Why low interest rates do not help the housing market and heavily benefit investment banks – 40 percent of Americans have mortgage rates higher than 6 percent. The SoCal housing market will enter a significant correction in 2011 based on seasonal sales and price changes.

Poverty is an anomaly to rich people: it is very difficult to make out why people who want dinner do not ring the bell.  –Walter Bagehot Over the weekend it was leaked that US authorities were gearing up to bring insider trading charges against investment banks, consultants, and a wide net of Wall Street players. We’ve gone down this road a few times since the crisis started and many of the crony banking institutions merely settled out of court paying the government off with taxpayer money. It’ll be interesting to see that going on our fourth year of the crisis whether anyone will be charged criminally for what has become the biggest Ponzi apparatus known to humankind. Wall Street simply doesn’t understand how so many people can be angry about their record profits as they push people out of their homes through rocket dockets like those in Florida. If you are poor or middle class then not paying your bills is sufficient for you to be “thrown out on the street with prejudice†but for the big banking system it merely means more generous bailouts. And those being thrown out are also selected with bias; for example how is it that many non-payers in expensive California homes have more leeway to ignore paying their mortgage while a person in Florida with a $90,000 loan is ushered out in a McDonalds like court system?   If you can rewind to 2007 when the proverbial debt hit the fan, most of the bailouts were pushed with the pretext of “saving†the housing market. If that was the mission, it has been an abject failure.

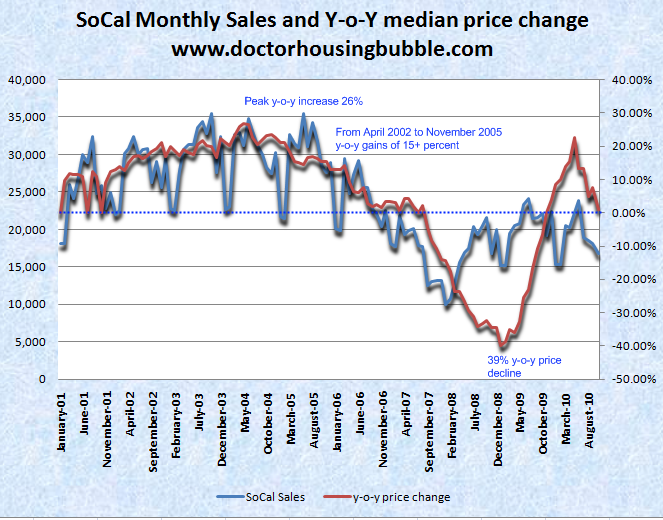

I bring this up under the context of the problems now facing Ireland. This weekend rumors were making the rounds of the price tag to bailout the nation. From $100 to $164 billion dollars. For the size of the country and GDP, this would be like the US getting a $9 to $10 trillion bailout. Why do this? Because many of the big banks from Germany, Spain, and the US have hundreds of billions of dollars connected to Irish debt. We’ve seen this story play out because we are living a similar bailout shell game. The extremely high price tag is being floated in the media so when the lower incredibly expensive price tag comes out, they can play psychological mind games with the public (“see, it wasn’t that bad.â€) The Federal Reserve is claiming that QE2 is to save the US consumer but really it is only a method of allowing banks to gamble with cheap funds while they figure out where to stash the nuclear debt waste. The reason many people can’t benefit from the lower funds is because so many homeowners are underwater and can’t refinance. Also, you have 17 percent of the nation unemployed or underemployed so they are out of the game to purchase housing. This is how the numbers break down regarding mortgage rates:

Source:Â JP Morgan

While banks keep salivating and screaming about low interest rates they simply don’t care that the American consumer is in a position unable to capitalize. They don’t understand why the poor don’t ring a bell for food. Yet at the same time, banks are borrowing at the Fed for record low rates and speculating in the global stock market casino. Now you might ask how is it that 40 percent of Americans have mortgages with rates higher than 6 percent when the current 30 year fixed rate is in the 4 percent range? Because many can’t refinance and many are underwater. Plus, banks have no incentive to automatically lower the rate when they can skewer paying customers to subsidize the many who are now living payment free in their distressed homes. The housing industry is one giant corrupt shell game at the moment.

Southern California housing implodes

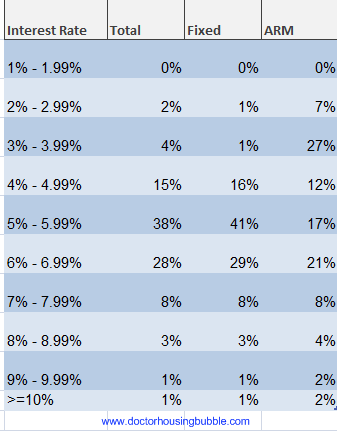

The Southern California housing market is imploding as we speak. You need to know where to look for this severe correction but many are unable to see beyond one month of data. So I decided to analyze and chart out year-over-year median price changes versus home sales to highlight the current trend:

This is a fascinating look at the SoCal housing market which covers over 22 million people and is incredibly diverse. From 2000 to early 2007 there was no y-o-y decline even during seasonally weak periods of winter. In fact, from April of 2002 to November of 2005 y-o-y median price gains never fell below 15 percent and many times hit the 20 percent range (peaking at 26 percent). Yet you can see that the correction in prices came with the collapse in sales. The collapse of 2006 sales was reflected in home prices in 2007. If you follow the current trend, y-o-y price increases are virtually done and sales are heading lower in the beginning of the seasonally weak period. In other words, 2011 will see price corrections. The question of course is whether it will be tepid (5 to 10 percent) or more significant (>10 percent).

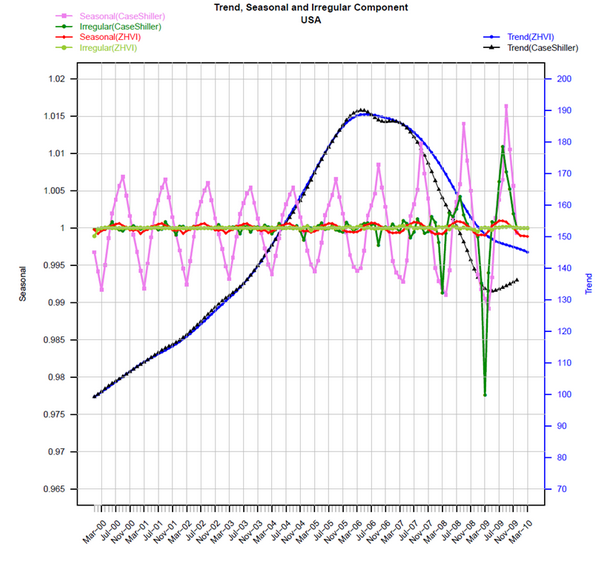

There is a fascinating analysis by Zillow regarding seasonal home sales and price fluctuations:

Source:Â Zillow

What Zillow found was that given the massive number of foreclosure re-sales, the Case-Shiller Index has been prone to more dramatic fluctuations because in the weak fall and winter months, when normal home sales are pulled from the market, the distressed inventory is still selling and with much lower prices depresses the overall market. Given the size of foreclosure re-sales, this has shifted the makeup of prices. That is why in one month we saw the median SoCal home price drop by over 4 percent. You can expect this kind of behavior throughout March of 2011.

You can see this on the current MLS and looking at shadow inventory for Southern California:

November 2010 data

Current MLS homes:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 95,095

MLS + distressed homes:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 257,824

So what does this data say about the next few months? Home prices will be coming down. The implications for the larger economy are yet to be seen. Yet public outrage against the banks and bailouts is boiling over and the public is ringing the bell against the massive fraud that is going on. 4 years into this crisis and no one has stepped up which tells you how cozy Wall Street and Washington are at the moment.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

36 Responses to “Why low interest rates do not help the housing market and heavily benefit investment banks – 40 percent of Americans have mortgage rates higher than 6 percent. The SoCal housing market will enter a significant correction in 2011 based on seasonal sales and price changes.”

Meanwhile the Kahleeforneeha state budget is STILL looking at $6 billion short for the rest of this year and $19 billion short for next year. Property tax reciepts have got to be dropping which result in layoffs at the public agencies that live off them…which means more foreclosures, more bankruptcies, and less money in the gubberment coffers. And that means even more layoffs.

We HAVE to bring back the jobs we sent overseas and curtail imports of foreign goods…which will also hurt our export markets…but we have to do that. We’d be net positive then. It’s the only way to stop circling the drain of our capital flowing away from us. Relax mining, logging rules and encourage industrial expansion. Build nukes to complement electric trains. Build refinerys. Stop exporting Alaskan oil. Export more coal. Develop our own engineers and stop the H1-b visa’s. Kick out all illegal aliens. Balance the federal budget. Win the damned war. Bring the troops home. Corral military spending…$700+/yr is way too much.

I have no problem with your prescription for fixing the economy except this:

“curtail imports of foreign goods…”

When Mexico curtailed imported of U.S. goods, the Mexican smuggling gangs got started. When trade opened up, they just shifted to another “curtailed imported good” – drugs. Now Mexico is in trouble and their people are being killed.

In my neighborhood here in Oregon, most or all of the illegals have self-deported, b/c jobs have dried up.

Stopping trade in goods and services is bad. Stopping govt spending at all levels is good.

we could start by closing some of the 1,000 overseas military bases and the 265 country clubs/ golf courses the Pentagon maintains.

You should read up on something called the Smoot-Hawley Tariff Act and reconsider what you are saying, or at least explain how it would be different this time?

No way to bring back jobs when CA college grads are in Sociology, Psychology, PoliSci, English, and History, NOT the hard sciences and engineering.

Heretofore government and its Welfare industry has provided jobs for all these lametards, at your great expense, so why strain the brain? I reckon they have lost not only the desire, but also the ability to use their minds.

What an excellent idea!

Go get a four-year degree in engineering, then a master’s maybe, get your licenses in order, on the way work for free and a pittance in internships, network, grow…and then come up against countless thousands of Asian engineers who will work for 1/3 the salary.

Here, let me hang some iron on you.

Diana Moon Glampers

Handicapper General

Yes let lower our standards so we can poison the environment completely in a vain attempt to compete with slave labor overseas. How about reinstating tarifs on imports. This is not rocket science, just do everything the way we did in the 50’s. High tarifs = more sales of American made goods, is that too hard to understand?

A few years ago when Donald Trump was bankrupt and owed millions of dollars, he was considered rich. If he would have owed only a few thousand dollars, he would have been considered poor. But because he owed millions of dollars, he was able to borrow millions more, and after gambling with the borrowed money, he became rich again. This bizarre concept applies to banks too. They are billions of dollars in the hole, so they get billions more.

Henry Ford touched on this concept 100 years ago.

He said that he could lose everything and within 2 years he would be back with a viable business, because he know “who” to contact, and his reputation would lead to financing and support.

Meanwhile, Mers is lobbying the Hell outta Congress, trying to make/buy themselves as the “national” holder of all mortgages, and by decree, not being responsible in any of the trillion lawsuits against them. BTW, have you noticed Doc, that the flipping shows have now been replaced by a plethora of Pawn Shop shows? I think there’s about five of them going right now. Those reality shows, they get ya coming…. and they get ya going.

Charles Gasparino wrote “Bought and Paid For, the unholy alliance between Barack Obama and Wall Street.” I think that we could have another banking crisis in a few years.

And you could write the same book at George Bush jr, Clinton, George Bush Sr, and Reagan, and…

at == about

Dr. H.B. I have been reading your blog for years and every article is spot on and well written, keep up the good work. Hope you have a Happy Thanksgiving.

Another insightful and timely post. Like many in southern california (Irvine, CA)… I find myself in a shared housing situation. Just this morning, we had a house meeting to discuss how much longer we wanted to do this. We are 3 adults, all employed and making “decent” wages… yet we continue to struggle. I am starting to believe the stats on rentals are just as cooked as the homedebtor stats. I see empty apartments in my complex, but the paper says rents are going UP. The question has become how to either move out of state or find affordable housing.

“The question has become how to either move out of state or find affordable housing.”

Population outflows are one thing that will help the housing market. I’m not saying you should move 🙂 but just that this type of thinking will, overall, help bring prices back down to inline with incomes.

It’s funny how one’s perspective about the numbers changes. The story about the coming prosecutions mentioned that the insider trading involved tens of millions of dollars.

But, really, so what? All the various forms of fraud involved in just the mortgage market, from mortgages issued to people who manifestly couldn’t pay them back, that being fraud in the inducement, to fraudulent foreclosures by entities who don’t hold the actual note, to frauds committed against mortgage backed securities holders, to paying out AIG counterparties whom the feds favored, like Goldman, at 100 cents on the dollar, hundreds of billions have been stolen.

It seems incredible to say it but, tens of millions? Whoop de freaking doo. It’s like pushing past a guy with a bloody knife and a hostage to stop a kid from putting a candy bar at a convenience store into his pocket.

DHB> You’ll love this. My favorite crook. Angelo Mozilo’s finest.

http://www.nakedcapitalism.com/2010/11/countrywide-admits-to-not-conveying-notes-to-mortgage-securitization-trusts.html

I have two comments/questions. One, interest rates are also starting to inch up. Also bad for housing prices. Thank the Fed and QE2?

Two… a question, really. What happens when property taxes are not paid? Can’t the municipalities foreclose and sell at auction on those who don’t pay their taxes? Why haven’t we heard more about this angle?

Unless people are paying their taxes, and not their mortgages. But it sounds like a lot of people are just not paying anything at all. Wouldn’t municipalities come under pressure in laying people off when they are not collecting taxes?

Non-payment of property tax results in a lien.

Three years ago most mortgage holders would have paid the property tax and tacked it to your loan — payment of taxes is one of the mortgagee responsibilities, as is insurance. As of now, are banks fronting money like that? Unlikely, so then the state/local government files a lien and after a period of time it sold at a tax sale. Prior to the sale the bank will come in a cure the tax lien at the last possible moment, so that can maintain their security. If they don’t come in it means that they feel the value of the property is below the level of the tax lien.

In some other states the lien is sold to investors, thus the state/local governments get the amount due and the investor gets a lien against the property and collects penalties and interest.

In OC property taxes can go unpaid for up to 5 years before the county will move to foreclose. There are MANY people now who are no longer making payments on their mortgages, property taxes and HOA fees, possibly 25-30%.

When the bank forecloses on a property they become liable for the property taxes and HOA fees so unless they think they can sell the property very quickly they have no incentive to foreclose in a timely fashion. This aggravates the problems with tax receipts and forces HOAs to spend large sums to attempt to collect while cutting maintenance or services or raising fees on other residents to cover the shortfalls.

This big ponzi scheme is most hurting the middle class and the poor(er) owners. It is sad to say but most people only have themselves to blame for their attempts to live the lifestyle of the rich and famous while earning average or below average wages. They used their homes as ATM machines or bought way beyond their means because they wanted in on the get rich quick schemes perpetuated by the lenders and realtors during that time.

Sadly we’re all paying the price for these people’s stupidity and for the greediness of the real estate profession, lenders and wall street types who are still laughing all the way to the Cayman Islands with their loot.

I don’t believe the comment about banks being responsible for past HOA dues is correct. HOA dues are a junior and only get satisfied if the other liens get satisfied first. Property taxes on the other hand do get paid before all else. HOAs are allowed to come after the person in court, but the taxes are attached to the property not the person… at least this is my limited understanding.

The banks are very slow in responding to refi. I have a pending refi so far for more than three months, and I don’t have a clue where it is now. if you are paying your mortgage now, why are they so eager to give you a refi? Many homeowners don’t pay their mortgage now, and the banks are losing money because of these unpaid mortgages. they are really happy to have some people still paying.

as for the homes on the markets, take a look at the high end homes, it looks like they didn’t get the memo that we are having a housing crisis. their prices are still much elevated for many of the homes.

http://www.sdlookup.com/

I always say this, low interest rate is great for refinancing, bad for buying.

You can not curtail imports from other countries. Many, many “American” cars are built in Canada and Mexico.

Banning them from the market would bankrupt GM and Ford.

In 1929 the depression was brought on by excessive debt from stock speculation. It it only took 10% down to buy stock. When the market dropped 80%, the banks were not re-payed and the security they held was worth much less than the debt. Also, as the result of the non-payment, the amount of money available to lend was severely reduced, thus hampering the parts of the economy not related to the stock market. The banks (with help from the FED) had to very slowly unwind the debt to preventive further instability. A reduction in value of the primary underlying asset – stocks, was inevitable. The result was deflation.

Now in 2010 we are facing exactly the same situation. Banks(with the help of the FED) will unwind the real estate held very slowly, so that they can minimize their losses. Expect the value of the in the underlying asset to go down. Deflation in non-real estate parts of the economy will not necessarily also be a consequence. Though possible.

This is exactly what Japan has been going through for 20 years. Unwinding from its credit induced spending binge of the 1980’s.

Not all the answers can be found in history. But there is one truism, ” Those that fail to learn form history are doomed to repeat it.”

Ironically, those who do learn from history are doomed to repeat it as well.

Ireland should just default and tell everybody who owns their debt they are outta luck. Eventually this will happen, then the real crisis will begin.

True. This “rescue” is insane. You have a nation which, instead of taking over its insolvent banks and putting them in, I think the term is “receivership”, guaranteed all their debts.

If Ireland can’t pay back it’s debts now, how will they pay it back with another $109-130 billion thrown on the heap?

Ireland only has a population of 4.4 million. That’s not adults or taxpayers, that’s the total population of Ireland. When you take even the low end of that “rescue” package and divide it by 4.4 million, you get a sudden new addition to the country’s debt of $24,773 per man, woman and child.

It’s absolutely insane. And then, to top it off, the rest of the EU wants Ireland to hike its corporate tax rate, the one thing that had been a lure for business to go there. What in the world do they think will happen to Ireland’s tax receipts and economy if they drive away the businesses locating there for that reason?

But the french, germans etc . . don’t care. The problem with Ireland’s 12.5% corporate tax rate from the perspective of the french is that it makes it that much harder to raise their rates. That’s a big part of what this is about from the perspective of the rest of the EU, squashing the competition. If the irish let them then they’re complete fools. As you say, just default now. They’re going to default down the line as sure as the sun will rise tomorrow. Those 4.4 million irish can’t all suddenly pay for $24,773 of additional debt each.

To put the Irish bailout in perspective, a similar bailout in the USA would have to be 4 trillion dollars.

On CNBC yesterday an expert said that early next year Portugal will ask for 75 billion and Spain will need 500 billion. All these bailouts are to shield bondholders from the consequence of risk. Completely unfair to those that performed proper due diligence and manged risk sensibly. Punishing the most productive in society, by 1) bailing out these idiots 2) creating a capital squeeze, and thus unemployment. Unemployment in Spain is 20%.

Crony capitalism is far worse than the worst communists. We need markets that price risk accordingly. Prices for bonds, real estate and stock need to properly reflect the risk involved. Bail-outs only encourage the speculators, and discourage steely eyed investment.

with all the pressure on municipalities and so many close to bankruptcy i wonder how long it would take to change those laws — so that unpaid taxes could be cause for seizure much earlier than five years or whatever?

Another Great Story Doc! And I appreciate the more focused, helpfull responses from everyone here… Hang in there people, the forces of Good are turning the momentum of the Evil! Be patient, things will get better! If only it wouldn’t take so long… Try not to look back for revenge or to get your “Pound of flesh”, the government wants us to be the “Bad Guy” in all of this. If you believe in a higher power or Karma, your positive energy will serve you better and will prevent accumulation of “Karma” Debt. Don’t feed the Beast! Peace to you All!

Banks are short selling here more quickly, to offload the debt burden before they go to foreclosure. It used to take up to a year. A co-worker bought a short-sale a few months ago and got the whole thing done in 90 days. So some of the lending institutions are recognizing that they have to move this inventory sooner than later. In some areas though, the real estate values are remaining at good levels. The maniac run up in prices did not occur in those areas, and though some of the homes have come down 15% or so, the best ones, the move in ready ones, are still selling very well. And this is in an area with high unemployment. The key is that in those markets, the owners are not all trying to sell becasue they don’t have a job or pension problem, or perhaps they already own that dwelling and can stay put for a while.

Eventually this will come home though (the debt) regardless of where you are living in the US, as the ATM process most homeowners used will be further cut off when they eliminate the tax write off on the interest. That is in the works for the new tax plan, or should I say revenue creation plan, which is just going to gut things further.

Damn, where do I get one of those <2.99% fixed loans shown in that JPM table?

Dr. HB,

Another excellent article on shadow inventory! Keep up the good work. You should send some samples of your work to Mish Shedlock, he might help you get more exposure which you certainly deserve.

I am not disputing your figures, but just curious where you derive the figure that 40% of mortgages have a rate above 6%.

Leave a Reply to wenstar2010