Real Homes of Genius – Seal Beach home from a price listing of $2,900,000 to selling for $900,000. Chasing the housing market down.

It isn’t everyday that you get to see a home in Southern California that shows the manic pricing behavior of the peak years of the bubble followed by the desperate bid to chase the market lower in such extreme fashion. There were many sellers that held out for peak prices but were always one step behind when the correction hit. They wanted to sell their home for $600,000 but the market only would support $550,000. So a few months later they adjust to $550,000 and then, the market would only support a price of $500,000. Consider this the reverse of the bidding wars in the heyday of the bubble.  Many for a year or even more attempted to chase the market lower and many eventually lost their homes this way. Now the typical case is of someone with some funky toxic mortgage and the often repeated story of buying more home than you can afford. There are many examples also of failed HGTV style flips. Today a reader sent me a home from the seaside community of Seal Beach that must be seen to be believed.

Seal Beach home and the history of chasing the market lower

No one is going to tell you that their greed was the large reason that they didn’t get out of the market in time. This is why you only hear about people winning in Las Vegas yet we all know the numbers and the house will always win in the long-run. War stories are always good entertainment but does very little to show the bigger macro economic trends hitting the market. Take a look at this place (hat tip to one of our readers):

409 OCEAN Ave, Seal Beach CA 90740

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3.75

Square feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1,820

Original building:Â Â Â Â Â Â Â Â Â Â Â Â Â 1956

This is a very nice home with all the typical upgrades:

Counter-tops, check

It isn’t exactly beach front but it is very close:

When I mapped this home it looks like a vacation rental is close by. Now as Real Homes of Genius go, this is a nice place. But being a RHOG means some housing bubble antics took place and for this home, we need to go into the history of the listing when it was on the market. The pricing action reveals a fascinating story of chasing the market lower:

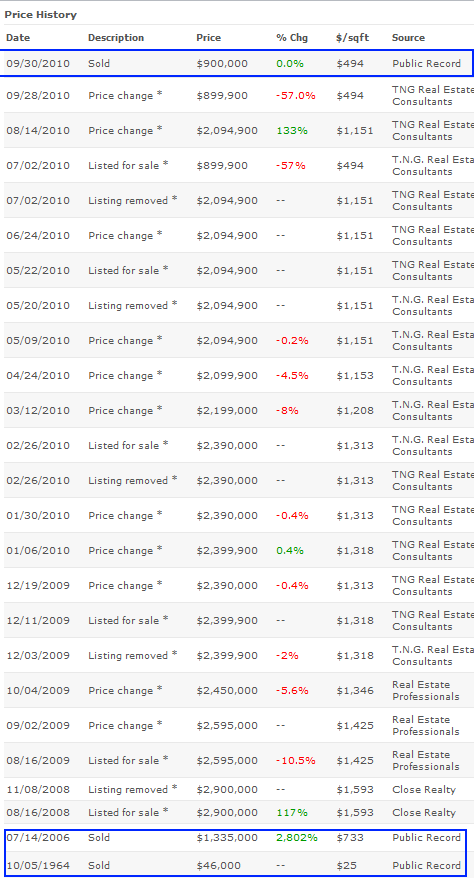

Source:Â Zillow

This is where things get interesting. The first recorded sale on this home occurred in 1964 and the place sold for $46,000. The next sale occurred in 2006 for $1,335,000. Hard to say if the upgrades were made before or after the home sold for that price. Interestingly enough, roughly two years after the home was purchased the owners tried to sell the place for $2,900,000! That is right, a Seal Beach 3 bedroom home for $2,900,000 that isn’t even on the beach front. The market didn’t bite so three months later the listing was pulled from the MLS. We are now in late 2008. Figuring $2,900,000 was a stretch, in August of 2009 the home was listed for $2,595,000.  Nice $300,000 chop might entice someone right? Didn’t happen. One month later another $150,000 was cut. The race to the bottom is now in.

From August of 2008 to August of 2010 it was virtually an experiment in chasing the market to the bottom. It looks like the game was over in September of 2010 when the home was sold for $900,000. This must have been a four year real estate rollercoaster for all who were involved.

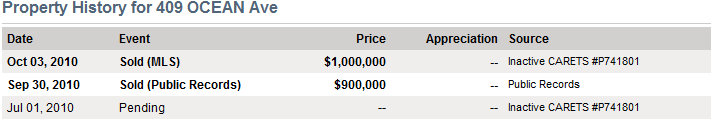

Some interesting data shows up on the MLS however:

The public records show a sale price of $900,000 but the MLS data which is manually put in lists the home sold for $1,000,000. I’ve seen this happen in many markets and usually there is an explanation (but not always).

This Real Home of Genius is a fascinating case of asking for too much at the wrong time. The irony is that in 2007 someone might have paid $1.5 or even $1.75 million for this place as the bubble was still going strong at that point. Yet going for $2.9 million priced these folks out and ultimately someone lost money here. It is unlikely that the original owners will be talking about this foray into real estate investing but the market is correcting and correcting in many markets. The action will be in these kinds of homes for the next few years and prices will come down as they are.

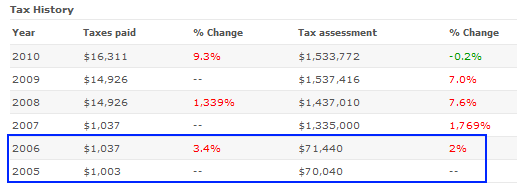

The bubble was a big win for the state as well:

This is part of the Prop 13 legacy here. In 2007 someone paid $1,037 in taxes and then in the next year it jumped to $14,926. I find the 2010 assessment amazing at $1,533,722 when the home on public records sold for $900,000. That is another lost revenue source from the state as homes sell for lower prices tax collections are also plummeting.

Today we salute you Seal Beach with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

72 Responses to “Real Homes of Genius – Seal Beach home from a price listing of $2,900,000 to selling for $900,000. Chasing the housing market down.”

In Aug of 2008 the banking crisis started. I guess the owner thought the beach was more powerful than a financial crisis.

Very interesting. They would have made a cool amount had they sold at the right time and for the right price. How on earth do people justify marking the property up by a million?!

…can the people that bought the house recently for $900k even make the payments for 30 years…?

The tax data are crazy. Someone paid $16,311 in taxes on this place in 2010? Lunacy! Government out of control! Housing prices out of control! This works out to $1359 per month in taxes. Just in taxes! What has happened to our country?

“Government out of control”? How do you figure? That works out to 1.04 percent of the assessed value of the property. What are YOUR property tax rates? Do you even OWN property?

Using the same tax rate and applying it to the $900,000 sale price, the new owners will be paying over $9,300 a year in property taxes.

This house is a nice house, but it’s NOT WORTH $900,000. Notice when the house sold for $1,335,000 – on 7/14/2006 – right at the peak of the housing bubble. In my expert opinion and analysis, this house is worth $450,000 maximum. The government and the banks have artificially propped up (inflated) housing prices. Poor fellow overpaid for the house.

Agreed.

The new asking price of $900,000.00 is still way too high.

They might get someone to purchase it if they reduce their price to the 1964 levels.

Maybe.

There is massive defaltion in housing while everything else is headed for the moon.

Or, perhaps better, they can donate it for their asking price to a charity, and wipe out a years worth of Taxes due to the IRS.

Something is always bettet then nothing.

I must presume you mean the 1964 price adjusted for 2010 dollars. Buy that house for $46,000.00? Including the upgrades? Hell, I’d buy three of them in todays dollars, even in the Inland Empire and quickly quintuple or more my money. I mean in like two months. Or rent them out and live on a great cash flow.

This is a mile-thick drippy baklava of nuts.

$2.9M? On what planet? It’s a nice little house…but that price history is an absolute fossil artifact of somebody was thinking like a creationist (“Let there be profits! Shazam! I’m rich…somewhere!”) but instead getting a two-year education in market evolution.

Reminds me of my old neighborhood in the Outer Sunset in San Francisco–a bunch of rowhouse/breezeway cottages built for WWII vets, in the 1,000 sf range, double that if they developed the downstairs garage into a second floor. This place, like the Seal Beach place a block or two from the beach, sold for $1.6M in April:

http://www.zillow.com/homedetails/2200-47th-Ave-San-Francisco-CA-94116/15118506_zpid/

Now take a look at the assessments on the SF place back to 2004–in the $50s, and paying about $800 a year on taxes. You just know that somebody in the assessor’s office is jumping up and down and drooling, because the new assessment will rocket up to around $15K and the taxes with it. And nobody making median wage will ever again be able to afford that house. If just the TAXES are $1250 a month you need $45K a year in income just to service that (at 3:1 housing budget). In other words, an entire US median wage income is barely enough even to pay the taxes on the place.

What’s the groundwater like there in Seal Beach? (What with the Naval Weapons Station so nearby.)

That valuation history chart is quite remarkable! A straight vertical climb in price before it jumps off the cliff.

I can’t blame a seller for chasing the market down. There still hoping that some fool will take it off their hands at a decent price. And there are many fools out there, so why not take the gamble. But if they were to make a drastic reduction, ahead of the market, they would then be considered comp-killers, would they not, making all the other properties necessarily come down in price. Ha ha… They can’t win for losing….

The sellers may have also felt they could capitalize on the attention focused on Seal Beach by Jesse James and Sandra Bullock whose oceanfront home wasn’t far from this one. Once the Bullock/James story faded from the papers and the summer ended, demand for overpriced, small beach property probably dried up. It’s like trying to sell a convertible automobile during the winter when it’s raining and cold.

The reason the MLS says 1M and the pub rec 900k is because the “Used house Salesman” or “Realtard” leaves it that way so people think it is a comp @ 1M. Some sheeple think a MLS printout must be official, spelling errors and all.

As an appraiser that refused to deal with their BS, my greatest feeling of schadenfreude was realized when I recognized a real SOB of an agent selling makeup @ Macy’s last week. How’s that Benz lease doing now….oops I mean used Chevy from your uncle.

I love a clever writer and the Realtard and Used House Salesman make you one..I am a Realtor and don’t give a rats’ ass about the market. I care about the people. Those hurt, me included, yes, I lost my house too. I am surviving in real estate not by doing Foreclosures. I am trying to do Short Sales, but the Lenders fight me every step of the way. I get them done, and if done quickly, they help the Sellers, but the bull sh** I have to hear from the Banksters is quite remarkable and does support charts like this one..

BS. You are lying to us or to yourself. If people knew the uncertainties of the market and unsustainability of current price levels, you would not be able to sell any homes, and you could not earn a living. Keeping the illusion that buying a home is a good idea alive is essential to your business model. If you really cared about people, as you claim, you would find a less fraudulent line of work. “Always a good time to buy” right?

Hey Kimberley, you were a realtor and you lost your house too? What does that say about you knowing your own profession…not a whole lot. My only question to you is “has a realtor EVER once said it’s not a good time to buy?” Like you said, that would be looking out for the people. Once upon a time being a realtor was an honorable proffesion. The last decade has made a mockery out of that profession. With so much information at your fingertip today, there really isn’t a need for a realtor anymore. Anybody can get comps, anybody can negotitate a price and terms and an escrow office can take care of all the paperwork…pretty simple isn’t it.

BS, Short Sales don’t help the sellers one bit. They only help banks and real estate agents. The sellers get a 100 to 300 point drop (depending on where they started) in their FICO credit score after a Short sale, the same as in a foreclosure or a 120 day late.

Which Appraiertard appraised it in 2006 for the bank?

The appraiser tard that did it in 2006 may have had nearby “comparables” that justified the value via the sales comparison approach. He may have been in the pocket of the realtor that is now selling makeup at Macy’s or the “loan officer” that was bartending up until the middle of the boom when one of his “bro’s” told him about how easy it was to sell snake oil. Either way the “lender” did not want to know the real value as they were going to sell it, the “buyer” just wanted in (who cares when you have no personal skin in the game), the city / county just wanted the increased tax revenue to dole out to DMV like welfare workers.

I was removed as a review appraiser from the big banks because I called bullshit on too many of their deals. Sold the 3 properties I owned (or part of) in late 2005 (left some $ on the table but did not get crushed on the way down) and have been renting and kicking my landlord’s asses on property upkeep and rent deductions. Most but not all “used house salesmen” I can remember in the hey day really though they had some kind of talent so I used that phrase whenever I could to remind them of reality. Strolling by that makeup counter in Macy’s was a nice piece of reality.

California cotton fields

Where labor camps were filled with worried men with broken dreams

California cotton fields

As close to wealth as daddy ever came

California is the garden of Eden

It’s a paradise to look at and see

But believe it or not you won’t find it so hot

If you ain’t go the do ray me

–

we miss you Woody, singer prophet of the PREVIOUS great depression

Greg Graffin has a great version of this song on “Cold as the Clay” (2006).

Asking or listing price is fun to talk about, but meaningless compared to the selling price. Asking price can be dellusional, as in this case. What matters is that they paid $13.M in 2006 and sold it for $900K in 2010. That sounds about right compared to other somewhat desireable areas in CA.

If you look at the Google Streetview of this location you’ll see nothing more than some plywood and two-by-fours. “Upgraded” is a bit of an understatement – this place was rebuilt from scratch. Not sure how that plays into all this though.

It used to be (not sure if this still works) that if you left one wall standing it was a remodel, not “new construction” and that was beneficial when it came to property taxes.

So they building may have bulldozed all but one wall (even if it was just the wood framing that was left standing) and “remodeled” from there. It wouldn’t surprise me if that property started out as a single story beach cottage with a wall furnace, no insulation in the walls and drafty, aluminum frame windows. 50 years later it would be been riddled with dry rot and termite damage – ripe for a remodel.

We didn’t get here because we were on a winning streak. My apologies to those people who spent responsibly. To those who didn’t; let me grab the Kleenex box.

http://thecivillibertarian.blogspot.com/

Lunacy, I agree that property taxes are way out of control in our country. I live in Chicago and I looked at some foreclosed properties just for giggles. Cook County and some of the other counties near Chicago are refusing to lower property taxes. For example, one house I saw was priced at 280K and the peak price for it was 700K. Cook County still wants about $9000 in property taxes. No thank you.

The good news, some counties and cities are learning they need to trim the fat from their budget and they need to lower property taxes in order to induce people to buy.

What do you feel would be a fair property tax rate? The tax rate on the Seal Beach property in 2007 worked out to about 1.04% of the assessed value.

It’s property values that spiraled out of control. Property taxes are a function of those values.

Up here in Canada I know many people still neck deep in the house flipping game. I’ve tried to warn them, tell them of what is to come but they are taking the “we are immune” mentality. This property really illustrates how dramatically the tables can turn. I wonder if the guy who got burned ever looks back to really see that clearly this home was not worth 1.33m let alone 2.90m? I wonder Dr. Housing Bubble, if you think these homes that have been literally thrown up hastily over the past two or three decades will even last the test of time. I hear that many homes and condos have been poorly constructed to boot, and amidst the mortgage fraud crisis, we never really factor in the fact that some of these places won’t even structurally maintain in the end…

I can offer this from Pugetopolis: WA State Supreme Court is getting ready to hear a lawsuit against the developer Quadrant Homes:

http://www.seattlepi.com/local/428095_quadrant08.html

Apparently at the boom-boom peak, they were going from lot to occupation in 54 days.

It appears that hidden within the buyers’ contracts was a clause that said they agreed to give up their right to trial by jury in event of any problems (i.e., mandatory arbitration/mediation clause).

Another mold lawsuit ! During these times I’m not surprised.

Mold generated lawsuits hit the industry some 20 years ago there about. A local home builder in our area saw the Tv special and counted 3 days before he was served with the first of many complaints.

The homes are evidence. Defendant filed for discovery. The plaintiff had to allow defendant into the home. The defendant did photograph plaintiffs dirty underwear and the filth that has been dragged into the home by someone.

Defense was, “The homeowner and I were both in attendence at the presale walk through. They didn’t mention mold. I sure as hell didn’t sell them a mold. Look at the pictures your honor. That’s not the condition I sold the home. Who brought the mold into the home your honor ?”

Home builders have been gun shy on mold since the 80’s. Contracting Firms today like the mentioned aren’t interested in mold litigation. Going to court doesn’t doesn’t figure well when your penciling the margins of profit.

These folks are going too loose.

These folks could be underwater home owners looking for any way out of negative equity territory or bankruptcy.

Like the folks were that sued our local area neighbor, good guy. home builder

Yes I’ve heard the Canucks are currently being delusional about real estate, same as the Aussies.

“This time is different”…”real estate NEVER loses value”…”buy now or be priced out forever”. You’re doing the Lord’s work trying to warn the brainwashed lemmings, but you can only really save yourself in this world. People will believe what the want to believe, particularly when it is in their financial interest to believe the opposite of facts/reality.

The $900,000 sale price INCLUDES ALL THE WATER YOU CAN DRINK, when the TSUNAMI comes rolling in over Seal Beach. No additional charges will apply!

Now will that tsunami be just in Seal Beach or other areas of the coast as well, Nostradamus?

That’s excellent logic. But wait! What if the TSUNAMI and the EARTHQUAKE happen at the same time? Then the ground opens up and all of the water will go into the hole. Then we will be safe.

I don’t think people in SoCal worry about this stuff.

You don’t need a Tsunami in Seal Beach for water damage. The beachfront homes in that area flood every winter. It would just take a sewer to back up or a storm during an astronomical high tide to leave ocean water on the floors of that baby. Next time you are in the area this winter, check out the 8 foot high sand burms on the beach. Fabulous.

Even 900K is still too expensive for this house, in a sane world I think this house would sell for 600K. Seal Beach is a nice little town, but there is no room for any price appreciation for MANY years to come. This new crop of buyers is probably banking on “good times are right around the corner” mentality and they will be sorely disappointed with the results.

I see housing as a standoff as the bubble unwinds. In one corner is the government, banks, FIRE industry and current homeowners who will do anything to keep prices propped up and keep the Ponzi scheme rolling. In the other corner is an ever shrinking group of potential buyers that will hopefully extend their middle fingers and start the stare down. I need another 15 to 20% drop in prices before I would even consider buying!

My neighborhood was selling in the 700K range two years ago and now its in the mid 3’s and two short sales came out today in the high 2’s, it shocked the neighbors! This latest downdraft might have a strong emotional impact on the Calif homeowners, sort of kicking the chair out from under them. Deflation is a new and different financial concept and as it continues to move into every niche neighborhood it undermines the basic belief that RE always goes up or is a great long term investment or the belief that appreciation is just around the corner, well maybe not!

Doc, have you seen that show “Real Estate Interventionâ€, on HGTV?

Here is the story line. A couple has house on the market for months, with no bites. They are wits end, and must sell before it is too late.

A Real Estate pro (?) comes to their house, looks around and drops several hints that they might be priced too high. He proceeds to show them other comps in their area, that have more land, better kitchen, more square footage, nicer layout, etc. and that comp has just sold for 40k less than the couples house. And they sold in one week. The plot comes to fruition when the couple decide to drop their price 40k, as Real Estate pro (?) suggested, in order to be in line with the other houses on the market. Repeat this formula each week, substituting a different couple, in a financial/real estate scrape, and you have the new show, that could only take place in this weird, anti-flipping environment.

The house was bought in 2006 for about 1.3M. By 2008 the house bubble already burst, one would think the asking price should be lower than 1.3M, instead, the seller ask for 2.9M. What on earth was he thinking? I see a lot of agents talking about insulting sellers when buyers offer low. Do they ever think about the sellers insulting buyers by sky high listing price?

A quick look at the sale dates tells you that the price went up two years later. Most likely the new owner was a flipper and paid 1.3mil for the bare bones original home and did all the upgrade, including as one poster suggested adding a second floor. Ergo, Mr/Mz Flip decided the new digs were worth 2.9mil. Oooops!

UCLA: O.C. home prices to surge 49%

http://lansner.ocregister.com/2010/10/27/ucla-o-c-home-prices-to-surge-49/86028/

…I guess we should all expect 49% pay raises too.

FLOL, 49% eh? China must be buying the entire OC as a sort of debt swap for all our debt they hold. 49% yeah good luck!

…in other good news, the foreclosure bums (The Earls of Simi Valley) have finally been locked out, kicked out, and tossed out of “their” home a few hours ago. I wonder what kind of damage they did in one week, and I wonder who is paying for moving their stuff out and for the storage container you see in the photos. Hopefully this is the last we hear about these deadbeats and their shyster lawyer.

http://www.vcstar.com/news/2010/oct/26/simi-family-locked-out-of-their-foreclosed-home/

I created a simple “value calculator” in Excel to determine what one should pay for a home. Basically, you choose a sales price in the history when CA dreamin’ wasn’t occuring and plug in what the inflation (appreciation rate) should be… Based on the 1964 sale (and not counting if it was a teardown) this place should be:

Sale Yr 1964

Appreciation Rate 4.00%

Sale Price $46,000

New Sale Price $279,442

While I appreciate your sensible approach to value based on inflation, your final price for this house is still unrealistic. Why? It is simply not the same house. It has been extensively upgraded and that work must be taken into account. There may be other economic factors at play as well among them location and population growth/change. I will still adopt your inflation modus as one tool in my evaluation of property.

That’s a damn ugly house for $900K, although a nice location, it’s still too much to pay. Agree, the real value of that house is probably around $600K in a normal market.

Incredible really the way a few of the respondents speak to others in reply to this article, way to flaunt your “intelligence”.

I am a fourth generation resident of Seal Beach and a Realtor specializing in Seal Beach. The home (when sold in 2006) was promptly torn down and rebuilt. The resulting listing was done by the investor/builder/agent that was from out of the area and had no concept of the market and obviously trying to recoup their subsequent investment (already gone).

Let’s talk for a moment about value and market. Value is a price where a seller and buyer agree on price, irregardless of market, inflation, bubbles etc. This price establishes and trend and thus a market is created. No amount of mud slinging and name calling is going to change these fundamentals. But hey what do I know, I’m just a “Realtard”…. lol

Hey yo Realtor; its like this. Since people “buy” houses with loans then it’s the bank telling us what the price is going to be. Not you. Not me. The bank. And the bank owns the house till you get the hand of the devil off the house.

The buyer is the bank. So, they are trying to figure out if you can pay the note long enough to move the mortgage onto a MBS with out getting a forced buyback. You got that?

I’m thinking part of the inflated value is due to the low rate enviroment. Should be concerned with how much you can rent the place out for when or if you need to move. So, the situation is very different now because of the low rate enviroment.

I’m guessing the deflationary enviroment along with past histories of bubbles say that prices in 2016 are probably going to about the same as they are now in real terms. Might be adjustment if the govt raises taxes increasing the value of the mortgage deduction, and or plays games with incentives. I suspect you will be able to pull money from your 401k for a home purchase and or 15k tax credit that almost went through. This time it will probably be a permanent credit though.

Deflation is an amazing and stubborn little economic animal. Primarily think people are looking at how quickly your credit disapears when times get tough and no one with a functioning brain wants to get tied to a massive debt and not have cash to sustain themselves. We could be staring at decreasing velocity for a long long time.

It’s nice to own a property but don’t mistake having a mortgage with owning. The house becomes a nominal asset but only when it’s paid off and you are collecting equivalent rent. Or you sell it and find out if you have any equity.

James is 100% correct. Unless you have a suitcase full of money and you can pay cash for the house…the deal is then truly between buyer and seller. Most schmucks need a loan from the bank to buy a house…the bank will send appraiser out and determine how much if any money will be lent to you. So in effect, banks do set prices. After this final meltdown, realtors deserve all the bad press given to them. Most realtors shrug off any responsibility for putting people in houses they could never afford, the blame went to the big, bad banks. It didn’t take any high education to determine that a guy making 50K per year buying a 500K house with zero down and a toxic mortgage probably wasn’t a good idea. Everybody in the FIRE industry deserves some of the blame!

“Irregardless?” Yeah, you’re not just a “realtard,” you’re a ‘tard for real, and illiterate to boot. Take a step up in life, and drive a taxi.

Good point Nat. Name calling such as “Realtard” or “Doom& Gloomers (D&G)†does not add any value.

I’m going to have to disagree on how a couple of terms are defined. Regarding value and price, I’m going to have to agree with the dictionary.com definitions. Price is defined as “the sum or amount of money or its equivalent for which anything is bought, sold, or offered for saleâ€. Value is more subjective and is defined as “relative worth, merit, or importanceâ€.

Here is very expensive lesson that I learned. The price that the market will bear at any given point in time is NOT a fundamental or a basic principle of real estate. Area incomes, the rent that the property is likely to generate and the location are some of the things that will heavily influence the value of the property.

When I purchased my first property I learned that you should buy within your means. That real estate is a three legged stool with three potential sources of income (tax benefit, equity build up and in a normal market appreciation). As we have seen this last go around the last leg can also be a source of lost income. In this last real estate bubble I learned that not only should you buy at a price that is within your means, you should buy at a price that is within your neighbors means. Otherwise you run the risk of over paying for the property, even if you can afford it. And as many “investors†are learning the hard way, if you are buying purely from an investment perspective you better make sure that you are getting paid a risk premium for the risk that you are taking. Otherwise why take the risk.

I have to hand it to the real estate industry(realtors, brokers, banks, etc), wall street and the politicians, they pulled a lot of bells and whistles and the market looks like it stopped dropping. But look what has been happening to inventories for Seal Beach since the beginning of 2010. Why is affordable housing a bad thing???

Since you have experience in this area maybe you can help me with a couple of questions. Are the potential buyers that are looking to buy in this area really making $240k+ or do they have enough income/equity to afford that property at almost $1 million? If so are they willing to take the risk in this market and make that large commitment or are they going to play it safe live below their means in case the real estate roller coaster goes into another death spiral? Personally I’m going to play it safe.

Your final question is quite apropros – what DO you know?

And I prefer the term “real-turd”, as in “My God that agent was a real turd!”

Realtard is insulting and demeaning to retards everywhere. Sure all realtors are retards, but not all retards are realtors, and don’t deserve to be treated as such.

BTW the Seal Beach shitbox with its cheesy McMansion feel and “use every square foot of the lot, all 2,000 (or less) square feet”, is ATROCIOUS. To think some moron paid even $900K for that tiny joke, well more power to them. Better than the “investor” that lost his ass buying a 50 year old worn out beach cottage for 1.335 million, tearing it down, and building that eyesore, also at no small cost. I’m glad morons like that are getting DESTROYED financially and look forward to laughing at them in their vans down by the river.

Thank you for joining us Nathanial!

Now, If the good Dr. could only be so kind as to pull the mortgages on these 3 properties to share them with the rest of us!

http://www.zillow.com/homedetails/740-Carmel-Ave-Seal-Beach-CA-90740/25307968_zpid/

http://www.zillow.com/homedetails/1503-E-Ocean-Blvd-Newport-Beach-CA-92661/25307778_zpid/

http://www.zillow.com/homedetails/130-5th-St-Seal-Beach-CA-90740/25307155_zpid/

Then we can pull all the other Ferguson records!

There is no such word as “irregardless”…but I do enjoy definitions from the NAR Handbook. I had no idea what Value meant. I’m learning new things…shooooweee!

Are you angry that Sean Stanfield has a corner market on all of the high-end delusional selling that goes on in Seal, Sunset and Huntington Harbor?

Do’th a wise man build his house upon the sand? When insanity is commonplace, it is called a social norm. A lot of money to be made in the hot seat if you can get out before the casino burns down.

It looks like the owner was TNG Real Estate. I will not be going to them for advice.

i thought 900,000 was insanity, how to justify offering 125,000 cash with the taxes they will want to keep this property, a fishing csnoe as beachside work bringing in a yearly average income of?

if the proprietor pays 125,000 for seaside rooming house may make for affordable classy vacations? less stress all around?….

As a side note on the various LIES which Duh Bubble was built on, I note the INTELLECTUAL bankruptcy of copping architectural styles and formats from previous centuries in Italy, instead of having the courage and originality to establish a unique, present day, identity that is organic to a special place like Seal Beach. In Italy, it is timeless and classic, BECAUSE it’s authentic, in context, and truly organic (not to mention the master artisan build quality).

In N. America, it is incongruent, and just silly, and therefore a transient fad, destined to lose appeal, and thus value, regardless of how well the materials and structure hold up… or don’t hold up.

This is especially ironic given the number of “prestige” universities in CA, most of which have Schools of (alleged) Architecture.

Just say No to Faux… your long-term property values will thank you. i.e. you won’t lose 30% when the hipsters/hypesters on HGTV move on to the next faux-style.

The Seal Beach home would probably rent for about $3500/month. If you value the house based on rental parity, that would justify about a $700,000 price tag.

I have been following Seal Beach real estate for a while now and always laughed at the $2+ million dollar asking price. I was pretty shocked that the sellar accepted a $1,000,000 offer.

At the time, I thought $1,000,000 was the real sale price. That also surprised me because it seemed a bit high. Based on comments here, it sounds like the actual sale price was $900,000. That’s about what I would have expeted in today’s market.

I believe there’s a big housing bubble in the high-end, but disagree with those of you who think that this house is more expensive to own at 900k than to rent.

Let’s assume you’re correct that this almost new beach-close home will rent for only $3,500 per month (I think you’re low-balling the rent for a house of this condition and location, but I’ll accept your $3,500 for the sake of argument).

Let’s do the math for a well qualified buyer with 20% down:

House Price: $900,000

Loan Amount (80%): 720,000

Fannie/Freddie Conforming Jumbo 30 year fixed rate: 4.25%

Monthly Mortgage: $3,541.97

Monthly Principal Payment/Forced Savings (1st month): $991 per month

True cost of Mortgage (Interest Payment) (1st month): $2,550

Notice, this is a simplified calculation since I’m not taking Mortgage Interest & property tax deductions into account, because those vary for every person. But generally, what you save in income taxes by owning a home in this price range and the income of those who qualify for a loan in this price range is about the same as you pay in Property Tax + Insurance, so it’s a wash & is why I’m not including it in the calculations.

So, based on your calculation that it costs $3,500 per month to rent, then it’s cheaper to buy at $2,500 per month in interest payments.

20 years from now, the rent for this place will be at least double at $7,000 per month, but you will still pay the same $3,500 total, but your actual real cost in terms of what you pay in interest will decline due to amortization.

Your calculation that this house is cheaper to rent than to buy at $900k is only true if interest rates weren’t kept artificially low by the Fed’s current actions, and went back to a more natural 8% rate.

Oh yes…of course. Oooobviously the rent will double. Says who? A realtor or a homedebtor.

Run those numbers with a 6% mortgage rate. I’m not even asking for 8$.

Then add in 2% annually for maintainance. Yes, 2%. I’ve been a homeowner so I’m not clueless on this one.

It was overpriced.

There were stupid people buying on the upside and there will be stupid people buying on the downside.

Y’all are fixated on this property that ended up selling for 494.00/sq ft and yet there are 60’s tract homes that could have been designed by community college architectural students that are even further away from the ocean still going for over 500.00/sq ft. Riddle me that one? Some are even still selling at those redonkulous prices. The sheer madness continues in this hamlet. I think “Tulip Beach” is a more appropriate name for this place.

Mark_LA, your simplified calculation is actually way off. The real cost of ownership is nowhere near $2500/month. If you run through all the numbers (including repair costs, taxes, tax breaks, insurance, oportunity costs on your downpayment, etc), $900,000 is still slightly over rental parity. If you count “Principal Payment” as “Forced Savings”, then rental parity (on $3500/month) would be about $850,000 or so. By that measure, this house is near rental parity.

However, the assertion that “Principal Payment” is equivalent to “Forced Savings” is very questionable in todays environment. Most calculators count “Principal Payment” as “Forced Savings” because, as a general rule of thumb, this is true. The problem is that these general rules don’t always apply to bubble/bust type situations.

For example, if you bought your house in 2005 and sold it today, how much “Forced Savings” would you have to show for it?

Here’s another example: Suppose 5 years from now, the equivalent rent on the Seal Beach house goes up to $4000/month but mortgage rates are at 7%. Now the rental parity value on this property (including Principal Payment) would be less than $750,000. So if you sell your property at rental parity value 5 years from now, where did your “Forced Savings” go?

Without counting “Principal Payment” as “Forced Savings”, rental parity on this house would be about $650,000. So I would say the fundamental value of the house is somewhere between $650,000 and $850,000.

Itokuda:

You shouldn’t purchase any home if you only plan to live in it for 5 years, or have an insecure job/career, and don’t have at least 20% downpayment.

If interest rates do go up to 7% in 4 years (yes, that’s very, very possible), yes, absolutely the price of this home will go down because people always purchase a home primarily based on their total monthly payment.

You can always just rent out the home if that were to happen, since rents will be $4,000 per month (your statement, not mine), but your payment (net of tax deductions) will still be ~3,500 for the life of the loan.

@EconE

Let’s assume I’m nuts and you’re right and that you’ll still be able to rent this home for $3,500 in 2030. The “homedebtor” who bought this home for 900k in Oct 2030 will have the following mortgage payment, thanks to amortization:

Principal Payment/Forced Savings in 10/2030: $2,244

Interest Payment: $1,297

Of course, by then the income tax savings will decrease as the interest payment decreases, so the true cost will be higher than simply the interest payment since at that point your inc

Who cares if in 2015, this home drops in price to $650k…it’ll reach bottom at some point, and rise at least at the rate of inflation, which by 2030 will mean that at the very least, this house would be worth $900k again.

I’m not a realtard or homedebtor, I’m a high-income business owner who lives in a paid off condo in a really nice part of Pasadena (Madison Heights), that I got for $165K out of foreclosure in 1998 and is now worth $470k, based on recent sales by neighbors. I’ve wanted to upgrade to a bigger SFR home, but have stayed on the sidelines since 2004, when I realized we were in a housing bubble.

The pessimism on here is understood (I’ve been a part of the choir since 2004), but a lot of times many of you have your heads in the sand as to how much prices will drop & the demand for homes in prime areas.

I’d love it if I could find a deal like this in La Canada (a home that was purchased for $1.3 million in 2006, gutted and rebuilt from the ground up, costing the bubble buyers at least $400k additional to “remodel”, and available for a steal at $900k), which places me in historically low Fannie/Freddie conforming jumbo loan territory with a 20% downpayment…you find me one before it hits the MLS and I’ll gladly pay you a 1% finders fee.

At $1.3 million and 7.0% 30 year fixed rate interest in 2006 + the required $400k to gut this place out and “remodel” completely, this was a stupid buy by a stupid bubble buyer, even if they planned to live here long term.

At $900k and 4.25% 30 year fixed rate in 2010, this is a great deal on a beach-close move-in-ready home for someone who plans to live there for the long term.

By popular request, here’s the detailed calculation of the true cost of living in this house for a well qualified couple.

Let’s make the couple a 30 year old Nurse and a Fireman who each make $65k per year, for a total household income of $130k. No fancy Wall St, neurosurgeon, or entertainment executive jobs required to qualify for a jumbo conventional Fannie/Freddie $720k loan, just your average couple who paid their dues and have established themselves as very useful members of society.

The nurse and fireman have been sitting on the sidelines of the bubble, waiting for a deal like this for the past 6 years, and have saved for a 20% downpayment for the beach-close house of their dreams.

They plan to retire here in 2040 mortgage free when they turn 60 with their nice pensions/401(k) from their jobs. By then they’ll only have to pay insurance, property taxes (relative low by future standards, thanks to Prop 13), and maintenance.

The income tax bracket for this married filing jointly couple who makes $130k per year is 25% for Federal and 9.3% for California Income Taxes, for a combined total of 32.3%.

Cost of Ownership

——————————

$900,000 .. Asking Price

$180,000 ..20% Down Conventional

4.25% ..Mortgage Interest Rate

$720,000.. 30-Year Mortgage

$3,542 .. Monthly Mortgage Payment

$780 .. Property Tax (1.04%)

$80 .. Homeowners Insurance

=============

$4,402.. Monthly Cash Outlays

-$978 .. Tax Savings (32.3% of Interest and Property Tax)

-$991 .. Equity Hidden in Payment (Forced Savings)

$150 .. Lost Income to Down Payment (1.5% CD net of taxes=1%)

$100 .. Maintenance (this IS an almost brand new home!)

=============

$2,683 .. Monthly Cost of Ownership

Monthly Cost of Rent: $3,500

Analysis: Cheaper to Buy than to Rent!

So, yes, this was a great deal for the couple or person who bought it for the long term (to live in it and retire in 30 years from now mortgage free)!

I guarantee you, equivalent rent will not still be $3,500 in 2040, but this couple will be mortgage free if they continue to pay the fixed mortgage, which is less than today’s rent for the next 30 years.

I remember when these types of houses were bought by highly educated professionals who spent years building a practice, or entrepreneurs who busted their tails for years to build successful businesses that actually created something, and employed people. Now union member, civil servant types with “nice” pensions and an early retirement are considered the prime candidates to buy near beachfront property in California. Sad.

Mark, your calculations are pretty good except for a few points. First,and most importantly, you way underestimated the maintenance cost. This is a pretty common error. Unfortunately, pretending that you won’t have to pay it doesn’t make it go away. You should allot 1-2% for maintenace and repairs. At 1.5%, the Buy Vs Rent value (on a $3500/month rental) goes down to about $800K.

I think Seal Beach’s Property tax is about 1.1%.

“Lost income due from the down payment” depends on which investment vehicle you use. A CD is guaranteed money and non-variable. “Forced Savings” is variable and very non-liquid. One isn’t a very good substitute for the other. If you’re depending on “Forced Savings” as giving you a historical rate of return over the long term, then I would suggest that you use the stock market’s historical rate of return for your “Lost Income to Down Payment”. For simplicity, say 10%.

Mark, in answer to your other comments:

The point I was making was that “Principal Payment” is not the same as “Forced Savings”. Whether you sell a house 5 years from now (as I used in the example) or 30 years from now is irrelevent.

Also, if you do the math and account for vacancy rates, rental management fees, and oportunity costs, then renting out the SB house at $4000/month turns out to be a very bad investment. Also, if you need cash immediately, then renting the house out may not even be an option.

Leave a Reply