Living Under the Shady Tree of Mortgage Advertising: 6 Advertisements That’ll Convert you to the Housing Bubble Camp.

I’ve been getting a lot of solicitations in the mail from mortgage companies. And apparently desperate times call for desperate measures. Some of the ads are good. And some are downright misleading, like a tobacco company telling you nicotine isn’t addictive and you are more likely to get hooked on drinking tap water. I wanted to show 6 advertisements all from mortgage companies or brokers that not only show the extent of the credit bubble we are living in, but the subtle implications each ad conveys of the American psyche. We will analyze each ad. So let us get to it.Ad #1 – You Got a Pulse, we Got a Mortgage Ad

I’ve been getting a lot of solicitations in the mail from mortgage companies. And apparently desperate times call for desperate measures. Some of the ads are good. And some are downright misleading, like a tobacco company telling you nicotine isn’t addictive and you are more likely to get hooked on drinking tap water. I wanted to show 6 advertisements all from mortgage companies or brokers that not only show the extent of the credit bubble we are living in, but the subtle implications each ad conveys of the American psyche. We will analyze each ad. So let us get to it.Ad #1 – You Got a Pulse, we Got a Mortgage Ad

Where to begin with this ad. Well first, you don’t need to verify your income. Second, who cares if you have every infraction on your credit record. Foreclosure(s)? Who cares. Bankruptcies? No problem. Mortgage lates? Call now! This last one really makes me laugh. So you are willing to give a mortgage to someone that already is chronically not going to pay a mortgage? One would think this ad is the pinnacle of common financial sense. Do you have an educated guess as to why we are in this mortgage mess? After reading this ad, I sure as hell don’t. Another thing you’ll notice is the “ask about our liar loan and referral paid program†in case the subtleties eluded you up until that point. And I love the sentence structure at the top of “mortgage payments around as low as 1%.†Brilliant.

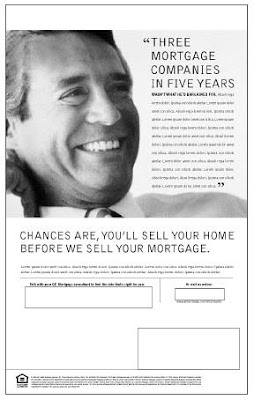

Ad #2 – You’ll Never Own Your Home

This ad strikes at an underlying message of American homeownership that is rather new. You will never own one property for a long period of time. You will carpetbag your way to the top. Each property is a subsequent step for your next and larger McMansion. Why not keep your previous home and rent it out? Why not stay in one place and invest in other areas? Of course anyone can do whatever they want but this ad speaks to the public’s desire for bigger and more expensive places at the behest of bigger mortgages. “Chances are, you’ll sell your home before we sell your mortgage.†They may be right since Wall Street’s appetite for mortgages is drastically declining.

Ad #3 – Why Read Your Mortgage Plan? Its Only Your Largest Purchase Ever!

I love the implication of this ad. You’re too busy to care about your largest financial obligation, so we’ll handle it for you. Let us worry about it and milk you to death with fees and coax you to refinance so we can get continuous payments. You’ll have time to worry about other things, like getting a second job because you were too lazy to read the fine print and didn’t realize the teaser rate was only good for 2 years. Don’t worry, you can trust us.

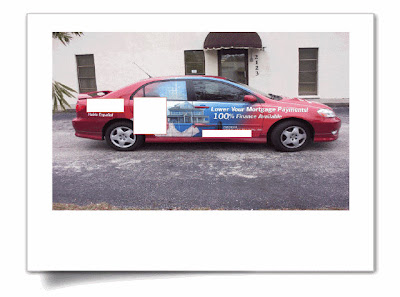

Ad #4 – I Can Finance while Driving!

Not only can we finance you for 125% of the value of your home, we’ll also drive you to get your dry cleaning. I’m not sure about you, but I get a better sense of security getting a $400,000 mortgage through a traditional brick and mortar operation. Mobile operations always scream transient to me but I may be old fashioned. Car ads are a mixed blessing. You increase your visibility but at what cost? Maybe we should have bumper stickers that say, “I financed my home through a mobile operation and all I got was this lousy license plate frame.â€

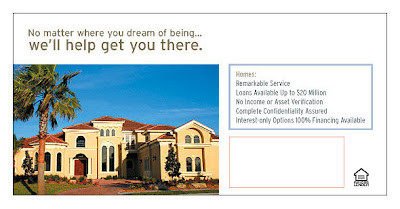

Ad #5 – Time to Bolt to the Caribbean with $5,000,000

I love this ad. First we have the comfort of getting remarkable service. And then in the next line we have loans up to $20,000,000. But the amazing part is the next line, “no income or asset verification.†Okay, $20,000,000 and no income verification shouldn’t appear on the same document ever but here we have them appear in the next sentence. This is a perfect example for breeding fraud. Why don’t we find a $20,000,000 home and do a 125% cash-out refinance? Since that’ll give us $5,000,000 in the pocket, we can fly off to the beautiful blue beaches of the Caribbean or South America and never be heard from again. The dollar goes far in many places and this money will keep us going for a very long time. You can write that novel kicking up in your head. Maybe explore ancient ruins and take up your love of archeology. This sounds great! Am I forgetting something? Oh yeah, the $20,000,000 home and mortgage note accompanying it. So much for unrestricted dreams. And we wonder why we have so many first payment defaults.

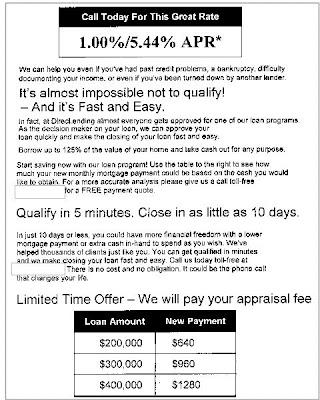

Ad #6 – Try and not Get this Loan! We Dare you!

And finally we have the try and fail to get this loan. I totally dig the line of “it’s almost impossible not to qualify!†They are dropping the gauntlet and challenging you to fail to get this loan. No income, job, money, life, food, or heart but we will find a way to get you into a loan. If we were to take score of restrictions for getting this loan like a baseball game, this would be a shut out. 125% loan to value? Yes! $400,000 for $1,280 a month? You got it boss! The public should be furious at the contempt these people have for your financial intelligence. They treat your home like an American Express card. Refinance to prosperity! Why rent when you can own…and rent from us with your home equity line of credit. These ads are so dysfunctional you’d think we were living in Bobby and Whitney’s relationship. I’m not sure what kind of finance calculator these people are using because 5.44% at 100% financing is $2,256 simply for P and I. But who cares! It’ll only take 5 minutes and then we can buy a Real Home of Genius.

There you have it folks. A sample of 6 ads from the mortgage industry demonstrating a disdain for financial prudence. I am amazed at the lack of risk management in the industry. Many companies have sealed their fate for instant gratification. The companies that are staying afloat kept more conservative mortgage portfolios in lieu of high rates on subprime or Alt-A risky loans. As you sift through your mail, don’t fall for the irrational exuberance of refinancing into risky teaser loans. I know we are all tempted to buy those bouncing-bobble-head-colorful-animal mortgage ads that sell us crazy mortgages because the animal is so freaking funny! Who can resist a talking cat trying to sell you a mortgage? Or the countless spam you get telling you about a $400,000 mortgage for $800 a month. Housing has tipped into a different dimension. I would show you more ads but I’m going to refinance my house at .0125% for 200 years.

Subscribe to Dr. Housing Bubble’s Blog to get more housing content and your full dose of Real Homes of Genius.

Subscribe to Dr. Housing Bubble’s Blog to get more housing content and your full dose of Real Homes of Genius.

Subscribe to feed

Subscribe to feed

6 Responses to “Living Under the Shady Tree of Mortgage Advertising: 6 Advertisements That’ll Convert you to the Housing Bubble Camp.”

I love the way the mortgage and real estate business has become so ghetto. I am beginning to sense the desperation in the developers of overpriced condos sending me postcards offering such things as “No HOA for 2 years” and “Live free for 6 months” Yeah, like that’s going to entice me to drop over $300K on a studio apartment. I guess the sign flippers weren’t doing the trick!

Dr. HB ur rat own, the marketing style of these loan brokers is very spam-like.

BTW, I know a few penny stocks about to go crazy, ____ & ____ are going to go ballistic, get in now before they go thru da roof!

You’d think the self-cleaning properties of laissez-faire would’ve taken care of these firms, but the reality is predatory lending is not only alive and well, it’s flourishing and encouraged by government officials. Hey, it’s spending, right? And spending is good for the economy, right?

I see that Gary Coleman (T.V. spokesperson for Cashcall.com) is disclosing 99.25% APR on a $2,600 loan! So a desparate borrower would have to pay back almost $9,100, over 42 months. How financially STUPID is THAT? Yet they sure do advertise alot, which can only mean business is GOOD….

When I was a kid, only the loan sharks would dare to charge such terms!

I’m actually a bit surprised we haven’t yet hit the legalization (and taxation) of drugs, prostitution, etc by now. After all, the free market and reduced regulation and enforcement is SUPPOSED to cure all ills, right?

Great post! I am amazed that people are still doing this – and the arrogance and audacity of coming right out and printing “Liar Loans?” I mean, when the law comes after them their lawyer will tear his hair out at that one (LOL).

Today driving from Culver City to Cerritos I saw a car with an advertisement plastered.

Stop Foreclosures! It had a web address. I scribbled it down thinking, this better not be some political/lobbying movement – if you make 50K a year and sign for a mortage for 600K you only need 4th grade math to figure out you can’t afford that. Turns out it’s one of these companies that “helps” you keep your home (read: ends up owning your home and making a killing). Their website is so lame it doesn’t even bother to fill in the text for the template they bought – It says “Headline Text Goes Here.” Sheesh.

I find it amazing that such outright criminal activity has gone on unabated for so long. Lie about your income, get a straw buyer and cash back, piggy back on someone else’s credit, put honest appraisers out of work.

What a world!

Dr. HB,

I think you are right when you said “If you buy now I hate to say it but you’ll lose a lot of equity in the next two years.” that is in the comment posted under the article on Friday, April 06, 2007.

But I have a dumb question. What if inflation surges? How much will inflation affect it? High inflation can help reduce your mortgage debt if it is 30yr fixed. Doesn’t it?

I wonder if the government is going to bail these morons out. If they do I hope everyone in the country mails in their keys.

I personally am about ready to pack it in and move someplace sane. However maybe if I start watching Faux News everything will appear ok. It worked for Iraq and Katrina.

Sequoia512

Leave a Reply