The signs of real estate mania in California: San Francisco Parking Spot Sells for $82,000. Median California home price up 25 percent year-over-year. Welcome back interest only loans.

Irrational exuberance is back in fashion in California real estate. The bullish case for real estate is so strong that the echoes of the last housing mania are slowly fading away into economic history. Flipping is now a big part of niche markets and we are starting to see the whacky stories that are common in manias. For example, In San Francisco’s trendy South Beach neighborhood a parking spot sold for $82,000. While that may sound extreme that is simply the behavior that occurs when virtually the entire state is cast under the spell of real estate fever. There can be no wrong and apparently incomes do not matter anymore. We’ve already discussed the reemergence of interest only loans so we are simply experiencing another mania with a different flavor.

The $82,000 parking spot

A parking spot in San Francisco recently sold of $82,000:

“(CNBC) While it may seem like a lot of money, real estate agents said parking could be a good investment in densely packed San Francisco, where vehicle spaces go for a premium. They can add as much as $100,000 to the purchase price of a property or be rented out at rates of $400 to $450 a month – the going rate in South Beach.â€

As we have stated before in terms of rental income, getting $400 a month for plunking down $82,000 is not exactly a wise investment especially for a parking spot. What is interesting in the above article highlighting the parking spot is the agent had sold a spot at the height of the last boom in the same building for $95,000. So we’re not exactly to the levels of the last boom but we’re getting close.

What is interesting is we are now seeing that this housing mania is largely a game for the financially connected whereas the last bubble was an open market for everyone. Take a look at the emergence of interest only loans:

“(NY Times) In particular, people in the financial services industry who derive most of their compensation from yearly bonuses commonly rely on interest-only loans to keep their mortgage payments manageable the rest of the year. “Then they take some of that bonus and pay down their mortgage each year,†said David Adamo, the chief executive of Luxury Mortgage in Stamford, Conn. “And their monthly payment then also goes down.â€

Thus, interest-only loans have evolved into a financial tool, and no longer a means to affordability.â€

And these loans are being marketed in particular in wealthier markets:

The low interest rate environment is allowing the financial industry to utilize low rates to speculate in the rental housing market but also, to use these low rates to essentially borrow for free when you factor in inflation. How this will help your regular buyer is limited especially when the market is being flooded by hot money.

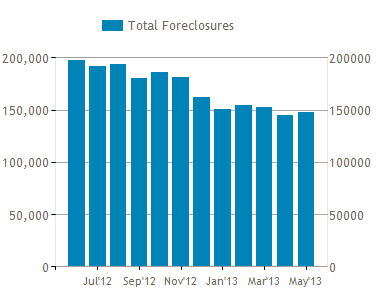

US foreclosure activity is still relatively high:

What was interesting is that last month, REOs jumped up by 11 percent.

“(Yahoo!) Banks repossessed 38,946 homes, an increase of 11 percent from the previous month. The number of homes hit with default notices for the first time grew by 4 percent.

Among the five lenders involved in last year’s national mortgage settlement, all but Citigroup (C.N) saw an increase in repossessions.

“It could be a sign of a trend we’re expecting, which is that eventually, the banks are going to pull the trigger and complete these distressed loans that have been sitting in limbo for some time,” said Daren Blomquist, vice president at RealtyTrac.â€

What this really means is that smart banks are seeing the mania in the market and are gearing up to unload some of the backlog in properties. And why not? The market is incredibly hot and you want to sell into momentum. I said this many years ago about the Fed and will remind you that the Fed is looking out for member banks first, and any secondary benefits are merely a consequence of this behavior.

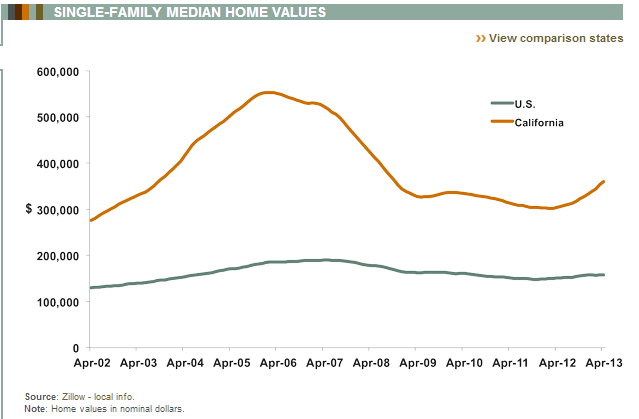

California home values

The median California home price is up a whopping 25 percent over the last year. Once again California home values are diverging dramatically from nationwide prices in the speed they are going up:

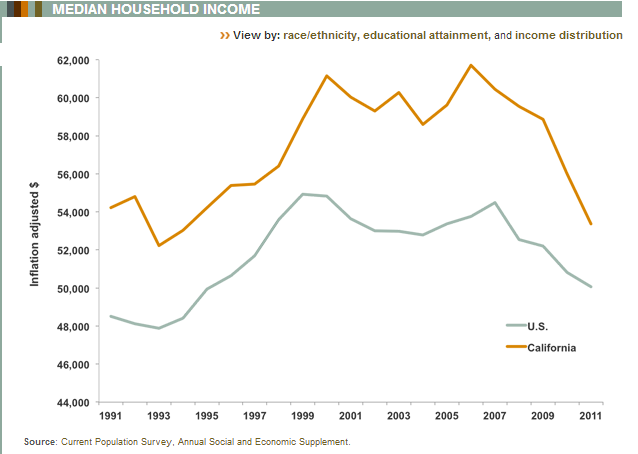

While the above is happening, this is happening with household incomes:

I know, incomes don’t matter when one-third of purchases are coming from hot money investors and another good amount of buying is coming from families stretching their budgets to the limits with low mortgage rates.

Interest only loans. Flipping. Hot investor money. Parking spots going for $82,000. Prices soaring by 25 percent while incomes are slowly edging up. Sure sounds like a normal market!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

49 Responses to “The signs of real estate mania in California: San Francisco Parking Spot Sells for $82,000. Median California home price up 25 percent year-over-year. Welcome back interest only loans.”

About the mortgage rates. I suspect the 30 percent of the market who’s taking FHA loans has the same monthly payments as when interest rates were around 7.5% with pre-bubble conventional loans. Am I crazy? Here it goes:

a) Base Interest Rate: 4.00%

b) MMI/Mortgage insurance: 1.55% – not cancelable for life of loan

c) The fact that average downpayment is about 5% instead of 20% – actually adds about the equivalent to 1.8% higher interest loan

Anyone getting FHA loans in California isn’t starting from a great financial footing to start with and is effectively paying the equivalent of what an old conforming loan with 7.5% interest would have cost.

These buyers are also at the bottom tax brackets and receive less of a tax break from interest payments. The current recovery is a sham in California and consists, to a large part, of one set of investors selling to another set of investors.

$82k for a parking spot? Sounds like a low-rent fixer-upper to me. The Boston area just had a pair of parking spots that, combined, for more then a half mil: http://www.boston.com/businessupdates/2013/06/13/tandem-parking-spots-sell-for/tsdqLBPRmQFEojy2US5vXO/story.html

Wouldn’t it be cheaper just to get and pay the parking tickets?

Might as well bring back the NINJA loans. All that matters now to the FED is the ‘ wealth effect ‘ ….. be it real or imaginary.

The “tell” in the RE market is when listing start to really climb up due to many wanna-be sellers seeing an opportunity to finally sell.

It’s starting to look like this is happening. My town had a 300% jump in listings in the last month. But it is summer and that’s when everyone starts to list their property for sale. But an other “tell” is when the time on the market starts to really stretch out as well. So, we’ll see how this plays out.

The $82k actually seems pretty reasonable if it’s renting for $450 a month. That would be a 6.6% gross yield; can’t imagine the cost to operate the garage is very high on a per-space basis. What am I missing?

I lived in San Francisco from 1994 to 2001. If one added a parking space to a house, either by buying a space or creating a garage, it would add about $100K to the value. So this is nothing really new for San Francisco.

Parking spot, I assume this is just a pad of concrete and not a garage. The cost to operate or upkeep should be zero for decades. In this environment, a 6.6% gross yield sounds like a no brainer.

I wouldn’t count on being able to resell it for $82k until the next bubble after this…if you’re lucky. For the guy who bought the $95k spot during the last boom, he’s still underwater by 14%.

Agreed. Fantastic risk adjusted rate of return if those nums are accurate. In fact, at 6+% a year, i think we found cali’s answer to its pension woes. In nyc a garaged spot (most likely indoor, but could be outdoor depending on a few neighborhoods that bave outdoor spots) is that rate approximately/almost exactly for a reg car. SUV/truck could take you to $625/$650 per month. Some negotiating is possible of course. Anyone wanna chip in on the next auction? 😉

“Prices soaring by 25 percent while incomes are slowly edging up.”

Based on the charts you show, incomes aren’t edging up at all.

+1

Neither do I. Adjusted for inflation, incomes are down by a significant margin since 1995.

When I came to this country in 1990, gas was 89 cents a gallon, $100 filled 2 shopping carts, construction jobs paid $20/hour, a 1200 square home home in Redondo Beach CA was $200,000 fast forward to today..(23 years), gas is $4.27 a gallon this morning, 2 bags of groceries at the grocerie store is $60+, the same construction job is paying $20/hour, and the same home in Redondo Beach is $650,000+ thats if you can find one and there will be a bidding war on it for sure at the moment……..Hmmmmm……

There’s been a war on the dollar over the past two administrations. Just look at the price of gold, 2000 vs. 2013, even after the major dip experienced by the commodity in the last six months.

Just to circle around on the wage stagnation vs. housing appreciation, I think that’s a reflection of some of the unintended consequences of “pro-consumer” policies, e.g. FHA, jumbo mortgages, etc… Ultimately, folks gain access to far too much leverage and only think in terms of monthly payment vs. total cost. That’s how car salesmen sweet-talk buyers into long-term financing just to buy a vehicle.

It would have been better if such “solutions” were never created. The entire market would be forced to save up 20% and only spend what they could afford…up to conforming loan limits, pretty much. Instead, a class of “winners” has been created who have enjoyed the real estate ride from the late 1960s to late 1980s, and everyone else more or less has to buy them out to get a slice of the pie. Unless, of course, buyers wait for another cyclical bubble to burst as buyers reach for more than they can truly afford…

Mike, I know exactly what you are saying. I remember the good ole days in the late 1990s when I was a worry free kid down in Orange County.

Late 90s:

Gas was around $1/gallon

College tuition was still cheap

3/2 ranchers in nice parts of Huntington Beach were about 250K (prior to the days of flipping and bidding wars)

Engineers fresh out of shool made close to 60K per year

National debt was about 5B

Fast forward 15 years

Gas is $4/gallon

College tuition is totally out of control

That same 3/2 rancher in HB is now 650k plus

Engineers fresh out of school make around 70K/year

We add 5B to the national debt every few years now

Noting to see here folks. Just keep busy with that iphone or your 300 TV channels. 🙂

Gas wasn’t $.89 a gallon in 1990 in Redondo Beach, CA. Try more like a buck 89. When trying to make a point at least be truthful.

It fluctuated of course, but I also remember .89 and .99 cent gas in the 90’s.

In Los Angeles

Gas in LA was $1.40 in 2000. That is far back as I could find for a specific city. However, US average for 1990 was below a buck. I don’t think it is stretching to believe gas was a lot closer to a buck rather than a buck 89 cents. It only takes 3 minutes to verify.

You might also like to see the large spike in 2008 to over four dollars a gallon when oil hit $150 a bar. With oil near $4 and climbing because Syria looks good for the economy.

http://gasbuddy.com/gb_retail_price_chart.aspx

http://www.nationwide.com/cps/rising-gas-prices-infographic.htm

I remember gas hovered around $1 to $1.50 per gallon during the 1990s. There was even a stretch during the late ’90s where it was under $1 per gallon. I had a 16 gallon tank in my car and filling it up near empty was under $15…how awesome is that!

$4/gallon gas is the new normal. It took a little getting used to but people don’t bat an eyelash at it anymore.

Funny you mention Redondo (where I live).. 650k is the start for a townhouse, and most I’ve seen sell in the last few months have been for 30-40k over asking. Homes are 750-1.5M now.

We have a great living arrangement (renting a family owned condo) but when my fiancee mentioned that she ‘couldn’t live anywhere else’ the other day I almost lost it. Leaping to a place with no one above or below us (and god forbid, an actual garage) is a huge proposition.

Here you go, Gas prices 1978-2000 In Los Angeles and Orange Counties.

http://www.laalmanac.com/energy/en12.htm

I have a friend that bought a tear down house with a distant ocean view in Corona Del Mar recently beating out 9 other people that had offers on the property. After two months of trying to design a floor plan decided to sell it on a Friday. Sunday he had a buyer at 2.8 million, $500,000 more than he paid two months earlier. This is a 8,000 square foot flat pad. That is $350 per sq ft for the land. That’s 5.45 million a flat acre. We are back at 2007 prices.

“What is interesting is we are now seeing that this housing mania is largely a game for the financially connected whereas the last bubble was an open market for everyone.”

The keyword is “now” and subprime could come back.

How about a $1M parking spot in Manhattan, but of course, that’s only asking price. I wonder what the purchase price was.

http://abcnews.go.com/blogs/business/2012/05/manhattans-million-dollar-parking-spot/

I really don’t understand what the problem is with interest only loans. The Federal government lives off interest only loans. Look, a family brings home a $100,000 net in California, not that uncommon. OK, now with interest only of 3.5 % the family can afford a 1.5 million dollar house and still have a 1.5 million dollars cash up front to spend on all the crap they ever wanted on this income. Do the math, it works. All you have to do is keep coming up with the $100,000 each year. This is how an real capitalist economy should work.

Since i comment here a decent amount, i feel like i have to admit that i caved today and closed on a house. To note though:

(1) i locked in a month ago at 3.5% on a 30 year jumbo so my rate was very tempting

(2) i ditched cali/la la and moved outside austin, less than 1/2 mile from lake travis, tx where population is going nuts (mostly so cal transplants bc it looks like cali here in hill country (it aint dallas or houston in terms of topography) but is definitely hotter with lots more critters) and jobs are plentiful.

(3) im 39 and have worked since i was 13 and this was my first home. I needed space and if i dont buy now, wtf already. It was not purely financial as many of you are basing it on and i work from home so wanted a castle. Couldnt get anything near la like i got here with 1.5 acres, pool, jacuzzi, 4000+ sq foot home and built in 2004.

(4) home prices peaked late 2007 here n only went down a little during the crash bc of the population growth of workers moving here. I was able to purchase cheaper than the first buyer in 2005 by a little.

(5) i had no family ties to cali as im an east coaster and own my own company so i had the fortunate luxury of making that move

(6) i personally wanted to be near a city that was growing based on jobs to protect my house depreciation downside bc i believe a downturn will come (i mean duh, teb world goes in cycles). homes appreciation built on hot money (flippers, wall streeters, foreign money, etc) scares me too much personally, especially la or miami.

(7) i did not stretch my budget, which i would have in la la

(8) i believe in my god given n constituonal rights. Not sure cali does. Texas seems to. Plus everyone here is just kind, warm, well mannered (very important to me personally) and dont care about celebrities, what youre wearing, what your driving and eating expensive dinners that turn to poop anyway.

(9) i dont work my butt off to pay a bunch of public workers to get great pensions n healthcare when ill get sht when im old. No f-ing way. How this doesnt infuriate anyone that works hard is beyond me. write a senator at least. CA has awful demographics and too much sun/not enough work/too many rich people claiming othe states residency so not paying cali taxes. As palo alto/sv loses more of its hold on tech in years to come, good luck making even annual budgets without as many tech IPOs, let alone long term solvency. Republican, democrat or indie, ya gotta love texas in terms of no income taxes and less govt expenditures. Also the homestead deduction helps some with property taxes. Maybe like 15%?

Fwiw, i feel awful for those stuck in cali out of love, fam, work, etc who want to buy. I lost a lot of sleep and woke up in the middle of the night being like ‘WTF are you doooing. Youre gonna buy an 1800 sq ft house on 6000 sq ft for 975k and then have that giant nut with a long hold time due to a crash coming at some point.’ I feel blessed to not have won a few houses i bid on at this point in LA. Feel free to join me in austin n good luck yall!

Congratulations FTB! You definitely made the right decision. For the younger generations who aren’t tied to this area for whatever reason, it makes sense to look elsewhere. The quality of life will be much greater.

I doubt California will ever lose the draw that attracts people here. It’s a revolving door where more people come in than leave. And of course everybody wants to live in the premium areas, so they will likely become even more sought after.

Good luck.

Thanks lord b. interesting to be rooting for more qe to bring this bubble up more before it pops. Fed in a weird spot. I think they sense they need to taper soon though. We’ll see if the markets allow them to or if they get too angry without their heroin and demand more or they will take the whole thing down so its more qe.

Btw, i got my license in 91. I remember under a dollar gas fo sure. Janes addiction and 89 cent regular gas for my beat up 88 wrangler that got 12 miles per gallon tops but it just didnt matter. Snoop/dre may have been there too, but maybe that was ’92?

I just moved the other way after twenty three years in Austin. Been in LA now for a year. Been reading this blog now since before I left Austin. Had a hell of a time finding a house here, but fortunately scooped a short sale fixer, that was priced before things started going batty again.

Austin is a great town, you’ll love it there. But I was done with that insufferable heat, and that drought is no bull shit. Texas as a whole and Austin in particular is way behind the curve when it comes to water supply issues. Look out your window and that parched rock that used to be a lake is your only water supply. I became very worried that water issues would eventually cause big problems for Austin, and my view has not changed. I’m a 25 year environmental engineer, and saw what San Antonio went through back in the 90’s with lesser problems than Austin now faces. Growing population, shrinking water supply, government inaction. Texas is very capable of great great things, but if they don’t get moving on this soon it’s,going to be an epic disaster. That great deal you got may look a whole lot different in a couple of years. Final comment. It’s not a drought. It’s the new normal. That said, I’d love to be wrong. Pray for rain.

A drop of nearly $10,000 in CA for income from peak is pretty significant money.

Here’s a house in the Eagle Rock neighborhood of LA flipped within 50 days and asking an $699,000. It was purchased in May for $485,000 (a profit of $214,000).

http://www.trulia.com/property/3121805253-5118-El-Rio-Ave-Los-Angeles-CA-90041

The Bubble is nearly fully re-blown in most parts of LA. I can’t believe that we are apparently destined to live this way forever. When, if ever, will this blow up in their faces again…hopefully this time for good (good meaning a real amount of time)? LA never fully reverted to normality before going up again.

Even the popping of the 2000-2007 bubble was largely illusory. Nominal values decreased, but at least in SoCal most good properties just stayed off the market because owners and banks had the wherewithal to keep them off. We shouldn’t kick ourselves for missing the bottom of 2009-2011. It was a bottom in name only with relatively few properties actually sold (at least to anyone other than connected insiders). Now that the nominal values have come most of the way back the sellers are coming back out of the woodwork. The last 5 years might as well never happened.

The one positive I’m seeing in Eastern Ventura County is that plenty of homes in the $600K+ region appear to be sitting for an awfully long time (several months). This belies the “everything sells in days with multiple offers” meme that seems to be circulating of late. I don’t realistically expect a significant drop in prices in the near future, but this kind of apparent softness in demand suggests that the potential for further appreciation may be weak as well.

Couldn’t agree more that “bottom” (2009-2011) was pure BS. I never saw a meaningful amount of desirable properties available at “normal” prices. 90% were junk fixers and the decent ones were still too expensive relative to what it would cost if you removed all the government props. The question is, can Gov’t props last forever? everyone used to say no, but now I wonder.

@JG wrote: “The Bubble is nearly fully re-blown in most parts of LA…”

This is a yes and no. The bubble is nearly fully re inflated in the desirable mid-tier and upper-tier areas.

In the lower-tier and bottom-tier markets, bidding wars on properties are largely non-existent. I know people who have bought in these areas (South Gate, Lynwood, Paramount, Gardena, Bell, Carson, Hawthorne, Inglewood, Van Nuys, North Hollywood, south Los Angeles), and there was no bidding war and the selling price was quite reasonable. Of course, these areas are majority minority (ethnic dominant, non-Asian) areas, i.e. whites are the minority.

The current re-inflated bubble looks a lot like the bubble of the early1990s where prices skyrocketed in the Caucasian/white/Asian majority mid-tier and upper-tier areas but in the ethnic majority (non-Asian) areas languished.

Hey FTB….I am one of those poor suckers in California wishing that home prices would come down to sane levels. It is total insanity. It is going to end very badly some day.

Anyway, do you feel like sharing with us how much your little castle in Paradise cost? I am sick of California. I can afford to buy here in some areas, but I refuse to! Real estate in California is a ****ing rip off! Someday it will be a disaster worse than the tornado in Moore Oklahoma.

Sure hell freezes over. I paid $688,000 with a little over $2k seller credit as i have about $4k of minor work to do (and a new AC coil) so we split the difference. I bought in an area about a 1/3 of a mile from lake travis so about 22 miles/35 mins from 6th street/happening part of austin. We wanted land (and it feels f-ing great to have an acre and a half and shoot my bow and pellet guns with no one saying a word), a pool/jacuzzi (we luckily got a heated saline one) and space (we were thinking 3000 sq ft, but everything is bigger in texas so ended up with a little over 4100 with 5 bedrooms (master has a jacuzzi tub and french doors from bedroom to backyard) and 5 bathrooms, study, hardwood floors, 2 wood burning fireplaces, 3 car garage, open concept kitchen/living room and solid wrought iron fences). Im also in a cul da sec so you can play in the streets too…motorized toys n fireworks are welcome cause its texas baby. 😉

I bought in an area that is gentrifying (with lots of so cal transplants) so youll see 2 million dollar homes and 200k homes. Some may be turned off by that. I kinda like it bc i seem to like down to earth people most. Lakeway is basically surrounding me, but thats more expensive with smaller lots and more land restrictions. Its going NUTS out here in terms of growth. Pretty cool to be a part of it as everyone has been super friendly. You wouldnt believe how just everyone has manners and is smiling with less stress. If you like bbq, run, dont walk here. Sorry cali, but mex and tex mex is just as good here, although cali has fresher guac. 😉

Negatives for some would be the humidity. I work from home so i dont need to wear a suit, but i can imagine that being rough when youre not in AC. I also grew up for 30+ years on the east coast so i know 99 degrees and 99 percent humidity. I think today wS more 90ish with 85ish percent humidity here but locals said this was more humid than normal (i couldnt tell u the real avgs yet). Good news is you can afford a pool here. ;). Last negative would be for those who have bug phobias. Unlike cali, be prepared some mosquito bites and look out for red ants and mini scorpions. I heard tarantulas are not that rare as well. Usually people see only one snake every 5-10 years. Just lots of bugs in general but most dont bother you and dont stare too hard at the ground. I consider those the two small tradeoffs but i grew up with both so whatever. Cali was turning me soft a little. Theres something to be said for a man to be man a little and not have every convenience, imo.

If i can help answer anything else lemme know. Btw, this is all my personal opinions. If i grew up in cali id prob think differently. I just loved cali weather. Beach was a-ite, but i dont surf or play beach volleyball and the water was always kinda cold in the pacific. i personally found the beach fun for like 2-3 hours a few times a year and then it was time to drive home…in traffic for 1.5 hours. Everything else can be gotten everywhere in 2013.

@when hell freezes over

I purchased a home in Baldwin Vista in Dec. 2012. After being a participant of this website since 2010 I realized that there was no guarantee of price reductions in the future. I purchased a home from the original owners for $270 per squarefoot. Today similar houses are selling for over $300 per square foot. By the time there is a ‘crash’ in housing prices (supposedly in the future )I will still be in much better shape then being a rent slave.

It’s very difficult to live in Texas if you are not used to that weather. I personally rather rent California than live where is hot and humid.

However, I too don’t see prices coming down anytime soon. Something has to happen to shock people again. Not sure what that will be. If I were to guess, I can see a lot of companies beginning to leave Southern California as they can’t hire new talent to the high cost of living. But even with that said, New York City and San Francisco still really prosperous. So Irvine will be for the rich and the two income families were both are willing to contribute 50% of their income the housing.

I grew up in nyc and nj so ive lived with 100 degrees and 99 percent humidity most of my life, compared to cali for 3.5 years. I hear ya on the hot n humid, but….eh, instead of writing something long, i’ll just go with, dont be such a pu$$y and act like every day is pure heaven weather wise in CA and everywhere else in the world has to be hell every day.

I lived in texas for 7 years before selling last year. I had enough of the 9k property taxes every year and 2-3K yearly housing insurance premium ripoff – not too mention the severe storms, the crap fire ants, and the summer heat (that doesnt go away at night). Plus the beaches suck and enjoy the #1 teen pregnancy state in the union!

Keep telling yourself that Rick Perry is smart too –

James,

Please compare the size of house and property for 9000 property taxes a year compared to a tiny 1930s broken box in la on a 6000 sq ft lot as well as your income taxes, gas prices, food costs, etc…or are you the guy who makes silly comparisons that make zero sense but you can be proud of low property taxes…today at least. I have no clue about what th

Oh no fireants. Maybe they should close texas or any of the other 48 states with bugs. You sound perfect for cali. Poor and getting poorer each year comparatively, but tan with sushi and think the whole world revolves around a beach.

As far hot at night, cool, ill be in my swimming pool while you get the night chill n a sweatshirt. Not sure why one is better. Seems like different strokes for different folks.

Also i paid 1478 for my annual homeowners insurance with a 1000 deductible ao ko clue about this 3000 house insurance.

PS. Politicians are puppets. You need to look at policies. No way id want a liberal stte with those demographics over a conservative state who understands low taxes drives the world (read the great Texodus from so cal to austin online:”;its eveywhere from business to people). What company do you think is coming to cali or expanding in cali? Good luck wit that. At least cali will increase its population on entitements so you have thT going for you.

Lastly, teen pregnancy as number one in the nation. Um…ok. Im losing lots of sleep each night about that one. I guess chicks like to have sex early withiut condoms. What can i say?! I dont have a daughter nor do i plan on getting any teenage girls prego.

Lastly, should new york city just shut down? Miami? They have sht weather based on your logic and bugs too. Does colorado suck bc too cold and snowstorms? chicago blows too huh. Millions upon millions of idiots i guess in the US who all most be so sad. Do you even realize how much of a spoiled little girl you sound like? We wonder why america is slipping behind the rest of the world. Geez. Maybe next you’ll start bragging about seeing a celebrity on larchmont.

I advise folks to stop picturing texas from movies and google hill country in texas (where i moved) and tell me its not beautiful. Its not dirt and oil rigs (although part of texas is…just like many parts of cali are, btw, james). Picture rolling green mountains with oak trees.

Regardless, i wish all those in cali the best. As i said, i think it has a ton of pluses, but some of yall need to relax a little on the its the best place on earth n everywhere else is cold diarrhea on a paper plate.

There will be a modest sell-off, but will occur over a generation as the babyboomers, at least those looking to cash out, find that they need to liquidate to stay afloat.

The NY Times just printed an article about the retirement nest egg and in regards to median income, “the median financial net worth of American households of all ages, excluding homes and cars, is $10,890, as estimated by Edward N. Wolff, an economics professor at New York University. For households headed by those in the 55-to-64 age bracket, it’s $61,300.”

http://www.nytimes.com/2013/06/16/your-money/suddenly-retiree-nest-eggs-look-more-fragile.html

I live in Austin and the RE market here is one of the most overvalued in the nation. And despite what they might say to your face, Austinites really don’t like people bringing their equity here driving up prices, turning our town into OC.

It’s definitely irrational and exuberant but I could not be more delighted because I just sold my house for a ridiculous price! A year ago, my realtor was very skeptical that I could get $400k for it and I got nervous and waited a while. A week ago, it sold for $561 to an all cash buyer who I think is an amateur flipper. And I think probably he is really clueless because believe me when I say, this house is a disaster. Structurally it’s sound but it’s got a crappy layout, a tiny kitchen and it’s really ugly and I spent five years trying to think of a way to make it less ugly–brought in designers, architects, the whole deal and basically everyone agreed it would cost 100 – 150k to remodel it into something slightly less ugly and more live-able. Oh did I mention, no garage and no yard? I LOVE THIS MARKET!!!!!!!!!

Leave a Reply to franz