California a Red State: Analyzing the Myth of Homeownership for all.

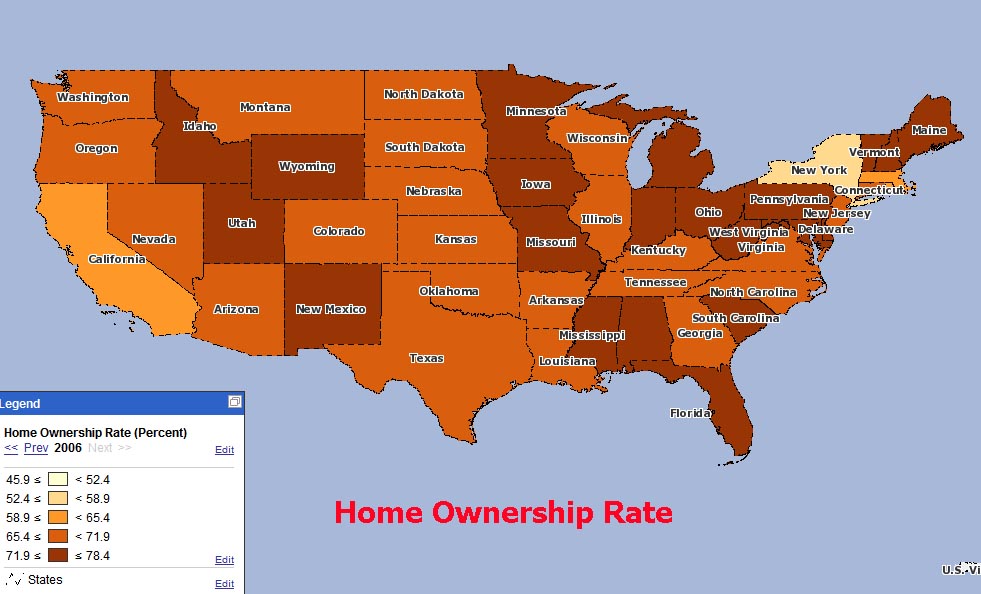

In order to understand why we are in our current predicament it is incredibly important to understand the psychology and the mythology that went with this housing saga. Along the way to reaching this “every home for every American dream†we somehow forgot to talk about income and avoiding toxic debt. It is simply amazing how little attention national income has garnered over the past decade. Let us take a look at a map of the

Fret not, this isn’t an electoral map. First what you’ll notice is

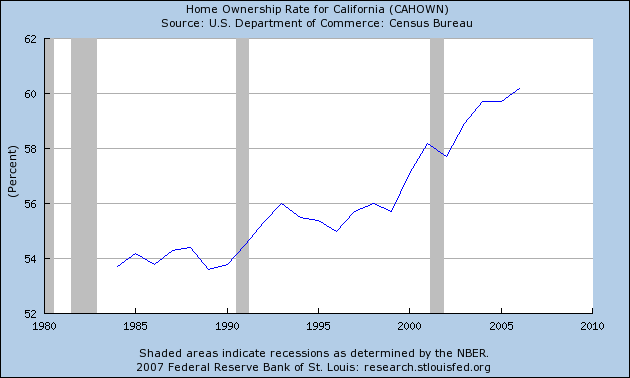

As you’ll notice from the graph above,

If we really want to see how we funded the

“Bush urged lawmakers to pass additional legislation that would revamp mortgage giants Fannie Mae and Freddie Mac and modernize the Depression-era Federal Housing Administration, which insures mortgages for low- and middle-income borrowers. The president also said Congress should approve legislation allowing state housing agencies to issue tax-free bonds to help squeezed homeowners refinance their mortgages.

These and other steps could help struggling homeowners “weather turbulent times in the market,” Bush said.

The stimulus package includes provisions that would temporarily raise to $729,750 the limit on Federal Housing Administration loans and the cap on loans that Fannie Mae and Freddie Mac can buy. Raising that cap on Fannie Mae and Freddie Mac should provide relief in the market for “jumbo” mortgages — those exceeding $417,000. The credit crunch hit that market hard, making it very difficult, if not impossible, for people to get those loans. And, that has plunged the housing market even deeper into turmoil.â€

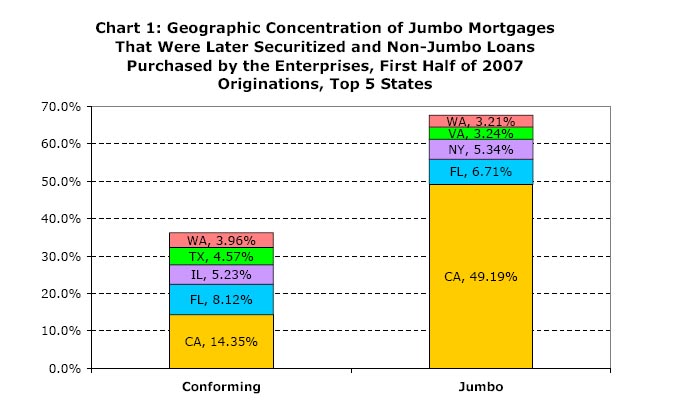

Since when did low to middle-income borrowers need $729,750 loans? Could it be that the reason it was nearly impossible for these people to get these loans is because they can’t afford it to begin with?! They talk as if jumbo loans were one step above government unemployment benefits. Again, looking at the OFHEO graph, which state do you think stands to benefit the most in this? They talk about the temporary lift in caps but we all know the government’s definition of temporary. As things stand, I’m not sure how deep of an impact this will have since there are some restrictions on these loans (at least for now) and you do have to verify your income. There was an article in the Los Angeles Times in September of 2006 that highlighted the absurdity of this housing market:

“One lender recently compared 100 stated-income loans with the borrowers’ tax returns and found that only 10 of the borrowers were telling the truth about their wages, according to Mortgage Asset Research Institute, a division of data firm ChoicePoint Inc.

Sixty of the borrowers had exaggerated their incomes by more than 50%, according to the institute, which didn’t identify the lender.â€

Believe it or not, this was in one of my first posts back in September of 2006. Incredibly, now the government is going into the business of insane mortgages. Just think about the findings in that report. Only 10 borrowers were telling the truth. And 60 percent of the borrowers exaggerated their income by 50 percent. It’s the income stupid! It simply does not make any sense. Look at it this way, a person putting 20 percent down can still purchase a $520,000+ home in

Los Angeles: $470,000

Orange: $565,000

Riverside: $355,000

San Bernardino: $315,000

San Diego: $430,000

Ventura: $525,250

Southern California: $425,000

Now really, why do we need $729,750 loans? After all, nearly 50 percent of all jumbo mortgages originated last year in the state of

We went from an idea that owning a home was a right of passage that required a few obstacles including saving money for a few years to this instant gratification idea that buying a home with no money down was a right. Is it any wonder why there are so many Real Homes of Genius out there? With all the negative numbers coming out of

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

15 Responses to “California a Red State: Analyzing the Myth of Homeownership for all.”

Hungry? Eat fast food and have a diet soda.

Don’t like your shape? Get a tummy tuck, implant, and collagen.

Horny but stress got you ‘down’? Take a little blue pill.

Kids too loud? Give them Ritalin.

Car too old? Trade in your old car and add its lease to your new one.

Want to be a home ‘buyer’ but don’t have scratch? Get a no-down NINJA loan.

Wall Street has the blues? Give the wealthy a permanent tax break and ‘temporary’ cheaper financing.

I know plenty of people in the Orange County real estate industry and to a person they applaud the increase in the conforming loan limit, hoping it will spur buyers into action and save their livelihoods. Essentially, they embrace the short term fix and don’t even want to know the long term consequences.

Private mortgage giant PMI announced Feb 11 it will only insure up to 97% LTV. http://www.marketwatch.com/news/story/story.aspx?guid=%7B855F3B2C%2D7B53%2D489C%2D946E%2D913BC0C37C75%7D&siteid=rss

Unless Congress mandates NINJA loans as part of the stimulus package, it appears doubtful that large enough numbers of the fabled NAR’s ‘sitting on the fence buyers’ with ‘pent-up demand’ will have the means to qualify, even with the increase in the CLL.

The American Way used to mean something different.

I was delayed in the supermarket yesterday when the lady in line in front of me found her ‘food stamp’ EBT card ( I preferred the humiliation of the old style play money coupons) was ‘overdrawn’ and did not have sufficient funds to pay for her meats, snacks and frozen pizzas. After several tries to get the EBT card to work

she gave up and produced a credit card to pay for her stuff. Welfare program beneficiaries with credit cards!

Does anybody but me notice the unbelievable irony of the names they have chosen for their succession of asinine ideas to artificially stabilize this insane real estate market?

First was FHA Secure. Secure’s a good word; steady, repliable, dependable – something you like to add to a less than perfect situation.

Then it was Hope Now. Usually when someone has to remind you to have hope things aren’t looking too good, but the right attitude could go a long way towards making it better.

Now it’s the Mortgage Lifeline. This means the boat you were having dinner on 30 minutes ago is now sitting on the bottom of the ocean and unless someone helps you big time – right now – you’re going down with it.

If this doesn’t help I guess the next one will be called the Mortgage Autopsy.

$730K jumbo caps? Is Bush friggin’ nuts?

“Flip this house” Hi Im ______ _______ I work for South Bay Remax and I’m a real estate professional specializing in residential properties in the South Bay area. Now they’re specializing in making breve latte’s at Starbucks on the morning shift. Oh, and by the way you got bathroom duty today. Please dont forget to mark the “This bathroom was check at ____ time” card………..

I think you miss the point on the conforming loan limit, Doctor Bubble… It is nothing more than an attempt to facilitate Refinancing in what is now jumbo territory, in hopes that the monthly reductions in cost for homeowners flow into the economy, just like the “rebates”. No one is getting into the market as a result of this adjustment, and DC knows it.

@Houser

I would add to your opinion, though I would propose that the good doctor misses little on the topic.

My take is that the primary goal of increasing the loan limits targets helping the lenders who hold jumbo paper. It secondarily might lead to borrowers spending the monthly difference into the economy, but that’s merely a collateral benefit.

Refinancing permits lenders currently holding the paper to offload risk from their balance sheets onto the taxpayer via placement of the loans in the GSE portfolios. Even if the borrowers can be presently considered ‘prime’, as recent developments show, even prime borrowers will be subject to distress.

This initiative is designed primarily to help the banks. Any benefit to the broader economy will just happen to be gravy.

@ Scott wrote “After several tries to get the EBT card to work

she gave up and produced a credit card to pay for her stuff. Welfare program beneficiaries with credit cards!”

THINK AGAIN. That “credit card” could (and probably was) a bank debit card that is marked as a Visa or a Mastercard. They look just like a credit card.

Nice article. Dr. HB

This is just a way to buy votes with taxdollars. The lemmings will think that the Bushites are trying to do something to save them. But like, Hope Now, it won’t do jack squat for J6P. In fact, it will only help the banks and enslave people by forcing them into their own virtual debt prisons.

We went from an idea that owning a home was a right of passage that required a few obstacles including saving money for a few years to this instant gratification idea that buying a home with no money down was a right.

So true. Just as I entered those years where saving was easy, I was always behind the curve on being able to afford the prices–assuming, of course, 20% down and a reasonable percentage of income towards the monthly nut. Then I entered the realm of Top 10% earners and affordability was still an issue. That’s when I paused and said, “Something isn’t right.” And now we know it On the brighter side, when the dust settles, should I want to purchase a house, I’ll be writing a check. 🙂

Funny story:

I tried to explain the housing problem to my brother, and he wouldn’t hear it. Then he said I’ll be renting when I’m 70. I replied that when and if I’m ready to buy, I’ll write a check. He said: “What do you think,… you’re rich?” I smiled, let it go, and thought, you have no effin’ idea how much I’m paid and how much I have in the bank. BWAHAHAHA And if I’m renting at 70, I really won’t care, either.

Credit where it is deserved:

“But the really bad news is that, even after a year of misery and falling prices, homes in many of these regions still aren’t cheap. They remain wildly overvalued compared to average personal incomes.”

http://online.wsj.com/article/SB120276871472760255.html

From the Wall Street Journal. The connection to income is obvious and should be a number one factor in talking about overpriced homes.

In a nice area of Diamond Bar Ca, (1686 Aspen Grove Ln) a house sold for $553,000 in January and it just went on the market for $639,000! There still a out there Doc! Just amazing…………

Just a thought why the jumbo line may be raised to $729k from $417k is that hyperinflation is already being planned for. It’s another trick. Ya know they have those big computers doing lots of “what-ifs†to guide their decisions to milk more money and power out of the people.

Soon a dozen eggs may cost $10 and gas at $7. So raising the jumbo limit on housing now will facilitate the non-jumbo loans during hyperinflation for easier financing. AND it’s possible that hyperinflation will facilitate the next bubble. Where this would lead I don’t know, but people will think they are getting richer in equity while actually not. Is this just the conspiracy theory side of me?

@Exit

I agree, the doctor & Exit have it right. It will all hinge on income.The impact of the higher limit will be minimal, due to the requirements for documented income. If you need to re-fi, and you didn’t document income, it was because your income wasn’t verifiable. I fondly remember the financial rectal exam we had to endure to borrow $40,000 for our first home, with the obligatory 20% down. All that for a deeply discounted 14% mortgage. We wouldn’t consider an adjustable, that seemed too risky……

I live in Encino/San Fernando Valley. They built a luxury condo across the

street from me (we rent) wanted nearly $800K for each units. Not a single unit

sold. They put it up for auction, still not a single unit sold. Each unit is now up for lease. Minimum $2,650 max $3,550 most units at $3,000 month.

Leave a Reply