Double dip economy – Housing entering troubling waters. Nationwide economic and housing data points to challenges ahead. 5 charts showing a difficult second half of 2010.

The economy enters the second half of 2010 on shaky ground. The stock market had a poor performing quarter reflecting the days of 2008. The large amount of troubled loans out in the market is rising to the surface in a non-uniform way. While banks try to re-work loans with government gadgetry and at the full expense of taxpayers, most of the public that operates in the real economy where the economy never really recovered understands that things are far from any recovery.

I normally listen to a few financial shows on my iPod but for the last month, took a hiatus from some of the financial media. As I put on my earphones and listened to shows from early to mid-June, I realize how utterly wrong “analyst†are in predicting trends. In fact, one show was aired when the DOW was up over 10,500 and they were talking how at the end of the month, only a few days away, we would end at 11,000. We ended the month at 9,774. Many in the financial mainstream press are like the shamans trying to heal illness with ritualistic dances. In this case, the dance involves singing the praises of housing and the inevitable bull market run that is around the corner.

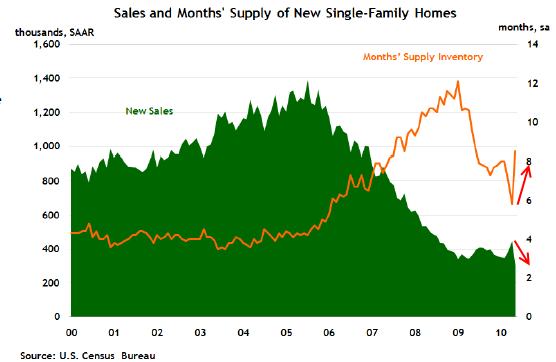

The first chart, shows the collapse in new home sales:

Chart 1 – New Home Sales

Why should we be concerned with the above? New homes usually sell for a higher price but also create demand for jobs in construction. With the market falling due to lack of demand (aka people dealing with a poor economy) there is little need for new home construction. Much of the demand was pulled forward with every imaginable gimmick that the government could muster. The U.S. Treasury and Federal Reserve have conjured up magical ways to get people to buy but there is only so much that can be done in the longer term. The drop in new home sales shows us that the second half is going to be a major challenge especially for housing. Keep in mind that spring and summer are the high selling seasons. We have roughly two months for spectacular results before entering the weaker fall and winter.

When I talk with colleagues about a double dip we usually have to reflect on where things improved. Sure, the 401k looks better than early 2009 but most don’t understand why. They just assume that since the government juiced up Wall Street that somehow this will take care of itself. Of course, much of the aid has been shifted to crony bankers who use the housing industry as a buffer for their own personal enrichment and at the detriment of society. New home sales tanking is simply reality coming to a massively subsidized market.

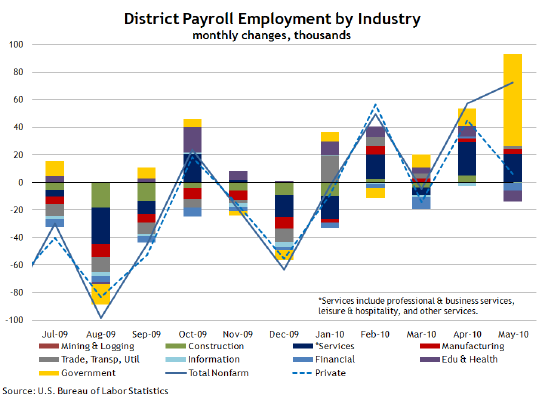

Chart 2 – Employment by Sector

Government has been the big sector out there hiring. Much of the growth in the last few months has come from temporary hiring by the Census. As this retreats the private sector will need to pick up the slack but it doesn’t look like it can do it. Some economist point to 1990 and 2000 with similar trends but 2010 is nothing close to those decades. During those times, we weren’t dealing with an epic global housing bubble. We also didn’t have a stock market reacting like the market during the Great Depression. Right now the government is the housing market, employment market, and best friend to Wall Street.

The ADP report this week showed tepid hiring in the private sector. This Friday we are expecting a job loss figure but the real data will be on how many jobs are added (or lost) from the private sector. The trend of artificial stimulus is simply unsustainable.

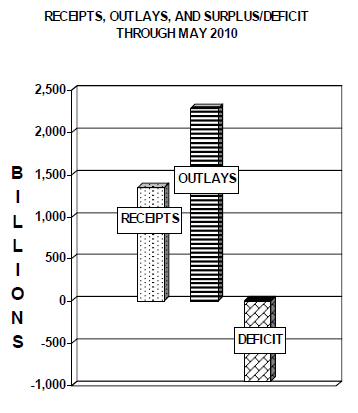

Chart 3 – Deficit

It cost money to do all that we are doing. The above chart looks like the balance sheet of many households. A household with a budget like the above will be at risk of foreclosure and bankruptcy. Yet for our government, we are supposed to believe that this is somehow good. In May, we collected $146 billion in receipts. At the same time we spent $282 billion. For the current fiscal year we have a $935 billion deficit. What are we spending this money on?

It would be one thing if we were spending these hundreds of billions in actually creating jobs and industry to put people back to work. At least that I can stomach. But we are using money for delusional tax breaks so people can buy homes they can’t afford and using the Federal Reserve as the Fort Knox of buying up mortgage backed securities. There is something disturbing about the massive wealth transfer that is occurring in our country. If the funds were actually going to putting people back to work it would be more palatable for the public but when all of it is going to backstop this real life Wall Street monopoly game, people start realizing something is seriously off.

If someone is going to argue about deficit spending they should at least argue that there can be no deficit spending without actually reforming the financial system first. Otherwise, you simply spend more with the bulk going to financial firms and the tiny bit of crumbs that fall off the plate go to the economy. It is taxpayer money that is keeping the system afloat yet they are being helped the least.

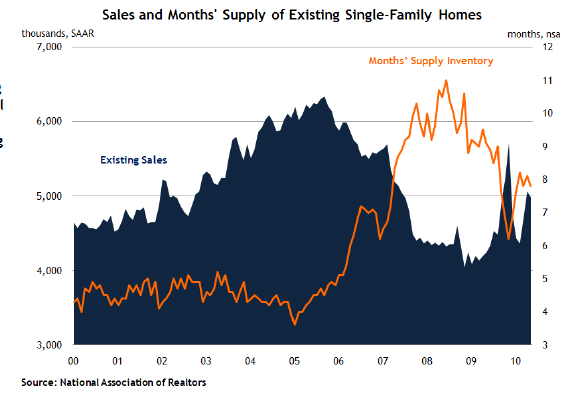

Chart 4 – Existing Home Sales

Existing home sales are a large reason why new home sales have collapsed. Why pay that much more when there are tens of thousands of foreclosures to be had at much lower prices? But even here, we are seeing demand wane as the tax credit euphoria begins to wear off. This shows us that nationwide housing is in for a challenging second half. Sure, the government can talk about extending tax credits and other gimmicks but part of the surge was the notion that “this was it†and people had to buy now to take advantage of these offers. If we are going to have tax credits into perpetuity the market will simply adjust. If people start seeing that home prices can move sideways and even fall going forward, why would they jump in?

You also need good income with a steady job to buy a home. Those hundreds of thousands of Census jobs are merely temporary. They won’t buy homes. Who will? Clearly the answer is not many once the air is let out of the balloon. Going forward we need to have the economy and jobs stabilize before seeing any housing recovery.

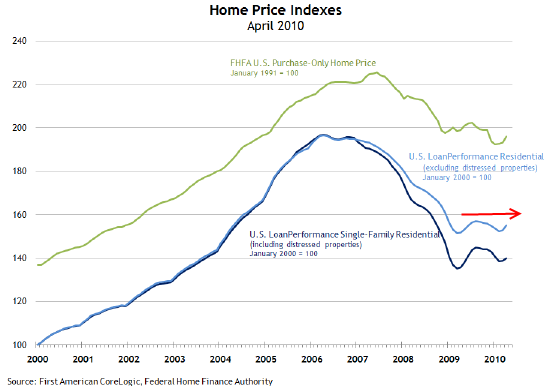

Chart 5 – Home Prices

Home prices have moved sideways even with all the government intervention. With some of this starting to wear off, we are likely to see two scenarios in the second half. The first one is a continuation of the sideways trend. In other words, prices don’t move up or down. The more likely case is prices move lower to reflect the demand pulled forward. Should interest rates rise, this would be another reason to push prices lower. Of course rates won’t go down because of the Fed but market forces can change dynamics quickly as we have seen in Ireland, Greece, and now Spain. Certain areas of California are still clearly in housing bubbles.

There is much to be cautious about in the second half. As I finished listening to the financial Podcasts from a few days ago, it is obvious that the so-called experts have no idea where we are heading. They merely react to the day to day movements in the market and don’t take a larger macro approach. The above data combined with massive amounts of shadow inventory and weak hiring tells us the economy needs to brace itself during the second half. Can’t call it a double dip if most Americans are still in the trench.    Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

34 Responses to “Double dip economy – Housing entering troubling waters. Nationwide economic and housing data points to challenges ahead. 5 charts showing a difficult second half of 2010.”

I am an avid reader of Dr. Housing Bubble and I hope this is not too off topic, but I would like some of the readers opinions. I am Thinking of Becoming a Real Estate Agent/Broker for the sole purpose of buying my first house. I figure the commission I would receive would far outweigh the costs and would help me buy furniture. I do not wish to sell real estate for a living (I’m not even a fan of most realtors at this point), although if someone wanted me to I suppose I’d be very happy to do it occassionally. I have a degree in Real Estate that is 20 yrs. old and never used. I do read up on the state of the real estate market, constantly, but that is my only real experience. Any thoughts? Also, since I have the degree would I be better off becoming a Broker as opposed to an Agent or does that even matter? Thanks in advance for your input!

P.S.- I am planning on waiting a bit to buy as where I wish to buy is one of the high end still outrageously overpriced areas.

so here’s a question, if you were advising the president, what would you tell him?

There were quite a few home purchases by my co-workers who took advantage of the tax-credit. I remember how smug they were. “It’s the best time to buy” they would say. “Interest rates will never be lower”,”You better jump in now” they would also say. I would just smile and congratulate them. Now the look of desperation on their faces says it all.

What I find most interesting and disturbing is how they still want me to buy a house so I can suffer right along with them. Now I tell them that I’ll wait until prices drop another 30%. They don’t like that.

@Nanci,

I would instead become chairman of Goldman Sachs and then Treasury Secretary. Now that’s a sweet plan…or you could just avoid the realtor and have a lawyer handle the deal, since you already know the ropes. I think in another year it will be like Mad Max out there and all you will need is a lot of rat bane and you can probably live anywhere you want for free.

Fred, I can relate. I have a brother-in-law who was recently told him and his wife and kids would have to leave their rental house in 30 days. They had a sweet deal as they were paying $400 a month in Murrieta for a house that could have rented for ~ $1800 a month. They are desperately looking to buy now as they can’t afford to rent. WTF? They want to buy because “rates are so low” and “there’s no way prices can continue to drop”. What about the fact that they can’t afford to rent for more than $1000 a month because they don’t make enough money? They refuse to get an apartment or a condo because they have two large dogs. I have directed them to all my favorite sites (DHB, IHB, Patrick.net, etc.) and they are still committed to buying. Just when I started to feel that a shortage of greater fools is coming…some people just cannot be reasoned with. The toxins in the kool-aid are just too damn overpowering for some people.

Fred, I had similar conversations with people I used to work with. One guy and his spouse (who didn’t make a lot of money) had some brilliant plan to buy two homes to get the tax credit and put themselves in the landlording business. I forget if it involved getting a loan on their current house. I know even since the bubble, people have been able to get home loans with very little down. It sounded very risky to me, since I expect the economy is going to continue to struggle for awhile still. And quite honestly it still sounded like bubble talk.

Nanci – Why would you buy instead of rent? Don’t fall into the trap that the only way to have shelter is buying.

Unless you believe Alan Greenspan who yesterday said that this hiccup in the economy was ok.

http://qedrealestate.wordpress.com/2010/07/01/stars-are-just-a-hole-to-heaven/

I know somebody that went from renting in compton 650 a month to

paying a mortgage 1500 a month while the home they bought was over 5x their income.

The Kool-Aid is definitely potent.

Just enjoying life renting at 17% of my income. Maybe one day I’ll lay down roots, but for now i’m good.

Can you spot the end of the tax credit?

http://www.zerohedge.com/sites/default/files/images/user5/imageroot/trichet/May%20pending%20home%20sales.jpg

Even the mainstream media is getting in on the doom n gloom…

Now, sure enough, even existing home sales are taking a BEATING! In May, signed contracts for existing homes also tanked nearly ONE THIRD – down 30%, to match the drop off in new home sales! And these are the numbers being reported from the NAR!

“The number of buyers who signed contracts to purchase homes tumbled 30 percent in May, the National Association of Realtors said.”

http://finance.yahoo.com/news/Weak-economic-data-suggest-apf-2896779054.html?x=0

Weak economic data suggest recovery is fizzling

Jobless claims rise and millions could lose benefits; home sales plunge; manufacturing slows

WASHINGTON (AP) — Fears that the economic recovery is fizzling grew Thursday after the government and private sector issued weak reports on a number of fronts.

Unemployment claims are up, home sales are plunging without government incentives and manufacturing growth is slowing.

New claims for benefits jumped by 13,000 to a seasonally adjusted 472,000, the Labor Department said Thursday. The four-week average, which smooths fluctuations, rose to 466,500, its highest level since March.

Claims have remained stuck above 450,000 since the beginning of the year. Requests for unemployment benefits dropped steadily last year after reaching a peak of 651,000 in March 2009.

The housing market is also weighing on the economy. The number of buyers who signed contracts to purchase homes tumbled 30 percent in May, the National Association of Realtors said.

For Nanci–your idea is a good one to save money–but look up the Credit Suisse chart on ARM resets–the current busting RES RE situation is twice as big as sub prime…and will continue to mid 2012…house prices are going to lose another 30% in ’10 and ’11.

Buying now is trying to catch a falling knife.

Watched a re run of “Oprah” last night. Show was from 2006, on “How to get rich”.

The advice was -you HAVE to buy a house, as the first step to getting wealthy.

How many people watched that show 4 years ago, and acted on it?

@ Karen & Fred. Your posts took me back in the way-back machine to 2005 … when I was working with a cadre of cool young dudes (I live in San Francisco and work in advertising – coolness abounds) who were strutting their stuff and crowing to anybody who would listen about the spiffy new condos they bought with the 5/1 ARMs they would of course refinance out of in a year or two when their condos appreciated the 20% they needed to qualify for a conforming 30 year fixed ….

and I did just like you. Smiled, said congratulations and went home to my comfy little rent-controlled flat in the best part of town.

My, oh my, how fast and far the mighty have fallen. And of course, thanks to Zillow, Propertyshark et al, I get to know know exactly how far. I don’t work with those dudes anymore, but I don’t have to to know how things are working out for them these days.

Okay, I know, schadenfreude may not be the most appealing of human emotions, but you really had to be there to appreciate the smug attitudes and condescending advice their coolnesses deigned to dispense at the time.

Not so much now would be my guess.

Two years after the crash of ’29, construction regarding new homes from 1931 through 1939 was virtually nill in Southern California. Check the records and you will find it true.

@Doc,

I think I spoted the teeny dip on the chart, but I’m not sure…could be the guy drawing the graph dropped his ruler on the floor…

I think folks are finally feeling the gravity of the situation, but they still gotta have that i-Pad or whatever makes them seem hip and cool. How could this much go wrong and folks still don’t get it?

@D1-Shilling on CNNFN noted after the Florida bubble popped with the 1926 killer ‘cane there were 50 years of falling or flat house prices in FL. I’ll be over 100 in fifty years, probably a number of those years in one of those small, bermed houses that folks are just dying to get into.

It’s more than just misguided–it’s devious manipulation and destructive recreation. Some people like to go to the woods and kill animals–sort of an old-brain instinct. Some like to destroy other people that are not like them. How many Americans lusted for the blood of Germans, Japanese, Vietcong, Iraqis, Aliens? Destruction of others enables your gene pool into the future in an old-brain way of thinking. Folks, it’s a trap. They got plenty of money–the enemy comes like a theif in the night to steal and destroy. This is the end game of a failed world financial system. Don’t make yourself more vulnerable than you are now. CA housing is in decline for the foreseeable future.

My real estate agent associate told me that the market is back to normal and I could expect appreciation of 2-4% a year here in Burbank(tune town) and it is a good time for sellers and buyers. I think that he is either stupid, or more likely feeding me bull so I will list my home with him. It is my impression that the real estate agents here in Burbank are desperate.

Thanks for your hard work and information Doc, have a nice 4th!

I’m signing a new one year lease tomorrow for my apartment (plus I’m getting a sizable rent reduction). Even with the stupid tax credit, it makes almost no sense to buy in the desirable areas…we are still in major bubble territory.

It looks like all the pent up bad news got released at once and will make for not such a nice summer for many people. I could ramble on and on and on about how anybody with an IQ above 40 could have seen this coming. The last thing anybody should do in this economy is sign up to buy overinflated housing. I’ll enjoy my reduced rent and hope for more price declines.

We along with U.K., Canada, Australia, China, and other European countries are all in the housing bubble. It looks like bubble everywhere. 2012 doomsday might be more a global financial shakedown, than a global natural disaster.

People don’t realize unless you buying a house with cash, you don’t own it. Even you own it, in some situations you can still lose it. On patrick.net, I read someone’s fully-paid house was sold under them because of overdue HOA fees, a mere few hundred dollars.

“schadenfreude may not be the most appealing of human emotions, but you really had to be there to appreciate the smug attitudes and condescending advice their coolnesses deigned to dispense at the time.”

I remember how BAD I used to feel in 2006 and 2007 when I used to think about the cheap, modest house I still live in, that was and is far below my ability to afford. Oh my goodness, the high rollers everywhere shouting housing porn played into my innate sense of guilt and shame!

My, how the tables have turned. All of a sudden, through no virtue or foresight on my part, I have realized that I inadvertently, probably through procrastination, made the wisest financial decision of my entire life. Buying a new house during the bubble would have equaled the other “worst” financial decision I made, NOT buying a numbers-matching 1970 Hemi Cuda for $2,800 in 1986 (it used too much gasoline and would frequently vapor lock in the hot summer, I reasoned).

Dr. – Sounds like you are listening to the wrong financial shows. Seriously, why even waste your time?

Fred – You aint kiddin. I’ve got a coworker about to close on a shortsale. I started inquiring about the zipcode he buying in, because I might be curious about living there. He starts asking me if I’m looking to buy also. I tell him I’m not in the market for a couple years, gonna wait for the housing mess to shake out. His reply? “That’s weak.” This is coming from a guy who already bought a home at the peak, is holding it, underwater, and renting it out at a loss of “about 1500”. I was afraid to even ask him if that is 1500 annually, or per month. It easily could be monthly.

That’s weak.

What kinds of stimulus spending would you support? You say the tax credit is unsustainable, I would argue that stimulus spending as a discipline is unsustainable. It creates temporary effects and dependency on government that only leaves people demanding for more spending.

I used to think of 2012 prophecy folks as funny. I know one who sold all his belongings and moved tot he Amazon jungle in Peru!

But looking at the world today, something is up. The financial system is collapsing in our country and dems and repubs are fighting about talking points. Meanwhile every little country and their cousin has nuclear weapons today. Maybe we just may go into world war III and that may pull us out of the depression like the last time. Although this time, not sure who will make it out.

@caboy

There used to be a show Barney Miller, and one of th eguys said, “If were gonna have this WW III, lets just have it and go on…the joke of course is there will be no humanity to go on if we do, so we get third world countries to fight now or just start a war whereever we want. The whole world wants us to go down.

@Eric

We have to have stimulus at this point because our economy is farce, based on world reserve currency. Fortunately, WE are too big to fail, so the rest of the world keeps us propped up like Citibank or Fannie. I would say a stimulus that creates energy independence, but it would be like cancer research, where finding a cure would be a disaster because the giant beauracracy would have to be retired–not going to happen. What gov’t department was ever dismantled? NRA?

@2012

Read Collapse, by Jared Diamond. Great societies have collapsed all throughout human history. That is the course we have chosen, or had chosen for us.

Folks….Its not the Kool-Aid, look up in the sky on a clear day. Notice those planes up in the sky with long streaks flying back and forth??? Your tax dollars hard at work!!!! Project ENOC in effect, 2012 right around the corner.

Eat, drink, spend, and be merry….

Don’t let other people goad you into “upgrading” to a larger house.

We bought our house 23 years ago in the San Francisco area.

1,906 sq,ft,, nice but not extravagent neighborhood.

Since that time, our net worth has increased by serveral million dollars.

We could easily afford to pay cash for a 5,000 or 6,000 sq.ft. “Mc Mansion”

in a tonier neighborhood.

But what is the point.?

We don’t need to impress anyone.

You will never regret living BELOW your income.

@Mike,

Agreed. Our house isn’t anything near that size, but it’s still too large. Kids are almost all moved out. I spent most of the last 15 years in motel rooms, so how much room do I need? Not much. We can’t figure out we are bing programmed to make foolish decisions. We are such manipulated morons. Forced slavery was abolished but voluntary slavery is promoted…odd.

@Caboy

I read about the Mayans and they follow the same formula for societal destruction:

1) Destruction of Habitat

2) Inability to endure climatic change, especially drought

3) War and conflict

4) Kings and nobels extracting too much from the peasants and building monuments to their greatness (Wall Street)

5) Failure to trade with others to develop survival synergies (we trade paper, they trade tangibles)

I think in 2013 we’ll be asking wondering what was all the fuss about 2012, just like Jan 1 2000, and 5/6/2005 (5/5/5 was another planetary alignment that destroyed the world with polar shift and such, except it didn’t). Still, I believe we are enroute to a major global economic collapse, just no man knows the day and hour.

We need positive feedback loops to build and preserve our hegemony, not just print money and occupy any nation that balks at our reserve status. All I ever hear about from our ‘liberal’ media is some psuedo-conservative appologizing for the sanctity of corporate greed and how much it benefits all of us.

In engineering, control systems are designed for stability, and perpetual growth is not stability–it’s unsustainable. That’s why housing it tapped out now. Nothing can grow compounded indefinately into the future. We have the wrong economic model and housing is the king-pin to it all.

Hi all,

I am a single female living at home with the folks. I am what I would think to be a pretty level headed person. I already own a triplex which I bought before the market was hot and am now looking to jump into another good deal. But the more and more I look the more and more I notice people are smoking crack. All my coworkers are telling me what a great deal the tax credit is blah blah…I keep thinking in my head “stupidos your house can drop in a minute what that tax credit is worth” My real estate officer is definitely smoking some crack. Everytime she sends me more investment properties that I could possibly be interested in I just die laughing at the costs. The rents are going down, people are losing their jobs, interest rates are at a super low and ummm she is trying to convince me now is the hottest time to buy….thank you folks for showing me I am not the only American out there drinking too much koolaid!

🙂

@mar

That good. No point in going down the river with the Jim Jones believers. No matter how many times they think it looks just like a Picasso, it’s just a picture off some mom’s refrigerator (even if it is stainless steel)

I also was deluding myself that I could buy a rental property and make a profit BUT:

All accounts are saying that the money is with the rich. Last year “the rest of us” lost 17% and the rich have gotten richer by 17% (Reuters). There is no way that there is a recovery happening, when the government is lying about welfare, unemployment and who knows what else and is encouraging the banks to hoard (Forbes).

Maybe it could all turn around tomorrow, but I think the green shoots are just spent food stamps (which are being cut). There is no such thing as a jobless recovery, when the poor (disabled and elderly) have no way to survive and the middle class has been decimated. -And my brainless, the most heavily taxed are the poor, definitely NOT the rich. Millions will die because of the “health” care bill.

I also was deluding myself that I could buy a rental property and make a profit BUT:

All accounts are saying that the money is with the rich. Last year “the rest of us” lost 17% and the rich have gotten richer by 17% (Reuters). There is no way that there is a recovery happening, when the government is lying about welfare, unemployment and who knows what else and is encouraging the banks to hoard (Forbes).

Maybe it could all turn around tomorrow, but I think the green shoots are just spent food stamps (which are being cut). There is no such thing as a jobless recovery, when the poor (disabled and elderly) have no way to survive and the middle class has been decimated. -And my precious, the most heavily taxed are the poor, definitely NOT the rich. Millions will die because of the “health” care bill.

Leave a Reply