San Francisco housing still in manic phase: Dump that is “uninhabitable†with fire damage has pending offer at $1.4 million.

Well being back in the Bay Area I realize once again how delusional people have become when it comes to chasing unicorn startups and all things real estate. I ran into multiple people and it seems like everyone is talking about real estate. Some of these people were showing me “deals†on apps like Zillow or Redfin on their phones. “This place with some work can then be flipped in a month for a $200,000 profit.â€Â Why work when you can speculate on housing? The housing market is now in cult status and this psychological territory isn’t new. We don’t have to dig deep into historical texts and read about Florida real estate in the 1920s but need only look at the 2000s. San Francisco is out of control. And of course you have insulated mindsets from many that work in tech or the financial sector since they feel that money or an app can solve all of life’s challenges. Today we take a look at a home worthy of the crap shack title in San Francisco.

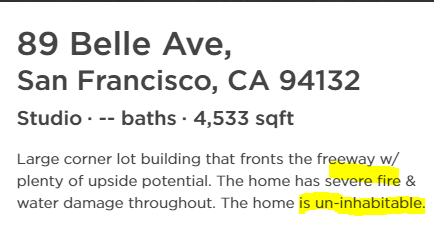

Uninhabitable San Francisco home with fire and water damage – $1.4 million

You always hear that you are paying for the land, not the property in California. If there is ever an example more worthy of that adage it will be with this home.

Take a look at this beauty:

Now this home comes with a winning ad:

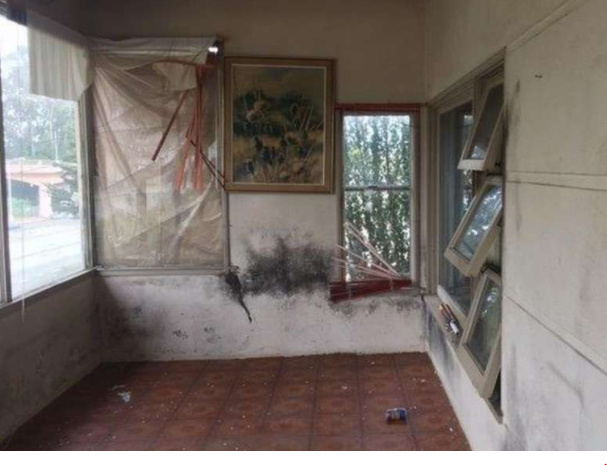

A gorgeous home that is ready for a dual-income tech couple ready to nest and put their new kid here:

Nic e little room for a mini tech baby. Or what about this room:

Now I know what you are asking, “but what about the bathrooms? Surely that is going to look nice.â€Â And you would be absolutely correct on that one:

The property was foreclosed on in 2012 and actually made the news because of the fire:

“SAN FRANCISCO (CBS SF) — The San Francisco Fire Department responded to a single-alarm fire in the city’s Ingleside Heights neighborhood Friday afternoon, according to a fire department official.

The fire was reported at 12:11 p.m. in a multi-story, single-family home at 89 Belle Ave., the official said.â€

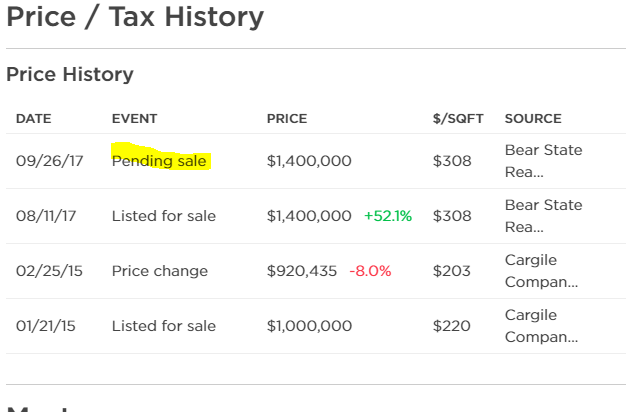

I had a reader send me this listing back on 9/20 and guess what? It has a pending offer:

Now to make this place livable you will need to drop $650,000 to $1 million based on contractors hired by the bank. But this is part of the cult status of San Francisco. You can tear this place down, build whatever it is you have in mind, and next you can flip it for a million dollar profit.

At this point, everyone is chasing easy money. Why slave away as a tech worker making a low six-figure salary when you can buy crap shacks across the state and simply flip them for profit? The place doesn’t even need to be livable apparently!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

168 Responses to “San Francisco housing still in manic phase: Dump that is “uninhabitable†with fire damage has pending offer at $1.4 million.”

Are Short Sales a sign of an impending bubble burst?

Here is one Butt Ugly house — $1 million — in Woodland Hills, that’s a short sale: https://www.redfin.com/CA/Los-Angeles/4234-Canoga-Dr-91364/home/22967009

A relatively new house, built in 2008. But is it worth a million?

It sounds to me like it was built with the idea that it could be converted to a 2-unit rental. It almost IS a two-unit building already- note that each floor has its own kitchen and W/D hookups. If so, it’s well worth $1M, if rental properties in less desirable neighborhoods, like Los Feliz, are good comparisons.

I agree it’s ugly.

Some TLC and bottomless pockets and it will feel like a Spanish villa.

You mean “A wonderful opportunity to build sweat equity”

“Why work when you can speculate on housing?”

Flipping houses is usually LOTS of work. And LOTS of risk. An ‘easy flip’ is far from the norm. Yes, the prices are insane. Which makes flipping an even bigger risk, which means any flipper in this market is earning their money.

100% agree. Flipping a house is not that easy. It is a full time job that requires quite a bit of knowledge and connections. Capital gains taxes, holding costs, RE transaction fees, permit and inspection fees, escrow costs, etc can gobble up quite a bit of profit. And you are self employed so nobody is helping fund your retirement or healthcare. M

The best time to flip is when the market is seeing big gains (+15% per year). Cosmetic flips can be done quick and can provide nice profits. Or you just turn the property into a rental for two years and then sell for a profit.

This is true and there’s lots of risk involved.

If it was easy, everyone would do it

To be fair, that might be taking the quote out of context. Flip doesn’t always mean making improvements.

It works until you are the unlucky person to have timed the market wrong, or simply didn’t do your homework properly!

Want to brighten up your morning?

Try doing a Google “street view” of this baby.

Would could possibly resist?

Nice, quiet dead end street. Beautiful view of Junipero Serra Boulevard. Web of power lines act like a mosquito net. What’s not to love?

And 100 feet from the freeway.

It doesn’t cover San Francisco, but the LA Times freeway pollution map should be one of the first stops before bidding on a property near a freeway.

Less than 1000 feet is not good. Less than 500 is baaaaad:

http://www.latimes.com/local/lanow/la-me-ln-freeway-pollution-filters-20170709-story.html

Being freeway adjacent doesn’t stop people on the westside of LA from buying. I regularly see homes along the 10 and 405 freeways priced in the $900k range sell surprisingly fast.

And yet this Santa Monica house, which FACES the 10 FREEWAY WALL, is offered for $1,750,000: https://www.redfin.com/CA/Santa-Monica/2901-Virginia-Ave-90404/home/6764434

From the listing description: Beautiful 3 Bedroom House in a GREAT LOCATION! Comfortable, quiet street in the middle of EVERYTHING. Minutes from DTLA, minutes from the beach, peaceful neighborhood.

GREAT LOCATION! The caps are in the listing. I didn’t add them.

Facing a FREEWAY WALL is a GREAT LOCATION? Such that the house is worth $1,750,000?

Several years ago, another house was listed on that same street, a block away, for only $750,000. Are they claiming that houses on that street have risen 133% in value in just 3 or 4 years?

SoaL,

3101 Virginia ave, an identical comp just closed at 1.15M

so, I suppose that’s what the one you shared is actually worth. Both look like complete dumps. Facing the freeway and on an alley too. Not even worth anywhere close to 1.1M in my opinion. I don’t think you could pay me to live there. YUCK

Also, I never can understand people who don’t bother to clean up their homes before taking photos for listings. Like really, how hard is it to throw your junk into boxes and move out of view while snapping photos?????

I love the smell of Freeway Carbon Monoxide in the morning!

It’s the smell of Victory!

Buy now before you are priced out forever!!!….It is the land next to the freeway which gives value!…..sarc. off

Reminds me of the days in 2006 when the Daily News was publishing headlines in “shout” font about the increase in “value” SF Valley housing stock.

Everyone was an “expert” on RE in those days. And everyone was talking about it.

The 1 BR house across the street from my shack in Van Nuys sold for $180,000, was demolished and a faux Spanish 4 BR McMansion installed in it’s place.

At the time I thought that was insane. Circa 2006.

Further back than that was the crash in the early 90s where Palmdale and that other town were decimated and featured in a PBS documentary.

Primarily pointed out the disconnect between “drive to qualify” and what sort of impact it had on families living in Palmdale and such and commuting to OC every day.

Not sustainable on many levels. So many instances of bubble mentality over the years: FL in the 20s, CA in the 19th century IIRC, Midwest, apartment overbuilding in the 70s.

These were all featured in “The Coming Real Estate Crash”, published in the 70s.

Well before the multiple crashes we’ve seen since. In the 80s, the 90s, the 00s.

But no, the internet experts tell us it’s never going to happen. This time.

It’s even more dangerous now. The crashes of the past 30 years were supported by a bullish bond market and falling mortgage rates. People now expect the bond market to turn around and mortgage rates to go up. Not good for a future real estate crash.

This. I don’t think the pundits/bulls recognize just how close the Fed is to pushing the marginal buyer out of the market place. The Fed has crashed the market before, albeit unwittingly, and will do so again. If the Fed wouldn’t have turned the housing market into everyone’s personal piggy bank under their asinine theory that the wealth effect would reflate the real economy after the NASDAQ crash, we wouldn’t have been trapped in this insane wash, rinse and repeat cycle to begin with. Stupid — and treasonous — pieces of shit.

Oh yeah, so true. Uncharted territory. Bubbles in many areas, public pension shortfalls everywhere.

I don’t know what the trigger will be, but a spark in one place can set the whole house of cards aflame.

When will people realize there are no “deals” on redfin or zillow. Whatever homes make the MLS are overpriced crap. If the home was actually a good deal a real estate agent or investor would purchase it before it ever listed.

+1

You are right. It’s kind of sad browsing the “sold” listings on Redfin. Houses go for A LOT cheaper when they’re not MLS listed! Just check it out. Any home without a photo was probably not listed and its price will be a lot less than MLS-listed home next to it.

I dont really agree on that point.

In my neighborhood (Baldwin Vista, LA) there are original 3bd 2ba mid-century homes coming on the market in the MLS for about $700K. There is one investor who has purchased several of them, he does a full classy remodel (kitchen, baths, windows) and then resells for about $950K. My guess is his investment is $100K but other flippers on this site may know what a new kitchen, 2 new baths and new windows would cost (along with inner and outer paint).

This one here sold for $630K, full remodel will go on market for $925K

https://www.redfin.com/CA/Los-Angeles/5612-Bowesfield-St-90016/home/6889831

I looked at a house in that same block on Bowesfield earlier this year. One street north is filled with old project-style apartment buildings. I saw three drug dealers on the corner serving product to at least two cars while I was roaming the neighborhood to get a feel for it. It may be a nice neighborhood some day, but paying $900k to buy there now doesn’t seem to make much sense.

In La and Orange County, half the houses have lower prices than 2,005. The truth is the housing market is actually lower than 2,005 if new houses are subtracted. I looked at Trula and other real estate sources it will show you the history of the houses and most peak during 2,005 and went down and are about 50,000 to 150,000 higher than 2014. There is lots of foreclosures now in La and OC compared to a year ago.

Cynthia – shhhhh!! This is supposed to be the mother of all bubbles! Prices will drop 50-70%!!

No question that the MLS currently is nothing more than a toxic waste dump of wet dreams.

But, the knife does cut both ways.

If the RE markets were to enter a serious decline, the MLS *could* actually serve its purpose and allow potential buyers to quickly scan large number of reasonably priced properties.

BTW of those posting who use the MLS regularly (I use Redfin and Coldwell) do you get large number of calls from Real Estate agents?

The web front ends as offered by Redfin and Coldwell are really quite sophisticated in that they report users navigation trends to the listing agents. One reason why I always drop calls to voice mail.

It would be under deposit before it got into the MLS computer.

This is an interesting study by UBS that just came out regarding a global housing bubble index. SF and LA are the worst offenders in the US, but by no means the in the “big leagues”, globally.

https://www.ubs.com/global/en/wealth-management/chief-investment-office/features/global-real-estate-bubble-index-2017.html

And UBS has some prime trading floor space to sell you in Stamford! Who gives a rip what those monkeys say?

Very curious to know how much you would need to earn to live the california dream.

Can someone tell me how much a couple with a young family would need to earn to live in a nice(not amazing neighbourhood) in San Francisco? Assuming they had an average house with reasonable space for two kids and they lived FRUGALLY? No new cars or foreign holidays? They had good health care and were paying into a reasonable pension? Also assuming they had placed a twenty percent deposit on their house.

Sorry for all the parameters but they are the sorts of things I would want to have covered living in a big famous city.

I wouldn’t call San Francisco the “California dream”, unless you’re a liberal hipster or homeless, in which case it’s nirvana. Sure, the food is amazing, but the weather is awful, the crime unacceptable, and the prices so far out of whack with incomes that there is no point in even considering it if you make less than $700k/year. There are far nicer places to live in California for far less. For example, San Luis Obispo.

Realistically, minimum $500k per year. These people who depend on high wages are called tax donkeys – they pay massive taxes to the FED and to the state. What is left is not too much given the super high cost of living; not just RE, but you pay more for everything else given the high cost of living for everyone else. A decent (not fancy) house also has massive property taxes, maintenance cost (high due to high cost of living for skilled people).

If your income is from investments, you can get by with $400k because you pay less in taxes.

Trick question. Couples with young families don’t live in SF. SF is populated by 20 something singles. It’s the progressive dream Everyone lives in apartments, nobody owns a car, nobody gets married, everyone is dependent on government.

NY Slimes wrote about this recently as well:

https://www.nytimes.com/2017/01/21/us/san-francisco-children.html

At this point I’d probably choose not to live in SF or maybe even the Bay Area. Yes- we bought 5 years ago during the downturn in the east bay and for us it worked out well. But now? Its insane. Rent AND buying are both obscene. On top of that the new tech boom has made the freeways impassable no matter what time of day or night you travel. Had we not bought when we did we would probably have moved away.

But if you’re gonna’ move here and have kids you’d better have at least a 200k income. 200k isn’t going to buy you a house here anymore and even if it did the taxes alone will eat you alive. 200k gets you an average, possibly somewhat comfortable lower middle class lifestyle renting a smallish home…

This is so true, Bob. My husband and I make combined $220K/year (gross) and we can’t afford to buy anything (even the smallest of homes) in good school districts (we have two school aged kids) in the east bay. We have over $200K saved for a down payment and we both have pretty stable non-tech jobs (healthcare and fed government). We indeed rent a small modest house (and that is even a stretch). Unfortunately our aging landlords (in their 90s) have already told us their children will sell the home when they die. We wonder what we will be able to rent (let alone buy) when we lose our current rental price that has not been increased in the 3.5 years since we moved in. It is no joke trying to make it in the bay area with a family, and we are better off than a good many!

EastBayDreaming – Have considered checking out the Green Valley area of Fairfield? Great schools (elementary/middle/high school all 9 rankings), still get a decent enough Bay breeze from the Carquinez Strait, very accessible to East Bay (and even SF via Vallejo ferry).

We moved out here about a year ago and love our house, neighborhood, and country feel. A lot of wineries are buying up land and making the move over from the more expensive Napa area. Caymus just became the latest and will be moving the majority o their operations over here.

Best of all you can still buy a very nice 4 bedroom home for 500,000-800,000.

https://www.realtor.com/realestateandhomes-detail/776-Overture-Ln_Fairfield_CA_94534_M15587-24582#photo0

https://www.realtor.com/realestateandhomes-detail/550-Pyramid-Ct_Fairfield_CA_94534_M13484-25654#photo0

Various banks have affordability calculators that you can run numbers through. Suffice it to say that you’d have to earn several hundred grand to afford a house in San Fran. Just look at the Housing Opportunity Index from Wells Fargo or other affordability indexes. What they show is shocking: In many California cities, people making the median income can only afford less than 10% of the homes sold. This is EXACTLY what we saw in 2007, and it’s the single greatest indicator of a bubble. I’m happy to be renting in a rent control building where my rent hasn’t increased in a decade. I’ll continue to save until the next crash, and then swoop in.

Lots people tried to swoop in during the last crash 2010-2012 and were hopelessly outbid and outmaneuvered by flippers and lets not forget Blackstone and others who bought thousands of foreclosed homes in back-room bank deals. When I purchased, I got lucky, as most homes had multiple all cash offers, over asking.

What is this “pension” of which you speak? Welcome to the 21st century after a generation of demonizing unions. How well did that strategy work out? Pretty good for the stockholders and CEOs.

San Francisco is almost not even worth talking about as a housing location / market.

It is an outrageously small city, only 800,000 people live there

and it’s not even that dense… it’s 7 miles X 7 miles

It’s mostly all young people renting from extremely wealthy people

Schools are not good and even if you own you are not guaranteed your school district because of the ridiculous liberal lottery system for schools. You could own a $2M home and have to ship your kid across town to a bad school.

Because of this families move to the areas outside of the city that have good schools like: San Ramon, Dublin, and Pleasanton.

Pleasanton lives up to its name. It has a small town downtown area, and also home to a lot of tech. It’s a bit of hike to get to SF, but the BART train is right there. If you’re looking for suburban living in the Bay Area, it’s a great option.

Riding Bart in the East Bay can be terrifying. There are numerous cases of gangs and groups of thugs attacking and robbing riders on Bart. Many of the news outlets in the Bay Area have stopped showing videos of the thugs because they are mostly from one racial group.

http://kron4.com/2017/04/24/hoards-of-crazed-teens-beat-rob-oakland-bart-passengers-in-apparent-orchestrated-attack/

http://kron4.com/2017/06/29/4-teens-attack-rob-bart-rider-in-dublin/

http://www.eastbaytimes.com/2017/09/14/bart-mob-robbery-six-victims-sue-transit-agency-over-brazen-attacks/

https://patch.com/california/berkeley/vicious-bart-robbery-man-knocked-ground-punched-kicked

Thanks for the comments everyone. I don’t have a job offer to move to California but was interested in the reality of the numbers. Similar problems for people in parts of the UK.

I think the only definition is insane. Anyone with a reasonable understanding of maths can see this is going to end badly.

San Francisco is a great city in your 20’s, I had a blast there.

There were times that my conservative sensibilities were greatly tested. During “leather week” every year navigating through the streets to my apartment reminded me of certain biblical towns. I’ll spare everyone the details because nobody would think it was real, but let’s just say that I saw some things that would make Howard Stern gag just walking home from work. T

he standout memory that haunts me now and again involves a leather clad gentleman giving out ‘free fellatio’ to strangers that were extinguishing lit cigarettes on his face and back. This was at like 1pm in the afternoon on a work day for me just walking down the public sidewalk.

Great dim sum in the city though! Especially at Shanghai Dumping King in the Avenues.

Not sure if you’ve been in a while, but unfortunately Shanghai Dumpling King has really taken a turn for the dumps.

Used to be amazing, but last time I went it was like it wasn’t even the same food.

Calexan, wow! is that right?? It actually hasn’t been too long, maybe 3 years?

Was always amazing.

Move to Marin County. Some of the best public schools in the state without the social engineering and records of failure over decades of San Francisco school system.

Plus no bums, no barf-pools, no corrupt police, no towaway zones, no noise pollution. San Francisco, some parts, is lovely to look at or visit, but you don’t want to live there.

Marin is safe, highly educated, the healthiest county to raise a child in, has more parks, more open spaces and better weather than nearby San Francisco.

Where would our society be without the great value add created by real estate arbitrage? Great wealth creation at tremendous risk is a truly noble calling. They are constantly making making lives better while bringing up society as a whole.

Slightly higher on the social totem pole are great value creators we call developers without whom modern civilization would fail.

Private property is the key to all great advancements in civilization.

Flippers and developers create a better world in which to live and realize the highest form of evolved man.

looks like a good tear down. It is the land. Location of the real estate.

Kind of expensive land (you add another 100k in demolished and hauling costs) to hear the freeway noise and breath the car smog day in and day out. You can’t use for commercial purposes if it is zoned residential.

The location sucks – it is 100 feet from the freeway.

put up sound walls by the freeway. Double pane sound windows.

If using sarcasm, please denote by writing “/sarc” at the end of your statement. Otherwise, people are likely to think you’re out of your freaking mind.

+1 LOL

Burnt Out, Uninhabitable Crap Shacks To Tank Hard in 2017!

Donpelon, there absolutely no sign of a real estate top at the moment in California. My guess is the top has been delayed until 2018–maybe until March or April of 2018. That means another 5-6% appreciation. That amounts to about 1% per month. Surprisingly, my home in South Orange Co. is appreciating at only about half that rate, but for some reason, almost all the other homes in the Orange County are appreciating faster than mine.

Negative. No chance of a CA meltdown this year either, sorry Jim.

I am a bear on this market to be clear, it is bonkers (although I found a great deal last year in it) but there are no signs of anything but further cresting/melt-up for now.

Sorry. That’s what all leading indicators are saying. Anything else is just regimented Jim Taylor style voodoo chanting.

It will happen indeed, but not yet my friend.

Per Zillow ;

“Large corner lot building that fronts the freeway….” Oh, and it overlooks the BART station parking lot. And it’s about a half mile from the Outer Mission. (Crime Fringe according to Trulia.)

What’s not to like?

That said, it is multi-family. Rehab and turn into high priced rentals.

What’s not to like?

That said, “Offer Pending” doesn’t mean that whoever wants to buy it is paying 1.4 for this POS. 600K might be more like it. Rehab it and rent out the three units for 4K maybe?…

Nahaa. You’re right. It’s insane.

Just a thought.

VicB3

Housing To Tank Hard Soon!

Sorry Jim, but there is no sign of real estate top occurring this year. That suggests that the Fed may not raise interests rate any more. That means 3.6% to 4.0% interest rates as far as the eye can see.

The way things are panning out, we will likely have low interest rates for the entire decade. The chances of tanking with low interest rates are slim to none. The cost of borrowing money is ultra low and this is why home prices are so high. The monthly cost of borrowing half a million dollars is equal to the monthly cost of renting a 2 bedroom apartment…that is all you need to know.

I beg to differ Gary. The feds have made it clear that they still want to reach their 2.75-3% target rate but at a slower pace than what was previously described. The current info suggests there will be one more increase this year in Dec. and if so it would be safe to assume multiple increases next year leading to at least a 2% rate. If this comes to pass, mortgage rates below 4% will be a thing of the past with near future rates being closer to 4.5 – 5% for 30 yr terms.

1.5M not that big of a deal. Look at these …

900 sq ft not near the beach …

https://www.redfin.com/CA/Los-Angeles/2001-Louella-Ave-90291/home/6744269

1400 sq ft not near the beach … 2.5M

https://www.redfin.com/CA/Los-Angeles/2377-Glendon-Ave-90064/home/6798841

1200 sq ft not on the ocean side of PCH … 2.1M

https://www.redfin.com/CA/Laguna-Beach/1648-Louise-St-92651/home/3260158

LA has many of these deals.

Wow $2M tear downs, the locations aren’t even that great.

Sure they are centrally located and that is valuable, but I wouldn’t say those are pristine amazing neighborhoods by any stretch of the imagination.

Also those lots aren’t huge, 7000 sq ft?

Hard to imagine someone wanting to spend $3M and do all that work.

But that’ reality.

Did you get lost at the exit sign for the bigger pockets blog?

FYI … I do not think these three homes are good deals … I wanted to show how crazy it is out there.

The one on Glendon, which you mention, may be overpriced by a couple of hundred thousand, if you take the current market and regulatory conditions into account. New regulations now limit the size of houses in that area, and this property already has permits in hand for a house that would be over 1,000 square feet larger than currently allowed under the new rules. I visited an open house a few blocks away for a new house roughly that size going for $2.9 million, and it’s now listed as pending.

The Big One will be a great equalizer!

Man, lucky seller after buying in 2015!

Soon…

https://www.cnbc.com/2017/10/03/rising-heat-in-home-prices-makes-buyers-rush-to-riskier-mortgages.html

Did you read this part of the article?

“While ARM loans are often blamed for the epic housing crash in the late 2000s, the current ARMs are nothing like those of the past. Products like negative amortization loans, which offered very low rates up front but then tacked that initial savings amount onto the loan itself, no longer exist.

Loans must now be fully documented and underwritten to the full length of the loan in order to make sure borrowers can pay even if the rate goes up. Lenders must also make it very clear to borrowers that their rate is only fixed for a certain term, and that it will likely go up after that term, given the current trajectory of rates overall.”

Also; 5 yr ARMS (fixed for 1st 5 years of the term) are underwritten utilizing a HIGHER qualifying interest rate than the 30yr; therefore, in order to qualify for 5yr ARM’s (or lesser ARMS) you would need more income than qualifying at a 30yr.

It is the 7yr ARMS (or higher) that will use the NOTE rate as qualifying rate.

I.E. Note rate on 5yr arm is 3.5%; but, underwriter will use 4.5% to qualify (30yr is at 4%)

Note rate on 7yr arm is 3.75%, underwriter will use 3.75% to qualify

Do not assume buyers that are getting 3yr or 5yr arm’s are doing so b/c they don’t qualify for a 30yr.

True, they’re doing it because real estate only goes up, forever.

It’s a triplex with 3 separate units. 2 are 2beds, one is a studio. The 2 bedroom units can bet $4K a month, the stupid, $2500 a month in rent. That’s $10,500 rental income.

$1.4M price, add in $200K for renovations, total cost $1.6M.

It cashflows positively.

Damn auto correct…studio not stupid.

but… but… but…but…

Rent to tank hard soon!!!

and rental parity is like a jack in the bean stock myth… avoid a calculator like the plague and put on the tin foil hat

Correct, Rents will go down during the crash just like every time the RE cycle ends.

A landlord is only as liquid as his renters.

Rental parity in California does not exist. RE cheerleaders will always say, of course their is rental parity, just pay 20, 30, 40% down!

Or, they make up fictional numbers to make their examples work. If there were rental parity more people would buy but during a bubble is smarter to rent, wait it out and buy at a steep discount when the crash happens. Not that hart to understand.

excuse any typos

Even on your rents and numbers that is almost a 13 GRM. Yikes…terrible.

With estimated multifamily (industry standard for something this size) expenses of 40% of your GSI that is a 4 CAP if you’re in that deal for $1.6M. No thanks!

I wouldn’t exactly say ‘they would make money.’ I think it’s more accurate to say there is a chance if they’re fully occupied without any vacancy ever or rent softening that perhaps they may not lose money. They may not lose money but that lucky buyer will be fixing toilets and fielding maintenance requests in the middle of the night for very little compensation.

Bernie Madoff’s accountant couldn’t make this thing pencil.

Tarek and Christina could flip that house in a heartbeat and make a tidy profit.

If he could take a break from shagging the babysitter.

They forgot to add “across the “street” from the San Francisco Golf Club!”

If you remember, last week I told you the home at 511 El Modena at 1.5M was a steal. Many chimed in and said I was nuts. However, many offers came in and it is already pending ….

https://www.redfin.com/CA/Newport-Beach/511-El-Modena-Ave-92663/home/3242054

Not remotely a steal. It was priced appropriately compared to comps and probably went for over asking, but at a time when coastal areas all over (including Newport Beach) have started a slight price decline. In several months we’ll know if it’s just the usual seasonal pause.

I disagree. In 10+ years, this place will do very well. When it comes to comps, most others have defects ( busy streets like Riverside, Tustin, Irvine, East 15th, Cliff Drive ), smaller lots, side an alley, or are too close to a school. Zillow never corrects for these issues so it fails to pick up on these deals.

jt – if it was intended as a primary, I can see that. I really like the neighborhood. But this is not an investment property – there are far better uses of your money right now. Keep in mind that unlike many affluent coastal communities, Newport took a 50% haircut in the last crash. That’s worth waiting a couple years to get a slightly worse property for 30-40% off.

50%? That did not happen. It fell about 25%, but that was not a big deal since Newport Beach real estate rose about 400% before it fell 25%. Then, it took off again.

I used:

https://www.trulia.com/real_estate/Newport_Beach-California/market-trends/

Median sales price, all properties, max history. It peaked at $1.6m in 2007 and fell to about $800k in ’09.

Hey, I hope it’s wrong. I was actually disappointed.

Something is wrong with Trulia. For the properties in the area I own, the drop was less than 20%. However, I did see inland areas of Newport fare worse … almost 30%. Zillow shows around 25% which is about right.

In hindsight, the properties which dropped the most and rebounded the most were condos on the ocean side of CDM. Those were hit hard, perhaps more than 30%, but have since exploded in value … The properties which fell the least were 1950s homes in good locations in Newport Heights. Those fell less than 20% and have risen strongly, but more money was made in CdM condos.

JT,

Yes I remember. You have a habit of posting overpriced crapshacks and stating that they are steals. Most people here are smarter than the average crapshack buyer and respond they would never pay that much. Then a few days later you say, see, i told you it was a steal. Its pending!!

As Spock would say, that is highly illogical.

JT should know by now that price does not equal value. Think about it…..do you buy gas at the gas station that charges 3.89 for a gallon or do you drive a few miles further down and buy it for 2.95? Of course you chose 2.95. But that does not mean there aren’t stupid people who pay 3.89.

For RE its a good thing that stupid people massively overpay and lose it later. That’s part of the cycle and benefits those who wait and save. This crapshack will easily sell for 50-70% less after the next crash.

Some high priced crap shacks I post are deals, and I say so. Nearly every home I said was a deal went pending quickly.

Others I post I do not say they are a deal … I post those just to show it is dangerous out there.

The trick is to develop the eye to quickly recognize the good ones then act quickly. For every good one, there are about 5 bad ones. The odds are against you if you don’t figure the market out … and don’t count on a realtor. Most of them are decent people who would like to get you a great deal, but many are not smart enough to spot the deal in the haystack.

“Some high priced crap shacks I post are deals, and I say so. Nearly every home I said was a deal went pending quickly.”

Naah, there are no deals on the MLS during a bubble. When you say 1,5MIO is a steal, the reality is a steal would be if its priced at 500k. A fair price would be 700k. Everything above is totally overpriced. 1,5MIo is just laughable. It does not matter if someone buys it for that price or not. There are always stupid people who overpay.

Just look at last time around. RE investors lost their shirt buying overpriced crap shacks in 2005-2007. There is something wired differently in their brains and greed takes over.

Another extreme example is Stephen Paddock the LV shooter. He was a RE investor and decided to kill 500 people. Why? Did he realize the upcoming crash is around the corner or was he just crazy? The point is…There is a high number of RE investors who are wired incorrectly.

That is because that entire area is highly sought after with multi-million dollar homes, great schools and a few blocks away from the harbor/PCH.

The land itself is worth a ton.

I will say once again what I said on an earlier thread about SF. There is an incredible amount of wealth in the area. Anyone who has worked for one of the tech behemoths for 2+ years is most likely a millionaire from stock options alone. Google’s stock price is up $400 since 2015. A typical employee at Google will have a few thousand shares options granted upon employment. And that’s at a minimum. Some will have tens of thousands. Do the math. And imagine an employee of Google who joined in 2010 or 2011 with a strike price of $250 and fully vested. They’re worth $3, $4, $5 million dollars. And now count how many employees there are at Google and Facebook and Apple and Salesforce and Netflix and all the other behemoths in the bay area. And then also add in the tens of thousands of people who had smaller companies bought out by Google or Facebook. You never hear about them in the news, but they’re all over the place.

Unless you’ve worked and lived in that environment it’s hard to understand the dynamic. And it’s also why you can’t go my the median salary. That’s irrelevant. The wealth is from equity, not salary.

Most employee’s at tech company dont get stock options. Whats common is that EE receive a discount for buying stock at the employee stock program. Options are common for executives. At least thats the case at our tech company, We have 60k employees worldwide. I get your point though. We make good money as a techie but its far from being millionaires and not enough to buy during this insane bubble. Once it pops it will be fine buying at a 50% discount.

“Most employee’s at tech company dont get stock options.”

That is absolutely false.

You are confusing it with a stock purchase program where EE’s can purchase the stock with a discount. This is very common for larger corporations. Stock options are rare and more for start up companies and/or executives.

If you dont believe me and think that every single EE at a tech company gets stock options, it should be easy for you to find a web link as backup for your claim?

I work at a medium sized company in tech. I agree that stock options are typically reserved for executives at the company. They are also common at start-ups who would rather pay you in future stock than raise your salary.

RSUs are more common at companies. Essentially the company pays you a slightly lower salary and gives you an amount of stock that vests after a period of time. Typically 4 years. If you stay at the company for the vesting period, you are given the stock no matter how much it is worth. If the stock price has risen exponentially, then you are doing very well. If it has fallen, then you still don’t lose everything.

RSUs are a way for a company to avoid paying you a higher salary now and to make you work harder and stay until your vesting period is up to ensure your company stock price will rise.

Every company I know has a stock purchase plan where you can buy company stock at a typical 15% discount under market rate over typically a 6 month period. If at the end of 6 months, you sell immediately, you get the 15% gains (and pay short term tax gains). If you hold for over a year, you are gambling the stock won’t fall more than 15% but even if it is stable, you will get the 15% gain at a long-term tax rate.

Since many tech companies’ stock has grown 8-10X over the last 8 years, people have held their vested RSU’s and stock purchase plan stocks.

I see an “all your eggs in one basket” problem with this.

I saw during the 2001 Tech Bubble where many co-workers were multi-millionaires on paper in 1999 when their Stock purchase plan and stock options (RSU’s weren’t invented yet) went from $1 per share to $120 per share. Many who had invested a meager $10K in stock in the early 1990’s found their net worth to be $1.2M. Then in 2001, their stock deflated from $120 down to $2 in a very short period of time. Some could sell during the plummet but others like at Enron, rode it all the way down.

I see the same thing happening again with younger co-workers.

I try to diversify but since almost every stock is high now, this is difficult.

And listen to yourself … it’s all paper value! This is an obsession of everyone … looking at Zillow every month to see that their home is increasing in value, following the value of their Google stock! How many people do you know that were confidently set for life in 2007? How many of those took a beating and essentially had to change all their plans because they lost 50% of the value of their stock portfolio and 30% of the value of their home????

You do realize that once someone is vested, they actually exercise the options and realize actual gains, yes? Doesn’t matter what the stock price does from now on. Someone who was hired in the early 2010s, and fully vested already has the millions in the bank.

Vesting schedules are almost always 4 years, with a 1 year cliff and monthly thereafter. Meaning it takes 1 year to vest the first 25%, then every month another 1/48 vests.

So take an example. Someone at Google was hired in 2013. They got 10K options with a strike price of $350. In 2014 1/4 of those were fully vested and the price was $600. Which means they exercised 2500 shares at $350 and sold them for $600. Meaning a profit (real profit not paper profit) of $2500 X $250 = $625,000. Just on 1/4 of the options. And then you can do the math what happened between 2014 and 2017. Strike price of $250 and now Google is around $1000 with 7500 shares. Gee you think this employee can afford a $2M house easily? Hmmmmm…..I wonder……

This isn’t some theoretical employee. This is every employee at Google, Facebook, Salesforce, Amazon, Netflix, Microsoft and every other public tech company in the country. And this is why SF and Seattle’s housing market has gone insane.

But why left facts get in the way of a good END OF THE WORLS IS COMING story from perma bears?

Intersting Mr. Landlord, very interesting. I actually did not know it worked that way either. I’ve lived in SF with friends in tech but never paid any mind to that. Good post.

Landlord,

“This is every employee at ….”

Dude, you have never worked for a tech company. Stop making stuff up. This is far from reality.

Landlord,

“This is every employee at ….â€

Dude, you have never worked for a tech company. Stop making stuff up. This is far from reality.

____

Millie is a sad young thing. Living in the Bay Area, surrounded by all that wealth. So close yet so far away, eh Millie Boy?

That is how it works. If you work for a tech company you get stock options. Period. There isn’t an employee at Google who doesn’t have options. Some have more than others, some have lower strike price than others. But every single employee there, from the receptionist to the CEO has stock options.

I went through it twice myself, both startups. Both paid off nicely. The first time around I was straight out of college so I didn’t really understand how it all worked. Looking back on it I should have asked for a lot more options. But oh well, live and learn. The second time around, I knew the game. So when I was made an offer, I agreed on taking less money upfront (ie a lower salary) in exchange for a few thousand more options. And that was the right decision. The second one paid off better than I ever imagined.

That is the goal of everyone who works in tech. Yeah salaries are OK, but $150K living in San Francisco is barely minimum wage. What counts is the 10K in options that could potentially turn into $2M. That’s what everyone is striving for. And over the last 5-6 years, those payouts have been happening all over.

If you don’t understand this phenomenon you are either clueless, or are sticking your head in the sand.

Thats a fairy tale. First of all i dont live in the bay area and second, why dont you provide any reference that states that every tech employee has stock options? If you know so much even though you dont live in California it should be easy to prove, right? Yes, for start ups its common but not for large tech corporations. They have no need to do that. People want to work there for the name recognition/resume and salary/benefits.

Mille,

Please stop be-clowning yourself.

https://www.forbes.com/sites/allbusiness/2016/02/27/how-employee-stock-options-work-in-startup-companies/#10c27a136633

“Thousands of people have become millionaires through stock options, making these options very appealing to employees. (Indeed, Facebook has made many employees into millionaires from stock options.) The spectacular success of Silicon Valley companies and the resulting economic riches of employees who held stock options have made Stock Option Plans a powerful motivational tool for employees to work for the company’s long-term success.”

http://www.nytimes.com/2007/11/12/technology/12google.html

“She was offered the part-time job, which started out at $450 a week but included a pile of Google stock options that she figured might never be worth a penny. After five years of kneading engineers’ backs, Ms. Brown retired, cashing in most of her stock options, which were worth millions of dollars. To her delight, the shares she held onto have continued to balloon in value.

https://www.wired.com/2015/08/alphabet-give-google-employees-stock-options/

“Now that Google will operate as multiple companies, Windsor says, each of these has the freedom to grant employees stock options in its particular operation—separate from the rest of Alphabet. Nest, for instance, could offer employees options in its internet-connected-home operation. Calico could offer options in its effort to extend the human lifespan. This would give in-demand employees more reason to join and stay with these specific companies. Until recently, shares in Google as a whole had flatlined. But a share in a company like Nest still has enormous potential.”

And on and on it goes. Of course not every single employee who works in SV is a millionaire. But anyone who has been at one of the behemoths for at least 2 years is at least on paper close to it. And since they are 1/2 vested, they could exercise that paper wealth into real wealth.

Are you really making it that easy for me?

Remember your own words:

“This isn’t some theoretical employee. This is every employee at Google, Facebook, Salesforce, Amazon, Netflix, Microsoft and every other public tech company in the country.”

I called BS and after you calling me names (“troll, sad thing”) I asked for a web link that back ups your claim that “every employee at Google, Facebook, Salesforce, Amazon, Netflix, Microsoft and every other public tech company in the country” has stock options.

You posted three articles. Nice read and nice try. None of these articles suggests what you are claiming. None of them references that every employee at tech companies has stock options.

Dont you think its odd? If its such a known fact and everyone except myself knows it why cant you find a single website backing it up?

That seems strange, doesnt it?

I can think of a few reasons:

1)Its a secret.Nobody wants to make it public on the world wide web

2)Its not a secret. In fact its such a known fact that its unnecessary to post it on the internet

3)It was published on thousands of websites but Millie and his perma-bear hackers took these websites down quickly.

Which one is it?

I cant wait for your next response.

Come on Landlord guy, you proved Millenial guy’s point with that story about the chick who got options at Google. She started there when it had 40 employees in 1999!

No downpayment? No problem. Now you can just ask your friends and even complete strangers for money to purchase your new home. New crowdfunding site HomeFundMe enables people to ask for gift money to buy a new home. Now there’s no excuse not to buy that crapshack you’ve been eyeing for months. What are you waiting for? Come up with a good SOB story and start soliciting strangers for money now! (There is absolutely nothing in it for the donors, all monies is purely gifted and I have no idea what the tax consequences are on this.)

https://www.cnbc.com/2017/10/05/a-new-way-to-buy-a-home-crowdfunding-the-down-payment.html?recirc=taboolainternal

https://www.homefundme.com/

Some of those sob stories on crowdfunding sites (e.g., my little girl needs a cancer operation) have been exposed as fake.

Like those Nigerian princes seeking to transfer money, people do lie on the internet.

Shameless.

What an idiotic idea

The only way is to build an 8 Story Building with 16 Units and selling the top units with a Golf course view across the Freeway. $999,000 each unit.

“…Florida real estate in the 1920s…”

If you’d like an entertaining “history” of this, track down a copy of the Marx Brothers in “The Coconuts”. Great movie with the famous “party of the first part” contract discussion…

https://en.wikipedia.org/wiki/The_Cocoanuts

I’ll have to look for that. It’s been years since I’ve seen it. And well before I ever knew about the Florida Real Estate bubble.

In the current climate there’s no way I would enter the market, Dos Tacos. Even to downsize to cut expenses.

What is everyone’s thoughts on the jobs report out today?

Seems harder and harder to claim no one has a job and we’re in a depression. Her, I’ll even post from zerohedge a favorite source of the housing tank crowd as it’s an Uber bear site:

http://www.zerohedge.com/news/2017-10-06/what-hurricane-full-time-jobs-soar-935000-biggest-increase-21st-century

…Â it was the full-time increase that was an absolute outlier: at 935,000 this was the single biggest monthly increase in the 21st century (excluding the bizarro Jan 2000 print), and one of the 4 highest monthly prints in history.

Dan, if you enjoy Zerohedge, here it is what it says:

http://www.zerohedge.com/news/2017-10-05/biggest-housing-bubble-ever

The culprit, the same like here, is the Central Bank (Committee) which distorts the markets like in communism. They hate price discovery. The just prepare the sheep for shearing. This is the fatten up stage before the kill.

It’s always been ludicrous to say nobody has a job and we’re in a depression.

Even if you don’t believe govt data (and I can’t blame people for being skeptical), just walk down any street in your city/town and look at all the help wanted signs in the window. I know where I live, pretty much every store/restaurant has one.

Oh but those are low paying minimum wage jobs, will be the reply from perma-bears. Yes they are, but they are an indication of the overall economy’s health. The coffee shop serving $6 lattes is looking for more employees because they have customers making $80K a year who can afford the $6 lattes. And the $80K a year workers have money to buy a house. And the house they’re buying will need new appliances which means Home Depot will need employees to sell the appliance and Whirpool or Maytag will need employees to make the appliances. And a truck driver will need to be hired to deliver the appliances. And on and on throughout the economy. It’s called the multiplier effect.

But don’t listen to me, or govt data or your own eyes as you walk down the street. Keep believing conspiracy theory blogs and perma-bears who have been wrong for the past 30 years. Hey, any day now they might be right!

In California, many people have several jobs just to pay for food and rent. None of them can actually support a standard of living. Often Employers don’t pay enough and/or pay no benefits. A job report is more for a trash can and has little to do with reality. The reality is that most Americans cant come up with a 1000 bucks in their emergency fund.

Mille you live in an odd world of doom and gloom where tech workers make $10 an hour and nobody has stock options. Are you for real, or just a really excellent troll?

Landlord,

“Mille you live in an odd world of doom and gloom where tech workers make $10 an hour and nobody has stock options. Are you for real, or just a really excellent troll?”

I never said techies make $10 an hour. I work for a tech company myself and make good money.

But, just because yo work for a tech company does not mean you can or should buy an overpriced crapshack.

Also, i never said nobody gets stock options. I said stock options are common for start up tech companies but at larger corporations its not common for every EE to have stock options. There are stock purchase programs where EE’s can purchase stocks at a discount.

Your claims are just false and I asked you to provide any backup or weblinks which you wont provide because you cant.

Just because another crash is around the corner does not mean i am a gloom and doom guy. Risk, corrections, crashes mean opportunity to me and are just part of the economic cycles. Sure, perma-bulls like to pretend all markets keep going up forever but that’s just entertainment.

Oh so now the story is changing. It went from nobody but the upper echelon gets stock options to only startups give out stock options. Poor confused Millie.

And I don’t know what you mean by “work in tech”. Hell the guys selling phones in mall kiosks “work in tech”. It’s a pretty broad term. I’m talking about employees of tech companies….Google, Apple, Salesforce, Facebook, Cisco, Amazon, Netflix, etc. Every full time employee at these companies has stock options. The fact you say otherwise shows me you have no clue what you’re talking about.

Yes Millennial must live in a very odd world indeed, because I’ve read him/her statements making reference to ‘white privilege’ as if it was actually a real thing not constructed in the putrid mental dungeons of idiotic liberals.

I’d like to coin a new term. Cognitive privilege means not being stupid.

This is fun.

“Oh so now the story is changing. It went from nobody but the upper echelon gets stock options to only startups give out stock options. Poor confused Millie.”

Why is the story changing? Your statement is all employees who work for a tech company have stock options. I am saying that total bogus. And yes, i work for a tech company with >60K employee’s and state of the art products that we sell globally.

“Every full time employee at these companies has stock options. The fact you say otherwise shows me you have no clue what you’re talking about.”

Dont you think its strange that this has never been documented or written on any article about tech companies? If this is such a known fact why dont you send me a link?

Nor cal,

“Yes Millennial must live in a very odd world indeed, because I’ve read him/her statements making reference to ‘white privilege’ ”

Huh? I don’t recall that. By the way I did not vote for crooked Hillary….and I am not a liberal but would not call myself a republican either.

“By the way I did not vote for crooked Hillary….and I am not a liberal but would not call myself a republican either.”

Did you vote for that nutjob Gary Whathisface?

Haha! You are hilarious! You act like there are so many people making $80K a year. You do realize the average middle class salary is what? $45K for a family of 4? And trust me I make over $80K and I’m not spending $6 for an overpriced latte. The reason there are so many help wanted signs is because there are so many young people sitting around on student loans going to college hoping some day they will land that dream $80K a year job. Fewer and fewer college kids are willing to work and go to school. Partly their fault partly the current state of scheduling and curriculum requirements. Lots of young people living with mom and dad playing video games, strung out on drugs, or just otherwise sucking off the system refusing to work. Why should they? If we are stupid enough to support laziness they are smart enough to take advantage of it. I see Help Wanted signs all over the place too. But yes most of those jobs pay crap, are part time, and offer no perks or benefits. Not even a part time barista at Starbucks gets any stock options. That’s pathetic. Oh sure everyone has a company/employee stock incentive program but where are the real stock options with these billion dollar companies?

Nick,

You, like Mille need to meet some new people. Stop hanging out with your burn out drug addict friends. Trust me there’s a whole other world out there.

“According to the US Census Bureau persons with doctorates in the United States had an average income of roughly $81,400. The average for an advanced degree was $72,824, with men averaging $90,761 and women averaging $50,756 annually. Year-round full-time workers with a professional degree had an average income of $109,600 while those with a Master’s degree had an average income of $62,300. Overall, “…[a]verage earnings ranged from $18,900 for high school dropouts to $25,900 for high school graduates, $45,400 for college graduates and $99,300 for workers with professional degrees (M.D., D.P.T., D.P.M., D.O., J.D., Pharm.D., D.D.S., or D.V.M.).[32]

I think there is something mesmerizing, fascinating, and addictive, about seeing these crazy prices, about looking on Zillow every month to see that some algorithm has your home increasing in value, that they’re asking a $1 million plus for a dump! There is also a danger by being sucked in and loosing sight of perspective! I think every homeowner and prospective owner ought to be asking themselves right now, will my world turn upside down if I lose 25% of my equity? How important is that equity to me? If I own, can I wait out market downturn? This market can’t continue forever! Better have a plan!

“looking on Zillow every month to see that some algorithm has your home increasing in value,”

Ha. I’ve been viewing my mom’s home on Zillow everyday for a week. Each day the Rent Zestimate would vary widely, by anywhere form $400-900 a month. Seriously. I mean one day the rent ‘Zestimate’ would be $3,800, and the very next day it would be something like $4600. And this type of wild fluctuation goes on everyday. Craziest algo-rhythm ever conceived.

Check this one …. pending at nearly 2.5M

https://www.redfin.com/CA/Los-Angeles/949-Nowita-Pl-90291/home/6743350

How about a 3 bed, 1 bath for just under 4M

https://www.redfin.com/CA/Manhattan-Beach/400-9th-St-90266/home/6711777

You’d have to be a frontal lobotomy patient to think those are good buys.

I’d pay $350k cash for the Venice house, but not a cent more. Since I’ve lived in that area before and recognize that vagrants and communists in CA find that area desirable, I would pay $350k, but not $350,000.01.

These locations are also awesome for from-home needle exchange programs. Definitely worth the cash!!!!!!!

As someone who doesn’t live in this area, I’m just curious about the one that sold for 3.8Mil on 9th street. The home interior looks somewhat average with modest furnishings and the kitchen isn’t updated; compared to what I’m used to this home is nothing spectacular so I’m sure the price is all about location. My question is what sort of family buys a home like this in that area? Middle class, upper middle class, etc? i.e. Two tech worker family? Because that’s one heck of a monthly mortgage payment assuming a conventional 20% down. Unless most buyers in this area are paying all cash of course.

Chinese investors is the other option.

Great point of equity in that area mentioned. Reminded me of these days

http://www.marketwatch.com/story/enron-workers-lost-everything-in-collapse-they-say

NY real estate foreclosures is up quite a bit:

http://www.zerohedge.com/news/2017-10-09/nyc-foreclosures-surge-79-yoy-q3-stand-highest-level-2009

You’ll also notice it increased by about the same % between 2015 and 2016. 400 to 650 is an increase of 60%. Then it fell back down to 480 in the next couple of quarters. And what did that mean for prices? Nothing. Kept going up, up , up.

Yeah up 79% sounds yuugley bigly yuuge. But put it in context. It’s a few hundred foreclosures in a city of 10M people. Does it really matter if it’s 400 or 700? At such a small %, it’s statistical noise, even though it makes for fun doom and gloom ZeroHedge headlines I suppose.

It’s something the MSM does effectively. You’ll have 3 people die from a drug in one year and 6 people die the next. And the MSM will scream about a 100% increase in deaths due to this drug and OMG OMG someone needs to do something about this epidemic. Yeah but what they don’t mention in the headline is that 100,000 people take this drug every year. So yes, it’s a 100% increase but really, statistically speaking it went from 0 to 0.

Yes, I understand statistics very well and I agree that they can be manipulated. Still, the point is that the article is speaking about one of the most prime of the market where according to some prices don’t move much. The market for those properties is not 10 mil. It is actually very, very small. There are not too many people who can afford those prices. The 10 mil. market is like a pyramid. At the top, the buyers are very few. That gives some significance to the article.

For the overall trend, without too much statistical noise, you can look on this article

http://www.mybudget360.com/millennial-epic-housing-crisis-living-at-home-incomes-not-keeping-up/

What I kept saying, that the middle class is disappearing, is very true. Our society will resemble more and more the one in Brazil – small % of rich and the vast majority poor. Financialization will just exacerbate this phenomena.

The article is the number of foreclosures in NYC. There are 10M people in the city. And whether those 10M own or rent, they all live in an apartment/house that is owned by someone. Doesn’t matter if all the unites are owned by 1 person or by 1M people. What matters is the foreclosure rate.

Assume 3 people per household and that’s about 3M housing units. So out of 3M housing units, there are under 1000 foreclosures. That’s less than a 0.3% foreclosure rate.

As for the middle class disappearing, we’ve been hearing this stuff for 30 years. That was Bill Clinton’s ’92 campaign…saving the middle class. It was BS then and it’s BS now.

The economy is at full employment right now and you guys are going on and on about the death of the middle class. Come on!

Thats great news!

More signs of the impending economic collapse:

Job openings in the United States reached a record high in July at 6.17 million, according to Labor Department data published Tuesday.

http://money.cnn.com/2017/09/12/news/economy/job-openings-record-high/index.html

Of course it’s a CNN report, so even this awesome news is somehow a bad thing because…..TRUMP!!! But anyone with an IQ north of 75 understand record number of job openings = booming economy.

Say what you will about Trump but his mere presence in the oval has given the economy confidence, jobs are available. Anyone who cannot find one or runs in a circle of friends who cannot, simply aren’t looking.

http://www.washingtonexaminer.com/unemployment-claims-fall-to-lowest-level-in-43-years-despite-hurricanes/article/2637266

Agreed. Unless one is sick or disabled or has some physical reason one cannot work, there is absolutely no reason one cannot find work. Anyone who says they are looking for a job but can’t find one is full of shit.

As bad as Trump is, he is a breath of fresh air after 8 years of Obama or the alternative – Hillary or Bernie.

We were in a really bad state when even Trump looks good after 8 years of darkness. The former CEO from Home Depot expressed that after Trump’s wining of election to explain the stock market euforia.

I’m not saying we are out of the woods, but it feels better for most investors, business owners – job creators. The bad part is that Trump is still on the strings of the Deep State. However, I have to admit that he still made few good moves. If he continues at the same pace, he will have a two term presidency. If he starts a major war, I doubt he will finish the first.

Flyover,

I would’ve previously agreed that Trump was on strings, but, I no longer think so. He’s uncontrollable and goes with his gut against advisors.

If he was a puppet we would’ve gone into Syria after the fake gas attack, that’s what the deep state has wanted. Trump decided against it and threw in a couple bombs at a useless air field and with advanced warning to placate the media and others. He’s a wildcard no one can control or predict (whether that’s good or not I don’t know).

Trump will easily win re-election. What is needed is the Bannon purge of the useless GOPe. That will be harder to do though. Not impossible but very hard.

I prey for a crash since that is the only way the average middle class family in Southern California will ever be able to buy a home. Will it happen? I just don’t know. Perhaps, there will be another crash. Perhaps, the 2007-2012 crash was a once in a generation event. I’m betting on a second crash, but I may regret that decision.

The biggest drop in prices I have found was a home in Corona, CA which dropped from a Zillow estimated high of $340,000 in 2006/7 to an actual selling price of $82,000 in March 2009. That same house, with no remodeling, is now selling for an asking price of $279,000 after a recent price drop from $290,000. Here is that home’s address:

717 W 9th St., Corona 92882

Imagine a 76% drop in price in a couple of years! How could such a drop even be possible? Doesn’t this home prove that the best homes to buy in a real estate crash are simply the one’s which drop the most regardless of their location. The dumpier the home, the greater the drop and the greater the resulting upside potential.

ERROR! I gave the wrong address for the home mentioned above, which dropped in price from $340,000 to $82,000. Her is the home’s correct address:

726 Harris St,

Corona, CA 92882

3 beds 2 baths 792 sq.ft.

The home with the above address is simply the most overpriced home I could find for sale in Corona today. It is a wreck and has an asking price of $300,000:

717 W 9th St,

Corona, CA 92882

2 beds 1 bath 874 sq ft

“I prey for a crash since that is the only way the average middle class family in Southern California will ever be able to buy a home. Will it happen? I just don’t know. Perhaps, there will be another crash. Perhaps, the 2007-2012 crash was a once in a generation event. I’m betting on a second crash, but I may regret that decision.”

I think that if there is a correction now, it won’t be so bad (maybe 30%), because most areas (excluding the coast) have not reached the previous highs, which is what makes me think this run-up may have a few years to go. Pick a random month any time in the last 3 years and people here were calling it the peak. I have already bet on a crash with real money (short REIT funds), a little prematurely apparently – my primary keeps stubbornly going up from when I bought it at the “peak” in January.

“Doesn’t this home prove that the best homes to buy in a real estate crash are simply the one’s which drop the most regardless of their location?”

Let me answer you that question from experience. While what you say has some truth to it, that is the lazy way to do it or if you have billions and can’t find enough properties to place so much money. That is not the case for most people, unless you work for Goldman Sacks or Blackstone.

If you do a good amount of research and negotiation you still put the money in an EXCELLENT location and deal with quality tenants. Quality tenants always pay the rent and take good care of property, but they look for good locations and properties. That is why they take care of the place because they don’t like to live in dumps and if they don’t take good care and pay on time, the only other option will be in the dumps.

After years of research, in 2011, I bought a condo separated from the ocean only by a golf course in an area where I can let my wife to walk in middle of the night. It was sold in 2007 for $360,000 (per county records). I bought it from the bank for $100,000 (2 br, 2 ba). I had to do some cosmetic work because it was kind of neglected by the bank. That condo now is worth easily $300,000.

If you invest in RE, NEVER settle for less than an excellent location. It is the location giving you the profit. That is how most people made money in RE. It is a reason (a very good one) why all the experienced RE investors give this advice – location, location and location. Condos are riskier but they have bigger drops and price fluctuation. If you can not stomach that, stick with SFR because their prices are more stable in comparison to condos.

Flyover, common sense would suggest that the quality of the neighborhood/location matters when making real estate investments; however, that is not true when real estate market becomes a series of crashes and booms. At the top, the greatest demand is for the cheapest/dumpiest homes because that is all buyers can afford to buy during a mania phase, and those homes end up appreciating the most percentage-wise–and perhaps even in absolute dollars. Tenants don’t matter because there are no long-term investments in real estate anymore. The dumpiest homes appreciate the most during the booms and can end up selling for the craziness prices during the mania phase.

“Doesn’t this home prove that the best homes to buy in a real estate crash are simply the one’s which drop the most regardless of their location. The dumpier the home, the greater the drop and the greater the resulting upside potential.”

Absolutely not true. The most important factor in home price is location. Location is everything.

This home appears to have been a foreclosure and probably bought at auction in 09.

Per price/tax history: It sold for 260k in 04. Assuming its priced correctly today, if you’d bought this home in 04 at 260 and held it for 13 years, you would be lucky to break even on the sale today.

I will add that had you been the one to buy at auction in 09, then yes you could make money if you didn’t put a lot into the home afterwards. But to buy at auction, you must have your cash offer already in the bank and be ready to swoop it up … the typical home buyer is in no position to do this.

Many “all cash” buyers don’t use all of their own money.

Typical inland scenario – a middle to upper-middle class couple (one of them is frequently a real estate agent) have a moderately successful contractor friend. They each put in 5-figures and get qualified for a hard money loan, then buy at auction. They fix the worst problems themselves and do cosmetic work as cheaply as possible, leaving the painting and landscaping to illegals. Put on the MLS with wide angle lens pictures, and use words like “cozy”, “established”, “bright” and “nestled” in the description. Pray it sells before the HM loan costs get out of hand. Repeat.

Anyone with credit and a little money can do it, but some are less successful than others due to lack of an RE license or with no contracting knowledge/connections.

LT, almost anyone in Southern California could have bought that Corona home in cash at $82,000. What is about what it would have cost just for a 20% down payment at the top a few years earlier. The house dropped 76%!!!

Sold right next to a freeway? But it’s a HIGHLY DESIRABLE freeway with tons of wealth parked on it! It must be special if it’s backed up morning till night. I mean surely all of those people sitting there must be having the time of their lives because the weather is perfect!

This is the year when Millennials go out and buy in droves! So we were told by the RE Cheerleaders! Like every year.

“Millennials Have Never Been More In Debt, And It Is Creating A Major Risk For The Economy”

http://www.zerohedge.com/news/2017-10-11/divergence-between-rising-consumer-delinquencies-and-sinking-unemployment-surges-rec

Hey, remember how the economy was supposed to tank with Trump? Yeah about that….

“The total number of laid-off workers receiving unemployment benefits fell to 1.89 million at the end of September, the Department of Labor reported Thursday, the lowest such mark in nearly 44 years. And new claims for unemployment benefits dropped 15,000 to 243,000 in the first full week of October, according to the agency, as the job market bounces back from hurricane damage even faster than forecasters expected.”

And keep in mind that 43 years ago the population was much lower. So really this number is significantly lower on a relative basis to population.

The economy is on fire. But why let pesky facts get in the way of a good doom and gloom story?

Landlord,

Tanking will occur at some point with or without trump. I am sure that retiring baby boomers, expiring eligibility for benefits, and the redefinition by the government that 30 hours being a full time job has nothing to do with it.

None of what you typed has any relevance to what I posted.

I’m guessing there’s gonna be a lot of burnt-up land for sale in wine country, by people who cannot afford to rebuild after the fire. But that’s primo land. I wonder how that will play out.

Majority of wineries are lucky to break even over a number of years. They have one year up and the next year down. Owners of winery are generally very wealthy with the winery being a vanity holding or hobby job. I am sure they are well insured.

Interesting data here:

https://www.bls.gov/news.release/wkyeng.t01.htm

Median weekly earnings in the first 2 quarters of 2017, are both higher than in all of B. Hussein Obama’s 32 quarters. Amazing what a difference having a pro-growth, pro-American capitalist in the white house can do, huh?

Quick rant….Do you guys know about these OPT students who steal american jobs. We have a ton of those at our company. OPT stands for Optional Practical Training. In plain English this means that these foreigners can work here full time (after or even during their studies) and we Americans compete against them. They are paid less and the company and “OPT employee” pays next to no taxes for this “training”. Of course its really a full time job and why would the company hire an American if they can get a cheap OPT guy? Its bad enough that we are laying people off and outsource these jobs to third world countries (which we have done in customer care, IT, administration etc) but now we are bringing in these foreign kids and let them have full time jobs which will ultimately suppress wages.

Instead of hiring Americans we find these foreign students and hire them because the company is saving money (which we all now that these savings just benefit the top executives). I love talking to these guys….this Chinese guy told me on Friday in his broken English how the company promised him to sponsor him for an H1B after the OPT extension is expired. I asked him, so what is so much better here than in China. (Of course i could come up with a few reasons but i am always interested in what they have to say). His plan is to stay here because we have cleaner air than in his Chinese town and it is less crowded. Also, he is trying to get his family over as well. Of course RE cheerleaders must love this. More Chinese means housing values go up on paper. Whats not to love?

Leave a Reply to NoTankinSight