The education of the housing market – Student loan debt and falling birth rates slow demand for the first time buyer market. The consequences of keeping young professional priced out of the housing market.

The crisis in housing seems to be leveling off only in the sense that we have grown accustomed to horrible news regarding the housing market for four years. We have developed coping strategies to combat the crushing reality that home prices continue to ebb lower as more foreclosures are pushed through the clogged up pipeline. What is equally disturbing is that young professionals, those 25 to 34 are equally educated as their baby boomer counterparts but with one major distinction. That major distinction is massive debt with college tuition inflation. I bring this topic up because this age group of 25 to 34 is the prime customer group for first home buying. While many baby boomers were able to graduate with little or no debt a few decades ago, that scenario is becoming more and more of a distant memory as public schools choked off of state funding are hiking tuition costs. Here in our state the University of California and California State University systems have been raising tuition in the last couple of years to make up for the cuts in state funding. With little blue collar work that pays well, having a college education is seen as one of the safest paths to the middle class but that path is getting more and more expensive. Potential new home buyers will have to contend with student loans even before taking on a mortgage.

The education of housing

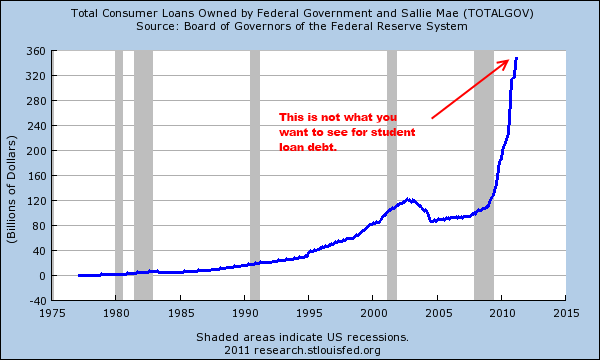

This chart is rather startling and shows only a portion of the Sallie Mae debt portfolio tracked by the Federal Reserve. The above chart does not include all student loans outstanding. Student loan debt has reached $900 billion. The above chart is rather indicative of what is happening in the industry. The rate of growth in student debt is troubling because much of this debt is backed by the Federal government. What checks and balances are in place to audit for-profit schools that operate like subprime lenders in poor communities? This is very troubling and we will crack the $1 trillion mark shortly. And defaults are jumping here as well:

“(Daily Pulse) College may the best years of your life, or it better be, if you’re going to be paying off or defaulting on those student loans well into mid-life. According to a new survey from the Institute for Higher Education Policy, only 37% of students pay back their loans on time; about ¼ of them need to postpone payments to avoid delinquency; and 2 out of every 5 are delinquent at some point in the first five years of repaying the loans. The numbers show education is a priority for Americans—at an estimated $896 billion, total student debt amounts to more than Americans’ credit-card debt—but as the average loan continues to rise ($24,000 last year) along with default rates, how can students know how to weigh the importance of a college education with mounting debt? The Department of Education has proposed regulations to would cut off federal aid to programs whose students graduate with high debt-to-income ratios at for-profit colleges, but what advice should students heed in the meantime?â€

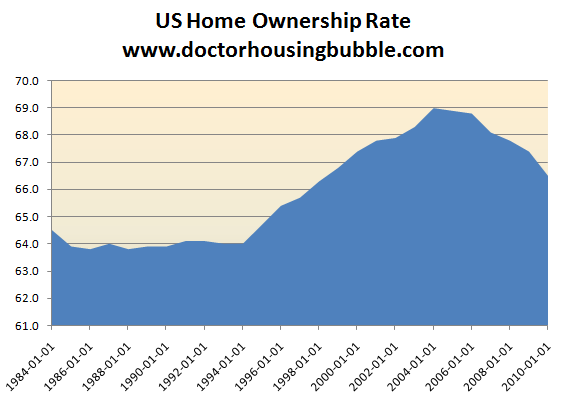

This is problematic on many fronts. Simply by carrying student loan debt a future buyer already is saddled with a monthly payment that will cut into how much “house†he or she can afford. As many lose their homes the home ownership rate continues to move lower:

Source:Â Census

The current home ownership rate now stands at levels last seen in 1998. Glass-Steagall was repealed in 1999 and allowed for every exotic mortgage idea to proliferate the market during the bubble. As it turns out, we did not increase home ownership in any sustainable fashion and simply set our economy down a tragic path chasing easy profits through flips and other get rich quick ideas. Like Oedipus who later receives the news about his father, the past is coming back to haunt us.

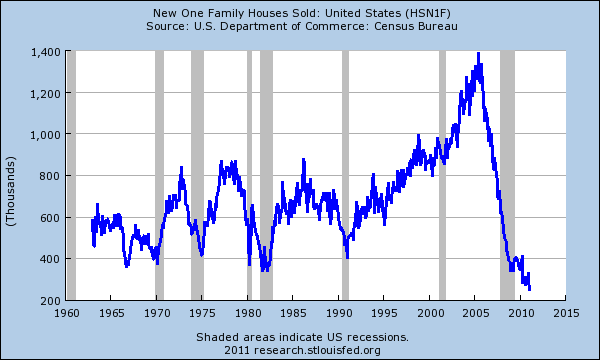

These young professionals who would be prime candidates to buy are typically purchasing from baby boomers that are still intoxicated by the elixir of the housing bubble and many times have unrealistic expectations. This is why many of the homes being sold are actually foreclosure re-sales or investors looking for buy and hold properties at the lower end of the price scale. The new home market which typically catered to this new buyer crowd is crawling at the bottom:

It doesn’t get any lower than that. The answer is rather obvious if the charts could speak to us. Many Americans looking to buy can only afford cheaper priced housing. Saddled with large amounts of debt already, they may not qualify or want to buy a more expensive home. Unlike the baby boomers who had limited debt prior to buying their first home and also entering a healthy economy, we are in a very different situation here.

One of the big pushes to own a home is usually for household formation (aka, making babies). One of the consequences of a deep recession is families holding off on forming households:

“(NPR) The national birth rate fell 4 percent between 2007 and 2009 — more than it had in any two-year period in the past 30 years. With a national average of 66.7 births per 1,000 women between the ages of 15 and 44, nearly every demographic group had lower birth rates, with the sole exception being women over 40.â€

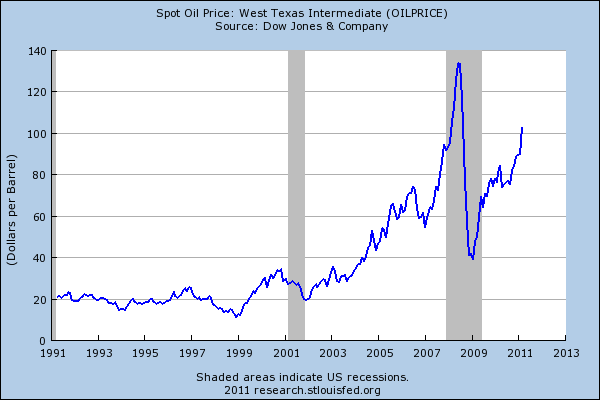

So a young couple may actually be willing to wait until they are on more stable footing. It doesn’t help that other costs like oil and energy are eating up more discretionary income:

The market as we have it right now really resembles nothing like we have had in the past. People think this is normal but it is not. Foreclosure sales and investors are the grease currently moving this market. The move up buyer and first time buyer which usually dominate the market in normal times are actually a smaller part of the mix. In the past you would have a first time buyer purchase a home from someone who would them move up to another home. This was typical. Today you have a “one and done†scenario where someone buys a foreclosure and that is it for the transaction.

The amount of student loan debt is really staggering and as you can see from the Sallie Mae chart above, student loan debt has gone up on a near vertical path. Unlike a mortgage, there is no walking away from student loan debt. With students coming out with $40,000, $80,000, and $100,000 in debt many already have a mortgage before buying a home.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

87 Responses to “The education of the housing market – Student loan debt and falling birth rates slow demand for the first time buyer market. The consequences of keeping young professional priced out of the housing market.”

After my first born went to an expensive college, we learned our lesson.

Send your kid to a community college for the first 2 years, while they “find themselves” and complete freshman entry level requirements. Put the difference in tuition in the bank.

After 2 years, they can transfer to another college. You should have the first year of that in the bank, from previous savings. Then, mom and dad can foot the bill for the final year, and your child is out of school debt free. (Graduate school is “on them.”.

Private colleges at $50,000. a year are ok for very affluent families, but trust me-

they do not get such a superior education, compared to a state school, to justify the immense debt load.

we did very much the same, and our daughters are so glad they do not have the millstone of tuition debt over them, we are too.

And how is this plan going to work in the face of continuing cuts to public higher education? If they can’t get the classes they need, can’t enroll in the major they want because the school is overcrowded and underfunded, then what?

Local JC’s have started to adjust what students will get what classes….my girlfriend in 32 an going back to college. Once you speak with the guidance counselors after 1 or 2 good semesters…..they put in you priority registration and then get all the classes you need. But you got to prove that you’re serious first.

I couldn’t disagree more! It depends on the kid and the student. Some private schools certainly are not worth the money but some are. I took a few classes at community college while in high school and then went on to college at a very good private school. No comparison. I have no doubt that if I had gone to a community college for college, I would have been a really mediocre student because the mediocrity there was just overwhelming. Coming from a not very super privileged background and going to a top notch college, catapulted me into a different universe. I’d pay triple what I did (and believe me it was a lot) and still feel like it was the best money ever spent.

I’m with Justin. I tried my hand at community colleges and found not that they were an extension of high school, but rather an extension of junior high. It seems they, by and large, are for kids who couldn’t (or didn’t want to) get into a real school but have to do something to appease their parents.

It appears to be a great, money-saving, idea, but unless your child is a highly motivated and otherwise stellar student, don’t waste your time.

It is worse tan a mortgage. Student debt is borrowed at adjustable rates. The payments will get steadily worse.

The weak Dollar will bring welfare losses which will bite 2 years later. Economic growth forever? No way! Thanks, Doc, and keep the depth and range of your blog!

The demographics are not good for housing. Less money, less jobs and smaller families. Once people come to the conclusion that home prices are not going to be rising any time soon, the market will stagnate for years. And this will only reinforce the logic to rent rather than buy.

This is really the group that was hurt the most by the housing bubble if they already had bought in. Some idiots like myself saddled themselves with high student loans and mortgage to debt to the tune of 75% DTI just to buy a home because they thought it was the only way it could ever happen. Now that this has come crashing down and many of us are abandoning these moronic loans we took out, we are out of the market for 5-7 years after the foreclosure occurs. Given that it takes 2-4 years to even get the bank to foreclose your home this will keep us out of the market for 10+ years possibly. Some people were smarter and in some cases just lucky not to have bought, but too many of us drank the cool-aid. So in 7-10 years I think we will see a reasonable recovery in housing… once those of us who bought into the hype are allowed to re-enter the market assuming that we haven’t written it off forever.

The student loan problem is getting a lot worse. I graduated in 2003 from a UC school and tuition in my time there had went from $4000-$7000 per year. Now tuition is closer to $12000 a year with 10-20% increases each year. If this keeps up student loan debt will eventually eclipse not just credit card debt, but also mortgage debt in this country. Given that not even a BK gets you out of student loan debt I do wonder what will happen as inevitably a large number of people will not have sufficient income to pay. Somehow we are supposed to also be able to pay for this massive health care benefit for the previous generation in a system that is so inefficient that costs are through the roof. Great Depression 2.0 is still coming… its just a matter of when it all comes crumbling down.

Graduates will have to get min wage job at Home depot. Maybe they can eventually move up to management through dilligent work and diploma waving, that’s how.

The sky is not falling. We are merely collectively suffering from a debt hangover. This too will pass. Leading economic indicators, like profits and orders look good. Trailing ones like employment and government deficits look bad, unsurprisingly. This, including recent government spending splurges are all according to plan. Hysteria unwarranted. Nothing to see here. Move along. Move along.

With no hope of any appreciation which pushed the housing market since WWII. And no interest tax deduction (a very unfair deduction anyway sincesome rich folks forced through the interest deduction) there is simply no reason to buy a house or any kind of abode. With prices continuing to be flat and a president and congress that have turned the foreclosures decision over the discretion of the banks – banks don’t have any discretion except in favor of themselves. With a President who has abandoned the elderly, the poor, the sick, education and the entire middle class plus a right wing that is determined to push the economy into depression (yes DEPRESSION this time) there is no hope for the housing market any time soon or in the foreseeable future.

The only hope for housing and the people is to commit civil disobedience and to rise up and fight for your very right to live. This is not a joke. If Paul Ryan’s budget plan is even partially accepted we are doomed. Now is not he time to cut budgets. Now is the time to get good jobs for Americans. It is the only hope for any market except things the uber rich buy. So don’t even think of buying a house now or in the near future maybe longer unless you just love to spend all your weekends and money repairing a home that is losing value. Unless we start looking at what is really happening in this country we won’t ever turn this around.

So from your perspective “turning this around” is based on:

– borrowing $4B+ a day to fund spending (which will increase under your solution)

– paying $2B a day for interest on existing debt (which will increase under your solution)

– pushing debt as a percent of GDP to 90%+ within 10 years (that will work wonders)

– spending money on programs that are proven not to yield returns (the Dems bluster about cutting $30B in spending as if the world is ending – tell me, is there ANYTHING aside from defense that Dems will be willing to cut? Harry Reid cries over the possible demise of federally funded cowboy poetry reading contests!)

Sounds like you’re all in with Francis Fox Piven’s lament that we aren’t seeing European style street riots and disobedience. Yeah, that it, that’s the ticket. Sheesh!

The longer Congress kicks the can down the road the harsher will be the corrective actions needed to address the condition of the economy. And just so you know, calculations show that taxing millionaires at 100% of their income won’t even begin to solve the problems.

“calculations show that taxing millionaires at 100% of their income won’t even begin to solve the problems”

Really? Calculations by whom? Goldman Sachs? They certainly won you over…

I am thankful that there are people in America that still have brains.

Paul Ryan has the gall to call for a tax cut on the wealthy for ANOTHER 10% while no tax cuts for the working class. What Ryan has for the working class is another kick in the arse!

I do agree that Medicare as we know it is not sustainable but the answer is not to deal with it by making sure the wealthy and big business are always given the upper hand while the average American is given the stick.

A one payer system like Germanynor France would save the U.S. economy about 5% of GDP on health care costs! Not a guess, a fact when comparing health costs of longer living Europeans versus Americans. Yet a one payer system is always demonized by Republicans because it would not be good for insurance companies who are one of the largest donors to Republicans and have the most lobbyists.

Europeans aren’t dropping like flies due to poor health care. Their life spans are actually longer than ours! Yet the Republicans in their desperate attempt to keep big business insurance companies flush with cash claim we would all die a slow early death in crowded waiting rooms if we move to a one payer system.

Social security is in surplus and is one of the most successful government plans in history. The problem is that now that the defense department has spent the social security surplus Republicans claim the elderly are the ones who must suffer.

A one payer system, minor defense cuts, and taxes on the wealthy at Ronald Reagan levels would be all we need to deal with our deficits, and of course, ending our foreign wars campaign. Simple, painless and we would be a better country.

But NO! The above plan is too good for the American people and not good enough for big business and the rich.

We are s out of luck.

So your theme /point is you are Against big Bussiness, but FOR big government? Do you understand the outcome of that scenario? You and your philosophy is the enemy of the free man. I lust to be free, therefore you are my enemy.

Martin, I am with you! But realistically you know this plan have no chance in the right wing obsessed zombieland…

@ Martin- I’ve never heard a better argument for freeing people from the shackles of government do-gooders than your statement….”Social security is in surplus and is one of the most successful government plans in history”.

If the Social Security program is one of the most successful, we should’ve shut the whole apparatus down for good last week.

So europeans aren’t dropping like flies due to their poor healthcare? Why don’t you read up on the incredible time periods you have to wait in the U.K. for any operation.

REPLY TO JAMES T IN MA

Come on, you your head. Out of the European Health Plans why choose the model that is the most underfunded and problematic of all the plans?

It is well know England is sub par but there is not waiting list for emergency operations like bypass. The waiting list is for things like hip transplants.

England under funds its health care system and it shows. Per Capita they spend HALF what we do. If they spent 50% more they would spend less than we do and insure everyone.

Only a conservative would want to hold up England as the model. We have lots of models to look at, we could choose one that works. But no, that is too good for the American People.

Check out these facts and then recheck from other sources. They are accurate.

Just remember, the link in the chart shows the u.s. spends 16% of GDP on healthcare while millions are without insurance and millions worry abount bankruptcy due to health. Those systems that spend far less don’t have millions uninsured nor millions worrying about losing everything they ever worked for due to illness.

http://en.wikipedia.org/wiki/Health_in_Germany#Insurance_systems

Reply to Suraddict

Quite the contrary. I want American companies to thrive. How do you expect American companies to compete in a global economy with the burden of health care?

The average American made car has 3K in health care costs associated with it, Japanese cars do not. The system you protect in the name of freedom is killing us financially, economically. Japan has a health care cost half ours, in the end, everyone in the economy pays the bills. How can we compete with such a high cost system? How can we compete with Europe?

http://en.wikipedia.org/wiki/Health_in_Germany#Insurance_systems

The facts of cost are indisputable, they are available all over the net. The only thing supposedly disputable is quality of health care. The fact is Europeans and Japanese live longer than us yet the Right claims they are all sickly people waiting to die early deaths in emergency waiting rooms. If that is so, who is building all their exports? Ghosts? Zombies?

No my friend, I am not against “big business”. I am only against a group of people who want to protect a particular segment of big business to the detriment of the rest of big business and more importantly your family, my family, my friends and neighbors.

There is only one party that claims a one payer system is expensive and deadly to our health and that is the Republican Party. Thank the Republican Party for the Frankenstein known as ObamaCare. That is what you get when you protect the big business of health insurance companies to the detriment of the American people. Obamacare is the result of merging private insruance with an “insurance for all” mandate.

Big business loves it. 40 million new customers.

If you are against giving American companies a level playing field, you are my enemy.

There are a few constants of “successful” welfare states:

Racially/culturally homogenous

High trust

High average IQ

Lebensraum

Natural resources

In sum, the ideal polity where everybody pays their share and doesn’t rent-seek requires a high degree of social cohesion. High population density, scarcity, diversity, low IQ (poor impulse control), rapine culture, all corrode this.

The Western social democracies are embarked on a grand experiment to prove that everybody everywhere can be Sweden.

We shall see.

I think the reason why many people disagree with the one payer model in the US is that both Democrats and Republicans created the initial plan in such a way that they themselves would not have to take part. In other words, they keep their expensive PPO health plans, on the taxpayer’s dollar, and the public receives lesser coverage.

If not for greed from both Democrats and Republicans, we would have been able to come up with a one payer system that could have covered everyone. Instead, we just added another level of mucky mucks to an already bloated system.

I have negotiated employee benefits contracts for 15 years now and I have seen prices go up at least 10-15% each year, which means, I have seen (depending on the company) between a 150% and 225% increase for employee health benefits. I have not seen much by way of increases for employee pay (per position, not by employee). With the new healthcare plan and its added layer of administrators, I foresee our healthcare costs, rise in price more than 10%-15% per year.

TRUTH!!!

From the article “Eat the Rich” on 4/13/2011 by Walter Williams, Professor of Economics, George Mason University:

Let’s look at some facts about the rich laid out by Bill Whittle citing statistics on his RealClearPolitics video “Eat the Rich.”

– This year, Congress will spend $3.7 trillion dollars. That turns out to be about $10 billion per day.

– According to IRS statistics, roughly 2 percent of U.S. households have an income of $250,000 and above. All told, households earning $250,000 and above account for 25 percent, or $1.97 trillion, of the nearly $8 trillion of total household income.

– If Congress imposed a 100 percent tax, taking all earnings above $250,000 per year, it would yield $1.4 trillion. That would keep the government running for 141 days

– Fortune 500 companies earn nearly $400 billion in profits. Taking all corporate profits would keep the government running for another 40 days, but that along with confiscating all income above $250,000 would only get us to the end of June.

– America has 400 billionaires with a combined net worth of $1.3 trillion. Congress could confiscate their stocks and bonds, and force them to sell their businesses, yachts, airplanes, mansions and jewelry. it would only get us to mid-August.

The fact of the matter is there are not enough rich people to come anywhere close to satisfying Congress’ voracious spending appetite. They’re going to have to go after the non-rich and cut spending.

Source: http://www.creators.com/opinion/walter-williams.html

To clarify.. …….Paul Ryan is calling for a tax bracket cut from 35% max to 25% max.

That is actually about a 30% tax cut for those with much and no change for those with little, except for less government services in exchange for their tax dollar.

The noble goal is to reduce the power, control, and influence of government, and the path to that is give them less $money to blow. I dont care how it is achieved. What do you rely on from them which will get the pinch? Are you unproductive and on the dole?

> The noble goal is to reduce the power, control, and influence of government, and

> the path to that is give them less $money to blow. I dont care how it is achieved.

> What do you rely on from them which will get the pinch? Are you unproductive

> and on the dole?

The right wing ideology has it a bit confused. The noble goal of government is to take raw power and drown it in a sea of checks, balances and other inefficiencies until softer powers (like money) can emerge and encourage folks to do the right thing and be happy about it. The problem is that the right wing confuses government (the wrapper around power) with the thing itself, and attempts to drown the government in the bathtub, instead of the power.

The problem is that power exists no matter what you do. It’s not going to go away, just because you underfund the thing that limits it. If you drown the government, you merely remove the cage and unleash the raging beast. Now, that might be good if you think as a economic or political elite, you might inherit it. However, it is just as likely that a raging underserved and starving proletariat will hand you your head on a plate. It’s better and safer for all if the bars remain tight.

Just not too tight, and don’t let the police state become an end unto itself — it appears as though I have to get fingerprinted by the police and have a background check done in order to enroll my 3 year old in preschool! I’m sure this made sense to someone, somewhere…

Conservaties often wax poetically about the golden years of the 1950’s – check out what the tax rates were then, when we were building roads, bridges, schools, a space program, and yes, even fighting in Asia

Did all the “elderly, the poor, the sick” have a gun to their heads forcing them to mortgage themselves to oblivion? Debt is failure, no matter what your political persuasion.

Well, lets take each in turn:

Elderly — very high medical bills. Can’t work. To the extent that they felt they had to pay for their medical bills or die, yes they had a gun to their head.

Poor — Can’t afford food and shelter. Can’t find work. To the extent that they felt they had to have these things to survive, then yes they had a gun to their head.

Sick — see Elderly.

So, yes it is entirely plausible these people did feel compelled to go into debt. The alternative is probably something like death. Better debtor than dead.

The people you want to demonize here are not the elderly, poor and sick, but rather the able bodied folk with a good job who recklessly spent far more than they could afford and got into debt. For them, debt is failure. For the elderly, poor and sick debt may be inevitable.

OK so they were stupid and a lot of middle-class people also mortgaged themselves to the hilt. However they did not commit criminal acts (for the most part); it was the financial wizards who made out like bandits while regulators turned a blind eye. Now we are all paying for their misdeeds.

The mentality about student loans is the same that I see with housing, that no matter what it’s a good investment. I don’t think very many students weigh the cost benefit analysis of expected earnings versus liabilities, just like a lot of people don’t factor in the massive liability a house can be if it stretches your income beyond reason. Not enough student look at college as a business transaction. I know far too many people my age that don’t think twice about the loans they are taking out to pay for undergrad or grad school because they are “bettering themselves.†I think for many it’s become an expensive piece of paper to put up on your wall to show how smart you are. And student loan debt is the worst kind, since it’s non-bankruptable.

One of the smartest decisions I made, or lucked into (through scholarships, help from parents, working summers to save money and going to an inexpensive public school) was coming out of college without any student loan debt. I have the same job as tons of other people that have massive student loan payments every month.

I think a college education is absolutely essential these days, just like I think buying a house makes sense in a normal market. But education at any cost, and housing at today’s prices just doesn’t make sense. I think these student loans are really going to start having an impact on housing in the coming years. People are paying the same prices for housing or more than in previous years, and the student loans have removed the wiggle room from their budgets. It’s a recipe for disaster whenever the most minor of road bumps comes along.

The point made regarding no thought being put into the decision for one’s higher education rings so true. I don’t know anyone, myself included, that had the forethought to conduct a cost/benefit analysis before deciding on furthering their education.

One thing not mentioned in this blog is any statistics on baby-boomers who went to college. I can’t think of one that I know. Most boomers went straight into the work force from high school. One big part of why they had no debt upon buying their first home. Student loan debt only exacerbates the issue currently straddling future first-time home buyers.

Thanks for the insightful information you bring us regularly, Doc.

You know you can fool some people some of the time, some people all of the time, but not all the people all the time. Some day people will get that trade is for “OUR” benefit . If you run a business-you run to make aprofit. Trade policies should be adjusted if we as a nation are not profiting. Sometimes if you go to one extreme like we are with this free trade/.deregulation mess-the pendulum might just swing back violently to the other extreme. the ones who are screaming socialism-might just not like the landscape ina few years. Just study history-when has a one sided no benefit equation lasted for ever???

I was driving through LA in January and saw a billboard off I-5 about how Arizona was the educational bargain for Californians.

I agree as my elder daughter just started in Flagstaff studying physics. Still, it costs us $25k a year but at least they committed to no tuition hikes for the duration of the BS degree.

I’m glad I’m still renting. Reading DHB helped me decide to backoff a planned home purchase here in Silicon Valley last year. Even the wife has stopped bugging me about buying her a house.

To any high pressure wife (or husband) I strongly encourage them to read this blog. It helps to take the edge off of the “American Dream” emotion during this poor time to invest in a home. There’s another emotion that is prevalent in my wife’s ego when she’s shopping for lower end materials (like clothes), and that emotion is simple: Good Deal.

Thank you! I really value these more general discussions far more than Culver City Genius awards. Your discussion of college debt probably should also have mentioned the rise of the for-profit U. Phoenix’s of the world, who work very hard to get students Gov’t backed student loans but charge a fair bit of change for tuition. In addition to getting more expensive, the public universities have also gotten more exclusive, with a number of students pushed out to the for-profit colleges.

Is there a way to short student loan debt like John Paulson, Michael Burry and Steve Eisman shorted mortgage loans? Are CDS’ available to small time investors?

Goldman Sachs, Morgan Stanley, etc. will set these up for you.

Think about who backs/guarantees a lot of this debt – USA. You need to find non-agency otherwise you are better off shorting the dollar to get real vs. notional.

An excellent article! I’d like to add a few points which weren’t covered, but are important.

1. Education is in a bubble. It’s yet another credit-fuelled bubble, similar to the Housing bubble. It too will crash. And those with a college or house loan will have a millstone around their necks.

2. The article mentions defaults, but doesn’t mention that defaulting doesn’t get rid of the loan. It is not cleared by normal bankruptcy, and will only grow.

3. The cost of Health Insurance must now also be considered, and added to the monthly expenses. I heard recently that the cost of Health Insurance was increasing to 20% of the monthly income, for the average American family. That will take away from the maximum monthly payment that one can afford, along with student loan debt.

4. Student loan debt has recently been the ONLY segment where Credit is increasing. People are using this to basically live off of, since they can’t find jobs. This is a really stupid approach. But it’s like education in this Country has been deliberately dumbed down, in order to get people to fall into debt traps.

You will notice that all three runaway sectors of the economy, heathcare, real estate and higher education, are areas where someone else pays the high cost up front, and you spend years paying them back. It appears the problem here is that Americans are too easily talked into monthly payment plans, that are quite expensive when you add it all up. (See also cable, cell phones, etc.)

That’s an interesting thought. Healthcare is the odd man out though, as both the housing and education bubbles are directly fuelled by credit expansion. And superfluous credit explains so much more than just those.

Cell phone and cable cost increases have more to do with the monopoly status of the carrier. When there’s competition, prices go down rather quickly and noticeably. Healthcare is more similar to the latter than the former, I’d say. With a boatload of extraneous complexity thrown in (from the inane patent system, to the marketing push). Healthcare can easily be far more cost effective (just look at nearly any other Country) without credit being directly involved.

But it’s still an interesting observation.

Another big problem is that folks with limited mortgage paying ability, college loan debt or not, will be in the market for smaller homes, if they buy at all. But builders spent most of the housing bubble building 2000 to 5000 sq. ft. homes.

A good starter home would be 1000 sq. ft. Affordable to heat/AC, and sell for maybe $65,000 or $75,000. But there is such a glut of homes on the market now, it doesn’t make sense to do a lot of building.

Another big problem is the location of so many homes, way out in the outer suburbs. Let’s say we get into an energy emergency where we have to have mandatory carpooling, and evertone you work with is spread out all over the county? I’m not a big fan of a centrally planned economy, but the mess we have now makes you wonder if there isn’t some reasonable middle ground somewhere.

Ahhh, California…where every third person over forty is underemployed way below their education level and earns half their previous salary, or unemployed, lives with parents or an employed honey who pays the bills, collecting bennies until they run out, probably will never have regular work again because they won’t take a job they consider beneath them. Also, no shortage of embittered twenty something Bachelors/Masters graduates making $10/hr, “lucky” to have a retail job, owing five/six figures on student loans. These people are going to be buying up houses? Should be interesting.

And yet you are here – on a California housing blog.

What’s the matter? Everyone mouth-breathes where you’re at? Or can’t articulate a complete sentence?

You get what you pay for:

http://amarillo.com/news/new-mexico-news/2011-04-11/doctor-sues-university-new-mexico

~Misstrial

You wrote:

“What’s the matter? Everyone mouth-breathes where you’re at? Or can’t articulate a complete sentence?”

How do California public schools rank compared to other US schools in “mouth breather” states? California ranks in the bottom five? LAUSD HS graduation rate? Around 50%? Sure, Californians are smarter and superior to everyone else on the planet. No need for hostility. Relax, dear. Go catch a wave, or maybe a movie is being made in your neighborhood today, you could be an extra. A star is born, get ready for that close up!

I don’t understand how this is any type of rebuttal for the previous comment… Perhaps you would like to articulate when you aren’t breathing through your mouth?

Although student loan debt is a crusher, the big costs of a university education are in housing costs, ie: rent.

EX: For an undergrad at SFSU, the tuition & fees are about $2500 for 2 semesters.

http://www.sfsu.edu/~bulletin/current/fee.htm

Rent at about $650/mo (which is the average in SF btw) for a studio efficiency begins at about $650/mo making a cost of about $8k per year.

http://sfbay.craigslist.org/sfc/apa/2318463104.html

Rents are high, and are intentionally so. The idea being to keep someone renting as long as possible as opposed to that person saving up for a home of their own.

Although I appreciate DHB articles on high home prices for buyers, I really don’t think enough attention has been paid to the damage done to the real estate market by landlords.

And I don’t mean landlords who own their properties outright.

I’m talking about those landlords who used leverage and loans and helocs in order to purchase overpriced rental properties and who are passing on the high costs of their bad financial decision-making onto renters and driving up the housing costs for any locale.

~Misstrial

“Rents are high, and are intentionally so. The idea being to keep someone renting as long as possible as opposed to that person saving up for a home of their own.”

YEPper… all us big tycoons with 2-6 units each meet in the big dark ‘Eee-vil Landlords Guild Hall’, where we “fix” the rents… make’m way above what locals can afford, yep, that’s what we do, ’cause that’s what works… 🙄 Luxury car dealers, cable companies, and trendy restaurants are members of The Guild too… they “trick” the innocent tenants into living beyond their means.

I guess the many tenants I’ve had move on to buy their own place didn’t get your memo about how I was “a-holdin’ ’em down” and “keepin’ ’em on da plantation” and just gen’rally oppressin’ dem to duh point they couldn’t save up even that piddly 3.5% FHA requires… 🙄

“… I really don’t think enough attention has been paid to the damage done to the real estate market by landlords.”

So those who buy, *HOLD*, UPGRADE, and MANAGE properties, to local code standards (or above), and provide decent human shelter are doing “damage”, but slap-dash speculative flippers and banks who let props become BLIGHTed are… not? WTF? 😕

NEWSFLASH: There was VERY little designed-to-be-rental property built during Duh Bubble. Quite the contrary, TONS of existing traditional rental apts. were converted to CONDOS!

“And I don’t mean landlords who own their properties outright.

I’m talking about those landlords who used leverage and loans and helocs in order to purchase overpriced rental properties and who are passing on the high costs of their bad financial decision-making onto renters and driving up the housing costs for any locale.”

You’ve posted these quasi-Marxist anti-landlord screeds before, and in terms of economic realities, they are baseless. Logically, they circle back on themselves.

Newsflash: Landlords (unlike TBTF banksters) canNOT pass on inflated costs to renters, nor the public at large. Banks–backed by Duh Fed–can afford to play extend-and-pretend for YEARS. Landlords, even huge ones, take a loss on VACANCIES every damn DAY they’re vacant. NOTHING brings rents down faster or more decisively than VACANCIES. Add to that the TONS of unsold condos coming online as rentals, and your assertions reach the farther shores of Lake Ridiculous.

I suggest you “stand up to Eee-vil” and put your own skin in the game. Start with a nice cheap foreclosure, cash outright–wouldn’t want you to “damage” the local economy, after all. Hey, it’s only money.

SFR, duplex, triplex, quadplex, your pick, they’re all available, mismanaged into foreclosure. Then commence with the fun process of screening prospective tenants. Since you’ll be “saving the day, and the town, and the downtrodden”, by offering BELOW MARKET RENTS, you’ll be doing a LOT of screening, because you’ll have a FLOOD of applicants. Make sure to point out what a great guy you are… repeatedly. Report back with the real-world results. :rofl:

Your immature post peppered with ALL CAPS and other signs of a disorganized mind does not impress me.

Nearly everyone knows that my post states the hard truth.

Your disingenuous rant speaks for itself.

~Misstrial

Ya right Enzo… Just move. You were aware of rent prices in SF prior to enrolling yes?

$650/month is quite cheap anyhow. I was splitting $1200 in Colorado for rent in my college days of 1999. I think you’d be lucky to find rent in a studio near any University in Los Angeles for $650.

Rents are not the thing that are high. They are higher than elsewhere, but only because property values are through the roof! (Still!) The problem is that californians will vote in any mad scheme they can think of to increase property valuation, and can live in denial about downturns for years. (You do read this blog, don’t you?) I don’t believe that rents are a landlord conspiracy. I think they reflect the relatively high carrying cost of owning property here. A $1M place will cost you $10k in property tax plus another $3-4k insurance, plus maintenance. Presuably landlords want to make at least some money on the deal.

If it was insanely profitable then investors would move in and quickly increase supply driving down rents. The only ones making out like bandits are the ones who have owned the property for 20 years and consequently pay little or nothing on property taxes.

“I don’t believe that rents are a landlord conspiracy. I think they reflect the relatively high carrying cost of owning property here. A $1M place will cost you $10k in property tax plus another $3-4k insurance, plus maintenance.

HELLO!… and thank you for the grown-up insights. (Misstrial sounds like a lifelong renter, with “savings issues”.) I only wished your CALI numbers applied to my state, FL. Here there’s no state income tax, so prop taxes are > 2%, so make that $21k on a $1M assessed value (like my quadplex, during Duh Bubble), and insurance more like $9k (Level 1 Hurricane Zone, oh yeah…). So there’s $30k = $2,500/MONTH out the door to the non-producing leeches before the Principal + Interest is even addressed!

“If it was insanely profitable then investors would move in and quickly increase supply driving down rents.”

BINGO!… can’t believe Misst isn’t all over this “juicy, low-risk” “opportunity”… ;’)

“The only ones making out like bandits are the ones who have owned the property for 20 years and consequently pay little or nothing on property taxes.”

Again, I WISH… in FL, only your primary residence enjoys “grandfathering” (formally titled ‘Save Our Homes’) limits on tax increases. The investment props pay full current freight! None of that Mills Exemption stuff for historically hip properties either… boo-hoo.

“Presuably landlords want to make at least some money on the deal.”

Not me, I do it as a public service… after all, peeps are “entitled” to a clean, painted, manicured landscape, pressure-cleaned, pest-free, hurricane-shuttered pad, close to Duh Beach, all at non-reality rent levels… the bigger loss I take, the better I feel, deep down inside, oh yeah… 🙄

Hey dummy: Rents are whatever the market will bear, not based on some whim or conspiracy.

Not quite sure about that. I have lived in 3 cities that saw huge rent spikes in the time that I lived there, and not sure it was all about supply and demand.

Rental prices are transparent: If you are a landlord, it’s relatively easy to find out what other places are renting for – just look on Craigslist or some other site. Landlords can price as high as they want because the incremental revenue loss from renting low vs. renting high is huge over the medium-term. So, they price high and keep a unit empty even if it loses them money in the short run. I dub this, “The Rich are Coming” approach. It worked in SF in the late 90’s as rich Taiwanese and dot-com workers would pay anything for a place in the Bay Area, a lot of people got priced out and moved elsewhere. There was still good availability, just no one willing to drop rents because it was easy to see what everyone else was getting and landlords didn’t want to drop prices. This also happened in NYC and LA. IF you need a place in one of these cities, you are out of luck because there is a lot of rental inventory that is not being rented because the price is too high. Investors do come in and make a profit but only because they see high prices on rentals and price their offerings accordingly. This works especially well in cities where people bought a long time ago and have no mortgage.

The second argument is that when pricing information for property is easily available, landlords know the opportunity cost of NOT SELLING. For instance, the apartment building next to mine in LA was valued at $1.9 million. After hearing this number, affordably priced apartments were jacked up to reflect the cash flows the owner thought he should be earning on such an investment. Never mind that his parents bought the place in the 50’s for a less than $100K. He wanted a 3-6% return on the $1.9 not the $100K. Get it? He did not want to sell for $1.9 million, so he rented at a price that would guarantee a predetermined return on an asset he didn’t even pay for. And what used to be a stable apartment complex with long-term tenants turned into a place with people leaving all the time for cheaper rent.

Just an amusing thought. If your house is your biggest asset, why not just use a home equity line of credit on the family home to pay for college for your children, then after they graduate declare bankruptcy, let them sell the house since you need to downsize anyway and rent a comfortable two bedroom place with the spouse till your credit rebuilds?

Benefits: Your kids aren’t saddled with huge debt that they can’t discharge in BK. You have a larger house when you need it, then you force yourself to downsize after the kids are moved out.

Awesome idea! This of course now only works for a small fraction of home owners (the ones with equity) but still, great idea!

Yes, crossed my mind as well. I presume you can also take out personal loans, cash advance whatever you have on CCs, get a few more CC balance transfer offers – use all that to pay off college loan and then declare a bankruptcy – no need for equity 🙂

The US middle class is really getting it from all sides. If they own a home, it’s gone down in value. If they rent, well, rents are going up. Their healthcare costs are zooming up, especially if they have to buy their own healthcare. And their food and fuel costs are going up as well. And of course tuition for their kids is a nightmare. The American Dream is turning into a nightmare for the middle class.

Increasingly, I read wacko stories of people with $300,000 in debt and no job. Not hard to do – Borrow $150K for five years in undergrad. Graduate and can’t find a good job (your fault or the economy’s fault, you’re still in debt). So go to law school or grad school and rack up another $150K in debt. Graduate into an even worse job market, plus you now have less work experience than others in your age cohort. By this point you’re just borrowing to live, just to make it through another month. Not good.

Henry

When a child of mine reaches 14 I tell them ” Come up with a plan for your life. If you don’t have a plan then that is what you will do. Be working at a steady job by the time your 16 or your time will be spent working for me. You decide which. Your going to work.”

When I see a youth over the age of 16 hanging around my house after school or on saturday I have only one thing to say. ” Why aren’t you at work ?”

One son bought his History degree and another bought a Cisco Certification . They payed with cash that they earned. It’s a novel concept.

Young people can work and do school. We all did. They can do it. The social networking that comes with work Is good for them. Kids thrive when they work.

Hear, HEAR! TOO RIGHT!

“Do not handicap your children by making their lives too easy… you should be gradually introducing them to reality, not shielding them from it.”

I can just see it, maybe ten years. In an over-overburdened prison system.

“Hey wooosy. I’m in for murder! What are you in for?”

“I defaulted on my student loan. And so did the rest of us.” Whereupon the thug is immediately surrounded by three-hundred prisoners, all who were punished for not paying their student loans.

One of the things that most people do not connect when they compare life in the United States in the early 1990’s and life now is the huge population boom America has had.

We have added around 36 million people here in the last 18 years. This population boom did not ocur through natural growth ( births from Americans) it has happened because we have a legal immigration rate that allows over 1 million new immigrants who move here each year ( usually through chain migration), plus another 1 million who come here each year through illegal immigration.

Add to that the birth rate of illegal immigrtants ( which is 80% Mexican and Central American),is nearly twice that of Americans. It is also a fact that the vast majority of all immigrants both legal and illegal are impoverished.

What we now have is a much more crowded and competitive country, with a higher degree of poverty, and a country that is quickly becoming divided by those who benefit from this lawlessness and those who are hurt by it.

If you want to have a cheaper, cleaner, less crowded California. Lets end birth right citizenship, have a immigration moratorium and mandate E-verify to ensure that all people that take jobs in California are legaly able to do so.

Then as more and more illegal aliens leave back to their homelands (self deport). Conditions and the environment in older neighborhoods closer to the city will improve for Americans and we will be able to reoccupy them. Public schools will also improve thus allowing Americans to use them again, and traffic will lesson. In a nut shell life in California will improve for all Americans.

Haven’t you noticed? You will never hear the word ILLEGAL immigrant on a news cast. They are “undocumented workers”, as if they somehow misplaced their documents, temporarily,.

Jerry Brown is too liberal to even hint at crackdowns, and Mr. Obama is counting on Calif. electoral votes to put him over the top in 2012.

Restrictions on Immigration or immegrants, legal or illegal will NEVER happen.

Great points. We also sorta “normalized” the labor rates across Mex, USA, Canada through NAFTA. I am for free trade, as the little guy gets lowest price, but the consequence is downward pressure on local wages, and/or exportation of jobs.

Are you kidding? Low wages, expensive housing and Univision are what made America great!

Greg, as a 4th-generation Californian, I could not agree more with you.

Common sense dictates that legal immigration must be halted and enforcement of existing law must resume relative to illegals.

However (and this is a *big* “however”) many of the elected officials in the city of L.A., Los Angeles County, and the California legislature are the anchor babies of anchor babies. They will vote according to their constituency and according to campaign contributions from ethnic/racial businesses and organizations.

Their identity is not in being American, but in either their ethnic or racial background.

Thus, legal and illegal immigration will continue until there is the political will to change the current posture.

Its a whole new country out there…..

One more thing: there are judges and prosecutors/public defenders in Los Angeles who own the apartment buildings that illegals live in. These are additional reasons why there is a reluctance and refusal to enforce/adjudicate existing law.

~Misstrial

Difference between home loan and student loan is no collateral except your future debt-slave labor. As you can tell by how stupid my comments are, I opted for state school because i wanted to exit with diploma and zero debt. It was tough, had to work, but I pulled it off despite them doubling the parking pass fee every year I was there. It started at $12, and was over $100 by my last semester!! Only a fool or someone who hates the poor believes in big govt and bureaucracies!

Wait who do you think pays for state schools like the one you graduated from? Wouldn’t that be the state governments (big government and bureaucracy)?

Like so many parents we have a daughter in her 5th year at one of the very nice state universities. Her major is 5 years long and she spent almost 1 year in Europe. She is in her 5th year and will soon graduate. The costs have been monstrous, but we made it through without any residual debt. Tuitions have doubled since she started her first year. This,of course, is only the beginning. Many of her friends have had to take loans.

They will be in debt for years. With the job market the way it is our daughter will be many years earning back her education costs. For those with debt there is no discharging this type of loan…. including bankruptcy. The only way to discharge this kind of loan is to pay it off. This, plus a mortgage, is a huge burden in the current economic environment. It will not be doable for most…….

Always have an exit strategy. If you’re burdened with insurmount debt consider setting up a new home in a different country especially if you speak a second language. Give your creditors the middle finger and tell ’em to come find you in Brazil with no forwarding address. Option 2: Declare Bankruptcy. Tell them you want your student loans discharged or you’ll quit your job, live with your parents, go on public assistance programs and generally become an unproductive, burden on society. Remember, there are no debtors prisons…yet. Then, you take odd jobs, switching frequently and try to live within your means. Option 3: Marry rich.

That Is some funny s$$$!!!!

Can someone tell me… The graph titled “US Home Ownership Rate” begins to rise in 1994. I expected to see it begin in 1999 after Glass-Steagal repeal. What was the trigger that cause the rise in 1994? Did banks start new lending practices prior to Glass-Steagal repeal?

I think 1994 was when we were coming out of the early 90’s recession and when they finally cleaned up the Savings and Loan fiasco.

Misstrial, You are correct that the politicians have sold the country out for their own profit. The country is totally divided between those who benefit from the immigration lawlessness and those who are hurt by it.

You are also correct that most Mexicans in America have a stronger allegiance and loyalty to their own tribe and race, hence the political group La Raza. Mexicans naturaly fight for their tribe.

I think though that Americans should learn from them. White Americans are now a minority in California, I think it is high time that we as Americans should also fight for our tribe. The old saying says , “what is good for the goose is also good for the gander”.

GreginLA:

Thank you for your comments – and believe me, I am doing preferencing of my own.

My educated guess is that POC already know somethin’s afoot.

http://www.marketwatch.com/story/wealth-of-black-families-has-disappeared-2011-02-09

Guess why?

~Misstrial

Think about this:

A $500 a month household student loan payment reduces a debtors home buying power by roughly $90,000. $500 a month is nothing for a professional and $1000 a month is common for dual income professional households. In fact, most associates in my law office under 35 are paying upwards of $750 or $800 per month and they make between $60,000 and $70,000 per year – these are decent associate salaries (not Biglaw but that’s a different tier). None of these associates including myself will be able to buy a home any time soon.

I recently had a child and my 970 sq ft apartment is getting cramped. My wife and I would like to buy a home but my student loan payments are roughly $490 a month and hers are $425 (although she’s prepaying a lot of principal). My home purchasing power has just been reduced by roughly $170,000. So if I wanted to buy a $500,000 house (which is just an updated house in my area) I can now only afford $330,000 (which buys far far less house). Moreover, given the roughly $1,000 a month student loan payments (And daycare, car insurance, etc) it is extremely difficult to save a down payment to buy a house.

The suburban homes where I want to live are all these boomers with their outdated homes with kitchens from 1985 with listing prices in the $400,000s! Yeah right – back out my generation’s student loan payments and maybe I’ll pay you $230,000. An offer of $230,000 would be an insult which wouldn’t even solicit a response or a counteroffer.

The student loans are the canary in the coal mine for things to come.

Been there serf…the way we were able to save for a down is to under-rent.

The only way for a lot of potential buyers since conventional loan lenders no longer look at a down payment funded by a family member as a Positive. Seen as a Negative now along with any financial gifts from family or business.

I have posted on this before; basically what you have to do is rent at about 1 percent of your gross. This has worked out to be a very good factor for us in order to save.

Really good article on how young professional working couples and individuals saved for a down in NYC can be found by typing “Every Penny Counts New York Times article 2007” into google.

http://www.nytimes.com/2007/07/29/realestate/29cov.html

I printed this article out and kept it bedside in order to read and reread the amazing personal stories of how those interviewed saved for a down in one of most expensive cities in the world without the financial assistance of family.

I wouldn’t wait for boomers to get a clue – nearly all of them have no hard assets other than their house and many made tragic assumptions with permanent repercussions regarding the real estate market going forward. They are trapped.

Best to you!

~Misstrial

” I don’t know anyone, myself included, that had the forethought to conduct a cost/benefit analysis before deciding on furthering their education.”

There’s a reason for this: Common brainwashing is that ‘education is always good’ and no mentioning of the debt: The ultrarich always have money to give their kids a proper education.

Yet another matter that guarantees that elite will stay elite and poor stays poor: You can’t raise to elite without education and taking the education away is a way to stop people raising to elite, in large scale. It’s simple as that.

Very intentional move from ruling class, not a coincidence and the goal is clear: Create a permanent ruling class, aristocracy and f**k the rest.

“Landlords, even huge ones, take a loss on VACANCIES every damn DAY they’re vacant.”

By “loss” you obviously mean “profit not earned”, not actual payment. That’s neglible, only major cost is property tax.

A landlord has the capital to keep a house empty very long time rather than rent it for too cheap and that effectively prohibits rents for lowering at that time.

This is very easy to see when the empty houses are the majority: Owners rather keep them empty than rent.

“Young people can work and do school. We all did. They can do it. ”

They can? Could you tell me how working for a $10/hr pays my college tuition of 20000 per year? That means 2000 hours or 50 working weeks, full time, if every penny I earn, goes to tuition, ie. I live and eat for free and pay no tax. Five times more hours in real life, so either I get paid $50 per hour or the tuition is just $4000 per year. Good luck finding either.

If you could that in 1970s, that doesn’t mean it can be done now: Take a calculator to hand and calculate: Mine is just one example and very crude, but it highlights the current huge disparity between wages and tuitions.

Thomas, there are a number of boomers who comment on this board.

Obviously their past experiences are different than the current reality.

This is why you see boasting “I did it and so can you” comments accompanied by a condescending attitude.

~Misstrial

The commentary brings up many good points. And yes we will be slogging our way through the housing debacle for a number of years. However, there are some positives in the mix. The biggest is immigration who are high propensity homebuyers. At about a million a year in new arrivals (legal) we are adding new demand for housing. Will the economy delay new household formation? Yes. However, this will not stop young families from wanting their own home in the future. Lastly, QE I&II and deficit spending are creating inflation in a big way. When renters start seeing their rent rising every year by 5% their will be more demand for housing. The seeds for a housing recovery are being planted as we go through this destructive phase.

Leave a Reply to serf ceorl