Real Homes of Genius: Today we Salute you Santa Monica. 929 Square Feet for $969,000. And You Thought the Bubble was Over.

Before you ring the bell and signal the end of the California housing bubble, there are cities and properties that still defy the laws of economics. California has corrected hard. The velocity of the one year correction is unlike anything we have ever seen in the history of our housing market. Seeing prices drop by 38.3% in one year has literally pulled the rug out of thousands of would be sellers. The California housing market is in the eye of the hurricane and many are shell shocked not knowing what their next move will be.

Part of the unintended consequences of foreclosure is many people are leaving pets behind. For a variety of reasons, many simply decide to pick up and go and let the pets fend on their own. The national media has been covering the story of Powder the 44-pound cat who is a victim of the foreclosure crisis:

Powder, initially named “Princes Chunk” was found wandering the streets in New Jersey after her owner gave the cat to a friend who was supposedly going to take the cat to a local shelter. As it turns out, Powder was left on her own roaming the streets (as much as she could move around). Of course with all the media coverage the cat will find a home.

In California another problem has been with foreclosed homes with pools that suddenly becoming breeding grounds for mosquitoes. In fact, local experts have recently attributed larger mosquito populations that correlate to the rise in foreclosures. One recent estimate puts 4,000 Los Angeles foreclosed homes with having a pool. Since the notice of default count is rising and many of these are simply foreclosures waiting to happen, we can expect many of these problems to occur in the future.

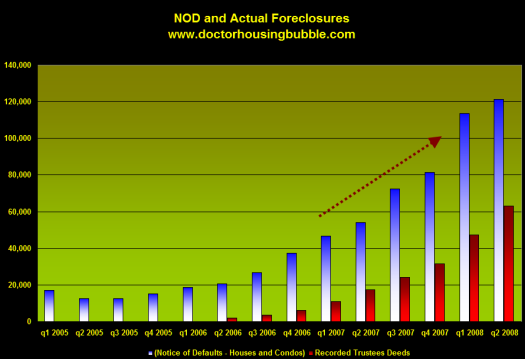

The notice of defaults usually meant a warning to sell the home. That normally was the case for years as the California housing market kept rising and rising and homeowners who bit off more than they could chew would simply offload the home into the market normally at a profit. With massive declining prices and many buyers going in with zero to very little down, any cushion of selling is completely gone. They are underwater on the mortgage usually by tens if not hundreds of thousands of dollars. Take a look at the notice of default chart:

The more disturbing trend is many of the NODs are now turning into foreclosures. Without a jump in home prices, we are virtually guaranteed another year of massively high foreclosures.

I did a recent report analyzing the 270 zip codes in Los Angeles County’s 88 cities and found that only 28 of those zip codes had a positive year over year increase in home prices. What we can see from the progression of price declines is that the last hold outs in prime areas are still holding hope that there status symbol will keep them above the rest. Today we are going to look at one of those zip codes in Santa Monica that is still up 28.9% on a year over year basis. That is correct, as the entire county of Los Angeles is down nearly 40% on a year over year basis, this hold out is still up 28.9%. Today we salute you Santa Monica with our Real Homes of Genius Award.

The Name Can Only Carry you so Far

Â

Today’s home takes us to the wonderful city of Santa Monica. Many people out of the state have a hard time understanding why Santa Monica carries such a heavy premium. First, it is an excellent location. Near the beach and centrally located to the entertainment zones in Los Angeles. It also carries the prestige of the 310 area code. This area code is desired because it carries the affluence of the West Side of Los Angeles that includes Beverly Hills and Malibu as well.

Yet more and more, simply having a home in said area code isn’t enough to command eye-popping prices. The above home is a perfect example. It is located in the 90405 zip code in Santa Monica that carries a median price of $1,625,000, an increase of 28.9% over the past year even given the current housing turmoil. Yet this house isn’t seeing much of that big gain. This 929 square foot home with 2 bedrooms and 1 bath was initially put on the market for $1,099,000 in May. Seems like a steep price tag for a place built in 1937 but apparently that doesn’t seem to matter.

After being on the market for over 2 months, they decided to lower the price by $130,000 in June. In 2 months did the price really drop $130,000 or is this just another example of the pie in sky anyone will pay whatever price because of the 310 area code mentality? The current price is now at $969,000. The ad seems to encourage the buyer to think about a “possible room for a pool” or about “double your living area” if you are not content with 929 square feet for nearly $1 million.

If we look at the sales history, someone is still poised to make a nice profit and that is something to be said given the current housing malaise:

Last sale and tax info

Sold 01/19/2007: Â Â Â Â Â Â Â $835,000

So if the home were to sell at the current price, we get the following:

$969,000 – $835,000 = $134,000 in profit in one year and seven months. That profit seems about as much as that $130,000 price reduction. Even though prices have been jumping in this zip code, sales have been falling. Another issue is many homes that recently sold in this area, even a few streets away have gone for $600 to $800 per square foot. At 929 square feet, this puts our math at:

929 x $600 = $557,400

929 x $800 = $743,200

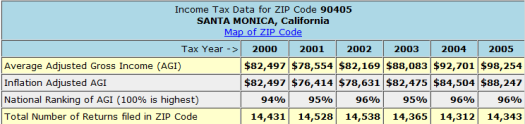

The current price tag puts a $1,043 premium on this place and the market isn’t responding. We are left with a really stunning range of prices here and since sales are so few, only 3 in June of 2008 for this zip code, it is hard to say how things will play out on this home. Incomes are high in this area with an adjusted gross income of nearly $100,000 per tax return filed:

*Source:Â MelissaData

Given tax write-offs and other deductions, this income understates the actual true income of local households. So let us assume a person making $150,000 a year wants to purchase this place with 10% down. Let us run the numbers:

Purchase Price:Â Â Â Â Â Â Â Â Â Â Â $969,000

Down payment:Â Â Â Â Â Â Â Â Â $96,900

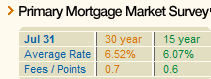

30 year fixed mortgage at 6.52% (PITI):Â Â Â Â Â Â Â $6,532/per month

Gross Income:Â Â Â Â Â Â Â Â Â Â Â Â $150,000 / per year

Net Income:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $7,634 / per month

So with that said, over 85% of this person’s net take home pay is going to pay for housing. We are simply including the principal, interest, taxes, and insurance. What if the person wants to add that pool? What if they want to upgrade the kitchen? Granite countertops anyone? A remodel? Anyone that owns real estate knows that the PITI is only the beginning in expenses. As you can see even a person with a solid income would be shelling out too much for this home. In fact, given the current FHA standards this person wouldn’t even qualify for a loan on this place!

Today we salute you Santa Monica with Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

15 Responses to “Real Homes of Genius: Today we Salute you Santa Monica. 929 Square Feet for $969,000. And You Thought the Bubble was Over.”

I actually like the old small quaint little homes. Better by far than the modern McMansions. But not at that price!!!!! Bwhahaha.

I just had to look this one up on Realtor.com. When it comes to humor, Santa Monica is the gift that keeps on giving. First of all, people assume that just because a house is located in this city, it must be “close to the beach.” This Real Home of Genius is actually 33 blocks from the beach, which is really far in a city this heavily congested with traffic. It’s only 1 block from the sights, smells, and sounds of the 10 freeway too. How about schools? I don’t know about you, but I would expect excellent schools if I pay over $1,000 per square foot. Nearby John Adams Middle School, gets a Great Schools rating of 6 out of 10. This isn’t horrible, but it’s nothing to write home about either. There are also 32 registered sex offenders living in the immediate area, according to the Megan’s Law website. Is an easy commute really worth paying this much for a tiny little box in a so-so nieghborhood? What prestige? I don’t see it. Anyone who thinks this is glamorous, can have it. I don’t care if gas goes to $10 per gallon, I’ll make a longer commute every day with a smile on my face. At these prices, let some other fool pay to live there.

Thank you for all the hard work you do to present these truly stupefying examples of men gone mad as a result of tasting fast and easy money.

“Easy commute.” I live in the Valley… and while the weather on the Westside is much nicer, I absoutely hate the commute over the hill. There is no easy

commute in Santa Monica, Bev Hills or the entire Westside. There is no easy

commute in LA at all. I can get to the studios faster from the Valley than

from Ocean Avenue.

I believe that is a house on Pearl Avenue on the very eastern edge of Santa Monica. If it is, you forgot to mention it becomes a bypass of the Santa Monica Fwy M-F for all of the entertainment business. You are virtually trapped inside your house from 3-7pm. I guess you should build a pool because you won’t be going anywhere. Prices in Santa Monica are now starting to drop significantly. 15 – 40% depending on location. I would estimate this one about 25% so that brings us to about (.75 x $835K) $625K right now…..

I have data by zip code on Santa Monica and most Westside neighborhoods at: http://westsideremeltdown.blogspot.com

The declines are just warming up here. Wait until the Alt-As and Prime mortgages reset anytime now. 40-60% drop from peak pricing is my estimate for homes on the Westside.

I believe this house is located on Pearl Street. If so, it’s driveway backs out onto bumper to bumper traffic in the afternoon for a good couple hours at leas M-F. All those entertainment workers like to use this as a bypass to the Santa Monica Freeway. It is a Westside Nightmare. Maybe that is one reason they are TRYING to flip it. In reality prices have dropped 15-40% YOY in Santa Monica, depending on the location. I estimate that house has dropped about 25% which would make worth $625K right NOW….

I have most of the Westside neighborhood declines documented at http://westsideremeltdown.blogspot.com

With Alt-A and Prime mortgages just beginning to reset here on the Westside, price declines have just begun. 40-60% declines from the peak is what many believe will ultimately hit the Westside.

The sad thing is that anyone at all would be willing to pay such a ridiculous amount of money just for an address in a pretty non-descript part of a moderately interesting Southern California city (have been there many times as my mom is employed there)? How many people in the area even are living a life of relative poverty on $150K/yr or more just so they can have bragging rights?

BTW, thanks for bringing back the RHOGs, Doc! They inject a dose of reality into an otherwise abstract discussion of the craziness of this market.

Its gonna take years for people to understand that you can lose money in real estate – you can lose it slowly, you can lose it fast, you can lose a lot in a hurry, or not a lot every month for years, and the price may not recover tomorrow, or in 6 months, or in 6 years, or in your lifetime. At one point, people BELIEVED Amazon was worth 400$ a share. When will it reach that price again… hmmm. 6% for 60 years gets you about there from today’s price

latesummer2008:

What do you see happening for the Fairfax/Grove area? Prices there are still pretty crazy. In 1999 a three bedroom one bath was around 300,000. Today they want 1.3 million. I just don’t get it. Who has the income to afford that? And if one did would they want a crappy little place like that? Maybe my expectations for a million dollar home are out of date?

There is this ilusion of the southland that the weather is beautyful year round & living in a Beach city like Santa Monica will fulfill ones desires. The fanticy goes something like this. Everybody rollerblades along the beach area, all of the guys are built like the Governator & all the women are tall & skinny like they just came from a swimsuit photo shoot. Think about the tv shows Beverly Hills 90210 or Melrose Place. Everyone drives expensive cars & lives in a big house because they have an immage to protect. Money isn’t a problem, because dollars can solve all problems, even down to plastic sergery. Think of the show Doctor 90210 for example & what message is being sent there.

TV masks the truth about what the southland is really like. Oh sure you have the super wealthy, but that is such a small part of the population. Most people live in middle class houses, earning middle class wages, & being bombarded with the message, “if you don’t act big you will never make it big.”

As a result of that people lived far beyond there means. Believing the fanticy that they had an unlimited ATM, & withdrew enormus sums to spend like Brittney Spears. Now they are upside down & they either walk away or go into forclosure.

I used to live on the L.A. Westside (Palms – much farther from the beach but not too far from Santa Monica) and was truly astounded at the prices people were willing to pay for real estate there. Venice actually shocked me more than SM. It’s heavily congested and there is TONS of crime there, it’s dirty and yucky, and people pay millions of dollars for crappy little boxes with no yards that look like they belong in the ghetto.

Meanwhile rents are high but much more reasonable compared with what it costs to own there. I rented a 650 sq. ft. 1 bedroom apartment in quite a nice building in a fairly nice, quiet, safe neighborhood for $960 in 2004-2005. To own the cute as a button, but also small as a button house across the street, which was the same if less square footage, but did have a bonus driveway (though no backyard and no garage) – I’d have had to shell out about $850K in 2005. That to me seemed the height of absurdity, and apparently even in this market people are still drinking the Kool Aid.

Very good post. I heart the RHOG series.

Fairfax/Grove area is also way overpriced. West Hollywood Total Sales Volume dropped 84.5% last June, measured from June of 07′. This will have a direct effect on pricing in the coming months/years. Also with credit crunch, loan resets, bloated inventory, foreclosures as Dr.Housing Bubble mentions will all take its toll. I figure about a 50% drop from the peak (07′).

Hold on…

I drove a cab in Santa Monica back in the 80s. Lived in a rathole at 4th and B’way in Venice. Used to see Tommy Chong at the Gold’s Gym. Took the daughter of one of the guys in Al Hirt’s band out to the jetty and drank vodka until she projectile vomited and slid into the pounding surf fully clothed. Ah, thems were the days… Do they still put up those over-the-top Xmas tableaus on Ocean? If so, that would be enough reason in itself to grossly overpay for the Santa Monica address if you ask me…

WOW…did the agent pull comps for this? Is this really going to appraise?

Hope you all know that the real reason why we are in this situation is not because homes are going in forclosure or people buying expensive homes. It is just one thing… the government. Okay, the government took more than they can chew with the iraq war and its billion dollar debt. So how do they get out of debt—think really hard. Real estate. “Real” estate backed by real property. So by hiking the interest rate just enough to start the real estate crash. with ARM at all time high–people are walking away. With more foreclosure, more prices will keep on dropping. The price will keep on dropping until people stop walking away and start paying.

Okay, so now the government is going to buy back all the bad mortgage loans and bail out banks. What does that mean? It means the government will own a lot of cheap homes. When the economy picks up they will sell it at a profit. That is there plan along to curve the trillion dollar debt we are in.

Don’t forget we are in a global market. If prices keeps dropping we are in deep shit. Banks are already in trouble. All those 401K that are backed by stocks basically tanked. So, if you are 50 and your 401K portfolio is now worthless and government says Social Security won’t be around when you retire— what do you have to retire with. Think really hard. If I was all of you I would invest in “Real” estate and protect your retirement. Don’t let the government purchase all these homes/properties so they can pay off their debt. What about our future security?

Leave a Reply