Blame the fall in homeownership on Generation X: Why did the homeownership rate fall so dramatically for those 35 to 44?

We’ve all heard about the broke Millennials living at home with mom and dad unable to move out into a very expensive rental. For years, we’ve been told that somehow this young group of people would represent some pent up demand to buy homes. This demand never materialized. Instead, you have tight inventory in certain markets being fought over by investors and those willing to pay current prices while stretching their budgets. Yet volume remains incredibly pathetic. The homeownership rate has fallen dramatically and some point the blame to the Millennials. But as it turns out, the big drop has come from those 35 to 44. Generation X overall has been a massive drag on the housing market. The young are simply not buying homes like they once did and many are opting into the rental market. So how big of a drag is Generation X on the housing market?

Generation X and housing

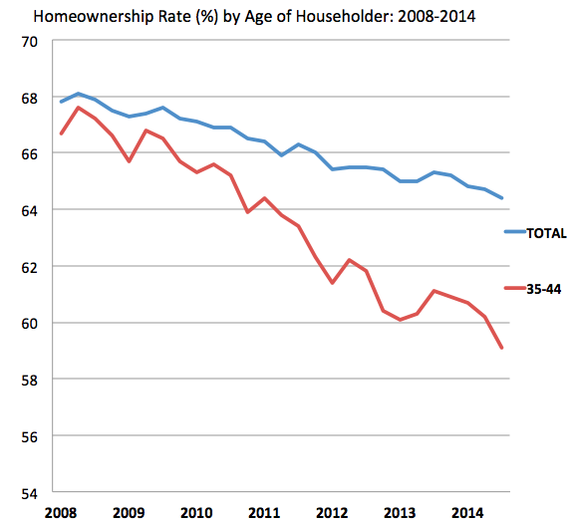

Since the housing market imploded, the homeownership rate in this country has been on a steady decline. Even with the blockbuster year in 2013 in terms of prices, the homeownership rate continues to remain weak. It is probably worth noting that some groups pulled back harder than others. Let us look at those 35 to 44:

Source:Â Census, The Atlantic

While the homeownership rate since 2008 has fallen overall, for the 35 to 44 age group range it has fallen at a rate twice the speed of the entire market. This group is pulling back on owning homes in a big way.

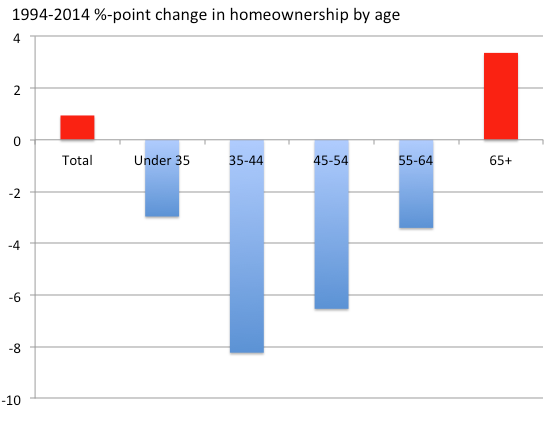

Take a look at various age ranges and homeownership over the last 20 years:

In the last 20 years, the only group that has seen their homeownership rate go up is the 65 and older crowd. For younger age groups, homeownership has been a less likely avenue over the last two decades. But what is most surprising is that those 35 to 44 have seen the biggest decline over this period.

Why did this happen? Part of this has to do with cohort size and a trough in births in the 1970s. You simply have fewer fortysomethings out there in the workforce or looking to buy. The 55 plus crowd is enormous and has also had time to build up equity in properties. The younger folks are left competing with higher home values or going head to head with investors.

I find this trend analysis fascinating because in the face of what would seem to be a great housing market if we look at prices, people are simply not buying in large numbers. Regular families are largely going for rentals while investors made up a large number of purchases of homes between 2008 and 2014.

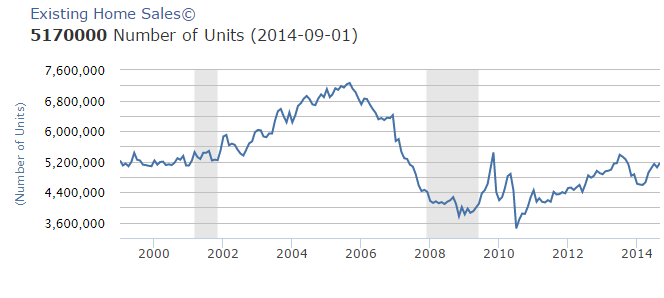

People still don’t realize how big of a hit we took with sales:

At the peak in 2005 we were seeing 7.2 million home sales per year of existing homes plus all of the new home sales. Today we have a rate of 5.1 million existing home sales per year (2.1 million less). Volume is still very low. And it is worse when you look at new home sales since many investors opted to go after deals in the existing home sale market which is the largest pool of transactions.

Will this trend change? Hard to tell. Right now we do have a clear trend to adding rental households. It does seem that Generation X is largely the hungriest to buy and is trying to dive in but given current prices, many are simply unable to compete because their incomes are lacking. We still have inventory out there but many are balking at current prices for the pride of owning a $700,000 crap shack. While there has been much to say about Millennials not buying homes, it looks like Generation X is not exactly chasing the American dream with both hands wide open.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

130 Responses to “Blame the fall in homeownership on Generation X: Why did the homeownership rate fall so dramatically for those 35 to 44?”

All about pay Dr., if wages go up then houses sell again no matter the cost. Pay these folks the real going rate for 2014 about $200k a year. Corp. America is in the ” let them eat cake mode”, till they change their stance America stays at a standstill.

Better yet, let prices fall and wages stay the same!

Yes. Obviously ‘corporate America’ ought to unilaterally raise wages and become less competitive. You must really hate the poor in China and India, Robert. They are stealing part of the standard of living Americans thought was their birthright post-WWII when all the economies of the world were destroyed but ours. Welcome to an irreversible globalized equalization of standards of living. Why you would blame corporations for attempting to remain profitable by cost-cutting in the face of dropping revenues is beyond me. In fact, for them to do anything else would be a lapse of fiduciary responsibility. The alternate of sharing the wealth dictated by government has been tried several times already. It always ends up with millions being slaughtered. “At some point, you’ve made enough money”? At some point you’ve murdered enough people.

Haven’t seen much genocide in Sweden lately….

PD Quig…Thanks for the sermon, I was never a corp owner, but did own three Appliance stores in greater LA and part owner of a auto dealership. We paid above avg wages and commissions to attract brighter and loyal working employees.

You see PD when you slave drive your workforce you get what is expected, low productivity, bad moral work habits, bad mouthing the company, and in general a poorer profit ratio.

Tell how it serves your employees to have me show up to work in expensive Euro cars and then tell the workforce you are not getting bonuses or pay increases due to lost revenue?

Capitalism is one thing, make all you can I did, but we always gave back to the workforce, we had employees stay over 22 years when I retired and sold out they cried PD, when is the last time somebody cried for BILL Gates or Warren Buffett?

Do you really think a person who makes 50 billion dollars a year has any idea of the cost of bread, milk, and eggs, giving to charities is a tax loss my friend a front.

I don’t need a lesson on China, we all know when Nixon went there in the 70’s a deal was made to make them a global player in exchange backing off with the Soviet Union, the West was scared to death of a union between the two countries in a effort to draw the West into a world war eventually, we had to make deals with them.

I can go on about major crop and players in the world, let me leave you with this PD, the real players of the world are never heard from, like in the Godfather, Hyman Roth I’m a small businessman I have no idea about anything else?

Almost no American gets the fact that this started in 1972 with the infamous visit to China by Richard Nixon. The writing was on the wall and has evolved over 40 years! There is no reversing the ‘globalization’ trend and American jobs, wages, benefits, and standard of living, are part of the cost! Wage pressure will continue until an equilibrium is reached and that will take decades. Until then, housing will have to adjust. Except for those homes with location, location, location, that can attract monied buyers, the vast majority of homes are overvalued! It is a game of roulette!

“Haven’t seen much genocide in Sweden lately.”

Nor have you in Venezuela, Ecuador, Bolivia, China, Cuba, or Myanmar. The notion that the economic system–that is as we speak losing altitude dangerously–of a small, ethnically homogeneous nation would be viable in a nation of 330 million is laughable on its face. But you enjoy that ganga. It makes for all sorts of interesting ideas at 3 AM.

This is a PERMANENT or at least a VERY LONG TERM SHIFT in the large percentage of the USA’s Demographic, who are telling us their views of the Future .. NOT optimistic.

CBS Evening News broadcast a report on this same issue just two evenings ago,

about ” GEN-X-ers ” who now refuse to “OWN” property .

… They are now PERMANENT RENTERS..

Once MAJOR MEDIA starts to report something .. It means “reality” is finally settling in.

This is more NORMAL … Not everyone should or can OWN property.

Maybe SANITY has finally arrived to the Real Estate Markets. Let’s HOPE !!

@Paul

Sanity will only return once the government and Fed end their extraordinary subsidies for the real estate industry and allow prices to find their natural bottom according to real demand. More people would be able to buy if prices were not artificially inflated by the lack of investment options, hidden inventory, and financial institution balance sheet manipulation.

It’s a start, gotta start somewhere. Next, ditch the high-priced degrees and learn a trade.

Rents are soaring — and so are evictions

CNN – MONEY:

http://money.cnn.com/2014/10/29/real_estate/evicted/index.html?iid=HP_River

Rent is the biggest component to the cpi. If we really have rent inflation that is not reflected in the cpi, watch gold and silver start heading north soon.

It’s no secret all you old fu__ers screwed the younger generations over with your lavish deficit spending. All was fine after WW2 for 30 years or so until the rest of the world started catching back up. Now look at us.

All the while supporting ungrateful kids like yourself. Also many having large medical debts etc and believing politicians who sold us untruths. The 1% superrich are controlling corporate America with their wealth. Who is going after them for their fair share?

Some say that deficit spending — Keynesian pump priming — was what got the U.S. out of the 1930s depression. Especially after deficit spending really picked up during WW2.

I don’t know if that’s true. But EVERY generation over the past 80 years has wanted government goodies. EVERY generation has demanded more and more goodies.

It’s not that Millennials are nobler, or more frugal, than past generations. They want as much govt goodies as they can get their fists on, same as past generations. It’s just their misfortune that the bill’s coming due as they’re entering adulthood.

And as I’ve previously observed, much of this deficit has been SPENT ON Millennials. Did they not receive 12 YEARS of FREE public education, paid for by their elders? Did they not receive FREE school breakfasts and lunches (not so when I was a kid in the 1970s)? Did they not receive other benefits built and paid for by older generations, from libraries, to safe streets, to cell phones, to the (government financed) internet?

I didn’t know that kids in the ’70s had to pay for their own meals at school. I always thought it was the generation before the boomers (aka “their parents”) doing that.

Son of B$#^ more like it. How do the poor, immigrants, and youngest among us deserver the blame while having little to no control over gov’t policy? You think they had a say in the Fed’s policies; TARP, HAMP, QE1-4, the LIBOR scandal, or the huge push to MBS / CDS after the tech bubble burst? All of it is to keep the economy propped up for the true owners of this country, and most is now tied to keeping the price from collapsing on everything from Municipal bonds to derivatives and everything in between. Wake the F’ up

“And as I’ve previously observed, much of this deficit has been SPENT ON Millennials. Did they not receive 12 YEARS of FREE public education, paid for by their elders? Did they not receive FREE school breakfasts and lunches (not so when I was a kid in the 1970s)? Did they not receive other benefits built and paid for by older generations, from libraries, to safe streets, to cell phones, to the (government financed) internet?”

Quite possibly the dumbest comment I’ve ever read on this board.

Istrilyin, since our parents paid for our school lunches in the 1970s, none of us were adding to the federal deficit, were we?

Back in the 1970s, kids brought their lunches to school in brown bags or lunchboxes. (Do they still make lunchboxes?) Today the govt pays for school lunches — and breakfasts, and after-school meals — and in L.A. there’s even talk of extending the meal programs to the summer months when kids don’t have classes.

“12 YEARS of FREE public education, paid for by their elders”

This is a funny notion as elders didn’t pay a thing: All of that money is debt and who is paying it back? The kids, if anyone. It’s for sure that the generation which took the debt isn’t going to pay any of it back.

The commenter is only fooling him/herself: That generation put every penny they made in to their own pockets and almost everything state is or was offering, is and was paid by debt, not taxes.

Now old debts and interests of old debts are paid by taking more debt and amount of debt is exponentially growing. Nice heritage.

Generational stealing in large scale and the US isn’t the only country where that is happening.

The really big deficits have been built up by unfunded war obligations. Even the social security fund has been raided to grow big government. The blanket NSA surveillance is costing us way more than school lunches or public libraries ever did. We built the highway system and much of the infrastructure that we’re still using, from bridges to cast iron pipes beneath our roads, with tax dollars, the WPA and other programs.

Tax rates on the wealthy are lower these past 30 years than they were when the U.S. economy was on an expansionary path both public and privately. Now add into the mix NAFTA and other so-called free trade agreements that have put us on an imbalanced playing field against workers who make pennies to our dollars and wages must fall to make us more competitive. With falling or stagnating wages comes a shrinking tax base, especially when you consider that the post Baby Boom generation is too small to replace the tax base that came before them.

If you were to plot the implementation of GATT, NAFTA and other free trade agreements against the decline of mid-skill jobs you would see very clearly why we are on track to a rentership society. The Baby Boomers were the last generation to see the single-breadwinner as a household norm, and now we are moving beyond the dual income household reality to one that, regardless of employment status, is that much more debt-burdened and increasingly asset-poor by comparison.

At the same time, Big Government continues to grow. Not so much in social welfare but in unfunded (prolonged) wars from Vietnam forward. To this add social security obligations as the baby boom generation transitions out of the workforce. The clincher in the equation is the demographic inversion, with too few Gen-X-M to support the boomers before them. This means the Big Government tax burden has come to rest on a (relative) small population.

Now what’s interesting to note is that around the same time we began making major free trade strides and thus became globalized as we know it today, the government also began to shift the way inflation is tabulated (per the website shadow stats). A lot of inescapable costs aren’t factored into inflationary statistics, such as food and energy costs. Inflation should be tracking much higher to account, for example why the cost of raising a child shot up by 40 percent in a 10 year span earlier this decade.

The picture of how much inflation has played into the decline of homeownership is similarly skewed, arguably to cover the fact that while inflation remains low per official standards, it’s not really so in practice. Americans have been left to absorb cost of living hikes in so many areas that simply aren’t tabulated. I don’t think this is any accident, either. Sure, NAFTA and many of the free trade agreements that have come since stood to expand the general global welfare, but that’s been accomplished, in part, by bleeding off domestic welfare. The only way to cover globalization’s tracks is to publish incomplete inflationary statistics. They’ve done that, and because we aren’t having an honest conversation it’s simply easier to grasp at straws — and worse yet, play the generational blame game.

You are right. Lots of deficit spending by the older folks. I still remember that bumper sticker that said ” I am spending my children’s inheritance” Usually stuck on the arse of a big gas guzzling RV. A true statement in more ways than one. Imagine they were so proud of themselves ;(

You are absolutely right!

The Boomers and their cultural and fiscal rot have been a curse on America. As a Boomer who went to UC Berkeley in the late 60’s and early 70’s but managed to come to my senses, I speak from insider knowledge. We have ruined every institution that we took over: academia, K-12 education, the bureaucracies at all levels, the news and entertainment media, etc., etc.

Unfortunately you Millennial chuckleheads voted in great numbers for King of Deficits, the King of Useless Regulations, and the Destroyer of Economies. You are no better or smarter than the Boomers are.

You will not be left holding the bag but you will be present when the SHTF–as will most Boomers. Personal, municipal, state, and federal debt is at 375 percent of GDP. The problems have been building since the Federal Reserve and income tax were established in 1913. Nobody knows when it will come, or what the triggering event will be, but the inevitability is not in doubt. You will not be paying back the debt: the debt will be defaulted upon.

You have a right to be angry at us Boomers, but you’ve proved to be every bit as foolish and self-absorbed. It’s called the “human condition.”

PD Quig…You went to Berkley congrats, I went to a state school solely to play sports and drop out in less then two years. So you got one up on me, but I did have a great father with a 3rd grade education from Sicily which means who had no schooling.

He taught me common sense and values, love of America, no matter that we certainly are not near perfect, but always try to do the right thing for fellow mankind’s.

There are 7 billion people in the world, the fortunate who live in the industrial countries try to watch out for the less fortunate but big numbers ,vast landscapes and cultures make this a daunting task.

Nobody is questioning the boomers like us per say PD, they want what everyone should have a fair shot at a home purchase, good wages, a safe environment, and protection from hateful invaders and police force they can trust.

They are mad PD, their kids face a world of turmoil, a internet that can’t be trusted because of spying on them and what they do in their free time on the net. Drones, conflicts which really are small wars, gray hair politicians of both parties who lost complete control of the forefathers dream for AMERICA, OUR CONSISTUTION.

So yes they are somewhat mad. downright angry, you say corporations don’t owe them anything for their getting up and punching a clock to make the CEO and board rich and walk away more wealthy when they raided the coffers on the backs of the workforce.

Let me leave you with this, I know you are infinitely more intelligent then this dropout I was, but there are a lot of Madoff’s out there and the young folks deserve to know why. Boomer’s or not somebody wreck the future of the young in this nation, sub-prime,recession,depresson for many poeple, yes they have a right to be angry about their future?

PD Quig…

You’re blaming the wrong generation — the wrong cohort.

ALL of the grand policies that you are detailing originated with both the Greatest Generation (JFK-Bush 41) and the Silent Generation. (Ted Kennedy, Pelosi, Reid, et. al.)

It somehow has eluded adult youth that national policy is dominated by seniority in Congress. This means that the generational cohort that is already on the backslide is still totally controlling the agenda.

The Silent Generation has even controlled all of the state legislatures too.

If the Speaker doesn’t bring a bill up for a vote — it may as well not have been written. BTW, MOST bills never get voted on. They die year after year.

A perfect example: the Civil Rights Act of 1964. It was introduced by the Republican party circa 1956 — having been stewed around for years even before that! Once the GOP lost control of the House, the bill didn’t even get debated.

FINALLY, LBJ — a racist of the first water — introduced the Republican bill as his own — tweaking it — and re-naming it — with the full intention of co-opting the Black vote — which had previously been largely Republican. (Blacks didn’t start voting Democrat in any serious numbers until FDR. The party that was founded to free the slaves had a lock on their votes for generations. Today’s Black voters usually tell me Lincoln was a Democrat. (!) I’ve never heard otherwise.

If you want to lift up the covers, read “Master of the Senate” on all of the political calculations made by LBJ. He proved to be correct — right on down the line.

Today, everyone credits the LBJ and the Democrats for passing the Civil Rights Act — even though they had been its sole opponents all along!

&&&

In both cases, blaming Boomers and crediting LBJ, you’re witnessing effective propaganda that has fulsomely shaped the popular memory.

In a similar vein, propaganda has made the second Gulf War into Bush’s war. Yet the record is clear: Bush was following directly down the path set by Clinton — and the Democrats. This was why Hillary Clinton voted for war powers: she was voting FOR the very policies that she and her husband had been pushing for eight-years.

&&&

Similar propaganda techniques are on the loose with regard to Southern California real estate.

TPTB have managed to talk the market up to the cliff face.

They’ve also managed to gut the cash flow of First Time Home-buyers. (0-care)

The truth distortion crafted by the MSM is so severe that one must realize that the more you listen and watch — further you get from reality.

Guarantee most of the debt was accumulated during your life so that makes it mostly your fault! How old are you? The truth hurts!

In actuality, it is not your fault, nor my fault, it is those with the power.

I fall right into the middle of this category.

I am 39yo. I bought my first home at age 24 and sold it for a nice profit at 28 due to a divorce and job loss. Have not bought another home since.

After 10yrs in sales, I decided to go back to school in 2006 part time. Sensed the pending 2008 economic doom having worked sales while in school for two industries that are very good indicators of a looming crash – A major job post/recruiter and Vehicle sales listing site.

I transferred to a FT state university and my income went to near zero. My tuition was thankfully covered in full due to being unemployed for enough time before switching, but living costs and school costs for projects and such and finished with a $50k bill I have just started paying last June. Working PT wasn’t much of an option because time involved with school and living in an expensive city which wiped out savings pretty quickly.

Took me over a year to find a well paying job and have begun paying things off as quickly as possible. A couple months before graduating, I moved back home and now one of those boomerang kids Dr. HB speaks about.

I can afford to move out, but it would take me far longer to pay off some of the non-student loan debt accumulated from school and be in a much less than ideal situation. I’m choosing to shovel money and pay this stuff off as fast as possible. I certainly cannot buy anything due to my current debt load/income ratio, but hope to eventually. I’d rather stay here instead of paying a bunch of money for some crappy studio apartment just to say I live on my own.

I have become a 39yo trapped in a millennial’s life situation. It’s not fun and all I can do is keep moving ahead and make progress however I can. Someday, I’ll be able to buy a place, but It’s going to be awhile as these student loans take a $580 chunk of buying power out of my income every month for the next 10 years. It’s what I had to do to get ahead (barely).

I certainly can’t buy anything in the LA area and even renting is a stretch.

Plummeting gold and oil prices are literally screaming DEFLATION , which is something the Fed is desperate to avoid. The Fed exists to prop the banks and uber-leveraged asset deflation ( residential and commercial ) is a massacre for the banking industry.

Odds are good for Real Estate Meltdown II by the end of next year.

Not sure that real estate will crash by the end of the year; the market can remain irrational longer than anyone can image. But I agree, the powers that be are sacrificing the welfare of future generations to protect the wealth of the elite .00001%. If anything, Gen X should be blamed for voting against their own interest by supporting the same two corrupt parties.

The 65+ year olds have it made…pensions/social security checks with COLA increases, free healthcare, low mortgage payments. There seems to be more stability in retirement than working full-time. So much for the old adage “poor granny is on a fixed-income.” The new adage should be “poor grandson is NOT on a fixed income.”

In those days one could work for the same company for 25 years and earn a pension.

They at the same time contributed to their SS. Now the only pensions are from government work. Be happy granny may have a little money left and an old house to keep the kids and grandkids from being homeless.

Well if that looks like it’s the case, that’s only going to be true about some of the people who are now already retired.

Most people in GenX do not have the types of pensions a lot of older baby boomers & especially silent generation people have.

According to the government its the weather!

Ps : Rip USA

As a 36 year old I can attest to not being able to afford a home in the current market. Both my wife and I make pretty good money compared to our friends that are a similar age, yet, prices are so high that the only properties that are available in our price range are houses that need massive amounts of work to look somewhat modern. To take a mortgage out on a house that needs $50k-$100k worth of work(also in areas that we don’t even want to really want to live) means that we have have been sitting around waiting to move for almost 3 years. I should note that we over $100k in savings, but we don’t want to throw that all away on a house that is already junk just to get our foot in the door. If the market tanks and employment becomes difficult, who wants to be stuck with a house they probably cannot sell again for 10-20 years?

I should also note that we already own a condo, but there have been massive foreclosures(that continue at a steady pace all the way up to present day) in our building and in our neighborhood. As a result, our condo is currently worth about 1/4 of what we paid for it. I bought the condo when I was single planning to move in less than 5 years. I am now married, wanting to start a family, but our place is VERY small and now we have been here 10 years unable to get out of our current mortgage. Not sure if anyone considers how terrible the condo market is in preventing people of my age group from moving up the property ladder and buying a new home. We are literally trapped in a home we do not want, but we refuse to foreclose or short sale simply because we have great credit and have no desire to ruin that. Almost all of our friends in a similar situation have let their places go into foreclosure or short sale, which hurts us even more, in terms of property value. Needless to say, this market sucks big time.

I’m 40

What city do you live in? I find it hard to believe that there is any place where condos are still 1/4 what you paid for, even if you bought at the absolute peak. Do you live in Detroit?

About a mile outside the city of Chicago. We have had at least 10 foreclosures in our building(roughly 26 units) in the last 3-5 years. More pending as my wife is on the association and we have several units that have stopped paying their association fees. I am not exaggerating when I say it is worth 1/4 what I paid. I bought in 2004.

You do realize this is a southern California blog, don’t you?

Thomas, who appointed you the internet police? Jesus your comment is pathetic.

There was a time your credit history was a very valuable asset that you wanted to protect at all costs. Those days are gone, as are the days of sound money. You can rebuild your credit in two years and be back above an 800 fico score in 4 years!

I say let Igood into foreclosure if it makes sense and forget about the credit history. Those who think it is morally wrong are either idiots or people who you owe money to.

Oh please….Let’s look at slave wages first and the siphoning-up economy.

Why does the doctor continue to state volume is so low by comparing past peak volume to prsenty? Looks to me that volume has returned to pre-bubble numbers.

Dear Doctor,

A couple of things. Gen X has been defined a few times. Jon Steward did a bit on it last year and it was in Time Magazine. We’ve been put into Gen-X–again–where we belong and not lumped in with the Boomers.

My generation hasn’t been on the receiving end of what the Boomers got. There are no pensions coming our way even though we’ve been working for over 25 years. Hell, I’m making exactly what I made in my 30s. I will never be able to afford a house in LA county. Never. Thanks to an illness and bankruptcy due to the illness, my wife and I are back to the beginning and we’re in our 50s. Now to find those winning lotto numbers.

Thats me. 40 years old. moved to LA in 1999 at age 24. Bubble for the next 15 years, even if I was brilliant enough to catch the falling knife in 2008, housing was still ridiculously expensive in prime areas, and when starting a family, paying 30-40% of take home for a home I dont really seemed ludicrous.

Gen X has had a weird ride, we were told all our lives that the job market was going too suck, and we had to take care of ourselves. Very cynical in general.

Then the tech bubble came along and changed that for 3 years. Turned out to be an illusion. Than Housing Bubble 1 came along for a few years, turned out be an illusion.

Yeah, I am not surprised that the cynical gen x’ers either have been priced out, bought in and foreclosed out, or never opted in in the first place. We don’t have a lot of children either. It will be interesting if History in the long term remembers us at all, with us being bookended by such giant sized genrations.

So true bro.

It’s a fixed game and always has been especially for us as they conveniently changed laws such as taxation, and ss later on to get us every way possible. What did we do to you?

The “breakfast Club” has explained their rationalizing this, yet we have lower divorce rates.

They have never understood us, but they will.

http://www.thefourthturning.com

http://www.theburningplatform.com

http://www.zerohedge.com

http://www.the automaticearth.com

We are thinking about the solutions…

http://www.geoeconomics.wordpress.com

Sorry Doc Gen-X won’t be able to save the Purina dog chow eating Baby Boomers with higher and higher realestate sales…better get used to dog chow!

Gen-x lost the most net worth during the last turn down so it’s really no surprise that this group retracted sharply out of the housing market. Gen-x mid level jobs that were lost were replaced with low paying service work and part-time jobs.

The issue is is not being able to afford a crap shack…more the crap we have been left with from the Boomers unrelenting selfishness and greed. Greedy bastard boomers are worried about their housing prices falling because no one can afford the shit. Wah wah…

Don’t blame us. At least in CA we were late to the market. Right out of college we were too young and not earning enough to buy right away (unlike Bubble Pop who kicked ass in sales and was able to get into the market)… When we had savings and ready to put down 20%, the dotcom bubble burst and I was set back… Very soon thereafter prices already appeared too high in Southern Cal. I remember a friend who bought a what you would call a crap shack across the street from the oil refinery (!!!) at the north end of Manhattan Beach for over $1M… He was a professor of Finance of all things and he was swept up in the madness… The we had the meltdown of 2008/2009… That would have been a good time to buy but who knew when the bottom would come… It’s been such a boom and bust market that frankly some of us are priced out and the others are afraid to buy high. Don’t blame us. It’s the baby boomers who put us in this world… We didn’t create it…

Thanks Doc, Always fantastic analysis.

Two kids making $140K living in OC. Lost out on a few bids the last few years. Prices have shot up and I refuse to live in a bad area.

Same here. Just got outbid on our fourth home. We’ve looked at 20 or so and I’m kind of done. Anything affordable has bars on the windows and anything nice is scooped up in a couple of days by people with more money than me..

Move to Murrieta. Second safest city in the country, and cost of living is low enough so that the wife can stay at home with the 2 kids.

Prices peaked in OC this summer. Look at the non-shadow listings, and you can see the number of homes and condos in MLS that have price reductions or are taken off the market is about 50-60%. As previously pointed out, there are a lot of people that would have to take a serious loss to sell a home they purchased between 2003-2007, which explains why inventory is so low in my opinion. At a certain point, median home prices will have to adjust to median income again, with seasonal / regional adjusting and foreign buyers taken into account.

@ Jon “or are taken off the market”

Exactly why it’s different this time. So many of the delusional sellers out there do not NEED to sell so they’re just pulling it off the market. Their attitude is give me X for my property and I’ll leave. If not, I’ll just stay or rent it out. And even you tank hards have to admit that rental prices are not going down and rental demand is increasing if anything. Even when there was blood in the streets, properties were still getting rented for quite a bit of $.

This is completely different from the implosion of 2008. There is no impetus for sellers to lower their prices. Unless something happens that creates that impetus there will be no tanking, tankers.

Many of you x’ers posting here are crying but you have missed multiple buying opportunities and you can only blame yourselves. I know because I am an x’er myself, age 39. I missed a buying opportunity in 99 because pops refused to co sign for me. I would have killed it had I purchased the home I wanted to and I bitch my dad out to this day for not helping me back then. I was able to step up myself in 03 and made it happen then; sold at peak in late 05 and have done it again twice since, playing the property ladder game as the good Dr. likes to say. There are always deals to be had but if you’re skurd of a little risk the opportunities will pass you by.

Right now, I could be holding a hot potato. Lots of equity I could pocket if I sell. But, since I am where I want to be and have exactly what I would want in a home, like so many others I have no reason to sell. With a mortgage payment less than equivalent rent, why would people freak out and sell now? It’s not like all of a sudden these conventional 20%+ down payment buyers will walk away or take a fat loss for no apparent reason. Even the FHA lames that bought in the recent trough are in good shape.

The debt slavery can and will continue.

What doesn’t make sense to me is why someone who is so content with not needing to sell and feeling like they’re in a catbird seat checking out a housing bubble blog. Why even bother coming here if there is no worry? Frankly I think you’re full of shit.

Cab sense is spot on with this comment. I’ve always thought the same when I read the comments here. Plenty of in debt millionaires here giving their bullish housing advise.

And CAB, I am looking for a rental now. Unlike 2 years ago the brokers/landlords are calling me back like crazy. They are accepting lower bids than advertised on the spot. Two have called me back and asked me to name my price. It helps that I have good credit because I never bought into the hype, but even so, you can tell they are desperate. Several properties I looked at I can also see from a quick search that they were failed attempts to sell a flip and now they are just trying to rent them. Just when the massive apartment boom is coming to market too.

Cab, thanks for sharing your viewpoints. It seems that others like Cabsense only want one sentiment expresses on this board

Thanks Terra. This is a discussion and the varying viewpoints are why I enjoy reading it. I am sure the same is true for others.

@ Cabsense – “frankly I think you’re full of ****”

When one has no argument they go ad hominem. Way to go cabsense!

@ Observer – that is great news for you. You should name your low price and said landlords will jump at it, right? I mean come on, you’re the only potential tenant out there with good credit, no? Don’t shoot the messenger…this info is readily available with multiple sources netting similar results. Hard to refute the factual data so I will go ahead and take your anecdotal “evidence” with a grain or two of salt…

http://projects.scpr.org/longreads/high-rent-few-options/

http://www.zillow.com/ca/home-values/

The debt slavery can and will continue.

Actually I made my point and then said you’re full of shit. Rebutted you first and some space for flavor. Not an ad hominem.

As for other points of view being expressed, I never said you shouldn’t raise any, rather I questioned your motive. Big difference and you’re still full of shit.

You rebutted me after making your point, nosense? Please. What point, that this is a bubble blog and how dare anyone mention that they made some $ off of it? That was a simple attack calling me a liar. And this all coming from someone who can’t even make up their own handle and who only wants to hear comments that are soothing to them, that everything is going to crash, the sky is falling, and properties are dropping to 1995 prices. Sure, nosense. Whatever you say, nosense.

You must be a fellow x’er that took offense to what I said because you wouldn’t know a deal if it slapped you upside the head. It’s not my fault you didn’t take initiative during all the buying opportunities my generation has had in the past 15 years. Many who have posted here have taken initiative and are better off now. If you prefer to disbelieve that and tell me I’m full of it, go right ahead, but that doesn’t change the facts.

It’s okay for you to label others as crying and basically be an smug asshole about how people missed this or that but don’t call you out for such behavior. That’s what makes you full of shit.

When there are job openings that require a long list of skills and 3-5 years of experience that are offering to pay $11-17/hr, and on top of that it is not easy to get these low paying jobs because there are too much competition, who can afford to even rent and scrape by? Buying a house certainly is in a very distant future.

Reading the comments above it’s amazing how many are similar to our story. But I think that’s a reflection of the fact we all read DHB rather then representative of our generation.

I’m 38 two young kids and we still rent. In hindsight… yes sure would have been great to catch a falling knife in 2009 but prices were not really that cheap IMO. We would have had to sink all our savings (which are substantial) into a crappy home we would be stuck in for years and years. I always figured better to just keep saving and have an even bigger down payment (or better yet buy a house for cash).

Unfortunately price increases are well outpacing our ability to save (although we make good money and are pretty frugal).

The problem, as I see it, most people our age are rushing right back in. Housing is religion. If the bank will give them a loan for X… they’ll spend X on a house. Future be damned. And I don’t see the lending being curtailed as it’s all driven by comps and low rates.

When rates go up we’re going to be a great position (we’ve got lots of $ saved). What I’m worried about is that might not happen for another decade. So what am I to do… Renting sucks although financially the smartest thing to do. By the time I’m 48 maybe we get a major correction. And at that point my 2nd grader will be heading off to college.

Would love to have her grow up in her own home. I would love to own a home. I don’t want to move yet again when this current landlord decides to sell our current rental into the housing mania. But I can’t justify these prices.

Just an odd generation to live in for those of us trying to act rationally in an irrational housing market.

@ same story –

Really, 09 would have been “catching a falling knife?” Um, you won’t see those prices again any time soon and you lost out on a huge buying opportunity. But yeah, go ahead and write whatever makes you feel good about blowing it. And keep on waiting for those rates to go up. It will be soon, I’m sure of it!

http://www.bankrate.com/funnel/graph/default.aspx?cat=2&ids=1,-1&state=zz&d=1825&t=MSLine&eco=-1

If insane conditions continue (ZIRP and other artificial asset inflation measures), then his best investment would be to pour his money into the stock market while continuing to rent.

Wow, were we seperated at birth?

I’m definitely one of those Gen-X’ers who got the cynicism routine the whole time I was growing up. I was taught that you had to go to college if you wanted a decent job, the economy was changing and the well-paying union jobs of yesteryear were going away. There was no ‘peace and love’ for our generation – there was angry punk rock and the looming terror of AIDS. I learned that half of all marriages end in divorce and being a single mother sucks, so the wife and mother thing wasn’t an option. I was warned that social security would be dried up by the time I needed it and nobody gets pensions anymore. Basically, for my generation, every one of what has been traditionally the stages of one’s life has been overshadowed by bad news. I don’t know why I was so bitter about housing getting so expensive – I should have known that stage of the traditional life would be taken away as well. And people wonder why I’m so negative …

Dead Kennedys “Forest Fire” or Descendants “Suburban Home”.

Yet here I am reading the good doctor’s housing site.

Gen X lol

Hmmm more like this in my opinion.

Dead Kennedys – Let’s Lynch The Landlord

https://www.youtube.com/watch?v=aCiYmCVikjo

I love this song, and nearly all of their other tracks.

What real problems has anyone under the age of 64 in this country really ever faced? I say 64 since if you’re younger than that, you missed the last shooting war this country fought.

Okay, for all the Gen Xers, Y’s, Millenials, whatever, what has been so hard for Americans in the last 40 years? There’s been no Dust Bowl, Great Depression, 1918 World Wide Flu Pandemic, WW I or WW II. My father fought in WW II in the infantry and virtually no kid today has a clue as to the cost and sacrifice that Americans made during that conflict.

And most of the men who became “The Greatest Generation” (a stupid term in itself), came from humble homes and standards of living that kids today can’t even imagine. What a bunch of whining cry babies!

So you can’t afford a house in L.A. or Orange County–SO WHAT?! And you complain about the lack of good paying jobs and gold plated retirement plans. Hey, I have news for you, it wasn’t that easy for the “greatest generation”.

Young people today grew up in an unprecedented time of affluence, and now that they can’t have it all as adults, they’re bitching and moaning. Never in the history of the world has so many people lived so well and had such an easy time of things as Americans in the last 40 years.

Americans have lost the edge and now we have real competition from Asia. Americans are going to lose this current battle to the Chinese, Japanese, S.E. Asians, Koreans and India. Why? Because the people in those countries are working like crazy to get ahead.

American kids can’t find the USA on a map and couldn’t do algebra to save their lives. There are still lots of opportunities here in America, but you might have to put down your iPhone and actually do some work and sacrificing.

Buying a stupid apartment, I mean condo, for $400,000 in the last boom cycle and then complaining that you’re stuck, well what do you expect?

Might want to google “Iraq war” or “War in Afghanistan” or some combination of those terms. Fair number of American men got wounded or died in those conflicts. I have a funny feeling you only refer to something when it suits your agenda though.

Wow, you are not well read.

So starting from the mid 70’s, the a short list of negatives we got to experience:

Oil embargo

Stagflation

The rise of islamic fundamentaliats

Hostage crisis

The disassembling of the new deal, bank regulation, social safety net

Peak divorce

Vietnam vet fathers and rising homeless

Crack epidemic

Sky rocketing tuition

Crumbling public educational system

Disappearance of pensions

Declining Unions

Rise in permanent temp worker status

Scaremongering over social security, which we still pay into.

Return to a finacial aristocracy last seen in the gilded age.

Wage stagnation

Red Sox winning World Series

Bankruptcy law changes

Loss of manufacturing sector

Corporate raiders

S and L scandals

Tech bubble

Two housing bubbles

3 stock market crashes

Sky rocketing health care

Sky rocketing rent

Oh and a 13 year war with over 2.3 million having served in less than desirable conditions for extended tours.

Also, my iPhone which is paid for by work so that I am never truly “off work”. The erosion of the 40 hour work week.

My over ambitious self who does quite well, with a wife who does quite well, can’t seem to find a 400k starter house with 3bdrms within 30-40 min driving distance of work is not high crime. To keep my payments a sane percentage of my gross, 20%

Those are facts. If stating those facts makes me a whiner, I guess I am.

Zzy you are correct, everything after WW2 has been first world problems. Those are facilitated only because we won the wars. Based on the stories my great grandpa tells, who fought in Normandy, nobody knows a real hardship today. There is no greater threat than a bloody fight for freedom and life.

Anybody arguing otherwise is a pompous fool. You better hope things never get that bad again.

@the realist

Nobody is advocating a return to times pre wwII or even pre depression when we had an economically stratified society and racially segregated with little to no middle class.

You are throwing out straw men arguments. You yourself do not know the pain of the Great Depression and wwII unless you are 80+ years old, and then they are childhood memories, I do not think any WWII vets are posting.

First world problems, yes. This is a first world problems blog.

What’s wrong with racism? Notice Americas decline as racism declined? Kicking ass is what put us on top.

36 with two kids–former homeowner in San Antonio, TX and current renter. Wife and I are both career-oriented PhDs who landed our first permanent jobs in the Norfolk, VA area. Family income is $160,000.00/year. We currently rent, because the places for sale in the Hampton Roads area are still at bubble prices… probably due to the preponderance of military jobs and the super-enhanced defense spending post 9/11.

Regardless, I’m not interested in buying overpriced houses even if I can afford it. I don’t want to bail out the boomers by shackling myself for 30 years. I’ll keep putting as much money as I can in equities earning ~10% annually in tax-deferred accounts (and even taxable ones), and I’ll buy when people figure out that 4 x median income is dumb. Once things deflate back to something closer to 2.5 x median income, then I might consider it.

I’m sure that the prices I’m balking at are ridiculously cheap relative to SoCal prices, but still… I won’t enslave my family for an overpriced box and the accompanying maintenance headaches and all other PITA factors that come with the joy of homeownership. I’m happy with my current highly efficient town home that I rent : ).

I Guess I got lucky…..

I’m 47, bought my one bedroom condo in nov 96 in downtown long beach at the bottom of the aerospace crash…. Wanted to sell in 05 but my brother needed a cheap place to stay after being laid off. Finally sold in May 14 after my brother got back on his feet for a nice profit. I now live with my mom living the life of a 20 something helping her out with bills

How is downtown long beach? Been shopping condos down there as they are relatively affordable near the water compared to other places in the LA area and have always wondered why.

I’m 29 single

Too close to da hood.

LB only invested up to 7th St. The rest are Snoop and Dre obsessed.

If you don’t mind living in the ghetto, downtown LB is a decent enough place to live for a single person. Stay south of 6th street. I was on 4th between 710 and pine. Walking distance to pine pike blue line and shoreline village

Contamination. Do you not smell the refineries when you’re down there? Among polluted LA areas, LB is one of the worst.

Gen-Xer here too. We owned a place in IL and moved out here to Socal 5 years ago. Tried to buy when we got here and have been chasing the market up ever since. Have good income at 160K plus, but refuse to overpay for a property. I’ll keep the huge bank account. I don’t see going forward how all the pensions and social security will be funded, so I’m saving my cash. Will buy a house when a good deal is available.

43, good 6 figure income and 7 figure net worth – with help from the previous housing bubble, where I sold my soCal house for 3.5x what I paid for right at the peak. Left soCal for much nicer area (think aloha) and while there were some attractive prices in retrospect in 2010/11 I didn’t take the plunge as I wanted the flexibility for my career (and out here, flexibility is definitely needed). Yeah, this bubble is different from the last but its still a bubble relative to jobs and income despite all the cash buyers over the last few years. Prices are already starting to head down and I think its better to be liquid and mobile more than ever – maybe even open to leaving the country.

Boomer story: was just back in soCal for a conference last week, had dinner with a former boss who has 30years in. He gets 6 weeks annual vacation, goes to Africa, Europe, South America, you name it. Lives well, house in soCal and another in Colorado he just sold. Complains that the company changed his pension from 65% of last 3 years to 1K/year of service which he estimates is a reduction of 3 million (I’m thinking more like half that, but I don’t know his salary). Thought it was funny that he would complain to a couple of Xers who won’t have anything close to that. Also suspect the cutting of his pension isn’t done – when I worked for him I looked at the pension terms and said not interested, and I’m sure many other Xers did the same, so there is nothing to hold up that fatted calf they were promised. This is the story across all organizations. The party is over and the reckoning is due.

This sounds like a huge pension, but such numbers had been fairly common among upper management until recently. Just to put some numbers on it a pension with a value of $3M would pay out $160-190K/yr depending on the age of the recipient. While that’s a pretty large pension those numbers are 65% of $240-290K – certainly well more than I make, but a fairly common salary for an executive in the Aerospace industry in SoCal,

Though I’m sure this will garner no sympathy around here, all Aerospace pensions are rapidly going the way of the dodo. When I was starting out folks in for 30 years could all expect a pension on the order of that 65% of salary quoted – leading to a very comfortable retirement indeed. By the time I retire it will have gone down to about 25%. I’m not complaining – I know it’s still better than most get. And those who joined up this century are just plain SOL. Better hope that 401K keeps growing – pensions are a thing of the past.

I am into my early 40s too, and am exhausted trying to save a deposit against what seems to have been a life of hyperinflating house prices. The QE fuelled reflation has been the worse pain, in good areas, where I was hoping to buy.

_____

Boeing profit jumps 18 percent, but cash is scarce

Wednesday, October 22, 2014

“Where’s the cash?” RBC Capital Markets Analyst Robert Stallard asked in the headline of a note to clients.

What a bunch of whiners. California is not the only state. People from China come to California and buy in Irvine. Boo Hoo. California is all about change. If you don’t like the change, you know where you can go, Texas, land of the proud red necks. Otherwise, accept your lot in the “Golden State” and stop your bellyaching, you are never going to see the cheap prices that the envied baby boomers got in at.

P.S. as you can see, in Kerrville, we do not take kindly to complainers. Time to make that chili, storm front is coming in.

Hey BigTex… you ain’t lyin. Many were whining even in 2010, 2011, 2012 when they could have scooped up a good deal. Now, hoping and praying that interest rates will rise and home prices will magically drop …. to what… 2010 prices again? For prices to be lower than 2010, they’d have to be back to 2003 prices…

And here both of you fools are, whining about whining. Stop your whining.

Tex, many on this site are in general scared of housing no matter where it is located. In my many travel even Las Vegas and Phoenix can be very expensive in the betters school districts especially. Retired people find that the HOA, golf dues etc are also getting beyond them.

So yes Ca. Is rough, but lot of nice places in boarding states also are not panacia’s. Housing in this country is not keeping pace with wages, in many cases 100k a years stills buys you very little, that is shameful.

I know of places in Ark. that are fairly cheap not giveway mind you, but again do you really want to wake up there?

I know nothing about Kerrville, but I’d have to ask:

How’s the diversity in Kerrville (race/cultural)?

Genuinely curious, do they teach evolution in the Kerrville schools?

You’re right, there are thousands of options out there. If someone was considering moving to a small Texas town, they might as well consider moving to small CA cities (Clovis, Eureka, Redding, Murrieta)

I know that this is a housing blog, but I married a woman that was born in a small Texas town, and I would like to share a few anecdotes about the first time she took me to Texas to introduce me to her family. She comes from a small farm town and her family has been there many, many, generations, since the area was first settled after the Civil War.

Anecdote #1

We went to the city cemetery to pay respects to her ancestors, and like most cemeteries it had green freshly mowed grass with white marble monuments. I noticed a section in back with weeds two feet tall and had tombstones sticking out, when I inquired about this, her reply was “that is the old Black cemetery, but they can be buried here now.â€

Anecdote #2

The streets in this town could hardly be considered paved, the city occasionally put crushed rock in the potholes and tamped it down, but this didn’t last long. The city park had playground equipment that was ancient, remember steep metal slides, wood plank Teeter Totters, and metal jungle gyms. There was no sand under the equipment, just hard Texas dirt, or mud after the rain. BUT this town of 1000 people had 7 police cars! This struck me as a horrible misallocation of resources, but this is what the citizens of the town wanted.

Anecdote #3

There are no building codes in this town, it’s your property and you can do what you want with it. Her Grandmother wanted an artist’s studio built, so she hired some guys to build a second story on the back of her house. She thought that the staircase would take up too much room on the first floor, and it would block a window, so she had them build a very steep staircase, like a ship’s ladder, you had to hold on to the railing with both hands when descending, or come down backwards.

Welcome to Texas y’all, enjoy your stay.

Eureka is in the Emerald Triangle. I am a farm advisor to those farmers. I live with Forest Lady. We are very happy in the Emerald Triangle, along with the farmers and the local town folks since the farmers raise the number one cash crop and keep that area alive, with the logging down. Keep Humboldt green and just say no to logging.

The problem with Texas is the Texans.

If you could change the weather, lose the insects, have some more varied terrain, a bit more of a liberal attitude, some decent skiing and beaches. Texas would be great.

But then it would be California.

The chart indicates the market is running out of Greater Fools. The housing bust of 2008 was an eye-opener to many RE buyers that the market could fall and was falling, was heavily rigged, and the market prices were deeply out of sync with the buyers’ economic lives. At this time, both the in-market Gen-X and Gen-Y cohorts are wisely refusing to play the patsy in the greed-in-housing game. Neither Gen-X or Gen-Y is a drag on the market, the current market’s inherent corruption is a drag on itself. When the RE bubble finally permanently pops, cleans itself up, and fall back into honest economic sync, Gen-X, Gen-Y, and Gen-Z will participate again.

That’s because the great Illusion of Home ownership being the cornerstone

of financial stability… has been revealed to be “untrue” .

Graduated from college then moved to SoCal 20 years ago. Started buying as many teardowns in the beach cities as I could pull down with subprime mortgages. Now, I am in my early 40s, and I am a multi-millionaire. I did not fall for the housing panic like so many others did. In fact, I picked another prime property last year, and I have one in escrow now. My renters are older than I am … they blew it.

So you’ve been a part of the problem. Congratulations.

Nice post cabsense. Some genius stuff there, blaming JT for making money. He is “part of the problem” for taking some risks and making investments that worked out for him…

JT, next time make sure you lose as much money as possible in your real estate transactions. Anyone who profits from real estate on this board, according to cabsense, is either “full of ****” or “part of the problem.”

Not just anyone CAB the full of shit award goes to you for making smug asshole statements such as people crying and missing this or that. As for JT you make it sound as if someone is exempt for being a part of a problem as long as they are making money. Why are you here again?

64 yrs old. Architect. I say that because we are hard wired to the economy. We are first to be laid off and the first to be re-hired. Been through a lot of recessions (my dad was one too) and this one is different.

When I got out of school in 76 there was no way I was going to own anything. In debt up to my eyes, measly pay with no benefits, home ownership was a chimera. Got married and eleven years later with a few promotions under my belt the 1988 housing bubble came along and I sold my GI Bill crap shack after less than a year for a wind fall and moved to our present home.

Since 08 I have worked only intermittently. I went to freaking Saudi Arabia for a year to stay afloat. Our son is still with us at age 27. He is going to school – our goal is to graduate him debt free. As I see it now, his future is attenuated. The best outcome might be for him to start buying us out (when he can) and eventually inherit the remainder. Apart form that, my advice to him might be to move to Germany and get a free graduate degree and hang out for a nice career.

America is over if your dad is not an oligarch, and I am most definitely not one.

I am a genXer, 40. In financial services. My advice…keep your powder dry and wait for the deals to come as these boomers begin to finally die off. Have seen too many over housed seniors parking themselves in the biggest houses on the best blocks, spending their retirement income on maintenance, repairs, etc. as they age they can do less and less, and they pay more and more. Our time will come when the boomers will need us to buy their assets. Or their heirs need to sell. As they die off en mass, prices will adjust. Sure, interest rates may be much higher, but we won’t need much leverage…or maybe pay cash for uncle Jesse’s home with that big house on a prime plot. And then we’ll make some serious kwan selling it to the GenY or this new wave of illegals behind us boomers had their easy economic cake…they are soon to be digging on dog food. Gen X will get the “golden years” the Boomers were promised.

… Really NOT REALISTIC….. Sorry to say

Your assumption is that there is a sufficient supply of “boomer” homes that

will satisfy qualified or non-qualified buyers … That’s NOT the case.

The population of potential Buyers has DECREASED

…. due to LACK OF SUFFICIENT INCOME.

The imbalance of Available homes and qualified Buyers would indicate

that many Buyers either can’t qualify and therefore can’t BUY

.. OR WILL JUST NOT BUY ANYTHING OUT OF “FEAR”

Paul.

Unless I am missing something, you’re a good and smart person; let’s hope the buyers are running out. I get the impression you want lower house prices (in the bubble areas) for the good of younger people / the economy / fairness.

Your entry of 4 October 2014 about how Realtors (and other VI) will turn on owner-sellers was one of my favorites. I cling onto it with all that’s left of my ebbing hope.

__

*** AND THAT IS EXACTLY HOW THIS WILL PLAY OUT.****

http://www.doctorhousingbubble.com/condo-alternative-santa-monica-real-estate/#comment-624215

I’m 63, retired for over three years with a good pension, tax-deferred accounts, social security, a payed-off home, and multiple cash-positive income properties nearly payed-off. I worry for my college-aged son but hope to leave him substantial assets to cushion him as his life unfolds. It seems that everything is going to hell in a hand-basket. I feel really blessed to be this secure. Never really thought I would be, but hard work, frugal living, and a lot of luck proved otherwise. I wish all of you well.

With Alan Greenspan recommending a buy on gold, there’s trouble in the horizon.

Bill Mink…Congrats to you, however I worry when someone says they have to live frugal and that is okay? I would feel better if you could afford a very nice car and bought it (one go around Bill). Your Son well your son has to worry like you did to get on with his life, when you close your eyes maybe he becomes frugal or maybe he visits a BMW dealer?

Just a quick story, my Chicago cousin’s mother died, my cousin took her mother’s money (this woman never owned a car or went no where to visit.)

Called her phone several times told she was in Fla. looking at beach property, and she and the husband bought matching Harley’s last week. Mother told me the same thing, I have to save everything for my daughter so she can be secure?

Enjoy now sir, your next check-up may reveal a hidden illness, I’ve seen it over, over, again, nobody wins in the end, live your life to its fullest.

Yes, there are a few ‘tight markets’ but by far and away the majority of areas are in deep recession. I work part time for an online company and check & verify addresses for them. It’s amazing how many >2,000 sf houses in ‘fly-over country’ are valued at less then $100k. Cali is very different b/c Canadians and Chinese want to move there; perhaps NYC the Russians and Middle easterners; and Houston is a grab bag of wealthy people (Chinese, Muslim, Russian, Norwegian, Iranian, etc) from all over to work in the energy sector. DC is propped up by Gubmint contracts. The rest of the nation is in still in deep correction territory from whaat I see.

German Daddy, claiming California is very different will get quite a reaction from the tank harder crowd. You are absolutely correct, California is VERY different and what makes it different has been discussed here a myriad of times.

For the Xers who are bellyaching about their lot in life, why didn’t you buy a few years ago? Prices were lower, there was much less competition, rates were very low and we were at or below rental parity in many areas. Now I keep reading that people are hoping for 2010-2012 prices again and they will then buy. If prices go back to those levels it will be because of much higher interest rates (same monthly payment as today) or other external events that will likely make people hesitant to buy.

How it all plays out will be real interesting. Keep your powder dry and ear to the ground!

Almost forgot, HOUSING TO TANK HARD IN 2017. 🙂

Time to wake up as it’s 2014 already. We all know how much you want to regale us with your tales of how well the reformed former housing skeptic became a believer and made the deal of the century but if you’re so sure and content with it you wouldn’t even be reading this blog anymore.

German Daddy…Good take, yes pockets in America are doing okay to very good, but the vast majority are still in a recession. Matter of fact many will never really recover.

The Feds and wealthy got what they wanted income distribution, the problem it all slanted to the rich getting much richer and the mid to poor person stuck on hold for many a moons to come.

40 yo. Have sufficient income to buy at these prices, but why? Who would I sell next to? What happens when the next _inevitable_ recession hits the chronically overleveraged Californian?

And no offence, I look at $1,000,000 houses and the neighbors aren’t exactly investment bankers with Ivy League degrees and nor has the neighborhood gentrified.

Fuck Texas.

I have nothing against the State of Texas because the many times I have been there I never gave it a thought, this is the place to be. Many people never leave there environment.

I was in Plano Texas several years ago, the cashier and I got to shooting the breeze at the time we lived in Northridge CA. She said, never been out of Plano heard CA. was the pits what do you do with that.

I said, like everywhere some good, some bad. She was so entrenched in Plano that I could have told her the streets of LA are paved with gold wouldn’t matter to her.

I have many relatives like that, they think the world ends on the North side of Chicago.

They couldn’t care less about weather or crime, all they know is Chicago land as being the big get.

We couldn’t move to a snow climate ever again, anything below 60 we get mad, as for Texas, well lot of people call it home, good for them, but to push it as the place that Californians or anybody else should run to because they are missing out, on what I say???

“The Realist”, don’t you mess with Texas! Wherever people live they can CHOOSE to be happy or unhappy. If the environment makes you unhappy, either move, or accept it. Accept it if there is nothing you can do about it, like the high price of the lifestyle on the westside that don’t match your income. Accept that on your income, you will never be able to afford that westside lifestyle because your daddy does not have a lot of oil wells in Texas. Ashley is spoiled with her trust fund I set up for her . Oh, well, what can you do, after all she is family. Good thing she lives out there in Bel Air, instead of here.

Yawn.

Fuck Texas and the King Ranch F250 it rode in on.

I’m 37, make in the $100K-$150K range owning a business, and my wife stays home with our 2 year old. We’re renting at $3K per month, and we’re getting a down payment together to finally move out of LA and buy in Portland. My business has become all digital/internet based over the last few years, so we’re done with the headache of LA real estate. Portland is in its own little bubble, but it’s still a world apart from the real estate issues here.

Many of you could basically retire in Appalachia right now. Some of the best mountains in the world and plenty of water. The sad thing is most people have an elitist perspective and cling to their fantasies so you’ll never free yourselves from your CA chains. That said, I have met a lot of ex-Californians here. Most agree there’s no way we’d go back. It’s too nice here. CA isn’t worth beating yourselves up for. (I used to think that San Diego was the only place I could ever live. Now I’m like F*ck San Diego, let that ahole Jerry Brown give it back to Mexico. lol)

Yeah, I could retire in flyover country today. But what’s health care like in Appalachia? As one gets older, health problems increase. And cities like L.A. and NYC are famous for having some of the best hospitals and doctors.

Nope. Boston has the best. West coast Drs are far inferior (with exception of UCSF) and they know it. Mr bro is a doc in CA, and he would tell you the same.

Housing to tank hard in 2014!

Not bloody likely.

California Ãœber Alles

Yet so few new fresh mortgages against the drop in transactions to 5.1m.

Classic pump and dump to me. Standby for the musical chairs back to what some believe to be ‘irrelevant dead-money cash’. Cash going to suddenly become very relevant, as banks look at outright/equity rich houses on which they want fresh mortgage debt in volume. Although I’ve stuck with that for many a year, and now the pain is extreme with such hyper-asset value reflation.

Blame the fall in home ownership on blaming. Read the comments here, they are the tell. You have been fragged and bagged. Look outward from your own navel, from your own little boxes — see the menticide…

Old but still timely…

http://www.boxthefox.com/articles/premiere%20article.html

Deception is the strongest political force on the planet.

I think the reason here is pretty obviously. Gen X was (especially the younger ones like myself) were hurt the most by the housing bubble. Many of us were buying our first homes near the peak of the bubble and we all know 90% of these loans ended up in foreclosure. Now we are locked out of the housing market for 3-7 years(if you want to pay insurance with FHA 3 years). Even ones who can come up with a large down payment and can have raised their credit score back above 700 are simply locked out. It will probably improve but since many foreclosures took 3-5 years the total time locked out of the market is up to 12 years so the improvement will be SLOW.

To me such buyers all the years into the runup to 2006-2007 were to blame. As someone above stated… paying ‘$400,000 for a condo’ like it was nothing.

There’s a queue, and I don’t want those who outbid me in 2004-2007, got foreclosed, to get special treatment, to be in position again to outbid me by fortunes, and pay yet another mad-ass price. The people who run to real estate at any crazy price and have a chronic entitlement… hoping banks will relax lending standards again so they can indulge themselves in paying crazy prices.

I’ve saved up an arsenal of savings, but it goes nowhere against these house prices, and the debt-hungry guilty buyers who gleefully ran to property and had bidding wars and set crazy-bubble prices in the past, should be locked out of this market. They need to stop itching to buy again at crazy high prices. WSJ yesterday said at least one banks unlikely to lower lending standards by much at all, despite moves by one Gov agency to try and bring down qualification criteria.

______

Rising Mortgage Tide Won’t Lift Banking Boats

Surge in Applications, Driven by Refinancings, Isn’t Sustainable

As a 40 year old X’er I feel I am in a pretty unique spot age-wise. i got out of school just as the current credit cycle began in the mid-late 90’s so I am not strapped with student loans. However, I wasn’t old enough to buy anything before housing blew up only a few years later. For the last two decades housing has been this moving glass ceiling that has always been out of reach unless I was willing to venture into 40%+ debt/income ratio, something I am not interested in doing. That’s a path to bankruptcy IMHO. I’m not leveraging myself that hard on a single investment/asset, especially in such a speculative market.

Last year, I easily earned more than both my graduate-degree-holding parents made (in relative dollars) combined at my age, and I still could never afford to buy a single house in the area I grew up in. I am just dumbfounded that I make more than 90% of individuals and 85% of households in this country and the only houses I can afford are in areas where I would hear occasional gunshots at night. Sorry… not risking my life for equity. That, and if I can’t “make it”, how the hell are families that only make 75-80K with kids ever going to prevail in this market?

In general, I’m just really tired of working 50% harder and ending up with half as much as my parents. It is also very frustrating to work with people who, although (1) you are better than them and (2) you make more money than them and (3) you are practically managing / supervising them, they got to attain this so-called “American Dream” by the simple virtue of being a handful of years older.

So that’s why I’m not buying. I’ll stick in my little rent-controlled apartment and bide my time. There are no sound economic fundamentals to warrant these housing prices, just two massive overlapping credit cycles offering cheap money to the people who are willing to take it. I look forward to “The Great Senior Selloff” and the correction that follows. People get older. People die. People sell their assets to the generations that supersede them. If these younger generations “can’t afford it” as many phrase it, the market will adjust to a point where they can. This will happen regardless of what policies governments try to enact to prevent it. In the words of Salman Khan of Khan Academy, “You can’t legislate reality”.

Read a lot of these stories and the main thing I see about my Generation (Age 40) is timing. As a California native I’m old enough to remember a time when homes here were affordable. Problem with our Generation is that you had to be pretty mature or able to buy during that time. Most of my friends who are also natives either bought homes in the early 90’s and still own or were like me and missed the boat. Now we are forced out of the game by investors or people moving here from out of town with big salaries. I was too busy surfing and partying to care about buying a home back in the day and am now paying the price for it although I’ll always have some great memories.

Early 90’s? We were still in High School! How could we have possibly qualified for a mortgage? We couldn’t even rent a real car until 1999.

Specific dates aside, I totally agree with the “timing” aspect. If you met your SO in college, hit the ground running and bought at 26-27 you made out. If you waited to 30 like I did, you were priced out. Of course if I knew the government would have stepped in with QE and zero interest after the bubble burst I might have made a different decision.

Um. A year late obviously, but I read the majority of these comments and well the solution is quite simple. Leave the over-paid state of California? I guess you don’t realize that having the majority of celebs, ceo’s, all-in-all the hmm lets put top 10% wealthiest people? <—Seems about right. Living in the same state as you is causing your cost-of-living to be well beyond your ability to pay. I thought I seen someone said earlier they paid 1m for a shack? I'm sorry but I must make an emphasized ~"LOL@you"~ |DUDE| seriously? How do you even justify that purchase honestly? "A fool is soon parted with his money" I saw another post that a couple I think were making a decent living at 165k annually, can't afford to purchase a home and is stuck renting until the housing market drops or they have enough to buy outright. For the love of common sense ffs MOVE AWAY! You all act as if Cali' just has it all, it does in some sense, but its not the only state to have this. With both of those incomes I could buy a mansion, I'm not shitting you a mansion, and you can't even buy a shack with the same $$$. It's so not worth it, wiser up or continue to snivel and bleed money your choice. ~My work here is done~

Leave a Reply to Christie S