Real Homes of Genius: Today we Salute you Covina. Banks Learn a Lesson in Mark to Reality and the $300 Billion FHA Bailout.

We are once again firmly in Wonderland and falling deeper into the rabbit hole as the market is responding to negative news as if it just won a Powerball contest. On Monday, UBS AG announced another $19 billion in writedowns putting it firmly in the lead of all those in the writedown 500. The race of course is dominated by investment banks and each writedown simply is a reflection of poorer performing mortgage assets;, aka Real Homes of Genius with sub-prime loans. Yet this is fantastic news somehow and the amazing plan that will turn the market around? Dilution of shares! You really have to enjoy the headline for this article:

And what does this plan further entail?

“To rebuild its cushion against further losses, UBS is seeking shareholder approval to raise $15 billion by selling new shares to existing shareholders in a so-called rights issue. “Our firm turned a page today at the end of a bitter chapter,” said Marcel Rohner, chief executive of UBS. “We will return our company to profitability.”

The write-downs at UBS and Deutsche Bank put financial firms’ total losses on subprime-mortgage investments well above $150 billion — more than halfway to the eventual total of $285 billion forecast by ratings firm Standard & Poor’s. That is based on a total of $1.4 trillion of subprime securities issued from 2005 through the third quarter of last year.”

It seems like a pattern is emerging here. First, if you are a large investment bank facing sub-prime problems you must:

A. Oust your leader with of course a nice severance package

B. Decide to sell more shares and call it “turning around” or some other cheerleading tagline

C. Announce the news in conjunction with horrible news (i.e., $19 billion in writedowns)

D. Add a touch of oregano and the market rallies

E. Rinse and repeat

If all goes bad, you always know that the Federal Reserve will step in and provide a back stop to a total collapse. There isn’t much to lose for those on Wall Street. Yet we now realize fully that the Fed cutting rates is doing nothing except kicking the dollar in the gonads and doing nothing to save the American homeowner. This has been the implication of course, that the rate cuts would somehow inject stability into the market which of course it has not. Now that we realize this hasn’t done much aside from diluting our US Dollar and we are still heading toward a recession, we get the amazing and fantastic $300 billion bailout via the FHA. Let us look at this puppy with closer eyes:

“Program would permit FHA to provide [up to $300 billion] in new guarantees that would help to refinance at-risk borrowers into viable mortgages. In exchange for the acceptance of a substantial write-down of principal, the existing lender or mortgage holder would receive a short payment from the proceeds of a new FHA loan if the restructured loan would result in terms that the borrower can reasonably be expected to pay. The existing lender or mortgage holder will have a cash payment and no further credit exposure to the borrower. This could potentially refinance between 1 and 2 million loans (and help these families stay in their homes), protect neighborhoods and help stabilize the housing market.”

Language is absolutely critical here. Whether you agree with this plan or not, this is a government sponsored bailout. I realize that this problem does require some solutions but if we are to seriously talk about these issues, let us call them for what they are. Heck, even Chairman of the House Financial Services Committee Barney Frank has this on the proposals:

“FRANK ANNOUNCES NEW ECONOMIC, MORTGAGE AND HOUSING RESCUE PROPOSAL”

So let us go back to the first paragraph. First, the wording on “viable mortgages” is very ambiguous. Does this mean 30 year fixed mortgages? Does this mean new mortgage products? Also, we read that lenders will need to accept “substantial” write-downs of principal to unload mortgages but what is substantial? Does that mean that the government will use independent appraisers to go to properties to accurately assess a value? If they are planning on allowing current appraisers to do the work this leaves the door wide open for more fraud and gaming of the system. Look what they’ve done with the current housing market! This here is extremely important since homes should be valued for their current market value and discounted at current rates.

It is clear even from the first paragraph that this will bailout mortgage holders. What if the property is worthless? There are some areas that simply have no market so how are these going to be valued? There does appear to be some back stops for these contingencies:

“Eligibility Requirements for Existing Loans (Requires All of the Following):

- Owner-occupied principal residences only (no investors, speculators or second homes);

- [Existing senior loan being refinanced must have been originated between January 1, 2005 and July 1, 2007];

- To remove any incentive for borrowers to “purposely default,” the borrower must have had a mortgage debt-to-income ratio of no less that 40 percent as of March 1, 2008, and must certify that he/she has not intentionally defaulted on existing mortgage(s). Regulators can make exceptions for involuntary changes after that date;

- Participating mortgage holders/investors must waive any penalties or fees on the existing mortgage and must accept proceeds of the new loan as payment in full;

- Existing mortgage holders/investors must accept their losses – taking substantial write-down sufficient to establish a 5 percent loan loss reserve for the FHA, bring the loan-to-value ratio on the new FHA-loan down to no greater than 90 percent of property’s current appraised value, result in a meaningful reduction in mortgage debt service by the borrower, and to pay all up-front fees for the new loan. Accordingly, to qualify, mortgage holders would need to accept a substantial write-down, receiving no more than 85 percent of the property’s current appraised value as payment in full for the existing loans.”

I actually tend to agree with most points however, the main concern I hold is that if we are to use the current infrastructure of oversight, there is huge potential for fraud once again. Unless we have new entities coming in and ensuring appraisals are correct and accurate and verifying owner occupancy and also income, we will once again be going into liar loan territory. There is a lot to gain and lose here and the pressure to commit fraud by institutions is high. Those hungry for commissions will do anything they can to squeeze people into homes once again. If this plan does go through as is, it is incredibly important that stiff penalties and oversight are put over the lenders like a hawk.

Some of the language here is too flexible. What do they mean by purposely default? Do they mean walking away? They have to be more specific here. Also, I’m certain that many investors will fight to keep the penalty fees in since that is a reason many brokers made out like bandits on these mortgages. The more toxic the higher the yield. Now who will be one of the few responsible for this oversight?

“Increased Fraud Prevention/Oversight

- The HUD Secretary shall establish independent quality reviews to determine underwriter compliance, and rates of delinquency, claims and losses;

- Submit semi-annual reports to Congress; and

- HUD Inspector General shall conduct annual audit of the program.”

Bwahaha! You mean Alphonso Jackson who just resigned a few days ago under massive cronyism charges? Interesting how right on the back of this new FHA proposal the HUD Secretary resigns. Oh man we are so screwed.

Real Homes of Genius – Today We Salute you Covina

Let us not forget that there is a ton of junk floating out there. We are nowhere close to seeing the end of sub-prime resets and we haven’t even taken a look at Alt-A or Pay Option ARMs. These are the next ticking time bomb that should hit in 2009 through 2011. The above home just hit the market a few days ago. It is a 3 bedroom 2 bath home in the city of Covina. The home is currently bank owned so fortunately, this would not qualify for the new FHA plan. But let us take a look at the sales history here:

Sale History

01/17/2008: $411,507 *

11/17/2003: $268,000

06/25/2002: $210,000

We can presume that the sale price in January was simply the bank taking the place back. You may be wondering, how can it be that a place that sold for $268,000 in 2003 now has a balance of $411,507 without any sales? Welcome to the next big issue, the home equity line and second mortgage problems. Given that recent data shows that $1.1 trillion in home equity mortgages is out there, and these certainly won’t qualify for the FHA bailout, we have another issue just waiting to fall. This place has a pool listed and one of the pictures shows that it has modern accents to it. Given that the home was built in 1954 I think you can put 2 and 2 together and have an idea where the 2nd mortgage went. The current price is $370,000 and I’m sure given the 424 other homes for sale in Covina, this place will have stiff competition.

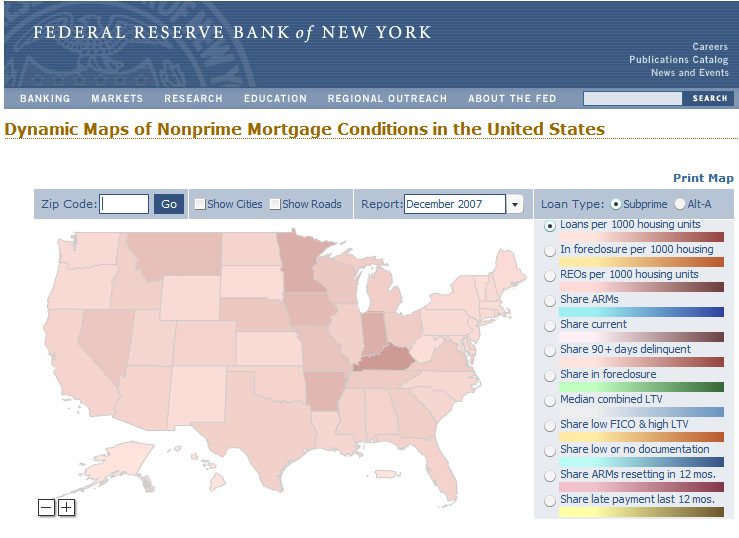

There is a great new tool out by the New York Fed that uses data from Loan Performance to show mortgage market data across the U.S. This is a very useful tool and may run a bit slow given that I’m sure many are using it:

I went ahead and ran the program on Covina and the results do not look promising:

Share in foreclosure: 10.8%

Share ARMs resetting in 12 mos: 43.2%

Share low or no documentation: 47.5%

Share ARMs: 73.8%

And how we are close to a bottom with the above statistics is beyond me. Today we salute you Covina with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

16 Responses to “Real Homes of Genius: Today we Salute you Covina. Banks Learn a Lesson in Mark to Reality and the $300 Billion FHA Bailout.”

First, I want to say that I completely enjoy your commentary. I’ve been reading your blog for a couple years now and always look forword to a new post. One thing about the New York Fed map, it only gave me the stats for all of California no matter what zip I used. Those stats look like the same one’s on your post, not just for Covina. Anyway, just thought I would bring that up. Keep up the great postings.

If this plan goes through and keeps housing prices propped up I don’t think I’ll never be able to buy a house.

Dr.HB wrote…”Existing mortgage holders/investors must accept their losses – taking substantial write-down sufficient to establish a 5 percent loan loss reserve for the FHA, bring the loan-to-value ratio on the new FHA-loan down to no greater than 90 percent of property’s current appraised value, result in a meaningful reduction in mortgage debt service by the borrower, and to pay all up-front fees for the new loan….” Strange way to stabilize housing prices and at the expense of those who are paying their mortage. Let’s say property owner A bought 1234 Elm St. in 2005 for $500,000. He put 20% down. 1236 Elm was bought with by B

with 100% or close to financing. B can’t pay his mortgage and the lender agrees to participate in the FHA plan. Meanwhile 1238 Elm St sold for $400,000 last month so the appraisal for both A and B’s home is $400,000. Now the FHA will only loan 90% of appraised value and requires an additional 5% ‘cushion’ for itself plus the former lender must pay all ‘up front fees’ ( how large are those for FHA loans?). That’s an apparent further $60,000 reduction in the value of A’s house since B is now living in an identical house which he ‘bought’ for a mere $340,000 and again with nothing down! Think A and B will be ‘good neighbors’?

If I may, what if, in my example above, B, after having his prior loan forgiven by his lender and securing this wonderful new free FHA loan then plants a ‘For Sale

By Owner’ in his yard. Anything over $340,000 is his right?

Scott,

We all have to share the pain, according to the talking heads.

As DHB’s article mentions who’s going to oversee this mess? Who is going to determine the borrowers financial capacity to pay the new mortgage?

Just from reading and some anecdotal info, it seems that the principles would have to be DRASTICALLY reduced to insure that an over extended borrowers could repay. would they really put a 50k/year borrower in a 350k house or would the lender be asked to cut this to 150k-200k? Yikes for those that have played by the rules.

Well, there you go. Thanks for the bailout. Now I”ll never afford a home in Los Angeles.

SoyPerdido , Gael

Stopping foreclosures will not stop prices from going down. Today with down payment, proof of income, and good Fisco score requirement there are very little pool of people to qualify for a loan in Los Angeles. Prices will go down even without a single foreclosure filed since some will have to sell and will not be able to without reducing the asking price to reflect income. Rest assure it will and actually happening at that moment. “ALL GOOD THINGS FOR THOSE WHO WAIT”

Comment by Scott: If I may, what if, in my example above, B, after having his prior loan forgiven by his lender and securing this wonderful new free FHA loan then plants a ‘For Sale By Owner’ in his yard. Anything over $340,000 is his right?

******Not the way the Frank bill was written. If, during the first 5 years, the house is sold, the borrower has to pay the FHA 3% of the original loan amount OR in year 1, 100% of anything above the original loan amount, year 2 80% above the amount, year 3 60%, year 4 40% and year 5 20% —- and it is which ever amount is greater that is the amount owed. After year 5, if it is sold, the borrowe owes the FHA 3% of the original loan amount. That stops any flipping.

****Gael and Soyperidido – just CHILL! If anything it sets the prices lower by only loaning 90% of CURRENT value. If it is a special section of FHA doing the loans, it is pretty easy to figure out the current value by looking at the loan docs, finding the amount and dividing by .9 (point 9). It won’t ‘prop up prices at all.

****Steve – you ask “who’s going to oversee this mess? Who is going to determine the borrowers financial capacity to pay the new mortgage?”

***** Easy. It would be a special program run by FHA. Loans would be full doc loans with fully document income (and address since it would ONLY be primary homes -no 2nd homes or speculators.) Only certain lenders can do FHA loans – and they are not the fly-by-night mortgage brokers. FHA lending standards are 31% of gross for PITI and 41% of gross for all fixed debt including PITI, credit cards, car loans/leases, student loans etc.

*****In any event, the bill that has arrived on the Senate floor has zip zero nada about creating such a program. It is all tax breaks for builders with a few crumbs thrown to homeowners in the form of a tax deduction and a 1 time tax deduction of $5000 or so if you buy a foreclosed or long vacant house. Also has money for counseling (and from on-the-ground experience I can tell you that means telling 37 out of 40 that there is nothing to be done since they couldn’t afford the house to start with) and for state housing authorities to (a) buy foreclosed houses, rehab and market them to middle and low income households and (b) issue more bonds to give them more capital for home loans (and the criteria for those loans is very strict -income caps, price caps, full doc, credit score over 680, …..) I will say I do like the money for the state housing authoirities to buy up foreclosed houses – we have a desperate affordability problem here due to 2nd homeowners who sent prices to the moon and that means there have been times that the fire trucks couldn’t roll on a call because only 2 of the volunteers actually live and work in town – the rest are up to 10 miles away or work 40 miles away. EMTs and the younger members of the fire department don’t make enough for $390,000 houses.

****Further even if such a refinance loan program were created, it assumes that the current lender will meekly take its losses on the drop in value AND take another 15% hit off current value. Not blodly likely said the little flower girl. The 2nd mortage holders will dig in their heels since they have nothing to lose (and they are already doing that per reports from the WSJ and NYT) The 1st mortgage holders will balk at losing another 15% from current value. The loan servicers will say ‘not our job to make those decisions’ because they will be scared out of their minds of being sued by the owners of the loans (whoever that may be since these things were sliced and diced into minute pieces and sold all over the world.) SO the odds of a loan going through where the 2nd lender will agree to walk away; the 1st lender agrees to take the loss of the drop in value plus 15% more; and the borrower can document income and not have a PITI more than 31% of income are not great – something between slim and none and slim just saddled up and rode out of town. There maybe a few – if say the foreclosure auction is in 2 weeks and the makret if falling really really fast and the lender is brighter than the average bear and gits while the gitting is good – but only a few. Tempest in a teapot.

Yawn… more election year posturing. All crap like this does is delay the inevitable but I’m a patient man. Japan tried all this and it didn’t work. Alt-A and option ARM reset time is when the real fun starts.

I do believe the “appraised value” will be the hard part. Appraised value requires comps, which requires a properly functioning market. As far as how this affects people, I see it like this:

1) Lenders (good deal): they screwed up and they’ll take some losses, however I believe the losses of getting X% on the dollar now is far less than (X% – foreclosure costs) later.

2) Borrowers (fair to good deal): they screwed up too. Some may pay the price having ruined their financial picture, while others will get a good deal as they will have a smaller mortgage to pay on the same house. Effectively they get a do-over on price.

3) Those on the sideline (bad deal): fewer foreclosures means less inventory of low priced homes. I do agree with Duboiz that prices will still drop, but less so since there will be less inventory on the market. Maybe this is justified ‘for the greater good’???

4) Speculators (good deal): smaller price drop means smaller loss.

5) Taxpayer (bad deal): covered well enough by our fine host.

We all need to remember that this is like a HUGE tsunami. The waves are way out in the middle of the ocean right now. By mid year 09 into 11 the real pounding will upon us. Like I have said before, until tried and true market fundamentals (homes worth 3 X income) return (which they will in time) this market is no were near a bottom. Also remember that when Govt is thrown into the mix things always get screwed up. We have and industry and govt that can’t manage their way of a paper bag. Just sit back, relax, and try to enjoy the ride.

Another good post Doc, keep up the good work.

This bailout plan is a classic example of fixing the symptom and ignoring the disease.

Removing the moral side of the question, let’s assume this plan goes through and 10% of Americans have their principal balance “adjusted†downward so the house becomes more affordable and they can “stay in itâ€. Let’s assume they get an average of a 20% adjustment, the amount prices have dropped in the last year according to Case-Shiller.

Well, what do you suppose the reaction is going to be from the pension funds / hedge funds / Foreign Sovereign Wealth funds, etc. that funded all these mortgages? I seriously doubt that they will be real thrilled to find out that when their 500 million dollar investment matures they are only getting back 80 cents on the dollar.

This action would essentially make mortgage bonds and related securities the riskiest of risky, and investors would either a) never touch them again, decreasing funds available to write mortgages or b) if they did play again they would demand much higher interest rates, lower LTVs, better coumentation of income, all of which would tighten lending standards even further.

So, by the gov’t saving the stupid/greedy few, the whole rest of the country will be faced with higher interest rates on mortgages, much tighter lending standards and an absolute decrease in the total funds available for mortgages.

And what do you suppose all of that will do to the price of housing? That’s right, drive it even lower.

The easiest way to picture this is to imagine that mortgages were illegal and all houses had to be paid for with cash that the purchaser saved themsleves; what do you suppose the median home price would be? Sure as hell not 408K like it is here in SoCal.

So, the whole point here is that this plan, which is wrong to begin with, will have the effect of tightening credit even further, depressing home prices even farther and faster, and in 18 months all these dummies we bailed out will be right back where they started today: owing more on their house than what it is worth.

Why is this so hard for the rest of the world to understand and why do people seem to not care?

Dr HB…

You missed some info for that dynamic mortgage map.

I’d like to see the first stat of how many loans per 1000 were subprime or Alt-A.

Just heard a report on the radio that states that prices and sales are up in the San Fernando Valley. A Realtor was stating in the report that things have turned around and she sees future increases ahead!

WTF? Must have closed a couple million+ homes to skew this, I’m guessing.

There truly is no solution to the Housing Problem, except for a severe price correction. Almost every property on the market today is under distress. Currently the lower class neighborhoods are getting hit the hardest (Compton, Huntington Park, Southgate, Watts, South Central), but wait until Alt-A and option ARM loans begin resetting in 2009-2011. Then we will see a sharp correction happening all over, including Bel Air.

AnnScott,

As always, you provide some great answers and info. Thanks.

Now, on Fox biz this evening they had a gentleman from some conservative bank that had avoided exotic lending practices. He mentioned that in some gub’ment bill the FHA would relax DTI to 55%. And I actually may have misunderstood….he may have been talking about just the mortgage (doubtful). Either way, he mentioned what many here have. this is the wrong thing to do and punishes the vast majority who have stayed within their means.

Leave a Reply