The resurgence of ARMs in the real estate market: Buyers taking on additional risk to squeeze into homes and increasing leverage in the housing market.

The amount of speculation occurring in the housing market is extremely high. Not to the levels of what was seen between 2005 and 2007 but it is certainly getting close. For example, the usage of adjustable rate mortgages is reaching multi-year highs. This is an odd choice unless you have a fanatical belief that home values will continue to go up or that the Fed has god-like powers to control the mortgage markets into eternity. Yet that perception is very real and perceptions drive a good amount of energy in the housing market. The logic of people using ARMs is very similar to what was used only a few years ago during the heyday of the housing bubble. Home prices are seen as never falling, income will only rise, and if everything goes off the financial cliff then you can simply refinance. It is interesting to witness this for a second go around but the surge in ARM usage is very telling especially in such a low rate environment.

ARMs and Hope

Bloomberg had a really interesting piece on the jump in ARM usage. As it happens, many of these users are in bubble-mania central, California:

“Jung Lim plans to offset the cost of rising mortgage rates by using an adjustable-rate loan to buy a home for his expanding family. For the California endodontist, the money he’ll save makes up for the ARM’s risky reputation.

Lim, 38, whose wife is expecting a second child in December, is leaving a two-bedroom condo in Los Angeles’s Hancock Park to buy a four-bedroom house in the city’s Sherman Oaks neighborhood for $1.12 million. His lender offered him a rate for an adjustable mortgage that is about a percentage point cheaper than a fixed loan.â€

Wait, it costs $1.12 million for a decent home to shelter a family with 2 kids? The California housing ladder is now fully in place. Sell a smaller place, use the wild appreciation in home prices, and move into the dream home and re-leverage. Of course, using an ARM is seeing as a logical step. Of course they are planning on staying put for a very long-time right?

“If I could have gotten a 30-year fixed at the interest rate I’m getting the ARM for, I would have felt a lot more comfortable,†said Lim, who’s also a professor of endodontics at the University of California, Los Angeles. “But I’m hoping to refinance in five years or less. And we’ll be in the house for about 10 years so we could also sell. Hopefully prices have bottomed so we won’t be underwater then.â€

Wait. So they are getting an ultra-low rate loan so they can refinance later on in five years? To what? Heck, even the Fed is saying that they will taper off on QE and rates in the mortgage markets have already reacted because the Fed’s balance sheet is well over $3.4 trillion and we are already seeing the consequences of this action by causing a flood of banking money into the rental housing market. What is interesting is the amount of speculation now permeating the market in various flips and also, the mentality being taken on by buyers like the case above.

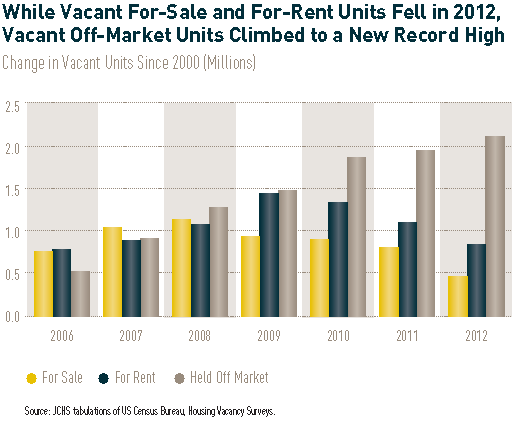

While the rigged market plays out, we have some concrete data showing the manipulation behind all of this. In 2012, for sale units hit a decade low while units held off the market reached a new record high:

And people are doing what they do best and are trying to mimic Wall Street behavior and are itching to get a piece of this pie.

Massive jump in ARMs

According to the Bloomberg report, in June the dollar amount of ARM applications reached 16 percent of all mortgage requests. This is the highest level since July 2008 or two months before Lehman Brothers bit the dust.

Of course many of the ARM borrowers are basing their decision on pure optimism:

“Another assumption of ARM applicants is that their income will be higher by the end of the loan’s fixed period so they can handle higher payments if they can’t sell, said Henry Savage, president of PMC Mortgage Corp.

“When you start making those calculations, you’re playing golf in the dark,†said Savage.

Borrowers like Baudler say they don’t have to worry where home prices will be when their loans adjust. He has the assets to weather rate changes at the end of his seven-year fixed period and plans to use his mortgage savings to pay off the loan in nine years. It was a cheaper alternative to using a 15-year fixed mortgage, he said.â€

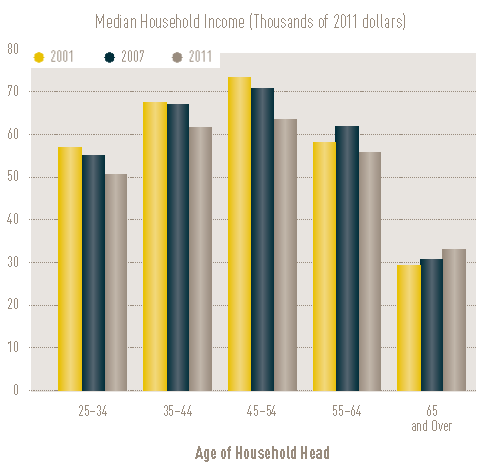

Really? Let us look at how household income has done recently:

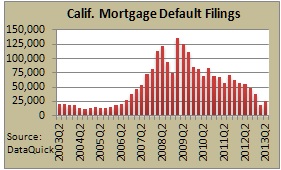

The mania is fully engaged. People crowd into open houses as if they were fighting for entry into a posh Hollywood club. And for what? So they can over-bid by tens of thousands of dollars? After the bid is taken, they close escrow with an ARM and the party begins. Yet as we have mentioned there are multiple signs a tipping point is being reached. For one, inventory is now finally rising. Another major point is foreclosure starts in California went up strongly last quarter:

California foreclosure starts went up by 38 percent in the last quarter. One big reason has to do with the first chart in this article. Now that banks and the Fed have manufactured an insane leveraged based mania, the crowd is now hungry to dive back in. So banks are acting on these foreclosures trying to exit at a prime time. A foreclosure start merely means a bank is moving on a non-paying “home-owner.â€Â Given the massive jump in prices in the last year, some banks are sensing this is a perfect time to unload some of the held off market inventory.

The usage of ARMs in SoCal was 9.2 percent last month (up from 6.7 last year). This is a 34 percent increase in one year when fixed rates are still near all-time lows. Yet people are trying to squeeze every little penny out of this leveraged game. Many have to compete with flippers and the all cash Wall Street crowd. Like the example in the story, the bet is that prices will only go up and that there will be easy refinancing options available in a few short years (there is no scenario for problems).

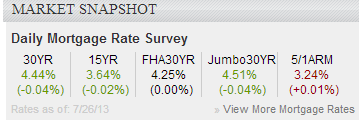

The difference is clear:

Save yourself 100 to 125 basis points on a $600,000 to $1,000,000 loan and you are talking about a good chunk of change. The leverage is real here.

What are your thoughts on the rise in ARM usage?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

85 Responses to “The resurgence of ARMs in the real estate market: Buyers taking on additional risk to squeeze into homes and increasing leverage in the housing market.”

I’ve never owned real estate and I will end up having to pay for this cr@p.

You already do by paying for homeowners’ mortgage interest tax deduction.

No, you will end up glad you haven’t!

I married a Japanese at the height of their real estate craziness in the 80s. We were shut out of buying and felt bad. Then we moved to California in 97, just in time to get shut out of their real estate craziness and felt bad. Now we rent in Portland, OR and are happy as clams because we are completely solvent, have money in the bank, have freedom to make our next decision, had enough to go to London last fall for pure pleasure, and our wonderful landlady lets me dig up the garden to plant anything I like whereas she has to fix things when they break and we have no real estate related taxes to pay.

Indeed we, like you, have ended up paying for this crap when it comes to government bailouts, etc. But at least we don’t live this crap. Nobody has to.

Yeah! !! And now this time around you don’t even have to feel bad! 🙂

I was similar to the endodontist circa 2005, but I was simply planning to climb the ladder again once the ARM reset. Thankfully, I learned my lesson and am now trying to take as little leverage as possible in real estate.

Yup. And then there’s also those of us who have owned real estate, who financed what we could afford, paid our home loans on time, paid our property taxes and followed all of the rules meticulously. And we get to watch the deadbeats get away with mods and loan reductions and living in homes for free for months and months while we get screwed for being upstanding citizens. AND we get to pay for all of this as well.

Makes a lot of sense!

and by deadbeats, I presume you are referring to the Wall Street crooks that stole everyone’s equity the day they closed escrow.? Or perhaps I should say their would be equity they would have had if it had not been stolen the day they closed escrow just like they’re doing now so people like you and me that put down 20 percent or more pay their mortgage payment faithfully followed all of the rules and then suddenly ended up with a home they were told was worth $850,000 is suddenly only worth $260,000 what moron would keep paying for that after they were already robbed? If you are fortunately enough to have missed out on this last tsunami that began in 2008. Hang on its going to be coming in waves for years because people don’t think it will happen to them.

There exists no honor today. Scammers and deadbeats win. The outcome of protecting people from their folly is to fill the world with fools. People of honor like you and I shall bare the burden of the dishonorable.

Schemers, fraudsters, conmen vote in schemers, fraudsters, and conmen politicians. Yeay for democracy! I would like to know what the ratio of shysters to honest people is.

It’s a pretty good general rule of investing that when the average retail investor decides to join the party, it’s about over. Transaction volume is so small. Wages and incomes have stagnated years ago. How long can cash buyers keep buying? Mortgage apps are drying up.

speaking about the retail investor I heard a few years ago that the next wave they were going to try to get the small retail investor into Wall Street and suck out every last penny during this, what will be known as the great transfer of wealth decade and recently I have been seeing several ads on TV for none other than Wall Street and the Dow I had never seen ads on TV for that I’m not talking about individual investment companies like Charles Schwab this was strictly just advertisements for Wall Street and the Dow which I found very odd so yeah they’re trying to suck the last bit of assets they can before the Great collapse, hang on everyone, much love.

Please use punctuation.

Do your own financial calculation here:

http://mortgage-x.com/calculators/amortization.htm

The case in the article mentioned someone who bought using 5/1 ARM @ 2.5% vs. Fixed Rate at 4.5%.

Looks imprudent, at first. But fact is, for the approximately $1,080,000 mortgage balance he took:

– the 5/1 ARM paid down $40,000 MORE principal (by 2018) than the Fixed Rate

– the 5/1 ARM paid $110,000 LESS principal (also by 2018, the reset time) than the Fixed Rate

– at the same time, the 5/1 ARM monthly nut is $1,200 LESS than the Fixed Rate! ($4,200 vs. $5,400).

So compared to fixed rate, he saved $150,000 over 5 years, or an embedded 15% appreciation in the house. Let’s say starting from here, the average appreciation until 2018 is 3% per year, then he’d make 15% more from prices. Total embedded appreciation is about 30% by my calculation. (* let me go out on a limb, saying that in San Fransisco, what I saw in the past was either a flat market or what you have today +20% annual increase, so 3% a year has really never happened in SF. Please pick 0% or 20% instead for a more realistic set of scenarios).

Doctor, why don’t you update your post with screenshot of the mortgage PITI calculation with the rates above, in case people don’t quite follow me? This is what most people miss and therefore unable to time the bubble correctly, and miss something cheap for something terribly expensive, and vice-versa.

If you want to have a carnage in bubble housing, there ARE currently a few cities, none of which are in California or Florida, and where they are will surprise you. My work is about creating ways to “short” housing markets in these area, all legitimate, of course. Presently, I charge about $400,000 per hour to divulge the analysis in power point vanilla type of presentation, so I hope I am right in these prognostications, Doctor.

Wow, $400,000 per hour and we got it for free here from you? Gee thanks for being such a nice kind hearted guy and sharing your wealth of knowledge with us peons who obviously know much less than you do. You big brained geniuses aren’t half bad. Where would we be without your kindness?

Puh-lease!

Karl “Meatspin” Denninger here:

That article told a story of a lawyer in SF who took $1,080,000 mortgage to buy a house. He said he chose Jumbo 5/1 ARM @ 2.5% as opposed to Fixed Rate @ 4.5%, so I did some calculation to get some sense of the numbers:

http://mortgage-x.com/calculators/amortization.htm

– Using 5/1 ARM, the lawyer will put $40k MORE in principal by 2018 (the ARM reset time), relative to the 30-yr Fixed Rate

– Using 5/1 ARM, the lawyer will put $110k LESS in interest by 2018, relative to the 30-yr Fixed Rate

– Using 5/1 ARM, the lawyer montly nut is $1,200 LESS than the Fixed Rate ($4,200 vs. $5,400).

So in the first 5 years, the lawyer in that story saved $150,000 by using 5/1 ARM relative to the Fixed Rate, on a million dollar property. This is exactly the same as 15% embedded gain in the property over 5 years.

About property appreciation, let’s say that we took the national average of 3% and apply it to SF location of the story, then you get additional 3% x 5 yr = 15% gain by 2018. (* at this point, I’ll go out on a limb to say that including data from the crash, SF home prices have either appreciated at 0% or 20% a year, but never 3% a year. So for a more realistic set of scenarios, you can change my #s above with either 0% appreciation or 20% appreciation).

Doctor, why don’t you take a snapshot of the mortgage PITI payment using the parameters I showed you above? That will help the bubble timers on this site to not mistake something expensive for value, and vice-versa.

But let me end the rain by this rain of sunshine for those of you looking for a housing bubble. There are a few cities for which a bubble are forming, but none of those is in California or Florida, or any of the coastal cities for that matter.

I should know because I make a living by helping create ways to “short” these fringe housing markets without harming the real market that investors care about (read: banks, hedge funds, REITs, US Government), legitimately, of course.

You assume appreciation will be between 0% and 20% per year. You completely ignore the possibility that the appreciation will be negative.

You also completely ignore the interest rate. You assume an ADJUSTABLE rate mortgage will retain its currently low value. That’s the entire principle of an ARM. Currently, interest rates are low. If you get an ARM, you have whatever the current interest rate is. If you want a 15 or 30 year fixed, you pay for this security with a higher than current interest rate.

What if the interest rate on the ARM shoots up to 8%? How do your calculations work then?

Your calculations assume impossible conditions, where the current status quo remains true forever. In all likelihood, especially in California, the housing market will either heat up or drop down hard. If it heats up, interest rates will shoot up and the ARM guy will be screwed. If it drops down hard, their property falls in price and again they’re screwed.

I guess by saying “house price appreciation” I basically baited everyone to bash me.

Hehehe. So that’s fine.

Please use your own appreciation number in there.

Point remains, that by taking the 5/1 ARM you pay down the debt faster, and paying less interest for 5 years, and by 2018 you have $150,000 more in your pocket compared to if you finance it with Jumbo fixed rate.

A jump to 8% in ARM rate will increase the interest payment by by about $30k/yr after 2018 – substantial, of course.

But that also means even with 8% interest rate in ARM, it will take about 5 years for that lawyer to “deplete” his initial $150k benefit.

Now my turn to devil-advocate you:

What if the 5/1 Hybrid rates are more closely tied to the short-term rates, that is rates controlled by the fed, as opposed to what you hear in Zerohedge about “bond rates” which are controlled by the market and referring to the longer-term rates? That way, QE or no QE the Hybrid rates stay below 3%.

What if the government adopts some canadian/european shorter term type of mortgage borrowing? It works there, doesn’t it?

Now here’s the kicker, what if people stay under-employed, like today, in 2018 – exactly as Zerohedgers surmise, correctly? Then I guess you’d say hybrid rates will be closer to 3% than it is to 8%? I thought you’d say so 🙂

Those probabilities occuring combined, from my personal knowledge, right now is north of 70%. At least one or two of them will happen, for sure. All three happening is even odd, by my reckoning.

Also Doctor,

I would argue that paying down $40k more in principal is not more leverage. It is less.

Everyone please welcome the new RE shill/troll to Dr Housing Bubble 🙂

I love how dong meat spin uses calculations that assume real estate can only go up up up until 2018 or at the very least we all can’t lose. That would be quite a bull run. Only someone with a vested interest in real estate would assume a minimum of 0-20% a year or 3% per year increases. Isn’t that what got us into bubble 1.0, long duck dong? What a world if we all the safety net of zero losses guaranteed.

Thank you N-0 – appreciate the welcome, 🙂

– although as a troll, I am certainly still waiting to learn how paying down $40,000 more balance than the fixed rate loan will mean that the ARM loan is “more leveraged”.

In the troll-school I was told that paying down debt means reducing leverage, so I could use some help understanding.

Hey DongMeatSpin, even if you are correct about those first 5 years, what happens when the ARM resets after that to the prevailing rates? Your implied action is to sell the house at the great big profit margin. You assume that 1. past house price increases will continue into the future. 2. you can sell the house easily. As many people who took out ARMs in the past (because of identical arguments to yours) have found that neither 1 nor 2 works out. Interest rates are not going down from zero percent. They can only go up. That means if you can’t sell you will be facing a great big increase in your mortgage because the banks will probably say you don’t qualify for a fixed rate mortgage if you are underwater.

I went into an arm in 1986 when 30 year mortgage rates spiked from 14% to 14% just when we were closing on our $200k house. I knew the 14% was a flier. A few years later refinanced to a 12% 30 year fixed. House is not worth $800k and will be paid off in another 4 years. Interest rates going from 14%-3.3% is what made houses appreciate in value. Impossible with interest rates stable or going the other way.

Correction to above. Sorry, typing to fast. Wish DHB gave us a period to edit.

I went into an arm in 1986 when 30 year mortgage rates spiked from 12% to 14% just when we were closing on our $200k house. I knew the 14% was a flier. A few years later refinanced to a 12% 30 year fixed. House is now worth $800k+ and will be paid off in another 4 years. Interest rates going from 14% down to 3.3% is what made houses appreciate in value. Impossible with interest rates stable or going the other way.

Bingo, Uncle Vito. Not to mention that sub 5% rates are the exception to the norm historically speaking. Of course, one can also look to Japan and the Bank of Japan’s attempt to control the destruction of the excess credit/fiat currency supply there post-downturn, where over two decades of rock bottom rates to combat the stock and RE market downturns, jumpstart the economy and spur inflation have resulted in pure failure. Of course, Japan is full of savers too, versus the debt addicted louts we are here.

After being screwed by Wells Fargo and letting the house go to foreclosure in 2011, I was itching to buy next February when I will be eligible for a fha loan.

Watching this complete insanity play out, and especially in my area which I will not move from due to my son’s school district. Watching housing prices go up and up and rents coming down and/or staying stagnant, I have decided I will just continue renting the house I’ve been in for the past 2.5 yrs.

Its a great house. Literally half a mile from the house I gave back to the bank. Its only 7 yrs old, great floorplan and in a fabulous low traffic street, and it backs on to a gorgeous greenbelt. Nice little back yard for the dogs and great neighbors.

The landlord is a local couple who moved to Washington state about 4 yrs ago. They let a property manager take care of it and they NEVER hassle me. I have permission in writing to paint anything I want inside or out, and to dig up the gardens and do what I want with it so I’m happy. It feels like owning my own house. I did repaint the interior to my taste and I love it.

Why the heck would I pay $600 a month MORE than what I’m paying in rent and be stuck with all the hassle of repairs and taxes?

If and when property prices come back down to a realistic level whereas rent parity or close to it is achieved, I will then think seriously about buying. Untl then I just renewed the lease for another 12 mths, at the same rent I’ve been paying for 2.5 yrs, which is still a good deal for my area.

The “must be a homeowner and renting is ghetto” mentality does not exist for a lot of people anymore, me included.

You are smart not to buy. Mortgage interest rates went from 17% to 3.3% during the last 30 years. That is what boosted housing prices. They are set to go the other way now. HOUSING IS DEAD MONEY FOREVER until interest rates first rise AND then begin to reverse. Remember that.

how did wells fargo screw you?

Not to be a jerk as I feel for people that lose on any investment, but I am curious as well how people who walked away from homes they chose to purchase got screwed by banks? I have lost well over $100k on different investments. Carbon credit trading is an example of a VC investment I made and its close to being kaput. Sucks for me, but no one put a gun to my head. Wasn’t it the taxpayers, especially those that didnt default or renters or future children who got screwed by those purchasing homes they couldn’t afford based on their income or not reading loan documents properly (or hiring an attorney for arguably the biggest decision of one’s life)? I totally understand feeling angry, but shouldnt there be a little personal responsibility here as well as maybe feeling slightly guilty for burdening the rest of us with others poor choices? We are not entitled to home ownership. We are not entitled to a job. We are not entitled to food. We are not entitled to anything, but our freedoms bestowed by god and the US constitution, IMO.

Of course I must just be a deadbeat… I just love how some assume another is a loser because their house was foreclosed on. Here’s how we got screwed: We owned that house for 6 years. Put $100,000 down and had a conventional 30 yr fixed mortgage. Paid on time every month. No second mortgages, refinanced once a year after we bought it and got a lower interest rate – did not take any cash out.

We always paid our own property taxes and insurance. We’ve owned houses since 1999, and have never had a bank escrow account. YES WE PAID THEM on time too, and insurance and taxes were up to date.

2009: Wells Fargo sent us an unsolicited letter informing us they had taken the liberty of setting up an escrow account and also had placed lender-forced insurance on our property. The insurance was triple what we paid Liberty Mutual, and the escrow account they paid 2 years ahead = $12,000.

In the letter they demanded full payment of $15,150 within 60 days. Of course we couldn’t pay it.

So to force an escrow account on a homeowner, plus high priced insurance, when all of these items were already current, knowing they homeowner could not pay, IS SCREWING the homeowner.

We tried loan mods, forebearance, all a complete joke. In the end we just gave it back to the bank.

Forced insurance basically make “walking away” the only sane option for a lot of people. Have read numerous horror stories about this. I wouldn’t call people put in that kind of position “deadbeats” as they probably would’ve tried to work something out if they weren’t put in that kind of position.

http://thomasjhenrylaw.com/blawg/consumer-fraud-force-placed-insurance-scams/

Notice, Wells Fargo is on the list.

Cal girl-to be honest, I never even knew such a practice existed. Sounds horrible, so I feel for you. I think everyone on this blog (or in the world in general) that complains of those that walked away from their homes, would not be considering victims of outright fraud. Curiously, after showing them paperwork of your current homeowners insurance, they still just said piss off basically? As a former attorney myself, I would hope/think there are attorneys taking such cases for free on a class action/contingency basis. Have you checked the statute of limitations on your cause of action? Have you contacted any local politicians or the federal government? I would definitely be fuming if I was in your position.

@Calgirl, if your insurance provider was licensed and authorized to do business in the state of California, all Wells Fargo would have needed would have been a copy of Declaration Page (aka Dec Sheet) as proof of insurance. In commercial real estate, we provide this to the lender on an annual basis.

Sorry, but it sounds like you either purchased mortgage insurance from an entity not allowed to do business in California or you had inadequate coverage.

Ya pray do tell how Wells Fargo committed fraud. And what are you going to do about it?

The one time we got an ARM was in 1993. We bought a house at a little under 1 1/2 times annual income and got the ARM at 4 1/% on a 30 year loan so payments were dinky. This allowed us to make larger payments and pay off the loan way early so we owned free and clear, but in the event of job loss we had more leeway. That was the last time we had a house with a mortgage and we were in our early 30’s when we paid it off. The two times we were in CA cities we rented and saved a fortune over buying. When we left CA we paid cash again. Cash equivalent returns are so low that I recently bought a rental in a good neighborhood on which I expect a measly 3% annual return, but since we paid cash if things go south we will still get something and at the same time have an inflation hedge. Real estate is less risky without leverage. Using an ARM to get into a house one cannot pay off quickly is insane. Trading up is for people who want to keep putting money into a non-producing asset. Totally crazy. Of course we are being punished for all of our saving and not only do we get to bail out both banks and borrowers in over their heads, our kids have no hope of financial aid.

Let’s not let memories of the last bubble taint every financial instrument now.

ARM loans are not an indication of a poor lending practices. ARMs these days require equity and documentation. Basically the people that are qualify ARM loans these days are those that could easily qualify for a 30 year-fixed but are making a financial decision to float their rate.

It’s currently NOT a case of people buying more than can afford. If we do get to that scenario, then you’ll know we’re in trouble.

In this particular case, you have an endodontist who probably makes at least 250k+ buying a 1m home, and probably has equity from the condo as well. Would you consider this is risky loan?

No-Doc loans / loans with very little money down are the instruments for financial disaster, not ARMs.

I would think he is taking a risk. Whether or not he can afford it is besides the issue. He’s taking money up front to gamble on the rates/home prices 10 years from now.

It sounds as though the endodontist wants the extra capital for something. Maybe paying down a different debt, or perhaps a business venture to expand his financial freedom sooner than later. Whatever it may be, he’s making a bet and hopefully trying to come out a winner.

IMHO… I don’t foresee any apocalypse coming to housing. There will be a few dips along with a few rallies. Overall, in 10 years, the landscape (at least in california) may not look so much different from today, but with the ups and downs, I would not be terribly surprised if Mr. Lim did not have opportunity to bail at minimal loss, or possibly a small gain before his 10 years are up. It’s just that it’s hard to figure out which train is the last one before you have to sleep at the station overnight haha

I’m not sure if this applies to him, but what would you do in the following scenario?

You had enough money to buy a home for cash at 1m. You can get an ARM for 3% instead of a 30 year at 4%.

You are confident that you can invest your cash between 2 – 7% over the next 10 years.

IMO it would be silly to pay cash, unless that helps you get a cheaper purchase price. If you’re financially responsible you could go for the ARM and take advantage of the MID making your effective rate well below 3%. If rates stay where they are and your investments outperforms your interest rate you stay the course.

Worst case scenario if rates explode and your investments can no longer cover your interest rates, you pay off the loan in full.

Consider the money he has after all assumed payments. Just because his housing cost is high it does not mean his other costs are high. Using x multiple logic does not work with people with good incomes. The money remaining per month is enormous even after such a large house payment.

MB-most folks are scared of investing in the casino stock market. Unless bank accounts pay 2-7%, where are they making such returns?

Also, 20k a month turns into $12k a month after taxes. He will be stuck in AMT at that salary so he’ll get very little of his interest deduction. If homeboy wants to actually save money for retirement and his kids colleges, buy food for his family, property taxes, homensurance, mantenance, 2 cars, gas, etc. see this as stretching himself personally.

FTB – The stock market is definitely volatile, but I wouldn’t exactly call it a casino. Diversification and a dividend paying stocks can reduce risk. 2%+ gains over the long-term have historically been easy. An allocation of bonds, stocks, and equities should be safe. Of course if the hypothetical buyer doesn’t believe they can get such a return, they should definitely purchase all-cash.

The MID is one of the few things one is able to deduct even if subject to the AMT. In fact the MID is really maximized with a $1M loan at the ~$200k bracket.

MB-I’m sure you are aware that the avg retail investor has not participated in the QE-built stock market ride of the past few years, despite big financial instiutions goal of getting them back in, arguably to pass off losses to. Only very recently, have some folks been getting back in. And lets just say I respectfully disagree that its not a casino these days with high frequency trading and stocks not based on fundamentals, but QE, low interest rates (so hard to find yield elsewhere), stock buy backs and other tricks, with companies barely beating downward revised earnings estimates based which are rarely based on top line growth. Historical averages can only mean so much as the world is not the same as it used to be and diversification is a concept that we all learned in business school, along with the bs efficent market hypothesis, but once again doesn’t work like it used to.

In terms of AMT, itemized deductions are capped, so if you deduct your state and local taxes, which folks making money in CA, NY, NJ, CT, etc, you will not get much of the benefit of the mortgage interest deduction.

FTB- Yes, the retail investors have been MIA from the stock market and have missed out on the recent bull run. Conventional wisdom has always been to ignore the ups and downs of the market and hold the course. Regrettably many individual investors jumped out during the last crash and will probably only start jumping in now that we’ve had a bull market for the last 4 years.

I’d say it’s similar to the housing markets where homeowners were scarred from the burst of the housing bubble, and afraid to purchase in 2011. Only when there’s a clear indication of an uptrend does the herd move back in and the effects can be seen in 2013.

Timing the markets may work for computers, but not for humans trading on emotion.

As I said before, the MID (purchase money) is one of two things that can be deducted from the AMT and for those making around 200-250k the deduction becomes maximized. TaxCaster has a nice little website where you can plug in numbers and see where the AMT comes into play with and without a mortgage deduction.

‘You are confident that you can invest your cash between 2 – 7% over the next 10 years.’

You’d have to have a heck of a lot of cash to invest at 2 to 7% over 10 years to offset 3 or 4% interest on a million dollars.

Sorry didn’t read the whole story.

If this professional has an income of ONLY $250K, I would consider a loan of $1.2M to be very risky. That is 5X his income. Unless he and his family are willing to make large sacrifices in other areas of their lives, which I doubt, he is biting off far more than he can chew, else he wouldn’t be getting an ARM that is bound to reset to a steeply higher interest rate and deliver a case of severe payment shock to him.

In fact, unless he has an income of $450K or more, it is a risky loan, especially since the market for houses over $1M is thin even in SoCal.

Haha…I wrote a very similar point below. Crazy thinking that such leverage is advisable on that salary.

“Crazy thinking that such leverage is advisable on that salary.”

Let’s skip the “only spend x times one’s salary” and take the interest rates into account”

He makes more than 20k/month and even if it’s a 0 down loan ARM loan (which doesn’t exist), his monthly payment of 1.1M financed @ 3.25% would be $4800/mo

If he puts 20% down, his monthly payments would be $4k / month. Not exactly “crazy” leverage is it?

MB,

Most people here would say “But let’s see if he still has a job 10 years down the road, otherwise surely he’ll default”.

The pre-occupation with long-term prognostication is why my name-sake, the great Karl Donglicker went bankrupt, sold his boat and drove around in a 15yr old jetta. And had to get a job starring in the famous meatspin video. LOL.

— Sent from my Blackberry Z10, the best phone to watch Meatspin on —-

Mb, as I mention below, being able to afford payments is all well and good, but you’re on the hook for $1 million even with a 20% down payment. If the house loses 20% value, which just happened (at the very least) to any of us who owned a property in the last seven years, that’s nearly the entire amount of the guy’s annual salary that he just lost. Ouch. And yes, such a loss is not tax deductible.

KR – There’s nothing in this world that doesn’t have a risk. There were some areas that lost almost 70% from peak to trough. Does that mean we should require people put 70% down to be safe?

If his home drops in value 20% and he loses a year’s salary worth of money, it would definitely be a tough pill to swallow, but his debt to income ratio tells me he can still make the payment and keep the house.

I’m generally very financially conservative. I’ve previously advocated taking a 30 year fixed instead of a 15 year fixed and making 15 year type payments instead. I wouldn’t take the a 5/1 ARM for a point discount because the risk/reward doesn’t match up with my personality. However, I can recognize that the ARM isn’t a tool of financial irresponsibility like no-doc loans or teaser rates and it’s silly characterize them as such.

Have an appraised home at 225k and owe 95k. About 2 months ago got a 5/1 arm 2.5% for first five, then max 4.5 the next five years, hardly anything out of pocket for fees. If we stay payments for the next ten years will still be lower than we were paying before the re-fi. Will be well into retirement by then, and can sell it, rent it, or pay it off with cash and stay – I didn’t see much down side in our case regarding an arm, we are investing the money we saved and so far have good returns.

Had I’d listened to all the naysayers in 2010-2011 telling me not to buy a home because prices were going to fall 20-30%, I’d be totally priced out of the current market. Well, maybe not priced out… because I’d have a much larger downpayment, but I’d still be paying at least a 20% purchase price premium over my 2011 purchase. Not to mention, I was able to refinance last year in the 3% 30-year fixed range. So, I now have PLENTY of cushion for any turbulence in the housing market ahead. It’s nice knowing we could rent our house out, and even with taxes and maintenance, make a couple hundred a month.

Do I really believe Zillow estimating my home increased $75K in the past year? No, I know it’s dependent on interest rates, economy, inventory ect… But 2011 buyers are sitting pretty that’s for sure.

Enjoy that couple hundred a month lol.

Most of my clients mis-calculated the cash flows from rental properties. They are usually individuals, not real estate investment companies that I do accounting for, who are more knowledgeable about estimating cash flows.

Rental properties cost money to maintain, such repair and depreciation cost are usually under estimated by clients.

If you had put the amount of down payment into investing a stock like Google, or even Target, you would have experienced very handsome returns. You could also have invested the down payment into investing in publicly traded REITs (Real Estate Investment Trusts), some of them more than doubled my clients’ original investments. These investments didn’t cost my clients time to manage like a rental property did and didn’t create the type of risks that a rental property presents (eg. risk of litigation, risk of damaged caused by tenants). Nobody really accounted for time spent on dealing with tenants when considering buying a house for rent. Institutional real estate investment companies have the big cash reserves and financial to enable them to enjoy the cost benefits in owning real estate that small individual owners don’t have and will never have. Worries about being priced out is a mental insecurity that is not rational but driven by the “crowd effect”.

Investing based on emotional fear of being priced out is not a good reason for buying a house. But if you really getting the real couple hundred dollars a month in cash for renting the house out. I wish you all the luck and pray that the tenant doesn’t cause too much costly damage or legal disputes. And I pray the tenant doesn’t cost you much time in listening to their complaints and request for repairs.

Good luck.

Great post. I always think about the opportunity cost of not being able to put all of that capital to work somewhere else.

Too bad the stock market is in a major asset bubble itself, although as always there are winners and losers. What REITs are worth a look at? I did VERY well in EOP back before it was bought out by Black Rock or one of the other major hedge/private equity funds.

Sure there’s a stock market bubble forming, but it ain’t done forming. Look at APPL’s P/E – like 11 or something. Average valuations are probably getting close to getting bubbly, but are still kinda normal.

I’m thinking economic recovery in the last half of 2013 and into 2014 is going to lure more average joe money back into the market. I’m thinking a rise will happen on larger volumes and joe’s will take that as a signal to get back in the game. Then that’s when the real bubble shows up.

Leading the lambs to slaughter. You know things are bad when there aren’t any greater fools left and they pick on the weak hands. Truly sad what homebuying has become in this country. BIg Ben is ready to sell the housing market down the river at the benefit of raising interest rates for foriegn investors. If he is raising rates now their must be trouble.

The real estate market has definitely peaked!

http://www.santamonicameltdownthe90402.blogspot.com

http://www.westsideremeltdown.blogspot.com

Lim is an Endodontist, so I think he probably can afford a $1.2 mil home. If people make over $250K a year, they can afford it.

But as a CPA myself, I will not buy a $1.2 million home regardless whether I can afford it or not. This market in Los Angeles is not a buyer’s market. I will not participate in this kind of over bidding game. The property tax + interest even deductible, will be too much and unnecessary.

So, saying that a $250k salary supports a $1.2 mil house is the kind of thing that I think makes So Cal screwed. Spending 5x your annual salary on a mortgage (or 4x if 20% down) is just not normal compared with the rest of the U.S. Can he afford the pay,nets at today’s rates? Of course. But what if he loses 20% on that investment–$240k? That is a year’s worth of salary before taxes…and a non-deductible loss at that. These numbers sound exactly like my situation in 2005, and that’s why I shake my head at that scenario. My nice(r) FL home nowadays is 2x my annual salary, and I can realistically plan to have it paid off in 15 years.

Arm’s this time around may lead to fisting

You did NOT just reference the Black Power salute! lol

I think he/she was referencing the sexual act, actually, which I have to imagine has to be VERY painful. Wouldn’t know firsthand as I’ve never been on the receiving (or giving) end, thankfully.

Maybe California is going to finally experience reality with lower tax assessments coming to town. What is a town or State to do then?

http://www.thenation.com/article/175244/rescue-local-economies-cities-seize-underwater-mortgages-through-eminent-domain#axzz2aUNW8c6B

Bought 6 condos for cash. 5 Miles from the state capitol. When I bought my first unit on the courthouse steps a few of the owners were laughing their asses off. Complex was in litigation for construction defects. Paid between $80,000 to $106,000 each. Litigation is over lenders are now lending in the complex again. Units rent for $1,300 each. They cost me $800 bucks a month. At the top of the market these units sold brand new for $360,000.

Btw a unit just sold for $225,000!

I have over 50 ARM loans on rental properties as well as on my personal residence. From an investment standpoint they have worked out very well. Most of the rates are currently in the mid 3’s and some in the high 2’s. I refinanced them in late 04 and early 05, so they have about 21 years left on them. Pulled out buckets of cash at the time.

Here is what is interesting.

They were all at 80% LTV at the time of refi’s. The market went up and peaked in late 06. At that time the LTVs were at about 60%. Then the market crashes and most of the properties went to about 10% underwater. However, interest rates declined and so did P&I. The properties are cash flowing monthly even though underwater! Never missed a payment.

Now values have returned to 05 levels… But I have been (or should i say the tenants have been) paying the mortgage for the last 10 years, and now the loan balances are down by 20 percent, putting me back to 60% LTV. The properties continue to cash flow but now since the ARM indexes are so low, and remaining amortization term relatively short, about half the payment goes to principal and half to interest. In five years the LTV will be at less than 40% even with NO additional appreciation from today!

At 40% LTV, the properties will cash flow monthly …even if rates reach the lifetime caps.

Since rental rates somewhat follow inflation, and interest rates are a function of inflation, my bet is that if rates go up, so do the rents.

I like ARMS.

A) This, for the most part, isn’t an investor forum…so the tricks of the trade that work for you don’t necessarily translate to the SFR buyers on this blog

B) Starting with 80% LTV will provide anyone with adequate protection to weather just about anything if you’re staying put for 10 years, no matter if you use ARMS or Fisting.

Chinese buyer redux –

Sally Forster Jones, an agent with Coldwell Banker International in Los Angeles, said Chinese are snapping up many of the trophy properties on the city’s Westside. She estimates that she’s sold about 10 multi-million dollar homes to Chinese nationals over the past 12 months.

“The uptick in sales to Chinese buyers started several years ago but it has increased dramatically lately,” she said.

Most of her Chinese clients are wealthy industrialists or real estate tycoons, many of whom spend less than half the year in the States.

“Some have children going to school in Los Angeles and use the homes as residences for them to stay at when they visit their kids,” said Jones.

http://money.cnn.com/2013/07/08/real_estate/chinese-homebuyers/index.html?iid=obnetwork

Why are wealthy Chinese overpaying in So Cal (and New York) versus Iowa (or, yes I’ll go there, Texas), where they could get soooooo much more! And think of the dearth of loonies and neo-fascist enviro’s and the extra freedoms!

Ain’t no Chi-nee welcome in those parts. Leave the last bastion of real America alone!

I’d venture to say partly because of ease of flights as well as because many minorities like to be with their own people. I know it can’t be for the Chinese food, because it sucks in LA.

That’s like asking, if you’re an international business person and money is not an issue, would you rather buy property in Hong Kong or Mongolia? I’d probably pick Hong Kong. What the heck would I be doing in Mongolia anyway?

Actually, Asian population in Texas is booming; several friends and ex-coworkers who have relocated to TX in the pas few years (both Asian and non-Asian) are very pleased to welcome their new neighbors…

http://www.dallasnews.com/news/local-news/20120111-asian-indian-population-booming-in-dallas-fort-worth.ece

http://www.statesman.com/news/news/local/asian-population-surges-in-austin-1/nRZpt/

http://www.dmagazine.com/Home/D_Magazine/2012/June/Why_30000_Chinese_People_Call_Plano_Texas_Home.aspx

I haven’t seen a decent, pithy argument to support current high home prices except “investor demand” and “Chinese money”.

Those 2 will fade fast. What’s left? Falling consumer incomes.

What are you driving at? Why must arguments be pithy to be true? Certainly you admit that investor demand and Chinese money are “decent” arguments, because they are true. Just because they may fade does not make them less valid.

Truth is, DHB has documented a constellation of arguments for why current home prices (especially in desirable So Cal) are high (interest rates, supply/demand, high FHA limits, Wall Street looking for yields, Prop 13 lottery winners, yada yada).

Yes none of those are sustainable except Prop 13.

Yet there’s a difference in investors selling off and people defaulting in mass. I would say the latter is the more volatile and frightening to folks with interest in the RE market. Rates going up – pretty predictable – not pop-worthy/crash-worthy. FHA tightening ship didn’t do much/anything to cool the market; if they keep on gradually tightening then not much of a catalyst there. Investors that go underwater are less likely to walk away. Even if they walked away, they’re just walking away from some other investor/money source who gave them a loan in the first place; not walking away from a mortgage, so no REO/shortsale or otherwise, pressuring the RE market downward (not discounting some collateral settlement where the home would have to be sold to recoup secondary money sources).

I’m thinking more sideways motion with less violent corrections, where fundamental upward forcings eventually meet deflation in the long term. Though the signal to noise ratio is too small to say anything near term.

All you need is a fundamental change on how people view debt and how they view retirement. Get the heard into the mindset that large debt and no retirement are the way to go and that puts a upward forcing on the system. Wait till the debt boiler gets too much pressure, blow off a little steam, wait till it climbs back up, blow off a little steam, etc.; never mind the pressure used not to be so high.

*herd

Blackstone officially about to securitize (aka pass of their risk) their rental income:

http://online.wsj.com/article/SB10001424127887324170004578638093802889384.html

Robert Shiller basically saying certain markets looking bubbly, including CA:

http://www.cnbc.com/id/100921135

5 to 10 yr ARM’s are not very dangerous and were not a big culprit during the housing crash in ’08. Those were Negative Amortization loans (option arms) and 100% Interest Only ARMs. The fully indexed rates on a regular bank ARM product are actually pretty good. 30 year fixed is the most expensive loan you can get. It provides security and peace of mind however, so most people dont care.

As someone in the lending business, I can tell you that borrowers are using ARMs as a way to expand their DTI ratios to squeeze into more house. Sure, some will use it to pay down the mortgage faster but this is the rare exception. Rates were low last year as well and very low for ARMs then as well so why all of a sudden a jump this year? The jump is coming from people lowering their monthly payment to qualify to keep up with higher home prices.

For example, some lending channels now have interest only loans on 5 or 7 year terms that make monthly payments look very low. Not bad to go this route to lower the monthly payment with rates so low. However, many that are opting for ARMs right now are simply using it as a means to buy more house in San Diego county.

SDBroker, how could there be anything NOT bad about an IO loan that is building negative amortization at a time when interest rates have nowhere to go but up?

If these borrowers can’t afford the payments on a conventional loan now, how will they be able to cope with higher payments at higher interest on a higher balance a few years down the road?

How could these loans NOT blow up in their faces? How could IO lenders not just generating another wave of foreclosures and massive loan losses in another few years?

Had a lady at work who makes about 25% of what I make tell me that she was able to loan modify a townhome from $2,200/mo down to $1,500/mo (including taxes). Her husband is on short term disability and makes about $1,600/mo.

Last year she said she wasn’t able to refi because she was underwater, having purchased this 400k townhome during the bubble years. She also said, some months go by, and they sometimes rely on parents for monthly mortgage payments.

What the heck? Wish someone would give my mortgage a haircut like that.

Leave a Reply to DFresh