Financial and psychological double dip for real estate – How new economic news will feed into lower home prices as incomes remain stagnant. Only 11 percent of recent loan volume in the first quarter dealt with purchases.

The official double dip in home prices is not significant in the sense that it is a surprising revelation but will carry more traction because of the way the news cycle works. The press reports on what happened especially when it comes to economics and feeds the beast especially with bubbles. Virtually every large news outlet missed the most obvious and biggest housing bubble ever witnessed by humankind. During the meteoric rise in housing prices the press fed into the feeding frenzy by drawing more and more buyers into the housing game either through cable shows erotically showing granite countertops or ordinary people making a mint by simply slapping on a coat of magenta paint to the living room wall. This is typically how manias work until they reach a tipping point. After the bubble burst the press reported on the “shocking†crash and fed into this part of the cycle. But for well over a year it has been stories about housing rebounding. The fact that we have now officially double dipped will create another news cycle reflecting the continued decline in home values. What you as a thoughtful reader and follower of the housing market should ask is why isn’t the press actually examining the connection between home values and actual household incomes? This is the absolutely most important item never examined. This is the most obvious item to explore from a big news story since mortgages are paid by W2 wages, not by some alchemy of finances or HD cameras.

Case Shiller double dip and the new news cycle

I follow a variety of sources in regards to news and as the above picture highlights, the press is running full steam ahead with the double dip. We’ve been tracking the massive amount of shadow inventory and large pipeline of troubled homes so the question of a double dip was never in doubt. The question was rather one of timing. It is now clear that the new bottom in housing prices, both in nominal and real levels is occurring fluidly today. This is now an active cycle low. The only question in doubt at this point is how much further will home prices fall before reaching an absolute bottom? I don’t think we can answer that question until we figure out how low household wages will go (or move up if the economy turns around). This is really the wild card in how deep this double dip goes.

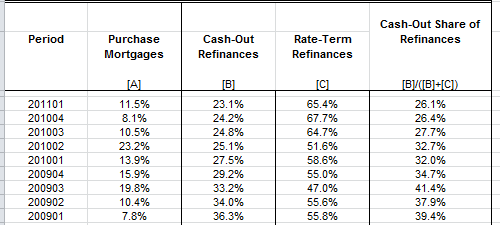

You also have the psychological component of home values tanking again. If you recall, the double recessions of the early 1980s started with a minor recession followed by a much deeper global recession. Ironically that recession was caused (on purpose) by hiking interest rates to curb global inflation. Today the Federal Reserve is doing everything it can to get people to borrow so long as they have household income to justify the borrowing. And therein lies the rub since the days of NINJA loans is long gone. The borrowing that is occurring is stimulating an already overly suffocating part of our economy in finance. For example, a large part of all recent mortgage activity is with refinancing:

Source:Â FHFA

This is really telling data here. The above looks at loan activity by quarter. Take the second quarter in 2005. What was going on at that time?

Purchases:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 40%

Cash-out refi:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 40%

Rate-term refis:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 20%

In other words a solid portion of the market involved boosting the economy via actual home purchases and folks yanking out money from cash-out refinancing. This was incredibly stimulating to economic growth even if it was all an illusory bubble. Now fast forward to the first quarter of 2011, the latest data points to:

Purchases:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 11.5%

Cash-out refi:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 23.1%

Rate-term refis:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 65.4%

Now think about what this data signifies, the market tanked in full force in early 2008 and the Federal Reserve went into full action. Yet purchase mortgage activity never really increased much but refinancing sure did. Who did this benefit?

-Those that had mortgages but really weren’t necessarily in financial trouble

-Banks/servicers as they charge a good portion for each refinance and churning loan activity (i.e., closing costs, etc)

Look at more normal times in the 1990s like in 1996 when 78 percent of loans were for purchase. Purchase mortgages should always be the dominant force of the market (i.e., above 50 percent). That has radically changed. It is just interesting to see the data reflect what we already know and that is people are buying lower priced homes (and keep in mind in some market like in Arizona half the purchases are done with investors so there is no need for a mortgage and that will not show up in the chart above). This is a really odd market we are in but this is clearly a bubble that is still popping.

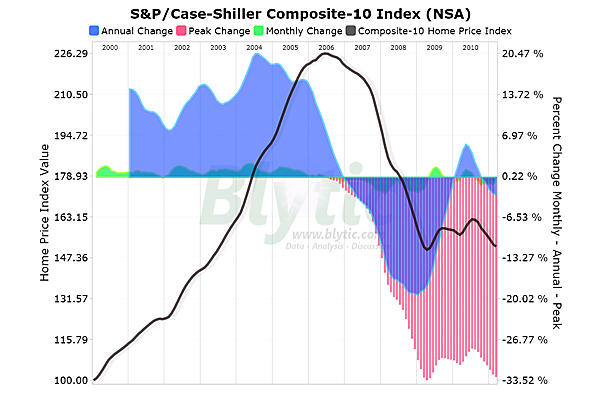

The troubling reality is that most Americans use their homes as the largest store of wealth. Home prices are rapidly going to a nominal lost decade (the real lost decade measured with inflation is already here):

Source:Â Paper Economy

What does all of this mean going forward? From the data I’m seeing it is hard to keep the housing market inflated for a few reasons:

-1. Home prices are still too high in many regions relative to household incomes

-2. The Fed has already pushed mortgage rates as low as it can without dangerously expanding its balance sheet (it currently holds over $1 trillion in mortgage backed securities alone which the market was unwilling to purchase)

-3. The religious belief that home values never go down is largely shattered across the country. Hard to bring back faith when it is lost especially when it is a faith based on economics.

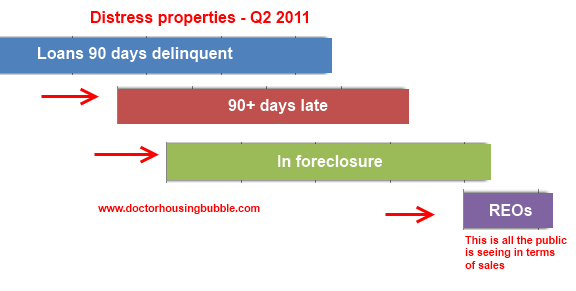

These forces combined make the future largely uncertain for home values but I do think they all point to lower prices (this could be nominal or inflation adjusted and we are getting both right now). Real mortgage interest rates should be anywhere from 150 to 250 basis points higher if the Fed were to step out. The Federal Reserve is risking larger consequences than merely seeing home values falter. Psychologically people will now be hearing story after story about the double dip and this will create a feedback loop. This is coming at a bad time when the backlog of shadow inventory is legendary:

It is amazing to me that 600,000 to 700,000 REOs are on the market to purchase yet over 2 million homes are in actual foreclosure (another 4 million are delinquent). As I discussed in a previous article you have 675,000 loans that are in foreclosure and have made no payment for over 2 years! These are not even part of the REO inventory and a separate piece of the foreclosure pie. Who will purchase these homes? Investors are already losing steam because vacancy rates are soaring in many markets as investors outdo one another trying to flip to others and are also battling for the few renters in areas.

The double dip is a nationwide phenomenon. Actually, it is global and we are starting to see cracks in Canada and Australia and these places had bubbles even larger than the U.S. in some cases. Yet some markets especially in high priced states like California will crash. Crash is such a vague term so let me define. We already know that in the state home values are down in aggregate by 50 percent. Yet some markets (all have corrected) are still inflated. This is where we will see home prices crash. When I say crash I mean a decline of at least 10 percent from where we stand today. This is a large amount considering over one third of purchases are made with 3.5 percent down FHA insured loans. The drop is sufficient to wipe all equity out and put someone in a 5 to 10 percent underwater situation quickly if we factor in the selling costs as well. That is a raw deal no matter how you slice it especially when the underemployment rate in the state is still close to 23 percent.

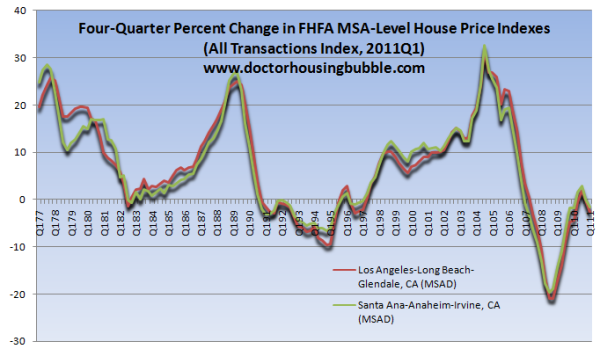

Take a look at the Los Angeles and Orange County markets:

Source:Â FHFA

I picked the data above merely because it goes back to 1977. It is clear to see that this was the biggest bubble ever in the region but also the deepest crash. You see the early 1990s bubble but that is nothing compared to what we are going through. Keep in mind during that bubble pop actual real household incomes were going up. And you can see that home prices went up from 1994 all the way up to 2007. The dip in the early 1990s was minor. Then if you look further back at the 1980s you have over 20 years of psychological conditioning of how great of an investment real estate is in the Southern California area. Those days are over. Just like the double dip is shocking many this new reality is a game changer. No one ever said this housing correction would be quick. Four years later from the crash and we are reaching a new nominal low. How many more years do we need before the big news outlets connect housing to actual household wages?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

97 Responses to “Financial and psychological double dip for real estate – How new economic news will feed into lower home prices as incomes remain stagnant. Only 11 percent of recent loan volume in the first quarter dealt with purchases.”

DHB Question:

“What you as a thoughtful reader and follower of the housing market should ask is why isn’t the press actually examining the connection between home values and actual household incomes?”

Ans from Misstrial:

Well DHB, that is a good question. In the past few years, bloggers have postulated that print media has refused to acknowledge a connection simply because the RE Industry doesn’t want them to and neither do their homeowner readership.

Both groups have vested interests in keeping prices artificially high and unrelated to incomes.

Ever watched “Selling New York” on the HGTV channel?

Do you *ever* see any potential buyer sit down with a mortgage lender and reveal their financial statements – proving that they can afford a $1.2M coop in NYC?

Ain’t gonna happen and since an entire generation used the SFH as a savings account, you’re not going to see any real push to restore prices to incomes either.

~Misstrial

Most of those NYC buyers pay cash.

Prove it.

~Misstrial

Hello Misstrial, I think I can prove it. I saw Selling New York this past Thursday & one of the buyers acording to their agent was ready to make an all cash offer & the unit was well past seven figgures.

The problem with that show is it is so far from reality as far as the average viewer is concerned. Are some of those viewers all of a sudden going to say to them selves, dam it I want a unit like that because I deserve it! Who cares if I can aford it or not, I want it!

I have to respectfully disagree somewhat with the good Doctor. I don’t think he’s taken the numbers far enough. That is, I don’t think either the MSM or the bloggers have cottoned on to the biggest story from yesterday’s Case-Shiller numbers, which showed that we’ve hit post 2009 lows.

The bigger story is that we’ve hit these lows with:

1. Incredibly low rates. Rates right now are at the lowest for the year.

2. The CS numbers were in the middle of the Spring selling season.

I have to seriously wonder if Real Estate is in the process of collapsing, from these numbers. If April’s CS numbers don’t at least flatten out, I would say that is a definitive “yes”.

“Collapse” is when a bridge falls, and is no loger passable. Crash, is what you do in your car and it is no longer drivable. We are really only talking about “corrections” towards a rational norm of which we are still away from due to idioacy, ignorance, sheeple, and suckers.

I take it you don’t do much in the market. A decrease in price of 20% or more is generally viewed as a collapse or crash. A correction is much smaller. Often attributed to profit taking.

I’ve been saying that RE will go down 10-20% this year, barring some rabbit trick from the Fed. So the crash is looking more likely. But I’m sure the Feds will try another magic trick; and I’m sure that one will fail as well.

Do not forget about low to NO down loans and high debt to income ratios. these all pay a major roll on the demand side. best way to see how stable the market is not case shiller index but what type of financing are people using to buy these homes.

True. The media can’t be trusted as they are just another business. As long as they have conflicts of interest, they can’t be trusted. I’ve never heard a used car salesman say it’s a bad time to buy a car.

Dr HB

I feel impelled to point out the error of your article. Despite the great prose of “…. cable shows erotically showing granite countertops” that is not the press that is the media. Mass Media of which you are a now member is all of it; the press, the TV shows, the movies, the magazines, pornography, music, etc.. Back before the Bush era (and I’m not blaming Bush for this despite his legion of flaws) the press engaged in investigative journalism. That’s what gave us the Pentagon Papers and countless other wonderful pieces that reported the realities of our world.

Today because of the growth of TV, cable and the internet mainstream publications can no longer afford the practice of truthful insightful, in-depth reportage. First, the kids lolling in tweet land cannot even handle a complete paragraph let alone 1000 words of what’s really going on.

But more importantly over the last twenty years the press has been co-opted by media conglomerates, many of them owned by Military Industrial conglomerates ala NBC by GE. This happened under the non-watchful eyes of both Clinton and Bush. The press’s current function is to support dollar wise and to tout the words of corporate agenda. nothing more nothing less. Keep the dog and the pony dancing to sell the advertising and be sure the company line is never challenged no matter how true the news. If it bleeds it leads. Ignore bad news if need be.

I am no longer shocked but still stunned every time they blindly parrot the words of banksters and realtors predicting the imminent “recovery” of housing. That said I have been surprised to read several articles in the last week that rehash what you have posting for the last umpteen months. The way I see it you have taken on the roll of investigative journalism and in so doing bring us the catch phrase of Walter Cronkite “And that’s the way it is,”.

Thank you and good night.

It’s actually almost painful for me now to watch US TV “news”. Walter Cronkite and Edward R. Murrow must be rolling in their graves. Thankfully, we do have alternatives.

But I think the MSM increasingly accepts that housing is very weak, and that people are questioning the whole idea that owning is better than renting. Just minutes ago, I was reading an MSM article about many rich people in Manhattan who choose to rent instead of buy.

H

In the evening after I posted that I caught Jon Stewarts satirical take on Wiener’s wiener issue. He scoffed at CNN commenting that they couldn’t get any more information because Wiener wasn’t on air to reply to Brietbart (who was). Stewart immediately showed a clip from a blog that information on the source of and forensic quality of the image posted on twitter. His comment was that journalism could be done and was being done by internet bloggers and not CNN or any mainstream media. So it seems clear that it is the doc and other bloggers carrying the torch and holding cultures feet to the fire. Word play not intended.

I think your point is excellent. I have been mourning the death of real investigative journalism that strives to present an unbiased view of both sides of an issue and underlying drivers. This has been replaced by parrot journalism where they state the party line of whatever affiliation they have, trying to sway the public one way or another and no better than a commercial for a new toy aired between Saturday morning cartoons.

What this country needs is a population of independent thinkers (the entire point of education) and less ‘party line rhetoric’ with more information to feed that decision making. I’d support it with money too. Bring an unbiased unaffiliated news product, harpoon the media whales, I will support it and buy if only to send the message that their service and kind is no longer wanted in our country and that they should go back to proper marketing and advertising.

I would say that the idea that any given issue can only have two sides is part of the media’s problem. The current state of the media is just a further reduction of analysis into sound bites. Journalism is always garbage when it doesn’t take a pluralistic approach.

You keep drinkin’ that Koolaid, Wydeeyed. You keep hold of that dream that Walter Cronkite was “unbiased.” And Edward R. Murrow didn’t have an agenda and get off being so powerful though not elected.

The media did everything it could to bring on this recession to undermine Bush and is doing everything it can now to tell us we are in recovery to support Obama.

If you can’t see that, you are hopelessly naive. 5% unemployment under Bush was a disaster!! 9% under Obama is the “new normal.”

Barney Frank was telling us nothing was wrong with Fannie Mae and that it was the Federal Government’s duty to make banks give NINJA loans to unqualified buyers by the thousands. Now he’s instantly pivoted to saying “I all along have said people should rent.” Duke Cunningham (R) was jailed for having a contractor build a house for him. Chris Dodd gets a sweetheart loan from Countrywide’s Angelo Mozilo and somehow ends up with an Irish “cottage” to boot, and simply leaves the Senate to become a Hollywood lobbyist.

Enron, Republican lobbyist Jack Abramhoff and Bernie Madoff are given stiff sentences and become the poster boys for the corrupt Bush administration, yet not one person associated with this multi-trillion dollar housing collapse is even indicted, much less jailed. Congresswoman Maxine Waters’ husband owns stock in a bank that’s in trouble and gets paid off. She’s still in office.

The media goes after those they want to destroy and turns away from the corruption they support. They definitely take sides.

Projection is a fascinating thing. I am by no means in love with any reporter except perhaps Woodward and Bernstein. I imagine that you though just love Americas play in Viet Nam, you know saving the world from monolithic communism. How’s that working out for you. Do you profit from our new trading partner? By the way the run up in housing, that event known to to have the fatal flaw of collapse built in as clearly pointed out here on Dr HB occurred on Bush’s watch as did the 911 attacks. I was just thinking the other day how authorities managed to stop the plot to blow up five jumbo jets over the Pacific by Jihadists but Ole GW played on his ranch and ignored Clintons warning about those folks planning airplane attacks here in the US. I mention it because a great deal of our federal financial woes are owed to his off the budget wars in Afghanistan and Iraq still going under Obama. I am not a fan of Obama mainly because he carries on like Bush’s understudy. But then again I am not otherwise particular to Democrats. It seems clear though from your rant that you are blinded by partisanship. I absolutely agree that it is a crime no one has been indicted for the housing debacle and a worse crime that no steps have been taken to re-regulate the financial industry.

I agree that it must have something to do with the wicked NAR.

Up until 08′, I watched Maria Bartiromo, Jim Cramer, et al, and kinda believed them. After the crash, I started wondering (like Charley Partanna in Prizzi’s Honor) ” if CNBC is so f*&K%@G smart how come they were so f*&k!&g wrong”.

I don’t watch them at all anymore, just follow the good Dr and other alternative news outlets to find out what’s really going on. Americans love denial. They refused to believe for many years that a foreign enemy would ever breach our shores. Now they still refuse to believe that a house is just something you live in, period.

Media stations should have to disclose opinion (v. journalism).

FOX for example is typically opinion not journalism, and they sensationalize to up their ratings, more like an entertainment show.

CNBC for example posts some disclaimers.

Food manufacturers must disclose the contents/chemicals in food.

Realtors must provide a zillion disclosures to buyers and sellers.

And so forth.

Catch a falling knife? Heck no.

Somehow though the banks will play this charade and wait with all the patience that free government money affords them as they slowly release houses on the market to keep supply as dwindled as they can to prop up prices. Prime areas in Los Angeles although seeing drops, are going to take a few more years to fall, unlike Riverside for example. What a crock. I’m a renter but I pay higher rent than I should because the Son of a Gun not paying his mortgage is just as guilty as the bank for keeping prices artificially high. More power to the Son of a Gun though, he’s really sticking it to the fat cats. What a crock. Truth is he bought that home thinking that real estate would rise forever, and he’d be a millionaire in two years, flip the house, quit his job at Mc Jobs and retire. I say throw the bum out and sell the house mark to market!!!!!

Not until the US government stops selling treasuries to banks to fund 28 billion dollar a week deficit will the banks need to collect on these toxic mortgages. Looks like Slacker Joe might be living free next door for a long time to come.

I have been actively reading your blog up here in bubble-land (aka Vancouver, British Columbia) for a long time – esp your comments on ‘shadow inventory’ – and it’s all playing out like you said it would. I told my father – this was in 1986, when the bubble began to inflate “I know firemen married to teachers who cannot afford houses here. WTF is up with that?” (well, WTF had not been invented, yet). American capitalism will not be happy until the average person earns, like, 6.00 an hour. But… caring and sharing aren’t what capitalism is about. What’s propping the bubble here are hugely lenient rules of ‘investor class’ individuals from Asia – mostly mainland China. These are actually middle class Chinese who want to leave because, well, they KNOW their economy is going to implode and they need an escape hatch when the army starts shooting on its citizens. You do great work. Of course, ‘it can never happen, here…’ yep. and there are plenty of ‘real homes of genius’ in my neighbourhood…

Down here in Silicon Valley, we’ve been seeing prices pretty stable but being propped up by cash buyers from Asia, if what I’m seeing at open houses is any measure. The US and Canada are both more stable than the PRC seems to be (!) and foreigners in general seem eager to get out of dollar holdings into a tangible asset like housing, even if prices are overvalued.

Yes, housing is a play on mortgages as well as the value of the dollar (or loonie) too. I can’t believe that current mortgage interest rates will stay this low for long. Ultimately, the Administration will change and the Fed will run out of credibility.

Inflation AND high interest rates can’t be far behind.

In 1865, one would have done well to buy a house with Confederate paper (except in Atlanta, GA or Columbia, SC.)

I recently read a great quote about money I just have to share —

“Stop buying things you don’t need, spending money you haven’t yet

earned, to impress people you don’t like.” — Deepak Chopra

Thorstein Veblen would disagree – people never give up conspicuous consumption. they will go hungry first.

Hi Doctor:

I live in Chicago, IL and can you please tell me how I can research/find the total amount of shadow inventory for my city? Or if anyone else on this board knows please share it. Thanks.

Well, I can tell you that I am very very sorry to have seen Google Maps search function for Real Estate gone because that feature used to show thousands of foreclosures in locales.

But there is zillow.com:

Enter the zip code or “Chicago”

On the next page, when the page opens, click on “More Filters” on your far right under “Results.”

When you click on “More Filters” you will get a small window where you can uncheck all selections except for “Foreclosures” and “For Sale.”

Click on the boxes indicating what sort of property you are looking for: SFH, condos, multi-family, etc.

Then click “Search.”

You will get zillow to show the foreclosures, ie: “shadow inventory.”

Can do similar for hotpads.com

Enter the zip code or city and State in the “Search” box. Or click on “Popular Cities” in the text box on your far right.

Click on the “Foreclosures” tab along the top menu bar.

Another great post by the Dr. but I’d like to hear a bit more on his estimate that the second dip will only reach 10% ? If you look back on historical Case Schiller analysis you see a post bubble drop after every recession to at least a pre-bubble mean. If that happens again won’t we see a further dip greater then 10%. I’d just like to hear the Dr. expand more on the basis for his prediction.

Kurt

Yesterday on KPBS radio (San Diego’s local NPR affiliate), the local midday talk show featured an economist from UCSD, and a local “real estate economist.” They both seemed to think that the “worst was over” and San Diego was poised for a rebound.

However, the “real estate economist” had to admit that for the past few years that he had been similarly predicting a rebound and had been wrong each time. He then said, and I am not making this up, that “we all have to have faith” that there would be a rebound.

I’m very tempted to write into the station about this and suggest that the producers not invite that guy back – ever.

@greggp

San Diego’s #’s are interesting for a couple of reasons.

1. I never thought that SD had a strong enough economy to support the home prices there. Sure there’s tech, universities, and military but those are some shaky foundations to build a housing bubble. Tech industry, esp. biotech, fluctuates like crazy, and a lot of Navy/Marines I know don’t buy because they know they will have to move/deploy in short time.

2. Lots of space compared to other built out cities. High prices would indicate a shortage, and since space is available, more construction should be happening.

I have a feeling that San Diego was probably the worst of the worst when it came to the housing bubble – worse than LA or Las Vegas. There is absolutely no reason that housing isn’t completely tanking there except that banks are keeping housing off the market. If banks realize this loss, SD alone could bankrupt all of them.

I lived in SD in the late 90’s and worked in the shipyards. All the skilled trades [welding, pipefitting, HVAC, etc.] work on the waterfront earn very low wages compared to the rest of the country, due to the open border policy.

After renting a tiny shack in the Ocean Beach neighborhood for several years, I decided to join them. For the same money I rented a mansion in Tijuana, BC and crossed the border every day for a year. This actually helps the taxpayer, since our Pacific Fleet is maintained by low cost labor.

But at $16/hr, not too many of those guys can buy anything north of Chula Vista, or east of 805.

Hey, to that Zillow thing on San Diego! I just did. It’s amazing! Thanks for the tips!

Here in NorCal, I expect to see another leg down in terms of house prices late summer or early fall of this year. With the State budget problems, UE at around 20% (which is never reported), and many walking away, there is only one direction the market can go. Down baby down. Until the govt gets out of the RE business, this will be a slow motion correction.

Re: wyedeyed

Not really correct to say DHB is part of media, as his accountability (vis compensation) is more skewed towards readers/subscribers whereas traditional media is skewed (80% print, closer to 100% in tv-land) towards corporate advertisers.

agree with article that price cannot bottom until supply matches demand. Also important that after first dip buyers came in, true bottom will not be reached until 100% of public agree that buying a house is the worst investment decision you can ever make.

Rab wrote:

Re: wyedeyed

“Not really correct to say DHB is part of media, as his accountability (vis compensation) is more skewed towards readers/subscribers whereas traditional media is skewed (80% print, closer to 100% in tv-land) towards corporate advertisers.”

Perhaps you misunderstand me. I am not saying that Dr HB is part of the mainstream media with accountability to corporate objectives. Also bear in mind that there was a time as referenced above by other posters where mainstream news was not accountable to the bottom line. TV stations for many years ran money losing news operations that answered to the ethics and principles of good journalism. Stations were directed to keep hands off on the activities and content of news. Media by definition is about subscribers – who you reach and not about your sponsors. Sponsors usually come on board because you deliver eyeballs and ears to catch their message.

In HB’s case he is part of media as in mass media often loosely defined as one to many. Think radio, magazines, newspapers, TV, movies. The internet while interactive is still a model most often of one be it the online Washington Post or even your radical blogger for Aryian brotherhood. HB fits that description and in my opinion does a fully solid job of presenting news (narrow casting in his field of expertise) based on fundamentals of economics, society and good journalism. Should the sponsors he has turn on his freedom to speak his mind look for us to have to pay a subscription. Let’s pray that does not happen. I personally think that advertising is an excellent vehicle of paying for medium (as in vehicle of delivery).

Ahhh too bad the rest of the country is screwed. But not Orange County!

See it’s true!! (Do they make Orange Koolaide? Oh yeah they do…)

http://lansner.ocregister.com/2011/06/01/o-c-property-index-at-highest-since-2008/111885/

Please allow me to keep this simple. Unemployment will rise. Actual income will fall. Expenses will rise. Taxes may go up. The US is financially bankrupt. The constant scientific advances in mechanization e.g. employment of robots and of course the outsourcing of jobs to foreign lands will be a never ending drag on the economy. Under these circumstances there may not be a recovery for a long time. The way out is a war. Big industry will produce war material (for defense only!) this will make people patriotic and willing to sacrifice even more. The Pentagon just announced the interruption of the Cyber communications by foreign powers is considered a declaration of war.

I was very surprised to read a couple of months ago that back in the 50s it was typical for people to use 1X their income as the upper limit of what they could afford to spend on a house. And I read in a different article that up until the late 60s, only the husband’s income was considered, even if the wife had a good job of her own. Most of the articles that I have seen lately assume that the current income multipliers of 2 1/2 to 3 1/2 will remain, but what if there is a shift? It would actually make sense for the Student Loan Generation to decide that 1X to 2X their income was the max that they could pay, as they will generally have to wait until they have paid down a good deal of their student loans before they can take out a mortgage. After years of school, and years of student loan payments, they may also want a more modest mortgage that they can pay off before their own children start college.

I’m middle-aged, divorced, and starting over from scratch. I assume that I’ll be working well into my senior years, and I probably have a significantly longer than average life-expectancy, but a 15-year mortgage at 2X my income would be my personal maximum, and I can’t be the only one thinking this way.

I also remember seeing a guy on the Mike Douglas show or the Merv Griffin show back in the late 70s talking about the price rises in housing that were already starting to happen. He said that people were NOT speculating on real estate — they were speculating on MORTGAGES. With the stagflation that was occurring (at that time), your smart move was to borrow as much money as possible NOW, to be paid back with cheaper money later on.

The only thing that MIGHT bail out the people who have borrowed too much to buy a house that they couldn’t afford would be high inflation, which is very possible. It wouldn’t have to be hyperinflation — just 10% inflation a year for several years would put a lot of people back in the black even though real estate investments may remain unfashionable for many years.

Really good points there. Thank you for making them. I’d like to comment on this:

“I was very surprised to read a couple of months ago that back in the 50s it was typical for people to use 1X their income as the upper limit of what they could afford to spend on a house.”

That is correct. What you have seen since is largely due to the effects of the FHA and Federally backed loans. These resulted in easy credit; in the past it was even 0% down, now it’s only 3% down.

The end result of this Government interference with the marketplace has been to push housing prices up to unsustainable levels. Even today. If you took out the Federal loan programs, 90+% of the loans wouldn’t fund, and we’d get back to realistic home prices.

That would cost the politicians votes. So in effect, homeowners are a key part to the general corruption propagated by Wall Street.

And don’t be fooled by the news stories today about the “bad economy”. This stuff is all propaganda designed to justify QE 3. Sure, the economy sucks. Once QE 3 has been legitimized, they’ll go back to last weeks’ news of how rosy things are.

If they don’t do QE 3, then the whole Ponzi comes crashing down. So it’s a certain bet, and in the meantime it’s an opportunity to make some money by buying stocks and commodities at bargain prices.

Questor:

What you’ve posted rings true and certainly supports my suspicions that homeowner voters are ultimately the ones behind all this nonsense. There are other voter populations that are getting blamed for this and they should not be.

Thank you for putting this into perspective so succinctly and without you and MP, I don’t know what I’d do. DHB should pay you both to post.

~Misstrial

Thank you for your kind words, Misstrial. I’m glad to know that I’ve helped reach someone and clarify what’s going on. So many family and friends are either clueless, apathetic or in strong denial.

It’s my belief that the more knowledge people have as to the big picture, the better prepared they’ll be to handle what’s coming. As well as understand what’s going on around them. Too many believe that what they were taught in High School is really how things work.

It’s been a fascinating journey for myself as well. I never understood President Eisenhower’s warning about the Military Industrial Complex until recently. The 1950’s seem quaint indeed, as it’s expanded far beyond just the Military.

The Reality Detached American:

http://www.youtube.com/watch?v=WCxBDDk4Y-M

~Misstrial

When mortgage rates go up housing prices go down = double dip. Then, in California with empty coffers, overpopulation, illegals, loss of jobs, foreign investors, and a shortage of affordable homes, housing prices may go flat-to-up in the long run. Two class society. Maybe LA/OC is the next New York – the haves and havenots.

I read China must soon build housing for 350Mil people due to their population growth – as many homes as the US has people! They will likely bid-up US raw materials making new housing in the US even less affordable.

Population explosion, loss of jobs to globalization, global tax cheats, labor trafficing, squeezing the middle class.

Wow, Doc.

Even the nitwits at Slate.com have figured out that renting might be okay. Check out the linked article:

http://www.slate.com/id/2295851/

“nitwits?” What are you implying?

“You ain’t in Kansas no mo…” Y ‘all fogot to mention them there tornados up on them there city parts.

Will all these unexaplainable weather anomilys have a direct impact on housing/RE prices???

If you’re in southern Cali, look up in the sky on a clear blue day…

Notice the long streaks way up in the sky. See how they turn to clouds and the wind blows from west to east…

Computer technology has been cutting employment for the knowledge workers since the dot. com bust. Large and small labs don’t need rooms filled with scientist pouring over data when a laptop or workstation will do the work in a fraction of the time and perfect. What has been happening to skilled manufacturing workers is now happening to the upper strata knowledge workers, they are being replaced by technology, something they never thought would occur. The implications for our employment and wage growth is that only a small slice of the population will be able to manage large debt loads such as Real Estate or even expensive auto/trucks.

All bets are off if another recession hits >

http://www.cnbc.com/id/43236764

I can see housing going back to ’98 levels if GDP contracts and UE > 10%.

The only people buying in NorCal are paying with cash from stock options, with another round of buyers soon coming from the linkedin IPO, which is a microcosmic display of the disparity of wealth in the U.S.

Good article. The comments are good too. I liked this one, “This has got to be one of the funniest stories I’ve ever seen on CNBC. After 2.7 trillion dollars speculative money handed to them, Wall Street is having a hard time figuring out what to do now? What a hoot. Didn’t create a single job, didn’t invest in the US, just bought silver, gold, oil and other commodoties, put money into the BRICS, not a dime was invested in the US and now they are wondering why the US economy is in trouble. LOL And thank you Ben, you’ve given us all a laugh today.”

A “minor” nit if you will. A lot of jobs have been created. Gerald Celente recently pointed out that it has cost about $4,000,000 per job to do so, IIRC.

I think his calculation may be off a little, as it doesn’t include the taxpayer funded bonuses for the Bankers.

Tar and feather Ben, Hank, Tim and all of their apologists like Andrew Ross Sorkin who yelp, “You don’t know how bad unemployment would have been and how much further the market would have crashed” without the corporate bailouts of AIG, GM, G&S, etc.

So what if it would have been bad, pain on the front end and time to rebuild instead of trickling away the wealth of the nation’s future in preemptively futile subsidies and band-aids on the failed system.

Bring on the higher inflation fighting FF Rate Ben and we can all watch as it slowly increases mortgage rates and puts a pinch on the ask/sell prices in local RE.

Its raining cat – crap in local OC real estate. Had a buddy call me to tell me to get on a Costa Mesa house 1500 sq ft at $375 K. Yeah…right on that one. It sold a couple years ago for $580 and IMO is worth $250 – $300K. I know the folks who lived there for free took wonderful care of the bank’s property. Lots of distressed stinker falling knives for people who just want a home to live in.

What more stopgaps can the banksters and their government cronies put in place to stop the inevitable slide in home prices to continue? They appear to have shot their wad – maybe 0.01 % interest with the 20% down? That might work.

Anyone on this Blog itching to risk their 20% down in this market? There always seem to be a few here, for reasons of necessity or false optimism, who think that this “the time.”

People in NorCal are also using FHA to buy homes…

I am as disgusted with msm, and have begun writing emails/letters to the different news outlets. I have written to the public editor of the new york times. I asked him why Matt Taibi of Rolling Stone magazine was doing the hard hitting journalism of the banking crisis. What happened to the New York Times. I then stressed as other readers here have how they start tuning out the main stream media(msm). I stressed that I am a paid subscriber to the ie. New York Times, and if they want to attract readership, they should provide examples. I even suggested that they contact people at zerohedge to start documenting what is going on in the financial markets. Maybe we should ask them to start interviewing Dr. HB. BTW- I got a nice response from the editor, and really do believe that we have to do this type of thing with our politicians as well as media. If they don’t report on the reality they will be increasingly irrelevant.

If you like RS, you may like The Daily Beast. The other day, DB presented an amazing investigative article revealing that Donald Trump has ties to organized crime and the Russian Mafia.

http://www.thedailybeast.com/blogs-and-stories/2011-05-26/inside-donald-trumps-empire-why-he-wont-run-for-president/?cid=hp:beastoriginalsC1

~Misstrial

In fact, Dr. HB, I think you should submit editorials to major newspapers with your research and ideas, and if you have I would like to know their response.

I just want to know when the F they going to kick out all the deadbeats who aren’t paying their mortgages!? It’s a slap in the face to everyone who’s paying their rent or mortgage. “Illegals and dead beats” is the new status quo of this country.

also the section 8…keeps the ball rolling. Ca is the biggest ripoff for the middle class.

I think what is so crucial is to understand that income has DECREASED since 2000. The Median Household Income was $50,732 then and it is 50,221 as of 2009. During this time, median home prices went from 119,600 to 170,500. This just doesn’t make any sense if you just pay attention to the data.

I have seen data to suggest that the GDP “growth” during this same time period can be entirely attributed by the Home Equity Lines of Credit and Refinances during the bubble. Essentially, if people weren’t using their homes as ATMs the US would have been in a state of negative GDP.

Private sector portion of GDP growth was indeed very flat. Government spending accounted for a huge amount of the growth in that period. Consider what private sector would have been without home equity withdrawals…consider what GDP would have been without government. Ouch.

This is one of the reasons they had rates so low and were spending so much. We were essentially deflating along with a good portion of the developed world. They probably thought the housing bubble would make people asset rich and force an increase in wages…that increase never happened and people found themselves massively overleveraged in homes they couldn’t afford on income. Now remove the financing which made that bubble possible and revert to fundamentals. Massive paper wealth destruction and balance sheet crusher for many many people.

Tech bubble and accompanying deflation was bad enough but doubling down on the largest most leveraged asset of most families was a huge risk. Totally irresponsible and completely facilitated/orchestrated by our government:

1) Push homeownership force lending to poor people/areas – increases demand by making housing available to people who never had it.

2) Remove leverage limits on banks and allow them to hold massive amounts of this debt as securities (see capital requirements on securitized loan vs. whole loan limits) so that they can spin up velocity. This is/was the shadow bank system

3) Continually lower rates and push social BSto keep the game on

In the orgy that followed people just plain forgot common sense. They stopped looking at income and started believing the same mania as the tech bubble except in massively overpriced and leveraged assets. I recall talking to a couple in CA – management consultant and PhD husband/wife (top firms/career paths). They were afraid they’d be priced out. My answer was – “if you two with your jobs and careers can’t afford decently desirable housing…who can?”

Today, the stock market spoke. We are headed to a double dip recession(goodbye Obama). The jobs growth is only 38k a month, manufacturing is down, and so on. Japan made components used by many car manufacturers, so sells dropped(this is what happens when companies outsource). Just wait until India and Pakistan have a go at it with nuclear bombs.

You know the routine. People out of work don’t pay mortgages.

John-“Today, the stock market spoke. We are headed to a double dip recession(goodbye Obama). ”

If you view the inflation data at shadowstats.com, I think you would conclude the country hasn’t emerged from the 2008 recession. The govt. is understating inflation. Therefore, they are OVER stating real, inflation adjusted, economic growth.

I think Obama is a horrible President. But the people that count, the financial elite, military industrial complex, Wall Street, etc. love him and think he’s doing a great job. He’ll be reelected by a huge margin. I don’t know how they will rig the election, probably a new war, but they’ll do it. Or they could rig it so his Republican opponent is unelectable, like Palin or Trump.

Not that it matters. Our problems are not fixable in the present context. We need to default on debts and unfunded liabilities and start over from scratch. But that would appear to be at least a couple of years off in the future.

Defaulting on debt would upset the Chinese. They know that it is coming through a weakening dollar. You left out the Democrat-media complex in your list of groups supporting Obama.

I don’t think anyone seriously cares about the Chinese. They’ll make lots of noise, but they have lots of problems, and can’t do much besides the smoke blowing that they’ve done. Though they are certainly trying, and will eventually get there.

The key country is Saudi Arabia. That’s who we don’t want to piss off. They are paid a good amount in gold for their oil. And the amount of payments is kept secret. In the Federal reports that I’ve seen detailing this information, the specific amounts for certain Arab countries are always left out.

The Arabs aren’t dumb enough to take just paper for their oil. Heh.

Man, I don’t think we even emerged from the 2001 recession. It was just papered over.

Well, that was appropo. Regarding China and our debt:

http://cnsnews.com/news/article/china-has-divested-97-percent-its-holdin

“China Has Divested 97 Percent of Its Holdings in U.S. Treasury Bills”

It seems the only reason now why we keep selling out to China is because of the U.S. Chamber of Commerce. I wonder how much money they’ll make off of destroying the U.S.?

Ignore the above link, please. It’s clickbait. Here’s a debunking:

http://www.zerohedge.com/article/china-dumps-us-bonds-attempts-clickbaiting

Jim Rickards (someone whom I respect) makes some rather sharp observations on the debt, and the financing of it:

http://kingworldnews.com/kingworldnews/Broadcast/Entries/2011/6/4_Jim_Rickards.html

The democrat-media complex? You don’t get it, JCPAJD. Just because the talking heads on NBC or CNN may be more liberal minded than right wing, you think the MSM is controlled by Democrats? Ha! The MSM competes in an open marketplace for corporate advertisor dollars. It’s a BUSINESS….not in the ideology promoting business but the profit business. It does so by producing drivel for the masses (including on the “news” programs) so that more Swifters can be sold. It’s not about choosing between one party or the other….the corporatocracy (including the consolidated MSM) lets the minor differences between the two parties distract us (abortion, gay marraige, 36% versus 39% tax rates, ownership of automatic weapons) so that they may elect the people who appear best suited to serve their interests. The two political parties are funded by corporate dollars, directly or indirectly. The natinoal candidates that emerge from the two political parties are deemed sufficient to serve the interests of their corporate masters. It matters not whether they have a “D” or “R” next to their names. Maybe you need another degree in common sense.

The American Dream By The Provocateur Network

http://www.youtube.com/watch?v=ZPWH5TlbloU

The home-buying tax credit of up to $8,000 was just a waste of money. The Fed should do the right thing and let the home prices correct as well as states. They like giving away money we all can’t afford. Remember they sucked the blood out of everyone gave loans to bums with out the right credit. On top of that 99.9 % of Collage students have Collage loans 50k plus for life or until it gets paid. America is broke everything has gone up and is going higher.

Damn Straight. For the majority of the $8k Tax Credit home purchasers – it defined the idiom pennywise and dollar foolish. Here in Socal, that $8K carrot was lost to the slumping market about the time escrow closed. DUMB.

I have a feeling that San Diego was probably the worst of the worst when it came to the housing bubble – worse than LA or Las Vegas.

Banks are very slow to foreclose on deadbeats because foreclosures show up on banks books as losses and banks don’t like to admit they are sitting on massive losses. The unreported part of this fiasco is that Federal and State bank regulators are letting the banks continue this charade. It is well within the power of these regulators to order banks to clean up their mortgage portfolios but this has not happened. Maybe somebody on this blog can explain why. My own guess is that the bank regulators are largely in the pockets of the bankers and have little incentive to irritate their future sugardaddy employer when they want to make the jump out of government.

Eddie

Not sure about this… my in law claims they write it off when it goes 60 days under… not sure if it is the full amount. Also the common bank worker bees are aware that first loss is usually the smallest.

This is not going to end well.

Your In-law is wrong. The Banks normally would. Now, they play all sorts of games and don’t have to write it off until it is actually sold.

Have your in-law explain the significance of mark-to-model versus mark-to-market. The former is what the Banks currently use, and it’s outright accounting fraud. They can make up any numbers they like, and don’t have to reflect them until the ugly deed of an actual sale is done.

This isn’t correct. With housing you have the asset as collateral so theoretically a loan should be covered by the home and any excess equity of the buyer. Granted there will be the time/expense to foreclose but traditionally there’s no reason to write your asset down at all because it’s covered. Obviously, now is a different time without that protection but one of the things holding these banks up is holding those loans at full value and not recognizing likely losses liquidation will have on first and second liens.

Companies must follow US GAAP FAS 115 and FAS 157 for mark to market. The banks are doing business in the US. Clear cut.

@OffTheBooks: Could you please do a modicum of research before posting incorrect information? The FASB rules were changed back in April of 2009, and this was well documented in the Press, as well as on blogs. Anyone even reasonably familiar with what FASB is should very well know this.

Here are some links to bring you up to speed:

http://www.cnbc.com/id/30009618/FASB_Unveils_Relaxed_Mark_To_Market_Rules

http://insideinformationdaily.info/fasb-enables-more-banker-fraud.htm

http://agonist.org/numerian/20090402/fasb_caves_in_on_mark_to_market_accounting

CoreLogic … today released its March Home Price Index (HPI) which shows that home prices in the U.S. declined for the eight month in a row. According to the CoreLogic HPI, national home prices, including distressed sales, declined by 7.5% in March 2011 compared to March 2010. … Excluding distressed sales, year-over-year priced declined by 0.96 percent in March 2011 compared to March 2010.

Hey all, Just moved to Hawaii and have a new job. Good times while it lasts.

Bubble prices are persisting here though I’m seeing a lot of short sales and foreclosures. Going to sit on the sidelines and keep renting.

About the double dip. Well, we are looking at EVERYONE who bought with 3.5% down being underwater for a long long time. Possibly 10 years. The FHA will probably be whipped out officially too. Prices still dropping is very significant.

Also think the shocks from Greece and the IMF will effect the monetary system as well. Could be an interesting second half the year.

Congrats, James! It must be nice indeed.

Regarding underwater mortgages, housing is now divided into three equal groups. About 1/3 own their home outright. 1/3 have a mortgage with equity, and about 1/3 are underwater (numbers are approximate, but close enough to be used).

And the new families coming on to the market either don’t make enough to afford a housing payment, and/or have too much student debt to qualify.

Something has to break at some point. The current situation with home prices just isn’t sustainable.

Never thought of Hawaii as a housing issue until I visited this winter. For sale signs everywhere. As close as I can tell housing is completely unaffordable now for the incomes of most native residents. I assume the cause was California and West Coast infecting the area with speculation on investment property etc…Heck, I saw iffy houses they wanted $1m+ for with a 1960’s piecemeal shack ready to fall down on the lot next door and plenty of empty raw land around.

Unfortunate the islands were infected with the spec bubble. Beautiful place and wonderful people.

You know there is something that I don’t understand, and that is blaming government for the mortgage fiasco. This is a global problem, but it burst first in US. Economics doesn’t really explain debt well, and their isn’t a real place for intermediates(financial people) in economic theory as well. It appears that people just go back to rhetorically blaming the government. I say why not the banks, nobody forced them to make shitty loans to people they know couldn’t pay it back. Most of the damage pre 2008 was done by the private lending agencies ie. countrywide, wtf did government have to do with countrywide. fannie and freddie came in later to try to support a market stupidly. But this is a global phenomenon, and fannie and freddie didn’t affect ireland, or greece, or spain, it was the freaking banks that overleveraged and took people to the laundry.

The Government allowed this nonsense to happen. Specifically at the urging of Alan Greenspan, Tim Geithner and Larry Summers. Those three got the Glass-Steagal act repealed, which set the stage for the securitization disaster that is still going strong.

Granted, they are owned by the Banks. So it’s more of a collusion between the crooks on Wall Street and the crooks in Government.

And, if you’re not aware of it, Geithner is now the Secretary of the Treasury. Summers used to be a key part of Obama’s economic team, and both are why there is no hope and no change.

Summers recently returned to Harvard. He set Harvard up to be bankrupted when he was in charge of that institution. And it was only because of a taxpayer bailout that Harvard is still around.

Geithner has botched everything that he’s handled. There was an article about this a year ago. He’s the reason why the Asian counties don’t want to deal with the IMF any more.

These are the guys who’ve been running the economy, along with Greenspans’ hand-picked successor, Bernake.

Think there’s a pattern here which might tell you what the future holds?

Couldn’t agree more, and Thomas Jefferson concurs:

I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.

Thomas Jefferson, (Attributed)

3rd president of US (1743 – 1826)

Exactly Questor. No apologies for Ben Bernanke and the Bailout Bunch.

avs – great analysis. Read about MMT and you will see how you are correct from an economic framework.

The government puts the laws in place that allow this. For example: if we didn’t have laws against monopolies, then company’s would pursue this. Banks will do whatever they are allowed to do.

Balance is definitely a great goal. Some laws need to be made to ensure balance, and deter incredible market turbulence. With the risks banks have taken during this recent meltdown, it does seem clear that banks don’t have the ability to regulate themselves.

There are surely many people to blame for the fiasco. I don’t think that the banks can take all the blame because they’ve got a nice out: Too big to fail. They’re playing the game in their favor, and the government has got their back. And we’ll be carrying the burden on our backs through taxes, inflation, etc…

Will the gov’t be to blame if the things they’re doing now don’t work? Are we in a better place now that the big banks are even bigger? IMHO: No.

Why is Goldman Sachs too big to fail?

Can’t agree with you more. Let’s voice it by pulling our money from the big banks, and storing it with the smaller local branches. All of these big banks are currently raising fee’s and looking for new ways to enable fee’s, and it appears very collusive and it’s getting so offensive… Raise fee’s on me! You’ve already got my tax money!

avs said: It appears that people just go back to rhetorically blaming the government. I say why not the banks, nobody forced them to make shitty loans to people they know couldn’t pay it back

Exactly. The gov’t is merely the vehicle – you have to look at the driver. Clearly financial institutions were (and are) at the wheel.

All I am saying is that there needs to be balance. I understand what the federal reserve principally Alan Greenspan did to lower interest rates. But the banking industry didn’t have to speculate on the grand scale that it did, and they also have a huge part to blame. A good example is by looking at healthy regional banks that didn’t do these shenanigans, and we are spent bailing out with our tax dollars and future austerity the banking sector that was irresponsible and took stupid risks because somebody would bail them out.

The simple answer is this: no bailouts. The S&L Crisis set an incredibly bad precedent that is pushing us to ruin today. There si no better restraint on risk than the consequences of failure. If you remove the consequences why wouldn’t anyone take massive risks with other people’s money?

Those managing massive amounts of capital should have a personal stake in the outcome. Nothing encourages clearer thinking than the prospect you’ll be ruined along with your clients.

You know, everyone defines “dump” differently.

I have friends that would gladly live in a place that other of my friends would disdain as a “hovel”

That is why if you want to compare prices in different neighborhoods you have to talk about the cost of the dirt.

For example, some of my friends just bought dirt in the Manhattan Beach “West of Highland” neighborhood. They bought a standard 2400 square foot lot and paid $900 a square foot

I myself am bidding in the “North of Montana” neighborhood of Santa Monica and the dirt I am looking at is asking $220 a square foot and I am prepared to bid more like $205 a square foot

Friends of mine are bidding in Culver City where dirt costs around $140 a square foot.

Are any of these neighborhoods bargains or are any over valued? You have to look at the cost per square foot of land and compare to the school system, amenities, etc.

If anyone on this blog, anyone at all knows of places on the West Side that are bargains, let me know. I am eager to hear of neighborhoods that are relative values.

For example, I have friends who own a medical practice in Palisades. I have urged them to buy in the Paliades Highlands. Palisades Highlands have incredibly cheap housing, probably the cheapest housing out of any West Side neighborhood with great schools, bar none.

Palisades Highlands are too long a commute for most of the people on this blog, but if you own a medical practice in the Palisades and commute from Palisades highlands your commute is very easy.

So the right neighborhood for each of the people reading this blog is different. You have to look at dirt cost in each neighborhood

Paying extra to be in a good school district USED to be good idea, but I’m not sure that it is a good idea going forward. I advise anybody thinking of doing so to spend a day or two volunteering in the 5th or 6th grade of your prospective local elementary before you make a final commitment to buy. People get so caught up with evaluating the Kindergarten and first grade that they don’t even check out the “finished product.” It goes without saying that the junior highs or middle schools are the weakest link in the public school system in nearly every school district.

I have relatives who paid big money for a house in a top school district. Their children ended up attending public school until the eldest got to the third grade. At that point, they took the children out of public school and placed them in private school for all of the usual reasons. At that point, they had a gigantic house, a gigantic mortgage, and gigantic tuition fees for a house full of kids. Remember: high test scores really only mean that the local school population consists of intelligent children who are good at multiple choice testing compared to other children of the same age in worse neighborhoods. It doesn’t mean that your child will be reading Shakespeare, and it certainly doesn’t mean that your child will learn to speak a foreign language.

There are so many changes coming to American society in the near future that I would NOT want to bet that school attendance zones will remain the primary method for grouping children in the public schools for much longer. And even terrible school districts often have a decent elementary school somewhere in the system if you look hard enough.

Sorry if this is considered off topic, but I would look at neighborhood demographics, and crime trends in the area. I would NOT let school test scores be the primary method of narrowing down where I would buy a house. I have lived in a couple of neighborhoods in which house prices varied wildly depending upon which side of a district line they were on. If there is a radical restructuring, the people who paid extra to be in a desirable school zone that no longer exists will be out of luck.

Schmuley KJ:

May want to also ask (if you haven’t already) on westsideremeltdown.blogspot.com

Laura, if I’m not mistaken you for another poster, you are in Chicago, right?

If so, the areas that Schmuley describes have excellent public schools much like Irvine and south Orange County.

What upper-class people have been doing is buying in upscale communities such as Newport Beach where the public schools are outstanding and thus, save money on private school tuition which in many cases on the Westside are, depending on the school, range from $15k on up per school year.

I understand what you are saying, Laura, and that would be applicable to many, if not most cities and towns, however the locales that Schmuley describes would not be among them. Same for Penninsula towns such as Los Altos, Cupertino, Menlo Park, parts of Palo Alto…these areas have very good public schools.

~Misstrial

Hey, to the poster that just moved to Hawaii, can you give us a flavor for what it costs to rent or to buy in a nice doorman high rise with a view?

Prices are all over the map here on the mainland.

In Chicago you can buy a beautiful doorman high rise condo with a view of the lake for $600 a square foot but in Manhattan that same exact place costs you $1300 a square foot.

What are the relative costs in a good part of Honolulu? I know the lifestyle is better in Honolulu. Fill us in

You can buy in a lovely newer Chicago “doorman high rise” in prime Streeterville and Gold Coast neighborhoods for quite a bit less than $600 a sq foot. Try $300-350.

Less in the laughably overbuilt South Loop, Chicago’s own Miami.

Way less in less desirable neighborhoods (which are still nice neighborhoods), such as Lakeview, and even less in Edgewater and other non-prime, though perfectly decent, areas, where the buildings are older

Chicago has the worst condo market in the country now. Will stay that way for quite a while, given the glut of new condo towers in River North and South Loop, and all the 6-unit ‘urban generic’ built all over the city.

Never mind all the conversions of existing rental buildings.

As in Miami, there is a list of buildings that there is no financing available for, because of large numbers of foreclosures and associated financial issues.

Prices will definately continue to go down. But there is a flaw in this assesment. Prices in the city (condos mostly) are certainly following a rental profit margin. Condo’s don’t sell until they hit a price where it is profitable to rent them (mort, tax, ass, insurance). But they are selling when they hit that mark. It is nearly impossible to buy a condo at an investment price because the shrewd investors are buying things up within a day, even an hour of when they go on the market at a profitable price. We are at bottom, the bottom with certain property. There will be “multiple bottoms” in reality.

i bet the HOA like that since most are at best on the verg of BK with due defaults, arrears, and rising cost. i have reviewed the budgets of many HOA in CA and they are in big- trouble which means raising the dues. besides with investor occ ratios out of wack, good luck getting any conventional and/or gov’y loans. which mean basicly cash and non-traditonal above going market rates financing.

Leave a Reply to Robin Thomas