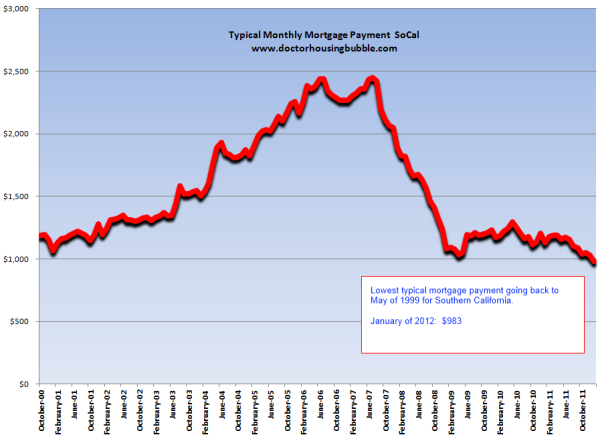

A $983 mortgage payment in Southern California is now typical? Buyers commit to lowest mortgage payment in January of 2012 since May of 1999. What does this say about the current makeup of real estate sales?

The appetite for more affordable homes in Southern California continues a trend from late 2011 into 2012. One of the more interesting aspects of the current housing market with so many investors buying cheap homes and a large number buying with FHA insured loans is the typical mortgage payment continues to be pushed lower. This week January 2012 data was released for Southern California home sales. The most interesting piece of information in the data was the typical amount people committed to paying for their mortgage last month. $983. That is right, the typical mortgage payment committed to was $983 last month for over 14,523 sales. We have to dig deeper into the data but this is another indicator that mid-tier and upper-tier cities have many challenges ahead given that current demand is on the lower-end right now.

The ever shrinking monthly mortgage payment

At the peak of the bubble in 2007 the typical mortgage payment committed to (not including insurance, taxes, etc) was $2,447 for SoCal. Today it is down to $983 for recent buyers (this amounts to a 59 percent drop). The monthly drop is probably a better indicator of what families can afford since lenders usually use debt-to-income (DTI) ratios that look at the monthly outlay for buying a home factoring income and other debts. This drop comes at a time when mortgage rates are at historical lows. Take a look at the typical mortgage payment data:

Besides going under $1,000 for the first time in the 2000s we are back to levels last seen in May of 1999. Of course many of you are asking where can I get a mortgage like that in mid-tier to upper-tier cities? Well obviously you cannot but this is a reflection of sales demand at the lower-end but also dropping prices in mid-tier areas. Some key points highlight this:

-A record 26.8 were absentee buyers in January of 2012

-31.4 percent of all purchases were all cash buyers paying a median $199,000

–FHA insured buyers were 31.2 percent of all sales

The overall trend is for lower home prices and this is merely a reflection of lower household incomes. Some people tend to think this is negative news. To the contrary, having home values more in line with household incomes will allow people to spend money on other discretionary items that actually make the economy go round and round. Housing is simply an idle asset class that typically tracks inflation over the long-term. The continuing fall in home prices is a reflection of what households can afford and that is why you now see the typical mortgage payment down to $983. This figure is largely driven by people purchasing homes at a lower prices in larger numbers.

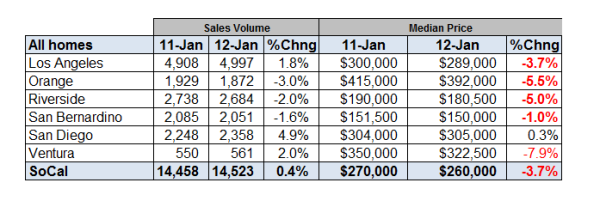

Every county last month saw year over year price declines:

Even the more expensive counties of Los Angeles and Orange saw prices move lower. The last time L.A. County was at this level you would need to go back to February of 2003. Orange County went under $400,000 for the first time since the markets were imploding back in Q1 of 2009.

The decline in higher priced areas and seeing these markets make post-bubble lows is really no surprise. What does seem surprising is lower priced markets like the Inland Empire continue to move lower. Riverside County is now down 5 percent from 2011 and San Bernardino fell 1 percent in the same timeframe. Ventura County saw the biggest year-over-year hit going down 7.9 percent.

Now run some hypothetical numbers. Say you bought a home in Ventura in January of 2011 for $350,000 with a 3.5 percent FHA insured loan:

January 2011 home purchase price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $350,000

FHA insured down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $12,250

Mortgage balance:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $337,750

Today the county has fallen overall by 7.9 percent:

Current home value in January of 2012: Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $322,350

Not only is the $12,250 down payment washed away, the home owner is now underwater by $15,400. This is nothing to sneeze at here. This one year rush to buy ended up taking out $27,000 and more given that the carrying cost of owning is higher than renting. Keep in mind sellers also pay the commission when selling a home ranging from 4 to 6 percent. Part of the drop in the higher priced counties has to do with more shadow inventory being leaked out. As a mortgage settlement is basically inked in, you can expect more properties coming online in 2012 at lower prices.

21.3 percent of all sales last month were short sales, a record number. What does a short sale require? A short sale requires a bank/lender to agree to a home sale price for less than the total mortgage balance. In other words, even those who own the note realize that housing is not going up in many markets. Foreclosure re-sales were 32.6 percent of the market so in total, 53.9 percent of all sales were from the distressed pipeline.

I am amazed how many people champion ridiculously high home prices with no rise in household income even though insane home prices with toxic mortgages were the reason for this economic crisis in the first place! Some of the most stable economic times in US history saw stable home values, rising household incomes, and moderate mortgage rates. What we had in the last decade was a massive bubble in home values, falling household incomes, and artificially low interest rates. If anything, this slow drop in home values is simply bringing us back to a more stable market. Of course, those in mid-tier to upper-tier markets still want to believe their home values are worth what they were back in 2007. Those that are now buying are not buying any of that.    Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

45 Responses to “A $983 mortgage payment in Southern California is now typical? Buyers commit to lowest mortgage payment in January of 2012 since May of 1999. What does this say about the current makeup of real estate sales?”

Houses in our area priced right are moving quickly. Prices are down on some homes, and others are still in the dream price point. A one-story pool home under $360K in our area (1,700+ sq ft) is finally getting more real. We’re a primary cash purchase. We’re just waiting for a “workable” home, and we’re in. We sold our former residence (regular sale) a long time ago, and have been waiting out a re-entry. We’ve been hunting for 2 years now. This is getting old. But at least the light is at the end of the tunnel. Some of the stuff we’re seeing now was $500K just two years ago. $360K is still too high, but time is clicking away. We’re getting old!

I can’t believe all these 20 somethings, not willing to live without a pool and spa. Who raised these people? I meet them house hunting all the time. I was just happy in my early 30’s to finally have a home. It was a new two-story 4+2 with a community pool. Growing up without, sure gives you some perspective.

Who raised these people (20 somethings)? Manhattan via Hollywood. Kids don’t see movies and TV as fantasy–they think that is how normal life should be and that they are entitled to it, so the most gullible, marketing-programmed-zombie generation ever is heading for disaster.

I heard about Europe going hat-in-hand to China for a bailout. Average Chinese makes a sixth of what a Greek makes and the citizens wonder why their money goes to bail out Europe???

As Ron Paul Said: ”Foreign aid is the act of taking money from poor people in a rich country and giving it to rich people in a poor country.”

Folks think Americans are entitled to live a high standard of living and not pay for it. That it is still working is the amazing part.

Who raised these people (20 somethings)? Manhattan via Hollywood. Kids don’t see movies and TV as fantasy–they think that is how normal life should be and that they are entitled to it, so the most gullible, marketing-programmed-zombie generation ever is heading for disaster.

I heard about Europe going hat-in-hand to China for a bailout. Average Chinese makes a sixth of what a Greek makes and the citizens wonder why their money goes to bail out Europe???

As Ron Paul Said: ”Foreign aid is the act of taking money from poor people in a rich country and giving it to rich people in a poor country.”

Folks think Americans are entitled to live a high standard of living and not pay for it. That it is still working is the amazing part.

I’m 27 and looking to buy a sfr in the South Bay area more specific in the Hawthorne, Lawndale, and Gardena area. I would be more than happy to purchase a home without a pool etc. With putting 20% down my max budget is around $325k which is what I got pre-qualified for. I agree that some of these people are very unrealistic with the prices I have seen some of the homes listed for.

MA Heck

I am 41 , married and one daughter and a dog and has been renting ..never bought a home with kool-aid drinkers in mid 2000s. I am still waiting for the prices to come back to normal..Its around the 2003 prices in SO CA where we are looking..we have waited so long we dont mind waiting more…wife is understanding but I despise the banksters and fraudsters for stealing away my 30s when we could have lived in a nice affordable home.

M Nair

I hear ya on robbing those years away. We live in the east Ventura County area (Thousand Oaks/Simi Valley/Westlake Village) and while the party was raging, we’ve been suck in an apt. with everything in storage. Who knew how long this insane bubble would rage on. It blows our mind. We’re older than you guys, and those are years we’ll never get back. I hear ya loud and clear.You and I have had our memories stolen.

Houses listing at $360K were sold for $275K in 2002. I looked it up in county records as we’ve passed on homes for all pool/no yard left. We want a dog, so we need a little dog roaming room

I love this website. There are lots of very rational people with excellent analysis of this crazy market.

Mad As Heck and John Doe, we’re in a similar boat as you guys. Have a kid, another one on the way. Renting since 2002 (sold our house in Northern CA and moved to Ventura county for a job). Both of us have good jobs, no debt, excellent credit scores and reasonable family income. We have more than sufficient down-payment but we’re going to wait another 4 or 5 years to buy and sock away the money in the meantime. We looked at buying vs renting and the former still doesn’t make sense. Some observations locally:

Renting:

We’ve been looking for a slightly larger rental. This sounds crazy but rents have gone up a lot (20%-30% since ’07 when we last looked for a rental) in Eastern Ventura county, especially Thousand Oaks, Westlake, Oak Park, Newbury Park, etc. Many places are renting out pretty fast, even at inflated prices. On the plus side, rents seem to coming down just a bit in February. Perhaps this trend will continue into the summer.

Buying:

Strangely, there are lots and lots of properties on both Redfin and Zillow that have been marked “Sold” in Nov/Dec/Jan/Feb. Most of them seem to be around $500K-$1.5M (about 30%-50% lower than at the peak of the bubble, but still high). I wonder if the agents/banks are playing games or if there has been an uptick in sales in Eastern Ventura county lately?

Any comments from residents in the area regarding rent and recent sales? Anyone else notice the high rents and high sales prices recently?

Your post could have been mine. Same exact situation but with a second child on the way. In my mind, flexibility to chase great job to other regions when my contract at work expires (if necessary) reigns supreme over all other factors. That being said, even renting a house in a nice area in LA is hardly affordable. Looking at finding a bigger place and pretty discouraged by what’s out there for the money. I am addicted to this blog and have major respect for all the candid and intelligent analytical posters found here.

Patiently Waiting and Waiting

Boy can we relate. We sold a oversized McMansion in Wood Ranch (built in fridge, fireplace in master w/ fr drs to deck overlooking T.O.- I mean stunning 4,000 sq ft) and wanted to downsize to a “toe tag” one-story paying cash around these woods, and have been stuck in a housing hell. There are a lot of FHA loan types squeezing into homes, which blows it for us $, no debt, FICO’s 800+ types. Get this, one REO we put an offer in on, wanted our FICO’s for a cash & close. We backed out due to yard noise, etc…, but the chutzpah of those sob’s. We had to show reserves, etc… I might assume it’s due to property tax rolls shrinking. CYA type thing.

I think realturds are still stretching idiots into homes still, and the idiots aren’t letting homes have price reductions. I am watching/seeing a pattern in the homes we’re targeting.

All I know is, homes that should be $60K-$100K less are being sold way beyond their value. Hell, most of these buyers are so stupid, they don’t realize the pool waterfall is on to mask street noise, and tell me I’m smart for getting it turned off.

I am frustrated and pissed off that these stupid buyers believe their nefarious realturds, that this is the bottom. What uneducated, no common sense, due diligence morons. OK, rant off. (I’m a lady, or I’d say more….)

BTW, the illegals are a growing demographics around here. We’re seeing the pattern we moved away from in 1984 in the San Fernando Valley. Bad omen!

M Nair, no despare, at least you were smart enought not to let them steal your money,

M. Nair,

Do not despair. I bought my first house in my mid-40s because of this bankster scam.

Got a nice house in the midwest at about 30% off the peak price of 2006. Though we have a mortgage I love the fact that I can sell this anytime and will be free from

the banksters. So hang in there. You are prudent. Your daughter will not wait tables when she goes to a college of her choice. You will easily pay the tuition just on what you save. In a land of fools the wise man looks like an idiot!

Beware of next bubble = student loans and fresh newly minted bubble being blown in the last year or so i.e. new car loans for everyone.

Good luck. Hang in there and cheer up. You do not have a bankster’s vise around your neck. This itself is an achievement in today’s world.

I recently lost a good long term tenant to a low mortgage payment. They bought a very similar house just a few miles down the road. According to Zillow (he gave me his forwarding address for me to return the deposit) his payment will be $1100 PITI, he was paying me $1800. This assumed that he had a 20% down payment.

I have no crystal ball, but i predict youll have to drop your rent soon….

Yup. That’s what investors should be considering before buying a rental property. The numbers may work at current rent levels. But what if you have to lower the rent? And as home prices keep falling, rents will have to become more attractive or renters will just buy a place.

As the empty units in shadow inventory re-enter the market either as owner occupied homes or rental units, there will be downward pressure on rents and competition for tenants. This is already happening in Vegas as DHB wrote about a few articles ago.

My landlord tried to raise my rent to $2000 a month which was a less than my last mortgage that I got rid of via short sale (my old house is now worth $230K, paid $500). I decided not to renew my lease and moved now pay $300 less than that. My landlord is now trying to rent the place for $2100. If someone is that silly to pay that good for them. From what I have seen the rents are getting lower. This is in the Toluca Lake area.

$1100 for payment, interest, taxes and insurance? That’s pretty cheap. The mortgage experts do this better than I but maybe a $190,000 house with $2000 in yearly taxes and a $450 insurance payment and you need to set aside (also) say $100 a month for maintenance. With a 4% loan on a 30 year amortization, I come up with $725 a month plus the $100 for maintenance, $166 for taxes and $37.50 for insurance ends up with $1030, or $70 shy of the number.

We still haven’t figured out the lost (invested) down payment of $38,000 (20% , right?) and the interest return on that (OK, only $100 a year at today’s meager rates)

Were you able to rent a $190K house for $1800 a month? Pretty impressive. I think probably your rate will need to fade a bit.

I suspect our newly minted house owners were unlikely to be paying $1100 for payment, taxes, interest, insurance and maintenance, but more likely for the payment and interest. An $1100 house payment may be less than $1800 rent, but much closer than you might think and the down payment is tied up and at the risk of a loss of value with a market drop and the mobility of our starry eyed couple has fallen too.

I think we have all drunk the Kool Aid on owning our own house (me too) but the numbers rarely pencil out as well as the realtards makes it look.

IN CASE MY OTHER POST GOT LOST….

M Nair

Boy, can I relate. We sold and are living in an apt with everything in storage. All those years are gone, and all those memories can’t be replaced.

We live in the So Ca east Ventura County (Thousand Oaks/Westlake/Simi Valley) area, and the homes that are now $360K, were $275K in 2002. I looked it up in the county records, as we’ve turned down a purchase or two for various caveats with the homes. Back then, jobs were more plentiful and they paid more. We are just blown away with how drawn out this nightmare has gone on. You and your wife aren’t alone.

Your articles are all good Dr. HB. Appreciate the insight and info. It has enlightened me. I know you mostly concentrate on SoCal, it would be nice to see your insight on the Santa Barbara county area sometime. I just had my house appraised in Goleta for $480k. At the peak of the market, these Goleta track houses were selling like hot cakes for $900k. Amazing.

In my Goleta neighborhood houses were going for 900k-1m at the peak around 2006. The price level has very slwoly deflated down to 600-700k but very little for sale now. Lots of retired people and others who bought in decades ago before it was exorbitant, and I guess they are waiting out the market thinking it will rise again. Still too rich for my blood.

Great post, as always.

One important point to add… There is a 1% upfront mortgage insurance premium on FHA loans that is almost always rolled into the loan. (IE: they buyer does not elect to pay it upfront, but instead elects for it to be rolled into their loan amount)

So if an FHA buyer puts 3.5% down (96.5% LTV) and then the 1% upfront mortgage insurance premium is rolled into the loan, their LTV actually ends up being 97.5%, so their negative equity position would be even more pronounced than your example.

Keep up the excellent work.

My hat is off to you, doctor housing bubble. I’ve been reading this blog 4-ever, and you still seem to find new angles at which to view this monumental collapse.

Along a similar angle as your current ‘shrinking payment committed to’ angle, you might want to look at ‘length of mortgage committed to’. I’m guessing that a lot of folks will be going the 15 year mortgage route. Also, I just saw an offer for a 20 year refinance option.

So we’ve got lower house prices, lower interest rates, and possibly shorter terms. How can the banks make any money? I know, I know, they can count on their crony capitalist ‘chief’ to print them some money, but I was asking about earning ‘honest’ money, lol.

We have been trying to get a loan mod since 2010. We’ve been turned down three times. We are now in our fourth attempt. The sad thing is even if we get one, our payment will still probably be too high. Plus, we just have a hard time paying over $2,000 a month when both houses on either side of us (larger than our house) short saled for less than what we owe on our house. At this point, we are thinking of doing a short sale and just getting out and renting. This article only reinforces that thought. We would have to wait 10-15 years at this rate to make any kind of a profit from saleing our house conventionally. And even then, we may only break even. What a waste!

BJ: Walk-Away…let me re-phrase that, RUN Away! buy your neighbros house for less= YOU WIN!!

If you can pay your mortgage, why are you thinking of bailing? If in 7 years, your house is above water, I am sure you would like to keep the profit when you sell. Isn’t it a bit childish to only want it one way?

I’m in the same boat as some of the above posters. I’ve been a renter for life, even as a child. I now have two young children and am hoping someone comes to their senses in the South Bay sometime before my kids grow up. I didn’t buy into the BS either, it didn’t make any sense to me how people could buy 700K homes on 100K/yr. I’ve never paid my rent late, ever, I just want a place to call my own, not an investment, not looking to flip, looking to stay put for once and be allowed to upgrade and paint the walls. Sigh. But I love everything else about this area, so I guess I’ll just keep renting!

I grew up in the South Bay – it’s gotten ridiculously gentrified over the past 15 years. Used to be a good mix of working/middle class people, now you seem to have to be a millionaire to live there. It bums me out because I always hoped I’d be able to move back some day – and I’m a degreed professional with a decent job! I can’t even justify paying the high rents there in order to move back. Maybe you never actually ‘own’ a property as one poster commented, but rentals are SO crappy in Los Angeles unless you want to pay half your salary for rent. I’d rather pay for a sh*tty condo mortgage & HOA than live in a beige-carpeted done-on-the-cheap apartment. That being said, I don’t want to overpay for said sh*tty condo either. I’m going to be 40 this year and it is dawning on me how I’ve lost out on a decade of potential investment/equity because of this whole bubble nonsense. At least I knew better than to pay those inflated prices.

Candace,

Do not think of a place of your own. In today’s world what matters is flexibility to move to where the income is. People have this ridiculous notion that you own

property. Even if you pay cash your local taxing authority can take your house

away if you do not pay taxes. So income rules supreme not buying a house.

You are wise like Nair. Stay that away.

There is no such thing as owning. You are always renting from the taxing

authority. Enjoy your freedom to move.

Good luck!

Thanks for your comments. Feel good reading them 🙂

Nair, and all of you guys/gals-

Nair- Glad to know we cheered you up. No, you’re not insane, you’re feeling what most of us are. We are the victims, screwed by this mess. To heck with all the a-holes gaming the system, and living in their over leveraged homes/lives for free. (Just pisses me off.)

And to our host, and all you great posters, thank you for a place to learn, share, and vent. It’s tough to be growing older without a place to call home. The euphemism “apt home” /”rental home” doesn’t work on us. I miss creating memories in a real home. But soon…

The one pattern I am noticing is REO’s that are new listings in my area, are priced $80K-$100K below what the regular sale comps are in some areas. I like that pattern. Screw the sellers putting a premium on their home for not being a short sale. They can go t0 h@ll.

Who says you can’t create memories in a rental? Don’t let consumer culture brainwash you. Life is what you make it! Brush up on your George Carlin.

I agree with Lora Lei. We have been renting for many years and have many fond memories in our rental home. Life is what you make of it. It also goes by too fast. Enjoy the time, especially with your kids, as it goes by too fast. Go outside and hike/bike/whatever. Smile and enjoy the fact that you have a reasonable savings account and no debt. There’s too much stress in our lives, no need to create more 🙂

Hi Loralei

Big Carlin fan here. What a bright wise mensch. that guy was! We’re renting, and have all our belongings in storage. My perspective is different. Neither good or bad, just different. We have owned homes for 23 years of our lives. It is different. Although you’re right, too. And of course, paying for it 100% with a wire transfer means we’re not “renting from the bank” either. Like I said, different perspective.

Can’t wait to not have a LL or HOA. It sucks.

I can attest to the trouble that owning property can cause you. I have two houses that came from an inheritance. They are located near a small town in rural Oregon. I tried last year to sell them, and couldn’t. I had previously rented them out. One house that I own with my Brother who acted as agent, we rented to a guy with a family who was out of work and didn’t pay rent from May to September (when he left the place a mess).

The other house was rented by another amateur agent from the town (recommended by my Brother) to a couple of guys who used the large upstairs bedroom as a grow room, until one of them had a mental breakdown and was hauled off to a mental institution by the cops. The cleanup cost a bundle eating up all of the profits. We had both houses on the market from Spring to Fall (the selling season in that wet cold climate) without any interest at all. With my Brother leaving the state to find work, and Winter approaching and thousands in expenses to maintain them, we’re renting them out using a professional real estate agency in the County seat . One has been rented, but I think we’ll be in the red for a couple of months to pay for the cleanup and repairs. The other one is still empty. It is 1900 square ft on 2 acres and is listed at $925/ month with garbage service paid. Our experience with past tenants is if you don’t pay for the trash service, they dump everything on the back acreage, some of which belongs to one of America’s largest timber companies. Shades of Alice’s Restaurant!

I also own my own home in Orange County free and clear, so it’s just maintenance and taxes. I don’t have to deal with a Landlord, and the cost of taxes is predictable thanks to Prop 13. I’m 22 miles from work and 5 miles from my Daughter’s place so it is fairly convenient. I have a job that looks to be there for a few years. The corporate owners sent their Canadian employees out to our facility to see how we make more money for them with fewer people. Its a business that seems to do well in a recession, as we provide technical services to other companies so they won’t have to hire more people. Life here is pretty good. I just wish I could get the Oregon property rented or sold and not have to worry about it constantly.

One other thing regarding Dr Bubble’s topic of the lowered monthly payment. If a bond market bubble pop causes interest rates to rise rapidly without wage inflation, that will further hammer property prices. Lower prices with higher interest rates will keep the monthly payment constant with Dr B’s new reality. That might be a good time for cash buyers with the ability to sit tight to cherry pick desirable properties at the real bargain basement prices we haven’t seen yet.

Think of this: you still pay $500+$400 (tax+hoa) after paid off in socal, you never own anything

That is the truth! Stop paying those taxes and you’ll see who really owns your property.

Those of us who have owned for a longer time pay a lot less. Usually no HOA dues in older neighborhoods (but of course there’s maintenance). My $250/mo in taxes is more than a lot of my neighbors who’ve owned longer than me!

All renters must realize that taxes and maintenance are figured into your rent. Look on Craigslist to see what you might have to pay in rent. Like maybe $1600/mo (if you got lucky) or more out here in Orange. Prop 13 rigs it in favor of long-timers like me. Right now, I’d be crazy to sell and rent. Maybe if I’d done it in 2006, sure, but that’s water under the bridge. Besides, my dog likes the big back yard we have.

Joe

This may be impacting future home sales as well…

http://www.nytimes.com/2012/02/18/us/for-women-under-30-most-births-occur-outside-marriage.html?_r=1&scp=1&sq=child%20trends&st=cse

The common life path of the past usually included college and/or career, marriage, then off to the burbs once a baby was on the way to buy a tract house in a safe neighborhood with good schools. Now, many couples aren’t marrying; they have a kid or two together, maybe live together, maybe not…relationships are more transient, less financially and/or emotionally stable…unsure how this might impact home buying patterns.

We should call this the Maur-ification of America. “You are not the father!”

We finally get it after two solid years of house hunting in Los Angeles. Tha games and scams going on we will never buy into. The short sale sellers want you to bail them out then strip the place. The flippers want you to over pay so they can make a profit and not have to get a “real” job. There are no bargins in this city, especially where we live on the Westside. Like the stock market, if it does not make financial sense, why buy ? The worst thing to do is buy a house on emotion. The buyers now seem to be desperate, sorry for them. Most sellers are dreaming, and many now list the house low to get multiple offers, we run from those too. Very bad time for buyers and sellers…..

Some close friends of mine just gave up on renting on the Westside after 15 years of paying crazy amounts of rent and moved to Texas. I’m currently house-hunting up here in NorCal and I’ve noticed EXACTLY the same scenarios with the short sellers, and the flippers. There really aren’t bargains in the area we’re now looking to buy in either.

You know, I get it that they are underwater on their homes but these folks assume zero responsibility for their poor choice to buy when and where they did. I get it because I made a poor choice myself, but the lack of accountability is astounding! We bought in Fall 2008 and are currently underwater about 30K, after having the 100K we put as a down evaporate into thin air. We don’t want to sell at this point and will be renting out our home. Many other homes devalued about 50-60% , so it could be worse I suppose! Either way, you play and sometimes you pay.

Don’t get me started on the realtors – they are desperate and like vultures. They come knocking on my door with their f%$*ing pamphlets at least a couple times per month and leave crap on my porch almost daily, the delusional vultures.

I am confused doesn’t it make better sense to buy then to rent? My friends are planning to move to the central core of Los Angeles as gentrification, low crime, high gas prices, and demographics have change at the some suburbs have push some middle-income folks back to the downtown areas and away from the suburbs.

willneverbuyinLA & Joe,

I hear ya both. The burbs where we live (Thousand Oaks/Westlake Village/Simi Valley area) is getting the Van Nuys demographics, and reminds us of the pattern of the SFV in the early 80’s, when we came out here to escape the invasion. Now TO in areas looks like Van Nuys West! So, the burbs are changing too.

And of course, with gas prices in another mini-bubble, imho-been here before) moving closer in makes sense for many. Prices are still way out of line with incomes, the economy, and what these places are really worth.

We’re big subway fans, and use it to go into downtown Los Angeles, and the Congress For New Urbanism is trying to sell city living and so far, it’s waking people up. But the quality of life for families suffers in the city, imho. The city is great for child-frees and singles.

I think the westside is nosebleed expensive, and great areas surrounding L A, like Burbank, Glendale, Pasadena and Ventura County are just way overpriced. I wish buyers would just say no. But of course their realturds didn’t take all those sales psychology classes for nothing, and NAR has a great media and govt lobby. OK, rant off. Everyone has a great day. You’re not getting it back!

In a healthy market it is better to buy than rent. When a person buys at a young age they can have it paid off for retirement. I can’t imagine renting and paying those prices during retirement. I know there are places that give discounts to retirees but still1 My MIL is almost 70 and the house is paid off. All she pays is taxes and that is WAY less than any rent or senior discount rent.

Buying is also SUPPOSE to create stable families and communities. Flexibility is not good for families or communities. People staying put and families growing up in an area they are familiar with, staying in the same school, neighbors growing up together. This is a better environment. Flexibility is a modern lifestyle and ideals that I personally have little respect for. I find it self centered an “All About Me” attitude that is sadly growing in our young people.

My husband and I have two kids and hopefully another one on the way and we are in our late 30’s. We live in Ventura County. We plan to buy in the next couple years. We want to be able to have our home paid off by the time my husband retires. My husband is very secure in his job and so even though prices may not bottom out by the time we buy we think it is wise to buy. We are planning for the long haul so when we find a place that is right for us and we can have it paid off by retirement than it’s a green light for us!!

All of this is to say sometimes it’s not just about finances or the bottom of the market.

Can someone then explain to me why there are so many pending home sales in South Orange County. Everywhere I look, homes are sales pending and many are getting full asking price because there are so many buyers vying for individual homes. I am beginning to wonder if the realtards are correct. Maybe we are at the bottom.

Leave a Reply to M Nair