Bernard Madoff: How to Create your own Ponzi Scheme: Consumer Psychology, Behavioral Economics, and Believing in the Free Lunch.

The rise and fall of Bernard Madoff is a tipping point for the current market. The market may be captivated next week with the automaker bailout but make no mistake, this will turn out to be a big case rivaling anything we have seen in this current climate. Why? Madoff actually admitted to the existence of fight club. The first rule of investing fight club is to deny its existence. He not only broke this rule but flatly stated that his investment strategy was nothing more than a Ponzi scheme. This case will be important because so far, all we have had is a theatre of bread and circus from our politicians giving lip service to CEOs only to let them go off after a verbal lashing to collect their million dollar golden parachutes.

This case has the potential to cement a generation of distrust. Here you have a market maker and former chairman of the Nasdaq. A market maker is essentially a firm that both quotes a buy and sell price. The profit is made on the turn which is the spread. Now this of course requires at least some integrity but here you have a huckster making it to the top at one of the “big 3” markets in the U.S.; the Dow, Nasdaq, and S & P 500.

How big is this? The Enron scandal, one of the biggest of the decade destroyed more than $60 billion of shareholder value. Enron at its peak in 2000 had about 22,000 employees. We already know that Madoff has put up to $50 billion at risk. And from all reports we are now getting, it appears most of it was done with his own hands! It is absolutely stunning. Yet what is equally stunning is how complicit people were to believe his strategy. Welcome to mania, a part of consumer psychology where people want to believe in fairy tales and easy street. As the days go on, more and more reports are coming out with early warning signs being issued yet no one in any enforceable arm of the government wanted to act.

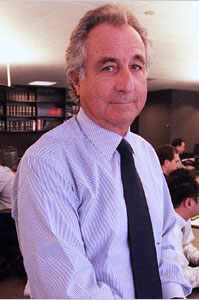

It is important to understand a bit of Madoff’s history to gain a bigger perspective of one of the biggest swindles of our time. Madoff was the chairman of Bernard Madoff Investment Securities which he founded in 1960. His firm was one of the top market makers especially in the Nasdaq. Madoff was born in New York in 1938 during the end point of the Great Depression. He has homes in Palm Beach, France, Roslyn New York, and an apartment on Manhattan’s Upper East side with a street value of $5 million. Not to be out done, he has a 55-foot fishing boat with the aptly put name of “Bull.” I think he forgot the last name of the boat that goes very nicely after bull.

Madoff tapped into the elite social circles of the east coast. Most of his clientele grew from word of mouth. He had consistent returns although most of his investors had little idea how he was able to yield such consistent returns. I would imagine many didn’t care so long as the money came in. How can they know? It was a Ponzi scheme. Many knew that something was amiss. He either had inside information (illegal) or had some other connections to gain the upper hand for his investors. Instead, we now find out that he was basically stealing from Peter to pay Paul.

Many of his investors trusted him to the point where the New York Times had an anonymous quote from a hedge fund executive who nicknamed him the Jewish T-Bill. I’m not sure you want to use that nickname anymore given that some T-Bills are returning zero percent.

The criminal complaint filed against Madoff alleges that investors lost $50 billion because of the scheme. That is right. $50 billion. He now faces 20 years in prison and a fine of $5 million if convicted. Madoff did something different. You mean run a $50 billion Ponzi operation? Nope. He confessed. According to the S.E.C. Madoff told the F.B.I. agent that there was “no innocent explanation” for his behavior and here is the kicker, that he “paid investors with money that wasn’t there.” This is the reason this story will gain traction. Not only is it the biggest swindle in U.S. history if things play out like they are going but it will also be the first major player simply admitting criminal activity. The public wants justice and we now start down the painful road of discovering what really went on in the cellar.

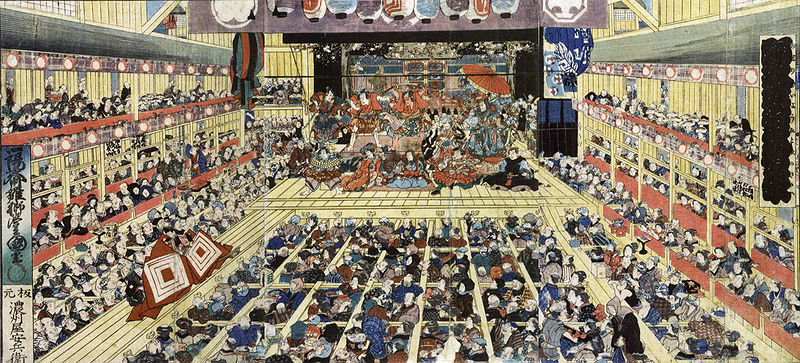

Why will this have such a big impact? Because on a macro level, collectively the public has been yearning for someone to simply admit to what is going on. We all know that each time some crony capitalist from the big Wall Street firms makes his way to Congress, all we are going to see is some Kabuki theatre. They’ll get nicely dressed up and entertain us for a few hours and then that is it. No one admits any guilt or responsibility. They get a verbal lashing and that is the extent of the punishment. The American public needs some representatives with a stronger spine. With Mr. Madoff, we have our first opportunity for a cathartic societal release of pent up retribution. Make no mistake, this is only the first of many. There is never just one roach.

So what is a Ponzi scheme? Named after the lovable Charles Ponzi, it is a fraudulent investment that pays a very high return to investors out of money paid in by subsequent investors. There are no true net revenues or money generated from a legitimate business. Sort of like injecting more and more into banks pretending they actually have valuable assets on their books. Charles Ponzi, went from a nobody to a Boston millionaire in six months in 1920 promising returns of 50% in 45 days in an international postal reply coupon scheme. Approximately 40,000 people jumped on the bandwagon with a total of $15 million. When it collapsed as all Ponzi schemes do, only a third was recovered. He went to jail but got out in time to gamble again in the middle 1920s Florida real estate speculation bubble. Went to jail again and was deported to die broke in Italy.

What Madoff did isn’t new. In fact, if you remember the 1920s was a roaring time. People want to believe in the free lunch and that they somehow have privy knowledge that no one else can obtain. The power of Ponzi schemes is they suck in even “bright” people. Think of going to a casino. You sit at a slot machine. You put in a quarter and right off the bat, you win $200. You put in another quarter. Bam! Another $200. Another quarter and a $300 win this time. After a few times, you are conditioned to believe that somehow this machine is lucky or you have some secret skill. You then decide that you are going to put all your winnings in the machine for one max payout play. The machine doesn’t pay out. Game over.

I’ll leave you with this great summary from John Kenneth Galbraith that sums up the stage of the collapse we are in:

“In many ways the effect of the crash on embezzlement was more significant than on suicide. To the economist embezzlement is the most interesting of crimes. Alone among the various forms of larceny it has a time parameter. Weeks, months, or years may elapse between the commission of the crime and its discovery. (This is a period, incidentally, when the embezzler has his gain and the man who has been embezzled, oddly enough, feels no loss. There is a net increase in psychic wealth.) At any given time there exists an inventory of undiscovered embezzlement in – or more precisely not in – the country’s businesses and banks. This inventory – it should perhaps be called the bezzle – amounts at any moment to many millions of dollars. It also varies in size with the business cycle. In good times people are relaxed, trusting, and money is plentiful. But even though money is plentiful, there are always many people who need more. Under these circumstances the rate of embezzlement grows, the rate of discovery falls off, and the bezzle increases rapidly. In depression all this is reversed. Money is watched with a narrow, suspicious eye. The man who handles it is assumed to be dishonest until he proves himself otherwise. Audits are penetrating and meticulous. Commercial morality is enormously improved. The bezzle shrinks.

…Just as the boom accelerated the rate of growth, so the crash enormously advanced the rate of discovery. Within a few days, something close to universal trust turned into something akin to universal suspicion. Audits were ordered. Strained or preoccupied behavior was noticed. Most important, the collapse in stock values made irredeemable the position of the employee who had embezzled to play the market. He now confessed.”

Human behavior rarely changes. The crash of 2008 will force many people to reveal their losses. We will be “shocked” at what we find. I am still stunned by crony capitalist calling for a freeze to mark-to-market accounting hoping their nepotism can continue. They want to keep their corrupt internal system hidden. They would like us to believe Madoff was an exceptional case but he is simply the tip of the iceberg. The secret of fight club is now out.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

51 Responses to “Bernard Madoff: How to Create your own Ponzi Scheme: Consumer Psychology, Behavioral Economics, and Believing in the Free Lunch.”

Many of the Wall St. scumbags stole money legally by selling derivatives/CDS’s/SIV’s and the like. It was all a bunch of bullshit and should never have been allowed. Why we as taxpayers have to pay for this is beyond me. They screwed us twice; both on the way up and now on the way down. Instead of money, I think that the bastards deserve bullets right between the eyes.

I wish that some lone sniper would start picking them off on by one…

Shit, the US is in Trouble……Unreal..

the AUDIT’s are COMPLETELY USEless

standard & poor are blind

oil was allowed to be MANIpulated from 60$ to 147$ killing the “big” 3

and now back to 40-45$…..& Amaranth collapsed losing 2their 3 billion.

Now it will take 100billion + to stall the death of us auto

I think that some of those millions of people loosing their houses & jobs,

instead of giving up & commiting suicide, are going to pay their local Banker a visit…

American’s don’t understand what the french revolution was about….yet

When the king owned everything, and the people starved…..heads rolled…

with 300 million guns in the us , it will get messy.

If you have a fire insurence on your 1 mill$ house for 1000$. and the insurence Co goes bankrupt, you have NOT lost 1 million$, you lost 1000$, and need a NEW insurence.

good luck over there

.

I am hearing rumors of a “Madoff Bailout”….Can this be for real?? America’s dying..Greedy bastards!!

I come up short whenever I read the words “east coast elite” and “Jewish” in the same piece. If Madoff IS made a scapegoat–and I assume the NYT slur has something to do with his faith practices–it would be a fitting insanity for age where born-again Christians have emptied all rationality out of the culture and replaced it with, as Sam Harris put it, Sarah Palin planting a “maternal, wounded, righteous, sexy” three-inch spike heel into the higher thinking center of every American.

~

For several millennia, crucifying Jews has been a strong cultural meme for those who like that sort of thing. But the fact is, guys like Madoff and companies like Enron only can run their schemes when average working stiffs believe in the festering pus they’re selling as “free market” or “investment” or whatever. If we didn’t believe that money was more important than our own lives, and that of our neighbors’, they couldn’t get off the ground. We’d never hand over our hard-earned wages to them. We’d sock them in the community credit union. If we believed in money as a tool, rather than magic, we’d create neighborhood microloan schemes. We’d consider our riches to be the strength of the networks we built, rather than the bling we flashed.

~

My partner and I were in the Bay Area for the dot-bubble runup. When Enron came online, we said to each other, “This is nothing but a Ponzi scheme; marking up a commodity for no reason, not contributing to anything. It will inflate, then go boom, and by then the big guys will have gotten out and left others holding the bag.”

~

And yet how many countless Average Jo(e)s did we know who put their hard-earned salary dollars in shares of Enron? How many howled and screamed about all they’d lost? Enron was engineered to do exactly what it did: harvest money, concentrate it, then leave the schmucks holding the bag.

~

Eugene Debs used to say, if you love your class, don’t speculate. I’d add: if you love yourself, don’t speculate. Because speculation is grounded in the love of money/the root of all evil. I’m not a theist, but I can agree with that precept, which has been proven true billions of times since the invention of the modern monetary system, in ancient Mesopotamia.

~

As my wonderful ol’ dad used to say, as we looked at photos of the “great archaeological sites of the ancient world,” you can’t have a pyamid without slaves. A little pointy stone stone sitting right down on the ground gets the worship only those who see the beauty in any humble thing. You have to have a distaste for the humble to want to see that pointy stone elevated on the mass suffering of many.

~

People worship Ponzi schemes out of an inner need to see OTHERS left holding the bag for their success. It only becomes a crisis when everyone has to pay a share of the suffering.

~

Remember what Winston Smith said when he finally capitulated to his torturers?

~

rose

compass rose – I strongly suggest that you READ the NYT article before blowing off about ‘slurs’ and ‘crucifying Jews”. You also appear to be completely ignorant of the social strata and alignments at the upper income levels of the old money families on the East Coast.

Since you haven’t read it, you do not know that Madoff (who is Jewish and on the board of Yeshiva University) used his contacts among the NY/East Coast upper bracket old Jewish families to run his scheme. He joined the country clubs favored by that social group, had 2nd homes in that group’s preferred places and participated in that group’s preferred chairties. And make no mistake there IS a difference between the clubs and 2nd home locations of the old WASP families and the old Jewish families (those who migrated to the US in the mid-19th century.) The crack about the “Jewish T-Bill” came from one of his social set who is a member of the same exclusive country club as Madoff – a club that is predominately if not virtually compeltely, Jewish. (And you obviously didn’t get it – that comment meant that investing with him was as safe as buying T-bills.)

HIs scheme worked because he relies upon social contacts and word-of-mouth for new investors which sometimes he accepted and sometimes he didn’t thus giving his operation an air of exclusitivity. And the old money social circles do NOT conform to the political-correctness demanded by the sensitive masses who want to believe that if they had the money, they too would be included at all the same clubs based upon their merit. (It doesn’t work like that – it is based upon whose family has known whose family the longest and who is of the smae background.)

Save the political correctness nonsense. There were no slurs and all of the garbage about ‘crucifying Jews’ as a result of Madoff’s conduct is absolute rot.

Cat is out of the bag! Party is over! This is the beginning of the end for a market that only consists of fluff and speculation. If you always wondered what you were really worth this next year will be sure to shed your answer. How did we let this happen??

yup. Madoff is Jew

Darwin-Rules,

WhatRU?

(a-racist-loser)

Hey, he fessed up. Maybe he’ll take it like a man. That would be a step towards restoring confidence.

Ann, I hold a Ph.D. from the University of Pennsylvania.

~

rose

Having a PHD doesn’t negate any of what Ann said. Pointing out that you have a PHD only serves to expose your oversized ego.

Thanks for another good post Doctor.

This guy Ponzi… did he invent fractional reserve banking?

Are you aware that the $1 billion dollar GABM Investment Fund III is also involved in Bernard Madoff ‘s fraudulent schemes. As a member of Global Association of Billionaires and Millionaires (GABM) I am absolutely shocked to the core about this situation. We as GABM members have established these funds to generate profits which we allocate to global philanthropic programs and towards the greater good of alleviating poverty all over the world. I am aware that some of our US members have already contacted the SEC and FBI to investigate this matter.

It’s not really even relevant that this guy was Jewish. Greed transcends religion, race, color and creed.

Rose,

Well, uh, Ph.D aside, the awful truth is that Christians have zero control over this country. The country is basically run by Jews. Wall St. and banking interests are Jewish run, for the most part. The media is Jewish run, for the most part. The FED is obviously Jewish run.

We’re in Iraq because Wolfowitz and Co. found a dummy named George Bush, and talked him into a proxy war for Israel. Anybody can go online and read Richard Perle on regime change in Iraq, his paper written for an Israeli think tank and handed to the Israeli prime minister back in ’92.

All of this is common knowledge, although one must not utter such things for fear of being called an anti-semite.

I think the best thing we can get from Madoff’s admittance is that he points fingers at other “elite” ponzi schemers.

The only question I have is which Insurance Company had the INVESTMENT & BROKERS E/O INSURANCE , AND who has the FIDELITY OR FIDUCIARY LIMITS FOR THE $$$$$$$ OF EXPOSURE. Somebody’s Lawyer , or ADVISOR asked for proof of Insurance .

The people who ,lost $$$$$$$$$$ must go after their advisors for not providing due Diligence.

Fight Club. Good one, Dr. HB. There is a lot more to this story lurking underneath. 10 million for bail?? Huh? His sons “turned him in??” Huh? Uber connected Wall Street market maker, primary dealer only indicted on one count on a 50 billion (that we know of) PONZI scheme? Afraid we’re just getting warmed up on this one folks.

Where did the money go ? Who has the Insurance on MADOFF SECURITIES, Barnard. The exposure for money management requires Insurance , WHO IS THE INSURANCE BROKER ?????????????????????????????????????

Congratulations to Comrade Housing Bubble for scooping 60 Minutes on the Alt-A debacle! Check out Scott Pelley’s story from 12/14. Looks like 2011 might actually be optimistic for a bottom.

Nice explanation of a Ponzi scheme but you neglected to point out that the largest one is legal and run by the government. It’s called Social Security. When do we start prosecuting the people involved with this admitted fraud?

Can some one explain “the existence of fight club”?

Ponzi Scheme I understand but what is fight club?

He’s a Jew. Anyone who cares about this minor fact is a major douche. No more on the subject, please.

I have to disagree about it’s impact. The general public are going about Christmas shopping now. The Big Three bail out is the big, big news and no one on Main Street gives a hoot, much less can name any of the players. This story will be forgotten in a week by the silent majority.

The people with money, that’s another story. This may cause a run on funds, both hedge and mutual, which will hopefully then waken the everyday Joe.

One has to wonder how many Ponzi’s lay undiscovered. Just as Enron was followed by Adelphia and the telecom Bernie Webbers was running (name escapes me) there is enough smoke out there to begin to wonder if the firemen have enough water to put out the coming blaze.

My .02c SGIP

@June: I disagree. While both Social Security and Ponzi schemes are pay-as-you-go, the similarity ends there. Key to a Ponzi scheme is the promise of unrealistically large returns; that’s where the fraud comes in. Social Security more resembles an insurance policy, where your premiums are (at least partially) going to pay current claims.

Let’s not stab one another. None of us is in the Crony Club. We are all screwed. This system will only work under certain assumptions–like that everyone on wall street, industry and the government is not a crook. Unfortunately, we have devolved into a race of cannibals hell bent on destruction of our own kind.

Rose, I think your comments have been brilliant. It doesn’t take much to PO someone to where they no longer hear you though. Too bad, much of what is said is falling on deaf ears; nonetheless, astute in my opinion..

David,

I have to disagree. SS is a Ponzi scheme by definition. Premiums are paid to Paul (current recipient) by Peter (current worker). Paul could even be a relative of an alien, and is now getting SSI. The system like any Ponzi is not based in valid accounting math, but assumptions that:

>folks will die before they receive significant payout

>population will increase indefinately

>inflation will increase amount new contriubutors make, and

>inflation statistics can be skewed so that payout increases less than payin.

Someone more knowledgeable on the subject could certainly say this much better.

I believe it was Cain. Abel was already trying to get subsidies for growing ethanol from corn…Eve and Satan Mozzillo were already marketing Alt-A mortgages. That’s why they got kicked out of the Garden.

For those of you who say his Jewishness doesn’t matter – think again. Had it been a person of a less politically correct ethnicity (say Chinese, Arab or Mexican), every major headline would scream “Arab rips off 50 billion” or “Mexican’s 50 billion fraud greatest ever” (much of it written gleefully by “conservative” wing Jewish columnists commenting on “their” culture).

So why should Jews enjoy ethnic immunity for their crimes (“white” when bad, “Jew” when good) when others don’t? Damn right you guys own this parasite and his crimes.

Please…get over yourself. You can’t be “white” when bad and “Jew” when good. Take responsibility for the crimes committed by your fellow Jews. Very few believe in your “Boohoo we’re persecuted Jews” b.s. any longer.

Really? Would you be so forgiving if this guy had been Chinese or Arab?

Rose,

Your post was nonsense. You can’t blame the average Joe for this meltdown, not in any way shape or form. The educated/elite class ran the show, and ran the country right into the ground. The Wall St. banksters knew exactly what they were doing every step of the way, as did our shithead “leaders” in Washington. You can’t blame the poor schmucks who bought houses to raise their families in.

But you CAN blame the Wall St.greedheads who made a godamned casino out of our economy.

Housing is essential and should NEVER have been allowed to become a tool for Wall St. speculation. When Greenspan chimed in and tacitly APPROVED of the entire debacle, extolling the toxic mortgage products, then and there we witnessed the downfall of a once great country.

This is a great book..I’m glad I found it. I will quote from it in my thesis about hedge fund operators. Madoff takes the cake!!!! (or matzaballs) I also learned a lot about hedge fund trading strategies from 2 other great books. Hedge Fund Trading Secrets Revealed..by Robert Dorfman..and Confessions of a Street Addict of course by Jim Cramer..written before he got really famous..both are riveting and very informative. You should check them out if you like reading behind the scenes stuff about hedge fund and what methods they use..…..

Of course CRose is right when she tries to hold (the common) people accountable for their part in this economic crisis.

They ran and ran with all the undeserved credit they were provided and now bitch when they can’t pay it back and want to play “victim of wall street”. Go to drhousingbubble and see how much these “common people” pulled out of their homes with helocs and tell me what “victims” they were.

Wall Street is very much to blame obviously… but as to us, who trusted the “financial experts” to protect US and not their own interests, we the “common people” exercised little to no due diligence and in fact enabled and fed this mess by our own greed and the fact that we paid no attention to it until its deniability was no longer an option. And then we elected for President someone who said plainly that even though the country is in absolutely horrible debt (approx 28% of our budget goes solely to debt service) we ought to send everyone “stimulus checks”. Extending our gross overindebtedness even more shamefully.

And where is the outrage about that? There isn’t any: we just want our stimulus checks.

Hey CRose I don’t always agree with what you post but I’m glad you’re here and I appreciate your generosity with your contributions-

Haha I thot I was somewhere else.

Thanks Doc for creating a place where I can refer people for enlightenment and I’ll try not to drink so many sodas before I post next time-

Boy, it doesn’t take much to bring out the racial crazies. Frankly they scare me. These are the crazies that would be running around this country if we ever had a complete economic collapse. Heaven help us.

I could point out that they are being absurd, that jews in general are no more responsible for the crimes of one jew than all white people are responsible for the crimes of Charles Manson. But frankly f@%* reasoning with them! Reasoning is too good for them.

And on the subject of crony captialism:

http://www.qando.net/details.aspx?Entry=9867

*We are all Chicagoans now!!!*

Good morning – Plumly here.

To protect the tender sensilbilities of those who beome instantly indignant and queasy – please pass the smelling salts, Dear – at mention of the “J” word, may I respectfully suggest we substitute the word “Bolivian”. This might at least help to amelioriate some of discomfiture and further, since the real Bolivians do not appear to be an officially protected group (as far as I’m aware), should result in not too much of a backlash. Hope this helps – and, it goes without saying, you’re welcome. Glad to have been of assistance.

@Robin: Tell me when the poor schmucks as you call them are to blame? The wall st. crowd is also to blame, but the poor schmucks were the enablers for them to continue. To put it another way the wall street crowd is the drug dealer and the poor schmucks are the drug addicts. Who can we blame? Certainly, not the innocent drugy. He just wanted to get his fix. The last time I checked people don’t need drugs and they are not entitled to them. I think the bigger problem is the drug addicts. When was the last time you saw a dealer going to rehab. The only difference is the dealer may serve more time in jail.

you could substitute the N word, bet you like that one too.

I have reading your blog for the last couple of years and screaming about your orginial post on Alt A and Pay Options. Like a tent preacher. Lame stream media late to the party, but thanks for coming.

Thank You.

Does anyone remember that Social Security was initially supposed to pay for itself by American workers with deductions from their pay and who then took this money back from the pool when they retired? They had surpluses in the early days (and didn’t like all that money laying around) so changed it to a pay-as-you-go, and essentially created a Ponsi scheme. And, in addition, the government “borrows” from this fund for other non-social security spending and owes a huge debt it. If the fund had been kept out of the hands of government to borrow from and left ONLY for social security benefits, and the fund had been managed properly, it would most likely still be paying its way and it wouldn’t be an issue.

But that’s like giving the keys to the hen house to the foxes. Imagine the government keeping a cash reserve of all that money Americans have paid in over their lives and paying it back out when they retire! And imagine astute money managers taking care of that Fund so that its amount and earnings kept it ahead of the curve of retirees! Now imagine hell freezing over…

David, you’re kidding, right? Social Security benefits going forward aren’t unrealistic, you wrote? Christ, I need to find an uninhabited island somewhere!

what Mr.Madoff did undermines the very structure of civilized society-because of him the rich people are losing money.

who cares about Joe the Plumber and his pathetic 401(k)-that is his punishment for wanting to play stock market with the Big Boys.

but,as F.S.Fitzgerald said, rich are different (not because they have more money!).

they wear nice dresses,drive nice cars,employ numerous domestic help and serve as role models and objects of admiration for teenage girls worldwide.

in 1998 the LTCM hedge fund in Connecticut went belly up down the s..t

creek -government reimbursed rich investor’s losses to the tune of $2.5B.

let’s call Washington immediately-our best and brightest,cream of the society should be saved no matter what!

I also need to find an uninhibited island somewhere!

Oh wait-

I quoted one number off the bat-here is the correction:

LTCM hedge fund and Mr.Meriwether antics merited the entry into WIKIPEDIA-

http://en.wikipedia.org/wiki/LTCM

their total loss was $ 4.6B then Federal Reserve Bank of NY organized $3.625B bailout-they just could not watch the rich people jump & holler.

Mr.Madoff –

http://en.wikipedia.org/wiki/Madoff_Investment_Securities

deserves entry into the Guinnes Book of Records and long-suffering jet set can be bailed out only by the BIS-Bank of International Settlements in Basel,Switzerland.This is a central bank for other central banks.

Save the Rich NOW !

Who would have doubted the integrity of one of the most reputable firms on Wall Street run by an individual that was instrumental in framing the structure of the SEC?

Once again, where were the auditors/accountants? Did it not raise any red flags that the company had reported consistent earnings for the past 20 years? And how could this privately-held company managing that amount of money not be regulated, audited, controlled or provide any safeguards to their so called “investors?â€

Apparently the SEC had even received numerous letters from investors trying to sound the alarm that something didn’t smell right. Why was no investigation conducted?

Yes, I understand the secretive nature of Hedge Funds, but will this finally be enough to wake up regulators to change these ineffective oversight rules?

I’ve always maintained that the word “investment†is a misnomer. It’s all speculation. Nothing is really safe. Now the search begins to find the gory details of the billions lost. But what has really been lost is more faith and trust in our financial system. Madoff’s firm had been highly regarded on Wall Street, but trust me, this downfall will just be the tip of the iceberg.

The economic downturn has already caused a run on Hedge Funds and the redemptions have been enormous. Investors cashed out a record $130 billion in November alone. In Madoff’s case, he’d only had requests for $7 billion of redemptions but was struggling to find the liquidity to return funds.

We’ll find out in the next few hours just how serious the collateral damages will be. Early indications are that the actual number of clients is few, but each stands to lose billions. This will not do much to bolster the confidence in the rest of the investment world.

It just drives home the point that there are so many weak links in our financial system, so little government oversight, and too many loopholes that invite under-handed deals.

It will take years to revamp the structure of the system. But I still have a hard time understanding how the watchdogs, the regulators, state auditors, private auditors, accountants, and even the investors can be so blind.

There are tough lesson to be learned, and many questions to be answered. One of the most important and relevant questions we have to ask ourselves is posed in the title of our book, “The Big Gamble: Are You Investing or Speculating?â€

This comment was posted by Jose Roncal, co-author of “The Big Gamble: Are you investing or speculating?” – For more information, visit http://www.financialspeculation.com

there is nothing new under the sun-

ask your grandparents about vibrant street

life in NYC about 60 years ago:

BIG CON:

Any big-time confidence game in which a ‘mark’ is put on the send for his money as contrasted to the SHORT CON where the touch is limited to the amount the ‘mark’ has with him.There are three recognized big-con games:the Wire,the Pay-off and the Rag.

1.locating and investigating a well-to-do victim:

putting the mark up

2.gaining the victim’s confidence :

playing the con for him

3.steering him to meet the insideman :

roping the mark

4.permitting the insideman to show him how

he can make a large amount of money dishonestly :

telling him the tale

5.allowing the victim to make a substantial profit :

giving him the convincer

6.determining exactly how much he will invest :

giving him the breakdown

7.sending him home for this amount of money :

putting him on the send

8.playing him against a big store and fleecing him :

taking off the touch

9.getting him out ouf the way as quickly as possible :

blowing him off

10.forestalling action by the law :

putting in the fix

one may add ‘hedging the loss’-that is the very meaning of ‘hedge’:

raking in 100% annual returns without wondering where this money

comes from then demanding bailout money or suing the ‘Big Store’ when things go sour.

Let us not forget that it takes two to tango! A Ponzi scheme only works where there are people who are either stupid or greedy or both that think they can get something too good to be true. Equally at fault are the money mangers and investment professionals who put money in this scheme–the real victims are the recipients of charities and grants, that had no impute into where the chartable money was invested. But the people that invested the money should also find another line of work.

Will someone at the SEC explain why this was brought to their attention and they ignored it?

http://www.scribd.com/doc/9189285/Markopolos-Madoff-Complaint

I have a few islands for sale currently used for target practice.

But they are uninhabited.

SS would be fiscally sound in a normal work to profit driven economy, but if you base your calculations on a failing/fiat economy SS will also fail.

But so will a private system.

Great in depth article. I am sure this guy will get his due. I just hope all the others involved including the regulators that ignored the problem get theirs too.

Leave a Reply to Robin Thomas