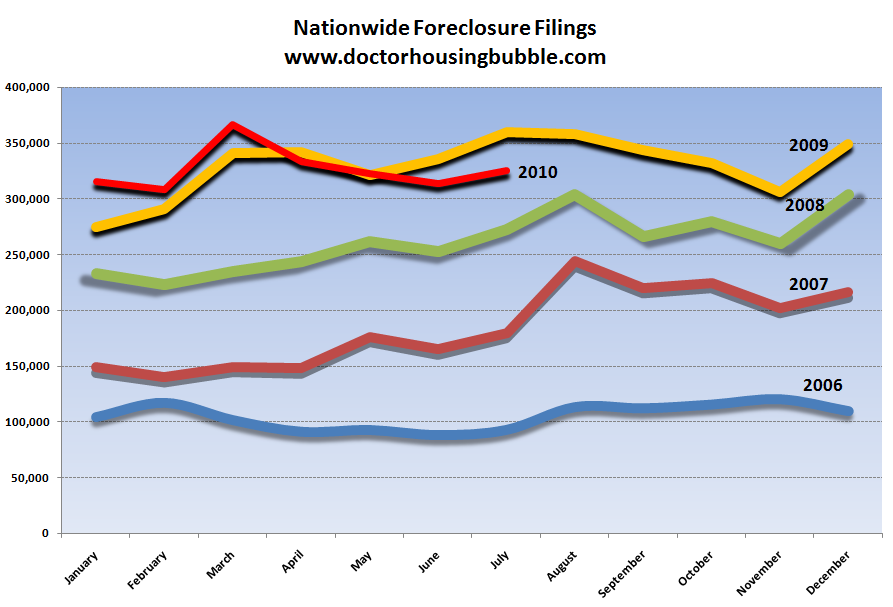

Nationwide foreclosure activity jumps by 12,000 from June to July. One in 397 received a foreclosure filing during the month of July.

In a sign that things are slow going in the housing market, foreclosure notices jumped nearly 4 percent from June to July. Over 325,000 housing units received a foreclosure filing in the month of July. This elevated level demonstrates that the housing market is still far from any sort of reasonable recovery especially with numerous troubled mortgages floating out in bank balance sheets. Keep in mind this high elevated amount of foreclosure activity comes at a time when the government has stepped up programs to help people with paying their mortgages. Let us take a look at the last five years of foreclosure activity.

“(RealtyTrac) July marked the 17th consecutive month with a foreclosure activity total exceeding 300,000,†said James J. Saccacio, chief executive officer of RealtyTrac. “Declines in new default notices, which were down on a year-over-year basis for the sixth straight month in July, have been offset by near-record levels of bank repossessions, which increased on a year-over-year basis for the eighth straight month.â€

Foreclosure Activity by Type

A total of 97,123 U.S. properties received default notices (NOD, LIS) in July, a 1 percent increase from the previous month but a 28 percent decrease from July 2009. Default notices in July were down 32 percent from their peak of 142,064 in April 2009.

Foreclosure auctions (NTS, NFS) were scheduled for the first time on a total of 135,248 U.S. properties in July, an increase of 2 percent from the previous month but a decrease of 2 percent from July 2009. Scheduled auctions in July were down 14 percent from their peak of 158,105 in March 2010.

Lenders foreclosed on 92,858 U.S. properties in July, a 9 percent increase from the previous month and a 6 percent increase from July 2009. July’s bank repossession (REO) total was the second highest monthly total since RealtyTrac began tracking REO activity in April 2005 and was 1 percent below the monthly REO activity peak of 93,777 in May 2010.â€

And the beat goes on in the housing market. Â The leading states once again rear their heads with California accounting for 21 percent of all the activity in July alone. Â These numbers are discouraging especially as we enter the slower fall and winter seasons.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

9 Responses to “Nationwide foreclosure activity jumps by 12,000 from June to July. One in 397 received a foreclosure filing during the month of July.”

Very discouraging news. Jobless “recoveries” are to blame here. Until someone does something about jobs, the foreclosures will continue.

Even if there are new jobs, how many of them can afford to support the current housing price.

Keep Foreclosing! These people signed up for mortgages they either never intended on paying off or couldn’t pay off. Many are wising up to the fact that debt does not equal wealth and are walking away. This should be encouraged so that people don’t stay debt slaves and poor so much of their income into housing and paying interest to banks. Wake up people, high homes prices are unhealthy for our economy.

Completely agree!!! Check out this video:

http://finance.yahoo.com/tech-ticker/you%27ve-entered-the-twilight-zone-barney-frank-is-right-bill-gross-%22wildly-incorrect%22-about-fannie–freddie-535338.html?tickers=FNM,FRE,XLF,XHB,HD,BAC,WFC

the bad loans are no longer on the private banks balance sheet … they’ve been moved over to the Federal Reserve’s balance sheet.

Recall in 2009 and early 2010 … the Fed purchased $1.25 trillion worth of JUNK mortgage backed securities from Fannie and Freddie … which then used the money to load up on junk mortgage loans sitting on the books of MS, GS, BAC, WFC, JPM and gang.

Now the banks are sitting on tons of cash … and the Fed is trying to decide how much inflation they can get away with.

And yet another round of handouts is being worked on. Unbelievable!

http://finance.yahoo.com/news/Banking-execs-say-govt-needs-apf-1176865107.html?x=0

Banking execs say gov’t needs to back mortgages

Banking executives tell Obama officials government needs to play large role in mortgage market

Yeah, government, save more bad debt!

FOA wrote back in April of 2001,

“My friend, debt is the very essence of fiat. As debt defaults, fiat is destroyed. This is where all these deflationists get their direction. Not seeing that hyperinflation is the process of saving debt at all costs, even buying it outright for cash. Deflation is impossible in today’s dollar terms because policy will allow the printing of cash, if necessary, to cover every last bit of debt and dumping it on your front lawn! Worthless dollars, of course, but no deflation in dollar terms!”

@Foolio

How can I get a deal like that for myself? I sell prodcuts-in the banks case mortgages-if it is successful, I keep the profits. If it fails, the govt keeps the loss and I cna sell even more products and get even more bonus? These clowns are probably the ones screaming socialism too !

The Khazars set up camp in Manhattan and have taken over the country. We are but their serfs at this point. Our bread and circus are now Pizza and TV…We gave up without a fight.

Leave a Reply