday whilest the debt slaves groan about their bills.

We all know the boomers need to downsize housing and realize their equity to retire. However lets talk about stocks. The demographics tell the same story. More sellers than buyers and the buyers have less money. But stocks are valued so much differently than homes (or are they?)

In addition you have so much more talent (MIT mathematicians, etc..) in the financial sector using computerized models trading from servers closer to Wall St in order to save milliseconds. They trade millions of times daily looking for a penny gain!

So for the average guy who looks to buy and hold stocks in order to build retirement….are we just pigeons lining up to get fleeced?

The nice things about stocks is that many of them pay dividends. If you are happy on the return you are getting through dividends alone, then you don’t need to find a buyer to realize your gains.

I certainly agree the demographic bulge will affect housing in most areas. I draw the line at stocks.

You need a healthy middle class for elevated housing prices, yet there are examples the world over to the contrary when it comes to stocks.

You can have a thousand retirees selling their stock holdings to finance their retirement but if one CEO making 100 million a year puts his money in the stock market, it would far outweigh any liquidation. And really, if you make a 100 million that is exactly what you will do for the most part.

The stock market doesn’t rely on “wage increases” to remain health, it only need rely on the real GDP of the U.S. to grow by any amount, as long as it is not zero or negative.

Martin – very insightful analysis of the stock market. good, big picture thinking. I think the stock market is one of the safer places for money right now – particularly if you focus on big cap, dividend paying, low price to earnings companies that have double digit growth projections (think INTC and many others).

Far and away beats buying a home as an “investment” right now.

Unlike housing, stock are valued globally.

I think stocks work differently. By and large, they aren’t oriented toward consumers the way houses are. The buyers and sellers are mostly pension and mutual and hedge funds. There’s always going to be a lot of volume in both buying and selling there.

Hi All – I posted a while back, and am now returning to say, wearily, happily, that I made it. We closed escrow on our Short Sale.

I am now happily back on the sidelines, watching the spectacle continue to unfold.

I will save and invest, but a home is just a place to live for now. We are renters once again!

We struggled to modify 3 times in 3 years, and were rejected each time, for no clear reason. Finally, we listed for sale, and submitted the offer to the bank. The offer was for 23% below our purchase price in 2006. The bank took a bath totally unneccesarily. We loved the condo, and wanted to stay, but our PITI was almost double what Rent would be for comparable unit. They would never adjust the loan to current rates or extend to bring payments in line. The key for us was getting a good Negotitator onboard. Things moved quickly after that!

I do agree with the MACRO info in this DHB post. However, as soon as our unit got bought, another unit listed at 12% above our price. It will probably sell. We are in the Marina. Its a nice place to live. LA is such a big city with so many high-paying jobs and not mayn good places to settle. Hence there may be pockets that defy expectations. The Doctor can still be correct overall, but Real Estate is heterogeneous, not homogenous.

However, if rate rise 1-2% over the next year, prices should drop to compensate, even on the west side. Add in the Sept drop in conforming loan limit. Add in the Shadow inventory, And add in the Trust sales and retiring boomers ( peeps are OLd in Santa MOnica and Pac Pal and the marina) and I think there is another 10% drop coming this year to the Prime West side. There is no algorythm though.

At the end of the day, is it reasonable to consider the rent/own question as analogous, roughly to the lease/buy option with cars. If you are going to own it for a long time, you want to get rid of making interest payments ASAP. Eventually, rents go up and up.

Moreover, as an owner, even if you can’t sell it, you can rent out your property for income as you age and downsize to a rental yourself.

Congrats, Dasher! Glad to hear that you got out.

Housing isn’t supposed to be an investment. It’s shelter.

Very true. And look at what happens when the masses cannot and will not take heed of a simplistic truth.

Welfare is to consume without effort. Lets see, buy something. Use that something for 7+ years. Then sell that something demanding 100% more than you originally paid. That is welfare.

Here is a hypothesis/theory of how incomes might increase in the United States in the future. Granted it is a distorted math equation with a lot of assumptions.

Having lived in the shadow of the Baby Boomers for a while, I see a changing of the guard in around 5-7 years in the labor market. At that point a good % of Boomers will have either retired or companies will start a transition them out of leadership. The logic is that the next wave of executives will be considered and there “should” be less interest in the Boomers to take the companies to the next stage (Do you really want a 60-67 year old CEO to invest in for the next 10 years? At that point there will be some natural age discrimination in the hiring practices and corporations will turn on the ones they have enriched since the 80’s. What this in turn does is provide opportunities and larger income opportunities to Generation X and Y folks (currently held down by the plethora of boomers with 20-25 years of experience plugging the ranks). Ultimately there will be less Gen Xers with experience and there will be a battle for talent. The question is will corporations look to capture that talent here in the US or in better tax havens in the global market… Either way Gen X and Gen Y will see salary increases and since the denominator will be less 75 million in the workforce, the income of the next wave will have the impression of growing. Again it might be similar to how the government calculates % of unemployed workers… Take away the number of folks that can get jobs and the stats go up…..

What do you think about ending the global free trade experiment that has sent so many unskilled and skilled jobs overseas, and thus stagnating household income? Introduce some substantial import tarrifs – sure, your Walmart T-shirt will cost more than $2, but once we start making things here again we’ll be increasing the number of decently-paid jobs and starting to raise household income again.

Very good idea that would be good for the average American, but not good for the Average multinational company, so it will not happen.

As long as the Republican party has duped the religious right into supporting them by giving lip service about Gays and abortion all the while “screwing thy neighbor” for the good of big business, nothing will change.

They have the organization, they have the numbers. 60 Democrats and 40 Republicans in the Senate are really 40 liberals. and 60 Conservatives. When Bush was running things it was 30 liberals and 70 conservatives.

Conservatives preach Liberals are ruining America but who has been in charge the last 30 years?

And now we have Michele “Batshit Crazy” Bachmann to contend with…

First, husband only working is so out of date. In this downturn, it is usually the husband who loses his job and it is only the wife that is working.

For the first time ever, the selfish generation, the baby boomers, those over 45 hold the voting control. You can surmise what the economic future will be with this selfish generation. The spoiled kids and grandkids will pay for our excesses. There will be no budget deal, there will be a default.

With 15million vacant units the construction industry and their 2 million jobs is not coming back. (if FDR was in he would bulldoze those homes like they did the farmers excess inventory)

We will adjust to the new normal, which is a lower standard of living.

“selfish?” Stop playing the cohort card, sucka’.

Let’s review what has happened so far.

Our esteemed moderator has been warning everyone that LA was in a bubble and would crash.

The realturds ignored him and encouraged people to buy.

The people that listened to the realturds and bought on the West Side in 2006 are now down 25%

The people that listened to the realturds and bought in Palmdale and Lancaster in 2006 are now down 50%

OK – no dispute about the above facts.

The argument on this blog is between the bulls, who think that the Westside has hit bottom after only 25% down and the BEARS who think that Westside will follow the same pattern as Palmdale and Lancaster and wind up down MORE than 25% before bouncing back

That is the scope of the debate here.

Why insult realtors? We all agree that they are either realTURDS or realTARDS.

Insulting realtors doesn’t advance the discussion, it isn’t useful. What is useful is discussing whether the West Side will bottom at 25% off or will go down more

So what are the facts? Will the Westside bottom at 25% off or plunge more

The fact is nobody knows…. When one buys anything they exchange something of value (paper money) for something else. There is always risk invoved. There is only one sure way to eliminate risk of losing buying a home at any price! Don’t.

w

Regarding the fact that our population is getting older, there is a simple reason for that. Estimates are that there have been over 53 million abortions since Roe v. Wade. Without getting into the morality of abortion, there can be no argument but that if our population ranging in age from 0-38 had 53 million more people in it, there would be far greater demand for everything in this country, including housing. We are reaping what we sowed.

Firnally an accurate viewpoint that few think about! They cry about social security being bankrupt,,when they do not realize that there used to be 16 people working to pay 3 social secuirty retires, now it is only 1 working to pay 3 social security retires, YES the 53 million babies are mising in action and now we are upside down without them having their place on earth to balance the ratio and ever contribute to anything much less have a strong voice in society. Yes, we are reaping what we have sown and no one seems to fit them into the present equasion. Thanks for saying what you did. May God have mercy on America

According to GAAS which is the government’s version of US GAAP – accounting standards, it is UNCONSTITUTIONAL to make one generation pay for anothers’ expenses. This includes social security.

Yes, 53 million Americans are missing in action, but cheer up, all is not lost, they have been replaced by 53 million foreigners who speak Spanish and Chinese and etc. Remember what we have been told, “diversity is our strength.” You “Nativists” keep working and paying your taxes to fund our schools, SSI, and Medical or Medicaid, and other welfare programs.

I’m seeing lots of comments about savings interest rates.

For those in CA, try to open accounts at Star One Credit Union. It will get you around 1%.

Of course, you have to ask if the US$ is safe. And you should never put all your eggs in one basket, particularly if there is risk associated with it.

Call me crazy but this is a good time for buying for those looking to hold on long term to housing. I do agree its not a time to go rush out since the deals aren’t going anywhere. As far as those complaining about the stock market you gotta be kidding me. I only invest in individual stocks since I desire to get higher annual interest rate on my roth account than I would get in a US savings account. So far I’m on year 5 where I usually get on average 10% returns. I find most of those returns come from buying stock prices low (usually stocks with no dividend offering), and then selling such stock as soon as stock values rise and I can recoup a decent return after commissions. This year I was able to get a 16% return by trading stocks and I only had to hold the stock for a couple of days–the rest of the year I’m out of the stock market. So I’m completely surprised at all of the above gripes about stock market investments.

I would recommend readers of this blog to read “Progress and Poverty”, 1879, by Henry George. It is the definitive piece on property tax and economics.

What we are experiencing is the 18 year cycle of land bubbles going back to the early 19th century. Some are worse then others due to a “perfect storm” effect, but they are all due to the treatment of land value as a commodity not a factor of production. The three are land then labor then capital.

There are two injustices we as Americans refuse to understand or correct. We treat the currency and the rental value of land as private property even though both, happen to be among the largest asset classes in our economy and are part of our commonwealth.

When money is put into circulation it should be used directly funding highways, bridges, and other government projects. These private bankers have no right charging the people to put OUR currency into circulation.

Land value in this country is directly a result of the community, NOT the landlord. This value should be recaptured back to the community that payed for all the infrastructure, police, jails, courts, schools, etc. bringing value to land.

The system we have now is set up for the royal privileged, (non-producers), to bleed the productive producers and capitalists. Shift taxation off productive human effort, off the economy, and recapture the rental value of land. These housing bubbles would end and the economy would thrive.

This will not happen so I would recommend living in places that tax land and avoid places fighting the property tax. California passed Prop 13 and the result was the least affordable locations to live on in America. Texas, a property tax State similar to California has a relatively better economy and more affordable housing.

Compare NH vs Mass. Mass. and Rhode Island have twice the unemployment. Compare Pittsburgh vs Cleveland. Pittsburgh a land tax region does not have any thing close to the problems in Cleveland.

The Asian Tigers all based their revenue on land to a higher degree then other competitors. These are thriving economies compared to the bubble economies. Even Japan after Mac Arthur had a land derived tax system they allowed to disintegrate over time resulting in a decades long recession.

People run from taxation on the economy, they do not run from stable land/mineral revenue derived locations.

Not all of those 15 million units classified as vacant are in fact vacant. Many of them are second homes (vacation homes), mostly owned by upper-middle and upper class families. I own a vacation home in Margate, NJ, a beach suburb of Atlantic City, and the 2010 census has 3,958 of the 7,114 Margate housing units classified as vacant (55.6% of the total). That is because no one resided in these homes in April, 2010, when the census was taken. However, almost all these houses are occupied on weekends in July and August by the Philadelphia suburbanites (mostly) who own them as summer vacation homes. Margate is a quite beach town in April, but is thronged with beach-goers on summer weekends. The same is true of most other New Jersey beach towns along NJ’s 125 miles of Atlantic Coast.

Additionally, many of them should be considered “dead” not vacant. Housing stock in Detriot, Flint, Cleveland and other similar cities will never be absorbed. They will either rot (if made of wood) or erode (if made of stone). That’s at least 1m of the 15m vacant units.

Leave a Reply to OCDan