Mortgage rates will go up in 2014 and the middle class is going to feel the burn of higher fees on mortgages: Can this momentum continue into 2014?

The Fed’s archaic language makes it very clear that there will be no taper anytime soon. To the contrary, the Fed will still be buying something like $75 billion a month in bonds instead of $85 billion. What bold movement right? Of course this sent the stock market into another easy money induced rally. However, during the same period we find that existing home sales took a hit and prices are definitely softening. Over the summer, the popular FHA insured loans took a giant hit via mortgage insurance premiums increasing dramatically. This action certainly impacted the origination volume of one product that was leveraging buyers into homes with as little as 3.5 percent down. Even in expensive SoCal, FHA insured loans made up 20 percent of purchases last month. In 2014 there will be new fees hitting vanilla mortgages as part of the Federal Housing Finance Agency (FHFA) trying to push private lenders to take on some of the mortgage market which is fully dominated by the Fed and government. These fees will happen at a time when home owners are already leveraging up to compete with big money investors.

The slowdown in housing

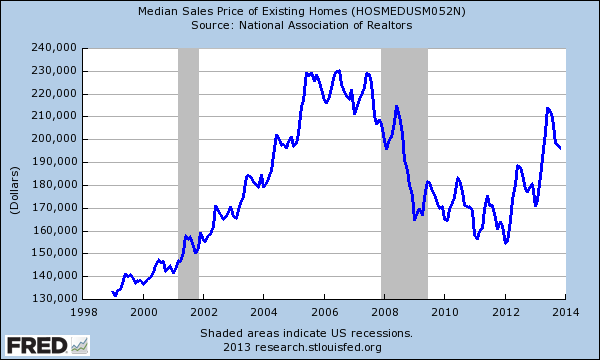

Higher rates have certainly had an impact on the housing market. The median price nationwide has certainly slowed down during the last few months (we will find out soon how much of this is seasonal and how much of this is due to changing winds):

We’ve already noted that investors are certainly pulling back in many inflated markets around the country. Some seem to think the Fed is fully omnipotent in controlling rates. People do realize that the 30-year fixed rate mortgage has gone up over 100 basis points in spite of the Fed now having a balance sheet well above $4 trillion and now owning 12 percent of the mortgage market? When the stock market is rallying as it is, tiny gains in land-lording don’t look as appealing as jumping on the next IPO.

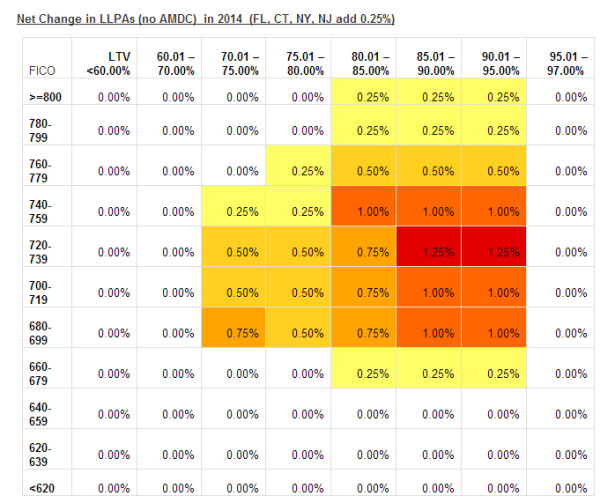

The new fee increases next year will have an impact. They come in two parts:

-1. A mandated 0.1 percent to the rate for all new loans

-2. Loan Level Price Adjustments (LLPAs)

The second item is going to make a bigger impact as it is going to make it more expensive for people to borrow (table below depending on LTV):

Source:Â MortgagenewsdailyÂ

These are fairly significant increases when you consider most middle class families are squeezing into mortgages. The bigger impact from LLPAs will come with raising the standard with credit scores for the best mortgage rates. For example, borrowers with scores of 740 receive Fannie Mae’s lowest pricing but the new requirements will push it above 800. In 2007 a 680 received the best (and look how things turned out).

Again, I want to be clear that the last housing crisis was brought on by more than just subprime buyers. The bulk of people that lost their homes were in traditional vanilla 30-year mortgages. The facts back this up. Yet people like to believe that subprime borrowers were the central cause of the implosion of our entire system.

The FHA already required a lifeline this year since loans were performing poorly in spite of the hot market. The problem with looking at aggregate data is that the 30 percent cash buyers have distorted the typical down payment across the board. For example, the typical down payment for FHA buyers is 4 percent (slightly above the mandated minimum 3.5 percent). Adjustable rate mortgages are already going up in usage as more regular buyers need more leverage as household incomes are not going up.

Folks in the mortgage industry realize this is going to be a big impact and there is already buzz because of this. When mortgage applications hit multi-year lows even before any of these changes hit:

Source:Â Bloomberg, ZeroHedge

Mortgage applications hit a 13 year low even with the housing market having one of its best years in terms of prices. Let us be clear, prices moved because of low inventory, low rates (for the first half), and manic demand from investors. Yet this has obviously changed towards the end of the year.

Regular buyers are already tapped out and the data reflects this. There is also an odd notion that folks, either domestic or international, are ready to lose their money no matter what in real estate. People do realize that many people that have saved a good amount are actually concerned about preserving their funds? This is why investors have slowed down buying in this market. As those double-digit price gains ebb to single-digit to possibly flat or negative year-over-year gains, the headlines will enter another echo chamber that isn’t going to sound so pleasing to investors. It already started in the middle of the year.

The fee increases coming next year simply add another cost to getting a mortgage regardless of what the 30-year does or doesn’t do (similar to MIP on FHA insured loans). People also were pointing to the nice little jump in recent housing starts but most of these were for multi-unit dwelling (i.e., the rental revolution continues).

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

65 Responses to “Mortgage rates will go up in 2014 and the middle class is going to feel the burn of higher fees on mortgages: Can this momentum continue into 2014?”

It’s unlikely these fee increases will go forward: http://www.bloomberg.com/news/2013-12-21/fannie-mae-fee-increases-to-be-delayed-by-fhfa-under-watt.html

Housing to Tank hard in 2014. Sell and rent until 2016 and buy for half.

You’ve said that before — Explanation please? Also, you are telling folks to sell now and rent until 2016. Why would they wait until 2016 if as you say prices will tank in 2014? If prices tank in 2014, then why wait until 2016 to buy? You’re just not making a whole lotta sense to me Jim Taylor. Trying to follow you. Please explain, thanks.

@ Scarlett – Don’t bother asking him. If he had anything solid to provide, he would. Jim Taylor = quack.

The reason I switched to this Username about 6 months is b/c the VAST MAJORITY of predictions I’ve read on many blogs the past several years have proven to be FLAT WRONG. In 2011 and 2012, many predicted a further decline in real estate prices and a tanking of the stock market. Fantastically incorrect!!

Trust your own gut about YOUR circumstances, don’t buy more than you can handle if tough situations arise (job loss, etc). And don’t buy unless you feel strongly that you’ll be able to own for a minimum of 7+ years b/c selling costs are huge and will likely kill the advantage of owning in a shorter time period.

I agree, it doesn’t make sense.

It makes about as much sense as when you jumped over the hedge.

The reason is because prices are going to start drifting lower at the start of 2014, and then accelerate. I see 25% lower by the end of the year, and then another 25% in 2015 so in 2016 it will be 50% less. Might as well rent for the two years while prices trend lower the pick a place up for much less.

Stock margin buying is at an all time high

Real Un employment remains very high

We have been in a 4 year bull run. Recessions hit every 5-6 years

QE has been enormous and tapering has begun as they are loosing control of the bond market

Corporate earnings are also coming in weaker

He’s got more data than you might believe. Perhaps it’s more believable when Fitch states that housing is somewhere between 40 and 50% overpriced compared to historical norms, even when corrected for inflation. I’d start there and the rest of the data starts to fall in place. Half off seems a little dramatic though. 10 to 15% is possible.

It’s said that real estate is all about LOCATION. That being so, I doubt that any price drop would fall at the same percentage amount nationwide.

No way is RE coming down 50% across the board, from IE to Santa Monica.

Jim, housing is down right cheap in most parts of the country, I’m pretty sure we won’t see 50% off prices there. Let me guess, you want it to tank in desirable parts of coastal CA so you can jump in and get a bargain. There were some bargains to be had a few years ago…the people who had their act together and pulled the trigger were rewarded.

As I’ve mentioned before, housing in desirable parts of socal will likely only tank if there is a crisis of some sort. Now knowing the Fed’s/government/PTB/Wall St. stance on housing…I sleep real well at night knowing I have plenty of entities looking out for me. Everybody has a different situation regarding buying RE. One thing is certain, RE in coastal CA will always be in high DEMAND!

Home prices should fall base on economics pressure… but the FEDS will be looking for new ways to keep the housing bubble inflated and they will continue to manipulate this housing market. They will continue until… ultimately, it gets too big and out of their control… and they won’t be able to keep the housing bubble inflated anymore… and this is when the real recession hits. Wait on the sideline with money in hand and be ready to buy when nobody can is buying and home prices is falling. Wait for the next recession. This bull run can’t last forever.

KEn did a great job answering for me. What people do not realize is our economy is in worse shape now than it was in 2008. LORD B – the only difference this time is that the policies of the government looking out to protect your housing has been used up now. When the next crisis hits there is nothing left to keep the bubble inflated. It is going to tank so hard it is not even funny once the hedge funds and other institutional investors start dumping their properties. Who will be left to buy? Mortgages are at a all time low.

What happens when there is no one left to sell to? Think about that one for a moment.

Kondratieff Waves and the Greater Depression of 2013 – 2020

….. it would be wise for our political and economic leaders to accept the lessons of history and realize that based on comprehensive economic evidence, following the 2007 systemic collapse of world banking and credit, things are likely to get much worse before they get better.

http://www.financialsense.com/contributors/christopher-quigley/kondratieff-waves-and-the-greater-depression-of-2013-2020

42% of sales were all cash in November: http://www.marketwatch.com/story/nearly-half-of-all-homes-are-purchased-in-cash-2013-08-29

And the rate increases get postponed again:

http://money.cnn.com/2013/12/23/real_estate/mortgage-fees/index.html

Many others have picked up on the fact that most houses are bought in cash now. Now some of new finance companies in certain areas of the country are trying a close to if not zero interest rate for loans – provided by the home builders themselves. This way the price of the home can continue to increase at a much faster rate…thus making the home builders more profit. The home builders are all for climbing house prices. There also all in for less regulation.

Other companies like Overstock.com also what the government and processing companies like VISA out of the picture. They are likely to start taking Bitcoin for purchases on Overstock.com.

Companies like Toyota have loans on cars for 0% and avoid all the standard banking nonsense.

So look for the NEW housing market to come up with some new ideas and forget the old ways. 2014 will be a wild year for the housing market.

I fail to see what the comment about overstock.com has to do with any of this. If overstock.com issues loans directly so buyers of merchandise on overstock.com wouldn’t have to use their visa cards, the price of said merchandise will only be reduced a miniscule amount. Visa and other credit card fees are not that high a percent of the purchase price.

The idea of home builders issueing their own cheap loans is interesting, but not new – they have had the opportunity to lower the percent interest or other rules on their own in-house loans for a long time.

Californians cashing out are a factor buried in the 42%…

It’s as common as dust for them to buy — all cash — and put the rest of the proceeds into the markets.

When the sellers are retired couples, even a cheap mortgage rate may look too expensive if they have to balance it against what said funds could earn in the money markets.

A debt is an inverse AAA bond, for you surely must pay it, come hell or high water. Further, you have to tack on extra expenses, too. (Title insurance in a platted subdivision is money poorly spent. The players are running a cartel.)

California is such a large factor that this situation skews even the national figures.

Further, investment partnerships are resolved to pay all cash… just to close the deals. Financing within escrow is causing bids to melt down. Instead, the financing is put on after the close. This also skews the national stats.

Between ZIRP and hyperinflating the money supply — all control signals are corrupted.

ZIRP even has induced the wrong type of investors to go into SFH.

Watt just announced today that he (fhfa) is delaying the implementation of these gfees, until they have had ample time to be reviewed. This was Demarcos policy, and it’s a whole new ball game now that Watt is in. Should be interesting to see what happens.

expect corruption of the highest order in Mel Watt. He is truly Congress corrupted scum. Time for borrowers whom took on to much to chew to get foreclosed on, time for interest rates to return to normal. time for reality. I’m personally tired of the bailing out of credit criminals. Rewarding greed is like sleeping with the devil.

He has an official web page and a Facebook page. Shame him. It will take you only three minutes. All it would take would be a few hundred people to send the message that he’s not fooling anyone.

Sometimes rising rates can people off the fence and start buying. But the fact that so many sales are all cash at this time points to a very different market than what we’ve traditionally seen. Low volume, all cash. I doubt that this can be sustained for too long.

Doctor Housing Bubble:

I would like to make a case that nothing has really improved since the bubble burst of 2007.

First, debt to GDP ratio is slightly lower but historically it is still extremely high.

http://www.macrotrends.org/1381/debt-to-gdp-ratio-historical-chart

Notice that the growth starts around 1982 this coincides with the original start of the savings and loans deregulation/debacle. The ratio has come down and this coincides with the great recession but it is nowhere near the mean.

Second, employment has not improved. The real employment number is labor participation rate.

http://data.bls.gov/timeseries/LNS11300000

Notice the drop off in 2007 that never recovers.

Third, income growth or lack there of…

http://advisorperspectives.com/dshort/updates/Median-Household-Income-Update.php

This chart speaks for itself.

Fourth, China isn’t going to save us.

http://www.cnbc.com/id/101099732

As I stated in a prior post, China a country of 1.36 billion has less millionaires than the “I†in “PIGS†Italy with a population of .06 billion and is creating less new millionaires as well…

Fifth, Value versus volume. There is a reason stock pickers watch volume as well as price because looking at one in isolation never tells the true story.

http://www.housingviews.com/2012/05/03/is-the-pace-of-home-sales-still-too-low/

Chart is a little old and does not show enough history but I think you get the picture.

Finally, is the myth of the “all cash buyerâ€.

The definition you use is anyone or thing that shows up to a open house, auction or inside deal to purchase a house that does not need approval from a financial institution to close the sale. Let’s walk through a couple of scenarios and see where it gets us.

Hedge fund manager goes to investment bank, sells the idea of securitizing rental income stream and then sell this new fund to pension funds, 401k funds, etc. This would be an “all cash investor†by your definition even though it is 100% financed.

Someone takes a line of credit on their 401k and purchases a house as an investment. This shows up as an “all cash buyerâ€

Someone with some net worth goes to the bank and gets a line of credit buys a house. This shows up as an “all cash buyerâ€.

This is and always was a debt induced asset bubble. Follow the debt because there never was any money to follow…

Thank you “What?” for breaking down the all cash buyer myth. This whole thing is going to fall apart over the next 2-3 years max. The FED is going to continue monetizing but that capital will only continue to juice the wall street bull run. In hindsight we’ll likely say Housing Bubble 2.0 likely popped fall 2013. The Hedge Funds will liquidate the under performing properties before long. While I still expect extraordinarily low mortgage rates because of FED policies, the increase in inventory and dwindling demand sans investors should push us below the 2010 trough.

By late 2015 we should be seeing 2010 prices negative 10% with mortgae rates in the 4s solely becaus eof FED intervention. If mortgages hit 5% plus (which is entirely possible if the FED loses control of the bond market) I expect it’s 2010 prices negative 15%. All this is assuming nothing REALLY bad happens in the interim.

A couple points.

First, tapering is relative. If there are less mortgages being initiated due to a slowing housing market, then the $420 billion in mortgage bonds the fed is buying could be even a bigger percentage of the total mortgage market than the $480 billion it was buying in a bigger market last year.

Second, mortgage rates are pretty much 1.8 percent plus the 10 year treasury yield with almost no variation, r=0.97! If the fed goes all into mortgage and not treasury bonds, this equation can actually be broken. Also, if the fed buys a vast majority of the mortgage bonds, confidence and control of rates won’t matter as it will be able to consume the entirety of mortgages issued. This is a scary thought. Does anyone know any technical reasons the Fed would be hindered from doing this?

Back in the Eighties when I was a Realtor, I sold a house to a man who bought it with cash advances from 15-20 credit cards. It was an “all cash deal”. He flipped the house and paid back the credit cards.

Saxo bank made this prediction for 2014…

6. Quantitative easing goes all-in on mortgages

Quantitative easing (QE) in the US has pushed interest expenses down and sent risky assets to the moon, creating an artificial sense of improvement in the economy. Grave challenges remain, particularly for the housing market which is effectively on life support.

The FOMC will therefore go all-in on mortgages in 2014, transforming QE3 to a 100% mortgage bond purchase programme and – far from tapering – will increase the scope of the programme to more than $100 billion per month.

Saxo bank is wrong on this prediction. QE3 allows the banks to transfer about 150,000 crap mortgages to the Federal Reserve each and every month. By the end of 2014 there will be no more garbage mortgages left to move off of the balance sheets of the banks.

The Fed will buy more treasuries and less mortgages. There’s not enough mortgages for them to buy.

Meaningless taper. Rates will continue to rise if there is another taper or more taper talk. At some point even more QE won’t stop rates from rising

…the end of the road for the Fed will be mid 2014 when the 10yr. will be at 3.5%

it doesn’t take a rocket scientist to see this is snowballing into a catastrophic event

Let’s put some of this hysteria in perspective. I bought my first home in 1982 with a 13.75% private mortgage. I was happy because banks were charging 18%. I became a Realtor in 1986 when mortgages were 12%. Business was booming and days on market (DOM) was 18. By 1988 rates had dropped to just under 9% and the market went into a 10 year hiatus in CT.

Rates are not as important as other factors, like buyer demographics, household income and debt levels, and supply.

This is a case where the facts are stated but the wrong conclusion is drawn from the facts.

First, mortgage rates have been on a steady downward trend since you bought your first house.

http://mortgage-x.com/trends.htm

Second, private debt has been on a steady upward trend since you bought your first house.

http://www.macrotrends.org/1381/debt-to-gdp-ratio-historical-chart

Income has arguably been flat at best over the past 20 years.

http://advisorperspectives.com/dshort/updates/Median-Household-Income-Update.php

We all agree that inventory is being controlled.

Demographics are a net wash at best. Rob Peter to pay Paul sort of thing.

We are still missing the point by concluding that interest rates don’t matter at a given point of time. The point is that there is nowhere for interest rates to go but up. The current housing market was an exercise of controlled inventory and cheap money. There is no cheaper money and not a lot more controlling of inventory left. Flat income and demographic wash is not going to help the overall market. I think the only area of argument would be do you believe in asset bubbles or not. I would argue that we would be flat here on out if there is no such thing as asset bubbles. If you believe in asset bubbles, then we have lost the fuel to continue to supply higher and higher numbers of greater fools. The reason that every ponzi scheme fails is that it requires ever greater number of greater fools and eventually there are not enough greater fools in the universe to support the scheme and it come crashing down on its self. Sure the Fed may still have a trick or two up their sleeve but I am not convinced that monetary policy can fix the current economic conundrum.

What were the lowest mortgage rates in Japan? Also what were the longest mortgage terms?

Is it true that rates can only go up? I’m not so sure. . . central control has gotten us this far. I doubt they will let anything catastrophic happen if it is within their power.

Hey Sakman what do we have in Japan at this point? Long slow death by deflation… Did you notice that Japan has lost more millionaires than any country over the last year? They lost 1/3 of their millionaires from 2012 to 2013. They went from 3.9 million to 2.6 million millionaires. That doesn’t sound like a great economy to me… I think we saw an interest rate bottom at 3.5% for a 30 year note. I believe that the fed is losing control of the interest rate and that is the reason they “decided” to taper.

http://www.cnbc.com/id/101099732

To answer my question: 40 years at 0.075% was the lowest I’ve been able to find.

The question that I would like to know the answer to now is, how did that happen? I ask the question because I want to know if it is even a remote possibility in the US, and I now nothing about the set up in Japan that lead to those rates.

Speaking of Japan, here is a pretty good comparison of Japan and US debt to GDP ratios. It appears that the US is attempting to go down the same path. The problem with this is that Japan is a net export nation who had their crisis when the rest of the world was fine but was unable to grow out of the problem. The US is a net import nation and the crisis occurred for many parts of the world at the same time. I am not convinced that the Japan model is even all that available for us.

http://www.thoughtofferings.com/2009/09/mystery-of-japans-private-debt-levels.html

I think to focus on price and duration at this point will not give the best insight. I believe the real issue is that at a certain point there is only some much future production you can pull back to the present. There are those that would argue that there is total debt ceiling that a given economy can sustain even with a nominal interest rate of 0% and 100 year term. That is why I believe we hit a interest rate bottom of 3.5% not because of the number but because of the lack of GDP growth it created. This is assuming that aggregate income is flat. Keep in mind that Japanese hold most of Japanese debt. That might explain why they can keep interest rates negative over a period of time and simultaneously lose a third of their millionaires…

IMHO… on Japan. They have seen a population peak and decrease over the past 10 years. You should see deflation with a decreasing population. As the population decreases you need fewer homes, stores, food, clothing…. you need less of everything. How do you sell an existing house when there is no new buyers.

rsu82

I think you are completely missing the fact that Japan had a debt based asset bubble extravaganza during the 1980’s and 1990’s.

http://www.thoughtofferings.com/2009/09/mystery-of-japans-private-debt-levels.html

I would argue that the impact of debt level has a much larger impact on money supply than population in the case of Japan…

Maybe the debate whether or not asset bubbles exist, or if the absolute value of the interest rate is a factor, means that these are secondary effects. Maybe the issue lies in our understanding of what growth is. Maybe growth is the accelerating depletion of an asset or resource. For example, the price of housing may be stable over time, at a historically moderate valuation according to accepted measures, but if the reserves of buyers decline, housing prices will decline and appear to be an asset bubble bursting. The point is, a fall in housing prices can follow when low rates no longer have the intended effect as What? has said, regardless of the absolute rate value or how long it has been in place. For housing values to rise, some asset like a new credit or wealth pool has to be created or exploited. For example if college education or health care cost was suddenly cut in half by some means and diverted to housing expenses. That’s not likely as far as I can see and in fact the opposite will probably be the case. So housing prices are probably at the start of a secular downward bias.

What?

I meant the last 10 years from 2003 to 2013. Japan had a serious asset bubble , stock and housing, that deflated and pretty much hit bottom in 2003-2004. Since that time their population has peaked and is in decline. Deflation seems like a natural consequence of a decreasing population. That is one of the battles that Japan is facing that is different the the U.S. Japan either needs to increase productivity (hard to do with low labor cost in China, etc.) or devalue. They have devalued and they are seeing inflation (stocks and assets) but without wage growth (no increase in productivity)

http://www9.ocn.ne.jp/~aslan/pfe/jpeak1.gif

http://ndainfo.files.wordpress.com/2009/11/usvsjapangdp.jpg?w=748&h=523

EB & JQ

Post crisis the banks had million of home mortgages on their books that went into default. If they had foreclosed and put the homes to market, prices would have collapsed. So the homes were sold to hedge funds with money loaned to them by the same banks. Securitizing the income stream has begun but the ultimate goal is to unload them to the taxpayers. When the plan is revealed the renters will be offered the home via the FHA and ultimately insured by Fannie and Freddie, none of whom are subject to the new mortgage rules. They were intentionally excluded. These renter to homeowner mortgages will have a no downpayment provision and will not be subject to the increased fees.

The Fed purchased 90 percent of the new mortgage bond issuance in November. This is just the beginning.

subprime redux. wash, rinse ,repeat

I believe Jill has summarized the basic game plan.

The question is…will things go as planned, or will they spin out of control?

“Post crisis the banks had million of home mortgages on their books that went into default. If they had foreclosed and put the homes to market, prices would have collapsed. So the homes were sold to hedge funds with money loaned to them by the same banks…”

Prices didn’t’ collapse because banksters forced their Congressional underlings to ease fair-value rules in late 2009, allowing banks to hold onto their underwater notes without suffering any hit to their balance-sheets. So, for a couple of years the banks hid their most onerous foreclosures and half-halfheartedly worked with home-owners looking to short-sell.

Wall Street/venture funds got involved around 2011.

2014 will be stable for housing, yes rates will rise, but overall many expect to pay 5.5 to 6% for a mortgage, anyway.

When zero funds rate is lifted in early 2105 another boom will occur. Nothing like getting 5% on your money market.

Excellent sight Dr. Bubble good job again in 2013. Please all, have a safe holiday stay healthy in 2014, and all will prosper ( in spite of Wash DC), because you have to believe.

The Shrill who stole Christmas…

You can be certain that housing prices will drop significantly if rates rise to 5.5-6%. The only chance housing prices rise is if there is an economic boom. My crystal ball does not foresee an economic boom in the future. Monetary expansion, yes. Economic boom, no.

The demographics that spawned the housing boom of the Eighties was the Baby Boomer “pig in the python” The largest demographic group to ever hit the scene was done playing around with the Sixties and the Seventies. They were married, had children and a career, and wanted to own a house. Now the pig is closer to the other end of the python. For at least 10 more years we will have Boomers retiring and downsizing. This will put a lot of non-starter homes on the market. This doesn’t help the first time buyers and without them there is no housing recovery. Boomers are also taking their money out of investments to live on because that’s what it was for. When the stock market suffers, the housing market suffers. I don’t see a recovery for a long time, not until the average house can be purchased by the average family.

I believe the real change in the 1980s was the growth of debt to GDP ratio.

http://www.macrotrends.org/1381/debt-to-gdp-ratio-historical-chart

I am not as convinced that it was simply the number of boomers buying housing that caused the asset boom. I believe the real cause was the increasing amount of debt the boomers used. Some have suggested that the boomers, the fist generation with no memory of the last great depression of the 1930’s, where much more open to carrying debt than their parents.

I think this difference is very important because if the asset price increase was simply higher natural demand we would not have asset bubbles. If the demand grew because of increasing debt than we have asset bubble no different than the FL real estate bubble in the 1920’s which crashed in 1927 prior to the great depression. Remember there were no boomers in the 1920’s and they had asset bubbles in both housing and the stock market. The majority of stocks were bought on margin in the 1920’s and housing was bought on mortgage financing. This is why the US debt to GDP ratio increased prior to the great depression.

@ What? — “Some have suggested that the boomers, the first generation with no memory of the last great depression of the 1930′s, where much more open to carrying debt than their parents.”

I wouldn’t dispute your overall statement because large numbers of people are trend followers, pure and simple. So, if the Joneses have a swankier house or car, others will assume more leverage just to meet that upscale threshold. Sad, but true.

What I will say is, at 54 years old….the latter end of the Boomers, I can assure you that me, my siblings and plenty of my friends have STRONG memories of what we learned from our parents who did go thru the Depression of the 1930’s. The lessons they learned were still fresh and vivid and they shared them with the children they were raising. I have 3 siblings, all in our 50’s, and not one of us carries a dime of net debt. I know other peers who live this way too. It seems to be an untold story.

I am not here to dispute your individual experiences but there is no doubt that the ratio of private debt to GDP sky rocketed during the later baby boomers adult years and continued until 2007. So, I would assume that you and your immediate friends are not the norm.

http://www.macrotrends.org/1381/debt-to-gdp-ratio-historical-chart

@ What – the chart is illuminating but I’m not sure the conclusion you’re drawing is entirely accurate. It may be, but here are a couple of other observations I can make.

It could very well be that only half (or whatever percentage) of Boomer went debt-heavy but they did it in a BIG way. The chart doesn’t define that. What I’m putting forth is that you could be surprised how many Boomers did not get sucked into that.

In a good portion of the time period in that chart there were people aging into their 20’s and 30’s and I’m not prepared to declare this generally, only anecdotally, but I’ve noticed quite a lot of that crowd who seem to think living with credit card debt is totally normal. In the 1980’s, when I was in my 20’s, none of my peers spoke of credit card debt. I haven’t heard one of that younger group speak of paying cash for a car. Their emergence into adulthood also lines up with large debt assumption.

So, I’m not sure we have the complete picture here on who all holds the NET debt.

The US population is increasing by 2 to 3 million people a year. That will require 500k to 1 million new housing units per year. Eventually the housing surplus from the mid 2000 will be exhausted. Devaluation of the USD will probably insure an increase in the price of homes over the long term.

rsu82: You assume that demand will drive up the cost of housing, but if you examine U.S. demographics you will notice that the highest growth occurs in minority population, i.e., those with less income. Now, if you happen to be one of the fortunate souls with a sizable income you’ll be happy to know that much of your tax dollars will go towards supporting housing for this demographic.

US population has been steadily growing since the start of the country.

http://chartsbin.com/view/gdn

I am not convinced that population growth has a direct correlation with asset bubble inflation. Now if you look at a debt to GDP chart, we start to see some correlations.

http://www.creditwritedowns.com/2011/09/total-private-market-debts-decline-should-be-a-glaring-warning-sign.html

Of course this assumes you believe in asset bubbles.

I guess I should clarify the statement. This is just my opinion which could be wrong.

For home builders…there will eventually be a demand that needs to meet the increase in population.

Home prices….I think home prices (under prudent lending practices) should be around 3x times gross salary. If salaries are stagnant then this could lead to stagnant house prices. But I think housing has, on a long term average, increased just a little more then the inflation rate (1 to 2 percent?). Thus the Fed wants 2% inflation (devaluation of currency) then housing will increase roughly at 2%. Enter 2% compounding rate in a excel spreadsheet and chart it eventually goes parabolic.

Interest Rates….I used to think that an increase in interest rates would lead to a decrease in housing (when we are not in a easy credit bubble causing asset inflation). I think if interest rates would spike to 6% would mean a new home buyer will have to downsize in the target price of his house. I think if rates spiked from 4% to 6% a $1400 month mortgage payment mean the home buyers target price dropped from $200k to $170k. I do not think the seller will drop his house price from $200k to $170k I think the home buyer will have to downsize the size of his house form 4 bd to 3 bd.

Now the mid 2000s looked like an asset bubble with cheap money available to everyone and many who were housing challenged (did not have the financial means to make payments once teaser rates or no interest loans reset).

What?:

That chart of total private debt is scary. It will probably get harder and harder from keeping a black swan event from deflating that debt chart.

Also….nice site chartbin site.

FHA is doing zero down now, plus they’ll put the costs into the loan. They’ll finance a beat-up fixer and finance the repairs. This, to me, is the last call for Johnny-come-lately’s to jump in.

Dick-and-Sons investors are dumping 5 at a time. Get this… Regular marketing takes too long, they want the property gone yesterday….they put ads on CL, line up appointments to show their properties, then call a realtor to keep the appointments and to fill out the contracts to list and sell, bam! Done!

MY NV/CA realtor-experience-since-1997 tells me the crashes we are accustomed to are a thing of the past. The game is changing all the time by the folks that pull the money strings. IF real estate drops, does anybody really believe that mom and pop will pick up a deal? Dick-and-Sons will have the cash that they scooped up this time around so they’ll do well. Anybody selling now will have cash to scoop up a deal.

This is the same game that started in 2K, it inflates, deflates, inflates, deflates. It’s really sad to see so many lovely people stuck in the belief that “it” will end. It’s just a game and, in order to get the footwork, you have to be in the game and actively playing.

This is a wow of a game.

So are you telling me that we will never have a recession again? That this time is different? I do agree that it will be unlikely that ma and pa will get a chance to take advantage of the next crisis but I believe it will be because they will not have the financial where with all. I think it is important to study the past because we appear to be repeating it…

http://www.pbs.org/wgbh/americanexperience/features/transcript/crash-transcript/

“Edward Lamont, Grandson of Thomas W. Lamont: Tom Lamont called a number of the other bankers, like Charles Mitchell of the National City Bank and people from the Bankers Trust and J. Albert Wiggin of the Chase Bank and so forth — there were about a half a dozen of them there — and they were gathered together to really discuss what they could do to stem this tremendous onslaught of selling stocks on the stock exchange that was taking place.

Craig Mitchell, Son of Charles E. Mitchell: About 12:30, there was an announcement that this group of bankers would make available a very substantial sum to ease the credit stringency and support the market. And right after that, Dick Whitney made his famous walk across the floor of the New York Stock Exchange.

Narrator: Richard Whitney, vice president of the Exchange, was chosen by the bankers to be their representative. At 1:30 in the afternoon, at the height of the panic, he strolled across the floor and in a loud, clear voice, ordered 10,000 shares of U.S. Steel at a price considerably higher than the last bid. He then went from post to post, shouting buy orders for key stocks.

Horace Silverstone, Former New York Stock Exchange telephone clerk: He stood up on one of the seats at the post and he said, “I give 45 for 50,000 Standard Oil,†and everybody started to applaud. “Oh, the crash is over. If Morgan’s putting his money in, then maybe the crash is over.â€

John Kenneth Galbraith, Economist: And sure enough, this seemed to be evidence that the bankers had moved in to end the panic. And they did end it for that day. The market then stabilized and even went up.”

What,

This time actually has been different. Many “retail investors” like myself had the wherewithal to buy during the most recent crash but couldn’t find much of anything to buy. Yes there where a few properties to be had ( before Lord Blankfein pipes in) but I was around during the Socal real estate crash of the 90s and the number of properties available in 2009-2012 was a tiny fraction of those in the earlier recession. Instead a vast majority of the good deals went to insiders. I lost track of the number of foreclosure or short sale listings I called on the 1st day only to find it had already gone pending to someone with inside information.

I make no prediction whether prices will continue upward or not, but I see no reason to expect decent deals will be available to us among the great unwashed.

AS, my guess this is a forest for the trees kind of thing. I think most people are not aware of the fact that the impact of the great depression started around 1927 with the housing crash in Florida and continued until around 1941. This was at least a 14 year event. The more I read about the run up to the great depression and how the powerful men of finance attempted to make the party go on forever the more I see that there really is no difference this time. I think we have not had enough time to see what is going to happen. I have no crystal ball but I have a hunch that the boom bust law of nature will apply as will the law of gravity…

I experienced the same thing as Apolitical, the crash of 1990 had many homes available for sale, while the 2009 event saw a burst then it trickled. And is still trickling today. Our financial overlords tend to put the breaks on hard whenever things get really ugly as they’ve learned that in the fullness of time they can get back to where they once were.

Merry Christmas to all 🙂

Looks like you were wrong about the taper — down $20 Billion and counting….

Leave a Reply to Tim C