The renting revolution: As home prices rise, the nation continues to add renters in lieu of home owners. Is this a temporary shift or something more permanent?

Renting is in vogue. Regardless of the rhetoric, we have added over 1 million renting households since the housing bubble burst in epic fashion while losing home owners. What is interesting in spite of the rapid rise in home values is that many more households are becoming renters. Part of this dynamic is occurring because of a dramatic amount of purchases going to investors seeking to become landlords but also, we have 5 million people that have lost their homes to foreclosure and may now opt to go the renting way. The nation is becoming much more comfortable with renting a variety of items including cars (ZipCar), locations for brief trips (AirBnB), and of course housing. It is also the case that a large part of our nation is having a tough time financially and job security is definitely not what it used to be so people are opting for more mobility. It is a fascinating reversal that reflects a change in economics and also a drive by investors leveraging low rates to chase yields in unlikely markets. Is this a temporary trend of something more permanent?

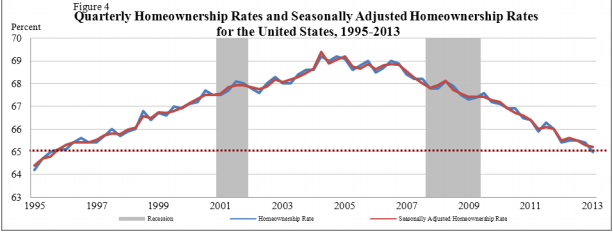

Nationwide homeownership rate

The homeownership trend is rather clear:

Source:Â Census

The peak was reached in 2004 and has now reliably fallen to levels last seen in 1995. Interestingly enough, household incomes adjusting for inflation are also back to levels last seen in 1995. As we mentioned in a previous article, if we include all additional households in negative equity positions the homeownership rate is likely closer to 62 percent pushing the chart to multi-decade lows. It is clear that once the bubble burst in 2007 that the quick reversal was because of people losing their leveraged properties. But the housing market is on a rapid ascent up at least with prices and in some markets with mania like actions taking place. So why is this happening?

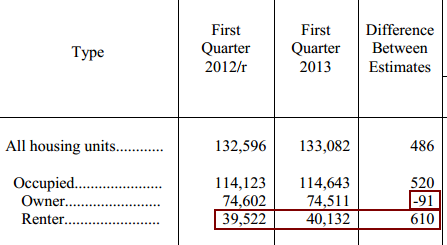

We’ve added over 1 million renting households since the bubble popped. In the last year alone, we’ve lost on a net basis 91,000 owner occupied households and added 610,000 renters. In this period, we’ve also added 486,000 additional housing units. Doing the math and given the investor demand, the additional housing units are very likely in favor of rental supply (multi-unit housing permits are also on the rise).

The push towards renting

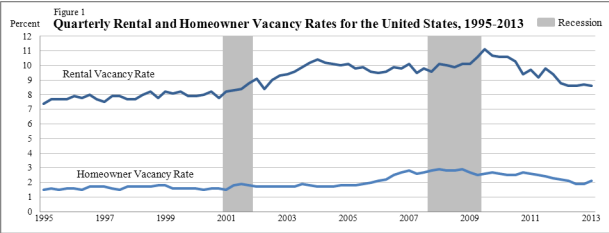

The good news is the rental vacancy rate continues to decline:

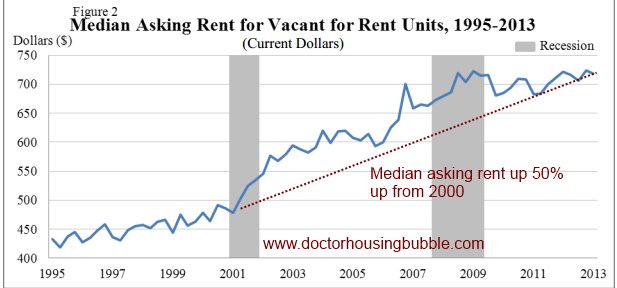

The rental vacancy rate is now at a decade low. While home prices are moving up, there is a push on rental costs on a nationwide basis. Simple supply and demand at work (with a sprinkle of paternalistic Fed intervention) and there is now a strong demand for rentals:

At least from a renting perspective, this is a positive trend for those owning rental properties. Obviously Wall Street spotted this trend since the bubble burst and has been diving in hand over fist into the housing market pool, initially empty but knowing the Fed would be the source of the water. Yet some markets in Arizona, Florida, and Nevada are saturated with rentals. There is now a likely tipping point in terms of large money investors putting in large sums of money for very weak yields. After all, with rates zooming up and the stock market on a roll there are other sectors to chase for money.

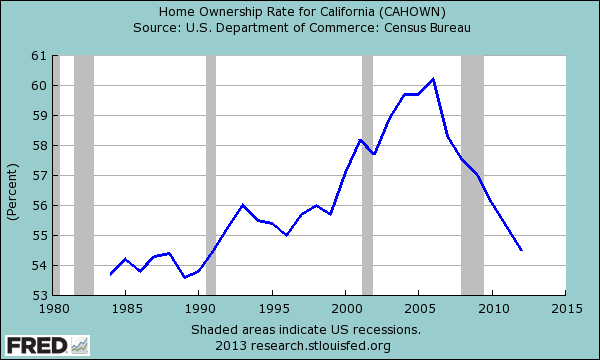

Expensive state nearly 50/50 when it comes to renters and home owners

California’s homeownership rate is inching closer to where it was in the 1980s in spite of home prices going bonkers in the last year or so:

California has a homeownership rate of 54 percent and with negative equity owners thrown in we are closer to 50 percent meaning half the state is renting. And make no mistake, those that are underwater are basically in a renting position or worse. They cannot move without selling their home for a loss. At least with a rental, you give a 30 day notice and you can move as you see fit. Some that bought at the peak, even with the wild appreciation in some areas, are still down $100,000 or $200,000. To leave, they would have to pay to sell.

There is this pervasive logic that somehow, some people missed another opportunity. These people claim that they want to buy to stay put so what does it matter that the mania pushed prices up again? You don’t unlock any equity until you sell! So in other words, they are speculating since they say “I missed out on a $100,000 gain†but this flies in the face of staying put and setting roots with your family. If a simple one year move is enough to price these people out they are not in a financial position to buy anyway. Yet some will never feel satisfied until they own a home like they lost their trusted childhood security blanket. Given the above data, this seems to be more of a minority in probably high cost areas because in most of the country you can buy a modest home with the absurdly low interest rates and likely be at rental parity. In very prime California markets, that is unlikely unless you come in with large down payments (i.e., $200,000+) and are ready to contend with the hoards of people stampeding into weekend open houses.

Looking at the data, the trend is very clear. As we have chronicled for a couple of years now the investor demand is unprecedented and many are left diving in to fight for the limited supply or rent. Because of the sour taste of the bursting housing bubble and emerging trends regarding home buying behavior, renting has been on a solid trend going back to 2007. Even with the recent gains in the market renting is powering forward over buying. People adapt. Many people are finding alternatives and are finding it more beneficial to live where they choose based on their career and lifestyle mobility versus “drive until you qualify†which is a very typical mindset in California. You also have to wonder what impact this will have where in states like California, half rent (think of raising taxes or other challenges that may arise in the future when they go to vote).

I’m curious to hear in the comments about those that have decided to rent versus buy in the current market even though they are financially in a position to buy.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

152 Responses to “The renting revolution: As home prices rise, the nation continues to add renters in lieu of home owners. Is this a temporary shift or something more permanent?”

DR HB

I am a renter who owned a small 2BR condo in Miami Beach from 2011 -2013. Before that we had always rented. The reason we sold was that even our small 24 unit building was selling to investors. While I didn’t have the vocabulary at the time, it seemed odd to me that we would want owners of units who lived as far away as Argentina. When we sold our unit the buyer was a colombian maid who claimed $650/week income on her application but her bank account had enough to buy our place with cash. Her plan was to rent out the unit. We took the deal and ran.

We now live in a rental in another neighborhood. I have no complaints. The current owner who owns a number of places, bought this one at foreclosure, fixed it up and we are enjoying not having the headaches. He is welcome to the gains from any risk. I am happy to no longer spend my weekends at Home Depot. I no longer feel hostage to the myriad of economic factors swirling around. My blood pressure has gone down.

I truly believe that the previous narrative of home ownership has been destroyed by many factors for a large majority of people (which is not a bad thing)

In the end, we’re all just visiting .

I don’t see the fundamentals of the American economy turning around ANY time soon (if ever), so unless Helicopter Ben can sustain or increase home affordability, there’s no way in the world that long-term housing prices will outpace inflation. Good move.

@KR – This is a misleadingly “macro” comment. Nationally, you are probably correct, but a person buy a home– a single one, in a neighborhood, with its own local dynamics. Here in Santa Monica, CA, housing costs absolutely can continue to outpace inflation for a long time. So long as local demand outpaces supply… kinda sucks!!

I see your point, Dasher, and there are a lot of variables. But let’s say the LA metro population shrinks 10%. Or wages stagnate in LA while rising in other parts of the country. Sure, salaries are stratified and that’ll affect demand in local markets, but the supply of foreign buyers is not infinite, and the ability for move-up-buyers to absorb high-end supply will most likely be mitigated.

Ok, I checked http://www.doctorhousingbubble.com/jumbo-loans-all-cash-investors-and-slow-population-growth-the-gentrification-of-southern-california/ and unless LA suddenly goes the way of Detroit, a 10% decline is unlikely, although it did dip, overall, circa 2005.

Still, there are enough other variables that can affect high-end home supply/demand balance in realistic scenarios. Prop 13? Prop 30 extension/escalation? I just don’t know how sustainable it is to expect foreign buyers or the growth of local industry (entertainment) to always fill the gap. I lived in PV during the aerospace collapse…pricing was 30-40% cheaper per square foot pretty quickly.

My family is one of these families. We lost our home 3 years ago due to a combination of furlough days and medical costs. We had moved up in 2006 and paid 650 for our home. We sold it in a short sale for 320. Even after the rise in prices recently I estimate it would sell for 450. We had been a traditional loan with 20% down. Our 20% pay cut meant we just couldnt do it any longer. We were thinking of buying again, until prices went crazy here. We live in a town an hour from San Jose. In April there was rental parity. Now houses bought and closed in May are listing again for 100 to 140k more than they were sold for in Feb…. or March. I hope the flippers get screwed. As soon as the pmi and interest rate rise went into effect the DOM according to Movoto rose a whopping 150%. Very little is selling now. We would not buy again unless there was rental parity. We rent a four bedroom for 1700. A comparable house with a 20% down would be 1000 more. Why would we do that? If when we have 20 there isnt parity… no way. We can take a trip to the beach, have not had to borrow for my daughters UC tuition, have saved 50k and can afford to pay my sons Autism therapists…. Buy a house and give that all up. No way… and who would pay these greedy opportunists 100k more for buying and reselling. I hope they all lose tons of money. I am not hopeful though. Ben will make sure the big banks get taken care of and keep the interest rate down. I personally think that the rise means he is losing control. Which is really scary actually. There is no recovery for most working people. The Reagan Revolution has given the rich just what they wanted a kingdom of Serfs. Now they control both parties so we are screwed. I listen to PapaNow on here you are truly sad and misinformed. Climate change is real and we need to change our way of life drastically or we will be like the dinosaurs. Read some news not controlled by the big media, like TruthOut, CounterPunch, or AlJeerhaz. Neither party works for we the people and if they can get us to attack each other like you are constantly doing on here they win…. Your fellow middle class liberals are not your enemy. What will be the price of real estate in California if much of the planet is uninhabitable, the population falls of a cliff (evolution suggests this will happen) and is drastically reduced. None of it will matter much if we dont get it together and work together.

Sounds like you are doing the right thing with your investments. Bubble #2 should pop, too, sooner or later.

And it has always amazed me, too, how many people in this country look forward to a feudal state — they are generally part of the middle class that is being destroyed yet seem to welcome its demise.

Agree completely on both points. The “middle class” is the EFFECT (not CAUSE) of a strong economy. The CAUSE of a strong economy is strong free-market capitalism, which means companies are able to make profits and, in turn, re-invest by hiring more people to make even more profits. That’s not in vogue nowadays.

I did give up my home/mortgage in foreclosure. How can it be another bubble if there are all cash buyer?

While I share some of your politics… don’t you feel it’s rather presumptous, to imply that man is responsible for climate change? And, can somehow, using behavior modification… reverse conditions? Perhaps, if the dinosaurs stopped their flatulance, they would still be among us? The fact remains that “Man” is only a speck on the global timeline. Our planet did what it wanted, before we appeared. And will continue to do so, long after we are gone. Global warming… global cooling… climate change, is all part of being a brief inhabitant of spaceship earth.

Reagan is a hero in my book–he turned around the economy and opened up “animal spirits” to encourage economic growth. Did the “rich” get richer? You bet. So did everyone else. Now, the poor are getting poorer and the rich are getting richer. Wow, what an improvement.

You have to kidding….right?

Atmospheric arbond dioxide is on a steep upward trend since the early 1800s and recently we hit 400 parts per million of carbon dioxide in the air. Assuming humans are part of the problem is not at all presumptuous. It is just facing the unpleasant facts.

We live in a nice suburb east of Sacramento. Same story as Ann, moved up in 2005, then in 2010 lost huge amt of income and medical bills for our child. We couldn’t pay it anymore, Tried for a loan mod (what a joke), short sale (bank wanted us to pay them) in the end we let it foreclose in 2011.

Rented a really cute house 800 sq ft smaller, literally down the street and our rent payment is HALF of what our PITI & HOA was in our “owned” house. YEs its smaller, and it doesn’t have granite but it is a great house and we’ve been here nearly 2 yrs now.

We actually can buy again on a VA loan (never used it before) in just a few months but this time regardless of what fools are jumping in and paying “whatever it takes” we won’t do it.

SO.. I get real time email updates on new listings and price reductions. Since the FHA change and interest rate rise 2 things have happened: 1. A TON of new listings have hit the market – people realizing its topped out and desperate to sell? and 2. Price reductions, multiple usually over weeks, are coming in fast and strong.

NOTHING IS SELLING NOW. Except at the very low end of my zip code’s market. IT HAS ALL COME TO A GRINDING HALT.

Like Ann, we now have no debts except my husband’s small car lease payment. We do basic maintenance to the rental house but if the A/C or hot water goes, its not our problem. We enjoy life a lot more nowdays, less stress, and quite frankly we’re not even sure we want to buy again. If prices went back to 2011 lows then maybe…

Nothing is selling in Sacramento and the market has come to a grinding halt? It’s probably because the Sacramento real estate market is very different than the real estate markets in cities on the California coast like San Francisco, San Diego, and Orange County which continue to soar ever higher. Sacramento is a hot, flat, smoggy government town with high unemployment and high crime. Like most of inland California, it has limited appeal. Who wants to live there?

Ann sounds like another aging NorCal leftist loony who has been brainwashed into blaming a president from over 40 years ago for the most recent housing collapse. Climate change is real? Oh please, climate change is being used by the elitists as an excuse to raise fees and taxes. Ann needs to wake up to reality. Of course read some news not controlled by the big media but AlJeerhaz? HAA!

Read the science on 350’org climate change is real and man is contributing to it significantly. It is accepted by the scientific community. SHAME on you Sam for the name calling. I respect your right to your opinion without calling you names. I don’t get the lack of civility for others opinions. Of course the Christian right thinks the government should tell us all what to think and do with our bodies so……also there is plenty of blame to go around right and left in regards to our country. The rise of the inequality started in earnest

With Reagan he was simply the beginning of the return to plutocracy. They have all been proletarians plutocracy since then and can continue as long as we stay divided.

Den autocracy not sure what word turned into proletarian. Weird typo

Ann, the stupid here has no limits. I rarely come here anymore because I feel like I’m reading Glenn Beck’s or Rush’s transcripts! This clearly shows the need for higher education funding in this country.

You are wrong about climate change. “49 Former NASA Scientists Send a Letter Disputing Climate Change”. http://www.businessinsider.com/nasa-scientists-dispute-climate-change-2012-4

We couldn’t if we wanted to.

That article is a perfect example of misleading by title. The “49 NASA scientists” turn out to be mostly structural engineers and astronauts – not one of whom appears to have the slightest credentials in climate science. You can find some legitimate arguments with climate change forecasts, but just dredging up 49 angry Texans willing to sign onto a rant doesn’t constitute one.

So the conclusion is – buy with a 30 year mortgage.

Lock in your housing payment forever (if you can qualify). Otherwise you will be stuck renting with annual increases.

Rents, like house prices, are subject to market forces. I am currently renting a 2 bdroom in Laguna Niguel for less than the 1 bdroom I rented (in the same complex) in 2007. BTW, I couldn’t afford to buy what I am comfortably renting (1,000sqf 2 bedroom in Laguna Niguel with Fireplace, garage, pool, dog run). Of course, you “owners” might not have a mortgage payment go up, but your HOA and Taxes certainly will and they are not subject to market forces at all. And good luck if the bottom falls out on your house’s value… but don’t worry! I’m sure you can get a bail out from us worthless renters. Just like last time.

CaliChris – get your facts straight. The taxes on the property are subject to market forces. If values go down, the property taxes will go down. You may be renting a 2 bedroom for the price of a 1 bedroom in 2007, but if you are you overpaid for the 1 bedroom. Anything you can buy at or close to rental parity is a good deal as long as you are on a fixed rate loan of 30 years and you have a few bucks in the bank to deal with a bad renter or repairs. My property taxes are lower than in 2007, but the rents I charge my tenants are higher.

KC#2:

But wouldn’t that depend on the state you are in. For example, in a county in western MA they actually admit that they base the amount of property tax on their bills for that time. They take the expenses and divide by number of property owners. They do not seem to ever lower the taxes, however.

I was shocked that they admitted to this…. but in that case we would have to all agree that the property taxes are quite divorced from market forces.

real estate is very location specific.

I bought my last house in upstate NY in 2005, towards the peak of the bubble. Sold in 2010.. one of the worst times to sell, but we had to move.

I lost about 20k in value and maybe another 10k in transaction costs.

However, i was paying a mortgage for 5 years of 1400, where my rent would be 1600 for a similar place. I built some equity and took tax write offs. So, even in a declining market it was still less expensive to own vs. rent.

No, you don’t have to rent forever. You do have to consciously save the money you would otherwise spend on a mortgage so that when market forces drive towards home ownership again you have enough money to purchase that house.

You can never buy on the bottom and sell on top.. real estate.. stocks.. no matter what.

So I buy when i need to buy and when i can easily afford it.

Nope been there done that. 30 yr. fixed rate. 20%down. Still Wall Street stole my equity the day I closed escrow. It was a scam people. It was done purposefully and intentionally. The banks did this because they can. It was a giant equity stripping ponzi scheme. Not Reagan, not Bush not Obama. If you want to blame a president. Or a hand picked front man, blame Clinton for passing the 1999 banking modernization act that repealed Glass-Steagall and allowed brokerages and banks to operate as one and the same and allowed banks to gamble with depositors money and do all kinds of crap! And I do mean crap.

I am not even sure what you mean.

Who stole your equity? How?

The market went down? It’s tough, although not sure you have someone to blame for it, besides market forces. But your payment stayed the same. If you bought conservatively, although your net worth went down your monthly expenses stayed the same.

I have some rental homes i bought starting in 1999 in Colorado. Property prices went up and went down, however i raised my rental rates like clockwork. It was irrelevant to me what the values were at any given time, as I was never looking to sell. Now, the values are back, principle is paid down, and rent is 50% more then original that I charged.

Lynn, The Gramm-Leach-Bliley Act (to REPEAL the Glass-Steagall Act) was introduced by three REPUBLICANS: in the U.S. Senate by Phil Gramm, R-Texas, in the U.S. House of Representatives by Jim Leach, R-Iowa and the Chairman of the House Commerce Committee Rep. Thomas J. Bliley Jr., R-Va. Yes, Clinton signed it – he too is guilty of the mess, just as the Republicans are.

Only if

1) market prices for rent continue to rise

or

2) market prices for rents go down, but you’re hell bent on staying in the same rented place for years upon years, and your landlord decides to take advantage of your reluctance to move by raising your rent despite rents going down

Frankly I don’t see how rents can continue to rise & rise.

I’m looking at a rental for the next year. Don’t want to buy after prices have run up 100%. Yes seriously I am seeing prices of Condo’s up 100% from the lows. This is bay area. I think it will take time to register what the FED is going to do. Of course buying now could end up better if prices continue much higher. But I will happily rent as I do not see home price having much more room to go higher. If I rent for a year I think prices could drift back down and the money spent on rent will more than pay for itself with a reduced purchase.

My husband and I have been renters since 2002 when we sold our home in Florida. Husband is ready to early-retire and we would like to settle in Colorado and purchase a home. Unfortunately, the home-buying frenzy is alive and well in our chosen destination (Fort Collins) and we refuse to be a part of it. We will wait until prices get realistic. We will be all-cash buyers but I’ll be damned if we’re going to pay 1) over the asking price, 2) compete with 8 other bidders, or 3) pay $50K or more over what the house was worth 6 months ago. It’s ridiculous. Until things settle down, my husband will just hang on to his job and keep it from a young person who needs it. Sad, but true.

I just signed a lease for another year of renting in San Diego. I’m a 25/m making $100,000 a year with no debt, perfect credit and with $65,000 in savings. I would love to own a home in San Diego but prices are once again out of control. Several of my friends with the same income have decided to purchase a home but have consistently been beaten out by all cash investors, even with large downpayments and excellent credit. I am content to rent by the beach for far less than owning a run down shack with a huge mortgage.

Wiseman told me once. If it flies, floats or f*cks. Rent it.

Couldn’t agree more!

I rent, therefore, I am.

Long time reader, first time poster. My husband and I are 33, recently married, no debt, able to make a $250K+ down payment …. and renting. Both of us would love to own a place, but we’re renting a decent place for far cheaper than it would be to own (and saving/investing the difference). Part of our issue is that we aren’t willing to settle on a place to buy, another is that if I go through a significant career change or we relocate in the next few years I’m a little apprehensive about trying to sell a house in that time frame. Consensus among my friends (mostly young lawyers, mostly no kids) is that we would rather rent where we love to live, than buy where we would hate to live.

I am glad to hear there are some folks like you, unscathed by the destruction all around you. But please bear in mind that you are rare. Exceedingly rare.

When (if) you have children you will want to buy because it is very difficult to move growing households with frequency. Then the danger will be that you have never owned and will not know about all the hidden expenses. Be cautious, err on the side of cheaper.

Your taxes will likely never go down and may rise steadily. Kids are expensive (in nicer neighborhoods, exceedingly so). Best of luck to you.

“we would rather rent where we love to live, than buy where we would hate to live.”

probably the smartest thing I have ever read here.

Outstanding game plan. I lived in California for 39 years, thought I’d be a lifer, and finally got sick and tired of paying hordes of money in taxes yet not enough in retirement. It killed me a ton in equity to sell to escape Cali, but it was a different world back in 2005. If I were in your shoes nowadays and thinking I’d want to stay in California, I’d be doing the exact same thing.

Thanks, guys, I appreciate the encouragement. I don’t think anyone is truly unscathed, though. I guess you could consider me “lucky,” if it’s luck to have only really started making a real living just before 2006, when prices were so obviously out of control that I couldn’t bear to add a ton of house debt to a ton of student loan debt (similarly lucky that the flagship public CA law school I attended jacked up the tuition 100% between my first and third year).

You went to Boalt too, eh? Congrats on the savings stash. We are contemporaries and mine is much lower. Kids will do that, though.

We would like to buy here in Dublin, CA but there are like 3 houses and 100 buyers. And I like to do my home work so I see that all the houses are asking well over what they would appraise for. And people are paying 20-40K over that. So I will keep renting. My money was hard earned over the last 10 years and am not going to give it away to some leech flipper. And I will continue renting apartments, never rent a house.

They need to regulate home appraisers and realtors.

Where we live now if a house is flipped most lenders will not lend for at least 6 months for that property.

There is on lender who will, but charges a lot more than the others for interest.

Not sure if this is common elsewhere, or not.

That is the case on financing flips, a year or so ago I held my nose and bid on one because the location was ideal for me. The sellers attempted to force me to use their bank and title company…a quick Google search revealed both had been fined millions by the feds for white collar crime (kickbacks, etc.) and both were incompetent to boot…on top of all this the sellers wanted to fine ME $100/day if the deal did not close in 30 days using their sleazy finance and title companies.

Between that experience and having several offers ignored because flippers and speculators offered 100% cash I retired to the sidelines in disgust…in the meantime am renting more or less happily, may try to buy again after Bubble 2.0 pops. FWIW am up in norcal in Sonoma Co.

As a landlord I have mixed feelings about this, on one hand there is an increased demand for rental housing, but if a majority of residents in a region are renters, they may have the political power to impose rent control.

Rent control is BS. So is prop 13

Proposition 13 is not “BS” if you are elderly person on a fixed income and you bought your home in the last century at a fraction of today’s market value. Without Proposition 13, many elderly people could not stay in their homes because they couldn’t afford the taxes! It depends on what stage of life you are in….just saying…

As I have said many times before, Prop 13 is a giant load of shit. If you don’t want granny taxed out of her house, fine. Prop 13 should then kick in for a primary residence when the owner reaches federal retirement age. All the other welfare needs to go…corporations, investment properties, gifting property to heirs, tax basis transfers, etc. I have full confidence that Prop 13 will likely be here for the rest of my lifetime so let the prices go to the moon!

Rent control is working for me. I get the benefit of long term home ownership, as far as living in a shelter-market at below shelter-market rates. I am paying about $800-1200 per month less than the market rental rate in my area. The drawback is that the apartment owner is using this place as an H-1b way station for the insurance companies in the area who refuse to hire Americans. My neighbors next door were stacked 6 to a bed and brought in all kinds of critters from their non-USDA inspected ethnic grocery store. They also brought in some very nasty bugs from India that required heat treatment to get rid of. It would be nice to own a home, but there is no income stability because of the foreign visa bills. Darrell Issa just introduced a bill to flood the high tech labor market with more foreign visa workers. It looks like the hoodlums from Silicon Valley have paid off another crooked politician.

http://thehill.com/blogs/hillicon-valley/technology/301327-issa-readies-immigration-bill-that-would-boost-visas-for-high-skilled-workers-cut-diversity-visas

This comes after the even worse immigration bill passed in the Senate that contained a massive increase in foreign work visas.

http://redbus2us.com/news-h1b-visa-immigration-reform-2013-cap-increase-65k-to-110k-passes-senate-judiciary-committee/

Between the foreign trade bills like NAFTA/CAFTA, ad nauseum and the flooding of cheap foreign labor onto the American labor market, this economy has been in a depression since the end of the 20th century.

http://heather.cs.ucdavis.edu/h1b.html

http://cis.org/Matloff-Publications

http://heather.cs.ucdavis.edu/minimaloutline.html

http://www.zazona.com/ShameH1B/

http://www.youtube.com/watch?v=TCbFEgFajGU

http://www.programmersguild.org/

Cheap foreign labor is causing a distortion in the housing market.

Say what? How would any reasonable person believe that “Rent control is working for me” with the following? “The drawback is that the apartment owner is using this place as an H-1b way station for the insurance companies in the area who refuse to hire Americans. My neighbors next door were stacked 6 to a bed and brought in all kinds of critters from their non-USDA inspected ethnic grocery store. They also brought in some very nasty bugs from India that required heat treatment to get rid of”

In the short term owning property, especially in places like California, may seem like an excellent way to riches. However, with a taxation system favoring land and property ownership rather than labor and trade you create a stagnate economy. Incentives should be directed toward producing real wealth and most importantly employment. California taxes the hell out of labor and pays public employees salaries and benefits way beyond market rates that are totally unsustainable. This is a receipt for a slow death. Young people who buy into the California dream today will eventually rue that decision. Also, the main reason such high paying and successful corporation are in Silicon Valley is because they fiddle the US tax code so they pay no taxes on off-shore brass plate offices in places like Dublin, thus subsidizing California’s high cost real estate. When this comes to a stop, and it will be soon, they just may all move to Austin.

“Apple isn’t alone – according to a new report, 18 of the largest companies in the U.S. avoid paying U.S. taxes in the exact same way, dodging an estimated $92 billion, collectively.”

It’s not just offshoring. Registering a corporation in another state, e.g., Delaware, can also save on corporate taxes.

California wont be the last state to tax its citizens to death. Expect other states to follow. Soda Tax, Rent Tax, Garbage Tax, all sorts of TAX. The addiction to Debt and Overspending cannot be UN-Done.

http://wallstreetfool.com/2013/06/26/stocks-and-options-trading-course-499/

I very nearly bought a house a few months ago. 20% down and payment would have penciled out easily. I couldn’t see how the current run up could end well and pulled the plug. Interest rates jumped not long after that. I’ve rented through Bubble 1.0 and now 2.0. The amount I save between renting and what owning would cost is a nice chunk of change, but renting just sucks.

I have to add that having a lease instead of a mortgage has become somewhat less stigmatized since the market crashed. I get very few dumb remarks about my choice to rent now vs. 2006.

If something pencils, why not buy it? Sure, prices can come down but at that point it still pencils out(unless rents come down significantly). I think everyone should purchase their owner occupied home from an investor standpoint. EX: If I lose my job, can I rent it out for enough to pay the mortgage and make me a little money? If you can, you are minimizing risk. When you approach a house this way, you will very rarely make the painful mistake of buying too high, or not being able to pay the mortgage. Someone who is very interested in a house, that pencils, and does not buy will be sitting on their ass bitching about the bubble 20 years from now. KC in Hollywood, I am with you(do not buy!)

Yeah, right, because renting out your house is just a piece of cake and always works out just swimmingly. Get real.

Not counting the 20% down payment, places for sale locally that are roughly equivalent to my rental would cost more than double what I pay in rent per month. It makes no financial sense to buy. I live in the Hollywood Hills and I have a view of the hills and downtown LA, a swimming pool with a beautiful view of the canyon, and my front door opens to the outside world only it’s no where near the street so I also have a lot of privacy. My rent goes up 3% per year so it would eventually equal a mortgage payment on a place if I purchased today, but it would take many years for that to happen.During that time, the money I am not spending on a mortgage could be invested and growing. If prices were closer to rental parity, I would buy.

By artificially reducing interest rates, the Feds have turned the most valued material thing we have — where we live — into a Las Vegas casino. If interest rates were allowed to rise to their natural place, like 6.5% or higher, this market would fall off the cliff again. Kids are graduating from college with an average $30,000 in tuition debt. Baby boomers are retiring and downsizing. Real incomes have fallen. I rent a place that has everything I need. I don’t want to be a part of this game. One day soon — whether it’s six months or a year or two years — the government will get out of this business and the market will fall back to basics and it will not be pretty.

Government and the Fed are in the bubble creation business. They know it is true. But they can’t do anything about it now or asset prices , including real estate , will crumble. That would return us to the 2008 debacle in an even more dramatic and destructive fashion. This is true on 3 economically developed continents.

I see a deep crisis in the Eurozone and/or Japan upsetting all the well programmed market and currency manipulations of the central banks. I agree with you….it will not be pretty.

Make sure that the huge Chinese bubble is accounted.

I agree — the government must continue to hold up the roof or we’d be in over our heads beyond what happened in 2008. What’s scary is that the fundamentals don’t support the market. People are still in debt, income is weak, the economy is treading water. Where does this go? At some point the government has to step back. We got a little taste of what will happen a month ago when Bernanke said the support would end and interest rates spiked up. That would really pour water on the economy and real estate would freeze again.

That’s right Zigzag. The U.S. and China are the two giants with feet of clay, helping prop each other up. The artificial “Eurozone” created mainly to serve Anglo-Saxon interests — certainly no one logical could look at Greece, Spain, France and Italy and think it serves those nations — will, if they continue with it, most likely result in ferocious riots that make the French Revolution look like Sunday in the Park with George. When you have armies of unemployed, seething, angry, idle youth, it is really not all that encouraging a prospect for the future. I have the feeling chaos in Europe will be the “black swan” event that resets the entire world economy, which could involve the utter destruction of certain nations, and America has the absolute highest risk.

Don’t forget the student loan rates doubled this past week to 6.8%, which means less available income from the next generation of prospective buyers.

This reminds me of the line Reagan most feared: “We’re from the government, and we’re here to help.” I can’t think of any market where government “intervention” in its financing has had a net positive effect…

I really do think renting is a lifestyle choice not an economic one and

A question of how much risk you can stomach as an owner.

I was not comfortable as an owner and was happy to pay rent for someone else to take the risk. That’s why I sold.

I’m 40, married with no kids, modest 6 figure income, a high fico and no debt. We gave up trying to buy a home here in San Diego last year. We use to bid on whatever scraps that the flippers didn’t buy, the day before, it hit the market. We rent a crappy little one bedroom in order to save up for a bigger down payment in some place other than Southern California. The middle class no longer has a chance in SoCal. I’m not interested in becoming a slave to some overpriced dump here. The writing on the wall for the middle class here in Socal. Its says, go away.

Here’s my tail (quick, grab the hanky before continuing). Where to start? Well, I’m old enough to remember both versions of the Chatanooga Choochoo (Glen Miller and Lawrence Welk, just in case you were wondering too). I’m also an on-again-off-again-fishagin single male homo sapien with 6 kids (the oldest one just got out of jail this morning). I can proudly state that I am also a no-figure income earner (which causes a constant dischord between my gaggle of squawkers). Oh, and I’ve worked a lifetime to produce a low fico score and a heap of debt just to keep me on my toes in my old age. At this juncture I should state, I no longer live in the US of A, I am an expat (a proud citizen of the world you might say). Okay, now we get to the meat: I and my on-again-off-again-fishagin tranny girlfriend gave up trying to buy a home in Outer Mongolia earlier this year. Consarnit, if we didn’t bid on every two-bit mansion the mean Inner Mongol warlords didn’t buy, but that equated to pert’ner nuttin’ for us. Then one day luck would be on my side. Me (and my on-again-off-again-fishagain tranny girlfriend) put claims on a fine-looking cardboard box at the base of the foothills to the Gobi desert. Our jaw-dropping Hacienda de Pulgas not only helped us to appreciate desert-living like fine Tuareg, but it also helped us get a foothold in Outer Mongolian real estate before prices hit the Big Dipper; now if this wasn’t enough, hold on to your pantaloons, we did it all while taking on a large amount of debt and selling my ungrateful little sh!t of a prodigal son too! All in all, being an expat here, I can’t help but feel the lower class has slim pickins in Outer Mongolia. In fact, you can damn well count me out of relocating my Gringo pompis here again! I am definitely not interested in becoming a slave to some meany warlord a second time around (well, uh, apart from my on-again-off-again-fishagin tranny girlfriend, that is). Well folks there’s been more than a few tears shed over my sad tail, but the writing is simply on the proverbial outhouse wall for the lower class here in Outter Mongolia — “mongols get out!”. In closing, I’ll leave you with a bit of sage advice from Ungbar Slappywhack (my Inner Mongolian broker currently residing in Ulan Bataar after a long and somewhat skeptical hiatus in Ciudad Juarez). After I told Mr Slappywhack of my intentions to uproot my kids, my hacienda, and my on-again-off-again-fishagin tranny girlfriend in Outter Mongolia for greener pastures in the US; Mr Slappywhack retorted, “Mr. McPrancy, you staying here… ‘cuz mongols going to California… mongols going to take over state… mongols going to conquer all of US of A (united states of asia-minor)… mongols going to start brand new laws and brand new religeon.” Why I told that SOB right back, “You give me to the Gobi in that desert-going Lamborghini of yours, and Mr. Slappywhack, I will personally help you push through them mongol laws and mongol religeon you seem so smitten about!”

I do believe the market is extra frothy, but I think we should expect to be spending more on housing as a percentage of income than we used to going forward, besides the lucky few. Life in general is just more expensive and more people get left behind, but no one gives a sht in power. If they cared, why would they keep changing definitions of metrics like GDP, inflation, labor, etc. in order to make things look rosier. Even though wages have been stagnant, that hasn’t stopped gas, utilities, water, food, college tuition, healthcare, etc from going back down. Im not saying we wont have years of lower rents, but the trend is going up, imo. We live in a greedy corpotracacy, unfortunately, and the squeeze is on from all sides. If you can’t get the consumer for goods, hit em on necessities.

I agree with this. There is no predicting the future based on anything in the past nowadays. There are no underlying fundamentals, we are in uncharted territory. Also the global component cannot be ignored, things are shuffling out worldwide and the USA didn’t have anywhere to go but down. I’m not saying things are easy but when I look back to the gross consumerism culture of the last decade I am disgusted with this country. Personally I’m all about rethinking the status quo all together, that’s how I circumvented this problem. We got a place with my mom with a nice suite for her, neighborhood is nice enough but in LAUSD but I plan to homeschool my boys. Most of this is about keeping up with the Joneses, people wanting that ideal neighborhood with that ideal school instead of making a struggling neighborhood into something better.

On the SF Peninsula we pay 4k/mo to rent a 5 bedroom in an area with good schools (we have kids). We bid 1.3 this Spring for a place that ended up going for close to 1.5. The house was a typical, mass produced ranch style in need of updating. We were prepared to put down 500k+ – but even then keeping our housing costs at 4k/mo would be tough. I’d say it is cheaper to rent in this location – assuming you can find a place, inventory seems scarce and we’ve found it’s more a matter of just taking what ever is available.

IDK – feels like a bubble to me…

It’s funny, we were in a similar situation (no kids yet). Were renting for 4050/month, and were looking at houses around 1.5mil. Ended up closing on a place that’s 1.4mil

With 20% down payment is 5800/month including taxes, which is actually cheaper vs. 4050/month rent, if you consider

1) tax benefit

2) portion that goes towards paying down the mortgage.

Good for you moshennik. I can see that you are one of the few that actually understands the math behind the rent vs. buy equation. Almost every article on this blog will have a post saying how their monthly rent payment is less than a hypothetical monthly payment for buying (which are all gross numbers). When you dissect the numbers and account for principal (which is huge given the low interest rates) and all the tax deductions, usually it points to buying. Add in all other myriad of benefits of owning that you can’t put a price on, buying looks pretty good.

Everybody on this blog wants to own. There will never be a “perfect” time to buy. If you have stable employment, plan on owning the house for at least a decade and can easily afford it (DTI<25%), don't waste any time, go out there and buy!

@ moshennik

I ran the numbers last year, and decided to purchase my first home in Baldwin Hills area. I purchased a 4 bed 2 ba home for $267 per sq ft on a 7000 sqft lot. this got me 15 minutes from the beach (on a weekend morning), 15 minutes from Hollywood or downtown LA. Some people complain about crime in Baldwin Hills,,, however I purchased a home in Dec. 2012 from a Jewish couple in their 80’s who said they had no problems with crime (and for 60 years living in that house, with no security screen door and no gate across the driveway). In any case the 4 bedroom 2 ba would rent for approx. $2400 per month. I pay a few hundred more than rent parity but have the tax deductions. I have taken a risk, but to try to wait it out a couple more years is also a possible losing proposition. If the prices were to drop today by 20% perhaps I would lose money, if prices drop 10% next year, I am still nearly ahead. I think lots of wanna be buyers on this site are too pessimistic to ever buy a home.

QE Abyss, you hit the nail on the head regarding too many people on this site being pessimistic about buying and likely never will. I ask everybody who is waiting, what would entice you to buy? I’m sure we’ll hear the answers: a better economy, lower prices, an abundance of homes to choose from in good neighborhoods, less government intervention, etc. Unfortunately I don’t think any of that is going to happen anytime soon.

The best time to buy was middle/end of 2011, timing that was almost impossible. Rates were 4.5% and prices were likely 15-20% lower than they were today. There was plenty of inventory and buyers called the shots. It only took a few short months for the pendulum to swing back to the sellers. The 2011 buyers look pretty good right now, they likely refinanced down in the low 3s and are sitting on a nice cushion. People wanted blood and rental parity wasn’t good enough.

1) You can’t count on the tax situation not to change.

2) You don’t lock in any profit until you sell.

If that is the stuff you have to tell yourself in order to feel good about being in a highly leveraged position, then whatever. Markets go up and down. To believe otherwise is simply foolish.

Oh and by the way, let us know how that rent vs buy equation works out for you on the next big outlay for that new roof, HVAC, foundation crack, water line repair, etc…

So full of crap it’s not even funny.

Joe,

Regarding the tax situation, it’s anybody’s guess on how things will change (if at all). You should be basing your decisions on today’s facts, not tomorrow’s unknowns. I’m quite aware you don’t make a profit until you sell. Having some instant equity via appeciation puts the owner in a pretty nice spot. If there is a 20% correction soon, it’s totally transparent to the 2011 era buyers.

And rent vs. buy calculators, plan on AT LEAST $200/month in maintenance and upkeep for a house. Some years you will have virtually no maintenance and others might require a new roof or new plumbing (the $200 should account for this). On the flipside, you should be including a 5% yearly rent increase when crunching these numbers. I’d be willing to bet that rents here in Socal will be MUCH higher in 30 years than they are now. My mortgage payment and property taxes (Prop 13)are essentially set in stone for the next 30 years.

Delusion.

Joe, read it and weep friend, that’s the truth.

I did read it, I’m not weeping, and it’s not objective truth.

Seeing much flipper activity around here, we are looking for a small farm, we found two in our area that we were interested in both, they had sold in 2009. One sold for 235k now asking 330k the other sold for 170k now asking 270k . But both went FHA with nothing down and 2 1/2% interest so they can hang onto them for a long time.

Bernanke scum has screwed the honest man, we are the ones with money in our pockets, where else can they get if from.

All the talk about cash being king is just that, talk. On the offers we have made all were cash, 5 cash offers, all lost by less than 5k under financed offers.

Much crookedness in the real estate market at present, to get the real good you have to be on the inside. Have been told that house is sold, only to find out it wasn’t then price dropped and scooped up for 25k less than we would have paid.

Excellent topic and well thought out responses. Simple. IF you can’t rent it out for enough to cover the expenses don’t buy it. The housing market in this country is no longer a free market. It is a totally controlled by the government. Even if you pay cash for the property the price is largely determined by the cost and availability money. You and I don’t determine that. We’re at the mercy of those who do. Seen any mercy coming out of Washington lately? And flippers aren’t ruining the market. Fools who pay to much for houses are ruining the market

Agreed, for the most part. However, remember the Fed is definitely not a government agency. And although banks and corporate investors may own the House of Wh0res/Senate/Administration, they still are not the ‘government’, per se.

Here’s the problem, Walt. Most people who would buy have no experience to guide them on what numbers make sense in regard to renting out a property. They would likely just pull a number out of their ass and hope that things pencil out.

It’s just not as simple as you worded it to be.

Completely concur with you as to the morons overpaying for houses. These are the same morons who assume they could simply “rent the place out” should their financial imprudence catch-up with them some day.

It is a state of mind!

I have always owned, always knew it was the right thing to do. But that way of thinking was formed from a very different situation. My first house that I bought with a 3% down FHA loan way back in 1987 gave me a house for less than I could rent. On top of the monthly savings came the tax savings.

In 1999 in San Diego when I bought, my house was actually 20% more than renting, but there was still tax savings.

I have been now renting for a number of years and the fact is if I bought a house 3% down my payment would be almost double compared to renting and the tax savings is not as much as it once was. How can this make any sort of sense unless you hope for the greater fool theory to play out? As they say, “Hope is a slippery slope”.

I want to buy but the fact is my standard of living would be in jeopardy unless the greater fool theory plays out.

I know I am taking the risk that while renting I might miss out should house prices continue to zoom ahead of rental rates, (and rental rates are tied to income growth) but if I am saving 2K a month, I can’t feel that bad.

I no longer feel that buying is “the right thing to do”. I am well aware that my preconceived notions about how things should be could cost me but again. Money and what money means seems to be changing before my eyes. However, if I am saving 50% on renting, how much can it really cost me?

If I were to capitulate and use all my savings to afford San Diego real estate ( so that my payment would be inline with rent) one thing about owning a home, you quite often die with a lot of equity that someone else gets to spend. If you are renting and squirreled away a lot of money, it is a lot easier to enjoy that money in your old age if it is liquid. I am only 50 but something I think about.

OOPs, got a couple lines mixed up in there but you get the picture.

Watch out there, Martin, you’re making too much sense!

You’ve been there and back. I suspect a lot of posters here either haven’t been there, or are there for the first time. That’s why we get a lot of oversimplified nonsense about rent vs buy when it’s rarely ever a simple or easy thing to calculate. Confirmation bias reigns supreme.

It’s worth repeating a million times over that you don’t lock in your profit until you sell.

People are now wise to the housing casino and realize that housing CAN go down. With most unsure about long term job prospects, timing the housing bubbles is dangerous, stressful and expensive. Housing has just become another tool of wall street to find greater fools in So. Calif. Too much downside risk versus upside for most.

http://Www.westsideremeltdown.blogspot.com

http://Www.santamonicameltdownthe90402.blogspot.com

To answer the Doctor’s question, I’m in my late 30s and happy to be renting a nice 3/2 house in Torrance. We spend less than 15% of our income on housing. We could comfortably buy with a decent down payment and high credit score, but entering the market at this moment seems like a terrible idea to us. Rational reasons don’t exist to buy a house in the current state of the market; only emotional. We’re smarter than that and enjoy living debt free. If a place comes on the market that we really like at a price we can afford, then we’ll buy it. It may happen tomorrow or it may never happen. Either scenario is okay to us. From a macro standpoint, keep in mind that we’re in the final year of all the corrupt 5/1 option ARM loans from 2008 snaking through the system, so the banks may not be as motivated next year to keep the prices high.

He had a 5/1 Option ARM from 2005 and were actually responsible with it. Interest rate went from just over 7% (5% Fed rate plus 2% bank margin) to something like 2.01% as we exited the five-year period, so it may be pretty affordable to folks, assuming they actually paid at the thirty- or fifteen-year rate over their mortgage period.

Rented for two years after losing our house. Bought a fixer-upper last fall (grandma’s house–her kids were selling). Had to scrape together a down payment from 401k. Still, well worth doing. We will pay ourselves back first, then pay down the mortgage (got a ten year). It’s a fraction of what we had before and we are doing a lot of work ourselves. Good for the soul, right? We pay next to nothing in mortgage but 1.5x that for the 401k loan and nearly as much for the taxes (outrageous here, 6-7% value of house).

First of all, rentals in good suburbs are now outrageous (advice: rent in fall, never July/August). If you don’t have writeoffs, your taxes are skyhigh. Schools will hassle you non-stop for proof of residency (and woe to you if you can’t comply). The stress is killer. And you can’t save a dime.

We may need to sell next summer to move for work. If we do we will be able to pull out enough for a much better house in the new locale. BIG step forward.

Screw the SOBs who are keeping people from buying in a down market and building back some of what they lost. It’s nothing short of criminal. I wouldn’t buy in Cali, but in most other states you are way better off buying than renting, even with rising interest rates, even with high taxes. Even with Obamacare and the end of the world. My 2 cents. Peace, out.

There is a long term stability factor to owning that I would not have understood in my younger years. I would rather own than rent, even at a small premium.

What amazes me is that I can build a home for less than the price of others on the market, why so many people do not hire people like those I work with to build rather than pay market price is amazing. Do you think the new homes going up in your area are being built at market parity? No, there is a 30%+ profit. Stop buying from the flippers/investors and go one step down the food chain and built it yourself using the same outsourcers.

Expand your thinking a little and you may just find that you can build what you want, save a considerable amount of money and at the same time beat the market – even in California where I build.

Jason,

Can you recommend a good builder? I’ve been looking for one.

Thank you!

I’d say it is not the contractor that you want to start with, it’s the plan. There is a saying, “give any contractor money and he will build, regardless if it makes any sense” – building for profit typically does not start with the contractor, because they will typically price you at parity with retail purchasing after factoring in land, permits, infrastructure, fees, etc.

I’ve been wondering / thinking the same thing myself about building versus buying. So true after calculating the numbers / costs.

You can win or lose big building yourself – just like any other venture the same magnitude, but there are ways to get it done right and save a bundle. Funny how people will waste the equivalent of one or two years salary, before taxes, in overpaying for a home because they do not have the time to do it another way.

for those who followed this blog long enough, we remember when even discussing your foreclosure was taboo. Then, as time went on, so many people were getting foreclosed upon, discussing your foreclosure at a cocktail party, for example, was finally okay to do… the social stigma had evaporated, after all, you weren’t alone. You were a victim of the economy, just like everyone else.

That change of perspective, as a reaction to the bubble bursting, has also removed the stigma of renting. Whereas home ownership was the capstone of the American Dream, many will have to search out a new kind of American dream. Maybe flying kites..?

33 years old, married, expecting our first child, earn between $150K-$200K/year depending on bonuses, no debt, 20% down for up to $650K property. We’re going to be renting for a while. We were seriously trying to buy earlier this year, but got outbid on properties that a) were $50-100K more than they were a year ago and b) that we could never rent for a comparable amount, if we ever needed to move. We were limited to looking in central/west LA due to our careers/refusal to commute more than 40 min one way. We have friends who have been able to buy affordably on the eastside of LA in gentrifying neighborhoods or in the south bay, but we work long hours already and wanted a home in reasonable distance of our jobs.

Ultimately, the math made our decision. We were still thinking about buying for some sense of home and stability but, when we realized what the new baby will cost ($2500/mo for daycare, healthcare, college fund, other misc needs), plus needing a new (used) car instead of my old 2-door beater, plus our ongoing retirement savings, we realized we could choose a child or a mortgage. Yes, we technically could choose both, but it would put us into a precarious financial situation. Having weathered a few layoffs since 2008 (landing on our feet, thank goodness) we want a cushion in case of emergencies. A mortgage plus a child could mean that a three month job hunt might turn into a debt-filled panic versus some difficult belt tightening in a rental. We don’t want to live with constant financial anxiety. We can stay in our nice 2-br duplex while the kid is small, save whatever we can and even afford to order in once in a while. Whenever we need to move for better schools, we can asses then whether it makes more sense to rent or buy. Until that time, we have no issue continuing to rent.

Excellent choice. Kids/retirement/college costs a ton. I’m in the low-mid-sixes annually, am 40, and still feel like I can’t save enough for everything. Don’t buy into the California “image” where consumption equals wealth…it’ll bite you in the butt one day when you really need your savings.

You could get away for quite awhile with only 1 kid and renting. However, you might consider the ramifications of having to uproot that kid after he’s grown up with his surroundings and friends that he’s made since he was a toddler. I had the same perspective as you and then when the kids were teens we up’d and moved them to where I could afford and socially the kids will never be on the same level as the kids that grew up here. They will never get to be the pitcher unless they are extremely talented. They will never get to be the quarterback, they will never get first pick at any of those social team events. That is because those are popularity contest positions and usually the kids that have roots in the community and grew up as a familiar face among their clique and their parents’ will get those positions first and foremost. Again, I speak from experience and at hindsight I didn’t consider this as a factor but I’m just making you aware of something I wasn’t. Also there’s the issue of being priced out of the market. I missed the boat way back in 1999 in South Bay thinking prices would go down. Needless to say it never had and never will again. According to housingpanic.blogspot.com, Keith has called it right on many occasion in which I argued *against*. This time I’m listening to him and he’s calling buy buy buy. Don’t let yourself be priced out indefinitely.

I am a little further into the life cycle than your Kids so would like address the “harm” of up rooting your children. I actually went to 8 different school districts as a child. At the time it certainly was not a pleasant thing to do, being the “new kid” is never fun.

But in the long run, I think it resulted in some superior skills in dealing with and getting along with other people because I had to learn how to do it at an early age.

In the end, “uprooting” has few to no lasting effects I could identify and can actually be a tool for self growth, as it was for me.

I don’t know what all the experts have to say but my opinion is my opinion.

I don’t understand why people think that all children are automatically traumatized by moving from one area to another. My parents bought a house in Culver City (one of the Doctor’s favorite locations) when I was small, and stayed there long after I grew up. Despite growing up in one spot, I wasn’t the least bit popular; I didn’t experience anything approaching popularity until after I got away from the place where everyone had already decided that I was a nerd and a loser. From junior high through high school I fantasized about moving elsewhere. Yes, you might be doing your kid a favor by raising him in one place…or you might not.

I sold a SFR rental in OC California November 2012. The house sold for $350k. The same house is selling for $365k now.

Rent in 2008-2010 was $2100 per month. When I sold, I couldn’t get $1850 per month rent. The quality of perspective tenants was deteriorating. This also was what other professionals in the market were seeing and expressing to me. The economy has hurt the average working family and many were just hanging on. They were one paycheck away from not being able to pay their bills (and rent).

The return on investment of $1800 per month rent, minus all expense, capital costs ($350k), risk on investment, etc., didn’t add up.

On a similar property in an area that has lower land costs, a similar property would cost @ $100K and rent would be @ $1k per month. Different market, different return on investment. 3 houses at $100k each with rents bring $3k per month as opposed to one property @ $350K bringing less than $2k per month.

Many first time Landlords don’t consider the costs of maintenance, vacancies, bad tenants – legal fees – lost rent – damage, etc. Unless there is substantial appreciation to subsidize the low rental income in many markets, SFRs can be a bad rental investment. (Not to mention the capital gains when the property sells.)

We also have a SFR in Los Angeles County in escrow for $600K. Prices in this market went up @ 10% over the last 12 month. Rent on this property would be @ $2800 per month. Returns as a rental don’t work for this property either.

We own our home, but the cost to own verses the cost to rent is a draw in our market. There are benefits to owning and benefits to renting. When it becomes a draw financially, there is much less risk to being a renter. We are considering selling our primary residence and becoming renters.

The cost of owning a home is not just the “monthly payment”. There are substantial maintenance costs. You can subsidize your monthly costs short term by deferring maintenance. But eventually the piper must be paid and this must be accounted for in the monthly ownership costs to have the true cost of ownership.

My humble opinion.

This, this, this.

No one has responded to dispute what you’ve wrote for a reason.

From what I’ve heard, a bank won’t usually give you a mortgage for a rental property, based solely on that rental property’s income, unless the monthly rent is 1/3 higher than all of the mandatory regular expenses (principle, interest, taxes, insurance, HOA). They figure a 1/3 premium, on top of all the regular monthly costs is needed to cover maintenance, vacancies, tenant default, etc.

If this is the rule the banks use, I think it’s reasonable for buyers looking for rental property to use as well.

Totally agree with late summer 2009’s analysis. Too scary to buy for normal people for whom this isn’t a game but a lifestyle.

I sat in on a meeting earlier this week between several homeowners and a house full of renters. The renters had decided to turn the rental property into cooperative housing and had almost 10 people living there. They were young and like to party. The homeowners had properties that surrounded the rental house and they were disturbed by the noise from the parties that were going on all day and all night. In listening to each side tell their respective story, it was clear that the homeowners had one set of values and the renters had another. They didn’t particularly care about the property or developing any long term relationships with the neighbors. This was “a moment in time” for them and they were going to make the most of it, neighbors be damned! The owner was simply collecting rent and didn’t really care about the plight of the neighbors. I think we’ll be seeing more and more of this as homes that were once owner occupied turn into rentals and pride of ownership disappears.

It’s not pride of ownership but rather pride of caring, period.

You don’t have to be highly leveraged up on a mortgage in order to care about the impact you have on your neighborhood.

There are plenty of home “owners” around that don’t give a shit about their property and how their lifestyle adversely affects their neighbors.

Get out of CA while you still can. There are way too many people here and it shows in everything. Mostly everything bad.

Median Prices Reno:

http://www.zillow.com/local-info/NV-Reno-home-value/r_13478/#metric=mt%3D34%26dt%3D5%26tp%3D4%26rt%3D8%26r%3D13478%26el%3D0

Median Rents Reno:

http://www.zillow.com/local-info/NV-Reno-home-value/r_13478/#metric=mt%3D50%26dt%3D5%26tp%3D4%26rt%3D8%26r%3D13478%26el%3D0

I ran the approximations for “middle tier” (middle income is a bit safer but it’s up to tenant screening). Assuming 10% vacancy (long-term tenants), 100$/mo property management (yes I found a good one for that local), property tax, insurance, city utilities.. It comes out to about 500$/mo. net income on a 190k investment (using median prices here). Chasing yields of 3% with at least a 20% downside in asset prices likely seems foolish.

But you notice also the rent flat-lining ? Stagnant wages means people just can’t pay anymore. I myself pay about 50% of net pay to rent in Bay Area (they raised it recently but there are no places to go and they know it). It sucks the life out of you and it is what I understand to be the ‘deflation’ which is to say stuff not lowering price but rather having to prioritize essentials over other stuff. I don’t see how anyone could survive that isn’t white collar/technical field, but people keep flooding in here as fast as other people leave for some reason.

I was excited at the prospect of having $150k to invest in housing in a few years, but if prices don’t drop it’s just not worth the risk. Cash may well be king when things get even worse, so as bad as it is I hope they get worse soon. We’re not going to heal as a country until we feel the pain – taking too much painkiller will kill the patient. If velocity plays any role here, the inflection point may create the spontaneous exit of many investors – this is what I hope for.

I used to commute over 60 miles to rent an apartment here before we bought. Why? because in the IE you can get a 2BR/2BA for $900 if you know where to look. Join a carpool and pay $150 to $200 per month in gas, that’s $100 per month to live in SoCal. Everyone I knew in the South Bay and Westside was paying double that in rent, and the places were not that nice.

Now we “own” in the IE, for not much more than that per month. Why? Because my Midwest morals refuse me to pay more than 2.5X income for a house. And by that math, $250k is a ton of money. When I was growing up a home for $150k was pretty darn nice, and still is decent today in the Midwest. And the prices haven’t changed much back there.

I have absolutely NO clue how Rancho Cucamonga, northern Upland, southern Riverside, et all are filled with $450k on up homes! I know many commute, that has to be it.

But I am deathly afraid of getting laid-off or hitting any bump in the road financially. We don’t have too much debt, less than $10k probably and no car payment. But everything coming in goes out with very little savings besides 401k.

“But I am deathly afraid of getting laid-off or hitting any bump in the road financially”

That sounds like an awful situation to be in. A mortgage is just not worth that stress.

This is the California dream?

Lord Blankfein

“Good for you moshennik. I can see that you are one of the few that actually understands the math behind the rent vs. buy equation. Almost every article on this blog will have a post saying how their monthly rent payment is less than a hypothetical monthly payment for buying (which are all gross numbers). When you dissect the numbers and account for principal (which is huge given the low interest rates) and all the tax deductions, usually it points to buying. Add in all other myriad of benefits of owning that you can’t put a price on, buying looks pretty good.

Everybody on this blog wants to own. There will never be a “perfect†time to buy. If you have stable employment, plan on owning the house for at least a decade and can easily afford it (DTI<25%), don't waste any time, go out there and buy!"

You are sooooo wrong in many ways so please do me a favor and don't post any advice on this forum. Today's market is for suckers. Yes, if you buy and pay inflated price today you are not very smart. There will be a "perfect' time to buy and that will be when The FED is forced by the market to let the interest rates go up. FED won't do it on its own but one day it will be forced to do it when they lose control over inflation.

Volcker raised interest rates to 23%. This time it will go much higher.

When dollar gets expensive, when our money becomes expensive assets overs will collapse.

In California alone asset prices need to come back down to earth by 60% to be affordable again.

Ignore this recent noise and avoid buying real estate now.

Housing is overpriced all over the US again.

If interest goes up to 23% and i am paying 3% on my mortgage, inflation will push up my property value through the roof. Asset prices are affordable to those who can afford it, does not mean everyone can live by the beach ;).

@moshennik wrote: “…If interest goes up to 23% and i am paying 3% on my mortgage, inflation will push up my property value through the roof..”

Your theory is largely uncorrelated. Case in point, Greek 10 year government bonds are currently paying out 10.5% interest but property values in Greece are deflating.

Interest rates are tied to perception of risk. Inflation is tied to a combination of wages, availability of resources and velocity of money. You can have any combination of interest rates and inflation.

I think most people here would agree that 2009-2012 was a damn good time(if not perfect) to buy if you survived the recession. Unfortunately many people at the time did not see it, just look at the archives on this blog. As far as interest rates going “much higher” than 23%, your entire post just lost its credibility.

More like 2009-2010. The refent rise in mortgage rates has turned most 2011-2012 purchasers into greater fools. Cap rates are getting crushed and that would have killed this specuvestor propelled bubble on its own. Add to that mortgage rates hitting 5% soon and Bubble 2.0 likely poppped last month, we just haven’t seen the confirming data yet.

MZAS, do us all a favor and don’t quit your daytime job as a comedian. I’ve been on this blog for years and was probably the biggest bear on here a few years ago. I finally accepted reality for what it was and couldn’t be happier with my home purchase last year.

Dude, you might need a little reality check regarding interest rates. If interest rates go to 23% or higher anytime soon, this country will cease to exist. Have you ever thought about that? Chances are you will not have a job, there will be rioting in the streets and finding your next meal and place to sleep will be the priority. Unless you are all cash and connected, buying real estate won’t even be possible.

Thanks for giving your advice regarding waiting for 23% plus interest rates for the perfect time to buy. Don’t hold your breath waiting…

I have given my advice many times before, here it is again:

1. Buy in a premium or near premium area.

2. Use at least a 20% percent down.

3. Have a stable income…somewhat subjective.

4. Plan on owing for at least a decade.

5. Keep housing costs around 25% DTI.

6. And very importantly, be close to rental parity.

If you can answer yes to all the above, buy, buy, buy! Housing (shelter) is a basic human need. You either own, rent or live in a car. Owners will always be favored, there is no doubt about this. And forget about all the crap you read in economics and finance books, most of this does NOT apply to desirable coastal California real estate. There are many reasons why prices in certain desirable areas will always command a premium and will have pricing floors to support these elevated levels.

I’ll enjoy my house and will likely jog down to the Strand tonight. Stay put in your rental and keep hoping for those monster interest rate hikes, I’m sure they’ll be here before you know it!

Lord Blankenfein wrote;

“Dude, you might need a little reality check regarding interest rates. If interest rates go to 23% or higher anytime soon, this country will cease to exist. Have you ever thought about that? Chances are you will not have a job, there will be rioting in the streets and finding your next meal and place to sleep will be the priority. Unless you are all cash and connected, buying real estate won’t even be possible.”

YES what you have seen at Greece is coming to US. There is no way to avoid that scenario. Bernanke is buying some time but we will have our Greece scenario make no mistake about that.

We could have begun raising interest rates slowly and steadily in 2001 and avoided the Housing Bubble, the commodity bubble, and the current Bernanked last gasp bubble, which would have give us a hard landing but not as hard a landing as we are heading for with all this dead to collapse. We did not. Now we are paying for it.

Several more things have to happen.

1) Gold needs to reverse and climb relentlessly through 201?or 201?;

2) the Fed needs to respond by jacking up rates. Volcker jacked them up to 23%. This time rates may go even highter. This will crash stocks, bonds, housing and commodities.

Our leadership is morally bankrupt. Bernanke is pumping adrenaline into a bedridden patient, very expensive adrenline, hoping to keep the staus quo intact. It won’t happen. Chaos comes next; and chaos means a new government, and a lot of punishment for those who drove the bus into the sea.

Lord Blankfein there is no ‘fixing’ our problems (massive indebtedness) that does not cause severe economic consquences. For our LEADERS who allowed this debt bubble to grow for so long, they should realize what they have done. They have created a horror show, through their greed.

MZAS, I see you realize all the real problems. Going through life preparing for the doomsday scenario that will likely never come is a bad use of your time. You only spend finite years on this planet, hunkering down in a cheap apartment stocking up on gold and bullets is a poor use of those years.

Going the way of Greece will likely never happen here, at least not in our lifetime. Go out there and enjoy life. Trust me, you are in the fringe element here.