United States of Renters (USR): Single Family Rental Home Growth Rate up 45 Percent since the Great Recession versus 15 Percent for All Housing Units. US Rental Home Value at $4.5 trillion.

This past weekend I was looking at communities across the United States that are now being built to house renters. So why is that even worth mentioning? Rentals are always part of the housing mix typically in the form of apartments. Yet this is something different in that it is a suburban built cookie-cutter individual home market that can easily be selling these homes, but instead they are designed for rentals. Welcome to the United States of Renters (USR). As I’ve discussed before many Millennials are built for rental properties. You usually hear from Taco Tuesday baby boomers that housing is the only option on the table. But the reality is, housing is a drag on the economy in terms of innovation. What is more innovative, designing an iPhone, Tesla, supply chain machine like Amazon, or building a home? Newsflash, people have been living in homes since humankind has been around (from caves to huts). So to have an insane amount of money going to a housing payment keeps discretionary money from funneling back into the entrepreneurial side of our economy which is really what separates our country in terms of innovation. That is, until we get too obsessed with real estate as we did leading up to the last housing bubble. The good news however is that the market is adapting to providing more rentals to Americans and the demand is not slowing down.

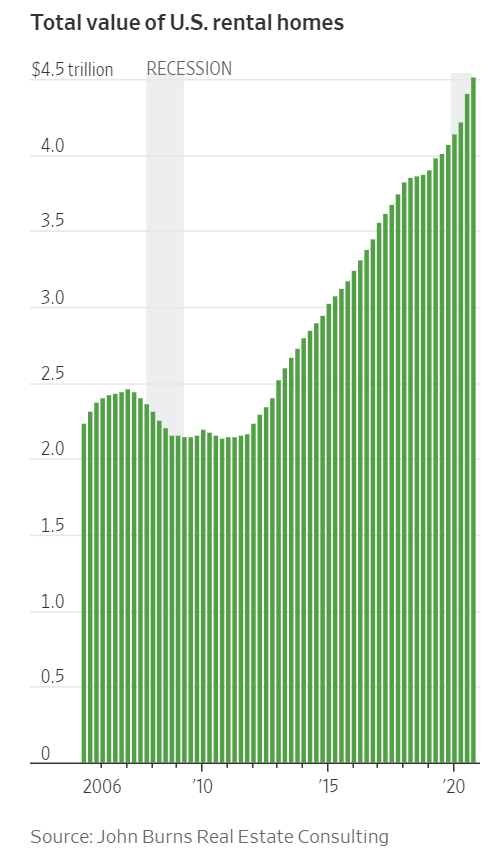

Value of Rental Market

First things first, the housing market is hot but so is the investor portion of the market in terms of rentals:

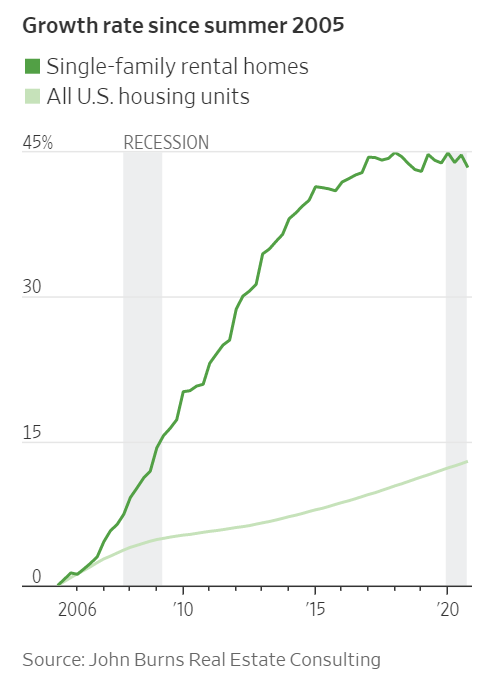

The value of rental real estate has gone from $2.2 trillion in 2014 to $4.5 trillion today (a 104% increase in 7-years). The single-family home rental market has far outpaced that of regular housing stock which is going up too:

Why is that? First, you have many investors including pension funds, hedge funds, foreign buyers, and small investors chasing real estate as an asset class. Given that inflation is high, people want a stable store of value. These are not crap shack hunting boomers but investors that see real estate for what it is, another asset class. Most of the cheerleaders want to tug on your heart strings about having a safe place to raise your family, or stability, or other emotional arguments but the reality is, most American home buyers sell their first home in 7 to 10 years (not exactly a long-term commitment there). Also, when you pay your home off, you still have property taxes, maintenance, insurance, and other upkeep that can be very high (possibly the cost of a rental in a more affordable market).

It is also worth noting that with many Millennials not having kids or waiting later in life to have children, they are more focused on advancing their career which typically means being flexible and not being tied down to an albatross of a mortgage early in your career.

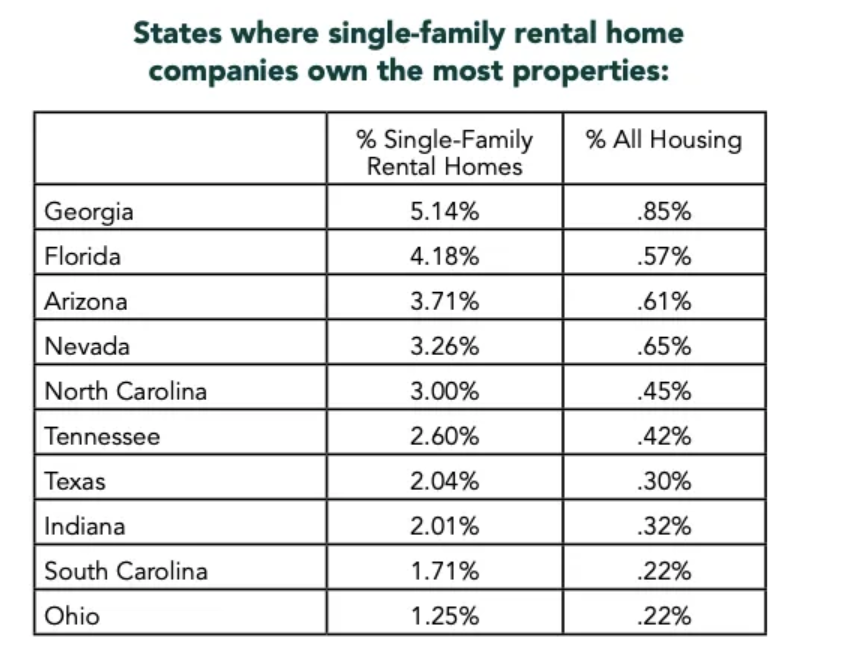

Investors of course are targeting more affordable states and these are places where home values are moving up much faster than expensive enclaves that are experiencing a Brazil effect – high cost real estate in tiny pockets with extraordinary poverty just a few miles away (think of Los Angeles).

Take a look at some of these states where investors are buying:

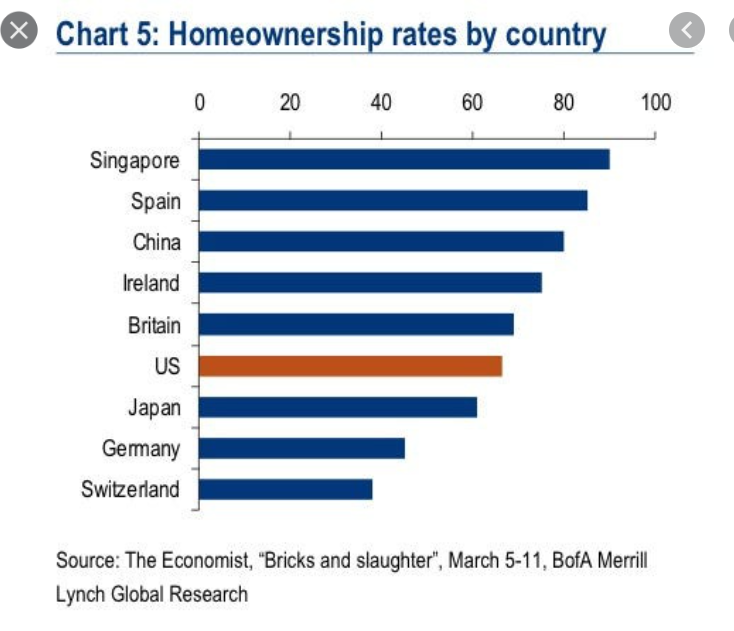

Notice something? These are also states that are seeing fast growth in their populations and economies because housing is much more affordable. In California, the NIMBYism of homeowners is insane. Many are buying homes today at insanely inflated prices and now carry an albatross around their neck for decades to come. You also don’t need high homeownership rates to have a successful economy.

Other Countries Homeownership Rates

Some seem to think that a high homeownership rate is critical to having a vibrant economy. Not so. Take a look here:

Japan, Germany, and Switzerland all have lower homeownership rates and more income equality while still being very productive economies (and less poverty as well). Spain has a very high homeownership rate yet the economy is struggling.

So why do I suggest that this rental trend is going to continue? First, generational differences and the ability to flex workspaces is here to stay. So everyone is going back into the office? Okay, but guess what? Many large organizations now realize they can do a lot of work remotely and many realize that having flexibility is incredibly valuable, and more productive than being stuck in traffic. So you will get more people open to leaving high cost areas to more affordable markets. This will be especially true if people try to force the workforce to go back to an 8 to 5 environment. For the most part, it seems like those wanting the old work schedules are older Americans that are technically inept and simply want to control their flock of workers in an old school way to justify their wages. Some jobs require you to be in person but those that flourished during the pandemic will have a tough time retaining talent if they don’t adapt. Tech companies are going with more hybrid schedules which provides more flexibility and the power to attract more talent, from anywhere around the world.

Also, younger Americans carry heavier student loan debt so they are already saddled with expenses and realize taking on more debt for a home may not make sense (or is not feasible). In California 2.3 million young adults live at home with their parents because they cannot even afford a rental, let alone buy a home. The big money in pension funds and hedge funds realizes renters are here to stay and are plowing money into that market. That should tell you something.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

185 Responses to “United States of Renters (USR): Single Family Rental Home Growth Rate up 45 Percent since the Great Recession versus 15 Percent for All Housing Units. US Rental Home Value at $4.5 trillion.”

I think Singapore is a but of an outlier, because it is a small island and most of the home ownership is actually condo buildings that are under some control by the govt. Very few single family homes. I went to Singapore many times on business, never met anyone who actually had a single family home. They all lived in condo towers.

Lot of assholes on this board.

Often the same righteous posters and the ugly underbelly of right-wing America.

“The ugly underbelly of right-wing Americaâ€

Sounds to me you don’t like free speech. Shouldn’t liberals be supportive of diversity and promote differences in opinions? Imagine we would all be BLM and Antifa? The US would look like Europe or Venezuela by next week.

No thanks! I rather be a patriot and enjoy the rewards of capitalism. Let’s celebrate our birthday/independence and buy more ammo, bitcoin, stocks and real estate. Go USA 🇺🇸📈🚀💰💵ðŸ‘ðŸ¡â¤ï¸

People sitting on cash have been the mega losers during these inflationary times. Bulls like me who own stock, RE and bitcoin have been the winners!

The beat time to buy was yesterday. The second best time is today! Stop being a loser!

Congratulations to M about how his “wise” decisions. I have to wonder, though, could you have done all this on your own? Wasn’t your home bought because of money given from family? Did you actually earn that money? How old are you M? Just curious. You seem to have all the answers.

I am in my 30’s.

For many years I was sitting on cash. Waiting for an epic RE crash to buy at a discount. 50-70% RE crash was my dream. Year after year went by – no crash. In the meantime, surprise….I got older….:still renting a little, cheap, crappy apartment and saved, saved, saved. A frugale life style to increase the downpayment. I did invest in crypto which made me a lot of money in 2017.

I could not get myself to pull the trigger to buy a house because I thought i am too smart to buy the top! It must crash I thought!

I would have never, ever bought. Then my situation changed significantly. I received inheritance money. Now I sat on so much cash that I couldn’t justify to not buy a house. Let’s finally buy and if it crashes so what, part of it was “free moneyâ€. I was certain I am buying the very top. I bought and covid hit. The entire blog cheered “Millie bought the topâ€and now the market will crash. Millions will lose their house due to covid. Market will crash. “

I wasnt wise. I had no idea how it will play out. Never ever would I have thought the market will skyrocket during the covid year and until now.

I got lucky. I needed the inheritance money. To push me over the fence and buy. I could have bought without it but just couldn’t pull the trigger. With free money I could do it.

Lucky! And extremely grateful! Not wise.

However….I learned. In places like SoCal, buy when you can.don’t try to time the market. Covid has shown how many, many were wrong! Learn from my story that waiting isn’t wise. The market can be bullish longer than you think.

He has the world’s only working crystal ball. 😛

I wish. Nope, I just got lucky buying at the right time! But here is the secret….it’s always a good time to buy. The best time was yesterday, the second best time is today!

That might be true if people kept their homes for longer than 8 or 9 years on average and if foreclosure were never be a thing again (you’d have to wonder). It was a bad time to buy in SoCal in 2006 for millions of people. Massive ruination.

The problem is knowing when is a good or bad time to buy or sell. Nobody can really know. I’d hate to be in the home buyer’s market right now but I do get your point. I constantly buy assets for the long term and think timing a market is a losing strategy.

You going to keep any cash on hand, just in case? There were some amazing deals all around for people with cash from 2009 – 2012. Dry powder has its place.

All the best, my friend.

I’ve some cash on hand. Most of it is in stocks and crypto…..we are going to the Moon!

M: “Stop being a loser!”

You don’t have to be a Psychologist to realize that singular, antagonistic, self-aggrandizing statement should compel anyone to avoid reading any of this guy’s posts.

More trolling by M.

Some of us (myself included) doubt he even bought a house.

You make it sound like aggrandizing your wealth is a bad thing.

I disagree with you tulip boy. Buying bitcoin and other alt coins has been a fantastic investment. Similar with real estate and stocks. Don’t be too scared of digital tulips! They can make you life changing money!

I admire M for his foresight in buying a house. He had the foresight to see that owning a house to live in is the best way to preserve security and wealth in any economic situation for the long term. I believe it is true since M did not waiver during the worst of the pandemic. However, one year is not long term so the jury is still out.

I admire his luck with bitcoin in the same way I admire a gambler in Las Vegas who is winning or a million dollar lotto winner.

Let’s see what happens if housing crashes 50% and bitcoin goes to 0. That is the true test for the long term. What happens when the tide goes out?

My guess is M will disappear from this blog. However, he may rename himself again and remain. This is a challenge to M since I have enjoyed his comments.

Thank you Bob!

A haircut in house of 50% is highly unlikely. Bitcoin going to zero is next to impossible. It’s far more likely that bitcoin will go to 100k and the moon and mars. The risk of missing out on one of the greatest investment opportunities in our life time is far too great.

I look at the past year and think to myself, if the perma bears would have invested their cash in stocks, re or crypto they would have easily doubled their money. Instead they lost due to inflation.

Don’t try to time the market. Dollar cost avg and have a long term outlook.

The last famous world of M….bitcoin to 100k…the last time he expressed his 2c bitcoin dived 50% 🙂

Bitcoin at a 100k is a given. Not an if but a when.

Bitcoin 200-300k is also in the cards, not this year though.

Right now, big discounts are available. It pays to buy the dip!

@M – i really dont know if you’re telling the truth or lying (it sounds to me likely you’re full of it) , either way you sound like you have bad mental issues. Massive inferiority complex and it’s unhealthy for you but it’s another thing to constantly subject everyone else to your sickness. We get that you want to be heard, but that’s what mental professionals are for, not this forum. I’m quite tired of hearing from you.

Lol foobar. That’s like your first post ever. You are probably son of landlord 🙂

Btw., someone asked me a question and I responded.

M: Lol foobar. That’s like your first post ever. You are probably son of landlord

Nope. Unlike you, Son of a Landlord is the only handle I’ve ever used on this blog. Do you imagine that only one person thinks you’re full of it?

Just more proof how narcissistic you are thinking just because people haven’t engaged in dialogue with you that means they have never posted. All you have to simply do is click the old threads and look for yourself. Please seek help. For your sake and for everyone else’s. Would be nice to get to read the threads without cringing every time I see your two cents.

Hehe nailed it. I knew foobar is son of landlord!

That thing, M, time ago said that the head and shoulder on bitcoin was negated. Unfortunately I cannot attach a graph of that head and shoulder pattern that brought bitcoin all the way down to the 30s to rub on that face of him. As a good friend of mine is used to say : press S to shit on millennials. Truly the most mentally challenged generation to ever existed on this planet.

M: Hehe nailed it. I knew foobar is son of landlord!

How have you “nailed it”? Because both of us responded?

If mention two people by name, it’s natural for both to respond.

Boh

I wouldn’t say mentally challenged. I would say millennials are open to invest in crypto versus boomers who like gold and silver. Millennials are more likely to be millionaires with crypto than a boomer with gold. Physical gold…..it doesn’t make you money but digits gold (bitcoin) makes you rich most likely.

M thinks I am a boomer….oh well as I said mentally challenged…thanks for confirming I was right calling your generation mentally challenged. The problem is you said the head and shoulder was negated and you have been proven wrong: this is a FACT, it is not opinable. Now sit and quiet.

I never said you are a boomer.

I don’t care what you are. You are new here and are still in the process of learning about new tech like bitcoin. (Aka best thing since sliced bread).

I trade Macro cycles. Short term dips are gifts. Follow my advice and you can be successful too. I made a lot of money by buying stocks, RE and crypto. 🚀ðŸ‹ï¸â€â™€ï¸ðŸ‘😊👌🇺🇸💰💵📈

M….I do not follow losers like you…that is how i made money, by not following losers like you.

“Losers”

Lol!

I bought a house in Q1 2020 which appreciate several 100k since then. A new construction in SoCal 🙂

Besides that I have a tech job and sit on a huge profit in crypto.

I bet my bet worth is 5x higher than yours. Don’t fight it, listen to people like me who make lots of money.

I own a house too that I bought during Covid. Family needed a home, everyone was afraid so I bought.

I want to buy a second home, but now everyone is greedy so I’m waiting again.

It’s not timing the market, but buying when everyone is afraid.

Smart girl. You could be me, except I am very masculine.

Wait a minute. M’s crystal ball doesn’t tell all.

BTC was at 63K in April, and now it is at 33K. A loss of 50%.

I hope M wasn’t pumping money into BTC in April.

However a year ago, BTC was at 10K with a gain of 3X now. I hope M put all of his money in BTC a year ago.

I think BTC is like gambling. I put all my money on Black and was lucky enough to double my money. Everyone should go to Vegas and bet on Black!!!

Wild gambling is going on in the market with irrational exuberance. We all know how that turns out.

Maybe M is correct and BTC goes to 100K or maybe he is not and BTC goes to 8K.

Unlike Vegas, it is hard to predict the odds on on BTC. It depends on human nature, what Musk says, and yada, yada, yada.

However,the House/Wall Street always wins in the long term. So I look at the odds and gamble accordingly. It is hard to put odds on human nature.

Does anyone have Vegas odds on BTC? I would be interested.

California is doing their best to destroy single family residential by passing a couple of horrible bills (SB9 and SB10) which would split up lots and allow everything to be defacto two and four plexes. San Diego has already destroyed the SFR with legislation passed last October which allows unlimited extra units if they’re dedicated affordable for the next 15 years. Single family does’t exist anymore in CA and will get worse. I think there’s something to this Brazil affect you mentioned. When one says NIMBY’s are a problem, the problem is that it really is in the backyards.

Agenda 2030 and the goal of the “elites” – “you’ll own nothing and be happy” – happy only if you take drugs!….Welcome to the new feudalism.

In WA, the state comes up with all sorts of new building and electrical codes, most of them don’t have anything to do with safety but everything to raise the cost of new homes through stratosphere. Between the new codes and increase in soft costs, they manage to add another $100,000 to the cost of an average house. The final goal, like in Europe, is to bring the herd into government funded projects with high density like in “CHAD” (Seattle). That is the goal of all communists who are sick minded and obsessed with control – totalitarians.

You are correct. So, what’s the solution? Ideologues and Bolsheviks don’t relinquish power easily. Hunker down in Spokane or Walla Walla until their policies strangle you?

I just hope more than half of the americans will wake up to what is happening, but I doubt it. Some people like Bob on this forum will never wake up – he still live in the Democrat – Republican paradigm when in reality the issue is globalists vs. nationalists. The Democrats are ALL globalists; I did not see a single one not to embrace globalism/collectivism. A good chunk of the GOP are just the same with an R after their name. There are though some in GOP who see and understand what is happening but they don’t have the numbers to alter the course. People should get involved in the primaries to vet each single candidate.

Till people will wake up, house prices like everything else will go through the roof and everyone will lose, including the homeowners – through higher property taxes, through high inflation (regressive form of taxation) and more taxes on inflation. In the end, the standard of living for 99% will sink regardless if they own a house or not.

When they say – “Build Back Better” – they mean for the Davos club at the expense of everyone else; ..but the stupid cheer them for that because they don’t have enough brains to see what is happening – their own enslavement.

Flyover sure read a lot into what I wrote. I suppose I better wake up now and stop dreaming I wrote a reply.

Sorry Bob,

I think Flyover is referring to me.

I’m not binary like Flyover. 🙂

I believe in this simple world.

Capitalist vs Democratic Socialism vs Corporatism/Fascism vs Communism

1) Capitalism – A true game of Monopoly. At the end there is one winner and everyone else is out of the game (ie dead or homeless and dying). It is a society of oligarchs before the game ends.

2) Democratic Socialism – a balance to avoid the hard ending of Capitalism. A wage balance is achieved. Home and industrial safety is implemented. ie people are not dying or losing limbs on the job, and homes aren’t built over toxic waste dumps with lead paint. This is what I am.

3) Corporatism/Fascism – Corporations, with government backing, don’t have any regulations for health, safety, or wages. Toxic waste can be dumped anywhere, and it is buyer vs corporation. Buyer beware since regulations have been revoked by government.

I think we are moving in this direction. Flyover will be happy.

4) Communism. – The faith that everyone will work hard for the common good of humanity and unicorns. It doesn’t work. It failed in CA communes in the 1970’s and it became failed brutal autocracies in the world in Russia, China, Cuba, Vietnam, etc.

I like it better when you weren’t as positive and more of a snide wise-ass. I left California-L.A. to be exact–not only because of the ridiculous real estate but the social justice, taxes and overall left-leaning nonsense.

There is nothing good about corporations making things unaffordable and I don’t understand why people are always pointing fingers at different generations. That’s quite a generalization. Baby Boomers this. Millenials that. Give me a break.

There is nothing in the United States that is positive or progressive. Everything is expensive and like your million-dollar crap-shacks the cost-to-value just doesn’t add up. You can have a better quality of life in another country and pay less taxes too.

People in the United States are the most self-entitled, self-righteous, arrogant individuals I’ve ever encountered traveling the world. What I’m seeing is a welfare-nation, drug culture of low-class uneducated whites and the rise of corporatism on a grand scale.

Somehow Americans always seem to land on their feet. Social justice my ass.

The only bubble in America is the one between the shoulders.

What I’m seeing is a welfare-nation, drug culture of low-class uneducated whites

Whereas blacks and browns avoid welfare, reject drugs, and are known for their love of learning and scholarly achievements.

Seriously, why target whites?

“Seriously, why target whites?”

Cuz it’s what all the cool hip kids are doing these days.

“Seriously, why target whites?”

Virtue signaling. It is fashionable among the liberals. It is open season, especially against straight white males!..sad!

Seriously, guys.

Why can’t you be like a good Nationalist Republican and shut down voter polling locations in non-white neighborhoods? Too many are trying to vote there.

Or be like Flyover and support that the Vice President should decide who the next President should be.

Our last President thought this should be perfectly Constitutional.

Let’s see if that happens in the 2024.

Somehow, even though Flyover supported it last time, I don’t think he would support it in 2024.

Crazy times!

The goal of Nationalist like Flyover, is to pit poor people against other different poor people. It worked after the Civil War, it works between poor Millennials and Boomers, and is a common tactic worldwide. Don’t fall for it.

It just distracts from the oligarchy and wealth disparity.

“It just distracts from the oligarchy and wealth disparity.”

I agree with you. Since none of us wants to get distracted from the billionaire class, lets focus on Bezos, Gates, Zuckerberg, Jack Dorsey, Tim Cook, Soros and others like them, all liberals voting for Democrats and who put Biden in power and who hate free speech for others except themselves. They are the biggest promoters of inequality and like good fascists, they married the government to their own oligarchy. Are these the ones we should focus on????….

California Senate Democrats want to pay for up to 45% of the purchase price for new home buyers:

https://www.businessinsider.in/policy/economy/news/if-youre-a-californian-the-state-wants-to-cover-almost-half-the-cost-of-your-new-home/articleshow/83407921.cms

Under the plan, the state would then own 45% (or whatever percentage) of the house.

The California program is meant to put homeownership back in reach for many residents, and the lawmakers are set to negotiate the budget, including the program, with California Gov. Gavin Newsom on June 15.

That is funny. I bet it wont pass.

But its not a new concept, I heard that Caltech offers such a program for faculty moving to Pasadena who cannot afford a home near campus. Caltech puts down about half of the home cost, then simply is reimbursed same proportion when that faculty member moves away and sells the home.

What is this, an article from The Onion or something?

So someone who could previously only afford a $300K home will now be able to “afford” a $600K home. Which means the people who paid $600K for theirs, will now have neighbors who can only afford 1/2 as much. Hilarity ensues.

Why stop at 45%? I say 95% or go home. I mean it is so unfair that only evil rich white people get to live in Malibu. Poor POC welfare recipients should as well. I say it is a human right that the govt buy everyone a beach home. To do otherwise is perpetuating the patriarchy and white supremacy.

No Malibu Home, No Peace!!

No Malibu Home, No Peace!!

Wow! I agree with Mr Landlord on something.

If you listen to Flyover, this would be a huge step toward communism. The State owns 45% of all of the housing. I agree that this is a bad choice. However, since some private corporations are already doing this, we are already moving toward a fascist regime. What do you want? Flyover fascism or Government communism? Flyover fascism is winning currently.

Bob, why should we all the time be forced to choose between two corrupt systems which are very much alike – concentration of power in the hands of the few, big government and zero freedom? In that respect, fascism and communism are the same and the result is the same – TOTALITARIANISM.

What about to cherish and respect the Constitution left by the Founding Fathers, the bill of rights, free markets and individual freedoms?!!!…such a novel idea for the liberals/democrats of today!…

Just because I condemn the communists, it doesn’t mean I support the fascists. Just because somebody declares himself anti-fascist (ANTIFA) does not make him a freedom loving individual with respect for the US Constitution. However, everyone knows that the Democrats are in bed with ANTIFA.

Sadly, I thought the market was high and it went on to double (or more) the past 10 years. My salary is about 15% higher because I switched jobs than it was 10 years ago. I am in a far worse position to buy a home today than before. I knew the housing market would continue to climb but never did I imagine it would have these huge gains. All of the sales are usually cash and there are lines of buyers at every decent home for sale. If you want a “fixer” you will spend top dollar on a teardown and good luck finding a contractor to fix your home in under 2 years. This housing market is out of control and there is no hope in sight. It’s actually very depressing. I am in SoCal and I need about 1.6M to buy an average home. Sure they tell you the average home is 800K. But for 800K you get a dangerous area, bad schools, and a 70-year-old home falling apart. It takes double the amount to put your kids in a good school, an updated/remodeled home, and a safe area to walk outside after dark.

Sure I can risk all of my money in stocks and bitcoin. The fact that is what we need to do in order to save for a home is an indication that something is wrong. It feels very dangerous when the biggest financial decisions feel like a casino.

@Sean, you seem to have very high tastes. For 800K, you can buy a decent house in many areas of socal (relatively safe, decent schools, etc). For 1.6M, you can buy in the upper crust areas all day long. Many younger people I have met in the recent years think their first home will be their “forever” home. That’s just not the way it works in socal, hasn’t been like that for decades.

Hello Sean, as I scanned your comment, I was looking for the area in which you live. Bingo. Los Angeles. I have lived here all my life. I share your frustration in that you cannot find a suitable home to buy. I think you may be in a tide that is turning for c retain pockets here in So Cal. The forbearance for mortgage relief is now coming to a close. I believe there will be a group of owners that will walk away for whatever reasons, some of which are written about in detail from the other bright commenters here. Get hooked up with someone in the know about defaulting loans on housing in your area. That is what I am doing

Sean,

You could always move. Oh but you won’t cuz the beach and weather and whatever else. Well OK, don’t move and rent forever. Life is nothing but a series of choices. Your choice seems to be weather+beach > owning a home. Which is coo. But just accept that as what you’re choosing and live with it. Complaining about how unfair things are will never make you happy.

$1.6M is not an average home in SoCal. What neighborhood did you grow up in?

Here’s a good one for you guys:

We just canceled escrow on a home in South OC – removal of loan contingency was supposed to be this Wednesday. We knew going in that it was a ‘light fixer’ – needed a new HVAC, roof repairs and termite remediation/repairs. Other than that the home appeared to be in pretty decent condition at a cursory look, albeit with all original fixtures and furnishings from when it was built (1985~).

Repeatedly the seller’s agent told us: “HOME SOLD AS IS NO REPAIRS NO CREDITS” until this became rhetoric. Ok sure…. but yellow flag for the rhetoric.

We had the inspection done this last Tuesday and I had a few contractors/vendors out to quote the HVAC, roof and termites. The general inspector called out an area of concern in the garage: a notable crack in the concrete slab that extended into the foundation. Uh oh. He said that he suspects sloping in the bedroom directly above this area of the garage. And he was right, there is a drop-off/slope from the part of the hallway leading towards that very bedroom. This was the first red flag…

I called around trying to get in touch with structural engineers and or foundation repair companies. I found a few that had availability last week but it seemed like everytime we would try to schedule one the seller/seller’s agent would balk and say that it wasn’t a convenient time and the seller wouldn’t be available… what?! Seller and seller’s agent were dragging their feet with responses and making it difficult to work with. This was the second red flag.

I ended up getting in touch with the engineering geologist who heads-up the soil and land surveys for this specific community/HOA – turns out he also does residential site surveys and so I scheduled with him to come check the property out today to do a floor level assessment and site survey (this would have cost another $600 btw). We had gone back and forth on this and they finally conceded to allowing for those inspections to occur.

After scheduling for the engineering geologist to come out, someone suggested we might want to consider factoring in the cost of repiping the place as it *appeared* from the report that the original copper piping was running through the home in most places. However, the general inspector also noted observing PEX in his report and also that there was PEX in the attic. I was discussing with a plumber and he cautioned that if there’s PEX running through the attic it likely means there was a slab leak. This was the third red flag.

We brought this up to the seller and my realtor asked directly if there had been any prior slab leaks or water damage. The seller’s agent replied back giving some story about how there was and attached images of receipts for slab repairs that were done in 2013 and 2014. That’s the fourth red flag.

We were not comfortable about the fact that they didn’t disclose this up front. After all, if they didn’t disclose these things, what else were they not disclosing? Benefit of the doubt….trust but verify. Frustrated at this news but reminding us to be diligent, our realtor advised us to try to find out if there were any *other* insurance claims on the property before we decide to cancel the geological assessment and other appointments and back out.

I contacted one insurance provider and they refused to disclose any information I suspect because it might be the same provider the current owner/seller uses for this property. Ok fine, so I called another insurance provider and he immediately disclosed to me that in 2017 there was a water damage claim submitted for just under $17,000. WHAT?!?!?! This was the final straw and fifth red flag that broke the camel’s back.

Basically, the seller and or her agent appeared to have willfully withheld this from us even after asking them directly – how do you find out that you had water damage in 2013 and 2014 but conveniently overlook/forget that there was a $17,000 claim even more recently?!

Sure, the home might have been sold/listed for less than other comparable homes in the area and maybe someone else will consider this a bargain but after what we went through, I think it was best that we backed out of this one. Even if we were to get them to come down in price, I don’t know if it would have been enough to make it worth our while. We weren’t in love with the property to begin with…

A few things to note/lessons learned:

1) the seller’s agent mentioned to us that they prefer to sell to a family – normally, this would give people the “warm and fuzzies” but in retrospect, it sure sounds like they were weeding out the savvy investors and preying on a young, unsuspecting and naive family who would never check into things like this or do any amount of due diligence because they’re just desperate to get a house…any house.

2) avoid older pre-90s construction homes that are in hilly areas or on slopes/grades

3) YMMV but it seems you can leverage insurance providers to disclose at least the past 5 years of claims history on a property – not sure if you need to have an existing quote with them already but I think it helps. Seems that you won’t be able to get this info though from the provider that the seller currently uses though.

Forgot to mention too that the price we landed at going into escrow was $56,000 OVER asking price. They listed under market of course due to the condition of the home based on and up to what was disclosed. The last comparable home in the neighborhood, which appeared to be in good to excellent turnkey condition, sold for only $26,000 more than this one but it closed back in the beginning of April and we all know prices have appreciated quite a bit even in a month’s time or so.

This one felt like a lemon though. After the non-disclosure of the $17,000 worth of water damage and the unknowns around the potential foundation issues (this was also not disclosed by the seller), we felt extremely uncomfortable.

If the extent of the disclosure was limited to what we knew of the house going in (HVAC, termites, roof) we would have had no issues with this. But the fact that they didn’t disclose everything and STILL didn’t disclose fully after calling them out on it is very disturbing.

I just want to say that comments like J’s are why I love to read this blog. Definitely a lot of marginal properties being offloaded right now.

If you ever watched Flip or Flop you would see that this kind of house is the kind of house that Tarek and Christina thrive on. They flip houses regularly that I would run from. They would level the house using piers, fill the cracks, put in a beautiful backsplash and pay to stage the home. It would take 3 or 4 months to fix everything, and cost near 100 K, but they would walk away with neat 200K profit. It’s all a risk, a calculated risk to be sure. But somehow they always land on their feet.

My wife has watched Flip or Flop a few times. I’m sure they also negotiate down the price hard too, so they’re not overpaying (or overpaying as much) as most people would. Apparently, there’s also a natural spring/aquifer sitting under that neighborhood and on top of that there has been lots of talk in the past several years to expand the neighborhood and build more homes further up the hill. This particular neighborhood only has two ways in/out. The more I think about it, the more I’m glad we didn’t jump into something that we would have instantly been in over our heads on then feel like we regretted buying for the long-term :T

Old M: “All realtards are liars.”

That is a very unfriendly word. Pls don’t use it again. I got to know many nice real estate agents. They can be very helpful. Not all people are the same and calling them “realtards†is not nice!

Maybe “M” stands for Mitt as the ultimate flip-flopper. M, you should go on Flip or Flop!

M stands for millennial.

I used to be a bear hoping for a nice discount.

At some point I had so much cash that I couldnt justify not buying.

I had to buy. Best thing ever. New construction.

THe beauty was that I bought during Q1 2020 and almost the entire blog told me I bought the peak. ROFL.

muhahahahahahah boy was the crowd wrong! I laugh about it many times per month.

Especially when I get the updated zillow value for my house 🙂 I killed it.

lesson learned…..dont be stupid….dont be a perma bear. Buy when you can comfortably afford it. Thank me later.

A horde of frenzied newb buyers sure makes it easy to unload lemons. Maybe why buyers remorse is so high with millennials. Due diligence is a must.

Being in the same position as many out there, I can say I completely understand why someone would be willing to buy a house, any house, regardless of if it’s a lemon or not. I just worry about what this is going to mean in the future for those folks… we’re in a position where we’re ready to buy. But having to compete in bidding wars with desperate people like this is what makes it all the more difficult. Apparently, we’ve proven to ourselves that we’re more than willing to do our due diligence and back out of a potentially bad situation. It sucks and felt like a waste of time but I’d rather feel that way knowing that we did our research than going in on something we’d regret and being nearly a million dollars out even after doing all that but ignoring the red flags.

Back in the 70s, my parents sold a house in LA on a moderate south facing slope. There were existing deep concrete footings, but we had to add a new concrete block retaining wall above one corner of the house. The geological engineer told me that the south facing sunny slope we were on was stable, in spite of the fact that the other side of the hill was well known to bu unstable. He explained that shady slopes don’t dry out as completely as sunny ones, and the subterranean water will undermine the house on such a slope. It was well worth the price of the wall and the engineer to get the house to where we could certify it was safe. If you are looking at a house on a slope, ask for the report, and make sure it is genuine.

Great job on the due diligence!

Good thing you did not waive an inspection.

We purchased a house in the past that after inspection, showed signs of a leaking roof. The seller wanted/needed to close so they contributed over half to a new roof at closing.

Ethically and legally, the seller has to disclose your inspection report to the next potential buyer. Most sellers would contribute half-way to avoid going back on the market.

Make a lower bid offer again if it is still on the market to cover the repairs. Christine and Tarek seemed to have to do major work like this frequently and they were doing it for a profit and not a long-term home.

These sellers and their agent are a greedy bunch – unwilling to budge or compromise one bit for *anything* so they would absolutely laugh at us if we asked them for any credit. The agent was ready to move onto the next buyer in line who is ready to close without any questions asked. I guess they’re banking on the fact that because it’s such a hot seller’s market they’ll eventually find one person who will buy no questions asked (although, perhaps at an even lower sale price…)

Thanks for the thorough narrative of your experience. Good job in walking away.The Donald once said “ the best deal I’ve ever done is one that I did not doâ€

How much is Blackrock paying you?

Are you on Blackrock’s payroll?

Isn’t this called feudalism? Are you saying it’s good I can never afford a home and get my housing costs fixed? My rent goes up every year and my saved downpayment can never keep up with house appreciation.

Yes, actually feudalism is exactly what it is. I’ve been saying this for years on this blog and everybody thought I was a delusional housing bull but the writing has been on the wall for a very long time. People analyze the market with such a narrow viewpoint citing the crashes of 08 and every other crash that happens once every decade but zooming out throughout centuries of history and you’ll truly understand that we are headed towards a society of serfdom and lordship.

And no, it’s not a good that you don’t have the ability to save as fast these prices are climbing. I’m sorry to hear this.

It’s a New Age people.

Ask any democrat in power and they’ll tell you that they’ll “Build Back Better” with a green economy and unicorns where “you’ll own nothing and be happy”. With democrats in power in WH and the whole Congress don’t expect to buy any house soon.

Maybe, if you’ll get to be a good slave, you’ll get to share a shack with few families of the millions of illegals Biden is importing from the south. They are going to help the 0.01% who pay for the democrats campaign and Biden is happy with that. If you can buy a house or not or if your rent goes up 10% per year is not going to bother the Democrats/Globalists in the least – just print 4 trillions every year.

California economy is booming.

By adding 1.3 million people to its non-farm payrolls since April last year — equal to the entire workforce of Nevada — California easily surpassed also-rans Texas and New York. At the same time, California household income increased $164 billion, almost as much as Texas, Florida and Pennsylvania combined, according to data compiled by Bloomberg. No wonder California’s operating budget surplus, fueled by its surging economy and capital gains taxes, swelled to a record $75 billion.

If anything, Covid-19 accelerated California’s record productivity. Quarterly revenue per employee of the publicly-traded companies based in the state climbed to an all-time high of $1.5 million in May, 63% greater than its similar milestone a decade ago, according to data compiled by Bloomberg. The rest of the U.S. was nothing special, with productivity among those members of the Russell 3000 Index, which is made up of both large and small companies, little changed during the past 10 years.

https://www.bloomberg.com/opinion/articles/2021-06-14/california-defies-doom-with-no-1-u-s-economy?fbclid=IwAR3gBLflkfJ2YH0fbMFcS4OjuB7z5xmfu61qDzkdpsNjffT_La4EIx0su7A

“California’s operating budget surplus, fueled by its surging economy and capital gains taxes, swelled to a record $75 billion.”

Would be interesting to have a deeper look into those capital gains taxes.

I’ve seen some of these rental subdivisions and it’s not pretty. Unkept lawns, cars parked all over the streets, junk on the front lawn, etc. It’s like a housing project that used to be a 10 story building is now a 100 home subs-division. Same people, same problems, just flattened out.

I can imagine. There’s a lot more space and why take care of property that’s not yours? Especially if you’re not going to stay there for too long. Renters cycle in and out pretty quick from what I’ve observed in my neighborhood.

It’s not renters per se. I have some great tenants who maintain the properties well. The problem is when neighborhoods are nothing but renters. My tenants could easily be owners themselves as they have the income and credit to do so, but for whatever reason have chosen not to buy. On the other hand BlackRock ghettoes are full of Section 8 deadbeats living together in a cluster. That is where the problems come in.

Another example. Near where I live there is a new subdivision of fairly high end homes. There is a park in the middle of the area. Really nice park, beautifully architected and landscaped. The park was finished about 2-3 years ago. Everyone loved it. Then an apartment complex was built right next to the park. Since that complex opened up, there’s garbage in the park, grafitti has started popping up, sketchy people hanging out.

This is universal. Get a lot of renters together and the surrounding areas suffer

“For the most part, it seems like those wanting the old work schedules are older Americans that are technically inept and simply want to control their flock of workers in an old school way to justify their wages.”

Nope. It’s quite the opposite. Millenials are the ones who want to get back to the office. The olds are perfectly happy staying home.

https://www.bloomberg.com/news/articles/2021-06-14/return-to-office-young-people-seek-wellbeing-at-home-purpose-at-work?srnd=premium-europe&sref=Oj0lY8Ko

I love this trend myself. The more renters there are the more I can charge for my rentals. If an entire generation wants to rent all their lives – and buy several houses for me in the process – I say go for it. Live the dream!!

I find it interesting that the “you have flexibility” as a renter argument gets pushed often. First off it’s not THAT flexible. Leases are for 12 months, sometimes 18 months. So if in month 3 you decide to move somewhere new, you’re still on the hook for the remainder of the lease. Rent forever proponents make it sound like you just snap your fingers and you’re moved into a new place. The worst part of moving isn’t the paperwork, it’s…moving. So you have the flexibility to do something everyone hates to do. Terrific.

And the other thing is say you own in City A and want to move to City B. You rent out the property in City A and buy something new in City B. And you still have all your precious flexibility. Then do the same if you want to move to City C. This is something military families do. Every few years they get re-assigned and keep the old house as a rental. After 20 years, they end up with several nearly or fully paid off rentals.

Having renters pay off your mortgage while your home keeps rising in value is a great thing. Some people will be life long renters. They’ll wake up one day in their fifties and realize their net worth is zero. This is a terrible existence, guaranteed you’ll be working until you croak.

As usual. Buy a home when you can afford it and plan on owning for the long run. You’ll thank me later!

I followed lord b’s advice and it changed my life. Buying a house was the best decision ever.

Hey M. How’s your stranger (tenant) working out?

Do you still like sharing your house with a stranger?

How’s that working out so far?

That stranger was in my kitchen and made herself at home. I am married and a second woman that just lives here isn’t something I like long term. If I were Mormon and I could alternate between women it might be different. Money isn’t an issue since I have a tech job and my wife works too. We had to let her go…..I am dying to have rental income…..I want a investment property as soon as possible. Actually I want a few.

M: We had to let her go…..

Really? You evicted a tenant during the Covid crisis and its rent moratoriums?

And she just walked away quietly? Even though she had a legal right to stay and refuse to pay rent?

Like all your other fables, that sounds implausible.

Lol, like with everything, son of landlord tries to sensationalize. I would love to have rental property but a stranger in my house isn’t something I like long term. I tried it and didn’t extend the rental agreement. We had to let her go. If there would have been an agreement to have threesomes at my house I could have been fine with it for a while longer.

M We had to let her go.

You dodge my point.

Your tenant didn’t have to go. She could have stayed in your house rent-free until even now. The eviction moratorium includes shared living arrangements.

The notion that your tenant would have left upon your say-so is not impossible. But not entirely plausible either.

Not extending a rental agreement means we let her go. I felt I had to. I don’t like strangers in the house unless they are hot and massage me.

I do love renters though. I want rental property!

“Rent forever proponents make it sound like you just snap your fingers and you’re moved into a new place. “

BLM/antifa renters haven’t been active in a while. Not much to move besides the acquired pair of Nike’s.

Millie,

Speaking of BLM rioting, a happy Juneteenth Day to you my friend. How are you celebrating?

I celebrated with free speech. Posted some articles about BLM leaders scamming their followers and an article about violence against Asians by black people. How do liberals explain racism by black people towards Asians?

M, if you want to get an answer to that question, ask a liberal like Bob. Only he can make sense out of that. A logical person can not answer that because there is no logic.

Just out today: Rent for single family homes is up 7.9% vs this time last year. As Uncle Mr. Landlord has been saying forever…..renting long term is financial suicide.

Couldn’t agree more. In fact, I have been saying this for a year now too.

Renting long term = financial suicide

Buying real estate = very good decision

Buying real estate yesterday = genius

Buying real estate today = awesome

Buying real estate tomorrow = still awesome

Renting out a room to a stranger = life hack

If I were single I would rent out spare rooms to hot chicks. My wife is hot but I do like the fantasy of being a landlord to several hot woman in their early 20’s in my house that like to jump in the shower with me.

“Good Morning my sexy millennial landlord, may I bring you breakfast�

“Would you like me to wash your back my millennial landlord�

//I would rent out spare rooms to hot chicks

I know it is a joke, but this is a path to serious economic losses.

Investment writer Jared Dillian has a short article on the current inflation rate. He states that the CPI is up 5% over May of last year. He calls it the fastest increase since the great recession. Here is a quote:

“Some people are saying this is transitory, either for political reasons… or because they’re stubborn. Maybe both.

The inflation we’re experiencing is not transitory. We have permanently reset prices higher.”

He explains that government money paid for not working is permanently altering the wage level needed to find workers. So the government prints money to give out to people not working, workers get more than those sitting it out to entice them back to work, and companies raise prices on everything. Hence a 5% inflation rate that appears to be going exponential. Don’t be surprised if at the end of the year, we have 10% inflation [my words, not his]. He says he’s investing based on inflation trades. And that it isn’t too late to get started.

I’m sinking cash into upgrading out of state rentals our family owns. I’ve been wanting to sell and move the money to somewhere else. Prices are up where I own now.

“I’ve been wanting to sell and move the money to somewhere else.”

What is the “something else” when everything (equities, housing, bonds) is in a bubble and cash is losing value due to inflation.

Gold? Bitcoin? What else? Rents are going up also. Is it good to have a rental property? Why sell unless the ROI on something else exceeds rent? At least rent income tracks wage/stimulus inflation.

At least rent income tracks wage/stimulus inflation.

Not in Santa Monica. Here rents can only go up 75% of the CPI: https://www.smgov.net/rentcontrol/

At their meeting on May 13, the Rent Control Board announced a 1.7 percent general adjustment for units that qualify for an increase this September. The amount of the increase is per a formula in the Rent Control Charter approved by voters and is based on 75 percent of the percentage change in the Consumer Price Index (CPI) for the greater Los Angeles area for the year ending in March.

There is an argument going on about that, SIABB.

1) Something not so far away (almost 1000 miles), like a rural property in SoCal close enough to do maintenance ourselves.

2) Something further away, like in another country far away from the US Govt. It would need to be a country with generous tax benefits for owning there. I already have a short list. But you can add to it.

Remember when mortgage rates were 16% and CD’s were yielding 17%? I don’t, because I wasn’t born, but I can read. It was to counter out of control inflation. But this Fed is a different animal, so…

Stay diversified,

Turtle

An article was just released saying investment bank Blackrock is going around in different states buy entire neighborhoods to keep them as rentals. I hear the bank can borrow the money at 0% interest too. These scum are a major problem in America and it’s the politicians that allow it. People shouldn’t have to spend 50% of their income on rent. This has to stop or in a few generations all we’re going to have is mostly a population of people working McJobs demanding high wages while China makes everything they buy at their big box stores. It’s crazy.

What if I told you BlackRock is in bed with China and Democrats to make this happen? It’s perfect for all parties involved. The end goal is the destruction of home ownership in America. Democrats get life long renters who are dependent on the govt and vote D. China gets a weakened America. BlackRock makes bank. Win-win-win all around.

Kent, you are finally figuring it out. Unfortunately this has been going on for DECADES. The middle class was essentially wiped out. You are left with a small wealthy class and the majority living paycheck to paycheck. The majority will be happy with government handouts and all the creature comforts of today. Politicians and corporations sold out to China in a big way. This is why Trump had to be removed at all costs, he was upsetting the globalist agenda in a big way! If you want to survive in this world, start thinking like these scumbags and profit from it. Mr. Landord has it figured out!

How worried are SoCal homeowners about Lake Mead being like 150 feet below full? Apparently it hasn’t been full in 20 years and now it’s as low as ever.

When will California get serious about desalinization? It works for Israel. But my goodness it’s expensive and California already has taxes exceeding every other state.

Biden’s proposed death tax and its impact on inherited homes: https://www.dailymail.co.uk/news/article-9697587/Tax-experts-slam-Bidens-mess-double-death-tax-make-bereaved-families-pay-TWICE.html

It proposes that when someone dies, any asset they leave behind to their kids that has appreciated in value to more than $1million should be taxed.

The tax would apply to the amount the asset’s value has increased by, so if a woman bought a home in New York in the 1970s for $200,000 and by the time she sells it, it has increased in value to $2million, the $1.8million increase is what is taxed when her children receive it.

The first $1million is exempt, so the 40.8% Biden death tax would be imposed on the remaining $800,000, producing an immediate tax bill upon the woman’s death for her kids of $326,400. Right now, they wouldn’t pay anything. Experts say that change will force some to sell the asset they’ve inherited just to be able to pay the tax on it. …

I can’t imagine any politicians would vote in favor of this as those voting usually have substantial estates and wouldn’t cheat their heirs.

Good. This will affect Democrats in SoCal whose parents bought houses in the 60s and 70s and 80s for nothing and are now worth millions. Let them get a taste of reality.

Ugh, the trend of Wall Street investment companies owning rental houses across the country. We live next to a rental house by Invitation Homes which is the largest single-family rental housing owner of all time, public or private, with 82,000 properties. On January 23, 2017, Fannie Mae funded $1 billion of debt to Invitation Homes as back-up money and in February 2017, Invitation Homes became a public company via an initial public offering, the second-largest initial public offering of a real estate investment trust in the United States with $1.77 billion. Invitation Home’s rental house next door is the worst looking house in the neighborhood with the front lawn is overgrown and full of weeds. The backyard wooden fence is rotten and close to falling down. Invitation Homes doesn’t appear to screen their tenants very well and rents to anyone who will pay the rent. The current tenants have loud parties that go late into the early morning hours. Invitation Homes won’t take any action against their tenants as long checks keep coming in. Avoid buying a home next to an Invitation Homes rental!

The Epoch Times has an article about California landlords who are pleading with state and local governments to end the eviction moratorium on rental properties as planned June 30, rather than extending it. Democrat Gov. Gavin Newsom on May 10 announced a plan to repay property owners 100 percent of rent owed from tenants that qualify for rental assistance due to COVID-19. However, more than a month later, the money hasn’t arrived.

It’s unclear whether which Orange County cities will vote on an emergency eviction moratorium ordinance but the city of Costa Mesa voted to suspend the moratorium in April.

The San Francisco Board of Supervisors (all Democrats) voted on June 7 extended the city and county’s moratorium on evictions until September and extends renter protection from evictions, non-payment of rent, and late fees.

The San Diego County Board of Supervisors (all Democrats) on May 4 voted in favor of rent control regulations and the prohibition of evictions for all rental units beginning June 3 and lasting for 60 days.

Woe to any landlord in California or any blue state controlled by Democrats?

I have some sympathy for my Landlord brethren. But then again, they keep voting for this, so f**k em. Have fun going bankrupt. But at least you don’t have any more mean tweets to deal with, so all will be well.

A 4BR house is selling a block away from me for over $800K and is now listed as “under contract”. On the multiple listing for 9 days.I didn’t check it earlier. It was the dumpiest house in the neighborhood, but the owner/occupier cleaned it up and put in new lawn grass and some new kitchen stuff. Doubt they spent more than $25000. Lipstick on a pig.

Another neighbor is adding a small rental flat. Supposedly a Mother-in Law flat. We’ll see. Hope it doesn’t turn out like Samantha’s story.

I’m starting to wonder about the bubble probability along with the sinking dollar. It’s a race to the finish line; pretty much depends on who’s running the Fed, like everything else in Bubble World.

I live in City of LA, alongside Culver City.

What I have noticed now on Zillow is in my neighborhood is the least amount of houses for sale since I have been looking in 2013.

Further the local broker told me that all homes that go on the market are getting 5-20 offers the opening weekend, all for asking or over asking (if they were priced according to comps).

AND worse yet, the new Cumulus project (30 story apartment building with restaurants and Whole Foods) at the corner of La Cienega and Jefferson are renting out 1 bedroom apartments for $3,000 !!!!

I seem to be noticing a lot of properties near me for sale. Maybe because I’m looking now? From the ocrealestateinc.com/orange-county-housing-report for May:

“Listing inventory in Orange County still remains at record lows. Our inventory has decreased in the past week down to 2,247 homes for listed for sale. Distressed homes for sale in Orange County account for less than 1% of the total listings.

Despite the “inventory shortage” Orange County had 3,374 residential real estate sales in April of 2021. This data is directly from the MLS and InfoSparks. In April of 2019, pre-pandemic, Orange County had 2,526 residential real estate sales. That doesn’t look like an inventory shortage. That looks like a super hot market.”

It will be interesting to see the June report. What I’m seeing is houses selling almost before they’re listed. A lot of insider buying? A lot of money looking for a “home” figuratively and literally?

Uh Oh, say it isn’t soooooooo, the bow is about to break, and M is running around rearranging deck chairs, typical Millennial.

Existing Home Sales Tumble For 4th Straight Month To Lowest In A Year

https://www.zerohedge.com/personal-finance/existing-home-sales-tumble-4th-straight-month-lowest-year

Don’t worry HomeDebtors, I’m here to buy that over priced crap shack you over paid for, .65 on the $ lmao

Mhm, but I don’t want to sell. Ever.

You want to pay me less than market value? I wouldn’t even sell if you offer 500k over market price. Don’t ever sell. Accumulate RE, rent it out and buy more.

Any dip would be a gift to buy more condos and SFH’s

“. Don’t ever sell. Accumulate RE, rent it out and buy more.”

I shed a single tear down my cheek reading that Millie. My little baby Millie is all grown up now.

.65 on the $ were prices just over 2 years ago. Why didn’t you buy it then? Well , then you probably still can’t buy it even if it happened then.

A 20% decline at this point would take some parts all the way back to… 2020. 😛

Imagine getting your news from ZeroHedge. LOL

May set yet another record for prices. Classic supply and demand stuff. The number of sales just reflects the insanely low inventory. Demand for homes continues to increase, hence higher prices. Which is why looking at home sales as a metric is kind of useless.

RE pros:

Know that low inventory, low interest rates, money printing and inflation lead to asset price inflation.

RE noobs:

Think they can buy at a 20% discount soon because home sales decline.

“Existing Home Sales Tumble For 4th Straight Month”

Ok. Seriously, before the laughter stops, let’s look at this for what it’s

actually saying. It doesn’t say “Prices” dropped for the 4th month. It says

“Sales” dropped. Why are sales dropping ? Well let’s see. Maybe because

everything’s being bought up, and inventory is not increasing, so there are

fewer and fewer homes to actually sell. Whala! Sales or supply drops, but

demand is still strong, so prices keep rising. Still a seller’s market. The only

current oversupply is the number of realtors w/o houses to sell. But as

everyone here knows Zerohedge always prints misleading titles for some

readers to misinterpret.

Realist is the last remaining perma bear on this blog. The sky is always falling.

Every blog needs a clown.

Bulls like us enjoy seeing our equity go up and up and up in the meantime. The sad part is, even if RE dips slightly, people like us will be in the position to buy the dips.

Perma bears never buy because tomorrow will be the big crash. And if not tomorrow than the day after. Until it’s 2050.

Biden extends nationwide eviction moratorium by another month. Instead of ending on June 30, it’s now supposed to end on July 31.

https://abcnews.go.com/Business/wireStory/biden-administration-extends-eviction-moratorium-30-days-78464601

The extensions seem to be getting shorter and shorter.

What’s next, a two week etension?

Santa Monica extended the rent and eviction moratorium until Sept 30, to align with California’s: https://www.smdp.com/eviction-moratorium-extended-until-sept-30-more-rent-relief-available-to-tenants/206212

Santa Monica has extended the City’s Eviction Moratorium until Sept. 30, providing relief for tenants and frustration for small landlords.

The City made this decision on June 24 in order to align with the recently extended County moratorium, and to give landlords and tenants time to apply to the statewide rental assistance program, which is reported to have over $5 billion dollars in rental assistance funds available.

On June 25, Governor Newsom announced that he had reached an agreement with leaders of the state Senate and Assembly to also extend the state’s moratorium to Sept. 30. Newsom additionally outlined a plan for the state’s rental relief fund to cover 100 percent of back rent owed by low-income households. …

So “low income” households enjoy a year and a half rent-free, plus enhanced unemployment benefits, paid for by middle and upper income Californians.

“So “low income†households enjoy a year and a half rent-free, plus enhanced unemployment benefits, paid for by middle and upper income Californians.”

Maybe those middle and upper income Californians should stop voting for far left Democrats. Crazy idea, I know. They won’t of course, cuz…..reasons.

Oh, wait. On further reading, it seems that California’s rent moratorium (and state payment of rents?) extends till Sept 2022:

Under the anticipated state moratorium extension, tenants will have until Sept 30, 2022 to pay rent that becomes due between July 1 through Sept. 30, 2021. To continue to receive eviction protection for non-payment of rent, tenants must submit a declaration to their landlord each month and pay at least 25 percent of rent due.

In order to qualify for the state’s rent relief, tenants must have incurred a financial hardship due to Covid-19, demonstrate a risk of housing instability such as a past due rent notice, and have a household income that is not more than 80 percent of the Area Median Income.

The qualifying income for Santa Monica, and the rest of LA County, is $66,250 for a household of one, $75,700 for a household of two, $85,150 for a household of three, and $94,600 for a household of four, …

Wanna hear a secret? IT WILL NEVER END. Rent is an oppressive, racist capitalist concept after all. It must be eliminated in the name of equity.

It’s no wonder the workforce is decreasing.

UBI is next, no doubt.

At some point this hysteria will end. It can’t keep going like this forever with multiple offers on any piece of junk listed. But for those of you hoping for a 50% fire sale, it ain’t happening. The inflation economy wise of the past 1-2 years has changed everything. The government printed $6T last year and is on track to print several trillion more through the graft knows as “infrastructure” spending.

All those trillions of dollars have to go somewhere. It’s classic Econ 101 stuff. Increase the money supply, asset values increase. Real estate, stocks, cars, art, you name it, it costs more now than 2 years ago. And once asset prices inflate due to money supply increase, they don’t go back. Look at the 1970s if you want to see what we will experience. Gas went from 30-40 cents a gallon in the late 60s, early 70s to over $1 in the early 80s. And it never went below that $1 again. An average car cost $3500 in 1970 and $7000 in 1980. It never went back to $3500. And the same is true of bread, milk, lumber and of course real estate.

After years of govt induced inflation, prices NEVER go back to what they were. A house that went for $250K a couple of years ago and is worth $500K today is never going back to $250K. Could it drop to $450K? Sure in the short term things fluctuate. But long term, the reality is $250K homes are now $500K homes just like post 1980 $1 gas was the norm.

As usual, Mr. Landlord is 100% correct. The effects of inflation are an economic death sentence for most Americans…your average Joe that has no savings, owns no property, owns no stocks, etc. The only way to combat this is by owning assets. This is taken to another level in places like socal where we have massive housing shortages. I have been preaching this for almost a decade, and it’s only gotten worse. Inflation, 2.X% interest rates, housing shortages, laws that clearly favor owners, etc. To think there will be massive fire sale with no competition anytime soon is laughable.

Yea, it’s the hysteria-induced multiple bidding wars that’s frustrating the heck out of us. We’ve conceded to accepting the fact that if you win a bidding war now you’re sort of “pre-paying” for the appreciation. If you were to wait for it to end, appreciation will likely have caught up in most cases. So you either pay for it now via bidding wars or you wait to buy and pay for the appreciation *then* but either without or with much less hassle of the “buy now think later crowd” – the downside of buying now, IMO, is that people are getting suckered into buying lemons. Now is the perfect time for sellers with lemons to unload them, because there are a bunch of desperate idiots out there who will buy anything.

Indeed, deflation at any significant level has never been a thing in any of our lifetime and probably never will be.

I don’t know what will happen but there is more at play here than just inflation. Housing was already far above the mean trend line before COVID and Uncle Sam’s printing rampage.

SoCal’s housing market has always been wild and the swings in both directions have been more ghastly than most other markets. But agreed, any “deal” will still be expensive.

40 Years!

https://newfi.com/home-loans/40-year-mortgage/

First ten years are interest only then converts to a traditional 30 year. The payment resets higher resulting in affordability issues. Smells familiar.

I would do a 40y loan in a heartbeat

Looked into it and the conditions suck.

I want a super low interest rate locked for 40y and pay principal from day one.

If someone offers that I am all ears.

That’ll fool some people. The average buyer sticks around for less than 10 years! Imagine “buying” a home and paying zero principal the whole time you own it. Better hope it’s true that up is the only direction home values go (which is false, of course).

Yep, I was just thinking that – interest only payments in the first 10 years. Sounds like a bargain with the low monthly payments, until you realize [after moving in 5 years] that all you got was a rent rate lock lol… I guess that’s better than nothing, except for the fact that you probably had to give up a nice sized down payment in exchange for that “rent rate lock.” I guess you can bank on appreciation making you money haha….<- Can you imagine *what* would happen if everyone thought this way? 😉

This loan structure is similar to the ARMs that were popular in 2005. Most buyers thought they would cash out for huge profits before the loan reset. Three of my friends had that same notion. All three foreclosed. Banks will benefit immensely at the expense of exuberant/uneducated buyers if home prices recede.

Banks will benefit only if the buyers/owners don’t foreclose though, right? It seems beneficial to nobody (except those waiting on the sidelines to pounce on the foreclosed home) to foreclose – neither the owner, lender or bank. What am I missing?

If no foreclosure happen, then the banks make a money on the interest only loan and then even more when the reset occurs. The bank can’t lose. Only the buyers can lose.

Banks will make money in any situation or they will get bailed out.

Just another leg kicked out from underneath the Housing Bubble, she gonna go DOWN HARD, and I’ll be there to buy .01’s on the $ homedebtors :)))))

Mortgage Apps Crash To Pre-COVID Lows As Homebuyer Confidence Collapses

https://www.zerohedge.com/personal-finance/mortgage-apps-crash-pre-covid-lows-homebuyer-confidence-collapses

“a sucker and his money are soon parted” what wise man said this ?????

ME!

“Realistâ€

“Just another leg kicked out from underneath the Housing Bubble, she gonna go DOWN HARDâ€

Isn’t that the tenth leg by now? Does the market just keep growing new legs or how does it work exactly?

In your opinion when will it crash? Iam Trying to buy a second home.

No doubt things are heating up fast but look at the Zero Hedge comments. Those people are nutty. Try Wolf Street. It offers the same market pessimism but with brilliant commenters.

Lol

I just refinanced. Thanks 10 year treasury yield + fed for lowering my house payment.

While the value of my house keeps going up and up. My fixed payment went down!

Yehaaa!

If you are a renter your rent can only go up over time…..don’t be a renter….. at least not long term…..it’s financial suicide!

M: If you are a renter your rent can only go up over time…..don’t be a renter….. at least not long term…..it’s financial suicide!

Perhaps you haven’t heard about the Covid rent moratoriums and their extensions?

And now Gov Newsom will have the state pay ALL the back rent for “low income” renters. (See my above links.) For a household of two, $75,700 a year qualifies as “low income.”

So you’re still paying rent, Milli — other people’s rent.

$94K for a household of 4 is now considered low income, LOL. I get that urban living in CA can be pricy but JFC, almost $100K is now low income? This is insane.

Yep, I plan on having a rental investment property soon. I love renters and I love paying a mortgage that can only go lower! Rent can only go up!

M: Yep, I plan on having a rental investment property soon. I love renters and I love paying a mortgage that can only go lower! Rent can only go up!

You’re intentionally obtuse, talking past (rather than addressing) the points being made. Sign of a troll.

Small landlords are hurting because rents have gone down … to zero. Their only hope is that non-renters — YOU — will pay their tenants’ rents.

Yet rather than address this (pro or con), you keep reposting the same, non sequitur, boilerplate happy talk.

As usual, sensationalizing. “ Small landlords are hurting because rents have gone down … to zero.â€

Why don’t you ask an actual landlord before you post incorrect statements?

@Mr landlord

A troll on the internet claims your rental income has gone to zero. Could you please tell us your experience? Thanks 🙂

Rents can only go up. Mortgages can only remain the same or go DOWN!

If you don’t pay rent you get evicted. That Covid exception is a one time thing in your lifetime.

M: @Mr landlord, A troll on the internet claims your rental income has gone to zero.

Don’t twist my words, troll. Read my words in context.

I wasn’t talking about all tenants, or any landlord specifically. I was saying that many renters haven’t paid rent since the Covid moratoriums kicked in. They’re enjoying zero rent. And that’s a fact.

Plenty of news stories reporting on this for over a year now:

https://www.cnn.com/2021/02/09/success/eviction-moratorium-landlord-plans/index.html

https://newyork.cbslocal.com/2021/06/17/exclusive-long-island-homeowners-claim-tenants-exploiting-eviction-moratorium-to-skip-paying-rent-altogether/

https://www.washingtonpost.com/dc-md-va/2020/12/09/small-landlords-struggle-under-covid-eviction-moratoriums/

https://nypost.com/2020/10/28/influencer-squats-at-hamptons-house-after-not-paying-rent-suit/

https://newyork.cbslocal.com/2020/05/21/covid-19-housing-issues-sag-harbor/

https://www.quora.com/My-tenant-in-SF-is-not-paying-rent-due-to-COVID19-but-he-provides-no-documentation-What-is-my-recourse-No-rent-control

M, trolls ignore evidence, talking past it.

I posted evidence of California taxpayers being required to pay the rent for “low income” renters. I post it again: https://www.smdp.com/eviction-moratorium-extended-until-sept-30-more-rent-relief-available-to-tenants/206212

I twice before said that YOU will be paying the rent for these people (as will I and all non-renters).

Prove you’re not a troll. Explain how YOU paying the rent for these people fits with your boilerplate claim that renting is always bad.

Millie,

Some rents have gone to zero. Those are deadbeat renters that I wouldn’t touch. My renters are A+. This means excellent credit, high income professionals, good references, etc. The kind of people who won’t risk their future financial reputation to save a few months of rent payments. And I have also begin requiring rent up front. The rental market is so hot right now, there are bidding wars for rentals as well as for sales. For me the bidding war isn’t on higher rent it’s now on who will pay the most upfront. I’m getting anywhere from 3-12 months paid in full. I kinda feel bad for people who don’t have that kind of money saved up and are struggling to find places to live. But hey, business is business.

I can’t imagine why anyone would want to be a renter these days.

The vast majority are still paying their rent. I haven’t heard a single first-hand account of a landlord hurting due to non-payment, but I am sure there are some (probably in not-so-great places where you’re best off not being a landlord in the first place).

>>> And now Gov Newsom will have the state pay ALL the back rent for “low income†renters. (See my above links.) For a household of two, $75,700 a year qualifies as “low income.â€

That’s hilarious. The median household income is now “low income” in California. This is where I talk about California folks having less disposable income than those in Alabama and how drastically the quality of life has dropped for the typical young family.

I’m just about done with my thoughts of returning to California. It’s pretty awesome watching the Texas cities being built up so fast. It’s the promised land that California once was. And I’ve finally acclimated to the long, hot summers.

See son of landlord….you were just sensationalizing.

Read mr landlords post

For instance: “ The rental market is so hot right now, there are bidding wars for rentals as well as for sales.”

To say that renters don’t pay anymore and we would have to pitch in is just laughable. Nothing could be further from the truth. Exactly like your made up stories about me.