Roommate Nation:Â 30 percent of working adults are now living with a roommate.

With the rent being too damn high, many Americans are now opting to live with a roommate (or two or three in the case of San Francisco and Los Angeles). We now have a record number of adult Americans living with roommates. This coincides with a stagnant growth in the homeownership rate especially in crap shack intensive areas like SoCal. The market continues to be constrained by low supply and Taco Tuesday baby boomers living in properties that they would not be able to purchase today at current price levels. Many older home owners bought during an era where one income (even one blue collar income) was enough to purchase a home. That is no longer the case in many metro areas where dual income professionals and all cash buyers are the dominant buying force. So how many adult Americans are now living with roommates?

Roommate nation

As it turns out, many people are dealing with high rents by finding roommates:

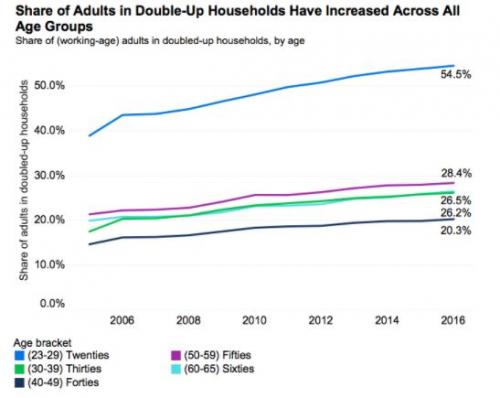

“(Zillow) As rent consumes a growing share of household income in many cities, some people must relocate or find ways to offset rising prices. An increasingly popular way to cut costs is by adding a roommate. Nationally, 30 percent of working-age adults—aged 23 to 65—live in doubled-up households, up from a low of 21 percent in 2005 and 23 percent in 1990.â€

So much for the affordability argument. Living like sardines is the new solution. And this is a record number of adult Americans living with roommates. And no, this isn’t looking at married people or couples:

“We define a doubled-up household as one in which at least two working-age, unmarried or un-partnered adults live together. For example, a 25-year-old son living with his middle-aged parents would constitute a doubled-up household, as would two 23-year-old roommates who are not partnered to each other. A doubled-up household contains people who might choose to live apart under different circumstances, financial or otherwise.â€

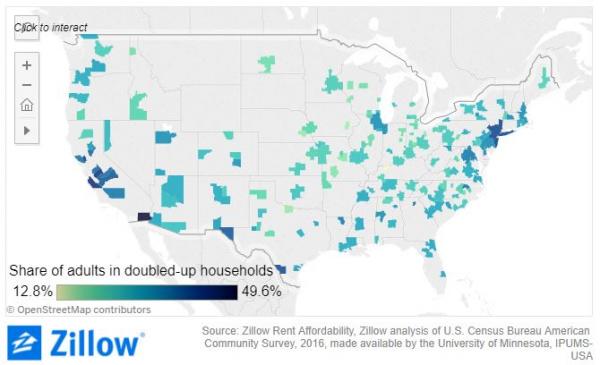

And of course the rates are much higher in expensive areas like Los Angeles:

I’ve driven around many cities in SoCal and you see streets packed with cars and in some other areas you see five to six cars in places were only two to three cars should go. So you see this congestion already taking place. The idea of having a big lawn and open space just doesn’t fit in with our crowded market. In SoCal we have 22,000,000+ people all trying to live within 100 miles of the coast. And you feel this in the massive traffic in various cities.

Is this sustainable? As we have noted, much of the new housing construction is catering to the new needs of Millennials which is rental apartments or condos which are glorified apartments with mortgages. Sure, you have some Millennials wanting to be Taco Tuesday baby boomers version 2.0 but the stats don’t highlight this. First, many are marrying later if they are marrying at all. Also, the size of a family today is much smaller. So why the need for insane McMansions? The needs are clearly different.

You also see this being reflected in roommate changes. Millennials are more open (obviously) to living with others. But this trend of rooming up is hitting all groups. So this is being driven by necessity and lifestyle choices. For example, a Millennial might be happier living in San Francisco with roommates versus having a McMansion out in Oklahoma.

One way to cut housing costs is to get roommates. An old fashioned solution to the high rental cost situation.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

373 Responses to “Roommate Nation:Â 30 percent of working adults are now living with a roommate.”

Having roommates is a step above living in a tent along a bike path.

How long before these people drive, bus, train, to DC to set up Hoovervile tent/shacks on the White House lawn like they did in the 1930″s?

Remember, that great Socialist, FDR, was elected for 4 terms after that. FDR was more Socialist than Bernie.

Conservatives should beware of where their politics are leading us.

Hoover had high unemployment that actually paid a living wage. Same as now.

Like Hoover, Trump had a lot of promises to fix this. After a year, I still see tents.

Poor Hoover. Poor Trump. We need a real solution and not just alternative fact promises.

I agree, this whole ‘conservative’ thing is really not working. If we had a more welcoming open border platform, added some more genders, and really ramped up the mass importation of the third world, then things will really start humming! This whole ‘free-market’ thing really is an abomination. But I don’t have to tell you, the crusty old barn owl Bobby has ‘seen it all before.’ Maybe your Oprah can help redistribute the wealth so that the racist white land barons finally stop micro-aggressing their tenants.

Ha! This guy gives the impression that skid row just became a thing in 2017.

Oprah for President lol.. today’s comedy post. A racist, white-hating, filthy rich elite DEMONcrat – oh yeah we really could do better with her in office ROFL.

That aside, over the past few years I’ve noticed the single family homes in my neighborhood moving more adults in, cars everywhere, adults with small kids, single adults, all living with grandma and grandpa. Probably 40% of the houses here have multiple families living there now. A few have (illegally) converted their garages to bedrooms.

I guess since property prices have DOUBLED since the crash in this area (Eastern subs of Sacramento) – surpassing peak prices of 2005, and rent for a 1 bed apartment is $1500, and 2 beds renting for $2000+ a month….

nor cal fella: “If we had a more welcoming open border platform … and really ramped up the mass importation of the third world, then things will really start humming! This whole ‘free-market’ thing really is an abomination.”

Your confused sarcasm is contradictory. It sounds like you oppose open borders, yet want a “free market.” But a free market demands open borders (and more Third World immigration).

America’s problems were made by both conservative/libertarians and socialists. I was a libertarian, long ago. But not for some years now.

I liked Trump’s original message. Populism, nationalism, America First. Close the borders, protect U.S. industries, tax and spending policies to benefit America’s working and middles classes, and no military or financial support to any foreign nations (and that includes our “special relationship” with Israel).

Unfortunately, Trump has increased support for Israel. He’s rattling the saber at Iran. He’s lavishly supporting Wall Street. And the wall is yet to be built.

“No business which depends for existence on paying less than living wages to its workers has any right to continue in this country.†(1933, Statement on National Industrial Recovery Act) – FDR

FDR saw the need to pay a living wage to prevent the US from becoming a third world country where people live in tents/shacks without running water or sanitation.

People are being forced to pack multiple people into tiny crapshacks because their wages are too low to afford a livable home while their corporation is using all profits for multi-million dollar stock buy-backs and CEO bonuses.

“Do not let any calamity-howling executive with an income of $1,000 a day, who has been turning his employees over to the Government relief rolls in order to preserve his company’s undistributed reserves, tell you – using his stockholders’ money to pay the postage for his personal opinions — tell you that a wage of $11.00 a week is going to have a disastrous effect on all American industry.†(1938, Fireside Chat, the night before signing the Fair Labor Standards Act that instituted the federal minimum wage)

You can see how we have seen this all before. We then elected a Socialist for 16 years.

Signed,

The Wise Crusty Old Barn Owl.

Cal girl,

“That aside, over the past few years I’ve noticed the single family homes in my neighborhood moving more adults in, cars everywhere, adults with small kids, single adults, all living with grandma and grandpa. Probably 40% of the houses here have multiple families living there now. A few have (illegally) converted their garages to bedrooms.â€

I am seeing the same here. There is no more parking available. People park across the street at the grocery store overnight. People who have lived in this are for decades told me they have never seen it that bad in their life time. It’s a good sign. People found ways to survive this severe housing bubble. As soon as house prices crash by 50-70% people can move out and buy homes.

Wise owl no call self wise owl.

What a blame and excuse ridden typical Californian! It’s always someone else’s fault … you take no responsibility. Your State is chasing away the middle class! Your State has a 20% poverty rate! Your State has its own debt that will crush it! Your State has the bulk of the nations homeless! Perhaps you ought to look in the mirror and at your own State before you try to blame everyone else and conservatives for your problems. Conservatives haven’t been in charge in California for years …

“Trump had a lot of promises to fix this. After a year, I still see tents”

That really is laugh out loud funny. And odd in that you crying that trump has had a year to fix this? Fix what exactly? What Obama created OR what Obama himself failed to “fix” after 8 years?

We have corporate rule in the USA it’s not right/left policies per se that are driving the country into the dirt. It’s laws and regulations written by and for corporations that is destroying the nation. One needs to look no further than the ACA, written for and by insurance companies. The hate party (AKA democrats) has this obsession with equating “insurance” with heath care…..insurance isn’t health care…..but I digress.

There is no money left for the middle class and it’s dying and will be gone in another 20 years. You best all learn Spanish since your caregiver in the old folks home will not speak one lick of English.

And if the rumors are true and Oprah does run in 2020 she WILL WIN and that will be game over.

Interesting, don’t scare us with Oprah – it’s not Halloween yet. I’m still traumatized by 8 years of Barry and you already started with Oprah?!?!…Please, I need some time to recover from 8 stressful years.

It’s a sad state of affairs when Oprah is the Dem’s last hope. Maybe Kanye or JayZ can be her running mate. With the collective IQ of this country, it wouldn’t surprise me if they won.

Democrats are the “hate party”? WTF are you talking about? Racist, plain and simple. Are you scared that people who don’t speak English are taking your jobs? Well, they are, because they work hard and value education. You are a lazy, entitled, little baby, who thinks because you were born here that something is owed to you. It is not.

Better start learning Spanish? Maybe you should, but you are too lazy and dumb to actually improve yourself so you whine online hoping to quiet the voice in your head that whispers quietly to you every day that “you are a failure”.

I started working when I was 12, got 2 scholarships so my school was not only paid for, but I actually made money going to school. I am not scared by immigration, because I am smart and hard working and can compete with anyone, American or not. America was founded by immigrants and if this bothers you, maybe you should be the one leaving the country. Oh, but where would you go? You can’t speak another language and would not be able to humble yourself to learning a new culture. You are on a sinking ship and you are slowly realizing, in your own sad way, that you cannot compete. I only want the best and brightest in America. If they come from another country, we should welcome them with open arms. They have dreams of success just like everyone else.

Maybe you should have worked harder in school. There is still time to learn, but you will not. You will post sarcastic and thinly veiled racist comments online…and that is all you will ever do. All you will ever be.

Dumpy is very angry. Which is good. The angrier they get the more I know we’re winning.

Just wait until Dems cave and fund the border wall, people like him will be suicidal, LOL

I always laugh at this notion that America was founded by immigrants stated by DumpTrump. The British and French colonized North America, many generations followed and we declared Independence from England and CREATED America. America was created by and for Americans not immigrants, later on in our history we allowed immigrants to come to this country but it was founded by them, but that was also during a time when an immigrant had no social safety net or any free anything, if you came here you had to make it or starve and the police in the cities were not too nice and the jails were one step above a medieval dungeon, America had debtor’s prisons up until 1833. I am fine going back to old immigration system with open boarders and no social safety net, not even free public education or emergency room access, but I think most people would not want that, and I am pretty sure the current batch legal and illegal immigrants would not want that either. I agree with DumpTrump in one aspect, Americans are lazy when it comes to education, we really need to dial up our education system to 11 and if kids cant keep up then the parents need to step up and supplement to keep the kid up to par, but I am pretty sure La Raza and the teachers union wont be happy with that, because they want schools to be mini-socialist paradises were kids get free lunches, counseling, day care, vaccinations, etc. In Asia, kids in 7th grade are taking Algebra, we start it at freshman year, we really need to up our game in America.

2 Years ago I would have laughed about Oprah. Now… considering we have never had anyone in the role that is dumber or more inexperienced, you have to take her seriously…

If you are upset or laughing about Oprah because you think he has no business running for or being president then you know exactly how a little over half the country feels about our current president.

As a registered democrat I will do my part to not vote for fucking Oprah in any primary ever. But given the rights capacity to vote for a jackass, I have no more faith in the left voter base to not swoon over a left wing shit choice for president………

I expect no president to un-fuck the California housing market. That is our states problem and I expect many more decades of failure given that’s what the home owners of this state want. Fight any potential good law that might fuck up our property value or tax shelters….

DumpTrump,

Yep, the hate party. You just proved me right!!! Damn dude I know you’re trolling but nobody could carry as much hate as you do unless it was on purpose.

game, set and match.

Dumpy is the clear example that liberalism is a mental disease.

The liberals/democrats/collectivists claim that corporations are evil and they are the party which support the middle class. That is what they CLAIM.

Now, the open border policy and massive immigration that they support is clearly decimating the middle class and help those “evil capitalist” who own those corporations. So, what they say and what they practice is totally opposite – HYPOCRITES. The republicans at least are honest and say that they want to help those small businesses. By helping them, they help the middle class to find jobs and they help the economy.

There are lots of these types of examples.

…and, no Dumpy, we are not afraid to compete with you even if we are conservatives white males. Unlike your stereotype learned from MSM, we do have perfect teeth, high level of education (doctors, engineers and business owners) even if we are “deplorables”. I have an MBA and decades of owning my own company through booms and busts and I can drive you circles in business. I am a self made multimillionaire, way above the middle class, but what I have does not change what I am saying about the middle class.

Trump was and still is right in what he says about open borders and immigration regardless if you or I like him or not.

So, you can get down from your high horse and learn something if you have an IQ above room temperature. It looks like you are not fool enough till you tell everyone on this blog that your logic is lacking.

Oprah will not win. Now that she’s been suggested for the Dem ticket, she is being subjected to a lot more scrutiny than she would ever be as merely a popular entertainer, and even the most left-leaning liberals are expressing their doubts about a woman who has built her vast fortune on retailing occult bullshit, magical thinking, and medical quackery. I was not aware of all this because I’m not a TV watcher, having viewed her show only once, at a friend’s home. But now that I see, my previous admiration for this talented business woman has faded and I’m beginning to dislike her, as are many liberal women. If she can win that crowd, she has nobody, because she totally loses it with conservatives, and most men.

In 1987, Oprah predicted that by 1990 one-fifth of all heterosexuals would be dead of AIDS: http://fumento.com/aids/pozaids.html

I actually remember when she said that in 1987.

When 1990 rolled around, and her prediction proved false, no one seemed to remember it, apart Rush and the rest of conservative “hate radio.”

@Dan,

Why so mad bro!???…

I know; truth hurts. Sorry! I can’t help it.

What is your current occupation and educational background?

Me or Crusty Bob?

https://www.facebook.com/PopulistWire/videos/536861416693301/

and here is that vibrant OC economy that I keep reading about here.

This number is likely much higher! I’ve talked to several people who find out months if not a lot later that they pennants sub-let rooms out, let their ‘south of the border’ family squeeze into the ‘pad’, etc.! I’d bet there are a lot of slum lords in places like L.A. that don’t much care and look the other way as long as the rent is paid! Also, it is embarrassing how dumb people play politics on this site. Get a clue … you despise Trump for being rich, privileged, and out-of-touch! Oprah is a billionaire, surrounded by her entourage! All those cheering her on at the Golden Globes are self-centered elitists who have small fortunes, who live in the City with the largest homeless population! I don’t see them opening their wallets!!!! Get a clue!

Heh. You’re 100% correct. The same dimwits who whine that Trump is a billionaire are orgasmic at the thought of Oprah or Mark Cuban running. Liberalism is a mental disease and it is proven over and over.

I think there is a very strong case for the liberalism, as expressed by Dumpy Pants above, to be classified as a mental disorder.

Dumpy Pants thinks that the ‘best and the brightest’ from the third world are being ushered into America. Dumpy Pants also has delusions of his own elevated intellect.

Dumpy Pants spends his unemployed days spewing hate towards conservatives, and reading Occupy Democrats on Facebook. I’ve never met a liberal who hasn’t had a history of mental health problems, and I suspect Dumpy Pants slides right into that group.

Contrary to Dumpy Pant’s “facts” he gleaned from Occupy Democrats or CNN, every person I know that is on welfare or “disability” is a liberal, who like Dumpy Pants, spends their days vomiting MSM drivel in the hope it may ease his (it?) frustrations that HITlery lost and Trump is implementing WELFARE REFORM and deportation of all of those “best and brightest” “victims” lol.

If nothing else, morons like Dumpy Pants, or “ranger one” or whoever it’s schizo mind wants to be in the moment, provide endless amusement for conservatives after a long day of work.

Where do all you right wing turds go when you are done spending half your day here? Breitbart? Trump is a billionaire? Let’s see those tax returns. The right leaning Rasmussen poll has Oprah clobbering the man/child that somehow slipped into that office. One thing is sure, there are enough of you dimwits left to elect that shithead again. Flyover – damn you are one self agrandizing liar. I come here one every two months and as certain as the sun irises there you are with your phony story of self made riches. Get a job and get off the blogs you are soooo booooring.

Where do all you right wing turds go when you are done spending half your day here? Breitbart? Trump is a billionaire? Let’s see those tax returns. The right leaning Rasmussen poll has Oprah clobbering the man/child that somehow slipped into that office. One thing is sure, there are enough of you dimwits left to elect that shithead again. Flyover – damn you are one self agrandizing liar. I come here one every two months and as certain as the sun irises there you are with your phony story of self made riches. Get a job and get off the blogs you are soooo booooring. And landlord

Old same you. What a broken record bullshit spewer..

Housing To Tank Hard Soon!

There he is! Good to see! Yep, tanking hard soon!

Jim, I believe that homes in Southern California have become so unaffordable that prices can only go one way–down. There are no longer enough investors/flippers who can or want to buy–and they were the last buyers. The only question unanswered is how far will prices fall and will any of us have the money to buy real estate at the bottom? These are scary times.

Gary, have you not noticed what the stock market has been doing?

If the stock market tanks, it’s reasonable to expect the housing market to follow. But if stocks don’t go down, are you really sure that housing will?

People have been saying what Gary is saying for years now. I bought my current house in 2015 and between appreciation and principle paydown I am plus $175K net worth in 25 months.

Buy the best house in the best area with the most upside you can afford and forget about trying to time the market.

falconator, this is absolutely true. Buying a home for yourself (as long as you have additional cash flow for savings) is a very good insulator against a speculative nature of everything else. But one does need those $$$ from rental parity to invest, then that person is truly not in a position to buy a home

Lol, another joker who bought high. It’s too funny that people who buy HIGH hang out on a Housing BUBBLE forum trying to convince us that now is a good time to

Buy this overpriced crapshack!! I love when they say “I am Up†as if these sky high prices were locked in. During the next crash all that artificial appreciating will just vaporize. Sine the downturn is on the horizon these bag holders are telling potential buyers on bubble forums to buy into this bubble in a pathetic attempt to keep the bubble going for a bit longer.

Appreciation and depreciation are not super important when you buy to live long term. It is a utility buy with good inflation hedge. You are drunk from crypto success

Good article Dr. HB

“As we have noted, much of the new housing construction is catering to the new needs of Millennials which is rental apartments or condos which are glorified apartments with mortgages. Sure, you have some Millennials wanting to be Taco Tuesday baby boomers version 2.0 but the stats don’t highlight this. First, many are marrying later if they are marrying at all. Also, the size of a family today is much smaller. So why the need for insane McMansions? The needs are clearly different.â€

Sooo weird, the RE experts on this blog JT and Mr Landlord just told all of us in a previous thread how millennials are buying houses en mass. In fact, per JT, the remaining ones that haven’t bought are soooo close to buying. Overnight they saved for a down payment. Wondering on which websites they got their news from or if it’s a special sense that only RE experts have? Both, JT and Mr Landlord are way ahead of the media. Fascinating!

Millie Vanilli,

I didn’t tell you. I linked to a study done by USC that said millenials are buying houses. Now remember, just because you and your loser friends are living at home with mom and dad, doesn’t mean everyone else in your age group is doing the same.

You have to remember CA is not a part of the US anymore. It is a quasi-independent 3rd World state. You would be very foolish to assume that what happens in SF or LA is also happening in Dallas or Atlanta or St Louis.

I wish I could still live at home. I would save even more than I do as a renter. Not sure why you call this being a loser. I call this being smart. You might remember I live in California. There is no rental parity in California. Every home even crapshack are heavily overpriced. If I would live in Spokane like you I could buy a house in all cash. Yes, don’t worry I won’t move there ;).

Point is, you said millennials are buying homes and I am asking why Have homeownership rates not improved? Don’t worry, it’s a rethorical question. Kinda like when you made the statement that ALL techies in California get stock options. I asked you to provide ANY reference. You posted three websites which proved me right. Same will happen with your millennials are buying houses in droves statement. At least you are consistant in Making up BS and providing zero backup.

Millie,

For the 3rd time **I** didn’t say millennials are buying houses. The data says they are buying houses. Now that’s not to say every single one of you is buying a house. But the trend has shifted from renting to buying. I know you’re not obtuse. So stop pretending to be.

As for stock options, again, you assume everyone is a loser like you. Hint: we’re not. Stock options have many many people very rich. And not just the Bezos and Zuckervergs. Low and mid level employees at Google, Amazon, Facebook, Twitter, etc have all made a lot of money as well.

You live in a weird world of doom and gloom. You need to get out more and meet some new people.

This is fun.

“For the 3rd time **I** didn’t say millennials are buying houses. The data says they are buying houses.â€

Yes you did. Multiple times last year and than just recently this year.

“As for stock options, again, you assume everyone is a loser like you. Hint: we’re not. Stock options have many many people very rich. And not just the Bezos and Zuckervergs. Low and mid level employees at Google, Amazon, Facebook, Twitter, etc have all made a lot of money as well.â€

Don’t change your story. It was one of my favorite discussions….â€every tech worker is getting stock options.â€

“You live in a weird world of doom and gloom. You need to get out more and meet some new people.“

Where Is the doom and gloom you are referring to? I am profiting from this market (stock market/crypto gains).

And why am I a loser for having cash and waiting on the sidelines for a crash? Are you calling all cash investors losers? Is warren buffet a loser for saying buy low sell high and be greedy when others are fearful?

Focusing on the extremes of doom and gloom, you miss all the great opportunities in between. Millennials are unfortunately too shell shocked to strike their own opportunity. Still see adulthood a ways away. Might as well figure them as delayed adults. As an employer best too look somewhere else, if and when possible.

Millennial,

Have you determined the opportunity cost for you choice to rent rather than buy? Have you compared you net worth after years of renting to what it would be if you’d bought a home/condo at the point when you had enough $ for the down payment?

I’d be interested to see the numbers for the years you’ve rented vs the numbers if you’d bought an equivalent home/condo/apartment to what you’ve been living in.

Jeff, I can easily answer that question. Instead of buying a condo in 2014 I invested a large junk of money (stocks and crypto). My monthly payment are 700 less by renting compared to buying. That 700 is also going towards crypto (and savings). Not in my wildest dreams would I have expected these gains from BTC, ETH, LTC and recently XRP, ADA. You probably don’t know what any of that means. Let me just tell you that the housing market did not go up by thousand of percentages from 2014 to 2017…..

That entire time I sat on cash, had no taxes, hoa’s, closing fees and all the other stuff you have to pay as a homeowner. There is not even a comparison. I won biggly by investing it versus tieing it up in an overpriced condo. I totally understand that older folks have a hard time even understanding what’s going on. All they know is buying real estate. 30 years ago there was no internet. People could not research within a few mouse clicks. A ton of older people have that stone age mindset that it is always a good idea to buy. The tools millennials grow up with is a huge advantage that has a tremendous financial benefit.

Gen-x,

I have no idea what the hell you are talking about. What doom and gloom?? It’s called cycles. You never took a economy or business course in school? As far as millennials in business goes I agree with you. I have been very successful in my career however I agree that the attitude of some millennials is rather undesirable. I believe you have to pay your dues. I don’t like the trend of job hopping. While I received 4 promotions since I started with the same company I have seen many younger employees jumping from one company to the next. The grass is not always greener somewhere else. Every challenge you face is also an opportunity.

Jeff, I can answer that for him. The answer is no, he doesn’t do math, ever, only pays attention to what is happening in his own home, and only chooses the data that suits his ideology – rent hasn’t gone up, therefore nobody’s rent has gone up. He hasn’t bought a home, therefore millennials aren’t buying homes anywhere. Prices went down 50-70% in the most undesirable areas last time, therefore prices will come down 50-70% in the most desirable areas next time. There’s a bubble where he lives, therefore there’s a bubble in the entire country. He has never seen a median price chart, and in fact won’t even acknowledge that they exist.

Jeff you cannot argue with this Millennial guy, he will win every time because he is a seasoned investor and financial expert. Not buying real estate is a fantastic strategy. All the savvy investors I know who have achieved high net worth steer clear of real estate and rent. Millennial is probably renting one of my properties from me without me even knowing it. Probably has wallpapered the place with $100 bills with all his amazing investment profits.

John, you almost got it right. Let me help you out.

“The answer is no, he doesn’t do math, ever,â€

That is too funny, coming from the guy who bought high, who thinks it’s ALWAYS a good time to buy a home, who said a house is NOT an investment AND who thinks we have rental parity in California. Hilarious! That’s why I live this blog so much for the entertainment.

“and only chooses the data that suits his ideology – rent hasn’t gone up, therefore nobody’s rent has gone up.â€

Almost correct. In my area rents have barely moved. I never had a rent increase. My landlord is giving me a gift. You should rent from s private landlord build a good trus-relationship and avoid professionally managed properties. Chances are good that if you are a good renter your landlord will be good to you as well.

“He hasn’t bought a home, therefore millennials aren’t buying homes anywhere.â€

I don’t understand that logic. I don’t think I can influence the market like that. That would be a truly amazing power. I think what you are trying to say is that I don’t believe this is he year millennials will go out and buy in droves. We have heard that for the last three years and I think it’s too funny that it comes up again and again. And sometimes you even hear that millennials waste their money with 10 dollar Avocado toast and Starbucks coffee. As if you could save 200k down payment if you stop eating avocado toast and Starbucks coffee. So, yes, I will continue to make fun of people who post that this is the year when millennials go out and buy in droves.

“Prices went down 50-70% in the most undesirable areas last time, therefore prices will come down 50-70% in the most desirable areas next time.â€

Yes. 100% agree. It’s just a matter of when. You see the same pattern. Dumb money invests in what goes up and rushes in at the top and panic when it goes down.

“There’s a bubble where he lives, therefore there’s a bubble in the entire country. “

Nope on that one. Yes, there is an enormous bubble in California. That’s where I live and that’s where I buy when prices crash. If I were to live in Spokane I would buy as my spreadsheet shows rental parity there. There are many parts of the country where buying makes sense. The issue is there are not high paying jobs and not the same conditions I have here in SoCal. Plus my family and relatives live here.

“He has never seen a median price chart, and in fact won’t even acknowledge that they exist.â€

Nope on that one. Not sure why you think that but okay. Whatever makes you feel better.

Cute post falconator. “Not buying real estate is a fantastic strategy. “

Who says I am not buying? I just wait until it crashes. I buy low not high. Every bubble needs dumb money who buys in at he top. Every bubble needs bag holders (you are a genius)

“That is too funny, coming from the guy who bought high, who thinks it’s ALWAYS a good time to buy a home, who said a house is NOT an investment AND who thinks we have rental parity in California. Hilarious! That’s why I live this blog so much for the entertainment.”

You do know that other people who read this blog actually comprehend what I write, so you trying to put words in my mouth doesn’t work? You’re only fooling yourself. I never said it’s always a good time to buy. I’ll try to make this as clear as I can – I said that SOME PEOPLE (including me) don’t consider a PRIMARY to be an investment. Our definitions of rental parity differ (mine includes all the benefits for the very long term, yours doesn’t go past the down payment and first month’s mortgage), so there is no point in rehashing that.

“Almost correct. In my area rents have barely moved. I never had a rent increase. My landlord is giving me a gift. You should rent from s private landlord build a good trus-relationship and avoid professionally managed properties. Chances are good that if you are a good renter your landlord will be good to you as well.”

What you think about landlord/tenant relations is not the point. The point was that literally dozens of times, you have stated that “rents haven’t gone up.” The entire internet and all the data available disagrees with that statement.

“Prices went down 50-70% in the most undesirable areas last time, therefore prices will come down 50-70% in the most desirable areas next time.â€

“Yes. 100% agree. It’s just a matter of when. You see the same pattern. Dumb money invests in what goes up and rushes in at the top and panic when it goes down.”

I don’t think you read that correctly. What I wrote is a completely illogical and sarcastic statement. The only pattern here is that prices don’t drop as far on the coast.

“There’s a bubble where he lives, therefore there’s a bubble in the entire country. “

Nope on that one. Yes, there is an enormous bubble in California. That’s where I live and that’s where I buy when prices crash. If I were to live in Spokane I would buy as my spreadsheet shows rental parity there. There are many parts of the country where buying makes sense.”

That’s the first time I’ve seen you admit that. Bravo!

“He has never seen a median price chart, and in fact won’t even acknowledge that they exist.â€

Nope on that one. Not sure why you think that but okay. Whatever makes you feel better.

Because you refuse to see that coastal prices hold up far better than inland prices. You’re expecting a coastal drop that won’t happen.

Millennial, you and your rental parity :).

Ok, 1mln dollar home rent = 4k, PITI = 5k. -1k rental parity. To make rental parity match, PITI must drop by 1k, which is around 200k in price on 30 year mtg (If interest rate increase or 15year mtg, 200k will be smaller). 200k is 20% correction, with even rental parity. Now, tell me where is additional 30%-50% will come from. Do you anticipate negative rental parity or rentals dropping by 33%? Please tell me why would anyone sell you a home (especially in a nice are) for 50% discount?

So far, you have not posted any thought supporting your crash prediction.

Millennial,

Waiting for a crash is a valid strategy, as long as you realize that it is a speculative strat fff

If you buy home for youself for a longer time frame (even at a relative peak) enables to significantly reduce speculative component of this game.

But the rationale and reasons that you are citing are completely off-base.

1st – yes, there is no rental parity. But, the amount you save by renting will not get you far. 1mln dollar home in Cali can be rented for 4k, and bought for 5k PITI. 1k/month – 60k/5 year, which is only 6% contribution to the price (assuming all is flat). With your targeted 50% drop -> it is only 12% of contribution over 5 years. You might have additional savings, but amount saved due to rental parity is really insignificant. (And this is before tax deduction and not ignoring the fact that principal portion is paid to reduce debt).

2nd – You mentioned crypto currencies. Sure, the run was good. However, considered environment where homes drop by 50% (heck even 20%). This will most likely be due to liquidity (in $$) crisis. $$ crisis will most likely cause stocks/crypto to drop like hell.

3rd – this time around there is a broad asset high valuation. In 2006 it was heavily concentrated on real estate, with MBOs linking the weakness of RE into the stock market. This time around, all assets are priced high and risk is systemic across the board.

What you do not understand is that thing like a House is a practically always a leveraged purchase. In fact, everything you buy it takes you that much long to save for (or pay for if financed). Car – typical lifetime 8 years, either you save for 8 years or you finance and pay for 8 years, either way it takes around 1 use timelife of a product to acquire. House – you live in it for 40 years, so it will either take you 40 years to pay for (10 years save for downpayment, 30 years mortgage).

This is for average person within his base. Of course, there is small percentage of people who do much better because they earn more while live below their earning means.

But nobody can save for a house just from rental parity. Even with 50% crash.

Of course, you have to have a breathing room financially.

Renting versus buying had paid massively for me surge. I think what you don’t understand is how much more you are paying compared to someone who waited three years and saved 30% of the purchase price. You can tell me all day long how buying now is a good idea. I could have never invested and gained that much money with in the last few years if I would have bought. It’s freakin simple math. All I have to do is look at my bank account and my investment accounts. I feel like you have to somehow tell yourself buying an overpriced house was somehow the right move for you. It would just hurt too much to admit how much a renter wins by investing the savings instead of tieing up the money in an overpriced crap box.

Correction: Waiting for a crash is a valid strategy, as long as you realize that it is a speculative approach.

To expand on your numbers Surge, I can provide first person details…I’m in coastal San Diego renting and on the fence about buying. After running the numbers, buying = out of pocket additional ~$500/mnth vs. renting, principal payment of $1k/mnth on mortgage. This is with 20% down payment invested in interest accounts/bonds factored for renting (minimal return rate). So, you can see it’s far from cut and dry for someone like me, a typical potential buyer in the area. I do appreciate all the different perspectives on this blog…lots of food for thought!

Roble,

Not clear are you saying you will pay extra $550/month or extra $1500/month if you buy compared to renting (assuming roughly the same time of dwelling).

In my opinion, ~1000k/month extra (before tax break and principal) is not that much, given that I have additional much higher savings rate / month. If you save for 3 years, that 1k/month ~36000. In context of home prices, it is nothing. Yes, you can invest the savings, but you need to get very lucky. You might need to wait to save for 20% DPT (assuming you do not have it yet). My point is rental parity is over-rated, 700$/month will not get you far. It is practically is a wash. If you feel that it is not a wash (meaning you will not have additional savings if you spend extra 1k / month), then you are probably not ready to buy. You can also wait for price drops, but then you are in speculation. Buying a crypto/stocks instead – you are in speculation. Your saved DPT will not yield much, or you have to go high risk (stocks/crypto, equally inflated assets).

Millenial, you tout you won big by investing in crypto currencies, etc…

This is all great, the only issue is that it is (as you definitely know assuming you truly do what you say you do) is highly speculative and does not differ much from housing bubble in 2006. If you truly invested in BTC/Crypto in the manner you say, you are millionaire by now (in USD) and the whole discussion about mortgages/buying home should be a moot point for you.

Surge, you are absolutely right! Buying now would not be an issue. I plan on buying here in SoCal as soon as it dips. I don’t disclosure actual numbers and I fully expect that the crypto bubble ends in tears. I take profits and try no to get greedy.

Yeah if you got cash, waiting will pay off as only really cash buyers will benefit from your target 50-70% crash. Investing 4-5 years ago in prime real estate would be a fantastic leverage play, I would even argue more fantastic than scooping up crypto at 700$/month (not sure about the numbers though)

Most others will not benefit from such a crash. Long term buyers wil not be impacted (as long as economy does not crash and burn, but then everyone is screwed)

I really want to see lots of people selling you at 50% discount in prime areas. Only highly leveraged will do it, but then it is pretty much a walk and you are dealing with banks. You just do not understand the event that is needed for 50% crash in prime real estate in So.Cal.

Surge, I am more than happy to share some details of my purchase when we see the market crash down. There is no need to buy unless we see a 50-70% crash. Renting is much cheaper. FYI, when foreclosure rates go up it does not matter what the owner wants or does not want. When you buy overpriced crapshacks and lose your job and can’t make the payments the house is gone. Maybe another fact you don’t understand is that you don’t own anything unless it’s paid off…. so saying nobody wants to sell you a house at a discount is a laughable statement.

Millennial, here is why 50% discount is highly unlikely, barring a catastrophe…(in which case who cares)

Yes, job loss is a risk for a homeowner, especially recent one, and that person might be forced to sell, but..

If someone has 20% down in equity and has to sell…anything over 20% discount and you are effectively dealing with a bank (because beyond 20% they are selling home that is underwater and they practically walk/short sell). Bank will go only so far, they will not give up remaining 30% of their loan.

If someone is 50%+ in equity and has to sell… do you think they will give up all their equity for your 50% discount? They will do anything (rent,etc…) to keep it going. Very tough for someone to accumulate 50% of equity just to give it up. I find it implausible that someone with 50% in equity will just lose his home to a bank (which in turn sell for 50% discount just to recover its end).

If someone is 3% in equity..well, if they have to sell at any discount they are practically walking and you are dealing with the bank.

The only ones that I see will sell at 50% discount might be fully paid off homes that will buy similar home at parity. But these are unlikely to be “forced” to sell.

As you can see, 50% discount is highly unlikely. 20%-25% seems to be a hard boundary in prime areas…at 20%-25% recent buyers might get wiped out, but beyond that resistance to sell is very high, even if faced with job loss. This is why in last crash prime areas losses were no more than 20-30%. Crappy areas did get hit with much larger

A more plausible scenario is flat market or maybe 10% dip for several years while inflation catches up with ownership cost

Surge, I am still not buying until we have a 50-70% crash. My rent is much cheaper compared to buying. Unless my rent is going up by a LOT or unless the RE market crashes there is simply no reason to buy. I much rather take the extra cash I am saving, put some in the bank and invest the rest. Much more fun, way more flexible in terms of playing the market and it will let me benefit from a crash. If you buy now at the peak your cards are played. You can’t do anything during the crash. You are locked in. Again, it does not matter who wants to sell or not…..the bank ownes the house unless you paid it off and own it outright. A buyer who bought sky high and loses his job will most likely lose the house as well. We had 7 mio foreclosure during the last crash. You want to tell us that all of these 7 mio “allowed†or “ok’d†the sale at a huge discount? If you can’t pay for the house anymore your emotions or plans do not matter at all. That’s what a foreclosure is. Let’s see how many millions of foreclosures we will get this time around.

This article is just another reminder that we are in a race to the bottom as living standards decline and the middle class disappears we are becoming a third world two class society of the obscenely rich and the obscenely poor. Open borders and a huge influx of low-skilled immigrants has only compounded the problem especially in CA where it’s common to see overcrowding and carmageddon on a daily basis . This didn’t start with Obama and it won’t end with Trump.

My house always had a furnished studio rental attached that has been occupied with a tenant for years now. The tenant pays 2/3 of the mortgage. Recently I divided up the 2200 sf so the place is now a triplex. The two rentals have full baths and kitchens, my unit has a fridge and microwave. I also have a detached two car garage with a shop for any stuff that doesn’t fit in my little unit.

It was time to adapt to a new America, so I did. I have everything I need and can save $2k a month. Without the triplex, I haven’t a clue how I would ever get ahead. I could make the mortgage payment on my own, but couldn’t save a dime without tenants.

Yes, this is normal. My first condo I always rented out the room, which covered 1/3 of expenses. I was single and it was absolute norm, no need to have a place all to yourself if you are starting out. I planned it out like this and it did help to get ahead and pay bunch of student loans, etc… 3 bedroom is even better, if you are ok with a crowd. You are getting ahead on both fronts: Equity accumulation and extra cash every month. If you did not own, chances are you would probably still have roommates. There is time for everything.

The bulk of the new apartments being built in LA are luxury apartments with high rents. They offer one parking space for two and three bedroom apartments because brilliant developers assume millennials will just Uber everywhere. Unfortunately that is absolutely delusional. What happens is those big priced apartments contain 2-3 roommates and their boyfriends and girlfriends and they end up parking where ever is possible: sidewalks, redzones, front yards. Developers need to offer a parking spot per bedroom or be denied a permit to build.

Is that developers or the city forcing them to only have 1 parking spot? In Seattle, the city has been making a big push to reduce the number of parking spots available. The city’s stated goal is the eventual elimination of all cars in the city.

Eliminating cars is a good thing! I hope my 3 year old daughter never has to get a driver license like I have today. Hopefully she can hail a self-driving car with tons of safety features and have it take her anywhere for a similar price to owning a vehicle.. with the added benefit of no storage or maintenance necessary. Cities always are on the forefront of the future. Why so much hate toward cities phasing out taking up space with everyone’s personal vehicles that sit around 90% of the day unused.

LA is doing the same thing in some west LA areas. Social engineering people into being forced to give up their cars/hassle. There is less and less parking everywhere.

Everyone using one of the self-driving taxis just takes away the personal responsibility part and that car ends up being trashed fast.

Do we really want to all become just “eaters” living in tiny apartments in high rises, with no cars or anything of value?

“Cities always are on the forefront of the future.”

Sort of like Skid Row, in that bastion of liberalism known as Los Angeles?

But yes, it will eventually happen in some places, after electric cars become the norm. California will help the process along by raising gas taxes so high that most people start buying electric, but the roads will continue going to shit, so they’ll need to enact a mileage tax on everyone, which they will promptly spend on insolvent teachers’ pension funds. Even some gearheads will realize that many all-electric cars are so fast they don’t need that flat-plane crank V8 anymore, and go to the dark side of silent running. They will be mocked by the rest of us even as we lose to them in drag races. Uber and Lyft drivers will be out of a job. Internal combustion engines will be outlawed in LA and SF first, maybe around the same time (20 years?) that human drivers are outlawed. First responders will have the only vehicles with steering wheels. Gas stations will be specialty shops only found near race tracks, which will eventually be the only places a real, living motor is allowed to run. Towed there by a self-driving truck, of course.

I will have long since left California in my fire-breathing M2.

Do we really want to all become just “eaters†living in tiny apartments in high rises, with no cars or anything of value?

—

That is the communist dream. No ownership of land or any assets and dependent on govt for everything.

yadda, great suggestion about requiring one parking space per bedroom. What you forget is overregulated Southern California never requires logical building requirements. They instead will require solar panels, dual pane windows and sprinkler systems in every unit. Why? The global warming hoax!

Rents for single rooms can be stunning.

In my neighborhood, (Irvine), someone has posted a room to rent for $1100/mo.

That’s almost double my (long ago paid off) mortgage!

My neighborhood used to be sleepy, with only the occasional car passing by.

Now, I wonder if my street leads to an on-ramp for the 405 freeway.

Too many cars, too many people, our infrastructure is at the breaking point, even in “wealthy” areas such as my part of Irvine.

Up here in desirable parts of the Bay Area single bedrooms are renting for an average of $1,500 and of course in SF city limits probably like $3,000 haha! And to make matters worse most of the ads have all kinds of landlord/roommate Nazis charging $1,300-1,800 for a bedroom and then saying No guests, No drinking, No pets, No whatever! And many people even state that the renter had to be out of the house at certain hours or they would prefer you to not be there during the day. It’s just horrible, anyone looking to laugh and/or be disgusted look at the rooms for rent ads on Craigslist for San Mateo county. I feel blessed to rent a mediocre crapshack for $3,500 a month, at least I can do whatever I want to and be home on a rainy day. Looking at not just the absurd prices in SF and parts of LA/OC and the shortage of housing which is already bad enough the conditions for many rentals are Nazi-esque and the housing is in such high demand many people will walk on eggshells and sacrifice many things to rent a $1,500 a month bedroom from somebody.

Needless to say, if you were a landlord you would do exactly the same thing.

But because you call someone nazi-landlord is exactly a part of your mindset which prevents you from becoming one (a landlord)

“(or two or three in the case of San Francisco and Los Angeles).”

Bbbbut bbbbut California is the 5th largest economy and it’s also where also the best and brightest work and stuff!!! LOL. Yes the best and brightest, working 60 hours a week, in the 5th largest economy in the world, to be able to sleep on a couch with 3 other roommates in a 2 bedroom apartment.

But at least they can walk to 17 Somalian restaurants, so they have that going for them……

LOL, ’bout sums it up. Cali is just TOO CROWDED. Whatever the California Dream was (1950-1980) is long gone. Replaced by Japanese style accommodations and working hours. There are of course folks who create and enjoy immense wealth here, but what’s the point if all you can do at the end of your 14 hour day is collapse into your $50,000 bed?

‘Somali’ restaurants not ‘Somalian.’ Have some cultural sensitivity Mr. Landlord!!!!!!! Your white privilege is on full display!!!!

These are the sacred third worlders that our country is ushering in..the ones that have gentrified Europe and made it so livable and diverse now. It is critical that we use the proper nomenclature so that your micro-aggressions do not make them feel unsafe.

NorCal, the US needs all the third worlders it can get – it’s continuing development, excellence and improvement of the middle class living conditions needs those like air – according to DumpyPanty. Someone has to be a special type of idiot to believe the talking points of the democrat/liberal masters and you can not fix stupid. They will continue with their pussy hats and crying at the sky for the next 7 years.

Oh good God. I said Somalian. I am LITERALLY worse than Hitler, aren’t I? I officially denounce myself. LOL.

But fair enough, I should have said Somali. Although I didn’t mean anything in reference specifically to Somalis. Could have been Asian fusion or Avocado Sandwich Shop or GMO free Vegan Bistro or whatever. The “best and brightest” work like dogs, live in 3rd world conditions, all for the “benefit” of having multiple overpriced pretentious restaurants within walking distance.

BEST AND BRIGHTEST BABY!!

nor cal fella,

Now that’s some funny shit right there. Funny because it’s true.

You gotta love it when libtards “protected” classes collide

Lesbian couple and two children found savagely stabbed to death

http://www.newnownext.com/arrest-troy-murder-lesbian-couple-myers-children/12/2017/

These are the kind of “folks” you’ll get to share rides with when they ban cars – theyve already infested BART in SF but the media refuses to report it.

Don’t worry fellas, once President Oprah is sworn in, she’ll give everyone a house and a car as an Inauguration present.

Maybe “a chicken in every pot and a car in every garage†was a good enough aspiration for the economy of the Roaring 20’s, but it looks like 2018 campaign slogan for the new millennium should be modified to “convenient, tasty food delivered to every doorstep and multiple hybrid/electric cars in every garage.â€

That would be a politics of hope at least. Instead, we have politics based on imaginary fears–the Russians or North Koreans are coming, the terrorist are going to kill us all, global warming will destroy the earth in 5 years, 10 years, etc.

And Trump will force Mexico to pay for the Wall. Oops! Never mind.

This is what MAGA looks like. After 8 years of Obama’s rein from hell, capitalism is finally back. Sorry Millie and Co…..looks like you’ll be living in mom’s basement until retirement age.

http://www.businessinsider.com/small-business-optimism-tax-reform-record-level-2018-1

“Small-business confidence hit a record high in 2017, according to the National Federation of Independent Businesses. The National Federation of Independent Businesses on Tuesday released its Small Business Optimism Index for, capping “an all-time record setter” of a year in 2017, according to the right-leaning lobbying group. The optimism index came in at 104.9 in December. According to the NFIB, the index’s average monthly level was 104.8 in 2017, the highest in the history of the the survey.”

Mr. Landlord, I will eat crow if these fake economy lasts until the election. The prosperity you hear about is all fake news based on manipulated government statistic. The backbone of the economy, the middle class, is going broke on borrowed money The economy will be lucky to avoid a recession until after the election. We have a government which in “good times” is raising 16.4% of the GPD in taxes and is spending 22.4% of the GDP. What will happen to borrowing when the next recession hits.

I think that the FED is preparing Trump to be the “sacrificial lamb” for the coffin of conservatism.

The new FED chief Jerome Powell is “nominated” by Trump just to link Trump to the collapse to be engineered by Powell. He was imposed on Trump and the president unaware just gave his blessing to what Wall Street imposed. The FED can do anything they want regardless of Trump. When they will collapse the economy through QT, I just hope against any hope that Trump will suspend the business license to this cabal of international financiers. I know; I am daydreaming – wishful thinking. In regard to QT I am not dreaming; it is happening.

Gary,

You have fallen into the trap of thinking Obama’s 8 years of depression is the new norm. It isn’t. Those 8 years were an aberration. 2017 was just getting out of the Obama depression. 2018-202? will be the real boom.

It’s also kind of sad that you’d rather have the entire country suffer economically than admit Trump is doing a good job.

people were just as optimistic in 2006…that turnaround came rather quickly.

NoNeed For Cars=Dumpy=shill for the globalists

Flyover, I’m with you 100%. The deep state/Fed will lop Trump’s head off soon and he will indeed be a ‘sacrificial lamb.’ This economy will not last through is first term. He has now owned the bubble and will be blamed for its burst. He should have stuck to calling it a bubble like he did on the campaign trail. Socialism will be ushered in after this collapse because people will say, ‘look, trump’s conservatives failed us, give us our nanny state and bring in the the 3rd world.’ That is what will happen here. I think it’s obvious.

nor cal fella,

you nailed it once again. Trump taking ownership of this bubble was/is a HUGE mistake.

I’ve been in recession since Q3 2014 and I see things only getting worse not better.

The fed can only do so much, raising rates slowly and reversing QE. Trump realizes (((they))) will try and pull the economic “rug” out from under him so he’s no doubt already got a plan to hang them. We should have had lots of people go to jail in 2008, now with this next downturn we finally have someone in place who will hold people to the law and let DHS, INS, IRS and SEC do their jobs for the first time in 2 decades or more. He can crush the fed, the hedge funds and all the slimy people involved in RE fraud and take their ill gotten gains and redistribute to the people, making him even more popular.

Govinda, I like your talk but I’m afraid it’s just wishful thinking. Sometimes I daydream like you, but these mafioso, by carrot or by stick will have Trump just where they want him. Only the army can still do something but in the last 8 years all top generals were changed.

We live in interesting times and the fight at the very top is still not over. The second guy from WikiLeaks was “suicided” this week. I think he used his nail gun about 150 time at the back of his head or something like that!!…:-)))…I don’t know what is the matter with these successful young tech guys that they “kill” themselves. These days, being a successful tech guy is one of the most dangerous occupations. I think he had too many “goods” on important people.

“Be fearful when others are greedy”

Yes that’s what MAGA is, tax break for corporations who give out one time bonuses that do not do anything to increase wages. Putting 30% tariffs on solar to kill jobs and kill the renewable energy industry. I am sure you will say yes to bringing back manufacturing but why stop there? Why not all manufacturing not just solar? Why only one sector? To kill renewable and bring back coal? Dumping billions in defense and a border wall (that mexico was to pay for?). Defense is a funny as most of that money goes to contractors who charge 10k for a toilet or 250 for a bolt. Deregulation’s and cutting of environmental rules? I remember seeing some of this in the early 90s before it all went boom in 2000 and 2008. What made it go boom?? Why is this blog in existence?? Yep, lack of oversight in a bubble economy.

At least Millennial has the right formula. Rent cheap, wait out the speculators and get rich quick guys. Pay off any wasted debt and invest in the stock market in a smart and efficient way. Diversify but dont be afraid to be a little aggressive. Since Millennial isnt investing in Real Estate you might as well take advantage of it. Real estate investment window is long gone, yes there are deals still but they are hard to find and now take longer to pay off without being a flipper.

As always, be prepared for the coming crash as it never ever lasts forever. Stay liquid pony boy. lol

Dan@”I guess you need to define “richer†because if that means ending the Trump term with more money in your pocket and making more money than when it began I think the vast majority of America will be richer. I guess it comes down to how much richer. Any small business will reap huge rewards on this 20% deduction for pass-through entities. Also for the Trump will make the rich richer argument that 20% deduction is phased out for a married couple Above 315000 So it seems to me that the lower end of the small business income scale is receiving the large deduction. As I stated in an earlier post I believe the only category that will not see a nice reduction in taxes is the single person with no kids that makes 6 figures and lives in a high tax state.”

Dan, I agree with you. What I meant was that at least 20% will benefit a lot which in itself is far better than Barry’s performance. I am all for helping the small businesses because they are the biggest job creators. The government destroy 3 real jobs for every one created to push papers around and harass the private sector.

I think a much higher percentage than 20% will benefit from the tax plan in addition there are results already coming through the pipeline such as big corporations raising wages and offering employee bonuses. Assuming a Black swan event or QT doesn’t take this economy down, it should really gear up and 4% GDP is attainable.

@interesting

Not sure on the engineer profession, but, there are plenty of professions doing very well. It is not all done and gloom out there.

Lastly, you guys do need to pick an argument because on the one hand you say that these foreign buyers are a myth and then on the other hand you say nobody can truly afford housing these days but then how can who is buying these homes???? Homes are being bought and someone is buying them.

Aren’t you a lender Dan? If sooooo many wealthy buyers are in line to purchase a home how come you are so bored and post all day how awesome the market is? Would it not be be more lucrative for you to do business with all these clients instead of telling all of us we should go out and buy?

@ Millie

Yes I am a lender and I do not post all day, nor do I tell people to go out and buy.

I merely point out that based on what I see, homes are moving and someone is buying them. When you have this type of demand and limited supply (of desirable homes), a crash is unlikely.

Btw; I mainly do conventional and FHA, the 1mil+ market is not my market as that is dominated by the big banks. I actually don’t care which way the market goes, I am in a forever home that is perfect for my family with a payment below what I can afford and have 0 debt (other than said mtg). Buyers are going to buy and life doesn’t just stop.

I also pointed out that I believe the tax cut will put more money into pockets of buyers and may nudge some fence sitters to proceed. As a self employed broker w/ a pass through entity that 20% deduction will come in handy for me personally.

I could be very wrong as I readily admit I was a housing bear in 2012-2015 and was proven wrong every single day. Lastly, I have commended you on your discipline in saving and financial goals, I just disagree that a crash of epic proportions is around the corner, but, if anyone had a crystal ball they’d be living on a private island and not arguing about CA RE.

One side effect of living like Sardines is the epidemic in Flu Cases across California. The Virus likes close living quarters. We may see that 2 Bed 2 Bath for 6 Adults is not enough when the Noro bug hits. Third World Standard Of Living has entered So Cal with Housing Prices way above affordability. Asset prices are inflated. Question is who will be buying these inflated assets tomorrow?

“ Asset prices are inflated. Question is who will be buying these inflated assets tomorrow?â€

Millennials! This is the year when millennials will go out and buy in droves! JT and Mr Landlord said so.

Millennial,

I always ask my older friends “which one of your kids can afford to buy the house you live in” (one friend still has all his kids but 1 living with him….the oldest is 30 something…yes that one is a bit of a loser but daddy lets him be, once again I digress) and I always get the same answer every single time.

“I couldn’t afford to buy the house I live in on my current income”

Mr Landlord likes to tell us that a “professional” couple can easily afford to buy but I don’t know where all those “professionals” are going to come from and how long before all those professional jobs are outsourced as well? My engineering profession was outsourced to China over a decade ago and all I get now is the scraps at the same price I did in 1997…….which is still “decent” money but not enough to buy a house on my own.

I don’t know how this ends but when this bubble does pop and pop it will I think were going to start hearing about a lot of this was once again all based on fraud.

1997. THat was 20 years ago. Instead of writing on these boards, I hope you took some steps to make yourself more competitive again.

Yep, cash is the most reliable asset 🙂

“I hope you took some steps to make yourself more competitive again”

I can’t not compete with a 3rd world worker will to work for $5 an hour. I live in a first world shithole where a starter home costs $700K. the only thing I have going for me is i’m here not 12,000 miles away. At least i’m still in business while many others are not.

The other thing is the trend IS starting to change. Many are getting tired of the absolute junk they are getting back from China so they are doing the engineering work here and forcing china to build to that……which means it’s not so “cheap” anymore.

No one can afford to buy at today’s real estate prices. The speculators/investor/flippers were the last buyers and they will now be the first sellers.

The buyers in North County San Diego are dual income couples, mostly white collar jobs…they are everywhere. In my circle of friends, the husbands usually make a bit more, salaries in the lower six digits and the wives pull in decent salaries but a bit less on average. These are people with bachelor’s degrees that have been working hard for 20 years give or take, not doctors or lawyers. Those are your buyers – if you look at price affordability index, we are well above 2006. As a home shopper, I would love a price drop, but Trump just juiced the what was already a healthy economy with the tax cuts….don’t see a drop other than black swan anytime soon.

Noro is the worst! Whole fam caught that and it decimated us for 2 weeks. In the end I had to get a shot to lessen the nausea and vomiting.

“Asset prices are inflated. Question is who will be buying these inflated assets tomorrow?”

I have lived in SoCal for almost 30 years, and have heard the same thing said over and over. Buy the best property you can afford and forget about timing.

So if I understand what my communist friends are saying here….

Rents are astronomical. But everyone wants to live in SoCal because….Somali Restaurants and weather and social justice (and none of those icky white people). But even though rents are astronomical and everyone wants to live there, somehow magically real estate values will decrease by 70% in the not too distant future.

OK that makes a lot of sense.

LOL

Mr. Landlord, prices are not set for desire. They are set by what buyers can afford to pay. Today, buyers are tapped out. Once the investors/flippers/spectaculars start to sell, there will be no one left to buy their “investments.” Prices will go down 25% within 18 months, then the foreclosures will hit the market and the second 25% decline will begin.

CA still has plenty of “icky white people.†As of the last count, we had just under 15 mil. That’s over 3X the amount of icky white people that reside in your state. Yes, the weather is great. We just had a couple days of rain and now back to the 70s. So how’s in the garden of eden AKA Spokane where you live? Looks cold and shitty… every day for months on end.

So how’s that crime rate in your paradise city?

http://www.krem.com/mobile/article/news/local/verify/verify-are-spokanes-crime-rates-the-worst-in-the-nation/494087652

Amazing… all those icky white people yet you rank right up there with Detroit. A much “darker†town.

And a 19.9% poverty rate in Spokane? Wow! You rank right up there with CA. And no mass illegal population? No Somali restaurants?

People move to CA because it’s promoted in the media, movies, music, etc. It’s the best place in the world *if* you can afford it. I do just fine and so do millions of other people. Trash it all you want with your bigoted comments. Just don’t act like you live in some paradise because you are delusional.

Fires. Smoke and smog. Mudslides. Perfect weather.

Increasing homelessness. Hosing disease off the sidewalks. Some might call it a shithole. Others know it as the reality in Los Angeles.

Mr, Landlord,

You did not understand our collectivists friends fully. I don’t blame you. Since liberalism is a mental disease and does not have anything to do with logic, I will try to explain it to you the way I heard it from them. It goes like this – if you let the borders open and accept all the millions of illegals, if you pay for all their education and hospital bills, if you give them food stamps and welfare, if you make the whole state a sanctuary state, all of a sudden, the rents drop, house prices drop, the middle class wages will increase because now they have more competition. Also, if they don’t have to use their cars anymore, their standard of living increases, because using public transportation is so much safer and faster than using your own car. Only those white bigots voting for Trump want to use such deplorable objects like cars. They really believe all of this because their gods in Sacramento told them so. Even Hollywood agrees with that. Sarc OFF

If you don’t believe all I stated, you must not have been too long on this blog. They said all of the above and much more. It “feels” just right for them. It doesn’t matter if it makes sense to you and I – white deplorable bigots – what counts is that it “feels” right to them. How those stupid politicians in Sacramento can win in a landslide for decades is beyond me. That till I visit CA once in a while and look in the stores and streets. Then everything start to make sense and when I read this blog then everything comes into focus – a small % of psychopaths manipulating the masses and a third world outside their circle.

So comrade, why do you continue to troll on here? SMH

Troll- One who posts a deliberately provocative message to a newsgroup or message board with the intention of causing maximum disruption and argument.

Do you spend your other free time trolling on atheist blogs trying to convince people God is real or vice versa?

This is supposed to be a discussion on housing, in CA. You know, for people who live and work here and are impacted. It’s not Breibart.com. Maybe there’s a i-hate-ca blog somewhere. Instead of housing, all I read is you and landlord giving each other virtual handjobs since you both are like-minded.

Seen it all before Bobby,

Let me spell it for you again Bobby since you were not able to understand it the first time.

What I said about open borders and illegal immigration and sanctuary state has EVERYTHING to do with high rents and high prices and overcrowding in SoCal. You did not get it even when I connected the dots for you.

This does not have anything to do with your ramble about Breimbart, God and atheism. There is not even a correlation, forget about causation.

With Landlord I disagree on lots of things but I did not attack him and he did not attack me based on “feelings” like the liberals do. Where we disagree we just “agree to disagree”.

Correction: SoCal Guy not Seen it before Bobby.

They sound the same and it is to confuse them.

I wish more people would understand this. Supply and Demand. Thousands are not leaving this state for those reasons above. Anywhere you go you have to sacrifice weather! I have been to many states and I would actually move to a few, but I still struggle with the climate in these states.

I am not sure if it been talked about, but many people affording these more expensive homes are just taking their own appreciation/equity to do so. So outside of a few hundred more in taxes, you can afford to buy a more expensive home, one you could not afford 2-3 years ago. (I am not saying this is a good idea, but I see it happending often here in socal)

Anecdotally, I would have a roommate no matter my financial situation, as I don’t want to live alone, I want to reduce my “footprint,” I want to save money, and I’m single. I own my own house in a major city and my roommate splits my mortgage with me.

While I am sure some of this doubling up is by necessity, I don’t think it is a bad thing.

Rather than “reduce your footprint”, how about we reduce the number of feet trampling everything? Would this perhaps be a reason to reduce/curtail legal and illegal immigration in to the USA? Is it something that can/should be done beyond our borders? (see Africa’s ticking population time bomb and get back to me…)

Tell that to our liberal/collectivists friends. According to them “multiculturalism”, “diversity” and open borders increase the standard of living of the middle class, make the available well paying jobs more abundant, make the environment less spoiled and those freeways bumper to bumper make everyone happier.

If you don’t believe me, ask Hillary and all those wearing the pussyhats. There are so much happier now for having CA a sanctuary state. As a result of the wise policies of their savior Obama, rents dropped significantly, house prices are less, medical insurance dropped significantly as a result of Obamacare and the student loans all decreased (that at the same time they paid the tuition for the “dreamers”). The reality does not matter. What counts is how they “feel” even if they end up sleeping in tents….sarc OFF

For those of you that think there is tons of equity and no demand (well qualified buyers); below is an email I just recveived from the agent that represented me on my purchase. It’s a copy/paste-

Hello Everyone.

I am reaching out because I need homes for my buyers. Inventory is low and I have 3 sets of buyer’s ready to purchase now! If you or anyone you know is thinking of selling, here are what my buyers are looking for:

Buyer 1 – looking to purchase a home in Dana Point/San Clemente area. Ocean view a must. 4+ bedrooms, pool, or backyard large enough to install one, bright and open floor plan. Well qualified buyer.

Buyer 2 – looking to purchase a 2 story SFR home in Lake Forest, Mission Viejo area, 3+ bedroom, 2.5+ bath, central a/c, attached garage, interior laundry, preferably hardwood floors.

Buyer 3 – looking for a 2 story SFR with a main floor bedroom and 3+ bedrooms upstairs, just about anywhere in Orange County. All cash buyers, 1800 sq. ft. minimum, turnkey.

I very much appreciate your help to spread the word. This year is expected to be a Seller’s market yet again, meaning very low inventory and a multitude of qualified buyers. Therefore, I am doing everything I can to ensure my clients have the best advantage possible

*Inventory not equity

“All cash buyers”

translation, Chinese money laundering…..and where is buyer #1 coming up with ~$3,000,000 in cash??? this is a fucking troll and here’s how I know it is.

https://www.zillow.com/dana-point-ca/ocean-view-_att/

71 houses for sale and this realtor has to send out an email? Give me a fucking break.

Realtor is trying to find an off market listing at a huge discount for their “buyer.” It is likely a realtor trying to collect a double commission as both the list and buy agent for both parties.

Her email did not indicate buyer #1 was all cash. Said “well qualified buyer” which means there is financing.