10 Significant Signs why this will be the worst Recession since World War II.

It is now official that the largest economies in the world are tipping into a synchronized recession. Japan and the Eurozone both are now in recessions. This is significant not only because these industrialized zones make up a large portion of the world’s GDP but they signify that systemically we are grouped together in the same boat. It is rather apparent that the U.S. economy is now in a full-blown recession. Citigroup today announced that it will be cutting more than 50,000 of its workforce, the second biggest job cut announcement in history. The only larger job cut announcement in history came from IBM in 1993 with a total of 60,000 employees.

The question now becomes how severe will this recession be? I will venture and say that this will be the worst recession we have seen since World War II. Why? Let me give you 10 clear reasons for this assessment:

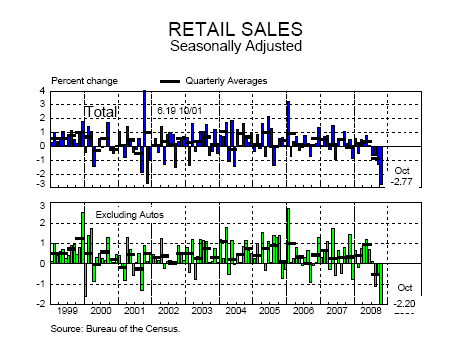

Significant Sign #1 – Retail Sales

Retail sales fell by 2.8% last month following a huge decline in auto sales. This was the largest decline since the index began in 1992. The previous record was a 2.65% drop that occurred in November 2001 right after the 9/11 attacks. This was a significant decline right before the crucial holiday season. Credit could not be frozen at a more imperfect time when many retailers make a large portion of their money during the November and December holiday seasons. With 71% of our GDP based on consumption, a 2.8% decline in consumption should cause us pause. No significant outside event such as the attacks in 9/11 caused this precipitous drop.

It wasn’t only this one month. This ugly report caps off four consecutive months of progressively bad reports. The big drop was caused by the automotive industry, which leads us to the second point.

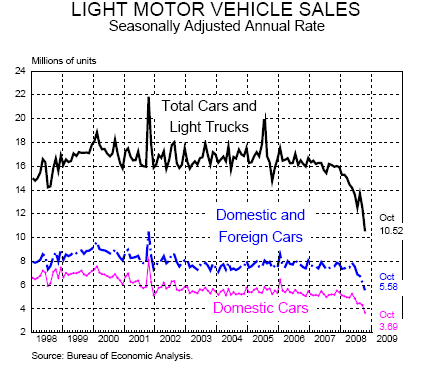

Significant Sign #2 – Light Motor Vehicle Sales

Auto sales posted the worst performance since World War II. Contrary to the notion that only big trucks are feeling the pain, all sectors of the automotive sector are seeing major drops in sales. And this isn’t with lack of help from collapsing fuel prices. Oil per barrel settled at $55 which you would instinctively think would be fantastic for automotive sales. That is not the case. Auto sales are falling because people are unable to spend money they do not have. The credit for financing cars is tight.

There is also a psychological component that people that feel threatened regarding their job security are not going to be in a spending mood. An auto purchase is normally the biggest consumption item purchase many will make only behind a home sale. Plus, the flip side of advances in automotive technology and efficiency make cars last a much longer time. The demand for quality and style has produced fuel efficient cars that can last you many years with basic service. When money is tight, people may start thinking, “you know what, I’m going to hold off on buying that newer model.”

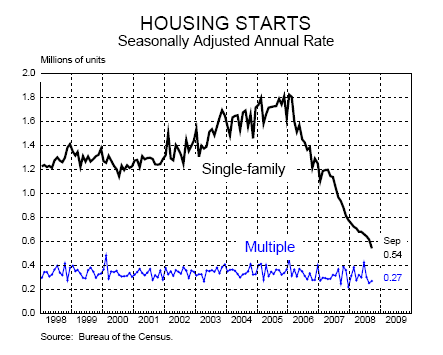

Significant Sign #3 – Housing Starts

Housing starts are an excellent leading indicator to keep your eye on to see when a bottom in housing is nearing. Why? These are builders and investors who have to stake their money in the market to build homes and bring them to market. The above chart clearly depicts that housing starts have fallen off a cliff. We are nowhere near a bottom. The market has too much inventory that needs to work through. In addition, we have at least for 1 or 2 years a steady stream of inventory coming form the worst place. Foreclosures. This almost guarantees that inventory will be high for the foreseeable future.

Until we see a sustained surge in housing starts, we can safely assume that there is no bottom in the housing market. And until foreclosures stop coming online at incredible numbers, we can also assume that inventory will continue to be high for the next few years.

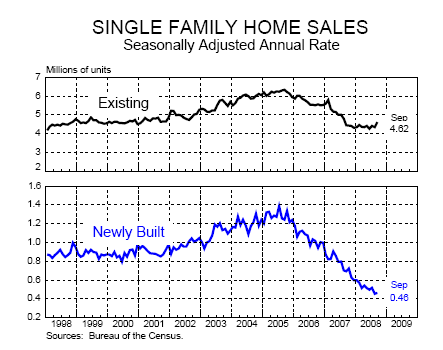

Significant Sign #4 – Single Family Home Sales

New home sales have tanked. The above chart clearly shows that. This goes in line with the housing starts chart. Existing homes have held up a little better but again many sales are simply foreclosure resales. Last month in California 50% of all homes sold were previous foreclosures. There is no distinguishing between the healthy market and the distressed market.

The newly built chart is another indicator to keep your eye on for a bottom. Clearly we are nowhere close to a bottom. The foreclosures that we will be dealing with will probably continue to make the existing sales chart fluctuate within a tighter range while the new home number continues to fall.

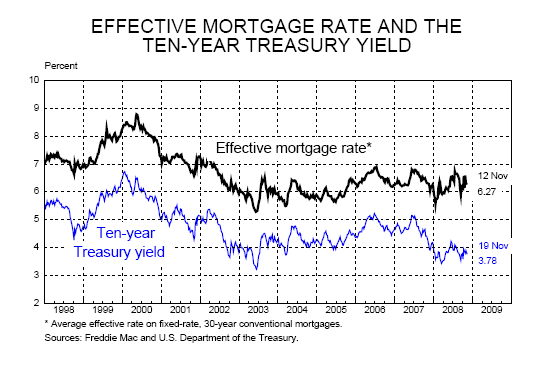

Significant Sign #5 – Mortgage Rates Stuck

All those rate cuts and mortgage rates are still higher than early 2003 when the bubble was gaining massive acceleration. We are now back to the 1% range where Alan Greenspan led us shortly after 9/11 but this time, the ammunition of rate cuts has lost any power. As you can see from the above chart we are solidly over 6% and now that people actually have to document their income, there is a relatively small number of qualified buyers for the massive amount of inventory.

You need to also remember that those low 1% rates led to the toxic mortgage business fueled by Wall Street demand. Even though 30 year fixed rates dropped to astonishingly low rates people didn’t prudently take fixed mortgages but elected to go with adjustable rate mortgages such as pay option ARMs or interest only loans. The menu was plentiful especially since documenting your income was voluntary.

Now, you have to document and go with a 30 year fixed and guess what? Not many people qualify for a mortgage even at historically decent rates. The reason rates are not moving lower is the inherent risk in the system. They can cut rates to 0% but it will not do much in this regard to help mortgage rates. People are maxed out.

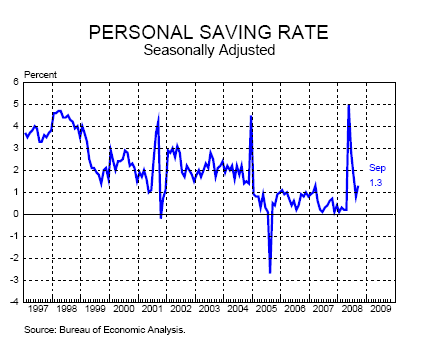

Significant Sign #6 – Personal Savings Rate Down

The above chart is interesting. You’ll notice the quick spike this year. You may be thinking, “this is great, at least people started saving.” Not exactly. The quick spike which is pretty much already gone is in effect people yanking money out of more risky investments and parking them in savings accounts for a short time. Now, those savings are being plowed through. This wasn’t “organic” savings in that people were saving excess money. This was saving because people needed quick access to cash which they are already blowing through.

This is also seen in data of 401k redemptions. Even last year, people started cashing in some of their 401ks because they needed money. That in hindsight may have been a smart move given the horrid market performance. But the savings rate of Americans has been abysmal for the last few decades. We actually went into a negatives savings rate which is an amazing accomplishment. You can expect this number to go down as the economic storm quickly depletes these emergency funds. Then slowly you will see it go up as people actually have to save to purchase consumption items.

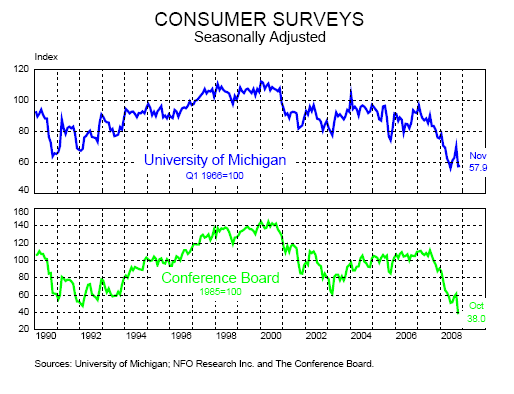

Significant Sign #7 – Consumer Confidence Record Low

Consumer confidence hit a record low last month. This isn’t your run of the mill recession. This is a completely different beast. Consumers are not going to spend if they do not feel confident in their jobs or with the economy. They won’t buy a home if they fear they will lose their job or have their incomes slashed. They will not buy a car if they are anxious about the future.

It becomes a self-fulfilling prophecy. This also fueled the bubble in the first place. A mass movement engulfed everyone believing that real estate never goes down. If everyone believes, then yes it will go up for the near term. But it doesn’t mean it makes sense. On the downside when bubbles burst, the negativity actually will get worse then the actual economic numbers. Unfortunately, the numbers are currently horrific so what is occurring is simply the consumer reflecting the actual reality of the situation.

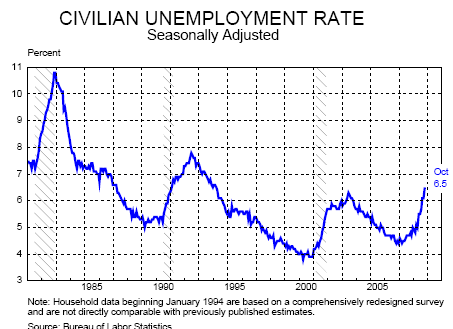

Significant Sign #8 – Unemployment

The unemployment rate is at its highest point in over a decade. The trend is unrelenting. It is hard to be consuming when you have no money to go out and consume. It is hard to buy a new car when you are unemployed. People who fear layoffs are not going to plunk down hundreds of thousands of dollars to purchase a home. It becomes a vicious feedback loop. The number of mass layoffs is growing each month. Companies are slashing and burning trying to stay afloat. This does not help the economy.

At a certain level employment is the most important factor. It is safe to say that unemployment will go over 8% and probably higher before we actually hit a bottom. In previous cycles, unemployment peaks 2 years after the recession officially begins. If that is the case, we can expect to see peak unemployment in 2010. Certainly a long time away given how things are.

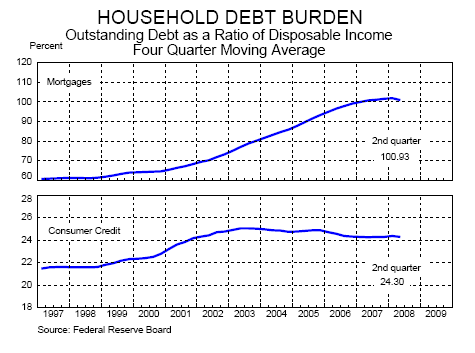

Significant Sign #9 – Household Debt Burden

Consumer debt and mortgage debt is crushing the household balance sheet. With stagnant wages and jobs at risk, this will only get worse in the near future. This is simply the logical extension of spending more than you actually make. Once the fortunes reverse, it only takes one or two paychecks to send many families off the edge.

In addition, with debt service consuming more of a household’s disposable income, there is less money to spend. When housing was rising, it was easy to tap the mortgage equity line and use that money to spend. It almost felt as if the home was a second ATM machine except with no limits. With home prices crashing, that well is dry. Plunking down all the money on credit cards is now ending. Many companies are pulling back credit lines at a time when most consumers will need that money. From a business stand point this makes absolute sense but from a main street perspective, this is another nail in the consumption coffin.

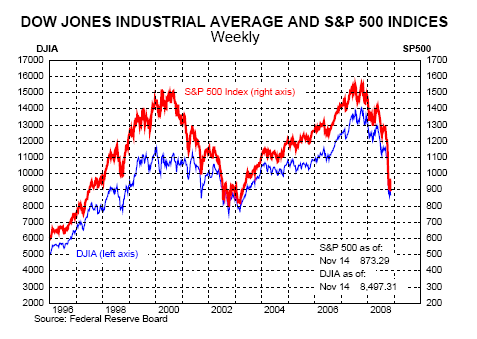

Significant Sign #10 – Crashing Stock Market

And finally, all this is reflected in a crashing stock market. Stock markets are usually the first to predict impending collapse but I would say by this housing and credit led bubble, the first sign would have come from housing starts. They peaked in late 2005 and have fallen ever since. The stock market peaked in August of 2007. Not really a good indicator of what was to come.

The Dow is now down 41 percent from that peak and the S & P 500 is down 45 percent. These are significant drops. We are approaching a 50 percent decline in slightly over one year. This is a crash. And the United States is not the only one facing destructive market declines. Japan, England, Germany, Brazil, China, Russia, Mexico, Canada, and practically every other market has seen similar if not worse declines.

This last year has seen the largest amount of wealth evaporate in the history of humankind. These signs are not pointing to a minor recession. This is a significant worldwide recession.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

45 Responses to “10 Significant Signs why this will be the worst Recession since World War II.”

Will the dollar crash? What do you think? Is hyperinflation possible here? I asked this question before and didn’t really get an answer. Peter Schiff scares the hell out of me!

Speaking of layoffs, my dad works for USPS and the 40,000 layoffs originally planned have now been doubled and when it’s all over there could be 150,000 laid off.

Are you sure that the spike in savings in 2008 isn’t the stimulus checks getting put into savings?

I consistently save for my daughter’s education in a traditional savings account, but I put the entire stimulus check into her account (since we stole it from her after all).

If a lot of people did that, it would explain the pop.

In America, you are worth what you OWE but in Mexico (and most other parts of the world) you are worth what you OWN.

Doctor.do you think my city (Whittier, CA) will allow me to OWN some chickens, a goat for milk, and maybe a horse for transportation?

When was the last time you gringos milked a cow? I ask because the situation might lead to this…

Lastly, my friend has a 5 year old, and we were sitting around talking watching TV. His daughter came up to us and told us that we needed to go the the store and “get some milk” my friend told her “No babe not now, I have no money” The brat said, “just get some money from the ATM”. I pointed out to my friend, that his kid needed to understand where stuff comes from. So he explained to her that eggs come from a chicken butt and that milk comes from the breast of a cow and that money does not just appear at the ATM. The 5 y.o. started to cry…

She cried differently though, not like when kids hurt themselves or fall off the porch or something. No she cried, with more emotion, with more deeply rooted sighs because he tapped into an area deep down inside where most of us never want to think about…

Stop crying…

Mucho love.

Real home of genius (NJ):

http://www.trulia.com/foreclosure/2002247346–Magnolia-Ave-Sea-Girt-NJ-08750

Listed at $1.5M earlier this year…in foreclosure for $500K.

40%+ of home sales each and every year for the past 5 years running.

Hey Eric, my sister in law works in the USPS here in central coast Califorina and she said the original layoffs planned for anyone with less than 6 years employment were cancelled and there will be no layoffs?? When did you hear about 150k layoffs? is that only in Nevada?

Speaking of layoffs, my dad works for USPS and the 40,000 layoffs originally planned have now been doubled and when it’s all over there could be 150,000 laid off.

Eric are you sure about his? my sister in law works in California USPS and she said the supervisor had said originally they would layoff all employees with less than 6 years employment there but a week later my friend said there would be no layoffs. are the layoffs you speak of only for Nevada?

Number 11 – An uneducated public.

Number 12 – A manufacturing base – destroyed.

Number 13 – A Congress that looks more like a “clown car”

I could go on….

Jeebus,

The nutters are out in force now. Better get your guns and gold. Pray to your false god of security.

Americans will never go back to milking cows, you dumb hicks. We have machines that do a better job for about $.50 an hour. You wanna work for $.50 and hour? How will you pay for gas to get to work? Hint: the apocalypse is not coming and the only way to win right now is to start buying solid assets that produce tangible income… it’s called investing and it’s a great time to be buying some assets (not houses).

Chuck Ponzi

Dr. HB: I tried to use the twit this feature for this, and it didn’t work. I really wanted to twitter it. Can you look into why it’s not working? And as an aside, the redit feature doesn’t seem to work either.

I don’t see the line being drawn between recession and depression here? Just as people went to the extreme of buying more than they could afford, I suspect that they will swing hard to the other extreme. That seems to be the trend in our culture, we never stay in the center of reason or balance for very long.

a bit off topic-

“His daughter came up to us and told us that we needed to go the the store and “get some milk†“The brat said,”

Milk is a basic and essential food item that you should always have in the house, especially if you have a small child. The child didn’t ask for candy, and they are not a “brat” if the parent has also failed to explain basic monetary issues. My jaw dropped when I read that bit.

In response to his questions- Yes you can own livestock. I don’t see people owning or milking cows for several reasons though, namely because it would be impractical if you are starving. I see more people growing vegetables and owning henhouses though.

ok…gold/guns/gin/girls. that’s your 2009 commodity index values.

well, it’s all anyone will barter for in the Obama economy to come.

yes, he bought it…now he owns it.

just like the old joke about a bald man’s toupee:

“is this MY hair? it sure is. i bought it. it’s mine.”

I own a small farm in the Central Texas area close to Austin(1hour drive) and not too terribly far from Dallas(2hour drive).. I’ve already seen a decent profit from my egg and lamb sales, I expect to diversify into pork and rabbit soon. The other side of my plan for the future is a web production company I started after plunking down $2700 for CS3 master collection and about $2000 in instructional costs.. It all boils down to sustainability, and most people only think they have that.. For example, the farms diesel supply comes from a algae photoreactor in a nitrogen free enviroment, the water supply is a deep well whose electric water pump is powered by a Bergy windmill, with the excess power operating the algae system. A 30kw generator is set up to power the farm, and as soon as it goes online I intend to run the captured CO2 into the algae system.

the situation is so deflationary right now, that the only way out will most likely be a contrived hyperinflationary solution. the gov’t of the us is broke. the only bullet left in the gun is “quantative easing”, in laymen’s terms, printing money like crazy, that or the continued borrowing from the asian, and middle east countries. i’m not sure that the second solution will be viable much longer. so in a sense creating ten’s of trillions of greenbacks with a few keystrokes is the plan. when this happens the dollar collapses in value, everything costs much more, pensions, and 401ks loose much of their value. recall that a dollar bill is a note, an obligation to someone. that means that all of those trillions of dollars will increase out debt service. very soon the taxes collected will struggle to cover debt service on all of those treasuries, the military, and the entitlement program. no other programs. which means that we either borrow, or print more money or collapse as a country. move over third world, that might be an insult to some third world countries, because some of them have better infrastuctures.

Livestock? I doubt it. We’ve really come to value appearances over frugality, in this country. A lot of homeowners’ associations won’t even let you put up a clothesline because they think it looks “lower class.”

Sacred Indio: you made a little girl cry and are proud of it? Nice. Real nice.

I would never milk a cow for survival. I would just drink water.

“We have machines that do a better job for about $.50 an hour.”

Those machines require expensive oil, oil that WILL become less and less affordable.

Nice try. Thanks for playing 🙂

Interesting that when I went beyond Depression right to another Dark Ages as our potential state of affairs, no one rebuffed that as rediculous. If you don’t think it is possible, you might need to review history. The collapse of Rome left the world in constant state of war and subsistent survival for most, and we are Rome of the 20th century, and the collapse of Rome in the 21st.

Consider that since WWII, no two significant states have been in conflict except through third parties (Korea, Veitnam, Afghanistan). If push comes to shove, things could get ugly (http://endofworld.net/ funny, but who knows) even so, in the Depression, bankers, industrialists, and the Fed all intervened and could only create bear-market rallies. The economy truly did not recover until the war, which started us on this debt-death spiral…No way the Big Three survive this. It’s just getting started and their already in intensive care. Vista is a disaster. Mac’s about outta gas. The collapse of oil prices is destroying all the alternative energy initiatives. The Mob’s been playing with the house’s money and now the house is broke. Please, somebody tell me I’m wrong and everything will be just fine in six months…how?

@ Ponzi – I’m an Indio NOT a Hick. And, “to win right now is to start buying solid assets that produce tangible income” i.e. chickens, a goat, and a horse… no?

In my country we have a saying “trabaja y deja trabajar” (work and allow me to work) To think that some HOA, or our government landuse policies will impede me from making a living is ridiculous…If I have no job. why will they not allow to make a living?

@Everyone: I thinking my reaction was harsh to the little girl but we were trying to make her understand better about our world. My point is that we need to explore the possiblities that things can/might/will get very bad and to think otherwise is delusional.

Lastly, I share a video that made me laugh. It’s about the state of the job market.

http://www.youtube.com/watch?v=3XGJq8wrw5I

Mucho love,

Great data, but how can you claim “the worst recession since World War II” when none of your charts goes back beyond 1980?? Most of them don’t even go back beyond 1995!!

Just wanted to point out that the spike earlier this year in the personal saving rate was due to the economic “stimulus” package. The portion of those IRS rebate checks not spent immediately after receipt were treated as savings by government statisticians.

I can understand Indio’s frustrations with a five-year-old who makes demands that money or things magically appear at whim. The definition of “brat” is a spoiled, demanding, or troublesome child. I don’t see why anyone finds that such a frightening or offensive term, given the number of these running around.

~

For such children to be informed there is no magic of that sort is at surely odds with the more fashionable/upscale rainbow-farting-unicorn type of parenting, that systematically turns small humans into Whim Addicts and Entitlement Mongers.

~

But somehow I think that kid will get over her tears at Indio’s response, and be the better for knowing that the real kinds of magic don’t reside in easy money. There are much worse kinds of tears to cry. Like when the kid doesn’t learn that lesson about money till much later in life.

~

I share Indio’s frustration that during the bubble run up, local policies were established that reflect a brattish/spoiled/entitlement-minded/consumerist kind of life. In many housing developments you cannot hang your laundry outside to dry; to live there you have to use a dryer and buy energy to do what the sun and breezes would for free. You can’t keep a flock of setting hens, though you can keep any number of large pooping slavering hounds. You can’t replant the HOA-dictated “landscaping” to food plants, even if you hire a tony sustainable gardener with a master’s in upscale landscape design using food plants. You can’t retrofit your house with solar panels–the HOA will make you take them down.

~

And so on. People might have very good responses to the current financial crisis…but the specter of upscale gourmet designer luxe-uber-alles will smack them down. Developers are given more land than community gardeners in areas that run on money and greed, even where the developers may be costing the community more in the long run. All that’s seen to matter is money, in the short term.

~

I also saw Indio (scared or sacred) reflecting on how deeply this luxury/consumer/spendy culture and mentality run in our nation: even five-year-olds have it. And sob piteously when told “NO.”

~

The difference between the five-year-old brat and the (presumably) adult ones posting nasty feelings on DHB’s comments is that the five-year-old will sob, but learn. The adults will suppress the sob and look for others to lash out at.

~

Doc puts so much effort, energy, thought, work, care into his postings…and here people are, bickering, name-calling, posturing, being thoughtless. Please let’s do better to honor his gift to all of us. Those of you with Divisive Personality Disorder–surely there must be some other place you can take it.

~

Nouri Roubini has an interview with Bloomberg today in which he asserts the current recession will be the worst in 50 years.

http://www.rgemonitor.com/roubini-monitor/254478/roubini_says_us_recession_to_be_worst_in_50_years_video

~

rose

“The bank is something more than men, I tell you. It’s the monster. Men made it, but they can’t control it.” Grapes of Wrath

Excellent message Rose. The bickering reveals that folks still don’t appreciate the severity of the situation and might assume things will be back to normal by next spring.

Dow lost support at 8000 today. If it doesn’t recover tomorrow that is a frightening thought. That might indicate total capitulation. S&P is clinging to 800. Considering inflation over the last 10 years, these prices are astonishingly dire.

Will the dollar crash?

Does it really matter all that much if the dollar drops 90% over a year or over 10 years?

Just remember it’s dropped by a factor of about 100 already…

I think the outraged response to Indio’s post is that people think the adults were threatening the kid with hunger, as food is a basic need and kids are dependent on thier parents for their basic needs etc.. Of course this being America there was probably plenty more food in the refrigerator that isn’t milk that the kid could eat. So it’s not like the kid would go hungry they can just eat something else. This being America most of that food is probably way less healthy than the milk but that’s neither here nor there.

That IBM thing was probably a delayed reaction to the .com bubble bust i guess.

With unprecedented indicaters like this makes you wonder how bad and how long this second “Great Depression” will last.

I agree with whats mentioned above about it being worst since WWII

Governments have lived off the credit for far too long, and now its catching up with them

The idea of the modern world turning on us and forcibly transporting us all to 1880 conditions is just far too much for most of us to swallow. The REALLY bad news is that if you haven’t swallowed the red pill of reality at least over a year ago, it is probably far too late for you to save yourself… Even so, most of you reading this have at BEST a 50% chance of living to see the year 2019.. Think about it. think of all you take for granted. Common injuries will have a good chance of killing you, simple and just annoying ailments today may very well have over 90% mortality rates within just 2 years, life expectancy WILL plummet, and everybody over 45 will be considered long-lived, any child that makes it to 13 will be considered VERY lucky. How many of you know how to preserve and store your own food without refrigeration? How many of you know the basics of animal husbandry? Basic livestock management? Can you even butcher your own chicken? Think you will be the only hungry person… with a gun? Could you shoot one of the neighborhood kids in the back if they were running off with your food? What if them getting away means you would have to watch your kids starve? You all seem quite amused to just bat around these times that are about to befall us as if were some silly mad max movie you can just walk away from when the credits roll two hours after it started… I’m not much of a religious man, but I’ve prayed harder than the pope as of late that our leaders would if nothing else out of sheer terror do what is needed and go back to the fundamentals of our Republic… But I doubt our leaders on either the left or right have much interest in relinquishing either their own or their cronies powers..

WHEW!!! That was close!!

I work at a local B/D, and CNBC plays all day here for the benefit of our customers -who are getting their clocks cleaned trying to play this choppy, volatile market.

Anyway, I had to sit here all day and listen to the totally idiotic discussion going on in Congress, with the Big 3 auto execs sitting there trying to justify $25B worth of Corporate Welfare in the form of loans that we have no assurance will ever even be partially repayed, given long term trends in fuel prices and supplies that auger very ill for the automotive industry over the next 5-10 years. Face it, the automotive industry is a sunset industry.I was literally getting sick at my stomach listening to it.

The Corporate Welfare State we put into place in this country 100 years ago has wrecked this country, and it’s the major cause of the rot that set into the Big 3 automakers 40 years ago. These companies were served notice 35 years ago that their products were no longer timely or relavent, but as long as the Corporate Welfare State was able to write legislation that grossly favored them, and throw them defense contracts and otherwise tilt the playing field in their favor, they did nothing to keep up with their industry and wasted every advantage they had. Sickening to watch- GM had incredible automotive technology, much of it never developed into marketable, cutting edge products, because why front all that money and risk when Big Daddy Fed is guaranteeing your greens fees at the Grosse Pointe Hills Country Club, in addition to all the other upper-class perks, which is all the execs in Detroit’s sclerotic,conforming rear-guard car culture cared about.

And to add insult to injury, our carmakers are begging for taxpayer assistance after spending $300 million to buid a plant in Russia. How does that help provide Americans with jobs?

Businesses fade everyday in this country, frequently at the cost of 10s of thousands of jobs. And how many jobs did SoCal lose to defense cuts? If my memory serves, north of 800,000 jobs (at least) were lost in SoCal in the 90s, at great cost to the local communities that often were built just to provide McDonnell Douglas and other defense contractors. And 165,000 a month across the U.S. economy are being lost right now, about 1.9 million a year, and I hear no proposal to bail out all the employers making the cuts.

If your business can’t compete, it has to fail. I am witnessing massive shrinkage in financial, which has to happen, even though it will cost my job, and I don’t expect to have any easier a time finding reasonable employment in another industry at my age than the displaced autoworkers.

Enough! This country has a severe case of Bailout Fatigue,and our politicians are finally beginning to get a faint clue as to what will happen if we continue to pile up treasury debt.

I have been saying for years that the ONLY way poor, beaten-down Detroit will ever recover as a city, is if our domestic car manufacturers fail, and Detroit denizens finally let go of any idea that the car industry will revive and put things back the way they were in 1960. The sooner these loser companies fade to black, the sooner Detroit and other post-industrial midwestern cities can get on with the work of rebuilding their economies around relavent, sustainable industries making the things we will need going forward- like, for example, rail cars. Let’s just let it happen.

Good job, Scared Indio!

Kids aren’t stupid. I have a very smart child myself. If I hadn’t taught her about money, banks and ATMs as soon as she could understand, and someone had suddenly explained the situation to her, I can easily imagine her bursting into tears over the shocking adjustment of her worldview.

“When was the last time you gringos milked a cow?” As a gringo myself I don’t find that offensive, and you did comment with concern, I thought, that it might come to that. It might, indeed. How much do most “gringos,” or city dwellers, or even “modern country folks” seriously do themselves? In my neck of the woods there are people who farm, milk, fish, hunt, raise livestock, preserve food, cut their own wood for heat, etc., as well as folks who commute to the city and whine about taking trash to the curb. You are worth not only what you own, but also what you can DO for YOURSELF AND OTHERS. Could the “economy keep crashing?” Who cares! The better argument is “could it, ever?” And how many gazillion surprises could render those dependent on others for survival dead in the water in an instant? If you haven’t been learning and practicing self-sufficiency, I feel very sorry for you. You have missed out on the most exciting and rewarding life imaginable. And you are SO behind the curve.

Anyone who eats 🙂 and has never gardened, fished, milked, harvested, gathered, preserved, studied local herbal medicine and basic survival — NO MATTER WHERE YOU LIVE — is quite simply living at the mercy of others. Anyone who thinks I’m crazy — have all your utilities shut off today. Go ahead, keep your job and income, but try it for a year and see how well you do. I did that exact thing 20 years ago, in a suburb, and did OK, but it was a towering eye-opener. Then I moved to the country and got serious about self-sufficiency. You wouldn’t believe how much money we’ve saved, how well we’ve lived on a small income, how warm we are. God provides, the land provides (and as God promised with His rainbow after the flood, the seasons will continue as long as the Earth exists).

You can do a LOT in the city, though. You can feed yourself with container vegetables, even forage in empty lots and parks (dandelions and lamb’s quarter are some of the most nutritious plants on earth…weeds to most people). Nature produces in profusion everywhere! Don’t be blind! Use the internet! Look up edible wild plants and medicinal herbs! Rooftop gardens! A milk goat! Stock your pond with edible fish! Grow amazingly nutritious sprouts!

If nothing else, rent a very interesting film called Wall-E, and check out how excited all those electronically-entertained star drifters are the first time they actually get to participate in the miracle of growing their own food. If you’ve never grown your own food before, you will probably feel the same way when you do.

My 4 year old son freaks out if a tree is cut down. He loves spending time in the garden at his school growing veggies and fruit. I’m not sure where he gets that since I have a black thumb and can kill a cactus. He is very aware of money or as he calls it ‘treasure.’ It is important to teach kids about money, but ya don’t need to make them cry.

Wall-E is a great movie. My son loved it too. He spent the entire movie worried about what would happen to the plant and wondering when someone would water it. Definitely check it out.

Where do we go from here? In NC and VA the textile industries have collapsed and the carnage is everywhere. It is just a matter of time for GM unless the union rules and pensions match the foreign car makers, regardless of the bailout plan. Other countries subsidize their industries. Even national health care that other contries enjoy is a form of corporate subsidization. At least the people get something more than golden parachutes for their money…The only thriving industries seem to be biotech and defense (offense, really). Honestly, we have been past the point of no return for decades. There really is no way out but to force the entire world to keep accepting federal reserve notes as money. Instead of being a revered nation, I’m sure most of the world would like to see us swept off the face of the earth, but we are just a composite of all of them. Not like the Native Americans caused all this…

Dear Comrades,

I am sensing fear on this board like I’ve never seen before. Maybe it’s time to take a stroll over to http://www.lifeaftertheoilcrash.net. Yes, I think you are now ready.

I don’t want to milk a cow for 50 cents an hour, I want to OWN a cow and keep the milk.

It’s nice to know where your dinner comes from, and that it will still be there next week, even if milk goes up to 10 dollars a gallon (hypothetically).

This is better and will keep your pants drier:

http://www.amazon.com/Bottomless-Well-Twilight-Virtue-Energy/dp/046503117X/ref=pd_bbs_sr_1?ie=UTF8&s=books&qid=1227244422&sr=8-1

Can someone on this forum with much more economic knowledge answer a question I’ve been posing to people for 20 years? So far, no one has been able to answer it, but I’m afraid that my answer is right. I hope not.

Corporations shipped manufacturing jobs overseas. We were told that America had to re-tool and re-train to a service economy. This way we would be able to buy goods at a much cheaper price. My objection to this was and still is that a service economy can’t work because it doesn’t produce anything tangible. One can touch electronic products, clothing, a refrigerator, small appliances like a toaster, etc. One cannot touch service industry “products” such as real estate and financial services, banking, insurance, investment, wholesale and retail sales, transportation, health care, legal, scientific, management services, education, arts, entertainment, travel, and food and beverage services. My point is America no longer produces what she consumes.

Most service jobs don’t pay as well as jobs that make tangibles, and now many of the service jobs such as call center representatives have been sent overseas. This has helped to increase unemployment.

Also, we’ve become a throw away society. Why bother to have your broken DVD player repaired when you can buy a new one cheaper than the repair bill?

My question has been and is now: What happens when Americans can’t afford to buy foreign-made products no matter how cheap they are? Would this have happened if we’d continued to produce nearly everything we use?

I think we’re approaching this point quickly if we aren’t already there. Am I wrong?

Sacred Indio writes:

“In my country we have a saying “trabaja y deja trabajar†(work and allow me to work) To think that some HOA, or our government landuse policies will impede me from making a living is ridiculous…If I have no job. why will they not allow to make a living?”

If your country is not the US, then you best return home where you will be allowed to work. If you are dissatisfied then what are you doing here? The agrarian values you expose won’t work in an urbanized population like the US. If we go back to muscle power and having half the population on the farm as we had in the 1930s then our population must shrink which means tens of millions of immigrants need to get sent home. This is what happened in the Great Depression. Even Mexicans who were citizens got sent back. Things get just that mean when the going gets rough.

a 50 percent off sale of assets is pretty good. I’m not going to bet on the collapse of civilization. I’m going to buy LTC with an 8 percent dividend yield that looks perfectly safe, unless of c ourse armageddon comes about. But otherrwise there are a couple of comments here right on the money. Buy income producing assets, particularly those that should improve if inflation occurs or economic growth occurs (i.e. not fixed income assets). Now my dollar is buying twice as many stock units as before. if it goes down another 50 percent I’m buying four times as many stock units. The key is to keep buying and it will work itself out, and if we ever get to a point where the stock market is at a DJIA of 2200 and an S and P of 300 then you need to put every penny you have in the stock market while everyone else is sitting on the hilltops singing and praying for armaggeddon, or hunkering down in their bunkers cleaning their guns. Bottoms clearly look hysterical, and the more hysterical it becomes the better the long term returns become. I heard old people tell me that many people thought the great depression was the end of the world, but if you dollar cost averaged from 1929 to 1939 you made five percent. Not bad. If you held for another thirty years you were a millionaire.

Buy & Hold? Few shares listed in 1929 are still listed,

only GE, C(ity bank & its merged firms), Sears dropped,

etc. Until 1971 the West still had a gold type backing.

see Deflation under fiat, and B.Bonner “Deflation now,

then (hyper) Inflation”

I’m not sure why anyone who is prepared for trouble is labeled a crackpot or paranoid in this country, not after what happened to all those folks after Katrina. The clear lesson there was, YOU ARE ON YOUR OWN. No, I don’t believe gold is going to $10000 an ounce, but why not have a little put aside, in case paper money becomes so worthless it gets used for heating? No, I don’t believe the economy will completely collapse into a great depression, but why not have a six month or so supply food and water? It costs less than a year’s worth of car insurance, and will keep for years. No I don’t think all the banks will go insolvent, but why not have a little cash on hand in case the bank machines dry up for a week or so?

The biggest critics are people who are unprepared, because they believe the government will take care of them, or that people will behave rationally in a crisis and that there will be plenty of everything for everyone. There is no historical precedent for that belief.

The precedent is that the majority will wallow along and take no precautions, and will hate people who do, and may decide to try and take what they want by force. That’s what the weapons and training are for.

@ A. Zarkov where should we return you? Mucho love.

it is not that complicated to operate a small farm and be self-sufficient.a lot of people live like this already (Amish)-but only because our Government lets them or does not care enough as of yet.

imagine one fine morning getting a notice from the IRS that you must deliver 80% of your homegrown food to the hungry children ( it is always children-best PR trick) in the city-payment of income tax in kind (even if there is no income).

they will watch you fields from the satellite and count your livestock from FLIR-equipped helicopter.reminds me of requisition squads in communist Russia.

concerning gold coin stashes-FDR made it illegal to own gold.he did not confiscate it outright but shamed people into returning it to the banks by printing names of gold hoarders in the newspapers.

why don’t we just sing a song:

beautiful streamer please open for me

blue skies above me-and no canopy

i counted 10000-waited too long

reached for the ripcord-the handle was gone

gory,gory what a hell of a way to die-

and we ain’t gonna SHOP NO MORE!

scared Indio writes:

“A. Zarkov where should we return you?”

Who is that “we.”

Indio – a five year old girl who wants a carton of milk is not a brat. In fact, she is probably the most delightful kid any parent could care for. A five year old drinking milk, will at the very least have healthy teeth, and healthy bones.

A brat is a five year old who wants a playstation, chocolate bars, or cola. And as such, bad teeth, and unhealthy bones.

Milk is nutritional and is a necessity. When the American soldiers landed in Europe in 1944, the Europeans were astounded by their height, and bone structure, because the “Yanks” drank more milk when they were children than British children, Italians etc… Maybe you might reflect on that the next time you pass a burger joint and you think about the obesity epidemic in today’s children !!

As a new supervisor at the USPS who was worried his non-contract protected job was about to be cut, I can assure you there is no plan to reduce jobs at the USPS (well not an actionable one anyway). There is a desperate need to get right-sized but we’re contractually obligated to more than 80% of our work force. It’s estimated that we’re overmanned by 150,000 or so, but in order to get right sized we would have to remove our casuals and TEs (temporary employees) which, is approximately 15-18% of our work force, long before we could remove career or contract employees.

That said, there is a freeze. We’re not hiring and our baby boomers aren’t retiring so our efforts to get right sized have been hampered to say the least. Operating at a nearly $3 Billion in the red didn’t help things (energy costs kicked our ass) but, with new technology innovation coming down the pipe, we’re hopeful we’ll pull our budget back into the black for our retiree’s medical/retirement funds and to contribute to the federal budget as we have in years past.

Leave a Reply to drudometkin