Serfdom nation: First time where a six year period of household formation of renters outpaced that of homeowners. Purchase applications back to levels last seen 20 years ago.

I think it is safe to say that investor activity in the housing market has changed the face of real estate buying. Back when the crisis hit in 2007, some analysts were cheerleading the hedge fund crowd as a tiny blip in the market. It is hard to call it a blip when 30 to 40 percent of all purchases are going to investors for close to half a decade. A recent analysis from RealtyTrac found that the estimated monthly home payment for a regular three bedroom home (costs include mortgage, insurance, taxes, maintenance, and subtracting the income tax benefit) rose an average of 21 percent from a year ago in 325 US counties. What about household incomes? That is another story. So it is no surprise that we are largely becoming a nation of renters. It is also no shocker that young households are largely unable to begin household formation via buying a home. Many are living with parents well into “young†adulthood. For the first time in history, we had a six year stretch where we added more renter households than that of actual homeowners.

Renter nation

Many large hedge funds and investors have already securitized large pools of single family homes and have created a monthly payout structure based on monthly rents. Returns so far are not looking fantastic since being a landlord is a slow churn business. The Wall Street crowd is accustomed to big wins via Google, Tesla, or Twitter and not a drip-drip leak that is provided from monthly rental payments. Keep in mind that with rentals, you have expenses via repairs, vacancies, and you are essentially capped on how much you can jack up rents by how much households actually earn since people pay rents out of monthly incomes, not heavily subsidized mortgage payments.

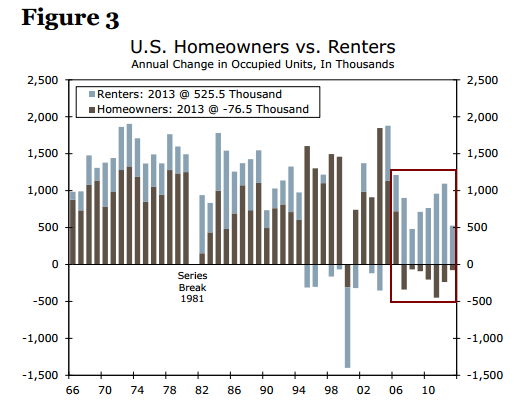

You would think that with rates still being low we would have been adding large numbers of households to the ownership column. The opposite has occurred:

Source:Â Wells Fargo

This is not your baby boomer housing market which many are accustomed to. In fact, you’ll notice that the period between 2006 to the present is very much an anomaly. We’ve been adding a boatload of renter households for six full years while the over 5,000,000+ foreclosed owners have shifted ownership back into the hands of the banking system. This is the first time a trend like this has occurred going back to data from 1966.

What is important to remember based on economic metrics is that the recession officially ended in the summer of 2009. We’ve been nearly half a decade in recovery and all we can muster is net adds of renter households? Is owning a home no longer part of the American dream? Not when you can’t afford to buy because you are being outbid by hedge funds leveraging cheap digital debt or your income is simply unable to swing the payment.

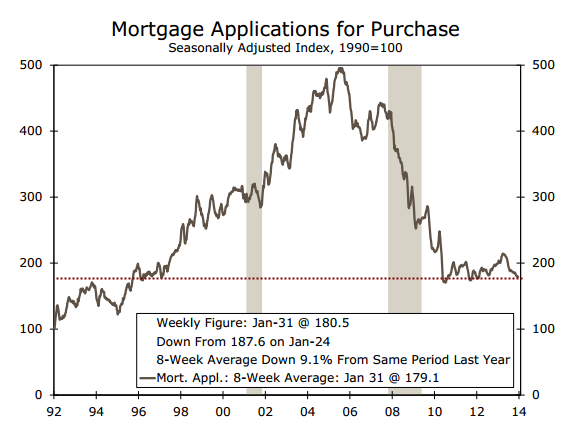

Purchase applications

The first chart should highlight the dramatic shift of adding renter households since 2006. It is also interesting to note that this trend started in 2006, not 2008 when the market went into full meltdown mode. Why? Because households were already broke going back prior to the official meltdown. The nucleus of the meltdown was households and banks using money they didn’t have to leverage into speculation. Households are paying the price while banks have mastered the churn business and are leveraging low rates for their own gain. You begin to scratch your head regarding the massive run-up in prices last year when you look at purchase applications:

Where is this demand to cause prices to go up? The demand is coming from controlled supply, banking demand for homes, and massive speculation. It certainly isn’t coming from households buying in mass. The chart above shows that purchase applications are essentially back to where they were 20 years ago. The difference? We’ve added 54,000,000 people since then.

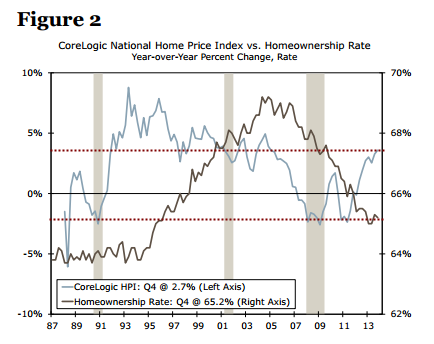

Homeownership

The homeownership rate peaked in 2006. This logically coincides with the jump in renter households starting around this period:

The current homeownership rate is the same as it was 20 years ago. We’ve done a good job cutting out young households from buying. Unfortunately there seems to be a myopic disregard of younger generations in the current economy. Rarely will someone admit it but the younger households of today are unlikely to have it as good as did the baby boomers.  The data backs this up. A common rebuttal to this revolves around all the goodies added by technological advancement. Sure, we all benefit from this, young and old. But you can’t live in an iPad or pay the grocery bill with your Facebook posts. Aside from a handful that can leverage technological gains, many others are left in the financial dust.

The middle class is simply shrinking in the US. This is a challenging reality. The “American Dream†of everyone owning a home may have been a baby boomer mantra but doesn’t seem to be the case since the early 2000s. Even the bubble of the 2000s was a delusional boom built on easy debt peppering over lost wages and a shrinking standard of living. In addition, not everyone should own but why subsidize big banks in purchasing single family homes by crushing real interest rates? There is absolutely nothing wrong with renting. In fact, this may make more sense for millions of households. Yet there is a massive propaganda machine for homeownership around the country that slowly nudges people into buying based on age and emotions rather than subtle personal economic circumstances.

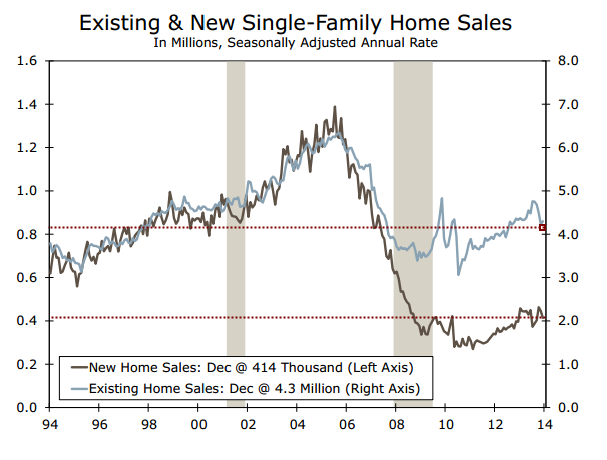

New home sales still extremely weak  Â

Another major divergence we are seeing is with new home sales. New home sales were always a big part of the “newly formed†household movement. Yet you need a steady tide of households to actually afford new homes that carry a premium in price. There has been a massive disconnect here going back to 2006 again:

New home sales remain incredibly weak. Investors are looking for lower priced deals for better cap rates. You don’t make solid money by purchasing a $250,000 new home and renting it out for $1,500.

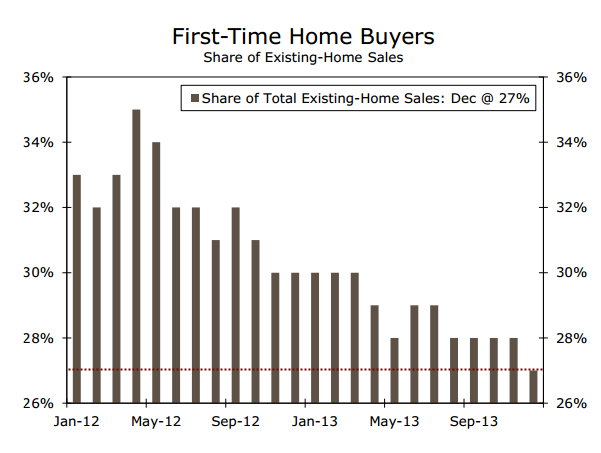

First time buyers shutout

Finally, the bread and butter of any healthy housing market is the first-time buyer. First-time buyers make up a remarkably small portion of the existing home sale market:

First-time buyers are typically young Americans. With $1.2 trillion in student debt and lower paying jobs, do you think the rise in home prices is a plus for this group? Ironically, government backed student debt is hovering around 6.8 percent while mortgages are cheaper at around 4.5 percent! Since the government owns both of these manipulated debt markets, they are essentially favoring housing over educating future generations which ultimately is a bigger asset to our nation. Instead, we rather finance a crappy World War II shack in Southern California with manipulated debt for up to $700,000 and allow others to lock in golden real estate handcuffs. These charts, if you looked at them without knowing the inside game of the Fed and banks, would lead you to believe that home values were falling or at best, stagnant. You wouldn’t expect to see one of the best annual increases in prices on record.

A few years ago when I mentioned that our economy was becoming more feudal in nature some readers felt this was farfetched. Those comments have slowly disappeared. Why? Because many people over these years have faced the repercussions of the massive number of big bank investor buyers either through being outbid, seeing prices re-inflate, or through a lack of inventory controlled by banks. What is certain is that we now have mega-landlords in this country and this trend continues as the overall homeownership rate dips. The fact that foreclosures recently surged tells you that something else is going on here. Given the above figures it is understandable why we’ve slowly shifted to a renter nation.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

115 Responses to “Serfdom nation: First time where a six year period of household formation of renters outpaced that of homeowners. Purchase applications back to levels last seen 20 years ago.”

thanks boomers (parents); you’ve totally fouled things up for us youngens (your kids). even those that actually save some money.

and this is how they messed everything up; again.

http://mhanson.com/archives/1546

I keep pointing out that much of boomer spending, personal and via debt and taxes, went to their children.

If you’re 22, odds are you’ve so far paid for nothing in your life. Free food, schooling, after school programs, housing, toys, gadgets. All of it paid for by parents, directly, or indirectly through debt and taxes.

That’s normal. Can’t expect children to pay for food or housing. But now it’s time to start putting back into the same system that nourished you.

that’s what parents are supposed to do, jesus. chris rock had something to say about this, but i’m sure he wasn’t directing it at a housing blog. you think kids should start saving their allowance to pay for their education? christ almighty, you boomers have the gall to bring garbage like this up. unbelievable. oh, and there’s over a trillion dollars in student loan debt. so i guess you boomers figured out a way to make us pay for everything. enjoy your retirement at 50 that you all expect us to pay for.

Gordon, I had SAID that it’s normal for parents to pay for their kids. Can’t you read?

I did NOT say that kids should pay for their upkeep while children.

I DID say that NOW that you’re an adult, it’s YOUR TURN to start paying into the system that nurtured you. That’s what adults do. So start paying up, Millennials.

BTW, who forced Millennials take out student loans to pay for useless degrees? Many could have gone to trade school, becoming a plumber or an electrician (two jobs that can’t be outsourced) and made a decent living.

great advice. let’s start putting back money into the system at a price 6 times income or more.

i’ll admit i’m very unhappy with an RE environment that is held together by massive QE and zirp; but don’t preach that i or anybody else should simply shutup about it and hand over our cash.

and the trade argument is just as bunk. a friend was in the elevator trade and then the bubble popped in 2009. he hasn’t been back to work in that trade since.

Thanks Gen y and Millennials; you’ve totally fouled things up for yourselves by voting for Obozo who totally has protected the TBTF New York bankers that were his biggest presidential campaign donors:

http://www.bloomberg.com/news/2012-03-20/jpmorgan-employees-join-goldman-sachs-among-top-obama-donors.html

http://www.rollingstone.com/politics/blogs/taibblog/obama-goes-all-out-for-dirty-banker-deal-20110824

Not one banker has been prosecuted by Obozo’s In-Justice Department!

Love your revisionist post. Although you have a case regarding Barry failing to prosecute, (would Bush have done anything different?), you are off base on everything else.

The bank bailouts were pretty much written in stone, along with GM ,BEFORE Barry became President.

hah, that’s rich! everyone knows Xers and Millenials don’t vote. blame the boomers again!

Gordon, why don’t millennials and Xers with their far superior tech skills and vast social networks do something about it? The internet is an incredibly powerful and democratizing tool. Stop complaining and scapegoating and start using your skills and demographic to change the law and the make-up of Congress, none of whom currently represent your interests. You know why? Because by and large, millenials and Xers don’t bother to vote.

We need to end QE. QE is socialism for the banks and the corporations. It needs to be stopped ASAP.

Overpriced housing is KILLING the economy. Americans are leveraged to the hilt for over-priced housing or are paying HUGE rents and have no money left over to support the consumer economy. Keeping housing costs inflated means the depression cannot end, and more American companies will go bankrupt because of it. And more Americans will continue to go bankrupt because of it.

Â

WE need lower housing prices and rent prices. Too large a % of earnings are going to finance overpriced housing.

Cut the housing prices in half, and we will begin to see the economy pick up.

I agree with that. But it’s almost to late. We really have ourselves in a mess with overpriced housing. If it tanks it hurts those who own and tax revenue if it stays the same or increases it hurts the SoCal job market as they can’t attract new talent for an affordable cost. Most likely it will just continue to bounce up and down.

Cutting prices to where they should be might cause major mayhem in the banking system at this point. They marked everything to make-believe, not to market. Marking things to where they should be would force illiquidity again. That said, I agree – 2-3x median income was the standard for nearly half a century.

I don’t think you’ll see a halving of the median in the larger metros and their suburbs but a third is VERY possible if not very PROBABLE. The FED is pushing on a string and they know it. Interest rates are going to rise in 2015 (check the most recent FED minutes) because they know that to continue the current course is suicide. The banking sector was saved, so QE accomplished it’s real goal of moving the toxic sludge away from the Wells, Chase, BofA and Citi. They know that wages are not rising anytime soon in this Global economy so they are trying to “manage” the deflation as best they can with bubbles here and there going forward so those in “The Big Club” can be spared losses. You’ve got it right though in that the deflationary process needs to resume so the economy can un-freeze. Most would say deflation would freeze the economy but we’re already frozen at the consumer level and the only way to free the consumer to spend is to lower his fixed costs as access to credit is tapped out. More debt creation at this point would only exacerbate the needed correction and the FED knows this.

I wonder if DRHB’s charts are strictly for California or the entire country. I think it’s the latter. In that case, it’s even more damning for California’s real estate market, given that housing prices are at a 2x or 3x multiple of the national average with no significantly greater income to support the purchase. (Unless you’re a typical fire righter making more than $200,000 a year, but I digress…)

Unfortunately, you still see buyers pull off the most foolhardy financial tricks I order to consummate a purchase at these nosebleed levels. I predict a slowly churning real estate market that may only deflate over time through inflation.

“I predict a slowly churning real estate market that may only deflate over time through inflation.”

I’m pretty sure that’s precisely what the Fed and the ECB would want to occur, but, unfortunately, inflation is not and will not take off as needed to effectively reduce this tremendous amount of debt the developed world is saddled with. They are doing everything in their power just to avoid deflation, and barely succeeding, except for certain assets, like equities and California RE. Looks like that may be the course we’re on for at least a decade or two, because there is no way wages will follow prices if inflation ever accelerates, with billions of third world workers on line and coming on line to suppress wages and other technologies like robots and the internet helping a lot.

“They are doing everything in their power just to avoid deflation, and barely succeeding, except for certain assets, like equities and California RE”

Their victory is going to be short lived. Think about the massive monetary (QE) and regulatory (suspension of mark to market) interventions of the last 6 years and all it has managed is a credit and stock bubble 90% of the populace knows is a sham (even if they are participating to their benefit) and Housing Bubble 2.0 based on the lowest volume of residential RE transaction in over 20 years.

It’s like the FED delivered a Superman monstrous right hook, and the economy’s jaw just jilted and it smirked back. I personally think Janet and company are pretty scared at this point.

Quote of the week. “It’s like the FED delivered a Superman monstrous right hook, and the economy’s jaw just jilted and it smirked back.”

I disagree that 90% of the populace knows it’s a sham. On this blog, certainly. But when I talk bearish about the housing market in social situations people either look at me like I’m nuts or their eyes glaze over.

I can go as far as “rents are too high compared to what people make” and get sympathetic nods, but discussion of purchase prices goes nowhere. Either people aren’t in the market and don’t understand the economics, or they own a home and are defensive about any suggestion their equity (if any) should drop.

I think one other factor that’s been contributing to the Real Estate market in California being propped is by the fact that the stock market is on an upward path. It’s basically two out of control wildfires feeding off of each other that are growing by the minute. The problem I see is that when all of the fuel (fools I mean investors buying either stocks or real estate) runs out both are going to collapse. We had a taste of it earlier this month with a 5% correction in the stock market and mortgage rates dropped. The bank loan officer I’m working with emailed me saying that rates for a 30 year Jumbo loan fell below 4% and were lower than a non-Jumbo loan during that week. As a lot of posters here will say the party boat is headed straight for an iceberg.

Wages won’t follow prices because they are flooding the labor market with cheap foreign labor. Amnesty for illegal aliens and more cheap labor visas are capping pay. I see food prices rising while labor rates slide or, at best, remain flat (if you are lucky enough to remain employed). One of the big growth areas in the economy is pest control. Cheap foreign workers are bringing in bedbugs and other disgusting vermin that are expensive to eliminate. Thank your local Chamber of Communists. Also, look for an increase in food prices with the drought and continued over-population. Food commodities look interesting here. Stay the heck away from real estate. Move home and live with Mom and Dad. It’s much smarter than paying the outrageous rents and mortgages.

So, Doc, after all we have been through over the past ten plus years, which you have documented so well, what is so wrong with “becoming a renter nation”? Hasn’t the problem been rooted in the fact that, for forty plus years, young adults were told that the first wise financial move in their lives was to “buy” a home, therefore creating the mania that produced, as you say, crappy WW2 homes going for 700,000? What’s so wrong with renting? One third of our population rents. I do. Most of Germany rents, and that’s the healthiest economy in Europe, maybe the western world. They’re not dealing with a mortgage crisis or zillions of foreclosures.

BTW, I wouldn’t conclude that the big bad evil hedge funds and PE firms are going to successfully become our feudal overlords with no bumps in the road. I could easily see that the whole business model of buying far flung single family homes of various vintages and expecting to make a profit from them made no sense at all, and the cube dwellers in Greenwich are finding that out, too, if they didn’t know it in the first place, and were just trying to pass it off on the muppets before someone found out:

http://www.nakedcapitalism.com/2014/02/rental-income-fall-7-6-three-months-blackstones-first-home-lease-securtization.html

Hello Doc

Recent LAT article echos your post.

http://www.latimes.com/business/money/la-fi-mo-rent-or-buy-20140220,0,6388101.story#axzz2txqlc1n9

It’s now cheaper to rent than own. Across a large swath of Southern California, owning a house has become less attractive financially in the wake of rapid home price gains last year, according to a new study.The mortgage payment on a median-priced, three-bedroom would exceed the rent on a comparable property in Los Angeles, Orange and Ventura counties, according to a RealtyTrac analysis released Thursday, based on prices from the fourth quarter of 2013.

Nationwide, there were only 29 large counties in that situation, including the Northern California counties of Santa Clara, Alameda and San Francisco. A year earlier, nowhere in Southern California was rent cheaper than monthly house payments. In Los Angeles County, RealtyTrac reported, the monthly house payment for a median-priced three-bedroom was $1,987 — about $100 more expensive than fair market rent for a similar property, as calculated by the U.S. Department of Housing and Urban Development.

A year earlier, house payments were about $500 a month cheaper than rent. The median price for a three-bedroom L.A. County house was $417,333 in the fourth quarter. The monthly house payment for such a home rose 40% compared with the fourth quarter of 2012.

To qualify to purchase such a house, a buyer would now need to make at least $95,389 annually, according to RealtyTrac. That’s about $42,000 more than the median-household income and $27,000 more than the income needed to buy the median house a year earlier.

The widening disparity between rent and home prices underscores a growing affordability crunch across the region. Real estate experts say the high costs, without corresponding income growth, have depressed sales.

“The cost of financed homeownership is becoming dangerously disconnected with still-stagnant median incomes,†RealtyTrac Vice President Daren Blomquist said in a statement.

Higher mortgage rates and swift price gains widened that gap, Blomquist said, attributing the steep price increases to “investors and other cash buyers who are not tethered to the typical affordability constraints.â€

In its analysis, RealtyTrac used median sales prices from the fourth quarter of 2013 and assumed buyers put 20% down and received a 30-year fixed mortgage at 4.46%. The monthly house payment includes principal, interest, property taxes and maintenance and insurance costs. Tax breaks for home owners were factored in. The potential for home price appreciation was not included in the analysis.

And take a look at this new loan for flippers, NO INCOME VERIFICATION has returned. I can say without a doubt the top has been hit and end is now near.

http://www.pr.com/press-release/541436

Stated Income Loan 90% LTV | Southern California Property Flippers BanCorp Realty

BanCorp Realty Offers: Orange County Stated Income Bridge Loan | Los Angeles County Stated Income Bridge Loan | San Bernardino County Stated Income Bridge Loan | San Diego County Stated Income Bridge Loan

Irvine, CA, February 09, 2014 –(PR.com)– BanCorp Real Estate Group is the first to release a 90% LTV, No Income Verification, No FICO Score Mortgage for Property Flippers in Southern California – From Los Angeles County to San Bernardino South to San Diego County. BanCorp Realty is presenting this perfect bridge loan to investors and property flippers with no junk fees and no prepayment penalties amortized over 30 or 40 years due in 12 months. This is an interest only rate loan with rates starting at 8.5% and there is no better financing source available on the open market for “Flip Investors.†The main underwriting criteria that BanCorp uses for this mortgage is a previous demonstrated track-record for flipping properties.

BanCorp Realty is one of the fastest growing real estate agencies in Southern California. To learn more about BanCorp Realty please visit them at BanCorp Realty.com. If a professional would like to join a winning team please visit the “Join BanCorp†section. Any professional coming on board with BanCorp Realty will have access to this financing and BanCorp projects that this funding source will run through Q4 2015 at this higher LTV limit. If there are Southern California real estate professionals with high integrity and they believe they would bring a value-added to BanCorp Realty, management would love to speak with them.

When a professional visits BanCorp’s website: BanCorpRealty.com a professional will quickly see that BanCorp is authentic and original and also master hybrid-viral marketers. BanCorp is in the process of developing and then building out its presence in South Orange County, and is aggressively seeking to secure high quality real estate professional in other selected regions/city’s/community’s in Southern California.

If a real estate professional would like to have access to this special mortgage/financing program or if they would simply like to join a dynamic real estate agency that is effecting change in each Southern California community that BanCorp operates in – contact BanCorp today (800) 936-BANC. BanCorp is audacious and is far more effective than other large National and Regional Real Estate companies. BanCorp Real Estate Group buys and sells Southern California real estate faster than anyone else – this is why BanCorp trademarked easier and fasterâ„¢. When BanCorp gets its clients in and out of the real estate transaction faster it allows them to start building short term equity and long term wealth faster – directly benefiting the client in the short and long term.

Program Highlights

· Up to $1mm

· Up to 90%

· Rates start at 8.5%

· 12 month term

· Amortized: 1/30 1/40

· No Fund Control for repairs

From the desk of CEO Greg Steinaker

Once I heard the ads on LA radio for RE Flip Seminars (using the actual dreaded “flip” term) I knew Housing Bubble 2.0 had already popped. We’re just waiting to see if the air comes out slowly or quickly. My bet is quickly and panic will have set in by early 2015.

Life goes in cycles, now is the cycle for feudalism. The “investors” fate will be the same as the Japanese when they bought so much California real estate that was overpriced, they lost big time way. Renting is in vogue amongst the young due to the job situation. A job is the most important thing amongst the young. It is the old folks, e.g. baby boomers(who have done well from real estate ownership), who have the mindset of owning real estate.

We live in interesting times. Enjoy the ride.

Yes, I remember when conversational Japanese language classes at the near by city college were packed with people racing to learn how to communicate with their future overlords. Books on Japanese etiquette where flying off the shelves of the local bookstore for all those wishing not to offend their future bosses. We actually had training at the first firm I worked at on how to work with Japanese clients. Something to do with how and when to present your business card. How long to look at it and when and how to place it in your pocket/purse. How and when to bow and how low. How quickly we forget…

As population becomes more renters than owners, juries become all tenants. Not good in eviction jury trials. Eg., Santa Monica juries are typically all tenants and they side with tenant litigants even when law and true facts favor landlord. Very easy for tenants to create prima facie case of uninhabitability. VEry expensive for landlord to go to trial. Tenants can always demand jury trial (most expensive) and those without money can often get fee and cost waivers, free legal aid from tenant rights groups and pro bono lawyers (usually they are tenants too — not enuf jobs for lawyers either). As tenant population continues to increase throughout So. Cal., more juries will be made up of mostly tenants. Not so great to be a landlord in Lost Angeles. Makes me wonder who in their right mind would buy-in to the rental securitization model as a source of wealth preservation? How long before investors who bought up all manner of “income” properties start to unload them even if it means selling at a loss…

Juries are the least of the problem. Renters will start voting renter’s bill of rights laws all over the country. This will be where the rubber hits the road.

The real problem with the “wealth preservation” investment is that it is being sold to fund managers that support YOUR pension fund/401k fund. I actually looked into our wealth preservation fund in 2009 at work and it was loaded with toxic MBS’s. I laughed my head off when I saw that. History really does have a way of repeating itself.

This level of investor participation in the SFR market has never been seen before and is likely to go on for a while as rentals are a pretty static investment. But they can be a hassle to manage and the returns are pretty static as well.

http://www.reuters.com/article/2014/02/21/us-usa-economy-housing-idUSBREA1K16J20140221

So far, Jim Taylor’s horse is looking to come out of the gate rather strong. It will be interesting to see what happens.

Thank you for the support

Jim, I don’t remember if I asked this question, or if you touched on the topic. But when you say that housing will tank hard this year, do you mean in Southern California, or in the entire nation?

In what areas/cities of the country do you expect housing prices to tank?

Nor Cal, So Cal, Las Vegas, Phoenix. Basically the same ones that burst last year and then shot back up last year. History repeats. Much of the country will be insulated if they kept their housing values at manageable levels.

There is nothing magical about my thoughts. I am simply looking at income and home prices across the nation. Much of the nation is at 5x income. But in California and the other boom towns we are seeing homes sell at much higher inflated levels.

Also let me go on record saying the Russell 2000 is going to be obliterated unless they increase QE back to 85b or more. If taper continues then this index will get crushed.

Two of the reasons us renters can’t afford to compete with the investors/rentiers is that a) we get outbid; and b) we can’t afford to reward them for buying and fixing up a house. For example, an “original condition†(but nothing major wrong) 3BR, 2BA house down the street from me (one of maybe 2-3 that have sold near me in Marin County in the last 6 months to a year…very low sales) listed for $600K, and got 6 “all cash†offers on the first day (according to the listing agent – I called him), eventually selling at about $650K. I could totally afford to buy at $650K and sink $150K or so into it to fix it up. That would put my total investment at about $800K, probably a little less. But when the “investor†fixes it up and tries to sell it for $985K or higher, I am priced out. I can’t afford to spend a million bucks on a house (nor would I, for a little crackerbox like this place). Plus, I have no assurance that they didn’t “hide†problems, like electrical issues, plumbing issues, etc. with all of the new drywall they installed. If I pulled the walls down to the studs, I’d get to see if it needs new plumbing, electrical, etc. So I won’t ever buy one that has been recently fixed up by someone else. And I can’t pay the flipper’s price when he/she is done remodeling. This is one of the biggest problems around me (and if they decide to rent after fixing it up, I can’t afford the $5K in rent either). My pay has not gone up more than 1-2 percent in 5 years. I can’t (well, WON’T) spend money I don’t have!

This really begs the question of sustainability. Keep in mind blert’s friend Steve Keen suggests that GDP = Income + Change in debt. Well, I think we can all agree that aggregate income is stagnant at best. Change in debt is not likely to increase as we are already at levels that actually slow economic growth. So, if a recession/depression is defined by stagnant or decreasing GDP (i.e. stagnant or decreasing (Income + increase in debt)) how do we avoid a recession or depression in the near future? Like I keep saying we are at a point where interest rate and loan terms are merely background noise. There really is very little wiggle room at this point…

GDP? Just came across this site today: http://wchildblog.com/2014/01/01/gdp-surprise-follows-major-calculation-change/comment-page-1/

I’m just north of you in Sonoma Co. and when I was still trying to buy in 2012 the problem was not being outbid $$$ wise, my bids were ignored on several houses as there were always cash offers to compete with. I’ve retired in the meantime and could pay cash now but houses are now up 100-150K in the last two years so I no longer want to buy and certainly won’t buy into a bubble.

When I was still looking I held my nose and actually bid on a flip as the location was excellent. but the sleazo flippers countered and attempted to force me to use their shady lender and title company. A few minutes on Google revealed that both provided terrible service and both had been fined millions by the feds for kickbacks, illegal payments, etc…on top of this the flippers wanted to fine ME $100/day if the deal did not close in 30 days using THEIR sleazy and incompetent service providers.

Am renting more or less happily in the meantime, may try to buy again after this bubble pops. I did own from 1997 to 2007 and enjoyed it, that also worked out really well financially as I sold for nearly triple what I paid…but I bought the house to live in, not as an investment and realize I’m not likely to see that sort of runup in my lifetime again.

Bluto, as a seller it is very smart putting a clause in the contract penalizing the buyer X dollars for every day escrow is delayed. Guess who pays for the delay if there is no such clause? The seller. When you factor in the mortgage, property taxes, insurance, maintenance, upkeep, moving delays, all the paperwork hassles…$100/day isn’t much.

If you don’t think you can get everything done with a 30 day escrow, don’t agree to it. I would recommend 45 days to anybody, there are simply many things to do and many people to rely on in a short period of time. A 30 day escrow can get delayed VERY easily.

You completely missed the point…the providers the flippers attempted to force me to use both were unethical and incompetent so the odds of closing being delayed were high and it was obvious that the flippers were getting some sort of kickback from both…I do understand that time is of the essence in business but when the seller attempts to force the use of incompetent title and mortgage companies the buyer should not be penalized if the deal does not close in time (as closing in 30 days requires everything to go right). There is no way in hell I would agree to that and the counter offer made it very clear that I was dealing with some really slimy people so I backed out. I have bought and sold a house before so I have some experience with how it is supposed to work…

Bluto, you are correct. If the seller was forcing the timeline AND all the entities involved (likely subpar), it would likely take a miracle to close on time.

Our posts may be of value to a first time buyer. There is simply a mountain of things to do in a short period of time when buying a house.

“Plus, I have no assurance that they didn’t “hide†problems, like electrical issues, plumbing issues, etc. with all of the new drywall they installed. If I pulled the walls down to the studs, I’d get to see if it needs new plumbing, electrical, etc. So I won’t ever buy one that has been recently fixed up by someone else.”

^^^

Exactly why I will no longer consider buying a flip. The flipper properties that I have looked at have all been resurfacing jobs using new, but shoddy materials that won’t last long. Even in higher priced homes, what I’ve often seen ignored or hidden about these places makes me even more determined to avoid them. Cracked slabs, roof issues, dangerous electrical… it’s as if typical buyers are mesmerized by low grade granite and wood product flooring to the point that the condition of the rest of the house is ignored.

The last one I looked at by a big “professional” flipping group was so bad that it made my realtor facepalm.

Here’s an interesting flip in Santa Monica, right near the freeway, in the poorer Pico neighborhood: http://www.redfin.com/CA/Santa-Monica/2128-Delaware-Ave-90404/home/6767275

Sold for $640,000 on Dec 31, 2013.

Sold LESS THAN ONE MONTH LATER — for $869,000 on Jan 24, 2014.

If you Google the location, you’ll see how crappy the house looked before its remodel. I also saw photos of it when it was listed at $640,000. It looked in really BAD shape.

I wonder, just how much remodeling can be done in under a month? Enough for a $229,000 markup?

That fence is new. Big whoop.

I hope you guys honestly don’t think flippers will be the only ones to “hide” problems. Your standard organic seller will too. If somebody wants to sell their house, the last thing they will do is spend 10K having it repiped or rewired just for you…they just want out. Yes, sellers need to state disclosures; however, legally enforcing any of these disclosures is almost impossible. They’ll just plead ignorance.

When buying any home (whether from a flipper, standard seller) you need a top notch home inspector. All inspectors will caveat that there some things they simply can’t “look at or vouch for” like things hidden behind walls. A good inspector should be able to piece things together if there are serious problems.

Speaking of home inspectors. When I purchased a home in 2012, I hired 4 different inspectors: 1) general home inspector. He did a wonderful job of pointing out all the nitty gritty details of the home (but no major flaws) Part of his job is to present a case that will make the seller feel that some work needs to be done. 2) sewer inspector – he found a broken sewer line under the front yard which the seller spent about $5K fixing immediately. 3) chimney inspector. I hired the chimney inspector because I intended to use the fireplace and many LA homes have cracked chimneys along with ceiling or roof lines and are unsafe for burning wood. The chimney was in excellent condition. 4) due to my allergies, I hired mold inspector. There was no mold in the home but because the raingutters were not dumping water far from the home, there was a little moisture in the 4 corners of the house where the raingutters are positioned. This was cured by moving the raingutter dumps a few feet further from the home. There are other inspectors that I decided not to hire: some people esp. in California and especially for older homes should consider a foundation inspector for weak or cracks from all the earthquakes. However, the general inspector went under the house and took photos of a well designed foundation and since the house was built in 1952 it was at a time when contractors had already beefed up foundations compared to homes built in the 20’s and 30’s. Lastly I could have hired a electromagnetic / geopathic inspector but since the home is not close to high voltage lines or transformers, I felt it was not necessary. Anyway, when I purchased my home there was a flurry of offers on the home, but since my offer asked for only 5 working days for inspections, I did not have a problem with the seller. I heard about buyers waiving inspections but as an engineer myself, I would never make that financial risk.

Marin’s nice, but not as special a place as most Marinites constantly say. Lived there for a while, and it’s not for everybody. $1 million for a very modest small house is absurd. A lot of properties there are also super inconvenient – long drive to grocery and other basic shopping, and the strange looping exits and entrances onto the freeway all over Marin.

Ah the good Doctor astute as always. The whole world is a circus casino. The middle class a shrinking demograph to be feed upon. The tech progress is the nothing, that furthur encases the masses in consummer oblivion. Oh how I wish my beautiful children wouldn’t be subject to a plutocracy i-nothing society. Thankfully I can take heart because he has overcome the world.

Just now on CNBC, Santelli Report, finally heard recognition that the emperor has no clothes. Saying everything the Doc, and we, are saying here. Current housing market is “bifurcated” and stats about who is buying were given. Investors making up most of the market, little guy squeezed out. This is the first time I’ve heard mainstream saying this, stating housing prices have gotta drop, banks have gotta start clearing those old foreclosures, etc. Don’t know what effect will, be, but finally hearing the truth spoken on “those shows” and them acknowledging that something’s gotta give, must mean it’s finally about to pop. Fine with me. I just got pre-approved for 3.5% 400K 15 year loan so I’m good to go to North San Diego. Wish me luck since I will be starting to look seriously in April.

Mr Santelli will go the the way of the failed cosmonauts of the USSR. He will be removed from all history, photos will be altered it will be as if he never existed… He will be replaced with a 20 something blonde with large chemical balls implanted in her chest area so that you never look in her eyes when she speaks. This makes it easier for the lies to get past the average viewer. Otherwise, you would see it in their eyes that even they know what they are saying is ridiculous… “Up next, the polar vortex strikes again causing upheaval in the Ukraine, stay tuned”…

Har! Right you are, What.

Oddly, in my very desirable city I’m am starting to see rents return to lower levels. We have seen a lot of increases in the last few years, I was shocked when I was looking to move last year.

Since then I’ve increasingly seen rents fall back in line with local income and those who stubbornly try to charge $1250/mo for a 400 sq ft studio sit empty.

Bay Area Renter…you’re dead right. This is exactly what I’m seeing…homes that I would be able to afford to buy and fix that I can’t buy because I get outbid by investors. They turn around and put the cheapest possible upgrades in and mark up it by a nifty 150k. I can’t, and wont, pay for their idea of upgrades, which usually include the typical Home Depot grade granite and stainless kitchen and a host of other cheap fixes. I’m not trying to flip a house, just to buy something to fix up for myself and live in long term. That seems to be near impossible these days. In the meantime, I see lots of those quick fix houses sitting empty…and they’re likely to stay that way at current prices. I won’t go near them, and apparently I’m not alone.

Well said! And as Bay Area Renter said, you don’t know what is hidden behind the walls. Not only are the upgrades low grade, they also have no style…conservative look and beige for days.

Amen!

If only more of us didn’t buy into their little scheme. We’re down in north San Diego county and have actually seen several homes get purchased, and re-listed for 100-150k just a couple/few months later, WITHOUT them even doing the home depot facelift. Exactly the same condition they bought it in.

With the junky upgrades they often are asking 200-250k more.

Not sure if that signals the investors are starting to see the writing on the wall and turn their get rich quick scheme into an even quicker scheme with less risk of putting money into it and taking more time to flip/risking the market down turn???

Existing-home-sales slowest in more than a year:

http://www.marketwatch.com/story/existing-home-sales-slowest-in-more-than-a-year-2014-02-21

There are so many factors that go into owning vs renting that it’s not as easy as saying “it’s cheaper to do this rather than that”. Even if there is a premium for buying a home, everyone must make the individual decision based on their own factors to determine if that premium is worth paying. You cannot use the contradictory logic that you shouldn’t treat homes as an investment and then also say that they’re in a bubble, so don’t buy. If homes are not an investment, then it shouldn’t matter how their prices relate to historical trends. Instead the purchase should be made based on whether you can afford it, and whether the item fulfills your needs (whatever they may be).

You sound a little shill/shrill to me but I’ll bite. Math is math. There is no way around the numbers from a finance perspective. So, I would argue as even LB has argued to “run the numbers first”. There is quite a bit of debate on what “numbers” to run but I think we all agree to run numbers. As you suggest the numbers should never to the final decision point. The numbers should definitely be the first step in the overly emotional decision to purchase home. As an honest finance person I would suggest that a home should always be viewed as consumption not investment. In reality it is a depreciating asset sitting on top of non depreciating lump of dirt. The mix up is that even with this understanding we should never buy an asset that we will get stuck underwater in, because that would make it even more of a liability than it was in the first place. The hope when buying a depreciating asset is that the salvage value will be equal to the price minus the useful value you received while holding the asset. This brings us back to the numbers question. If you include asset inflation/deflation in your equation it will defiantly have an impact on the outcome. The elephant in the room is that we now expect average joe home purchasers to include asset speculation into the equation. This can not end well as predicting the future appears to be impossible for the “experts†the average joe will most likely get it wrong, really wrong…

“definitely” not “defiantly” although they might be interchangeable in this context…

f’ing spell check…

Actually, my comment was not directed at you specifically, but rather to the readers of this site in general. Your assessment of the numbers that go into this asset purchase is sound. However, I will argue against one aspect: the notion that we also must include asset speculation into our decision making criteria. As you’ve already stated, no one can predict the future, and as a result to even attempt to include this in the decision making is unnecessary, futile and somewhat irrational. All I know is that a home purchase will provide me with certain attributes at a certain price. If I’m willing to pay that price, I shouldn’t be worrying about things that are unknowable (especially if we are talking 30, 20, 15, even 10 years from now).

I was directing my comment at the same audience as you. The reality is that we have no choice but to become asset speculators when we purchase a home. The current market is almost all speculators of one flavor or another. My point is very simple. The average stay in a home is seven years. You assume that someone buys a home with a 30 year mortgage and stays for the rest of their lives. This is actually pretty rare. The reason that we must be speculators as home buyers is because the principal value of the home can drop faster than the principal pay off of the loan. I know many folks who are still in this condition. This then becomes a liability both financially and emotionally. You are now trapped by your financial decision and your options are hindered. On the other hand your property value could go up and you could take that increase and use it open up other options. There is no way around becoming an asset speculator in the current housing bubble/market.

I agree with What on this one. If this were the job market of the 50s where you got a job and kept it til retirement, you can value a house in the same fashion.

But that’s not how modern employment works. Most of us can’t count on faithful employers, not to mention if you really want to ‘get ahead’ you often have to change firms, or accept transfers, etc.

The risk that a house might not be viable to resell (either b/c of significant loss of equity or dead markets) in a mid-term time horizon is a very significant ‘cost.’ The possibility of cashing out at a gain is a nice bonus, but it’s really the downside risk you have to consider most, particularly if you’re buying at 4-5-6-10 times salary and going to be heavily leveraged.

Good food for thought. Most here are Kiwasakists in thinking of our own SFR not as an asset these days, but just a place to live on our own terms. When 30% of homes are purchased by investors, however, it’s hard to argue that smart money doesn’t see the investment potential.

Others have brought up the “forced savings” of buying a home as a legitimate factor to consider, especially in this uber-low APR environment, and with the missing savings gene with most Americans.

It’s hard to ignore that near-prime and prime real estate in Southern California has rewarded buyers handsomely over the past 50 years.

The sheer amount of leverage available to the average Joe is unmatched in any other purchase…putting only 3-20% of your own money into a vehicle that returns 5% or 10% per year, for example, is an awesome appreciation on that money.

I think the “bubble” concern is people don’t want to over-pay. Period.

I think not. It is not the amazing investment potential, which was surely greater in 1997 when prices were half what they are today. So where were investors then? Chasing better investments. Because there are no sound investments in the era of financial repression does not mean that equities and RE simply because they are going up – they are merely the “least dirty shirts”.

Like the Japanese in the 80s, these guys are sitting on a huge board of cash in a low interest rate environment, and they can’t figure out what to do with it. So they overpay, and they do so knowingly. Why??? Because unlike the Japanese, they know who the sucker at the table is. It’s thosr who will invest in their rental securitizations ant REO to Rental IPOs. That those investors are going to get creamed is already a demonstrable fact.

“…it’s hard to argue that smart money doesn’t see the investment potential.”

Let’s not get ahead of ourselves – we’ll see how “smart” this money is in due time.

“Others have brought up the “forced savings†of buying a home as a legitimate factor to consider, especially in this uber-low APR environment, and with the missing savings gene with most Americans.”

Why does this statement remind me of those who view giving the government interest free float in order to get a “surprise” refund once a year as a “forced savings” plan?

“It’s hard to ignore that near-prime and prime real estate in Southern California has rewarded buyers handsomely over the past 50 years.”

I would be hard to ignore if it were true for all situations. It all depends on when one gets in and gets out. Ask those that bought (yes, even in prime areas) high and sold low how “handsomely” rewarded they feel? Believe it or not, RE price levels move in two directions, even in “prime” SoCal. You don’t always get to choose when to get out and that’s why choosing when to get in is important…. which leads to why most of us are here.

“The sheer amount of leverage available to the average Joe is unmatched in any other purchase…putting only 3-20% of your own money into a vehicle that returns 5% or 10% per year, for example, is an awesome appreciation on that money.”

We are considering real return after factoring inflation and expenses, right?

“I think the “bubble†concern is people don’t want to over-pay. Period.”

Well, duh.

“…it’s hard to argue that smart money doesn’t see the investment potential.â€

Let’s not get ahead of ourselves – we’ll see how “smart†this money is in due time.

* * Recommend you read DHB’s post. We’re in a feudal cycle. Lord of manor win. Serf loses.

“Others have brought up the “forced savings†of buying a home as a legitimate factor to consider, especially in this uber-low APR environment, and with the missing savings gene with most Americans.â€

Why does this statement remind me of those who view giving the government interest free float in order to get a “surprise†refund once a year as a “forced savings†plan?

* * Why ignore the real point? Low interest rates = faster principal pay-down. And, for most Americans, due to poor savings habits, their home is their biggest asset.

“It’s hard to ignore that near-prime and prime real estate in Southern California has rewarded buyers handsomely over the past 50 years.â€

I would be hard to ignore if it were true for all situations. It all depends on when one gets in and gets out. Ask those that bought (yes, even in prime areas) high and sold low how “handsomely†rewarded they feel? Believe it or not, RE price levels move in two directions, even in “prime†SoCal. You don’t always get to choose when to get out and that’s why choosing when to get in is important…. which leads to why most of us are here.

* * Ha! World-class “duh.” Prime SoCal is boom/bust, thanks for that. But, it has AWAYS boomed higher (still waiting on the class of 2006-07, suppose). But, go ahead and take a long-time short position on prime SoCal real estate.

“The sheer amount of leverage available to the average Joe is unmatched in any other purchase…putting only 3-20% of your own money into a vehicle that returns 5% or 10% per year, for example, is an awesome appreciation on that money.â€

We are considering real return after factoring inflation and expenses, right?

* * Inflation? Did you really think that through? And yes, including expenses. You gotta live somewhere. If it’s not you replacing your roof it’s your landlord raising your rent to do so.

“I think the “bubble†concern is people don’t want to over-pay. Period.â€

Well, duh.

* * Not everyone on this board is considering we’re in a bubble when they buy. That’s one reason for the rich debate here. Investors aren’t…they see relative ROI. Chinese buyers aren’t…they have a host of particular reasons. And, take Lord B…he could care less. He bought because of opportunity costs and rental parity, and, wow, he actually wants to live here.

Anon, from the last few decades of socal RE history, hindsight has shown that timing your entry point is key. Sometimes this is just dumb luck, other times the numbers scream BUY. That was the case a few years ago and many people were caught unprepared…as we saw the opportunity window closed very quickly.

Regarding viewing buying as forced savings. Most of the ham and eggers out there can’t rub two dimes together. To these people, paying $1000/month toward mortgage principal is a huge accomplishment. After 10 or 15 years, that forced savings account looks pretty good. Any home appreciation is just icing on the cake after that.

One other thing I keep hearing on this blog is that you don’t profit from your house until it is sold. I call BS there. You can always cashout refi and then use this money as a down payment for a move up home and rented out their first home. I personally know of several people who have done this in the South Bay. This is your competition that can easily come up with a 200K down payment…one more benefit of being a homeowner.

DFresh has it right. Feudal Lords: 1. Serfs: 0.

Dfresh/Anon:

Dfresh-you should be walking around with one of those big sandwich boards that says “Go All-in California at any Cost!” LordB will go halvsies on it so you can save some money.

If you don’t smell a top or near top, I don’t know what to tell you. Every warning sign is flashing in front of your eyes today, but you’ll find anecdotal stories to keep the dream alive. Next you’ll tell me doctcom 2.0 is not bursting soon too bc things are different this time with tech stocks. There is a line of shittier companies than whatspp about to try and tap the IPO markets and they likely will. That should help hasten the decline too.

On “smart money” always winning. Anon is correct. Smart money doesnt always win (maybe they do with a govt handout) and the smartest money securitizes their sht and passes off the risk. Smart money, btw, is only the top banks and top funds (usually). Its not all banks and all funds. Glad you think that these owners will just keep being able to raise rents forever (in a market which they don’t own 100% of so outside pressures lurk) and handle their maintenance from 1000 miles away. That’s what the model requires. All you hear is people having trouble making rent/mortgage payments at this level, but sure, they’ll keep going up every year with minimal property damage.

Drfresh: “Why ignore the real point? Low interest rates = faster principal pay-down.”

–Even though my mortgage is at 3.5%, you sure as hell dont pay 3.5% interest during the first half of the loan. banks arent stupid. They know you’re going to live in that home like 3-10 years so interest is completely frontloaded on a mortgage. On my a tad under $2500 mortgage, over $1600 of each payment goes toward interest. since your rate is only 3.5% the incentive is actually not to pay down additional principal and to either keep it safe in cash (and deal with the negatives that go with that) or invest elsewhere.

Dfresh; “But, it has AWAYS boomed higher (still waiting on the class of 2006-07, suppose). But, go ahead and take a long-time short position on prime SoCal real estate.”

—so you admit you are still waiting on the 2006/2007 people who bought to be overwater. Me too bc thats when I know a lot of people that bought in prime areas and they are still down. Thats right, Cali prome areas purchased 7-8 years ago is still underwater. Tack on selling costs and these people are REALLY underwater. Now, if housing tanks again, they may be underwater for a LONG time. who’s to say the next down (coming to a neighborhood to you soon enough), doesnt take 06/07 buyers down further and 10/11/12/13 and 14 buyers underwater too? Basically, your comment at the height of a bubble is bs Drfesh. Shoudnt we see the next bust to see how well people are doing, especially considering QE is the only thing that saved cali housing/brought people out of being underwater (not fundamentals). No one said to take a short position, but why rush and either buy (1) an overpriced pile of junk with a defective slab, etc or (2) an overpriced flip that you KNOW they put in $50k tops yet want $200k more take a long one. (1) and (2) is 90% of whats out there for anyone that was looking in a halfway decent neighborhood.

“The sheer amount of leverage available to the average Joe is unmatched in any other purchase…putting only 3-20% of your own money into a vehicle that returns 5% or 10% per year, for example, is an awesome appreciation on that money.â€

—or you lever up for a depreciating asset and are stuck in it and every principal payment you make is throwing good money on bad. Kinda depends on which way the speculative asset, that is somewhat illiquid with high sales costs, you just purchased goes. If you think Cali real estate is going up 5-10% every year going forward, you should buy as much ca real estate as possible, even if only to rent out. Why comment here? You should be home shopping!!

“If it’s not you replacing your roof it’s your landlord raising your rent to do so.”–not true at all. Rents are not dictated by a landlords costs even though landlords would like this. Rents are dictated by a big world of supply n demand. If no one else is raising rents in the neighborhood or raising them by 2%, I dont think Joe landlord will be able to pass off a $20k roof that easily. Besides the landlord has insurance floor the roof and will write-off the costs. If anything, the destroyed roof would give the tenant and out of his lease and possibly pay less per month due to the inconvenience.

IT IS NOT 2010 or 2011, its 2014, Dfresh. The economics have changed significantly over the past few years. higher home prices mixed with higher mortgage rates have made houses TOO expensive. “Investors aren’t…they see relative ROI.”…not really anymore. “Chinese buyers aren’t…they have a host of particular reasons.” if their reason isnt the same as the average person buying here (DONT LOSE MONEY!!), why would I care their reason for my home purchase? “And, take Lord B…he could care less. He bought because of opportunity costs and rental parity, and, wow, he actually wants to live here.” Even LordB wouldnt buy today from how I read his comments. He always talks about his purchase YEARS ago.

FTB/Anon,

Don’t mistake me for a raging bull. I bought in 98 and sold in 05 (doubled) because I smelled a bubble. I made an “emotional buy” in 05 (long story) and sold again in 07 (wash, but lost on transaction costs even tough I used now-defunct Help-U-Selll @ 2%).

I think we all do a bit of cheerleading on this board depending on your circumstances and time-frames.

I have a sweet deal on a 2/1 SFR in Torrance at $1,600/month. It’s enough for me and my two elementary school-age kids. Stable LL.

We all make economic calls here….that’s the fun part of the game. I’ve presented my case for why we’re in a long-term Manhattanization period in prime and gentrifying SoCal where there’s no looking back (only brief ~5% dips followed by larger gains).

I simply won’t stretch myself to buy in my neighborhood right now:

A) I’m single and want to be flexible

B) Sweet rental

C) These prices are irrational….for me

So, I’d love nothing more than to see a 15-30% drop in the South Bay. I’m building my war chest for that unlikely event, because I believe in my bounce-back thesis.

BTW history never repeats itself exactly the same. Many of the bubble tech companies of yore (Cisco, Intel, Apple, IBM) are actually screaming buys these days and I’m happily dollar-cost averaging. As for FB, Twitter, et al? Meh, who cares? I’m not buying indexes.

– On smart money…

It’s only “smart” in hindsight.

– On forced savings…

Fresh wrote “Why ignore the real point? Low interest rates = faster principal pay-down. And, for most Americans, due to poor savings habits, their home is their biggest asset.”

If that was the real point, then why not state that from the get-go? “due to poor savings habits” supports what I mentioned, which is that it’s similar to looking at tax refunds as a desirable method to accumulate savings.

– On SoCal rewards…

Fresh wrote:

“It’s hard to ignore that near-prime and prime real estate in Southern California has rewarded buyers handsomely over the past 50 years.â€

Then followed-up to my response that points out it’s not quite so simple with:

* * Ha! World-class “duh.†Prime SoCal is boom/bust, thanks for that. But, it has AWAYS boomed higher (still waiting on the class of 2006-07, suppose). But, go ahead and take a long-time short position on prime SoCal real estate.

This supports my point. First, define “long-time” and then let us know how realistic it will be for most people to stay in one house for that time period.

– On 5%-10% annual returns…

Fresh stated:

“The sheer amount of leverage available to the average Joe is unmatched in any other purchase…putting only 3-20% of your own money into a vehicle that returns 5% or 10% per year, for example, is an awesome appreciation on that money.â€

I wrote:

We are considering real return after factoring inflation and expenses, right?

Fresh responds:

* * Inflation? Did you really think that through? And yes, including expenses. You gotta live somewhere. If it’s not you replacing your roof it’s your landlord raising your rent to do so.

Considering that housing has traditionally tracked inflation, I’ve no idea where the 5-10% figures are coming from.

Furthermore, if Fresh had any sufficient experience at landlording, he would know that the market determines the rent level, not the landlord’s expenses.

– On the bubble…

“I think the “bubble†concern is people don’t want to over-pay. Period.â€

Well, duh.

* * Not everyone on this board is considering we’re in a bubble when they buy. That’s one reason for the rich debate here. Investors aren’t…they see relative ROI. Chinese buyers aren’t…they have a host of particular reasons. And, take Lord B…he could care less. He bought because of opportunity costs and rental parity, and, wow, he actually wants to live here.

Bubble is in the name of the blog, is it not? “rich” debate? I don’t know how “rich” we can consider the recycling of talking points such as “you gotta live somewhere” among the many.

FTB – I completely agree with your conclusion but I have a couple of observations to add.

I “smell a top†as well but I would argue that predicting the top is really not possible in a world economy with so many moving parts. I would say that as we continue on a path of divergence of income to housing the greater the likelihood of a major correction. I don’t think anyone in 2008/2009 would have predicted 2013 accurately. If they did we would have laughed at them.

I believe history has proven that the only smart money in the world is not the asset speculators rather they are the folks who charge fees for transactions. The ones that come to mind would be loan originators, fund managers, brokers, refinancers, RE agents, etc. They are the true lords of taking money off the table…

The reason interest appears to be front loaded in monthly payments is not because bankers are smart it is because of basic math. The interest is charged each month on the outstanding loan balance. The fixed monthly payment is backed into by taking the loan amount, number of payments and the interest rate. So as the loan balance goes down the amount of interest paid in your fixed monthly payment goes down. The other option would be to have a fixed principle pay down and interest will make your initial payments significantly higher then your last payment. The real increase in cost is the loss of mortgage interest write-off as the amount of interest in your monthly fixed payments goes down. I have never seen someone run the numbers with this in mind.

The real problem with Dfresh’s comment “ALWAYS boomed higher†is that there is a difference between nominal and real. That is like saying the cost of pickles have always boomed. Not really. Most charts actually show real estate in real terms have moved with inflation until around 1987 and the big change in this period was the growth of public debt. That is what explains the ever higher real estate market growth in real terms… How sustainable is increased values based on increasing public debt levels? I would argue that the average Joe’s leverage is pretty maxed out. I agree that for those who bought a home with the small fixed payment are making out like bandits now. I think the wrong conclusion would be to believe that this will always be the case going forward. Remember Japan has been printing to high heaven and there is no inflation to be found. Printing does not always lead to inflating your problems away.

The rent always increasing is the funniest argument of them all. Aggregate rent in real terms must keep in line with income. Unlike housing where leverage can make up the difference between income and price, you pay rent from your paycheck. Rent crowding out other consumption will cause an economic slowdown which will actually lay the foundation for the next recession/depression. There is not a whole lot of GDP growth in increasing rent on existing housing.

At the end of the day we have now come to the point where we now must include currency inflation, currency deflation, asset speculation, asset bubble, asset deflation, asset inflation, job market, etc. in our decision to purchase a home. This is why we are all losing our minds. We are asking ourselves to predict the future better than the “experts†who have a horrible track record. The stakes are so high at this point that one signature can have the most significant impact to your future well being. One of the biggest decisions in your life has become significantly bigger. Financial ruin is in the balance. Choose wisely…

LB writes:

“One other thing I keep hearing on this blog is that you don’t profit from your house until it is sold. I call BS there. You can always cashout refi and then use this money as a down payment for a move up home and rented out their first home. I personally know of several people who have done this in the South Bay. This is your competition that can easily come up with a 200K down payment…one more benefit of being a homeowner.

DFresh has it right. Feudal Lords: 1. Serfs: 0.”

What’s left out is a very important key word: lock-in

It’s lock-in profit… as in lock-in a profit when you sell. I always make this important distinction when stating the point.

Leveraging equity is not locking-in a profit. You’re still liable for any potential loss that could mitigate any leveraged advantage. When you sell and a net profit is realized, the liability is gone.

There’s no BS to call.

Beating a dead horse, I know, however…

Fresh wrote “* * Not everyone on this board is considering we’re in a bubble when they buy. That’s one reason for the rich debate here. Investors aren’t…they see relative ROI. Chinese buyers aren’t…they have a host of particular reasons.”

It’s noteworthy that Chinese buyers are brought up. Theories are abound as to the motivations that are making Chinese buyers so active. Fresh states that they have “a host of particular reasons.” As far as I know, no one knows for sure what the aggregates are in terms of said motivations. I can’t help but wonder how many of them are making pure speculative plays.

If indeed the Chinese buying activity is driven mostly by speculation, I submit that Fresh’s point on the Chinese buyer is ominously ironic. Something tells me there will be no legislation to protect those who do not get out in time. It would be quite the fantastic “accident” for those repatriated dollars to be destroyed in such a way.

What? stated “The stakes are so high at this point that one signature can have the most significant impact to your future well being. One of the biggest decisions in your life has become significantly bigger.”

This is why those with the most to gain in housing try preempt rational perspective with counterpoints such as “buy now or be priced out forever” which is really a shrewd ploy to persuade potential purchasers into making quick decisions. They don’t want there to be questioning as it impacts the status quo that benefits them most.

It dovetails into why I think it’s important to question why any housing “cheerleaders” are even on this blog commenting. They’ll respond that they’re simply here to debate housing. I suspect that there’s more to it than that. I’ll even go as far to surmise that they subconsciously know something isn’t right and that by arguing with us, they are really arguing with themselves on some perverse level.

Anon, I think you are confusing “profit” with “locking in a profit.” If you can rent out that first house and it puts money into your pocket every month…you are profiting from here on out. Sure there are uncertainties with everything; however, collecting steady rent in a near prime socal area from here on out shouldn’t be one.

“Anon, I think you are confusing “profit†with “locking in a profit.†If you can rent out that first house and it puts money into your pocket every month…you are profiting from here on out. Sure there are uncertainties with everything; however, collecting steady rent in a near prime socal area from here on out shouldn’t be one.”

You continue to obfuscate. I’m not confusing anything.

Homes are not an investment for a single family home owner. Unlike a landlord you cannot write off maintenance costs or depreciation.

In most cases homes are a money pit and is a place to live. Me, like some of my neighbors have seen my property value increase from 185k to 225k over the past 15 years. Nice but I have kept track of 15 years of maintenance and repairs (which are not tax deductions) total 50k. Now when I sell I guess I will not have to pay cap gains so the $40k gain is tax free. But I am 10k in the hole via repairs and maintenance. Seems like a wash.

rsu82,

We’ll have none of your “it’s just a house” talk on our “fear and loathing in Los Angeles” RE blog! Here we all wanna buy smart and get rich, b!tch!

This. It’s the inconvenient truth of home ownership that a powerful lobby works hard at obfuscating. It’s not that ownership is necessarily better or worse than renting, it’s that when one is being honest about how it typically pans out for most people in most situations, there’s no free ride with either choice.

Forget the distracting bulls vs bears, owners vs renters, etc hyperbolic bullshit distractions that the benefitting entities are always hurling.

The issue with rent vs buy equation everyone is talking about…

To buy it would have cost me about $2700 (after tax savings) in a place I am renting for $1600. So I save $1100 month.

So in the past 5 years…I saved $1100 * 60 = 66,000.

But the home has gone up in value by $200,000.

So the true cost of not buying as based on today’s numbers was $200K-$66K=$134,000

Seems like investing the extra $1100 into buying had a better leveraged return than he 0.5% bank interest.

Nice Sean, I bet you love the renters, will great folks to know, have you check on your car is it still there. Love the sound of loud rap music I bet you do?

If you rent a house bet you just love when you move out and the landlord who collected your rent sells the house for a nice profit you just made them wealthier pal.

Try buying okay and live a little in your own place, nothing like it in the world, your own home sweet home?

little “r” don’t you have an open house to get to?

Welcome to the world of asset speculation…

Sean, from the numbers you gave it sounds like everything points to renting is the better deal. However, what percent down payment was assumed for the example? Also, how principal is paid off every month? One dollar in principal is not equal to one dollar in rent. All things to consider when buying.

Two things come to mind.

a) Unexpected expenses for repairs or maintenance that rentals typically don’t have. That’s the catch, you can’t precisely account for the unknown.

b) When you sell to lock-in the profit, will you buy another home of like kind in the same market that you just sold in? If so, you’ve traded one item for another at the same price level, not to mention the cost of selling.

Home ownership rate is misleading. It’s abt 84% in Mexico. The rate doesn’t count those adults living as part of household already led by someone else. Kind like unemployment rate not counting those who are not looking for work. So, head of household rate more important, which is much lower than ownership rate, thus more important to watch

I know this is a housing bubble blog so be patient I will get to the housing part…

You can’t make this stuff up. I was under the impression that we lacked retirement savings in this country. Why would our great leader want to “disincentivise†retirement savings? I get the idea that high wage earners pay higher rates on additional earnings but we are talking 17500 – 23000. This could raise some short term money but then future tax receipts will go down because they are simply pulling back future revenue to the present. The real way to tax the rich is to raise the capital gains tax to the same rate as ordinary income. No one wants to do that so we start dicking around with idiotic ideas like this.

http://www.marketwatch.com/story/obama-plan-cut-tax-breaks-for-rich-retirement-savers-2014-02-21?siteid=yhoof2

How does this relate to the housing bubble? Easy, I believe retirement savings is the fuel for securitizing of rental income steam. No real investor would touch this stuff. Pension and 401k fund managers need to have “investment products†that purport to be “wealth preservation†investments. With the Fed’s zirp and QE policy, there really is nothing for the fund manager to purchase to fit this description except this new product. This would be a good thing to those who want to save the housing market. But now we have this new idea floating that would create less demand for these new investment products. Why would you discourage retirement savings when that is really the way you plan to save the housing market? We really do live in bizarro world.

Yes there is “everything wrong in renting if you can afford a house”. Most of the world rents and for the most part these are the most depress people . Ever see their faces, these are miserable folks with no privacy, no back yards, nothing to show from work then rent receipts to landlords getting well off on your rent.

No person unless circumstances are such they have to rent for job location while looking for a home or personal preference which many won’t admit, they yearn for their open front entrance into there castle no matter how small or big.

The American dream is still there folks, this administration will be history and we will be rid of a socialist mentality, wages will rise, old fashion buying and selling will reinvent itself.

Never give up on America, there is no place on the planet with movers and shakers like this nation, we will come alive when the present politicians including narrow minded Republicans and ultra liberals, see that the 21 century is young and the future is a strong capitalistic nation.

Most will embellish the new order of things,we have to, what else is there China please???

RE shill/shrill alert!!! We really need to have all shills/shrills identify themselves as such when giving free finance/life advise…

Robert: “ever see their faces, these are miserable folks with no privacy, no back yards,”

I live in a condo. I agree that there’s the problem of no privacy when you share walls. For that reason, I’d prefer to live in a house.

But believe it or not, some people prefer condo/apt living. Most especially older women who live alone. Also people who travel a lot. This is because a condo, especially with a 24/7 doorman (as mine has) provides greater security. Whenever I travel, I don’t have to worry about burglars.

You’re confusing rent vs buy equation with detached vs attached equation. You can buy or rent either type.

@robert wrote: “…The American dream is still there folks,…”